Discovering Potential Technology Opportunities for Fuel Cell Vehicle Firms: A Multi-Level Patent Portfolio-Based Approach

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Topic Analysis

3.2. Technical Specialization

3.3. Evaluation Indicators

3.4. Multidimensional Scaling

3.5. Local Outlier Factor

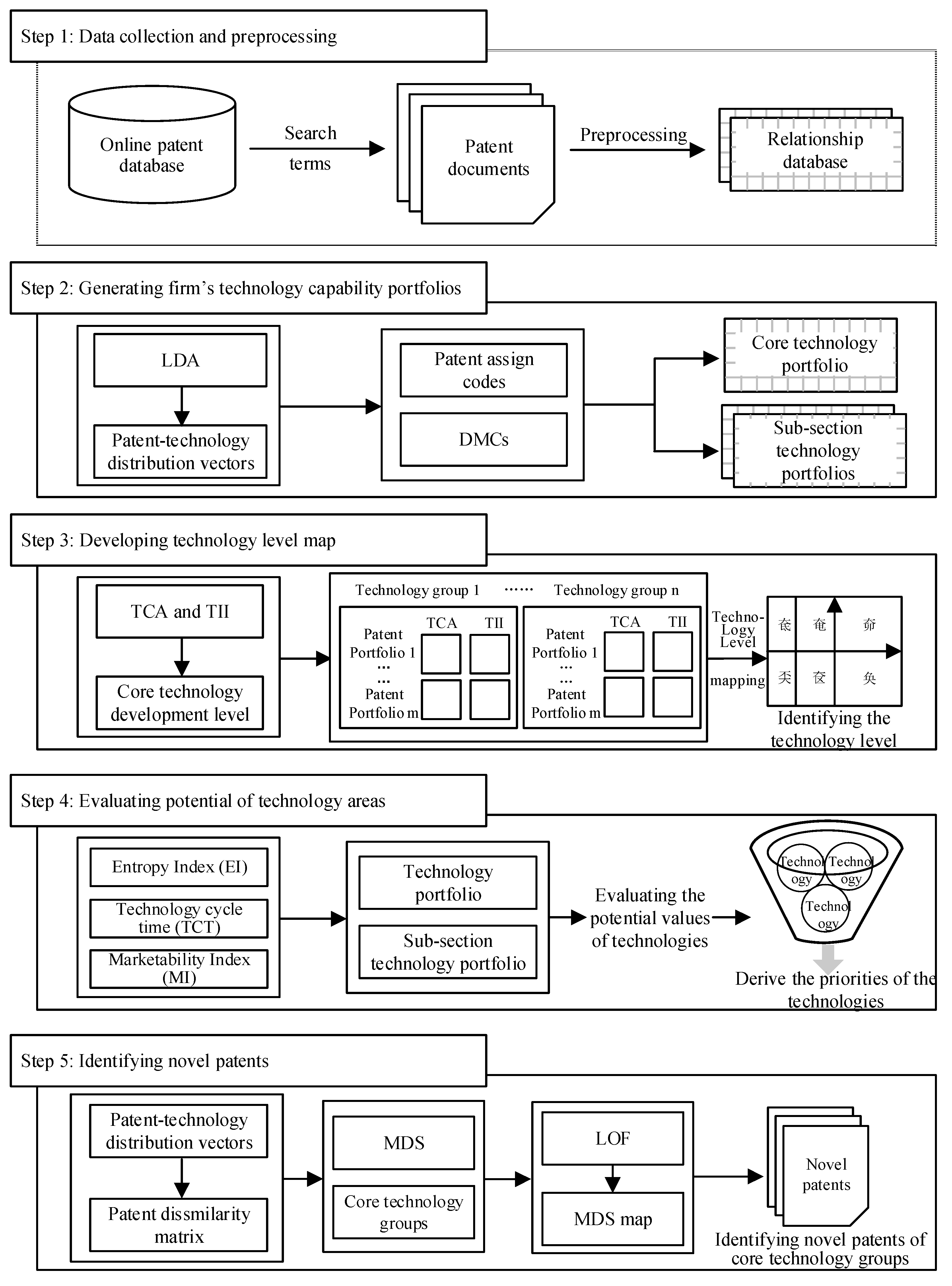

4. A Multi-Level Framework Based on Patent Portfolio Analysis for Identifying a Firm’s Technology Opportunities

4.1. Data Collection and Pre-Processing

4.2. Generating the Firm’s Technology Capability Portfolios

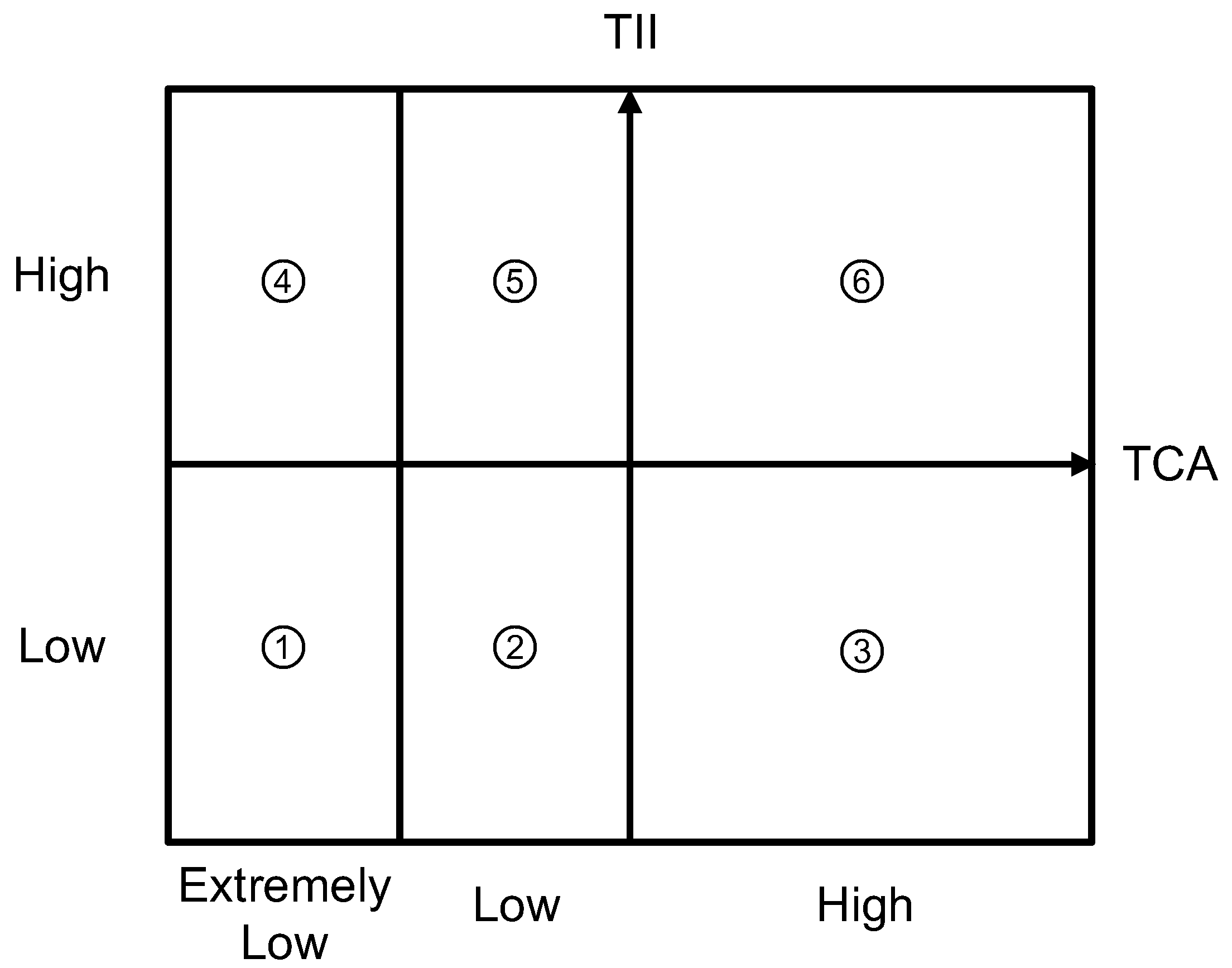

4.3. Developing Technology Level Map

4.4. Evaluating the Potential of Technology Areas

4.5. Identifying Novel Patents

5. Illustration and Discussion

5.1. Data

5.2. Identifying Technology Portfolio of Firm X

5.3. Constructing Technology Level Map of Firm X

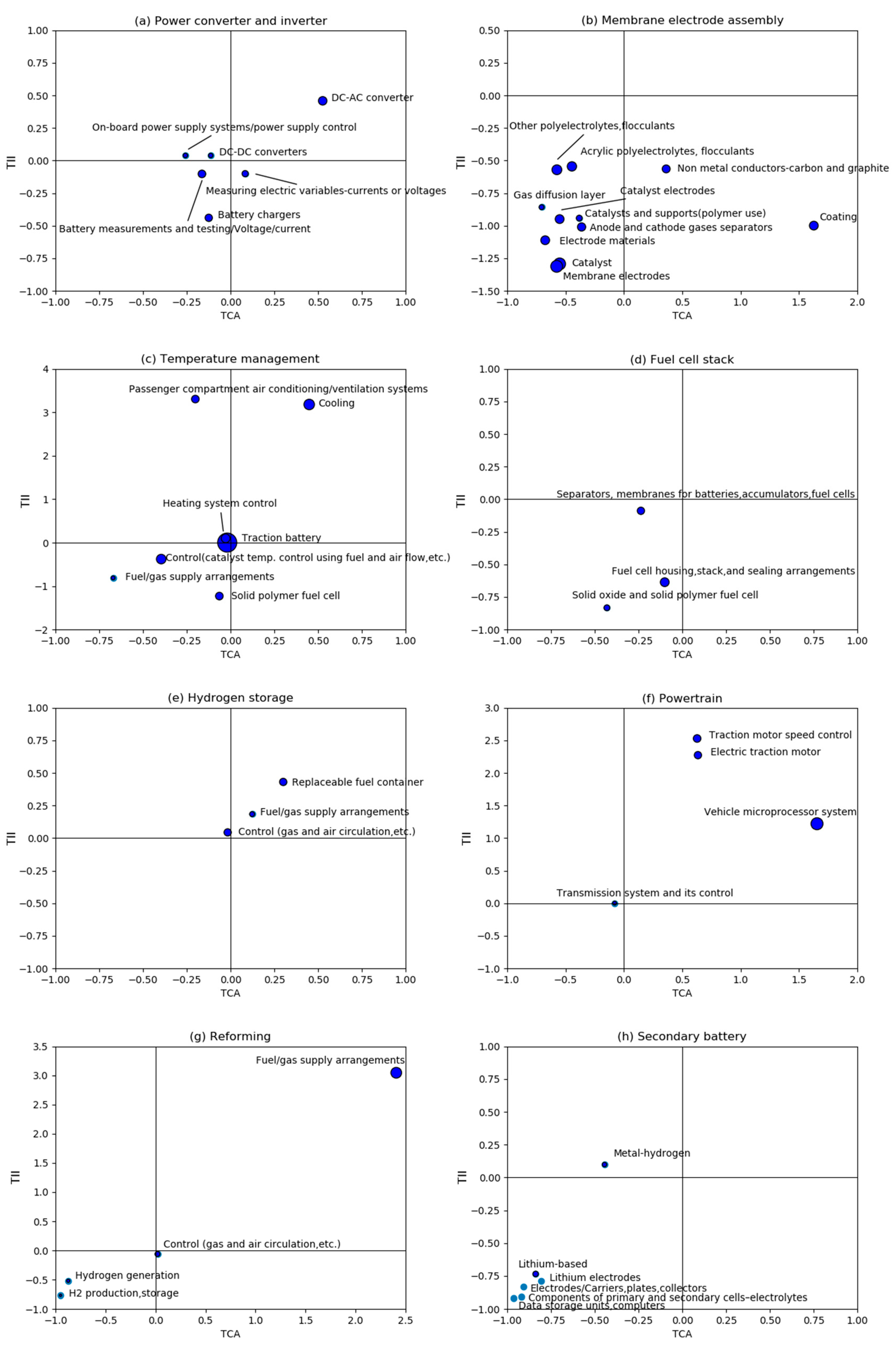

5.4. Evaluating Potential Technology Areas of Firm X

5.5. Discovering Novel Patents of Firm X

6. Conclusion

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Tech. group 1 | Tech. group 2 | Tech. group 3 | Tech. group 4 | ||||

| Power converter and inverter | Membrane electrode assembly | Temperature management | Fuel cell stack | ||||

| Word | Prob. | Word | Prob. | Word | Prob. | Word | Prob. |

| voltage | 0.0260 | membrane | 0.0170 | temperature | 0.0129 | cell stack | 0.0144 |

| circuit | 0.0187 | electrolyte | 0.0166 | heat | 0.0117 | stack | 0.0144 |

| converter | 0.0185 | polymer | 0.0165 | air | 0.0115 | fuel cell stack | 0.0143 |

| switch | 0.0170 | electrode | 0.0160 | pump | 0.0109 | end plate | 0.0134 |

| charging | 0.0163 | catalyst | 0.0155 | valve | 0.0105 | port | 0.0114 |

| power supply | 0.0138 | layer | 0.0151 | water | 0.0101 | lamination | 0.0113 |

| control unit | 0.0137 | polymer electrolyte | 0.0138 | flow | 0.0099 | lamination direction | 0.0109 |

| direct current | 0.0130 | electrode assembly | 0.0126 | cooling | 0.0096 | surface | 0.0102 |

| inverter | 0.0126 | catalyst layer | 0.0124 | heater | 0.0094 | magnet | 0.0092 |

| output voltage | 0.0126 | membrane electrode assembly | 0.0122 | exchanger | 0.0084 | cooling | 0.090 |

| Tech. group 5 | Tech. group 6 | Tech. group 7 | Tech. group 8 | ||||

| Hydrogen storage | Powertrain | Reforming | Secondary battery | ||||

| Word | Prob. | Word | Prob. | Word | Prob. | Word | Prob. |

| tank | 0.0205 | motor | 0.0143 | reaction | 0.0159 | lithium | 0.0230 |

| pressure | 0.0171 | engine | 0.0137 | reforming | 0.0133 | secondary battery | 0.0195 |

| hydrogen | 0.0144 | torque | 0.0134 | carbon | 0.0130 | lithium ion | 0.0186 |

| valve | 0.0128 | wheel | 0.0129 | gas | 0.0125 | negative electrode | 0.0174 |

| high pressure | 0.0112 | control system | 0.0123 | modification | 0.0117 | positive electrode | 0.0163 |

| Gas | 0.0112 | speed | 0.0122 | reformed gas | 0.0107 | active material | 0.0157 |

| hydrogen gas | 0.0109 | generator | 0.0100 | chemical reaction | 0.0105 | collector | 0.0151 |

| control part | 0.0106 | shaft | 0.0099 | reactive | 0.0102 | electrode active material | 0.0128 |

| vessel | 0.0105 | electric motor | 0.0095 | electrochemical | 0.0102 | material | 0.0127 |

| filling | 0.0096 | rotation | 0.0093 | electrochemical reaction | 0.0101 | lithium ion secondary battery | 0.0126 |

| Competitiveness | Technology Cycle Time | Marketability | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Tech. Group | Tech. Code | Tech. Title | Tech. Grade | EI | Z-Score | TCT | Z-Score | MI | Z-Score | Average Z-Score |

| Power converter and inverter | S01-D01 | Measuring electric variables-currents or voltages | ③ | 0.915 | 65.914 | 3.214 | 62.916 | 3.25 | 49.985 | 59.605 |

| X16-H03 | Battery measurements and testing/ Voltage/current | ② | 0.788 | 55.336 | 4.4 | 47.644 | 3.417 | 57.753 | 53.578 | |

| X21-B01B | On-board power supply systems/power supply control | ⑤ | 0.686 | 46.916 | 5 | 39.917 | 3.5 | 61.614 | 49.482 | |

| U24-D05 | DC-AC converter | ⑥ | 0.728 | 50.396 | 4.577 | 45.364 | 3.267 | 50.775 | 48.845 | |

| X16-G | Battery chargers | ② | 0.711 | 48.975 | 3.111 | 64.242 | 2.818 | 29.89 | 47.702 | |

| U24-D02 | DC-DC converters | ⑤ | 0.511 | 32.463 | 5 | 39.917 | 3.25 | 49.985 | 40.788 | |

| Membrane electrode assembly | X16-E06A5E | Gas diffusion layer | ① | 0.914 | 57.957 | 2 | 66.078 | 3 | 52.549 | 58.861 |

| X16-E06A1 | Electrode materials | ① | 0.925 | 60.907 | 3.417 | 47.218 | 3.188 | 60.372 | 56.166 | |

| X16-C16 | Anode and cathode gases separators | ② | 0.941 | 64.96 | 3.625 | 44.45 | 3.071 | 55.504 | 54.971 | |

| A12-M02 | Other polyelectrolytes, flocculants | ① | 0.891 | 52.022 | 3.818 | 41.881 | 3.15 | 58.791 | 50.898 | |

| X16-E06A5A | Catalyst | ① | 0.879 | 48.986 | 3.167 | 50.546 | 2.897 | 48.263 | 49.265 | |

| A12-W11K | Catalysts and supports (polymer use) | ② | 0.799 | 28.495 | 1.333 | 74.955 | 2.714 | 40.647 | 48.032 | |

| A12-M01 | Acrylic polyelectrolytes, flocculants | ② | 0.861 | 44.441 | 3.9 | 40.79 | 3.111 | 57.168 | 47.466 | |

| L03-E04B2 | Membrane electrodes | ① | 0.928 | 61.645 | 3.625 | 44.45 | 2.586 | 35.32 | 47.138 | |

| A11-B05 | Coating | ③ | 0.865 | 45.432 | 3.889 | 40.936 | 3 | 52.549 | 46.306 | |

| L03-A02B | Nonmetal conductors-carbon and graphite | ③ | 0.921 | 59.754 | 3.333 | 48.336 | 2.462 | 30.16 | 46.083 | |

| L03-E04B1 | Catalyst electrodes | ① | 0.839 | 38.825 | 3.389 | 47.591 | 2.813 | 44.767 | 43.728 | |

| Temperature management | X16-C01C | Solid polymer fuel cell | ② | 1.015 | 70.603 | 3.250 | 59.756 | 2.917 | 57.843 | 62.734 |

| T01-J07D1 | Heating system control | ⑤ | 0.765 | 36.535 | 3.550 | 56.771 | 3.063 | 66.963 | 53.423 | |

| X16-C09 | Control (catalyst temp. control using fuel and air flow, etc.) | ② | 0.823 | 44.487 | 4 | 52.293 | 2.895 | 56.469 | 51.083 | |

| X21-C02 | Passenger compartment air conditioning/ventilation systems | ⑤ | 0.897 | 54.568 | 3.778 | 54.502 | 2.583 | 36.981 | 48.684 | |

| X16-K01 | Cooling | ⑥ | 0.818 | 43.804 | 3.684 | 55.437 | 2.652 | 41.291 | 46.844 | |

| X16-C15A | Fuel/gas supply arrangements | ① | 0.875 | 51.512 | 5 | 42.342 | 2.667 | 42.228 | 45.361 | |

| X21-B01A | Traction battery | ⑤ | 0.852 | 48.491 | 6.351 | 28.899 | 2.763 | 48.224 | 41.871 | |

| Fuel cell stack | X16-C01 | Solid oxide and solid polymer fuel cell | ② | 0.729 | 36.624 | 2.5 | 63.821 | 2.714 | 62.381 | 54.276 |

| A12-E06B | Separators, membranes for batteries, accumulators, fuel cells | ② | 0.821 | 60.665 | 3.5 | 45.683 | 2.636 | 49.731 | 52.026 | |

| X16-C18 | Fuel cell housing, stack, and sealing arrangements | ② | 0.791 | 52.711 | 3.786 | 40.496 | 2.563 | 37.891 | 43.699 | |

| Hydrogen storage | X16-C09 | Control (gas and air circulation, etc.) | ⑤ | 0.663 | 48.564 | 3 | 61.908 | 2.455 | 42.929 | 51.134 |

| X16-C15A | Fuel/gas supply arrangements | ⑥ | 0.598 | 38.534 | 3.667 | 50.652 | 2.800 | 64.142 | 51.11 | |

| X16-C15C2 | Replaceable fuel container | ⑥ | 0.757 | 62.902 | 4.45 | 37.439 | 2.455 | 42.929 | 47.757 | |

| Powertrain | T01-J07D1 | Vehicle microprocessor system | ⑤ | 0.889 | 62.214 | 3.591 | 64.077 | 3 | 48.991 | 58.427 |

| X21-A02A | Transmission system and its control | ⑥ | 0.681 | 34.458 | 4 | 54.038 | 3.667 | 65.923 | 51.473 | |

| X21-A07 | Electric traction motor | ⑥ | 0.82 | 53.032 | 4.4 | 44.22 | 2.909 | 46.681 | 47.977 | |

| X21-A04 | Traction motor speed control | ⑥ | 0.8 | 50.297 | 4.667 | 37.666 | 2.583 | 38.405 | 42.123 | |

| Reforming | X16-C15A | Fuel/gas supply arrangements | ⑥ | 0.94 | 66.643 | 4.286 | 44.688 | 2.958 | 56.957 | 56.096 |

| L03-E04I | Hydrogen generation | ① | 0.787 | 43.549 | 3.25 | 53.554 | 3 | 57.471 | 51.524 | |

| X16-C09 | Control (gas and air circulation, etc.) | ③ | 0.825 | 49.188 | 5.125 | 37.508 | 2.6 | 52.576 | 46.424 | |

| E31-A02C | H2 production, storage | ① | 0.77 | 41.013 | 2 | 64.251 | 1 | 32.996 | 46.087 | |

| Secondary battery | L03-H03A | Data storage units, computers | ① | 0.616 | 60.503 | - | - | - | - | 60.503 |

| X16-B01A3 | Metal-hydrogen | ⑤ | 0.482 | 42.224 | 3.5 | 60 | 2.5 | 60 | 54.075 | |

| L03-E01C | Components of primary and secondary cells–electrolytes | ① | 0.551 | 51.613 | - | - | - | - | 51.613 | |

| X16-B01F1 | Lithium-based | ① | 0.65 | 65.139 | 3.8 | 40 | 2.167 | 40 | 48.38 | |

| L03-E01B5B | Lithium electrodes | ① | 0.482 | 42.226 | - | - | - | - | 42.226 | |

| X16-E02 | Electrodes/Carriers, plates, collectors | ① | 0.453 | 38.295 | - | - | - | - | 38.295 | |

References

- Hu, Z.; Li, J.; Xu, L.; Song, Z.; Fang, C.; Ouyang, M.; Dou, G.; Kou, G. Multi-objective energy management optimization and parameter sizing for proton exchange membrane hybrid fuel cell vehicles. Energy Convers. Manag. 2016, 129, 108–121. [Google Scholar] [CrossRef]

- Ha, S.H.; Liu, W.; Cho, H.; Kim, S.H. Technological advances in the fuel cell vehicle: Patent portfolio management. Technol. Forecast. Soc. Chang. 2015, 100, 277–289. [Google Scholar] [CrossRef]

- Ananthachar, V.; Duffy, J.J. Efficiencies of hydrogen storage systems onboard fuel cell vehicles. Sol. Energy 2005, 78, 687–694. [Google Scholar] [CrossRef]

- Veziroglu, A.; Macario, R. Fuel cell vehicles: State of the art with economic and environmental concerns. Int. J. Hydrogen Energy 2011, 36, 25–43. [Google Scholar] [CrossRef]

- Zapata, C.; Nieuwenhuis, P. Exploring innovation in the automotive industry: New technologies for cleaner cars. J. Clean. Prod. 2010, 18, 14–20. [Google Scholar] [CrossRef]

- Van Bree, B.; Verbong, G.P.; Kramer, G.J. A multi-level perspective on the introduction of hydrogen and battery-electric vehicles. Technol. Forecast. Soc. Chang. 2010, 77, 529–540. [Google Scholar] [CrossRef]

- Porter, A.L.; Detampel, M.J. Technology opportunities analysis. Technol. Forecast. Soc. Chang. 1995, 49, 237–255. [Google Scholar] [CrossRef]

- Lee, S.; Yoon, B.; Park, Y. An approach to discovering new technology opportunities: Keyword-based patent map approach. Technovation 2009, 29, 481–497. [Google Scholar] [CrossRef]

- Jia, Y.B.; Cheng, Y.; Du, X.K.; Feng, L.J. Analysis of technology opportunities about the CBM mining method based on multidimensional technology innovation map. Procedia Eng. 2017, 174, 251–259. [Google Scholar] [CrossRef]

- Yoon, B.; Magee, C.L. Exploring technology opportunities by visualizing patent information based on generative topographic mapping and link prediction. Technol. Forecast. Soc. Chang. 2018, 132, 105–117. [Google Scholar] [CrossRef]

- Yoon, J.; Park, H.; Seo, W.; Lee, J.M.; Coh, B.Y.; Kim, J. Technology opportunity discovery (TOD) from existing technologies and products: A function-based TOD framework. Technol. Forecast. Soc. Chang. 2015, 100, 153–167. [Google Scholar] [CrossRef]

- Seo, W.; Yoon, J.; Park, H.; Coh, B.Y.; Lee, J.M.; Kwon, O.J. Product opportunity identification based on internal capabilities using text mining and association rule mining. Technol. Forecast. Soc. Chang. 2016, 105, 94–104. [Google Scholar] [CrossRef]

- Yoon, J.; Park, H.; Kim, K. Identifying technological competition trends for R&D planning using dynamic patent maps: SAO-based content analysis. Scientometrics 2013, 94, 313–331. [Google Scholar]

- Yoon, J.; Seo, W.; Coh, B.Y.; Song, I.; Lee, J.M. Identifying product opportunities using collaborative filtering-based patent analysis. Comput. Ind. Eng. 2017, 107, 376–387. [Google Scholar] [CrossRef]

- Chang, S.H.; Fan, C.Y. Identification of the technology life cycle of telematics: A patent-based analytical perspective. Technol. Forecast. Soc. Chang. 2016, 105, 1–10. [Google Scholar] [CrossRef]

- Haupt, R.; Kloyer, M.; Lange, M. Patent indicators for the technology life cycle development. Res. Policy 2007, 36, 387–398. [Google Scholar] [CrossRef]

- Ardito, L.; D’Adda, D.; Petruzzelli, A.M. Mapping innovation dynamics in the Internet of Things domain: Evidence from patent analysis. Technol. Forecast. Soc. Chang. 2018, 136, 317–330. [Google Scholar] [CrossRef]

- Choi, S.; Yoon, J.; Kim, K.; Lee, J.Y.; Kim, C.H. SAO network analysis of patents for technology trends identification: A case study of polymer electrolyte membrane technology in proton exchange membrane fuel cells. Scientometrics 2011, 88, 863. [Google Scholar] [CrossRef]

- Lee, C.; Kang, B.; Shin, J. Novelty-focused patent mapping for technology opportunity analysis. Technol. Forecast. Soc. Chang. 2015, 90, 355–365. [Google Scholar] [CrossRef]

- Jun, S.; Park, S.S.; Jang, D.S. Technology forecasting using matrix map and patent clustering. Ind. Manag. Data Syst. 2012, 112, 786–807. [Google Scholar]

- Zhou, X.; Zhang, Y.; Porter, A.L.; Guo, Y.; Zhu, D. A patent analysis method to trace technology evolutionary pathways. Scientometrics 2014, 100, 705–721. [Google Scholar] [CrossRef]

- Geum, Y.; Jeon, J.; Seol, H. Identifying technological opportunities using the novelty detection technique: A case of laser technology in semiconductor manufacturing. Technol. Anal. Strateg. Manag. 2013, 25, 1–22. [Google Scholar] [CrossRef]

- Yoon, B.; Park, I.; Coh, B.Y. Exploring technological opportunities by linking technology and products: Application of morphology analysis and text mining. Technol. Forecast. Soc. Chang. 2014, 86, 287–303. [Google Scholar] [CrossRef]

- Park, H.; Ree, J.J.; Kim, K. Identification of promising patents for technology transfers using TRIZ evolution trends. Expert Syst. Appl. 2013, 40, 736–743. [Google Scholar] [CrossRef]

- Park, Y.; Yoon, J. Application technology opportunity discovery from technology portfolios: Use of patent classification and collaborative filtering. Technol. Forecast. Soc. Chang. 2017, 118, 170–183. [Google Scholar] [CrossRef]

- Mun, C.; Kim, Y.; Yoo, D.; Yoon, S.; Hyun, H.; Raghavan, N.; Park, H. Discovering business diversification opportunities using patent information and open innovation cases. Technol. Forecast. Soc. Chang. 2019, 139, 144–154. [Google Scholar] [CrossRef]

- Lee, J.; Kim, C.; Shin, J. Technology opportunity discovery to R&D planning: Key technological performance analysis. Technol. Forecast. Soc. Chang. 2017, 119, 53–63. [Google Scholar]

- Frishammar, J.; Lichtenthaler, U.; Rundquist, J. Identifying technology commercialization opportunities: The importance of integrating product development knowledge. J. Prod. Innov. Manag. 2012, 29, 573–589. [Google Scholar] [CrossRef]

- Jeong, Y.; Park, I.; Yoon, B. Identifying emerging Research and Business Development (R&BD) areas based on topic modeling and visualization with intellectual property right data. Technol. Forecast. Soc. Chang. 2019, 146, 655–672. [Google Scholar]

- Brockhoff, K.K. Instruments for patent data analyses in business firms. Technovation 1992, 12, 41–59. [Google Scholar] [CrossRef]

- Ernst, H. Patent portfolios for strategic R&D planning. J. Eng. Technol. Manag. 1998, 15, 279–308. [Google Scholar]

- Ernst, H. Patent information for strategic technology management. World Pat. Inf. 2003, 25, 233–242. [Google Scholar] [CrossRef]

- Fabry, B.; Ernst, H.; Langholz, J.; Köster, M. Patent portfolio analysis as a useful tool for identifying R&D and business opportunities—An empirical application in the nutrition and health industry. World Pat. Inf. 2006, 28, 215–225. [Google Scholar]

- Lin, B.W.; Chen, C.J.; Wu, H.L. Patent portfolio diversity, technology strategy, and firm value. IEEE Trans. Eng. Manag. 2006, 53, 17–26. [Google Scholar]

- Momeni, A.; Rost, K. Identification and monitoring of possible disruptive technologies by patent-development paths and topic modeling. Technol. Forecast. Soc. Chang. 2016, 104, 16–29. [Google Scholar] [CrossRef]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Jeong, B.; Yoon, J. Competitive intelligence analysis of augmented reality technology using patent information. Sustainability 2017, 9, 497. [Google Scholar] [CrossRef]

- Furukawa, T.; Mori, K.; Arino, K.; Hayashi, K.; Shirakawa, N. Identifying the evolutionary process of emerging technologies: A chronological network analysis of World Wide Web conference sessions. Technol. Forecast. Soc. Chang. 2015, 91, 280–294. [Google Scholar] [CrossRef]

- Uchida, Y.; Cook, P. The transformation of competitive advantage in East Asia: An analysis of technological and trade specialization. World Dev. 2005, 33, 701–728. [Google Scholar] [CrossRef]

- Acar, W.; Sankaran, K. The myth of the unique decomposability: Specializing the Herfindahl and entropy measures? Strateg. Manag. J. 1999, 20, 969–975. [Google Scholar] [CrossRef]

- Kayal, A.A.; Waters, R.C. An empirical evaluation of the technology cycle time indicator as a measure of the pace of technological progress in superconductor technology. IEEE Trans. Eng. Manag. 1999, 46, 127–131. [Google Scholar] [CrossRef]

- Narin, F. Technology indicators and corporate strategy. Rev. Bus. 1993, 14, 19–23. [Google Scholar]

- Sagarra, M.; Mar-Molinero, C.; García-Cestona, M. Spanish savings banks in the credit crunch: Could distress have been predicted before the crisis? A multivariate statistical analysis. Eur. J. Financ. 2015, 21, 195–214. [Google Scholar]

- Weiwei, X.; Liya, S.; Xiang, W. Human motion behavior segmentation based on local outlier factor. Open Autom. Control Syst. J. 2015, 7, 540–551. [Google Scholar] [CrossRef]

- Domingues, R.; Filippone, M.; Michiardi, P.; Zouaoui, J. A comparative evaluation of outlier detection algorithms: Experiments and analyses. Pattern Recognit. 2018, 74, 406–421. [Google Scholar] [CrossRef]

- Wang, H.; Chi, Y.; Hsin, P. Constructing patent maps using text mining to sustainably detect potential technological opportunities. Sustainability 2018, 10, 3729. [Google Scholar] [CrossRef] [Green Version]

- Wang, B.; Liu, S.; Ding, K.; Liu, Z.; Xu, J. Identifying technological topics and institution-topic distribution probability for patent competitive intelligence analysis: A case study in LTE technology. Scientometrics 2014, 101, 685–704. [Google Scholar] [CrossRef]

| Item | Patent Number | Outlierness | Tech. Group | Num. of Patent Countries | Application Year |

|---|---|---|---|---|---|

| a | US212757 | 2.626 | Fuel cell stack | 2 | 2017 |

| b | US383125 | 2.242 | Fuel cell stack | 3 | 2016 |

| c | US383154 | 1.99 | Fuel cell stack | 1 | 2016 |

| d | US229864 | 1.386 | Powertrain | 3 | 2016 |

| e | US950780 | 1.039 | Temperature management | 3 | 2015 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shi, X.; Cai, L.; Song, H. Discovering Potential Technology Opportunities for Fuel Cell Vehicle Firms: A Multi-Level Patent Portfolio-Based Approach. Sustainability 2019, 11, 6381. https://doi.org/10.3390/su11226381

Shi X, Cai L, Song H. Discovering Potential Technology Opportunities for Fuel Cell Vehicle Firms: A Multi-Level Patent Portfolio-Based Approach. Sustainability. 2019; 11(22):6381. https://doi.org/10.3390/su11226381

Chicago/Turabian StyleShi, Xuan, Lingfei Cai, and Hongfang Song. 2019. "Discovering Potential Technology Opportunities for Fuel Cell Vehicle Firms: A Multi-Level Patent Portfolio-Based Approach" Sustainability 11, no. 22: 6381. https://doi.org/10.3390/su11226381