Biomass Power Generation Investment in China: A Real Options Evaluation

Abstract

:1. Introduction

2. Model Formulation

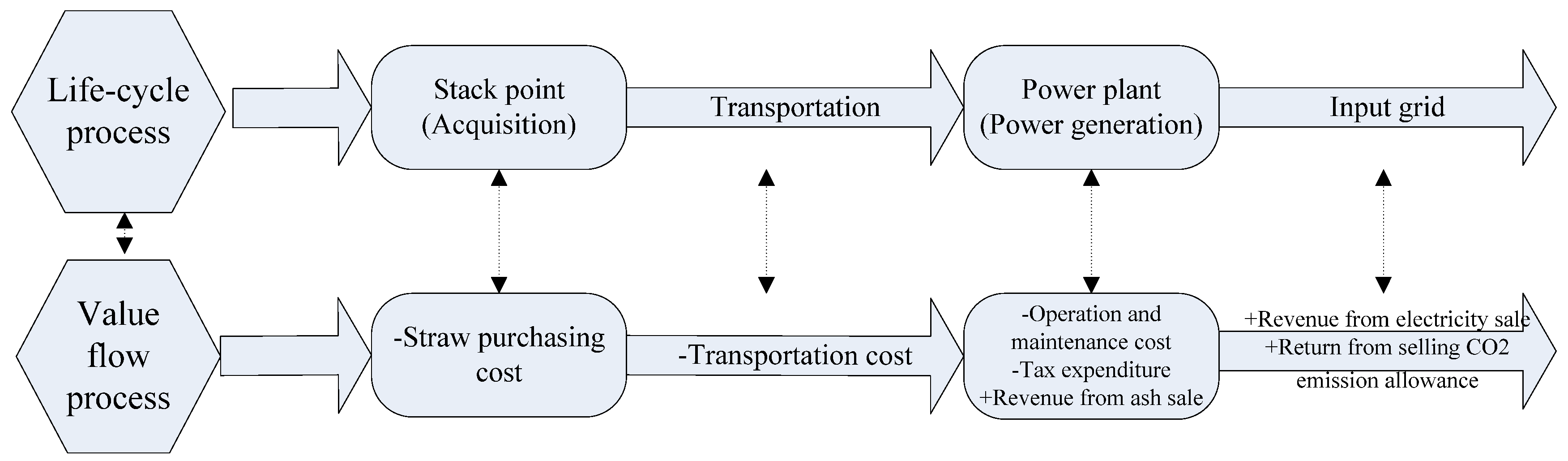

2.1. System Boundary

2.2. The Income Composition of Straw-Based Power Generation

2.2.1. Revenue from Electricity Sale

2.2.2. Returns from Selling CO2 Emission Allowance

2.2.3. Revenue of Ash Sale

2.3. The Cost Structure of Straw-Based Power Generation

2.3.1. Investment Cost

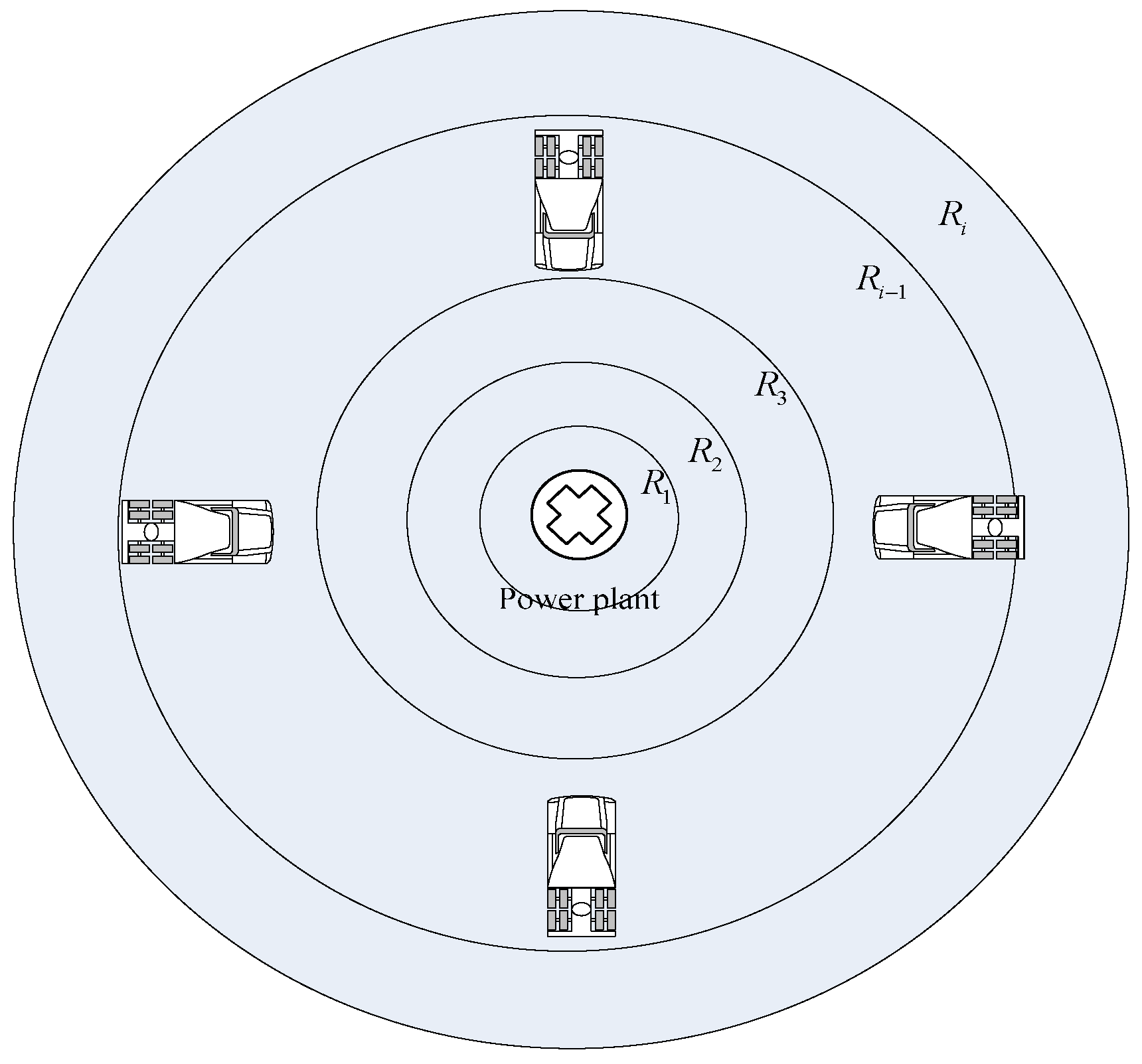

2.3.2. Fuel Cost

2.3.3. Operation and Maintenance Cost

2.3.4. Tax Expenditure

2.4. Net Present Value of the Straw-Based Power Generation Project

2.5. Optimal Investment Rules

2.6. Model Solution

3. Data

4. Results and Discussions

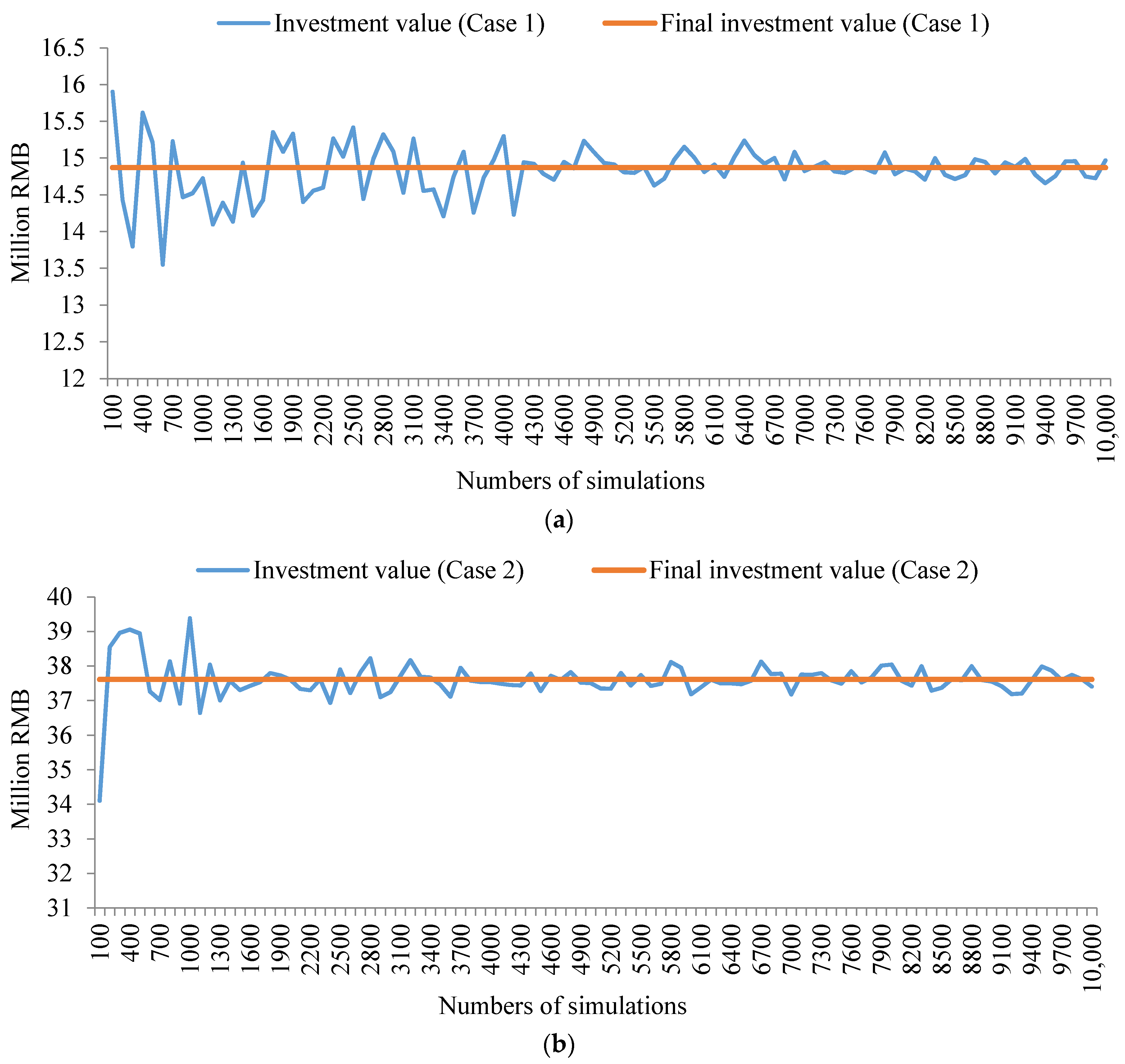

4.1. Base Case Analysis

4.2. Discussions

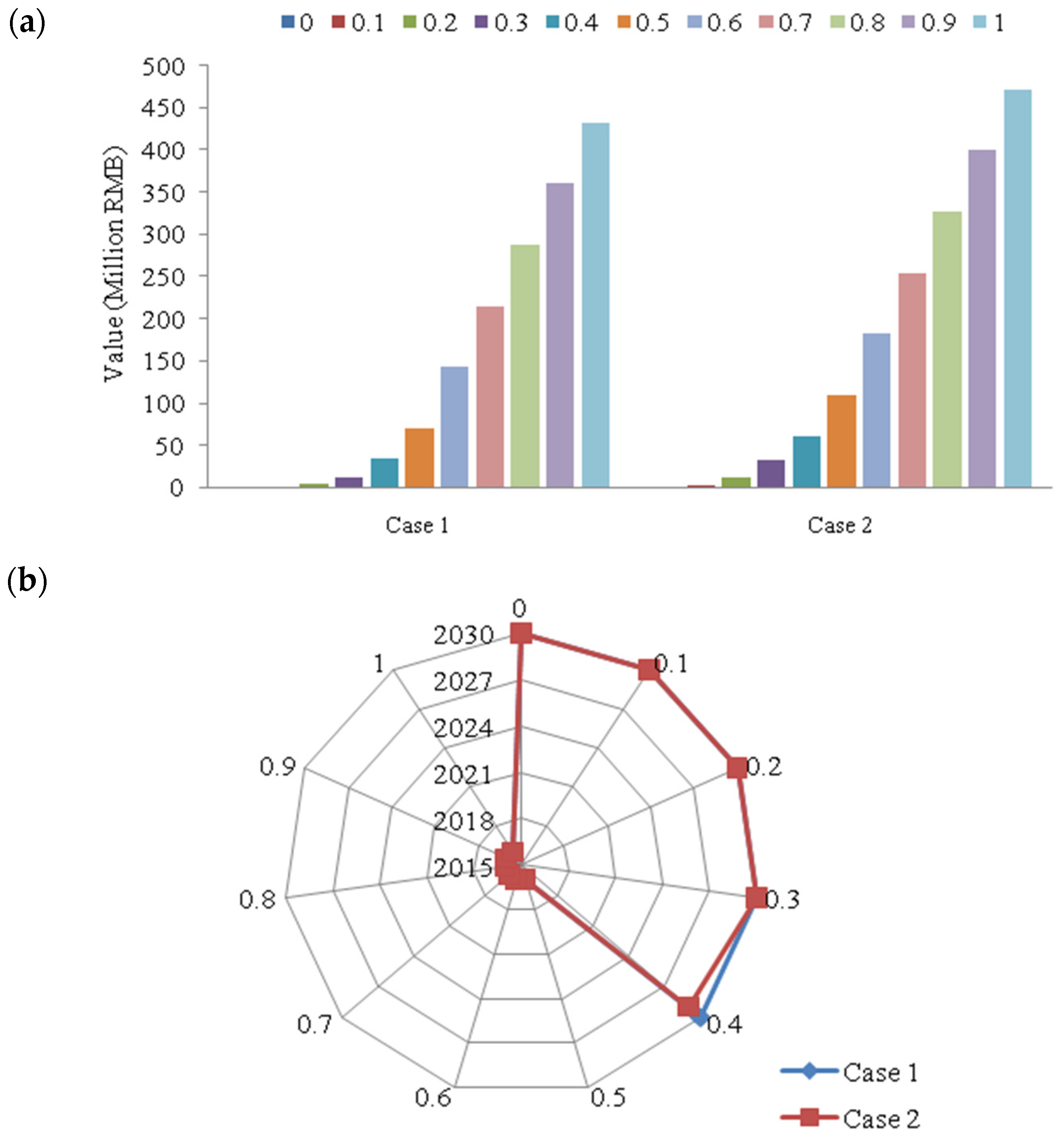

4.2.1. Implications of Subsidy Policy

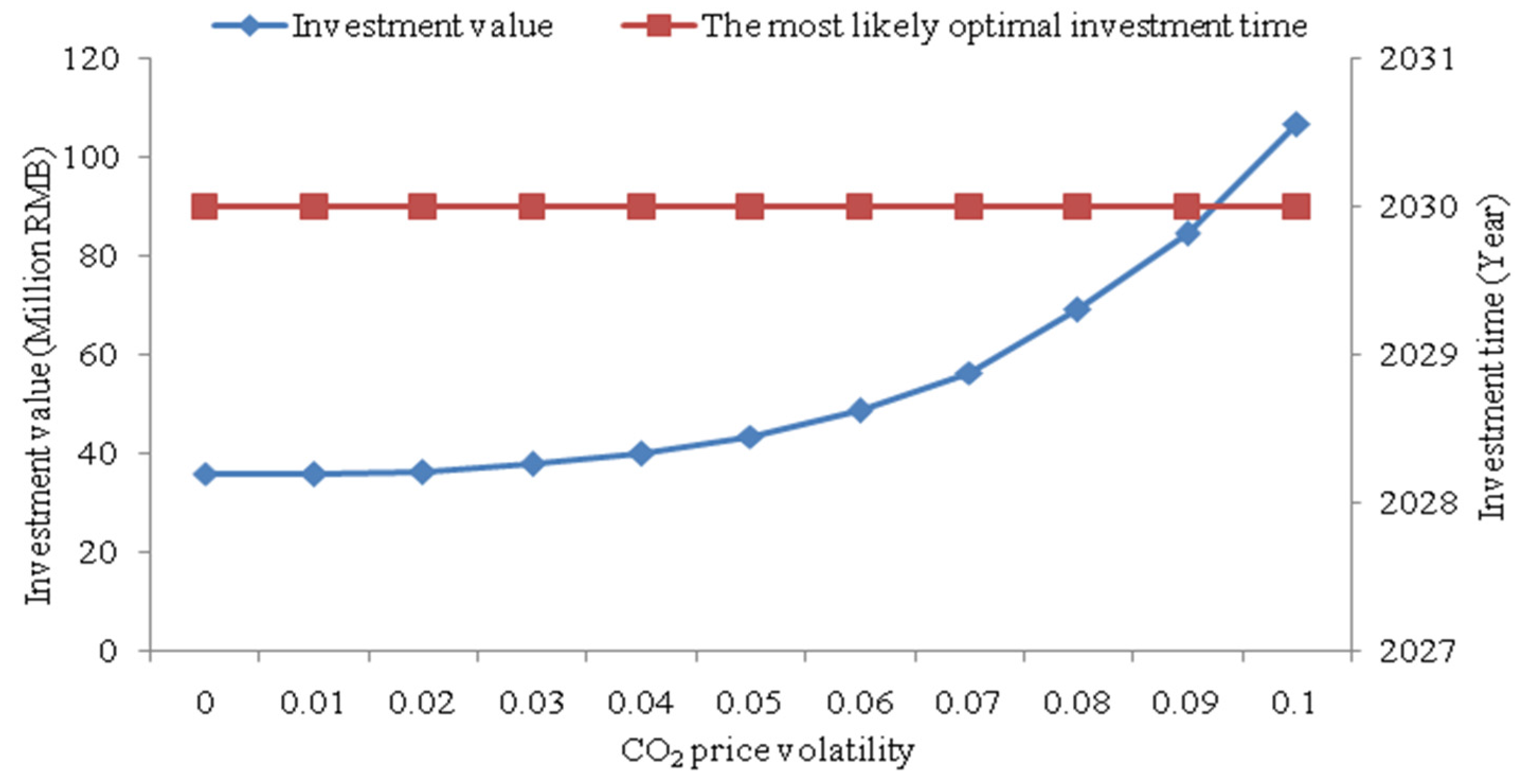

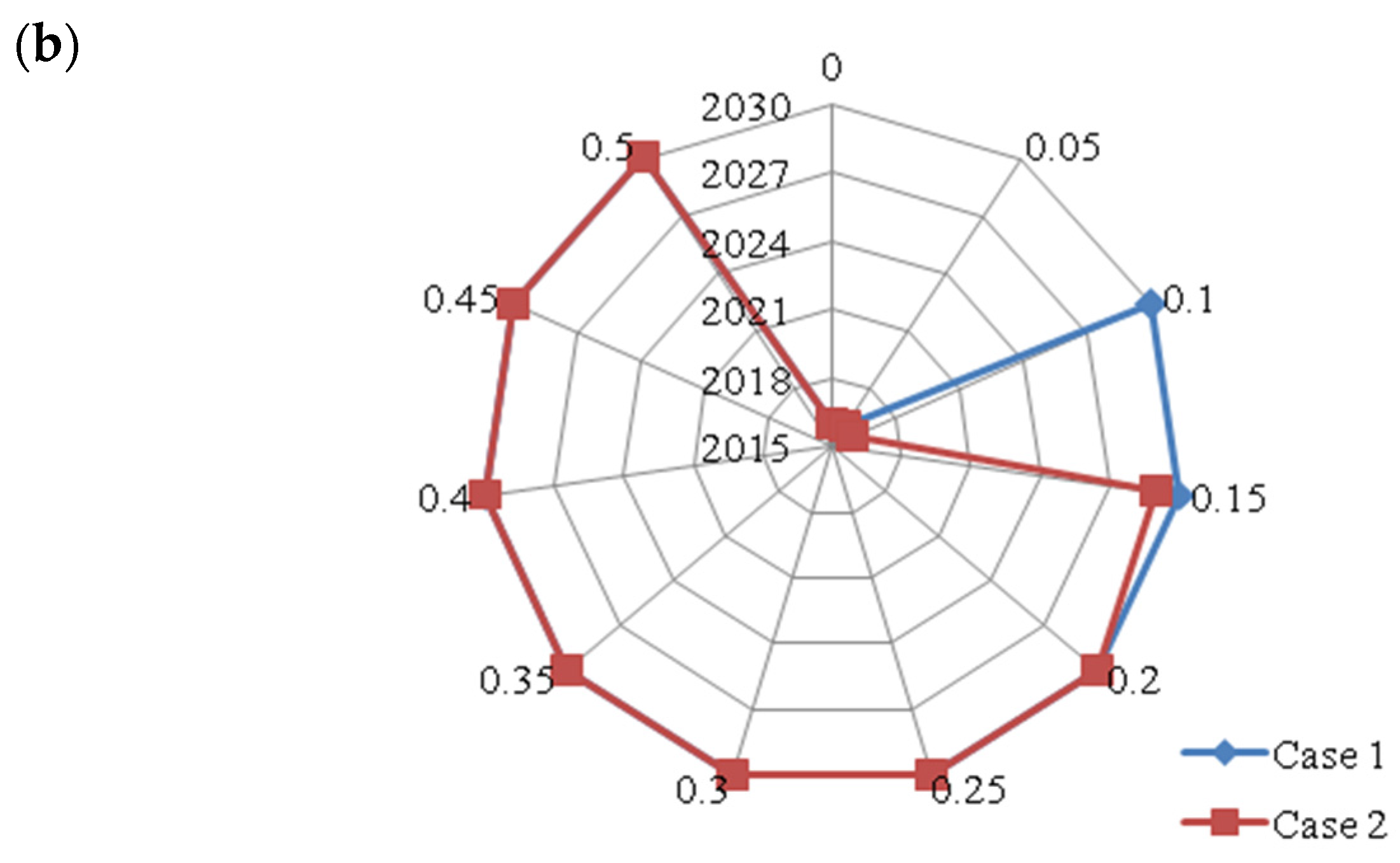

4.2.2. Implications of the Carbon Emission Trading Scheme

4.2.3. Influence of Straw Price

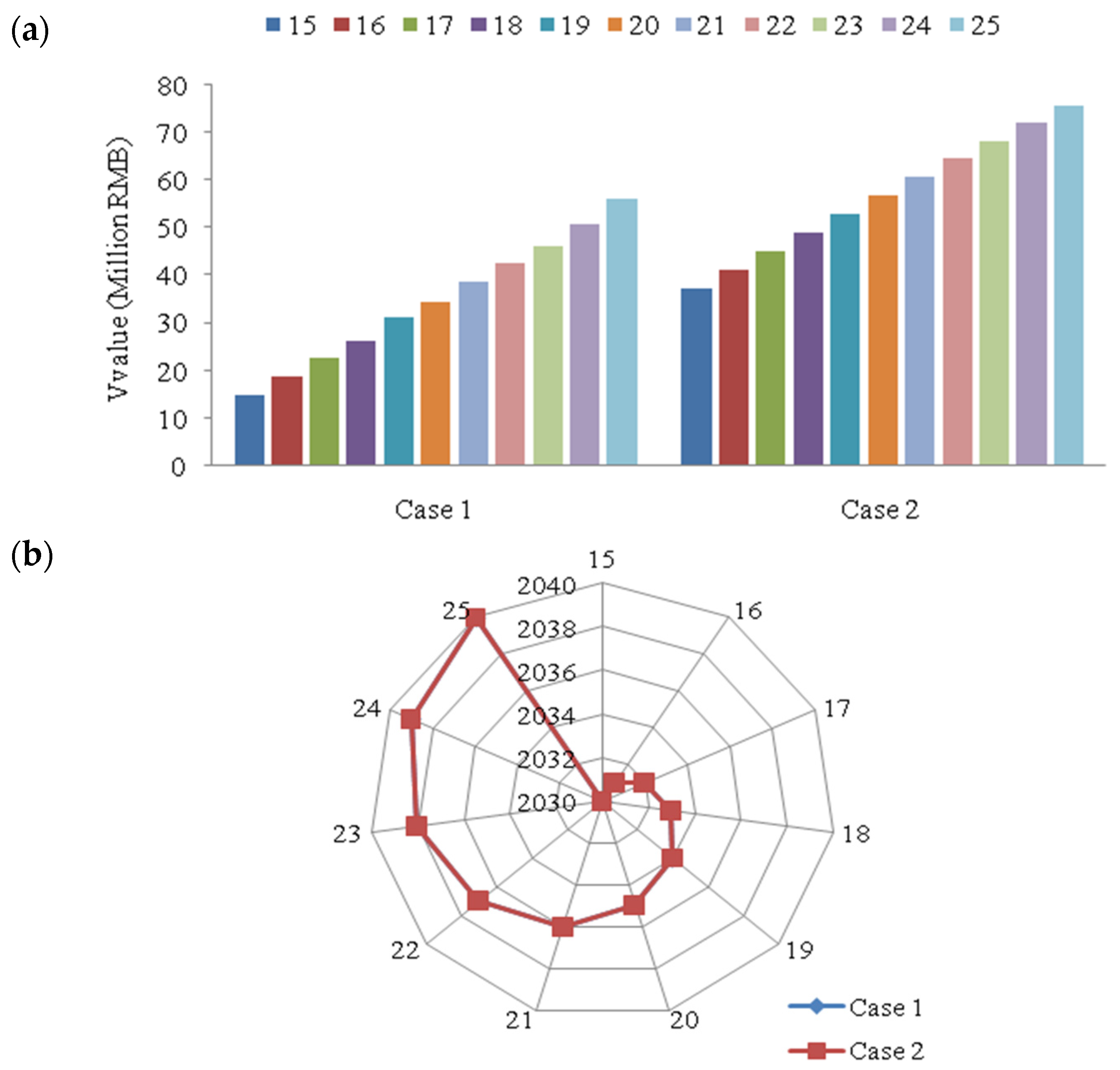

4.2.4. Influence of Installed Capacity

4.2.5. Impact of Correlation Structure

4.2.6. Impact of the Validity Period of Investment

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- National Development and Reform Commission (NDRC). Middle and Long Term Plan for Renewable Energy Development; National Development and Reform Commission: Beijing, China, 2007. (In Chinese) [Google Scholar]

- Liu, G.; Shen, L. Quantitive appraisal of biomass energy and its geographical distribution in China. J. Nat. Resour. 2007, 22, 9–19. (In Chinese) [Google Scholar]

- Zhang, Q.; Zhou, D.Q.; Zhou, P.; Ding, H. Cost analysis of straw-based power generation in Jiangsu province, China. Appl. Energy 2013, 102, 785–793. [Google Scholar] [CrossRef]

- Chen, L.Q. How about the future of China’s biomass power generation? Rev. Econ. Res. 2013, 51, 37–44. (In Chinese) [Google Scholar]

- Venetsanos, K.; Angelopoulou, P.; Tsoutsos, T. Renewable energy sources project appraisal under uncertainty—The case of wind energy exploitation. Energy Policy 2002, 30, 293–307. [Google Scholar] [CrossRef]

- Kjarland, F. A real option analysis of investments in hydropower—The case of Norway. Energy Policy 2007, 35, 5901–5908. [Google Scholar] [CrossRef]

- Bockman, T.; Fleten, S.; Juliussen, E.; Langhammer, H.; Revdal, I. Investment timing and optimal capacity choice for small hydropower projects. Eur. J. Oper. Res. 2008, 190, 255–267. [Google Scholar] [CrossRef] [Green Version]

- Kumbaroglu, G.; Madlene, R.; Demirel, M. A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ. 2008, 30, 1882–1908. [Google Scholar] [CrossRef]

- Reuter, W.H.; Szolgayova, J.; Fuss, S.; Obersteiner, M. Investment in wind power and pumped storage in a real options model. Renew. Sustain. Energy Rev. 2012, 16, 2242–2248. [Google Scholar] [CrossRef]

- Boomsma, T.K.; Meade, N.; Fleten, S.E. Renewable energy investments under different support schemes: A real options approach. Eur. J. Oper. Res. 2012, 220, 225–237. [Google Scholar] [CrossRef]

- Reuter, W.H.; Szolgayova, J.; Fuss, S.; Obersteiner, M. Renewable energy investment: Policy and market impacts. Appl. Energy 2012, 97, 249–254. [Google Scholar] [CrossRef]

- Detert, N.; Kotani, K. Real options approach to renewable energy investments in Mongolia. Energy Policy 2013, 56, 136–150. [Google Scholar] [CrossRef]

- Lin, B.; Wesseh, P.K., Jr. Valuing Chinese feed-in tariffs program for solar power generation: A real options analysis. Renew. Sustain. Energy Rev. 2013, 28, 474–482. [Google Scholar] [CrossRef]

- Zhang, M.M.; Zhou, D.Q.; Zhou, P. A real option model for renewable energy policy evaluation with application to solar PV power generation in China. Renew. Sustain. Energy Rev. 2014, 40, 944–955. [Google Scholar] [CrossRef]

- Santos, L.; Soares, I.; Mendes, C.; Ferreira, P. Real Options versus Traditional Methods to assess Renewable Energy Projects. Renew. Energy 2014, 68, 588–594. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. Renewable energy technologies as beacon of cleaner production: A real options valuation analysis for Liberia. J. Clean. Prod. 2015, 90, 300–310. [Google Scholar] [CrossRef]

- Wesseh, P.K., Jr.; Lin, B. A real options valuation of Chinese wind energy technologies for power generation: Do benefits from the feed-in tariffs outweigh costs? J. Clean. Prod. 2016, 112, 1591–1599. [Google Scholar] [CrossRef]

- Wang, X.W.; Cai, Y.P.; Dai, C. Evaluating China’s biomass power production investment based on a policy benefit real options model. Energy 2014, 73, 751–761. [Google Scholar] [CrossRef]

- Zhao, Z.; Yan, H. Assessment of the biomass power generation industry in China. Renew. Energy 2012, 37, 53–60. [Google Scholar] [CrossRef]

- Wu, C.Z.; Huang, H.; Zheng, S.P.; Yin, X.L. An economic analysis of biomass gasification and power generation in China. Bioresour. Technol. 2002, 83, 65–70. [Google Scholar] [CrossRef]

- Liu, J.; Wu, J.; Liu, F.; Han, X. Quantitative assessment of bio-energy from crop stalk resources in Inner Mongolia, China. Appl. Energy 2012, 93, 305–318. [Google Scholar] [CrossRef]

- Zhao, X.G.; Feng, T.T.; Ma, Y.; Yang, Y.S.; Pan, X.F. Analysis on investment strategies in China: The case of biomass direct combustion power generation sector. Renew. Sustain. Energy Rev. 2015, 42, 760–772. [Google Scholar]

- Zhao, Z.Y.; Zuo, J.; Wu, PH.; Yan, H.; Zillante, G. Competitiveness assessment of the biomass power generation industry in China: A five forces model study. Renew. Energy 2016, 89, 144–153. [Google Scholar] [CrossRef]

- Sun, Y.; Wang, R.; Liu, J.; Xiao, L.; Lin, Y.; Kao, W. Spatial planning framework for biomass resources for power production at regional level: A case study for Fujian Province, China. Appl. Energy 2013, 106, 391–406. [Google Scholar] [CrossRef]

- Morais, J.; Barbosa, R.; Lapa, N. Environmental and socio-economic assessment of co-combustion of coal, biomass and non-hazardous wastes in a power plant. Resour. Conserv. Recycl. 2011, 55, 1109–1118. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, X.; Chen, J.; Xie, X.; Wang, K.; Wei, Y. A novel modeling based real option approach for CCS investment evaluation under multiple uncertainties. Appl. Energy 2014, 113, 1059–1067. [Google Scholar] [CrossRef]

- Osmani, A.; Zhang, J. Optimal grid design and logistic planning for wind and biomass based renewable electricity supply chains under uncertainties. Energy 2014, 70, 514–528. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). Trial Measures for the Management of Renewable Energy Power Generation Prices and Cost Sharing; NDRC Pricing Bureau: Beijing, China, 2006. (In Chinese) [Google Scholar]

- Fuss, S.; Szolgayova, J.; Obersteiner, M.; Gusti, M. Investment under market and climate policy uncertainty. Appl. Energy 2008, 85, 708–721. [Google Scholar] [CrossRef]

- Abadie, L.M.; Chamorro, J.M. European CO2 Prices and carbon capture investments. Energy Econ. 2008, 30, 2992–3015. [Google Scholar] [CrossRef]

- China Electricity Council. The Development Status of China's Power Industry in 2014 and the Analysis of Development in 2015; China Electricity Council: Beijing, China, 2015. (In Chinese) [Google Scholar]

- The United States of America and the People’s Republic of China. U.S.-China Joint Statement on Climate Change. Available online: http://finance.chinanews.com/gn/2015/09-26/7545884.shtml (accessed on 14 June 2016).

- Climate Conference in Paris. Paris Agreement. Available online: http://www.xinhuanet.com/world/bldh/index.htm (accessed on 14 June 2016). (in Chinese).

- Alnatheer, O. Environmental benefits of energy efficiency and renewable energy in Saudi Arabia’s electric sector. Energy Policy 2006, 34, 2–10. [Google Scholar] [CrossRef]

- Nguyen, T.L.T.; Hermansen, J.E.; Mogensen, L. Environmental performance of crop residues as an energy source for electricity production: The case of wheat straw in Denmark. Appl.Energy 2013, 104, 633–641. [Google Scholar] [CrossRef]

- Ajanovia, A.; Haas, R. CO2 reduction potentials and costs of biomass-based alternative energy carriers in Austria. Energy 2014, 69, 120–131. [Google Scholar] [CrossRef]

- Bentsen, N.S.; Jack, M.W.; Felby, C.; Thorsen, B.J. Allocation of biomass resources for minimizing energy system greenhouse gas emissions. Energy 2014, 69, 506–515. [Google Scholar] [CrossRef]

- Fan, Y.; Zhu, L. A real options based model and its application to China’s oversea oil investment decisions. Energy Econ. 2010, 32, 627–637. [Google Scholar] [CrossRef]

- Zhu, L.; Fan, Y. Modelling the investment in carbon capture retrofits of pulverized coal-fired plants. Energy 2013, 57, 66–75. [Google Scholar] [CrossRef]

- Longstaff, F.A.; Schwartz, E.S. Valuing American options by simulation: A simple least square approach. Rev. Financ. Stud. 2001, 14, 113–147. [Google Scholar] [CrossRef]

- Zhu, L.; Fan, Y. A real options-based CCS investment evaluation model: Case study of China’s power generation sector. Applied Energy. 2011, 88, 4320–4333. [Google Scholar] [CrossRef]

- Zhou, W.J.; Zhu, B.; Chen, D.J.; Zhao, F.X.; Fei, W.Y. How policy choice affects investment in low-carbon technology: The case of CO2 capture in indirect coal liquefaction in China. Energy 2014, 73, 670–679. [Google Scholar] [CrossRef]

- Shahnazari, M.; McHugh, A.; Maybee, B. Evaluation of power investment decisions under uncertain carbon policy: A case study for converting coal fired steam turbine to combined cycle gas turbine plants in Australia. Appl. Energy 2014, 118, 271–279. [Google Scholar] [CrossRef]

- Hach, D.; Spinler, S. Capacity payment impact on gas-fired generation investments under rising renewable feed-in—A real options analysis. Energy Econ. 2016, 53, 270–280. [Google Scholar] [CrossRef]

- Pringles, R.; Olsina, F.; Garces, F. Real option valuation of power transmission investments by stochastic simulation. Energy Econ. 2015, 47, 215–226. [Google Scholar] [CrossRef]

- Zeng, Y.; Klabjan, D.; Arinez, J. Distributed solar renewable generation: Option contracts with renewable energy credit uncertainty. Energy Econ. 2015, 48, 295–305. [Google Scholar] [CrossRef]

- Lavenberg, S.S.; Welch, P.D. A perspective on the use of control variables to increase the efficiency of Monte Carlo Simulations. Manag. Sci. 1981, 27, 322–335. [Google Scholar] [CrossRef]

- National Development and Reform Commission (NDRC). Notice on Reducing the Price of Coal-Fired Electricity and Electricity Prices for Industrial and Commercial Use in 2015; NDRC Pricing Bureau: Beijing, China, 2015. (In Chinese) [Google Scholar]

- Insley, M. A real options approach to the valuation of a forest investment. J. Environ. Econo. Manag. 2002, 44, 471–492. [Google Scholar] [CrossRef]

- State Administration of Taxation. The Provisional Regulations on Value Added Tax of China; State Administration of Taxation: Beijing, China, 2009. (In Chinese) [Google Scholar]

- State Administration of Taxation. Corporate Income Tax Law of the People’s Republic of China; State Administration of Taxation: Beijing, China, 2007. (In Chinese) [Google Scholar]

- National Development and Reform Commission (NDRC). Trial Measures for the Management of Renewable Energy Power Generation Prices and Cost Sharing; NDRC Pricing Bureau: Beijing, China, 2006. (In Chinese) [Google Scholar]

- National Development and Reform Commission (NDRC). Notice of Improving the Price Policy of Biomass Power; NDRC Pricing Bureau: Beijing, China, 2010. (In Chinese) [Google Scholar]

| Study | Purposes of Study | Solution Methods | Uncertain Factors |

|---|---|---|---|

| Zhao and Yan [19] | Assessing the strengths, weaknesses, opportunities and threats (SWOT) of the biomass power generation industry of China. | SWOT analysis | — |

| Wu et al. [20] | Analyzing the economic characteristics regarding the associated costs for investment, electricity generation and waste treatment. | Net present value | — |

| Liu et al. [21] | Analyzing temporal and spatial patterns of crop stalk resources, the potential bio-energy of straw resources and the possible pathways of straw-based energy strategies. | Cost-profit analysis | — |

| Zhao and Feng [22] | Exploring the characteristics, opportunities and risks of the investment in biomass direct combustion power generation. | Cost-profit analysis | — |

| Zhao and Zuo [23] | Assessing the competitiveness of China's biomass power industry. | Five forces model | — |

| Zhang et al. [3] | Estimating the straw-fired power generation costs. | Cost-profit analysis | — |

| Sun et al. [24] | Identifying the appropriate developing areas of biomass energy at the regional level. | Spatial analysis technology, economic model and scenario analysis | — |

| Wang et al. [18] | Evaluating China’s biomass power production investment based on a policy benefit model. | Real options method (binomial tree) | Straw price and CO2 price |

| Variables | Descriptions | Values |

|---|---|---|

| Annual running time | 5500 | |

| Installed capacity | 25MW | |

| Power generation efficiency | 0.85 | |

| House-service consumption rate | 15% | |

| Market price of electricity | 0.43 RMB/kWh | |

| Unit subsidy level | 0.32 RMB/kWh | |

| Drift rate of electricity price | 0.02 | |

| Volatility rate of electricity price | 0.02 | |

| The change rate of subsidy | −0.02 | |

| Lifetime of straw-based power generation | 20 year | |

| Discount rate | 0.06 | |

| Emission factor | 0.997kg/kWh | |

| CO2 price | 0.04 RMB/kg | |

| Drift rate of CO2 price | 0.02 | |

| Volatility rate of CO2 price | 0.03 | |

| The correlation coefficient | 0.1 | |

| The price of ash content | 0.00628RMB/kWh | |

| Unit investment cost | 10,470 RMB/kW | |

| Reduction rate of investment cost | −0.02 | |

| Straw price | 0.25RMB/kWh | |

| Drift rate of straw price | 0.017 | |

| Volatility rate of straw price | 0.03 | |

| The average yield of straw | 15 t | |

| Collection coefficient | 0.8 | |

| Planting coefficient | 0.7 | |

| Unit straw consumption | 0.00105t/kWh | |

| The coefficient of straw used as fuel | 0.6 | |

| Unit loading and unloading cost | 10 RMB/t | |

| The frequency of loading and unloading | 2 | |

| Unit transportation fuel cost | 2 RMB/t. km | |

| Unit storage cost | 0.042RMB/kWh | |

| Unit repair cost | 0.04994 RMB/kWh | |

| Unit management cost | 0.01847 RMB/kWh | |

| Unit finance cost | 0.03748 RMB/kWh | |

| Unit material cost | 0.02736 RMB/kWh | |

| The rate of value-added tax | 0.17 | |

| The rate of corporate income tax | 0.25 | |

| The validity period of investment | 15 year (2016–2030) |

| Cases | Case 1 | Case 2 |

|---|---|---|

| Investment value (RMB) | 14,869,254.8 | 37,608,727.6 |

| Most likely optimal investment time (Year) | 2030 | 2030 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, M.; Zhou, D.; Ding, H.; Jin, J. Biomass Power Generation Investment in China: A Real Options Evaluation. Sustainability 2016, 8, 563. https://doi.org/10.3390/su8060563

Zhang M, Zhou D, Ding H, Jin J. Biomass Power Generation Investment in China: A Real Options Evaluation. Sustainability. 2016; 8(6):563. https://doi.org/10.3390/su8060563

Chicago/Turabian StyleZhang, Mingming, Dequn Zhou, Hao Ding, and Jingliang Jin. 2016. "Biomass Power Generation Investment in China: A Real Options Evaluation" Sustainability 8, no. 6: 563. https://doi.org/10.3390/su8060563