1. Introduction

The Socio Emotional Wealth perspective (SEW) (Gomez-Mejia

et al. [

1]) represents an emerging stream of family business literature that aims to explain why family controlled firms engage in behavioral activities that place emphasis on the attainment of non-economic goals over the economic ones. Studies that have explored theoretical explanations (e.g., Berrone

et al. [

2]) and provided empirical results (e.g., Berrone

et al. [

3]; Gomez-Mejia

et al. [

4]; Naldi

et al. [

5]) argue that the preservation of socio emotional endowments separate the governance of family controlled firms from those who are run by professional managers or have their ownership dispersed without a dominant coalition aligned with particular kinship ties. Although the incidence of family controlled firms tends to dominate different industries worldwide (Morck and Young [

6]; La Porta

et al. [

7]), the economic implications of preserving socio emotional endowments to satisfy non-economic aspirations may affect stakeholders who are just looking to satisfy their own economic goals by acting as passive investors while seeking to attain their non-economic goals in other domains (Chrisman

et al. [

8]; Kellermanns

et al. [

9]; Berrone

et al. [

10]). Put differently, SEW preservation may drive a family to pursue a “self-serving behavior” [

9] (p. 1179) that may even create liabilities when family members are in charge of running the firm (Naldi

et al. [

5]).

In the case of the Real Estate Investment Trusts (REITs), recent findings tend to call to attention that founder CEOs exert particular control over their boards, compromising their independence and effectiveness and in turn, REITs’ performance (Noguera [

11]). Even though REITs represent a particular investment vehicle that must pay significant dividends out to their shareholders and are believed to have strong corporate governance practices, many are still under the control of their founders or their founders’ families (Ghosh

et al. [

12]; Noguera [

11]). Particularly, a typical REIT is created from a family owning some valuable real estate properties. Subsequently, the REIT status is acquired as a growth strategy by the family who will later decide to list it in a stock exchange as a potential exit strategy for the family or as an investment vehicle that becomes available to other investors. Furthermore, the founding family not only reaps the benefit of making hard assets become liquid but also retains managerial control over the properties. As a result, it is reasonable to expect performance variances when founders and their family are capable of controlling and governing the REIT even with the presence of outsiders in the board of directors to comply with current regulations (Coates [

13]; Duchin

et al. [

14]; Valenti [

15]).

Our purpose in this paper is to engage in exploratory analysis of the most recent results in the REIT industry and provide some explanations that are rooted in the SEW perspective. We consider that the family plays an important role in the REIT industry in at least two aspects. First, we argue that REITs founders will focus more on preserving their socio emotional endowment on behalf of the family than on satisfying the performance demands of their primary stakeholders (in this case, their own REIT investors). Second, the founder’s preference for choosing direct descendants to become the next REIT CEO and even chair of the board of directors implies the attainment of non-economic goals that may affect the REIT performance. In that regard, our arguments imply that the corporate governance mechanisms that pertain to REITs do not diverge significantly from those found in other industries where family-controlled firms provide a particular and unique approach to other types of organizational forms (Carney [

16]; La Porta

et al. [

7]; Morck and Young [

6]). To test our contentions, we engage in a series of exploratory analysis with an average sample of 66 publicly-traded equity REITs for the 1999–2012 period that resulted in 921 REIT-year observations.

Our results offer support to our theoretical developments and provide an initial understanding for why certain REITs led by direct descendants of the founders underperform other REITs led by either professional managers after succeeding the REIT founder or REITs led by their founders. Moreover, our results show evidence about the positive impact on performance when the founder uses the family name to identify the REIT. In addition, we encountered that family name and the presence of a successor moderate the relationship between ownership and control of the dominant family and performance. As a result, our empirical evidence supports our contention about the prevalence of non-economic goals in an industry that is heavily regulated (e.g., Internal Revenue Services [

17]) and expected to perform above the average market returns for its investors. In that manner, our study provides a useful contribution that goes beyond the domain of the family business literature but also as an initial explanation to enhance the investigation of the dynamics surrounding REIT governance, management, and performance.

In the remainder of the paper, we proceed as follows. First, we develop our theoretical framework to set our hypotheses. Second, we provide our methodology and data analysis. Third, we present and discuss our empirical results. Fourth, we conclude with future directions for research and managerial implications.

2. Theory and Hypotheses

In their seminal piece about Spanish olive oil mills, Gomez-Mejia

et al. [

4] started to study the utilities that family owners attain from non-economic aspects to develop SEW or affective endowments that preserve the long run operation of the firms. These authors built behavioral agency models (Wiseman and Gomez-Mejia [

18]) to argue that family owners will set a frame of reference in the management of the firm regardless of potential economic gains or losses. In their view, the attainment of non-economic goals such as the preservation and/or enhancement of the family’s dominance in the firm sets them apart from other types of organizations where the lack of kinship ties becomes less relevant. In this situation, socio-emotional wealth can be considered as a unique feature for a family-controlled business because the dominant family-owner will exert a direct influence on everything that the firm does (Gomez-Mejia

et al. [

1]). In contrast, these authors argued, firms that lack certain levels of family influence will establish a clear separation in the relationship between the different stakeholders (e.g., owners, managers, employees) that can be considered transitory, economically-driven, or even individualistic. Put differently, the SEW enhances the interpretation of principal–principal or principal–agent conflicts emanating from the agency theory perspective (e.g., Gedajlovic

et al. [

19]; Gomez-Mejia

et al. [

1]; Wiseman and Gomez-Mejia [

18]) because family owners will sacrifice the economic performance of the firm to satisfy their own agenda. This represents a particular phenomenon that drives family firms to rely on stocks of family influence where a self-serving behavior may evolve for focusing on particularistic aspects that will make them reach managerial decisions that do not occur in professional-managed entities so the needs of the controlling family are placed above those of other stakeholders (Kellermanns

et al. [

9]).

In an extended review, Berrone

et al. [

2] argue that SEW captures the owner’s desires for exerting the family influence, appointing family members, retaining a strong family identity, or even renewing the intentions for transgenerational succession. As a result, the SEW construct can be considered as a multi-dimensional one where Berrone

et al. [

2] (pp. 262–264) identified it using the acronym FIBER: Family influence and control, Identification of the family members with the firm, Binding social ties, Emotional attachment, and Renewal of family bonds to the firm through dynastic succession. According to Chrisman

et al. [

8], the concept of SEW is also linked to the attainment of non-economic goals by owners and managers because families can accumulate wealth (monetary and non-monetary) in the long run as their long-term orientation may allow them to navigate under short-term periods of uncertainty and environmental turbulence.

2.1. REITs and Family

REITs can be considered as new entrants in the financial services industry where funds are collected from investors (institutional and general public) to invest in real estate properties (“equity REITs”) and real estate mortgages or mortgage related securities (“mortgage REITs”). U.S. REITs were created by law in 1960 but really started to grow in the 1990s after the creation of UPREITs (a structure that provides tax deferral benefits and investment diversification to commercial property owners, who exchange ownership of appreciated property for operating partnerships units without immediate tax consequences) and a relaxation of the original rule by the IRS. This rule allowed equity REITs to select investment properties and manage their own assets, basically paving the way for more REITs to become internally rather than externally advised. In the US, REITs are highly regulated by the Securities and Exchange Commission (SEC) [

20] and in order to be tax exempted at the federal level, they are required to distribute as dividends at least 90% of their taxable income. In addition, REITs must have a board of directors (trustees), have a dispersed ownership structure where five or fewer individuals can own no more than 50% of the shares, invest at least 75% of its total assets in real estate, and derive 95% of its income from dividends, interests, and property income (US Securities and Exchange Commission [

20]; Internal Revenue Services [

17]). In that regard, one can assume that the separation of ownership and control provides a balanced situation as REIT shareholders will seek to reap economic benefits and deposit their trust in the REIT managers and directors in their exchanges.

However, outside of the market returns that these investment vehicles will bring to shareholders, the REIT control from founders may resemble the similar scenarios depicted by Carney [

16] who argued that family firms tend to be governed by personalism, particularism, and parsimony. Specifically, recent findings by Noguera [

11] showed evidence of entrenchment from founder CEOs who use their influence on the structure of REIT boards as they are less independent and those situations result in lower performance when compared against the performance of REITs managed by non-founders. This situation may even sound contradictory as the SEC has exerted market controls since 2002 through the Sarbanes-Oxley Act that requires independent board members to exert control mechanisms on behalf of shareholders (Coates [

13]). Consequently, it becomes an empirical question for determining the family effect on the performance of the REIT, and our key premise is that founders are seeking to preserve their socio-emotional endowments. Particularly, our central arguments are aligned with the intentionality of the founder to view the REIT as an extension of themselves and provide a sense of legacy to their family by way of non-economic goals before they can turn their attention to performance (e.g., Gedalojvic

et al. [

19]; Gomez-Mejia

et al. [

1]). In the next subsections, we use the SEW perspective to develop a set of our testable hypotheses. Particularly, we rely on three dimensions of the FIBER framework developed by Berrone

et al. [

2]: family influence and control; family identification; and renewal of family bonds to the firm through dynastic succession.

2.1.1. SEW Preservation and Performance

For preserving SEW, REIT founders may incur in different behaviors that ultimately affects REIT performance. The first one is related to the use of their own family name to identify the REIT. This is very critical for some REITs as they are new entrants in the industry, particularly, the ones trading in the stock exchanges, and need to position themselves in the minds of the general public. Dyer and Whettten [

21] argue that carrying the name of the family provides a close link between the family and the firm with the desire of the owner to retain family control inside the firm (Astrachan

et al. [

22]). In their FIBER acronym, Berrone

et al. [

2] explain that the family identity placed on the company name signals to internal and external stakeholders that the family is viewing the firm as an extension of the family domain. Deephouse and Jaskiewicz [

23] argue that family members are more invested in the family firm when the family name is part of the business. Particularly, there is a perception held by the family members toward enhancing the reputation of the business and giving a positive image to external stakeholders. In that manner, when REIT founders chose to use their names to identify the REIT, they are selling the notion to the general public of the good reputation of the family, its image, or even the notion of transcending over the long term (Gomez-Mejia

et al. [

1]).

However, using the family name for identifying the REIT cannot only be signaled towards SEW preservation as it creates a hurdle for founders and their directors to perform. For achieving long term stability and survival, the family will also require achieving financial performance thresholds; otherwise, the survival of the REIT will be at stake and the welfare of the family may also be compromised (Gedajlovic

et al. [

19]; Chrisman

et al. [

8]). In that regard, it is expected that attaching the founder’s last name as part of enhancing SEW to the REIT will positively affect performance. Consequently:

The second behavior is related to the willingness of the REIT founder to designate a family descendant as successor. From the FIBER acronym, this event represents a renewal by the family to continue its dominance in the firm (Berrone

et al. [

2]). As succession is a central element for characterizing a family firm (Chrisman

et al. [

24]; De Massis

et al. [

25]), designating a family member to become CEO and even Chairman of the REIT implies a commitment to retaining family influence or even meeting particular non-economic goals that satisfy the founder and the family’s wishes. Gomez-Mejia

et al. [

1] argue intra-family succession is a fundamental driver for enhancing and preserving SEW as control remains within the family. Especially in the long run, the transfer of the baton to the next generation ensures the family influence and maintains the family identity and reputation (Zellwegger

et al. [

26]). Furthermore, family succession is highly desirable even though the incoming family member may not be the most qualified individual for the position (Cruz

et al. [

27]; De Massis

et al. [

25]). Henceforth, REIT founders count as part of their SEW endowment the future benefits of control by appointing a family successor.

However, SEW preservation in terms of intergenerational succession may imply that appointing family members to lead the REIT will be negatively related to performance. Given the founder’s intentions toward preserving SEW; Gomez-Mejia

et al. [

1] argue that such event seeks to create a dynastic succession in the firm where the controlling family is willing to incur an economic cost by pursuing a family candidate. Even though, Jaskiewics and Luchak [

28] considered the notion that appointing a non-family CEO is not going to seriously affect the SEW preservation of the family coalition, there is an image and a family commitment toward the CEO position (Berrone

et al. [

2]) that can be consistent with the identification of the family with the business in the long run. In general terms, empirical findings have shown that there is a negative market reaction to family-CEO appointments (Bennedsen

et al. [

29]; Villalonga and Amit [

30]). Particularly, one can argue that these results are potential outcomes of principal–principal or principal–agent conflicts that are framed under the agency theory perspective (e.g., Gedajlovic

et al. [

18]) or that owners may exert a stewardship behavior to benefit their offspring as they may consider them to be aligned with the family regardless of their qualifications (e.g., Chrisman

et al. [

31]).

1 Even more, Naldi

et al. [

5] argue that a family CEO is a liability in terms of stock market situations because of the greater difficulty in balancing stakeholders’ demands and implementing firm strategies. It can be also understood that a founder CEO will transfer the power to a descendant to perpetuate the family control and influence over the REIT even if this is not in the best economic interest of the firm (Miller

et al. [

32]).

Furthermore, passing the baton to the next generation rather than designating an incoming CEO in terms of professional experience or even competence and knowledge may also result in performance variations (e.g., Chrisman

et al. [

8]). For example, incoming CEOs with no kinship ties to the founders will behave as agents to work on behalf of the REIT shareholders as their level of compensation may be tied to the REIT performance. In contrast, successors taking the CEO position may tie their level of compensation outside of the economic performance as founders seek to maintain first the family influence and expect a sense of stewardship and altruism emanating from such a succession process (e.g., Gedajlovic

et al. [

19]; Hall and Nordqvist [

33]). Furthermore, the CEO–Chairman duality tends to be used as a proxy for determining a stewardship characteristic in a family firm although the SEW perspective may also consider this situation as a direct effect of preserving SEW (e.g., Gomez-Mejia

et al. [

1]. In fact, Memili

et al. [

34] provided evidence that family owners are less reluctant to award compensation packages to non-family managers vis-à-vis family managers so a professional CEO (e.g., non-family) will seek to maximize shareholders’ value to enhance the prospects of keeping his/her position in the REIT. Consequently, the presence of successors in CEO positions may negatively affect REIT performance and their designation may result in lower performance when compared to REITs that are professionally managed or that are still led by the founder. Thus, our next hypotheses imply that:

Hypothesis 2a: REIT founders preserve their SEW by designating a family member as the REIT CEO and this succession decision is negatively related to REIT performance.

Hypotheses 2b: REITs whose CEOs are descendants of the founder will underperform versus (1) those REITs whose CEOs have no family ties to the founder or (2) those that are still run by the REIT founder.

2.1.2. Moderating Effects in Ownership and Control

Our first set of hypotheses implies the contrasting relationships between SEW preservation and performance in terms of two FIBER dimensions: identification and succession (e.g., Berrone

et al. [

2]). We consider that these effects are not isolated from family power dynamics if we incorporate a third FIBER dimension: family influence and control. In that regard, we move a step forward from Berrone

et al. [

2] SEW conceptualization by stating that identification and succession will moderate the relationship between (a) family influence and control and (b) performance. Naldi

et al. [

5] argue that family ownership in a firm represents one way for preserving SEW because the family may also hold a significant proportion of voting power toward strategic decisions. Sometimes, such strategic decisions like engaging in transferring power to family successors may come at the expense of non-family shareholders (Morck and Young [

6]). Even the potential controls exerted by independent directors may be diminished because the ownership concentration by the founder or his/her descendants may give the family unrestricted power (Jones

et al. [

35]). Even in general terms, outsiders are a minority in family firms’ boards (Gersick

et al. [

36]) and oftentimes the CEO is also the chairperson of the board (Voordeckers

et al. [

37]). Especially, before the Sarbanex-Oxley Act, about one-third of the largest publicly traded companies in the U.S. where founding families exerted control of about 20% of board seats (Shleiffer and Vishny [

38]). Noguera [

39] found that after the Sarbanes-Oxley Act, a higher number of outside directors are sitting on REIT boards and fewer CEOs chair their boards, the latter because of SOX. However, her 2014 study [

11] still found a significant prevalence of REITs founders who are not only the CEO but also the Chair of the board. Similar situations have been reported in other large companies that may question the effectiveness of independent directors (e.g., Duchin

et al. [

14]; Valenti [

15]) due to the passing of the act. Furthermore, as the family controlling the REIT via the founder’s successor, it is possible that the existence of outside directors may also be used to comply with regulations. However, as the board is chaired by a family member or even the ownership lies also in the family, there is an explicit indication about the influence from the family over the main strategic directions that the REIT may take.

As a result, we foresee that founders’ SEW preservation moderates the relationship between ownership and control and REIT performance. Particularly, the REIT founder exerted a direct influence by naming the REIT after the family and designating a family member to become the next CEO. Hence, we formalize our hypotheses in this manner:

Hypotheses 3a: The relationship between ownership and REIT performance is negatively moderated by the presence of a founder’s successor as CEO.

Hypotheses 3b: The relationship between control and REIT performance is negatively moderated by the presence of a founder’s successor as CEO.

Hypotheses 4a: The relationship between ownership and REIT performance is positively moderated by the founder’s use of the family name.

Hypotheses 4b: The relationship between control and REIT performance is positively moderated by the founder’s use of the family name.

4. Results

Table 3 and

Table 4 present the descriptive statistics and correlations of the variables that we used in our regression analysis before the independent variables were centered to create the interactions. The average REIT in the sample has a market capitalization of $6.5 billion, has been around for 14 years, has 71% of outsiders in the board of directors, a 43.81% leverage ratio, and 4.61% return on assets. In addition, CEOs own on average 5.66% of the REIT and 51% are also the chairman of the board. The highest bi-variate correlations (

p < 0.001) occurred between Firm Size (Ln) and Firm Age (Ln) (−0.37); CEO Ownership and Family Name (0.33).

Table 5 provides means and medians of 10 variables from a panel of two CEO groups: (a) Family successor as CEO and (b) Non-family CEO. The table provides evidence that REITs led by successor CEOs are newer but bigger, and with higher leverage as in the case of founder CEOs (Ghosh

et al. [

12]). The successor CEO himself is younger, but with longer tenure and higher share ownership in newer REITs, compared to his counterparts. Unlike the case for founder CEOs (e.g., Noguera [

11]), CEO–chairman duality is not prevalent for the case of successors as the difference in means is not statistically significant. However, there is still evidence of successors’ power over their boards as the successors coexist with a bigger board but are not as independent (as measured by a lower percentage of outsiders sitting on those boards) as in the case of REITs whose CEO has no ties with a family coalition.

Table 3.

Descriptive Statistics.

Table 3.

Descriptive Statistics.

| Descriptive Statistics | Number | Mean | SD | Min | Max |

|---|

| Firm Age (Ln) | 921 | 2.62 | 0.66 | 0.00 | 3.99 |

| Firm Size (Ln) | 921 | 22.60 | 1.42 | 18.57 | 26.28 |

| Debt to Asset Ratio % | 921 | 43.81 | 21.07 | 0.00 | 1.04 |

| Outside Directors % | 921 | 71.00 | 11.49 | 37.50 | 93.33 |

| CEO Ownership % | 921 | 5.66 | 10.03 | 0.00 | 79.13 |

| CEO Chairman | 921 | 0.51 | 0.50 | 0.00 | 1.00 |

| Family Successor as CEO | 921 | 0.11 | 0.31 | 0.00 | 1.00 |

| Family Name | 921 | 0.13 | 0.33 | 0.00 | 1.00 |

| Return on Assets | 921 | 4.61 | 5.00 | −58.11 | 45.83 |

Table 4.

Correlations Matrix.

Table 4.

Correlations Matrix.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|

| 1. Firm Age (Ln) | 1.00 | | | | | | | | | | | | | | | |

| 2. Firm Size (Ln) | −0.37 | *** | 1.00 | | | | | | | | | | | | | |

| 3. Debt to Asset Ratio | −0.23 | *** | 0.17 | *** | 1.00 | | | | | | | | | | | |

| 4. Outside Directors | 0.14 | *** | 0.05 | | −0.19 | *** | 1.00 | | | | | | | | | |

| 5. CEO Ownership | 0.01 | | −0.10 | ** | 0.24 | *** | −0.19 | *** | 1.00 | | | | | | | |

| 6. CEO Chairman | −0.02 | | −0.01 | | 0.09 | ** | −0.03 | | 0.32 | *** | 1.00 | | | | | |

| 7. Family Successors as CEO | −0.08 | ** | 0.03 | | 0.01 | | −0.04 | | −0.06 | | −0.09 | ** | 1.00 | | | |

| 8. Family Name | −0.06 | + | −0.11 | *** | 0.16 | *** | −0.04 | | 0.33 | *** | 0.14 | *** | 0.19 | *** | 1.00 | |

| 9. Return on Assets | 0.13 | *** | −0.16 | *** | −0.21 | *** | −0.02 | | −0.05 | | −0.04 | | −0.07 | * | 0.12 | *** |

Table 5.

Descriptive Statistics Given CEO Profile.

Table 5.

Descriptive Statistics Given CEO Profile.

| Variable | Family Successor as CEO | Non-family CEO | |

|---|

| N = 98 | N = 465 | |

|---|

| Mean | Median | Mean | Median | p-value |

|---|

| Firm Size (Ln) | 22.74 | 22.37 | 22.59 | 22.63 | |

| Debt to Asset Ratio % | 44.15 | 48.77 | 40.48 | 45.11 | + |

| Firm Age (Ln) | 2.47 | 2.48 | 2.79 | 2.83 | *** |

| CEO Age | 50.05 | 50.00 | 53.19 | 53.00 | *** |

| CEO tenure | 8.26 | 8.00 | 6.98 | 6.00 | * |

| CEO Ownership % | 4.20 | 2.61 | 2.97 | 0.92 | * |

| Board Size | 9.00 | 9.00 | 8.55 | 8.00 | * |

| Outside Directors % | 69.78 | 70.71 | 72.72 | 75.00 | ** |

| CEO chair | 0.38 | 0.00 | 0.31 | 0.00 | |

| Return on Assets % | 3.63 | 3.74 | 4.96 | 4.64 | * |

Table 6 presents the results of the regression models used to test the hypotheses. Model 1 entered the set of control and independent variables. Models 2–5 included one interaction effect. Model 6 includes all the variables and the interactions. The adjusted R

2 of the models ranged from 0.07 in Model 1 to 0.10 in Model 6. The set of control variables has significant influence on performance at the 0.05 level or better. Firm Age (Ln) was positively related while Firm Size (Ln), Debt to Asset Ratio, and Outside Directors were negatively related to performance.

Model 1 provides evidence to support H1 and H2a as both the Family Name and the Family Successor as CEO are significant at the 0.05 level and in the hypothesized directions. In that manner, the model provides evidence of SEW preservation by the founder that influences REIT performance.

To test H2b, we ran a t-test for comparing the return on assets of REITs led by family successors and (1) non-family CEOs and (2) founders. The difference was significant (

p < 0.05) as the average performance was 3.63 for REITs with successors as CEOs and 4.73 for REITs with other types of CEOs. This analysis complements what has been presented in

Table 2 where the average performance for REITs with non-family CEOs is 4.96. Thus, we provide evidence that professionally managed REITs will attain a relatively higher performance than those with family control.

Table 6.

Regression Results using Return on Assets as Dependent Variable.

Table 6.

Regression Results using Return on Assets as Dependent Variable.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|

| Intercept | 15.01

(3.15) | *** | 15.02

(3.15) | *** | 13.80

(3.14) | *** | 14.85

(3.14) | *** | 14.30

(3.17) | *** | 12.39

(3.16) | *** |

| Firm Age (Ln) | 0.61

(0.27) | * | 0.63

(0.27) | * | 0.64

(0.26) | * | 0.57

(0.26) | * | 0.60

(0.27) | * | 0.61

(0.26) | * |

| Firm Size (Ln) | −0.30

(0.12) | * | −0.30

(0.12) | * | −0.27

(0.12) | * | −0.29

(0.12) | * | −0.27

(0.12) | * | −0.22

(0.12) | + |

| Debt to Asset Ratio | −4.72

(0.82) | *** | −4.72

(0.82) | *** | −4.69

(0.81) | *** | −4.65

(0.81) | *** | −4.81

(0.82) | *** | −4.76

(0.81) | *** |

| Outside Directors | −4.50

(1.44) | ** | −4.51

(1.44) | ** | −3.75

(1.45) | ** | −4.70

(1.44) | ** | −4.38

(1.44) | ** | −3.59

(1.45) | * |

| CEO Ownership (Own) | −0.11

(0.18) | | −0.05

(0.22) | | −0.12

(0.18) | | −0.25

(0.19) | + | −0.12

(0.18) | | −0.19

(0.22) | |

| CEO Chairman (Chair) | −0.18

(0.17) | | −0.18

(0.17) | | 0.17

(0.17) | | −0.16

(0.17) | | −0.15

(0.17) | | −0.10

(0.17) | |

| Family Successor as CEO (Successor) | −0.40

(0.16) | * | −0.37

(0.17) | * | −0.52

(0.17) | ** | −0.31

(0.17) | + | −0.31

(0.17) | + | −0.30

(0.18) | + |

| Family Name (Family) | 0.38

(0.18) | * | 0.39

(0.18) | * | 0.28

(0.18) | | 0.15

(0.20) | | 0.27

(0.19) | | −0.08

(0.20) | |

| Successor x Own | | | 0.20

(0.42) | | | | | | | | 0.29

(0.41) | |

| Successor x Chair | | | | | −0.62

(0.17) | *** | | | | | −0.78

(0.17) | *** |

| Family x Own | | | | | | | 0.35

(0.13) | ** | | | 0.29

(0.14) | * |

| Family x Chair | | | | | | | | | 0.33

(0.18) | + | 0.45

(0.14) | * |

| F-Value | 10.21 | *** | 9.09 | *** | 10.71 | *** | 9.93 | | 9.46 | *** | 9.36 | *** |

| R2 | 0.08 | | 0.08 | | 0.10 | | 0.09 | | 0.09 | | 0.11 | |

| Adjusted R2 | 0.07 | | 0.07 | | 0.09 | | 0.08 | | 0.08 | | 0.10 | |

| Change in Adjusted R2 | | | 0.00 | | 0.013 | *** | 0.006 | ** | 0.002 | + | 0.02 | *** |

Model 2 was used to test H3a and the hypothesis is not supported as the interaction of Family Successor as CEO and CEO Own is not significant. Model 3 was used to test H3b and the hypothesis is supported as the interaction of Family Successor as CEO and CEO Chair is negative and significant (p < 0.001). In addition, the adjusted R2 increased to 0.09 with a change of 0.013. Model 4 was used to test H4a and the hypothesis is supported as the interaction of Family Name and CEO Own is positive and significant (p < 0.01). In addition, the adjusted R2 increased to 0.08 with a change of 0.006. Model 5 was used to test H4b and the hypothesis is partially supported as the interaction of Family Name and CEO Chair is positive and marginally significant (p < 0.10). In addition, the adjusted R2 increased to 0.08 with a change of 0.002.

Model 6 is presented for completeness as the four interactions are entered with the set of controls and independent variables. The adjusted R2 increased to 0.10 with a change of 0.021. It provides support for H4b as the interaction of Family Name and CEO Chair is positive and significant (p < 0.05). The model also provides further support to H3b and H4a as the interactions effects were significant at the 0.05 level or better.

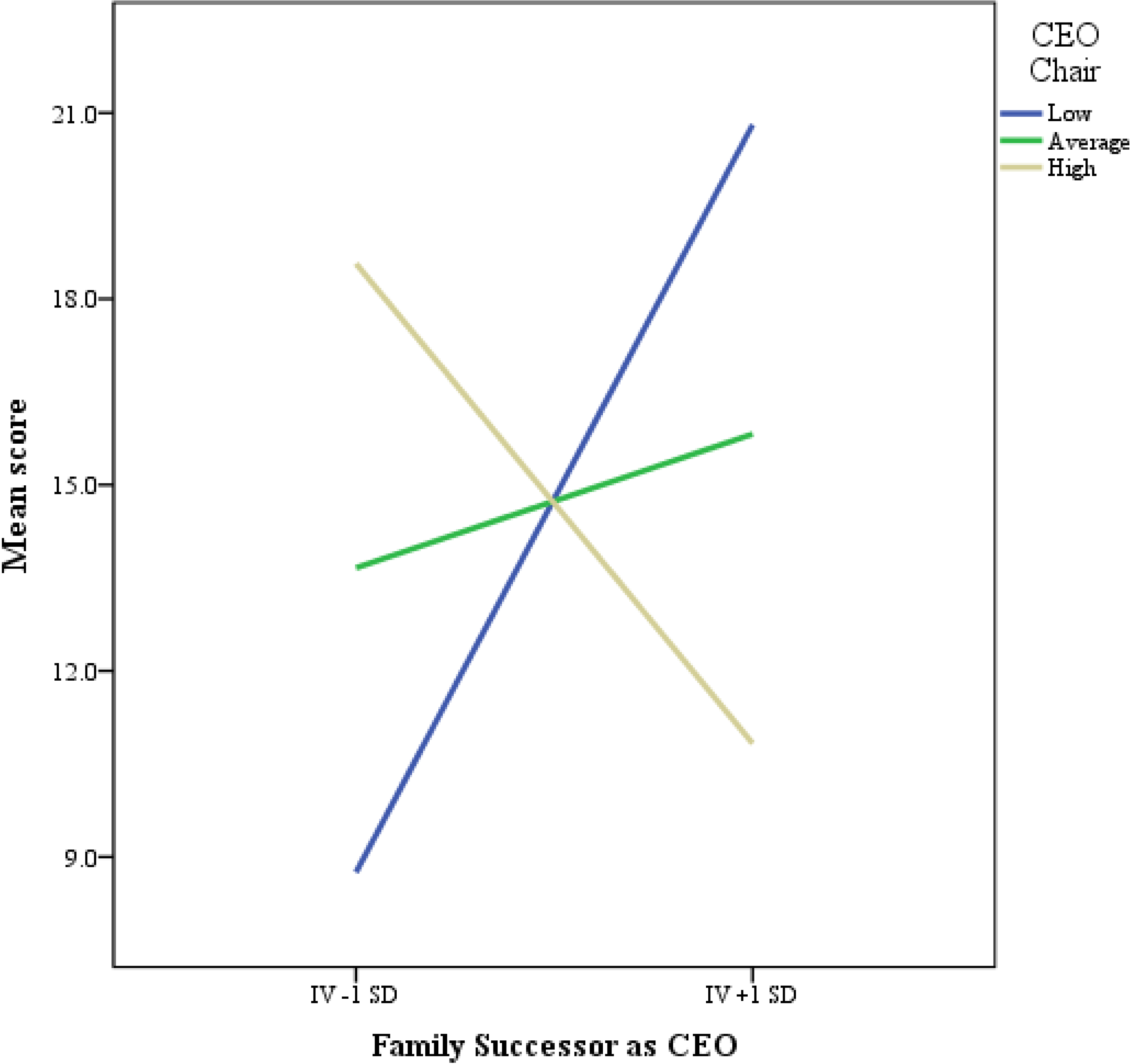

For further explanation of our results, we plotted the three significant moderations effects. We followed the procedure explained by Cohen and Cohen [

10] for plotting the interaction effects by setting high and low levels at +/−1 standard deviation.

Figure 1 plots the Family Successor as CEO and CEO Chair. It can be noted the negative slope in the high proportion of duality (CEO and Chair).

Figure 2 and

Figure 3 plot the Family Name and CEO Own and CEO Chair, respectively, where it can be noted the positive slopes in the high proportion of both moderators. Overall, our exploratory analysis provides empirical support for all of the hypotheses except H3a.

Figure 1.

Interaction Plot: Family Successor and CEO Chair.

Figure 1.

Interaction Plot: Family Successor and CEO Chair.

Figure 2.

Interaction Plot: Family Name and CEO Own.

Figure 2.

Interaction Plot: Family Name and CEO Own.

Figure 3.

Interaction Plot: Family Name and CEO Chair.

Figure 3.

Interaction Plot: Family Name and CEO Chair.

4.1. Robustness Tests

We engaged in a series of robustness tests to provide further support to our hypotheses. First, we used Tobin’s Q as a dependent variable. Tobin’s Q represents a typical measure of performance for REITs, available at Bloomberg. We re-ran the models discussed above and the overall results were consistent in terms of significant levels and hypothesized relationships. However, the main difference is the adjusted R2 of the models that ranged from 0.02–0.045 so we opted for not including the results in subsequent tables. Second, we created a new variable that included the family successors and the founder-CEO to re-run the regression models to assess, and the results did not differ. Third, we ran panel data analysis using a random effect model (a fixed effect model controlling for year effects will render no results for the founder status variable, since it is time invariant) with both Return on Assets and Tobin’s Q as dependent variables. We obtained mixed results in our hypothesized relationships. On one side, we attained a consistency in the signs of the coefficients as we described in our hypotheses. On the other side, we were unable to attain levels of significance (p < 0.10) for our hypotheses. The panel data results could only provide support for H1 as the family name was positively related to Tobin’s Q (p < 0.05) and the R2 of such model was 0.39.

5. Discussion and Conclusion

Our central argument developed in this paper considers that REIT founders aim to preserve SEW by using the family name to identify the REIT and designate family members to attain CEO or chair positions once they retire. Although their intentions create performance implications—positively for family name and negatively for intergenerational transfers of power—they are also exerting a moderation effect between ownership and control and REIT performance. Our theoretical developments relied on three of the five Berrone

et al. [

2] FIBER conceptualizations of SEW: family influence and control, family identification, and renewal of family bonds through succession. Particularly, we consider that these three dimensions may interact (e.g., family influence and control interacting with identification and renewal) rather than being treated as independent factors behind the main SEW construct. In fact, our empirical evidence provided support for such contention as family business researchers who have studied these dimensions outside of the SEW perspective have attained similar results (e.g., Gedalojvic

et al. [

19]).

Our empirical results from an average sample of 66 REITs that produced 921 year-observations confirm our hypothesized relationships. These are very interesting findings because of two reasons. On one hand, our results support the desires of the founder to use the family name as an intangible resource that can bring further recognition to external stakeholders (e.g., Berrone

et al. [

10] Deephouse and Jaskiewicz [

23]). On the other hand, the lower performance of REITs where the successor is the CEO implies that the founder may be benevolent and opt to pass the baton without paying attention to professionalizing the REIT (e.g., De Massis

et al. [

25]; Gedalojvic

et al. [

19]; Gomez-Mejia

et al. [

1]). In that manner, the family influence towards achieving non-economic goals (e.g., Chrisman

et al. [

8]) exerts a critical role in a commodity-like industry where the attainment of economic performance is critical for being competitive or even surviving in the long run. In addition, it is important to note the significant and negative relationship between outside directors and performance. Besides potential evidence of CEO entrenchment that may occur in rent-seeking family-controlled firms (Morck and Young [

6]), it is evident that CEOs exert higher levels of controls over the management of the REIT.

From our knowledge, this is the first integration of the family business domain within the REIT research stream. We consider this to be our first contribution to the literature as the SEW perspective is also present in this industry and family influence toward the management of a publicly-traded investment vehicle is exposed to identify performance variances. In that regard, we validate the claims made by Gomez-Mejia

et al. [

1] about the uniqueness of SEW to explain the phenomena towards seeking non-economic goals beyond the normal economic ones (e.g., Chrisman

et al. [

8]) that can be even extended to particular tax advantages attained by families whose asset diversification strategy may also be tied to the REIT market performance. Particularly, our measures tend to agree with three dimensions of the FIBER proposal suggested by Berrone

et al. [

2], not only in regards to the direct effects of identification and renewal but also the interaction effects of these two dimensions with family influence and control. Our second contribution is related to the ambivalence that SEW preservation may bring to REITs. Especially, the desires of REIT founders to pass the baton to the next generation diminish performance, which may affect the competitive position of the REIT among its direct rivals. Such a scenario provides empirical evidence to the arguments developed by Kellermanns

et al. [

9] about the dark side of SEW because the enhancement of the endowments of the family controlling the REIT may end up being considered as a liability in having a successor running the operations (e.g., Naldi

et al. [

5]) or discouraging non-family stakeholders to benefit from either the economic performance of the REIT (as investors) or having governance and management conflicts (as independent directors or managers). Even though Jaskiewicz and Luchak [

28] stated that non-family leaders may not be at conflict with the demands of the controlling family, we noticed that REIT performance is lower when successors of the founder become the next CEO. Particularly, this is a critical aspect if we consider the fact that publicly-traded REITs are subjected to competitive pressures or even analysts’ opinions. Even though the SEW preservation will keep the family control in the hands of the successor, having a continuous record of lower performance against non-family CEOs may call the attention of non-family shareholders who may even question the successor’s tenure. Furthermore, the reputation of the firm (or even the controlling family’s reputation) may be at stake if non-family shareholders become dissatisfied with the founder’s selection of the next CEO (e.g., Deephouse and Jaskiewicz [

23]). As a result, the potential benefits toward SEW preservation may end up endangering the market survival of the REIT in the long run.

We also need to address our limitations in this study. First, we consider our results to be exploratory in nature as we did not obtain full support of our contentions by using panel data analysis. Our regression results were very consistent and our data did not present evidence of multicollinearity among the variables; however, multicollinearity becomes a problem when one starts to run interactions. Although we relied on McGrath [

42] for testing one interaction at a time, once we introduced the four interactions, the levels of significance in the independent variables were altered. However, our robustness tests discussed earlier demonstrated a consistency in the results. Second, our data collection efforts focused on short-term performance so it can be argued that the family successors may require some tenure to really prove their qualifications for the position. Third, we encountered data collection problems that restricted our sample size so we considered situations where the founder is still controlling the REIT or just transferred the baton to either a descendant or to a professional manager. Fourth, we relied on naming the REIT after the founder as an objective proxy for identification without considering subjective elements within the REIT. For example, there is the possibility that a REIT founder may have used a symbol or another family-related event that could have led to an increase in the number of REITs identified as family.

Our methodological limitations provide opportunities for future investigation to enhance our understanding of family influence in the REIT sector. In addition, future investigation is needed to explore the effectiveness of having independent directors to govern the direction of the REIT. Particularly, outsiders can also enable a sense to respond to the economic demands of non-family shareholders or even comply with the Sarbanes-Oxley Act (Coates [

13]). A second extension for further investigation is to explore the other two components of the FIBER framework proposed by Berrone

et al. [

2]—emotional intelligence and binding social ties—as these may be used to enhance understanding of the strategic behavior of REIT founders and their intentions toward SEW preservation. Third, it is encouraged to investigate situations where older REITs may be facing a succession transfer to the third generation and analyze if SEW preservation was enough to maintain family dominance or market forces will require the REIT to involve outsiders (e.g., Gersick

et al. [

36]). Fourth, future investigations may want to use other performance measures such as CAPM adjusted or multi-factor adjusted one-year excess returns as a potential measure of risk and return.

2 This measure can be considered as an alternate explanation for determining the exposure of the family toward SEW preservation. These considerations may not only apply to the REIT industry but also to family firms operating in different industries and/or countries. Fifth, future investigations may also need to establish the potential implications of naming family successors in balancing the reputation of the firm in the long run. As suggested by Deephouse and Jaskiewicz [

23], stakeholders may have limits in accepting the non-economic goals of the family firm to support their SEW preservation; however, financial performance may remain a key element to determine the level of satisfaction with the family successor. Otherwise, the survival of the business will be at stake if the successor is unable to meet the market and stakeholder thresholds.

In terms of practical implications, our study can also be used for developing strict guidelines and policies toward succession. Especially, family descendants will need adequate training and rely on professionals and outsiders, not only for the family benefit in terms of economic and non-economic wealth preservation but also for the rest of the stakeholders. Furthermore, it is important that family firms that opt to become publicly traded recognize that attaining particular non-economic goals (e.g., reaping benefits from tax minimization due to lower market returns) may not satisfy the wealth maximization of non-family investors. In the case of REITs, our results implied that not only do successors underperform non-family ones, but also that independent board members are not exerting a positive influence on governing the REIT. Even though the family may be reaping benefits for keeping control in the family, the long-term image of the family may be at stake if there are not proper guidelines or incentives to have outsiders (e.g., non-kin related managers and directors) that may demotivate non-family shareholders to maximize their investment. Put differently, families may need to establish their limits before being subjected to shareholder activism and/or other market controls.

In conclusion, it is our hope that researchers can build on our conceptual and empirical developments as both family business and REIT literature are emerging streams that deserve attention in the future.