The Spatiotemporal Dynamics of Natural Gas Imports in OECD Countries

Abstract

:1. Introduction

2. Literature Review

2.1. Literature Review of Stochastic Matrices

2.2. Literature Review of Natural Gas Import

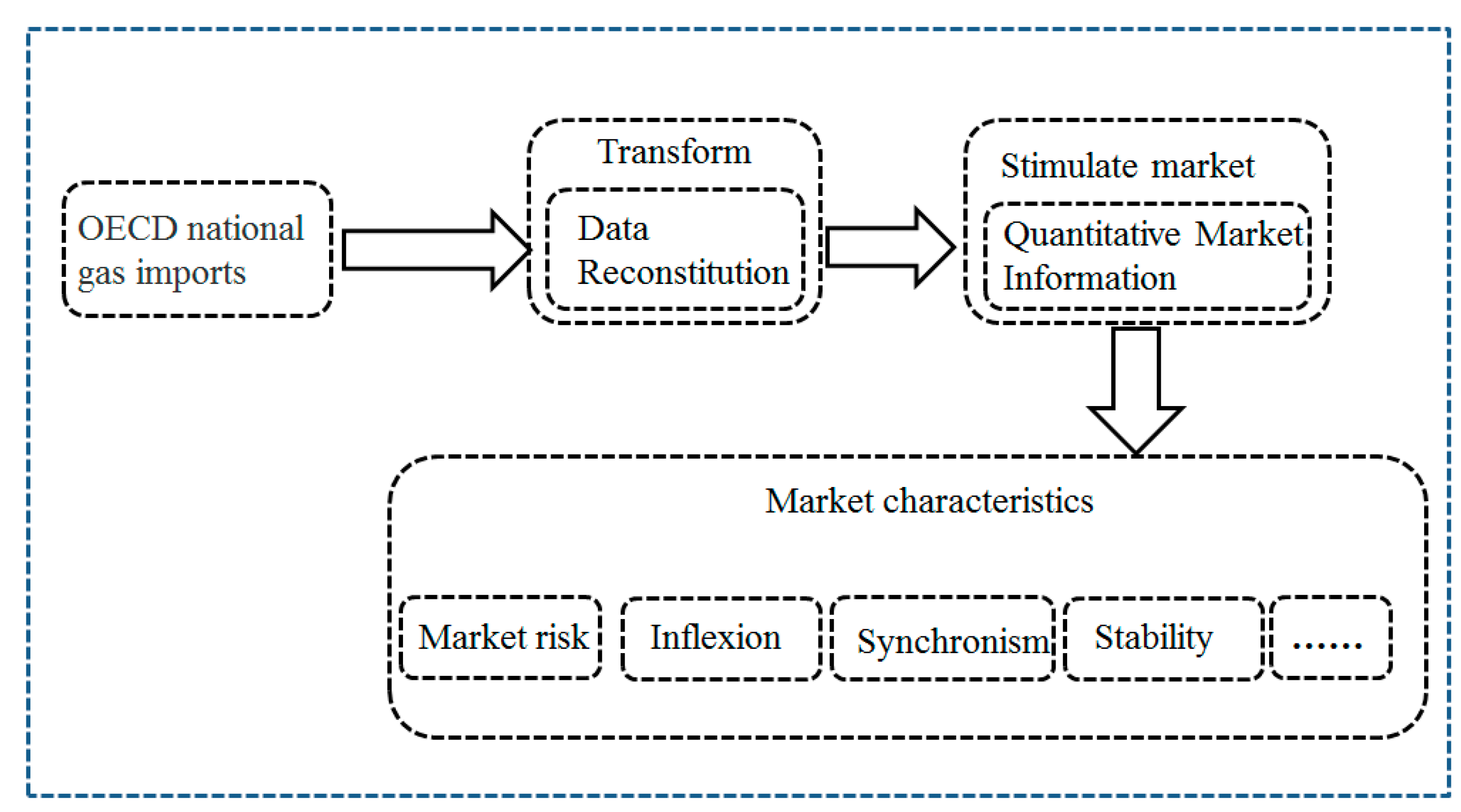

3. The Empirical Analysis

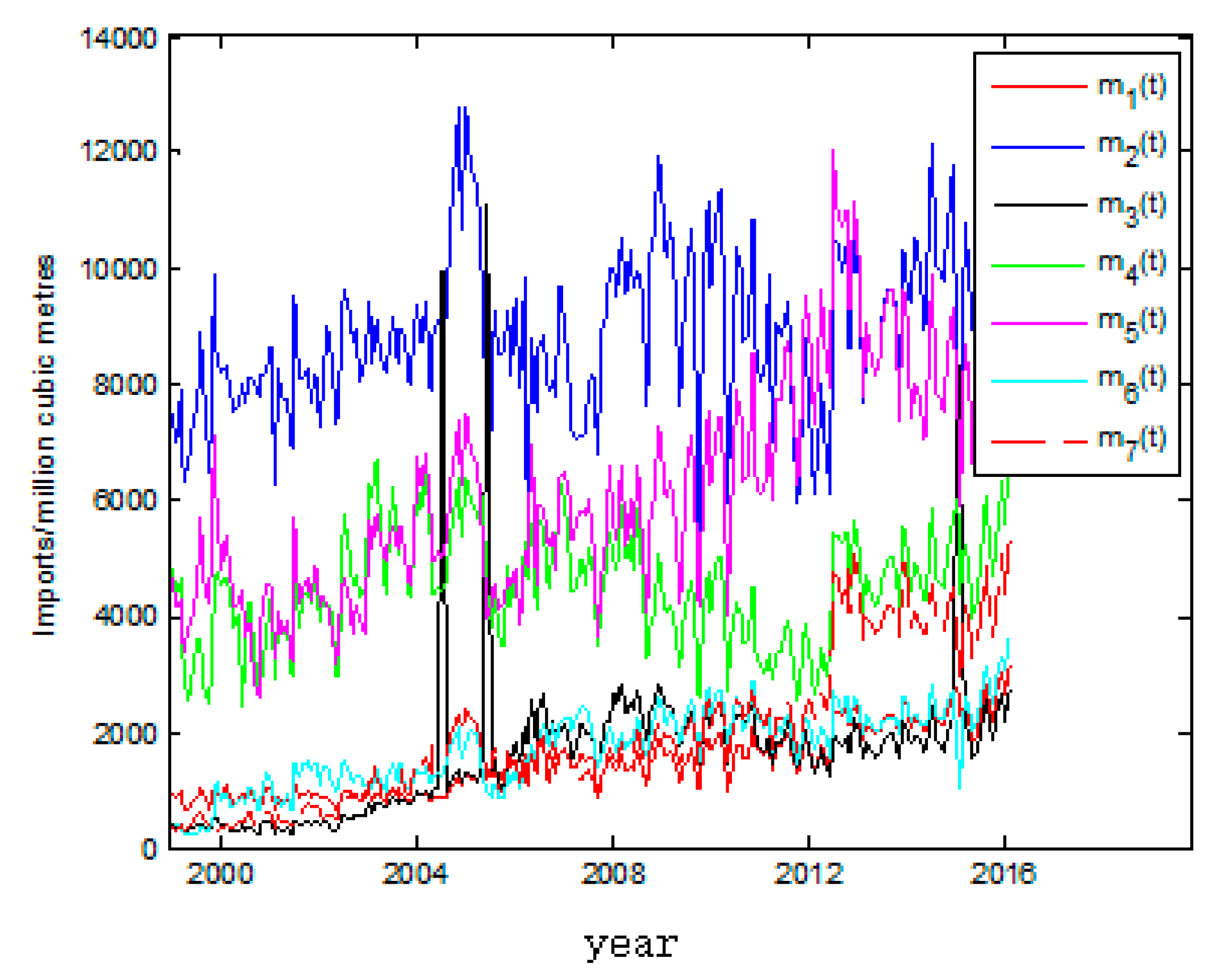

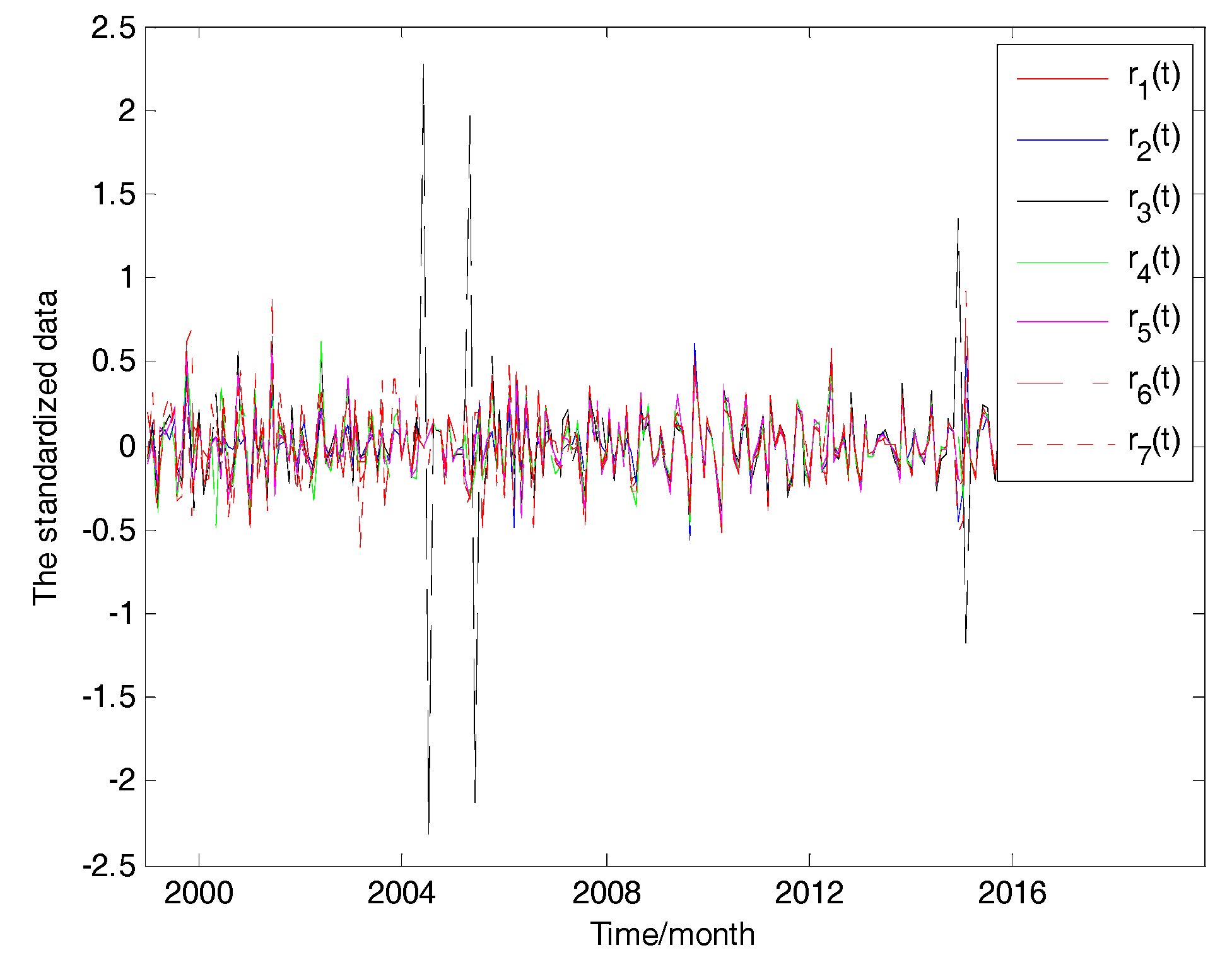

3.1. Data

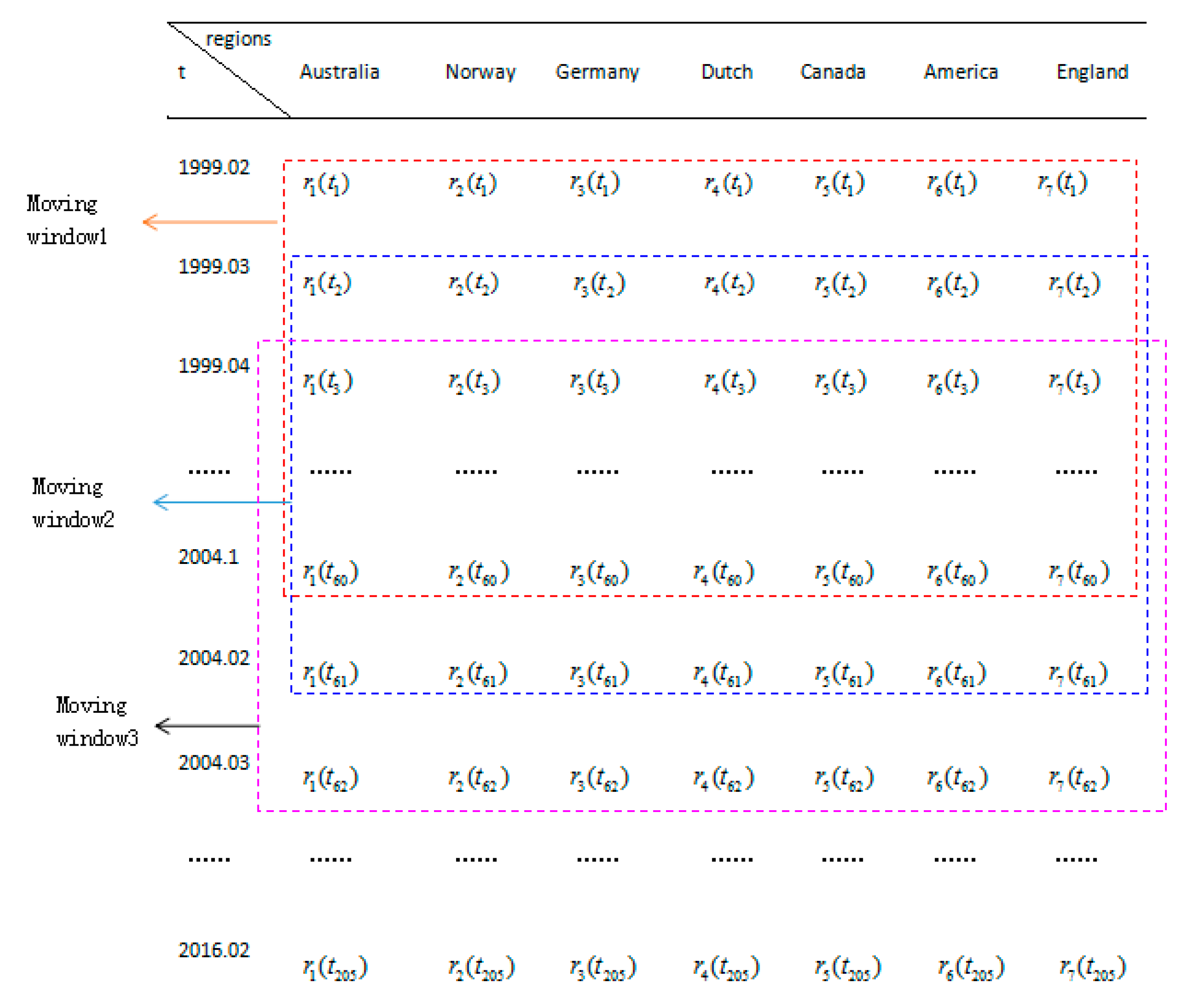

3.2. Establishing the Moving Windows

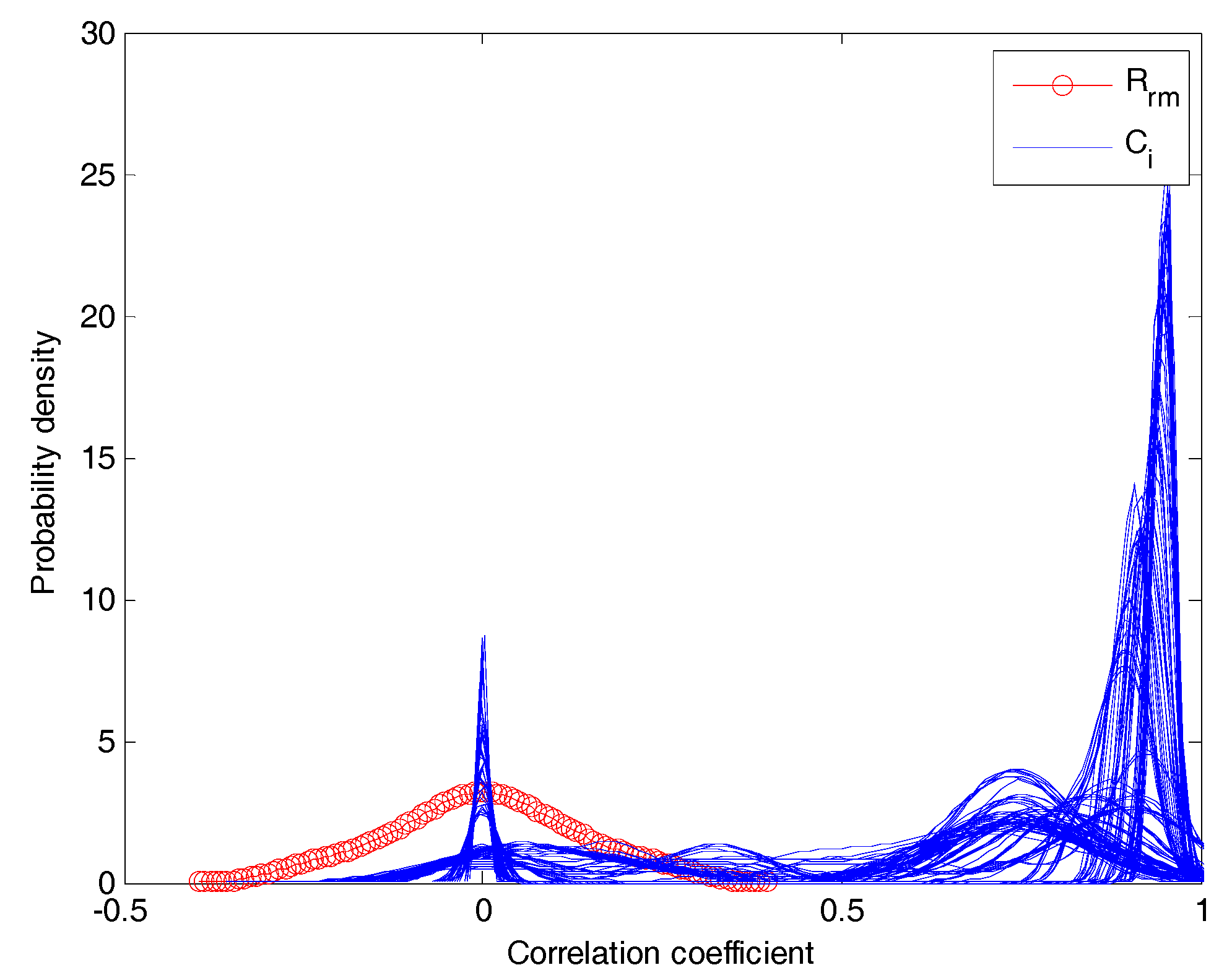

3.3. Probability Density of Correlation Coefficients

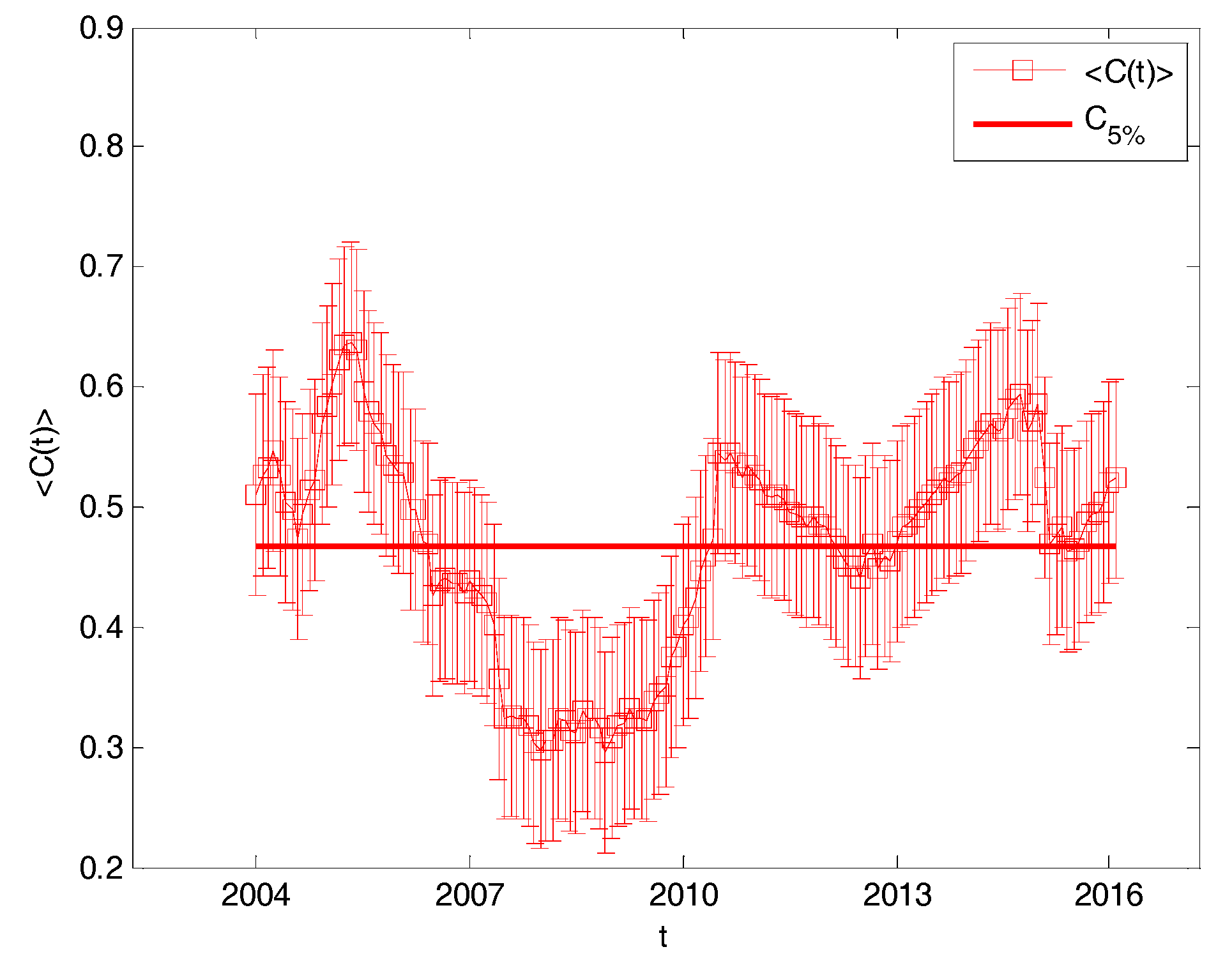

3.4. The Analysis of Average Correlation Coefficient

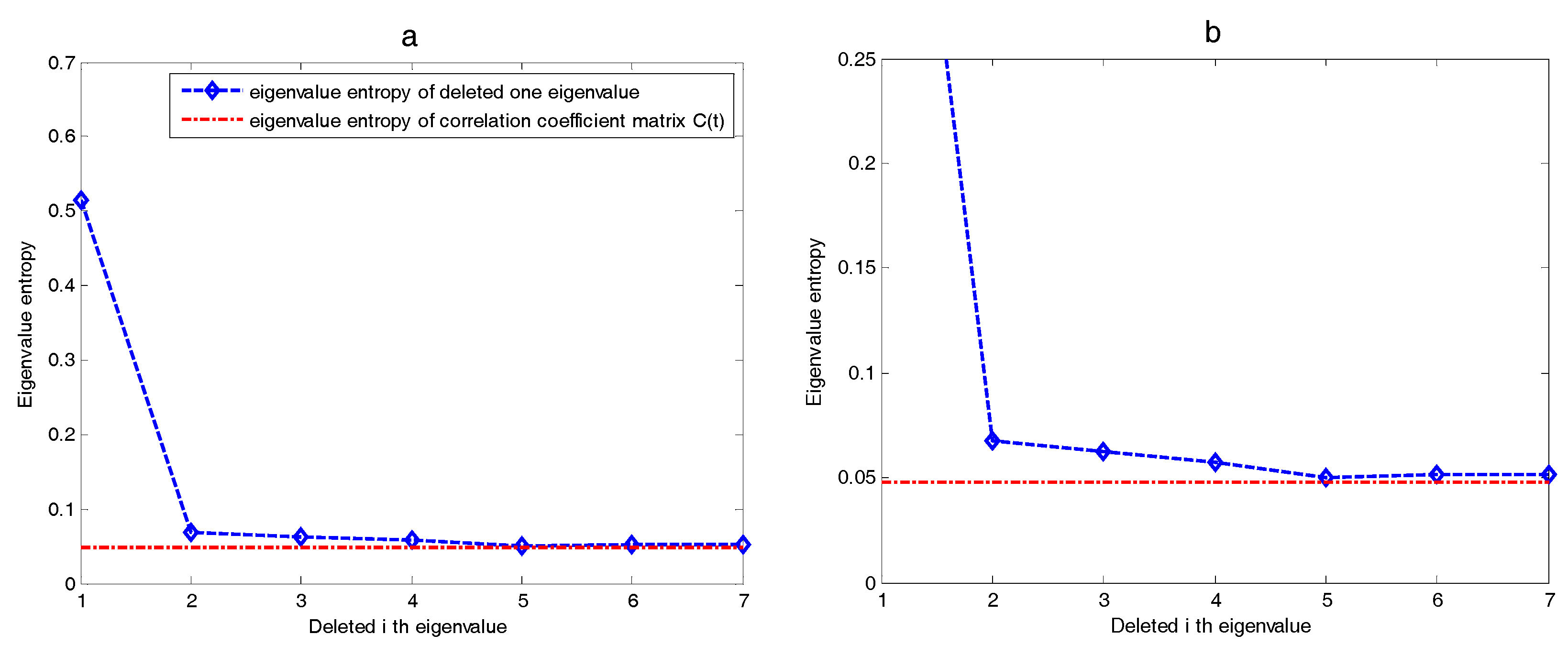

3.5. Researching on the Entropy of Eigenvalues

- 1)

- , If the value is 1, the remaining values are 0, that ; otherwise, ;

- 2)

- For a given , when all equal, then gets the maximum value of 1.

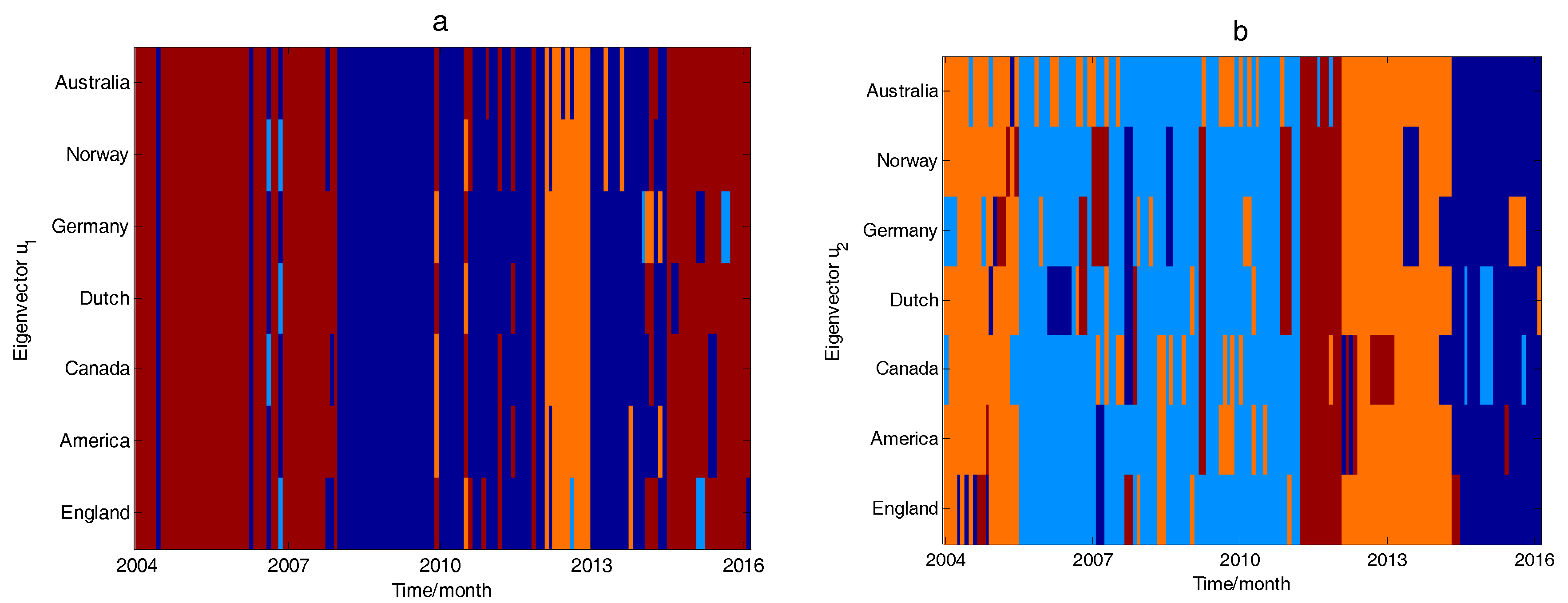

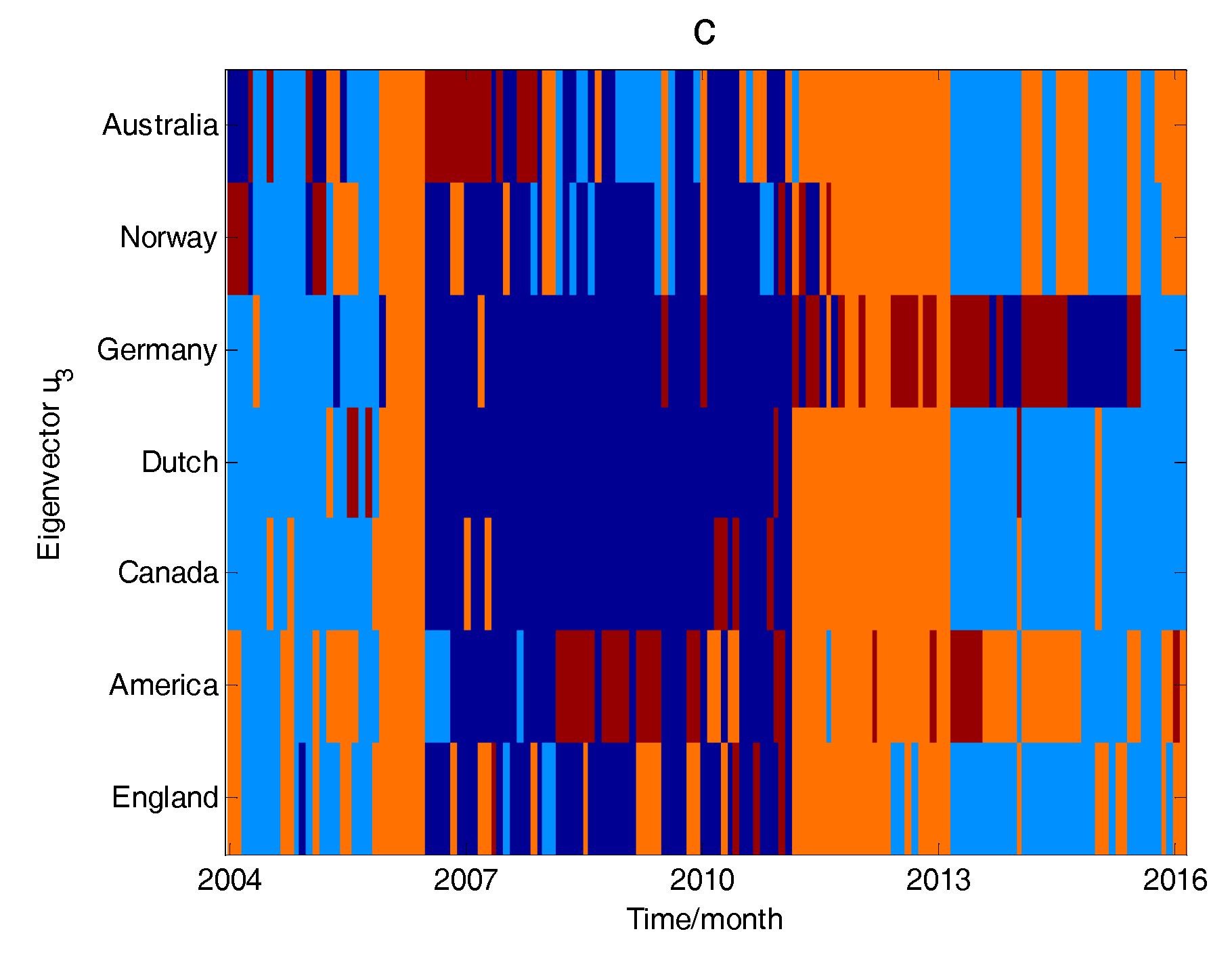

3.6. The Analysis of Eigenvectors

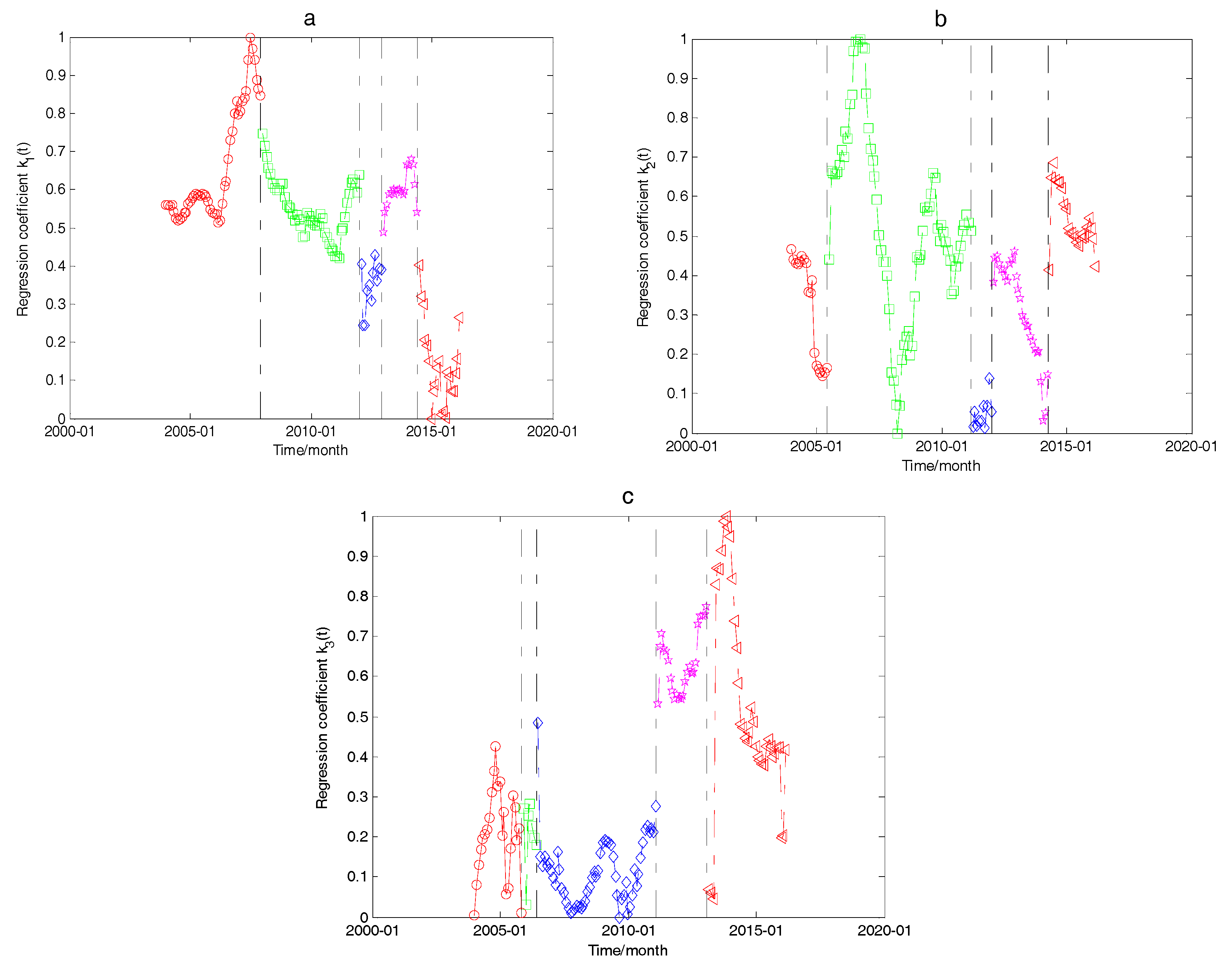

3.7. Feature Combination and Regression Analysis

3.7.1. Feature Combination Algorithm

3.7.2. Regression Analysis

4 Market Risk

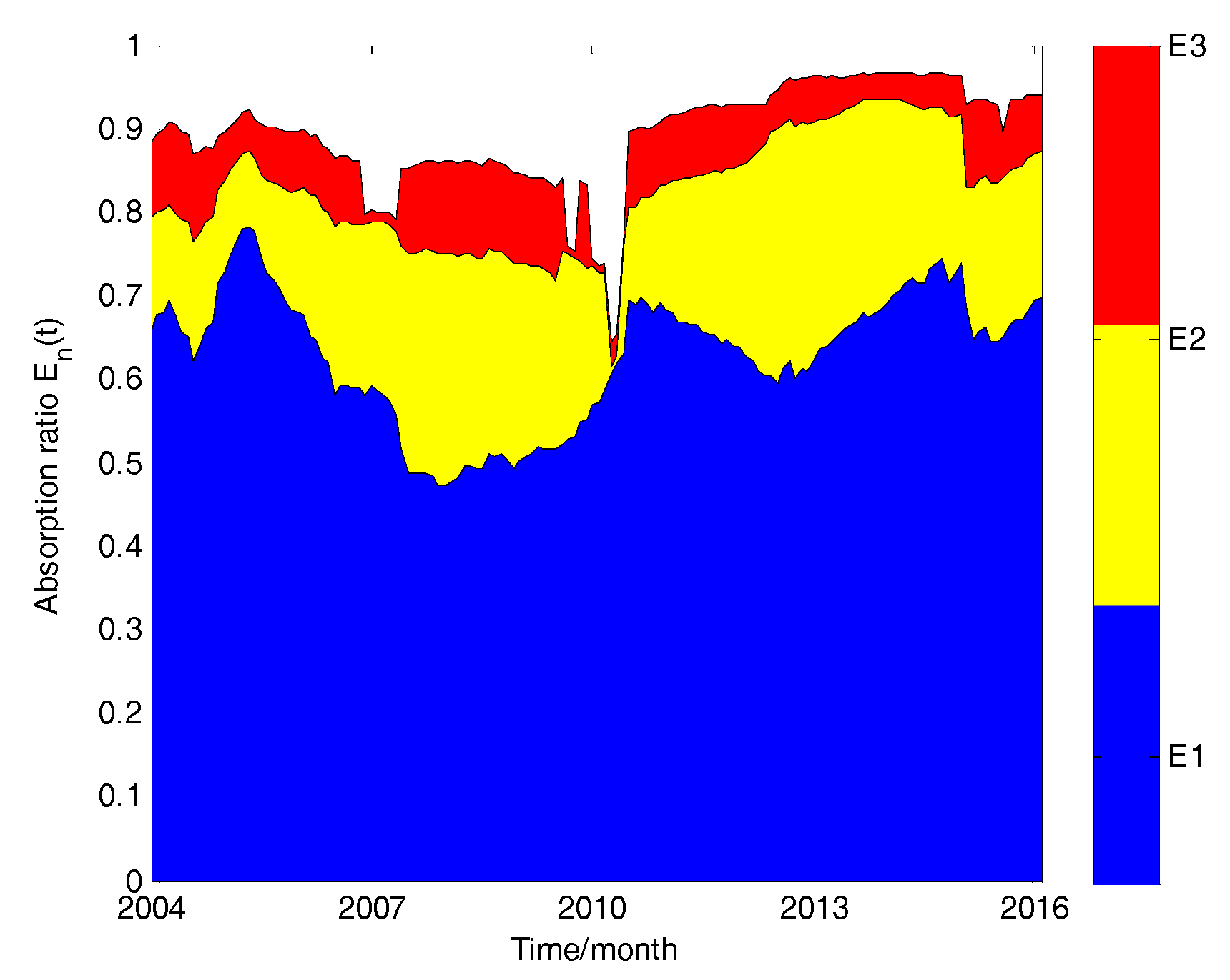

4.1. Absorption

4.2. The Risk Assessment of Natural Gas Imports Market in OECD Countries

4.3. The Region Division of Natural Gas Imports Market in OECD Countries

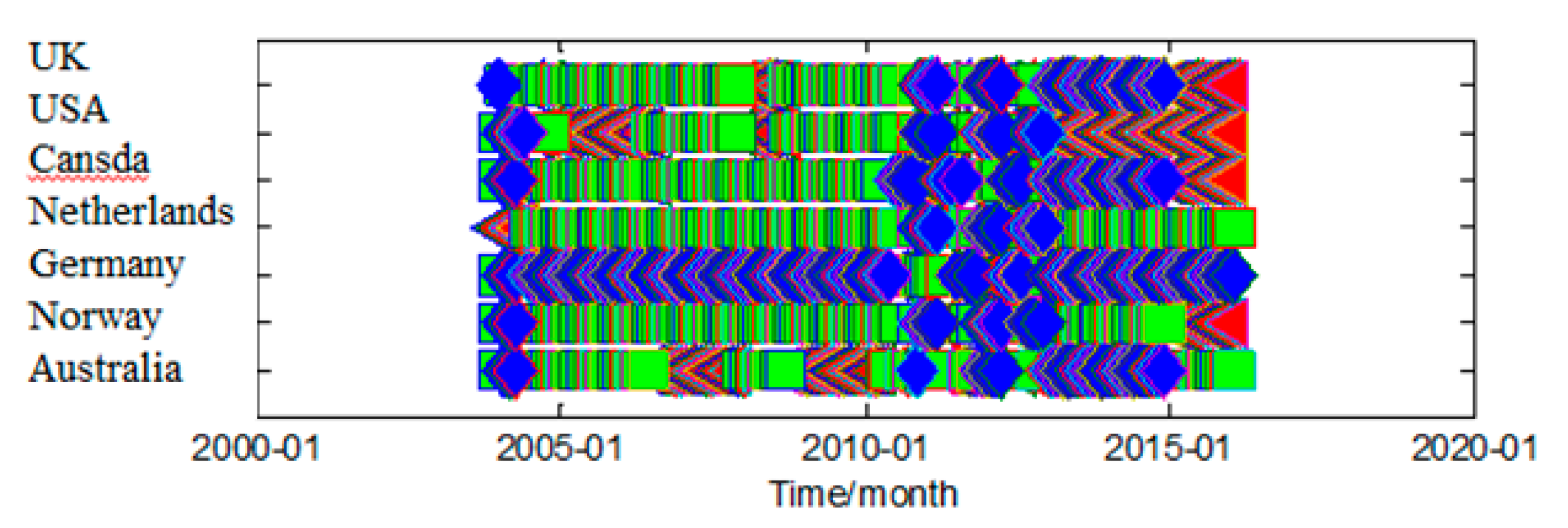

4.4. The Classification Verification of the United Kingdom, Canada and Australia

5. Conclusions

- Combined with the stochastic matrix theory, the OECD countries are not independent of the correlation of natural gas imports. At the same time, the average correlation coefficient of the correlation coefficient matrix shows that the OECD national gas import market has a great degree of correlation and high risk.

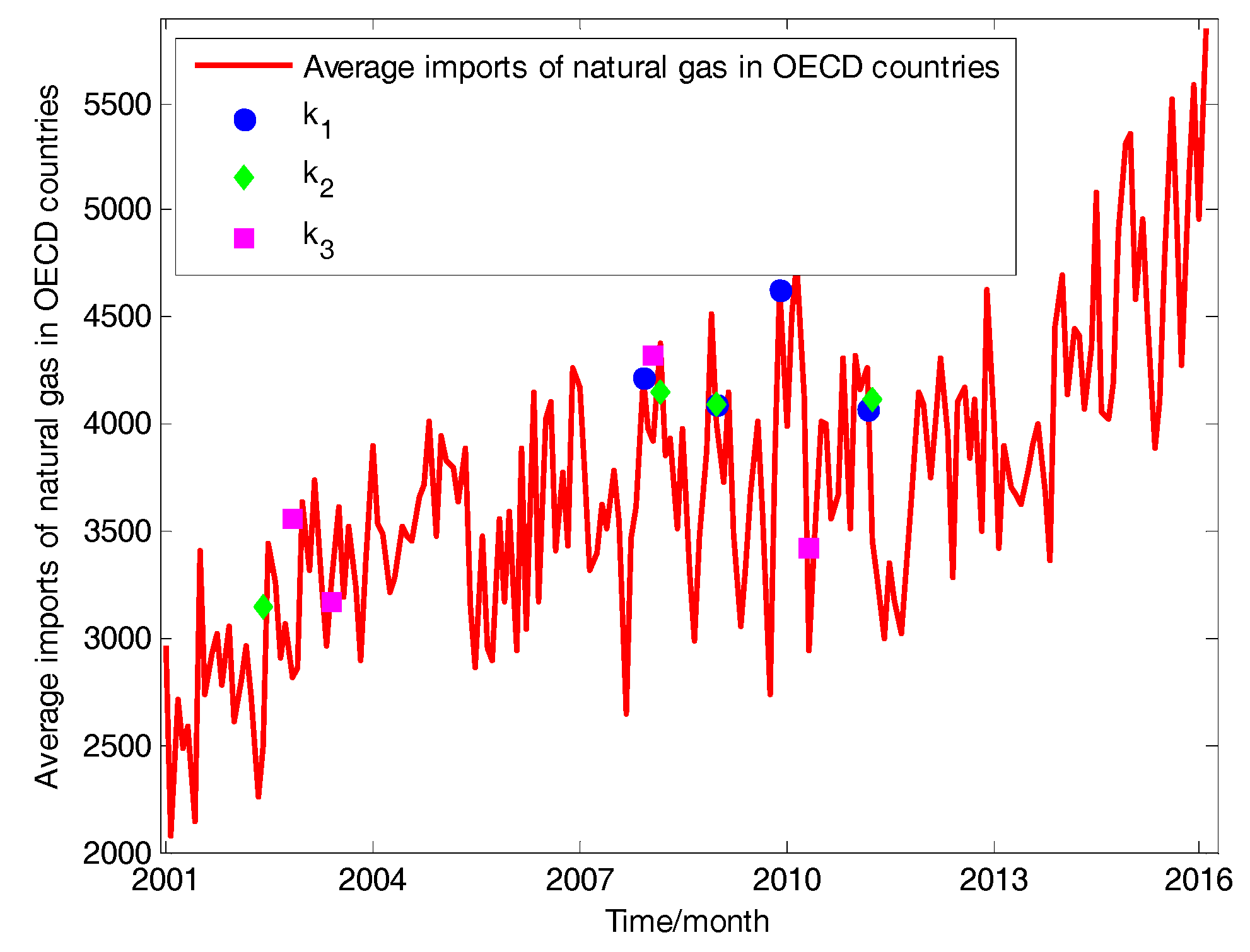

- Through the characteristic combination and regression analysis, we can roughly divide OECD national gas import market into 8 different stages and the correlation degree of OECD gas import market varies in each stage.

- The discontinuity point of the regression coefficient appeared earlier than the fluctuation inflexion of the average import volume of natural gas in OECD countries. Thus, the inflection point of natural gas import quantity in OECD countries can be roughly predicted, and the correlation coefficient matrix can imply the market information at the same time.

- Through the absorption rate method, the authors find that the OECD country’s natural gas imports market is not stable, with high and increasing risk. Overall, in recent years, especially since April 2013, with the development of science and technology, the increase of natural gas utilization rate and the improvement of natural gas transportation pipelines around the world, natural gas has been favored by many countries. The OECD countries have used and imported natural gas extensively, and the degree of association of the whole natural gas import market in the OECD is becoming stronger. At the beginning of 2015, a warming up of the gas pricing mechanism led to higher gas prices and a sharp fall in the prices of fuels such as oil and coal, which reduced the use and import of natural gas in OECD countries, and the market correlation of the entire gas import volume began to decline.

- It can be found through the clustering method that, except Germany, the synchronization of the OECD national imports of natural gas market is very high; Norway and the Netherlands in recent years have been in line with the basic pace of import demand for natural gas. In addition, the 7 countries can be roughly divided into 4 categories. Germany and the United States belong to one category, Norway and Netherlands belong to one category, and United Kingdom, Canada and Australia belong to one category.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- World Energy Agency. Available online: http://www.iea.org/statistics/ (accessed on 14 November 2017).

- Mehta, M.L. Notes-Random Matrices (Revised and Enlarged Second Edition); Elsevier: Amsterdam, The Netherlands, 1991; pp. 535–544. [Google Scholar]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Amaral, L.A.N.; Stanley, H.E. Universal and non-universal properties of cross-correlations in financial time series. Phys. Rev. Lett. 1999, 83, 1471–1474. [Google Scholar] [CrossRef]

- Tulino, A.M.; Verdú, S. Random matrix theory and wireless communications. Commun. Inf. Theory 2004, 1, 1–182. [Google Scholar] [CrossRef]

- Kulkarni, V.; Deo, N. Correlation and volatility in an Indian stock market: A random matrix approach. Eur. Phys. J. B 2007, 60, 101–109. [Google Scholar] [CrossRef]

- Meng, H.; Xie, W.J.; Jiang, Z.Q.; Podobnik, B.; Zhou, W.X.; Stanley, H.E. Systemic risk and spatiotemporal dynamics of the US housing market. Sci. Rep. 2014. Available online: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3888986/ (accessed on 14 November 2017).

- Tian, L.; Ding, Z.; Wang, M.; Zhen, Z. The spatiotemporal dynamic analysis of the implied market information and characteristics of the correlation coefficient matrix of the international crude oil price returns. Energy Ecol. Environ. 2016, 1, 197–208. [Google Scholar] [CrossRef]

- Wang, M.; Chen, Y.; Tian, L.; Jiang, S.; Tian, Z.; Du, R. Fluctuation behavior analysis of international crude oil and gasoline price based on complex network perspective. Appl. Energy 2016, 175, 109–127. [Google Scholar] [CrossRef]

- Wang, T.; Lin, B. Impacts of unconventional gas development on China’s natural gas production and import. Renew. Sustain. Energy Rev. 2014, 39, 546–554. [Google Scholar] [CrossRef]

- Tian, C. Analysis of China’s oil & gas imports and exports in 2012. Int. Pet. Econ. 2013, 3, 44–45. [Google Scholar]

- Ma, S.; Han, F. Natural gas reserves situation and experiences of foreign countries. Nat. Gas Ind. 2010, 30, 62–66. [Google Scholar]

- Sen, A. Natural gas imports into South Asia: A study in international relations. Energy Policy 2000, 28, 763–770. [Google Scholar] [CrossRef]

- Dong, X.; Kong, Z. The impact of China’s natural gas import risks on the national economy. J. Nat. Gas Sci. Eng. 2016, 36, 97–107. [Google Scholar] [CrossRef]

- Maxwell, D.; Zhu, Z. Natural gas prices, LNG transport costs, and the dynamics of LNG imports. Energy Econ. 2010, 33, 217–226. [Google Scholar] [CrossRef]

- Jia, Q.; Geng, J.; Fan, Y. Separated influence of crude oil prices on regional natural gas import prices. Energy Policy 2014, 70, 96–105. [Google Scholar] [CrossRef]

- Egging, R.; Pichler, A. Risk aversion in imperfect natural gas markets. Eur. J. Oper. Res. 2017, 259, 367–383. [Google Scholar] [CrossRef]

- Batten, J.A.; Ciner, C.; Lucey, B.M. The dynamic linkages between crude oil and natural gas markets. Energy Econ. 2017, 2, 155–170. [Google Scholar] [CrossRef]

- Bernstein, P.; Tuladhar, S.D. Economics of U.S. natural gas exports: Should regulators limit U.S LNG exports? Energy Econ. 2016, 60, 427–437. [Google Scholar] [CrossRef]

- Zhang, K. Natural gas supply-demand situation and prospect in China. Nat. Gas Ind. B 2014, 10, 103–112. [Google Scholar]

- Egging, R.; Holz, F. Risks in global natural gas markets: Investment, hedging and trade. Energy Policy 2016, 94, 468–479. [Google Scholar] [CrossRef]

- Vivoda, V. LNG import diversification in Asia. Energy Strategy Rev. 2014, 2, 289–297. [Google Scholar] [CrossRef]

- Shi, X.; Variam, H. Global impact of uncertainties in China’s gas market. Energy Policy 2017, 104, 382–394. [Google Scholar]

- Vivoda, V. Natural gas in Asia: Trade, markets and regional institutions. Energy Policy 2014, 74, 80–90. [Google Scholar] [CrossRef]

| Eigenvalue Entropy in Each Case | The Value of the Characteristic Entropy |

|---|---|

| Eigenvalue entropy with the maximum eigenvalues | 0.0476 |

| The eigenvalue entropy of the largest eigenvalue is removed | 0.5154 |

| The eigenvalue entropy of the second largest eigenvalue is removed | 0.0684 |

| The eigenvalue entropy of the third largest eigenvalue is removed | 0.0618 |

| The eigenvalue entropy of the fourth largest eigenvalue is removed | 0.0587 |

| The eigenvalue entropy of the fifth largest eigenvalue is removed | 0.0516 |

| The eigenvalue entropy of the sixth largest eigenvalue is removed | 0.0523 |

| The eigenvalue entropy of the seventh eigenvalue is removed | 0.0520 |

| The Correlation Coefficient between the Variables and The p Value | |||||

|---|---|---|---|---|---|

| Correlation Coefficient | p Value | ||||

| Canada | United Kingdom | Canada | United Kingdom | ||

| Australia | 0.8663803 | 0.9271938 | Australia | 2.2 × 10−16 | 2.2 × 10−16 |

| Canada | 0.9041986 | Canada | 2.2 × 10−16 | ||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fu, M.; Yang, Y.; Tian, L.; Zhen, Z. The Spatiotemporal Dynamics of Natural Gas Imports in OECD Countries. Sustainability 2017, 9, 2106. https://doi.org/10.3390/su9112106

Fu M, Yang Y, Tian L, Zhen Z. The Spatiotemporal Dynamics of Natural Gas Imports in OECD Countries. Sustainability. 2017; 9(11):2106. https://doi.org/10.3390/su9112106

Chicago/Turabian StyleFu, Min, Yang Yang, Lixin Tian, and Zaili Zhen. 2017. "The Spatiotemporal Dynamics of Natural Gas Imports in OECD Countries" Sustainability 9, no. 11: 2106. https://doi.org/10.3390/su9112106