An Investigation on Factors Affecting Stock Valuation Using Text Mining for Automated Trading

Abstract

:1. Introduction

2. Background

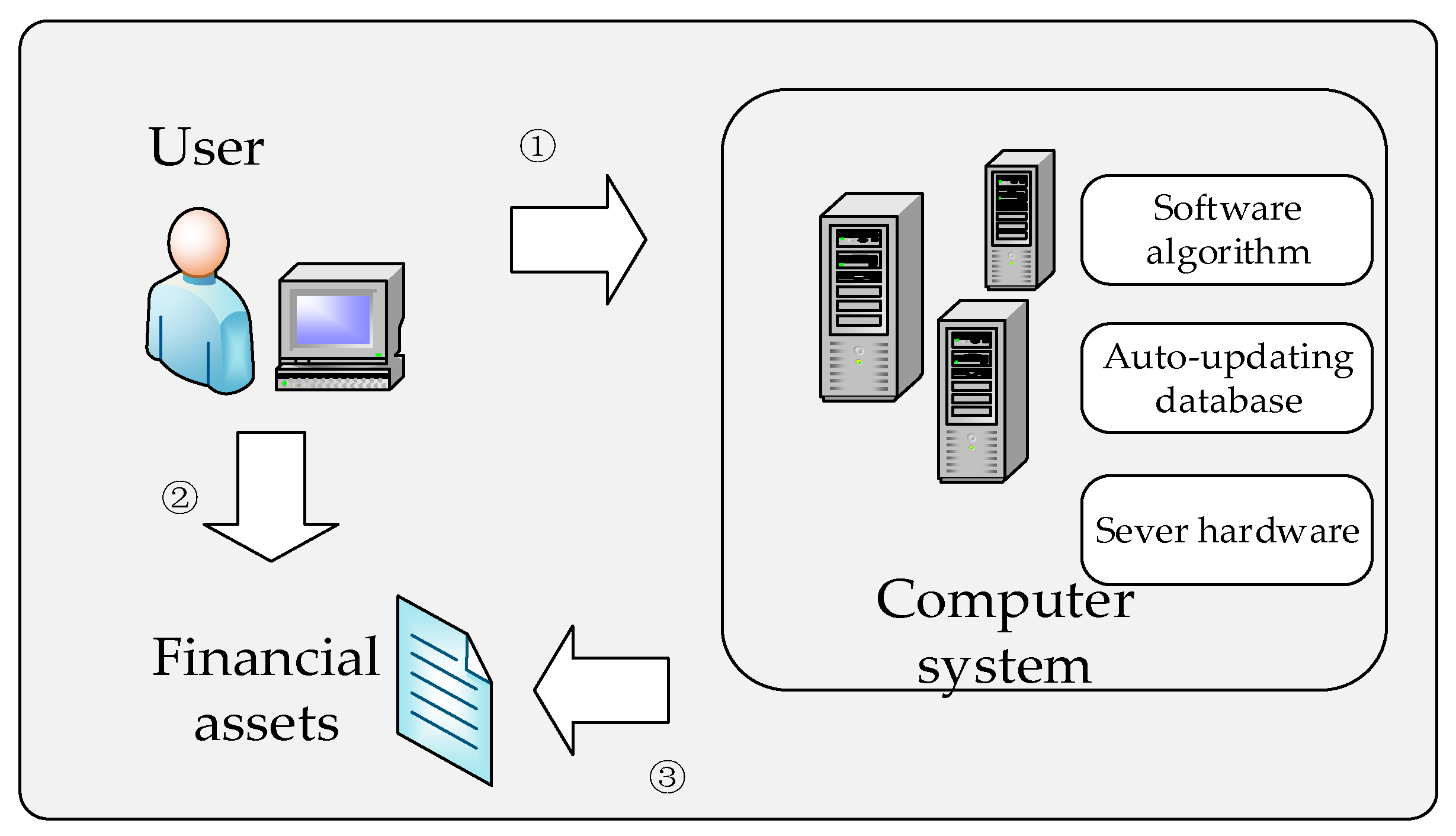

2.1. Automated Trading System (ATS)

2.2. Valuation Method Using P/BV Ratio

2.2.1. P/BV Ratio

2.2.2. Valuation Factors

2.3. Latent Dirichlet Allocation (LDA)

3. Methodology

3.1. Research Procedure

3.2. Data Collection and Processing—First Stage

3.3. Data Collection—Second Stage

3.4. Data Processing—Second Stage

- We choose a website and combine the title of each news item with the content of the article to form a training corpus.

- For a high accuracy, we use the jieba instrument to segment words. This instrument is suitable for text analysis because its specialized financial dictionary ensures that the proper nouns in the financial field are not combined or cut by error.

- Right after word segmentation, we eliminate stop-words and high-frequency words which have little relationship with the topics. We then mainly retain the nouns, verbs, and adjectives.

- Once the total frequency or the length of words is lower than 2, we eliminate these words.

- The LDA model is used to extract the main topics from all posts.

4. Results

4.1. Result—First Stage

4.2. Result—Second Stage

4.2.1. Word Frequency Statistics

4.2.2. Result Analysis with Word Cloud

4.2.3. Result Analysis with the LDA Model

5. Discussion and Conclusions

5.1. Discussion

5.2. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Dohler, M.; Ratti, C.; Paraszczak, J.; Falconer, G. Smart cities. IEEE Commun. Mag. 2013, 51, 70–71. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. A comparative survey of artificial intelligence applications in finance: Artificial neural networks, expert system and hybrid intelligent systems. Neural Comput. Appl. 2010, 19, 1165–1195. [Google Scholar] [CrossRef]

- Meiring, G.A.M.; Myburgh, H.C. A review of intelligent driving style analysis systems and related artificial intelligence algorithms. Sensors 2015, 15, 30653–30682. [Google Scholar] [CrossRef] [PubMed]

- Lee, H.; Kim, S.G.; Park, H.W.; Kang, P. Pre-launch new product demand forecasting using the bass model: A statistical and machine learning-based approach. Technol. Forecast. Soc. Chang. 2014, 86, 49–64. [Google Scholar] [CrossRef]

- Paiva, F.D.; Cardoso, R.T.N.; Hanaoka, G.P.; Duarte, W.M. Decision-making for financial trading: A fusion approach of machine learning and portfolio selection. Expert Syst. Appl. 2019, 115, 635–655. [Google Scholar] [CrossRef]

- David, W. Empowering automated trading in multi-agent environments. Comput. Intell. 2010, 20, 562–583. [Google Scholar]

- Petropoulos, A.; Chatzis, S.P.; Siakoulis, V.; Vlachogiannakis, N. A stacked generalization system for automated forex portfolio trading. Expert Syst. Appl. 2017, 90, 290–302. [Google Scholar] [CrossRef]

- Geva, T.; Zahavi, J. Empirical evaluation of an automated intraday stock recommendation system incorporating both market data and textual News. Decis. Support Syst. 2014, 57, 212–223. [Google Scholar] [CrossRef]

- Raudys, S. Portfolio of automated trading systems: Complexity and learning set size issues. IEEE Trans. Neural Netw. Learn. Syst. 2013, 24, 448–459. [Google Scholar] [CrossRef] [PubMed]

- Izumi, K.; Toriumi, F.; Matsui, H. Evaluation of automated-trading strategies using an artificial market. Neurocomputing 2009, 72, 3469–3476. [Google Scholar] [CrossRef]

- Huang, D.; Cheng, X.; Hou, T.; Liu, K.; Li, C. Exploring evaluation factors and framework for the object of automated trading system. In Proceedings of the 52nd Hawaii International Conference on System Sciences (HICSS), Maui, HI, USA, 8–11 January 2019; Available online: https://scholarspace.manoa.hawaii.edu/handle/10125/59564 (accessed on 8 January 2019).

- Cheng, X.; Wang, X.; Huang, J.; Zarifis, A. An Experimental Study of Satisfaction Response: Evaluation of Online Collaborative Learning. Int. Rev. Res. Open Distrib. Learn. 2016, 17, 60–78. [Google Scholar] [CrossRef]

- Damodaran, A. Book value multiples. In Investment Valuation: Tools and Techniques for Determining the Value of any Asset, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2012; pp. 498–513. [Google Scholar]

- Błażej, P. The accuracy of alternative stock valuation methods—The case of the warsaw stock exchange. Ekon. Istraživanja 2017, 30, 416–438. [Google Scholar] [CrossRef]

- Jianu, I.; Jianu, I.; Țurlea, C. Measuring the company’s real performance by physical capital maintenance. Econ. Comput. Econ. Cybern. Stud. Res. 2017, 51, 37–57. [Google Scholar]

- Freitas, F.D.; Freitas, C.D.; De Souza, A.F. Intelligent trading architecture. Concurr. Comput. Pract. Exp. 2016, 28, 929–943. [Google Scholar] [CrossRef]

- Tetlock, P.C. Giving content to investor sentiment: The role of media in the stock market. J. Financ. 2007, 62, 1139–1168. [Google Scholar] [CrossRef]

- Hu, Y.; Liu, K.; Zhang, X.; Su, L.; Ngai, E.W.T.; Liu, M. Application of evolutionary computation for rule discovery in stock algorithmic trading: A literature review. Appl. Soft Comput. 2015, 36, 534–551. [Google Scholar] [CrossRef]

- Fernandez, P. Valuation using multiples. How do analysts reach their conclusions? IESE Bus. Sch. 2001, 1–13. [Google Scholar] [CrossRef]

- Bradshaw, M.T. How do analysts use their earnings forecasts in generating stock recommendations? Account. Rev. 2004, 79, 25–50. [Google Scholar] [CrossRef]

- Cakici, N.; Chan, K.; Topyan, K. Cross-sectional stock return predictability in China. Eur. J. Financ. 2017, 23, 581–605. [Google Scholar] [CrossRef]

- Chen, X.; Kim, K.A.; Yao, T.; Yu, T. On the predictability of Chinese stock returns. Pac. Basin Financ. J. 2010, 18, 403–425. [Google Scholar] [CrossRef]

- Westerlund, J.; Narayan, P.K.; Zheng, X. Testing for stock return predictability in a large Chinese panel. Emerg. Mark. Rev. 2015, 24, 81–100. [Google Scholar] [CrossRef]

- Nezlobin, A.; Rajan, M.V.; Reichelstein, S. Structural properties of the price-to-earnings and price-to-book ratios. Rev. Account. Stud. 2016, 21, 438–472. [Google Scholar] [CrossRef]

- Chue, T.K. Understanding cross-country differences in valuation ratios: A variance decomposition approach. Contemp. Account. Res. 2015, 32, 1617–1640. [Google Scholar] [CrossRef]

- Wilcox, J.W. The P/B-ROE valuation model. Financ. Anal. J. 1984, 40, 58–66. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. The anatomy of value and growth stock returns. Financ. Anal. J. 2007, 63, 44–54. [Google Scholar] [CrossRef]

- Pätäri, E.; Leivo, T. A closer look at value premium: Literature review and synthesis. J. Econ. Surv. 2017, 31, 79–168. [Google Scholar] [CrossRef]

- Aydoğan, K.; Gürsoy, G. P/E and price-to-book ratio as predictors of stock returns in emerging equity markets. Emerg. Mark. Q. 2000, 4, 1–18. [Google Scholar]

- Kim, Y.J.; Cin, B.C.; Cho, K.; Yi, J. Introduction: Technology, finance, and trade in emerging markets. Emerg. Mark. Financ. Trade 2015, 51, 945–946. [Google Scholar] [CrossRef]

- Hendershott, T.; Jones, C.M.; Menkveld, A.J. Does algorithmic trading improve liquidity? J. Financ. 2011, 66, 33. [Google Scholar] [CrossRef]

- Thompson, G.F. Time, trading and algorithms in financial sector security. New Political Econ. 2017, 22, 1–11. [Google Scholar] [CrossRef]

- Kirilenko, A.; Kyle, A.S.; Samadi, M.; Tuzun, T. The flash crash: High-frequency trading in an electronic market. J. Financ. 2017, 72, 967–998. [Google Scholar] [CrossRef]

- Katz, M.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–440. [Google Scholar]

- Blocher, J. Network externalities in mutual funds. J. Financ. Mark. 2016, 30, 1–26. [Google Scholar] [CrossRef]

- Cao, C.; Xia, C.; Chan, K.C. Social trust and stock price crash risk: Evidence from China. Int. Rev. Econ. Financ. 2016, 46, 148–165. [Google Scholar] [CrossRef]

- Kim, S.; Ha, W.; Seo, J.; Han, S.; Kim, M. A method of evaluating trust and reputation for online transaction. Comput. Inform. 2015, 33, 1095–1115. [Google Scholar]

- Haleblian, J.J.; Pfarrer, M.D.; Kiley, J.T. High-reputation firms and their differential acquisition behaviors. Strateg. Manag. J. 2017, 38, 2237–2254. [Google Scholar] [CrossRef]

- Gentzkow, M.; Kelly, B.T.; Taddy, M. Text as data. Natl. Bur. Econ. Res. 2017, w23276. [Google Scholar]

- Baker, M.; Wurgler, J. Investor sentiment and the cross-section of stock returns. J. Financ. 2006, 61, 1645–1680. [Google Scholar] [CrossRef]

- Heiberger, R.H. Collective attention and stock prices: Evidence from Google trends data on standard and poor’s 100. PLoS ONE 2015, 10, e0135311. [Google Scholar] [CrossRef]

- Shen, D.; Zhang, Y.; Xiong, X.; Zhang, W. Baidu index and predictability of Chinese stock returns. Financ. Innov. 2017, 3, 4. [Google Scholar] [CrossRef]

- Groenewold, N. (Ed.) The Chinese Stock Market: Efficiency, Predictability, and Profitability; Edward Elgar Publishing: Cheltenham, UK, 2004. [Google Scholar]

- Vosoughi, S.; Roy, D.; Aral, S. The spread of true and false news online. Science 2018, 359, 1146–1151. [Google Scholar] [CrossRef]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Liu, Y.; Wang, J.; Jiang, Y. PT-LDA: A latent variable model to predict personality traits of social network users. Neurocomputing 2016, 210, 155–163. [Google Scholar] [CrossRef]

- Dyer, T.; Lang, M.; Stice-Lawrence, L. The evolution of 10-K textual disclosure: Evidence from Latent Dirichlet Allocation. J. Account. Econ. 2017, 64, 221–245. [Google Scholar] [CrossRef]

- Li, W.; Chen, H.; Nunamaker, J.F., Jr. Identifying and profiling key sellers in cyber carding community: AZSecure text mining system. J. Manag. Inf. Syst. 2016, 33, 1059–1086. [Google Scholar] [CrossRef]

- Gaskell, H.; Derry, S.; Moore, R.A. Is there an association between low dose aspirin and anemia (without overt bleeding)?: Narrative review. BMC Geriatr. 2010, 10, 71. [Google Scholar] [CrossRef]

- Rumshisky, A.; Ghassemi, M.; Naumann, T.; Szolovits, P.; Castro, V.M.; McCoy, T.H.; Perlis, R.H. Predicting early psychiatric readmission with natural language processing of narrative discharge summaries. Transl. Psychiatry 2016, 6, e921. [Google Scholar] [CrossRef] [PubMed]

- Sun, J.; Wang, G.; Cheng, X.; Fu, Y. Mining Affective Text to Improve Social Media Item Recommendation. Inf. Process. Manag. 2015, 51, 444–457. [Google Scholar] [CrossRef]

- Kim, S.G.; Kang, J. Analyzing the discriminative attributes of products using text mining focused on cosmetic reviews. Inf. Process. Manag. 2018, 54, 938–957. [Google Scholar] [CrossRef]

- Teresi, J.A.; Golden, R.R.; Gurland, B.J. Concurrent and predictive validity of indicator scales developed for the comprehensive assessment and referral evaluation interview schedule. J. Gerontol. 1984, 39, 158. [Google Scholar] [CrossRef]

- Mercer, B. Interviewing people with chronic illness about sexuality: An adaptation of the PLISSIT model. J. Clin. Nurs. 2008, 17, 341–351. [Google Scholar] [CrossRef] [PubMed]

- Cheng, X.; Macaulay, L. Exploring Individual Trust Factors in Computer Mediated Group Collaboration: A Case Study Approach. Group Decis. Negot. 2014, 23, 533–560. [Google Scholar] [CrossRef]

- Chang, R.P.; Rhee, S.G.; Stone, G.R.; Tang, N. How does the call market method affect price efficiency? Evidence from the Singapore Stock Market. J. Bank. Financ. 2008, 32, 2205–2219. [Google Scholar] [CrossRef]

- Kalach, G.M. Contemporary trend in financial policy at stock market. Actual Probl. Econ. 2009, 96, 216–222. [Google Scholar]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Independent director reputation incentives and stock price informativeness. J. Corp. Financ. 2017, 47, 219–235. [Google Scholar] [CrossRef]

- Carter, R.B.; Strader, T.J.; Dark, F.H. The IPO window of opportunity for digital product and service firms. Electron. Mark. 2012, 22, 255–266. [Google Scholar] [CrossRef]

- Wang, X.L.; Shi, K.; Fan, H.X. Psychological mechanisms of investors in Chinese Stock Markets. J. Econ. Psychol. 2006, 27, 762–780. [Google Scholar] [CrossRef]

| Symbol | Meaning |

|---|---|

| W | Word |

| N | Number of words |

| M | Number of texts |

| K | Number of topics |

| Z | Assignment of topics |

| Comments Example | Keywords | Sub-factors | |

|---|---|---|---|

| Technology | (I4) Whether it has enough data to support it to make this decision | Data diversity, Data abundance | Data Acquisition and Processing |

| (I3) A machine may be more rational than a human being. It may be more comprehensive. (I6) It has to ensure the safety of our data, such as bank cards. If the database leaks, it is all over. | Comprehensiveness Security | System maturity | |

| (I7) The R&D personnel of the platform may only be an information technology personnel, so there may be a problem of disconnection. | Technical team | R&D team performance | |

| (I7) Some practitioners seem to break national law and regulations when developing the system or trading stocks. | Legitimacy | Technology compliance | |

| Market mechanism | (I5) The design of algorithms needs an adjustment on the basis of public feedback and policy. | Feedback Adjustment | Market reaction |

| (I4) The efficiency of the market and the development of those tools are promoted by each other. | Mutual promotion | Market prioritizing | |

| (I7) The amount of funds will also have an impact. | The amount of funds | Assets concentration level | |

| Regulation | (I4) In my view, it is necessary to consider a series of procedures and qualifications. (I2) They are supposed to make an introduction about what support they have rallied for people who do not know about it. | Qualification | Qualification authentication |

| (I3) Market manipulation can be found anywhere for they cannot make a profit without it. (I6) The program is written by people, while people are probably breaking the law to do some things. | Market manipulation, Legitimacy | The legitimacy of return | |

| (I5) It is necessary for those companies to respond to national policy, which will help to improve the corporate value. | National policy | Policy response | |

| Network externalities | (I10) The value of shares needs to be determined by their own price. | Price | Stock price |

| (I8) There are different strategies including black box and white box to choose from in every platform. | Different strategy | Functional development | |

| (I9) The practicability of the automated trading platform can be influenced by the involvement of customers. | Customer involvement | Customer involvement | |

| A corporate trust | (I6) In the whole market, if the ability to earn profits is getting higher and higher, more and more people will rely on this system. | Rely | Dependency |

| (I7) The impact on the fund security and user privacy, which are brought by the high-tech, needs to be given more attention. | Security | Perceived security | |

| (I4) Evidence needs to be provided for users to convince them that the system can help them make a profit. | Profitability | Benefit | |

| Reputation | (I4) The information that is disclosed by firms with goodwill is authentic. | Authentic information | Information disclosure |

| (I1) Investors are influence by a firm’s reputation and word-of-mouth. | Brand | Long-term brand effect | |

| (I6) The latter refers to things like bad news. (I1) Big news | Report | Social capacity | |

| (I7) Tt is necessary to consider its duration. | Duration | Operating condition |

| Topic | High Frequency Words | Categories | Related factors |

|---|---|---|---|

| 1 | Industry segments, The overall market, Leading shares, Range, Bear market, Choice, Transaction, Strategy, Expectation, Stock index | Market reaction | Market mechanism |

| 2 | Factor analysis, Model, Portfolio, Market value, Stock selection, Weight, Build, Multifactor, alpha, Calculation | R&D team performance | Technology |

| 3 | CSI100, Evaluation, Trillion yuan, Determine, Stock price, Index, Random walk, Shanghai and Shenzhen stock markets, GDP | Assets concentration level | Market mechanism |

| 4 | Performance, Product, Consumption, Growth, Enterprise, Development, Improve, Business, Continued, Brand, Income | Brand, Operating condition, Service | Reputation, Service |

| 5 | Enterprise, Cash flow, Growth rate, Formula, Calculation, Intrinsic value, Expectation, Dividend, Per share, Growth, Net profit, Discounted rate | Expected growth rate Dividend | Fundamentals |

| 6 | Dividend, Range, Medicine, Classification, Transaction on exchange, Reasonable price hike, Rating, Public, OTC | Qualification The legitimacy of return | Regulation |

| 7 | Strategy, Hedge, Arbitrage, Portfolio, Fundamentals, Stock selection, Products, Analysis, Trend, Study, Index, Tools, Use, Program, Statistics | System maturity | Technology |

| Topic | High Frequency Words | Categories | Related Factors |

|---|---|---|---|

| 1 | Innovation, Institution, Pilot, Strategy, CSRC (China Securities Regulatory Commission), Standard, Institutions, Investors, Technology, Release, News Report, Number, Rules | Technology compliance, Legitimacy, Social capacity Policy response | Technology, Regulation, Reputation |

| 2 | Past, Hopeful, Shock, Fluctuation, The market momentum, Emotion, Market value, Profit, Stock selection, Reverse | Market reaction, Emotion | Market mechanism, Investor psychology |

| 3 | Capacity, Information, R & D, Expansion, Demand, Global, Industry, Revenue, Business, Service | Operating condition, Service | Reputation Service |

| 4 | United States, Business cycle, Interest rates, Dollar, FED, RMB, Policy, Treasury bonds, Monetary policy, Industry segments, Consumption, Inflation, GDP, Exchange rate | Economic conditions at home and abroad | Market mechanism |

| 5 | Factor analysis, Report, Model, Forecast, Index, Method, Portfolio, Use, Rating, Beta, Artificial intelligence | R&D team performance | Technology |

| 6 | Fund, Management, Holders, Share, Trustees, Contract, Provisions, Account, Shareholders Meeting, Notice, Should | Information disclosure | Reputation |

| 7 | Stock, index, Fall, Average, Loss, Customer, Lead to, Pessimistic, Change | Market reaction, Emotion | Market mechanism, Investor psychology |

| Topic | High Frequency Words | Categories | Related Factors |

|---|---|---|---|

| 1 | MACD, Strategy, Probability, Position, Buy, Software, Setting, Value, Indicator, Average, Parameters, Match, Algorithm | System maturity | Technology |

| 2 | Fund manager, Configuration Shareholding, App, Trading system, Repurchase, Research, Risk, Information, Performance, The listed companies, The overall market, Investors, | R&D team performance Data Acquisition and Processing System maturity | Technology |

| 3 | History, China, Underestimates, Pharmaceuticals, Brand, Consumer, Securities, Group | Brand | Reputation |

| 4 | P/E, Yield, PB/V, ROE, Dividend, Market index, Rise and fall, Average, Growth rate, Net assets, Net profit | Fundamentals Multiples | Fundamentals |

| 5 | Industry, Enterprise, Products, China, Economy, Business, Financing, Development, Technology, American, Customers, Global, Future, Risk, Science | Operating condition, Economic conditions at home and abroad | Market mechanism Reputation |

| 6 | User, Services, Internet, Network, Publishing, Digital, Product, Value, Indicators, A leading reference | Service modernization | Service |

| 7 | Strategy, Model, Financial, Python, Predictive, Platform, Technology, Algorithm, Machine, System, Development, Language, Training, Artificial intelligence, Information | System maturity Data Acquisition and Processing | Technology |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, X.; Huang, D.; Chen, J.; Meng, X.; Li, C. An Investigation on Factors Affecting Stock Valuation Using Text Mining for Automated Trading. Sustainability 2019, 11, 1938. https://doi.org/10.3390/su11071938

Cheng X, Huang D, Chen J, Meng X, Li C. An Investigation on Factors Affecting Stock Valuation Using Text Mining for Automated Trading. Sustainability. 2019; 11(7):1938. https://doi.org/10.3390/su11071938

Chicago/Turabian StyleCheng, Xusen, Danya Huang, Jin Chen, Xiangsong Meng, and Chengyao Li. 2019. "An Investigation on Factors Affecting Stock Valuation Using Text Mining for Automated Trading" Sustainability 11, no. 7: 1938. https://doi.org/10.3390/su11071938