1. Introduction

In recent years, with the development of Chinese industry and the growth of consumer levels, the economy has grown rapidly, and behind this economic development, the greenhouse effect and environmental pollution have been an unneglectable problem; the emission reduction of the electrical industry is its most critical part. Although the proportion of coal consumption in China has been decreasing in recent years, China will still use a large amount of coal due to the scarcity of environmental resources in the future, which will inevitably lead to the emission of carbon dioxide and other pollutants. To control carbon emissions and pollution emissions, the Chinese Government has implemented pollution rights trading (PRT) policies and carbon emissions trading (CET) policies to alleviate environmental pressure and reduce pollutant emissions. In 2011, the Chinese government issued the “notice on the implementation of pilot carbon emission trading” and approved the four municipalities directly under the central government to carry out carbon emission trading pilots [

1]. In the carbon emission reduction program of the 13th five year plan, it is clearly proposed that the ultra-low emissions from coal power should reach the level of gas and electricity [

2]. By the end of 2018, China had opened eight pilot projects, with Fujian adding new ones, gradually moving towards a nationwide carbon trading policy [

3]. For pollutant rights trading (PRT), China’s first emission trading center was established by Jiaxing in 2007, marking the gradual institutionalization, standardization, and internationalization of China’s emission trading [

4]. In Chongqing, the pollution rights trading (PRT) was launched in 2009, and the paid use and trading of pollutant discharge rights were fully implemented in 2015. With the establishment of the CET market and PRT market, the effectiveness and design of CET and PRT have inevitably become the focus of attention.

Since the adoption of the Kyoto protocol, many scholars and experts have paid attention to this hot topic. Galinis et al. [

5] described a CGE model to study the impact of different transaction scenarios on Lithuania’s economy and environment. Then, in 2005, the European Union established the European Union Emission Trading Scheme (EU ETS). In the process of research, Stern [

6] stated that the carbon trading mechanism is better than the carbon tax policy. After that, Linares et al. [

7] constructed a market equilibrium model to address emissions permits and tradable green certification solutions, allowing every company to address the electricity, carbon, and green certification markets simultaneously. To study whether the carbon trading mechanism can achieve a good emission reduction effect, Keohane [

8] concluded, through research, that emission reduction targets are always guaranteed in the carbon trading scheme on the condition that the total emission limit is well set. Although many countries and regions are currently implementing carbon trading policies, different countries and regions have different marginal carbon emission reduction costs under their respective emission reduction commitments (Yun, [

9]). After 2011, due to China’s voluntary participation, many Chinese scholars also began to study the situation of trading mechanisms in China. Cui et al. [

10] built a trans-provincial emission rights trading model, which was divided into no carbon, covering pilot, and covering the whole region for analysis and discussion. Li et al. [

11] suggested that ETS is an effective strategy for CO

2 reduction, and the free quota ratio should be gradually reduced in ETS. With the official launch of China’s national unified carbon trading system (ETS) in 2017, based on the multi-agent model, Tang et al. [

12] introduced an auction mechanism in ETS. As for how to allocate the carbon emissions quota, Zhang and Hao [

13] studied the carbon emission quota allocation of China in 2020 and made the allocation scheme reach the Pareto optimality with the consideration of carbon emission reduction capacity, responsibility, and potential. In terms of the efficiency of carbon trading mechanism, Zhao et al. [

14] analyzed China’s four major carbon trading markets and determined that China’s current carbon trading market only achieved a weak efficiency, but the expansion of the market can improve that efficiency. Concerning the efficiency of carbon emission reduction, Li et al. [

15] believe that the expansion of carbon finance trading and the market mechanism of carbon finance can improve the efficiency of carbon emission reduction. Zhou et al. [

16] proposed a method for carbon emission license allocation combining data envelopment analysis (DEA), analytic hierarchy process (AHP), and principal component analysis (PCA). Since the European Union Emission Trading Scheme (EU ETS) has gradually become mature, Ralf Martin et al. [

17] summarized the research of scholars and the data sheets provided by some EU countries and enterprises, believing that carbon trading has a great impact on the economy, and the effects of emission reduction in the second stage is relatively obvious. At the same time, they agreed that innovation could make the EU ETS more dynamically efficient and that renewable energy obligations and feed-in tariffs for electricity generation could drive innovation more than carbon trading.

Concerning the emission of pollutants, from the perspective of pollution rights trading, as far back as 1997, students at an American school played the game of comparing the cost of reducing pollution to the cost of getting an emissions permit (Nugent, [

18]). Chen et al. [

19] explained the theory of property rights and put forward the overall planning of the definition of emission rights, emission rights transactions, and emission rights reorganization. Lu [

20] interviewed businesspeople to study the actual performance of emission trading on SO

2 emission, and unexpectedly found that the sulfur dioxide emission trading plan of Taiyuan seemed ineffective. However, based on the theory of system dynamics, Liao et al. [

21] established the pollutant trading model in China and found that the impact of trading policies on the total emission control of SO has increased steadily since 2011. The establishment of the equilibrium model of the power network shows that the total emissions do not exceed the total emission permit (Li and Liu, [

22]). In terms of the impact of sulfur dioxide emission rights trading on average emission reduction costs (APAC) and marginal emission reduction costs (MPAC), (Tu and Shen [

23]) found through a calculation that trading policy can effectively reduce APAC and MPAC. With the help of the CGE model, Ma et al. [

24] found, through simulation, that only a few regions in China can meet the national SO

2 emissions standard under the existing SO

2 trading mechanism. From the perspective of China’s energy, to reduce the emission of pollutants, China’s energy structure needs to be transformed from primary energy, such as wood and coal, to renewable energy. Zhao et al. [

25] believe that economic development or the development of the non-agricultural labor market or the accumulation of human capital can help accelerate the process of rural energy transformation in China. Further, Tomas Baležentis and Dalia Štreimikienė, [

26] think that the transformation of the energy mix needs to be guided by financial incentives to maintain China’s efficient energy production and consumption. From the Perspective of Pollution Sources, Chen et al. [

27] found, through research, that China’s coal consumption is gradually declining, while India’s coal consumption is gradually increasing. International scrutiny and support for India’s emissions should be strengthened to link environmental pressures. Changes in the productivity index (LPI), which is related to energy and pollutant variables, are increasing from the southeast coast to the west inland, so Wu et al. [

28] propose that the government needs to strengthen environmental regulations in the west. According to the power industry, several scholars have explored the carbon trading policies of the power industry. Chappin et al. [

29] studied the impact of CO

2 emissions trading (CET) on power company decisions in the context of oligopolies. Based on the carbon emission trading theory, the development potential of the power industry is analyzed in three aspects (Chu et al. [

30]). Zhang et al. [

31] investigated the market mechanisms of carbon emission trading in the power industry. Huang et al. [

32] found that carbon trading has limited incentives for long-term investment in coal-fired power companies. For companies that implement carbon trading under the EU trading system, we find that enterprises with carbon emission allowances have higher profits than those without carbon emission allowances, and enterprises with high carbon emissions face higher carbon risks and higher expected benefits (Oestreich and Tsiakas [

33]).

As far as we know, the existing literature mainly focuses on the impact of a single emission reduction trading mechanism (CET or PRT) on the economy and environment; there are few integrated analyses of CET and PRT for the power industry. Therefore, we think it is a problem worth studying. Kahrl et al. [

34] concluded that although the trading policy has been implemented, the carbon dioxide emission of the power industry is expected to double in the next ten years with the increasing demand for electricity. Moreover, power enterprises are also the most important sources of pollutant emissions according to the data of the China Environment Statistical Yearbook (CESY) [

35]. Thus, this study aims to explore the integrated efficiency of CET and PRT for the power enterprise. Motivated by the simulation research method of the emission control market in many recent studies (see, e.g., [

12,

16]), this paper will adopt the system dynamics (SD) simulation method to study the CET market and PRT market of Chongqing. The combined effect of the CET market and PRT market in Chongqing on the industrial economy of power, and its effect on the environment, will be analyzed. The policy suggestions of promoting CET and PRT will also be discussed. In

Section 2, we analyze the logic of the SD model and establish a causal loop diagram and stock-flow diagram. Based on a qualitative analysis combined with quantitative formulas, the parameters and variables are explained. In

Section 3, we first test the validity of the model; then, under different circumstances, the impact of transaction mechanism on corporate profit and the regional environment was analyzed, and optimization experiments were conducted to simulate the optimal situation. In

Section 4, based on the simulation data, three simulation results are obtained, and reasonable suggestions are put forward for pollution rights trading and carbon emission trading in the power industry, to make the trading mechanism more effective in the power industry.

2. Modelling Methodology

2.1. Description of the Problem

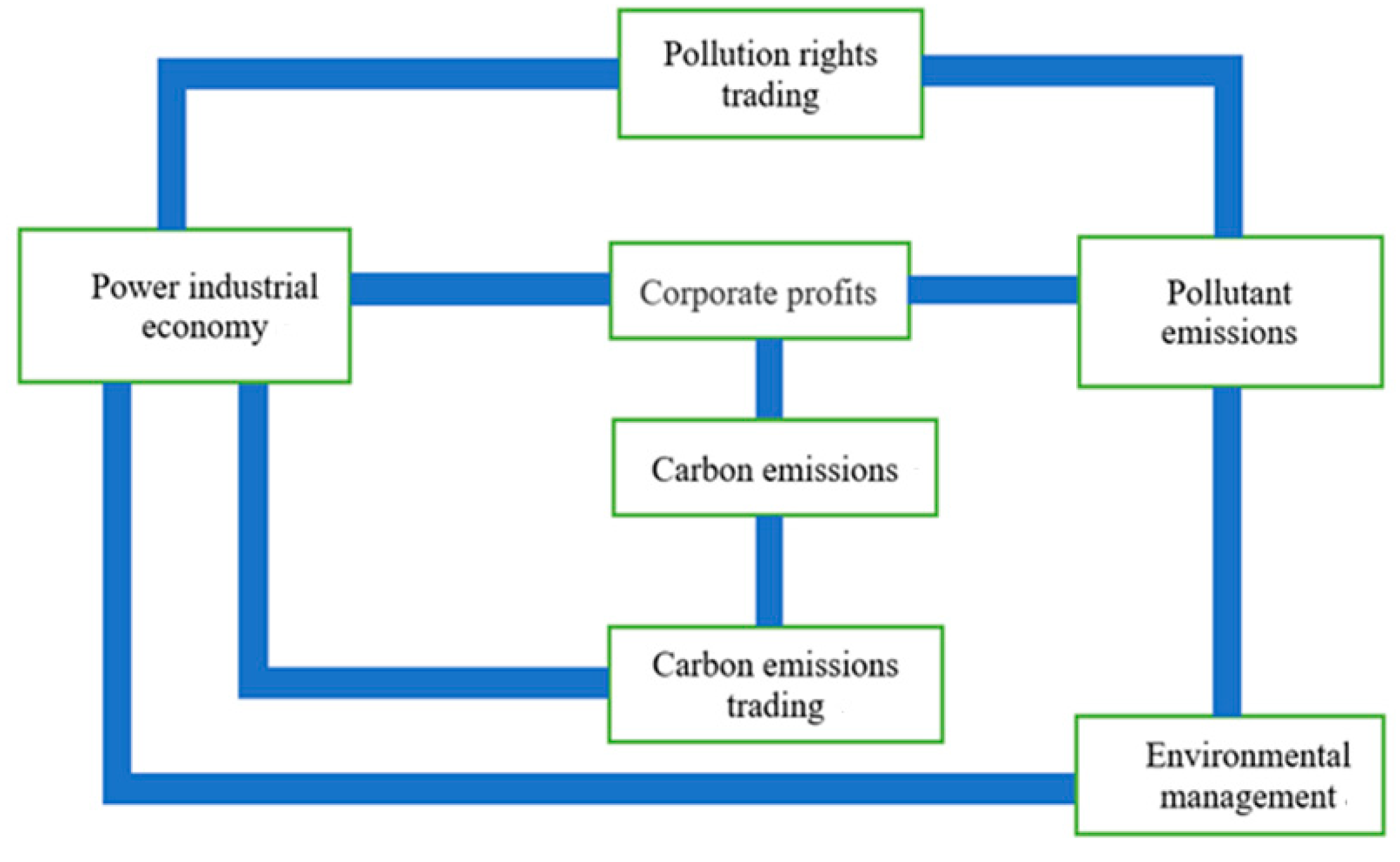

With the official launch of the carbon emission trading system, Chongqing has become the only city in western China to participate in the joint construction of the national carbon market, and it has taken the lead in China’s carbon trading market. As the only western city participating in carbon trading, the analysis of its trading impact can provide valuable experience for western cities and provide favorable support for further national policy release. In this paper, Anylogic software is used to establish the dynamic model of the combined system of carbon trading and pollution rights trading of Chongqing coal and power enterprises, which include five main parts: industrial power economy, corporate profit, carbon trading, emission trading, and environment. The increase of the industrial power economy promotes the growth of enterprises, while the increase of corporate profits leads to the increase of pollutants and carbon emissions. Under the influence of the implementation of trading policies, it also promotes environmental governance, thus jointly affecting the industrial power economy in two aspects. The specific logic frame diagram is shown in

Figure 1.

The economic growth of the power industry increases the profit of enterprises through the role of subsidies, and the increase of profit will promote enterprises to expand scale, thus increasing the total coal consumption of enterprises, thus leading to an increase of CO2 and pollutant emissions. At this point, the two transaction policies and the three aspects of environmental governance jointly affect the economic situation.

2.2. Software Introduction

AnyLogic is a widely used tool for the modeling and simulation of discrete, system dynamics, multi-agent, and hybrid systems. Based on the latest complex system design methodology, it is the first tool to introduce the UML language into the field of model simulation. Compared with other simulation software, it has unique advantages in system dynamics, such as convenient dragging of variables and parameters, convenient writing of relations, and having a database interface. Due to the powerful integration ability, chart output ability, and experimental analysis ability of Anylogic, we can use the system dynamics module of the Anylogic software to conduct complex dynamic system simulations and study the model mechanism. In this paper, we first used Anylogic software to draw a causal loop diagram in the system dynamics section, followed by the drawing of the stock flow diagram and the demarcation of the subsystem. Finally, after validity verification, a comparative operation experiment and optimization experiment were established in the experimental section to complete the model construction and analysis in this paper.

2.3. Causal Circuit Diagram

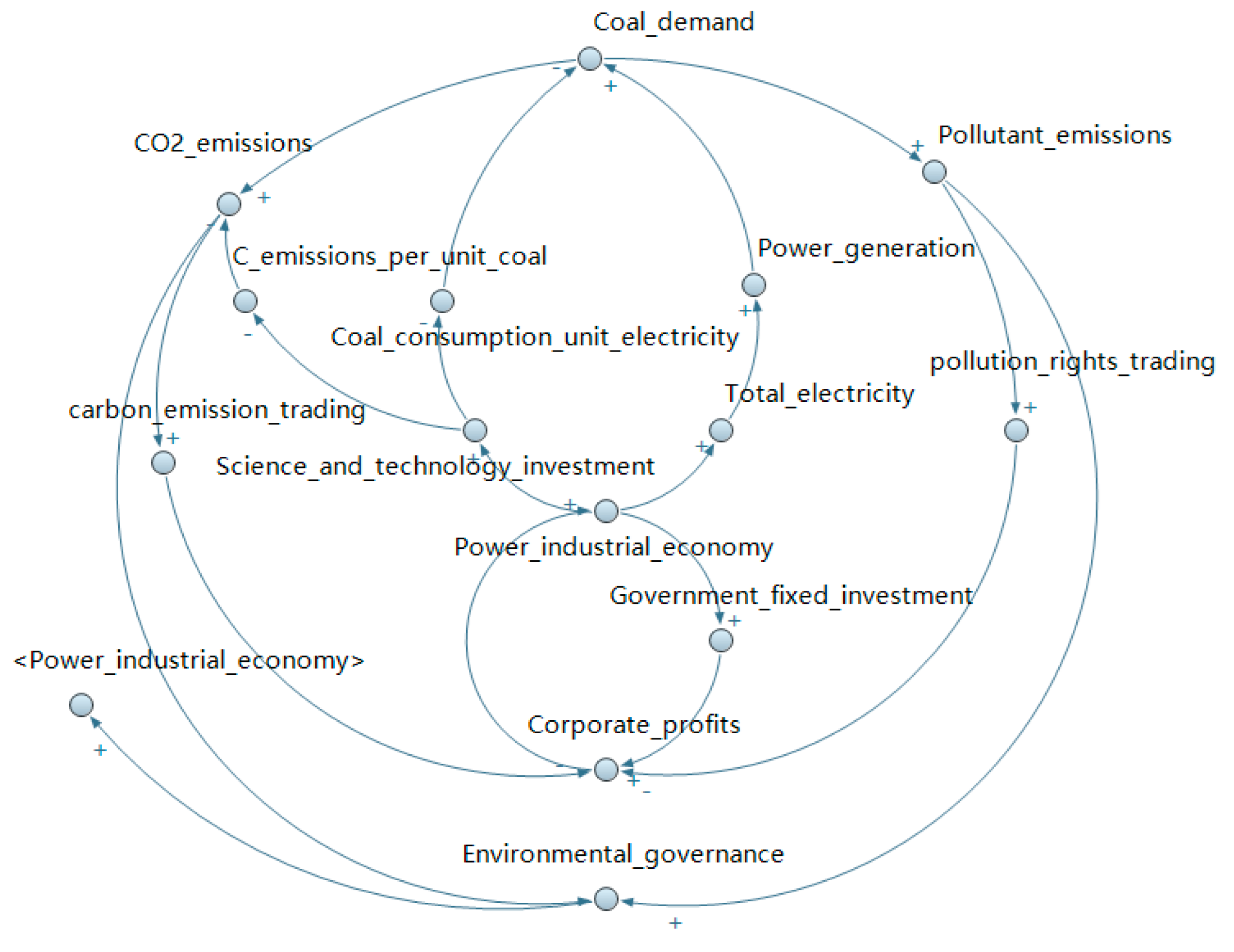

According to the transaction mechanism and model frame diagram, the causal circuit diagram of the model is constructed by using Anylogic software, as shown in

Figure 2.

There are six major feedbacks in the causal loop diagram, three of which are negative, and three of which are positive.

Industrial power economy→ (+) Government fixed investment→ (+) Corporate profits→ (+) Industrial power economy

The development of the economy enables the government to invest more capital to support enterprises, which can increase their profits and ultimately promote economic growth.

1. CO2 emissions→ (+) Carbon emission trading→ (−) Corporate profits→ (−) Science and technology investment→ (+) CO2 emissions

Increased carbon dioxide emissions promote the implementation of carbon trading policies, which will have a certain impact on the profits of enterprises, resulting in slow regional economic growth and reduced investment in science and technology, thus slowing down the reduction of carbon dioxide emissions.

2. CO2 emissions→ (+) Environmental governance→ (+) Industrial power economy→ (+) Science and technology investment→ (−) CO2 emissions/ (−) Coal consumption per unit of electricity→ (−) Coal demand→ (−) CO2 emissions

Carbon dioxide emissions would increase the cost of environmental governance, which can be incorporated into the industrial power income, which can increase the country’s science and technology investment, improve energy efficiency, thereby reducing unit coal carbon and carbon emissions; on the other hand, it can also decrease the number of units needed for coal power generation, reducing coal demand, and thereby reducing carbon dioxide emissions.

3. Pollutant emissions→ (+) Environmental governance→ (+) Industrial power economy→(+) Science and technology investment→(−) Coal consumption per unit of electricity→ (−) Coal demand→ (−) Pollutant emissions

The emission of pollutants has increased the cost of environmental governance, thus contributing to industrial power’s economic growth. The state has increased its investment fund in science and technology, and technological progress has reduced the amount of coal required for each unit of power generation, thus reducing the number of pollutants discharged.

4. Pollutant emissions→ (+) Pollution rights trading→ (−) Corporate profits→ (−) Industrial power economy→ (−) Science and technology investment→ (+) Coal consumption per unit of electricity→ (+) Pollutant emissions

The emission of pollutants promotes the implementation of pollution rights trading policies, which correspondingly reduces the profits of enterprises, leads to the slow growth of the industrial power economy, and reduces the investment in science and technology, thus slowing down the reduction rate of pollutant emissions.

5. Carbon and pollutant emissions→ (+) Trade policy→ (−) Corporate profits→ (−) Industrial power economy→ (−) Total electricity→ (−) Power generation→ (−) Coal demand→(−) Carbon and pollutant emissions

The emissions of carbon and pollutants promote the implementation of trading policies, which hurt corporate profits and inhibit industrial power’s economic growth. The slow growth of total electricity use reduces the demand for coal burning and ultimately reduces carbon dioxide emission.

2.4. Stock Flow Diagram

According to the causal loop diagram, the stock flow diagram of coal power enterprises under the integration of carbon trading and emission trading is established, as shown in

Figure 3.

This model is mainly divided into three subsystems: carbon trading subsystem (Left), economic subsystem (Middle), and pollutant trading subsystem (Right). Under the joint action of the three, the development situation and regional environment of the power industry are studied. In the process of model construction, all the data required were taken from the references of China low-carbon industry network, National Development and Reform Commission (NDRC), China carbon trading network, Chongqing carbon trading centre, the clean energy network, etc.

2.5. Main Parameters and Variables

In this paper, the entire power industry in Chongqing is selected. The enterprise profit, coal demand, and other variables are derived from the annual report of the Chongqing city. The system dynamics model is mainly divided into parameters and variables. Variables can be divided into endogenous variables and exogenous variables.

The exogenous variables of the model are mainly obtained by referring to databases, literatures, official websites, etc., mainly including the industrial power economy, carbon emission coefficient, investment coefficient, government fixed investment coefficient, carbon quota free ratio, carbon trading price, pollution emission ratio of free quota, pollutant trading price, etc. The carbon trading price and pollutant trading price come from China’s low carbon industry net.

The endogenous variables of the model mainly include regional economic growth, fixed government investment, carbon emission costs, pollution rights trading costs, scientific and technological investment, pollutant trading volume, and carbon trading volume. Based on the qualitative analysis, the formula is obtained according to the variable relationship in the system dynamics model (SD). The main variables and parameters are shown in

Table 1 and

Table 2.

Here, we mainly choose two variables for a detailed explanation. The calculation of carbon emissions is the carbon emission per unit of standard coal multiplied by the coal demand of the enterprise and then multiplied by an actual carbon emission coefficient. Emissions of pollutants are the sum of SO2 emissions per unit of coal and NOx emissions per unit of coal multiplied by the demand for coal and then subtracted by the amount of reduction imposed by the government. In recent years, China has been very strict in the control of heavy polluting enterprises, so the government’s role has made the emission of pollutants decline.

In

Table 2, all the parameters are from the official website of the Chinese government, and the carbon trading price is from the low-carbon industrial network of China. To make the simulation more obvious, the initial price of carbon trading is set at 40 yuan/ton. Since only SO

2 and NOX are traded in Chongqing, we set their prices as the product of their transaction prices and the corresponding transaction proportion. The emission coefficient of SO

2 and NOX is based on the emission data of unit standard coal in Chongqing. The proportion of the free quota is based on existing national policies and literature. The proportion of fixed government investment is set by reference [

36]. The line loss rate and power utilization rate are based on the actual situation in China and the standard data published by the state grid. The change rate of the total quota comes from the Chongqing development and reform commission, and its setting is based on previous average data.

In this model, we use some abbreviations to make the model cleaner, as shown in

Table 3.

4. Conclusions and Future Research Needs

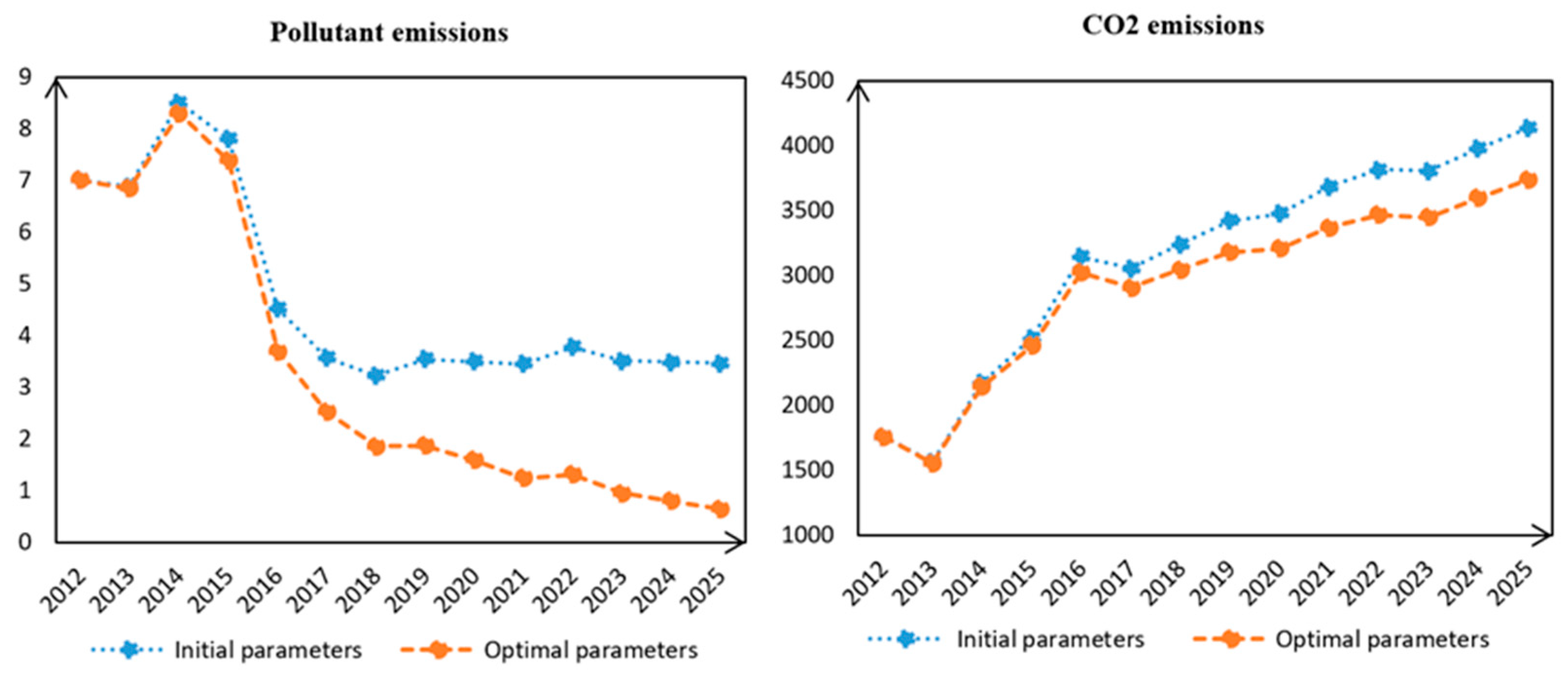

This paper considers the relationship between the economy of Chongqing electric power industry and the regional environment under the combined effect of carbon emissions trading (NCET) and pollution rights trading (PRT). By analyzing the internal relations among the profits of enterprises involved in carbon emissions trading and pollution rights trading, and using the sensitivity analysis experiment, policy optimization simulation was carried out to provide theoretical support for the future development of power enterprises in Chongqing and even the whole region. The specific simulation results are as follows.

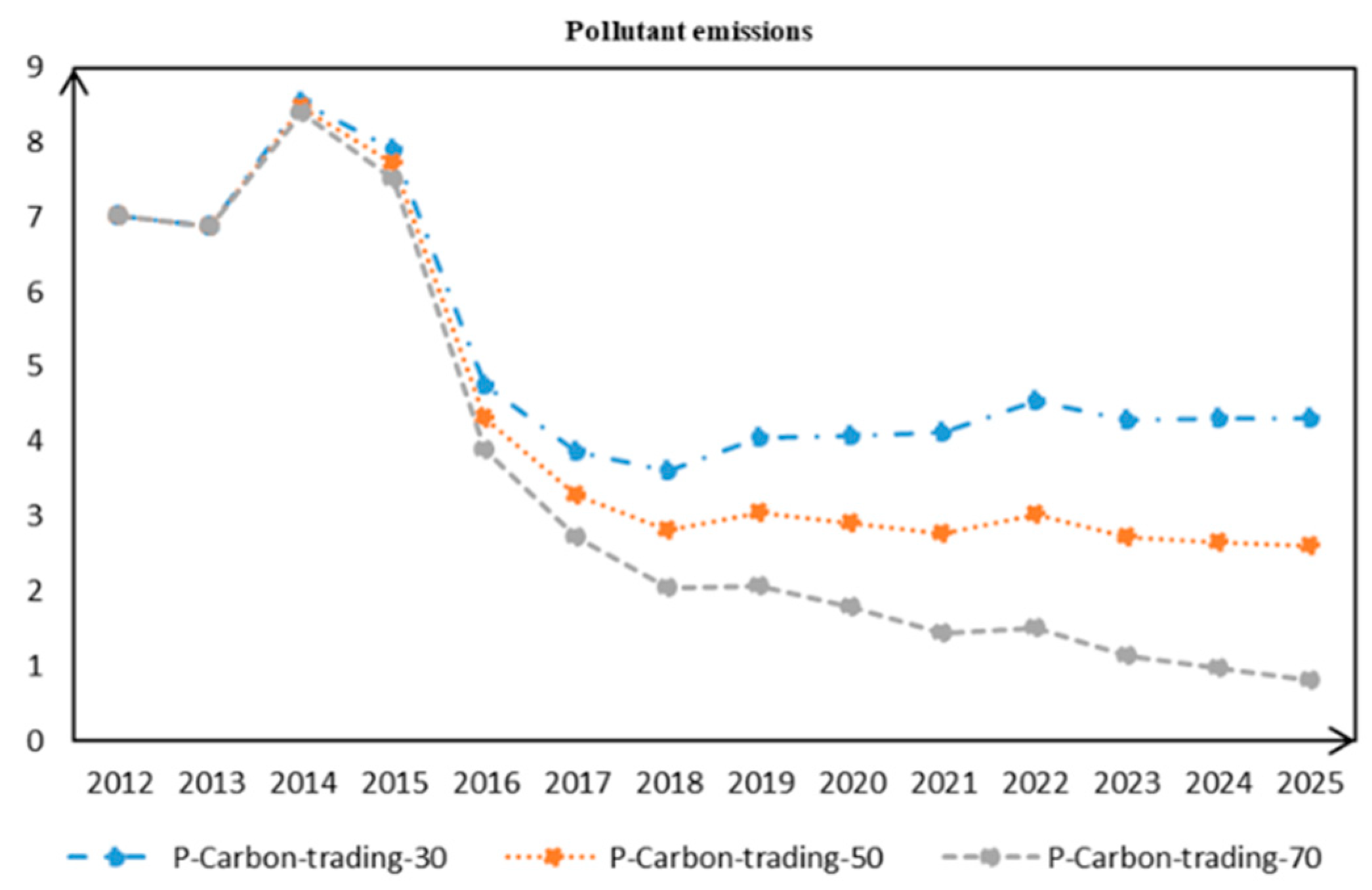

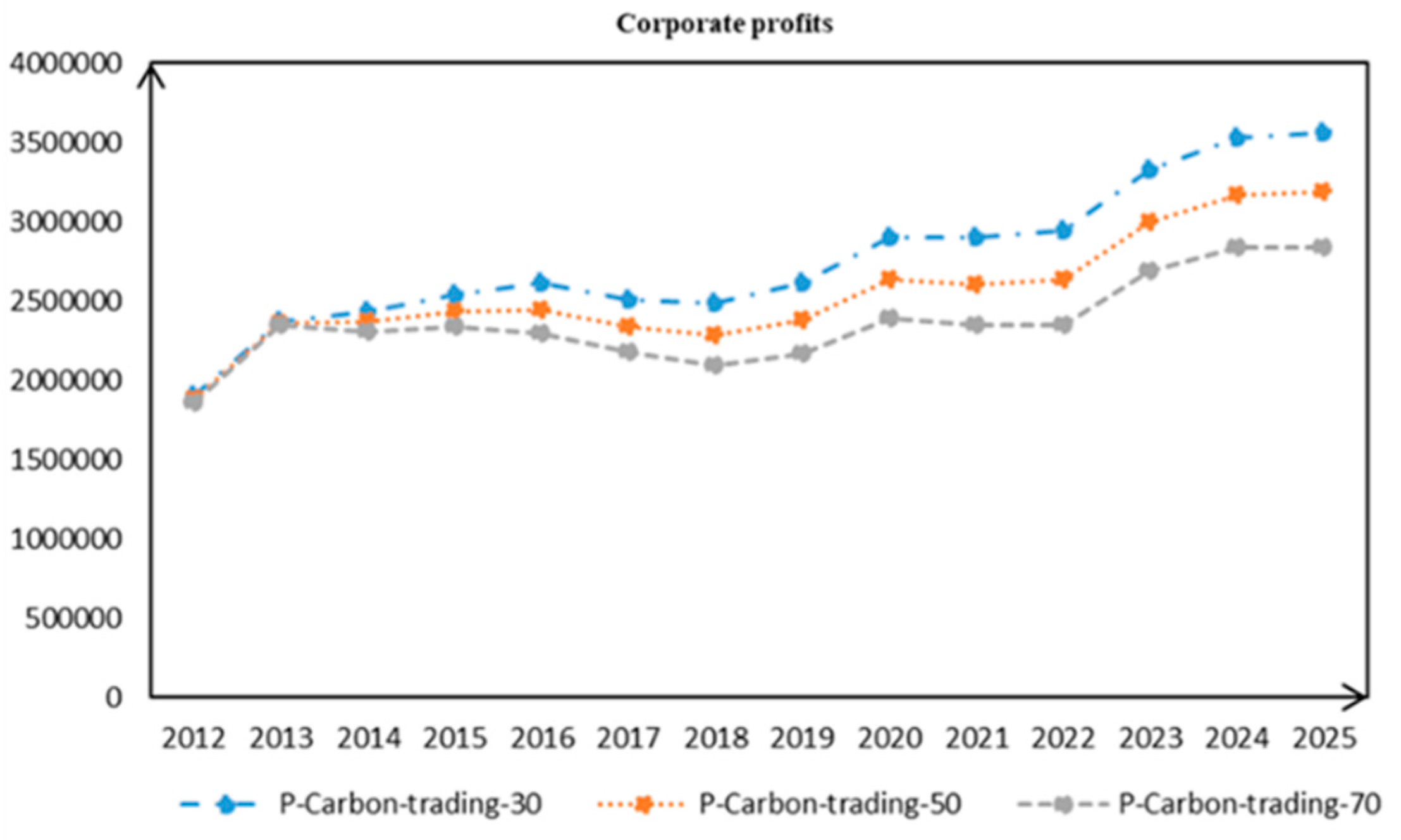

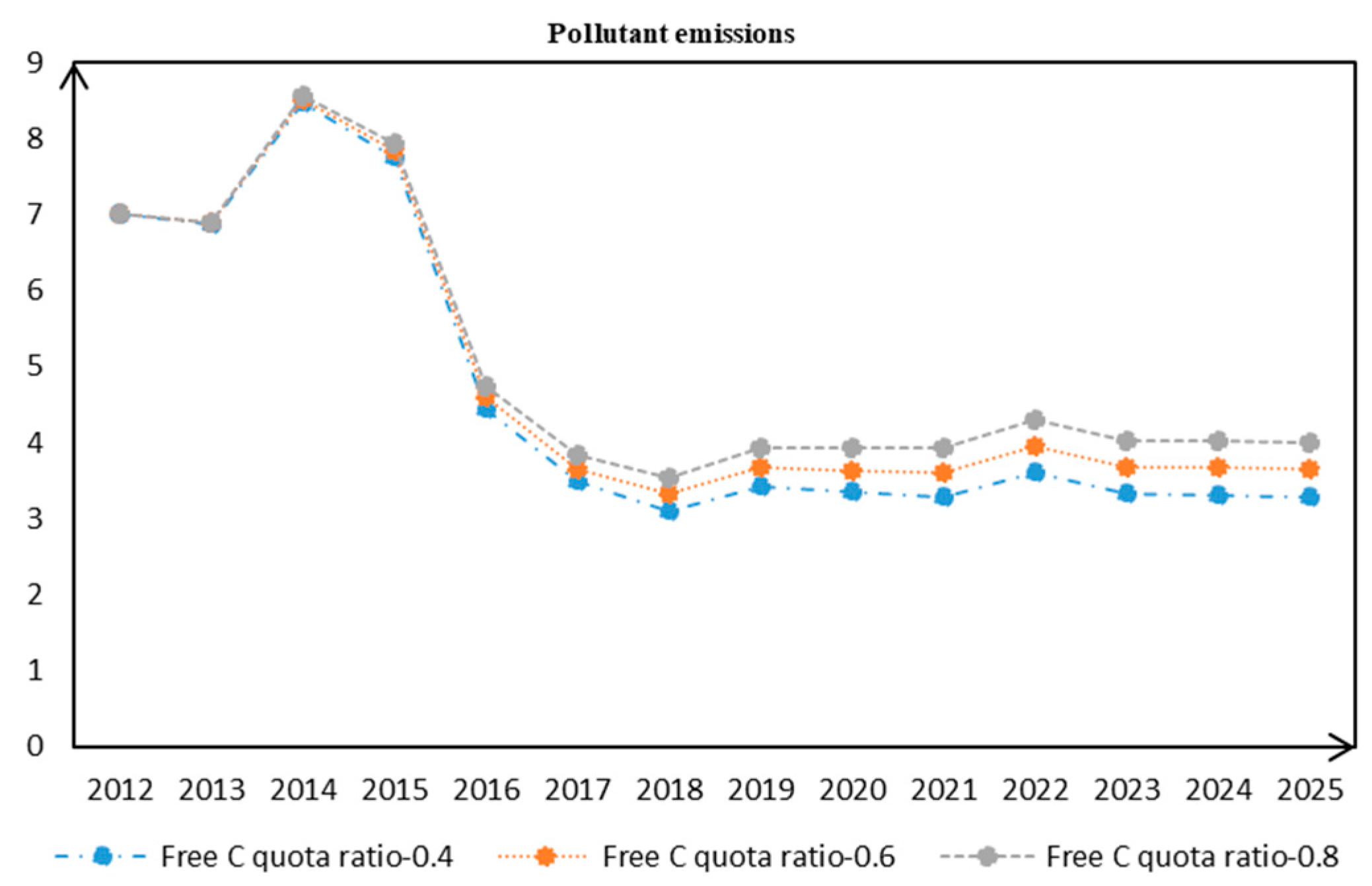

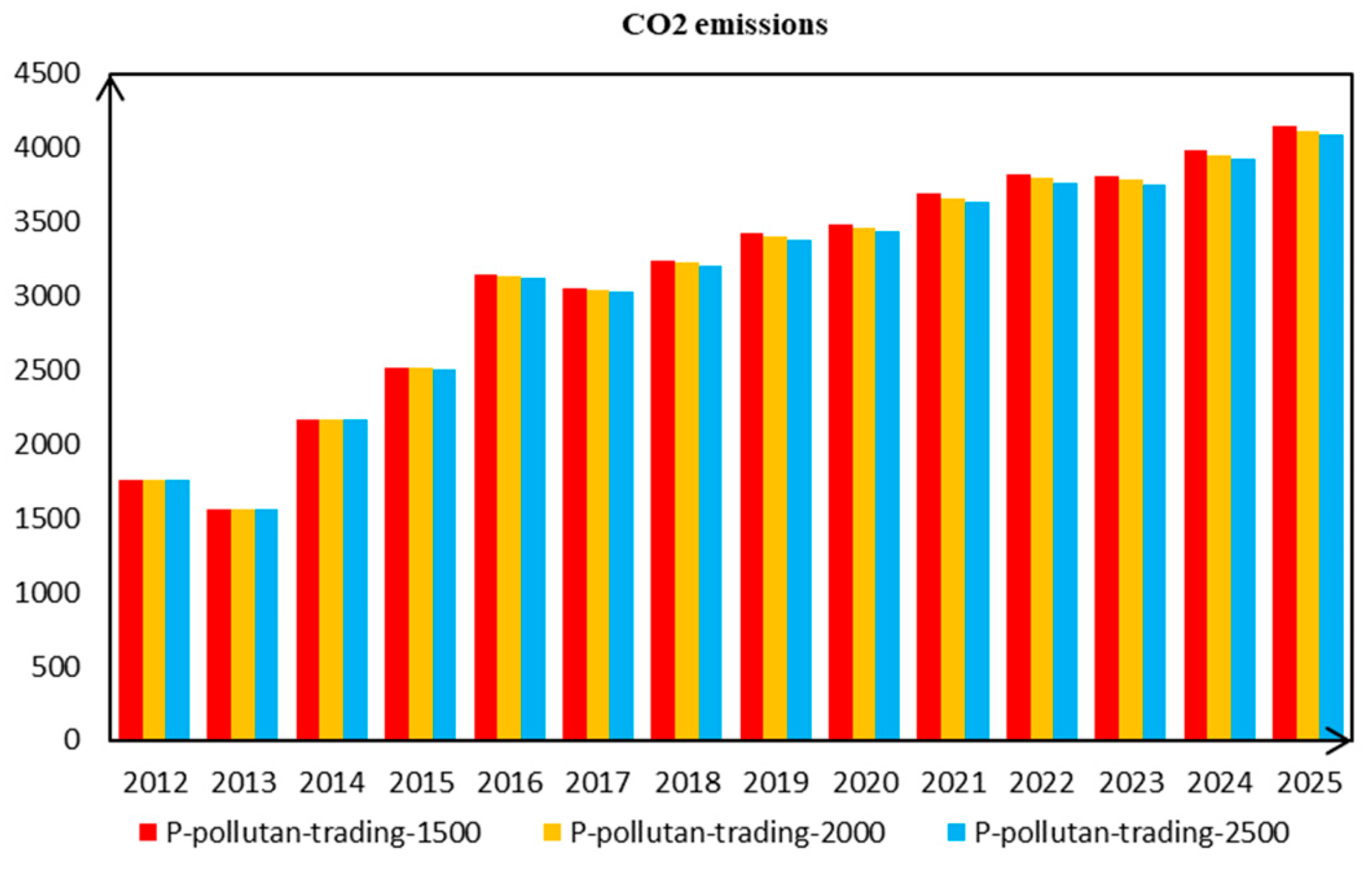

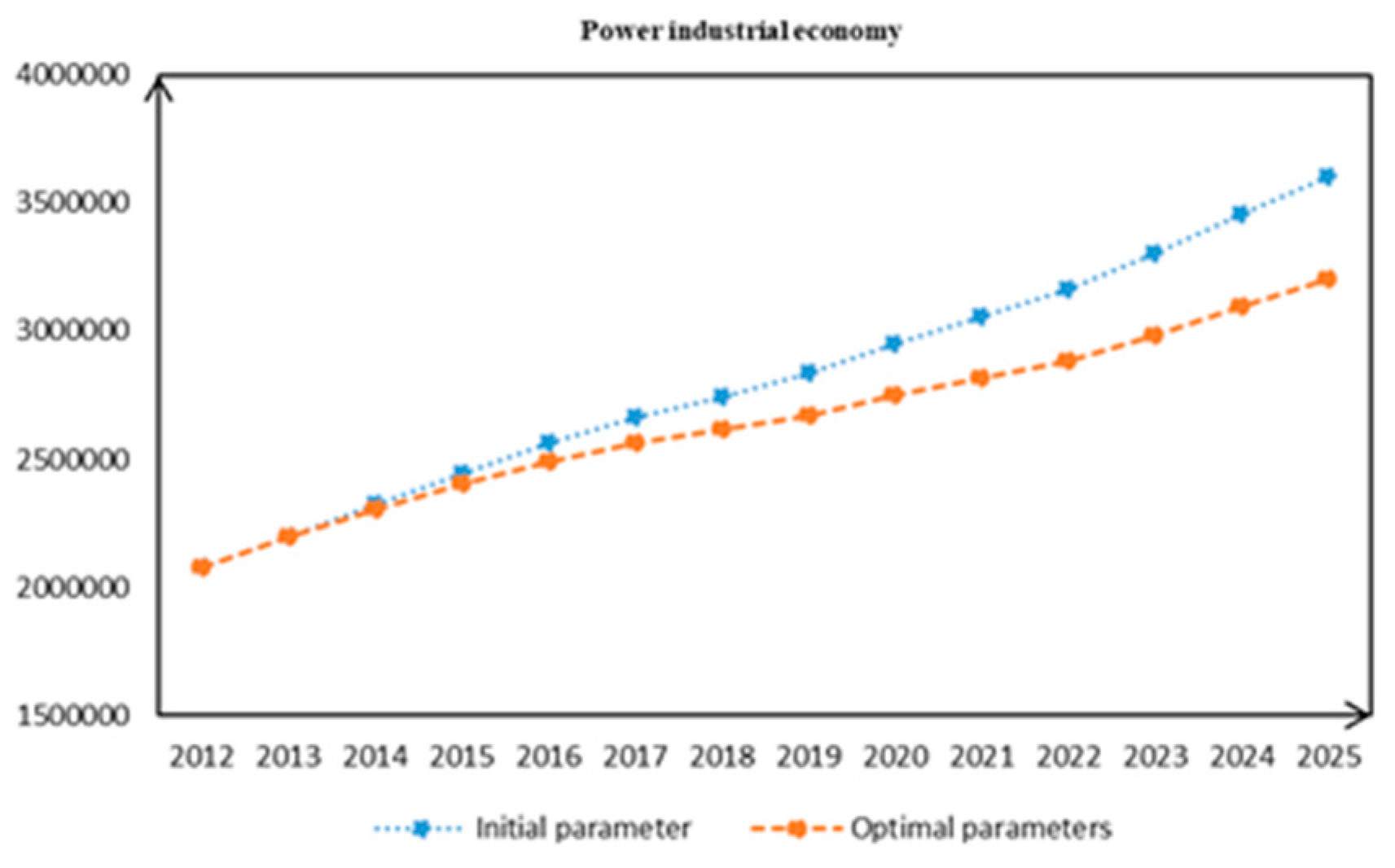

Under the influence of carbon emissions trading (NCET) and pollution rights trading (PRT), the pollutant discharge and carbon dioxide emissions of the power industry in Chongqing have been significantly reduced, and the environment has been improved noticeably, but at the same time, it will have a certain impact on the economy and reduce the profits of enterprises.

Under the effect of the carbon trading mechanism, reducing the amount of free quota or increasing the price of carbon trading will reduce the emission of pollutants; pollution rights trading (PRT) has a similar effect on carbon dioxide emissions, but not as strong.

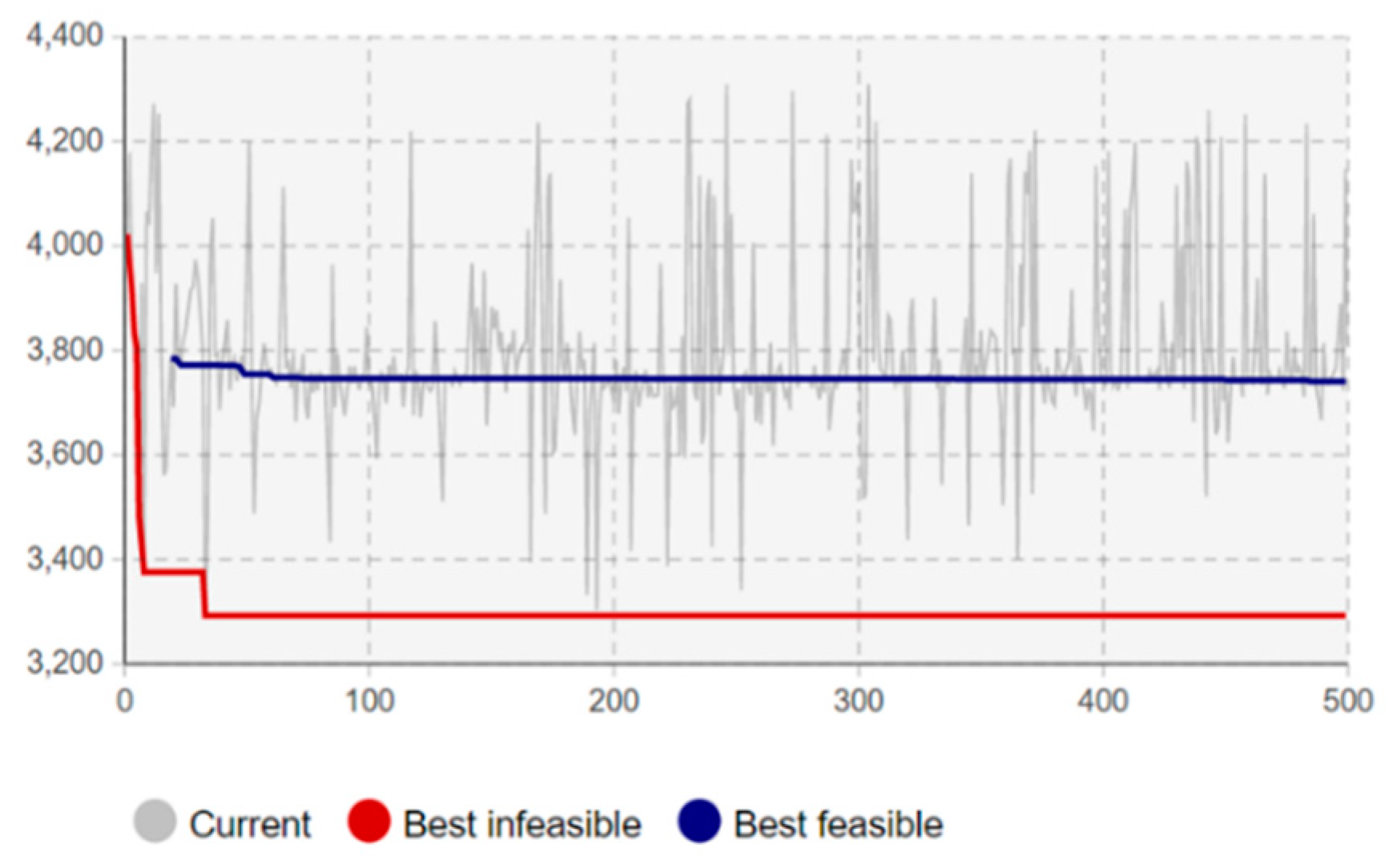

At a certain range of economic levels and corporate profits, the simulation optimization can make the corporate profit loss smaller under certain conditions and at the same time obtain a larger income from emission reduction.

Based on the above conclusions, we may put forward some useful policy suggestions for the country. We believe that, in the future, the state should continue to increase the intensity of carbon trading, and gradually increase the price of carbon trading, so that carbon emission rights as a commodity can exist for a long time. In terms of pollutant emissions, we believe that in China, the pollution subject base is still large, so we still need to reduce the proportion of the free pollutant quota, so as to make China’s environmental quality improve.

In this study, the current situation of the power industry was firstly analyzed logically. Secondly, based on system dynamics theory, Anylogic software was used for model construction and model verification. Finally, different parameters were configured to conduct sensitivity analysis experiments, and corresponding conclusions were drawn through the analysis of charts and data, providing theoretical support for the improvement of the government’s emission reduction policy.

However, this model also has some shortcomings. It only considers the influence of two trading mechanisms and fails to fully show the influence of power generation right transactions on Chongqing regional power enterprises. In addition, this paper only considers the situation of coal-fired power, without considering the impact of the trading mechanism under the circumstances of green power of enterprises and subsidies of the state to green power. Moreover, it does not carry out an in-depth analysis of the technology investment of enterprises themselves. We also did not analyze the carbon and polluting gases produced by the transport links of the supply chain for the coal needed for power generation. Therefore, based on the research in this paper, in the future, on the basis of carbon trading and pollution rights trading, we will consider the supply chain transportation link and enterprise investment as they relate to the model, so that the research can more fully reflect the reality, and provide strong theoretical support for corporate decision-making and national policy.