Appraisal of Building Price in Urban Area Using Light Detection and Ranging (LiDAR) Data in Depok City

Abstract

:1. Introduction

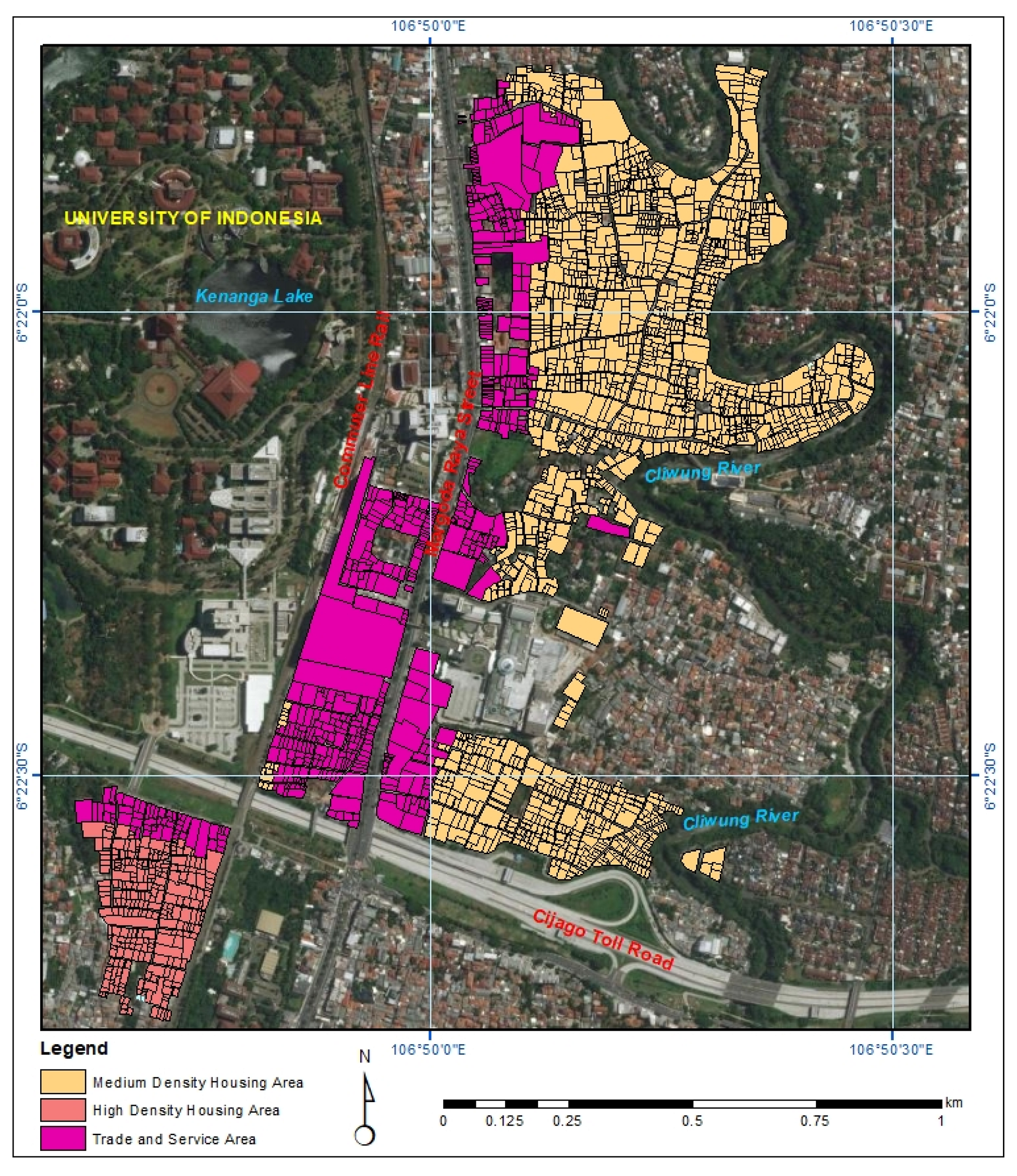

2. Study Areas and Materials

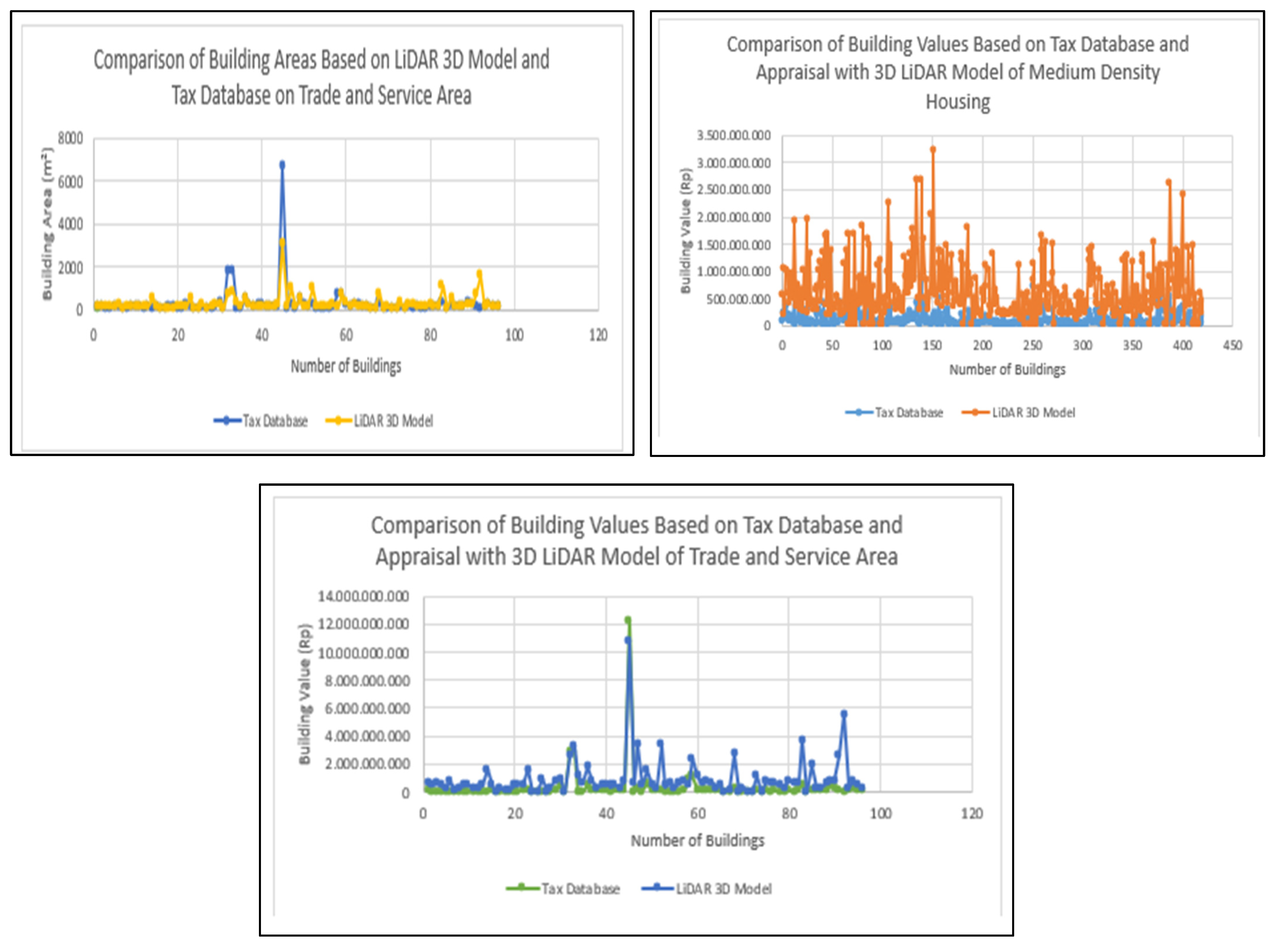

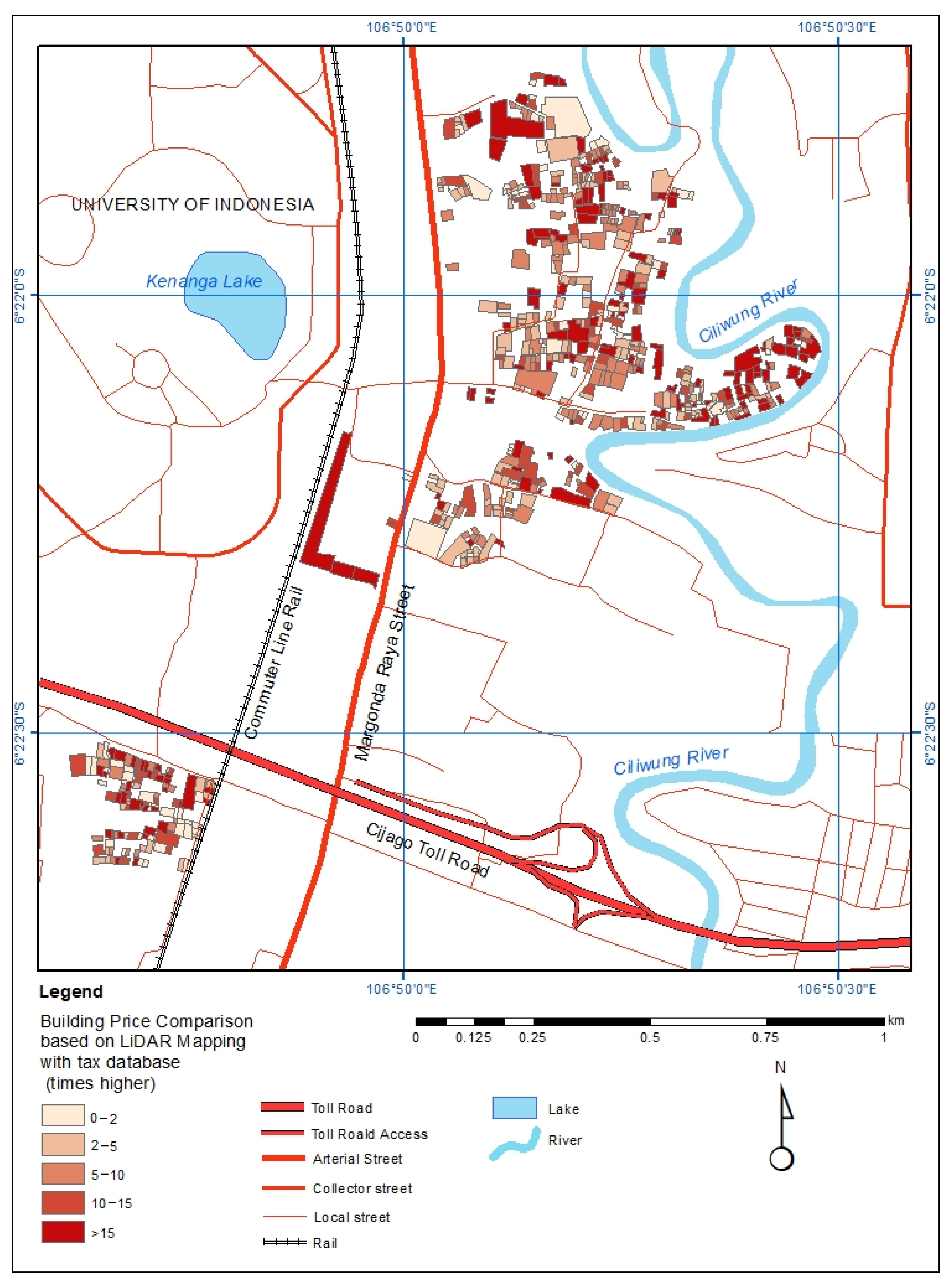

2.1. Study Areas

2.2. Data Source

3. Methods

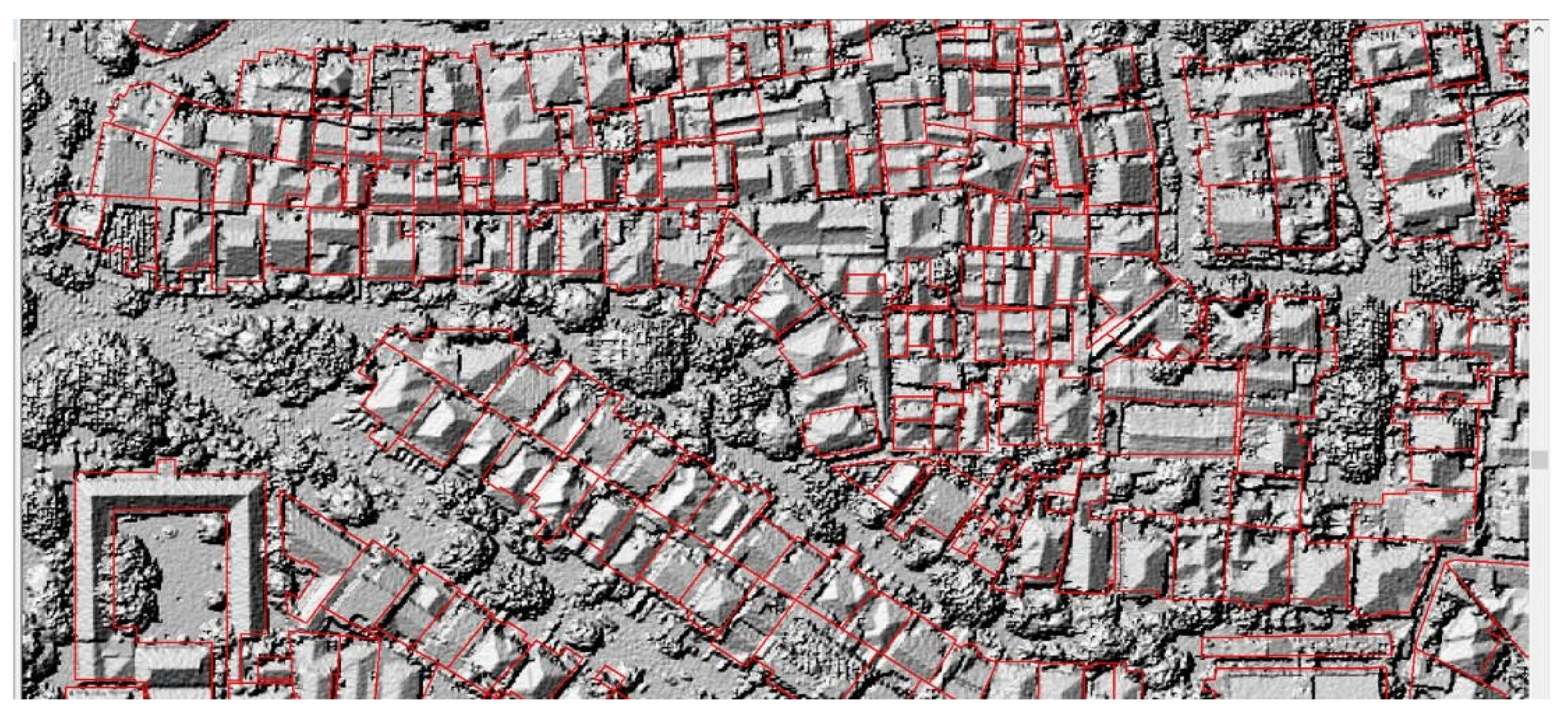

- Create a digital terrain and surface model (DTM and DSM).

- 2.

- Extract the shape of the roof and determine the building site in 3D.

- BLDGHEIGHT (building height): The maximum building height.

- EAVEHEIGHT (eave height): The minimum building height, i.e., the level of construction without or with a flat roof.

- ROOFFORM (roof form): The shape of the roof.

- BASEELEV (base elevation): The base height of the building, which is often equal to the elevation of the ground level.

- ROOFDIR (roof direction): The direction of the roof (in degrees).

- RoofDirAdjust (roof direction adjusted): This value is changed to manually adjust the direction of the roof. Since the default value is 0, the estimations of 1 and 2 are observed to counterclockwise rotate the roof by 90° and 180°, respectively.

- 3.

- Edit the 3D model of the building.

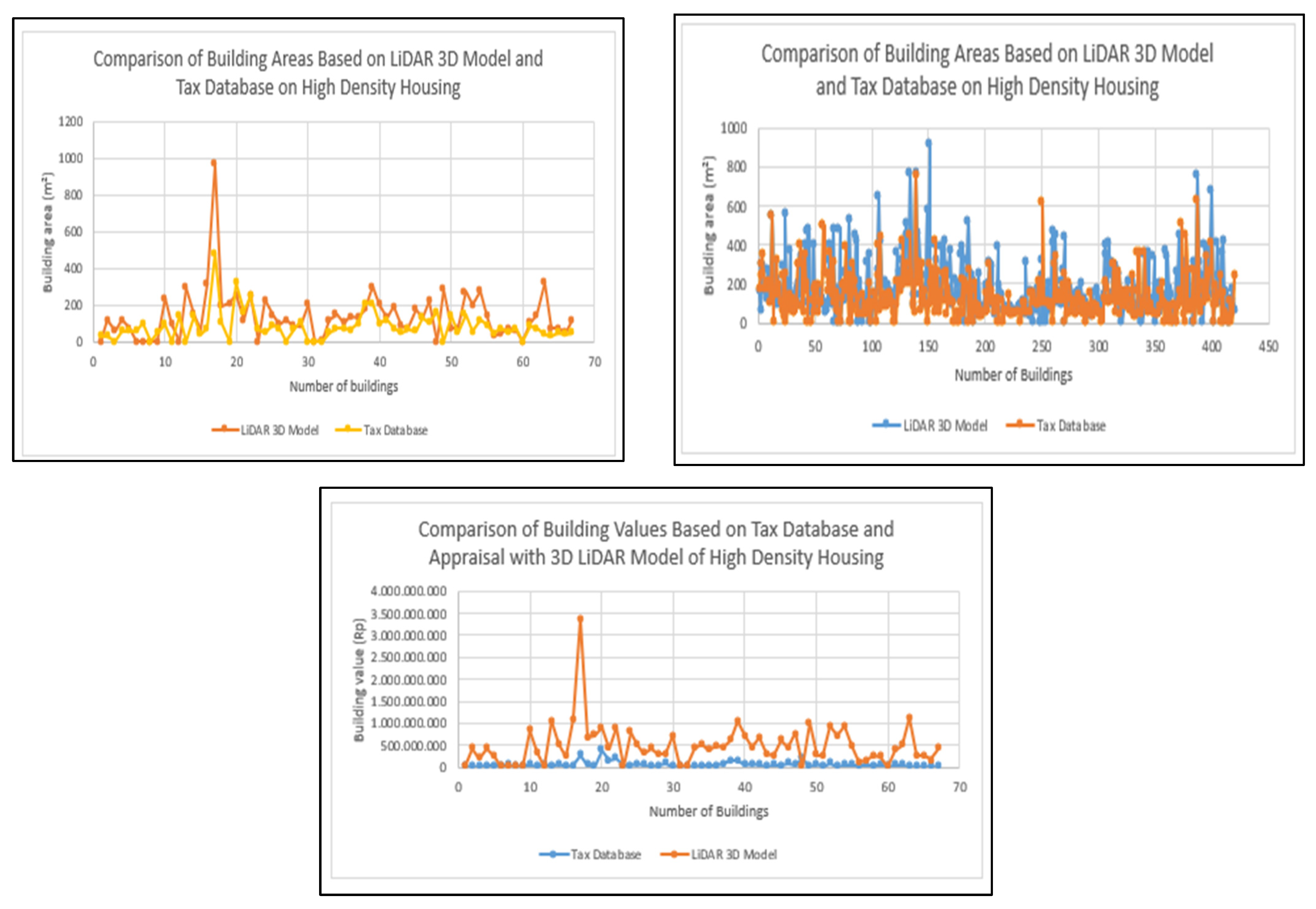

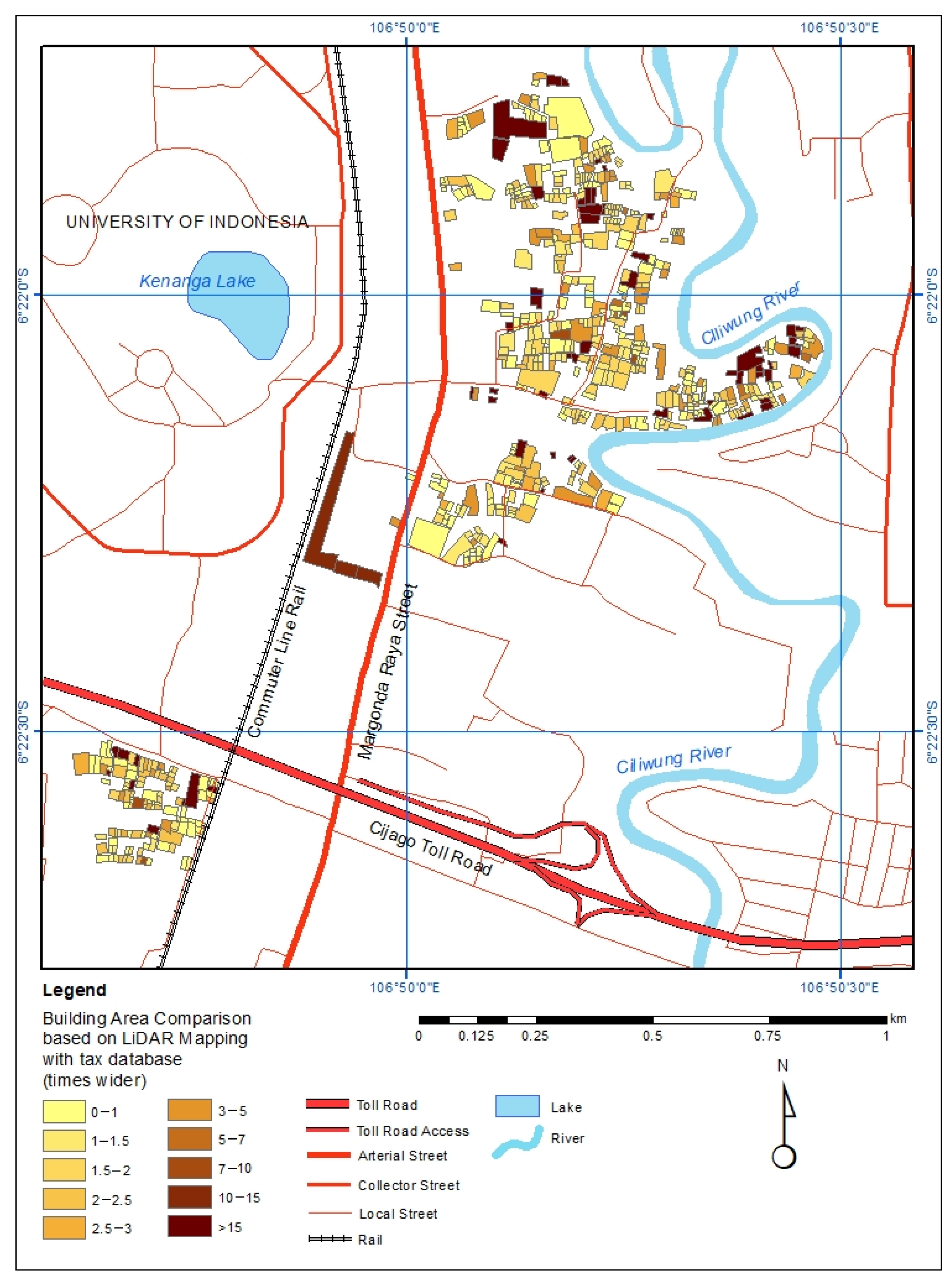

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- The World Bank. Aspiring Indonesia—Expanding the Middle Class; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- The World Bank. Realizing Indonesia’s Urban Potential; The World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Ministry of Finance of the Republic of Indonesia. Macroeconomic Framework and Fundamentals of Fiscal Policy for 2022—Economic Recovery and Structural Reform; Ministry of Finance of the Republic of Indonesia: Jakarta Utara, Indonesia, 2020. [Google Scholar]

- BPS. Statistical Yearbook of Indonesia 2019; BPS: Depok City, Indonesia, 2019; Volume 34, Nomor 46. [Google Scholar]

- Government of Depok City. Depok City Regional Regulation Number 9 of 2021 Concerning the Medium Term Development Plan of the Depok City of 2021–2026; Government of Depok City: Depok City, Indonesia, 2021. [Google Scholar]

- von Haldenwang, C. The Political Cost of Local Revenue Mobilization: Decentralization of the Property Tax in Indonesia; Public Finance and Management: Jakarta, Indonesia, 2017; ISSN 1523-9721. [Google Scholar]

- BPS. Statistical Yearbook of Indonesia 2022; BPS: Jakarta, Indonesia, 2019; Volume 37, Nomor 49. [Google Scholar]

- Terefenko, P.; Wziatek, D.Z.; Dalyot, S.; Boski, T.; Lima-Filho, F.P. A high-precision LiDAR-based method for surveying and classifying coastal notches. ISPRS Int. J. Geo-Inf. 2018, 7, 295. [Google Scholar] [CrossRef]

- Diana, S.R.; Rafikasari, A.; Musdafia, I.; Tinggi, I.S.; Economics, I.; Jakarta, Y.A.I.; Rahma Diana, S.; Hidayat, A.; Musdafia Ibrahim, I.; Farida, F. Economic Assessment of Satellite Remote Sensing Data in Indonesia: A Net Present Value Approach. Int. J. Econ. Financ. Issues 2019, 9, 140–146. [Google Scholar]

- Biljecki, F.; Ledoux, H.; Stoter, J. An improved LOD specification for 3D building models. Comput. Environ. Urban Syst. 2016, 59, 25–37. [Google Scholar] [CrossRef]

- Law, S.; Paige, B.; Russell, C. Take a look around: Using street view and satellite images to estimate house prices. ACM Trans. Intell. Syst. Technol. 2019, 10, 1–19. [Google Scholar] [CrossRef]

- Lee, G.; Cho, D.; Kim, K. The modifiable area unit problem in hedonic house-price models. Urban Geogr. 2016, 37, 223–245. [Google Scholar] [CrossRef]

- Bharathi, N.; Malghan, D.; Mishra, S.; Rahman, A. Fractal urbanism: City size and residential segregation in India. World Dev. 2021, 141, 105397. [Google Scholar] [CrossRef]

- Mahyeda, A.; Buchori, I. Utilization of Lidar for Determination of Zoning Value of Tax Objects Free of Spatial Utilization Plans. J. Urban Reg. Dev. 2020, 16, 158–172. [Google Scholar]

- Shirowzhan, S.; Trinder, J. Building Classification from Lidar Data for Spatio-temporal Assessment of 3D Urban Devefiscalopments. Procedia Eng. 2017, 180, 1453–1461. [Google Scholar] [CrossRef]

- Minister of Public Works and the State Minister of Public Housing. Joint Decree between the Minister of Home Affairs, the Minister of Public Works and the State Minister of Public Housing, Numbers 648-381 of 1992, 739/kpts/1992, and 09/kpts/1992 Concerning Guidelines for the Development of Housing and Settlements with a Balanced Residential Environment; Minister of Public Works and the State Minister of Public Housing: Jakarta, Indonesia, 1992. [Google Scholar]

- Ministry of Finance of the Republic of Indonesia. Law of the Republic of Indonesia Number 1 of 2022 Concerning Financial Relations between the Central Government and Regional Governments; Ministry of Finance of the Republic of Indonesia: Jakarta Utara, Indonesia, 2020. [Google Scholar]

- Liu, L. The relationship between liveability and price of residential houses—A case study of shenzhen. Int. Arch. Photogramm. Remote Sens. Spat. Inf. Sci. 2020, 42, 141–144. [Google Scholar] [CrossRef]

- Bergman, U.M.; Sørensen, P.B. The interaction of actual and fundamental house prices: A general model with an application to Sweden. J. Hous. Econ. 2021, 54, 101792. [Google Scholar] [CrossRef]

- Kang, Y.; Zhang, F.; Peng, W.; Gao, S.; Rao, J.; Duarte, F. Understanding house price appreciation using multi-source big geo-data and machine learning. Land Use Policy 2020, 111, 104919. [Google Scholar] [CrossRef]

- Chen, K.; Long, H.; Qin, C. The impacts of capital deepening on urban housing prices: Empirical evidence from 285 prefecture-level or above cities in China. Habitat Int. 2020, 99, 102173. [Google Scholar] [CrossRef]

- Liebelt, V.; Bartke, S.; Schwarz, N. Hedonic pricing analysis of the influence of urban green spaces on residential prices: The case of Leipzig, Germany. Eur. Plan. Stud. 2018, 26, 133–157. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, L.; Huang, Y.; Wilson, B.; Mosey, G.; Deal, B. Spatial impacts of multimodal accessibility to green spaces on housing prices in Cook County, Illinois. Urban For. Urban Green. 2022, 67, 127370. [Google Scholar] [CrossRef]

- Jayasekare, A.S.; Herath, S.; Wickramasuriya, R.; Perez, P. The price of a view: Estimating the impact of view on house prices. Pac. Rim Prop. Res. J. 2019, 25, 141–158. [Google Scholar] [CrossRef]

- Cabras, I.; Sohns, F.; Canduela, J.; Toms, S. Public houses and house prices in Great Britain: A panel analysis. Eur. Plan. Stud. 2021, 29, 163–180. [Google Scholar] [CrossRef]

- Gasparėnienė, L.; Remeikienė, R.; Skuka, A. Assessment of the impact of macroeconomic factors on housing price level: Lithuanian case. Intellect. Econ. 2016, 10, 122–127. [Google Scholar] [CrossRef]

- Ihlanfeldt, K.; Mayock, T. Panel data estimates the effects of different types of crime on housing prices. Reg. Sci. Urban Econ. 2010, 40, 161–172. [Google Scholar] [CrossRef]

- Awrangjeb, M.; Fraser, C.S. Automatic segmentation of raw LIDAR data for extraction of building roofs. Remote Sens. 2014, 6, 3716–3751. [Google Scholar] [CrossRef]

| No. | Data Type | Source/Method of Obtaining Data |

|---|---|---|

| 1. | The building specifications (area and number of floors) | The 3D LiDAR data-processing model obtained from Smart Land-Surveillance System (SLSS) |

| 2. | A detailed description of the building and the study environment | The Smart Land-Surveillance System (SLSS) processed from building parcel maps and DHKP (list of the tax assessment) of the Depok City Revenue, Financial Management, and Assets Office. |

| 3. | The sales value of the tax object (NJOP) of the building, which is presently used for the imposition of PBB-P2 | The SLSS processed by the Department of Revenue, Financial Management, and Assets Office of Depok City. |

| 4. | The real tax object selling value (NJOP) | The calculation of the building values emphasizes the cost of constructing a building per square metre. This is multiplied by the construction area regarding the 3D modelling outcome and online market price surveys. |

| 5. | The cost of building | The observation of building prices from several online sites. |

| 6. | The model data validation | Field survey |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Atiqi, R.; Dimyati, M.; Gamal, A.; Pramayuda, R. Appraisal of Building Price in Urban Area Using Light Detection and Ranging (LiDAR) Data in Depok City. Land 2022, 11, 1320. https://doi.org/10.3390/land11081320

Atiqi R, Dimyati M, Gamal A, Pramayuda R. Appraisal of Building Price in Urban Area Using Light Detection and Ranging (LiDAR) Data in Depok City. Land. 2022; 11(8):1320. https://doi.org/10.3390/land11081320

Chicago/Turabian StyleAtiqi, Randhi, Muhammad Dimyati, Ahmad Gamal, and Rizki Pramayuda. 2022. "Appraisal of Building Price in Urban Area Using Light Detection and Ranging (LiDAR) Data in Depok City" Land 11, no. 8: 1320. https://doi.org/10.3390/land11081320

APA StyleAtiqi, R., Dimyati, M., Gamal, A., & Pramayuda, R. (2022). Appraisal of Building Price in Urban Area Using Light Detection and Ranging (LiDAR) Data in Depok City. Land, 11(8), 1320. https://doi.org/10.3390/land11081320