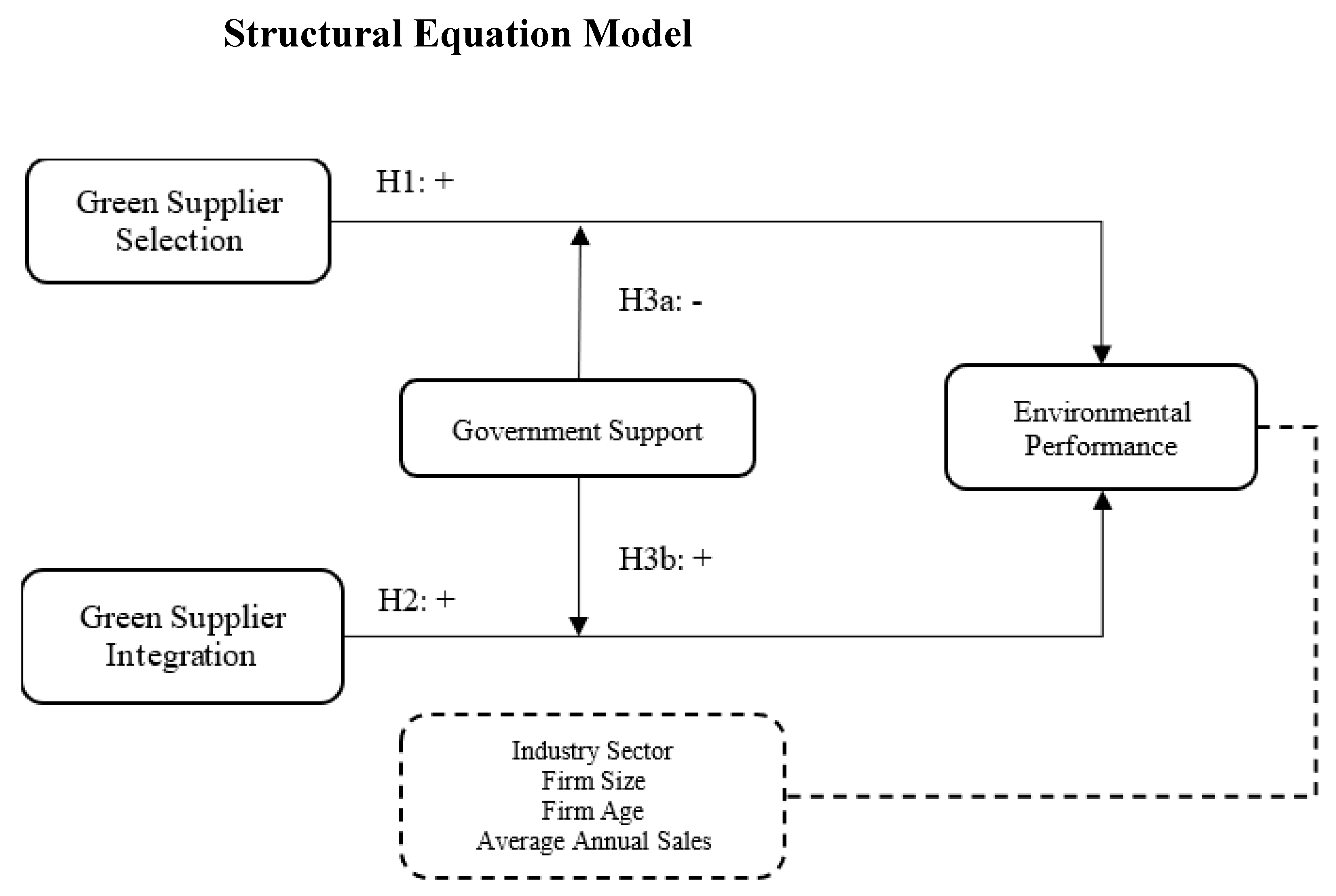

Comparing the Impact of Green Supplier Selection and Integration on Environmental Performance: An Analysis of the Moderating Role of Government Support

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Green Supplier Selection

2.2. Green Supplier Integration

2.2.1. Environmental Performance

2.2.2. The Main Effect on ERBV Framework

2.3. The Moderative Effect of Government Support

3. Research Method

3.1. Overview of Research Methods

3.2. Data-Collection Procedures

3.3. Measurement Items

3.4. Construct Validity

3.5. Non-Response Bias and Common Method Bias

4. Hypothesis Results

5. Discussions

5.1. Theory Integration

5.2. Theoretical Implications

5.3. Practical Impalications

5.4. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wang, J.; Zhu, L.; Feng, L.; Feng, J. A meta-analysis of sustainable supply chain management and firm performance: Some new findings on sustainable supply chain management. Sustain. Prod. Consum. 2023, 38, 312–330. [Google Scholar] [CrossRef]

- Giri, B.C.; Molla, M.U.; Biswas, P. Pythagorean fuzzy DEMATEL method for supplier selection in sustainable supply chain management. Expert Syst. Appl. 2022, 193, 116396. [Google Scholar] [CrossRef]

- Zhang, Q.; Pan, J.; Jiang, Y.; Feng, T. The impact of green supplier integration on firm performance: The mediating role of social capital accumulation. J. Purch. Supply Manag. 2020, 26, 100579. [Google Scholar] [CrossRef]

- Qu, K.; Liu, Z. Green innovations, supply chain integration and green information system: A model of moderation. J. Clean. Prod. 2022, 339, 130557. [Google Scholar] [CrossRef]

- Guo, X.; Xia, W.; Feng, T.; Sheng, H. Sustainable supply chain finance adoption and firm performance: Is green supply chain integration a missing link? Sustain. Dev. 2022, 30, 1135–1154. [Google Scholar] [CrossRef]

- Yildiz Çankaya, S.; Sezen, B. Effects of green supply chain management practices on sustainability performance. J. Manuf. Technol. Manag. 2019, 30, 98–121. [Google Scholar] [CrossRef]

- Lee, H.; Wu, X. Green supplier selection and environmental performance of firms in the Chinese manufacturing industry: The roles of behavior and outcome controls. J. Manuf. Technol. Manag. 2023, 34, 1141–1161. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.; Boon-itt, S. Effects of green supply chain integration and green innovation on environmental and cost performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Shou, Y.; Shao, J.; Lai, K.-h.; Kang, M.; Park, Y. The impact of sustainability and operations orientations on sustainable supply management and the triple bottom line. J. Clean. Prod. 2019, 240, 118280. [Google Scholar] [CrossRef]

- Anvarjonov, N.B.U.; Um, K.-H.; Zhong, D.; Shine, E.-K. Achieving sustainability in manufacturing: The nexus of green supplier selection, green performance and outcome and process controls. J. Manuf. Technol. Manag. 2024, 35, 480–501. [Google Scholar] [CrossRef]

- Cai, J.; Cheng, J.; Shi, H.; Feng, T. The impact of organisational conflict on green supplier integration: The moderating role of governance mechanism. Int. J. Logist. Res. Appl. 2022, 25, 143–160. [Google Scholar] [CrossRef]

- Grover, A.K.; Dresner, M. A theoretical model on how firms can leverage political resources to align with supply chain strategy for competitive advantage. J. Supply Chain Manag. 2022, 58, 48–65. [Google Scholar] [CrossRef]

- Zhong, D.; Um, K.-H. Exploring the Nexus of Supplier and Customer Integration: Unraveling the Impact on Disruption Absorption Capability with IT Alignment. J. Korean Soc. Qual. Manag. 2024, 52, 221–239. [Google Scholar]

- Cui, L.; Wu, H.; Dai, J. Modelling flexible decisions about sustainable supplier selection in multitier sustainable supply chain management. Int. J. Prod. Res. 2023, 61, 4603–4624. [Google Scholar] [CrossRef]

- Kusi-Sarpong, S.; Gupta, H.; Khan, S.A.; Chiappetta Jabbour, C.J.; Rehman, S.T.; Kusi-Sarpong, H. Sustainable supplier selection based on industry 4.0 initiatives within the context of circular economy implementation in supply chain operations. Prod. Plan. Control 2023, 34, 999–1019. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Yu, Z.; Farooq, K. Green capabilities, green purchasing, and triple bottom line performance: Leading toward environmental sustainability. Bus. Strategy Environ. 2023, 32, 2022–2034. [Google Scholar] [CrossRef]

- Kaufmann, L.; Carter, C.R.; Buhrmann, C. The impact of individual debiasing efforts on financial decision effectiveness in the supplier selection process. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 411–433. [Google Scholar] [CrossRef]

- Trautrims, A.; MacCarthy, B.L.; Okade, C. Building an innovation-based supplier portfolio: The use of patent analysis in strategic supplier selection in the automotive sector. Int. J. Prod. Econ. 2017, 194, 228–236. [Google Scholar] [CrossRef]

- Hosseini, S.; Morshedlou, N.; Ivanov, D.; Sarder, M.; Barker, K.; Al Khaled, A. Resilient supplier selection and optimal order allocation under disruption risks. Int. J. Prod. Econ. 2019, 213, 124–137. [Google Scholar] [CrossRef]

- Haeri, S.A.S.; Rezaei, J. A grey-based green supplier selection model for uncertain environments. J. Clean. Prod. 2019, 221, 768–784. [Google Scholar] [CrossRef]

- Lo, H.-W.; Liou, J.J.; Wang, H.-S.; Tsai, Y.-S. An integrated model for solving problems in green supplier selection and order allocation. J. Clean. Prod. 2018, 190, 339–352. [Google Scholar] [CrossRef]

- Hu, H.; Tadikamalla, P.R. When and how to introduce upstream competition in an innovation supply chain. Comput. Ind. Eng. 2023, 186, 109749. [Google Scholar] [CrossRef]

- Singh, R.; Charan, P.; Chattopadhyay, M. Effect of relational capability on dynamic capability: Exploring the role of competitive intensity and environmental uncertainty. J. Manag. Organ. 2022, 28, 659–680. [Google Scholar] [CrossRef]

- Xu, D.; Huo, B.; Sun, L. Relationships between intra-organizational resources, supply chain integration and business performance: An extended resource-based view. Ind. Manag. Data Syst. 2014, 114, 1186–1206. [Google Scholar] [CrossRef]

- Cousins, P.D.; Menguc, B. The implications of socialization and integration in supply chain management. J. Oper. Manag. 2006, 24, 604–620. [Google Scholar] [CrossRef]

- Fernandes, K.J.; Milewski, S.; Chaudhuri, A.; Xiong, Y. Contextualising the role of external partnerships to innovate the core and enabling processes of an organisation: A resource and knowledge-based view. J. Bus. Res. 2022, 144, 146–162. [Google Scholar] [CrossRef]

- Homayounfard, A.; Zaefarian, G. Key challenges and opportunities of service innovation processes in technology supplier-service provider partnerships. J. Bus. Res. 2022, 139, 1284–1302. [Google Scholar] [CrossRef]

- Trang, S.; Mandrella, M.; Marrone, M.; Kolbe, L.M. Co-creating business value through IT-business operational alignment in inter-organisational relationships: Empirical evidence from regional networks. Eur. J. Inf. Syst. 2022, 31, 166–187. [Google Scholar] [CrossRef]

- Leng, J.; Ruan, G.; Jiang, P.; Xu, K.; Liu, Q.; Zhou, X.; Liu, C. Blockchain-empowered sustainable manufacturing and product lifecycle management in industry 4.0: A survey. Renew. Sustain. Energy Rev. 2020, 132, 110112. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhao, C.; Guo, Y.; Sheng, H.; Feng, T. Green supplier integration and environmental innovation in Chinese firms: The joint effect of governance mechanism and trust. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 169–183. [Google Scholar] [CrossRef]

- Qin, Z.; Chen, P.-K. Enhancing the resilience of sustainable supplier management through the combination of win–win lean practices and auditing mechanisms—An analysis from the resource-based view. Front. Environ. Sci. 2022, 10, 962008. [Google Scholar] [CrossRef]

- Luthra, S.; Garg, D.; Haleem, A. An analysis of interactions among critical success factors to implement green supply chain management towards sustainability: An Indian perspective. Resour. Policy 2015, 46, 37–50. [Google Scholar] [CrossRef]

- Pham, T.; Pham, H. Improving green performance of construction projects through supply chain integration: The role of environmental knowledge. Sustain. Prod. Consum. 2021, 26, 933–942. [Google Scholar] [CrossRef]

- Fontoura, P.; Coelho, A. How to boost green innovation and performance through collaboration in the supply chain: Insights into a more sustainable economy. J. Clean. Prod. 2022, 359, 132005. [Google Scholar] [CrossRef]

- Serrano-García, J.; Llach, J.; Bikfalvi, A.; Arbeláez-Toro, J.J. Performance effects of green production capability and technology in manufacturing firms. J. Environ. Manag. 2023, 330, 117099. [Google Scholar] [CrossRef]

- Khan, A.; Tao, M. Knowledge absorption capacity’s efficacy to enhance innovation performance through big data analytics and digital platform capability. J. Innov. Knowl. 2022, 7, 100201. [Google Scholar] [CrossRef]

- Gast, J.; Gundolf, K.; Cesinger, B. Doing business in a green way: A systematic review of the ecological sustainability entrepreneurship literature and future research directions. J. Clean. Prod. 2017, 147, 44–56. [Google Scholar] [CrossRef]

- Agrawal, V.; Mohanty, R.P.; Agarwal, S.; Dixit, J.K.; Agrawal, A.M. Analyzing critical success factors for sustainable green supply chain management. Environ. Dev. Sustain. 2023, 25, 8233–8258. [Google Scholar] [CrossRef]

- Wiredu, J.; Yang, Q.; Sampene, A.K.; Gyamfi, B.A.; Asongu, S.A. The effect of green supply chain management practices on corporate environmental performance: Does supply chain competitive advantage matter? Bus. Strategy Environ. 2024, 33, 2578–2599. [Google Scholar] [CrossRef]

- Yang, C.; Zhu, C.; Albitar, K. ESG ratings and green innovation: AU-shaped journey towards sustainable development. Bus. Strategy Environ. 2024, 33, 4108–4129. [Google Scholar] [CrossRef]

- Wang, R.; Heugens, P.P.; Wijen, F. Green by affiliation? Ownership identity and environmental management system adoption in Chinese business groups. J. Manag. 2024, 50, 1331–1360. [Google Scholar] [CrossRef]

- Castiglione, C.; Pastore, E.; Alfieri, A. Technical, economic, and environmental performance assessment of manufacturing systems: The multi-layer enterprise input-output formalization method. Prod. Plan. Control 2024, 35, 133–150. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

- Miao, C.; Fang, D.; Sun, L.; Luo, Q. Natural resources utilization efficiency under the influence of green technological innovation. Resour. Conserv. Recycl. 2017, 126, 153–161. [Google Scholar] [CrossRef]

- Al-Sheyadi, A.; Muyldermans, L.; Kauppi, K. The complementarity of green supply chain management practices and the impact on environmental performance. J. Environ. Manag. 2019, 242, 186–198. [Google Scholar] [CrossRef] [PubMed]

- Opazo-Basáez, M.; Monroy-Osorio, J.C.; Marić, J. Evaluating the effect of green technological innovations on organizational and environmental performance: A treble innovation approach. Technovation 2024, 129, 102885. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Yang, Y.; Jia, F.; Xu, Z. Towards an integrated conceptual model of supply chain learning: An extended resource-based view. Supply Chain Manag. Int. J. 2019, 24, 189–214. [Google Scholar] [CrossRef]

- Sahoo, S.; Kumar, A.; Upadhyay, A. How do green knowledge management and green technology innovation impact corporate environmental performance? Understanding the role of green knowledge acquisition. Bus. Strategy Environ. 2023, 32, 551–569. [Google Scholar] [CrossRef]

- de Mello Santos, V.H.; Campos, T.L.R.; Espuny, M.; de Oliveira, O.J. Towards a green industry through cleaner production development. Environ. Sci. Pollut. Res. 2022, 29, 349–370. [Google Scholar] [CrossRef] [PubMed]

- O’Rourke, D.; Strand, R. Patagonia: Driving sustainable innovation by embracing tensions. Calif. Manag. Rev. 2017, 60, 102–125. [Google Scholar] [CrossRef]

- Zavodna, L.S.; Trejtnarova, L. Sustainable packaging in footwear industry: Case study of PUMA. Econ. Manag. Sustain. 2021, 6, 27–33. [Google Scholar] [CrossRef]

- Khan, A.H.; López-Maldonado, E.A.; Alam, S.S.; Khan, N.A.; López, J.R.L.; Herrera, P.F.M.; Abutaleb, A.; Ahmed, S.; Singh, L. Municipal solid waste generation and the current state of waste-to-energy potential: State of art review. Energy Convers. Manag. 2022, 267, 115905. [Google Scholar] [CrossRef]

- Singh, A.; Sharma, M. Development of a ‘green IT brand image sustainability model for competitive advantage’. Environ. Dev. Sustain. 2022, 25, 40–60. [Google Scholar] [CrossRef]

- Shah, N.; Soomro, B.A. Internal green integration and environmental performance: The predictive power of proactive environmental strategy, greening the supplier, and environmental collaboration with the supplier. Bus. Strategy Environ. 2021, 30, 1333–1344. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, Q.; Seuring, S. Linking capabilities to green operations strategies: The moderating role of corporate environmental proactivity. Int. J. Prod. Econ. 2017, 187, 182–195. [Google Scholar] [CrossRef]

- Jell-Ojobor, M.; Raha, A. Being good at being good—The mediating role of an environmental management system in value-creating green supply chain management practices. Bus. Strategy Environ. 2022, 31, 1964–1984. [Google Scholar] [CrossRef]

- Feng, T.; Li, Z.; Shi, H.; Jiang, W. Translating leader sustainability orientation into green supply chain integration: A missing link of green entrepreneurial orientation. J. Bus. Ind. Mark. 2022, 37, 2515–2532. [Google Scholar] [CrossRef]

- Mishra, R.; Singh, R.K.; Subramanian, N. Exploring the relationship between environmental collaboration and business performance with mediating effect of responsible consumption and production. Bus. Strategy Environ. 2023, 32, 2136–2154. [Google Scholar] [CrossRef]

- Hartmann, J.; Vachon, S. Linking environmental management to environmental performance: The interactive role of industry context. Bus. Strategy Environ. 2018, 27, 359–374. [Google Scholar] [CrossRef]

- Donaldson, L. The Contingency Theory of Organizations; Sage: Newcastle, UK, 2001. [Google Scholar]

- Luthans, F.; Stewart, T.I. A general contingency theory of management. Acad. Manag. Rev. 1977, 2, 181–195. [Google Scholar] [CrossRef]

- Shrader, C.B.; Lincoln, J.R.; Hoffman, A.N. The network structures of organizations: Effects of task contingencies and distributional form. Hum. Relat. 1989, 42, 43–66. [Google Scholar] [CrossRef]

- Ren, S.; He, D.; Yan, J.; Zeng, H.; Tan, J. Environmental labeling certification and corporate environmental innovation: The moderating role of corporate ownership and local government intervention. J. Bus. Res. 2022, 140, 556–571. [Google Scholar] [CrossRef]

- Wu, T.; Yang, S.; Tan, J. Impacts of government R&D subsidies on venture capital and renewable energy investment--an empirical study in China. Resour. Policy 2020, 68, 101715. [Google Scholar]

- Ma, H.; Li, L. Could environmental regulation promote the technological innovation of China’s emerging marine enterprises? Based on the moderating effect of government grants. Environ. Res. 2021, 202, 111682. [Google Scholar] [CrossRef] [PubMed]

- Chan, R.Y.; He, H.; Chan, H.K.; Wang, W.Y. Environmental orientation and corporate performance: The mediation mechanism of green supply chain management and moderating effect of competitive intensity. Ind. Mark. Manag. 2012, 41, 621–630. [Google Scholar] [CrossRef]

- Chang, L.; Li, W.; Lu, X. Government engagement, environmental policy, and environmental performance: Evidence from the most polluting Chinese listed firms. Bus. Strategy Environ. 2015, 24, 1–19. [Google Scholar] [CrossRef]

- Joo, H.-Y.; Suh, H. The effects of government support on corporate performance hedging against international environmental regulation. Sustainability 2017, 9, 1980. [Google Scholar] [CrossRef]

- Awwad, A.; Anouze, A.L.M.; Ndubisi, N.O. Green customer and supplier integration for competitive advantage: The mediation effect of sustainable product innovation. Sustainability 2022, 14, 10153. [Google Scholar] [CrossRef]

- Allenbacher, J.; Berg, N. How assessment and cooperation practices influence suppliers’ adoption of sustainable supply chain practices: An inter-organizational learning perspective. J. Clean. Prod. 2023, 403, 136852. [Google Scholar] [CrossRef]

- Dillman, D.A. Procedures for conducting government-sponsored establishment surveys: Comparisons of the total design method (TDM), a traditional cost-compensation model, and tailored design. In Proceedings of the American Statistical Association, Second International Conference on Establishment Surveys, Buffalo, NY, USA, 17–21 June 2000; pp. 343–352. [Google Scholar]

- Roh, T.; Noh, J.; Oh, Y.; Park, K.-S. Structural relationships of a firm’s green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 2022, 356, 131877. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef]

- Byrne, B.M.; Shavelson, R.J.; Muthén, B. Testing for the equivalence of factor covariance and mean structures: The issue of partial measurement invariance. Psychol. Bull. 1989, 105, 456. [Google Scholar] [CrossRef]

- Bonett, D.G.; Wright, T.A. Cronbach’s alpha reliability: Interval estimation, hypothesis testing, and sample size planning. J. Organ. Behav. 2015, 36, 3–15. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef]

- de Jong, P.F. Hierarchical regression analysis in structural equation modeling. Struct. Equ. Model. Multidiscip. J. 1999, 6, 198–211. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Routledge: London, UK, 2013. [Google Scholar]

- Son, I.; Lee, D.; Lee, J.-N.; Chang, Y.B. Market perception on cloud computing initiatives in organizations: An extended resource-based view. Inf. Manag. 2014, 51, 653–669. [Google Scholar] [CrossRef]

- Beamish, P.W.; Chakravarty, D. Using the resource-based view in multinational enterprise research. J. Manag. 2021, 47, 1861–1877. [Google Scholar] [CrossRef]

- Lu, J.W.; Beamish, P.W. Partnering strategies and performance of SMEs’ international joint ventures. J. Bus. Ventur. 2006, 21, 461–486. [Google Scholar] [CrossRef]

- Dai, L.; Eden, L.; Beamish, P.W. Caught in the crossfire: Dimensions of vulnerability and foreign multinationals’ exit from war-afflicted countries. Strateg. Manag. J. 2017, 38, 1478–1498. [Google Scholar] [CrossRef]

- Stonebraker, P.W.; Afifi, R. Toward a contingency theory of supply chains. Manag. Decis. 2004, 42, 1131–1144. [Google Scholar] [CrossRef]

- Hanisch, B.; Wald, A. A bibliometric view on the use of contingency theory in project management research. Proj. Manag. J. 2012, 43, 4–23. [Google Scholar] [CrossRef]

- Wong, C.Y.; Boon-Itt, S.; Wong, C.W. The contingency effects of environmental uncertainty on the relationship between supply chain integration and operational performance. J. Oper. Manag. 2011, 29, 604–615. [Google Scholar] [CrossRef]

- Aselage, J.; Eisenberger, R. Perceived organizational support and psychological contracts: A theoretical integration. J. Organ. Behav. Int. J. Ind. Occup. Organ. Psychol. Behav. 2003, 24, 491–509. [Google Scholar] [CrossRef]

- Baard, S.K.; Rench, T.A.; Kozlowski, S.W. Performance adaptation: A theoretical integration and review. J. Manag. 2014, 40, 48–99. [Google Scholar] [CrossRef]

- Wall, T.D.; Cordery, J.L.; Clegg, C.W. Empowerment, performance, and operational uncertainty: A theoretical integration. Appl. Psychol. 2002, 51, 146–169. [Google Scholar] [CrossRef]

- Markóczy, L.; Deeds, D.L. Theory building at the intersection: Recipe for impact or road to nowhere? J. Manag. Stud. 2009, 46, 1076–1088. [Google Scholar] [CrossRef]

- Shaw, J.D.; Tangirala, S.; Vissa, B.; Rodell, J.B. New ways of seeing: Theory integration across disciplines. Acad. Manag. J. 2018, 61, 1–4. [Google Scholar] [CrossRef]

- Mellahi, K.; Frynas, J.G.; Sun, P.; Siegel, D. A review of the nonmarket strategy literature: Toward a multi-theoretical integration. J. Manag. 2016, 42, 143–173. [Google Scholar] [CrossRef]

- Zhang, Q.; Pan, J.; Feng, T. Green supplier integration and environmental performance: Do environmental innovation and ambidextrous governance matter? Int. J. Phys. Distrib. Logist. Manag. 2020, 50, 693–719. [Google Scholar] [CrossRef]

| Frequency | Percentage | ||

|---|---|---|---|

| Industry sector | Textile | 69 | 17.6 |

| Furniture | 61 | 15.6 | |

| Chemicals, Pharmaceutical | 78 | 19.9 | |

| Automobile | 29 | 07.4 | |

| Electric machinery and equipment | 95 | 24.3 | |

| Others | 59 | 15.2 | |

| Firm size (the numbers of employees) | <500 | 214 | 54.7 |

| 500–1000 | 63 | 16.1 | |

| 1000–2000 | 71 | 18.1 | |

| >2000 | 43 | 11.1 | |

| Annual sales (hundred million RMB) | <300 | 26 | 06.6 |

| 300–500 | 88 | 22.5 | |

| 500–1000 | 165 | 42.2 | |

| >1000 | 112 | 28.7 | |

| Investment in environmental (Million RMB) | <50 | 139 | 35.5 |

| 50–100 | 75 | 19.2 | |

| 100–500 | 168 | 42.9 | |

| >500 | 103 | 26.4 | |

| Firm age | <1 year old | 8 | 02.2 |

| 1–5 years old | 42 | 10.7 | |

| 6–10 years old | 109 | 27.8 | |

| 11–20 years old | 153 | 39.1 | |

| >20 years old | 79 | 20.2 | |

| Overall Model Fit: χ2/df = 2.069; p < 0.01; CFI = 0.977; IFI = 0.978; RMSEA = 0.038 | ||||||

|---|---|---|---|---|---|---|

| Variables | Measurement Items | SFL | SE | α | CR | AVE |

| Green Supplier Selection [10] | Our firm invests in selecting green suppliers whose processes/products are environmentally safe | 0.789 | 0.889 | 0.890 | 0.613 | |

| Our firm invests in selecting green suppliers who use recyclable/reusable packaging | 0.803 | 0.075 | ||||

| Our firm invests in selecting green suppliers who participate in green purchasing initiatives | 0.799 | 0.074 | ||||

| Our firm selects green suppliers that create as little waste as possible | 0.812 | 0.072 | ||||

| Greem Supplier Integration [8] | Our firm shares environmental information (e.g., emission reduction technology) with key suppliers | 0.801 | 0.910 | 0.910 | 0.648 | |

| Our firm collaboratively anticipates and resolves environment-related problems with key suppliers | 0.809 | 0.062 | ||||

| Our firm makes joint decisions with key suppliers about the ways to reduce overall environmental impact of its activities | 0.796 | 0.081 | ||||

| Our firm couples its environmental management system with that of key suppliers | 0.831 | 0.053 | ||||

| Government Support [75] | Chinese government implements policies and programs that are beneficial to our firm’s environmental operations. | 0.845 | 0.908 | 0.908 | 0.685 | |

| Chinese government provides needed technology information and technical support to our firm’s environmental operations. | 0.862 | 0.063 | ||||

| Chinese government plays a significant role in providing financial support for our firm’s environmental operations. | 0.881 | 0.063 | ||||

| Chinese government helps our firm obtain license for imports of technology, manufacturing, and other equipment needed to our firm’s environmental operations. | 0.874 | 0.061 | ||||

| Environmental Performance [74] | Our company reduces pollution. | 0.810 | 0.913 | 0.912 | 0.588 | |

| Our company reduces waste and emissions (such as air emissions, wastewater, and solid waste). | 0.832 | 0.071 | ||||

| Our company has reduced the negative impact of our products on the environment. | 0.793 | 0.074 | ||||

| Our company has reduced the consumption of hazardous/harmful/toxic materials. | 0.778 | 0.068 | ||||

| Our company is reducing energy and material consumption. | 0.762 | 0.071 | ||||

| Our company has reduced the frequency of environmental accidents. | 0.759 | 0.071 | ||||

| Constructs | Mean | SD | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|---|

| Green Supplier Selection | 5.513 | 0.813 | 0.401 | 0.504 | 0.464 | |

| Green Supplier Integration | 5.506 | 0.886 | 0.633 ** | 0.346 | 0.372 | |

| Government Support | 5.610 | 0.831 | 0.710 ** | 0.588 ** | 0.326 | |

| Environment Performance | 5.591 | 0.862 | 0.681 ** | 0.610 ** | 0.571 ** |

| Constructs | Environmental Performance | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |||||

| β | VIF | β | VIF | β | VIF | β | VIF | |

| Control variables | ||||||||

| Textile | 0.196 * | 2.198 | −0.103 | 2.877 | −0.021 | 3.155 | −0.016 | 3.008 |

| Furniture | 0.261 ** | 2.069 | 0.010 | 3.951 | 0.007 | 2.921 | −0.192 * | 2.432 |

| Chemicals Pharmaceutical | 0.281 ** | 1.486 | 0.013 | 3.054 | −0.023 | 3.452 | −0.045 | 2.313 |

| Automobile | 0.171 * | 1.328 | −0.009 | 2.943 | 0.007 | 1.891 | −0.013 | 2.096 |

| Electric machinery and equipment | 0.286 ** | 2.495 | 0.021 | 3.132 | 0.013 | 3.762 | −0.041 | 3.187 |

| Firm size | 0.167 * | 1.482 | 0.019 | 1.541 | 0.022 | 1.033 | 0.003 | 1.458 |

| Annual sales | 0.029 | 1.367 | 0.035 | 1952 | 0.030 | 1.078 | 0.008 | 1.031 |

| Investment in Environmental products | 0.061 | 1.081 | 0.024 | 1.734 | −0.019 | 1.011 | 0.021 | 1.078 |

| Firm age | 0.149 | 2.004 | −0.026 | 2.912 | −0.031 | 2.233 | −0.048 | 2.945 |

| Predictor | ||||||||

| Green supplier selection | 0.299 *** | 2.478 | 0.305 *** | 2.996 | 0.231 *** | 2.125 | ||

| Green supplier integration | 0.420 *** | 2.922 | 0.421 *** | 2.781 | 0.391 *** | 2.977 | ||

| Moderators | ||||||||

| Government support | 0.173 * | 2.115 | 0.161 * | 2.881 | ||||

| Interaction effects | ||||||||

| Green supplier selection× Government support | −0.211 ** | 2.157 | ||||||

| Supplier integration× Government support | 0.393 *** | 2.330 | ||||||

| R2 | 0.021 | 0.481 | 0.485 | 0.508 | ||||

| Adjusted R2 | 0.019 | 0.476 | 0.481 | 0.501 | ||||

| F change | 3.481 | 349.710 | 15.146 | 24.128 | ||||

| Durbin-Watson | 1.903 | |||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, J.; Zhong, D. Comparing the Impact of Green Supplier Selection and Integration on Environmental Performance: An Analysis of the Moderating Role of Government Support. Sustainability 2024, 16, 7228. https://doi.org/10.3390/su16167228

Li J, Zhong D. Comparing the Impact of Green Supplier Selection and Integration on Environmental Performance: An Analysis of the Moderating Role of Government Support. Sustainability. 2024; 16(16):7228. https://doi.org/10.3390/su16167228

Chicago/Turabian StyleLi, Jianwei, and Deyu Zhong. 2024. "Comparing the Impact of Green Supplier Selection and Integration on Environmental Performance: An Analysis of the Moderating Role of Government Support" Sustainability 16, no. 16: 7228. https://doi.org/10.3390/su16167228

APA StyleLi, J., & Zhong, D. (2024). Comparing the Impact of Green Supplier Selection and Integration on Environmental Performance: An Analysis of the Moderating Role of Government Support. Sustainability, 16(16), 7228. https://doi.org/10.3390/su16167228