A Dynamic Programming Approach for Pricing Weather Derivatives under Issuer Default Risk

Abstract

:1. Introduction

2. Dynamic Pricing Model for Weather Derivatives

2.1. Assumptions and Notation

- Assets. There are WDs on S weather indices (at different geographical sites and/or on different weather events) that are priced at times At T the payoff of each WD is determined and the cash settlement takes place. The non-negative price of the WD on underlying s in time t is denoted as where and . The final value corresponds to the non-negative payoff of the sth WD. We denote the vector of prices at t as . Besides the WDs, a risk free asset with a constant per period return r is available. Trading with is not restricted in any way, that is, unlimited borrowing and lending at the interest r in each t is allowed. We assume there is no transaction costs on the asset market. No capital addition or withdrawals are possible throughout the investment horizon, such that the agents are exposed to self-financing constraints.

- Agents. There are heterogeneous market participants, indexed by i, with the risk preferences described by the exponential utility function of the form , where is the risk aversion of agent i. All agents have the same multi-period investment horizon of length T. They invest at and they consume their terminal wealth at . At agents rebalance their weather portfolios and renegotiate the prices for WDs. All agents are endowed with an initial wealth of zero monetary units. We distinguish between J buyers, indicated by subscript j, , who hedge weather exposure of their random income , and a purely financial investor, indicated by subscript m, who issues WDs. Each buyer holds a basket of WDs on the relevant weather indices to hedge weather caused fluctuations in her profits. The issuer holds positions in all S WDs. A portfolio of agent i includes shares of the corresponding WDs and shares of the asset . Both and are real valued, that is, all assets are perfectly divisible and short sales are allowed. We denote the value of ith agent’s portfolio at time t as , where . In each period t of the investment horizon, the agents maximise their expected utility of the terminal wealth with the available WDs and attain their demand and supply for the WDs. That is, in each period every agent i determines her self-financing trading strategy , in particular, she constructs the optimal hedging portfolio given the state of the system at time t. Partial market clearing with respect to WDs determines the equilibrium prices for the WDs.

- State. The observable state of the system at time t, denoted by , contains values of the underlying weather indices at t and the variables regarding default risk at t. The random state is characterised by the conditional distribution function . We assume that this transition function satisfies the Feller property Stokey et al. (1989). Expectation taken with respect to is denoted by .Each agent is faced with the following discrete time stochastic control system:where incorporates portfolio value of agent j with . are controls of the agent in the system (1). The law of motion maps to the next state of the stochastic system.

2.2. Pricing WDs without Default Risk

2.3. Default Risk

2.4. Alternative Investment

- 1a

- Assets. Let assumption 1. hold. Let be a quoted price of an exchange traded financial asset at time t. While is given, is random, bounded, and predictable at t. Trading with is not restricted in any way, that is, short and long positions in the asset in each t are possible. We assume there is no transaction costs on the asset market. As before, no capital addition or withdrawals are possible throughout the investment horizon, such that the agents are exposed to self-financing constraints.

- 2a

- Agents. Let assumption 2. hold. Now, issuer m holds additionally shares of the exchange traded financial asset with exogenous price . Also, is real valued, that is, all assets are perfectly divisible and short sales are allowed. The value of the issuer’s portfolio at time t becomes .

- 3a

- State. Let assumption 3. hold. The observable state of the system at time t, denoted by , contains additionally the quoted price . The random state is characterised by the conditional distribution function . Expectation taken with respect to is denoted by .

3. Pricing Weather Derivatives Using Weather Data

3.1. Pricing Chinese Rain

3.1.1. Setup

3.1.2. Generation of Dependent Rainfall Paths on a Daily Basis

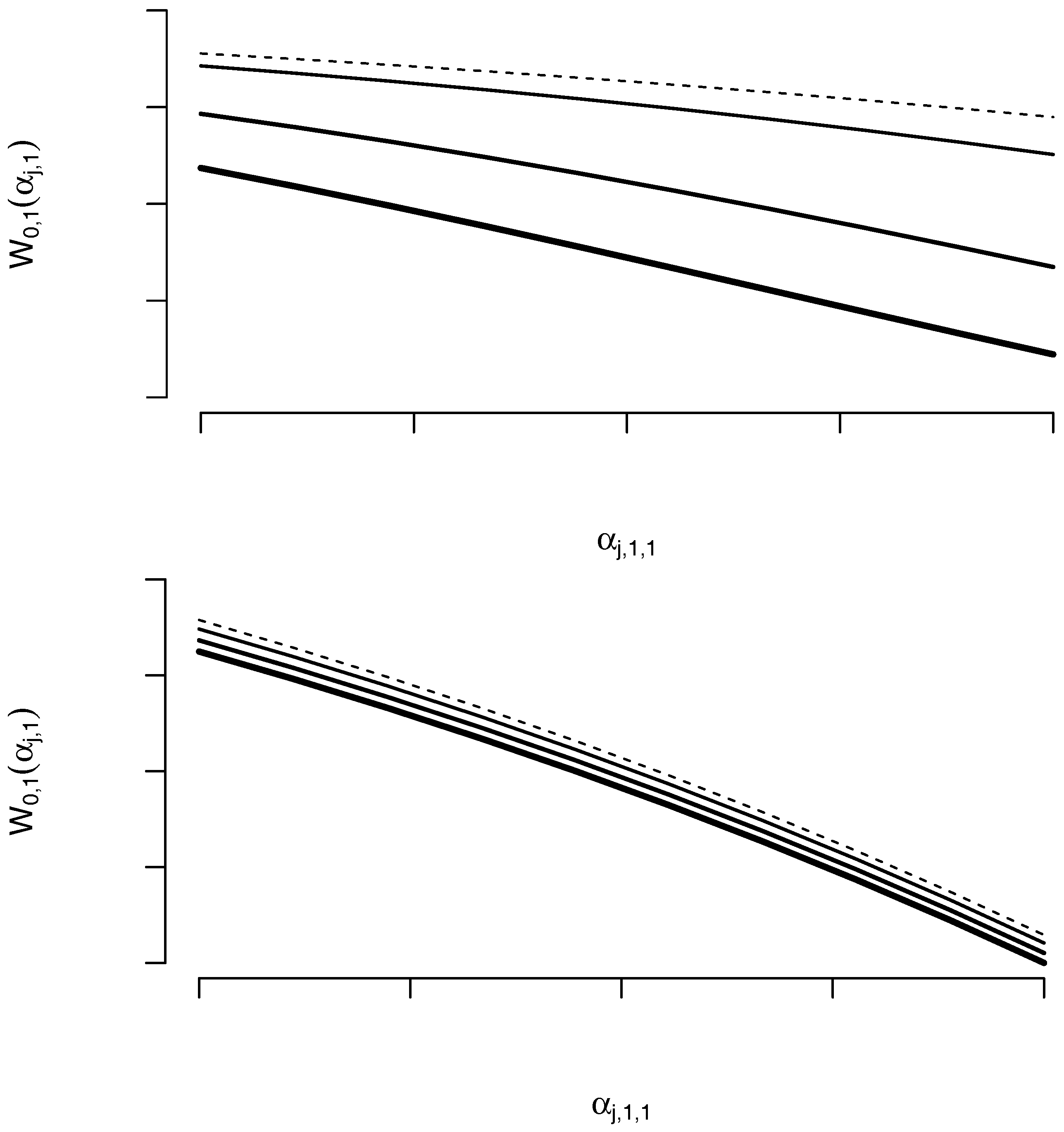

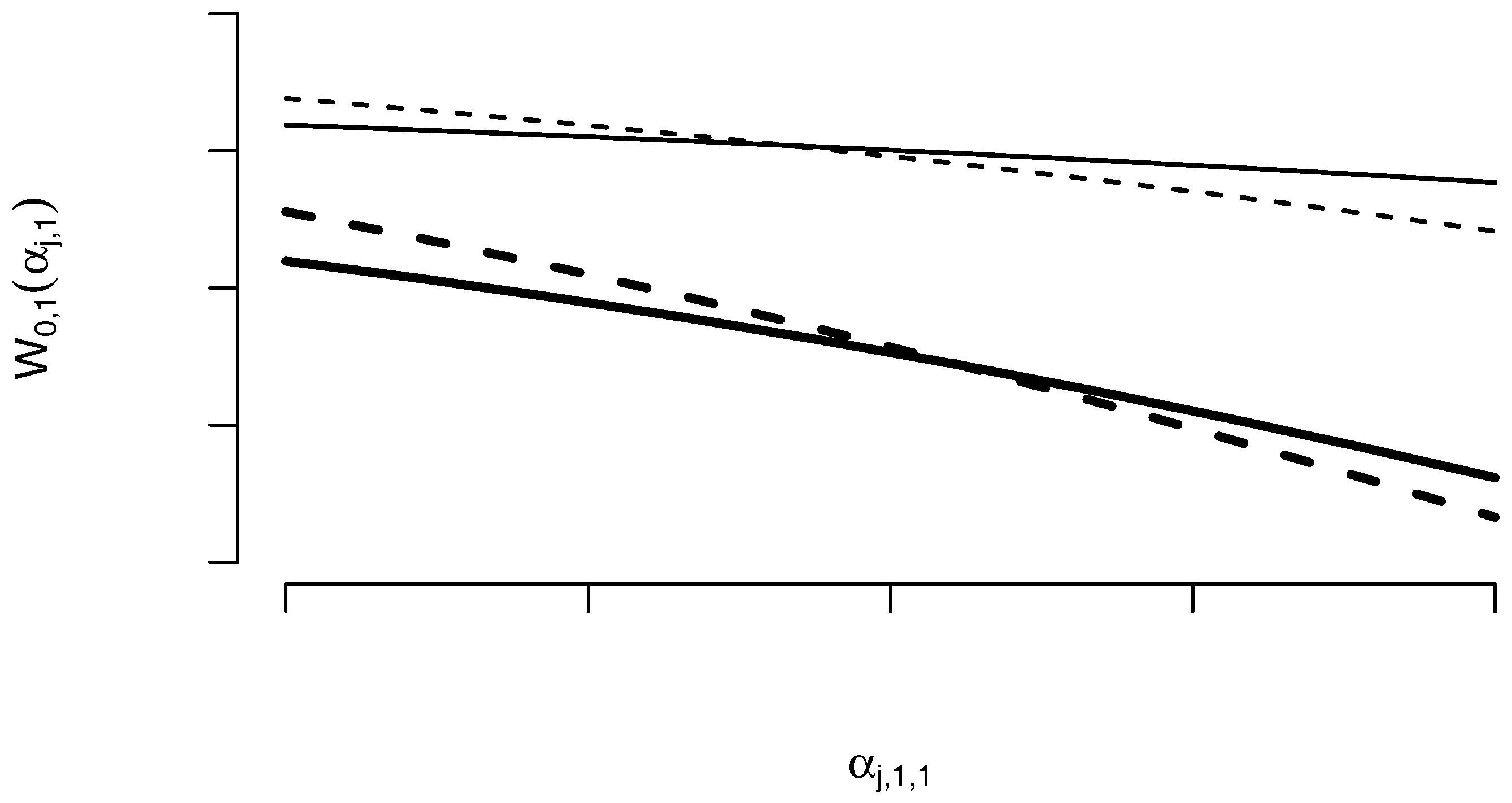

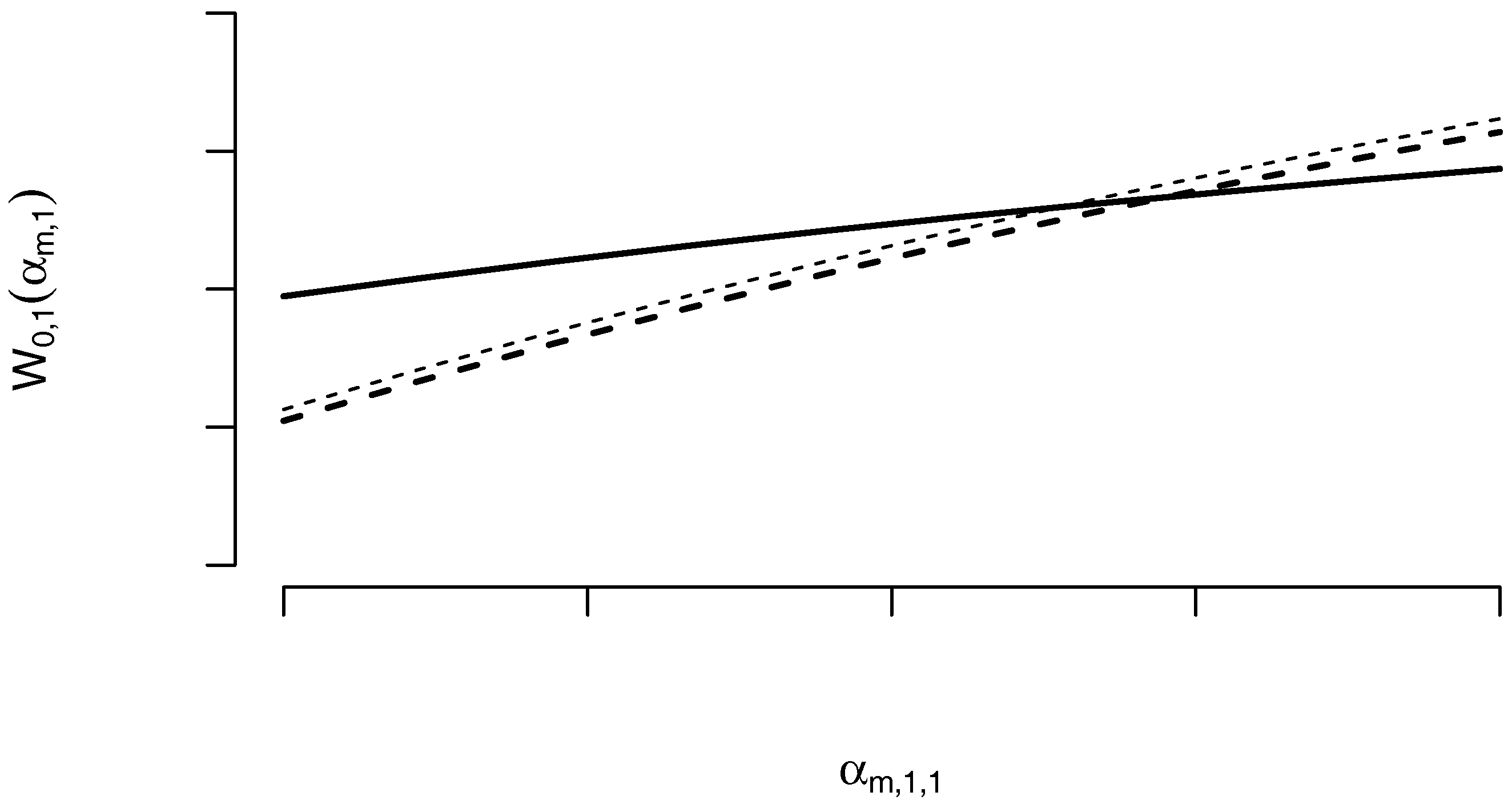

3.1.3. Results

4. Summary

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

References

- Alaton, Peter, Boalem Djehiche, and David Stillberger. 2002. On modelling and pricing weather derivatives. Applied Mathematical Finance 1: 1–20. [Google Scholar] [CrossRef]

- Allen, Franklin, and Andrew Postlewaite. 1984. Rational expectations and the measurement of a stock’s elasticity of demand. Journal of Finance 39: 1119–25. [Google Scholar] [CrossRef]

- Benth, Fred Espen, Jūrate Šaltyté Benth, and Steen Koekebakker. 2007. Putting a price on temperature. Scandinavian Journal of Statistics 34: 746–67. [Google Scholar] [CrossRef]

- Cao, Melanie, and Jason Wei. 2004. Pricing weather derivative: An equilibrium approach. Journal of Futures Markets 24: 1065–89. [Google Scholar] [CrossRef]

- Carmona, René, and Pavel Diko. 2005. Pricing precipitation based derivatives. International Journal of Theoretical and Applied Finance 8: 959–88. [Google Scholar] [CrossRef]

- Çanakoǧlu, Ethem, and Süleyman Özekici. 2009. Portfolio selection in stochastic markets with exponential utility functions. Annals of Operations Research 166: 281–97. [Google Scholar] [CrossRef]

- Chaumont, Sébastian, Peter Imkeller, and Matthias Müller. 2006. Equilibrium trading of climate and weather risk and numerical simulation in a Markovian framework. Stochastic Environment Research and Risk Assessment 20: 184–205. [Google Scholar] [CrossRef]

- Glauber, Joseph, Keith Collins, and Peter Barry. 2002. Crop insurance, disaster assistance, and the role of the federal government in providing catastrophic risk protection. Agricultural Finance Review 62: 81–101. [Google Scholar] [CrossRef]

- Golden, Linda, Mulong Wang, and Chuanhou Yang. 2007. Handling weather related risks through the financial markets: Considerations of credit risk, basis risk, and hedging. Journal of Risk & Insurance 74: 319–46. [Google Scholar]

- Heath, David, Robert Jarrow, and Andrew Morton. 1992. Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econometrica 60: 77–105. [Google Scholar] [CrossRef]

- Horst, Ulrich, and Matthias Müller. 2007. On the spanning property of risk bonds priced by equilibrium. Mathematics of Operation Research 32: 784–807. [Google Scholar] [CrossRef]

- Hull, John, and Allan White. 1995. The impact of default risk on the prices of options and other derivative securities. Journal of Banking & Finance 19: 299–322. [Google Scholar]

- Jarrow, Robert A., and Stuart M. Turnbull. 1995. Pricing derivatives on financial securities subject to credit risk. Journal of Finance 50: 53–85. [Google Scholar] [CrossRef]

- Katz, Richard. 1981. On some criteria for estimating the order of a Markov chain. Technometrics 23: 243–49. [Google Scholar] [CrossRef]

- Lee, Yongheon, and Shmuel Oren. 2010. A multi-period equilibrium pricing model of weather derivatives. Energy Systems 1: 3–30. [Google Scholar] [CrossRef]

- Leobacher, Gunther, and Philip Ngare. 2011. On modelling and pricing rainfall derivatives with seasonality. Applied Mathematical Finance 18: 71–91. [Google Scholar] [CrossRef]

- López Cabrera, Brenda, Martin Odening, and Matthias Ritter. 2013. Pricing rainfall futures at the CME. Journal of Banking & Finance 37: 4286–98. [Google Scholar]

- Lucas, Robert E. 1978. Asset prices in an exchange economy. Econometrica 46: 1429–45. [Google Scholar] [CrossRef]

- Musshoff, Oliver, Martin Odening, and Wei Xu. 2010. Management of climate risks in agriculture—Will weather derivatives permeate? Applied Economics 43: 1067–77. [Google Scholar] [CrossRef]

- Pennacchi, George. 2008. Theory of Asset Pricing. Boston: Pearson Addison-Wesley. [Google Scholar]

- Peréz-González, Francisco, and Hayong Yun. 2013. Risk management and firm value: Evidence from weather derivatives. Journal of Finance 68: 2143–76. [Google Scholar] [CrossRef]

- Stokey, Nancy, Robert Lucas, and Edward Prescott. 1989. Recursive Methods in Economic Dynamics. Cambridge: Harvard University Press. [Google Scholar]

- The World Bank. 2007. China: Innovations in Agricultural Insurance—-Promoting Access to Agricultural Insurance for Small Farmers. Technical Report. Washington: The World Bank. [Google Scholar]

- Turvey, Calum, and Rong Kong. 2010. Weather risk and the viability of weather insurance in China’s Gansu, Shaanxi and Henan provinces. China Agricultural Economic Review 2: 5–24. [Google Scholar] [CrossRef]

- Wilks, Daniel. 1998. Multisite generalization of a daily stochastic precipitation generation model. Journal of Hydrology 210: 178–91. [Google Scholar] [CrossRef]

- Wu, Yang Che, and San Lin Chung. 2010. Catastrophe risk management with counterparty risk using alternative instruments. Insurance: Mathematics and Economics 47: 234–45. [Google Scholar] [CrossRef]

| 1. | Station numbers given by the World Meteorological Organisation are 57662 for Changde and 57447 for Enshi. |

| Station | Number | Latitude | Longitude | Start Date | End Date |

|---|---|---|---|---|---|

| Changde | 57,662 | 29.05 | 111.68 | 1951/01/01 | 2009/11/30 |

| Enshi | 57,447 | 30.28 | 109.47 | 1951/08/01 | 2009/11/30 |

| Order/BIC | Changde | Enshi |

|---|---|---|

| 0 | 70.83 | 60.02 |

| 1 | 53.21 | 43.21 |

| 2 | 53.47 | 44.69 |

| 3 | 65.64 | 59.72 |

| Parameter | Changde | Enshi |

|---|---|---|

| 0.78 | 0.58 | |

| 15.90 | 23.14 | |

| 0.62 | 1.86 |

| Scenarios | Put on | Put on | ||||

|---|---|---|---|---|---|---|

| 100.00 | 100.30 | 100.00 | 96.68 | |||

| 99.67 | 99.95 | 98.81 | 96.35 | |||

| 91.22 | 93.95 | 86.74 | 87.45 | |||

| 90.87 | 93.62 | 85.95 | 87.12 | |||

| 100.00 | 100.31 | 100.23 | 96.68 | |||

| 99.67 | 99.97 | 99.71 | 96.36 | |||

| 91.23 | 94.23 | 86.88 | 87.73 | |||

| 90.92 | 93.99 | 86.47 | 87.51 | |||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Härdle, W.K.; Osipenko, M. A Dynamic Programming Approach for Pricing Weather Derivatives under Issuer Default Risk. Int. J. Financial Stud. 2017, 5, 23. https://doi.org/10.3390/ijfs5040023

Härdle WK, Osipenko M. A Dynamic Programming Approach for Pricing Weather Derivatives under Issuer Default Risk. International Journal of Financial Studies. 2017; 5(4):23. https://doi.org/10.3390/ijfs5040023

Chicago/Turabian StyleHärdle, Wolfgang Karl, and Maria Osipenko. 2017. "A Dynamic Programming Approach for Pricing Weather Derivatives under Issuer Default Risk" International Journal of Financial Studies 5, no. 4: 23. https://doi.org/10.3390/ijfs5040023