Can Environmental Regulations Promote Corporate Environmental Responsibility? Evidence from the Moderated Mediating Effect Model and an Empirical Study in China

Abstract

:1. Introduction

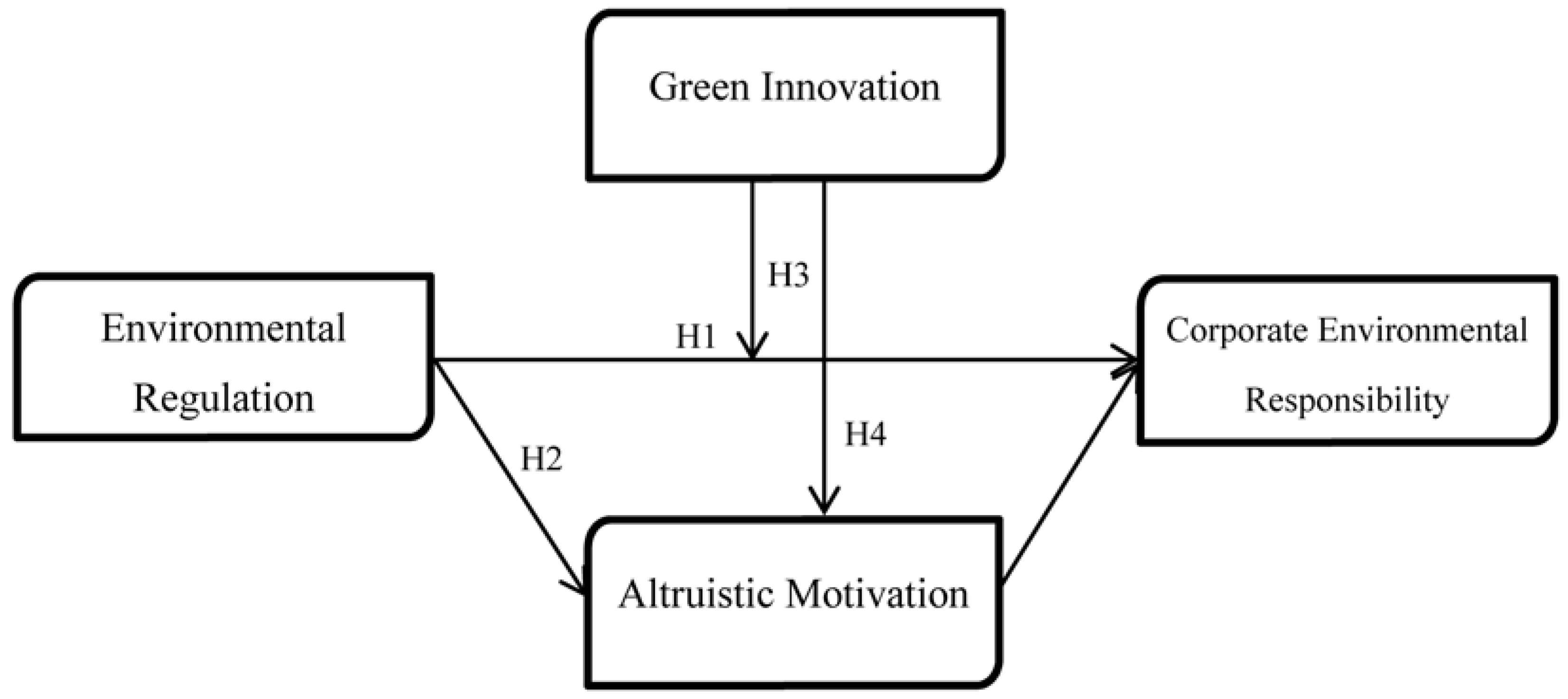

2. Conceptual Framework and Research Hypothesis

2.1. Theoretical Review

2.2. ER and CER

2.3. Mediating Effect of Altruistic Motivation

2.4. Moderating Effect of Green Innovation

2.5. Moderated Mediating Effect

3. Methodology

3.1. Questionnaire Design and Data Collection

3.2. Variable Measurement

3.3. Reliability and Validity Measurement

3.4. Descriptive Statistics

4. Hypothesis Testing

4.1. Regression Analysis

4.2. Structural Equation Model

5. Discussion

- (1)

- Positive effects of ER on CER. Corporate initiative in shouldering environmental responsibility needs obligation by ERs and guidance by altruistic motivation (As shown in Model 2 and Model 3, Table 5, the coefficients both pass the significance test). This is different from previous conclusions that enterprises make environmental protection behaviors by a single factor [57]. Therefore, business managers should consider mandatory pressure of policies and non-mandatory influence of public opinion as well as overall interests of all stakeholders including supplier, client, and wholesaler. Then by undertaking environmental responsibility, enterprises can solve appeals of stakeholders and gain both social performance and competitive advantages [58]. Moreover, the empirical study above reveals that the correlation coefficient of ER on CER is positive (In Table 5, the coefficient is 0.341. In Table 7, the coefficient is 0.28. In addition, they all pass the test of significance in 1% level). In other words, ER has a positive impact on CER, which verifies the Porter Hypothesis to the particular Chinese situation. In detail, ERs impose great pressure on enterprises which adopt old-fashioned production technologies. So those enterprises are forced to invest in pollution control technology and advanced production technology and implement environmentally friendly operations in the whole life cycle. Although enterprises must put abundant resources in the process of undertaking environmental responsibility, advantages (such as environmental tax refunding, productivity growth and social image improvement) which are brought from behaviors of environmental protection will contribute to long-term development [59]. So, if only enterprises focused on long-term development, they would have the initiative to implement environmental protection behaviors. In addition, it is the objective of ERs. Conversely, once more enterprises undertake environmental responsibility actively or more environmental responsibilities are accepted by enterprises on their own initiative, CER will be blended into an enterprise’s daily operation and even into industry regulations [60]. Then corresponding ERs will be improved and enhanced. Therefore, the relationship between ERs and CER may be interacted.

- (2)

- Mediating effect of altruistic motivation. In Figure 3, we can clearly find that altruistic motivation works as a mediator variable in the relationship between ERs and CER. So, value factors such as altruistic motivation play an important role in promoting enterprises to fulfill environmental protection responsibility. This disagrees with conclusions of Broon and Kenny [56]: policy constraint plays the decisive role in driving enterprises to adopt environmental protection technology [12]. However, a great change has taken place in the modern market. Unlike the concept of marketing in the late 1980s when Broon and Kenny were working, the concept of social marketing becomes more and more recognized this century, especially in the Internet era [61]. Faced with intensifying market competition and social networking, an enterprise’s survival is determined not only by its strength, but also by the comprehensive interests of stakeholders including employees, clients, and social organizations [22]. Besides, alliance of government, production, teaching, research, and consumers contributes to information sharing and becomes an important way to improve an enterprise’s discourse power in the industrial chain. It is becoming a popular pattern in modern business. So nowadays market competition has been evolved from the primary stage (individual-to-individual pattern) to the senior stage (group-to-group pattern) [62]. Therefore, business managers must set up the idea of altruism and integrate altruistic motivation into corporate culture. Furthermore, enterprises are supposed to formulate an operation strategy of “value co-production and win-win cooperation” and construct a platform for regular communication among partners, which can promote the free circulation of talents, information, technology, and other resources [63]. A community of shared interests thereby will be established. Altruistic behaviors are also necessary because the enhancement of ERs and CER is keeping up the pressure against the enterprises. Enterprise’s competitive advantages will disappear gradually in the inter-group competition situation. The value of altruism is becoming an essential concept of operation in the Internet age.

- (3)

- Moderating effect of green innovation. Regression analysis results reveal that green innovation can regulate the effects of ER on CER (s shown in Table 5, the coefficient of ER is 0.341 in Model 2, while the coefficient of interaction term, ER × Green innovation, is 0.414 in Model 6), and enterprises with high-level green innovation will implement environmental protection behaviors more actively (As shown Figure 2). So green innovation decides whether the enterprise could take an advantage in a fierce market competition. Enterprises with low-level green innovation should regard environmental protection as a profitable opportunity and implement a proactive environmental strategy [64]. This will help the enhancement of ERs and CER. Then mandatory constraint such as ERs, and non-mandatory factors such as CER and altruistic motivation, both will promote green innovation to get into business operation. Finally, green innovation will help enterprises take an unshakable advantage in reducing unnecessary costs such as avoiding supervision of environmental authorities and the public. Those enterprises also should actively improve environmental management level and realize a “win-win” between environmental performance and economic performance by setting about to construct a pollution-free and low-consumption production system from multiple aspects including product design, environmental governance, energy saving, emission reduction, pollution control as well as waste recycling. Subsequently, managers could improve the consciousness of green innovation by training or learning. Managers also need to enhance the propagation of environmental business culture to lead employees to accept and support green innovations [65]. It will help create a feasible atmosphere for green innovation. Meanwhile, the government must strengthen ERs and use different combinations of ERs such as command-control ER, market-based incentive ER and voluntary ER. The intensive cleaner production also needs to be introduced in laws to gradually dissolve the ecological crisis [66]. Not to be neglected, the media and the public should take their wider regulatory role in encouraging and supervising green innovation behaviors in enterprises. The media can expose an enterprise’s production process in time and rev up publicity for green innovation. The public can choose green and environmentally friendly commodities or services proactively.

6. Conclusions

- (1)

- ER and CER. The former can influence the later significantly. Enterprises faced with ERs may be able to improve competitiveness through “first-mover advantage” and “innovation compensation”. Thus, the environmental responsibility offers an opportunity for the long-term development in enterprises. It further verifies the Porter Hypothesis.

- (2)

- Mediating effect of altruistic motivation. Altruistic motivation plays a medium role in the relationship between ERs and CER. This offsets the shortages of previous research which emphasized the decisive role of external environment but neglected the influence of personal features.

- (3)

- Moderating effect of green innovation. Green innovation can strengthen the constraints of ER on CER. The higher the level of green innovation, the stronger the willingness of enterprises to undertake environmental responsibility. Attention to value factors such as corporate culture in studying CER is beneficial to improve the smoothness of business strategies.

- (4)

- Moderated mediating effect. The indirect effect of ER on CER through altruistic motivation will be strengthened by green innovation.

7. Prospect

Acknowledgments

Author Contributions

Conflicts of Interest

References

- BP Public Limited Company. BP World Energy Statistical Yearbook 2016; BP Public Limited Company: Beijing, China, 2016. [Google Scholar]

- Lelieveld, J.; Evans, J.S.; Fnais, M.; Giannadaki, D.; Pozzer, A. The contribution of outdoor air pollution sources to premature mortality on a global scale. Nature 2015, 525, 367–371. [Google Scholar] [CrossRef] [PubMed]

- Yang, G.; Wang, Y.; Zeng, Y.; Gao, G.F.; Liang, X.; Zhou, M.; Wan, X.; Yu, S.; Jiang, Y.; Naghavi, M.; et al. Rapid health transition in China, 1990–2010: Findings from the Global Burden of Disease Study 2010. Lancet 2013, 381, 1987–2015. [Google Scholar] [CrossRef]

- Feng, Z.; Chen, W. Environmental regulation, green innovation, and industrial green development: An empirical analysis based on the Spatial Durbin model. Sustainability 2018, 10, 223. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, Y.; Liang, J.; Li, Y.; Jia, R.; Wang, L. The sustainable development of the economic-energy-environment (3E) system under the carbon trading (CT) mechanism: A Chinese case. Sustainability 2018, 10, 98. [Google Scholar] [CrossRef]

- Guo, S.; Ding, G.; Zhao, Q.; Jiang, M. Bonus point system for refuse classification and sustainable development: A study in China. Sustainability 2017, 9, 1776. [Google Scholar] [CrossRef]

- Agnieszka, M.; Małgorzata, J.K.; Stankiewicz, J. Environmental issues of the corporate social responsibility. Management 2014, 18, 58–70. [Google Scholar]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Ooba, M.; Hayashi, K.; Fujii, M.; Fujita, T.; Machimura, T.; Matsui, T. A long-term assessment of ecological-economic sustainability of woody biomass production in Japan. J. Clean. Prod. 2015, 88, 318–325. [Google Scholar] [CrossRef]

- Blackman, A.; Lahiri, B.; Pizer, W.; Planter, M.R.; Pina, C.M. Voluntary environmental regulation in developing countries: Mexico’s clean industry program. J. Environ. Econ. Manag. 2010, 60, 182–192. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building and construction sector in some EU regions. J. Environ. Manag. 2011, 9, 2136–2144. [Google Scholar] [CrossRef] [PubMed]

- Brännlund, R.; Lundgren, T. Environmental policy and profitability: Evidence from Swedish industry. Environ. Econ. Policy Stud. 2010, 12, 59–78. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment—Competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Nie, P.Z.; Huang, L. An empirical study of environmental regulation’s different impact on industrial total factor energy productivity. Ind. Econ. Res. 2013, 4, 50–58. (In Chinese) [Google Scholar]

- Wu, L.Z.; Kwan, H.K.; Yim, H.K.; Chiu, R.K.; He, X. CEO ethical leadership and corporate social responsibility: A moderated mediation Model. J. Bus. Ethics 2015, 130, 819–831. [Google Scholar] [CrossRef]

- Tamborini, R.; Lewis, R.J.; Prabhu, S.; Grizzard, M.; Hahn, L.; Wang, L. Media’s influence on the accessibility of altruistic and egoistic motivations. Commun. Res. Rep. 2016, 33, 177–187. [Google Scholar] [CrossRef]

- Li, D.; Cao, C.; Zheng, M.; Huang, M.; Ren, S.; Chen, X. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Yang, H. China must continue the momentum of green law. Nature 2014, 509, 535. [Google Scholar] [CrossRef] [PubMed]

- Xia, Q.; Li, M.; Wu, H.; Lu, Z. Does the central government’s environmental policy work? Evidence from the provincial-level environment efficiency in China. Sustainability 2016, 8, 1241. [Google Scholar] [CrossRef]

- Friedman, M. Free to Choose: A Personal Statement; Thomson Learning: Stamford, CT, USA, 1990. [Google Scholar]

- Meng, X.H.; Zeng, S.X.; Xie, X.M.; Qi, G.Y. The impact of product market competition on corporate environmental responsibility. Asia Pac. J. Manag. 2016, 33, 267–291. [Google Scholar] [CrossRef]

- Lee, M.D.P. Configuration of external influences: The combined effects of institutions and stakeholders on corporate social responsibility strategies. J. Bus. Ethics 2011, 102, 281–298. [Google Scholar] [CrossRef]

- Gong, X.; Cortese, C. A socialist market economy with Chinese characteristics: The accounting annual report of China mobile. Account. Forum 2017, 41, 206–220. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Soc. Sci. Electron. Publ. 1984, 9, 193–206. [Google Scholar]

- Haniffa, R.; Hudaib, M. Exploring the ethical identity of Islamic banks via communication in annual reports. J. Bus. Ethics 2007, 76, 97–116. [Google Scholar] [CrossRef]

- Trivers, R.L. The evolution of reciprocal altruism. Q. Rev. Biol. 1971, 46, 35–37. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, C. Corporate governance, social responsibility information disclosure, and enterprise value in China. J. Clean. Prod. 2016, 142, 1075–1084. [Google Scholar] [CrossRef]

- Ghisetti, C.; Rennings, K. Environmental innovations and profitability: How does it pay to be green? An empirical analysis on the German innovation survey. J. Clean. Prod. 2014, 75, 106–117. [Google Scholar] [CrossRef]

- McGee, J. Commentary on corporate strategies and environmental regulations: An organizing framework. Strateg. Manag. J. 1998, 19, 377–387. [Google Scholar] [CrossRef]

- Joseph, E. Corporate social responsibility: Delivering the new agenda. Public Policy Res. 2010, 8, 121–123. [Google Scholar] [CrossRef]

- Cannella, S.; Framinan, J.M.; Bruccoleri, M.; Barbosa-Póvoa, A.P.; Relvas, S. The effect of inventory record inaccuracy in information exchange supply chains. Eur. J. Oper. Res. 2015, 243, 120–129. [Google Scholar] [CrossRef] [Green Version]

- Bergman, M.M.; Bergman, Z.; Berger, L. An empirical exploration, typology, and definition of corporate sustainability. Sustainability 2017, 9, 753. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- He, L.M. Research on oil company’s environmental performance information disclosure in separated environmental reports. China Popul. Resour. Environ. 2009, 19, 97–102. (In Chinese) [Google Scholar]

- Zeng, S.; Chen, M. Marketing strategy analysis of yogurt under consumption upgrading: A case study of Le Pur. Open J. Soc. Sci. 2017, 5, 195–205. [Google Scholar] [CrossRef]

- Palmer, C.; McShane, K.; Sandler, R. Environmental ethics. Annu. Rev. Environ. Resour. 2014, 39, 419–442. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2008, 24, 403–441. [Google Scholar] [CrossRef]

- Graafland, J. Motives for corporate social responsibility. Economist 2012, 160, 377–396. [Google Scholar] [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Financ. 2011, 66, 563–600. [Google Scholar] [CrossRef]

- Osman, L.H.B. How structure influence relational capital: The impact of network communication in centralized structure. Aust. J. Ophthalmol. 2015, 7, 114–125. [Google Scholar] [CrossRef]

- Pentland, B.T.; Hærem, T. Organizational routines as patterns of action: Implications for organizational behavior. Organ. Stud. 2015, 2, 465–487. [Google Scholar] [CrossRef]

- Flamholtz, E.G.; Randle, Y. Corporate culture, business models, competitive advantage, strategic assets and the bottom line. J. Hum. Resour. Cost. Account. 2012, 16, 76–94. [Google Scholar] [CrossRef]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Marx, A. Ecological modernization, environmental policy and employment: Can environmental protection and employment be reconciled? Innov. Eur. J. Soc. Sci. Res. 2000, 13, 311–325. [Google Scholar] [CrossRef]

- Wang, J.M.; Chen, H.X.; Yuan, Y. Mediating role of green innovation strategy of firm enterprises in Jiangsu. China Popul. Resour. Environ. 2010, 20, 111–117. (In Chinese) [Google Scholar]

- Nath, P.; Ramanathan, R.; Black, A.; Lamond, D.; Muyldermans, L. Impact of environmental regulations on innovation and performance in the UK industrial sector. Manag. Decis. 2010, 48, 1493–1513. [Google Scholar]

- Edwards, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol. Methods 2007, 12, 1–22. [Google Scholar] [CrossRef] [PubMed]

- Kshetri, N. Institutional factors affecting offshore business process and information technology outsourcing. J. Int. Manag. 2007, 13, 38–56. [Google Scholar] [CrossRef]

- Feng, Z. Conformity or compliance: Corporations′ choice of social responsibility under institutional pressure. Financ. Econ. 2014, 4, 82–90. [Google Scholar]

- Tian, Q.; Liu, Y.; Fan, J. The effects of external stakeholder pressure and ethical leadership on corporate social responsibility in China. J. Manag. Organ. 2015, 21, 388–410. [Google Scholar] [CrossRef]

- Wahba, H. Does the market value corporate environmental responsibility? An empirical examination. Eco-Manag. Audit. 2008, 15, 89–99. [Google Scholar] [CrossRef]

- Testa, M.; D’Amato, A. Corporate environmental responsibility and financial performance: Does bidirectional causality work? Empirical evidence from the manufacturing industry. Soc. Responsib. J. 2017, 13, 221–234. [Google Scholar] [CrossRef]

- Schwartz, S.H.; Boehnke, K. Evaluating the structure of human values with confirmatory factor analysis. J. Res. Personal. 2004, 38, 230–255. [Google Scholar] [CrossRef]

- Chang, C.H. The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 2011, 104, 361–370. [Google Scholar] [CrossRef]

- Judge, W.Q.; Douglas, T.J. Performance implications of incorporating natural environmental issues into the strategic planning process: An empirical assessment. J. Manag. Stud. 1998, 35, 241–262. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Clemens, B.; Bakstran, L. A framework of theoretical lenses and strategic purposes to describe relationships among firm environmental strategy, financial performance, and environmental performance. Manag. Res. Rev. 2016, 33, 393–405. [Google Scholar] [CrossRef]

- Dibrell, C.; Craig, J.B.; Hansen, E.N. How managerial attitudes toward the natural environment affect market orientation and innovation. J. Bus. Res. 2011, 64, 401–407. [Google Scholar] [CrossRef]

- Lanoie, P.; Patry, M.; Lajeunesse, R. Environmental regulation and productivity: Testing the Porter Hypothesis. J. Product. Anal. 2008, 30, 121–128. [Google Scholar] [CrossRef]

- Kahneman, D.; Knetsch, J.L.; Thaler, R. Fairness as a constraint on profit seeking: Entitlements in the market. Am. Econ. Rev. 1986, 76, 728–741. [Google Scholar]

- Mitchell, A.; Madill, J.; Chreim, S. Social enterprise dualities: Implications for social marketing. J. Soc. Mark. 2016, 6, 169–192. [Google Scholar] [CrossRef]

- Mckague, K.; Zietsma, C.; Oliver, C. Building the social structure of a market. Organ. Stud. 2015, 36, 1063–1093. [Google Scholar] [CrossRef]

- Tu, Y.; Peng, B.H. On the Relation of Dual Social Capital, Dual Learning and Open Services Innovation Performance in the Platform Enterprise. Sci. Technol. Process Policy 2017, 34, 83–90. [Google Scholar]

- Wu, T.; Wu, Y.C.J.; Chen, Y.J.; Goh, M. Aligning supply chain strategy with corporate environmental strategy: A contingency approach. Int. J. Prod. Econ. 2014, 147, 220–229. [Google Scholar] [CrossRef]

- Roxas, B.; Coetzer, A. Institutional environment, managerial attitudes and environmental sustainability orientation of small firms. J. Bus. Ethics 2012, 111, 461–476. [Google Scholar] [CrossRef]

- Bezdek, R.H.; Wendling, R.M.; Diperna, P. Environmental protection, the economy, and jobs: National and regional analyses. J. Environ. Manag. 2008, 86, 63–79. [Google Scholar] [CrossRef] [PubMed]

| Category | Distribution | Sample Size | Percentage (%) |

|---|---|---|---|

| Ownership nature | State-owned or state-controlled enterprise | 58 | 26.6 |

| Private enterprise | 109 | 50.0 | |

| Foreign-capital enterprise | 21 | 9.6 | |

| Joint-venture enterprise | 30 | 13.8 | |

| Enterprise scale | Less than 100 workers | 16 | 7.3 |

| From 100 to 300 workers | 31 | 14.2 | |

| From 300 to 600 workers | 69 | 31.7 | |

| More than 600 workers | 102 | 46.8 | |

| Annual turnover | Less than 60 million yuan | 12 | 5.5 |

| From 60 million to 100 million yuan | 28 | 12.8 | |

| From 100 million to 300 million yuan | 86 | 39.5 | |

| More than 300 million yuan | 92 | 42.2 | |

| Position | Top-level manager | 72 | 33.0 |

| Department head | 86 | 39.5 | |

| Technician | 16 | 7.3 | |

| Scientific personnel | 44 | 20.2 | |

| Operating age | Less than 1 year | 15 | 6.9 |

| From 1 to 3 years | 64 | 29.4 | |

| From 3 to 5 years | 81 | 37.1 | |

| More than 5 years | 58 | 26.6 | |

| Industry | Electrical and electronic | 83 | 39.9 |

| Automobile | 60 | 28.8 | |

| Lead-acid battery | 65 | 31.3 |

| Variable | Cronbach’s α | KMO Value | F Value of Bartlett’s Test | Percent Explained (%) |

|---|---|---|---|---|

| ER | 0.714 | 0.658 | 0.000 | 63.706 |

| CER | 0.738 | 0.686 | 0.000 | 65.619 |

| Altruistic motivation | 0.822 | 0.677 | 0.000 | 74.805 |

| Green innovation | 0.869 | 0.732 | 0.000 | 62.738 |

| Variable | Item | Factor Loading | Composite Reliability | AVE |

|---|---|---|---|---|

| ER | Environmental policies are systematic and specific. | 0.559 | 0.750 | 0.435 |

| We hold the view that the intensity of ERs in China is enhancing. | 0.735 | |||

| Existing punishments in ERs are severe. | 0.612 | |||

| Business operations are in the supervision from the public and the media. | 0.694 | |||

| We pay close attention to comments from the public and the media. | 0.711 | |||

| Journalists focus on negative reports about enterprise operations such as pollution discharge surreptitiously. | 0.549 | |||

| The public prefers goods produced with environmentally-friendly technologies. | 0.727 | |||

| CER | We take environmental protection into consideration when formulate strategies for business. | 0.694 | 0.712 | 0.450 |

| We put a great deal of resources in developing green production technologies. | 0.698 | |||

| Waste recycling system is complete and recovery rate is high. | 0.647 | |||

| We help to increase living quality of community actively. | 0.681 | |||

| Our social reputations are elevated due to green management. | 0.630 | |||

| Altruistic motivation | We share the environment. | 0.785 | 0.733 | 0.486 |

| We hold the view that man should live harmoniously together with nature. | 0.723 | |||

| Our environmentally-friendly practices would affect others positively. | 0.621 | |||

| We response to the call for ecological civilization construction in China. | 0.664 | |||

| Ecological environment is abominable nowadays. | 0.738 | |||

| Later generations would benefit from green production technologies. | 0.637 | |||

| Green innovation | The concept of environmental protection is integrated into the product design and packaging. | 0.723 | 0.791 | 0.550 |

| Outlook on green development has incorporated into production process. | 0.742 | |||

| Production technologies need to be environmentally-friendly. | 0.711 | |||

| Supporting services such as transportation should also be environmentally-friendly. | 0.787 |

| Item Variable | Mean | Standard Deviation | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|---|

| Enterprise scale | 5.816 | 0.644 | 1 | |||||

| Ownership nature | 2.374 | 1.215 | −0.001 | 1 | ||||

| ER | 3.135 | 0.640 | 0.251 * | 0.175 | 1 | |||

| CER | 4.239 | 0.518 | 0.044 | 0.239 * | 0.134 * | 1 | ||

| Altruistic motivation | 3.718 | 0.689 | 0.087 | 0.062 | 0.286 | 0.256 ** | 1 | |

| Green innovation | 3.461 | 0.903 | 0.046 | 0.156 * | 0.115 * | 0.185 ** | 0.206 ** | 1 |

| Independent Variable | Altruistic Motivation | CER | ||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Enterprise scale | 0.014 | 0.135 ** | 0.156 * | 0.205 ** | 0.079 * | 0.075 * |

| (0.008) | (0.074 **) | (0.087 **) | (0.113 **) | (0.044) | (0.041) | |

| Ownership nature | 0.006 | 0.243 ** | 0.097 | 0.153 * | 0.136 * | 0.128 * |

| (0.003) | (0.134 **) | (0.054) | (0.085 *) | (0.075 *) | (0.070 *) | |

| ER | 0.236 * | 0.341 ** | 0.309 * | |||

| (0.130 **) | (0.188 **) | (0.170 **) | ||||

| Altruistic motivation | 0.187 * | 0.096 * | ||||

| (0.103 *) | (0.053 *) | |||||

| Green innovation | 0.438 ** | |||||

| (0.243 **) | ||||||

| ER × Green innovation | 0.414 * | |||||

| (0.229 **) | ||||||

| R2 | 0.416 | 0.510 | 0.457 | 0.590 | 0.604 | 0.623 |

| F value | 6.042 * | 43.409 ** | 21.372 * | 34.861 * | 64.887 ** | 65.364 * |

| D-Watson | 1.973 | 2.127 | 2.214 | 2.252 | 2.075 | 2.094 |

| Moderator Variable | Stage | Effect | |||

|---|---|---|---|---|---|

| Stage One | Stage Two | Direct Effect | Indirect Effect | Cumulative Effects | |

| ER(X)→Altruistic Motivation(M)→CER(Y) | |||||

| Low-level green innovation | 0.183 ** | 0.279 ** | 0.154 ** | 0.057 ** | 0.211 ** |

| High-level green innovation | 0.183 ** | 0.396 ** | 0.154 ** | 0.144 ** | 0.298 ** |

| Intergroup difference | 0.117 ** | 0.087 ** | 0.087 ** | ||

| Function Route | Path Coefficient | F Value | Corresponding Hypothesis | Result |

|---|---|---|---|---|

| ER→CER | 0.28 | ** | H1 | Support |

| ER→Altruistic motivation | 0.17 | * | H2 | Support |

| Altruistic motivation→CER | 0.20 | ** | H2 | Support |

| Green innovation→ER | 0.14 | ** | H3 | Support |

| Green innovation→Altruistic motivation | 0.27 | ** | H3 | Reject |

| Green innovation→CER | 0.33 | ** | H3 | Support |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peng, B.; Tu, Y.; Wei, G. Can Environmental Regulations Promote Corporate Environmental Responsibility? Evidence from the Moderated Mediating Effect Model and an Empirical Study in China. Sustainability 2018, 10, 641. https://doi.org/10.3390/su10030641

Peng B, Tu Y, Wei G. Can Environmental Regulations Promote Corporate Environmental Responsibility? Evidence from the Moderated Mediating Effect Model and an Empirical Study in China. Sustainability. 2018; 10(3):641. https://doi.org/10.3390/su10030641

Chicago/Turabian StylePeng, Benhong, Yu Tu, and Guo Wei. 2018. "Can Environmental Regulations Promote Corporate Environmental Responsibility? Evidence from the Moderated Mediating Effect Model and an Empirical Study in China" Sustainability 10, no. 3: 641. https://doi.org/10.3390/su10030641