The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China

Abstract

:1. Introduction

2. Methodology

2.1. Theoretical Framing Analysis

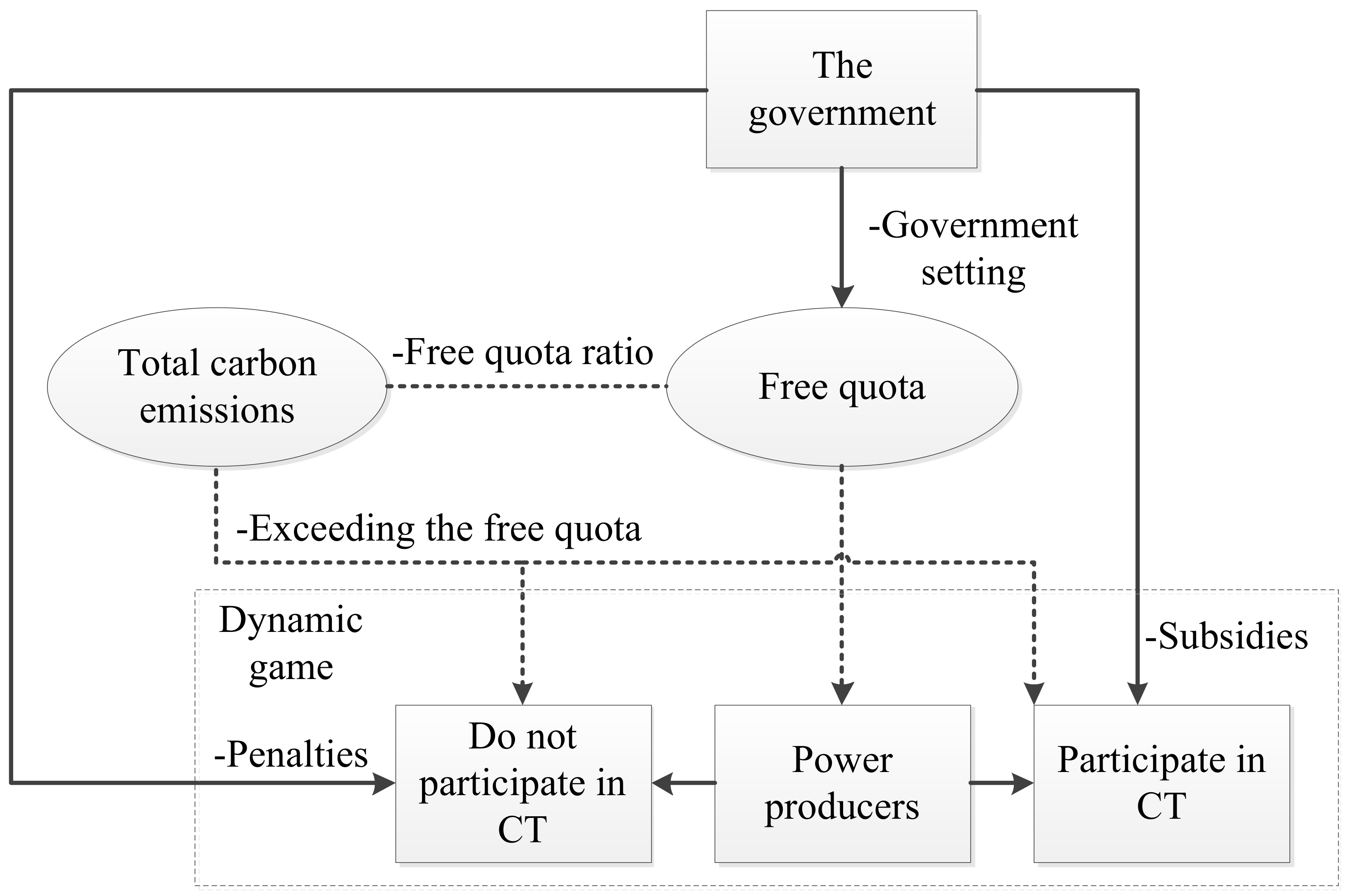

2.2. Evolutionary Game Model

2.2.1. Game Payment Function

2.2.2. Evolutionarily Stable Strategy (ESS)

2.3. SD Simulation Model

3. Case Study

3.1. Data

3.2. Results Analysis

4. Discussion

4.1. Dynamic Subsidies

4.2. Dynamic Penalties

5. Conclusions

- (1)

- The evolutionary game model and SD simulation model constructed in this paper can clearly and effectively demonstrate the evolutionary game process of government and power producers’ behavioral strategies under CT, which provide references for scholars to study related issues.

- (2)

- There is a central point and four saddle points in the game system between government and power producers under CT, and there is no ESS. The evolution process of the system is a closed-loop line with periodic motion, which indicates that the two game players of the government and power producers show a periodic behavior pattern.

- (3)

- The trajectories of game players are spiraling inward and tending to stabilize focus when the government implements dynamic subsidies or penalties. This shows that the probability of government supervision and power producers participating in CT gradually converge with the increase of time, and ultimately stabilizes at the ESS in the mixed strategy, so that the game system can reach equilibrium.

- (4)

- Reducing the unit subsidy and raising the unit fine can both promote the participation of power producers in CT, but the former increases the probability of government supervision. The purpose of CT implementation is to achieve the optimal allocation of resources through market-oriented means, and the government is only responsible for the basic supervision [37,38]. Thus, it is best to increase the fines when the government makes strategic adjustments, followed by reducing subsidies.

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Variables | Economic Meanings |

|---|---|

| Government’s revenues when the government supervises and power producers participate in CT | |

| Government’s revenues when the government supervises and power producers do not participate in CT | |

| Government’s revenues when the government does not supervise and power producers participate in CT | |

| Government’s revenues when the government does not supervise and power producers do not participate in CT | |

| Power producers’ revenues when power producers participate in CT and the government supervises | |

| Power producers’ revenues when power producers do not participate in CT and the government supervises | |

| Power producers’ revenues when power producers participate in CT and the government dose not supervise | |

| Power producers’ revenues when power producers do not participate in CT and the government dose not supervise | |

| The costs paid by the government during supervision, including the costs of manpower, material resources, and financial resources | |

| Treatment costs of environmental pollution paid by the government caused by power producers not participating in CT | |

| The costs of energy-saving equipment for the completion of quotas when power producers participate in CT | |

| The comprehensive benefits when power producers participate in CT, such as the reduction of energy consumption costs | |

| The subsidies when the government supervises and power producers participate in CT | |

| The revenues generated by power producers participating in CT | |

| The penalties when power producers do not participate in CT and the government supervises | |

| Unit carbon emission supervision cost | |

| Total carbon emissions | |

| Free quotas | |

| Unit treatment cost of carbon emissions | |

| Unit energy-saving reform cost of carbon emissions | |

| Long-term marginal cost of carbon emissions when participating in CT | |

| Long-term marginal cost of carbon emissions when not participating in CT | |

| Unit subsidy | |

| CT price | |

| Unit fine |

References

- Baidu Net. Paris Agreement. 2016. Available online: https://baike.baidu.com/item/%E5%B7%B4%E9%BB%8E%E5%8D%8F%E5%AE%9A/19138374?fr=aladdin (accessed on 22 April 2016).

- Central People’s Government of the People’s Republic of China. National Carbon Emissions Trading System Starts. 19 December 2017. Available online: www.gov.cn/xinwen/2017-12/19/content_5248641.htm (accessed on 19 December 2017).

- Zhao, X.G.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Zhao, X.G.; Jiang, G.W.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar]

- Song, Y.; Liang, D.; Liu, T.; Song, X. How China’s current carbon trading policy affects carbon price? An investigation of the Shanghai Emission Trading Scheme pilot. J. Clean. Prod. 2018, 181, 374–384. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China-Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar]

- Hu, H.; Xie, N.; Fang, D.; Zhang, X. The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl. Energy 2018, 211, 1229–1244. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Impact of quota decline scheme of emission trading in China: A dynamic recursive CGE model. Energy 2018, 149, 190–203. [Google Scholar] [CrossRef]

- Li, W.; Jia, Z. The impact of emission trading scheme and the ratio of free quota: A dynamic recursive CGE model in China. Appl. Energy 2016, 174, 1–14. [Google Scholar] [CrossRef]

- Yang, B.; Liu, C.; Gou, Z.; Man, J.; Su, Y. How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions. Sustainability 2017, 10, 605. [Google Scholar] [CrossRef]

- Jiang, H.; Shao, X.; Zhang, X.; Bao, J. A Study of the Allocation of Carbon Emission Permits among the Provinces of China Based on Fairness and Efficiency. Sustainability 2017, 9, 2122. [Google Scholar] [CrossRef]

- Chen, Y.; Sun, Y.; Wang, C. Influencing Factors of Companies’ Behavior for Mitigation: A Discussion within the Context of Emission Trading Scheme. Sustainability 2018, 10, 414. [Google Scholar] [CrossRef]

- Song, X.; Lu, Y.; Shuai, C. Optimal Carbon Reduction Strategies in the Building Sector with Emission Trading System. Energy Procedia 2017, 143, 307–312. [Google Scholar] [CrossRef]

- Zhu, Y.; Li, Y.P.; Huang, G.H. An optimization decision support approach for risk analysis of carbon emission trading in electric power systems. Environ. Model. Softw. 2015, 67, 43–56. [Google Scholar] [CrossRef]

- Yang, L.; Li, F.; Zhang, X. Chinese companies’ awareness and perceptions of the Emissions Trading Scheme (ETS): Evidence from a national survey in China. Energy Policy 2016, 98, 254–265. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, W.; Liu, B. Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Clean. Prod. 2017, 14 Pt 3, 1118–1128. [Google Scholar] [CrossRef]

- Wang, C.; Wang, W.; Huang, R. Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 2017, 152, 271–280. [Google Scholar] [CrossRef]

- Qin, Q.; Liu, Y.; Li, X.; Li, H. A multi-criteria decision analysis model for carbon emission quota allocation in China’s east coastal areas: Efficiency and equity. J. Clean. Prod. 2017, 168, 410–419. [Google Scholar] [CrossRef]

- Cai, L.R.; Wang, H.W.; Zeng, W. System dynamics model for a mixed-strategy game of environmental pollution. Comput. Sci. 2009, 36, 234–238. [Google Scholar]

- Zhao, X.; Zhang, Y.; Liang, J.; Li, Y.; Jia, R.; Wang, L. The Sustainable Development of the Economic-Energy-Environment (3E) System under the Carbon Trading (CT) Mechanism: A Chinese Case. Sustainability 2018, 10, 98. [Google Scholar] [CrossRef]

- Kamarzaman, N.A.; Tan, C.W. A comprehensive review of maximum power point tracking algorithms for photovoltaic systems. Renew. Sustain. Energy Rev. 2014, 37, 585–598. [Google Scholar] [CrossRef]

- Kim, D.H. A system dynamics model for a mixed-strategy game between police and driver. Syst. Dyn. Rev. 1997, 13, 33–53. [Google Scholar] [CrossRef]

- Sice, P.; Mosekilde, E.; Moscardini, A.; Lawler, K.; French, I. Using system dynamics to analyse interactions in duopoly competition. Syst. Dyn. Rev. 2000, 16, 113–133. [Google Scholar] [CrossRef]

- Liu, L.; Feng, C.; Zhang, H.; Zhang, X. Game Analysis and Simulation of the River Basin Sustainable Development Strategy Integrating Water Emission Trading. Sustainability 2015, 7, 4952–4972. [Google Scholar] [CrossRef]

- Zhu, Q.H.; Wang, Y.L.; Tian, Y.H. Analysis of evolutionary game between local governments and manufacturing enterprises under carbon reduction policies based on system dynamics. Oper. Res. Manag. Sci. 2014, 23, 71–82. [Google Scholar]

- Friedman, D. Evolutionary games in economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Friedman, D. On economic applications of evolutionary game theory. J. Evol. Econ. 1998, 8, 15–43. [Google Scholar] [CrossRef]

- Ginits, H. Game Theory Evolving, 2nd ed.; Princeton University Press: Princeton, UK, 2009. [Google Scholar]

- Zhang, Y.Z.; Zhao, X.G.; Ren, L.Z.; Liang, J.; Liu, P.K. The development of China’s biomass power industry under feed-in tariff and renewable portfolio standard: A system dynamics analysis. Energy 2017, 139, 947–961. [Google Scholar]

- State Statistical Bureau. China Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2017.

- State Statistical Bureau. China Energy Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2017.

- State Statistical Bureau. China Environmental Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2017.

- China Electricity Council. Statistics. 2017. Available online: www.cec.org.cn/guihuayutongji/tongjxinxi/ (accessed on 1 January 2018).

- Hang, J.R.; Wang, Z.D.; Tang, L.; Yu, L.A. The Simulation of Carbon Emission Trading System in Beijing-Tianjin-Hebei Region: An Analysis Based on System Dynamics. Chin. J. Manag. Sci. 2016, 24, 1–8. [Google Scholar]

- Fan, R.; Dong, L. The dynamic analysis and simulation of government subsidy strategies in low-carbon diffusion considering the behavior of heterogeneous agents. Energy Policy 2018, 117, 252–262. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Fu, M.; Sun, M. Government control or low carbon lifestyle? Analysis and application of a novel selective-constrained energy-saving and emission-reduction dynamic evolution system. Energy Policy 2014, 68, 498–507. [Google Scholar] [CrossRef]

- Tanpaifang Net. Nature and Institutional Framework of Carbon Trading. 18 November 2015. Available online: www.tanpaifang.com/tanguwen/2015/1118/49044.html (accessed on 18 November 2015).

- Tengxun Net. Carbon Emissions Trading: Marketization Measures Promote Green and Low Carbon Sustainable Development. 14 March 2017. Available online: http://sh.qq.com/a/20170314/037275.htm (accessed on 14 March 2017).

| Game Players | Power Producer | ||

|---|---|---|---|

| PCT () | NPCT () | ||

| Government | S () | ||

| NS () | |||

| Game Players | Power Producer | ||

|---|---|---|---|

| PCT () | NPCT () | ||

| Government | S () | ||

| NS () | |||

| Local Equilibrium Point | Stability | ||

|---|---|---|---|

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| + | 0 | Center Point |

| Variables | Data | Unit | Data Resource |

|---|---|---|---|

| Unit carbon emission supervision cost () | 37 | Yuan/Unit carbon emission | [30,31,32] |

| Unit treatment cost of carbon emissions () | 220 | Yuan/Unit carbon emission | [30,31,32] |

| Unit energy-saving reform cost of carbon emissions () | 2120 | Yuan/Unit carbon emission | [30,31,32] |

| Long-term marginal cost of carbon emissions when participating in CT () | 3000 | Yuan/Unit carbon emission | [33] |

| Long-term marginal cost of carbon emissions when not participating in CT () | 5000 | Yuan/Unit carbon emission | [33] |

| Unit subsidy () | 100 | Yuan/Unit carbon emission | [20,33] |

| CT price () | 120 | Yuan/Unit carbon emission | [20,33] |

| Unit fine () | 150 | Yuan/Unit carbon emission | [33,34] |

| Free quota ratio () | 60% | - | [33,34] |

| Local Equilibrium Point | Stability | ||

|---|---|---|---|

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| + | - | ESS |

| Local Equilibrium Point | Stability | ||

|---|---|---|---|

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| - | ± | Saddle Point | |

| + | - | ESS |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, X.-g.; Zhang, Y.-z. The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China. Sustainability 2018, 10, 1150. https://doi.org/10.3390/su10041150

Zhao X-g, Zhang Y-z. The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China. Sustainability. 2018; 10(4):1150. https://doi.org/10.3390/su10041150

Chicago/Turabian StyleZhao, Xin-gang, and Yu-zhuo Zhang. 2018. "The System Dynamics (SD) Analysis of the Government and Power Producers’ Evolutionary Game Strategies Based on Carbon Trading (CT) Mechanism: A Case of China" Sustainability 10, no. 4: 1150. https://doi.org/10.3390/su10041150