Investigating Private Sectors’ Behavioral Intention to Participate in PPP Projects: An Empirical Examination Based on the Theory of Planned Behavior

Abstract

:1. Introduction

2. Background, Research Model, and Hypotheses

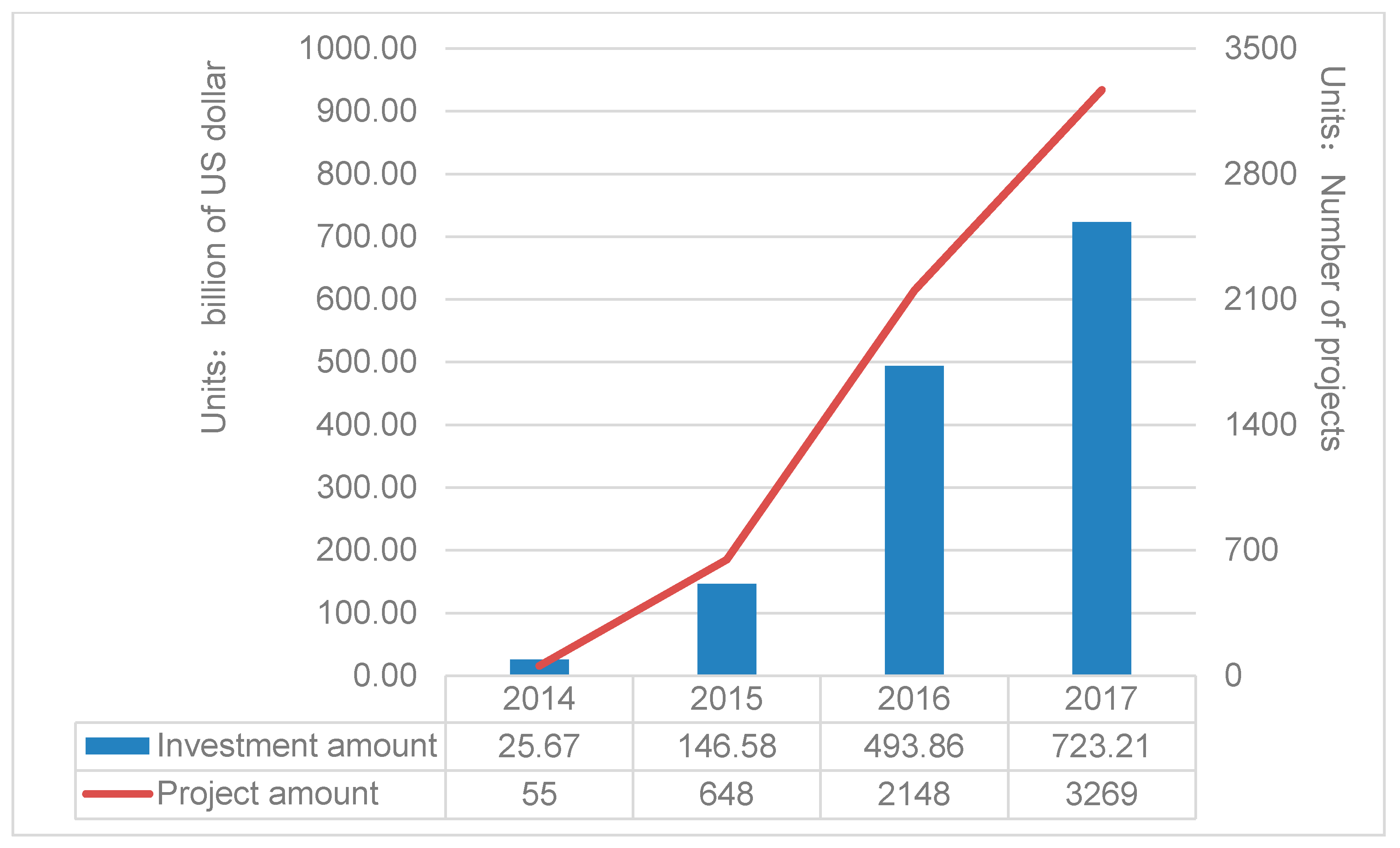

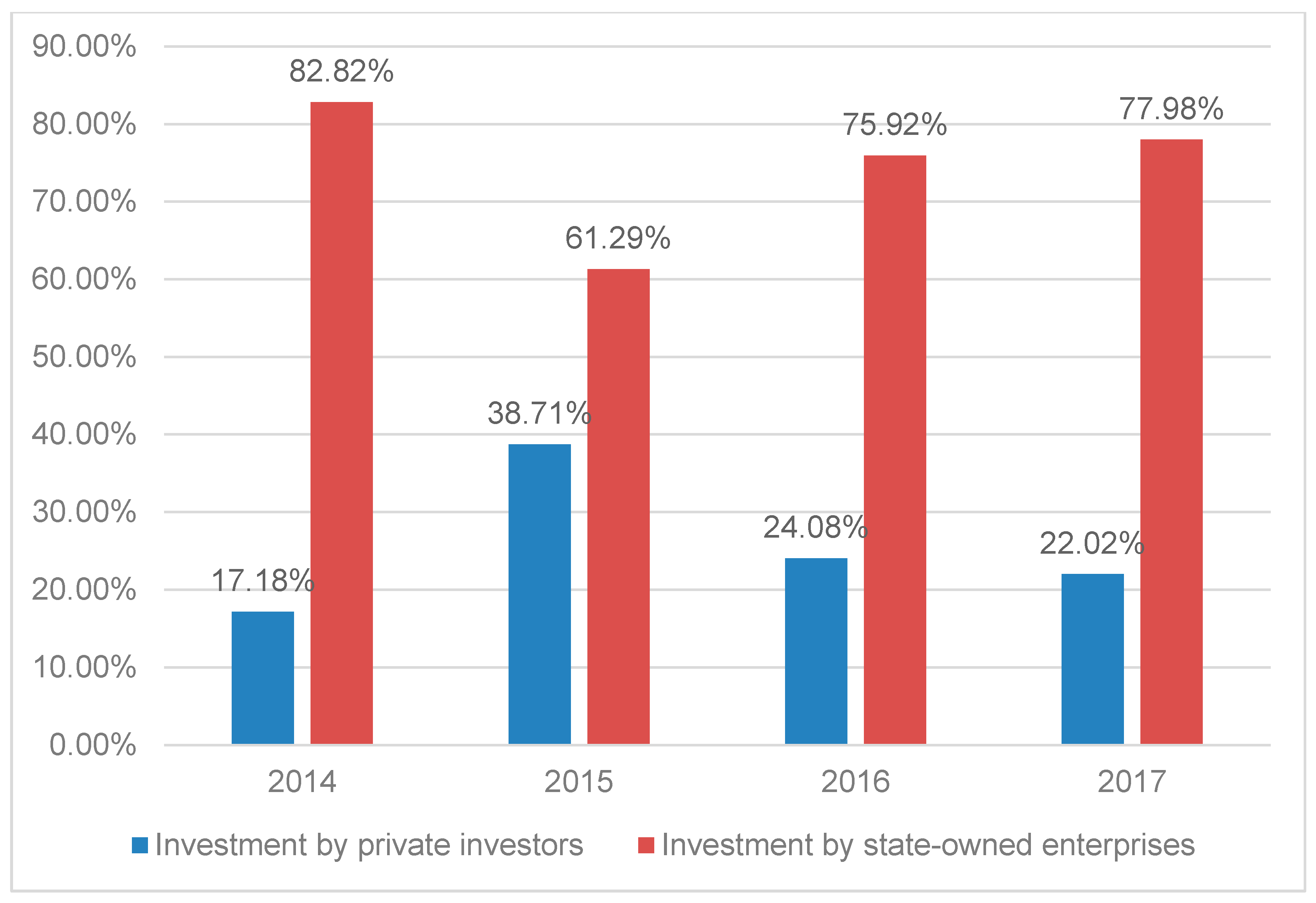

2.1. Background

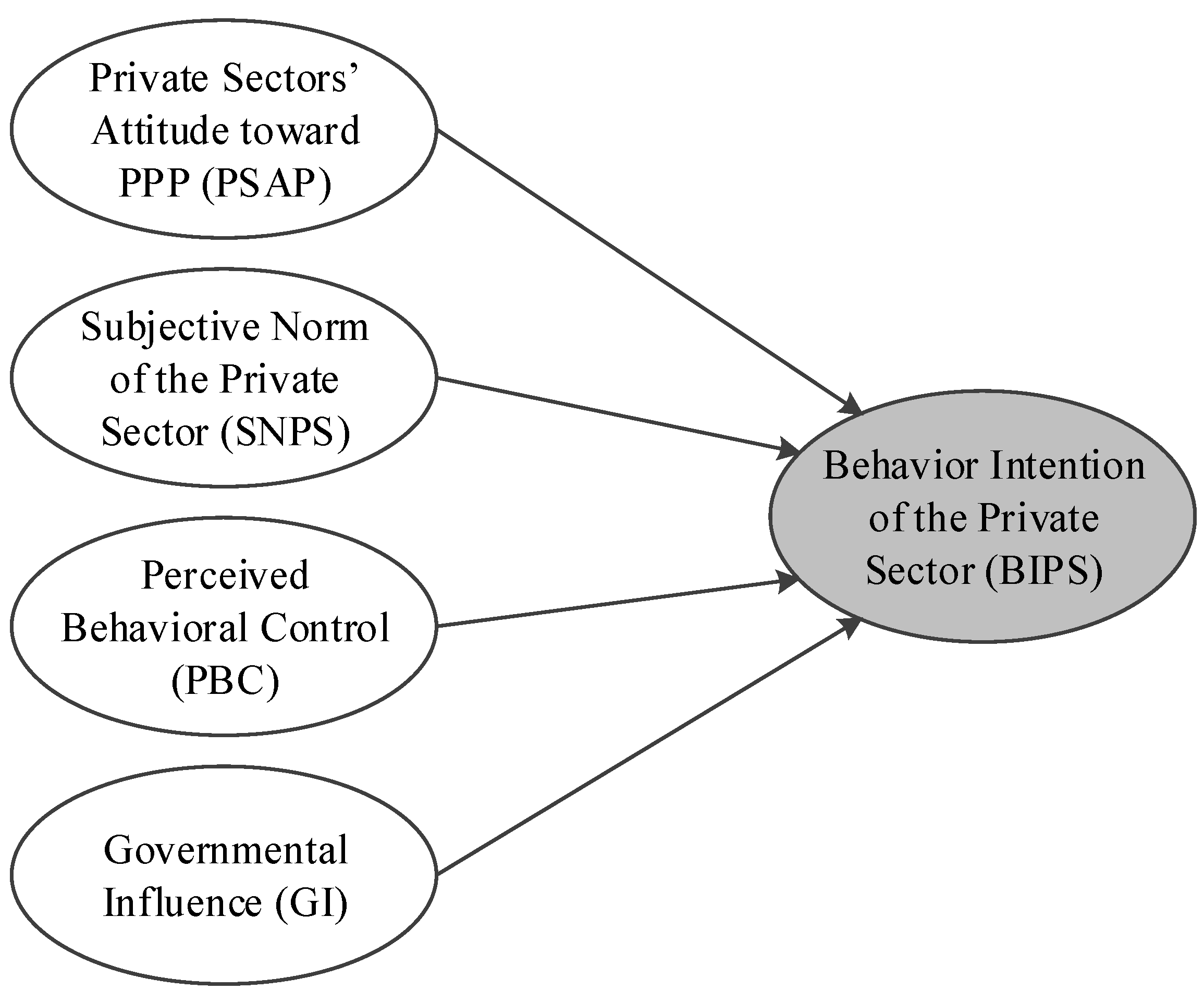

2.2. Research Model and Hypotheses

2.3. Latent Variables and Observable Variables

2.3.1. Private Sectors’ Attitude toward PPP

2.3.2. Subjective Norm of Private Sector

2.3.3. Perceived Behavioral Control

2.3.4. Governmental Influence

2.3.5. Behavioral Intention of the Private Sector

3. Research Methodology

3.1. Questionnaire Design and Data Collection

3.2. Partial Least Squares Structural Equation Modeling

4. Data Analysis and Results

4.1. Inter-Group Comparison

4.2. Measurement Model Analysis

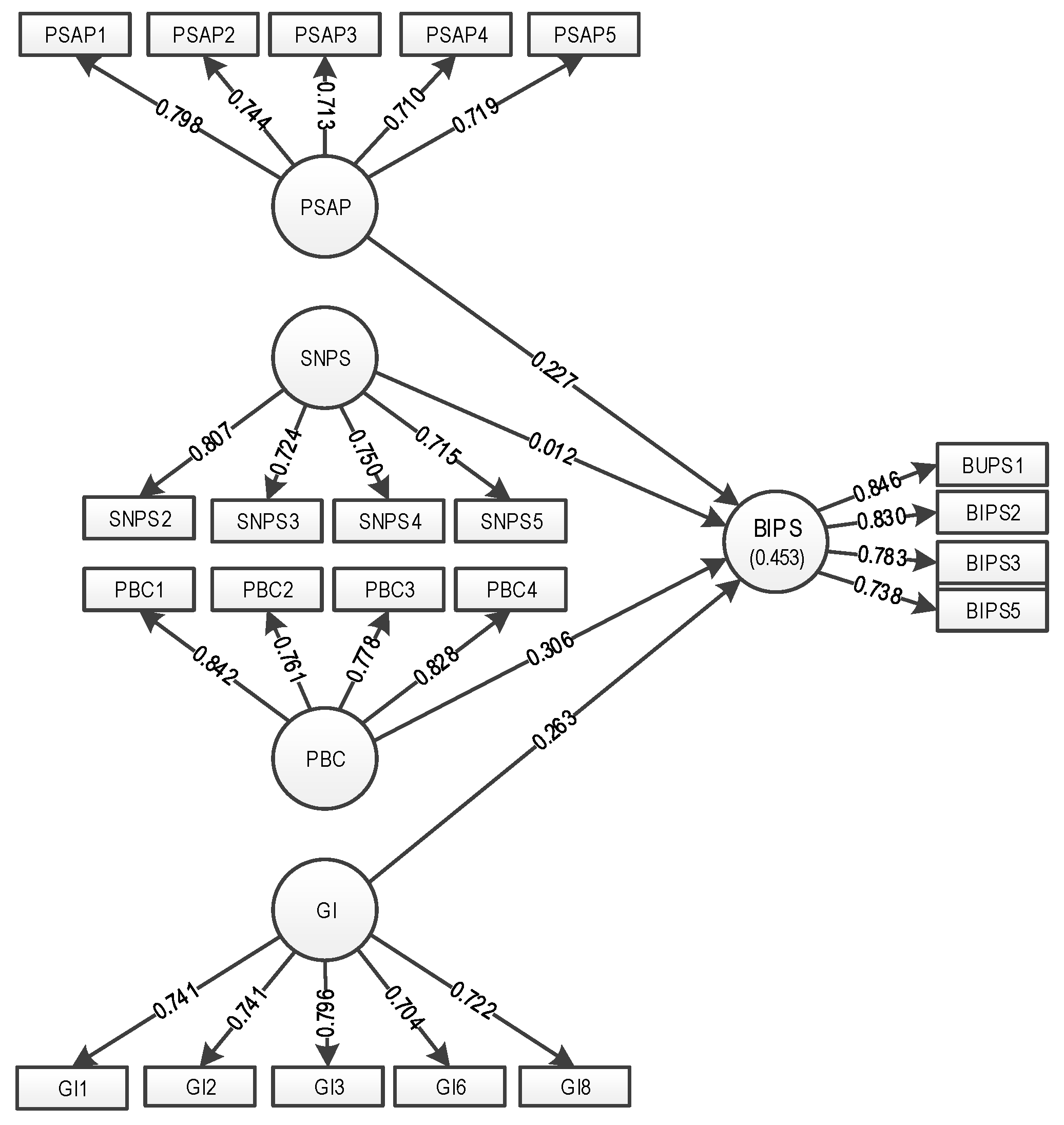

4.3. Structural Model Analysis and Research Hypotheses Tests

- (1)

- Hypothesis 1 (H1), the private sectors’ attitude toward PPP projects has a direct and significant effect on the behavior intention of the private sector to participate in PPP projects, was supported.

- (2)

- Hypothesis 2 (H2), the subjective norm of the private sector regarding PPP projects has a direct and significant effect on the behavior intention of the private sector to participate in PPP projects, was not supported.

- (3)

- Hypothesis 3 (H3), the private sectors’ perceived behavioral control over participating in PPP projects has a direct and significant effect on the behavior intention of the private sector to participate in PPP projects, was supported.

- (4)

- Hypothesis 4 (H4), governmental influence has a direct and significant effect on the behavior intention of the private sector to participate in PPP projects, was supported.

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Bohun, V. Developing Best Practices for Promoting Private Sector Investment in Infrastructure: Airports and Air Traffic Control; Asian Development Bank: Manila, Philippines, 2015. [Google Scholar]

- Zhang, S.; Gao, Y.; Feng, Z.; Sun, W. PPP application in infrastructure development in China: Institutional analysis and implications. Int. J. Proj. Manag. 2015, 33, 497–509. [Google Scholar] [CrossRef]

- Cheng, E.W.L.; Chiang, Y.H.; Tang, B.S. Alternative approach to credit scoring by DEA: Evaluating borrowers with respect to PFI projects. Build. Environ. 2007, 42, 1752–1760. [Google Scholar] [CrossRef]

- Nisar, T.M. Implementation constraints in social enterprise and community public private partnerships. Int. J. Proj. Manag. 2013, 31, 638–651. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Comparative analysis of the success criteria for public-private partnership projects in Ghana and Hong Kong. Proj. Manag. J. 2017, 48, 80–92. [Google Scholar] [CrossRef]

- Cheng, Z.; Ke, Y.; Lin, J.; Yang, Z.; Cai, J. Spatio-temporal dynamics of public private partnership projects in China. Int. J. Proj. Manag. 2016, 34, 1242–1251. [Google Scholar] [CrossRef] [Green Version]

- Effah, E.A.; Chan, A.P.C.; Owusu-Manu, D.G. Critical success factors for attracting private sector participation in water supply projects in developing countries. J. Facil. Manag. 2017, 15, 35–61. [Google Scholar]

- Apurva Sanghi. Public Private Partnership Units: Lessons for Their Design and Use in Infrastructure; The World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Skietrys, E.; Raipa, A.; Bartkus, E.V. Dimensions of the efficiency of public-private partnership. Eng. Econ. 2015, 105, 45–50. [Google Scholar]

- Erridge, A.; Greer, J. Partnerships and public procurement: Building social capital through supply relations. Public Adm. 2002, 80, 503–522. [Google Scholar] [CrossRef]

- Shen, L.Y.; Platten, A.; Deng, X.P. Role of public private partnerships to manage risks in public sector projects in Hong Kong. Int. J. Proj. Manag. 2006, 24, 587–594. [Google Scholar] [CrossRef]

- Yuan, J.; Wang, C.; Skibniewski, M.J.; Li, Q. Developing key performance indicators for public-private partnership projects: Questionnaire survey and analysis. J. Manag. Eng. 2011, 28, 252–264. [Google Scholar] [CrossRef]

- Zhang, S.; Chan, A.P.C.; Feng, Y.; Duan, H.; Ke, Y. Critical review on PPP research—A search from the Chinese and international journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Harris, F., Jr. How the Entrepreneurial Spirit Is Transforming the Public Sector. Foundation for Economic Education. 1993. Available online: https://fee.org/articles/reinventing-government-how-the-entrepreneurial-spirit-is-transforming-the-public-sector-from-schoolhouse-to-statehouse-city-hall-to-the-pentagon-by-david-osborne-and-ted-gaebler (accessed on 1 June 2017).

- Almarri, K.; Boussabaine, H. The influence of critical success factors on value for money viability analysis in public–private partnership projects. Proj. Manag. J. 2017, 48, 93–106. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Yeung, J.F.Y.; Yu, C.C.P.; Wang, S.Q.; Ke, Y. Empirical study of risk assessment and allocation of public-private partnership projects in China. J. Manag. Eng. 2010, 27, 136–148. [Google Scholar] [CrossRef]

- Geddes, R.R.; Reeves, E. The favourability of US PPP enabling legislation and private investment in transportation infrastructure. Util. Policy 2017, 48, 157–165. [Google Scholar] [CrossRef]

- Wildau, G. China Admits to Disguised Fiscal Borrowing Risk. Financial Times, 3 August 2017. Available online: //www.ft.com/content/5fe8b3c2-7754-11e7-90c0-90a9d1bc9691(accessed on 12 June 2018).

- Chan, A.P.C.; Osei-Kyei, R.; Yi, H.U.; Yun, L.E. A fuzzy model for assessing the risk exposure of procuring infrastructure mega-projects through public-private partnership: The case of Hong Kong-Zhuhai-Macao bridge. Front. Eng. Manag. 2018, 5, 64–77. [Google Scholar] [CrossRef]

- Yuan, J.; Xu, W.; Xia, B.; Skibniewski, M.J. Exploring key indicators of residual value risks in China’s public–private partnership projects. J. Manag. Eng. 2018, 34, 04017046. [Google Scholar] [CrossRef]

- Ma, G.; Du, Q.; Wang, K. A concession period and price determination model for PPP projects: Based on real options and risk allocation. Sustainability 2018, 10, 706–727. [Google Scholar]

- Ye, X.; Yang, J. Research on PPP project pricing based on multi-objective programming model. Stat. Decis. 2012, 6, 74–77. [Google Scholar]

- Liu, H.; Sun, H. Selection of social capital for PPP projects based on fuzzy network analysis. Financ. Account. Mon. 2016, 32, 50–54. [Google Scholar]

- Shakeri, E.; Dadpour, M.; Jahromi, H.A. The combination of fuzzy electre and swot to select private sectors in partnership projects case study of water treatment project in Iran. Int. J. Civ. Eng. 2015, 13, 55–67. [Google Scholar]

- Wang, L. Research on evaluation methods and decision making of PPP project under market economy. Chin. Commer. Theory 2016, 36, 157–158. [Google Scholar]

- Liu, X. Market vs. Government in Managing the Chinese Economy. China Research Center, 15 October 2014. [Google Scholar]

- Guidance on Encouraging Private Capital to Participate in Public-Private Partnership (PPP) Projects. 2017. Available online: http://www.ndrc.gov.cn/gzdt/201711/t20171130_869138.html (accessed on 27 June 2018).

- Guidance on Further Encouraging the Vitality of Civilian Effective Investment to Promote the Sustainable and Healthy Development of Economy. 2017. Available online: http://www.gov.cn/zhengce/content/2017-09/15/content_5225395.htm (accessed on 27 June 2018).

- Guidance on Innovating the Institutional Mechanism of Rural Infrastructure Investment and Financing. 2017. Available online: http://www.gov.cn/zhengce/content/2017-02/17/content_5168733.htm (accessed on 27 June 2018).

- Infrastructure and Public Utilities Franchise Management Measures. 2015. Available online: http://fgs.ndrc.gov.cn/zttp/ppplftj/lftj/201605/t20160511_801405.html (accessed on 27 June 2018).

- Interim Measures for the Administration of Special Subsidy Funds for Preliminary Work of Government and Social Capital Cooperation Projects. 2015. Available online: http://www.ndrc.gov.cn/yjzx/yjzx_add.jsp?SiteId=99 (accessed on 27 June 2018).

- Notice on Accelerating the Use of Public-Private Partnership (PPP) Mode to Activate Infrastructure Assets. 2017. Available online: http://www.ndrc.gov.cn/gzdt/201707/t20170707_854099.html (accessed on 27 June 2018).

- Notice on Conscientiously Deepening the Work Related to the Government’s Cooperation with Social Capital in the Field of Traditional Infrastructure. 2016. Available online: http://www.ndrc.gov.cn/zcfb/zcfbtz/201608/t20160830_816401.html (accessed on 27 June 2018).

- Notice on Deepening Opinions on Key Work for Deepening Economic System Reform in 2016. 2016. Available online: http://www.gov.cn/zhengce/content/2016-03/31/content_5060062.htm (accessed on 27 June 2018).

- Notice on Developing Public-Private Partnership (PPP) Innovation Work in Major Municipal Engineering Sectors. 2016. Available online: http://bgt.ndrc.gov.cn/zcfb/201610/t20161011_822293.html (accessed on 27 June 2018).

- Notice on the General Office of the State Council of China on Further Opotimization the Work Related to Private Investment. 2016. Available online: http://www.gov.cn/zhengce/content/2016-07/04/content_5087839.htm (accessed on 27 June 2018).

- Notice on Requesting Typical Cases of Traditional Public-Private Partnership (PPP) Projects in the Field of Traditional Infrastructure. 2016. Available online: http://bgt.ndrc.gov.cn/zcfb/201609/t20160906_817790.html (accessed on 27 June 2018).

- Promotion of Private Investment in Typical Experiences and Practices. 2016. Available online: http://www.ndrc.gov.cn/fzgggz/gdzctz/tzfg/201609/t20160921_819117.html (accessed on 27 June 2018).

- Promotion Several Policies and Measures for the Healthy Development of Private Investment. 2016. Available online: http://www.ndrc.gov.cn/gzdt/201610/t20161012_822431.html (accessed on 27 June 2018).

- Ajzen, I. The theory of planned behavior, organizational behavior and human decision processes. J. Leis. Res. 1991, 50, 176–211. [Google Scholar]

- Koropp, C.; Kellermanns, F.W.; Grichnik, D.; Stanley, L. Financial decision making in family firms: An adaptation of the theory of planned behavior. Fam. Bus. Rev. 2014, 27, 307–327. [Google Scholar] [CrossRef]

- Aibinu, A.A.; Al-Lawati, A.M. Using PLS-SEM technique to model construction organizations’ willingness to participate in e-bidding. Autom. Constr. 2010, 19, 714–724. [Google Scholar] [CrossRef]

- Cheng, E.W.L. Intentions to form project partnering in Hong Kong: Application of the theory of planned behavior. J. Constr. Eng. Manag. 2016, 142, 04016075. [Google Scholar] [CrossRef]

- Xian, Z.; Lu, Y.; Yun, L.; Li, Y.; Fang, J. Formation of inter organizational relational behavior in megaprojects: Perspective of the extended theory of planned behavior. J. Manag. Eng. 2018, 34, 04017052. [Google Scholar]

- Tang, T. Research on Bidding Decision-Making of PPP Project Based on the Theory of Planned Behavior and Prospect Theory. Ph.D. Dissertation, Tianjin University, Tianjin, China, 2016. [Google Scholar]

- Wu, Z.; Yu, A.T.; Shen, L. Investigating the determinants of contractor’s construction and demolition waste management behavior in mainland China. Waste Manag. 2016, 60, 290–300. [Google Scholar] [CrossRef] [PubMed]

- Karim Ghani, W.A.; Rusli, I.F.; Biak, D.R.; Idris, A. An application of the theory of planned behaviour to study the influencing factors of participation in source separation of food waste. Waste Manag. 2013, 33, 1276–1281. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Song, H.; Lü, X.; Jiang, Y. The Effects of Characteristics of Tourists on Chinese Outbound Tourism Destination Choice Behavior: An Empirical Study Based on TPB Model. Tour. J. 2016, 43, 33–43. [Google Scholar]

- Wibowo, A.; Alfen, H.W. Government-led critical success factors in PPP infrastructure development. Built Environ. Proj. Asset Manag. 2015, 5, 121–134. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Implementing public private partnership (PPP) policy for public construction projects in Ghana: Critical success factors and policy implications. Int. J. Constr. Manag. 2016, 17, 113–123. [Google Scholar] [CrossRef]

- Wang, S.Q.; Tiong, R.L.K.; Ting, S.K.; Ashley, D. Evaluation and management of political risks in China’s bot projects. J. Constr. Eng. Manag. 2000, 126, 242–250. [Google Scholar] [CrossRef]

- Shan, M.; Chan, A.P.C.; Le, Y.; Hu, Y.; Xia, B. Understanding collusive practices in Chinese construction projects. J. Prof. Issues Eng. Educ. Pract. 2016, 143, 05016012. [Google Scholar] [CrossRef]

- Shan, M.; Chan, A.P.; Le, Y.; Hu, Y. Investigating the effectiveness of response strategies for vulnerabilities to corruption in the Chinese public construction sector. Sci. Eng. Ethics 2015, 21, 683–705. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Shan, M.; Le, Y.; Yiu, K.T.; Chan, A.P.; Hu, Y. Investigating the underlying factors of corruption in the public construction sector: Evidence from China. Sci. Eng. Ethics 2017, 23, 1643–1666. [Google Scholar] [CrossRef] [PubMed]

- Ozorhon, B.; Oral, K. Drivers of innovation in construction projects. J. Constr. Eng. Manag. 2016, 143, 04016118. [Google Scholar] [CrossRef]

- Liu, Q.; Ren, J. A study of the characteristics of social capital participating in public private partnerships—Evidence from Chinese listed firms. Rev. Econ. Manag. 2017, 6, 38–46. [Google Scholar]

- Ye, X.; Shi, S.; Liu, L. The choice and driving force of social capital participation in PPP projects in western China. J. Civ. Eng. Manag. 2017, 34, 77–82. [Google Scholar]

- Ye, X.; Shi, S.; Chong, H.Y.; Fu, X.; Liu, L.; He, Q. Empirical analysis of firms’ willingness to participate in infrastructure PPP projects. J. Constr. Eng. Manag. 2018, 144, 04017092. [Google Scholar] [CrossRef]

- Zhang, G.; Xiao, G. Analysis on the reasons why private enterprises participate in the PPP project “double drop” and policy Suggestions (below). Constr. Enterp. Manag. 2018, 2018, 88–91. [Google Scholar]

- Babatunde, S.O.; Perera, S. Barriers to bond financing for public-private partnership infrastructure projects in emerging markets: A case of Nigeria. J. Financ. Manag. Prop. Constr. 2017, 22, 2–19. [Google Scholar] [CrossRef]

- Liu, H.; Liu, J. Empirical analysis on the dynamic factors that attract social capital participation in PPP projects. Commer. Econ. Res. 2016, 3, 29–31. [Google Scholar]

- Mostaan, K. Stakeholder Alignment Strategies for Highway Infrastructure Public-Private Partnerships. Ph.D. Thesis, Georgia Institute of Technology, Atlanta, GA, USA, 2017. [Google Scholar]

- Osei-Kyei, R.; Dansoh, A.; Kuragu, J.K.O.Â. Reasons for adopting public “private partnership (PPP) for construction projects in Ghana. Int. J. Constr. Manag. 2014, 14, 227–238. [Google Scholar]

- World Bank. Attracting Investors to African Public-Private Partnerships: A Project Preparation Guide; World Bank Publications: Washington, DC, USA, 2009. [Google Scholar]

- Li, B.; Akintoye, A.; Hardcastle, C. Critical success factors for PPP/PFI projects in the UK construction industry. Constr. Manag. Econ. 2005, 23, 459–471. [Google Scholar] [CrossRef]

- Ke, Y.; Wang, S.; Chan, A.P.C. Government incentives for private sector involvement in infrastructure PPP projects. J. Tsinghua Univ. 2009, 49, 1480–1483. [Google Scholar]

- Li, Y.; liu, M.; Wang, F. Study on project operation mode of large-scale construction enterprises based on PPP mode. Constr. Technol. 2017, 46, 107–112. [Google Scholar]

- Liang, L. Research on Investment and Financing of Sewage Treatment Industry Based on PPP Mode—Taking Bishuiyuan as an Example. Ph.D. Thesis, East China University of Science and Technology, Shanghai, China, 2016. [Google Scholar]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. Factors influencing the success of PPP at feasibility stage—A tripartite comparison study in Hong Kong. Habitat Int. 2012, 36, 423–432. [Google Scholar] [CrossRef]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. A structural equation model of feasibility evaluation and project success for public–private partnerships in Hong Kong. IEEE Trans. Eng. Manag. 2010, 57, 310–322. [Google Scholar] [CrossRef] [Green Version]

- Akintoye, A.; Hardcastle, C.; Beck, M.; Chinyio, E.; Asenova, D. Achieving best value in private finance initiative project procurement. Constr. Manag. Econ. 2003, 21, 461–470. [Google Scholar] [CrossRef]

- Kanji, G.K. Performance measurement system. Total Qual. Manag. 2002, 13, 715–728. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Privileges and attractions for private sector involvement in PPP Projects—A comparison between China and the Hong Kong special administrative region. In Proceedings of the International Structural Engineering and Construction Conference, Vegas, NV, USA, 22–25 September 2009; pp. 751–755. [Google Scholar]

- Porter, M.E. How Competitive Forces Shape Strategy. Harv. Bus. Rev. 1979, 57, 137–145. [Google Scholar]

- Smith, K.G.; Ferrier, W.J.; Ndofor, H. Competitive Dynamics Research: Critique and Future Directions. In Handbook of Strategic Management; Hitt, M.A., Freeman, R.E., Harrison, J.S., Eds.; Blackwell Publishers: Malden, MA, USA, 2001; pp. 315–361. [Google Scholar]

- Mol, M.J.; Birkinshaw, J. The sources of management innovation: When firms introduce new management practices. J. Bus. Res. 2004, 62, 1269–1280. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Cheung, E.; Kajewski, S. Factors contributing to successful public private partnership projects. J. Facil. Manag. 2012, 10, 45–58. [Google Scholar] [Green Version]

- Dulaimi, M.F.; Alhashemi, M.; Ling, F.Y.Y.; Kumaraswamy, M. The execution of public–private partnership projects in the UAE. Constr. Manag. Econ. 2010, 28, 393–402. [Google Scholar] [CrossRef]

- Jefferies, M. Critical success factors of public private sector partnerships: A case study of the Sydney SuperDome. Eng. Constr. Archit. Manag. 2006, 13, 451–462. [Google Scholar] [CrossRef]

- Wang, B.; Zhang, X.; Wang, X. Function positioning and construction thinking of PPP industry association. Chin. Gov. Procure. 2018, 2018, 66–69. [Google Scholar]

- Long, W.; Li, S.; Xing, D. Environmental performance of industry associations and small and medium-sized enterprises: A perspective of informal environmental regulation effect. Chin. Adm. 2017. [Google Scholar] [CrossRef]

- Yuan, J.F.; Skibniewski, M.; Li, Q.; Shan, J. The driving factors of China’s public private partnership projects in metropolitian transportation systems: Public sector’s viewpoint. Statyba 2010, 16, 5–18. [Google Scholar] [CrossRef]

- Almarri, K. Perceptions of the attractive factors for adopting public–private partnerships in the UAE. Int. J. Constr. Manag. 2017. [Google Scholar] [CrossRef]

- Liu, Q.; Zhang, S. Development process, major problems and reform prospects of China’s PPP. Financ. Superv. 2017, 4, 5–9. [Google Scholar]

- Zou, P.X. An overview of China’s construction project tendering. Int. J. Constr. Manag. 2007, 7, 23–39. [Google Scholar] [CrossRef]

- Han, S.H.; Diekmann, J.E. Approaches for making risk-based go/no-go decision for international projects. J. Constr. Eng. Manag. 2001, 127, 300–308. [Google Scholar] [CrossRef]

- Ozdoganm, I.D.; Talat Birgonul, M. A decision support framework for project sponsors in the planning stage of build-operate-transfer (BOT) projects. Constr. Manag. Econ. 2000, 18, 343–353. [Google Scholar] [CrossRef]

- Liu, T.; Wilkinson, S. Adopting innovative procurement techniques: Obstacles and drivers for adopting public private partnerships in New Zealand. Constr. Innov. 2011, 11, 452–469. [Google Scholar] [CrossRef]

- Shen, L.Y.; Li, Q.M.; Drew, D.; Shen, Q.P. Awarding construction contracts on multicriteria basis in China. J. Constr. Eng. Manag. 2004, 130, 385–393. [Google Scholar] [CrossRef]

- Walker, C.; Smith, A.J. Privatized Infrastructure: The BOT Approach; Thomas Telford: London, UK, 1995. [Google Scholar]

- Ye, K.; Shen, L.; Xia, B.; Li, B. Key attributes underpinning different markup decision between public and private projects: A China study. Int. J. Proj. Manag. 2014, 32, 461–472. [Google Scholar] [CrossRef] [Green Version]

- Bryde, D.J.; Robinson, L. Client versus contractor perspectives on project success criteria. Int. J. Proj. Manag. 2005, 23, 622–629. [Google Scholar] [CrossRef]

- Peters, D.H.; Phillips, T. Mectizan donation program: Evaluation of a public-private partnership. Trop. Med. Int. Health 2010, 9, A4–A15. [Google Scholar] [CrossRef] [PubMed]

- Fu, W.K.; Drew, D.S.; Lo, H.P. Competitiveness of inexperienced and experienced contractors in bidding. J. Constr. Eng. Manag. 2003, 129, 388–395. [Google Scholar] [CrossRef]

- Abdul-Aziz, A.R.; Kassim, P.S.J. Objectives, success and failure factors of housing public–private partnerships in Malaysia. Habitat Int. 2011, 35, 150–157. [Google Scholar] [CrossRef]

- Gannon, M.J.; Smith, N.J. An effective outline business case to facilitate successful decision-making. Constr. Manag. Econ. 2011, 29, 185–197. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhao, X.; Gay, M.J.S. Public private partnership projects in Singapore: Factors, critical risks and preferred risk allocation from the perspective of contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Jacobson, C.; Sang, O.C. Success factors: Public works and public–private partnerships. Int. J. Public Sector Manag. 2008, 21, 637–657. [Google Scholar] [CrossRef]

- Aziz, A.M.A. Successful delivery of public-private partnerships for infrastructure development. J. Constr. Eng. Manag. 2011, 133, 918–931. [Google Scholar] [CrossRef]

- Chan, D.W.M.; Chan, A.P.C.; Lam, P.T.I. A feasibility study of the implementation of public private partnership (PPP) in Hong Kong. In Proceedings of the CIB W89 BEAR 2006 International Conference on Construction Sustainability and Innovation, Hong Kong, China, 10–13 April 2006. [Google Scholar]

- Jefferies, M.; Mcgeorge, W.D. Using public–private partnerships (PPPs) to procure social infrastructure in Australia. Engineering 2009, 16, 415–437. [Google Scholar] [CrossRef]

- Meng, X.; Zhao, Q.; Shen, Q. Critical success factors for transfer-operate-transfer urban water supply projects in China. J. Manag. Eng. 2011, 27, 243–251. [Google Scholar] [CrossRef]

- Albalate, D.; Bel, G.; Geddes, R.R. The determinants of contractual choice for private involvement in infrastructure projects. Public Money Manag. 2015, 35, 87–94. [Google Scholar] [CrossRef]

- Hon, C.K.H.; Chan, A.P.C.; Yam, M.C.H. Empirical study to investigate the difficulties of implementing safety practices in the repair and maintenance sector in Hong Kong. J. Constr. Eng. Manag. 2012, 138, 877–884. [Google Scholar] [CrossRef]

- Zhao, X.; Hwang, B.G.; Sui, P.L. Understanding enterprise risk management maturity in construction firms. J. Constr. Eng. Manag. 2014, 140, 905–915. [Google Scholar] [CrossRef]

- Zheng, J.; Wu, G.; Xie, H. Impacts of leadership on project-based organizational innovation performance: The mediator of knowledge sharing and moderator of social capital. Sustainability 2017, 9, 1893. [Google Scholar] [CrossRef]

- Babakus, E.; Mangold, W.G. Adapting the SERVQUALservqual scale to hospital services: An empirical investigation. Health Serv. Res. 1992, 26, 767. [Google Scholar] [PubMed]

- Jenkins, G.D.; Taber, T.D. A Monte-Carlo study of factors affecting three indices of composite scale reliability. J. Appl. Psychol. 1977, 62, 392–398. [Google Scholar] [CrossRef]

- Saleh, F.; Ryan, C. Analysing service quality in the hospitality industry using the SERVQUAL model. Serv. Ind. J. 1991, 11, 324–345. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, X.; Yan, P. Risk paths in international construction projects: Case study from Chinese contractors. J. Constr. Eng. Manag. 2016, 142, 05016002. [Google Scholar] [CrossRef]

- Zahoor, H.; Chan, A.P.C.; Utama, W.P.; Gao, R.; Memon, S.A. Determinants of safety climate for building projects: SEM-based cross-validation study. J. Constr. Eng. Manag. 2017, 143, 05017005. [Google Scholar] [CrossRef]

- Eybpoosh, M.; Dikmen, I.; Birgonul, M.T. Identification of risk paths in international construction projects using structural equation modeling. J. Constr. Eng. Manag. 2011, 137, 1164–1175. [Google Scholar] [CrossRef]

- Xiong, B.; Skitmore, M.; Xia, B.; Masrom, M.A.; Ye, K.; Bridge, A. Examining the influence of participant performance factors on contractor satisfaction: A structural equation model. Int. J. Proj. Manag. 2014, 32, 482–491. [Google Scholar] [CrossRef] [Green Version]

- Reinartz, W.; Haenlein, M.; Henseler, J. An empirical comparison of the efficacy of covariance-based and variance-based SEM. Soc. Sci. Electron. Publ. 2009, 26, 332–344. [Google Scholar] [Green Version]

- Dijkstra, T.K. Latent Variables and Indices: Herman Wold’s Basic Design and Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 23–46. [Google Scholar]

- Chin, W.W. The partial least square approach to structural equation modeling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Erlbaum: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PlS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Ning, Y.; Ling, F.Y.Y. Reducing hindrances to adoption of relational behaviors in public construction projects. J. Constr. Eng. Manag. 2013, 139, 04013017. [Google Scholar] [CrossRef]

- Zhao, X.; Hwang, B.G.; Sui, P.L. Critical success factors for enterprise risk management in Chinese construction companies. Constr. Manag. Econ. 2013, 31, 1199–1214. [Google Scholar] [CrossRef]

- Rajendran, S.; Gambatese, J.; Behm, M. Impact of green building design and construction on worker safety and health. J. Constr. Eng. Manag. 2009, 135, 1058–1066. [Google Scholar] [CrossRef]

- Tixier, A.; Hallowell, M.; Albert, A.; van Boven, L.; Kleiner, B. Psychological antecedents of risk-taking behavior in construction. J. Constr. Eng. Manag. 2014, 140, 04014052. [Google Scholar] [CrossRef]

- Hwang, B.G.; Shan, M.; Looi, K.Y. Key constraints and mitigation strategies for prefabricated prefinished volumetric construction. J. Clean. Prod. 2018, 183, 183–193. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Doloi, H. Rationalizing the implementation of web-based project management systems in construction projects using PLS-SEM. J. Constr. Eng. Manag. 2014, 140, 615–621. [Google Scholar] [CrossRef]

- Tonglet, M.; Philips, P.S.; Read, A.D. Using the theory of planned behavior to investigate the determinants of recycling behavior: A case study from Brixworth, UK. Resour. Conserv. Recycl. 2004, 41, 191–214. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Campbell, D.T.; Fiske, D.W. Convergent and discriminant validation by the multitrait-multimethod matrix. Psychol. Bull. 1959, 56, 81–105. [Google Scholar] [CrossRef] [PubMed]

- Ling, F.Y.Y.; Ning, Y.; Ke, Y.; Kumaraswamy, M.M. Modeling relational transaction and relationship quality among team members in public projects in Hong Kong. Autom. Constr. 2013, 36, 16–24. [Google Scholar] [CrossRef]

- Ning, Y. Quantitative effects of drivers and barriers on networking strategies in public construction projects. Int. J. Proj. Manag. 2014, 32, 286–297. [Google Scholar] [CrossRef]

- Cenfetelli, R.T.; Bassellier, G. Interpretation of formative measurement in information systems research. Mis Q. 2009, 33, 689–707. [Google Scholar] [CrossRef]

- Hulland, J. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 2015, 20, 195–204. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications, Inc.: Los Angeles, CA, USA, 2014. [Google Scholar]

- Li, J.; Zou, P.X. Fuzzy AHP-based risk assessment methodology for PPP projects. J. Constr. Eng. Manag. 2011, 137, 1205–1209. [Google Scholar] [CrossRef]

- Zhang, W.-K.; Yang, Y.-H.; Wang, Y.-Q. An empirical study on key factors influencing the performance of public–private partnerships (PPP) in some transitional countries. J. Public Manag. 2010, 7, 103–112. [Google Scholar]

- Wang, S. The Government Credibility as the PPP Mode “Obstacle”. 2015. Available online: http://www.ccgp.gov.cn/specialtopic/pppzt/news/201509/t20150914_5844025.htm (accessed on 12 June 2018).

- Qi, X.; Ke, Y.; Wang, S. Based on the case analysis of the main risk factors for PPP projects in China. China Soft Sci. 2009, 5, 107–113. [Google Scholar]

| Latent Variables | Code | Observable Variables | Description |

|---|---|---|---|

| Private sectors’ attitude toward PPP (PSAP) | PSAP1 | Profitability | Participation in PPP projects is profitable |

| PSAP2 | Gain access to the markets of infrastructure and public service | Participation in PPP projects contributes to access to the infrastructure and public service market | |

| PSAP3 | Increase the market share | Participation in PPP projects contributes to increasing market share | |

| PSAP4 | Benefit enterprise strategic development | Participation in PPP projects can promote enterprise development and strategic transformation | |

| PSAP5 | Establish reputation and social image | Participation in PPP projects can establish company’s reputation and social image | |

| Subjective norm of private sector (SNPS) | SNPS1 | Competitors’ attitudes toward PPP | Most of the competitors participate in PPP projects actively |

| SNPS2 | Encouragement from government | The government encourages private sectors to participate in PPP projects | |

| SNPS3 | Attitude of industry associations toward PPP | Industry associations support my company to participate in PPP projects | |

| SNPS4 | Financial sectors’ attitude toward PPP | Cooperative financial institutions support my company to participate in PPP projects | |

| SNPS5 | Attitudes of experienced private sectors | Private sectors with PPP experiences have a positive attitude towards PPP | |

| Perceived behavioral control (PBC) | PBC1 | Financial capability | My company has adequate funds to participate in PPP projects |

| PBC2 | Technical strength | My company has the technical strength to participate in PPP projects | |

| PBC3 | Past experiences | My company has adequate PPP projects experiences | |

| PBC4 | Borrowing capacity | My company can successfully obtain funds from financial institutions when participating in PPP projects | |

| PBC5 | Good relationship with government | My company has good cooperative relationship with the government—the initiator of PPP projects | |

| PBC6 | Information superiority | My company can easily acquire relevant information on the PPP projects to be initiated | |

| Governmental influence (GI) | GI1 | Help create a fair and competitive PPP market | The government can help create a fair and competitive market for PPP projects development |

| GI2 | Complete legislations and workable policies | There are proper legislations and polices for PPP projects development | |

| GI3 | Full compliance with PPP contracts | The government, as a party of PPP contract, can carry out contracts with integrity | |

| GI4 | Government financial assistance | The government provides financial assistances to private companies participating in PPP projects | |

| GI5 | Active coordination between private companies and financial sectors | The government coordinates private companies and financial sectors actively, helping the former to raise more funds for PPP projects | |

| GI6 | Appropriate allocation of risks between government and private sector | The risks of PPP projects can be allocated fairly between the government and private sector | |

| GI7 | Tax incentives | The government provides relevant tax incentives for PPP projects | |

| GI8 | Limited intervention in the implementation of PPP projects | The government will not unreasonably interfere with the implementation of the PPP projects | |

| Behavior intention of private sector (BIPS) | BIPS1 | Have intention to participate in PPP projects | My company intends to carry out PPP business |

| BIPS2 | Be willing to increase the proportion of PPP in business portfolio | My company is willing to increase the proportion of PPP business | |

| BIPS3 | Be ready to participate in PPP bidding | My company will participate in bidding for PPP projects with high probability | |

| BIPS4 | Have more interest in PPP projects | Compared to traditional projects, my company is more willing to participate in PPP projects | |

| BIPS5 | Be willing to recommend partner companies to participate in PPP projects | My company is willing to recommend partner companies to participate in PPP projects |

| Attributes | Categories | N | % |

|---|---|---|---|

| Years of working in private company | <1 year | 65 | 19.58% |

| 1–3 years | 173 | 52.11% | |

| >3 years | 94 | 28.31% | |

| None | 56 | 16.87% | |

| Years of involvement in PPP projects | <1 year | 142 | 42.77% |

| 1–3 years | 72 | 21.69% | |

| 3–5 years | 52 | 15.66% | |

| >5 years | 10 | 3.01% | |

| Job position | Top managerial level | 31 | 9.34% |

| Middle managerial level | 177 | 53.31% | |

| Professional | 65 | 19.58% | |

| Others | 59 | 17.77% | |

| Company size a | Large | 149 | 44.88% |

| Medium | 118 | 35.54% | |

| Small | 46 | 13.86% | |

| Micro | 19 | 5.72% | |

| Company Category | Construction contractors | 138 | 41.57% |

| Developers | 74 | 22.29% | |

| Other types of investment institutions | 13 | 3.92% | |

| Cultural, sports and travel operators | 6 | 1.81% | |

| Other types of operators | 11 | 3.31% | |

| Integrated environment service provider | 22 | 6.63% | |

| Materials and equipment suppliers | 26 | 7.83% | |

| Technical service provider | 42 | 12.65% |

| Observable Variables | Kruskal-Wallis Test (p-Value) | ||||

|---|---|---|---|---|---|

| Years of Working in Private Company | Years of Involvement in PPP Projects | Job Position | Company Size | Company Category | |

| PSAP1 | 0.342 | 0.079 | 0.412 | 0.423 | 0.630 |

| PSAP2 | 0.140 | 0.374 | 0.741 | 0.598 | 0.980 |

| PSAP3 | 0.223 | 0.750 | 0.591 | 0.698 | 0.801 |

| PSAP4 | 0.571 | 0.936 | 0.513 | 0.188 | 0.200 |

| PSAP5 | 0.448 | 0.219 | 0.704 | 0.373 | 0.394 |

| SNPS1 | 0.881 | 0.454 | 0.848 | 0.763 | 0.517 |

| SNPS2 | 0.340 | 0.552 | 0.217 | 0.232 | 0.242 |

| SNPS3 | 0.601 | 0.300 | 0.584 | 0.859 | 0.954 |

| SNPS4 | 0.948 | 0.863 | 0.336 | 0.637 | 0.161 |

| SNPS5 | 0.928 | 0.210 | 0.733 | 0.839 | 0.554 |

| PBC1 | 0.802 | 0.864 | 0.094 | 0.392 | 0.141 |

| PBC2 | 0.843 | 0.989 | 0.200 | 0.957 | 0.819 |

| PBC3 | 0.276 | 0.689 | 0.604 | 0.143 | 0.980 |

| PBC4 | 0.506 | 0.364 | 0.669 | 0.735 | 0.851 |

| PBC5 | 0.716 | 0.371 | 0.843 | 0.213 | 0.318 |

| PBC6 | 0.755 | 0.087 | 0.817 | 0.221 | 0.872 |

| GI1 | 0.420 | 0.960 | 0.378 | 0.523 | 0.859 |

| GI2 | 0.987 | 0.767 | 0.436 | 0.035 a | 0.171 |

| GI3 | 0.766 | 0.732 | 0.569 | 0.096 | 0.020 a |

| GI4 | 0.388 | 0.159 | 0.941 | 0.212 | 0.064 |

| GI5 | 0.484 | 0.665 | 0.181 | 0.545 | 0.312 |

| GI6 | 0.437 | 0.773 | 0.428 | 0.215 | 0.517 |

| GI7 | 0.990 | 0.638 | 0.613 | 0.170 | 0.502 |

| GI8 | 0.158 | 0.340 | 0.341 | 0.058 | 0.058 |

| BIPS1 | 0.963 | 0.977 | 0.676 | 0.996 | 0.868 |

| BIPS2 | 0.915 | 0.353 | 0.809 | 0.749 | 0.502 |

| BIPS3 | 0.672 | 0.121 | 0.260 | 0.233 | 0.339 |

| BIPS4 | 0.081 | 0.354 | 0.431 | 0.300 | 0.429 |

| BIPS5 | 0.899 | 0.574 | 0.468 | 0.416 | 0.736 |

| Observable Variables | Factor Loadings | Mean of Evaluation |

|---|---|---|

| PSAP1 | 0.802 | 3.620 |

| PSAP2 | 0.742 | 3.699 |

| PSAP3 | 0.711 | 3.693 |

| PSAP4 | 0.712 | 3.681 |

| PSAP5 | 0.717 | 3.611 |

| SNPS1 | 0.466 a | 3.575 |

| SNPS2 | 0.784 | 3.861 |

| SNPS3 | 0.718 | 3.720 |

| SNPS4 | 0.723 | 3.666 |

| SNPS5 | 0.700 | 3.633 |

| PBC1 | 0.800 | 3.509 |

| PBC2 | 0.751 | 3.816 |

| PBC3 | 0.760 | 3.825 |

| PBC4 | 0.821 | 3.741 |

| PBC5 | 0.651 a | 3.623 |

| PBC6 | 0.692 a | 3.789 |

| GI1 | 0.732 | 3.401 |

| GI2 | 0.711 | 3.286 |

| GI3 | 0.756 | 3.410 |

| GI4 | 0.589 a | 3.325 |

| GI5 | 0.626 a | 3.395 |

| GI6 | 0.706 | 3.419 |

| GI7 | 0.612 a | 3.416 |

| GI8 | 0.723 | 3.482 |

| BIPS1 | 0.805 | 3.855 |

| BIPS2 | 0.829 | 3.479 |

| BIPS3 | 0.769 | 3.620 |

| BIPS4 | 0.684 a | 3.364 |

| BIPS5 | 0.735 | 3.614 |

| Latent Variables | Observable Variables | Factor Loadings | Composite Reliability | Cornbach’s α | AVE |

|---|---|---|---|---|---|

| PSAP | PSAP1 | 0.798 | 0.856 | 0.791 | 0.544 |

| PSAP2 | 0.744 | ||||

| PSAP3 | 0.713 | ||||

| PSAP4 | 0.710 | ||||

| PSAP5 | 0.719 | ||||

| SNPS | SNPS2 | 0.807 | 0.837 | 0.742 | 0.562 |

| SNPS3 | 0.724 | ||||

| SNPS4 | 0.750 | ||||

| SNPS5 | 0.715 | ||||

| PBC | PBC1 | 0.842 | 0.879 | 0.818 | 0.645 |

| PBC2 | 0.761 | ||||

| PBC3 | 0.778 | ||||

| PBC4 | 0.828 | ||||

| GI | GI1 | 0.741 | 0.859 | 0.796 | 0.550 |

| GI2 | 0.741 | ||||

| GI3 | 0.796 | ||||

| GI6 | 0.704 | ||||

| GI8 | 0.722 | ||||

| BIPS | BIPS1 | 0.846 | 0.877 | 0.812 | 0.640 |

| BIPS2 | 0.830 | ||||

| BIPS3 | 0.783 | ||||

| BIPS5 | 0.738 |

| Observable Variables | PSAP | SNPS | PBC | GI | BIPS |

|---|---|---|---|---|---|

| PSAP1 | 0.798 | 0.372 | 0.388 | 0.420 | 0.414 |

| PSAP2 | 0.744 | 0.261 | 0.376 | 0.332 | 0.388 |

| PSAP3 | 0.713 | 0.480 | 0.450 | 0.355 | 0.439 |

| PSAP4 | 0.710 | 0.363 | 0.427 | 0.410 | 0.315 |

| PSAP5 | 0.719 | 0.330 | 0.527 | 0.449 | 0.457 |

| SNPS2 | 0.425 | 0.807 | 0.422 | 0.223 | 0.349 |

| SNPS3 | 0.340 | 0.724 | 0.387 | 0.247 | 0.234 |

| SNPS4 | 0.355 | 0.750 | 0.398 | 0.324 | 0.260 |

| SNPS5 | 0.347 | 0.715 | 0.403 | 0.322 | 0.290 |

| PBC1 | 0.486 | 0.409 | 0.842 | 0.438 | 0.483 |

| PBC2 | 0.456 | 0.392 | 0.761 | 0.431 | 0.444 |

| PBC3 | 0.459 | 0.440 | 0.778 | 0.360 | 0.358 |

| PBC4 | 0.499 | 0.481 | 0.828 | 0.438 | 0.554 |

| GI1 | 0.438 | 0.234 | 0.394 | 0.741 | 0.428 |

| GI2 | 0.418 | 0.326 | 0.407 | 0.741 | 0.412 |

| GI3 | 0.465 | 0.284 | 0.421 | 0.796 | 0.454 |

| GI6 | 0.290 | 0.245 | 0.289 | 0.704 | 0.308 |

| GI8 | 0.341 | 0.270 | 0.403 | 0.722 | 0.406 |

| BIPS1 | 0.491 | 0.355 | 0.524 | 0.449 | 0.846 |

| BIPS2 | 0.493 | 0.374 | 0.520 | 0.467 | 0.830 |

| BIPS3 | 0.383 | 0.221 | 0.393 | 0.419 | 0.783 |

| BIPS5 | 0.392 | 0.259 | 0.415 | 0.418 | 0.738 |

| Latent Variables | AVE | PSAP | SNPS | PBC | GI | BIPS |

|---|---|---|---|---|---|---|

| PSAP | 0.544 | 0.737 | ||||

| SNPS | 0.562 | 0.493 | 0.750 | |||

| PBC | 0.645 | 0.593 | 0.537 | 0.803 | ||

| GI | 0.550 | 0.534 | 0.367 | 0.522 | 0.742 | |

| BIPS | 0.640 | 0.554 | 0.384 | 0.584 | 0.548 | 0.800 |

| Hypotheses | Path | Standardized Coefficient Estimate | p-Value | t-Value | Interpretation |

|---|---|---|---|---|---|

| H1 | PSAP -> BIPS | 0.227 | 0.000 | 3.652 | Supported |

| H2 | SNPS -> BIPS | 0.012 | 0.816 | 0.233 | Not Supported |

| H3 | PBC -> BIPS | 0.306 | 0.000 | 5.230 | Supported |

| H4 | GI -> BIPS | 0.263 | 0.000 | 4.400 | Supported |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Gu, J.; Shan, M.; Xiao, Y.; Darko, A. Investigating Private Sectors’ Behavioral Intention to Participate in PPP Projects: An Empirical Examination Based on the Theory of Planned Behavior. Sustainability 2018, 10, 2692. https://doi.org/10.3390/su10082692

Zhang Y, Gu J, Shan M, Xiao Y, Darko A. Investigating Private Sectors’ Behavioral Intention to Participate in PPP Projects: An Empirical Examination Based on the Theory of Planned Behavior. Sustainability. 2018; 10(8):2692. https://doi.org/10.3390/su10082692

Chicago/Turabian StyleZhang, Yanchun, Jianglin Gu, Ming Shan, Yazhi Xiao, and Amos Darko. 2018. "Investigating Private Sectors’ Behavioral Intention to Participate in PPP Projects: An Empirical Examination Based on the Theory of Planned Behavior" Sustainability 10, no. 8: 2692. https://doi.org/10.3390/su10082692