The Resource Benefits Evaluation Model on Remanufacturing Processes of End-of-Life Construction Machinery under the Uncertainty in Recycling Price

Abstract

:Highlights

- Build up a resource benefits evaluation model on the remanufacturing of end-of-life products.

- Five uncertainty factors in remanufacturing process were taken into account in the model.

- The optimal recycling price and profits were obtained with maximization of resource benefits.

- Change regularity of resource benefits and profits were obtained as other factors varied.

- The study aims to provide government and manufacturers with decision support.

- These findings suggest that the uncertainty factors existing in remanufacturing can be controlled within a reasonable range.

1. Introduction

2. Model Establishing

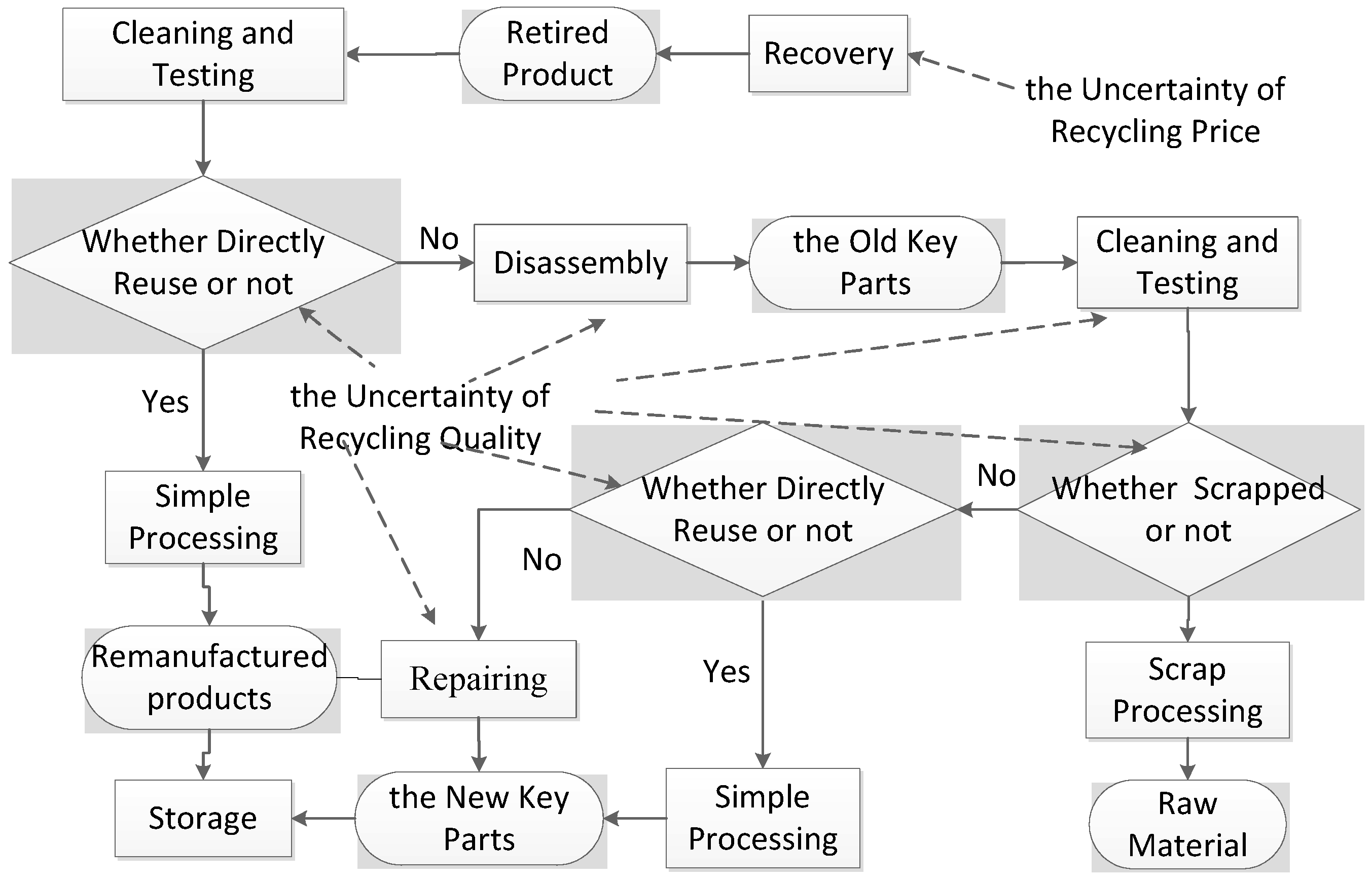

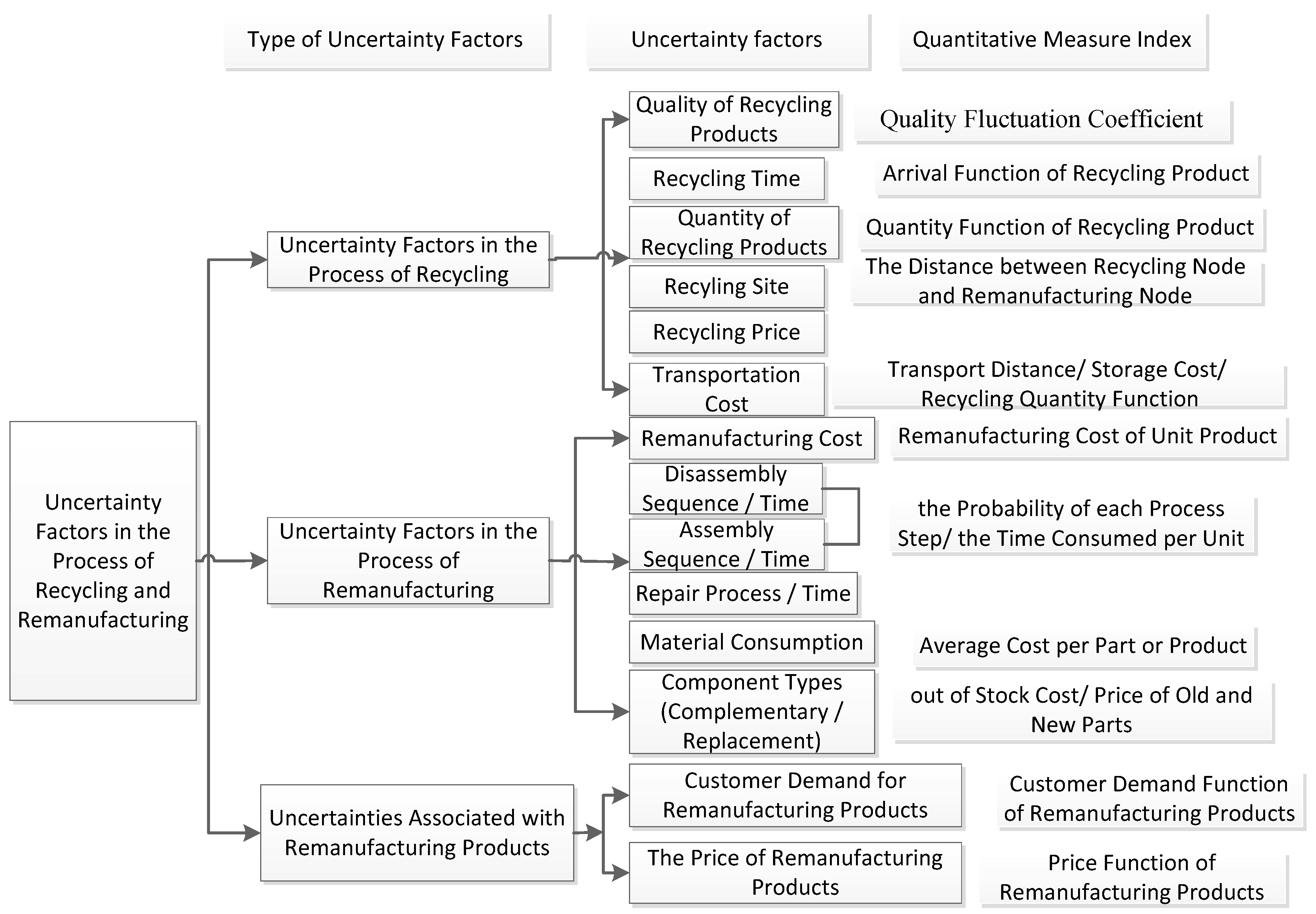

2.1. Problem Description

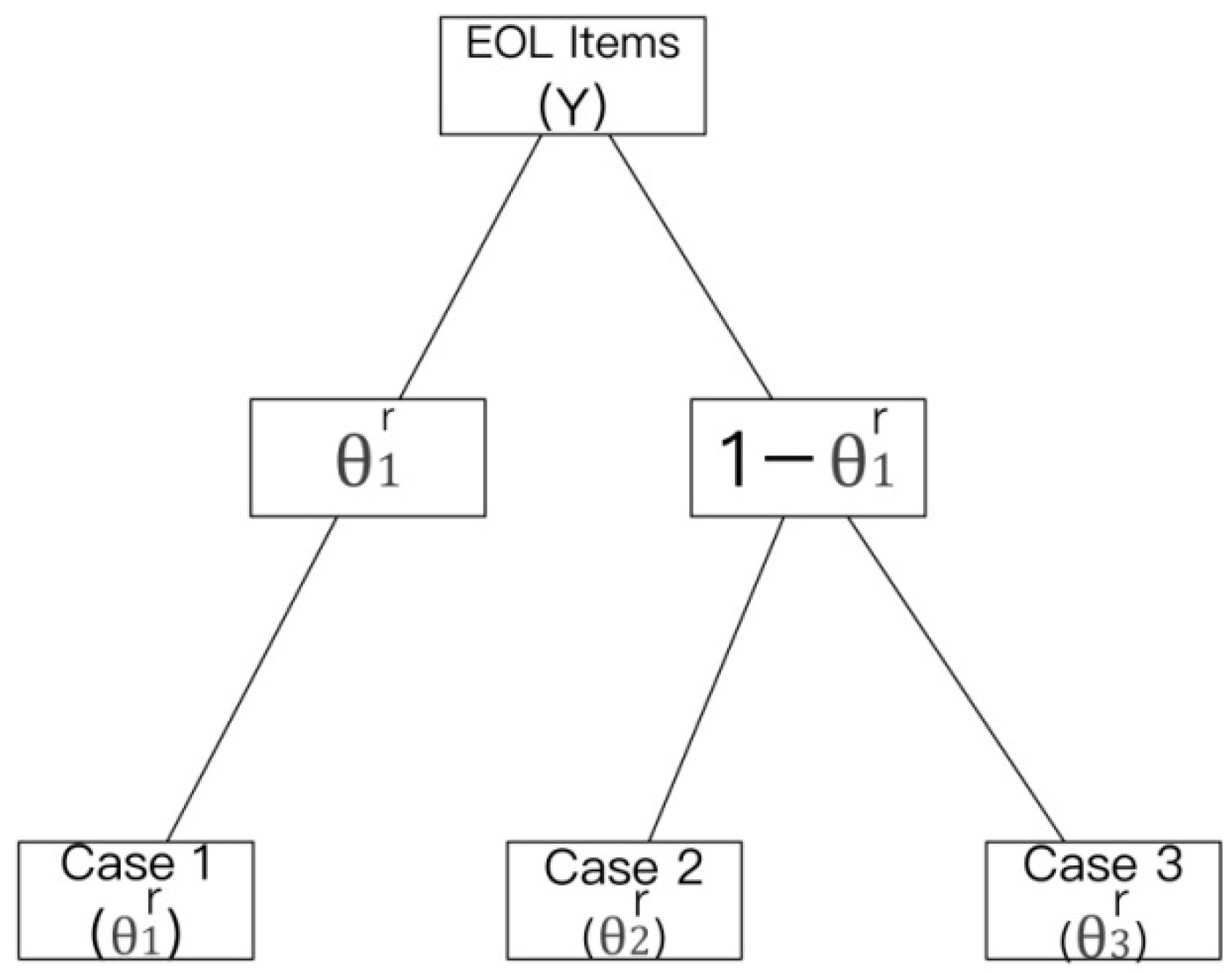

2.2. Model Establishing

- Case 1:

- When EOL construction machinery can be reused directly, and represent the remanufacturing resource benefits and the profits of remanufacturer.

- Case 2:

- When EOL construction machinery cannot be reused directly while its crucial components can be reused after repairing, and denote the remanufacturing resource benefits and the profits of remanufacturer.

- Case 3:

- Neither the product nor its crucial components can be remanufactured, and represent the remanufacturing resource benefits and the profits of remanufacturer. This is reasonable in practice. When recycling EOL products, the remanufacturer usually set certain requirements and only products above the condition threshold are recycled or remanufactured. The rates of these three cases are shown as Figure 3.

3. Model Solving

4. Impact Analysis of the Uncertainty Factors

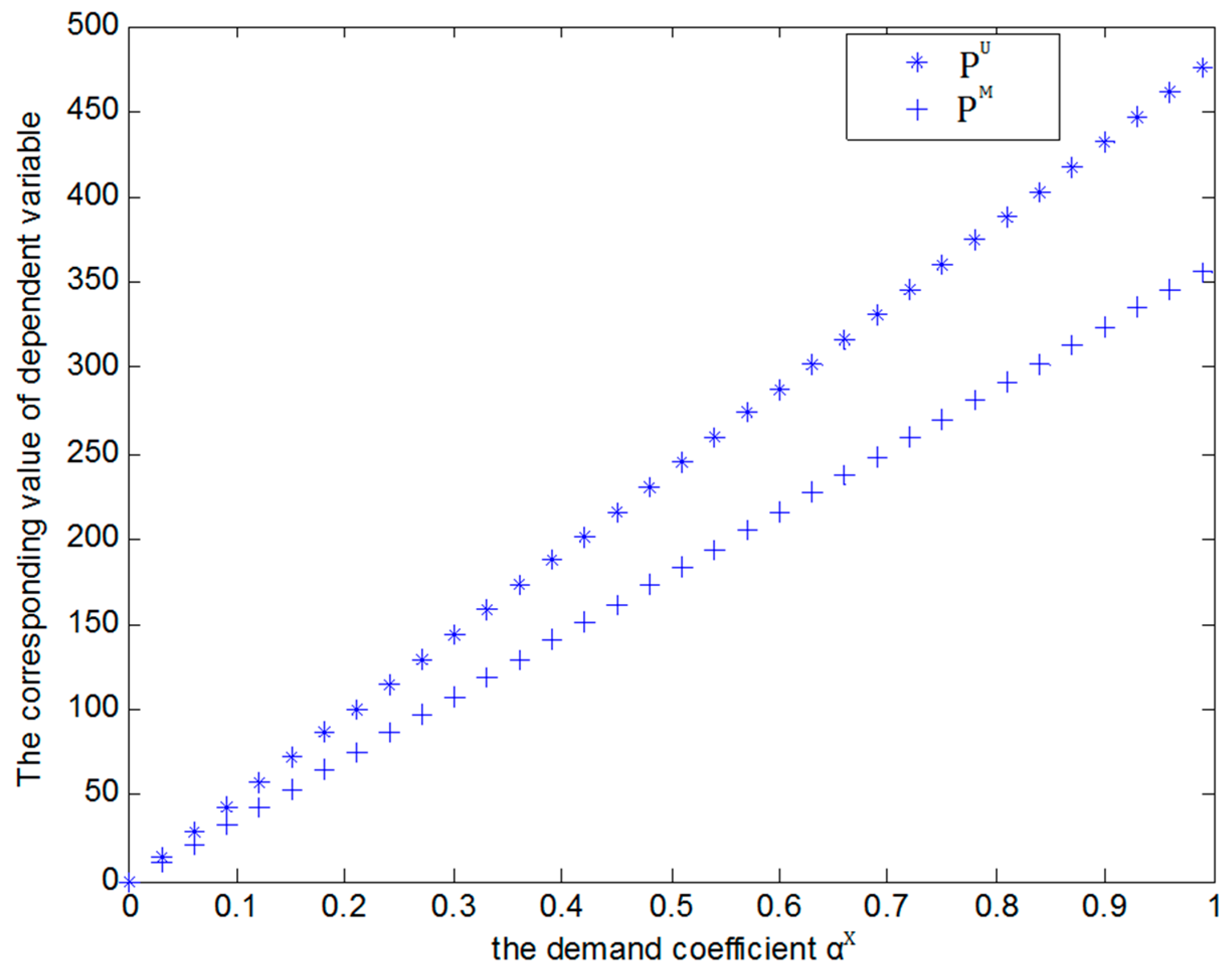

4.1. Analysis of the Uncertainty Factors Associated with Customer Demand

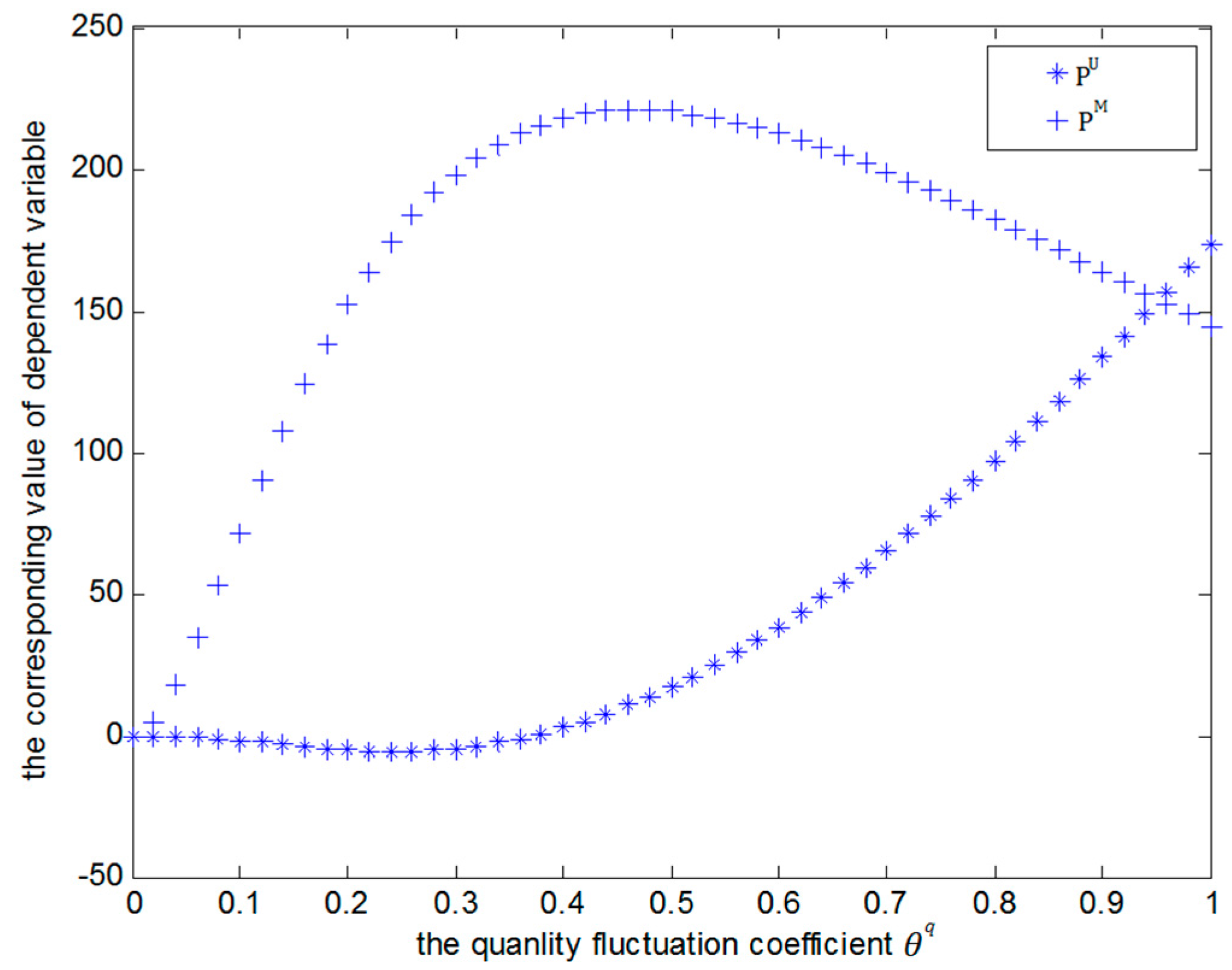

4.2. Analysis of the Quality Fluctuation Coefficient

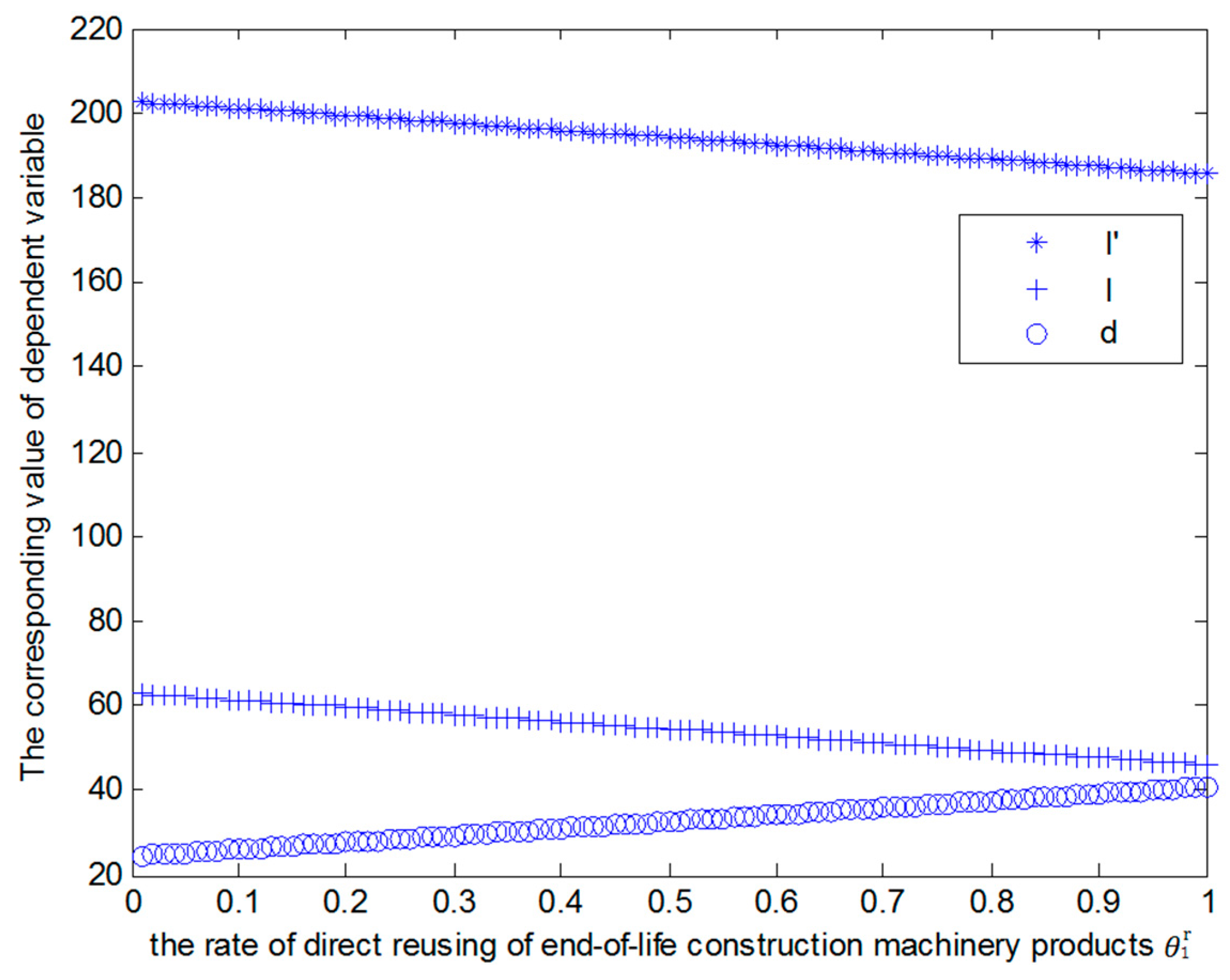

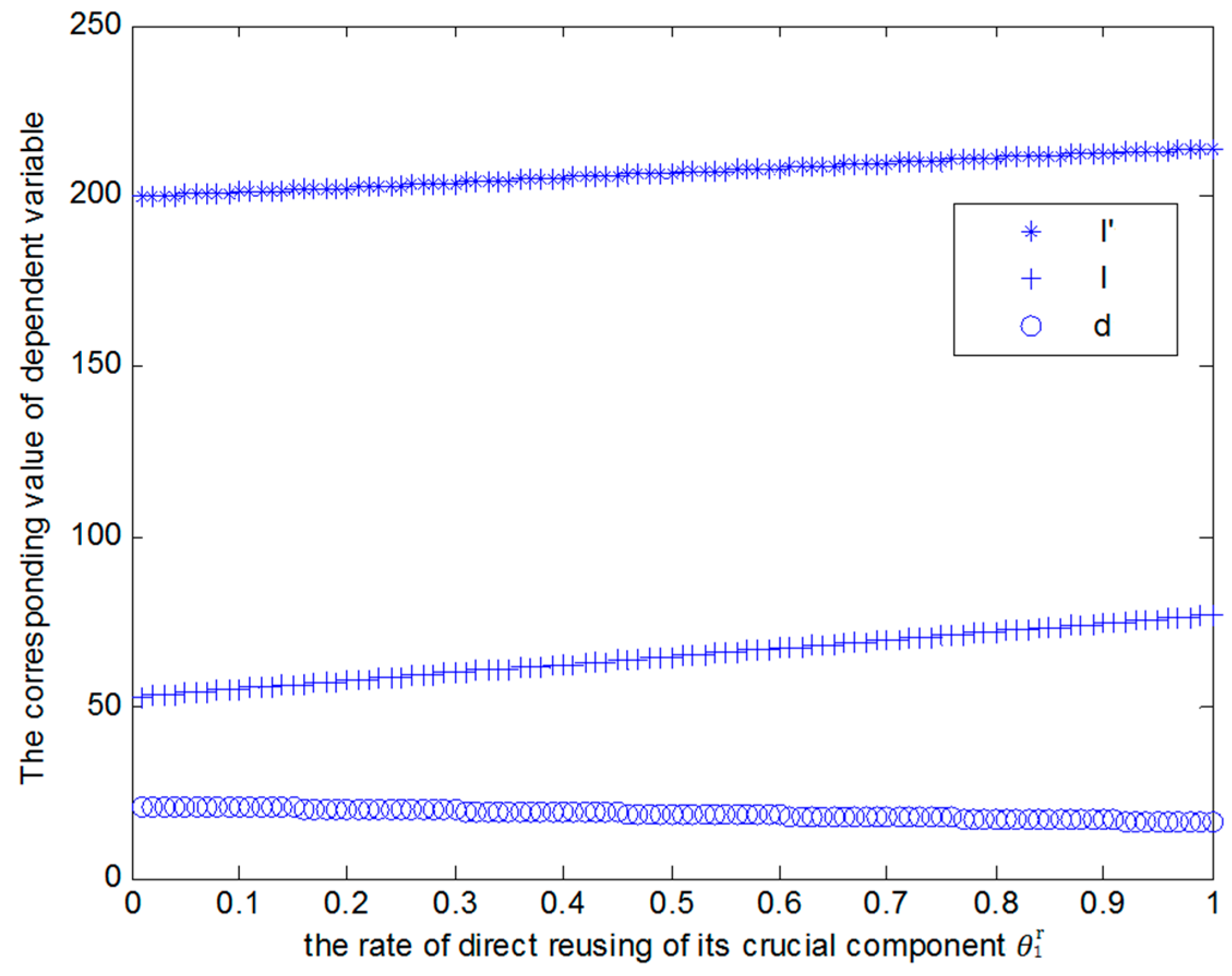

4.3. Analysis of the Direct Reusing Rate of EOL Product and Its Components

5. Analysis of Numerical Examples

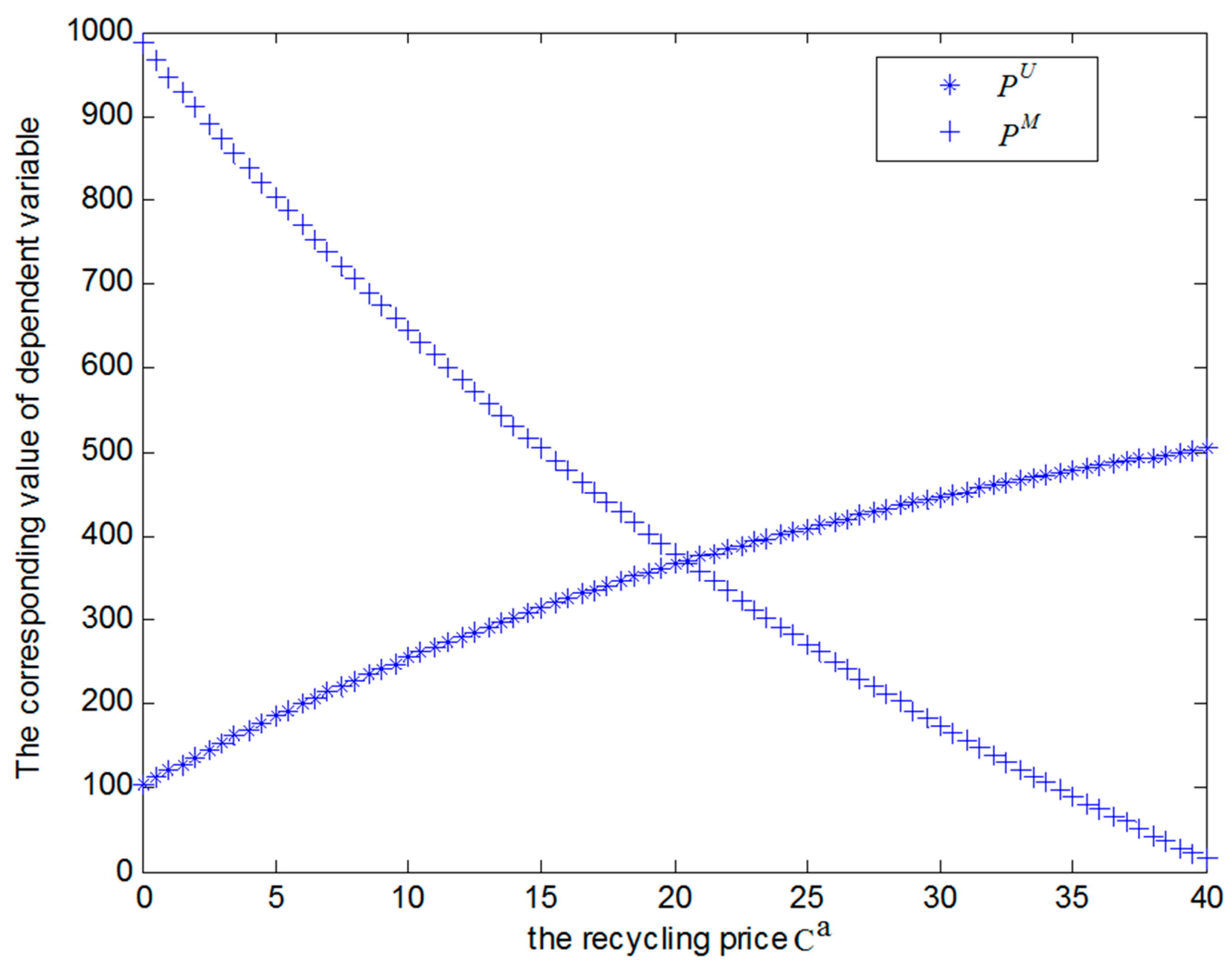

5.1. Example Analysis of the Recycling Price

5.2. Example Analysis of the Recycling Price

5.3. Example Analysis of the Direct Reusing Rate of EOL Product and Its Components

6. Conclusions

- (1)

- If the condition whether the demands in the current period is satisfied or not is independent on previous state, then the ultimate value of customer demands satisfaction of multi-periods converges to a fixed value.

- (2)

- When recycling price is rising, the maximal resource benefits and the profits of remanufacturer are showing a decline trend, and the maximal resource benefits is a convex function of recycling price, the profits of remanufacturer is a concave function of recycling price. The decline rate of remanufacturer profits is higher than that of total resource benefits in remanufacturing.

- (3)

- There is a recycling price to make the resource benefits and the profits of remanufacturer and the value of recycling price is dependent upon the rate of the direct reusing of EOL construction machinery, the rate of the direct reusing of its crucial component and quality fluctuation coefficient.

- (4)

- As the rise of the quality fluctuation coefficient, the profits of remanufacturer, resource benefits and the recycling price are decreasing gradually, furthermore, the decline rate of total resource benefits in remanufacturing is much higher than the recycling price and the profit of remanufacturer. However, when the quality fluctuation coefficient is approaching 1, the values of the profits of remanufacturer, the maximal resource benefits and recycling price grade into constants. Meanwhile, the optimal value of the quality fluctuation coefficient, which can make the resource benefit reach its maximum value, is related to the direct reusing rate of EOL construction machinery and the reusing rate after repairing of the crucial components. In addition, the quality fluctuation coefficient is also influenced by the value of profits of unit EOL construction machinery product and the price-elasticity index: the larger profits of unit EOL construction machinery product and the price-elasticity index are, the smaller the value of the quality fluctuation coefficient will be.

- (1)

- When EOL products are remanufactured by the recycling price under the maximum resources benefits, the profits of remanufacturer will decrease to some extent. Therefore, while regulating the price in market, the government should also offer remanufacturer appropriate subsidies to arouse their enthusiasm.

- (2)

- The model analysis indicates that the demand and acceptance of customers to remanufactured products present a positive correlation to resources benefits. Therefore, enterprises are required to take appropriate marketing strategy (such as advertising, public image) for improving the customer acceptance of remanufacturing products.

- (3)

- The recycling price can be determined by remanufacturer according to the actual value of quality fluctuation coefficient; conversely, it is also feasible to choose EOL products of better quality from recycling merchants in light of the actual recycling price.

- (4)

- The expression of quality fluctuation coefficient shows that the smaller the value of the quality fluctuation coefficient is, the larger the profits of remanufacturer and the price-elasticity index will be. Moreover, the value of quality fluctuation coefficient directly decided by the direct reusing rate of EOL construction machinery and its components, so when recycling the EOL construction products, remanufacturers should choose those products that their quality is comparatively low but the parts of them can be reused directly, which can ensure not only low recycling price but also larger quantity of reusable parts to increase the remanufacturing profits.

- (5)

- Through the analysis on uncertain parameters in this model, they can also make these uncertain factors controlled in a reasonable range, in order to coordinate between profits and resource benefits, and promote healthy development of the whole remanufacturing industry. The details of how the parameters affect the conclusions of the model and how they affect optimality and managerial decisions are shown in Appendix E.

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Solving Process of Objective Functions

Appendix B. Solving Process of the Uncertainty Factors Associated with Customer Demand

Appendix C. Solving Process of the Quality Fluctuation Coefficient

Appendix D. Solving Process of the Direct Reusing Rate of EOL Product and Its Components

Appendix D.1. Impact that , and Have on The Optimal Values

Appendix D.2. Impact of on , and

Appendix E. The Effects by Parameters on Objective Functions and Managerial Decisions

| Parameters | Abbreviations | Change regularity | Managerial decisions |

|---|---|---|---|

| the quality fluctuation coefficient | The smaller the value of the quality fluctuation coefficient is, the larger the profit of remanufacturer and the price-elasticity index will be | When recycling the EOL construction products, remanufacturers should choose those products that their quality is comparatively low but the parts of them can be reused directly, which can ensure not only low recycling price but also larger quantity of reusable parts to increase the remanufacturing profit. | |

| recycling price | When EOL products are remanufactured by the recycling price under the maximum resources benefits, the profit of remanufacturer will decrease to some extent | While regulating the price in market, the government should also offer remanufacturer appropriate subsidies to arouse their enthusiasm | |

| the demand coefficient | The demand and acceptance of customers to remanufactured products present a positive correlation to resources benefits | Enterprises are required to take appropriate marketing strategy (such as advertising, public image) for improving the customer acceptance of remanufacturing products. | |

| the fill rate of customer demand | The fill rate of customer demand | Remanufacturers should meet customer needs as much as possible. |

References

- Binshi, X.U. Remanufacture Engineering and Its Development in China. China Surf. Eng. 2010, 23, 1–6. [Google Scholar]

- Deng, Q.; Liu, X.; Liao, H. Identifying Critical Factors in the Eco-Efficiency of Remanufacturing Based on the Fuzzy DEMATEL Method. Sustainability 2015, 7, 15527–15547. [Google Scholar] [CrossRef]

- Xu, B. States and prospects of china characterised quality guarantee technology system for remanufactured parts. J. Mech. Eng. 2013, 49, 84. [Google Scholar] [CrossRef]

- Yan, C. Remanufacturing and benefits analysis of construction machinery hydraulic valves. China Surf. Eng. 2013, 401–403, 2266–2270. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Cai, X. Remanufacturing and pricing decisions with random yield and random demand. Comput. Oper. Res. 2015, 54, 195–203. [Google Scholar] [CrossRef]

- Ketzenberg, M.E.; Zuidwijk, A.A. Optimal Pricing, Ordering, and Return Policies for Consumer Goods. Prod. Oper. Manag. 2009, 18, 344–360. [Google Scholar] [CrossRef]

- Guo, J.H.; Yang, L.; Li, B.L.; Ni, M. Jointed pricing decision of remanufacturing system under uncertain demand. Syst. Eng.-Theory Pract. 2013, 33, 1949–1955. [Google Scholar]

- Meng, K.; Lou, P.; Peng, X.; Prybutok, V. An improved co-evolutionary algorithm for green manufacturing by integration of recovery option selection and disassembly planning for end-of-life products. Int. J. Prod. Res. 2016, 54, 1–27. [Google Scholar] [CrossRef]

- Ghazalli, Z.; Murata, A. Development of an AHP-CBR evaluation system for remanufacturing: End-of-life selection strategy. Int. J. Sustain. Eng. 2011, 4, 2–15. [Google Scholar] [CrossRef]

- Galbreth, M.R.; Blackburn, J.D. Optimal Acquisition and Sorting Policies for Remanufacturing. Prod. Oper. Manag. 2006, 15, 384–392. [Google Scholar] [CrossRef]

- Sabharwal, S.; Garg, S. Determining cost effectiveness index of remanufacturing: A graph theoretic approach. Int. J. Prod. Econ. 2013, 144, 521–532. [Google Scholar] [CrossRef]

- Golinska, P.; Kuebler, F. The Method for Assessment of the Sustainability Maturity in Remanufacturing Companies ☆. Procedia Cirp 2014, 15, 201–206. [Google Scholar] [CrossRef]

- Geyer, R.; Atasu, A. The Economics of Remanufacturing Under Limited Component Durability and Finite Product Life Cycles. Manag. Sci. 2007, 53, 88–100. [Google Scholar] [CrossRef]

- Luglietti, R.; Taisch, M.; Magalini, F.; Cassina, J.; Mascolo, J.E. Environmental and economic evaluation of end-of-life alternatives for automotive engine. In Proceedings of the 2014 International ICE Conference on Engineering, Technology and Innovation, Bali, Indonesia, 23–25 June 2014.

- Du, Y.; Li, C. Implementing energy-saving and environmental-benign paradigm: Machine tool remanufacturing by OEMs in China. J. Clean. Prod. 2014, 66, 272–279. [Google Scholar] [CrossRef]

- Goldey, C.L.; Kuester, E.-U.; Mummert, R.; Okrasinski, T.A.; Olson, D.; Schaeffer, W.J. Lifecycle assessment of the environmental benefits of remanufactured telecommunications product within a “green” supply chain. In Proceedings of the IEEE International Symposium on Sustainable Systems and Technology, Arlington, VA, USA, 17–19 May 2010.

- Zahedi, H.; Mascle, C.; Baptiste, P. A quantitative evaluation model to measure the disassembly difficulty; application of the semi-destructive methods in aviation End-of-Life. Int. J. Prod. Res. 2016, 54, 3736–3748. [Google Scholar] [CrossRef]

- Yi, P.; Huang, M.; Guo, L.; Shi, T. A retailer oriented closed-loop supply chain network design for end of life construction machinery remanufacturing. J. Clean. Prod. 2016, 124, 191–203. [Google Scholar] [CrossRef]

- Diener, D.L.; Tillman, A.M. Scrapping steel components for recycling—Is not that good enough? Seeking improvements in automotive component end-of-life. Resour. Conserv. Recycl. 2016, 110, 48–60. [Google Scholar] [CrossRef]

- Wolfram, P.; Wiedmann, T.; Diesendorf, M. Carbon footprint scenarios for renewable electricity in Australia. J. Clean. Prod. 2016, 124, 236–245. [Google Scholar] [CrossRef]

- Xiong, Z.K.; Cao, J.; Liu, K.J. Study On the Quality Control Policy in the Closed-loop Supply Chain Based on the Dynamic Game Theory. Chin. J. Manag. Sci. 2007, 15, 42–50. [Google Scholar]

- Jin, X.; Hu, S.; Ni, J.; Xiao, G. Assembly Strategies for Remanufacturing Systems With Variable Quality Returns. IEEE Trans. Autom. Sci. Eng. 2014, 4, 1–18. [Google Scholar] [CrossRef]

- Abdulrahman, M.D.; Gunasekaran, A.; Subramanian, N. Critical barriers in implementing reverse logistics in the Chinese manufacturing sectors. Eng. Costs Prod. Econ. 2014, 147, 460–471. [Google Scholar] [CrossRef]

- González-Torre, P.; Alvarez, M.; Sarkis, J.; Adenso-Diaz, B. Barriers to the Implementation of Environmentally Oriented Reverse Logistics: Evidence from the Automotive Industry Sector. Br. J. Manag. 2010, 21, 889–904. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and differentiated remanufactured products. Eur. J. Oper. Res. 2010, 203, 370–379. [Google Scholar] [CrossRef] [Green Version]

- Xiang, L.I.; Yong-Jian, L.I.; Cai, X.Q. Collection pricing decision in a remanufacturing system considering random yield and random demand. Syst. Eng. 2009, 29, 19–27. [Google Scholar]

- Huang, M.; Yi, P.; Shi, T.; Guo, L. A modal interval based method for dynamic decision model considering uncertain quality of used products in remanufacturing. J. Intell. Manuf. 2015. [Google Scholar] [CrossRef]

- Sutherland, J.W.; Jenkins, T.L.; Haapala, K.R. Development of a cost model and its application in determining optimal size of a diesel engine remanufacturing facility. CIRP Ann. 2010, 59, 49–52. [Google Scholar] [CrossRef]

- Pandey, V.; Thurston, D. Variability and Component Criticality in Component Reuse and Remanufacturing Systems. J. Comput. Inf. Sci. Eng. 2007, 10, 208–216. [Google Scholar]

- Zhang, T.; Chu, J.; Wang, X.; Liu, X.; Cui, P. Development pattern and enhancing system of automotive components remanufacturing industry in China. Resour. Conserv. Recycl. 2011, 55, 613–622. [Google Scholar] [CrossRef]

- Sundin, E.; Hui, M.L. In what way is remanufacturing good for the environment? In Design for Innovative Value towards a Sustainable Society; Springer: Berlin, Germany, 2012; pp. 552–557. [Google Scholar]

- Haapala, K.R.; Zhao, F.; Camelio, J.; Sutherland, J.W.; Skerlos, S.J.; Dornfeld, D.A.; Jawahir, I.S.; Clarens, A.F.; Rickli, J.L. A Review of engineering research in sustainable manufacturing. J. Manuf. Sci. Eng. 2013, 135, 599–619. [Google Scholar] [CrossRef]

- Wu, Y.; Li, W.; Yang, P. A study of fatigue remaining useful life assessment for construction machinery part in remanufacturing. Procedia Cirp 2015, 29, 758–763. [Google Scholar] [CrossRef]

- Xia, X.; Govindan, K.; Zhu, Q. Analyzing internal barriers for automotive parts remanufacturers in China using grey-DEMATEL approach. J. Clean. Prod. 2015, 87, 811–825. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.H. Supply chain-based barriers for truck-engine remanufacturing in China. Transp. Res. Part E Logist. Transp. Rev. 2015, 68, 103–117. [Google Scholar] [CrossRef]

- Teunter, R.H.; Flapper, S.D.P. Optimal core acquisition and remanufacturing policies under uncertain core quality fractions. Eur. J. Oper. Res. 2011, 210, 241–248. [Google Scholar] [CrossRef]

| Parameters | Abbreviations | Definitions |

|---|---|---|

| X | The quantity of demands | The quantity of demands for new remanufactured products |

| Y | The quantity of acquisition | The quantity of returned EOL products |

| Case 1 | When EOL construction machinery can be reused directly | |

| Case 2 | Not in Case 1, but its crucial components can be reused in remanufacturing after repairing | |

| Case 3 | Neither the product nor its crucial components can be remanufactured(not in Case 1 or Case 2) | |

| Recycling price | Unit recycling price of EOL construction machinery | |

| Processing costs | Processing costs(cleaning, testing, etc.) of EOL construction machinery in case i(i = 1,2,3) | |

| Unit processing costs | Unit processing costs(cleaning, testing, etc.) of EOL construction machinery in case i(i = 1,2,3) | |

| Unit disposal costs | Disposal costs of unit EOL product | |

| Costs of uncertainty | Cost of uncertainty caused by EOL products quality | |

| , | Left/Right end point | Left/Right end point of the interval of the uncertainty costs |

| The demand coefficient | The customer demand for remanufacturing products () | |

| Demand satisfaction coefficient | The relationship between customers’ demands and the quantity of EOL products | |

| Direct reusing rate of product in case 1 | The direct reusing rate of EOL construction machinery in case 1 () | |

| Direct reusing rate of components in case 2 | The reusing rate after repairing of the crucial components in case 2 () | |

| The rate of the case does not belong to case1 or case or () | ||

| Recycling quality | The quality fluctuation coefficient () | |

| Recognition coefficient | The recognition coefficient of new remanufactured products by customers | |

| Resource net benefits | The overall resource benefits when the demand of customers are satisfied in case i(i = 1,2,3) | |

| Unit net resource benefits | Unit resource benefits when the demand of customers are satisfied in case i(i = 1,2,3) | |

| Net profits of reman | The profits of remanufacturers when the demand of customers are satisfied in case i(i = 1,2,3) | |

| Unit net profits of reman | Profits of unit EOL item construction machinery in case i(i = 1,2,3), | |

| Unit profits of reman | Revenue of unit EOL item construction machinery in case i(i = 1,2,3) |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Deng, Q.-w.; Liao, H.-l.; Xu, B.-w.; Liu, X.-h. The Resource Benefits Evaluation Model on Remanufacturing Processes of End-of-Life Construction Machinery under the Uncertainty in Recycling Price. Sustainability 2017, 9, 256. https://doi.org/10.3390/su9020256

Deng Q-w, Liao H-l, Xu B-w, Liu X-h. The Resource Benefits Evaluation Model on Remanufacturing Processes of End-of-Life Construction Machinery under the Uncertainty in Recycling Price. Sustainability. 2017; 9(2):256. https://doi.org/10.3390/su9020256

Chicago/Turabian StyleDeng, Qian-wang, Hao-lan Liao, Bo-wen Xu, and Xia-hui Liu. 2017. "The Resource Benefits Evaluation Model on Remanufacturing Processes of End-of-Life Construction Machinery under the Uncertainty in Recycling Price" Sustainability 9, no. 2: 256. https://doi.org/10.3390/su9020256