Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development

Abstract

:1. Introduction

2. Literature Review

2.1. The Development Pathways of China’s PV and WP Industries

2.1.1. China’s Renewable Energy Policy Frameworks

2.1.2. Differences between PV and WP Industries

2.2. The Three Dimensions of International Knowledge Flows

2.2.1. Inter-Country Knowledge Flow-Based Clusters

2.2.2. Inter-Firm Explicit Knowledge Flows

2.2.3. Inter-Firm Tacit Knowledge Flows

3. Methodology

3.1. Research Design and Case Selections

3.2. Patent Citation Network Clustering

3.3. Patent Citation Network

3.4. Expert Interviews and Desktop Research

- Licensing: A firm’s codified technology and its exclusive right is sold to another through a commercial way, which is the most obvious pathway.

- Joint venture/acquisition: The alteration of firm’s controlling stake, meaning that a firm obtains a certain degree of control over other firms through property rights transactions.

- Movement of personnel: The flow of tacit knowledge, meaning that skilled workers from one multinational firm to another new firms or country with the knowledge of know-how, which is significant for the effective technology transfer.

- Joint development/protocol: When a firm ratifies a protocol in consent with another or develops projects, together for their mutual benefit.

4. Empirical Analysis: Knowledge Clustering, Knowledge Flow Networks and Collaborations

4.1. Inter-Country Knowledge Flow-Based Clusters

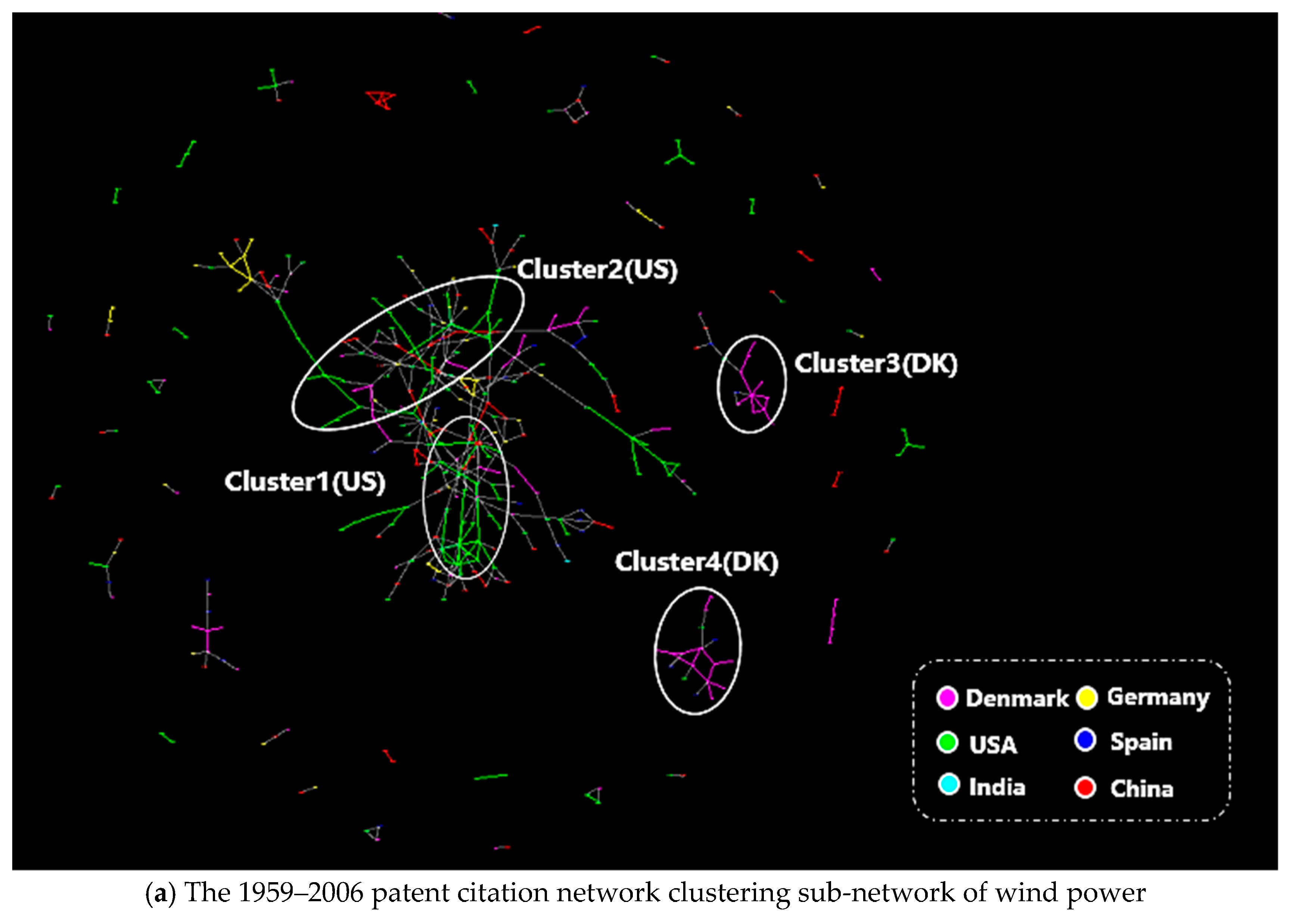

4.1.1. Wind Power Inter-Country Knowledge Flow-Based Clusters

4.1.2. Solar PV Inter-Country Knowledge Flow-Based Clusters

4.2. Inter-Firm Explicit Knowledge Flow Analysis

4.2.1. Wind Power Inter-Firm Explicit Knowledge Flow Analysis

4.2.2. Solar PV Inter-Firm Explicit Knowledge Flow Analysis

4.3. Inter-Firm Tacit Knowledge Flow Analysis

4.3.1. Wind Power Inter-Firm Tacit Knowledge Flow Analysis

4.3.2. Solar PV Inter-Firm Tacit Knowledge Flow Analysis

4.4. Comprehensive Comparison Analysis of Wind Power and Solar PV Industry

4.4.1. Divergent Global Knowledge Positions between Wind Power and Solar PV

4.4.2. Validity of Analysis and Methodological Limitations

5. Discussion: Industrial Characteristics, Market Preference, and Policy Models

5.1. Industrial Technology Characteristics and Technology Policy of Chinese WP and PV

5.2. Market Orientation and Demand Policy of Chinese WP and PV

5.3. Policy Implementation of Chinese WP and PV

6. Conclusions and Policy Implications

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

| Indicators | Chinese Wind Power Industry (Top-Down) | Chinese PV Industry (Bottom-Up) |

|---|---|---|

| Industry development model | Pulled by the local market | Pulled by the international market |

| Financing model | Government dominant | Pushed by manufactures |

| Role of central government | Active dominant | Passive dominant |

| Role of local government | Active participant | Active pusher |

| Role of banking and capital markets | Policy signal receiver | Driven by capital profit |

| Role of manufacturer | Active participant | Pusher |

| Support of local market | Yes | No |

| Policy making | Influenced by the clear development strategy of central government. | Influenced by PV manufacturers and local government. |

| Policy implementation | Under the clear policy guidance, governments, manufactures and banks have formed a huge force, promoting the development of wind power. | Under the impetus of the PV manufacturers and local government, the central government promotes the related national photovoltaic policy. |

References

- World Energy Council (WEC). World Energy Resources: Waste to Energy; World Energy Council: London, UK, 2018. [Google Scholar]

- Braun, F.G.; Schmidt-Ehmcke, J.; Zloczysti, P. Innovative Activity in Wind and Solar Technology: Empirical Evidence on Knowledge Spillovers Using Patent Data; Discussion Paper 993; German Institute for Economic Research: Berlin, Germany, 2010. [Google Scholar]

- Liu, Q.; Lei, Q.; Xu, H.; Yuan, J. China’s energy revolution strategy into 2030. Resour. Conserv. Recycl. 2018, 128, 78–89. [Google Scholar] [CrossRef]

- Quitzow, R.; Huenteler, J.; Asmussen, H. Development trajectories in China’s wind and solar energy industries: How technology-related differences shape the dynamics of industry localization and catching up. J. Clean. Prod. 2017, 158, 122–133. [Google Scholar] [CrossRef]

- Van Eynde, S.; Chang, P.F. Explaining the development of China’s renewable energy policies: Comparing wind and solar power. In Governance of Climate Relations between Europe and Asia: Evidence from China and Vietnam as Key Emerging Economies; Edward Elgar: Cheltenham, UK, 2013; pp. 76–106. [Google Scholar]

- Sun, B.; Yu, Y.; Qin, C. Should China focus on the distributed development of wind and solar photovoltaic power generation? A comparative study. Appl. Energy 2017, 185, 421–439. [Google Scholar] [CrossRef]

- Huenteler, J.; Schmidt, T.S.; Ossenbrink, J.; Hoffmann, V.H. Technology life-cycles in the energy sector—Technological characteristics and the role of deployment for innovation. Technol. Forecast. Soc. Chang. 2016, 104, 102–121. [Google Scholar] [CrossRef]

- Zhang, F.; Sims Gallagher, K.S. Innovation and technology transfer through global value chains: Evidence from China’s PV industry. Energy Policy 2016, 94, 191–203. [Google Scholar] [CrossRef]

- Lewis, J.I.; Wiser, R.H. Fostering a renewable energy technology industry: An international comparison of wind industry policy support mechanisms. Energy Policy 2007, 35, 1844–1857. [Google Scholar] [CrossRef] [Green Version]

- Lewis, J.I. Building a national wind turbine industry: Experiences from China, India and South Korea. Int. J. Technol. Glob. 2011, 5, 281. [Google Scholar] [CrossRef]

- Lewis, J. Green Innovation in China: China’s Wind Power Industry and the Global Transition to a Low-Carbon Economy; Columbia University Press: New York, NY, USA, 2013. [Google Scholar]

- Urban, F.; Zhou, Y.; Nordensvard, J.; Narain, A. Firm-level technology transfer and technology cooperation for wind energy between Europe, China and India: From North–South to South–North cooperation? Energy Sustain. Dev. 2015, 28, 29–40. [Google Scholar] [CrossRef] [Green Version]

- Urban, F. China’s rise: Challenging the North-South technology transfer paradigm for climate change mitigation and low carbon energy. Energy Policy 2018, 113, 320–330. [Google Scholar] [CrossRef]

- Fitjar, R.D.; Rodríguez-Pose, A. Firm collaboration and modes of innovation in Norway. Res. Policy 2013, 42, 128–138. [Google Scholar] [CrossRef]

- Nepelski, D.; De Prato, G. International technology sourcing between a developing country and the rest of the world. A case study of China. Technovation 2015, 35, 12–21. [Google Scholar] [CrossRef]

- Collins, H.M. The TEA set: Tacit knowledge and scientific networks. Sci. Stud. 1974, 4, 165–185. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Lema, R.; Urban, F. Comparing the knowledge bases of wind turbine firms in Asia and Europe: Patent trajectories, networks, and globalisation. Sci. Public Policy 2015, 43, 476–491. [Google Scholar] [CrossRef]

- Pan, M.; Zhou, Y.; Zhou, D.K. Comparing the innovation strategies of Chinese and European wind turbine firms through a patent lens. Environ. Innov. Soc. Transit. 2017. [Google Scholar] [CrossRef]

- Nesta, L.; Saviotti, P.P. Coherence of the knowledge base and the firm’s innovative performance: Evidence from the US pharmaceutical industry. J. Ind. Econ. 2005, 53, 123–142. [Google Scholar] [CrossRef]

- Bekkers, R.; Martinelli, A. Knowledge positions in high-tech markets: Trajectories, standards, strategies and true innovators. Technol. Forecast. Soc. Chang. 2012, 79, 1192–1216. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, H.; Ding, M. How public demonstration projects affect the emergence of new industries: An empirical study of electric vehicles in china. Innov. Manag. Policy Pract. 2015, 17, 159–181. [Google Scholar] [CrossRef]

- Dones, R.; Heck, T.; Emmenegger, M.F.; Jungbluth, N. Life-cycle inventories for the nuclear and natural gas energy systems, and examples of uncertainty analysis. Int. J. Life Cycle Anal. 2005, 10, 10–23. [Google Scholar] [CrossRef]

- Vautard, R.; Thais, F.; Tobin, I.; Bréon, F.M.; De Lavergne, J.G.D.; Colette, A.; Yiou, P.; Ruti, P.M. Regional climate model simulations indicate limited climatic impacts by operational and planned European wind farms. Nat. Commun. 2014, 5, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Xue, B.; Ma, Z.; Geng, Y.; Heck, P.; Ren, W.; Tobias, M.; Maas, A.; Jiang, P.; de Oliveira, J.A.P.; Fujita, T. A life cycle co-benefits assessment of wind power in China. Renew. Sustain. Energy Rev. 2015, 41, 338–346. [Google Scholar] [CrossRef]

- Duan, H. Emissions and temperature benefits: The role of wind power in China. Environ. Res. 2017, 152, 342–350. [Google Scholar] [CrossRef] [PubMed]

- He, D.X. Coping with climate change and China’s wind energy sustainable development. Adv. Clim. Chang. Res. 2016, 7, 3–9. [Google Scholar] [CrossRef]

- Xiang-Wan, D.U. China’s goal to increase non-fossil energy sources. Adv. Clim. Chang. Res. 2016, 1, 1–2. [Google Scholar]

- Altenburg, T.; Pegels, A. Sustainability-oriented innovation systems–managing the green transformation. Innov. Dev. 2012, 2, 5–22. [Google Scholar] [CrossRef]

- Buen, J. Danish and Norwegian wind industry: The relationship between policy instruments, innovation and diffusion. Energy Policy 2006, 34, 3887–3897. [Google Scholar] [CrossRef]

- Jonsson, D. Sustainable infrasystem synergies: A conceptual framework. J. Urban Technol. 2000, 7, 81–104. [Google Scholar] [CrossRef]

- Wang, Q. Effective policies for renewable energy—The example of China’s wind power—Lessons for China’s photovoltaic power. Renew. Sustain. Energy Rev. 2010, 14, 702–712. [Google Scholar] [CrossRef]

- Urban, F.; Geall, S.; Wang, Y. Solar PV and solar water heaters in China: Different pathways to low carbon energy. Renew. Sustain. Energy Rev. 2016, 64, 531–542. [Google Scholar] [CrossRef]

- REN21, R. Global Status Report; REN21 Secretariat: Paris, France, 2016. [Google Scholar]

- Sun, H.; Zhi, Q.; Wang, Y.; Yao, Q.; Su, J. China’s solar photovoltaic industry development: The status quo, problems and approaches. Appl. Energy 2014, 118, 221–230. [Google Scholar] [CrossRef]

- Zhao, X.; Li, S.; Zhang, S.; Yang, R.; Liu, S. The effectiveness of China’s wind power policy: An empirical analysis. Energy Policy 2016, 95, 269–279. [Google Scholar] [CrossRef]

- Zhang, S.; Andrews-Speed, P.; Ji, M. The erratic path of the low-carbon transition in China: Evolution of solar PV policy. Energy Policy 2014, 67, 903–912. [Google Scholar] [CrossRef]

- Zhou, Y.; Pan, M.; Zhou, D.; Xue, L. Stakeholder risk and trust perceptions in the diffusion of green manufacturing technologies: Evidence from china. J. Environ. Dev. 2017, 27, 46–73. [Google Scholar] [CrossRef]

- Goodrich, A.C.; Powell, D.M.; James, T.L.; Woodhouse, M.; Buonassisi, T. Assessing the drivers of regional trends in solar photovoltaic manufacturing. Energy Environ. Sci. 2013, 6, 2811–2821. [Google Scholar] [CrossRef]

- Hughes, L.; Quitzow, R. Low-carbon technologies, national innovation systems, and global production networks: The state of play. In Handbook of International Political Economy of Energy and Natural Resources; Goldthau, A., Keating, M., Kuzemko, C., Eds.; Edward Elgar: Cheltenham, UK, 2017. [Google Scholar]

- Sorenson, O.; Rivkin, J.W.; Fleming, L. Complexity, networks and knowledge flow. Res. Policy 2006, 35, 994–1017. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.; Minshall, T. Building global products and competing in innovation: The role of Chinese university spin-outs and required innovation capabilities. Int. J. Technol. Manag. 2014, 64, 180–209. [Google Scholar] [CrossRef]

- Lundvall, B.A. National Innovation System: Towards a Theory of Innovation and Interactive Learning; Pinter: London, UK, 1992. [Google Scholar]

- Parrilli, M.D.; Heras, H.A. STI and DUI innovation modes: Scientific-technological and context-specific nuances. Res. Policy 2016, 45, 747–756. [Google Scholar] [CrossRef]

- Zhou, Y.; Xu, G.; Minshall, T.; Liu, P. How do public demonstration projects promote green-manufacturing technologies? A case study from china. Sustain. Dev. 2015, 23, 217–231. [Google Scholar] [CrossRef]

- Wang, D. Activating cross-border brokerage: Interorganizational knowledge transfer through skilled return migration. Adm. Sci. Q. 2015, 60, 133–176. [Google Scholar] [CrossRef]

- De la Tour, A.; Glachant, M.; Meniere, Y. Innovation and international technology transfer: The case of the Chinese photovoltaic industry. Energy Policy 2011, 39, 761–770. [Google Scholar] [CrossRef] [Green Version]

- Guan, J.; Chen, Z. Patent collaboration and international knowledge flow. Inf. Process. Manag. 2012, 48, 170–181. [Google Scholar] [CrossRef]

- Ernst, H. Patent information for strategic technology management. World Pat. Inf. 2003, 25, 233–242. [Google Scholar] [CrossRef]

- Griliches, Z. Patent Statistics as Economic Indicators: A Survey (No. w3301); National Bureau of Economic Research: Cambridge, MA, USA, 1990.

- Breitzman, A.; Thomas, P. Using patent citation analysis to target/value M&A candidates. Res. Technol. Manag. 2002, 45, 28–36. [Google Scholar]

- Andersen, T.F.; Madsen, M.; Jørgensen, J.; Mellemkjoer, L.; Olsen, J.H. The Danish National Hospital Register. A valuable source of data for modern health sciences. Dan. Med. Bull. 1999, 46, 263–268. [Google Scholar] [PubMed]

- Dubarić, E.; Giannoccaro, D.; Bengtsson, R.; Ackermann, T. Patent data as indicators of wind power technology development. World Pat. Inf. 2011, 33, 144–149. [Google Scholar] [CrossRef]

- Barberá-Tomás, D.; Jiménez-Sáez, F.; Castelló-Molina, I. Mapping the importance of the real world: The validity of connectivity analysis of patent citations networks. Res. Policy 2011, 40, 473–486. [Google Scholar] [CrossRef] [Green Version]

- Verspagen, B. Mapping technological trajectories as patent citation networks: A study on the history of fuel cell research. Adv. Complex Syst. 2007, 10, 93–115. [Google Scholar] [CrossRef]

- De Rassenfosse, G.; Dernis, H.; Guellec, D.; Picci, L.; de la Potterie, B.V.P. The worldwide count of priority patents: A new indicator of inventive activity. Res. Policy 2013, 42, 720–737. [Google Scholar] [CrossRef] [Green Version]

- Bekkers, R.; Bongard, R.; Nuvolari, A. Essential patents in industry standards: The case of UMTS. In Proceedings of the 6th International Conference on Standardization and Innovation in Information Technology (SIIT 2009), Frederiksborg, Denmark, 17–19 June 2009; pp. 8–10. [Google Scholar]

- Martinelli, A. An emerging paradigm or just another trajectory? Understanding the nature of technological changes using engineering heuristics in the telecommunications switching industry. Res. Policy 2012, 41, 414–429. [Google Scholar] [CrossRef] [Green Version]

- Haakonsson, S.J.; Kirkegaard, J.K. Configuration of technology networks in the wind turbine industry. A comparative study of technology management models in European and Chinese lead firms. Int. J. Technol. Manag. 2016, 70, 281–299. [Google Scholar] [CrossRef]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef] [Green Version]

- Gereffi, G. The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production Networks. In Commodity Chains and Global Capitalism; Gereffi, G., Korzeniewicz, M., Eds.; Greenwood Press: Westport, CT, USA, 1994. [Google Scholar]

- Lema, A.; Lema, R. Technology transfer in the clean development mechanism: Insights from wind power. Glob. Environ. Chang. 2013, 23, 301–313. [Google Scholar] [CrossRef] [Green Version]

- Binz, C.; Truffer, B.; Coenen, L. Why space matters in technological innovation systems—Mapping global knowledge dynamics of membrane bioreactor technology. Res. Policy 2014, 43, 138–155. [Google Scholar] [CrossRef]

- Bergek, A.; Jacobsson, S.; Carlsson, B.; Lindmark, S.; Rickne, A. Analyzing the functional dynamics of technological innovation systems: A scheme of analysis. Res. Policy 2008, 37, 407–429. [Google Scholar] [CrossRef] [Green Version]

- Hendry, C.; Harborne, P.; Brown, J. So what do innovating companies really get from publicly funded demonstration projects and trials? Innovation lessons from solar photovoltaics and wind. Energy Policy 2010, 38, 4507–4519. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage: Thousand Oaks, CA, USA, 2003; pp. 5–11. [Google Scholar]

- Global Wind Energy Council. Global Wind Statistics 2014; GWEC: Brussels, Belgium, 2015. [Google Scholar]

- Bourqui, R.; Auber, D.; Mary, P. How to draw clusteredweighted graphs using a multilevel force-directed graph drawing algorithm. In Proceedings of the 11th International Conference Information Visualization, Zurich, Switzerland, 4–6 July 2007; pp. 757–764. [Google Scholar]

- Eades, P.; McKay, B.D. An algorithm for generating subsets of fixed size with a strong minimal change property. Inf. Process. Lett. 1984, 19, 131–133. [Google Scholar] [CrossRef]

- Shibata, N.; Kajikawa, Y.; Sakata, I. Extracting the commercialization gap between science and technology—Case study of a solar cell. Technol. Forecast. Soc. Chang. 2010, 77, 1147–1155. [Google Scholar] [CrossRef]

- Kajikawa, Y.; Ohno, J.; Takeda, Y.; Matsushima, K.; Komiyama, H. Creating an academic landscape of sustainability science: An analysis of the citation network. Sustain. Sci. 2007, 2, 221. [Google Scholar] [CrossRef]

- Lee, K.; Lee, S. Patterns of technological innovation and evolution in the energy sector: A patent-based approach. Energy Policy 2013, 59, 415–432. [Google Scholar] [CrossRef]

- Hsieh, C.H. Patent value assessment and commercialization strategy. Technol. Forecast. Soc. Chang. 2013, 80, 307–319. [Google Scholar] [CrossRef]

- Park, H.; Kim, K.; Choi, S.; Yoon, J. A patent intelligence system for strategic technology planning. Expert Syst. Appl. 2013, 40, 2373–2390. [Google Scholar] [CrossRef]

- Karvonen, M.; Ka¨ssi, T. Patent citations as a tool for analysing the early stages of convergence. Technol. Forecast. Soc. Chang. 2013, 80, 1094–1107. [Google Scholar] [CrossRef]

- Freeman, L.C. Centered graphs and the structure of ego networks. Math. Soc. Sci. 1982, 3, 291–304. [Google Scholar] [CrossRef]

- Hakanson, L.; Nobel, R. Technology characteristics and reverse technology transfer. Manag. Int. Rev. 2000, 1, 29–48. [Google Scholar]

- Stock, G.N.; Tatikonda, M.V. A typology of project-level technology transfer processes. J. Oper. Manag. 2000, 18, 719–737. [Google Scholar] [CrossRef]

- Tsang, E.W. Choice of international technology transfer mode: A resource-based view. MIR Manag. Int. Rev. 1997, 37, 151–168. [Google Scholar]

- Minshall, T. A resource-based view of alliances: The case of the handheld computer industry. Int. J. Innov. Manag. 1999, 3, 159–183. [Google Scholar] [CrossRef]

- Chen, X.; Yuen, C.; Zhang, Z. Wireless energy and information transfer tradeoff for limited-feedback multiantenna systems with energy beamforming. IEEE Trans. Veh. Technol. 2014, 63, 407–412. [Google Scholar] [CrossRef]

- Frietsch, R.; Schmoch, U. Transnational patents and international markets. Scientometrics 2010, 82, 185–200. [Google Scholar] [CrossRef]

- Perrez, C.; Soete, L. Catching up in technology: Entry barriers and windows. In Technical Change and Economic Theory; Dosi, G., Nelson, R., Silverberg, G., Soete, L., Eds.; Pinter: London, UK, 1988; pp. 458–479. Available online: https://core.ac.uk/download/pdf/6786506.pdf (accessed on 28 May 2018).

- Lema, R.; Sagar, A.; Zhou, Y. Convergence or divergence? Wind power innovation paths in Europe and Asia. Sci. Public Policy 2015, 43, 400–413. [Google Scholar] [CrossRef]

- Lema, A.; Lema, R. Low-carbon innovation and technology transfer in latecomer countries: Insights from solar PV in the clean development mechanism. Technol. Forecast. Soc. Chang. 2016, 104, 223–236. [Google Scholar] [CrossRef]

- REN21. Global Status Report [Online]; Ren21: Paris, France, 2012. [Google Scholar]

- Urban, F.; Nordensvärd, J.; Zhou, Y. Key actors and their motives for wind energy innovation in China. Innov. Dev. 2012, 2, 111–130. [Google Scholar] [CrossRef]

- Zhao, Z.Y.; Hu, J.; Zuo, J. Performance of wind power industry development in China: A Diamond Model study. Renew. Energy 2009, 34, 2883–2891. [Google Scholar] [CrossRef]

| Wind Power Leading Firms | Solar PV Leading Firms | |||

|---|---|---|---|---|

| Global Top 10 Leading Firms in 2015 | Important Firms with Strong Influence Relevant for Innovation | Global Top 10 Leading Firms in 2015 | Important Firms with Strong Influence Relevant for Innovation | |

| Firms from China | Goldwind, Guodian United Power, Envision, Mingyang, | Shanghai Electric, Dongfang Electric, Sinovel, XEMC, CSIC Haizhuang, Zhejiang Windy | Trina, Canadian Solar, Jinko, JA solar, Hanwha Qcells, GCL New Energy, Yingli, Suntech (SFCE), Renesola, | Dongfang Risen, Changzhou Eging, Hareon, Saiwei LDK |

| Firms from other countries | Vestas (DK), GE (US), Siemens (DE), Gamesa (ES), Enercon (DE), Senvion (DE) | Nordex (DE), Vensys (DE), Aerodyn (DE), Suzlon (IN); | First Solar (US) | Sanyo (JP), Sharp (JP), Kyocera (JP), Sunpower (US), MEMC (US), Solarworld (DE) TATA (IN) |

| Sector and Number of Interviews | Affiliation of Interviewee |

|---|---|

| Wind power: 31 interviews | Firms including Goldwind (Beijing, China), Mingyang (Zhongshan, Guangdong, China), Sinovel (Beijing, China), Vestas China (Tianjin, China), Huaneng Corporation (Beijing, China), State Grid for North East China (Beijing, China) etc. |

| Business associations including the Global Wind Energy Association (GWEA), Chinese Renewable Energy Industries Association (CWEA), the Chinese Renewable Energy Industries Association, China National Renewable Energy Centre and the Beijing Energy Association etc. | |

| Government agencies including National Development Reform Commission (NDRC), provincial Development Reform Commissions (DRC), Ministry of Environmental Protection (MEP), Ministry for Science and Technology (MOST), Ministry of Commerce (MOFCOM), Ministry of Finance (MOF), China Meteorological Administration etc. | |

| Research institutes including Tsinghua University in Beijing, Tianjin University of Technology, Peking University, NDRC’s Energy Research Institute (ERI), Chinese Academy of Sciences (CAS), Chinese Academy of Social Sciences (CASS), Chinese Academy of Engineering, Wind Energy Technology Institute of Gansu State Grid etc. | |

| NGOs including Greenpeace, the Natural Resources Defence Council NRDC, WWF, Asia Foundation, Greenovation Hub etc. | |

| Solar PV: 27 interviews | Firms including Yingli Solar (Baoding, Hebei, China), Trina Solar (Changzhou, Jiangsu, China), JA Solar (Shanghai, China), Jinko Solar (Beijing, China), Hanergy (Beijing, China) etc. |

| Business associations including China National Renewable Energy Centre, Beijing Energy Association etc. | |

| Government agencies including National Development Reform Commission (NDRC), provincial Development Reform Commissions (DRC), Ministry of Environmental Protection (MEP), Ministry for Science and Technology (MOST) etc. | |

| Research institutes including Tsinghua University in Beijing, Tianjin University of Technology, Zhejiang University, Peking University, Hunan University, Shanghai University, Fudan University, NDRC’s Energy Research Institute (ERI), Chinese Academy of Sciences (CAS) etc. | |

| NGOs including the Natural Resources Defence Council (NRDC), Greenovation Hub etc. |

| Indicators | 1959–2006 Network | 2007–2015 Network | Full Time Network |

|---|---|---|---|

| Density (including self-citation) | 0.3179 | 0.5625 | 0.5650 |

| Density (excluding self-citation) | 0.3072 | 0.5421 | 0.5447 |

| Average distance | 1.316 | 1.511 | 1.508 |

| Distance-based cohesion | 0.375 | 0.762 | 0.764 |

| Distance-weighted fragmentation | 0.625 | 0.238 | 0.236 |

| Out-degree centrality | 30.020% | 20.239% | 19.665% |

| In-degree centrality | 14.915% | 16.037% | 15.835% |

| FirmsIndicators | Betweenness Centrality | Out-Degree | In-Degree | Net Citation | ||||

|---|---|---|---|---|---|---|---|---|

| Centrality | Centrality | Counts | ||||||

| 1959– | 2007– | 1959– | 2007– | 1959– | 2007– | 1959– | 2007– | |

| 2006 | 2015 | 2006 | 2015 | 2006 | 2015 | 2006 | 2015 | |

| GENERAL ELECTRIC | 4.043 | 23.655 | 292 | 811 | 296 | 515 | −4 | 296 |

| VESTAS | 4.043 | 20.266 | 141 | 572 | 246 | 619 | −105 | −47 |

| SENVION | 1.56 | 10.093 | 118 | 394 | 243 | 328 | −125 | 66 |

| ENERCON | 13.043 | 24.468 | 507 | 372 | 125 | 242 | 382 | 130 |

| SIEMENS | 14.71 | 25.089 | 214 | 347 | 258 | 676 | −44 | −329 |

| GAMESA | 0.143 | 16.072 | 36 | 225 | 133 | 127 | −97 | 98 |

| NORDEX | 3.25 | 6.826 | 84 | 185 | 112 | 159 | −28 | 26 |

| AERODYN | 2.21 | 0 | 185 | 96 | 38 | 15 | 147 | 81 |

| GUODIAN UNITED POWER | 0 | 17.021 | 0 | 58 | 5 | 105 | −5 | −47 |

| MINGYANG | 0 | 4.873 | 0 | 29 | 6 | 74 | −6 | −45 |

| GOLDWIND | 0 | 16.844 | 0 | 27 | 6 | 95 | −6 | −68 |

| SINOVEL | 0 | 4.861 | 0 | 27 | 4 | 42 | −4 | −15 |

| XEMC | 0 | 15.524 | 0 | 17 | 28 | 32 | −28 | −15 |

| SUZLON | 0 | 2.617 | 0 | 17 | 55 | 56 | −55 | −39 |

| CSIC HAIZHUANG | 0 | 4.478 | 0 | 14 | 5 | 19 | −5 | −5 |

| SHANGHAI ELECTRIC | - | 0.904 | - | 6 | - | 20 | - | −14 |

| ENVISION | 0 | 0.41 | 1 | 6 | 15 | 63 | −14 | −57 |

| ZHEJIANG WINDEY | - | 0 | - | 6 | - | 4 | - | 2 |

| DONGFANG ELECTRIC | 0 | 0 | 0 | 5 | 1 | 20 | −1 | −15 |

| VENSYS | 0 | 0 | 0 | 1 | 2 | 4 | −2 | −3 |

| Indicators | 1962–2006 Network | 2007–2015 Network | Full Time Network |

|---|---|---|---|

| Density (including self-citation) | 0.1698 | 0.2857 | 0.3039 |

| Density (excluding self-citation) | 0.1601 | 0.2690 | 0.2881 |

| Average distance | 1.807 | 1.658 | 1.665 |

| Distance-based cohesion | 0.309 | 0.633 | 0.667 |

| Distance-weighted fragmentation | 0.691 | 0.367 | 0.333 |

| Out-degree centrality | 12.421% | 10.792% | 10.691% |

| In-degree centrality | 7.830% | 6.998% | 6.875% |

| FirmsIndicators | Betweenness Centrality | Out-Degree | In-Degree | Net Citation | ||||

|---|---|---|---|---|---|---|---|---|

| Centrality | Centrality | Counts | ||||||

| 1959– | 2007– | 1959– | 2007– | 1959– | 2007– | 1959– | 2007– | |

| 2006 | 2015 | 2006 | 2015 | 2006 | 2015 | 2006 | 2015 | |

| SHARP | 29 | 15.383 | 445 | 259 | 229 | 128 | 216 | 131 |

| SANYO | 9.333 | 5.643 | 318 | 172 | 302 | 186 | 16 | −14 |

| KYOCERA | 10 | 15.952 | 232 | 213 | 244 | 86 | −12 | 127 |

| SUNPOWER | 7.667 | 20.879 | 36 | 47 | 70 | 103 | −34 | −56 |

| MEMC | 15 | 14.183 | 3 | 16 | 27 | 24 | −24 | −8 |

| TRINA | 0 | 40.474 | 1 | 95 | 23 | 62 | −22 | 33 |

| FIRST SOLAR | 38 | 7.107 | 9 | 17 | 21 | 65 | −12 | −48 |

| YINGLI | 0 | 60.074 | 0 | 34 | 9 | 155 | −9 | −121 |

| CSI SOLAR | 0 | 8.26 | 0 | 39 | 15 | 90 | −15 | −51 |

| JA SOALR | 0 | 17.679 | 0 | 52 | 11 | 49 | −11 | 3 |

| SAIWEI LDK | 0 | 16.493 | - | 29 | - | 27 | - | 2 |

| SUNTECH | 0 | 0.917 | 0 | 27 | 14 | 17 | −14 | 10 |

| EGING | 0 | 3.617 | 0 | 13 | 1 | 17 | −1 | −4 |

| HANWHA | 0 | 4.248 | 0 | 8 | 48 | 18 | −48 | −10 |

| HAREON SOLAR | - | 1.483 | - | 14 | - | 4 | - | 10 |

| JINKO SOLAR | 0 | 1.1 | 0 | 10 | 6 | 28 | −6 | −18 |

| GCL ENERGY | - | 5.1 | - | 9 | - | 9 | - | 0 |

| RENESOLA | 0 | 0.4 | - | 8 | - | 5 | - | 3 |

| SOLARWORLD | 0 | 0.617 | 1 | 4 | 23 | 6 | −22 | −2 |

| RISEN | - | 0 | - | 4 | - | 0 | - | 4 |

| TATA | 0 | 0 | 1 | 9 | 3 | 0 | −2 | 9 |

| Chinese WP Firms | Knowledge Flow Mode | Knowledge Flow Strength | Foreign Firms |

|---|---|---|---|

| CSIC Haizhuang | Licence | strong | DeWind (Irvine, USA and Hamburg, Germany) |

| Joint development | weak | Aerodyn Energiesysteme (Rendsburg, Germany) | |

| Goldwind | Licence | strong | Jacobs/REpower (now a part of Senvion, headquarters in Hamburg, Germany) |

| Joint venture/acquisition | strong | Vensys (Neunkirchen/Wellesweiler, Germany) | |

| Protocol | weak | Renewable Energy Systems Americas Inc. Rattlesnake wind project (Brady, TX, USA) | |

| protocol | weak | Shady Oaks (Compton, CA, USA) | |

| protocol | weak | Infineon Technologies AG (Neubiberg, Germany) | |

| protocol | weak | Mainstream Renewable Power (Dublin, Ireland) | |

| protocol | weak | Australia local power grid firm | |

| protocol | weak | Empresa Eléctrica del Ecuador (Guayaquil, Ecuador) | |

| protocol | weak | Adama wind project (Ethiopia) | |

| protocol | weak | EGCO—Subsidiary of Thailand’s national grid (Bangkok, Thailand) | |

| Guodian United power | Licence | strong | Aerodyn Energiesysteme (Rendsburg, Germany) |

| Mingyang | Joint development | weak | Aerodyn Energiesysteme (Rendsburg, Germany) |

| Acquisition | strong | Global Wind Power Ltd. (Mumbai, Maharashtra, India) | |

| Sinovel | Licence | strong | Fuhrländer (formerly Liebenscheid, Germany, now bancrupt) |

| Zhejiang Windey | Licence | strong | REpower (now a part of Senvion, headquarters in Hamburg, Germany) |

| Shanghai Electric | Joint venture/acquisition | strong | AnsaldoEnergia (Genoa, Italy) |

| Envision Energy | Joint development | weak | ParStream (now part of Cisco, San Jose, CA, USA) |

| Acquisition | strong | BazeField (Porsgrunn, Norway) | |

| XEMC | Acquisition | strong | Darwind (Hilversum, The Netherlands) |

| Chinese PV Firms | Knowledge Flow Mode | Knowledge Flow Strength | Foreign Firms |

|---|---|---|---|

| Trina | Acquisition | strong | Solland Solar (Heerlen, The Netherlands) |

| Yingli | Protocol | weak | Dupont (Wilmington, DE, USA) |

| Protocol | weak | Borrego Solar (San Diego, CA, USA) | |

| Joint development | weak | Innovalight (Sunnyvale, CA, USA) | |

| CSI Solar | Acquisition | strong | Recurren Energy (San Francisco, CA, USA) |

| Jinko Solar | Protocol | weak | Ygrene (Petaluma, CA, USA) |

| Protocol | weak | Vivint Solar (Lehi, UT, USA) | |

| Protocol | weak | Lumos Solar (Boulder, CO, USA) | |

| Protocol | weak | Acciona (Alcobendas, Spain) | |

| JA Solar | Acquisition | strong | Silver Age Holdings (British Virgin Islands) |

| Renesola | Protocol | weak | Solairedirect SA (Paris, France) |

| Hanwha | Acquisition | strong | Q-Cells (Thalheim, Germany) |

| Dongfang Risen | Protocol | weak | Mytrah Energy India (Hyderabad, India) |

| Protocol | weak | Chemtech Solar (Cologno al Serio, Italy) | |

| GCL New Energy | Acquisition | strong | SunEdison (Maryland Heights, MO, USA) |

| Acquisition | strong | One Stop Warehouse (Berrinba, Australia) | |

| Acquisition | strong | Sterling and Wilson (Mumbai, India) | |

| Acquisition | strong | Jakson (Noida, India) | |

| Protocol | weak | North Carolina Eastern Municipal Power Agency (Raleigh, NC, USA) | |

| Suntech (SFCE Energy) | Acquisition | strong | Powin Energy (Tualatin, OR, USA) |

| Acquisition | strong | MSK (Tokyo, Japan) | |

| Hareon Solar | Acquisition | strong | Brilliant Harvest 003 Limited (Shepton Mallet, UK) |

| Acquisition | strong | Greenvision Ambiente Photo Solar S.r.l. (GAPS) (Roncocesi, Italy) | |

| Acquisition | strong | Forshine (Hong Kong, China) | |

| Saiwei LDK | Acquisition | strong | Sunways (Shenzhen, China) |

| Acquisition | strong | SolarPower (Roseville, CA, USA) |

| Dimensions | Indicators | Wind Power (1959–2015) | Solar PV (1962–2015) |

|---|---|---|---|

| Industrial Contexts | 1. technology complexity | complex production systems | mass produce goods |

| 2. technological lifecycles | fast-development stage | fast-development stage | |

| 3. China’s market share | gobal No. 1 | gobal No. 1 | |

| 4. technology trajectory | gearbased DFIT/SFIT; gearless DD | single/polycrystalline silicon modules; thin-film modules | |

| Inter-country knowledge flow-based clusters | 1. The technical distribution of industry | strong convergence | great divergence |

| 2. Technical focus of China | applied technologies and applications | hold some core technologies inherent for the manufacturing | |

| 3. Technical focus of other countries | Countries like DK, DE and US cover a wider spectrum of technologies and applications | JP cover a wider range of technologies and applications, the US is more clustered in specific areas. | |

| Inter-firm explicit knowledge flow | 1. Network position | periphery | core |

| 2. Network role | knowledge consumers | a certain knowledge spillovers | |

| 3. Future competition roles | knowledge learners | technology innovators and global leaders | |

| Inter-firm tacit knowledge flow | 1. Scope of tacit knowledge flow | a high degree of product-specific tacit knowledge | process-related knowledge and comparatively lower scope of tacit knowledge |

| 2. Types of global countries that interactions | developing countries | developed countries | |

| 3. Knowledge collaboration mechanisms | mainly in joint development/protocol and licenses | mainly in acquisition and movement of personnel |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Y.; Pan, M.; Urban, F. Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development. Sustainability 2018, 10, 1883. https://doi.org/10.3390/su10061883

Zhou Y, Pan M, Urban F. Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development. Sustainability. 2018; 10(6):1883. https://doi.org/10.3390/su10061883

Chicago/Turabian StyleZhou, Yuan, Meijuan Pan, and Frauke Urban. 2018. "Comparing the International Knowledge Flow of China’s Wind and Solar Photovoltaic (PV) Industries: Patent Analysis and Implications for Sustainable Development" Sustainability 10, no. 6: 1883. https://doi.org/10.3390/su10061883