Can Digital Economy Development Facilitate Corporate ESG Performance?

Abstract

:1. Introduction

2. Research Hypotheses

3. Materials and Methods

3.1. Sample Selection and Data Source

3.2. Empirical Model and Variables

4. Results

4.1. Benchmark Regression

4.2. Robustness Check

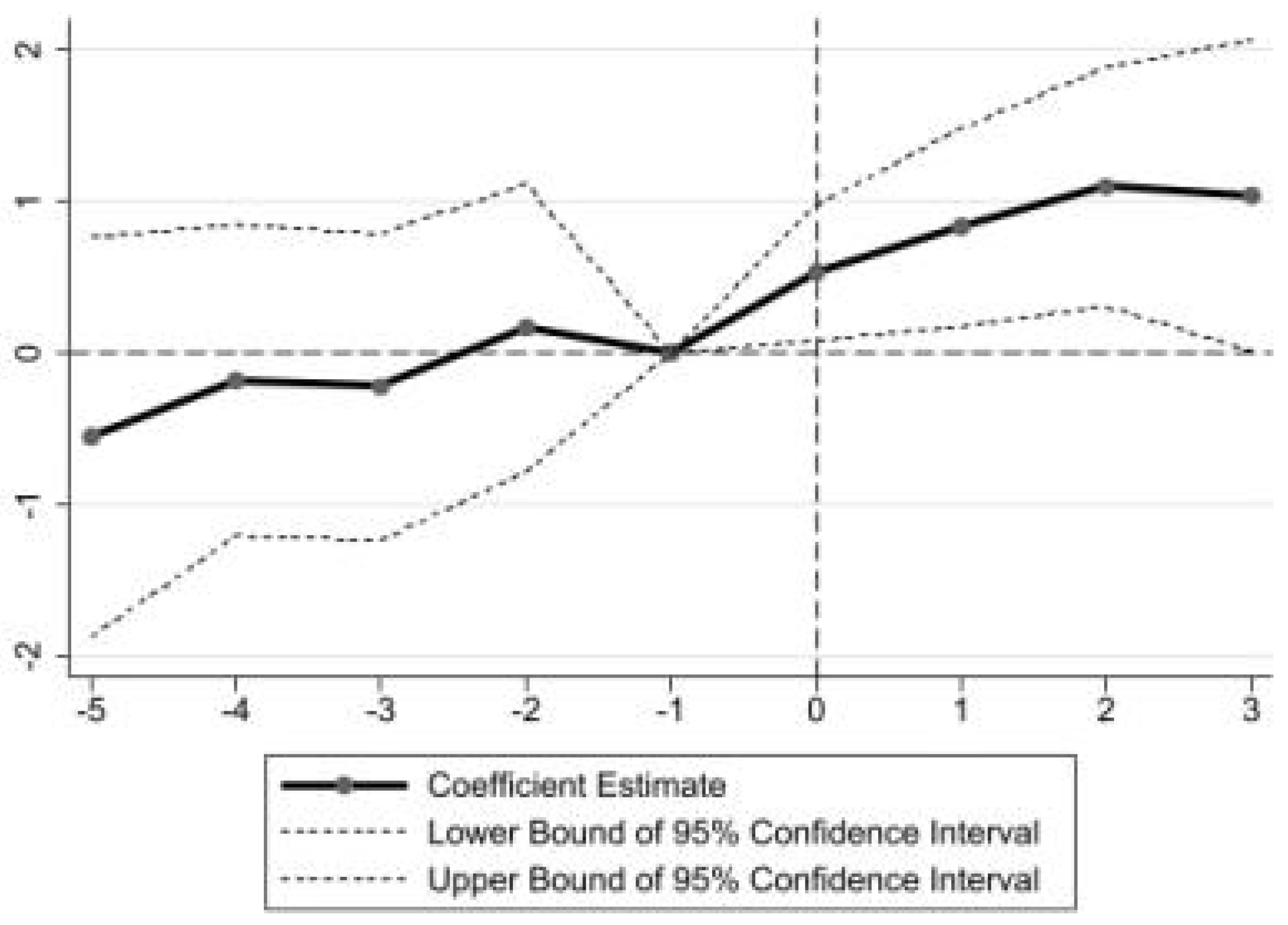

4.2.1. Test for Parallel Trends

- Notes: Based on the event study method, this paper plots the coefficients and 95% confidence interval of Model (2) in Figure 1.

4.2.2. Goodman–Bacon Decomposition

- Notes: There are four comparison types, including “Earlier Treatment vs. Later Comparison”, “Later Treatment vs. Earlier Comparison”, “Treatment vs. Never Treated” and “Treatment vs. Already Treated”. The weights are 0.3%, 0.3%, 94.1%, and 5.3%, respectively. The coefficients are −1.937, −0.165, 0.669, and 3.275, respectively.

4.2.3. Instrument Variable Method

4.2.4. Controlling for Lag Effect of Policy

4.2.5. DID Based on Propensity Score Matching (PSM-DID)

4.2.6. Changing Dependent Variable

4.2.7. Changing Independent Variable

4.3. Placebo Tests

4.3.1. Placebo Test at the Implementing Year Level

4.3.2. Placebo Test at the Implementing City Level

4.4. Mechanism

4.5. Heterogeneity Analysis

4.5.1. Heterogeneity of Enterprise Ownership

4.5.2. Heterogeneity of City Hierarchy

4.6. Other Analysis

4.6.1. Moderating Effect of Digital Economy Development

4.6.2. Effect of Greenwashing

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, Q.; Yu, Z.; Kong, D. The real effect of legal institutions: Environmental courts and firm environmental protection expenditure. J. Environ. Econ. Manag. 2019, 98, 102254. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.; Wu, X.; Nie, X. Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—Empirical analysis based on the PSM-DID method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Chen, Y.; Jin, G.Z.; Kumar, N.; Shi, G. The promise of Beijing: Evaluating the impact of the 2008 Olympic Games on air quality. J. Environ. Econ. Manag. 2013, 66, 424–443. [Google Scholar] [CrossRef]

- Li, X.; Qiao, Y.; Zhu, J.; Shi, L.; Wang, Y. The “APEC blue” endeavor: Causal effects of air pollution regulation on air quality in China. J. Clean. Prod. 2017, 168, 1381–1388. [Google Scholar] [CrossRef]

- Tu, Z.; Hu, T.; Shen, R. Evaluating public participation impact on environmental protection and ecological efficiency in China: Evidence from PITI disclosure. China Econ. Rev. 2019, 55, 111–123. [Google Scholar] [CrossRef]

- Tu, M.; Zhang, B.; Xu, J.; Lu, F. Mass media, information and demand for environmental quality: Evidence from “Under the Dome”. J. Dev. Econ. 2020, 143, 102402. [Google Scholar] [CrossRef]

- Wang, K.; Li, T.; San, Z.; Gao, H. How does corporate ESG performance affect stock liquidity? Evidence from China. Pac.-Basin Financ. J. 2023, 80, 102087. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Stambaugh, R.F.; Taylor, L.A. Sustainable investing in equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business Sustainability Performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate Social Responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2019, 65, 4451–4469. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Hanclova, J.; Doucek, P.; Fischer, J.; Vltavska, K. Does ICT capital affect economic growth in the EU-15 and EU-12 countries? J. Bus. Econ. Manag. 2014, 16, 387–406. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Nair, M.; Bennett, S.E.; Bahmani, S. Short-term and long-term dynamics of venture capital and economic growth in a Digital Economy: A Study of European countries. Technol. Soc. 2019, 57, 125–134. [Google Scholar] [CrossRef]

- Rehman, N.U.; Nunziante, G. The effect of the digital economy on Total Factor Productivity in European regions. Telecommun. Policy 2023, 47, 102650. [Google Scholar] [CrossRef]

- Tao, J.; Wang, Z.; Xu, Y.; Zhao, B.; Liu, J. Can the digital economy boost rural residents’ income? Evidence from China based on the spatial Durbin model. Econ. Anal. Policy 2024, 81, 856–872. [Google Scholar] [CrossRef]

- Zhang, Y.; Qu, Y. Has the digital economy improved the consumption of poor and subsistence households? China Econ. Rev. 2024, 83, 102083. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef]

- Liu, J.; Chen, Y.; Liang, F.H. The effects of digital economy on breakthrough innovations: Evidence from Chinese listed companies. Technol. Forecast. Soc. Change 2023, 196, 122866. [Google Scholar] [CrossRef]

- Huo, P.; Wang, L. Digital economy and business investment efficiency: Inhibiting or facilitating? Res. Int. Bus. Financ. 2022, 63, 101797. [Google Scholar] [CrossRef]

- Li, Q.; Chen, H.; Chen, Y.; Xiao, T.; Wang, L. Digital economy, financing constraints, and corporate innovation. Pac.-Basin Financ. J. 2023, 80, 102081. [Google Scholar] [CrossRef]

- Chang, H.; Ding, Q.; Zhao, W.; Hou, N.; Liu, W. The digital economy, industrial structure upgrading, and carbon emission intensity—Empirical evidence from China’s provinces. Energy Strategy Rev. 2023, 50, 101218. [Google Scholar] [CrossRef]

- Shahbaz, M.; Wang, J.; Dong, K.; Zhao, J. The impact of digital economy on energy transition across the globe: The mediating role of government governance. Renew. Sustain. Energy Rev. 2022, 166, 112620. [Google Scholar] [CrossRef]

- Hunjra, A.I.; Zhao, S.; Goodell, J.W.; Liu, X. Digital Economy Policy and corporate low-carbon innovation: Evidence from a quasi-natural experiment in China. Financ. Res. Lett. 2024, 60, 104910. [Google Scholar] [CrossRef]

- Bano, S.; Liu, L.; Khan, A. Dynamic influence of aging, Industrial Innovations, and ICT on tourism development and renewable energy consumption in BRICS economies. Renew. Energy 2022, 192, 431–442. [Google Scholar] [CrossRef]

- Shvakov, E.E.; Petrova, E.A. Newest trends and future scenarios for a Sustainable Digital Economy Development. In Scientific and Technical Revolution: Yesterday, Today and Tomorrow; Springer: Berlin/Heidelberg, Germany, 2020; pp. 1378–1385. [Google Scholar]

- Zhai, C.; Ding, X.; Zhang, X.; Jiang, S.; Zhang, Y.; Li, C. Assessing the effects of Urban Digital Infrastructure on corporate environmental, social and governance (ESG) performance: Evidence from the Broadband China policy. Systems 2023, 11, 515. [Google Scholar] [CrossRef]

- Zhou, H.; Liu, J. Digitalization of the economy and resource efficiency for meeting the ESG goals. Resour. Policy 2023, 86, 104199. [Google Scholar] [CrossRef]

- Asif, M.; Searcy, C.; Castka, P. ESG and industry 5.0: The role of technologies in enhancing ESG disclosure. Technol. Forecast. Soc. Change 2023, 195, 122806. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2009, 77, 1–19. [Google Scholar] [CrossRef]

- Cai, C.; Tu, Y.; Li, Z. Enterprise digital transformation and ESG performance. Financ. Res. Lett. 2023, 58, 104692. [Google Scholar] [CrossRef]

- Lange, S.; Pohl, J.; Santarius, T. Digitalization and energy consumption. Does ICT reduce energy demand? Ecol. Econ. 2020, 176, 106760. [Google Scholar] [CrossRef]

- Nair, K. Overcoming today’s digital talent gap in organizations worldwide. Dev. Learn. Organ. Int. J. 2019, 33, 16–18. [Google Scholar] [CrossRef]

- Shang, Y.; Raza, S.A.; Huo, Z.; Shahzad, U.; Zhao, X. Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. Int. Rev. Econ. Financ. 2023, 86, 1–13. [Google Scholar] [CrossRef]

- Zhang, C.; Fang, J.; Ge, S.; Sun, G. Research on the impact of enterprise digital transformation on carbon emissions in the manufacturing industry. Int. Rev. Econ. Financ. 2024, 92, 211–227. [Google Scholar] [CrossRef]

- Lyu, Y.; Xiao, X.; Zhang, J. Does the digital economy enhance green total factor productivity in China? The evidence from a national big data comprehensive pilot zone. Struct. Chang. Econ. Dyn. 2024, 69, 183–196. [Google Scholar] [CrossRef]

- Tang, M.; Liu, Y.; Hu, F.; Wu, B. Effect of digital transformation on enterprises’ green innovation: Empirical evidence from listed companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- Jacobson, L.S.; LaLonde, R.J.; Sullivan, D.G. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Baker, A.C.; Larcker, D.F.; Wang, C.C.Y. How much should we trust staggered difference-in-differences estimates? J. Financ. Econ. 2022, 144, 370–395. [Google Scholar] [CrossRef]

- Goodman-Bacon, A. Difference-in-differences with variation in treatment timing. J. Econom. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- Stock, J.H.; Yogo, M. Testing for weak instruments in Linear IV regression. Identif. Inference Econom. Models 2005, 80–108. [Google Scholar] [CrossRef]

- Tu, Z.; Kong, J.; Sun, L.; Liu, B. Can the digital economy reduce the rural-urban income gap? Sustainability 2024, 16, 938. [Google Scholar] [CrossRef]

- Chetty, R.; Looney, A.; Kroft, K. Salience and taxation: Theory and evidence. Am. Econ. Rev. 2009, 99, 1145–1177. [Google Scholar] [CrossRef]

- Wu, K.; Lu, Y. Corporate digital transformation and financialization: Evidence from Chinese listed firms. Financ. Res. Lett. 2023, 57, 104229. [Google Scholar] [CrossRef]

- Li, P.; Zhao, X. The impact of digital transformation on corporate supply chain management: Evidence from listed companies. Financ. Res. Lett. 2024, 60, 104890. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New evidence on measuring financial constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Du, X. How the Market Values Greenwashing? Evidence from China. J. Bus. Ethics 2014, 128, 547–574. [Google Scholar] [CrossRef]

- Yu, E.P.; Luu, B.V.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Lin, X.; Zhu, H.; Meng, Y. ESG greenwashing and equity mispricing: Evidence from China. Financ. Res. Lett. 2023, 58, 104606. [Google Scholar] [CrossRef]

| Variable | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| ESG | 7084 | 27.92 | 8.53 | 7.85 | 65.78 |

| Lev | 7084 | 0.50 | 0.21 | 0.07 | 0.94 |

| Size | 7084 | 23.38 | 1.59 | 20.57 | 29.10 |

| Roa | 7084 | 0.05 | 0.05 | −0.16 | 0.22 |

| Tobin | 7084 | 1.88 | 1.22 | 0.86 | 7.73 |

| Cash | 7084 | 0.05 | 0.07 | −0.17 | 0.25 |

| Concen | 7084 | 37.23 | 16.29 | 7.84 | 77.27 |

| Top | 7084 | 0.38 | 0.05 | 0.33 | 0.57 |

| Lnage | 7084 | 2.41 | 0.67 | 0.69 | 3.40 |

| Bmr | 7084 | 0.67 | 0.26 | 0.13 | 1.16 |

| Degdp | 7084 | 17.94 | 1.02 | 15.35 | 19.39 |

| Deavegdp | 7084 | 11.42 | 0.73 | 9.6 | 12.87 |

| Intervene | 7084 | 0.16 | 0.05 | 0.08 | 0.31 |

| Structure | 7084 | 0.55 | 0.14 | 0.28 | 0.84 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | ESG | ESG | ESG | ESG | ESG |

| Treat × Post | 7.515 *** | 5.517 *** | 0.652 * | 0.833 *** | 0.989 ** |

| (0.217) | (0.222) | (0.379) | (0.319) | (0.422) | |

| Constant | 26.050 *** | −34.800 *** | 27.714 *** | 22.422 | −4.854 |

| (0.108) | (2.509) | (0.094) | (20.187) | (21.096) | |

| Observations | 7084 | 7084 | 7006 | 7006 | 6937 |

| Adjusted R2 | 0.145 | 0.376 | 0.833 | 0.834 | 0.841 |

| Control variables | No | Yes | No | Yes | Yes |

| Year FE | No | No | Yes | Yes | No |

| Year × Industry FE | No | No | No | No | Yes |

| Firm FE | No | No | Yes | Yes | Yes |

| Clustering at the city level | No | No | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variable | ESG | F.ESG | ESG | Median | ESG |

| Treat × Post | 0.815 * | 0.792 ** | 1.285 ** | 0.085 * | |

| (0.446) | (0.360) | (0.620) | (0.045) | ||

| DEDI | 6.344 * | ||||

| (3.386) | |||||

| Constant | −17.136 | −29.675 | −3.130 | −7.557 | |

| (28.659) | (26.283) | (2.280) | (20.673) | ||

| Observations | 6672 | 5787 | 4387 | 15,915 | 6937 |

| Centered R2 | 0.014 | ||||

| Adjusted R2 | 0.851 | 0.815 | 0.615 | 0.841 | |

| KP-Wald F statistic | 39.274 |

| Dimension | Indicator | Sign | Weight |

|---|---|---|---|

| Digital economy Innovation ability | Digital economy-related invention patent application | + | 5.68% |

| Digital economy-related invention patent authorization | + | 12.28% | |

| Digital economy-related utility model patent application | + | 3.29% | |

| Digital economy-related utility model patent authorization | + | 3.57% | |

| Digital economy Development | Percentage of internet users | + | 13.24% |

| Percentage of ICT employment | + | 12.46% | |

| Telecommunications services revenue per capita | + | 22.96% | |

| Percentage of mobile phone users | + | 10.77% | |

| Digital finance Inclusion Development | Coverage breadth | + | 5.10% |

| Usage depth | + | 5.25% | |

| Digitization level | + | 5.39% |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | ESG | ESG | ESG | ESG |

| Treat × Post | 1.048 * | 1.185 ** | 1.212 ** | 1.408 ** |

| (0.533) | (0.540) | (0.579) | (0.694) | |

| Treat × Pre1 | 0.191 | |||

| (0.488) | ||||

| Treat × Pre2 | 0.393 | |||

| (0.343) | ||||

| Treat × Pre3 | 0.326 | |||

| (0.356) | ||||

| Treat × Pre4 | 0.491 | |||

| (0.458) | ||||

| Constant | −4.047 | −3.784 | −4.835 | −5.516 |

| (21.655) | (21.363) | (21.051) | (20.922) | |

| Observations | 6937 | 6937 | 6937 | 6937 |

| Adjusted R2 | 0.841 | 0.841 | 0.841 | 0.841 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| State-Owned Enterprise | Private Enterprise | Capital City | Non-Capital City | |||

| Variable | Transform_1 | Transform_2 | ESG | ESG | ESG | ESG |

| Treat × Post | 0.066 * | 0.001 ** | 0.770 | 1.252 *** | 1.519 ** | 0.794 |

| (0.037) | (0.001) | (0.616) | (0.414) | (0.581) | (0.737) | |

| Constant | −2.496 | 0.036 | −25.516 | −18.819 | −30.822 | −40.900 |

| (2.363) | (0.033) | (27.058) | (29.306) | (39.587) | (26.697) | |

| Observations | 6929 | 5433 | 3442 | 3052 | 4192 | 2582 |

| Adjusted R2 | 0.755 | 0.868 | 0.850 | 0.824 | 0.852 | 0.819 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | FC | FC | ESG | ESG |

| ESG × Treat × Post | 0.001 *** | |||

| (0.000) | ||||

| ESG × DEDI | 0.006 *** | |||

| (0.001) | ||||

| Treat × Post | 0.840 * | |||

| (0.490) | ||||

| GWS | 1.618 *** | 1.624 *** | ||

| (0.089) | (0.090) | |||

| DEDI | 7.762 * | |||

| (4.688) | ||||

| Constant | −5.940 *** | −5.601 *** | −29.492 | −33.419 |

| (0.372) | (0.469) | (21.305) | (21.412) | |

| Observations | 7006 | 7006 | 4836 | 4836 |

| Adjusted R2 | 0.978 | 0.976 | 0.876 | 0.876 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kong, J.; Goh, M.; Cao, Y. Can Digital Economy Development Facilitate Corporate ESG Performance? Sustainability 2024, 16, 3956. https://doi.org/10.3390/su16103956

Kong J, Goh M, Cao Y. Can Digital Economy Development Facilitate Corporate ESG Performance? Sustainability. 2024; 16(10):3956. https://doi.org/10.3390/su16103956

Chicago/Turabian StyleKong, Jiayang, Mark Goh, and Yu Cao. 2024. "Can Digital Economy Development Facilitate Corporate ESG Performance?" Sustainability 16, no. 10: 3956. https://doi.org/10.3390/su16103956