Policy Incentives for the Adoption of Electric Vehicles across Countries

Abstract

:1. Introduction

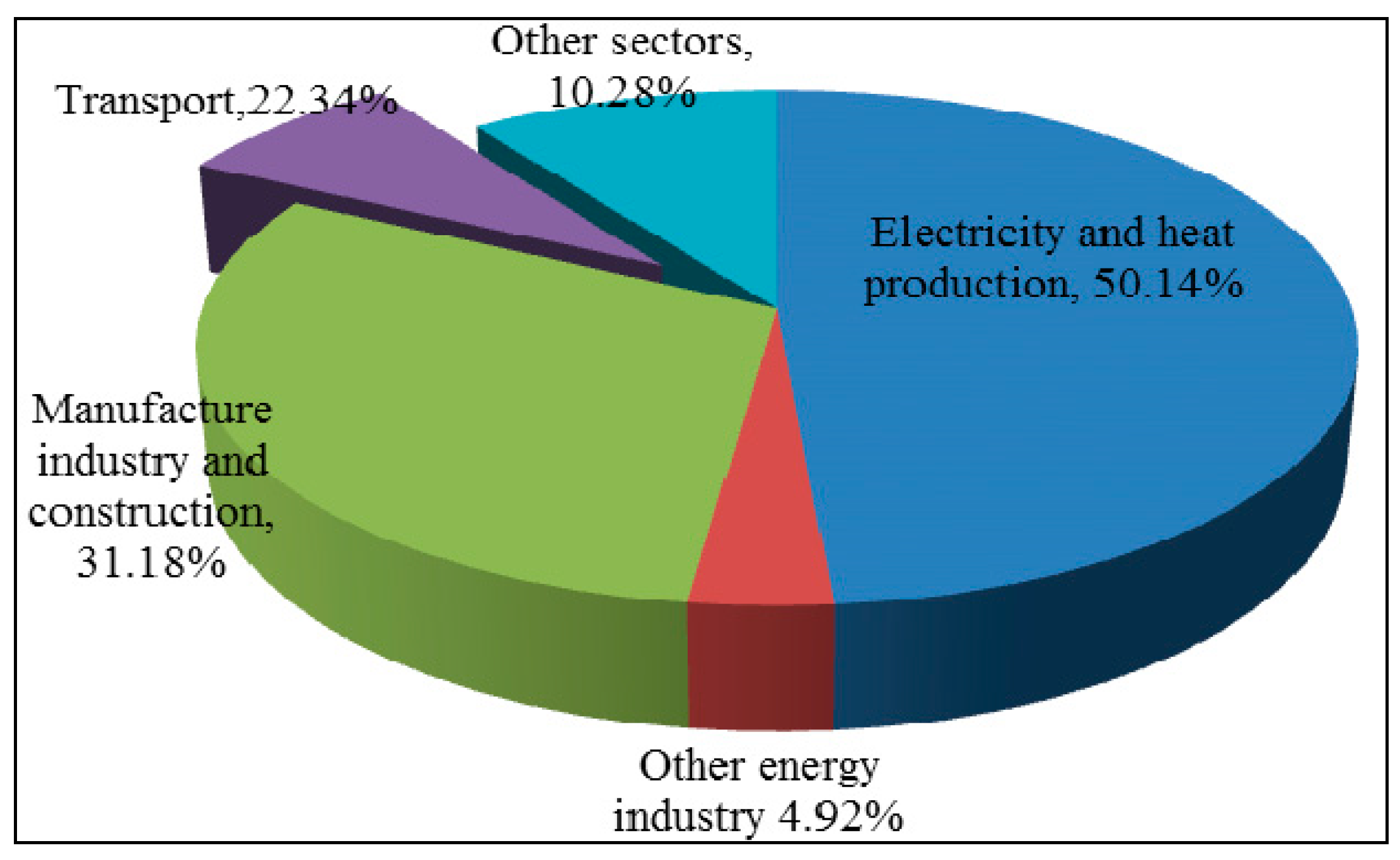

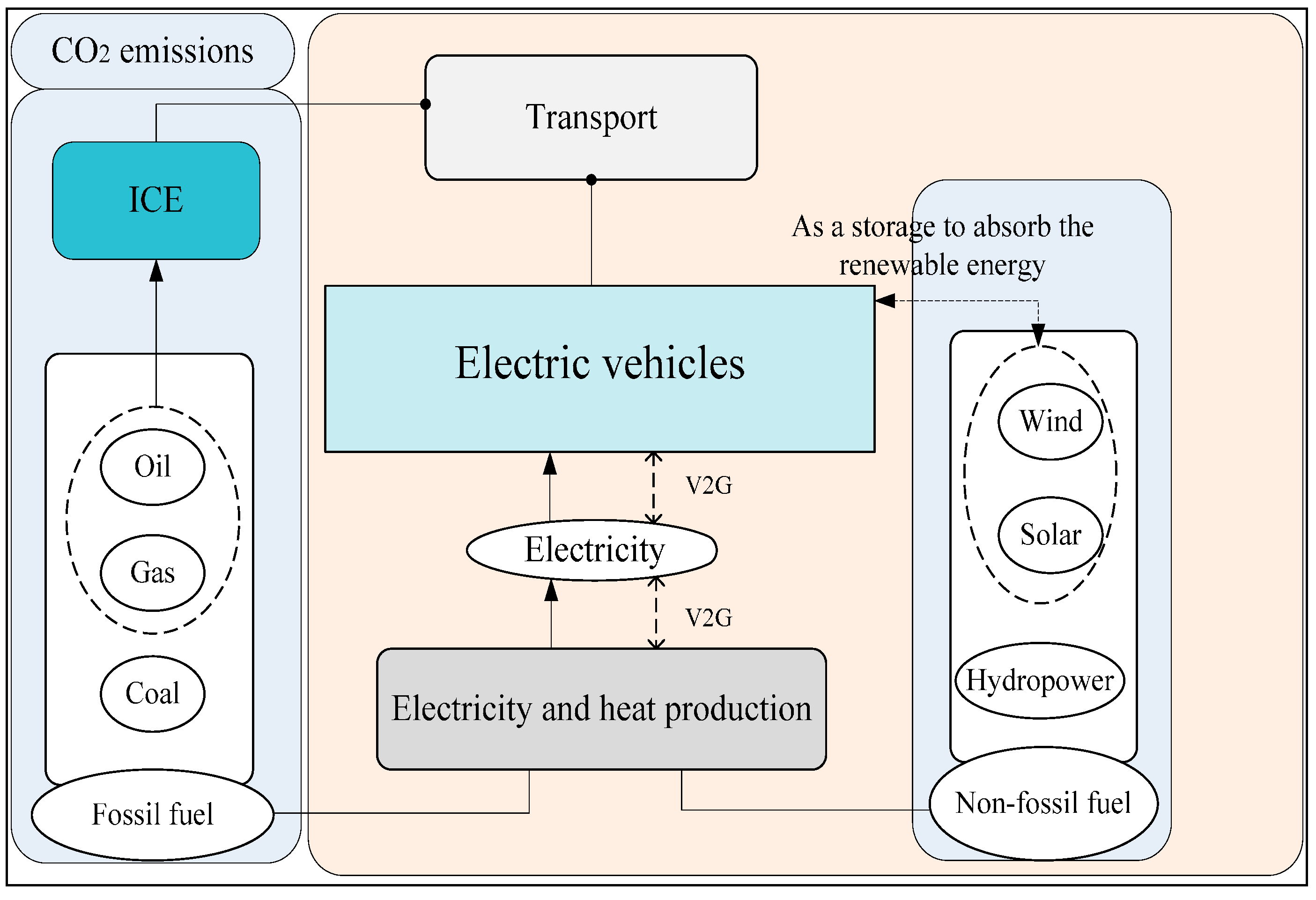

1.1. Why Do Most Countries Need to Develop EVs?

1.2. The Targets and the Current Situations of EVs in Different Countries

| Countries | Targets | Deadline | Plan or Legislation |

|---|---|---|---|

| United States (U.S.) | 1 million EVs | 2015 | EV Everywhere Grand Challenge Blueprint, 2012 [11] |

| United Kingdom (U.K.) | 1.7 million EVs | 2020 | Committee on Climate Change, 2010 [12] |

| Germany | 1 million EVs | 2020 | National Development Plan for Electric Mobility, 2009 [13] |

| France | 2 million EVs | 2020 | French government (IA-HEV, 2014) [14] |

| Japan | EV market share reaches 50% in total vehicle sales | 2020 | Next-Generation Vehicle Strategy2010 [15] |

| China | 0.5 million EVs | 2015 | Energy saving and energy automobile industry planning (2012–2020) [16] |

| 5 million EVs | 2020 | ||

| Norway | 0.05 million EVs | 2018 | The Norwegian government [17] |

1.3. The Research Status and Layout

2. Financial Incentives

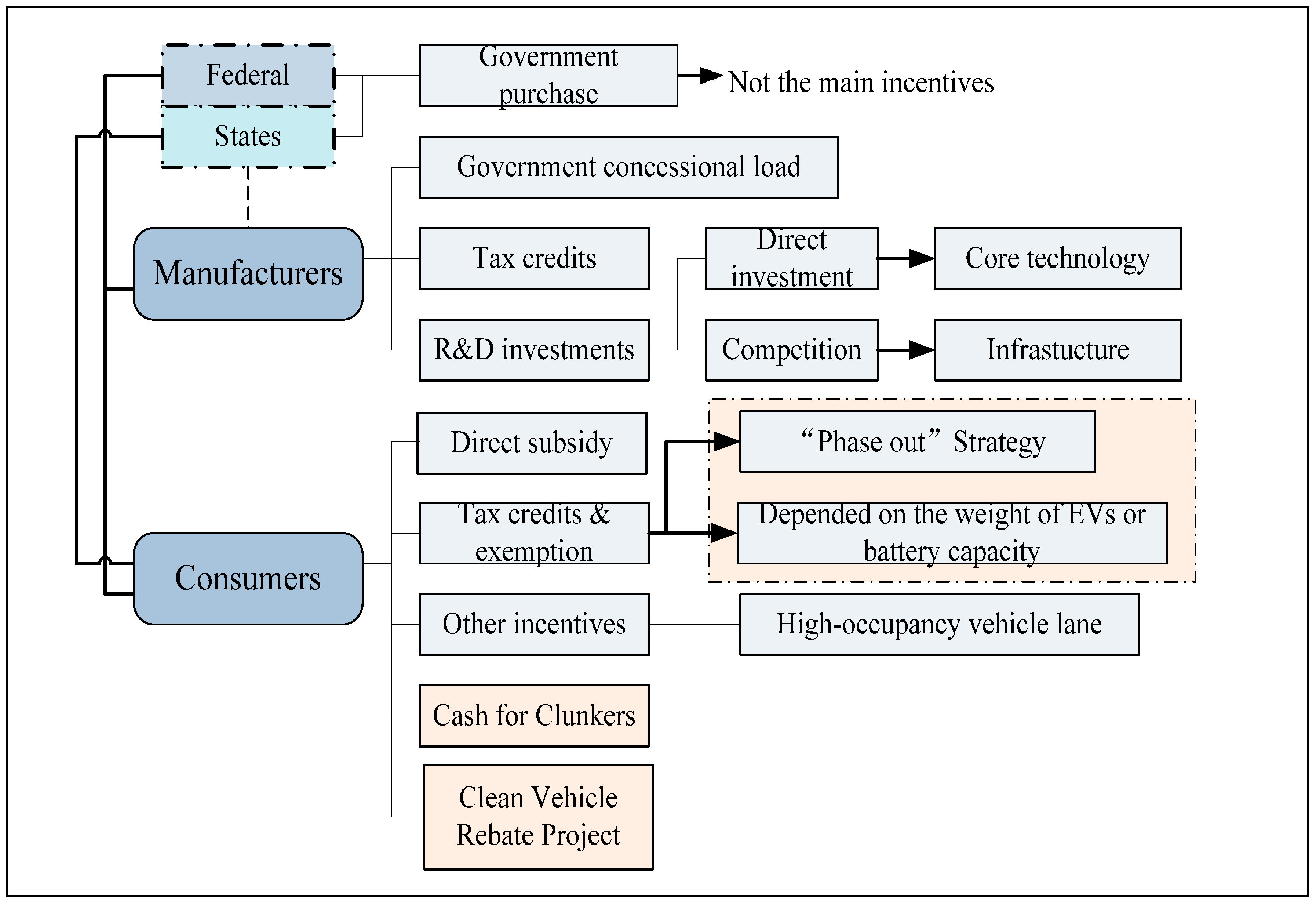

2.1. The Financial Incentives in United States

2.1.1. A Policy Review of Financial Incentives in the United States

| State | Amount of Incentive | High-Occupancy Vehicle Lane | Type of Incentive |

|---|---|---|---|

| California | $1500 for PHEVs and $2500 for BEVs | No | Income tax credit |

| Washington | No | Yes | Sales tax exemption |

| Massachusetts | $2500 for PHEVs and BEVs | No | Purchase rebate |

| New Jersey | $4000 for BEVs | Yes | Sales tax exemption |

| Oregon | $5000 for PHEVs and $1500 for BEVs | No | Income tax credit |

| Colorado | $6000 for PHEVs and BEVs | Yes | Income tax credit |

| Montana | $500 for PHEVs and BEVs | n.a. (not available) | Conversion cost credits |

| South Carolina | $1500 for PHEVs and BEVs | No | Income tax credit |

2.1.2. The Mechanism of Financial Incentives in the United States

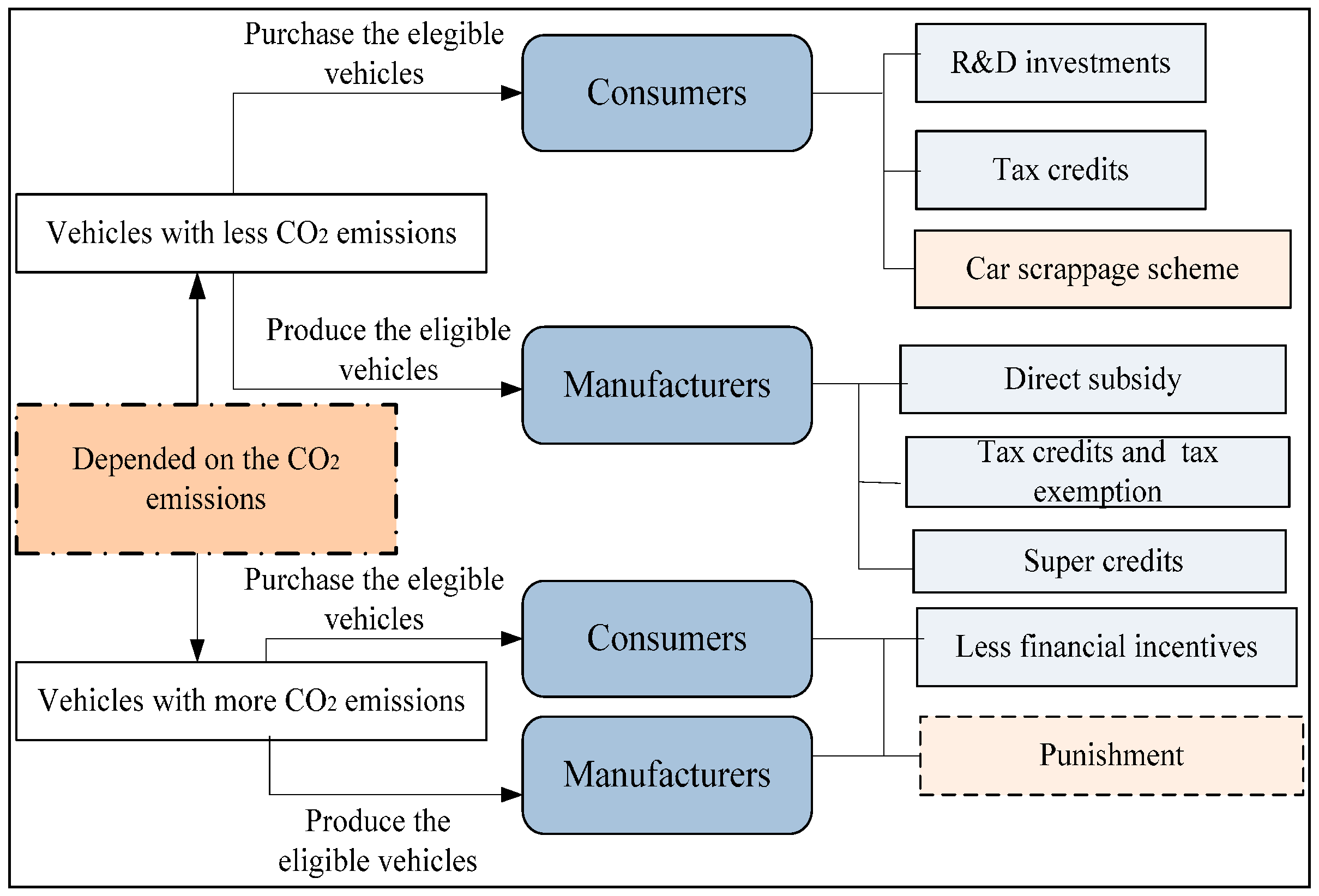

2.2. The Financial Incentives in Europe

| Countries | Credits Based on the CO2 Emissions | Tax Credits |

|---|---|---|

| Belgium | Yes | Registration tax exemption |

| Germany | No | Annual circulation tax exemption |

| Denmark | No | Registration tax exemption |

| Finland | Yes | Pay the minimum rate (5%) of the CO2-based registration tax. |

| France | Yes | Company car tax exemption |

| Ireland | n.a. | Registration tax credits |

| Norway | No | Purchases tax exemption |

2.3. The Financial Incentives in China

2.4. The General Framework of Financial Incentives

3. Support for Technology

3.1. The Importance of Technology Support

3.2. Technology Support in United States

| Technology | Targets(by 2022) |

|---|---|

| Battery | Reduce cost from $500/kWh in 2012 to $125/kWh |

| Electric drive system | Reduce cost from $30/kWh in 2012 to $8/kWh |

| Vehicle weight reduction | Reduce vehicle weight by nearly 30%; includes body, chassis, interior, electric drive components |

3.3. Technology Support in Other Countries

4. Support for Charging Infrastructure

5. The Relationship between the Adoption of EVs and Policies

6. Conclusions and Further Research

6.1. Conclusions

6.2. Further Research

Acknowledgments

Author Contributions

Conflicts of Interest

References

- International Energy Agency. World Energy Outlook 2012; OECD/IEA: Paris, France, 2012. [Google Scholar]

- Sierzchula, W.; Bakker, S.; Maat, K. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- International Energy Agency. CO2 Emissions from Fuel Combustion; IEA: Paris, France, 2013. [Google Scholar]

- Clean Energy Ministerial; Electric vehicles initiative; International Energy Agency. Global EV Outlook: Understanding the Electric Vehicle Landscape to 2020; OECD/IEA: Paris, France, 2013. [Google Scholar]

- Yabe, K.; Shinoda, Y.; Seki, T. Market penetration speed and effects on CO2 reduction of electric vehicles and plug-in hybrid electric vehicles in Japan. Energy Policy 2012, 45, 529–540. [Google Scholar] [CrossRef]

- Gass, V.; Schmidt, J.; Schmid, E. Analysis of alternative policy instruments to promote electric vehicles in Austria. Renew. Energy 2014, 61, 96–101. [Google Scholar] [CrossRef]

- National Thermal Power Installed Capacity Returns to Account for Less than 70% in 2013. Available online: http://www.coalstudy.com/news/dlhgzx/dl/2013-12-09/1364.html (accessed on 6 June 2014). (In Chinese)

- Zhang, X.P.; Rao, R.; Xie, J.; Liang, Y.N. The current dilemma and future path of China’s electric vehicles. Sustainability 2014, 6, 1567–1593. [Google Scholar] [CrossRef]

- Bellekom, S.; Benders, R.; Steef, P.; Moll, H. Electric cars and wind energy: Two problems, one solution? A study to combine wind energy and electric cars in 2020 in The Netherlands. Energy 2012, 45, 859–866. [Google Scholar] [CrossRef]

- Battistelli, C.; Baringo, L.; Conejo, A.J. Optimal energy management of small electric energy systems including V2G facilities and renewable energy sources. Electr. Power Syst. Res. 2012, 92, 50–59. [Google Scholar] [CrossRef]

- US Department of Energy. EV Everywhere Grand Challenge Blueprint; U.S. Department of Energy: Washington, DC, USA, 2013.

- Intelligent Grid Interfaced Vehicle Eco-Charging: Project Description. Available online: http://igive.wikidot.com/project-description (accessed on 3 April 2014).

- Germany Federal Government’s National Electro Mobility Development Plan. Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety. Available online: http://www.bmub.bund.de/fileadmin/bmu-import/files/pdfs/allgemein/application/pdf/nep_09_bmu_en_bf.pdf (accessed on 15 May 2014).

- France. Available online: http://www.ieahev.org/by-country/france/ (accessed on 13 April 2014).

- Next-Generation Vehicle Strategy 2010. Ministry of Economy, Trade and Industry. Available online: http://www.meti.go.jp/english/press/data/pdf/N-G-V2.pdf (accessed on 17 May 2014).

- The State councial of China. Energy Saving and Energy Automobile Industry Planning (2012–2020); The State Council: Beijing, China, 2014. Available online: http://www.china.com.cn/policy/txt/2012-07/09/content_25855476_3.htm (accessed on 21 June 2014).

- Norwegian Parliament Extends Electric Car Initiatives Until 2018. Available online: http://www.avere.org/www/newsMgr.php?action=view&frmNewsId=611§ion=&type=&SGLSESSID=tqiice0pmjdclt7l4q0s3s1o27 (accessed on 18 October 2014).

- Over 20,000 Rechargeable Electric Cars on Norwegian Road. Available online: http://www.gronnbil.no/nyheter/over-20-000-ladbare-biler-pa-norske-veier-article366-239.html?redirect=invalidurl (accessed on 18 October 2014). (In Norwegian)

- Jenn, A.; Azevedo, I.L.; Ferreira, P. The impact of federal incentives on the adoption of hybrid electric vehicles in the United States. Energy Econ. 2013, 40, 936–942. [Google Scholar] [CrossRef]

- Diamond, D. The impact of government incentives for hybrid-electric vehicles: Evidence from US states. Energy Policy 2009, 37, 972–983. [Google Scholar] [CrossRef]

- Krause, R.M.; Carley, S.R.; Lane, B.W. Perception and reality: Public knowledge of plug-in electric vehicles in 21 US cities. Energy Policy 2013, 63, 433–440. [Google Scholar] [CrossRef]

- Pohl, H.; Yarime, M. Integrating innovation system and management concepts: The development of electric and hybrid electric vehicles in Japan. Technol. Forecast. Soc. Chang. 2012, 79, 1431–1446. [Google Scholar] [CrossRef]

- Ahman, M. Government policy and the development of electric vehicles in Japan. Energy Policy 2006, 34, 433–443. [Google Scholar] [CrossRef]

- Zheng, J.; Mehndiratta, S.; Guo, J.Y. Strategic policies and demonstration program of electric vehicle in China. Transp. Policy 2012, 19, 17–25. [Google Scholar] [CrossRef]

- Cohen, N.; Naor, M. Reducing dependence on oil? How policy entrepreneurs utilize the national security agenda to recruit government support: The case of electric transportation in Israel. Energy Policy 2013, 56, 582–590. [Google Scholar] [CrossRef]

- Jarvinen, J.; Orton, F.; Nelson, T. Electric Vehicles in Australia’s National Electricity Market: Energy Market and Policy Implications. Electri. J. 2012, 25, 63–87. [Google Scholar] [CrossRef]

- Multilateral Technology Initiatives, Known as Implementing Agreements. Available online: http://www.ieahev.org/about/ (accessed on 14 April 2014).

- Mock, P.; Yang, Z.F. Driving Electrification: A Global Comparison of Fiscal Incentive Policy for Electric Vehicles; White Papers. The International Council on Clean Transportation: San Francisco, CA, USA, 2014. Available online: http://www.theicct.org/driving-electrification-global-comparison-fiscal-policy- electric-vehicles (accessed on 5 June 2014).

- Hybrid and Electric Vehicles: The Electric Drive Gains Traction. Available online: http://www.ieahev.org/assets/1/7/IA-HEV_Annual_Report_May_2013_3MB.pdf (accessed on 13 June 2014).

- Chevy Volt gets a Low Emissions Package for California; HOV Lanes Access. Available online: http://www.greencarcongress.com/2011/11/volt-20111117.html (accessed on 6 June 2014).

- $1Billion Plug-In Incentives Will Speed Auto Industry’s Transformation. Available online: http://www.calcars.org/calcars-news/1008.html (accessed on 8 June 2014).

- Energy Policy Act of 2005; U.S. Department of Energy: Washington, DC, USA, 2005. Available online: http://www. afdc.energy.gov/laws/epact_2005 (accessed on 25 June 2014).

- Energy Improvement and Extension Act of 2008. Available online: http://en.wikipedia.org/wiki/Energy_Improvement_and_Extension_Act_of_2008#Energy_Improvement_and_Extension_Act_of_2008 (accessed on 25 June 2014).

- Notice 2009-89. New Qualified Plug-in Electric Drive Motor Vehicle Credit. In Internal Revenue Bulletin: 2009-48. Available online: http://www.irs.gov/irb/2009-48_IRB/ar09.html (accessed on 17 June 2014).

- US Department of Energy. American Recovery and Reinvestment Act of 2009; U.S. Department of Energy: Washington, DC, USA, 2009. Available online: http://www.afdc.energy.gov/laws/arra.html (accessed on 29 June 2014).

- Cash for Clunkers. Available online: http://en.wikipedia.org/wiki/Cash_for_Clunkers (accessed on 17 May 2014).

- State & Federal Incentives: United States Incentives Map. Available online: http://www.pluginamerica.org/incentives (accessed on 27 June 2014).

- Energy Independence and Security Act of 2007; U.S. Department of Energy: Washington, DC, USA, 2007. Available online: http://www.afdc.energy.gov/laws/eisa.html (accessed on 27 June 2014).

- President Obama Announces $2.4 Billion in Grants to Accelerate the Manufacturing and Deployment of the Next Generation of U.S. Batteries and Electric Vehicles. Available online: http://www.whitehouse.gov/the_press_office/2.4-Billion-in-Grants-to-Accelerate-the-Manufacturing-and-Deployment-of-the-Next-Generation-of-US-Batteries-and-Electric-Vehicles (accessed on 13 June 2014).

- Egbue, O.; Long, S. Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions. Energy Policy 2012, 48, 717–729. [Google Scholar] [CrossRef]

- Clean Vehicle Rebate Project. Available online: http://energycenter.org/programs/clean_vehicle_rebate_project (accessed on 15 October 2014).

- Zero-Emission Vehicle Standards for 2018 and Subsequent Model Year Passenger Cars, Light-Duty Trucks, and Medium-Duty Vehicles. Available online: http://www.arb.ca.gov/msprog/zevprog/zevregs/1962.2_Clean.pdf (accessed on 10 October 2014).

- Reducing CO2 Emissions from Vans. Available online: http://ec.europa.eu/clima/policies/transport/vehicles/vans/index_en.htm (accessed on 15 June 2014).

- Wilde, H.P.J.; Kroon, P. Policy options to reduce passenger cars CO2 emissions after 2020. Available online: http://www.ecn.nl/docs/library/report/2013/e13005.pdf (accessed on 3 June 2014).

- Green Car&Van Guide. Website of Green Wise Weekly. Available online: http://www.greenwisebusiness.co.uk/resources/green-car-and-van-guide-10.aspx (accessed on 5 June 2014).

- Changes to the Congestion Charge. Available online: http://www.tfl.gov.uk/modes/driving/congestion-charge/changes-to-the-congestion-charge (accessed on 5 June 2014).

- London to Introduce New Ultra Low Emission Discount for Congestion Charge Scheme; Countering Dieselization. Available online: http://www.greencarcongress.com/2013/04/uled-20130424.html (accessed on 7 October 2014).

- Plug-in Car and Van Grants. Available online: https://www.gov.uk/plug-in-car-van-grants/eligibility (accessed on 7 October 2014).

- Scrappage Scheme Boosts Car Sales. Available online: http://news.bbc.co.uk/2/hi/business/8186992.stm (accessed on 17 June 2014).

- Overview of Purchase and Tax Incentives for Electric Vehicles in the EU. Available online: http://www.acea.be/uploads/publications/Electric_vehicles_overview_2014.pdf (accessed on 19 June 2014).

- Reducing CO2 Emissions from Passenger Cars. Available online: http://ec.europa.eu/clima/policies/transport/vehicles/cars/index_en.htm (accessed on 29 September 2014).

- The Subsidy Policy of New Energy Vehicles in Seven Cities of China. Available online: http://news.ddc.net.cn/newsview_48562.html (accessed on 29 June 2014). (In Chinese)

- Thousands of Electric Sanitation Cars Were Purchased for Building the Green City in Beijing. Available online: http://www.360che.com/news/130105/24401.html (accessed on 13 June 2014). (In Chinese)

- New Day Electric Vehicles became the Sponsors of Shanghai Expo to Reflect the Concept of Low Carbon in the expo. Available online: http://www.expo2010.cn/a/20091229/000009.htm (accessed on 21 June 2014). (In Chinese)

- What Type of BEVs in Beijing? The Brands and Government Subsidies. Available online: http://bj.bendibao.com/news/2013521/104206.shtm (accessed on 10 October 2014). (In Chinese)

- Double Policies to Buy Electric Vehicles in Beijing. Available online: http://www.qqddc.com/html/news/201207/news_24839.html (accessed on 12 October 2014). (In Chinese)

- Team Led by Argonne National Lab Selected as DOE’s Batteries and Energy Storage Hub. Available online: http://energy.gov/articles/team-led-argonne-national-lab-selected-does-batteries-and-energy-storage-hub (accessed on 23 June 2014).

- New SAE International Technical Standards Help Harmonize Hydrogen Fueling Across the Globe. Available online: http://www.prweb.com/releases/2014/03/prweb11672351.htm (accessed on 25 May 2014).

- Mobility and Transport Technologies: The Third Transport Research Programme of the German Federal Government. Federal Ministry of Economics and Technology (BMWi). Available online: http://www.bmwi.de/English/Redaktion/Pdf/mobility-and-transport-technologies,property=pdf,bereich=bmwi2012,sprache=en,rwb=true.pdf (accessed on 12 June 2014).

- Research and Innovations for Germany: Results and Outlook. Federal Ministry of Education and Research. Available online: http://www.bmbf.de/pub/forschung_und_innovation_fuer_deutschlan_en.pdf (accessed on 3 July 2014).

- Bakker, S.; Jacob, T.J. Policy options to support the adoption of electric vehicles in the urban environment. Transp. Res. Part D Transp. Environ. 2013, 25, 18–23. [Google Scholar] [CrossRef]

- State Grid Corporation of China Submits the Report: 400 Charging Station and 190,000 Charging Outlets Were Built. Available online: http://xiehui.cpsa.com.cn/Html/37886_1.html (accessed on 17 June 2014).

- Hybridcars. Available online: http://www.hybridcars.com/june-2014-dashboard/ (accessed on 1 July 2014).

- The Subprime Mortgage Crisis. Available online: http://www.christianet.com/interestrates/subprimemortgagecrisis.htm (accessed on 1 July 2014).

- Cash for Clunkers: Only Hours Remain. Available online: http://www.money.cnn.com/2009/08/24/autos/cash_for_clunkers_final_day/index.htm (accessed on 27 June 2014).

- Shen, H.C. The Top Institutions of AMERICA Promote the Policies of Electric Vehicles Industry. Available online: http://www.cet.com.cn/wzsy/gysd/1230641.shtml (accessed on 19 May 2014).

- Zhu, Y.F.; Fang, H.F. Research on the electric vehicles’ policies in America and the significance to apply in China. Auto Ind. Res. 2013, 8, 30–33. (In Chinese) [Google Scholar]

- Zhang, F.Z.; Cooke, P. The Green Vehicle Trend: Electric, Plug-in Hybrid or Hydrogen Fuel Cell; Centre for Advanced Studies: Cardiff University, UK. Available online: http://www.dime-eu.org/files/active/0/Cooke-09-Fang-Green-vehicle-Review.pdf (accessed on 27 June 2014).

- Nissan Leaf. Available online: http://en.wikipedia.org/wiki/Nissan_Leaf (accessed on 27 June 2014).

- Cheverolet Volt. Available online: http://en.wikipedia.org/wiki/Chevrolet_Volt (accessed on 27 June 2014).

- Axsen, J.; Kurani, K.S. Hybrid, plug-in hybrid, or electric-What do car buyers want? Energy Policy 2013, 61, 532–543. [Google Scholar] [CrossRef]

- Philip, R.; Wiederer, A. Policy Options for Electric Vehicle Charging Infrastructure in C40 Cities. Available online: http://www.innovations.harvard.edu/cache/documents/11089/1108934.pdf (accessed on 2 July 2014).

- The Models that Enjoy the Subsidies in Beijing. Refuse the Imported Electric Vehicles. Available online: http://news.ddc.net.cn/newsview_49285.html (accessed on 9 October 2014).

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Xie, J.; Rao, R.; Liang, Y. Policy Incentives for the Adoption of Electric Vehicles across Countries. Sustainability 2014, 6, 8056-8078. https://doi.org/10.3390/su6118056

Zhang X, Xie J, Rao R, Liang Y. Policy Incentives for the Adoption of Electric Vehicles across Countries. Sustainability. 2014; 6(11):8056-8078. https://doi.org/10.3390/su6118056

Chicago/Turabian StyleZhang, Xingping, Jian Xie, Rao Rao, and Yanni Liang. 2014. "Policy Incentives for the Adoption of Electric Vehicles across Countries" Sustainability 6, no. 11: 8056-8078. https://doi.org/10.3390/su6118056