Life-Cycle Assessment and Monetary Measurements for the Carbon Footprint Reduction of Public Buildings

Abstract

:1. Introduction

- 1)

- a technical–technological analysis of the hypothesized energy performance improvement by means of the use of sustainable materials, components, and techniques such as wooden double-glazed windows, organic external wall insulation systems, and green roofs;

- 2)

- an environmental analysis of this project, developing the life-cycle assessment (LCA) aimed at quantifying the potential impacts on the environment and human health associated with the implementation of the above-mentioned project in order to verify its environmental effectiveness and compliance with the environmental standards [14,15]; and

- 3)

- an economic and financial valuation aimed at identifying the cost-effectiveness and the financial sustainability of the project as a whole and in its three parts [16,17]. Due to the complementarity of economic and financial performances, such evaluations involve different areas of decision-making [18,19,20]. Similarly, the complexity of the environmental issue brings up practical and symbolic components [21,22,23] that monetary measurement can represent only partially [24,25,26]. Finally, as the energy retrofit programs are typically characterized by large expenses and scarcely irreversible installments and works, the correct and systematic economic assessment of these investments [27,28] supports both private and public decision making, [29,30,31,32], as well as the convergence of many axiological perspectives towards the unique ethical prospect of sustainability.

2. Methods

2.1. Technologies

- CorkPan thermal insulation.

- Double-glazed windows.

- Green roof.

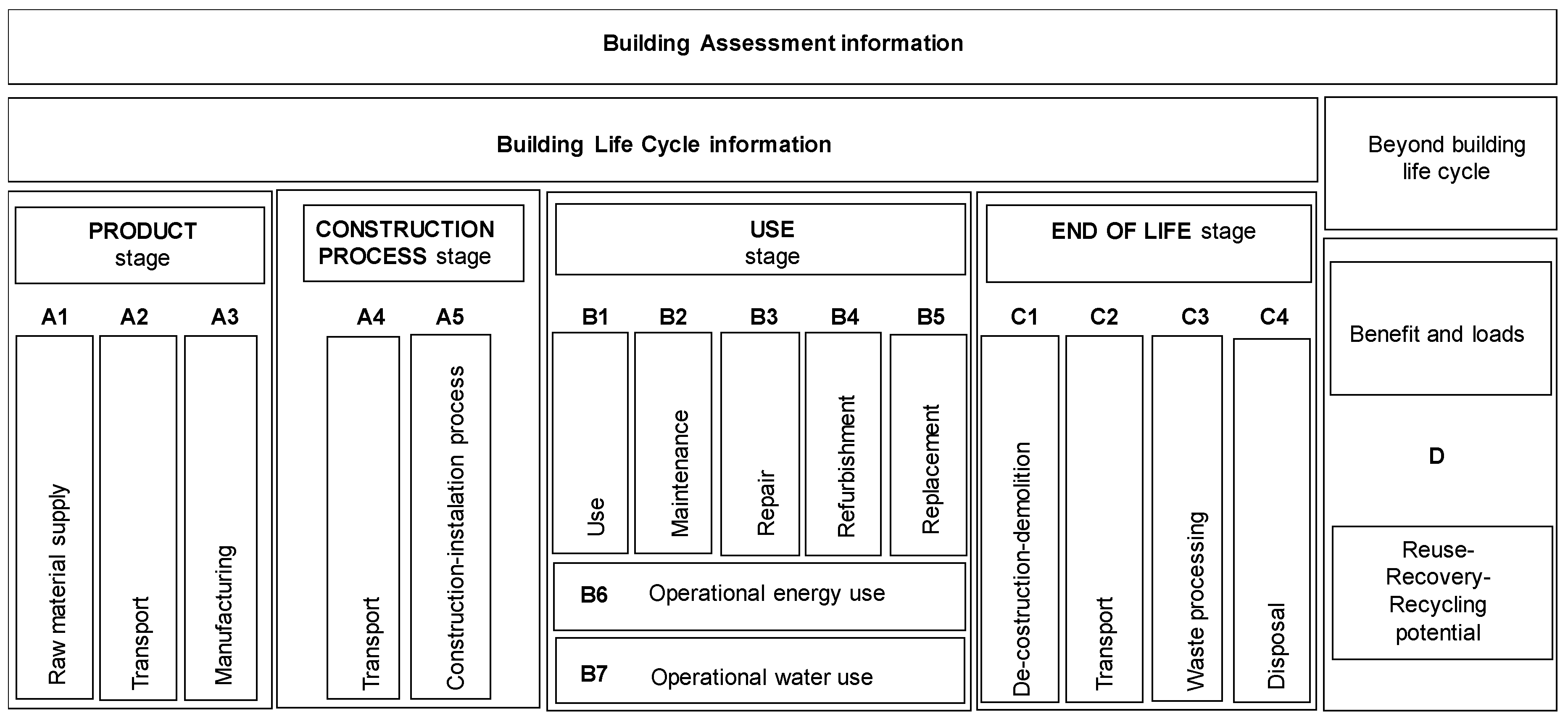

2.2. Life-Cycle Assessment

2.3. Simulation Software

2.4. Economic Analysis: Monetary and Contents

2.5. Integrating Externalities into the DCFA

- The first approach is the social cost of carbon (SCC).

- The second approach is called marginal abatement cost (MAC).

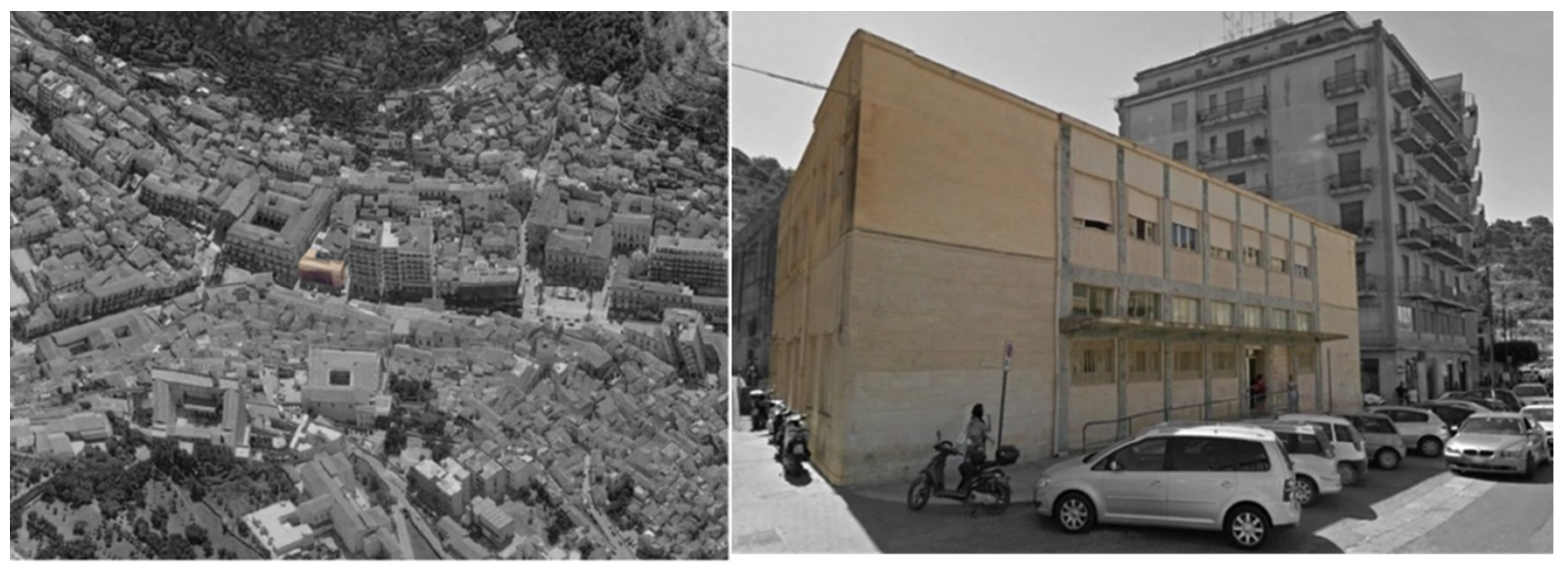

3. Materials

4. Application, Results, and Discussions

4.1. Energy Needs at the Current State

4.2. Building Retrofit

- (1)

- improvement of building envelope performance by increasing the thermal insulation;

- (2)

- replacement of the windows; and

- (3)

- installation of a green roof.

4.3. LCA Imaging

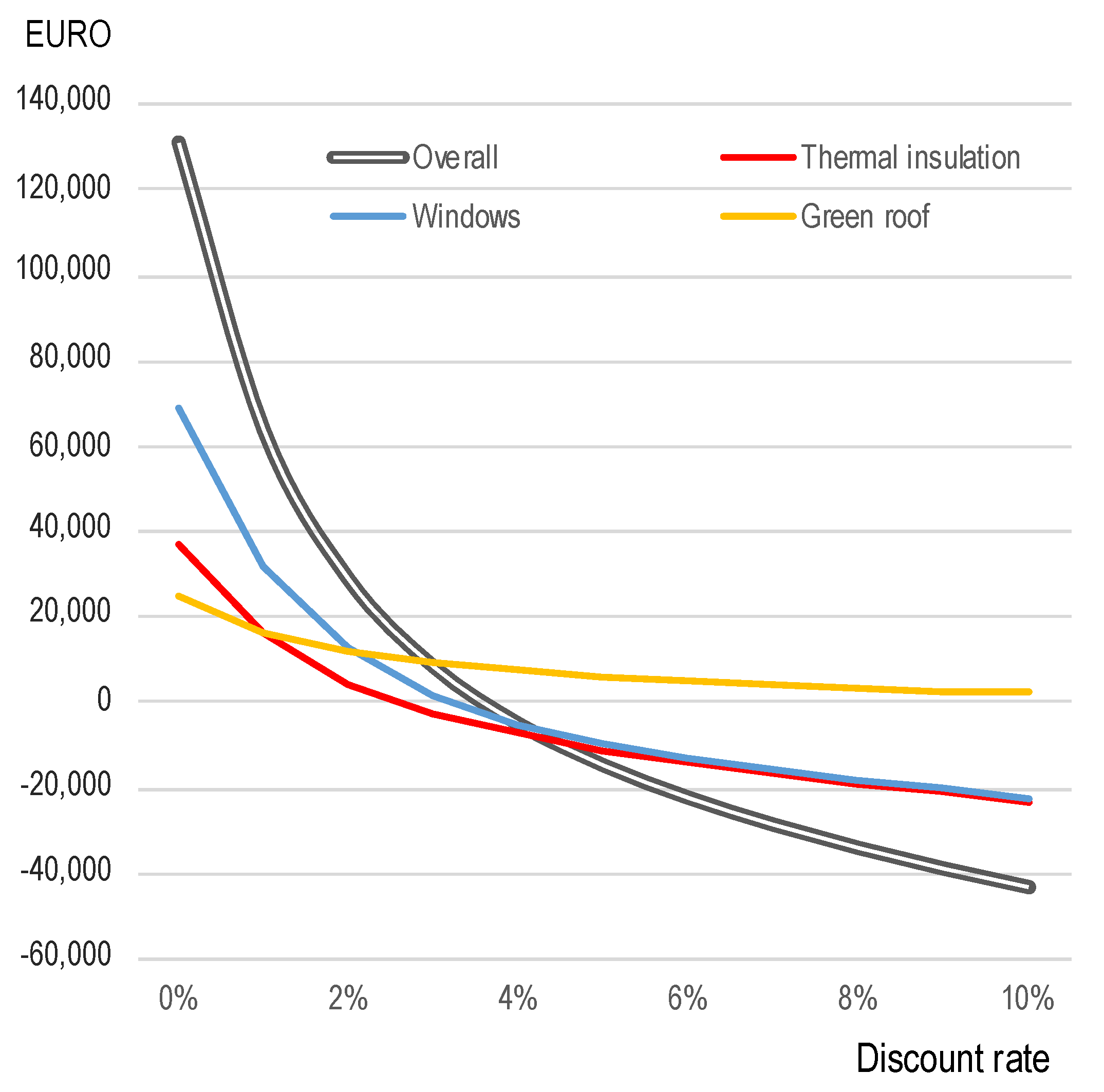

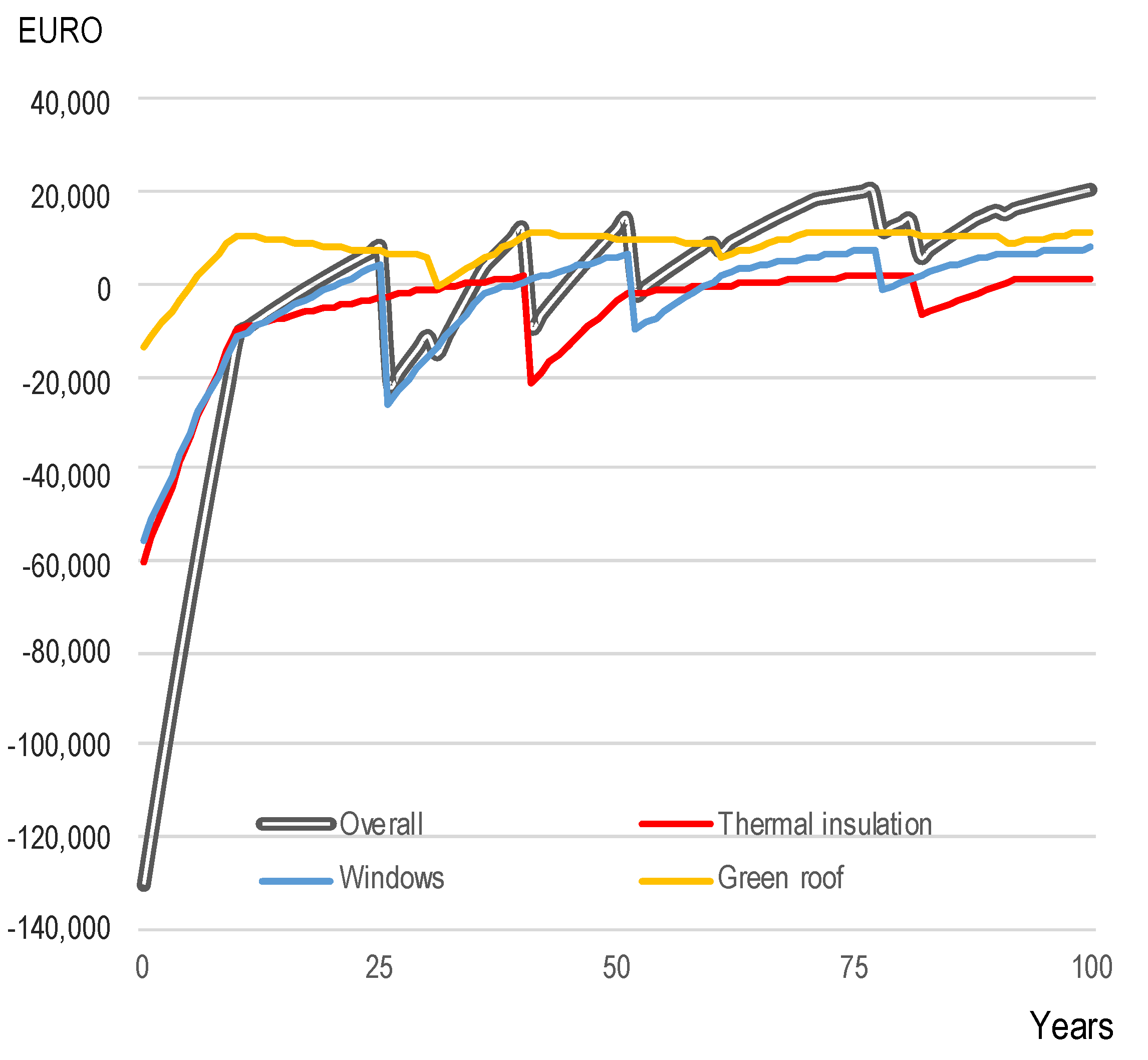

4.4. Economic Analysis and Valuation Issues

5. Conclusions

5.1. Energy–Environmental Issues

5.2. Economic–Environmental Issues

- -

- according to the traditional perspective, the shorter , the more cost-effective the investment; while, according to the inverse and complementary perspective, the longer , the less risky the project;

- -

- since the latter statement can be assumed only if the cost-effectiveness of the project is significant, “project” can be considered a dimension of economic acting that differs from the “investment” in terms of vision; as such, project can be considered complementary to investment for the following reasons:

- ○

- the “investment” is considered economically profitable and financially sustainable based on monetary measurements: the greater the latter, the greater the cost-effectiveness of the investment; no limit must be imposed on profitability;

- ○

- the “project” instead underlies a wider decision-making context, in which the financial soundness compensates for lower profitability, especially in case of investment involving social, cultural, environmental, territorial, urban, or landscape capital.

Author Contributions

Funding

Conflicts of Interest

References

- Directive 2010/31 of the European Parliament and of the Council of 17 May 2010 on the Energy Performance of Buildings and Its Amendments; (the recast Directive entered into force in July 2010, but the repeal of the current Directive will only take place on 1/02/2012); European Parliament: Brussels, Belgium, 2010.

- Giuffrida, S.; Casamassima, G.; Trovato, M.R. Le norme EMAS-ISO nella valutazione della qualità del servizio idrico integrato. Aestimum 2017, 70, 109–134. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. From Surface to Core: A Multi-layer Approach for the Real Estate Market Analysis of a Central Area in Catania. In ICCSA 2015; LCNS 9157; Gervasi, O., Rocha, A.M.A.C., Murgante, B., Taniar, D., Apduhan, B.O., Gavrilova, M.L., Misra, S., Torre, C., Eds.; Springer: London, UK, 2015; Volume III, pp. 284–300. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Functions and Perspectives of Public Real Estate in the Urban Policies: The Sustainable Development Plan of Syracuse. In ICCSA 2016; LNCS 9789; Gervasi, O., Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Taniar, D., Apduhan, B.O., Stankova, E., Wang, S., Eds.; Springer: London, UK, 2016; Volume IV, pp. 13–28. [Google Scholar] [CrossRef]

- Braulio-Gonzalo, M.; Bovea, M.D. Relationship between green public procurement criteria and sustainability assessment tools applied to office buildings. Environ. Impact Assess. Rev. 2020, 81, 106310. [Google Scholar] [CrossRef]

- Gabrielli, L.; Giuffrida, S.; Trovato, M.R. Gaps and overlaps of urban housing sub market: A fuzzy clustering approach. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2017; pp. 203–219, Issue 9783319496757. [Google Scholar] [CrossRef]

- Nocera, F.; Faro, A.L.; Costanzo, V.; Raciti, C. Daylight performance of classrooms in a mediterranean school heritage building. Sustainability 2018, 10, 3705. [Google Scholar] [CrossRef] [Green Version]

- Güçyeter, B.; Günaydın, H.M.; Gunaydin, H.M. Optimization of an envelope retrofit strategy for an existing office building. Energy Build. 2012, 55, 647–659. [Google Scholar] [CrossRef] [Green Version]

- Massimo, D.E. Green Building: Characteristics, Energy Implications and Environmental Impacts. Case Study in Reggio Calabria. In Green Building and Phase Change Materials: Characteristics, Energy Implications and Environmental Impacts; Serie Energy Science, Engineering and Technology; Mildred, C.S., Ed.; Nova Science Publishers, Inc.: New York, NY, USA, 2015; pp. 71–101. ISBN 978-163482749-2. [Google Scholar]

- Musolino, M.; Malerba, A.; De Paola, P.; Musarella, C.M. Building Efficiency Adopting Ecological Materials and Bio Architecture Techniques. ArcHistoR 2019, 6, 1–10. [Google Scholar]

- Malerba, A.; Massimo, D.E.; Musolino, M.; Nicoletti, F.; De Paola, P. Post Carbon City: Building Valuation and Energy Performance Simulation Programs. In New Metropolitan Perspectives: Local Knowledge and Innovation. Series: Smart Innovation, Systems and Technologies; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer: Berlin, Germany, 2019; Volume 101, pp. 513–531. [Google Scholar] [CrossRef]

- Giuffrida, S.; Ventura, V.; Nocera, F.; Trovato, M.R.; Gagliano, F. Technological, axiological and praxeological coordination in the energy-environmental equalization of the strategic old town renovation programs. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2020; pp. 425–446. [Google Scholar] [CrossRef]

- Trovato, M.R. A multi-criteria approach to support the retraining plan of the Biancavilla’s old town. In Smart Innovation, Systems and Technologies, 3rd International New Metropolitan Perspectives. Local Knowledge and Innovation Dynamics towards Territory Attractiveness through the Implementation of Horizon/Europe2020/Agenda2030, Reggio Calabria, Italy, 22–25 May 2018; Bevilacqua, C., Calabro, F., Della Spina, L., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; Volume 101, pp. 434–441. [Google Scholar] [CrossRef]

- Gulotta, T.; Guarino, F.; Mistretta, M.; Cellura, M.; Lorenzini, G. Introducing exergy analysis in life cycle assessment: A case study. Math. Model. Eng. Probl. 2018, 5, 139–145. [Google Scholar] [CrossRef]

- Cellura, M.; Guarino, F.; Longo, S.; Mistretta, M. Energy life-cycle approach in Net zero energy buildings balance: Operation and embodied energy of an Italian case study. Energy Build. 2014, 72, 371–381. [Google Scholar] [CrossRef]

- Giuffrida, S.; Trovato, M.R. From the object to land. Architectural design and economic valuation in the multiple dimensions of the industrial estates. In ICCSA 2017; LNCS 10406; Borruso, G., Cuzzocrea, A., Apduhan, B.O., Rocha, A.M.A.C., Taniar, D., Misra, S., Gervasi, O., Torre, C.M., Stankova, E., Murgante, B., Eds.; Springer: London, UK, 2017; Volume III, pp. 591–606. [Google Scholar] [CrossRef]

- Giuffrida, S.; Trovato, M.R.; Falzone, M. The information value for territorial and economic sustainability in the enhancement of the water management process. In ICCSA 2017; LNCS 10406; Borruso, G., Cuzzocrea, A., Apduhan, B.O., Rocha, A.M.A.C., Taniar, D., Misra, S., Gervasi, O., Torre, C.M., Stankova, E., Murgante, B., Eds.; Springer: London, UK, 2017; Volume III, pp. 575–590. [Google Scholar] [CrossRef]

- Napoli, G.; Mamì, A.; Barbaro, S.; Lupo, S. Scenarios of climatic resilience, economic feasibility and environmental sustainability for the refurbishment of the early 20th century buildings. In Values and Functions for Future Cities, Green Energy and Technology; Mondini, G., Stanghellini, S., Oppio, A., Bottero, M., Abastante, F., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 89–115. ISBN 978-3-03023784-4. online ISBN 978-3-030-23786-8. [Google Scholar] [CrossRef]

- Napoli, G.; Gabrielli, L.; Barbaro, S. The efficiency of the incentives for the public buildings energy retrofit. The case of the Italian Regions of the “Objective Convergence”. Valori e Valutazioni 2017, 18, 25–39. [Google Scholar]

- Manganelli, B.; Morano, P.; Tajani, F.; Salvo, F. Affordability Assessment of Energy-Efficient Building Construction in Italy. Sustainability 2019, 11, 249. [Google Scholar] [CrossRef] [Green Version]

- Giannelli, A.; Giuffrida, S.; Trovato, M.R. Madrid Rio Park. Symbolic Values and Contingent Valuation. Valori e Valutazioni 2018, 21, 75–86. [Google Scholar]

- Giuffrida, S.; Trovato, M.R. A Semiotic Approach to the Landscape Accounting and Assessment. An Application to the Urban-Coastal Areas. In Proceedings of the 8th International Conference on Information and Communication Technologies in Agriculture, Food and Environment, Chania, Greece, 21–24 September 2017; Volume 2030, pp. 696–708. [Google Scholar]

- Giuffrida, S.; Trovato, M.R.; Giannelli, A. Semiotic-Sociological Textures of Landscape Values. Assessments in Urban-Coastal Areas. In Information and communication technologies in modern agricultural development, Communications in Computer and Information Science; Salampasis, M., Bournaris, T., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; Volume 953, pp. 35–50. [Google Scholar] [CrossRef]

- Giuffrida, S. The True Value. On Understanding Something. In Appraisal: From Theory to Practice; Stanghellini, S., Pierluigi Morano, P., Bottero, M., Oppio, A., Eds.; Springer: Berlin/Heidelberg, Germany, 2016; pp. 1–14. ISBN 978-3-319-49675-7. [Google Scholar] [CrossRef]

- Giuffrida, S. City as Hope. Valuation Science and the Ethics of Capital. Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2018; pp. 469–485. [Google Scholar] [CrossRef]

- Giuffrida, S. A Fair City. Value, Time and the Cap Rate. Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2018; pp. 425–439. [Google Scholar] [CrossRef]

- Gagliano, A.; Giuffrida, S.; Nocera, F.; Detommaso, M. Energy efficient measure to upgrade a multistory residential in a Nzeb. IMS Energy 2017, 5, 601–624. [Google Scholar] [CrossRef]

- Giuffrida, S.; Gagliano, F.; Nocera, F.; Trovato, M.R. Landscape Assessment and Economic Accounting in Wind Farm Programming: Two Cases in Sicily. Land 2018, 7, 120. [Google Scholar] [CrossRef] [Green Version]

- Trovato, M.R.; Giuffrida, S. A DSS to Assess and Manage the Urban Performances in the Regeneration Plan: The Case Study of Pachino. In ICCSA 2014; LNCS 8581, Part III; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer: Basel, Switzerland, 2014; pp. 224–239. [Google Scholar] [CrossRef]

- Trovato, M.R.; Giuffrida, S. The choice problem of the urban performances to support the Pachino’s redevelopment plan. Int. J. Bus. Intell. Data Min. 2014, 9, 330. [Google Scholar] [CrossRef]

- Della Spina, L. Historical Cultural Heritage: Decision Making Process and Reuse Scenarios for the Enhancement of Historic Buildings. In New Metropolitan Perspectives. ISHT 2018. Smart Innovation, Systems and Technologies; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer: Cham, Germany, 2019; Volume 101. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Trovato, M.R. Efficiency versus Fairness in the Management of Public Housing Assets in Palermo (Italy). Sustainability 2019, 11, 1199. [Google Scholar] [CrossRef] [Green Version]

- Barreira, E.; De Freitas, V. External Thermal Insulation Composite Systems: Critical Parameters for Surface Hygrothermal Behaviour. Adv. Mater. Sci. Eng. 2014, 2014, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Peri, G.; Rizzo, G.; Scaccianoce, G.; Sorrentino, G. Role of Green Coverings in Mitigating Heat Island Effects: An Analysis of Physical Models. Appl. Mech. Mater. 2012, 260–261, 251–256. [Google Scholar] [CrossRef]

- Gagliano, A.; Detommaso, M.; Nocera, F.; Patania, F.; Aneli, S. The retrofit of existing buildings through the exploitation of the green roofs—A simulation study. Energy Procedia 2014, 62, 52–61. [Google Scholar] [CrossRef] [Green Version]

- Gagliano, A.; DeTommaso, M.; Nocera, F.; Evola, G. A multi-criteria methodology for comparing the energy and environmental behavior of cool, green and traditional roofs. Build. Environ. 2015, 90, 71–81. [Google Scholar] [CrossRef]

- Sailor, D. A green roof model for building energy simulation programs. Energy Build. 2008, 40, 1466–1478. [Google Scholar] [CrossRef]

- ISO. ISO 15686-5:2017buildings and Constructed Assets, Service Life Planning, Part 5: Life-Cycle Costing; ISO: Geneva, Switzerland, 2017. [Google Scholar]

- ASHRAE Handbbok HVAC Applications; ASHRAE: Atlanta, GA, USA, 2011.

- UNI EN 15459:2008. Prestazione Energetica Degli Edifici-Procedura DI Valutazione Economica Dei Sistemi Energetici Degli Edifici; UNI: Milan, Italy, 2008.

- Nässén, J.; Holmberg, J.; Wadeskog, A.; Nyman, M. Direct and indirect energy use and carbon emissions in the production phase of buildings: An input–output analysis. Energy 2007, 32, 1593–1602. [Google Scholar] [CrossRef]

- Upton, B.; Miner, R.; Spinney, M.; Heath, L.S. The greenhouse gas and energy impacts of using wood instead of alternatives in residential construction in the United States. Biomass Bioenergy 2008, 32, 1–10. [Google Scholar] [CrossRef]

- Cellura, M.; Cusenza, M.A.; Longo, S. Energy-related GHG emissions balances: IPCC versus LCA. Sci. Total. Environ. 2018, 628–629, 1328–1339. [Google Scholar] [CrossRef] [PubMed]

- Energy Plus. Engineering Reference. The Reference to Energy Plus Calculation, Green Roof Model (Ecoroof); University of Illinois: Champaign, IL, USA; University of California: Oakland, CA, USA, 2011; pp. 123–132. [Google Scholar]

- Giuffrida, S.; Trovato, M.R.; Circo, C.; Ventura, V.; Giuffrè, M.; Macca, V. Seismic Vulnerability and Old Towns. A Cost-Based Programming Model. Geosciences 2019, 9, 427. [Google Scholar] [CrossRef] [Green Version]

- Bottarelli, M.; Gabrielli, L. Payback period for a ground source heat pump system. Int. J. Heat Technol. 2011, 29, 145–150. [Google Scholar]

- Gabrielli, L.; Bottarelli, M. Financial and economic analysis for ground-coupled heat pumps using shallow ground heat exchangers. Sustain. Cities Soc. 2016, 20, 71–80. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Trovato, M.R.; Valenti, A. Cap Rate as the Interpretative Variable of the Urban Real Estate Capital Asset: A Comparison of Different Sub-Market Definitions in Palermo, Italy. Buildings 2017, 7, 80. [Google Scholar] [CrossRef] [Green Version]

- Giuffrida, S.; Ventura, V.; Trovato, M.R.; Napoli, G. Axiology of the historical city and the cap rate the case of the old town of Ragusa superior. Valori e Valutazioni 2017, 18, 41–55. [Google Scholar]

- Mancarella, P.; Canova, A.; Chicco, G.; Genon, G. Cogenerazione Distribuita a Gas Naturale. Modelli E Tecniche per Valutazioni Energetiche Ambientali Ed Economiche; FrancoAngeli: Milan, Italy, 2009. [Google Scholar]

- Simonotti, M. La Stima Immobiliare Con Principi DI Economia E Applicazioni Estimative; UTET Libreria: Milan, Italy, 1997. [Google Scholar]

- Hicks, J.R. Value and Capital; Clarendon Press: Oxford, UK, 1946. [Google Scholar]

- Bleyl, J.W.; Bareit, M.; Casas, M.A.; Chatterjee, S.; Coolen, J.; Hulshoff, A.; Lohse, R.; Mitchell, S.; Robertson, M.; Ürge-Vorsatz, D. Office building deep energy retrofit: Life cycle cost benefit analyses using cash flow analysis and multiple benefits on project level. Energy Effic. 2018, 12, 261–279. [Google Scholar] [CrossRef] [Green Version]

- Naselli, F.; Trovato, M.R.; Castello, G. An evaluation model for the actions in supporting of the environmental and landscaping rehabilitation of the Pasquasia’s site mining (EN). In ICCSA 2014; LNCS 8581; Murgante, B., Misra, S., Rocha, A.M.A.C., Torre, C.M., Rocha, J.G., Falcão, M.I., Taniar, D., Apduhan, B.O., Gervasi, O., Eds.; Springer: Brussels, Switzerland, 2014; Part III; pp. 21–64. [Google Scholar] [CrossRef]

- IPCC. IPCC, 2013: Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Stocker, T.F., Qin, D., Plattner, G.K., Tignor, M., Allen, S.K., Boschung, J., Nauels, A., Xia, Y., Bex, V., Midgley, P.M., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 1535. [Google Scholar]

- Moore, F.C.; Diaz, D. Temperature impacts on economic growth warrant stringent mitigation policy. Nat. Clim. Chang. 2015, 5, 127–131. [Google Scholar] [CrossRef]

- Diaz, D.; Moore, F. Quantifying the economic risks of climate change. Nat. Clim. Chang. 2017, 7, 774–782. [Google Scholar] [CrossRef]

- Interagency Working Group on Social Cost of Greenhouse Gases. United States Government Technical Support Document: Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis—Under Executive Order 12866; Interagency Working Group on Social Cost of Greenhouse Gases: Washington, DC, USA, 2016. [Google Scholar]

- Nordhaus, W. Revisiting the social cost of carbon. Proc. Natl. Acad. Sci. USA 2017, 114, 1518–1523. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Trovato, M.R.; Giuffrida, S. The protection of territory in the perspective of the intergenerational equity. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2018; Volume Part F8, pp. 469–485. [Google Scholar] [CrossRef]

- Stephen Smith, S.; Nils Axel Braathen, N.A. Monetary Carbon Values in Policy Appraisal. An Overview of Current Practice and Key Issues; OECD: Paris, France, 2015; Volume 92. [Google Scholar]

- Ricke, K.; Drouet, L.; Caldeira, K.; Tavoni, M. Country-level social cost of carbon. Nat. Clim. Chang. 2018, 8, 895–900. [Google Scholar] [CrossRef]

- Kesickia, F. Marginal Abatement Cost Curves for Policy Making–Expert-Based vs. Model-Derived Curves; Ucl Energy Institute: London, UK, 2011. [Google Scholar]

- EIEA. CO2 Emission from Fuel Combustion—Highlights; EIEA: Amsterdam, The Netherlands, 2019. [Google Scholar]

- Commissione Europea. Guide to Cost-Benefit Analysis of Investment Projects. Economic Appraisal Toolfor Cohesion Policy 2014–2020. 2015. Available online: http://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/cba_guide.pdf (accessed on 19 December 2014).

- Gagliano, A.; DeTommaso, M.; Nocera, F.; Berardi, U. The adoption of green roofs for the retrofitting of existing buildings in the Mediterranean climate. Int. J. Sustain. Build. Technol. Urban Dev. 2016, 7, 1–14. [Google Scholar] [CrossRef]

- UNI 11235:2007 Criteria for Design, Execution, Testing and Maintenance of Roof Garden; UNI: Milan, Italy, 2007.

- Fernandez-Antolin, M.M.; del Río, J.M.; Costanzo, V.; Nocera, F.; Gonzalez-Lezcano, R.A. Passive design strategies for residential buildings in different Spanish climate zones. Sustainability 2019, 11, 4816. [Google Scholar] [CrossRef] [Green Version]

- Costanzo, V.; Evola, G.; Marletta, L.; Nocera, F. The effectiveness of phase change materials in relation to summer thermal comfort in air-conditioned office buildings. Build. Simul. 2018, 11, 1145–1161. [Google Scholar] [CrossRef]

- Costanzo, V.; Evola, G.; Marletta, L.; Nascone, F.P. Application of Climate Based Daylight Modelling to the Refurbishment of a School Building in Sicily. Sustainability 2018, 10, 2653. [Google Scholar] [CrossRef] [Green Version]

- Vilches, A.; Garcia-Martinez, A.; Sanchez-Montañes, B. Life cycle assessment (LCA) of building refurbishment: A literature review. Energy Build. 2017, 135, 286–301. [Google Scholar] [CrossRef]

- Sonetti, G.; Lombardi, P. Multi-criteria decision analysis of a building element integrating energy use, environmental, economic and aesthetic parameters in its life cycle. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2020; pp. 463–477. [Google Scholar] [CrossRef]

- Cellura, M.; Longo, S.; Montana, F.; Sanseverino, E.R. Multi-Objective Building Envelope Optimization through a Life Cycle Assessment Approach. In Proceedings of the 2019 IEEE International Conference on Environment and Electrical Engineering and 2019 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I and CPS Europe), Genova, Italy, 11–14 June 2019; p. 8783807. [Google Scholar] [CrossRef]

- Gagliano, A.; Nocera, F.; Patania, F.; Detommaso, M.; Bruno, M. Evaluation of the performance of a small biomass gasifier and micro-CHP plant for agro-industrial firms. Int. J. Heat Technol. 2015, 33, 145–154. [Google Scholar] [CrossRef]

- Shafique, M.; Azam, A.; Rafiq, M.; Ateeq, M.; Luo, X.; Xiaowei, L. An overview of life cycle assessment of green roofs. J. Clean. Prod. 2020, 250, 119471. [Google Scholar] [CrossRef]

- Bianchini, F.; Hewage, K. How “green” are the green roofs? Lifecycle analysis of green roof materials. Build. Environ. 2012, 48, 57–65. [Google Scholar] [CrossRef]

- Berardi, U.; GhaffarianHoseini, A.; GhaffarianHoseini, A. State-of-the-art analysis of the environmental benefits of green roofs. Appl. Energy 2014, 115, 411–428. [Google Scholar] [CrossRef]

- Bianchini, F.; Hewage, K. Probabilistic social cost-benefit analysis for green roofs: A lifecycle approach. Build. Environ. 2012, 58, 152–162. [Google Scholar] [CrossRef]

- Chenani, S.B.; Lehvävirta, S.; Häkkinen, T. Life cycle assessment of layers of green roofs. J. Clean. Prod. 2015, 90, 153–162. [Google Scholar] [CrossRef]

- Spampinato, G.; Massimo, D.E.; Musarella, C.M.; De Paola, P.; Malerba, A.; Musolino, M. Carbon Sequestration by Cork Oak Forests and Raw Material to Built up Post Carbon City. In New Metropolitan Perspectives: Local Knowledge and Innovation. Series: Smart Innovation, Systems and Technologies; Calabrò, F., Della Spina, L., Bevilacqua, C., Eds.; Springer: Berlin, Germany, 2019; Volume 101, pp. 663–671. [Google Scholar] [CrossRef]

- Guarino, F.; Croce, D.; Tinnirello, I.; Cellura, M. Data fusion analysis applied to different climate change models: An application to the energy consumptions of a building office. Energy Build. 2019, 196, 240–254. [Google Scholar] [CrossRef]

- Matias, L.; Santos, C.; Reis, M.; Gil, L. Declared value for the thermal conductivity coefficient of insulation corkboard. Wood Sci. Technol. 1997, 31, 355–365. [Google Scholar] [CrossRef]

- Tártaro, A.S.; Mata, T.; Martins, A.; Da Silva, J.C.E. Carbon footprint of the insulation cork board. J. Clean. Prod. 2017, 143, 925–932. [Google Scholar] [CrossRef]

- ISO/TS 14067, Greenhouse Gases and Carbon Footprint of Products and Requirements and Guidelines for Quantification and Communication (Technical Specifications); International Organization for Standardization: Geneve, Switzerland, 2013.

- Citherlet, S.; Di Guglielmo, F.; Gay, J.-B. Window and advanced glazing systems life cycle assessment. Energy Build. 2000, 32, 225–234. [Google Scholar] [CrossRef]

- International Organization for Standardization (ISO). ISO 15099, Thermal Performance of Windows Doors and Shading Device Detailed Calculation; ISO: Geneva, Switzerland, 2003. [Google Scholar]

- Sinha, A.; Kutnar, A. Carbon Footprint versus Performance of Aluminium, Plastic, and Wood Window Frames from Cradle to Gate. Buildings 2012, 2, 542–553. [Google Scholar] [CrossRef] [Green Version]

- De Ruggiero, M.; Manganelli, B.; Marchianò, S.; Salvo, F.; Tavano, D. Comparative and evaluative economic analysis of ground mounted photovoltaic plants. In Green Energy and Technology; Springer: Berlin/Heidelberg, Germany, 2020; pp. 181–199. [Google Scholar] [CrossRef]

- Massimo, D.E.; Malerba, A.; Musolino, M.; Nicoletti, F.; De Paola, P. Energy Comparative Assessment of Buildings, for the Post Carbon City Valutazione energetica comparativa degli edifici, per la post carbon city. Laborest 2019, 19, 63–73. [Google Scholar]

- D’Alpaos, C.; Bragolusi, P. The Valuation of Energy Retrofit Measures in Public Housing: A Hierarchical Approach. Laborest 2019, 19, 47–62. [Google Scholar]

- Nocera, F.; Giuffrida, S.; Trovato, M.R.; Gagliano, A. Energy and New Economic Approach for Nearly Zero Energy Hotels. Entropy 2019, 21, 639. [Google Scholar] [CrossRef] [Green Version]

- Trovato, M.R.; Giuffrida, S. The Monetary Measurement of Flood Damage and the Valuation of the Proactive Policies in Sicily. Geosciences 2018, 8, 141. [Google Scholar] [CrossRef] [Green Version]

| Geometric Features | Envelope Component | U-Value (W·m−2·K−1) | Superficial Mass (kg·m−2) |

|---|---|---|---|

| Heated gross volume (V) = 2000 m3 | External walls | 1.477 | 606.13 |

| Total external surface (S) = 911 m2 | Flat roof | 1.592 | 395.50 |

| Shape factor (S/V) = 0.455 m−1 | Ground floor | 0.934 | 1131.50 |

| Net floor area (Sn) = 473 m2 | Windows | 5.850 | - |

| External Walls | Thickness | Thermal Conductivity | Density | Thermal Capacity |

| (m) | (W·m−1·K−1) | (kg·m2) | (J/kg−1·K−1) | |

| Marble cladding | 0.03 | 3.00 | 2800 | 1000 |

| Cement mortar | 0.03 | 1.35 | 2000 | 1000 |

| Limestone blocks | 0.2 | 2.00 | 2000 | 1000 |

| Air gap | 0.1 | 0.66 | 1.3 | 1008 |

| Perforated bricks | 0.08 | 0.40 | 775 | 840 |

| Lime/gypsum plaster | 0.02 | 0.80 | 1300 | 1000 |

| Roof | Thickness | Thermal Conductivity | Density | Thermal Capacity |

| (m) | (W·m−1·K−1) | (kg·m2) | (J/kg−1·K−1) | |

| Gravel | 0.04 | 1.2 | 1700 | 1000 |

| Bituminous waterproofing membrane | 0.005 | 0.23 | 1100 | 1000 |

| Mortar | 0.06 | 1.35 | 2000 | 1000 |

| Load-bearing floor-slab | 0.2 | 0.6 | 918 | 840 |

| Lime/gypsum plaster | 0.02 | 0.8 | 1300 | 1000 |

| Openings | Thickness | Thermal Conductivity | Ug-Value | Uf-Value |

| (m) | (W·m−1·K−1) | (W·m−2·K−1) | (W·m−2·K−1) | |

| Clear glass | 0.003 | 0.90 | 5.89 | - |

| Aluminum | 0.002 | 230 | - | 3.00 |

| Flat Roof Components | Thickness (m) | Thermal Conductivity (W·m−1·K−1) | Density (kg·m2) | Thermal Capacity (J/kg−1·K−1) |

| Ground | 0.15 | 1.00 | 1500 | 2000 |

| Geotextile fabric | 0.0005 | 0.22 | 1800 | 910 |

| Expanded clay | 0.1 | 0.92 | 900 | 1000 |

| Anti-roots barrier | 0.0005 | 0.25 | 1200 | 1800 |

| Bituminous waterproofing membrane | 0.005 | 0.23 | 1100 | 1000 |

| Mortar | 0.06 | 1.35 | 2000 | 1000 |

| Loadbearing floor slab | 0.2 | 0.6 | 918 | 840 |

| Lime/gypsum plaster | 0.02 | 0.8 | 1300 | 1000 |

| U-value (W·m−2·K−1) | 1.154 (−27.5%) | |||

| Superficial mass (kg·m−2) | 657.5 (+66.2%) | |||

| External Walls Components | Thickness (m) | Thermal Conductivity (W·m−1·K−1) | Density (kg·m2) | Thermal Capacity (J/kg−1·K−1) |

| Lime/gypsum plaster | 0.02 | 0.8 | 1300 | 1000 |

| Corkpan™ | 0.06 | 0.036 | 130 | 1900 |

| Limestone blocks | 0.2 | 2.00 | 2000 | 1000 |

| Air gap | 0.1 | 0.66 | 1.3 | 1008 |

| Perforated Bricks | 0.08 | 0.40 | 775 | 840 |

| Lime /gypsum plaster | 0.02 | 0.80 | 1300 | 1000 |

| U-value (W·m−2·K−1) | 0.39 (73.6%) | |||

| Superficial mass (kg·m−2) | 470.58 (−22.4%) | |||

| Wooden Window | Thickness (m) | Thermal Conductivity (W·m−1·K−1) | Ug-Value (W·m−2·K−1) | Uf -Value (W·m−2·K−1) |

| Low emission double glass 4/18/4 | 0.036 | 0.90 | 1.65 | - |

| Wood | 0.1 | 0.12 | - | 0.98 |

| U-value (W·m−2·K−1) | 1.65 (−71.8%) |

| Building’s Life-Cycle Steps | CO2 Equivalent (CO2 eq) Emissions (kg·CO2 eq) |

|---|---|

| Site activities, transportation, and ground use | 86,500 |

| Screed and foundation | 46,800 |

| Structure | 54,800 |

| Loadbearing floor slab | 83,800 |

| Exterior walls | 46,000 |

| Internal works | 27,400 |

| Roof | 50,000 |

| Windows | 7400 |

| Electric and thermal system, waterworks | 10,400 |

| Maintenance | 76,600 |

| Electricity for lighting, cooling, heating, and other uses | 1,153,000 |

| Demolition and afterlife treatment | 107,000 |

| Net CO2 equivalent emission | 1,952,700 |

| Corkpan’s Life-Cycle Steps | Carbon Footprint (kg CO2 eq/m3) |

|---|---|

| CO2 embodied in Corkpan | −272.186 |

| Extraction from tree | 145.843 |

| Transportation | 8.628 |

| Production | 1.485 |

| Net CO2 equivalent emissions | −116.229 |

| Green roof’s Life-Cycle Steps | Carbon Footprint (kg CO2 eq/m2) |

|---|---|

| CO2 embodied in green roof | 18.50 |

| Transportation | 5.90 |

| Usage | 0.12 |

| Carbon sequestration | −0.62 |

| Net CO2 equivalent emissions | 23.90 |

| Actions | Id. | Description | U.m. or % | Unit Price (€/U.m.) | Extent | Total Amount (€) |

|---|---|---|---|---|---|---|

| Termal insulation | 1 | Scaffolding 30 days | m2 | 8.52 | 631.8 | 5383 |

| 2 | Scaffolding over 30 days | m2 | 0.24 | 631.8 | 150 | |

| 3 | Corkpan works | m2 | 0.50 | 631.8 | 316 | |

| 4 | Corkpan plaster demolition | m2 | 1.50 | 631.8 | 948 | |

| 5 | Corkpan materials | m2 | 23.60 | 631.8 | 14,909 | |

| 6 | Corkpan construction | m2 | 40.00 | 631.8 | 25,270 | |

| 7 | Wall painting | m2 | 13.20 | 631.8 | 8339 | |

| 8 | Delivery to dump | m3 | 24.70 | 19.0 | 468 | |

| 9 | Dump fees | m3 | 36.00 | 19.0 | 682 | |

| 10 | Additional expenses | 7% | 8471 | |||

| 11 | Incentives | 90% | 76,242 | |||

| 12 | Savings | m2 | 1.21 | 631.8 | 768 | |

| 13 | Maintenance | 1% | 149 | |||

| Windows | 14 | Reflective windows | m2 | 42.00 | 92.4 | 3881 |

| 15 | Thermal break windows | m2 | 489.40 | 92.4 | 45,225 | |

| 16 | Windows removal | m2 | 14.20 | 92.4 | 1312 | |

| 17 | Doors removal | m2 | 14.20 | 3.0 | 43 | |

| 18 | New doors | m2 | 544.40 | 3.0 | 1633 | |

| 19 | Dump fees | m3 | 12.00 | 3.8 | 46 | |

| 20 | Additional expenses | 7% | 4483 | |||

| 21 | Incentives | 65% | 41,626 | |||

| 22 | Savings | m2 | 30.65 | 95.4 | 2924 | |

| 23 | Maintenance | 0,5% | 28 | |||

| Green roof | 24 | Green roof | m2 | 50.00 | 242.0 | 12,100 |

| 25 | Additional expenses | 15% | 1210 | |||

| 26 | Incentives | 50% | 6050 | |||

| 27 | Savings | m2 | 12.89 | 242.0 | 3118 | |

| 28 | Maintenance | 3,15% | 121 |

| Stocks/Streams | Overall | Thermal Insulation | Windows | Green Roof |

|---|---|---|---|---|

| Investment cost—building works (stock) | −130,123 | −60,418 | −55,790 | −13,915 |

| Maintenance (annuities over the 30-y lifetime) | −585 | −149 | −55 | −381 |

| Incentives (annuities over 10 y) | 9076 | 5082 | 3389 | 605 |

| Savings (annuities over the 30-y lifetime) | 5060 | 824 | 1667 | 2569 |

| External environmental benefit (annuities over the 30-y lifetime) | 250 | 71 | 90 | 89 |

| Year | Overall | Thermal Insulation | Windows | Green Roof |

|---|---|---|---|---|

| 0 | 130,123 | 60,418 | 55,790 | 13,915 |

| 1 | 13,234 | 5622 | 4884 | 2728 |

| 2 | 12,925 | 5491 | 4770 | 2664 |

| 3 | 12,624 | 5363 | 4659 | 2602 |

| 4 | 12,329 | 5237 | 4550 | 2541 |

| 5 | 12,041 | 5115 | 4444 | 2482 |

| 6 | 11,760 | 4996 | 4340 | 2424 |

| 7 | 11,485 | 4879 | 4239 | 2368 |

| 8 | 11,217 | 4765 | 4140 | 2312 |

| 9 | 10,956 | 4654 | 4043 | 2258 |

| 10 | 10,700 | 4545 | 3949 | 2206 |

| 11 | 1469 | 520 | 1243 | −294 |

| 12 | 1435 | 508 | 1214 | −287 |

| 13 | 1401 | 496 | 1186 | −280 |

| 14 | 1369 | 485 | 1158 | −274 |

| 15 | 1337 | 473 | 1131 | −267 |

| 16 | 1305 | 462 | 1104 | −261 |

| 17 | 1275 | 451 | 1079 | −255 |

| 18 | 1245 | 441 | 1053 | −249 |

| 19 | 1216 | 431 | 1029 | −243 |

| 20 | 1188 | 421 | 1005 | −238 |

| 21 | 1160 | 411 | 981 | −232 |

| 22 | 1133 | 401 | 959 | −227 |

| 23 | 1107 | 392 | 936 | −221 |

| 24 | 1081 | 383 | 914 | −216 |

| 25 | 1055 | 374 | 893 | −211 |

| 26 | 55,632 | 365 | 55,790 | −206 |

| 27 | 5039 | 356 | 4884 | −201 |

| 28 | 4921 | 348 | 4770 | −197 |

| 29 | 4807 | 340 | 4659 | −192 |

| 30 | 4694 | 332 | 4550 | −188 |

| 31 | −9147 | 324 | 4444 | 13,915 |

| 32 | 7385 | 317 | 4340 | 2728 |

| 33 | 7212 | 309 | 4239 | 2664 |

| 34 | 7044 | 302 | 4140 | 2602 |

| 35 | 6880 | 295 | 4043 | 2541 |

| 36 | 6719 | 288 | 3949 | 2482 |

| 37 | 3949 | 281 | 1243 | 2424 |

| 38 | 3856 | 275 | 1214 | 2368 |

| 39 | 3766 | 269 | 1186 | 2312 |

| 40 | 3678 | 262 | 1158 | 2258 |

| Indices | Overall | Thermal Insulation | Windows | Green Roof | ||||

|---|---|---|---|---|---|---|---|---|

| Non Env Benefit | with Env. Benefit | Non Env Benefit | with Env. Benefit | Non Env Benefit | with Env. Benefit | Non Env Benefit | with Env. Benefit | |

| 12,973 | 20,368 | −1332 | 1305 | 4424 | 7756 | 9881 | 11,308 | |

| 8.52% | 13.37% | −2.02% | 1.97% | 7.64% | 13.40% | 34.84% | 39.87% | |

| 3.15% | 3.58% | 2.19% | 2.58% | 2.88% | 3.24% | 12.94% | 13.94% | |

| 2.45% | 2.48% | 2.38% | 2.40% | 2.43% | 2.46% | 2.64% | 2.67% | |

| 3.60 | 2.55 | 11.47 | 13.22 | 5.46 | 3.43 | 0.73 | 0.72 | |

| 21 | 19 | 42 | 35 | 23 | 21 | 6 | 6 | |

| 75 | 72 | 87 | 80 | 80 | 76 | 48 | 48 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trovato, M.R.; Nocera, F.; Giuffrida, S. Life-Cycle Assessment and Monetary Measurements for the Carbon Footprint Reduction of Public Buildings. Sustainability 2020, 12, 3460. https://doi.org/10.3390/su12083460

Trovato MR, Nocera F, Giuffrida S. Life-Cycle Assessment and Monetary Measurements for the Carbon Footprint Reduction of Public Buildings. Sustainability. 2020; 12(8):3460. https://doi.org/10.3390/su12083460

Chicago/Turabian StyleTrovato, Maria Rosa, Francesco Nocera, and Salvatore Giuffrida. 2020. "Life-Cycle Assessment and Monetary Measurements for the Carbon Footprint Reduction of Public Buildings" Sustainability 12, no. 8: 3460. https://doi.org/10.3390/su12083460