Research on Supply and Demand of Aged Services Resource Allocation in China: A System Dynamics Model

Abstract

:1. Introduction

2. Model Conceptualisation

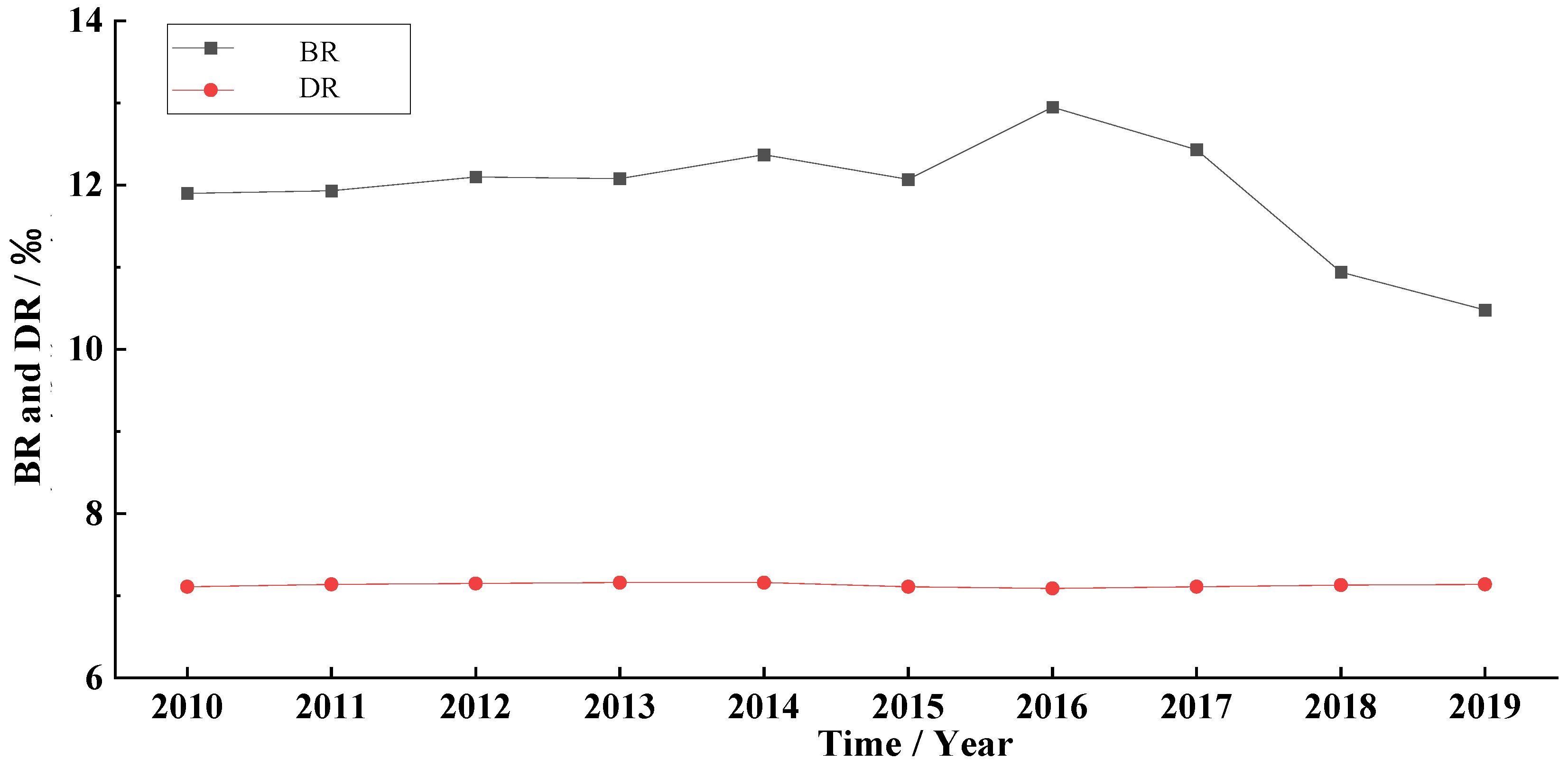

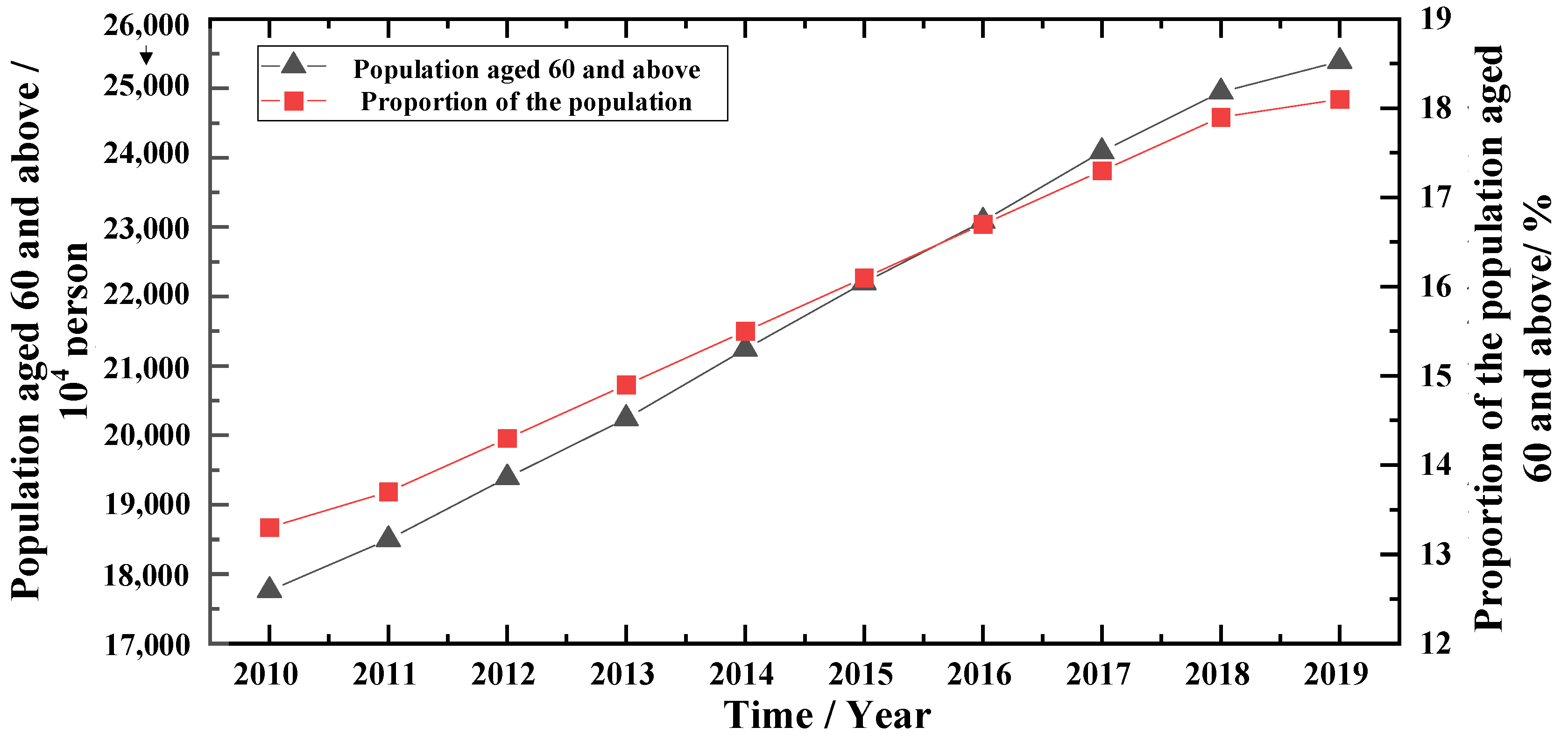

2.1. Subsystem of Population and Economy

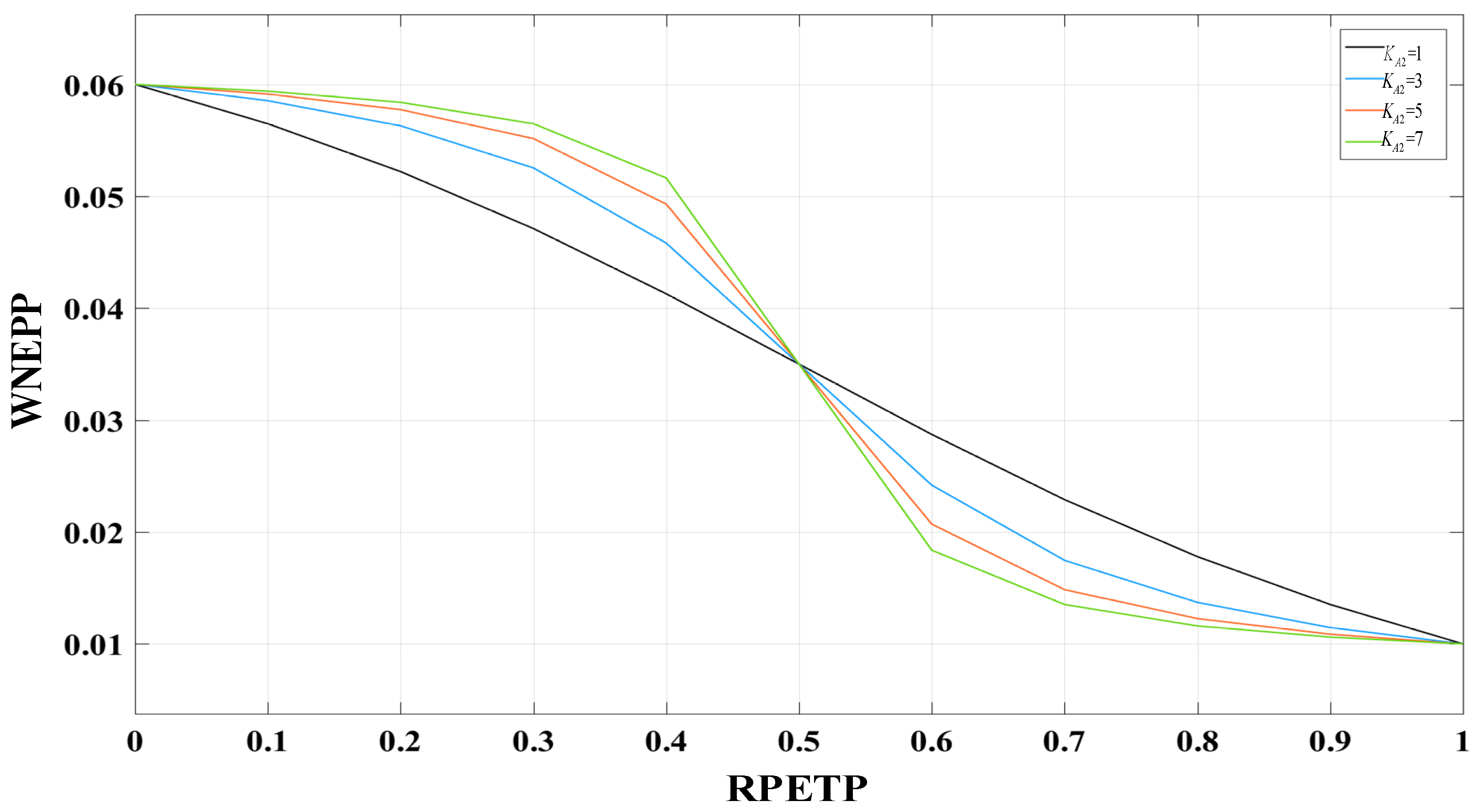

2.2. Subsystem of Aged Service Resource Demand

2.3. Subsystem of Aged Service Resource Supply

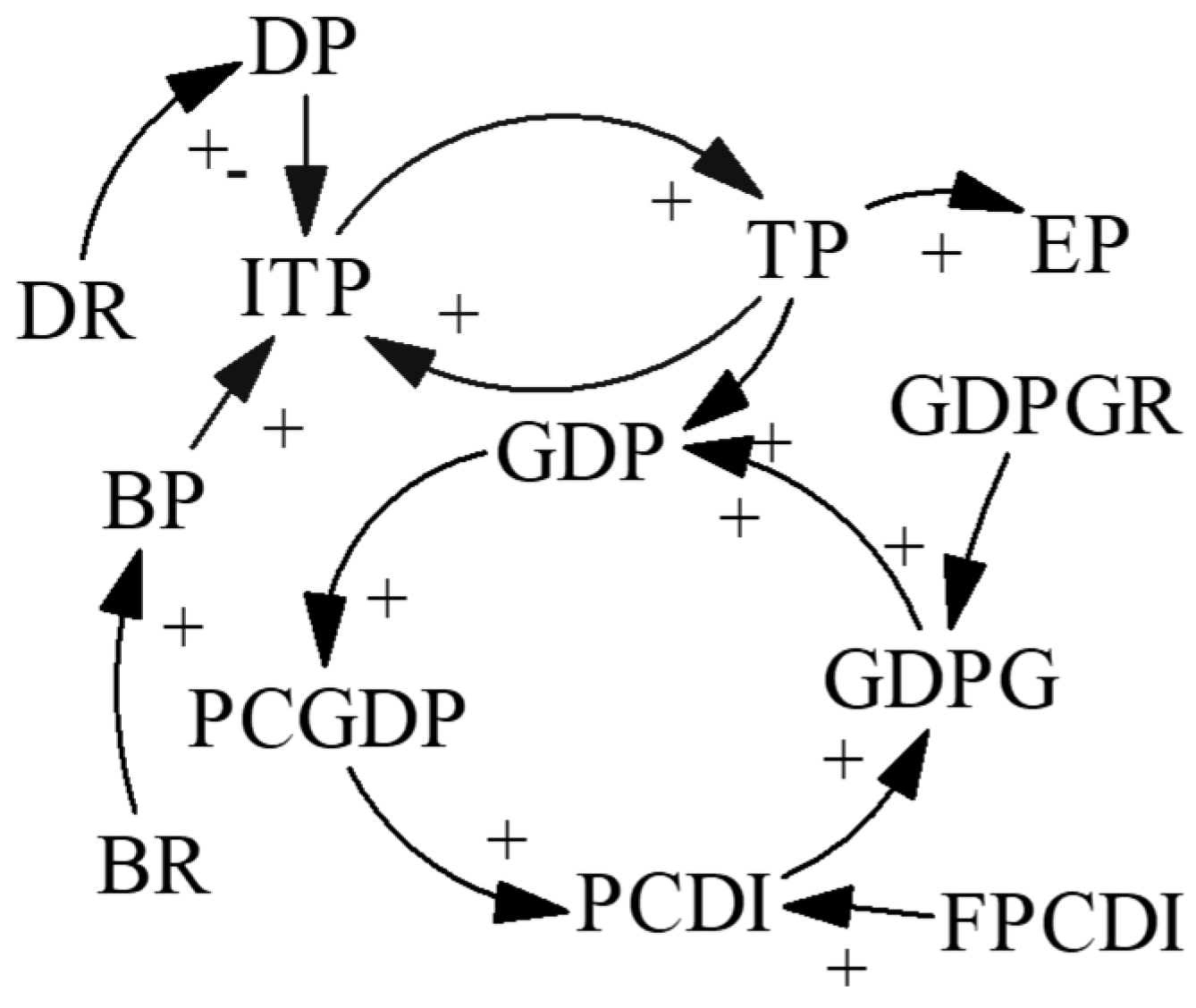

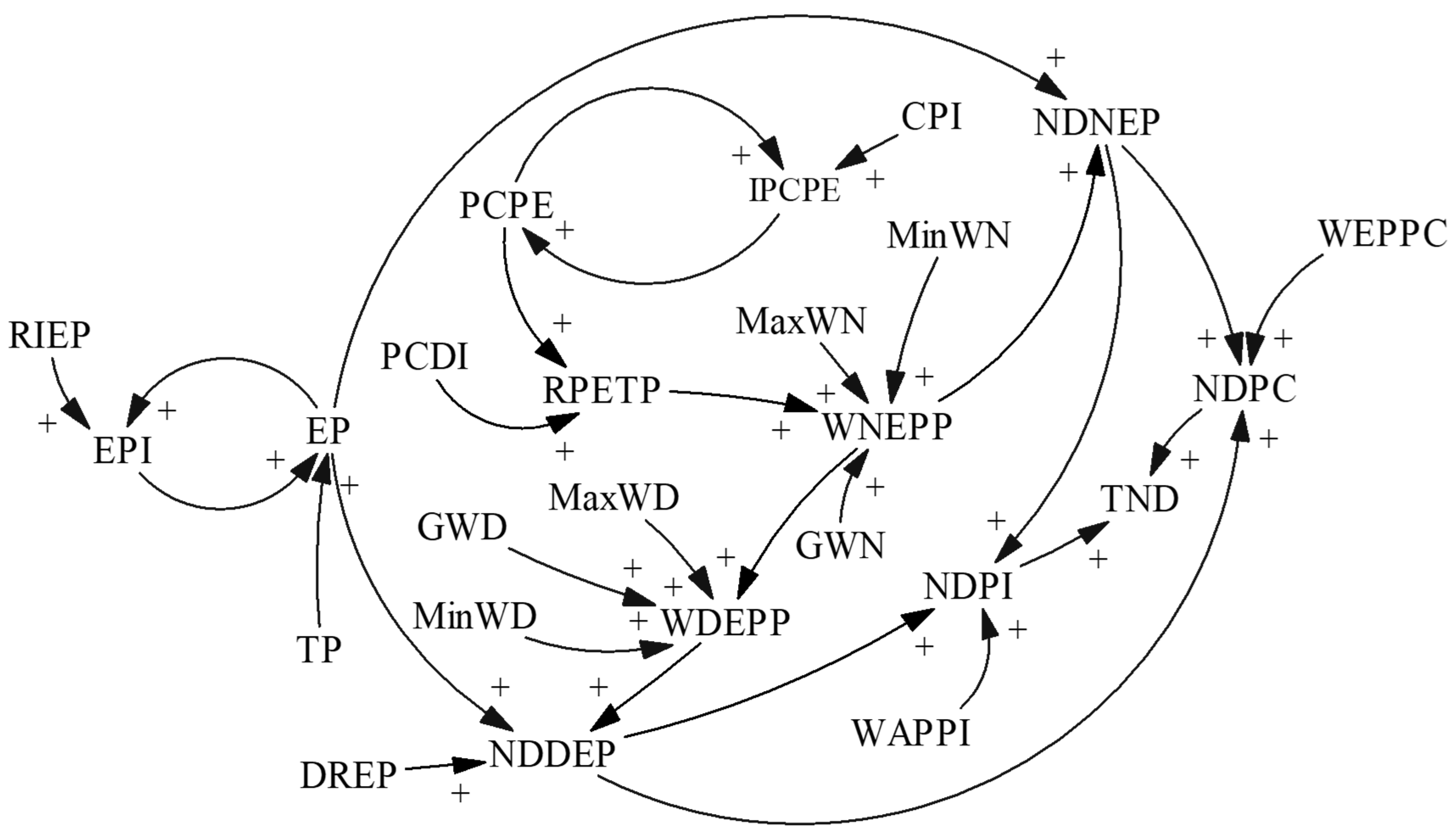

3. Causal Loops/Dynamic Hypothesis

3.1. System Boundary

3.2. Variable Definition

3.3. Dynamic Hypothesis

4. Simulation

4.1. Initial Parameter Values and Variable States

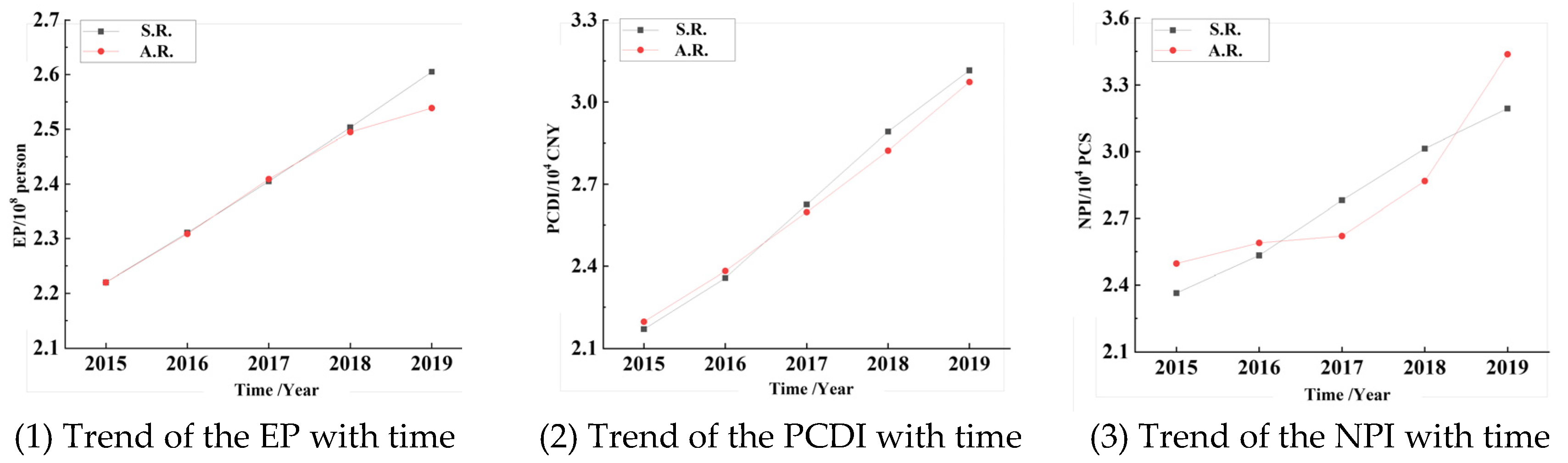

4.2. Model Validation

5. Results Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Number | Variable | Abbreviation | Attributes |

|---|---|---|---|

| 1 | Total Population | TP | State variable |

| 2 | Increase of Total Population | ITP | Auxiliary variable |

| 3 | Born Population | BP | Auxiliary variable |

| 4 | Death Population | DP | Auxiliary variable |

| 5 | Birth Rate | BR | Parameter variable |

| 6 | Death Rate | DR | Parameter variable |

| 7 | Gross Domestic Product | GDP | State variable |

| 8 | GDP Growth | GDPG | Auxiliary variable |

| 9 | GDP Growth Rate | GDPGR | Parameter variable |

| 10 | Per Capita GDP | PCGDP | Auxiliary variable |

| 11 | Per Capita Disposable Income | PCDI | Auxiliary variable |

| 12 | Factor of Per Capita Disposable Income | FPCDI | Parameter variable |

| Number | Variable | Abbreviation | Attributes |

|---|---|---|---|

| 1 | Elderly Population | EP | State variable |

| 2 | Elderly Population Increase | EPI | Auxiliary variable |

| 3 | Rate of Increase in Elderly Population | RIEP | Parameter variable |

| 4 | Per Capita Pension Expenditure | PCPE | State variable |

| 5 | Per Capita Pension Expenditure Increase | PCPEI | Auxiliary variable |

| 6 | Willingness of Disabled Elderly Population to Pay | WDEPP | Auxiliary variable |

| 7 | Max Willingness of Disabled Elderly Population to pay | MaxWD | Auxiliary variable |

| 8 | Min Willingness of Disabled Elderly Population to pay | MinWD | Parameter variable |

| 9 | Gain of Willingness of Disabled Elderly Population to pay | GWD | Auxiliary variable |

| 10 | Numbers of Demand of Disabled Elderly Population | NDDEP | Auxiliary variable |

| 11 | Willingness of Non-disabled Elderly Population to Pay | WNEPP | Auxiliary variable |

| 12 | Max Willingness of Non-disabled Elderly Population to pay | MaxWN | Parameter variable |

| 13 | Min Willingness of Non-disabled Elderly Population to pay | MinWN | Parameter variable |

| 14 | Gain of Willingness of Non-disabled Elderly Population to pay | GWN | Parameter variable |

| 15 | Numbers of Demand of the Non-disabled Elderly Population | NDNEP | Auxiliary variable |

| 16 | Ratio of Pension Expenditure To Per capita disposable income | RPETP | Auxiliary variable |

| 17 | Average of CPI | ACPI | Parameter variable |

| 18 | Disability Rate of Elderly Population | DREP | Parameter variable |

| 19 | Willingness of Elderly Population to participate in Pension Institutions | WAPPI | Auxiliary variable |

| 20 | Numbers of Demand of the Elderly Population to participate in Pension Institutions | NDPI | Auxiliary variable |

| 21 | Willingness of Elderly Population to participate in Pension Community | WEPPC | Auxiliary variable |

| 22 | Numbers of Demand of Elderly Population to participate in Pension Community | NDPC | Auxiliary variable |

| 23 | Total Numbers of Demand of Elderly Population to participate in both pension communities and pension institutions | TND | Auxiliary variable |

| Number | Variable | Abbreviation | Attributes |

|---|---|---|---|

| 1 | Total National Pension Expenditure | TNPE | State variable |

| 2 | Increase of National Pension Expenditure | INPE | Auxiliary variable |

| 3 | Increase Rate of National Pension Expenditure | IRNPE | Parameter variable |

| 4 | Total Pension Expenditure of Pension Institutions | TPEPI | Auxiliary variable |

| 5 | Total Pension Expenditure of Pension Communities | TPEPC | Auxiliary variable |

| 6 | Market Engagement of Pension Institutions | MEPI | Parameter variable |

| 7 | Weight Factor of Pension Expenditure for Pension Institutions | WFPEPI | Parameter variable |

| 8 | Market Engagement of Pension Communities | MEPC | Parameter variable |

| 9 | Weight Factor of Pension Expenditure for Pension Communities | WFPEPC | Parameter variable |

| 10 | Numbers of Pension Institutions | NPI | Auxiliary variable |

| 11 | Operating Subsidies of Pension Institutions | OSPI | State variable |

| 12 | Weight factor of Beds construction Subsidies of Pension Institutions | WBSPI | Parameter variable |

| 13 | Average Numbers of beds in Pension Institutions | ANPI | Parameter variable |

| 14 | Numbers of Supply of Elderly Population provided by Pension Institutions | NSPI | Auxiliary variable |

| 15 | Numbers of Pension Communities | NPC | Auxiliary variable |

| 16 | Operating Subsidies of Pension Communities | OSPC | State variable |

| 17 | Average Numbers of Elderly Population served by Pension Community | ANPC | Parameter variable |

| 18 | Numbers of Supply of Elderly Population provided by Pension Communities | NSPC | Auxiliary variable |

| 19 | Factor of OSPI and OSPC | FOO | Parameter variable |

| 20 | Total Numbers of Supply of Elderly Population provided by both pension institutions and pension community | TNS | Auxiliary variable |

| 21 | Total Ratio between Supply and Demand | TRSD | Output variable |

| 22 | Ratio between Supply and Demand of Pension Institutions | RSDPI | Output variable |

| 23 | Ratio between Supply and Demand of Pension Communities | RSDPC | Output variable |

Appendix B

Appendix B.1. State Space Variable Definition

Appendix B.2. Mathematical Model of State Equation

Appendix B.3. Mathematical Model of Output Equation

References

- Pond, A.M. Environmental health and the Elderly Population. Am. J. Public Health Nations Health 1950, 40, 27–33. [Google Scholar] [CrossRef] [Green Version]

- Sinestrari, E. Non-linear age-dependent population growth. J. Math. Biol. 1980, 9, 331–345. [Google Scholar] [CrossRef]

- Mico, J.C.; Soler, D.; Caselles, A. Age-Structured Human Population Dynamics. J. Math. Sociol. 2006, 30, 1–31. [Google Scholar] [CrossRef]

- Colchero, F.; Jones, O.R.; Conde, D.A.; Hodgson, D.; Zajitschek, F.; Schmidt, B.R.; Malo, A.F.; Alberts, S.C.; Becker, P.H.; Bouwhuis, S.; et al. The diversity of population responses to environmental change. Ecol. Lett. 2019, 22, 342–353. [Google Scholar] [CrossRef] [Green Version]

- Canudas, R.V.; Shen, T.; Payne, C.F. The Components of Change in Population Growth Rates. Demography 2022, 59, 417–431. [Google Scholar] [CrossRef]

- Yang, S.; Jiang, Q.; Sánchez-Barricarte, J.J. China’s fertility change: An analysis with multiple measures. Popul. Health Metr. 2022, 20, 12. [Google Scholar] [CrossRef]

- Han, Y.; Shen, T. Long-Term Care Insurance Pilot Programme in China: Policy Evaluation and Optimization Options-Taking the Pilot Programme in the Northeast of China as an Example. Int. J. Environ. Res. Public Health 2022, 19, 4298. [Google Scholar] [CrossRef]

- George, L.K.; Fillenbaum, G.G. OARS Methodology. J. Am. Geriatr. Soc. 1985, 33, 607–615. [Google Scholar] [CrossRef]

- Alders, P.; Schut, F.T. Trends in ageing and ageing-in-place and the future market for institutional care: Scenarios and policy implications. Health Econ. Policy Law 2019, 14, 82–100. [Google Scholar] [CrossRef] [Green Version]

- Haimi, M.; Gesser, E.A. Application and implementation of telehealth services designed for the elderly population during the COVID-19 pandemic: A systematic review. Health Inform. J. 2022, 28. [Google Scholar] [CrossRef]

- Tatsuya, N. Quantitative Properties of the Macro Supply and Demand Structure for Care Facilities for Elderly in Japan. Int. J. Environ. Res. Public Health 2017, 14, 1489. [Google Scholar]

- Reitinger, E.; Schuchter, P.; Heimerl, K.; Wegleitner, K. Palliative care culture in nursing homes: The relatives’ perspective. J. Res. Nurs. 2018, 23, 239–251. [Google Scholar] [PubMed]

- Kuo, C.L.; Wang, S.Y.; Tsai, C.H.; Pan, Y.F.; Chuang, Y.H. Nurses’ perceptions regarding providing psychological care for older residents in long-term care facilities: A qualitative study. Int. J. Older People Nurs. 2019, 14, 122–142. [Google Scholar] [CrossRef] [PubMed]

- Laura, W.M.; Paul, B.; Chris, M.; Ngaire, K. Met and unmet need for personal assistance among community-dwelling New Zealanders 75 years and over. Health Soc. Care Community 2014, 22, 317–327. [Google Scholar]

- Walsh, K.; Callan, A. Perceptions, Preferences, and Acceptance of Information and Communication Technologies in Older-Adult Community Care Settings in Ireland: A Case-Study and Ranked-Care Program Analysis. Ageing Int. 2011, 36, 102–122. [Google Scholar] [CrossRef] [Green Version]

- Menzies, L. Integrating housing into the whole system of care for older people. J. Integr. Care 2015, 21, 178–187. [Google Scholar]

- Aboagye, E.; Agyemang, O.S.; Tjerbo, T. Elderly Demand for Family-based Care and Support: Evidence from a Social Intervention Strategy. Glob. J. Health Sci. 2014, 6, 94–104. [Google Scholar] [CrossRef] [Green Version]

- Gomi, I.; Fukushima, H.; Shiraki, M.; Miwa, Y.; Ando, T.; Takai, K.; Moriwaki, H. Relationship between serum albumin level and aging in community-dwelling self-supported elderly population. J. Nutr. Sci. Vitaminol. 2007, 53, 37. [Google Scholar] [CrossRef] [Green Version]

- Valkila, N.; Saari, A. The productivity impact of the voice link between elderly and nurses: An assisted living facility pilot. Arch. Gerontol. Geriatr. 2011, 52, 44–49. [Google Scholar] [CrossRef]

- Tsukada, N. A study of japanese nursing homes that hired nursing care worker candidates from indonesia and the philippines based on economic partnership agreement (EPA). Gerontologist 2011, 51, 502. [Google Scholar]

- Hughes, N.; McDonald, J.; Barrett, B.; Parfrey, P. Planning the restructuring of long-term care: The demand, need and provision of institutional long-term care beds in Newfoundland and Labrador. Healthc. Manag. Forum 2008, 21, 6–13. [Google Scholar] [CrossRef] [Green Version]

- Barron, D.N.; West, E. The quasi-market for adult residential care in the UK: Do for-profit, not-for-profit or public sector residential care and nursing homes provide better quality care. Soc. Sci. Med. 2017, 179, 137–146. [Google Scholar] [CrossRef] [PubMed]

- Farid, M.; Purdy, N.; Neumann, W.P. Using System Dynamics Modelling to Show the Effect of Nurse Workload on Nurses’ Health and Quality of Care. Ergonomics 2019, 63, 952–964. [Google Scholar] [CrossRef] [PubMed]

- Uppal, A.; Silvestri, D.M.; Siegler, M.; Natsui, S.; Boudourakis, L.; Salway, R.J.; Parikh, M.; Agoritsas, K.; Cho, H.J.; Gulati, R.; et al. Critical Care and Emergency Department Response at The Epicenter of the COVID-19 Pandemic. Health Aff. 2020, 39, 1443–1449. [Google Scholar] [CrossRef]

- Zhang, X.; Zhou, L.; Antwi, H.A. The impact of China’s latest population policy changes on maternity insurance—A case study in Jiangsu Province. Int. J. Health Plan. Manag. 2019, 34, 617–633. [Google Scholar] [CrossRef] [Green Version]

- Kianmehr, H.; Sabounchi, N.S.; Sabounchi, S.S.; Cosler, L.E. A system dynamics model of infection risk, expectations, and perceptions on antibiotic prescribing in the United States. J. Eval. Clin. Pract. 2019, 26, 1054–1064. [Google Scholar] [CrossRef]

- Giulia, S.; Sarah, M.; Astrid, M.; Babic, S.; Shin, S. Pre-service language teacher wellbeing as a complex dynamic system. Syetem 2021, 103, 102642. [Google Scholar]

- Horsch, A.; Khoshsima, D. Towards modeling and simulation of integrated social and health care services for elderly. Stud. Health Technol. Inform. 2007, 129, 38–42. [Google Scholar]

- Ansah, J.P.; Koh, V.; Chiu, C.T.; Chei, C.L.; Zeng, Y.; Yin, Z.X.; Shi, X.M.; Matchar, D.B. Projecting the Number of Elderly with Cognitive Impairment in China Using a Multi-State Dynamic Population Model. Syst. Dyn. Rev. 2018, 22, 89–111. [Google Scholar] [CrossRef]

- Ansah, J.P.; Matchar, D.B.; Malhotra, R.; Love, S.R.; Liu, C.; Do, Y. Projecting the effects of long-term care policy on the labor market participation of primary informal family caregivers of elderly with disability: Insights from a dynamic simulation model. BMC Geriatr. 2016, 16, 69. [Google Scholar] [CrossRef] [Green Version]

| Year | GDP | GDPGR | TNPE | IRNPE |

|---|---|---|---|---|

| 2015 | 688,858.2 | 0.070 | 270.8 | 0.047 |

| 2016 | 746,395.1 | 0.084 | 306.1 | 0.130 |

| 2017 | 832,035.9 | 0.115 | 306.9 | 0.003 |

| 2018 | 919,281.1 | 0.105 | 376.6 | 0.227 |

| 2019 | 990,865.1 | 0.078 | 400.4 | 0.063 |

| Variables or Parameters | Initial Value | Unit | Variables or Parameters | Initial Value | Unit |

|---|---|---|---|---|---|

| AP | 22,200 | 104 CNY | MEPI | 0.3 | — |

| TP | 137,500 | 104 CNY | WFPEPI | 0.45 | — |

| GDP | 688,858.2 | 108 CNY | MEPC | 0.1 | — |

| TNPE | 270.8 | 108 CNY | WFPEPC | 0.7 | — |

| PCPE | 0.83 | 104 CNY | WAPPI | 0.3 | — |

| OSPI | 24.5 | 104 CNY | WAPPC | 0.7 | — |

| OSPC | 24 | 104 CNY | WBSPI | 0.6 | — |

| Time | 2015 | Year | ANPI | 135 | PCS |

| GDPGR | Table function | — | ANPC | 50 | Person |

| FPCDI | 0.433 | — | MaxWD | 0.6 | — |

| ACPI | 0.02 | — | MinWD | 0.1 | — |

| BR | Table function | — | MaxWN | 0.06 | — |

| DR | Table function | — | MinWN | 0.01 | — |

| DRAP | 0.118 | — | 3 | — | |

| RIAP | 0.04 | — | 3 | — | |

| FOO | 0.02 | — |

| Variable Name | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|

| EP | Simulation value | 2.22 | 2.31 | 2.40 | 2.50 | 2.60 |

| Actual value | 2.22 | 2.31 | 2.41 | 2.49 | 2.54 | |

| 0.00% | 0.09% | −0.17% | 0.32% | 2.62% | ||

| 0.64% | ||||||

| PCDI | Simulation value | 2.17 | 2.36 | 2.62 | 2.89 | 3.11 |

| Actual value | 2.20 | 2.38 | 2.60 | 2.82 | 3.07 | |

| −1.24% | −1.06% | 1.09% | 2.45% | 1.38% | ||

| 1.45% | ||||||

| NPI | Simulation value | 2.36 | 2.53 | 2.78 | 3.01 | 3.19 |

| Actual value | 2.50 | 2.59 | 2.62 | 2.87 | 3.44 | |

| −5.28% | −2.18% | 6.12% | 5.12% | −7.06% | ||

| 5.15% | ||||||

| NSPI | Simulation value | 319.18 | 341.95 | 375.38 | 406.86 | 431.18 |

| Actual value | 331.21 | 352.93 | 358.49 | 379.40 | 438.82 | |

| −3.63% | −3.10% | 4.74% | 7.24% | −1.74% | ||

| 4.09% | ||||||

| NPC | Simulation value | 9.30 | 10.78 | 12.79 | 14.99 | 17.17 |

| Actual value | 8.81 | 11.13 | 12.59 | 13.96 | 16.92 | |

| 5.60% | −3.19% | 1.62% | 7.36% | 1.49% | ||

| 3.85% | ||||||

| TNPE | Simulation value | 270.80 | 295.92 | 331.35 | 366.32 | 395.98 |

| Actual value | 270.80 | 306.1 | 306.91 | 376.66 | 400.44 | |

| 0.00% | −3.33% | 7.96% | −2.74% | −1.11% | ||

| 3.03% | ||||||

| The Serial Number | Variable Name | Variable Property | Grouping Number |

|---|---|---|---|

| 1 | EP | State variable | ① |

| 2 | PCDI | State variable | ① |

| 3 | TNPE | State variable | ① |

| 4 | WDEPP | Auxiliary variable | ② |

| 5 | WNEPP | Auxiliary variable | ② |

| 6 | NDDEP | Auxiliary variable | ③ |

| 7 | NDNEP | Auxiliary variable | ③ |

| 8 | NPI | Auxiliary variable | ④ |

| 9 | NPC | Auxiliary variable | ④ |

| 10 | NSPI | Auxiliary variable | ⑤ |

| 11 | NSPC | Auxiliary variable | ⑤ |

| 12 | NDPI | Auxiliary variable | ⑥ |

| 13 | NDPC | Auxiliary variable | ⑥ |

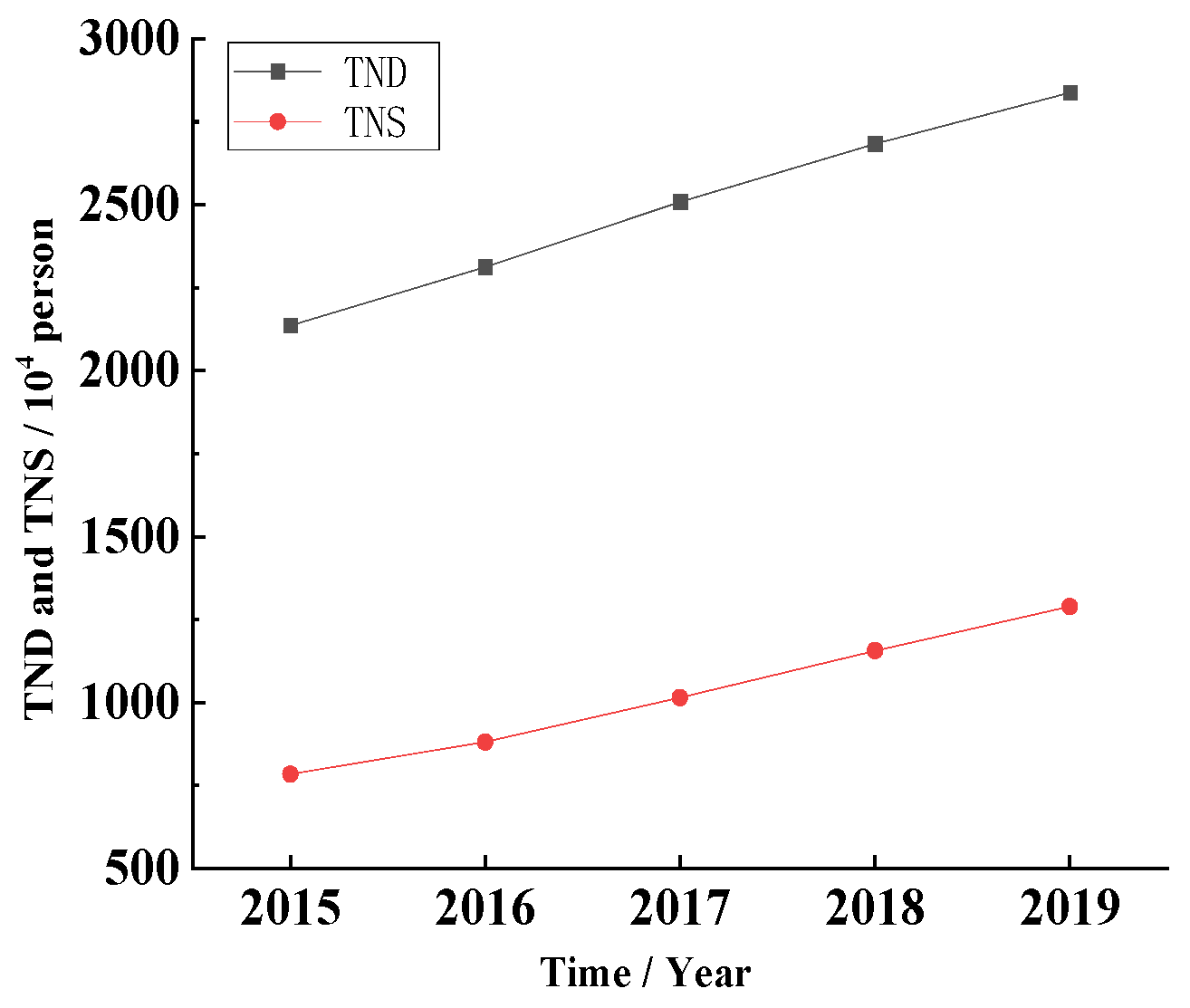

| 14 | TND | Auxiliary variable | ⑦ |

| 15 | TNS | Auxiliary variable | ⑦ |

| 16 | TRSD | Output variable | ⑧ |

| 17 | RSDPI | Output variable | ⑧ |

| 18 | RSDPC | Output variable | ⑧ |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Zhang, M.; Hu, H.; He, X. Research on Supply and Demand of Aged Services Resource Allocation in China: A System Dynamics Model. Systems 2022, 10, 59. https://doi.org/10.3390/systems10030059

Zhang Y, Zhang M, Hu H, He X. Research on Supply and Demand of Aged Services Resource Allocation in China: A System Dynamics Model. Systems. 2022; 10(3):59. https://doi.org/10.3390/systems10030059

Chicago/Turabian StyleZhang, Yijie, Mingli Zhang, Haiju Hu, and Xiaolong He. 2022. "Research on Supply and Demand of Aged Services Resource Allocation in China: A System Dynamics Model" Systems 10, no. 3: 59. https://doi.org/10.3390/systems10030059