1. Introduction

Literature on human decision making broadly demonstrates that humans rely upon a number of heuristics [

1]. Many of these heuristics might adversely affect human decision making on important global problems (e.g., climate change). To improve human decisions, one option is to design manipulations that make humans aware and help them overcome their reliance on heuristics; however, another and perhaps easier manipulation is to present information in a way that people’s reliance on heuristics improves their decisions [

2,

3,

4]. In this paper, we follow the latter approach and show how information about ecological (eco) tax increases may be presented such that this presentation takes advantage of people’s reliance on a “proportional-thinking” heuristic and enables them to make choices that result in larger reductions in CO

2 emissions. Furthermore, we discuss that our information-presentation manipulation may be used to improve people’s decision choices in many other societal problems (e.g., cigarette smoking, pollution in rivers, air pollution and overfishing).

An eco-tax (or carbon price) is the cost people would pay to emit a unit of CO

2 in the atmosphere (units: $/ton of CO

2 emissions or $/ton). Eco-taxes are promising economic mechanisms to enable eco-friendly decisions—decisions that reduce carbon-dioxide (CO

2) emissions in the atmosphere and mitigate climate change [

5,

6,

7,

8]. Yet, very few people would likely agree to pay eco-taxes to reduce CO

2 emissions on account of their reliance on heuristics. One of these heuristics is called proportional thinking, according to which people assume a strong positive correlation between a problem’s independent (input) and dependent (output) variables [

9,

10,

11,

12,

13,

14,

15,

16]. For example, by relying on the proportional-thinking heuristic for the Earth’s climate, people might wrongly infer that the shape of CO

2 concentration (output) over time should be identical to the shape of the CO

2 emissions (input) [

14,

17,

18]. Therefore, if CO

2 emissions are assumed to increase linearly over time, then by relying on proportional thinking, people will infer a linear increasing shape for the atmospheric CO

2 concentration that is similar to the shape of CO

2 emissions. Consequently, such linear judgments are likely to make people underestimate the actual nonlinear increase in CO

2 concentration, undermine the seriousness of the climate problem, and cause them to defer acting on climate change [

19].

People’s reliance on the proportional-thinking heuristic is likely to be present for their decisions about eco-tax payment preferences and judgments. For example, by relying on the proportional-thinking heuristic, people are likely to prefer smaller tax increases, while associating larger tax increases to mean

proportionally greater benefits or reductions in CO

2 emissions. An evidence for this belief comes from the marketing literature. For example, most shoppers believe that higher prices are a sign of greater product quality, and repeated studies have shown that while shopping, people expect more expensive products to be beneficial or better in quality [

20,

21,

22]. A recent evidence of this finding comes from [

21], who told their participants that they were drinking five different varieties of wine and disclosed the prices for each as participants drank. In practice, the participants were only consuming three different wines, since two were offered twice: a $5 wine described as costing $5 and $45 and a $90 bottle presented as $90 and $10. (There was also a $35 wine with the accurate price.) People rated identical wines as tasting better when they were priced higher (e.g., $45), and fMRI scans showed greater activity in the brain’s pleasure regions.

According to the proportional-thinking heuristic, given a range of options for eco-tax payments to choose between and due to people’s tendency to avoid the displeasure of paying higher taxes [

21], people are likely to prefer an option with the smallest possible tax increase. Indeed, there is some real world evidence to support this expectation. For example, in a large poll conducted in the U.S. (n > 600), only 17% of respondents preferred an increase in carbon taxes [

23,

24]. Similarly, when the French President Nicolas Sarkozy recently scrapped a planned carbon tax, 69% of respondents endorsed his decision, while only 21% said that it was wrong (n = 948) [

25].

In addition, for eco-tax payments and the corresponding CO2 emission reductions, relying on proportional-thinking means that people believe that larger eco-tax increases will result in proportionally greater CO2 emissions reductions (i.e., benefits) compared to smaller increases. For example, under the 2009 America’s Energy Security Trust Fund Act, a yearly $10/ton increase in carbon tax was believed by Congressmen to result in a proportional 31% reduction in CO2 emissions below their 2005 level. Thus, policymakers, including laypeople, are likely to believe that larger tax increases are also those that result in greater reductions of CO2 emissions.

The problem with applying the proportional-thinking heuristic to eco-taxes is that it is not true that larger eco-tax increases result in greater CO

2 emissions reductions. According to [

26], there is considerable uncertainty and difficulty in determining the base tax (in $/ton of CO

2 emissions in the atmosphere) for eco-taxes (believed to vary between $3/ton to $95/ton). A suggested method is to allow people to choose between multiple tax increases with different base taxes [

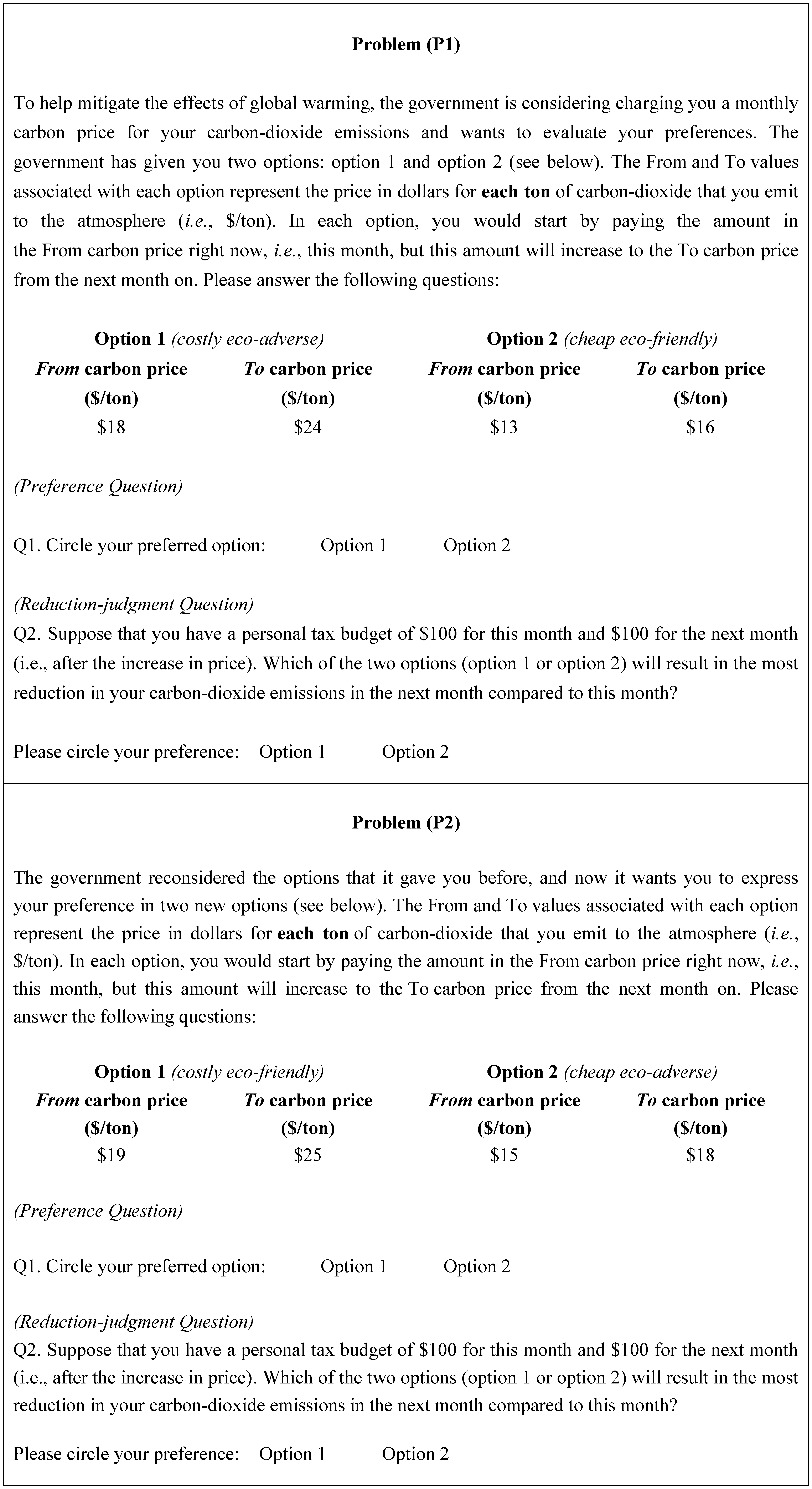

27]. For example, suppose a person has a budget constraint (based on his monthly income) of $100 each month [

32]. This constraint is the limit on the CO

2 emissions that this person could afford each month [

31]. Under this scenario, if the person uses this budget on carbon tax, then a $6/ton tax increase from a base tax of $18/ton tax would reduce this person’s emissions by 1.39 tons (=100

× (1/18 – 1/24)). However, a smaller $3/ton increase from a smaller base tax of $13/ton would reduce his emissions by 1.44 tons. Thus, in this case, the smaller base tax with a smaller tax increase is associated with a greater reduction of CO

2 emissions, in contrast to the proportional-thinking heuristic. In fact, the problem is mathematically similar to the ones that involve judgments with reciprocals, including the common misconception of associating a large increase in mileage of an automobile in “miles per gallon” (mpg) to equate to large savings in fuel used in gallons [

15]. Similarly, by relying on the proportional-thinking heuristic, people are likely to prefer a smaller base tax with the smaller increase over a larger base tax with the larger increase and are likely to judge a larger base tax with the larger increase to reduce CO

2 emissions the most.

The main idea that we demonstrate in this paper is that a proper presentation of eco-taxes and their increases is likely to enable more eco-friendly choices, while people continue to associate larger tax increases with greater CO

2 emissions reductions. Prior research in human psychology shows that a change in information presentation of a nonlinear mathematical problem can improve people’s decisions in that problem [

2,

3,

4]. We demonstrate the effectiveness of this information-presentation manipulation with an experiment involving eco-taxes in the next section.

3. Results

We compared the proportions of cheap and costly choices and the proportions of eco-friendly and eco-adverse choices in the preference question (Q1) aggregated across the two problems (see

Table 1a). The proportion of cheap choices (70%) was greater than costly choices (30%) (χ2(1) = 108.824,

p < 0.001,

r = 0.41), but there was no difference between the proportions of eco-friendly choices (48%) and eco-adverse choices (52%) (χ2(1) = 1.552,

ns,

r = 0.05), showing participants’ preferences for smaller tax increases to be irrespective of whether the increase reduced greater or lesser CO

2 emissions.

When comparing individual preferences in

Table 1b, the proportions of cheap eco-friendly choices (68%) and cheap eco-adverse choices (73%) were greater than the proportions of costly eco-adverse choices (32%) and costly eco-friendly choices (27%), respectively (cheap eco-friendly > costly eco-adverse: χ2(1) = 42.194,

p < 0.001,

r = 0.36; cheap eco-adverse > costly eco-friendly: χ2(1) = 68.182,

p < 0.001,

r = 0.46). Furthermore, the proportions of cheap eco-friendly choices (68%) and cheap eco-adverse choices (73%) and proportions of costly eco-friendly choices (27%) and costly eco-adverse choices (32%) were not significantly different (χ2(1) = 0.929,

ns,

r = 0.05). Consistent with the proportional-thinking heuristic, these results suggest that participants preferred the cheap options, irrespective of the actual reductions in CO

2 emissions.

We performed similar comparisons between choices, but now for the reduction-judgment question (Q2). For the reduction-judgments in

Table 1c, the proportion of costly choices (67%) was greater than the proportion of cheap choices (33%) (χ2(1) = 73.333,

p < 0.001,

r = 0-.33), but there was no difference between proportions of eco-friendly choices (52%) and eco-adverse choices (48%) (χ2(1) = 0.873,

ns,

r = 0.04), showing participants implicitly assumed that larger tax increases would reduce CO

2 emissions the most, irrespective of whether or not they actually reduced CO

2 emissions. Upon comparing individual judgments for the reduction-judgment question in

Table 1d, the proportions of costly eco-adverse choices (65%) and costly eco-friendly choices (68%) were greater than the proportions of cheap eco-friendly choices (35%) and cheap eco-adverse choices (32%), (costly eco-adverse > cheap eco-friendly: χ2(1) = 29.103,

p < 0.001,

r = 0.30; costly eco-friendly > cheap eco-adverse: χ2(1) = 45.103,

p < 0.001,

r = 0.37). Moreover, the proportions of costly eco-friendly and costly eco-adverse choices and proportions of cheap eco-friendly and cheap eco-adverse choices were not significantly different (χ2 (1) = 0.491,

ns,

r = 0.04). Consistent with proportional thinking, these results suggest that participants judged the costly options to reduce CO

2 emissions the most, irrespective of the actual reductions.

Table 1.

(a) Proportion of choices across the two problems for preferences, (b) Proportion of choices for preferences.(c) Proportion of choices across the two problems for reduction-judgments. (d) Proportion of choices for reduction-judgments.

(a).

| | Costly | Cheap |

|---|

| Preference (Q1) | 30% (n = 98/330 1) | 70% (n = 232/330) |

| | Eco-friendly | Eco-adverse |

| Preference (Q1) | 48% (n = 157/330) | 52% (n = 173/330) |

(b).

| Questions | Costly Eco-adverse (6 unit increase; 1.39 tons CO2 emissions reduction) | Cheap Eco-friendly (3 unit increase; 1.44 tons CO2 emissions reduction) | Costly Eco-friendly (6 unit increase; 1.26 tons CO2 emissions reduction) | Cheap Eco-adverse (3 unit increase; 1.11 tons CO2 emissions reduction) |

| Preference (Q1) | 32% (n = 53/165 1) | 68% (n = 112/165) | 27% (n = 45/165) | 73% (n = 120/165) |

(c).

| | Costly | Cheap |

|---|

| Reduction-judgment (Q2) | 67% (n = 220/330 1) | 33% (n = 110/330) |

| | Eco-friendly | Eco-adverse |

| Reduction-judgment (Q2) | 52% (n = 171/330) | 48% (n = 159/330) |

(d).

| Questions | Costly Eco-adverse (6 unit increase; 1.39 tons CO2 emissions reduction) | Cheap Eco-friendly (3 unit increase; 1.44 tons CO2 emissions reduction) | Costly Eco-friendly (6 unit increase; 1.26 tons CO2 emissions reduction) | Cheap Eco-adverse (3 unit increase; 1.11 tons CO2 emissions reduction) |

| Reduction-judgment (Q2) | 65% (n = 107/165 1) | 35% (n = 58/165) | 68% (n = 113/165) | 32% (n = 52/165) |

3.1. Consistency Between Preferences And Reduction-Judgments

Next, we determined how people’s reduction-judgments (Q2) matched with their preferences (Q1) within a problem. As shown in

Table 2, 44% of participants simultaneously preferred cheap options and judged costly options as reducing CO

2 emissions the most, while only 7% of participants simultaneously preferred costly options and judged cheap options as reducing emissions the most. This pattern of choices for costly and cheap options seems to be consistent with reliance on proportional-thinking heuristic in preferences and judgments about CO

2 emissions reductions, respectively. In addition, the proportion for simultaneous preferences and judgments about CO

2 emissions reductions were comparatively smaller for the Costly-Costly and Cheap-Cheap choice combinations (see

Table 2). Moreover, preferences for eco-friendly or eco-adverse options and simultaneous reduction-judgments for eco-friendly or eco-adverse options were about the same in all choice combinations. These results show that people decided primarily based upon options being costly or cheap, irrespective of whether their choices reduced greater or less CO

2 emissions.

3.2. Consistency Of Preferences And Reduction-Judgments Between The Two Problems

As shown in

Table 3, 63% preferred cheap options in both problems, while the proportion of preferences were comparatively smaller for the following combination of options across the two problems: cheap in the first problem and costly in the second problem, costly in the first problem and cheap in the second problem, and costly in both problems. Similarly, in

Table 4, 55% judged costly options in both problems to reduce CO

2 emissions the most, while the proportion of reduction-judgments were comparatively smaller for the following combination of options across the two problems: costly in the first problem and cheap in the second problem, cheap in the first problem and costly in the second problem, and cheap in both problems.

Table 2.

Participants’ proportion of reduction-judgments with respect to their proportion of preferences within problems.

Table 2.

Participants’ proportion of reduction-judgments with respect to their proportion of preferences within problems.

| | Preference (Q1) |

|---|

| Reduction-judgment (Q2) | Costly (n = 98) | Cheap (n = 232) | Eco-friendly (n = 157) | Eco-adverse (n = 173) |

|---|

| Costly (n = 220) | 23% (n = 76/330 1) | 44% (n = 144/330) | | |

| Cheap (n = 110) | 7% (n = 22/330) | 26% (n = 88/330) | | |

| Eco-friendly (n = 171) | | | 25% (n = 81/330) | 27% (n = 90/330) |

| Eco-adverse (n = 159) | | | 23% (n = 76/330) | 25% (n = 83/330) |

These results show that participants were pretty consistent about their preferences for cheap options and reduction-judgments for costly options across the two problems, irrespective of whether their preferences and reduction-judgments reduced greater or less emissions.

Table 3.

Participants’ proportion of preferences across the first and second presented problems.

Table 3.

Participants’ proportion of preferences across the first and second presented problems.

| | First Presented Problem’s Preference (Q1) |

|---|

| Second Presented Problem’s Preference (Q1) | Costly (n = 48) | Cheap (n = 117) |

|---|

| Costly (n = 50) | 22% (n = 36/165 1) | 8% (n = 14/165) |

| Cheap (n = 115) | 7% (n = 12/165) | 63% (n = 103/165) |

Table 4.

Participants’ proportion of reduction-judgments in the first and second presented problems.

Table 4.

Participants’ proportion of reduction-judgments in the first and second presented problems.

| | First Presented Problem’s Reduction-judgment (Q2) |

|---|

| Second Presented Problem’s Reduction-judgment (Q2) | Costly (n = 112) | Cheap (n = 53) |

|---|

| Costly (n = 108) | 55% (n = 91/165 1) | 10% (n = 17/165) |

| Cheap (n = 57) | 13% (n = 21/165) | 22% (n = 36/165) |

3.3. Are Preferences Based on Options being Eco-Friendly or Cheap?

In our results, a large majority (68%) of participants preferred the cheap eco-friendly option (see

Table 1). A possible explanation for this 68% (=112/165) preference is that it is based on the option being eco-friendly rather than it being cheap. The cheap eco-friendly option boasts a small carbon-price increase (=3 units), but also reduces CO

2 emissions most (=1.44 tons) at the same time. However, 60% (=68/112) of those that preferred the cheap eco-friendly option also judged the costly eco-adverse option to save more CO

2 emissions in the same problem. Furthermore, 92% (=103/112) of those that preferred the cheap eco-friendly option also judged the cheap eco-adverse option as reducing CO

2 emissions the most in the next problem. In both judgments, the costly or cheap eco-adverse options do not reduce CO

2 emissions the most, and thus, these options are not eco-friendly. Therefore, a closer inspection of results reveals that the 68% of cheap eco-friendly preferences represented participants that were relying on the proportional-thinking heuristic and driven by selecting a cheap option, rather than participants that acted because the option was eco-friendly.

3.4. Are Preferences Driven by Accumulated CO2 Reductions or Choice for the Cheaper Option?

We believe that people’s preference for cheap options is likely due to their displeasure of incurring a greater loss due to tax payment. But, as we simply asked people which option they

preferred, one possibility could be that they prefer a smaller increase with a smaller base tax, because the smaller increase causes the most

accumulated CO

2 reductions over the two months compared to the larger tax increase [

34]. For example, smaller tax increases like $13/ton to $16/ton and $15/ton to $18/ton, cause greater CO

2 reductions of 13.9 tons and 12.2 tons, respectively, compared to those for larger tax increases, like $18/ton to $24/ton (=9.7 tons) and $19/ton to $25/ton (=9.3 tons), respectively. In order to test this possibility, we ran an identical study with n = 155 participants [

35]; however, where we now changed one problem to be a choice between an increase from $19/ton to $25/ton or an increase from $21/ton to $24/ton, the other problem with increases $18/ton to $24/ton and $13/ton and $16/ton was unchanged. The $21/ton to $24/ton increase is a small three units increase, but the accumulated CO

2 reduction in this increase equals 8.9 tons, which is less than that in the $19/ton to $25/ton increase (=9.3 tons). If people decided according to accumulated CO

2 reductions, then fewer people should have chosen the smaller increase; however, results indicated that 63% of participants still chose the smaller tax increase ($21/ton to $24/ton), thereby preferring the cheaper option.

4. Conclusions

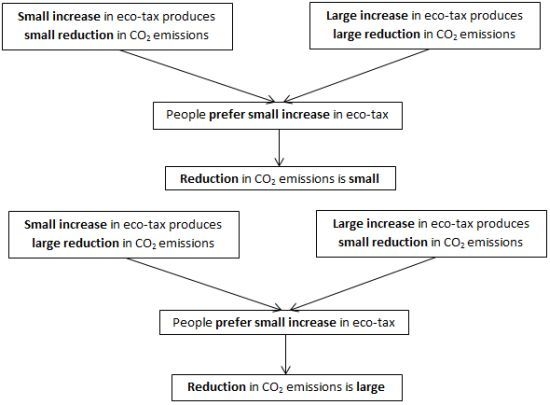

We find that consistent with the proportional-thinking heuristic, people prefer smaller rather than larger eco-tax increases, while simultaneously judging larger increases as reducing CO2 emissions more, consistent with the proportional-thinking heuristic. Furthermore, we demonstrated how one could make use of the proportional-thinking heuristic to enable participants to make more eco-friendly choices: when participants are provided with ranges of tax increases, they prefer smaller increases, and their preference can result in greater CO2 reductions, depending on how information is presented.

People’s preferences for smaller eco-taxes is likely due to the proportional-thinking heuristic [

19]: people are likely to perceive that a larger increase with a larger base tax (e.g., $18/ton to $24/ton) will reduce their current wealth more and bring them greater displeasure [

20,

21,

22]. Furthermore, people’s implicit reasoning of a proportional relationship between increases in eco-taxes and the corresponding increases in CO

2 emissions reductions is also likely driven by the proportional-thinking heuristic. People are more likely to associate a larger eco-tax increase with a larger base tax as resulting in

proportionally greater emissions reduction compared to a smaller increase with a smaller base tax. This reasoning is more so because we specifically asked people to choose the option with most CO

2 reduction next month

compared to the reduction this month in the reduction-judgment question.

Therefore, people’s reliance on the proportional-thinking heuristic can be used to enable more eco-friendly choices, even while people believe that they are saving money by preferring the smallest eco-tax increase. This manipulation does not require any change in people’s psychological processes, but only a change in the way information is presented for decision making. This kind of manipulation is also effective in enabling improved judgments in other decision problems [

2,

3,

4]. For example, [

2] have shown that changing probability numbers from fractions (e.g., 29/36) to decimals (e.g., 0.8) caused people to make consistent choices for risky options in two lotteries that had the same expected value, but where the risky option had a small probability of a large outcome in one lottery and a large probability of a small outcome in the other. Similarly, changing the presentation of eco-taxes such that a smaller increase also reduces CO

2 emissions more will promote more eco-friendly decisions.

According to [

5], the current prices of gasoline, electricity and fuels in most parts of the world include none of the costs associated with catastrophic climate change. This omission suppresses incentives to develop and deploy CO

2 reduction measures that are energy efficient (e.g., high-mileage cars, high-efficiency heaters and air conditioners in homes). Conversely, taxing people’s consumption of fuels according to their emissions will infuse these incentives at every link in the chain of decision and action—from individuals’ choices and uses of vehicles, appliances, and housing. The main implication of our manipulation benefits eco-tax policies, provided policymakers present eco-friendly options as the ones that also offer smaller increases. By doing so, we expect that society’s adoption of eco-friendly taxes will be more readily accepted, because people would not need to change their current behavior.

Although eco-tax is specifically used in this study, the applicability of our manipulation is broad and widespread, given people’s reliance on heuristics. A number of other important real-world problems (e.g., cigarette smoking, pollution in rivers, air pollution and overfishing) could be improved by presenting information in a similar form. For example, the government could consider increasing the tax per packet of cigarette to reduce smoking. One of the tax options could be a tax increase of a dollar, from $1 per cigarette packet this month to $2 per packet next month. Another option could be a tax increase of $2, from $3 per packet this month to $5 per packet next month. If smokers spend on average a $100 tax buying cigarettes each month, then the first option will reduce their consumption by 50 cigarette packets, while the latter option only by 13 packets. On account of the proportional-thinking heuristic, we expect smokers to also readily prefer the option with a $1 tax increase compared to the $2 tax increase. The end result would be a larger reduction in packets smoked—a desirable outcome. In the real world, it might be very difficult to change existent human behavior and reliance on heuristics [

3]. We suggest an alternative: to change people’s decision environment such that existent behavior and reliance on heuristics enables people to improve their decision choices.