A Preliminary Forecast of the Production Status of China’s Daqing Oil field from the Perspective of EROI

Abstract

:1. Introduction

2. EROI and Net Energy of the Daqing Oilfield

2.1. Formulas for EROI and Net Energy

2.2. Forecasting Energy Outputs

2.2.1. Annual oil Production

2.2.2. Annual Gas Production

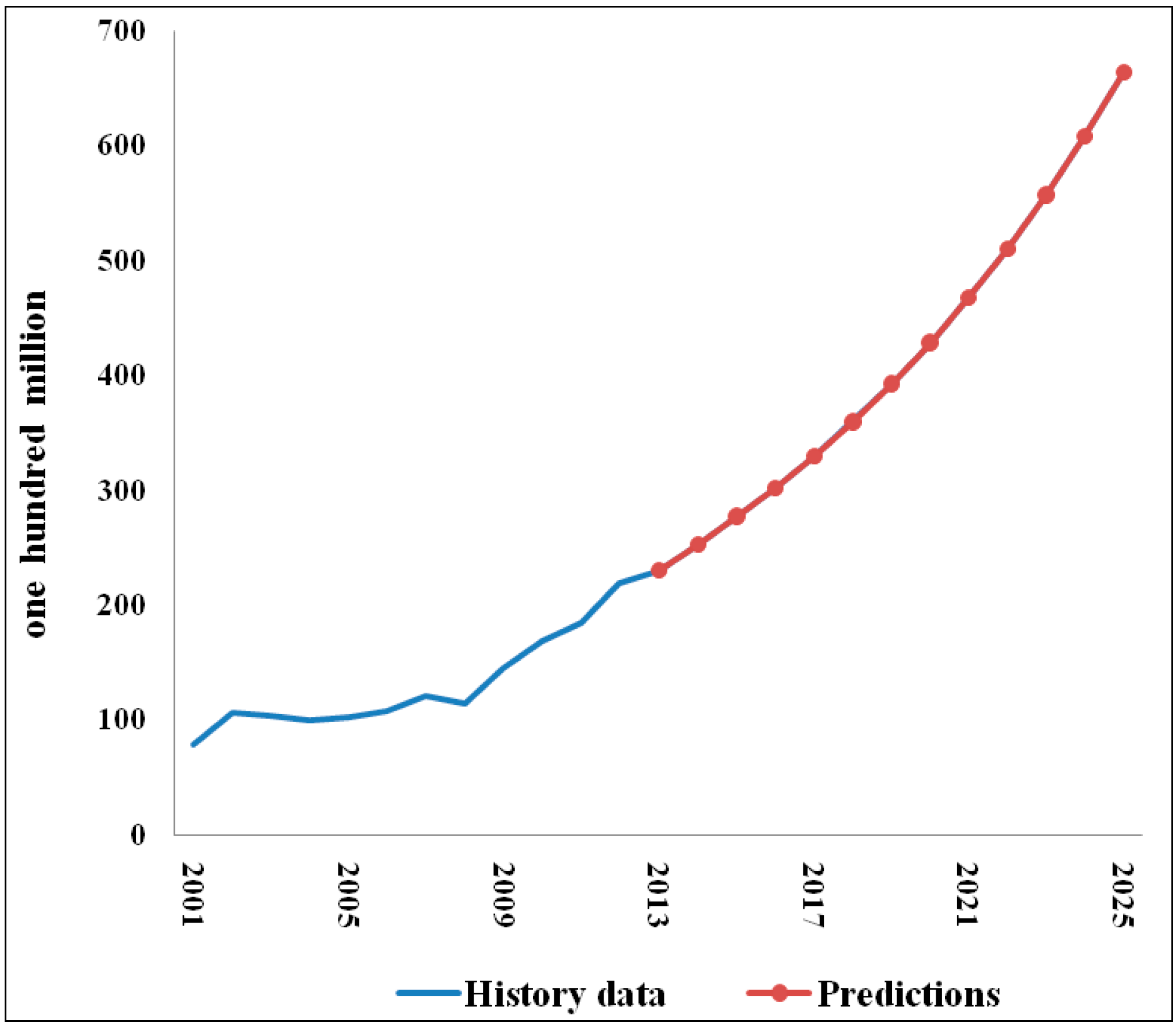

2.3. Forecasting Energy Inputs

2.3.1. Operating Costs

2.3.2. Depreciation and Depletion

2.3.3. Expenses

2.3.4. Energy Intensity

3. Forecast Results of Daqing’s EROI and Net Energy

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Production (1012 MJ) | 1.77 | 1.75 | 1.74 | 1.73 | 1.72 | 1.72 | 1.73 | 1.75 | 1.71 | 1.68 | 1.65 | 1.62 | 1.59 |

| EROI | 7.3 | 7.0 | 6.7 | 6.4 | 6.2 | 6.0 | 5.9 | 5.8 | 5.5 | 5.3 | 5.1 | 4.9 | 4.7 |

| Net energy (1012 MJ) | 1.53 | 1.50 | 1.48 | 1.46 | 1.45 | 1.44 | 1.44 | 1.44 | 1.40 | 1.36 | 1.32 | 1.29 | 1.25 |

4. Relating EROI and MROI Analyses

4.1. Implications of Daqing’s EROI and MROI

- Group 1 with Eins =3.5 MJ/yuan and EROI = 7.3 for 2010–2014;

- Group 2 with Eins =3.0 MJ/yuan and EROI = 6.4 for 2015–2018;

- Group 3 with Eins =2.5 MJ/yuan and EROI = 5.3 for 2019–2025.

4.2. Forecasting Daqing’s MROI

5. Discussion

5.1. Forecast of the Production Status by EROI and MROI

5.2. Comparison with Previous Estimates for the Daqing Oil Field

5.3. The Sensitivity of Daqing’s EROI and MROI

| High Oil Price | Low Oil Price | |

|---|---|---|

| High Production–High Intensity Scenario | EROI = 3.5; MROI = 2.1 | EROI = 3.5; MROI = 1.8 |

| High Production–Low Intensity Scenario | EROI = 5.7; MROI = 2.1 | EROI = 5.7; MROI = 1.8 |

| Low Production–High Intensity Scenario | EROI = 2.9; MROI = 2.1 | EROI = 2.9; MROI = 1.8 |

| Low Production–Low Intensity Scenario | EROI = 4.7; MROI = 2.1 | EROI = 4.7; MROI = 1.8 |

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Wang, Y. Catching hold of historical opportunities, establishing a hundred-year oilfield. Pet. Geol. Oilfield Dev. Daqing 2004, 23, 3–4. [Google Scholar]

- China National Petroleum Corporation. The Daqing Oilfield Sustainable Development Program; China National Petroleum Corporation: Daqing, China, 2012. [Google Scholar]

- Meng, Q.A.; Bentley, R.W. Global oil peaking: Responding to the case for “abundant supplies of oil”. Energy 2008, 33, 1179–1184. [Google Scholar] [CrossRef]

- Tang, X.; Zhang, B.; Höök, M.; Feng, L. Forecast of oil reserves and production in Daqing oilfield of China. Energy 2010, 35, 3097–3102. [Google Scholar] [CrossRef]

- Höök, M.; Tang, X.; Pang, X.P.; Aleklett, K. Development journey and outlook of Chinese giant oilfields. Pet. Explor. Dev. 2010, 37, 237–249. [Google Scholar] [CrossRef]

- Li, J.; Guo, S.; Chen, Z. A study of the incremental trend of the reserves in the Daqing oilfield and its controlling factors. Earth Sci. Front. 2009, 16, 379–383. [Google Scholar] [CrossRef]

- Brandt, A.R.; Dale, M. A general mathematical framework for calculating systems-scale efficiency of energy extraction and conversion: Energy return on investment (EROI) and other energy return ratios. Energies 2011, 4, 1211–1245. [Google Scholar] [CrossRef]

- Odum, H.T. Energy, Ecology, and Economics. AMBIO 1973, 2, 220–227. [Google Scholar]

- Bardiand, U.; Lavacchi, A. A Simple Interpretation of Hubbert’s Model of Resource Exploitation. Energies 2009, 2, 646–661. [Google Scholar] [CrossRef]

- Hall, C.A.S.; Cleveland, C.J.; Berger, M. Energy return on investment for United States petroleum, coal and uranium. In Energy and Ecological Modeling; Mitsch, W., Ed.; Elsevier: Amsterdam, The Netherlands, 1981; pp. 715–724. [Google Scholar]

- Dale, M.; Krumdieck, S.; Bodger, P. Net energy yield from production of conventional oil. Energy Pol. 2011, 39, 7095–7102. [Google Scholar] [CrossRef]

- Dale, M.; Krumdieck, S.; Bodger, P. A dynamic function for energy return on investment. Sustainability 2011, 3, 1972–1985. [Google Scholar] [CrossRef]

- Gagnon, N.; Hall, C.A.S.; Brinker, L. A preliminary investigation of energy return on energy investment for global oil and gas production. Energies 2009, 2, 490–503. [Google Scholar] [CrossRef]

- Cleveland, C.J. Net energy from the extraction of oil and gas in the United States. Energy 2005, 30, 769–782. [Google Scholar] [CrossRef]

- Hall, C.A.S.; Cleveland, C.; Kaufmann, R.K. Energy and Resource Quality: The Ecology of the Economic Process; Wiley-Interscience: New York, NY, USA, 1986; p. 577. [Google Scholar]

- Freise, J. The EROI of conventional Canadian natural gas production. Sustainability 2011, 3, 2413–2432. [Google Scholar] [CrossRef]

- Poisson, A.; Hall, C.A.S. Time Series EROI for Canadian Oil and Gas. Energies 2013, 6, 5940–5959. [Google Scholar] [CrossRef]

- Feng, L.; Hu, Y.; Hall, C.A.S.; Wang, J. The Chinese Oil Industry: History and Future; Springer: New York, NY, USA, 2013. [Google Scholar]

- Hu, Y.; Feng, L.; Hall, C.A.S.; Tian, D. Analysis of the energy return on investment (EROI) of the huge Daqing oil field in China. Sustainability 2011, 3, 2323–2338. [Google Scholar] [CrossRef]

- Hall, C.A.S.; Balogh, S.; Murphy, D.J.R. What is the minimum EROI that a sustainable society must have? Energies 2009, 2, 25–47. [Google Scholar] [CrossRef]

- Murphy, D.J.; Hall, C.A.S.; Dale, M.; Cleveland, C.J. Order from chaos: A preliminary protocol for determining the EROI of fuels. Sustainability 2011, 3, 1888–1907. [Google Scholar] [CrossRef]

- Smil, V. Energy in Nature and Society: General Energetics of Complex Systems; The MIT Press: Cambridge, MA, USA, 2008; p. 480. [Google Scholar]

- Yuanqian, C. The classification, contrast and evaluation of water drive curve method. Xinjiang Pet. Geol. 1994, 15, 348–355. (In Chinese) [Google Scholar]

- Qitai, Y. Characteristics of oil water seepage flow for several important water drive curves. Acta Petrolei Sin. 1999, 20, 56–60. [Google Scholar]

- Hubbert, M.K. Techniques of prediction as applied to production of oil and gas. In Proceedings of the Oil and Gas Supply Modeling Symposium, Washington, DC, USA, 18–20 June 1980; Gass, S.I., Ed.; Department of Commerce: Washington, DC, USA, 1982; pp. 16–141. [Google Scholar]

- Wenbo, W. The Foundation of the Forecasting Theory; The Press of the Petroleum Industry: Beijing, China, 1984. (In Chinese) [Google Scholar]

- Hu, J.; Zhang, D. Symposium of Practical Forecasting Method for Oil and Gas Reservoir Engineering; The Press of the Petroleum Industry: Beijing, China, 2002. [Google Scholar]

- Feng, L.; Li, J.; Pang, X. China’s oil reserve forecast and analysis based on peak oil models. Energy Pol. 2008, 36, 4149–4153. [Google Scholar] [CrossRef]

- Arps, J.J. Analysis of Decline Curves. Trans. Am. Inst. Min. 1945, 160, 228–247. [Google Scholar]

- Arps, J.J.; Mortada, M.; Smith, A.E. Relationship between proved reserves and exploration effort. In Proceedings of the SPE 45th Annual Fall Meeting, Houston, TX, USA; 1970; p. 5. [Google Scholar]

- Wang, Y. Study on the Oil and Gas Operating Costs Prediction for the Dagang oilfield. Master’s Thesis, China University of Petroleum, Tsingtao, China, April 2007. [Google Scholar]

- Méjean, A.; Hope, C. Modelling the costs of non-conventional oil: A case study of Canadian bitumen. Energy Pol. 2008, 36, 4205–4216. [Google Scholar] [CrossRef]

- Luo, D.; Zhao, X. Modeling the operating costs for petroleum exploration and development projects. Energy 2012, 40, 189–195. [Google Scholar] [CrossRef]

- McDonald, A.; Schrattenholzer, L. Learning rates for energy technologies. Energy Pol. 2001, 29, 255–261. [Google Scholar] [CrossRef]

- Sorrell, S.; Speirs, J.; Bentley, R.; Miller, R.; Thompson, E. Shaping the global oil peak: A review of the evidence on field sizes, reserve growth, decline rates and depletion rates. Energy 2012, 37, 709–724. [Google Scholar] [CrossRef]

- National People’s Congress. 12th Five-Year Development Plan Outline. Available online: http://www.gesep.com/News/Show_2_280136.html (accessed on 7 March 2011). (In Chinese)

- Yan, Q.; Liu, F. China’s 2010–2030 industrial energy consumption intensity analysis and prediction. East China Electr. Power 2011, 11, 1858–1861. [Google Scholar]

- International Energy Agency. World Energy Outlook 2013. Available online: http://www.worldenergyoutlook.org/publications/weo-2013/ (accessed on 12 November 2013).

- King, C.W.; Hall, C.A.S. Relating financial and energy return on investment. Sustainability 2011, 3, 1810–1832. [Google Scholar] [CrossRef]

- Energy Statistics Department of National Bureau of Statistics of China. China Energy Statistical Yearbook 2009; China Statistics Press: Beijing, China, 2009; pp. 3–15. [Google Scholar]

- Heuna, M.K.; de Wit, M. Energy return on (energy) invested (EROI), oil prices, and energy transitions. Energy Pol. 2012, 40, 147–158. [Google Scholar] [CrossRef]

- Kreith, F.; Krumdieck, S. (Eds.) Principles of Sustainable Energy; CRC Press: Boca Raton, FL, USA, 2014, 2nd ed. pp. 698–728. Available online: http://www.crcpress.com/product/isbn/9781466556966 (accessed on 19 August 2013).

- Krumdieck, S. Transition Engineering: Adaptation of complex systems for survival. Int. J. Sustain. Dev. 2013, 16, 310–321. [Google Scholar] [CrossRef]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, B.; Feng, L.; Wei, W.X.; Hu, Y.; Wang, J. A Preliminary Forecast of the Production Status of China’s Daqing Oil field from the Perspective of EROI. Sustainability 2014, 6, 8262-8282. https://doi.org/10.3390/su6118262

Xu B, Feng L, Wei WX, Hu Y, Wang J. A Preliminary Forecast of the Production Status of China’s Daqing Oil field from the Perspective of EROI. Sustainability. 2014; 6(11):8262-8282. https://doi.org/10.3390/su6118262

Chicago/Turabian StyleXu, Bo, Lianyong Feng, William X. Wei, Yan Hu, and Jianliang Wang. 2014. "A Preliminary Forecast of the Production Status of China’s Daqing Oil field from the Perspective of EROI" Sustainability 6, no. 11: 8262-8282. https://doi.org/10.3390/su6118262