An Approach to Generating Reference Information for Technology Evaluation

Abstract

:1. Introduction

2. Literature Review

2.1. Reference Information for Technology Evaluation

2.2. Structural Similarities between Firms

3. Methods

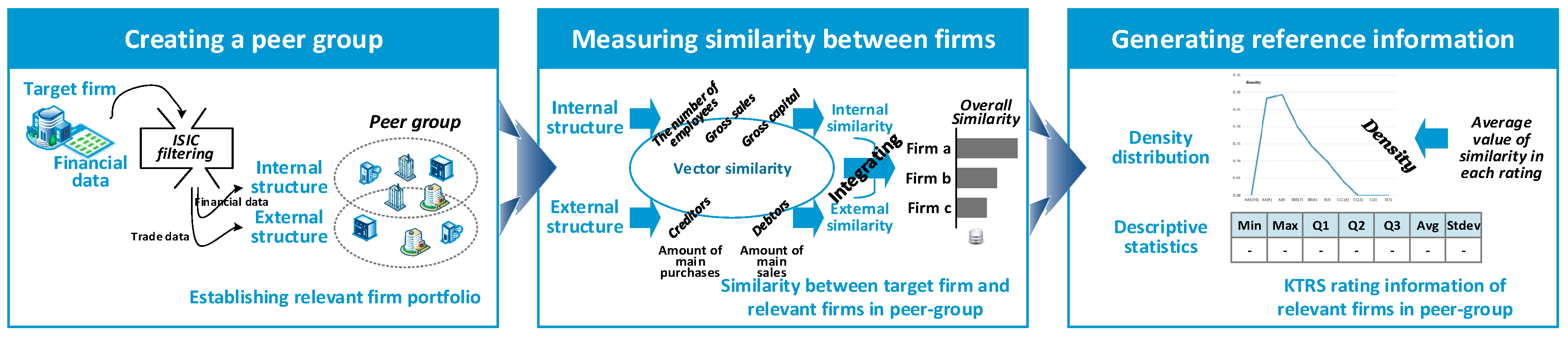

4. Approach to Generating Reference Information for Technology Evaluation

4.1. Creating Peer Groups

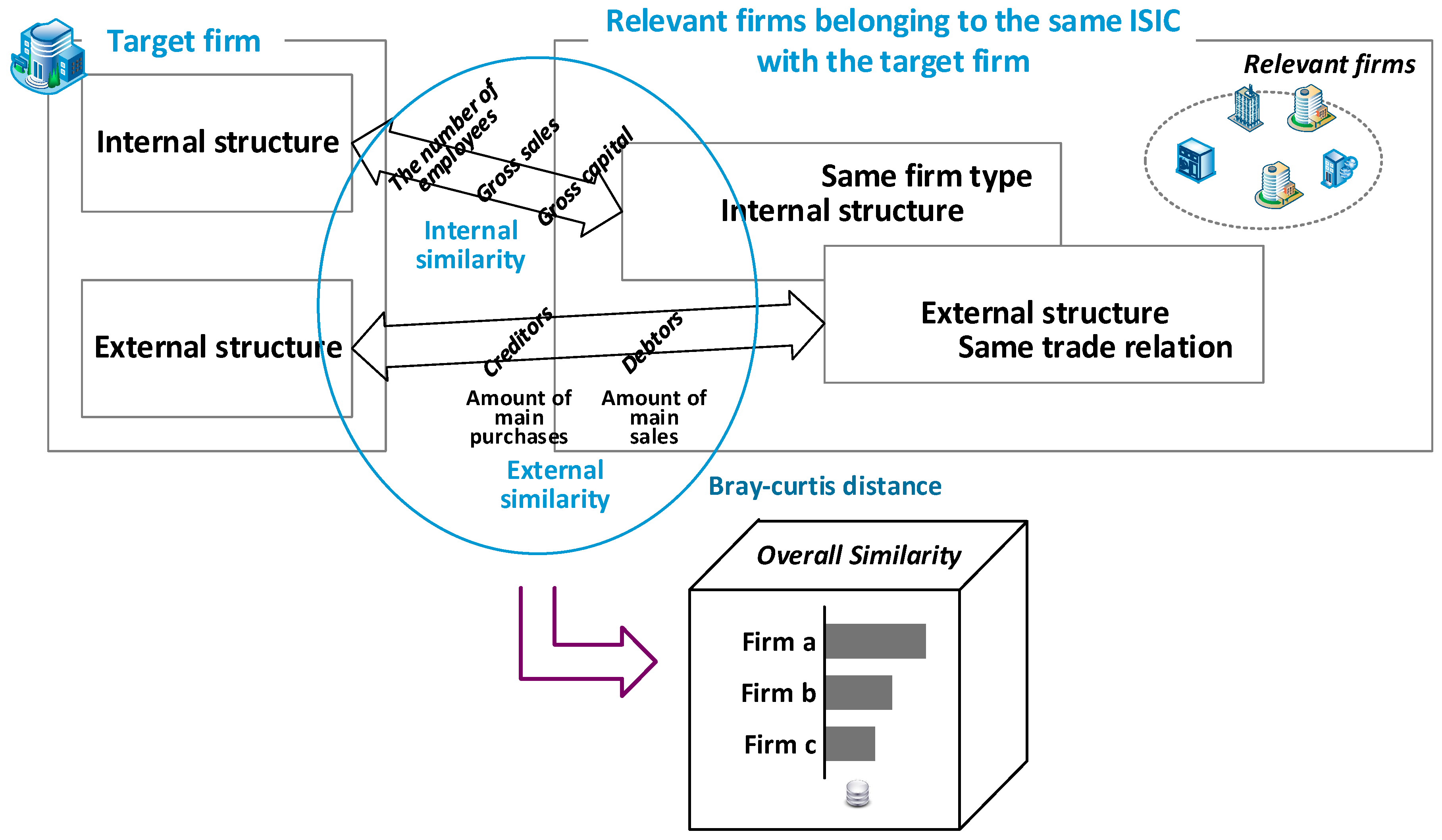

4.2. Measuring Similiarity between Firms

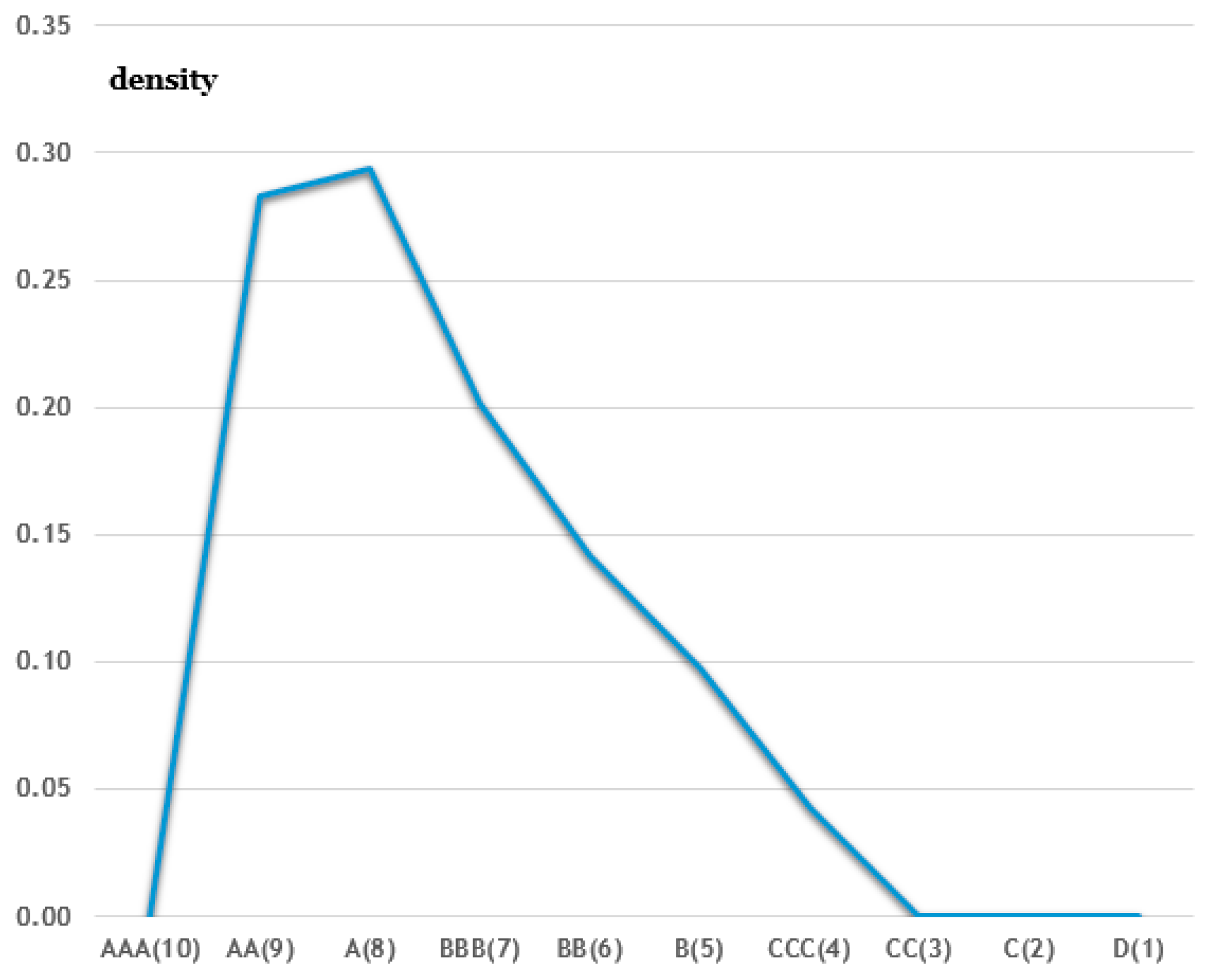

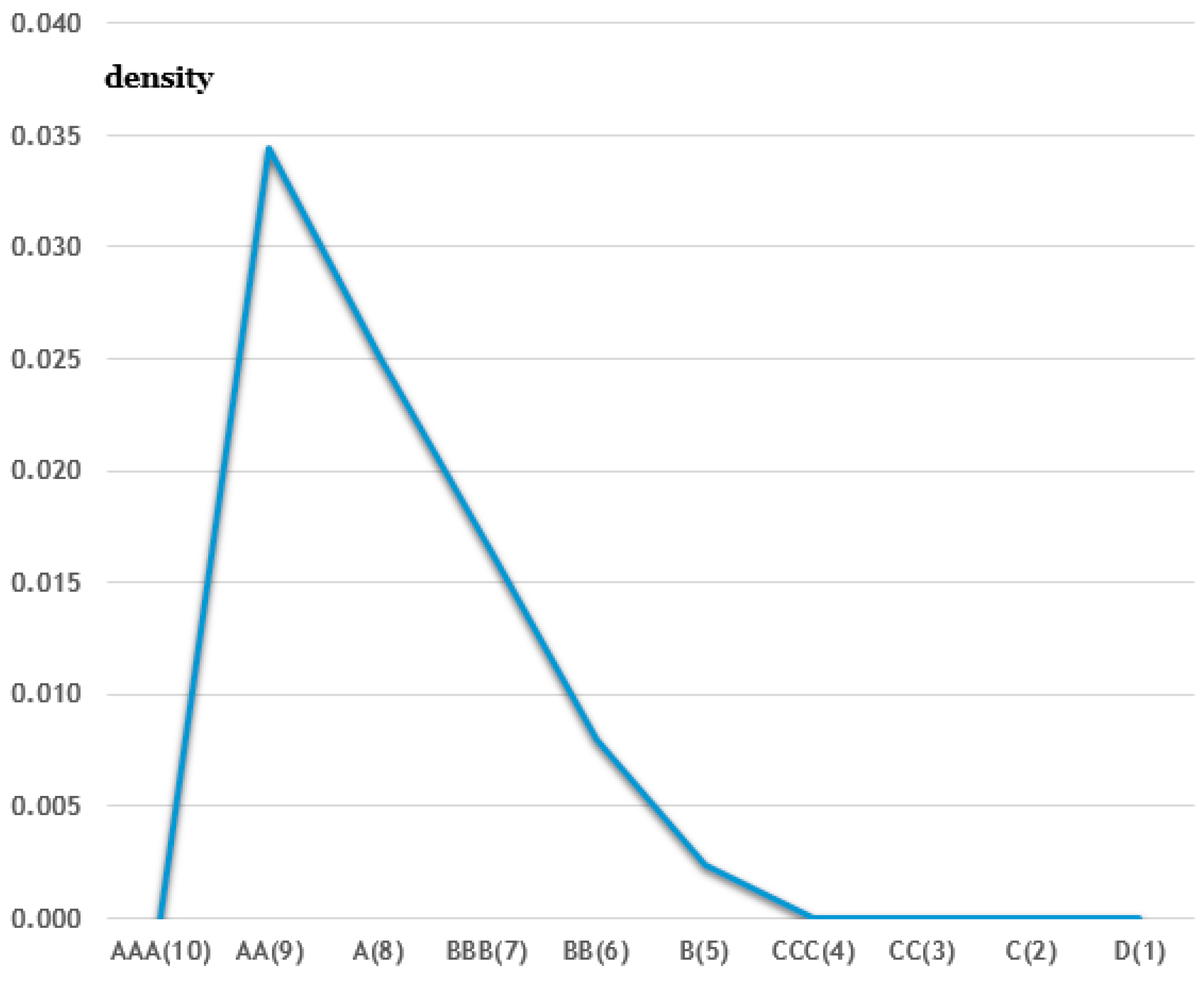

4.3. Generating Reference Information

5. Illustration

5.1. Peer Group Creation

5.2. Firm Similarity Measurement

5.3. Reference Information Generation

6. Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Park, S.; Lee, S.-J.; Jun, S. A network analysis model for selecting sustainable technology. Sustainability 2015, 7, 13126–13141. [Google Scholar] [CrossRef]

- Yu, C.; Zhang, Z.; Lin, C.; Wu, Y.J. Knowledge creation process and sustainable competitive advantage: The role of technological innovation capabilities. Sustainability 2017, 9, 2280. [Google Scholar] [CrossRef]

- Lin, H.-P.; Hu, T.-S. Knowledge interaction and spatial dynamics in industrial districts. Sustainability 2017, 9, 1421. [Google Scholar] [CrossRef]

- Zhu, H.; Chen, K.W.; Dai, J. Beyond apprenticeship: Knowledge brokers and sustainability of apprentice-based clusters. Sustainability 2016, 8, 1279. [Google Scholar] [CrossRef]

- Martins, J.T. Relational capabilities to leverage new knowledge: Managing directors’ perceptions in UK and portugal old industrial regions. Learn. Organ. 2016, 23, 398–414. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. How to deal with knowledge management misalignment: A taxonomy based on a 3D fuzzy methodology. J. Knowl. Manag. 2018, 22, 538–566. [Google Scholar] [CrossRef]

- Bagnoli, C.; Giachetti, C. Aligning knowledge strategy and competitive strategy in small firms. J. Bus. Econ. Manag. 2015, 16, 571–598. [Google Scholar] [CrossRef]

- Bassi, L.J. Harnessing the power of intellectual capital. Train. Dev. 1997, 51, 25–31. [Google Scholar]

- Bismuth, A.; Tojo, Y. Creating value from intellectual assets. J. Intellect. Cap. 2008, 9, 228–245. [Google Scholar] [CrossRef]

- Shangzhen, L.I. A literature review of technology and finance. Can. Soc. Sci. 2015, 11, 89–93. [Google Scholar]

- Trang, D.T.V. Experiences of green credit development—Lessons learned to vietnam. Rev. Bus. Econ. Stud. 2016, 4, 85–91. [Google Scholar]

- Choi, S.; Noh, M.S.; Yoon, J.; Park, H.; Seo, W. Analyzing technological spillover effects between technology classes: The case of korea technology finance corporation. IEEE Access 2018, 6, 3573–3584. [Google Scholar] [CrossRef]

- Wonglimpiyarat, J. Management and governance of venture capital: A challenge for commercial bank. Technovation 2007, 27, 721–731. [Google Scholar] [CrossRef]

- Kobayashi, H.; Kato, M.; Maezawa, Y.; Sano, K. An R&D management framework for eco-technology. Sustainability 2011, 3, 1282–1301. [Google Scholar]

- Wonglimpiyarat, J. Technology financing toward effective economies In Technology Financing and Commercialization; Palgrave Macmillan: London, UK, 2015; pp. 239–256. [Google Scholar]

- Sufi, A. Information asymmetry and financing arrangements: Evidence from syndicated loans. J. Financ. 2007, 62, 629–668. [Google Scholar] [CrossRef]

- North, D.; Baldock, R.; Ullah, F. Funding the growth of uk technology-based small firms since the financial crash: Are there breakages in the finance escalator? Ventur. Cap. 2013, 15, 237–260. [Google Scholar] [CrossRef]

- Kassicieh, S.; Ahluwalia, S.; Majadillas, M.A. Financial analysis in management of technology programs: Links in a clinical approach. Technol. Forecast. Soc. Chang. 2015, 100, 66–77. [Google Scholar] [CrossRef]

- Abereijo, I.O.; Fayomi, A.O. Innovative approach to SME financing in Nigeria: A review of small and medium industries equity investment scheme (SMIEIS). J. Soc. Sci. 2005, 11, 219–227. [Google Scholar] [CrossRef]

- Lee, S.H.; Lim, E.-S.; Hwang, J. Do credit guarantees for small and medium enterprises mitigate the business cycle? Evidence from korea. Empir. Econ. 2017, 52, 1367–1378. [Google Scholar] [CrossRef]

- Noh, H.; Seo, J.-H.; Yoo, H.S.; Lee, S. How to improve a technology evaluation model: A data-driven approach. Technovation 2018, 72–73, 1–12. [Google Scholar] [CrossRef]

- Shen, Y.-C.; Chang, S.-H.; Lin, G.T.R.; Yu, H.-C. A hybrid selection model for emerging technology. Technol. Forecast. Soc. Chang. 2010, 77, 151–166. [Google Scholar] [CrossRef]

- Yu, P.; Lee, J.H. A hybrid approach using two-level SOM and combined AHP rating and AHP/DEA-AR method for selecting optimal promising emerging technology. Expert Syst. Appl. 2013, 40, 300–314. [Google Scholar] [CrossRef]

- Jun, S.; Park, S.; Jang, D. A technology valuation model using quantitative patent analysis: A case study of technology transfer in big data marketing. Emerg. Mark. Financ. Trade 2015, 51, 963–974. [Google Scholar] [CrossRef]

- Wortley, S.; Tong, A.; Lancsar, E.; Salkeld, G.; Howard, K. Public preferences for engagement in Health Technology Assessment decision-making: Protocol of a mixed methods study. BMC Med. Inform. Decis. Mak. 2015, 15, 52. [Google Scholar] [CrossRef] [PubMed]

- Chiu, Y.-J.; Chen, Y.-W. Using ahp in patent valuation. Math. Comput. Model. 2007, 46, 1054–1062. [Google Scholar] [CrossRef]

- Kim, S.K.; Lee, B.G.; Park, B.S.; Oh, K.S. The effect of R&D, technology commercialization capabilities and innovation performance. Technol. Econ. Dev. Econ. 2011, 17, 563–578. [Google Scholar]

- Caves, R.E.; Porter, M.E. From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. Q. J. Econ. 1977, 91, 241–261. [Google Scholar] [CrossRef]

- Chen, M.-J. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Acad. Manag. Rev. 1996, 21, 100–134. [Google Scholar] [CrossRef]

- Fuentelsaz, L.; Gómez, J. Multipoint competition, strategic similarity and entry into geographic markets. Strateg. Manag. J. 2006, 27, 477–499. [Google Scholar] [CrossRef]

- D’Aveni, R.A.; Dagnino, G.B.; Smith, K.G. The age of temporary advantage. Strateg. Manag. J. 2010, 31, 1371–1385. [Google Scholar] [CrossRef]

- Belderbos, R.; Olffen, W.V.; Zou, J. Generic and specific social learning mechanisms in foreign entry location choice. Strateg. Manag. J. 2011, 32, 1309–1330. [Google Scholar] [CrossRef]

- Brennan, N.; Connell, B. Intellectual capital: Current issues and policy implications. J. Intellect. Cap. 2000, 1, 206–240. [Google Scholar] [CrossRef]

- Lin, C.; Ma, Y.; Su, D. Corporate governance and firm efficiency: Evidence from China’s publicly listed firms. Manag. Decis. Econ. 2009, 30, 193–209. [Google Scholar] [CrossRef] [Green Version]

- Su, D.; Dai, J. A stochastic frontier analysis of firm efficiency in China. Afr. J. Bus. Manag. 2012, 6, 11254–11265. [Google Scholar]

- McDonald, M.; Millman, T.; Rogers, B. Key account management: Theory, practice and challenges. J. Mark. Manag. 1997, 13, 737–757. [Google Scholar] [CrossRef]

- Coates, J.F. What is technology assessment. Impact Assess. 1982, 1, 20–24. [Google Scholar] [CrossRef]

- Braun, E. Technology in Context: Technology Assessment for Managers; Routledge: London, UK, 1998. [Google Scholar]

- Nazarko, Ł. Future-oriented technology assessment. Procedia Eng. 2017, 182, 504–509. [Google Scholar] [CrossRef]

- Coates, J.F. Technology-assessment-tool kit. Chemtech 1976, 6, 372–383. [Google Scholar]

- Banta, D. What is technology assessment? Int. J. Technol. Assess. Health Care 2009, 25 (Suppl. 1), 7–9. [Google Scholar] [CrossRef] [PubMed]

- Ko, N.; Yoon, J.; Seo, W. Analyzing interdisciplinarity of technology fusion using knowledge flows of patents. Expert Syst. Appl. 2014, 41, 1955–1963. [Google Scholar] [CrossRef]

- Seo, W.; Yoon, J.; Park, H.; Coh, B.-Y.; Lee, J.-M.; Kwon, O.-J. Product opportunity identification based on internal capabilities using text mining and association rule mining. Technol. Forecast. Soc. Chang. 2016, 105, 94–104. [Google Scholar] [CrossRef]

- Grimaldi, M.; Cricelli, L.; Giovanni, M.D.; Rogo, F. The patent portfolio value analysis: A new framework to leverage patent information for strategic technology planning. Technol. Forecast. Soc. Chang. 2015, 94, 286–302. [Google Scholar] [CrossRef]

- Roure, J.B.; Keeley, R.H. Predictors of success in new technology based ventures. J. Bus. Ventur. 1990, 5, 201–220. [Google Scholar] [CrossRef]

- Estep, J.; Daim, T. A framework for technology transfer potential assessment. In Proceedings of the Portland International Conference on Management of Engineering and Technology (PICMET), Honolulu, HI, USA, 4–8 September 2016; IEEE: Piscataway, NJ, USA, 2016. [Google Scholar]

- Benjamin, C.O. A framework for evaluating new technologies. Int. J. Technol. Transf. Commer. 2006, 5, 181–194. [Google Scholar] [CrossRef]

- Baek, D.-H.; Sul, W.; Hong, K.-P.; Kim, H. A technology valuation model to support technology transfer negotiations. R D Manag. 2007, 37, 123–138. [Google Scholar] [CrossRef] [Green Version]

- Sohn, S.Y.; Kim, H.S.; Moon, T.H. Predicting the financial performance index of technology fund for sme using structural equation model. Expert Syst. Appl. 2007, 32, 890–898. [Google Scholar] [CrossRef]

- Van Zee, R.D.; Spinler, S. Real option valuation of public sector R&D investments with a down-and-out barrier option. Technovation 2014, 34, 477–484. [Google Scholar]

- Wang, J.; Wang, C.-Y.; Wu, C.-Y. A real options framework for R&D planning in technology-based firms. J. Eng. Technol. Manag. 2015, 35, 93–114. [Google Scholar]

- Daim, T.; Yates, D.; Peng, Y.; Jimenez, B. Technology assessment for clean energy technologies: The case of the pacific northwest. Technol. Soc. 2009, 31, 232–243. [Google Scholar] [CrossRef]

- Hsu, Y.-L.; Lee, C.-H.; Kreng, V.B. The application of fuzzy delphi method and fuzzy ahp in lubricant regenerative technology selection. Expert Syst. Appl. 2010, 37, 419–425. [Google Scholar] [CrossRef]

- Kalbar, P.P.; Karmakar, S.; Asolekar, S.R. Selection of an appropriate wastewater treatment technology: A scenario-based multiple-attribute decision-making approach. J. Environ. Manag. 2012, 113, 158–169. [Google Scholar] [CrossRef] [PubMed]

- Lee, S.; Kim, W.; Kim, Y.M.; Lee, H.Y.; Oh, K.J. The prioritization and verification of it emerging technologies using an analytic hierarchy process and cluster analysis. Technol. Forecast. Soc. Chang. 2014, 87, 292–304. [Google Scholar] [CrossRef]

- Sohn, S.Y.; Moon, T.H.; Kim, S. Improved technology scoring model for credit guarantee fund. Expert Syst. Appl. 2005, 28, 327–331. [Google Scholar] [CrossRef]

- Hernández Pardo, R.J.; Bhamra, T.; Bhamra, R. Sustainable product service systems in small and medium enterprises (SMEs): Opportunities in the leather manufacturing industry. Sustainability 2012, 4, 175–192. [Google Scholar] [CrossRef] [Green Version]

- Halicka, K. The reference methodology of prospective analysis of technology in production engineering. In Proceedings of the 8th International Conference on Engineering, Project, and Product Management (EPPM 2017), Amman, Jordan, 20–22 September 2017; Springer: Cham, Switzerland, 2017; pp. 99–107. [Google Scholar]

- Liu, Y.-J.; Liu, S.-J. The intellectual property policy of Taiwan: A strategic viewpoint. In Proceedings of the IEEE International Engineering Management Conference, Singapore, 18–21 October 2004; IEEE: Piscataway, NJ, USA, 2004; pp. 42–46. [Google Scholar]

- Ruskov, P.; Tsolova, S.; Panov, S. Model for technology adoption supporting system. In Proceedings of the International Scientific Conference—UNITECH, Gabrovo, Bulgaria, 18–19 November 2016. [Google Scholar]

- Ju, Y.; Sohn, S.Y. Technology credit scoring based on a quantification method. Sustainability 2017, 9, 1057. [Google Scholar] [CrossRef]

- Csaszar, F.A.; Siggelkow, N. How much to copy? Determinants of effective imitation breadth. Organ. Sci. 2010, 21, 661–676. [Google Scholar] [CrossRef]

- Peteraf, M.A. The cornerstones of competitive advantage: A resource-based view. Strateg. Manag. J. 1993, 14, 179–191. [Google Scholar] [CrossRef]

- Gimeno, J.; Woo, C.Y. Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organ. Sci. 1996, 7, 322–341. [Google Scholar] [CrossRef]

- Zeng, M. Managing the cooperative dilemma of joint ventures: The role of structural factors. J. Int. Manag. 2003, 9, 95–113. [Google Scholar] [CrossRef]

- Zhang, Y.; Shang, L.; Huang, L.; Porter, A.L.; Zhang, G.; Lu, J.; Zhu, D. A hybrid similarity measure method for patent portfolio analysis. J. Inform. 2016, 10, 1108–1130. [Google Scholar] [CrossRef]

- Leydesdorff, L. On the normalization and visualization of author co-citation data: Salton’s cosine versus the jaccard index. J. Am. Soc. Inf. Sci. Technol. 2008, 59, 77–85. [Google Scholar] [CrossRef]

- Rohrbeck, R. Corporate Foresight: Towards a Maturity Model for the Future Orientation of a Firm; Physica-Verlag, Springer: Heidelberg, Germany, 2010. [Google Scholar]

- Rohrbeck, R.; Kum, M.E. Corporate foresight and its impact on firm performance: A longitudinal analysis. Technol. Forecast. Soc. Chang. 2018, 129, 105–116. [Google Scholar] [CrossRef]

- Park, S.H.; Ungson, G.R. The effect of national culture, organizational complementarity, and economic motivation on joint venture dissolution. Acad. Manag. J. 1997, 40, 279–307. [Google Scholar]

- Saxton, T. The effects of partner and relationship characteristics on alliance outcomes. Acad. Manag. J. 1997, 40, 443–461. [Google Scholar]

- Lee, G.K. Understanding the timing of ‘fast-second’ entry and the relevance of capabilities in invention vs. Commercialization. Res. Policy 2009, 38, 86–95. [Google Scholar] [CrossRef]

- Chen, F.; Li, F.; Meng, Q. Integration and autonomy in Chinese technology-sourcing cross-border M&As: From the perspective of resource similarity and resource complementarity. Technol. Anal. Strateg. Manag. 2017, 29, 1002–1014. [Google Scholar]

- Gong, B. Total-factor spillovers, similarities, and competitions in the petroleum industry. Energy Econ. 2018, 73, 228–238. [Google Scholar] [CrossRef]

- Signori, A.; Vismara, S. M&A synergies and trends in IPOs. Technol. Forecast. Soc. Chang. 2018, 127, 141–153. [Google Scholar]

- Wajeed, M.A.; Adilakshmi, T. Different similarity measures for text classification using KNN. In Proceedings of the 2nd International Conference on Computer and Communication Technology (ICCCT), Allahabad, India, 15–17 September 2011; IEEE: Piscataway, NJ, USA, 2011. [Google Scholar]

- Limberger, R.; Wickham, S.A. Disturbance and diversity at two spatial scales. Oecologia 2012, 168, 785–795. [Google Scholar] [CrossRef] [PubMed]

| Research Purpose | Factors Used to Measure the Firm Similarity | References |

|---|---|---|

| Exploring the competition between firms with structural similarity | Internal structure—R&D, advertising, cost structures | [29] |

| Presenting a framework of competitor analysis considering resource similarity and market commonality | Internal structure—Industrial classification, products External structure—Resources, customers (accounts) | [30] |

| Investigating the effects of strategic similarity on interfirm rivalry | Internal structure—The number of times service performed External structure—Market share, market density | [65] |

| Exploring the impact of the degree of firm similarity on interfirm collaboration | Internal structure—Sales, organizational structure and process, business scopeExternal structure—Customers (accounts) | [66,71,72] |

| Investigating the effect of similarity between firms‘ capabilities in invention and commercialization on timing of market entry | Internal structure—The number of employees, R&D expenditure, return on assets, the number of product categories | [73] |

| Examining the performance of technology innovation after technology-sourcing cross-border Mergers and Acquisitions (M&As) from the perspective of resource similarity and complementarity | Internal structure—Industrial classification | [74] |

| Investigating the effect of firm similarity on multi-dimensional competitions in the petroleum industry | Internal structure—Output share of products External structure—Output share of business segments and region | [75] |

| Measuring the potential M&A synergies based on text-based analysis of business similarity | Internal structure—Products | [76] |

| Firm ID | ISIC | Firm Type | Number of Employees | Gross Sales (Million KRW) | Total Capital (Million KRW) | KTRS Rating |

|---|---|---|---|---|---|---|

| 248928 | 58 | Corporate | 38 | 10,177 | 400 | A |

| Internal Structure | External Structure | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Firm ID | Firm Type | Number of Employees | Gross Sales | Total Capital | Firm ID | Number of Main Creditors | Amount of Main Purchases | Numer of Main Debtors | Amount of Main Sales |

| 347396 | Corp. | 41 | 10,164 | 200 | 296342 | 3 | 1739 | 5 | 5433 |

| 260847 | Corp. | 34 | 11,724 | 300 | 327695 | 5 | 1757 | 9 | 2736 |

| 322389 | Corp. | 38 | 13,970 | 300 | 313323 | 3 | 1039 | 9 | 1622 |

| 282356 | Corp. | 35 | 7243 | 400 | 351034 | - | - | 3 | 1119 |

| 150124 | Corp. | 43 | 7727 | 365 | 264308 | 5 | 1131 | 9 | 3666 |

| 253472 | Corp. | 38 | 5453 | 400 | 315926 | - | - | 7 | 1479 |

| 178440 | Corp. | 33 | 7703 | 360 | 331026 | 4 | 779 | 5 | 2680 |

| 226327 | Corp. | 45 | 8925 | 635 | 316679 | 5 | 32 | 8 | 542 |

| 281998 | Corp. | 43 | 8100 | 625 | 252405 | 5 | 1050 | 5 | 4017 |

| 307142 | Corp. | 27 | 10,367 | 500 | 302334 | - | - | 8 | 541 |

| Firm ID | Internal Structure (IS) | External Structure (ES) | OS | KTRS Rating | ||||

|---|---|---|---|---|---|---|---|---|

| IS | IS_nor | ES_sale | ES_purc | ES | ES_nor | |||

| 296342 | 0.7549 | 0.7934 | 0.0000 | 0.3922 | 0.1961 | 1.0000 | 0.8967 | A |

| 351034 | 0.3629 | 0.3808 | 0.0000 | 0.2692 | 0.1346 | 0.6808 | 0.5308 | BBB |

| 347396 | 0.9512 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.5000 | AA |

| 260847 | 0.9298 | 0.9775 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4888 | A |

| 322389 | 0.9264 | 0.9740 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4870 | AA |

| 282356 | 0.9223 | 0.9697 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4848 | BBB |

| 264308 | 0.6488 | 0.6818 | 0.0000 | 0.1160 | 0.0580 | 0.2837 | 0.4827 | A |

| 150124 | 0.9160 | 0.9629 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4815 | A |

| 253472 | 0.9129 | 0.9598 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4799 | A |

| 178440 | 0.9079 | 0.9544 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.4772 | BBB |

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| 1. IS | 1 | −0.029 | 0.019 | 0.604 * | 0.005 |

| 2. ES_sale | 1 | −0.003 | −0.011 | −0.006 | |

| 3. ES_purc | 1 | 0.024 | −0.012 | ||

| 4. ISIC | 1 | 0.109 * | |||

| 5. Tech. code | 1 |

| Number of Relevant Firms | Min. | Max. | Q1 | Q2 | Q3 | Avg. | Stdev. |

|---|---|---|---|---|---|---|---|

| 1520 | 4 | 9 | 6 | 8 | 9 | 7.3741 | 1.4393 |

| Approach | Accuracy | Macro Average | Micro Average | ||

|---|---|---|---|---|---|

| Precision | Recall | F1 Score | F1 Score | ||

| Proposed approach | 0.7236 | 0.8234 | 0.4306 | 0.5655 | 0.7236 |

| Current approach (ISIC) | 0.6301 | 0.7829 | 0.3417 | 0.4758 | 0.6301 |

| Current approach (Tech. code) | 0.6599 | 0.8322 | 0.4178 | 0.5563 | 0.6599 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, E.; Ock, Y.S.; Shin, S.-J.; Seo, W. An Approach to Generating Reference Information for Technology Evaluation. Sustainability 2018, 10, 3200. https://doi.org/10.3390/su10093200

Kim E, Ock YS, Shin S-J, Seo W. An Approach to Generating Reference Information for Technology Evaluation. Sustainability. 2018; 10(9):3200. https://doi.org/10.3390/su10093200

Chicago/Turabian StyleKim, Eungchan, Young Seok Ock, Seung-Jun Shin, and Wonchul Seo. 2018. "An Approach to Generating Reference Information for Technology Evaluation" Sustainability 10, no. 9: 3200. https://doi.org/10.3390/su10093200