Researching the Main Causes of the Romanian Shadow Economy at the Micro and Macro Levels: Implications for Sustainable Development

Abstract

:1. Introduction

2. Theoretical Considerations and Hypothesis Development

- HA1: Monitoring the unemployment rate contributes to sustainability through the achievement of Sustainable Development Goal 8: Decent work and economic growth.

- HA2: Monitoring the employment rate and its components (the self-employment rate and part-time employment rate) contributes to sustainability through the achievement of Sustainable Development Goal 8: Decent work and economic growth.

- HA3: Monitoring the real growth contributes to sustainability through the achievement of Sustainable Development Goal 8: Decent work and economic growth.

- HB: Monitoring the government efficiency contributes to sustainability through the achievement of Sustainable Development Goal 16: Peace, justice and strong institutions.

3. A Brief Overview of the Main Estimates of the Romanian Shadow Economy

4. Measuring Progress toward the Sustainable Development Goals—the Case of Romania

5. Identifying the Main Causes of the Romanian Shadow Economy

5.1. Data and Methodology

5.2. Empirical Results

5.2.1. The Sample Profile of Romanian Entrepreneurs

5.2.2. Highlighting the Opinions of Romanian Entrepreneurs Regarding the Romanian Shadow Economic Activity

- There is a high level of tolerance for bribery and tax avoidance, which is a common behavior among Romanian mangers.

- The lack of trust in public officials was associated with a high level of dissatisfaction regarding tax policies and business legislation, which is related to a higher level of shadow economy.

- A poor quality of business legislation, the government’s tax policy, and little government support for entrepreneurs led to an increase in shadow economic activity.

- High social contributions determined whether companies hired workers without legal forms.

- A relatively high level of corruption, anti-competitive practices of other competitors, political instability, high tax rates, and a certain uncertainty about regulation policies also led to an increase in the unofficial sector.

5.2.3. Identifying the Main Determinants of the Romanian Shadow Economy Using the MIMIC Model

5.2.4. Emphasizing the Main Implications of the Shadow Economy for Sustainable Development

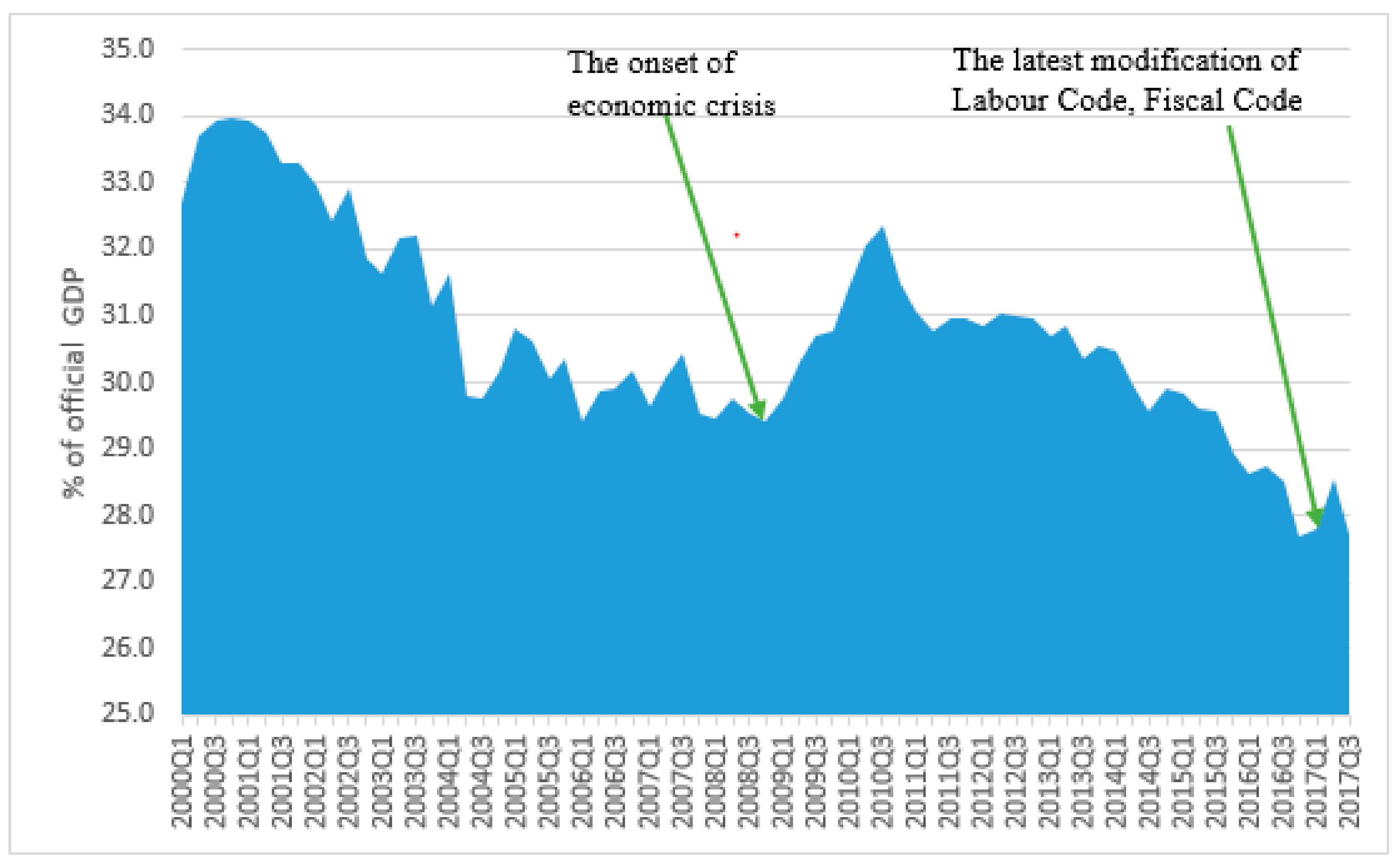

5.2.5. Computing the Size of the Romanian Shadow Economy

- is the index of the SE computed by Equation (3).

- is the exogenous estimate of the SE.

- is the value of the index computed by Equation (4) in 2005.

- is a measure that is used to make the conversion from the base year to current GDP.

- is the estimated SE as a percentage of official GDP.

6. Conclusions and Further Research

6.1. Main Conclusions and Suggestions for Future Work

6.2. Policy Implications

- (1)

- Reducing the administrative burden of businesses. This involves simplifying the procedures for obtaining licenses and authorizations by accelerating the release of documents required for entrepreneurship, reducing bureaucratic barriers for such documents, and increasing the transparency of the whole process.

- (2)

- Increasing the amount of fines for companies that practice informal economic activity; specifically, penalties for the non-compliance with labor regulation.

- (3)

- Enforcement of institutions responsible for labor inspections and controls.

- (4)

- Increasing the number of information campaigns.

- (5)

- Introduction of more electronic instruments of contract registration.

- (6)

- Enforcement of penalties for situations where undeclared work is considered as ‘significant’.

- (7)

- Discouraging the use of cash by increasing the popularity of electronic payments. In the last period, the ratio of currency in circulation as a % of GDP was almost 60%, revealing a level that was six times higher than the level recorded by the countries of the Eurozone. In 2013 in Romania, a person makes on average 4.3 electronic payments (excluding card payments and including applications such as internet banking, home banking, mobile banking, electronic transactions made at ATMs) annually, which was about 18 times less than the European Union (EU) average and 11 times less than the average in the Central and East European countries, placing Romania in the last position of the ranking of EU countries. Also, a person makes on average 9.4 card payments annually, which is about 10 times less than the EU average and five times less than the average in the Central and East European countries, and was ahead of only two states, Greece and Bulgaria. The level of undeclared work in Romania, Bulgaria, and Greece seems to be related to the high proportion of cash payments.

- (8)

- Elaborating multiannual studies of the shadow economy by carrying out disaggregated analyses by sectors, or types of taxes, aiming at knowing more precisely where, through who, and how the existing fraud occurs.

- (9)

- Developing a functional collaboration between different public administrations: establishing an effective collaboration between the regional and local tax administrations, promoting co-responsibility and the consortium in the fight against tax fraud.

- (10)

- Creating a shared database: the different territorial administrations must share a tax database and the subsidies granted with information from the central, regional, and local spheres.

- (11)

- Improving the efficiency and the speed of the procedures: improve the actions and investigations of the administrations by means of the revision of the procedures and management methods to reduce the duration of the files and the litigation.

- (12)

- Carrying out a better monitoring of risk contributors: the creation of a file of insolvent fiscal debtors (with limitations on the right to obtain subsidies, create companies, occupy positions, and take on public works until they enter or guarantee the debts).

- (13)

- Carrying out fiscal reforms, creating a battery of fiscal measures that help prevent fraud and strengthen the fight against the underground economy.

- (14)

- Revising the taxation of small and medium-sized enterprises (SMEs) and the self-employed to adapt to the economic difficulties of a time of crisis. For this, it is recommended that employers and professionals pay under direct estimation as a general rule, and that the module system is only allowed to micro entrepreneurs who sell exclusively to the final consumer.

- (15)

- Establishing electronic transaction control systems.

- (16)

- Creating an awareness and training plan on the negative effects of the shadow economy.

Author Contributions

Funding

Conflicts of Interest

Appendix A. The Description and Source of the Data

| Variables | Unit Root | Description | Sources |

| Fiscal regime | I (1) | Total fiscal revenues/GDP, % | Quarterly Government Finance Statistics, Eurostat. |

| Direct taxes (X1) | I (1) | Current taxes on income, wealth/GDP, % | Quarterly Government Finance Statistics, Eurostat. |

| Indirect taxes (X2) | I (1) | Taxes on production and imports/GDP, % | Quarterly Government Finance Statistics, Eurostat. |

| Social contributions (X3) | I (1) | Net social contributions/GDP, % | Quarterly Government Finance Statistics, Eurostat. |

| Unemployment rate (X4) | I (1) | ILO unemployment rate, %. | Labour Force Survey, Eurostat. |

| Self-employment (X5) | I (1) | Self-employed persons/active pop, % | Labour Force Survey, Eurostat. |

| Government consumption (X6) | I (1) | Final consumption expenditure of general government/GDP, %. | Quarterly Government Finance Statistics of Eurostat. |

| Part-time employment as a percentage of the total employment (X7) | I (1) | Part-time employment rate, % | Labour Force Survey, Eurostat |

| Government employment (X8) | I (1) | Government employment/active pop. %. | Labour Force Survey, Eurostat. |

| Regulatory Quality (X9) | I (1) | The scores of this index lie between −2.5 and 2.5, with higher scores corresponding to better outcomes. | Worldwide Governance Indicators, WB |

| Government Effectiveness (X9′) | It ranges from approximately −2.5 (weak) to 2.5 (strong) governance performance. | Worldwide Governance Indicators, WB | |

| Index of real GDP (2005=100) | I (1) | Chain linked volumes, index 2005=100 | Quarterly National Accounts database of Eurostat. |

| C/M1 | I (1) | C/M1, %. It corresponds to the currency outside the banks as a proportion of M1. | Monthly Bulletins of National Bank of Romania |

| Labour force participation rate | I (1) | Labour force participation rate, %. | Labour Force Survey, Eurostat. |

Appendix B. The Empirical Results of Mardia Test

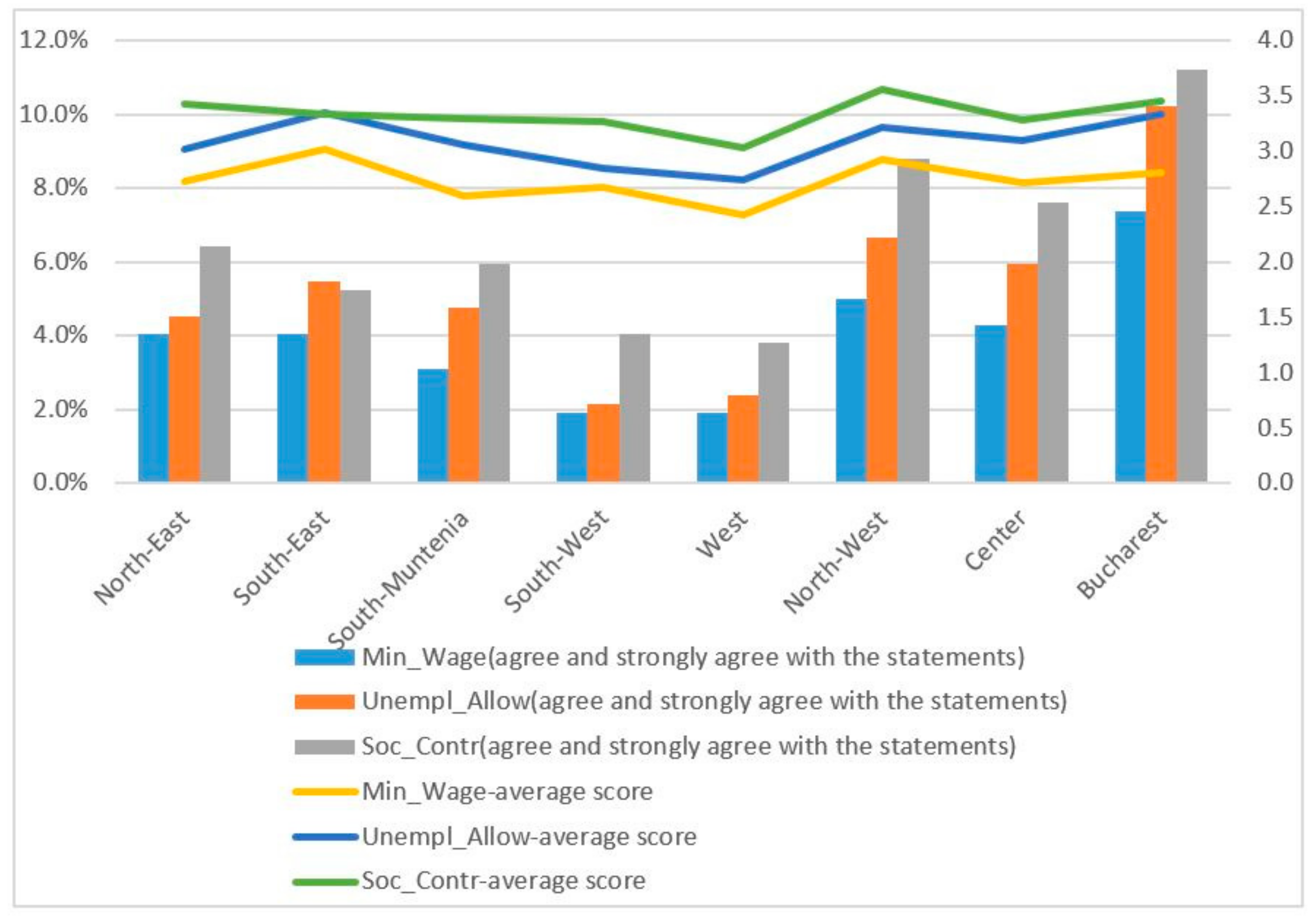

Appendix C. The Regional Analysis of the Main Determinants of Shadow Economic Activity

References

- Schneider, F.; Buehn, A. Estimating the Size of the Shadow Economy: Methods, Problems and Open Questions. 2013. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2353281 (accessed on 15 March 2018).

- Schneider, F.; Williams, C. The Shadow Economy; The Institute of Economic Affairs: London, UK, 2013. [Google Scholar]

- Thomas, J.J. Informal Economic Activity, LSE, Handbooks in Economics; Harvester Wheatsheaf: London, UK, 1992. [Google Scholar]

- Medina, L.; Schneider, F. Shadow Economies around the World: What did We Learn over the Last 20 Years? IMF Working Paper WP/18/17. 2017. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3124402 (accessed on 20 May 2018).

- Gurtoo, A.; Williams, C.C. Entrepreneurship and the informal sector: Some lessons from India. Int. J. Entrep. Innov. 2009, 10, 55–62. [Google Scholar] [CrossRef]

- Williams, C.C.; Gurtoo, A. Women entrepreneurs in the Indian informal sector: Marginalisation dynamics or institutional rational choice? Int. J. Gend. Entrep. 2011, 3, 6–22. [Google Scholar] [CrossRef]

- Williams, C.C.; Nadin, S. Entrepreneurship and the informal economy: An overview. J. Dev. Entrep. 2010, 15, 361–378. [Google Scholar]

- Enste, D.H. Shadow economy and institutional change in transition countries. In The Informal Economy in the EU Accession Countries: Size, Scope, Trends and Challenges to the Process of EU Enlargement; Centre for the Study of Democracy: Sofia, Bulgaria, 2003; pp. 81–113. [Google Scholar]

- Asea, P.K. The informal sector: Baby or bath water? A comment. In Carnegie-Rochester Conference Series on Public Policy; Elsevier: North-Holland, The Netherlands, 1996; Volume 45, pp. 163–171. [Google Scholar]

- Schneider, F.; Enste, D. Shadow Economies: Size, Causes and Consequences. J. Econ. Lit. 2000, 38, 73–110. [Google Scholar] [CrossRef]

- Kucera, D.; Galli, R. Informal Employment in Latin America: Movements over Business Cycles and the Effects of Worker Rights. 2003. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=403481 (accessed on 20 January 2018).

- Chen, M.A.; Vanek, J.; Carr, M. Mainstreaming Informal Employment and Gender in Poverty Reduction: A Handbook for Policy-Makers and Other Stakeholders; Commonwealth Secretariat: London, UK, 2004. [Google Scholar]

- Chen, M.A.; Vanek, J.; Lund, F.; Heintz, J.; Jhabvala, R.; Bonner, C. Progress of the World’s Women 2005: Women, Work, and Poverty; UNIFEM: New York, NY, USA, 2005. [Google Scholar]

- Farzanegan, M.R.; Hassan, M. The Impact of Economic Globalization on the Shadow Economy in Egypt. 2017. Available online: https://papers.ssrn.com/Sol3/papers.cfm?abstract_id=2965941 (accessed on 10 September 2018).

- La Porta, R.; Shleifer, A. Informality and development. J. Econ. Perspect. 2014, 28, 109–126. [Google Scholar] [CrossRef] [Green Version]

- Gerxhani, K. The informal sector in developed and less developed countries: A literature survey. Public Choice 2004, 120, 267–300. [Google Scholar] [CrossRef]

- Loayza, N. The causes and consequences of informality in Peru. Serie de Documento de Trabajo 2007, 18, 1–22. [Google Scholar]

- Oviedo, A.M.; Thomas, M.R.; Karakurum-Özdemir, K. Economic Informality: Causes, Costs, and Policies-a Literature Survey. The World Bank, 2009. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-0-8213-7996-7 (accessed on 10 September 2018).

- Biswas, A.; Farzanegan, M.R.; Thum, M. Pollution, shadow economy and corruption: Theory and evidence. Ecol. Econ. 2012, 75, 114–125. [Google Scholar] [CrossRef] [Green Version]

- Bacchetta, M.; Ernst, E.; Bustamante, J.P. Globalization and Informal Jobs in Developing Countries. International Labour Organization: Geneva, Switzerland, 2009. Available online: https://www.wto.org/english/res_e/booksp_e/jobs_devel_countries_e.pdf (accessed on 20 May 2018).

- Briassoulis, H. Sustainable development and the informal sector: An uneasy relationship? J. Environ. Dev. 1999, 8, 213–237. [Google Scholar] [CrossRef]

- Ruzek, W. The informal economy as a catalyst for sustainability. Sustainability 2014, 7, 23–34. [Google Scholar] [CrossRef]

- Smit, S.; Musango, J.K. Towards connecting green economy with informal economy in South Africa: A review and way forward. Ecol. Econ. 2015, 116, 154–159. [Google Scholar] [CrossRef] [Green Version]

- Rupani, K.F. The Organization of the Informal Sector for Sustainable Development. In Proceedings of the 3rd International Conference on Global Business, Economics, Finance and Social Sciences (GB14Mumbai Conference), Mumbai, India, 19–21 December 2014; ISBN 978-1-941505-21-2. [Google Scholar]

- Chambwera, M.; MacGregor, J.; Baker, A. The Informal Economy. In A Primer for Development Professionals on the Importance of the Informal Economy in Developing Countries; International Institute for Environment and Development: London, UK, 2011. [Google Scholar]

- Beeton, J. Very Small Is Beautiful for the Majority of Our People: Entrepreneurs Informal Traders. 2010. Available online: http://www.ngopulse.org/search/node/Ligthelm (accessed on 10 September 2018).

- Acey, C.S.; Culhane, T.H. Green jobs, livelihoods and the post-carbon economy in African cities. Local Environ. Int. J. Justice Sustain. 2013, 18, 1046–1065. [Google Scholar] [CrossRef]

- Agamuthu, P. The Role of Informal Sector for Sustainable Waste Management. Waste Manag. Res. J. Int. Solid Wastes Public Clean. Assoc. 2010, 28, 671–672. [Google Scholar] [CrossRef] [PubMed]

- Jha, C.K. Financial Reforms and Corruption: Which Dimensions Matter? Int. Rev. Financ. Forthcom. 2018. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. Does local financial development matter? Q. J. Econ. 2004, 119, 929–969. [Google Scholar] [CrossRef]

- Jha, C.; Panda, B. Individualism and Corruption: A Cross-Country Analysis. Econ. Pap. J. Appl. Econ. Policy 2017, 36, 60–74. [Google Scholar] [CrossRef] [Green Version]

- Fisman, R.; Miguel, E. Corruption, norms, and legal enforcement: Evidence from diplomatic parking tickets. J. Polit. Econ. 2007, 115, 1020–1048. [Google Scholar] [CrossRef]

- Jha, C.K.; Sarangi, S. Women and corruption: What positions must they hold to make a difference? J. Behav. Organ. 2018, 151, 219–233. [Google Scholar] [CrossRef]

- Heshmati, A. The Shadow Economy and Corruption as Development Impediments. Economic Integration, Currency Union, and Sustainable and Inclusive Growth in East Africa; Springer: Cham, Switzerland, 2016; pp. 115–133. [Google Scholar]

- Dell’Anno, R.; Solomon, O.H. Shadow economy and unemployment rate in USA: Is there a structural relationship? An empirical analysis. Appl. Econ. 2008, 40, 2537–2555. [Google Scholar] [CrossRef]

- Schneider, F.; Buehn, A. Shadow Economies in 10 Transition and 6 Developing OECD Countries: What Are the Driving Forces? 2013. Available online: Studien/pfuschneu/2013/ShadEcOECD_DrivForces2013.doc (accessed on 20 January 2018).

- Schneider, F. Size and Development of the Shadow Economy of 31 European and 5 Other OECD Countries from 2003 to 2014: Different Developments? J. Self-Gov. Manag. Econ. 2015, 3, 7–29. [Google Scholar]

- Albu, L.L. A Model to Estimate Spatial Distribution Of Informal Economy. J. Econ. Forecast. Inst. Econ. Forecast. 2008, 5, 111–124. [Google Scholar]

- Albu, L.L.; Iorgulescu, R.; Stanica, C. Estimating Hidden Economy and Hidden Migration: The Case of Romania. J. Econ. Forecast. Inst. Econ. Forecast. 2010, 2, 46–56. [Google Scholar]

- Albu, L.L.; Ghizdeanu, I.; Stanica, C. Spatial Distribution of the Informal Economy. A Theoretical and Empirical Investigation; SCIENZE REGIONALI, Franco Angeli Editore: Milan, Italy, 2011; pp. 63–80. [Google Scholar]

- Alexandru, A.A.; Dobre, I. The Impact of unmployment rate on the size of Romanian shadow economy. Public Financ. Rev. 2013, 41, 608–632. [Google Scholar]

- Davidescu, A.A. Estimating the size of Romanian shadow economy. A labour Approach. J. Soc. Econ. Stat. 2014, 3, 25–37. [Google Scholar]

- Davidescu, A.A. Mapping the Informal Employment in Romania. A Comparative Analysis based on Labour and Discrepancy Approaches. J. Appl. Quant. Methods 2016, 11, 64–88. [Google Scholar]

- Andrei, T.; Ştefănescu, D.; Oancea, B. Quantitative Methods for Evaluating the Informal Economy. Case Study at the Level of Romania. Theor. Appl. Econ. 2010, 7, 15. [Google Scholar]

- Schneider, F.; Buehn, A.; Montenegro, C.E. Shadow Economies All over the World: New Estimates for 162 Countries from 1999 to 2007; Policy Research Working Paper 5356; The World Bank Development Research Group Poverty and Inequality Team & Europe and Central Asia Region Human Development Economics Unit: Washington, DC, WA, USA, 2010. [Google Scholar]

- Schneider, F. Size and Development of the Shadow Economy of 31 European and 5 Other OECD Countries from 2003 to 2013: A Further Decline; Johannes Kepler Universität: Linz, Austria, 2013; pp. 5–7. Available online: http://www.econ.jku.at/members/schneider/files/publications/2013/shadeceurope31_jan2013.pdf (accessed on 20 May 2018).

- Schneider, F. Size and Development of the Shadow Economy of 31 European and 5 other OECD Countries from 2003 to 2016: Different Developments. Unpublished work. 2016. [Google Scholar]

- French, R.; Balaita, M.; Ticsa, M. Estimating the Size and Policy Implications of the Underground Economy in Romania, US Department of the Treasury; Office of Technical Assistance: Bucharest, Romania, 1999. [Google Scholar]

- Kaufmann, D.; Kaliberda, A. Integrating the Unofficial Economy into the Dynamics of Post-Socialist Economies: A Framework of Analysis and Evidence; World Bank Policy Research Working Paper WPS1691; World Bank: Washington, DC, USA, 1996. [Google Scholar]

- Johnson, S.; Kaufmann, D.; Shleifer, A. The Unofficial Economy in Transition. Brook. Pap. Econ. Act. 1997, 28, 159–240. [Google Scholar] [CrossRef]

- Johnson, S.; Kaufmann, D.; Zoido-Lobatón, P. Regulatory discretion and the unofficial economy. Am. Econ. Rev. 1998, 88, 387–392. [Google Scholar]

- Lackó, M. Hidden Economy an Unknown Quantity? Comparative Analyses of Hidden Economies in Transition Countries in 1989–95; Working Paper; Department of Economics, University of Linz: Linz, Austria, 1999. [Google Scholar]

- Eilat, Y.; Zinnes, C. The Shadow Economy in Transition Countries Friend or FOE. A Policy Perspective. World Dev. 2002, 30, 1233–1254. [Google Scholar] [CrossRef]

- Schneider, F.; Enste, D. Increasing Shadow Economies all over the World—Fiction or Reality? A Survey of the Global Evidence of their Size and of their Impact from 1970 to 1995; The Institute for the Study of Labor (IZA): Bonn, Germany, 1998. [Google Scholar]

- Schneider, F.; Enste, D. The Shadow Economy: Theoretical Approaches, Empirical Studies, and Political Implications; Cambridge University Press: Cambridge, UK, 2002. [Google Scholar]

- Schneider, F.; Chaudhuri, K.; Chatterjee, S. The Size and Development of the Indian Shadow Economy and a Comparison with Other 18 Asian Countries: An Empirical Investigation (No. 0302); Working Paper; Department of Economics, Johannes Kepler University of Linz: Linz, Austria, 2003. [Google Scholar]

- Schneider, F.; Klinglmair, R. Shadow Economies around the World: What Do We Know? IZA Discussion Papers 1043; Institute for the Study of Labor (IZA): Bonn, Germany, 2004. [Google Scholar]

- Schneider, F.; Buehn, A. Shadow economies and corruption all over the world: Revised estimates for 120 countries, Economics—The Open-Access, Open-Assessment E-Journal. Kiel Inst. World Econ. 2007, 1, 1–53. [Google Scholar]

- Schneider, F. Shadow economies around the world: What do we really know? Eur. J. Polit. Econ. 2005, 21, 598–642. [Google Scholar] [CrossRef]

- Schneider, F. Shadow Economies and Corruption All Over the World: What Do We Really Know? Economics Working Papers 2006-17; Department of Economics, Johannes Kepler University Linz: Linz, Austria, 2006. [Google Scholar]

- Sustainable Development Solutions Network (SDSN). The 2018 SDG Index and Dashboards Report. Global Responsibilities. Implementing the Goals, Bertelsmann Stiftung, 2018. Available online: http://www.sdgindex.org/reports/2018/ (accessed on 22 September 2018).

- Adam, M.C.; Ginsburgh, V. The effects of irregular markets on macroeconomic policy: Some estimates for Belgium. Eur. Econ. Rev. 1985, 29, 15–33. [Google Scholar] [CrossRef]

- Giles, D.E.A.; Tedds, L.M. Taxes and the Canadian Underground Economy; Canadian Tax Paper n.106; Canadian Tax Foundation: Toronto, ON, Canada, 2002.

- Loayza, N.V. The Economics of the Informal Sector: A Simple Model and Some Empirical Evidence from Latin America. In Carnegie-Rochester Conference Series on Public Policy; World Bank: Washington, DC, USA, 1996; Volume 45, pp. 129–162. [Google Scholar]

- Dell’Anno, R. Estimating the Shadow Economy in Italy: A Structural Equation Approach; Working Paper 2003–2007; Department of Economics, University of Aarhus: Aarhus, Denmark, 2003. [Google Scholar]

- Dell’Anno, R. What is the relationship between unofficial and official economy? An analysis in Latin American countries. Eur. J. Econ. Financ. Adm. Sci. 2008, 12, 185–203. [Google Scholar]

- Dell’Anno, R.; Gómez-Antonio, M.; Pardo, A. The shadow economy in three Mediterranean countries: France, Spain and Greece. A MIMIC approach. Empir. Econ. 2007, 33, 51–84. [Google Scholar] [CrossRef]

- Berdiev, A.N.; Saunoris, J.W. Financial development and the shadow economy: A panel VAR analysis. Econ. Model. 2016, 57, 197–207. [Google Scholar] [CrossRef]

- Schneider, F.; Bajada, C. The Size and Development of the Shadow Economies in the Asia-Pacific (No. 0301); Working Paper; Department of Economics, Johannes Kepler University of Linz: Linz, Austria, 2003. [Google Scholar]

- Johnson, S.; Kaufmann, D.; Zoido-Lobatón, P. Corruption, Public Finances and the UNOFFICIAL Economy; MIT, The World Bank: Washington, DC, USA, 1998. [Google Scholar]

- Christopoulos, D.K. Does underground economy respond symmetrically to tax changes? Evidence from Greece. Econ. Model. 2003, 20, 563–570. [Google Scholar] [CrossRef]

- Tanzi, V. Uses and Abuses of Estimates of the Underground Economy. Econ. J. 1999, 109, 338–347. [Google Scholar] [CrossRef]

- Luo, J.; Shang, J. Exploratory data analysis on unemployment rates in USA. Adv. Appl. Stat. 2016, 48, 303–316. [Google Scholar]

- Saafi, S.; Farhat, A. Is there a causal relationship between unemployment and informal economy in Tunisia: Evidence from linear and non-linear Granger causality? Econ. Bull. 2015, 35, 1191–1204. [Google Scholar]

- Saafi, S.; Farhat, A.; Mohamed, H.; Bel, M. Testing the relationships between shadow economy and unemployment: Empirical evidence from linear and nonlinear tests. Stud. Nonlinear Dyn. Econom. 2015, 19, 585–608. [Google Scholar] [CrossRef]

- Bordignon, M.; Zanardi, A. Tax evasion in Italy. Giornale degli Economisti 1997, 56, 169–210. [Google Scholar]

- Feld, L.P.; Schneider, F. Survey on the shadow economy and undeclared earnings in OECD countries. Ger. Econ. Rev. 2010, 11, 109–149. [Google Scholar] [CrossRef]

- Hokamp, S.; Seibold, G. Tax Compliance and Public Goods Provision—An Agent-based Econophysics Approach. ArXiv, 2014; arXiv:1409.8528. [Google Scholar]

- Dell’Anno, R.; Solomon, H.O. Informality, Inequality, and ICT in Transition Economies. Eastern Eur. Econ. 2014, 52, 3–31. [Google Scholar] [CrossRef]

- Kucera, D.; Roncolato, L. Informal employment: Two contested policy issues. Int. Lab. Rev. 2008, 147, 321–348. [Google Scholar] [CrossRef]

- Schneider, F.; Buehn, A. Estimating the Size of the Shadow Economy: Methods, Problems and Open Questions, 2016, IZA DP No. 9820. Available online: http://ftp.iza.org/dp9820.pdf (accessed on 20 March 2018).

- Bollen, K.A. A new incremental fit index for general structural equation models. Sociol. Methods Res. 1989, 17, 303–316. [Google Scholar] [CrossRef]

- Long, J.S. Covariance Structure Models: An Introduction to LISREL; Sage Publishing Company: Beverly Hills, CA, USA, 1983. [Google Scholar]

- Dell’Anno, R.; Schneider, F. A complex approach to estimate shadow economy: The structural equation modelling. In Coping with the Complexity of Economics; Faggnini, M., Looks, T., Eds.; Springer: Berlin, Germany, 2009; pp. 110–130. [Google Scholar]

- Mardia, K.V. Measures of multivariate skewness and kurtosis with applications. Biometrika 1970, 57, 519–530. [Google Scholar] [CrossRef]

- Doornik, J.A.; Hansen, H. An omnibus test for univariate and multivariate normality. Oxford Bull. Econ. Stat. 2008, 70, 927–939. [Google Scholar] [CrossRef]

- Henze, N.; Zirkler, B. A class of invariant consistent tests for multivariate normality. Commun. Stat. Theory Methods 1990, 19, 3595–3617. [Google Scholar] [CrossRef]

- Friedman, E.; Johnson, S.; Kaufman, D.; Zoldo-Lobaton, P. Dodging the Grabbing Hand: The Determinants of Unofficial Activity in 69 Countries. J. Public Econ. 2000, 76, 459–493. [Google Scholar] [CrossRef]

- Razmi, M.J.; Falahi, M.A.; Montazeri, S. Institutional Quality and Underground Economy of 51 OIC Member Countries. Univers. J. Manag. Soc. Sci. 2013, 3, 1–14. [Google Scholar]

- Transparency International. Corruption Perception Index. Available online: https://www.transparency.org/news/feature/corruption_perceptions_index_2017#table (accessed on 1 September 2018).

- Fiscal Council. Fiscal Council’s Opinions. 2013. Available online: http://www.fiscalcouncil.ro/publicatii-opinii-en.2013.pdf (accessed on 15 February 2018).

- Blanco-Portela, N.; Benayas, J.; Pertierra, L.R.; Lozano, R. Towards the integration of sustainability in Higher Education Institutions: A review of drivers of and barriers to organisational change and comparison against those found of companies. J. Clean. Prod. 2017, 166, 563–578. [Google Scholar] [CrossRef]

- Lozano, R.; Suzuki, M.; Carpenter, A.; Tyunina, O. An analysis of the contribution of Japanese business terms to corporate sustainability: Learnings from the “looking-glass” of the east. Sustainability 2017, 9, 188. [Google Scholar] [CrossRef]

- Nuñez-Cacho, P.; Górecki, J.; Molina-Moreno, V.; Corpas-Iglesias, F.A. What Gets Measured, Gets Done: Development of a Circular Economy Measurement Scale for Building Industry. Sustainability 2018, 10, 2340. [Google Scholar] [CrossRef]

- Núñez-Cacho, P.; Molina-Moreno, V.; Corpas-Iglesias, F.A.; Cortés-García, F.J. Family Businesses Transitioning to a Circular Economy Model: The Case of “Mercadona”. Sustainability 2018, 10, 538. [Google Scholar] [CrossRef]

| Authors | Approach | Size of SE (% of Official GDP) |

|---|---|---|

| Albu [38] Albu et al. [39,40] | Income discrepancy method | 21.7–22.3% (2000) 20.6–21.2% (2001) 20.2–20.7% (2002) 19.3–19.6% (2003) 17.6–17.6% (2004) 17.2–17.3% (2005) 16.3–16.5% (2006) 14.6–15.0% (2007) |

| National Institute of Statistics | Labor input method | 18.1% (2000) 15.4% (2003) 16.6% (2005) 20.0% (2007) 21.3% (2009) 23.5% (2010) |

| Andrei, Ştefănescu, Oancea [44] | Monetary method | 25–35% (2000–2009) |

| Schneider, Buehn and Montenegro [45] Schneider [37,46,47] Medina and Schneider [4] | the MIMIC approach | 34.4% (2000) 30.5% (2005) 26.8% (2010) 29.1% (2012) 24.0% (2013) 28.0% (2015) 27.6% (2016) |

| Alexandru and Dobre [41] | Currency demand approach Vector Error Correction Models (VECM) | 36.5% (2000) 34.23% (2003) 33.6% (2005) 32.1% (2008) 31.6% (2010) |

| Models | Causes | Indicators | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax Burden | Direct Taxes | Indir. Taxes | Social Contr. | Gov. Cons. | Unempl. Rate | Self-Empl. | Gov. Empl. | Reg. Qual. | Govern. Effectiveness | Part-Time Empl. | Real GDP Index | Lab. Force Part. Rate | ||

| MIMIC 9-1-3a | - | 0.084 | 0.150 | 0.143 | 0.102 | 1.229 * | 1.003 *** | 0.650 | −4.79 * | 0.086 | −1 | 0.476 * | 0.059 | |

| MIMIC 9-1-3b | 0.066 | 0.179 | 0.162 | 0.082 | 1.190 ** | 0.793 * | 0.706 | −5.90 * | 0.135 | −1 | 0.481 * | 0.039 | ||

| MIMIC 8-1-3a | - | - | 0.111 | 0.131 | 0.112 | 1.274 * | 0.967 ** | 0.644 | - | −5.11 * | 0.104 | −1 | 0.483 * | 0.052 |

| MIMIC 8-1-3b | - | - | 0.149 | 0.152 | 0.088 | 1.223 ** | 0.755 * | 0.687 | −6.18 * | - | 0.155 | −1 | 0.492 * | 0.035 |

| MIMIC 7-1-3a | - | - | 0.148 | 0.146 | 0.070 | 1.213 ** | 0.758 * | - | −5.17 * | - | 0.208 * | −1 | 0.588 | 0.080 |

| MIMIC 7-1-3b | 0.031 | - | - | - | 0.111 | 1.194 * | 0.820 ** | 0.872 | −5.21 * | 0.166 | −1 | 0.491 * | 0.044 | |

| MIMIC 7-1-2a | - | - | 0.172 | 0.245 | - | 1.232 ** | 0.756 * | 0.767 | −7.03 * | - | 0.134 | −1 | 0.443 * | - |

| MIMIC 6-1-3a | - | - | 0.114 | 0.141 | - | 1.100 ** | 0.819 ** | - | −4.30 * | - | 0.268 * | −1 | 0.661 * | 0.195 * |

| MIMIC 6-1-3b | - | - | 0.016 | 0.069 | - | 0.859 * | 0.876 ** | - | - | −2.62 * | 0.281 * | −1 | 0.606 * | 0.421 * |

| MIMIC 5-1-3a | - | - | 0.026 | - | - | 0.743 * | 0.789 * | - | −1.00 * | - | 0.292 * | −1 | 0.710 * | 0.428 ** |

| MIMIC 5-1-3b | - | - | 0.008 | - | - | 0.807 * | 0.829 ** | - | - | −2.20 * | 0.285 * | −1 | 0654 * | 0.461 * |

| MIMIC 4-1-3a | - | - | - | - | - | 0.668 * | 0.769 ** | - | −0.535 * | - | 0.286 * | −1 | 0.705 * | 0.477 ** |

| MIMIC 4-1-3b | - | - | - | - | - | 0.796 * | 0.823 ** | - | - | −2.18 * | 0.285 * | −1 | 0651 * | 0.471 ** |

| Global Goodness of Fit Statistics | Chi-square 2 (p-value) | RMSEA 3 (p-value) | CFI | TLI | SRMR | CD | AIC | SBC | ||||||

| MIMIC 9-1-3a | 23.22 + (0.182) | 0.06 + (0.197) | 0.577 | 0.294 | 0.062 | 0.364 | 1779.91 | 1941.80 | ||||||

| MIMIC 9-1-3b | 24.11 + (0.151) | 0.07 + (0.142) | 0.594 | 0.324 | 0.062 | 0.365 | 1779.80 | 1941.70 | ||||||

| MIMIC 8-1-3a | 19.56 + (0.24) | 0.056 + (0.199) | 0.685 | 0.469 | 0.065 | 0.358 | 1572.24 | 1709.40 | ||||||

| MIMIC 8-1-3b | 19.80 + (0.229) | 0.058 + (0.17) | 0.713 | 0.516 | 0.066 | 0.367 | 1572.46 | 1709.62 | ||||||

| MIMIC 7-1-3a | 16.46 + (0.286) | 0.05 + (0.192) | 0.789 | 0.639 | 0.067 | 0.410 | 1588.06 | 1702.74 | ||||||

| MIMIC 7-1-3b | 20.07 + (0.128) | 0.079 + (0.088) | 0.589 | 0.295 | 0.072 | 0.339 | 1424.18 | 1538.85 | ||||||

| MIMIC 7-1-2a | 4.34 + (0.63) | 0.00 + (0.822) | 1.00 | 1.382 | 0.028 | 0.316 | 1108.74 | 1216.67 | ||||||

| MIMIC 6-1-3a | 12.65 + (0.39) | 0.028 + (0.295) | 0.935 | 0.886 | 0.063 | 0.514 | 1283.88 | 1378.31 | ||||||

| MIMIC 6-1-3b | 12.31 + (0.42) | 0.019 + (0.47) | 0.958 | 0.926 | 0.060 | 0.867 | 1283.54 | 1377.98 | ||||||

| MIMIC 5-1-3a | 12.15 + (0.275) | 0.055 + (0.275) | 0.794 | 0.629 | 0.065 | 0.778 | 1093.19 | 1169.63 | ||||||

| MIMIC 5-1-3b | 10.44 + (0.402) | 0.025 + (0.455) | 0.944 | 0.900 | 0.064 | 0.862 | 1093.11 | 1169.55 | ||||||

| MIMIC 4-1-3a | 9.18 + (0.32) | 0.046 + (0.295) | 0.880 | 0.775 | 0.066 | 0.820 | 843.27 | 903.98 | ||||||

| MIMIC 4-1-3b | 7.89+ (0.44) | 0.00+ (0.44) | 1.000 | 1.025 | 0.065 | 0.872 | 842.68 | 903.39 | ||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Popescu, G.H.; Davidescu, A.A.M.; Huidumac, C. Researching the Main Causes of the Romanian Shadow Economy at the Micro and Macro Levels: Implications for Sustainable Development. Sustainability 2018, 10, 3518. https://doi.org/10.3390/su10103518

Popescu GH, Davidescu AAM, Huidumac C. Researching the Main Causes of the Romanian Shadow Economy at the Micro and Macro Levels: Implications for Sustainable Development. Sustainability. 2018; 10(10):3518. https://doi.org/10.3390/su10103518

Chicago/Turabian StylePopescu, Gheorghe H., Adriana Ana Maria Davidescu, and Catalin Huidumac. 2018. "Researching the Main Causes of the Romanian Shadow Economy at the Micro and Macro Levels: Implications for Sustainable Development" Sustainability 10, no. 10: 3518. https://doi.org/10.3390/su10103518