Can Resilience Thinking Inform Resilience Investments? Learning from Resilience Principles for Disaster Risk Reduction

Abstract

:1. Introduction

2. Background

2.1. Framing Resilience

- •

- Resilience of what (and for whom): communities (this can also refer to a constellation of inter-connected communities within a given region, e.g., urban communities).

- •

- Resilience to what: natural hazards that are exacerbated by climate change impacts and can be alleviated through a range of DCR activities (droughts, tropical cyclones, floods, landslides, heat waves, fires, extreme precipitation).

- •

- Resilience interventions: climate adaptation and mitigation activities linked with DRR projects implemented at company, community or municipality level.

- •

- Resilience investment: funding or finance that is provided for implementing resilience interventions.

2.2. Motivations for and Barriers to Investment in Resilience

3. Methodology

4. Are Resilience Principles Aligned with Resilience Investments?

4.1. Resilience Principles

- (1)

- Maintain diversity and redundancy: Diversity and redundancy provide options for responding to uncertainty and surprise. Systems with many different components (e.g., species, landscape types, knowledge systems or institutions) are generally more resilient than systems with few components. Redundancy provides “insurance” within a system by allowing some components to compensate for the loss or failure of others. Redundancy is even more valuable if the components providing the redundancy are themselves diverse, and thus react differently to disturbance.

- (2)

- Manage connectivity: Connectivity is the structure and strength of ecological and social interactions. High levels of connectivity can facilitate recovery after a disturbance, but can also increase the potential for disturbances (such as disease) to spread across the entire system so that all components of the system are impacted. Connectivity can therefore both enhance and reduce the resilience of social-ecological systems and the ecosystem services they produce, and thus needs to be well managed.

- (3)

- Manage slow variables and feedback: SES tend to exist in different configurations of regimes, each of which provides a unique set of ecosystem services. Changes in the underlying slow variables govern shifts in the system from one regime to another (such as when a clear lake becomes polluted). Managing slow variables and feedbacks is often crucial to keep social-ecological systems “configured” and functioning in ways that produce essential ecosystem services that people depend on. Shifts into a different configuration or regime can be extremely difficult to reverse.

- (4)

- Foster complex adaptive systems thinking: Complex adaptive systems (CAS) thinking is a mental model for interpreting the world that appreciates the complexity of SES. Acknowledging that social-ecological systems are based on a complex and unpredictable web of connections and interdependencies is often essential for designing management actions that can foster resilience.

- (5)

- Encourage learning: Because knowledge of SES is always partial and incomplete, learning and experimentation through adaptive and collaborative management is an important mechanism for building resilience in social-ecological systems. Learning ensures that different types and sources of knowledge are valued and considered when developing solutions, and leads to greater willingness to experiment and take risks.

- (6)

- Broaden participation: Participation, or the active engagement of relevant stakeholders in the management and governance process, can support transparency, enable knowledge sharing, build trust, create a shared understanding and uncover perspectives that may not be acquired through other scientific processes. Participation can also promote understanding of system dynamics and facilitate collective action to implement or respond to SES change.

- (7)

- Promote polycentric governance systems: Polycentricity is a governance system comprising multiple autonomous governing bodies, which interact with one another both horizontally and vertically. Collaboration across institutions and scales improves connectivity and learning across scales and cultures. Well-connected governance structures can swiftly deal with change and disturbance because they are addressed by those with the greatest agency and capacity to respond in a particular place and time.

4.2. Investing in Resilience

| Preparedness or Response Stage | DCR Interventions | |

|---|---|---|

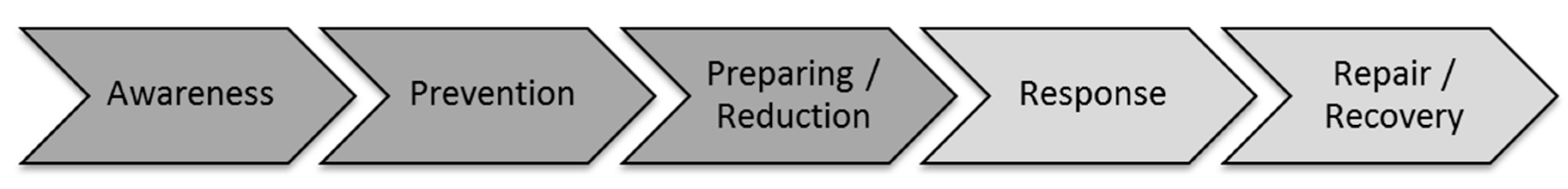

| Reduce Hazards and Exposure | Awareness | Disaster loss accounting systems; building institutional capacity; risk assessment and identification; early warning and prediction systems; advocacy, education and awareness raising; climate change modelling; seasonal climate forecast models; climate change allowances for structures. |

| Prevention | Land-use planning; catchment & ecosystem management; community relocation; contingency planning; hazard zoning & hot spot mapping; water demand management and efficiency; rain & groundwater harvesting/storage systems; structural and non-structural flood controls (grey and green, i.e., mangrove planting, forest & wetland management); disaster proof livelihoods against unpredictable disasters and changing climates. | |

| Preparing/Reduction | Preparing evacuation plans; incentive mechanisms for individual actions to reduce exposure; preparing evacuation plans; improved agricultural and pastoralist techniques and diversification; strengthen alternative and resilient livelihoods. | |

| Respond and Repair | Response | Establishing branch disaster response teams; tracking displacement during crises; managing evacuations to reduce impacts of disasters; evacuation planning; relief supplies. |

| Repair | Post disaster planning; post-disaster livelihoods support and recovery. | |

4.3. Applying Resilience Thinking to Resilience Investing

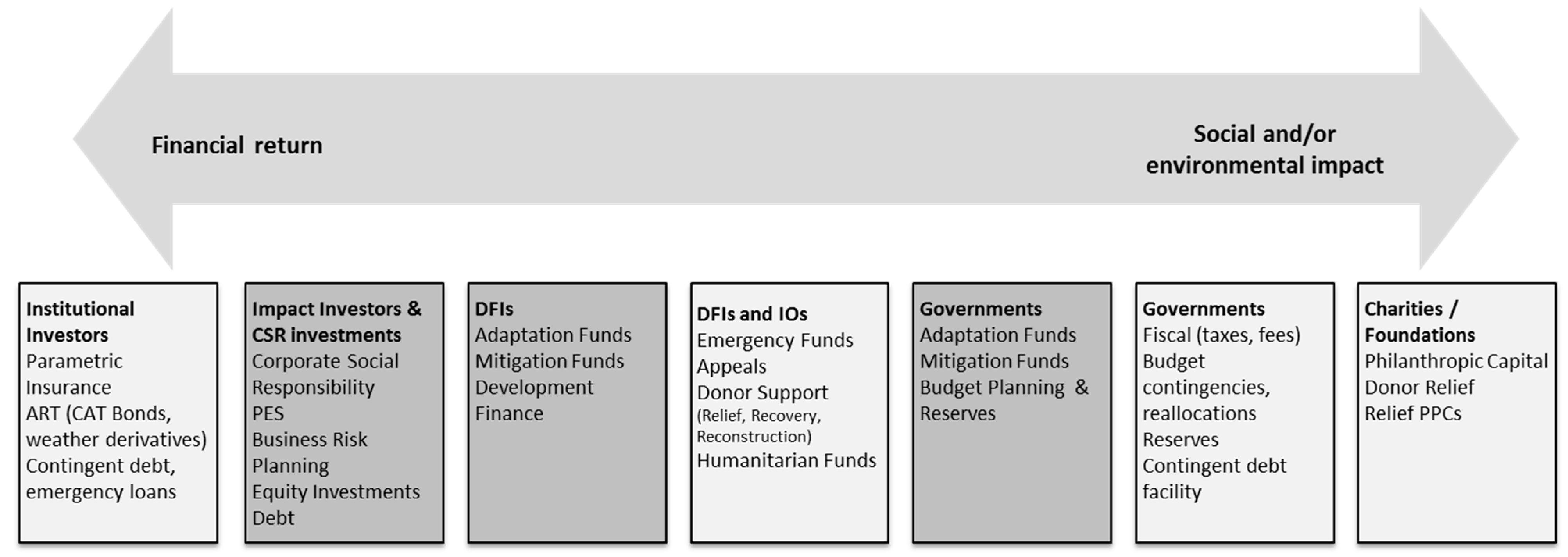

| Investors | Risk—Reward Requirements | Potential Instruments and Specific Options for Resilience Investments. | Addressing Resilience Principles and Financing Requirements | ||

|---|---|---|---|---|---|

| Towards Commercialisation and Scale | Charities, Foundations, NGOs, CSOs | No expectation of recovery of principle |

| Technical seed funding for disaster action plans in collaboration with private sector investees. | Structure resilience-supporting assets that can be matched with revenue-generating mechanisms.

|

| Development Finance Institutions |

|

| Risk finance/guarantees for climate resilience bonds. | Create general replicable models from individual projects with multi-stakeholder buy-in to leverage larger scales of investment.

| |

| Investment & Asset Managers |

|

| Post disaster credit schemes: micro-insurance funds (i.e., Alliance Trust). | Monitoring and evaluation frameworks must support the involvement and integration of actors and institutions across scales, so that they match scales of problems and solutions.

| |

| Commercial Banks | Low risk |

| Mobile/ICT business solutions for early warning programmes. | Give consideration to interlinkages, connectivity and causal relationships between system drivers to avoid superficial and myopic outcomes that are harmful in the medium to long term.

| |

| Institutional Investors (e.g., Pension Funds, Insurance) |

|

| Investors in climate resilience bonds, green infrastructure. | Match yield and maturity requirements, without taking a reductionist approach to CAS properties, e.g., recognising high levels of interconnectedness, potential for non-linear change, and inherent uncertainty and surprise.

| |

4.4. Potential Implications for Scaling Resilience Investments

5. Potential Limitations and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Munich, R.E. Natural Catastrophes 2012: Analyses, Assessments, Positions; Münchener Rückversicherungs-Gesellschaft: Münich, Germany, 2013. [Google Scholar]

- Everson, M.; Pujadas, J. Introduction to the journal. http://www.pwc.com/gx/en/governance-risk-compliance-consulting-services/resilience/publications/introduction-winning-with-risk.jhtml (accessed on 9 July 2015).

- World Bank. Building Resilience: Integrating Climate and Disaster Risk into Development; World Bank Group: Washington, DC, USA, 2013. [Google Scholar]

- Cabot Venton, C.; Fitzgibbon, C.; Shitarek, T.; Couleter, L.; Dooley, O. The Economics of Early Response and Disaster Resilience: Lessons from Kenya and Ethiopia. Economics of Resilience Final Report; Department for International Development: London, UK, 2012. [Google Scholar]

- Kull, D.; Mechler, R.; Hochrainer-Stigler, S. Probabilistic cost-benefit analysis of disaster risk management in a development context. Disasters 2013, 37, 374–400. [Google Scholar] [CrossRef] [PubMed]

- Aldunce, P.; Beilin, R.; Howden, M.; Handmer, J. Resilience for disaster risk management in a changing climate: Practitioners’ frames and practices. Glob. Environ. Chang. 2015, 30, 1–11. [Google Scholar]

- Global Facility for Disaster Risk Reduction. Managing Disaster Risks for a Resilient Future: A Strategy for the Global Facility for Disaster Reduction and Recovery 2013–2015; Global Facility for Disaster Risk Reduction: Geneva, Switzerland, 2013. [Google Scholar]

- Kellet, J.; Peters, K. Dare to Prepare: Taking Risk Seriously. Financing Emergency Preparedness: From Fighting Crisis to Managing Risk; Overseas Development Institute: London, UK, 2014. [Google Scholar]

- Kellet, J.; Caravani, A. Financing Disaster Risk Reduction: A 20 Year Story of International Aid; Overseas Development Agency: London, UK, 2013. [Google Scholar]

- WMO. Climate Information for Reducing Disaster Risk; World Meteorological Organization & United Nations International Strategy for Disaster Reduction: Geneva, Switzerland, 2009. [Google Scholar]

- Deloitte. Building Our Nation’s Resilience to Natural Disasters; Australian Business Roundtable for Disaster Resilience and Safer Communities & Deloitte Access Economics: Canberra, Australia, 2013. [Google Scholar]

- Leitch, A.M.; Bohensky, E.L. Return to “a new normal”: Discourses of resilience to natural disasters in australian newspapers 2006–2010. Glob. Environ. Chang. 2014, 26, 14–26. [Google Scholar] [CrossRef]

- Hill Clarvis, M.; Schoon, M.L. Business and resilience: Convergence or critical mis-match? Available online: http://rs.resalliance.org/2014/12/09/business-resilience-convergence-or-critical-mismatch/ (accessed on 13 November 2014).

- UNISDR. Sendai Framework for Disaster Risk Reduction 2015–2030; United Nations Office for Disaster Risk Reduction: Geneva, Switzerland, 2015. [Google Scholar]

- WB. Financing for Development Post-2015; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Cui, L.-B.; Zhu, L.; Springmann, M.; Fan, Y. Design and analysis of the green climate fund. J. Syst. Sci. Syst. Eng. 2014, 23, 266–299. [Google Scholar] [CrossRef]

- Biggs, R.; Schlüter, M.; Schoon, M.L. Principles for Building Resilience: Sustaining Ecosystem Services in Social-Ecological Systems; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Walker, B.; Holling, C.S.; Carpenter, S.R.; Kinzig, A. Resilience, adaptability and transformability in social-ecological systems. Ecol. Soc. 2004, 9. Article 5. [Google Scholar]

- Allison, H.E.; Hobbs, R.J. Resilience, adaptive capacity, and the “lock-in trap” of the western australian agricultural region. Ecol. Soc. 2004, 9. Article 3. [Google Scholar]

- Biggs, R.; Schlüter, M.; Biggs, D.; Bohensky, E.L.; BurnSilver, S.; Cundill, G.; Dakos, V.; Daw, T.M.; Evans, L.S.; Kotschy, K.; et al. Toward principles for enhancing the resilience of ecosystem services. Annu. Rev. Environ. Resour. 2012, 37, 421–448. [Google Scholar] [CrossRef]

- Hill, M.; Engle, N.L. Adaptive capacity: Tensions across scales. Environ. Policy Gov. 2013, 23, 177–192. [Google Scholar] [CrossRef]

- Pittock, J. Dammed if You Do; GWF Discussion Paper 1102; Global Water Forum: Canberra, Australia, 2011. [Google Scholar]

- Carpenter, S.; Arrow, K.; Barrett, S.; Biggs, R.; Brock, W.; Crépin, A.-S.; Engström, G.; Folke, C.; Hughes, T.; Kautsky, N.; et al. General resilience to cope with extreme events. Sustainability 2012, 4, 3248–3259. [Google Scholar] [CrossRef]

- Brown, K.; Westaway, E. Agency, capacity, and resilience to environmental change: Lessons from human development, well-being, and disasters. Annu. Rev. Environ. Resour. 2011, 36, 321–342. [Google Scholar] [CrossRef]

- Gledhill, R.; Hamza-Goodacre, D.; Low, L.P. Business-not-as-usual: Tackling the impact of climate change on supply chain risk. Resil. Win. Risk PWC 2013, 2, 15–20. [Google Scholar]

- Vassiliadis, C.G.; Goldbach, G. How the strongest supply chains protect what customers cherish most. http://www.pwc.com/gx/en/governance-risk-compliance-consulting-services/resilience/publications/supply-chains.jhtml (accessed on 9 July 2015).

- UNISDR. Final Report: The Business Case for Disaster Risk Reduction; The United Nations Office for Disaster Risk Reduction: Suva, Fiji, 2015. [Google Scholar]

- PSI. Top Insurers Call for Urgent Action to Reduce Risk from Natural Disasters, Highlight Us $190 Billion Annual Losses and Threat to Lives and Livelihoods; United Nations Environment Programme—Principles for Sustainable Insurance: Geneva, Switzerland, 2015. [Google Scholar]

- Michel-Kerjan, E. Harnessing financial innovation to strengthen disaster resilience. Resil. Win. Risk PWC 2013, 2, 8–12. [Google Scholar]

- GFDRR. Innovation in Disaster Risk Financing for Developing Countries: Public and Private Contributions; Global Facility for Disaster Reconstruction and Recovery (GFDRR): Washington, DC, USA, 2011. [Google Scholar]

- Becker-Birck, C.; Crowe, J.; Lee, J.; Jackson, S. Resilience in Action: Lessons from Public-Private Collaborations around the World; Meister Consultants Group, Inc.: Boston, MA, USA, 2013. [Google Scholar]

- PwC. Working Together to Reduce Disaster Risk; PwC and United Nations International Strategy for Disaster Reduction: Geneva, Switzerland, 2013. [Google Scholar]

- Huwyler, F.; Käppeli, J.; Serafimova, K.; Swanson, E.; Tobin, J. Conservation Finance: Moving beyond Donor Funding toward an Investor-Driven Approach; Credit Suisse, WWF, McKinsey & Company: Zurich, Switzerland, 2014. [Google Scholar]

- Min, S.-K.; Zhang, X.; Zwiers, F.W.; Hegerl, G.C. Human contribution to more-intense precipitation extremes. Nature 2011, 470, 378–381. [Google Scholar] [CrossRef] [PubMed]

- Coumou, D.; Rahmstorf, S. A decade of weather extremes. Nat. Clim. Chang. 2012, 2, 491–496. [Google Scholar] [CrossRef]

- PwC. Stimulating Private Sector Engagement and Investment in Building Disaster Resilience and Climate Change Adaptation: Recommendations for Public Finance Support; PwC and Department for International Development: London, UK, 2013. [Google Scholar]

- UNISDR. Post-2015 Framework for Disaster Risk Reduction (HFA2): Report from 2013 Global Platform Consultations; United Nations Office for Disaster Risk Reduction: Geneva, Switzerland, 2013. [Google Scholar]

- Shames, S.; Hill Clarvis, M.; Kissinger, G. Financing Strategies for Integrated Landscape Investment; Landscapes for People, Food and Nature: Washington, DC, USA, 2014. [Google Scholar]

- Lai, J.; Morgan, W.; Newman, J.; Pomares, R. Evolution of an Impact Portfolio: From Implementation to Results; Sonen Capital & KL Felicitas Foundation: San Francisco, CA, USA, 2013. [Google Scholar]

- BridgesVentures. Investing for Impact: Case Studies across Asset Classes; Bridges Ventures, Parthenon Group, Global Impact Investing Network: London, UK, 2010. [Google Scholar]

- Walker, B.H.; Salt, D. Resilience Thinking: Sustaining Ecosystems and People in a Changing World; Island Press: Washington, DC, USA, 2006. [Google Scholar]

- Walker, B.H.; Gunderson, L.H.; Kinzig, A.P.; Folke, C.; Carpenter, S.R.; Schultz, L. A handful of heuristics and some propositions for understanding resilience in social-ecological systems. Ecol. Soc. 2006, 11. Article 13. [Google Scholar]

- Anderies, J.M.; Walker, B.H.; Kinzig, A.P. Fifteen weddings and a funeral: Case studies and resilience based management. Ecol. Soc. 2006, 11. Article 21. [Google Scholar]

- Bacinoni, B.; Steed, I.; Tolvanen, P.; Hakiziman, T. Pilot Project: Building Sustainable Local Capacity in the Branches of the Burundi Red Cross Society. Available online: https://www.ifrc.org/docs/Evaluations/Evaluations2011/Africa/978-92-9139-180-6%20Burundi-evaluation-report.pdf (accessed on 17 November 2011).

- IFRC. Saving Lives, Changing Minds: Strategy 2020; International Federation of Red Cross and Red Crescent Societies: Geneva, Switzerland, 2010. [Google Scholar]

- IFRC. The Road to Resilience: Bridging Relief and Development for a More Sustainable Future. Ifrc Discussion Paper on Resilience; International Federation of Red Cross and Red Crescent Societies: Geneva, Switzerland, 2012. [Google Scholar]

- IFRC. Breaking the Waves: Impact Analysis of Coastal Afforestation for Disaster Risk Reduction in Viet Nam; International Federation of Red Cross and Red Crescent Societies: Geneva, Switzerland, 2011. [Google Scholar]

- Mitchell, T.; Mechler, R.; Harris, K. Tackling Exposure: Placing Disaster Risk Management at the Heart of National Economic and Fiscal Policy; Climate & Development Knowledge Network: London, UK, 2012. [Google Scholar]

- Douste-Blazy, P. Innovative Financing for Development; United Nations: New York, NY, USA, 2009. [Google Scholar]

- Borsa, L.; Frank, P.; Doran, H. How can Resilience Prepare Companies for Environmental and Social Change? PwC: London, UK, 2013. [Google Scholar]

- Kharrazi, A.; Kraines, S.; Hoang, L.; Yarime, M. Advancing quantification methods of sustainability: A critical examination of emergy, exergy, ecological footprint, and ecological information-based approaches. Ecol. Indic. 2014, 37, 81–89. [Google Scholar] [CrossRef]

- Carpenter, S.R.; Folke, C.; Norström, A.; Olsson, O.; Schultz, L.; Agarwal, B.; Balvanera, P.; Campbell, B.; Castilla, J.C.; Cramer, W.; et al. Program on ecosystem change and society: An international research strategy for integrated social-ecological systems. Environ. Sustain. 2012, 4, 1–5. [Google Scholar] [CrossRef]

- UNEP Finance Initiative and Global Footprint Network. In E-risc: A New Angle on Sovereign Credit Risk; UNEP Finance Initiative and Global Footprint Network: Geneva, Switzerland, 2012.

- Ang, A.; Andersson, M.; Ithurbide, P.; Haugerud, P.; Orr, A. Sovereign wealth fund governance for a long-term investment horizon. In Long-Term Investing: Optimal Strategy in Short-Term Oriented Markets; Columbia University: New York, NY, USA, 2013. [Google Scholar]

- Huppé, G.A.; Hug Silva, M. Overcoming Barriers to Scale: Institutional Impact Investments in Low-Income and Developing Countries; International Institute for Sustainable Development: Geneva, Switzerland, 2013. [Google Scholar]

- CBI. Bonds and Climate Change: The State of the Market in 2014; Climate Bonds Initiative and HSBC: London, UK, 2014. [Google Scholar]

- IFC. Forest-Backed Bonds Proof of Concept study. http://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/ifc+sustainability/learning+and+adapting/knowledge+products/publications/publications_report_forestbackedbonds__wci__1319577141755 (accessed on 9 July 2015).

- Fatunla, D.M. Diaspora Bonds: New Emerging Market Capital; Mckinsey: New York, NY, USA, 2013. [Google Scholar]

- WB. An analysis of trends in the cost of migrants remittance services. http://documents.worldbank.org/curated/en/2015/03/24336612/analysis-trends-average-total-cost-migrant-remittance-services (accessed on 9 July 2015).

- PSI. Building Disaster-Resilient Communities and Economies; UNEP Finance Initiative and Insurance Group Australia: Geneva, Switzerland, 2014. [Google Scholar]

- Whiteman, G.; Walker, B.; Perego, P. Planetary boundaries: Ecological foundations for corporate sustainability. J. Manag. Stud. 2013, 50, 307–336. [Google Scholar] [CrossRef]

- Mitchell, T. Rethinking the Global Agreement for Disaster Risk Reduction; Climate and Development Knowldege Network: London, UK, 2014. [Google Scholar]

- Saltuk, Y. A Portfolio Approach to Impact Investment: A practical Guide to Building, Analyzing and Managing a Portfolio of Impact Investments; J.P. Morgan: New York, NY, USA, 2012. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Clarvis, M.H.; Bohensky, E.; Yarime, M. Can Resilience Thinking Inform Resilience Investments? Learning from Resilience Principles for Disaster Risk Reduction. Sustainability 2015, 7, 9048-9066. https://doi.org/10.3390/su7079048

Clarvis MH, Bohensky E, Yarime M. Can Resilience Thinking Inform Resilience Investments? Learning from Resilience Principles for Disaster Risk Reduction. Sustainability. 2015; 7(7):9048-9066. https://doi.org/10.3390/su7079048

Chicago/Turabian StyleClarvis, Margot Hill, Erin Bohensky, and Masaru Yarime. 2015. "Can Resilience Thinking Inform Resilience Investments? Learning from Resilience Principles for Disaster Risk Reduction" Sustainability 7, no. 7: 9048-9066. https://doi.org/10.3390/su7079048