Spatial Dynamics of Intercity Technology Transfer Networks in China’s Three Urban Agglomerations: A Patent Transaction Perspective

Abstract

:1. Introduction

2. Data and Methods

2.1. Study Area

2.2. Data Sources and Processing

2.3. Methods

2.3.1. Network Construction

2.3.2. Social Network Analysis

2.3.3. Negative Binomial Regression Analysis

3. Results

3.1. Urban Centrality in the Technology Transfer Network

3.1.1. Degree Centrality and Betweenness Centrality

3.1.2. Weighted Degree

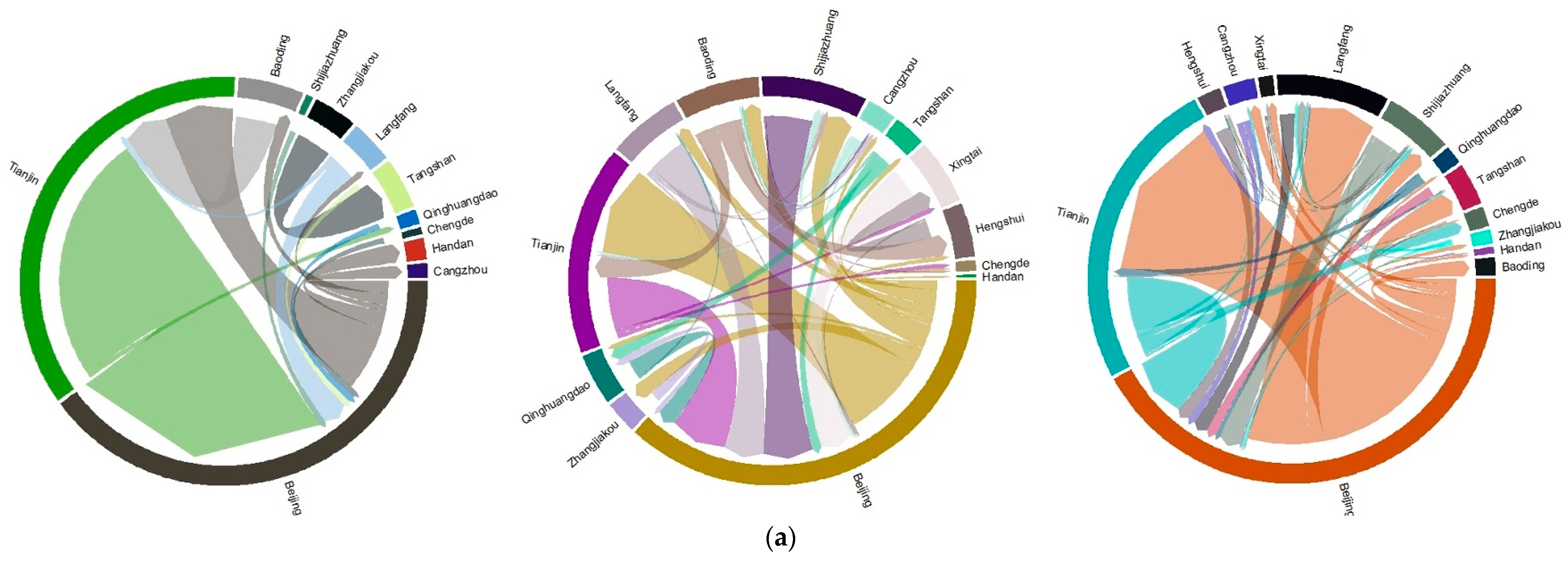

3.2. Flow Direction in the Technology Transfer Network

3.3. Flow Hierarchy in the Technology Transfer Network

3.4. Potential Determinants of the Strength of Intercity Patent Transfer

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Regions | BTH | YRD | PRD |

|---|---|---|---|

| Municipality | Beijing (Capital 13.63) Tianjin (10.44) | Shanghai (14.50) | |

| Provincial capital | Shijiazhuang (10.38) | Nanjing (6.63)/Hangzhou (7.36)/Hefei (7.30) | Guangzhou (8.70) |

| Vice-provincial city | Ningbo (5.91) | Shenzhen (3.85) | |

| Prefecture level city | Xingtai (7.88) Baoding (1.207) Hengshui (4.55) Cangzhou (7.80) Langfang (4.70) Zhangjiakou (4.70) Tangshan (7.60) Handan (10.55) Qinghuangdao (2.98) | Nantong (7.67)/Shaoxing (4.45) Suzhou (6.78)/Yancheng (8.31) Jiaxing (3.52)/Xuancheng (2.80) Ma’anshan (2.29)/Huzhou (2.65) Changzhou (3.75)/Wuxi (4.86) Chuzhou (4.54)/Zhoushan (9.70) Taizhou (6.00)/Yangzhou (4.62) Tongling (1.71)/Anqing (5.29) Zhenjiang (2.72)/Wuhu (3.88) Jinhua (4.81)/Chizhou (1.62)/Taizhou (5.08) | Dongguan (2.01)/Zhuhai (1.15) Jiangmen (3.94)/Huizhou (3.64) Qingyuan (4.32)/Yunfu (3.01) Zhaoqing (4.44)/Heyuan (3.73) Zhongshan (1.61)/Foshan (4.00) Shaoguan (3.34)/Shanwei (3.62) |

| Pearson Correlation | GDP | Input | Output | |

|---|---|---|---|---|

| DC | 0.796 ** | 0.695 ** | 0.815 ** | |

| Sig. (two-tailed) | 0.000 | 0.000 | 0.000 | |

| BC | 0.441 ** | 0.863 ** | 0.727 ** | |

| Sig. (two-tailed) | 0.001 | 0.000 | 0.000 |

| Regions | Beijing–Tianjin–Hebei | Yangtze River Delta | Pearl River Delta | ||||||

|---|---|---|---|---|---|---|---|---|---|

| From | To | Weight | From | To | Weight | From | To | Weight | |

| 2008 | Tianjin | Beijing | 42 | Hangzhou | Taizhou | 19 | Dongguan | Shenzhen | 41 |

| Beijing | Tianjin | 11 | Shanghai | Ningbo | 14 | Shenzhen | Dongguan | 28 | |

| Baoding | Tianjin | 7 | Zhenjiang | Nanjing | 14 | Zhuhai | Zhongshan | 15 | |

| Zhangjiakou | Tangshan | 6 | Suzhou | Shanghai | 12 | Foshan | Huizhou | 9 | |

| Langfang | Beijing | 4 | Xuancheng | Wuhu | 12 | Guangzhou | Dongguan | 7 | |

| 2012 | Beijing | Tianjin | 38 | Hangzhou | Shaoxing | 97 | Shenzhen | Dongguan | 184 |

| Tianjin | Beijing | 24 | Shanghai | Suzhou | 52 | Guangzhou | Dongguan | 62 | |

| Shijiazhuang | Beijing | 21 | Shaoxing | Hangzhou | 30 | Shenzhen | Huizhou | 53 | |

| Langfang | Beijing | 17 | Wuxi | Nanjing | 29 | Dongguan | Shenzhen | 44 | |

| Xingtai | Beijing | 14 | Nanjing | Shanghai | 27 | Guangzhou | Shenzhen | 39 | |

| 2015 | Beijing | Tianjin | 115 | Shanghai | Suzhou | 166 | Shenzhen | Dongguan | 128 |

| Beijing | Langfang | 45 | Suzhou | Shanghai | 148 | Shenzhen | Huizhou | 108 | |

| Tianjin | Beijing | 41 | Shaoxing | Hangzhou | 135 | Zhaoqing | Foshan | 82 | |

| Beijing | Tangshan | 16 | Shanghai | Jiaxing | 134 | Shenzhen | Zhongshan | 64 | |

| Shijiazhuang | Beijing | 15 | Hangzhou | Jiaxing | 46 | Shenzhen | Guangzhou | 60 | |

References

- Sorenson, O.; Rivkin, J.W.; Fleming, L. Complexity, networks and knowledge flow. Res. Policy 2006, 35, 994–1017. [Google Scholar] [CrossRef] [Green Version]

- Van Egeraat, C.; Kogler, D.F. Global and regional dynamics in knowledge flows and innovation networks. Eur. Plan. Stud. 2013, 21, 1317–1322. [Google Scholar] [CrossRef]

- Krätke, S. Regional knowledge networks: A network analysis approach to the interlinking of knowledge resources. Eur. Urban Reg. Stud. 2010, 17, 83–97. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Polit. Econ. 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Teece, D.J. Technology transfer by multinational firms: The resource cost of transferring technological know-how. Econ. J. 1977, 87, 242–261. [Google Scholar] [CrossRef]

- Ferraro, G.; Iovanella, A. Technology transfer in innovation networks: An empirical study of the enterprise Europe network. Int. J. Eng. Bus. Manag. 2017, 9, 1847979017735748. [Google Scholar] [CrossRef]

- Freeman, C. Networks of innovators: A synthesis of research issues. Res. Policy 1991, 20, 499–514. [Google Scholar] [CrossRef]

- Grimaldi, M.; Hanandi, M. Evaluating the intellectual capital of technology transfer and learning public services. Int. J. Eng. Bus. Manag. 2013, 5, 5–7. [Google Scholar] [CrossRef]

- Katz, J.S. Geographical proximity and scientific collaboration. Scientometrics 1994, 31, 31–43. [Google Scholar] [CrossRef]

- Glückler, J. Economic geography and the evolution of networks. J. Econ. Geogr. 2007, 7, 619–634. [Google Scholar] [CrossRef]

- Chen, Z.; Guan, J. Mapping of biotechnology patents of China from 1995–2008. Scientometrics 2011, 88, 73–89. [Google Scholar] [CrossRef]

- Gao, X.; Guan, J.; Rousseau, R. Mapping collaborative knowledge production in China using patent co-inventorships. Scientometrics 2011, 88, 343–362. [Google Scholar] [CrossRef]

- Grillitsch, M.; Nilsson, M. Innovation in peripheral regions: Do collaborations compensate for a lack of local knowledge spillovers? Ann. Reg. Sci. 2015, 54, 299–321. [Google Scholar] [CrossRef] [Green Version]

- Hu, X.; Du, D. Inter-city innovation linkage and its spatial structure in megalopolis: A case study of the Yangtze River Delta, China. In Proceedings of the 2011 19th International Conference on GeoInformatics, Shanghai, China, 24–26 June 2011. [Google Scholar] [CrossRef]

- Yun, J.J.; Jeong, E.; Yang, J. Open innovation of knowledge cities. J. Open Innov. Technol. Mark. Complex. 2015, 1, 16. [Google Scholar] [CrossRef]

- Bell, R. Industrial cites in turnaround. In Proceedings of the Remarks Presented at the Smart Communities Conference, Santa Monica, CA, USA, 22–23 September 1997. [Google Scholar]

- Duranton, G.; Puga, D. Micro-foundations of urban agglomeration economies. In Handbook of Regional and Urban Economics; Elsevier: Amsterdam, The Netherlands, 2004; Volume 4, pp. 2063–2117. ISBN 1574-0080. [Google Scholar]

- Li, Y.; Phelps, N.A. Knowledge polycentricity and the evolving Yangtze River Delta megalopolis. Reg. Stud. 2017, 51, 1035–1047. [Google Scholar] [CrossRef]

- Li, Y.; Phelps, N. Megalopolis unbound: Knowledge collaboration and functional polycentricity within and beyond the Yangtze River Delta Region in China, 2014. Urban Stud. 2018, 55, 443–460. [Google Scholar] [CrossRef]

- Chen, H.; Xie, F. How technological proximity affect collaborative innovation? An empirical study of China’s Beijing–Tianjin–Hebei region. J. Manag. Anal. 2018, 5, 287–308. [Google Scholar] [CrossRef]

- Amin, A.; Wilkinson, F. Learning, proximity and industrial performance: An introduction. Camb. J. Econ. 1999, 23, 121–125. [Google Scholar] [CrossRef]

- Gui, Q.; Liu, C.; Du, D. International knowledge flows and the role of proximity. Growth Chang. 2018, 49, 532–547. [Google Scholar] [CrossRef]

- Boschma, R.A. Proximity and innovation: A critical assessment. Reg. Stud. 2005, 39, 61–74. [Google Scholar] [CrossRef]

- Hoekman, J.; Frenken, K.; van Oort, F. The geography of collaborative knowledge production in Europe. Ann. Reg. Sci. 2009, 43, 721–738. [Google Scholar] [CrossRef]

- Ma, H.; Fang, C.; Pang, B.; Li, G. The effect of geographical proximity on scientific cooperation among Chinese cities from 1990 to 2010. PLoS ONE 2014, 9, e111705. [Google Scholar] [CrossRef]

- Crescenzi, R.; Nathan, M.; Rodríguez-Pose, A. Do inventors talk to strangers? On proximity and collaborative knowledge creation. Res. Policy 2016, 45, 177–194. [Google Scholar] [CrossRef] [Green Version]

- Marek, P.; Titze, M.; Fuhrmeister, C.; Blum, U. R&D collaborations and the role of proximity. Reg. Stud. 2017, 51, 1761–1773. [Google Scholar] [CrossRef]

- Hoekman, J.; Frenken, K.; Tijssen, R.J.W. Research collaboration at a distance: Changing spatial patterns of scientific collaboration within Europe. Res. Policy 2010, 39, 662–673. [Google Scholar] [CrossRef]

- Elkan, R. Catching up and slowing down: Learning and growth patterns in an open economy. J. Int. Econ. 1996, 41, 95–111. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Tsai, K.H.; Wang, J.C. External technology sourcing and innovation performance in LMT sectors: An analysis based on the Taiwanese technological innovation survey. Res. Policy 2009, 38, 518–526. [Google Scholar] [CrossRef]

- Huggins, R.; Prokop, D. Network structure and regional innovation: A study of university–industry ties. Urban Stud. 2017, 54, 931–952. [Google Scholar] [CrossRef]

- Kill, C.; Torossian, A.; Freisburger, C.; Dworok, S.; Massmann, M.; Nohl, T.; Henning, R.; Wallot, P.; Gockel, A.; Steinfeldt, T. Basic life support with four different compression/ventilation ratios in a pig model: The need for ventilation. Resuscitation 2008, 77, 1060–1065. [Google Scholar] [CrossRef]

- Gui, Q.; Liu, C.; Du, D. Does network position foster knowledge production? Evidence from international scientific collaboration network. Growth Chang. 2018, 49, 594–611. [Google Scholar] [CrossRef]

- Yun, J.H.J.; Jeong, E.S.; Park, J.S. Network analysis of open innovation. Sustainability 2016, 8, 729. [Google Scholar] [CrossRef]

- De Araújo, I.F.; Gonçalves, E.; Taveira, J.G. The Role of Patent Co-Inventorship Networks in Regional Inventive Performance. Int. Reg. Sci. Rev. 2018, 0160017618770. [Google Scholar] [CrossRef]

- Tseng, C.-Y.; Lin, S.-C.; Pai, D.-C.; Tung, C.-W. The relationship between innovation network and innovation capability: A social network perspective. Technol. Anal. Strateg. Manag. 2016, 28, 1029–1040. [Google Scholar] [CrossRef]

- Capello, R.; Lenzi, C. Territorial Patterns of Innovation and Economic Growth in European Regions. Growth Chang. 2013, 44, 195–227. [Google Scholar] [CrossRef]

- Andersson, D.E.; Gunessee, S.; Matthiessen, C.W.; Find, S. The geography of Chinese science. Environ. Plan. A 2014, 46, 2950–2971. [Google Scholar] [CrossRef]

- Serrano, C.J. The dynamics of the transfer and renewal of patents. RAND J. Econ. 2010, 44, 686–708. [Google Scholar] [CrossRef]

- Gambardella, A.; Giuri, P.; Luzzi, A. The market for patents in Europe. Res. Policy 2007, 36, 1163–1183. [Google Scholar] [CrossRef]

- Burhop, C. The transfer of patents in Imperial Germany. J. Econ. Hist. 2010, 70, 921–939. [Google Scholar] [CrossRef]

- Shen, H.; Huang, C.; Mao, H.; Sharif, N. To License or Sell: A Study on the Patent Transaction Modes in China; Social Science Electronic Publishing: Rochester, NY, USA, 2018; pp. 27–31. [Google Scholar] [CrossRef]

- Caviggioli, F.; Ughetto, E. The drivers of patent transactions: Corporate views on the market for patents. R D Manag. 2013, 43, 318–332. [Google Scholar] [CrossRef]

- Galasso, A.; Schankerman, M. Trading and enforcing patent rights.pdf. J. Econ. 2014, 44, 275–312. [Google Scholar]

- Akcigit, U.; Celik, M.; Greenwood, J. Buy, Keep or sell: Economic growth and the market for ideas. Econometrica 2013, 84, 943–984. [Google Scholar] [CrossRef]

- Sánchez-Sellero, P.; Rosell-Martínez, J.; García-Vázquez, J.M. Absorptive capacity from foreign direct investment in Spanish manufacturing firms. Int. Bus. Rev. 2014, 23, 429–439. [Google Scholar] [CrossRef] [Green Version]

- Marrocu, E.; Paci, R.; Usai, S. Proximity, networking and knowledge production in Europe: What lessons for innovation policy? Technol. Forecast. Soc. Chang. 2013, 80, 1484–1498. [Google Scholar] [CrossRef]

- Levinthal, D.A. Economic security for a better world. Indian J. Labour Econ. 2004, 47, 601–607. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, K. Proximity effect, preferential attachment and path dependence in inter-regional network: A case of China’s technology transaction. Scientometrics 2016, 108, 201–220. [Google Scholar] [CrossRef]

- Song, J.-D. Agglomeration economies of China’s three major urban agglomerations, 1994–2008. Int. Area Stud. Rev. 2010, 13, 25–58. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Trajtenberg, M.; Henderson, R. Geographic localization of knowledge spillovers as evidenced by patent citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Maurseth, P.B.; Verspagen, B. Knowledge spillovers in Europe: A patent citations analysis. Scand. J. Econ. 2002, 104, 531–545. [Google Scholar] [CrossRef]

- De Marco, A.; Scellato, G.; Ughetto, E.; Caviggioli, F. Global markets for technology: Evidence from patent transactions. Res. Policy 2017, 46, 1644–1654. [Google Scholar] [CrossRef]

- Fischer, T.; Henkel, J. Patent trolls on markets for technology—An empirical analysis of NPEs’ patent acquisitions. Res. Policy 2012, 41, 1519–1533. [Google Scholar] [CrossRef]

- Scott, J.; Carrington, P.J. The SAGE Handbook of Social Network Analysis; SAGE Publications: Thousand Oaks, CA, USA, 2011; ISBN 1847873952. [Google Scholar]

- Liu, C.; Wang, J.; Zhang, H. Spatial heterogeneity of ports in the global maritime network detected by weighted ego network analysis. Marit. Policy Manag. 2018, 45, 89–104. [Google Scholar] [CrossRef]

- Borgatti, S.P. Centrality and network flow. Soc. Netw. 2005, 27, 55–71. [Google Scholar] [CrossRef] [Green Version]

- Freeman, L.C. Centrality in social networks conceptual clarification. Soc. Netw. 1978, 1, 215–239. [Google Scholar] [CrossRef] [Green Version]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: Cambridge, UK, 1994; Volume 8, ISBN 0521387078. [Google Scholar]

- Scherngell, T.; Hu, Y. Collaborative knowledge production in China: Regional evidence from a gravity model approach. Reg. Stud. 2011, 45, 755–772. [Google Scholar] [CrossRef]

- Hilbe, J.M. Negative Binomial Regression; Cambridge University Press: Cambridge, UK, 2011; ISBN 0521198151. [Google Scholar]

- Cameron, A.C.; Trivedi, P.K. Econometric models based on count data. Comparisons and applications of some estimators and tests. J. Appl. Econom. 1986, 1, 29–53. [Google Scholar] [CrossRef]

- Nepelski, D.; De Prato, G. The structure and evolution of ICT global innovation network. Ind. Innov. 2018, 25, 940–965. [Google Scholar] [CrossRef]

- Sigler, T.J.; Martinus, K. Extending beyond ‘world cities’ in World City Network (WCN) research: Urban positionality and economic linkages through the Australia-based corporate network. Environ. Plan. A 2017, 49, 2916–2937. [Google Scholar] [CrossRef]

- Glass, A.J.; Saggi, K. International technology transfer and the technology gap. J. Dev. Econ. 1998, 55, 369–398. [Google Scholar] [CrossRef]

- National Bureau of Statistics. China City Statistical Yearbook; China Statistics Press: Beijing, China, 2016.

- Barabási, A.-L.; Albert, R. Emergence of scaling in random networks. Science 1999, 286, 509–512. [Google Scholar] [CrossRef]

- Liu, C.; Guan, M.; Duan, D. Spatial pattern and influential mechanism of interurban technology transfer network in China. Acta Geogr. Sin. 2018, 73, 1462–1477. [Google Scholar] [CrossRef]

- Pan, F.; Bi, W.; Lenzer, J.; Zhao, S. Mapping urban networks through inter-firm service relationships: The case of China. Urban Stud. 2017, 54, 3639–3654. [Google Scholar] [CrossRef]

- Qi, W.; Abel, G.J.; Muttarak, R.; Liu, S. Circular visualization of China’s internal migration flows 2010–2015. Environ. Plan. A 2017, 49, 2432–2436. [Google Scholar] [CrossRef] [Green Version]

- Gui, Q.; Liu, C.; Du, D.; Duan, D. The changing geography of global science. Environ. Plan. A 2018. [Google Scholar] [CrossRef]

- Baptista, E.A.; Abel, G.J.; Campos, J. Internal migration in Brazil using circular visualization. Reg. Stud. Reg. Sci. 2018, 5, 361–364. [Google Scholar] [CrossRef]

- Gu, Z.; Gu, L.; Eils, R.; Schlesner, M.; Brors, B. Circlize implements and enhances circular visualization in R. Bioinformatics 2014, 30, 2811–2812. [Google Scholar] [CrossRef]

- Gulati, R.; Gargiulo, M. Where do interorganizational networks come from? Am. J. Sociol. 1999, 104, 1439–1493. [Google Scholar] [CrossRef]

| Beijing–Tianjin–Hebei (BTH) | Degree Centrality | Betweenness Centrality | ||||||||||

| 2008 | 2012 | 2015 | 2008 | 2012 | 2015 | |||||||

| Beijing | 0.75 | Beijing | 0.92 | Beijing | 1.00 | Beijing | 0.43 | Beijing | 0.60 | Beijing | 0.66 | |

| Tianjin | 0.33 | Baoding | 0.54 | Tianjin | 0.67 | Tianjin | 0.12 | Tianjin | 0.05 | Tianjin | 0.06 | |

| Baoding | 0.17 | Tianjin | 0.46 | Shijiazhuang | 0.58 | Tangshan | 0.08 | Shijiazhuang | 0.03 | Shijiazhuang | 0.05 | |

| Langfang | 0.17 | Cangzhou | 0.38 | Langfang | 0.42 | Langfang | 0.00 | Baoding | 0.02 | Hengshui | 0.04 | |

| Tangshan | 0.17 | Langfang | 0.38 | Xingtai | 0.33 | Qinghuangdao | 0.00 | Langfang | 0.01 | Langfang | 0.04 | |

| Yangtze River Delta (YRD) | Degree Centrality | Betweenness Centrality | ||||||||||

| 2008 | 2012 | 2015 | 2008 | 2012 | 2015 | |||||||

| Shanghai | 0.44 | Shanghai | 0.88 | Shanghai | 1 | Shanghai | 0.33 | Shanghai | 0.29 | Shanghai | 0.19 | |

| Hangzhou | 0.32 | Suzhou | 0.64 | Suzhou | 0.88 | Hefei | 0.2 | Suzhou | 0.13 | Nanjing | 0.09 | |

| Hefei | 0.32 | Hangzhou | 0.6 | Ningbo | 0.8 | Nanjing | 0.2 | Hangzhou | 0.09 | Suzhou | 0.07 | |

| Nanjing | 0.28 | Ningbo | 0.56 | Nanjing | 0.8 | Hangzhou | 0.12 | Nanjing | 0.09 | Hefei | 0.07 | |

| Ningbo | 0.24 | Nanjing | 0.56 | Hangzhou | 0.72 | Wuhu | 0.06 | Ningbo | 0.06 | Hangzhou | 0.05 | |

| Pearl River Delta (PRD) | Degree Centrality | Betweenness Centrality | ||||||||||

| 2008 | 2012 | 2015 | 2008 | 2012 | 2015 | |||||||

| Shenzhen | 0.62 | Guangzhou | 0.92 | Shenzhen | 0.92 | Shenzhen | 0.31 | Guangzhou | 0.28 | Shenzhen | 0.26 | |

| Guangzhou | 0.46 | Shenzhen | 0.85 | Guangzhou | 0.85 | Foshan | 0.19 | Shenzhen | 0.24 | Guangzhou | 0.14 | |

| Foshan | 0.38 | Foshan | 0.77 | Foshan | 0.85 | Guangzhou | 0.15 | Foshan | 0.15 | Foshan | 0.11 | |

| Dongguan | 0.31 | Dongguan | 0.46 | Jiangmen | 0.69 | Dongguan | 0.08 | Dongguan | 0.08 | Jiangmen | 0.02 | |

| Zhongshan | 0.31 | Zhongshan | 0.38 | Dongguan | 0.54 | Zhongshan | 0.00 | Zhongshan | 0.01 | Dongguan | 0.02 | |

| (a) Beijing–Tianjin–Hebei | ||||||||

| 2008 | 2012 | 2015 | ||||||

| City | WD | NFD | City | WD | NFD | City | WD | NFD |

| Beijing | 69 | 31(50/19) | Beijing | 171 | 15(93/78) | Beijing | 313 | −125(94/219) |

| Tianjin | 62 | −24(19/43) | Tianjin | 77 | 21(49/28) | Tianjin | 186 | 66(126/60) |

| Baoding | 9 | −5(2/7) | Shijiazhuang | 39 | −5(17/22) | Langfang | 67 | 45(56/11) |

| Tangshan | 7 | 5(6/1) | Baoding | 31 | −13(9/22) | Shijiazhuang | 41 | −7(17/24) |

| Langfang | 6 | −4(1/5) | Langfang | 27 | −15(6/21) | Tangshan | 25 | 11(18/7) |

| Zhangjiakou | 6 | −6(0/6) | Xingtai | 24 | −4(10/14) | Cangzhou | 19 | −1(9/10) |

| Handan | 3 | 3(3/0) | Hengshui | 20 | 2(11/9) | Hengshui | 14 | −6(4/10) |

| Qinghuangdao | 2 | 0(1/1) | Qinghuangdao | 19 | 1(10/9) | Chengde | 12 | 8(10/2) |

| Cangzhou | 2 | 2(2/0) | Tangshan | 12 | −8(2/10) | Qinghuangdao | 11 | −7(2/9) |

| Shijiazhuang | 1 | −1(0/1) | Zhangjiakou | 12 | 2(7/5) | Baoding | 11 | 11(11/0) |

| Chengde | 1 | −1(0/1) | Cangzhou | 11 | −1(5/6) | Xingtai | 9 | 5(7/2) |

| Xingtai | 0 | 0(0/0) | Chengde | 4 | 4(0/4) | Zhangjiakou | 8 | −2(3/5) |

| Hengshui | 0 | 0(0/0) | Handan | 1 | 1(1/0) | Handan | 4 | 2(3/1) |

| (b) Yangtze River Delta | ||||||||

| 2008 | 2012 | 2015 | ||||||

| City | WD | NFD | City | WD | NFD | City | WD | NFD |

| Shanghai | 74 | 24(49/25) | Shanghai | 355 | −129(113/242) | Shanghai | 972 | −174(399/573) |

| Hangzhou | 62 | −12(25/37) | Hangzhou | 257 | −143(57/200) | Suzhou | 647 | −67(290/357) |

| Taizhou | 43 | −1(21/22) | Suzhou | 195 | 39(117/78) | Hangzhou | 469 | −21(224/245) |

| Nanjing | 35 | 1(18/17) | Nanjing | 164 | 10(87/77) | Nantong | 341 | 195(268/73) |

| Wuxi | 34 | −4(15/19) | Shaoxing | 133 | 71(102/31) | Nanjing | 331 | −33(149/182) |

| Hefei | 25 | 11(18/7) | Wuxi | 114 | −20(47/67) | Shaoxing | 305 | −147(79/226) |

| Ningbo | 24 | 2(13/11) | Changzhou | 74 | 26(50/24) | Ningbo | 258 | −48(105/153) |

| Wuhu | 21 | 11(16/5) | Ningbo | 63 | −15(24/39) | Jiaxing | 244 | 154(199/45) |

| Changzhou | 19 | −11(4/15) | Jiaxing | 63 | −1(31/32) | Changzhou | 179 | −29(75/104) |

| Suzhou | 18 | −12(3/15) | Hefei | 53 | −29(12/41) | Wuxi | 176 | −36(70/106) |

| Jiaxing | 15 | 3(9/6) | Taizhou | 51 | 35(43/8) | Jinhua | 154 | −78(38/116) |

| Zhenjiang | 12 | −12(0/12) | Nantong | 50 | 6(28/22) | Huzhou | 140 | 48(94/46) |

| Shaoxing | 9 | −1(4/5) | Yancheng | 49 | 39(44/5) | Yancheng | 100 | 74(87/13) |

| Nantong | 4 | 2(3/1) | Huzhou | 48 | 40(44/4) | Taizhou | 95 | 59(77/18) |

| Taizhou | 3 | −3(0/3) | Yangzhou | 37 | 27(32/5) | Hefei | 87 | 53(70/17) |

| Tongling | 3 | 3(3/0) | Jinhua | 36 | 4(20/16) | Taizhou | 71 | −13(29/42) |

| Yancheng | 2 | 0(1/1) | Taizhou | 33 | 11(22/11) | Zhenjiang | 62 | −10(26/36) |

| Chuzhou | 1 | 1(1/0) | Wuhu | 25 | 15(20/5) | Yangzhou | 61 | 33(47/14) |

| Xuancheng | 1 | −1(0/1) | Anqing | 19 | 19(19/0) | Chuzhou | 56 | 16(36/20) |

| Yangzhou | 1 | −1(0/1) | Ma’anshan | 17 | −7(5/12) | Wuhu | 52 | 16(34/18) |

| Zhoushan | 0 | 0(0/0) | Zhenjiang | 16 | −2(7/9) | Ma’anshan | 27 | 5(16/11) |

| Chizhou | 0 | 0(0/0) | Chuzhou | 11 | 11(11/0) | Zhoushan | 27 | 17(22/5) |

| Anqing | 0 | 0(0/0) | Tongling | 10 | −6(2/8) | Xuancheng | 19 | −1(9/10) |

| Jinhua | 0 | 0(0/0) | Xuancheng | 5 | −1(2/3) | Anqing | 12 | −6(3/9) |

| Huzhou | 0 | 0(0/0) | Zhoushan | 0 | 0(0/0) | Tongling | 8 | −8(0/8) |

| Ma’anshan | 0 | 0(0/0) | Chizhou | 0 | 0(0/0) | Chizhou | 5 | 1(3/2) |

| (c) Pearl River Delta | ||||||||

| 2008 | 2012 | 2015 | ||||||

| City | WD | NFD | City | WD | NFD | City | WD | NFD |

| Shenzhen | 107 | −3(52/55) | Shenzhen | 444 | −210(117/327) | Shenzhen | 648 | −262(193/455) |

| Dongguan | 80 | −10(35/45) | Dongguan | 344 | 154(249/95) | Guangzhou | 341 | 107(224/117) |

| Guangzhou | 38 | −14(12/26) | Guangzhou | 294 | −70(112/182) | Dongguan | 252 | 70(161/91) |

| Foshan | 32 | 4(18/14) | Foshan | 168 | 2(85/83) | Foshan | 250 | 12(131/119) |

| Zhongshan | 26 | 12(19/7) | Zhongshan | 93 | 51(72/21) | Huizhou | 188 | 54(121/67) |

| Zhuhai | 22 | −14(4/18) | Huizhou | 77 | 55(66/11) | Zhongshan | 146 | 8(77/69) |

| Huizhou | 22 | 16(19/3) | Zhuhai | 40 | −14(13/27) | Zhaoqing | 128 | −94(17/111) |

| Jiangmen | 6 | 6(6/0) | Qingyuan | 22 | 18(20/2) | Jiangmen | 94 | 50(72/22) |

| Heyuan | 3 | 3(3/0) | Heyuan | 21 | 9(15/6) | Zhuhai | 81 | 11(46/35) |

| Zhaoqing | 1 | −1(0/1) | Jiangmen | 17 | 5(11/6) | Qingyuan | 39 | 17(28/11) |

| Qingyuan | 1 | 1(1/0) | Zhaoqing | 12 | 0(6/6) | Shaoguan | 31 | 13(22/9) |

| Shaoguan | 0 | 0(0/0) | Shaoguan | 5 | 1(3/2) | Heyuan | 31 | 17(24/7) |

| Yunfu | 0 | 0(0/0) | Shanwei | 2 | −2(0/2) | Shanwei | 6 | −6(0/6) |

| Shanwei | 0 | 0(0/0) | Yunfu | 1 | 1(1/0) | Yunfu | 3 | 3(3/0) |

| Dependent Variable: The Volume of City-Pair Patent Transactions in 2015 | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Explanatory variables | ||||||

| Distance | −2.284 *** | −1.915 *** | −2.096 *** | −1.784 *** | ||

| (−5.37) | (−4.81) | (−4.97) | (−4.48) | |||

| Industrial similarity | −1.331 * | −2.705 *** | 0.476 | −0.835 | ||

| (−2.28) | (−4.06) | (0.91) | (−1.53) | |||

| Technology gap | 0.191 ** | 0.371 *** | 0.0775 | 0.270 *** | ||

| (2.73) | (5.37) | (1.12) | (4.00) | |||

| Absorptive capacity | 0.0430 | 0.0182 | 0.0453 | 0.0232 | ||

| (1.49) | (0.76) | (1.40) | (0.77) | |||

| Control Variables | ||||||

| Region | 0.314 | |||||

| (1.74) | ||||||

| Economic gap | −0.467 *** | −0.548 *** | −0.608 *** | |||

| (−4.97) | (−4.92) | (−5.93) | ||||

| Key city output | 1.356 *** | 1.048 *** | 1.116 *** | |||

| (7.46) | (5.63) | (6.69) | ||||

| cons | 1.695 *** | 2.898 *** | 2.426 * | 1.515 | 2.926 ** | 1.968 * |

| (4.12) | (12.86) | (2.38) | (1.77) | (2.98) | (2.46) | |

| lnalpha_cons | 0.331 *** | 0.103 | 0.153 * | 0.0308 | 0.0738 | −0.0746 |

| (3.98) | (1.18) | (2.09) | (0.36) | (1.03) | (−0.81) | |

| N | 368 | 368 | 368 | 368 | 368 | 368 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, C.; Niu, C.; Han, J. Spatial Dynamics of Intercity Technology Transfer Networks in China’s Three Urban Agglomerations: A Patent Transaction Perspective. Sustainability 2019, 11, 1647. https://doi.org/10.3390/su11061647

Liu C, Niu C, Han J. Spatial Dynamics of Intercity Technology Transfer Networks in China’s Three Urban Agglomerations: A Patent Transaction Perspective. Sustainability. 2019; 11(6):1647. https://doi.org/10.3390/su11061647

Chicago/Turabian StyleLiu, Chengliang, Caicheng Niu, and Ji Han. 2019. "Spatial Dynamics of Intercity Technology Transfer Networks in China’s Three Urban Agglomerations: A Patent Transaction Perspective" Sustainability 11, no. 6: 1647. https://doi.org/10.3390/su11061647