Public Debt, Public Investment and Economic Growth in Mexico

Abstract

:1. Introduction

2. Literature Review

- (1)

- Comparison between revenue and public expenditure by means of a definition of public deficit, where it tends to zero at the optimal levelwhere is the nominal budget deficit, is public spending, is the public income, is the volume of interest paid, is the nominal effective rate of interest, and is the total value of domestic public debt from the period 0 to period t − 1.

- (2)

- Compliance with the intertemporal budget constraint

- (3)

- Following Blanchard et al. [12] (p. 12) the comparison between the rate of economic growth and the interest rate that is paid by the debt should be considered:where is the original debt, g is government spending and t tax revenues expressed as proportion of the actual product, r is the interest rate and θ is the rate of growth of the economy. Thus, fiscal policy is sustainable if the present value of the primary deficit is equal to the negative of the initial value of the debt, which means you can keep any level of debt and primary deficit if and only if the growth rate of the economy exceeds the rate of interest paid on the debt. With this framework, we tried to reaffirm the idea according to which the contracted debt goes to public investment and the latter translates into higher economic growth, completing a virtuous circle.

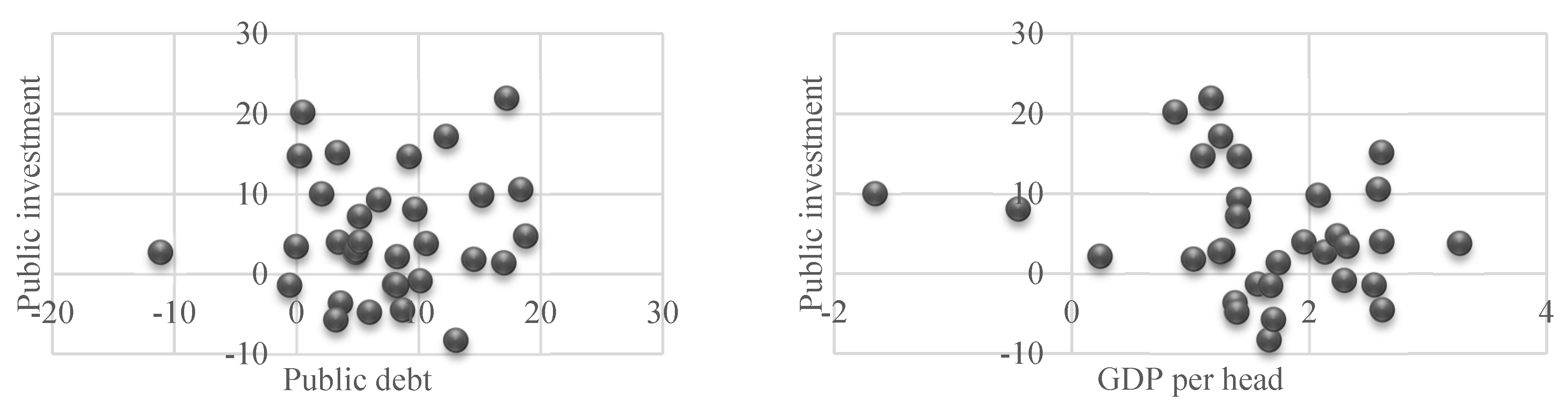

3. Origin and Characteristics of the Data

4. Description of Data and Econometric Method

5. Results

- The first lag of GDP per capita was statistically significant at 0.01.

- Public investment lagged three periods has a positive effect on output per person, with a significance level of 0.01—although marginal effects, as measured by the coefficient, indicate that its impact is reduced.

- The public debt is positively correlated with output per person, with a significance level of 0.01. As in the case of public investment, marginal effects are reduced.

- In this way, part of the hypothesis of research seems to be confirmed; it is possible to say that public investment is a determinant of economic growth, as well as public debt. However, the marginal effect is negligible.

- In addition, it was found that the average years of schooling, proxy variable of education and human capital are positive determinants of economic growth.

- Foreign direct investment is negatively related to production, with a statistical significance of 0.01.

- As a measure of the goodness of the estimates, the J statistic and its probability value were calculated. A rejection of the null hypothesis means that instruments do not satisfy the orthogonality conditions required for its use. This may be because they are not really exogenous or because they have been incorrectly excluded from the regression (Baum et al. [36] (p. 16)). The estimated statistical was 30.50 with a value of probability of 0.33, which does not reject the null hypothesis, the model was specified correctly.

- The first lag of public investment was statistically significant at 0.01, both in absolute values as estimated in logarithms.

- The current expenditure on the estimation in absolute values was a positive sign, indicating that it is complemented with public investment. In the estimation of logarithms, the expected negative sign was obtained, but the associated coefficient was not statistically significant. Authors such as Vivanco and Solís [37], using similar data for the period 1993–2006, found that the relationship between public investment and current expenditure is negative but, as in this study, the coefficient was not statistically significant.

- The total population, both in absolute values and in logarithms, is shown correlated positively with public investment, with the result significant at 0.01.

- The foreign direct investment in absolute values presented the expected positive sign and is statistically significant at 0.01. However, in logarithms, the correlation is negative, although the estimated coefficient is not significant.

- The increases in public debt reduce public investment, if the results are considered in absolute values, but in logarithms have the expected positive sign, although the coefficient is not significant. It was decided to consider the relationship is positive as Kinto [38] and Vivanco and Solis [37] report in the Mexican case. With the estimation of Equation (7), this will become clear.

- The variable output per capita lagged one period was significant in the estimation with absolute values and logarithms.

- The variable interaction between public investment and public debt was statistically significant at 0.01, using absolute values and logarithms. In the case of the logarithms, the interaction variable was lagged three periods. This confirms the two proposed hypotheses, according to which the debt which is channeled for public investment collaborates to observe a greater economic growth. However, the marginal contribution of increases in public debt and public investment on growth are small, since for every 1% increase in this interaction variable, output per capita rises 0.0000508 per cent.

- Education is a variable that persistently shows as statistically significant and implies that the greater degree of schooling of the population of a state, the greater the chance of increased production per person.

- Finally, foreign direct investment, if logarithms are used, is statistically significant at 0.01 and has the expected positive sign. In absolute terms, it is statistically significant, but with a negative sign; it presents a negative correlation with output per person, so it is not possible to reach a conclusion about its effect on economic growth.

6. Discussion

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- A. Robles, and L. Huesca. “Incidencia fiscal en México: ¿Es posible aumentar la recaudación sin afectar a la población? ” Finanz. Política Econ. 5 (2013): 59–78. [Google Scholar]

- Secretaría de Hacienda y Crédito Público (SHCP). Información de Finanzas Públicas y Deuda Pública, Enero-Diciembre de 2012. Ciudad de México, México: Secretaría de Hacienda y Crédito Público, 2013. [Google Scholar]

- México Evalúa. Gasto y Deuda Pública Estatal ¿Para Qué? Ciudad de México, México: México Evalúa, 2013. [Google Scholar]

- Secretaría de Hacienda y Crédito Público (SHCP). Deuda Pública de Entidades Federativas y Municipios 2014. Ciudad de México, México: Secretaría de Hacienda y Crédito Público, 2015. [Google Scholar]

- J. Barth, and J. Cordes. “Substitutability, complementarity, and the impact of government spending on economic activity.” J. Econ. Bus. 3 (1980): 235–242. [Google Scholar]

- J. Hernández. “Inversión pública y crecimiento económico: Hacia una nueva perspectiva de la función del gobierno.” Econ. Teoría Práct. 33 (2010): 59–95. [Google Scholar]

- F. Balassone, and D. Frando. “Public investment, the stability pact and the “golden rule”.” Fisc. Stud. 21 (2000): 207–229. [Google Scholar] [CrossRef]

- C. Hurtado, and G. Zamarripa. Deuda Subnacional: Un Análisis del Caso Mexicano, 1st ed. Ciudad de México, México: Fundación de Estudios Financieros, 2013. [Google Scholar]

- A. Srithongrung, and I. Sánchez-Juárez. “Fiscal policies and subnational economic growth in Mexico.” Int. J. Econ. Financ. Issues 5 (2015): 11–22. [Google Scholar]

- R. Barro. “On the determination of public debt.” J. Political Econ. 85 (1979): 940–971. [Google Scholar] [CrossRef]

- A. Rodríguez, and A. Azamar. “Crecimiento económico, inversión pública y endeudamiento en las entidades federativas de la República Mexicana.” In El Retorno del Desarrollo, 1st ed. Federico Novelo; Ciudad de México, México: Universidad Autónoma Metropolitana Xochimilco, 2013, pp. 343–366. [Google Scholar]

- O. Blanchard, J. Chouraqui, and R. Hagermann. “The sustainability of fiscal policy: New answers to an old question.” OECD Econ. Stud. 15 (1990): 7–36. [Google Scholar]

- H. Minsky. “Capitalism financial processes and the instability of capitalism.” J. Econ. Issues 14 (1980): 505–523. [Google Scholar] [CrossRef]

- O. Rubio, J. Ojeda, and E. Montes. “Deuda externa, inversión y crecimiento en Colombia.” Banco Repúb. Estudios Econ. 1 (2003): 1–41. [Google Scholar]

- M. Obstfeld, and R. Kenneth. Foundations of International Macroeconomics. Cambridge, MA, USA: MIT, 1996. [Google Scholar]

- K. Megersa, and D. Cassimon. “Public debt, economic growth and public sector management in developing countries: Is there a link? ” Public Adm. Dev., 2015. [Google Scholar] [CrossRef]

- C. Patillo, H. Poirson, and L. Ricci. External Debt and Growth. International Monetary Fund Working Papers in Economics; Washington, DC, US: International Monetary Fund, 2002, Volume 69. [Google Scholar]

- A. Salamanca, and V. Monroy. “Deuda externa pública e inversión en Colombia 1994–2007: Evidencia de un modelo no-lineal TAR.” Cuad. Econ. 28 (2009): 205–243. [Google Scholar]

- E. Díaz. “Deuda pública interna, tasa de interés y restricciones a la inversión productiva.” Comer. Exter. 60 (2010): 38–55. [Google Scholar]

- C. Reinhart, and K. Rogoff. Growth in a Time of Debt. National Bureau of Economic Research Working Papers No. 15639; Washington, DC, US: National Bureau of Economic Research, 2010. [Google Scholar]

- J. Irons, and J. Bivens. Government Debt and Economic Growth. Overreaching Claims of Debt “Threshold” Suffer from Theoretical and Empirical Flaws. Economic Policy Institute Briefing Papers No. 271; Washington, DC, US: Economic Policy Institute, 2010. [Google Scholar]

- T. Herndon, M. Ash, and R. Pollin. Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff. Political Economy Research Institute Working Papers No. 322; Amherst, MA, US: Political Economy Research Institute, 2013. [Google Scholar]

- A. Pescatori, D. Sandri, and J. Simon. “Debt and Growth: Is There a Magic Threshold? ” Washington, DC, USA: International Monetary Fund, 2014. [Google Scholar]

- J. Ostry, A. Ghosh, and R. Espinoza. When Should Public Debt Be Reduced? Washington, DC, USA: International Monetary Fund, 2015. [Google Scholar]

- H. Rito, T. Vaicekauskas, and A. Lakstutiene. “The effect of public debt and other determinants on the economic growth of selected European countries.” Econ. Manag. 17 (2012): 914–921. [Google Scholar]

- K. Kellerman. “Debt financing of public investment: On a popular misinterpretation of “the golden rule of public sector borrowing”.” Eur. J. Political Econ. 23 (2007): 1088–1104. [Google Scholar] [CrossRef]

- R. Ramírez, and A. Erquizio. “Análisis del ciclo político electoral a partir de variables de gasto público por entidad federativa en México, 1993–2009.” Paradig. Econ. 4 (2012): 5–27. [Google Scholar]

- C. Gámez, and A. Ibarra-Yúñez. “El ciclo político oportunista y el gasto de los estados mexicanos.” Gest. Política Pública 18 (2009): 39–65. [Google Scholar]

- M. Sánchez. “Endeudamiento y ciclo político-presupuestario: Aplicación a los municipios asturianos.” Presup. Gasto Público 65 (2011): 75–96. [Google Scholar]

- W. Romp, and J. de Haan. “Public capital and economic growth: A critical survey.” Perspektiven der Wirtschatftspolitik 8 (2007): 6–52. [Google Scholar] [CrossRef]

- I. Sánchez-Juárez, and R. García. “Producción, empleo e inversión pública en la frontera norte de México.” Rev. Int. Adm. Finanz. 7 (2014): 111–126. [Google Scholar]

- R. Castillo, and E. García. “El impacto de la deuda externa pública sobre la inversión privada en México: Un análisis de cointegración.” Estudios Front. 8 (2007): 99–119. [Google Scholar]

- A. Shrithongrung, and K. Kriz. “The impact of subnational fiscal policies on economic growth: A dynamic analysis approach.” J. Policy Anal. Manag. 33 (2014): 912–928. [Google Scholar]

- G. Boris. “Implications of public debt on economic growth and development.” A European perspective. IEB Int. J. Finance 9 (2014): 42–61. [Google Scholar]

- M. Arellano, and S. Bond. “Some tests of specification for panel data: Monte-Carlo evidence and an application to employment equations.” Rev. Econ. Stud. 58 (1991): 277–297. [Google Scholar] [CrossRef]

- C. Baum, M. Schaffer, and S. Stillman. “Instrumental variables and GMM: Estimation and testing.” Stata J. 3 (2003): 1–31. [Google Scholar]

- E. Vivanco, and M. Solís. “Impacto del endeudamiento público estatal sobre la inversión productiva en México, 1993–2006.” Trimest. Fisc. 95 (2010): 299–327. [Google Scholar]

- M. Kinto. ¿Por Qué se Endeudan los Gobiernos Estatales en México? Ciudad de México, México: Algunas Consideraciones para la Reforma Constitucional y la Ley Reglamentaria en Materia de Responsabilidad Hacendaria, Centro de Estudios de las Finanzas Públicas, Premio Nacional de Finanzas Públicas, 2014. [Google Scholar]

| pob | pib | pibpc | ||||

| 1993 | 2012 | 1993 | 2012 | 1993 | 2012 | |

| Mean | 2,773,500 | 3,438,205 | 36,097,881 | 61,155,975 | 12,702 | 16,978 |

| Median | 2,097,378 | 2,617,777 | 20,538,029 | 35,798,136 | 11,029 | 15,658 |

| Max | 11,040,075 | 15,408,294 | 274,667,008 | 392,208,211 | 32,386 | 44,305 |

| Min | 353,348 | 606,545 | 5,859,721 | 10,273,317 | 5826 | 7079 |

| SD | 2,400,337 | 2,990,185 | 49,756,805 | 74,779,241 | 6015 | 7740 |

| inver | corriente | ied | ||||

| 1993 | 2012 | 1993 | 2012 | 1993 | 2012 | |

| Mean | 289,534,124 | 463,443,058 | 924,820,677 | 2,194,580,746 | 477,076,067 | 1,231,759,769 |

| Median | 142,885,658 | 357,176,663 | 409,476,770 | 1,655,109,435 | 71,025,506 | 658,897,140 |

| Max | 2,355,390,500 | 1,871,759,340 | 8,332,723,300 | 7,284,889,015 | 9,622,367,375 | 15,231,373,178 |

| Min | 6,511,000 | 20,481,574 | 107,500,030 | 188,021,815 | 311,515 | −123,214,538 |

| SD | 441,885,358 | 407,973,457 | 1,564,591,466 | 2,005,536,099 | 1,690,156,048 | 2,682,549,554 |

| edu | deuda | |||||

| 1993 | 2012 | 1993 | 2012 | |||

| Mean | 6.60 | 8.81 | 571,193,750 | 2,306,647,763 | ||

| Median | 6.67 | 8.98 | 281,950,000 | 1,166,103,681 | ||

| Max | 9.02 | 10.70 | 2,728,500,000 | 9,978,480,210 | ||

| Min | 4.53 | 6.90 | 30,000,000 | 7,323,227 | ||

| SD | 0.98 | 0.83 | 751,271,880 | 2,581,294,466 | ||

| pibpc | inver | deuda | ||||

|---|---|---|---|---|---|---|

| 1 | Distrito Federal | 44,305 | México | 1,871,759,340 | Distrito Federal | 9,978,480,210 |

| 2 | Nuevo León | 33,511 | Oaxaca | 1,606,488,654 | Nuevo León | 7,971,556,605 |

| 3 | Coahuila | 25,877 | Sonora | 964,582,289 | Veracruz | 6,796,018,878 |

| 4 | Chihuahua | 24,202 | Veracruz | 855,378,661 | México | 6,779,103,510 |

| 5 | Sonora | 23,381 | Michoacán | 729,412,411 | Coahuila | 6,183,585,802 |

| 6 | Aguascalientes | 22,756 | Guerrero | 680,683,530 | Jalisco | 4,416,811,924 |

| 7 | Quintana Roo | 22,003 | Sinaloa | 658,709,015 | Chihuahua | 3,953,241,187 |

| 8 | Querétaro | 21,899 | Aguascalientes | 610,637,198 | Chiapas | 2,786,548,495 |

| 9 | Baja California Sur | 20,612 | Hidalgo | 536,518,065 | Michoacán | 2,636,318,344 |

| 10 | Baja California | 17,921 | Chiapas | 511,032,704 | Sonora | 2,564,623,536 |

| 11 | Tamaulipas | 17,902 | Quintana Roo | 487,578,853 | Quintana Roo | 2,547,775,085 |

| 12 | Colima | 17,729 | Nuevo León | 480,397,970 | Baja California | 2,166,729,727 |

| 13 | Jalisco | 16,979 | Puebla | 477,227,756 | Tamaulipas | 1,854,670,862 |

| 14 | Morelos | 16,607 | Coahuila | 466,006,690 | Puebla | 1,547,514,972 |

| 15 | Campeche | 16,352 | Distrito Federal | 458,659,939 | Guanajuato | 1,370,804,871 |

| 16 | Durango | 15,917 | Chihuahua | 384,517,647 | Sinaloa | 1,259,199,019 |

| 17 | San Luis Potosí | 15,400 | Baja California | 329,835,680 | Nayarit | 1,073,008,343 |

| 18 | Guanajuato | 14,581 | Tamaulipas | 277,287,654 | Oaxaca | 961,014,167 |

| 19 | Sinaloa | 14,565 | Tlaxcala | 239,480,925 | Zacatecas | 903,518,374 |

| 20 | Yucatán | 13,865 | Baja Cal. Sur | 216,073,411 | Tabasco | 818,970,244 |

| 21 | México | 13,814 | Colima | 214,802,735 | San Luis Potosí | 795,950,418 |

| 22 | Zacatecas | 13,352 | Durango | 214,617,022 | Durango | 723,864,222 |

| 23 | Puebla | 12,308 | Tabasco | 205,484,506 | Hidalgo | 618,475,714 |

| 24 | Tabasco | 11,678 | Zacatecas | 204,290,962 | Aguascalientes | 535,803,867 |

| 25 | Veracruz | 11,007 | Jalisco | 204,225,123 | Guerrero | 516,063,147 |

| 26 | Nayarit | 10,969 | Nayarit | 203,419,733 | Morelos | 487,440,279 |

| 27 | Michoacán | 10,671 | Campeche | 178,089,613 | Yucatán | 411,873,372 |

| 28 | Hidalgo | 10,582 | Querétaro | 174,950,555 | Colima | 363,108,415 |

| 29 | Guerrero | 9139 | Guanajuato | 165,388,813 | Querétaro | 307,477,831 |

| 30 | Tlaxcala | 8716 | San Luis Potosí | 145,678,244 | Baja California Sur | 286,527,363 |

| 31 | Oaxaca | 7620 | Morelos | 56,480,582 | Campeche | 189,326,409 |

| 32 | Chiapas | 7079 | Yucatán | 20,481,574 | Tlaxcala | 7,323,227 |

| Independent Variables | Dependent Variable pibpc | Independent Variables | Dependent Variable logpibpc |

|---|---|---|---|

| pibpc(−1) | 0.824900 * | logpibpc(−1) | 0.750674 * |

| (54.85) | (39.50) | ||

| inver(−3) | 2.78 × 10−7 * | loginver(−3) | 0.000380 |

| (5.11) | (0.364) | ||

| edu | 73.01667 ** | logedu | 0.211917 * |

| (2.01) | (7.50) | ||

| ied | −2.42 × 10−8 * | logied | 0.000227 |

| (−5.20) | (0.942) | ||

| deuda | 1.54 × 10−7 * | logdeuda(−1) | 0.001533 * |

| (3.75) | (2.65) | ||

| J-statistic | 30.5066 | J-statistic | 38.97 |

| Probability | 0.339415 | Probability | 0.081389 |

| Instruments | @DYN(pibpc,−2) inver(−3) edu ied deuda | Instruments | @DYN(logpibpc,−2) loginver logedu logied logdeuda |

| Independent Variables | Dependent Variable inver | Independent Variables | Dependent Variable loginver |

|---|---|---|---|

| inver(−1) | 0.528249 * | loginver(−1) | 0.438549 * |

| (376.32) | (7.37) | ||

| corriente | 0.049889 * | logcorriente | −0.012266 |

| (30.98) | (−0.09) | ||

| pob | 191.3417 * | logpob | 3.418949 * |

| (23.94) | (5.45) | ||

| ied | 0.006541 * | logied | −0.006209 |

| (65.62) | (−1.12) | ||

| deuda | −0.059481 * | logdeuda(−2) | 0.002043 |

| (−35.28) | (0.21) | ||

| J-statistic | 30.08 | J-statistic | 19.77 |

| Probability | 0.359115 | Probability | 0.839896 |

| Instruments | @DYN(inver,−2) corriente pob ied deuda | Instruments | @DYN(loginver,−2) logcorriente logpob logied logdeuda(−2) |

| Independent Variables | Dependent Variable pibpc | Independent Variables | Dependent Variable logpibpc |

|---|---|---|---|

| pibpc(−1) | 0.830284 * | logpibpc(−1) | 0.750485 * |

| (167.05) | (532.6) | ||

| edu | 422.8647 * | logedu | 0.219623 * |

| (18.33) | (43.10) | ||

| ied(−1) | −3.49 × 10−8 * | logied | 0.000306 * |

| (−10.54) | (2.81) | ||

| inver*deuda | 4.91 × 10−17 * | loginver*logdeuda(−3) | 5.08 × 10−5 * |

| (4.53) | (3.15) | ||

| J-statistic | 30.68 | J-statistic | 38.41 |

| Probability | 0.331425 | Probability | 0.139409 |

| Instruments | @DYN(pibpc,−2) edu ied(−1) inver*deuda | Instruments | @DYN(logpibpc,−2) logedu logied loginver*logdeuda(−3) |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sánchez-Juárez, I.; García-Almada, R. Public Debt, Public Investment and Economic Growth in Mexico. Int. J. Financial Stud. 2016, 4, 6. https://doi.org/10.3390/ijfs4020006

Sánchez-Juárez I, García-Almada R. Public Debt, Public Investment and Economic Growth in Mexico. International Journal of Financial Studies. 2016; 4(2):6. https://doi.org/10.3390/ijfs4020006

Chicago/Turabian StyleSánchez-Juárez, Isaac, and Rosa García-Almada. 2016. "Public Debt, Public Investment and Economic Growth in Mexico" International Journal of Financial Studies 4, no. 2: 6. https://doi.org/10.3390/ijfs4020006