Evaluating Ancillary Business Scale for PPP-BOT Projects: A Social Housing BOT Case in Taiwan

Abstract

:1. Introduction

2. Research Gaps and Paper Contributions

3. Literature Review

3.1. Risk Management

3.2. Financial Evaluation

3.3. Contract Negotiation

3.4. Ancillary Business

4. The Model

- The NPV ≥ 0

- The IRR (internal rate of return) ≥ the discount rate (after WACC)

5. Case Study

5.1. Case Description

5.2. Parameter Setting

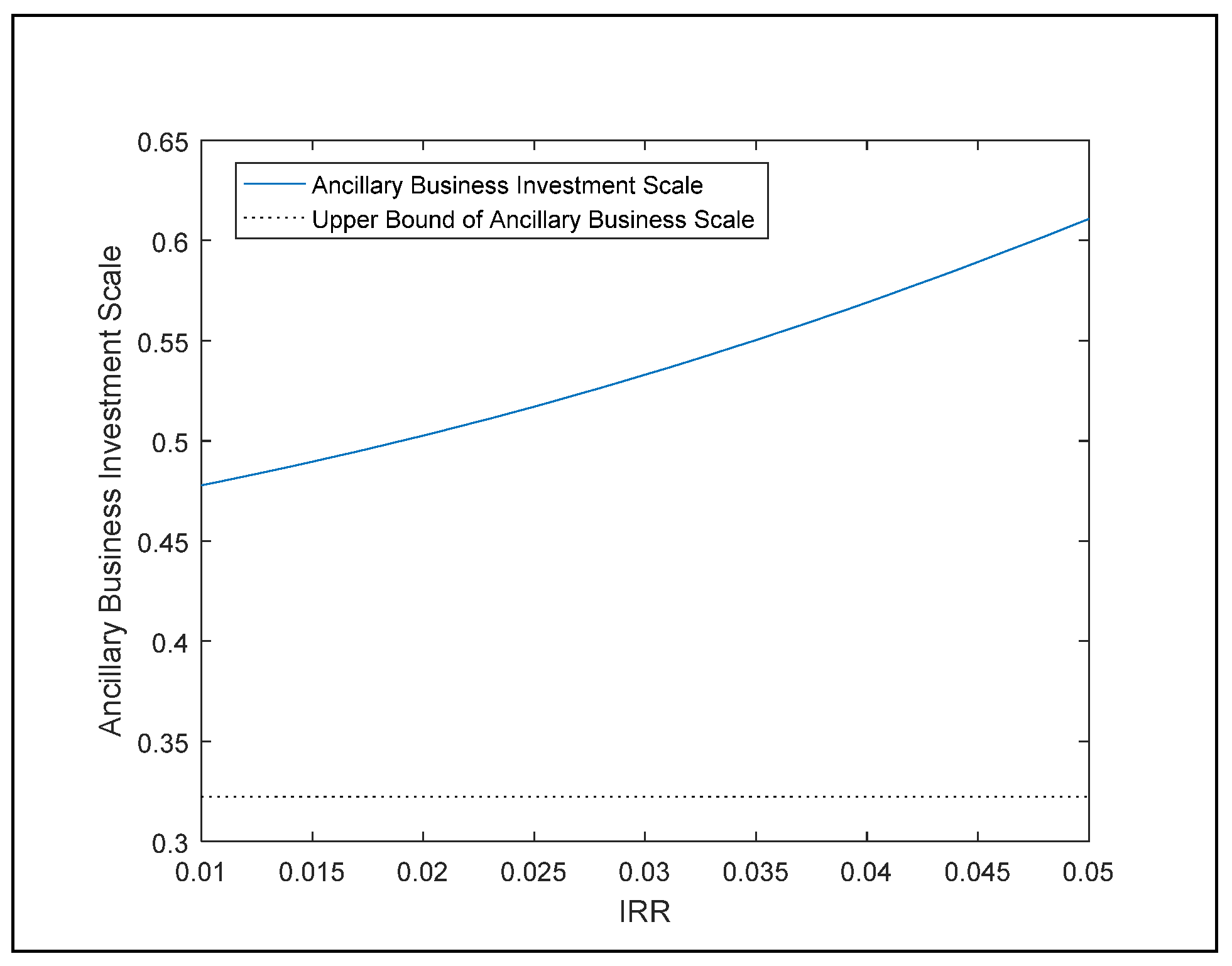

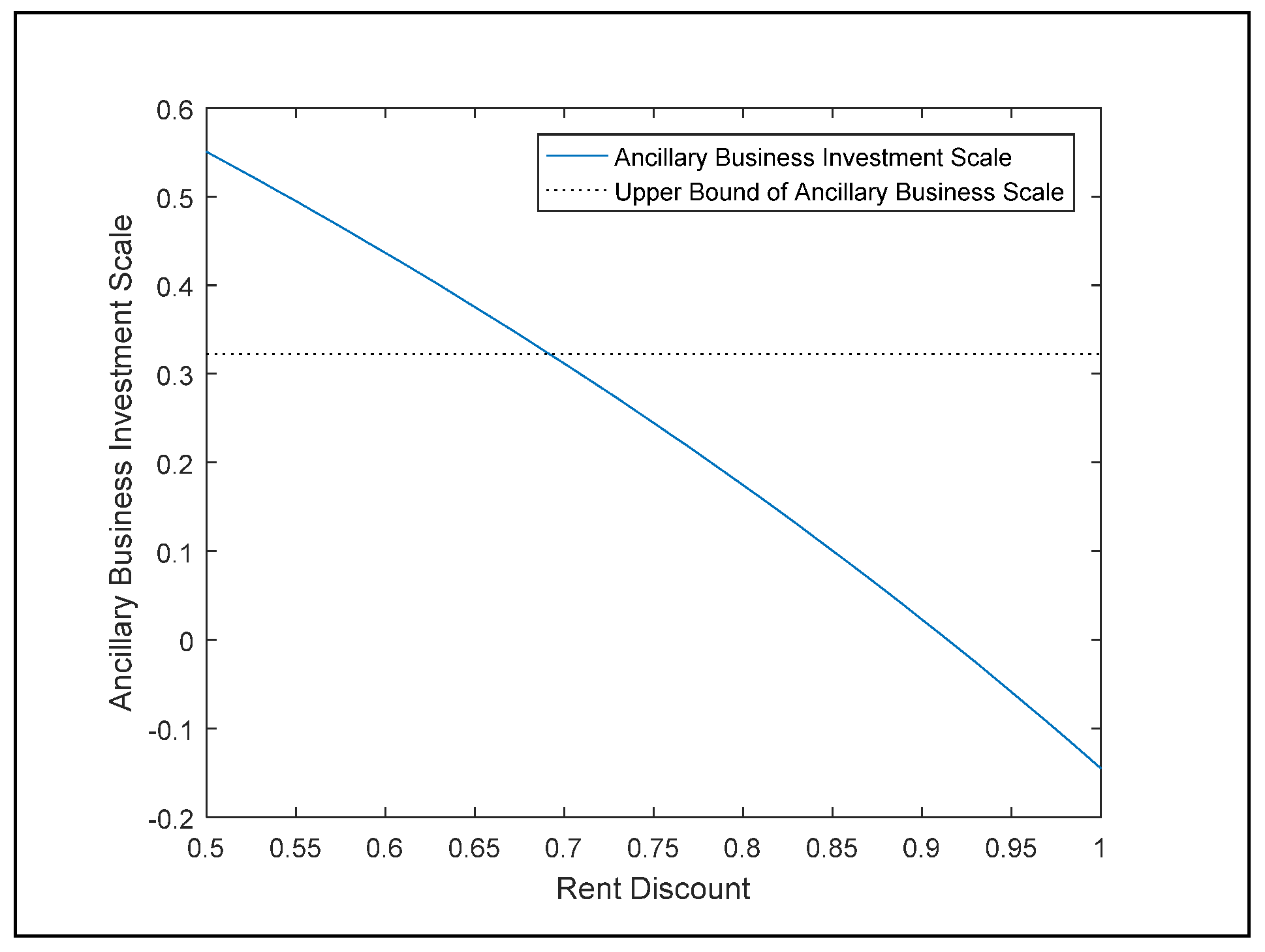

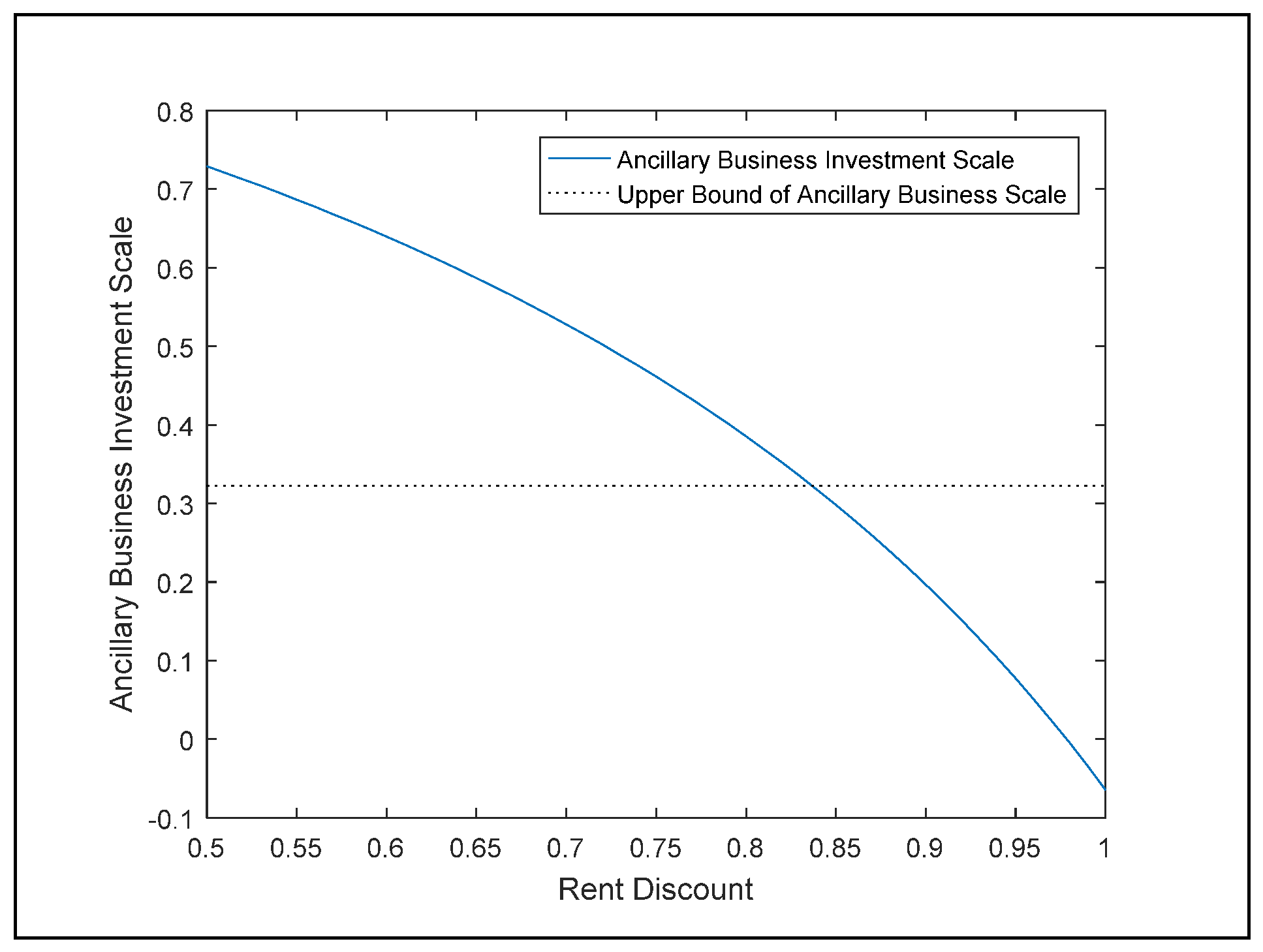

6. Ancillary Business Scale

7. Research Scope and Limitations

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- World Bank Institute. Public-Private Partnerships—Reference Guide Version 1.0; International Bank for Reconstruction and Development/International Development Association or The World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Grimsey, D.; Lewis, M.K. Public Private Partnerships: The Worldwide Revolution in Infrastructure Provision and Project Finance; Edvard Elgar: Cheltenham, UK, 2004; 288p. [Google Scholar] [CrossRef]

- Engel, E.; Fischer, R.; Galetovic, A. The Joy of Flying: Efficient Airport PPP Contracts. Transp. Res. Part B Methodol. 2018, 114, 131–146. [Google Scholar] [CrossRef]

- Chang, C.Y.; Chou, H.Y. Dilemma of Taiwan’s Private Finance Policy and its Solutions. Constr. Manag. Q. 2011, 85, 1–13. [Google Scholar]

- Urban Development Bureau Taichung City Government (UDBTCG). Feasibility Assessment Report on BOT of Social Housing in Taichung Huilai House Section 2016. Available online: http://www.ud.taichung.gov.tw/public/Attachment/127010/7391613030.pdf (accessed on 6 June 2017).

- Zhang, X. Win-Win Concession Period Determination Methodology. J. Constr. Eng. Manag. 2009, 135, 550–558. [Google Scholar] [CrossRef]

- Carbonara, N.; Pellegrino, R. Revenue guarantee in public-private partnerships: A win-win model. Constr. Manag. Econ. 2018, 36, 584–598. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Pellegrino, R. Concession period for PPPs: A win-win model for a fair risk sharing. Int. J. Proj. Manag. 2014, 32, 1223–1232. [Google Scholar] [CrossRef]

- Carbonara, N.; Pellegrino, R. Public-private partnerships for energy efficiency projects: A win-win model to choose the energy performance contracting structure. J. Clean. Prod. 2018, 170, 1064–1075. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C.; Javed, A.A.; Ameyaw, E.E. Critical success criteria for public-private partnership projects: International experts’ opinion. Int. J. Strateg. Prop. Manag. 2017, 21, 87–100. [Google Scholar] [CrossRef]

- Al-Azemi, K.F.; Bhamra, R.; Salman, A.F.M. Risk management for build, operate and transfer (BOT) projects in Kuwait. J. Civ. Eng. Manag. 2012, 20, 415–433. [Google Scholar] [CrossRef]

- Graham, A. How important are commercial revenues to today’s airport? J. Air Transp. Manag. 2009, 15, 106–111. [Google Scholar] [CrossRef]

- Whitehead, C.; Scanlon, K. Social Housing in Europe; LSE: London, UK, 2007. [Google Scholar]

- Liu, T.; Chan, A.P.C.; Wang, S.Q. PPP Framework for Public Rental Housing Projects in China. In Proceedings of the International Conference on Construction and Real Estate Management, Kunming, China, 27–28 September 2014. [Google Scholar]

- Chen, Y.L. New Prospects for Social Rental Housing in Taiwan: The Role of Housing Affordability Crises and the Housing Movement. Int. J. Hous. Policy 2011, 11, 305–318. [Google Scholar] [CrossRef]

- Chang, C.O. The Expectations of Modern Social Housing. Architectural Institute of Taiwan. 2011, pp. 10–13. (In Chinese). Available online: http://www.architw.org.tw/ftp/magazine/mag63/p10-13.pdf (accessed on 6 June 2017).

- Qin, W.; Sanchez, A.; Alcaraz, V. Introducing public-private partnerships for affordable housing in China. Open House Int. 2017, 42, 75–81. [Google Scholar]

- Roehrich, J.K.; Lewis, M.A.; George, G. Are public-private partnerships a healthy option? A systematic literature review. Soc. Sci. Med. 2014, 113, 110–119. [Google Scholar] [CrossRef] [PubMed]

- Grimsey, D.; Lewis, M.K. Evaluating the risks of public private partnerships for infrastructure projects. Int. J. Proj. Manag. 2002, 20, 107–118. [Google Scholar] [CrossRef]

- Liou, F.M.; Chen, B. Reducing the BOT Financial Risk with Two-Stage Real Options: Using the Kaohsiung Cable Car Project in Taiwan as an Example. J. Technol. 2011, 26, 143–155. [Google Scholar]

- Tsai, W.P.; Pan, N.H.; Hsieh, B.M. Investment Risk Assessments of BOT Project- A Case Study of Yamay Resort. J. Stat. Manag. Syst. 2012, 15, 261–280. [Google Scholar] [CrossRef]

- Shahrara, N.; Çelik, T.; Gandomi, A.H. Risk analysis of BOT contracts using soft computing. J. Civ. Eng. Manag. 2017, 23, 232–240. [Google Scholar] [CrossRef]

- Doloi, H. Understanding impacts of time and cost related construction risks on operational performance of PPP projects. Int. J. Strateg. Prop. Manag. 2012, 16, 316–337. [Google Scholar] [CrossRef]

- Jun, J. Appraisal of combined agreements in BOT project finance: Focused on minimum revenue guarantee and revenue cap agreements. Int. J. Strateg. Prop. Manag. 2010, 14, 139–155. [Google Scholar] [CrossRef]

- Sanni, G.A.; Adebiyi, J.O. Performance Risks Allocation in BOT Infrastructure in Nigeria: A Case Study of Lagos Infrastructure Project. J. Built Environ. 2017, 5, 43–57. [Google Scholar] [CrossRef]

- Li, D.; Chen, Y.; Chen, H.; Hui, E.C.M.; Guo, K. Evaluation and Optimization of the Financial Sustainability of Public Rental Housing Projects: A Case Study in Nanjing, China. Sustainability 2016, 8, 330. [Google Scholar] [CrossRef]

- Xu, Y.; Peng, Y.; Qian, K.; Chan, A.P.C. An Alternative Model to Determine the Financing Structure of PPP-Based Young Graduate Apartments in China: A Case Study of Hangzhou. Sustainability 2015, 7, 5720–5734. [Google Scholar] [CrossRef] [Green Version]

- Chang, L.M.; Chen, P.H. BOT Financial Model: Taiwan High Speed Rail Case. J. Constr. Eng. Manag. 2001, 127. [Google Scholar] [CrossRef]

- Huang, Y.L.; Pi, C.C. Valuation of Multi-Stage BOT Projects Involving Dedicated Asset Investments: A Sequential Compound Option Approach. Constr. Manag. Econ. 2009, 27, 653–666. [Google Scholar] [CrossRef]

- Finnerty, J.D. Project financing: Asset-Based Financial Engineering; John Wiley & Sons, Inc.: New York, NY, USA, 1996. [Google Scholar]

- Wang, R.H. A Study on Royalty of Private Participation in Infrastructure. Master’s Thesis, University of NCCU, Taipei, Taiwan, 2003. (In Chinese). [Google Scholar]

- Wu, S.Y. Royalty Models for the BOT Projects of Transportation Infrastructures. Master’s Thesis, University of NCTU, Hsinchu, Taiwan, 2002. (In Chinese). [Google Scholar]

- Chiou, Y.C.; Shen, C.M. Royalty Models for Transportation Infrastructure BOT Projects under Uncertain Environment. J. Chin. Inst. Transp. 2004, 17, 123–146. (In Chinese) [Google Scholar]

- Hsiao, H.Y. Royalty Models for the Transportation Infrastructure BOT Projects with Consideration of Managerial Flexibility-Application of Real Options. Master’s Thesis, University of NCTU, Hsinchu, Taiwan, 2004. (In Chinese). [Google Scholar]

- Kang, C.C.; Feng, C.M.; Huang, S.C. Modeling the Concession Fee for BOT Projects from the Government’s View point. J. Manag. 2004, 22, 173–189. [Google Scholar]

- Kang, C.C.; Feng, C.M.; Huang, S.C. A New Financial Engineering Model for Analyzing the Royalty of BOT Projects: The Taiwan Case. In Proceedings of the International Conference on Industrial Engineering and Engineering Management, Singapore, 2–4 December 2007; IEEE: Piscataway, NJ, USA, 2007; pp. 277–281. [Google Scholar]

- Chiou, Y.C.; Lan, L.W. Royalty Models for Build-Operate-Transfer Transportation Projects with Uncertainties. Transportmetrica 2006, 2, 175–197. [Google Scholar] [CrossRef]

- Kang, C.C.; Feng, C.M.; Kuo, C.Y. A Royalty Negotiation Model for BOT Projects: A Bi-Level Programming approach. In Proceedings of the International Conference on Industrial Engineering and Engineering Management, Singapore, 8–11 December 2008; IEEE: Piscataway, NJ, USA, 2008; pp. 1764–1768. [Google Scholar]

- Kang, C.C.; Feng, C.M.; Kuo, C.Y. A Royalty Negotiation Model for BOT (build-operate-transfer) Projects: The operational revenue-based model. Math. Comput. Model. 2011, 54, 2338–2347. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Pellegrino, R. A transaction costs-based model to choose PPP procurement procedures. Eng. Constr. Archit. Manag. 2016, 23, 491–510. [Google Scholar] [CrossRef]

- Soliño, A.S.; de Santos, P.G. Influence of the Tendering Mechanism in the Performance of Public-Private Partnerships: A Transaction Cost Approach. Public Perform. Manag. Rev. 2016, 40, 97–118. [Google Scholar] [CrossRef]

- Siemonsma, H.; Van Nus, W.; Uyttendaele, P. Awarding of Port PPP contracts: The added value of a competitive dialogue procedure. Marit. Policy Manag. 2012, 39, 63–78. [Google Scholar] [CrossRef]

- Vinogradov, D.; Shadrina, E. Public-Private Partnerships as Collaborative Projects: Testing the Theory on Cases from RU and Russia. Int. J. Public Adm. 2018, 41, 446–459. [Google Scholar] [CrossRef]

- Shen, L.Y.; Li, H.; Li, Q.M. Alternative Concession Model for Build Operate Transfer Contract Projects. J. Constr. Eng. Manag. 2002, 128. [Google Scholar] [CrossRef]

- Hanaoka, S.; Palapus, H.P. Reasonable concession period for build-operate-transfer road projects in the Philippines. Int. J. Proj. Manag. 2012, 30, 938–949. [Google Scholar] [CrossRef]

- Zhang, X.; Bao, H.; Wang, H.; Skitmore, M. A model for determining the optimal project life and concession period of BOT projects. Int. J. Proj. Manag. 2016, 34, 523–532. [Google Scholar] [CrossRef]

- Liou, F.M.; Huang, C.P. Automated Approach to Negotiations of BOT Contracts with the Consideration of Project Risk. J. Constr. Eng. Manag. 2008, 134, 0733–9364. [Google Scholar] [CrossRef]

- Lo, L.W.; Wang, C.F. The Operating Strategy for Subsidiary Business of Mass Rapid Transit System-Exemplified by TamshiuLine of Taipei Mass Rapid Transit System. Master’s Thesis, University of NCTU, Hsinchu, Taiwan, 1995. (In Chinese). [Google Scholar]

- Chen, Y.L.; Huang, Y.L. Land-Grant-Related Investments and Privatized Infrastructure Investments. Master’s Thesis, University of NCTU, Hsinchu, Taiwan, 2002. (In Chinese). [Google Scholar]

- Chiang, C.M. Policy Review: Government Intervention in Housing: The Case of Macao. Hous. Stud. 2005, 20, 149–155. [Google Scholar]

- Regarding the reasonable of Public Service Facilities by BOT. Research, Development and Evaluation Commission Taipei City Government, 2011. Available online: http://rdnet.taipei.gov.tw/xDCM/DOFiles/pdf/00/00/01/69/84/1000119-pdf-testproj-153711.pdf (accessed on 6 May 2017).

- Chien, L.F.; Lai, T.Y. A Review of Private Participation in Public Transportation Projects in Terms of the Interactive Effects of Authority and Agency. Soochow J. Political Sci. 2007, 25, 179–217. [Google Scholar]

- Fatma, A.E.A. Linear projects scheduling using spreadsheets features. Alex. Eng. J. 2011, 50, 179–185. [Google Scholar] [Green Version]

| Symbol | Definition |

|---|---|

| NPV | Net present value |

| IRR | Internal rate of return |

| DPB | Discounted payback |

| SLR | Self-Liquidating ratio |

| B | Total floor area |

| L | Required floor area of principal business |

| x | Ratio of ancillary business to project in total floor area |

| n | Concession period (years) |

| t | time |

| CTotal | Total construction cost and land use rent per square meter |

| CS | Construction cost of principal business and land use rent per square meter |

| Cp | Construction cost of ancillary business and land use rent per square meter |

| Depreciation of principal business per square meter | |

| Depreciation of ancillary business per square meter | |

| W | The sum of present value of the royalty |

| wt | The present value of the annual royalty at time t |

| ks | Average net income of principal business per square meter |

| Vs | Monthly net rent income of principal per square meter |

| Ms | Monthly net property management income of principal per square meter |

| Ps | Monthly net parking lot income per square meter |

| kp | Average net income of ancillary business per square meter |

| Hp | Monthly net hotel income per square meter |

| Vp | Monthly net shopping mall income per square meter |

| Mp | Monthly net property management income of ancillary per square meter |

| Yp | Monthly net parking lot income of ancillary business per square meter |

| NPR | Expected Net after-tax Profit, Margin of business |

| Expected Net after-tax Profit Margin of principal business | |

| D | After-rent-discount percentage |

| Expected Net after-tax Profit Margin of ancillary business | |

| Taxrate | Income tax rate on the BOT project’s income |

| Equity capital cost | |

| The risk-free interest rate | |

| The beta (β) coefficient of investment assets | |

| The expected rate of return on the market | |

| WACC | Weighted average cost of capital |

| The discount rate | |

| The weight of equity | |

| The weight of debt | |

| Mortgage Constant |

| Room Type | Percentage (%) | Indoor Net Area (m2) | Number of Room |

|---|---|---|---|

| Single | 40 | 19.8–29.8 | 300 in total |

| Double | 40 | 49.6–59.5 | |

| Triple | 20 | 79.3–89.3 |

| Room Type | Percentage (%) | Monthly Rent (USD per m2) | Monthly Administrative Expense (USD per m2) |

|---|---|---|---|

| Single | 40 | 8.6 | 0.5 |

| Double | 40 | 7.4 | |

| Triple | 20 | 7.2 |

| Season Type | Percentage of Days (%) | Occupancy Rate (%) | Monthly Rent (USD per m2) | Monthly Administrative Expense (USD per m2) |

|---|---|---|---|---|

| Low | 72 | 60 | 58.9 | 0.5 |

| High | 28 | 85 | 71 |

| Net Income (USD per m2) | Monthly Administrative Expense (USD per m2) |

|---|---|

| 304.4 | 0.5 |

| Investment Ratio (%) | 7-yearNPR p (%) | 17year NPR p (%) | |

|---|---|---|---|

| Shopping Mall | 15 | 12.80 | 6.70 |

| Hotel | 85 | 10.53 | 9.13 |

| Portfolio | 100 | 10.87 | 8.77 |

| Start/End Year | Period (Year) | Rate of Return on the Market |

|---|---|---|

| 2016 | 1 | 10.97% |

| 2014–2016 | 3 | 2.88% |

| 2012–2016 | 5 | 5.87% |

| 2000–2016 | 17 | 4.41% |

| Investment Ratio (%) | 7-year β Coefficient | Expected Rate of Return (%) | 17-year β Coefficient | Expected Rate of Return (%) | |

|---|---|---|---|---|---|

| Shopping Mall | 15 | 0.7652 | 4.21 | 0.7119 | 3.58 |

| Hotel | 85 | 0.9324 | 3.73 | 0.7435 | 3.67 |

| Portfolio | 100 | 0.9073 | 4.14 | 0.7387 | 3.66 |

| Owned Capital Ratio (%) | Owned Capital Cost (%) | Financing Ratio (%) | MC (%) | WACC (%) | |

|---|---|---|---|---|---|

| Given 7-year Expected Rate of Return | 30 | 4.14 | 70% | 2.5 | 2.92 |

| Given 17-year Expected Rate of Return | 30 | 3.66 | 70% | 2.5 | 2.85 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, C.-Y.; Dzeng, R.-J. Evaluating Ancillary Business Scale for PPP-BOT Projects: A Social Housing BOT Case in Taiwan. Sustainability 2019, 11, 1415. https://doi.org/10.3390/su11051415

Huang C-Y, Dzeng R-J. Evaluating Ancillary Business Scale for PPP-BOT Projects: A Social Housing BOT Case in Taiwan. Sustainability. 2019; 11(5):1415. https://doi.org/10.3390/su11051415

Chicago/Turabian StyleHuang, Chih-Yao, and Ren-Jye Dzeng. 2019. "Evaluating Ancillary Business Scale for PPP-BOT Projects: A Social Housing BOT Case in Taiwan" Sustainability 11, no. 5: 1415. https://doi.org/10.3390/su11051415