Carbon Emission Performance of Independent Oil and Natural Gas Producers in the United States

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Abbreviations and Nomenclatures

3.2. Efficiency and Malmquist Index

- for

- for

- for

3.3. Inputs and Outputs

3.4. Data

4. Results

4.1. Unified Efficiencies

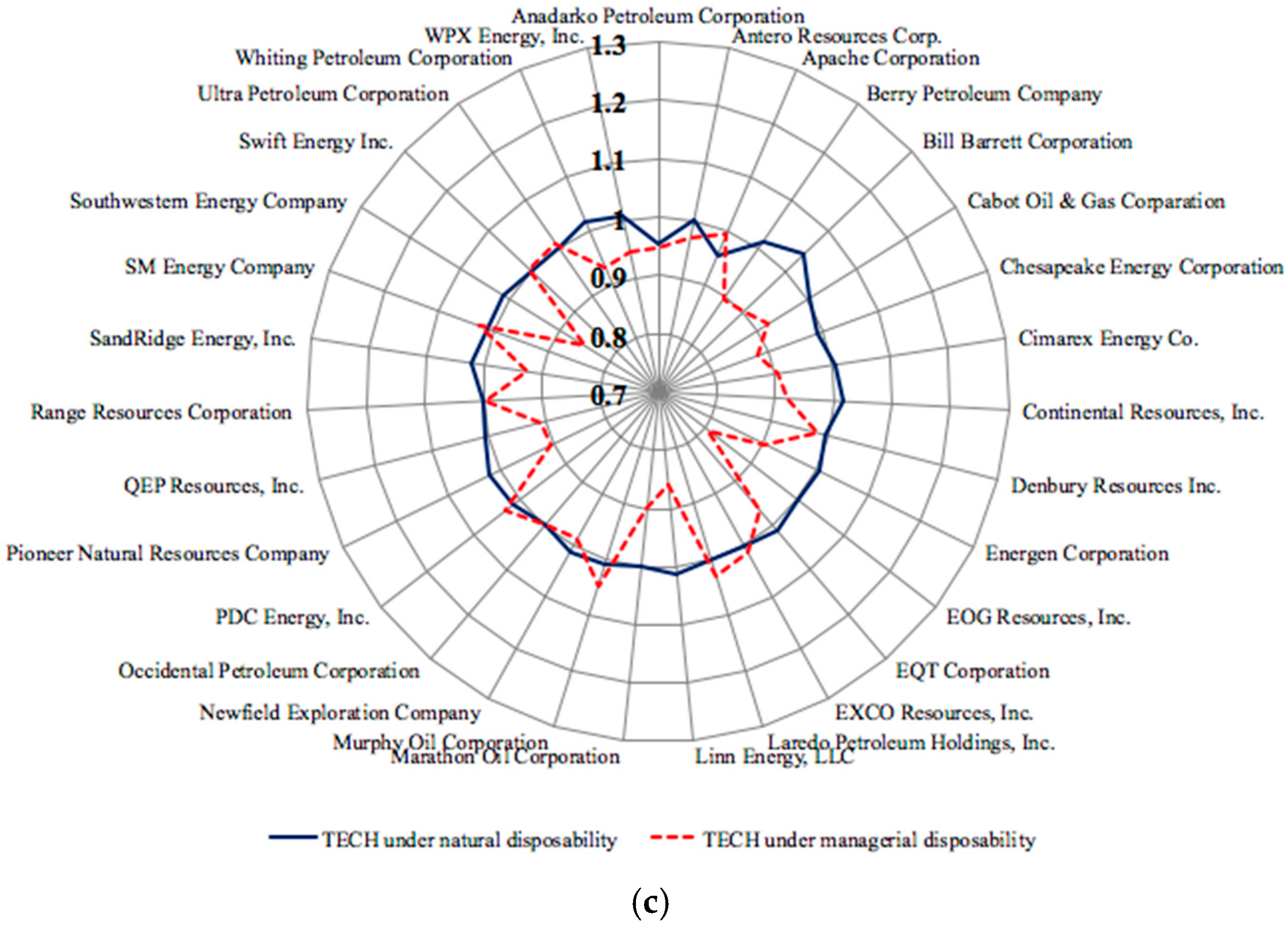

4.2. The Malmquist Index

5. Discussions and Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Van den Hove, S.; Le Menestrel, M.; de Bettignies, H.-C. The oil industry and climate change: Strategies and ethical dilemmas. Clim. Policy 2002, 2, 3–18. [Google Scholar] [CrossRef]

- Skjaerseth, J.B.; Skodvin, T. Climate Change and the Oil Industry: Common Problems, Different Strategies. Glob. Environ. Politics 2001, 1, 43–64. [Google Scholar] [CrossRef]

- Hiatt, S.R.; Grandy, J.B.; Lee, B.H. Organizational Responses to Public and Private Politics: An Analysis of Climate Change Activists and U.S. Oil and Gas Firms. Organ. Sci. 2015, 26, 1769–1786. [Google Scholar] [CrossRef]

- Weitz, M. U.S. EPA GHG Emission Data: Natural Gas and Petroleum Systems. Available online: https://www.epa.gov/sites/production/files/2015-09/documents/weitz_pres.pdf (accessed on 10 December 2017).

- EPA. Greenhouse Gas Emissions Reporting From the Petroleum and Natural Gas Industry. Available online: https://www.epa.gov/ghgreporting/greenhouse-gas-emissions-reporting-petroleum-and-natural-gas-industry-background (accessed on 10 December 2017).

- Weinhold, B. The Future of Fracking: New Rules Target Air Emissions for Cleaner Natural Gas Production. Environ. Health Perspect. 2012, 120, a272–a279. [Google Scholar] [CrossRef] [PubMed]

- Dittrick, P. EPA’s Deadline on Drilling-Related Air Pollution Standards Extended. Available online: http://www.ogj.com/articles/2012/04/epas-deadline-on-drilling-related-air-pollution-standards-extended.html (accessed on 30 December 2017).

- Sueyoshi, T.; Goto, M. Weak and strong disposability vs. natural and managerial disposability in DEA environmental assessment: Comparison between Japanese electric power industry and manufacturing industries. Energy Econ. 2012, 34, 686–699. [Google Scholar] [CrossRef]

- Levy, D.L.; Kolk, A. Strategic Responses to Global Climate Change: Conflicting Pressures on Multinationals in the Oil Industry. Bus. Politics 2002, 4, 275–300. [Google Scholar] [CrossRef]

- Kolk, A.; Levy, D. Winds of Change: Corporate Strategy, Climate change and Oil Multinationals. Eur. Manag. J. 2001, 19, 501–509. [Google Scholar] [CrossRef]

- Silvestre, B.S.; Gimenes, F.A.P.; Neto, R.S. A sustainability paradox? Sustainable operations in the offshore oil and gas industry: The case of Petrobras. J. Clean. Prod. 2017, 142, 360–370. [Google Scholar] [CrossRef]

- Nasiritousi, N. Fossil fuel emitters and climate change: Unpacking the governance activities of large oil and gas companies. Environ. Politics 2017, 26, 621–647. [Google Scholar] [CrossRef]

- Jung, E.; Kim, J.; Rhee, S. The measurement of corporate environmental performance and its application to the analysis of efficiency in oil industry. J. Clean. Prod. 2001, 9, 551–563. [Google Scholar] [CrossRef]

- Paun, D. Sustainability and Financial Performance of Companies in the Energy Sector in Romania. Sustainability 2017, 9, 1722. [Google Scholar] [CrossRef]

- Shvarts, E.A.; Pakhalov, A.M.; Knizhnikov, A.Y. Assessment of environmental responsibility of oil and gas companies in Russia: The rating method. J. Clean. Prod. 2016, 127, 143–151. [Google Scholar] [CrossRef]

- Alazzani, A.; Wan-Hussin, W.N. Global Reporting Initiative’s environmental reporting: A study of oil and gas companies. Ecol. Indic. 2013, 32, 19–24. [Google Scholar] [CrossRef]

- Wang, D.; Li, S.; Sueyoshi, T. DEA environmental assessment on U.S. industrial sectors: Investment for improvement in operational and environmental performance to attain corporate sustainability. Energy Econ. 2014, 45, 254–267. [Google Scholar] [CrossRef]

- Zhao, X.; Zhong, C. Low Carbon Economy Performance Analysis with the Intertemporal Effect of Capital in China. Sustainability 2017, 9, 853. [Google Scholar]

- Cao, L.; Qi, Z.; Ren, J. China’s Industrial Total-Factor Energy Productivity Growth at Sub-Industry Level: A Two-Step Stochastic Metafrontier Malmquist Index Approach. Sustainability 2017, 9, 1384. [Google Scholar]

- Meng, M.; Fu, Y.; Wang, T.; Jing, K. Analysis of Low-Carbon Economy Efficiency of Chinese Industrial Sectors Based on a RAM Model with Undesirable Outputs. Sustainability 2017, 9, 451. [Google Scholar] [CrossRef]

- Klumpp, M. Do Forwarders Improve Sustainability Efficiency? Evidence from a European DEA Malmquist Index Calculation. Sustainability 2017, 9, 842. [Google Scholar] [CrossRef]

- Gómez-Calvet, R.; Conesa, D.; Gómez-Calvet, A.R.; Tortosa-Ausina, E. Energy efficiency in the European Union: What can be learned from the joint application of directional distance functions and slacks-based measures? Appl. Energy 2014, 132, 137–154. [Google Scholar] [CrossRef]

- Wang, D.D.; Sueyoshi, T. Assessment of large commercial rooftop photovoltaic system installations: Evidence from California. Appl. Energy 2017, 188, 45–55. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Wang, D. Measuring scale efficiency and returns to scale on large commercial rooftop photovoltaic systems in California. Energy Econ. 2017, 65, 389–398. [Google Scholar] [CrossRef]

- Wang, D.D. Do United States manufacturing companies benefit from climate change mitigation technologies? J. Clean. Prod. 2017, 161, 821–830. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y.; Goto, M. A literature study for DEA applied to energy and environment. Energy Econ. 2017, 62, 104–124. [Google Scholar] [CrossRef]

- Li, J.; Li, J.; Zheng, F. Unified Efficiency Measurement of Electric Power Supply Companies in China. Sustainability 2014, 6, 779–793. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Data envelopment analysis for environmental assessment: Comparison between public and private ownership in petroleum industry. Eur. J. Oper. Res. 2012, 216, 668–678. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. DEA environmental assessment in time horizon: Radial approach for Malmquist index measurement on petroleum companies. Energy Econ. 2015, 51, 329–345. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Wang, D. Sustainability development for supply chain management in U.S. petroleum industry by DEA environmental assessment. Energy Econ. 2014, 46, 306–374. [Google Scholar] [CrossRef]

- Bevilacqua, M.; Braglia, M. Environmental efficiency analysis for ENI oil refineries. J. Clean. Prod. 2002, 10, 85–92. [Google Scholar] [CrossRef]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estad. 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Bjurek, H.; Hjalmarsson, L. Productivity in multiple output public service: A quadratic frontier function and Malmquist index approach. J. Public Econ. 1995, 56, 447–460. [Google Scholar] [CrossRef]

- Grifell-Tatjé, E.; Lovell, C.A.K. A note on the Malmquist productivity index. Econ. Lett. 1995, 47, 169–175. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lindgren, B.; Roos, P. Productivity Developments in Swedish Hospitals: A Malmquist Output Index Approach. In Data Envelopment Analysis: Theory, Methodology, and Applications; Springer: Dordrecht, The Netherlands, 1994; pp. 253–272. [Google Scholar]

- Mahlberg, B.; Luptacik, M. Eco-efficiency and eco-productivity change over time in a multisectoral economic system. Eur. J. Oper. Res. 2014, 234, 885–897. [Google Scholar] [CrossRef]

- Asmild, M.; Paradi, J.C.; Aggarwall, V.; Schaffnit, C. Combining DEA Window Analysis with the Malmquist Index Approach in a Study of the Canadian Banking Industry. J. Product. Anal. 2004, 21, 67–89. [Google Scholar] [CrossRef]

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and Undesirable Outputs: A Directional Distance Function Approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Lovell, C.A.K. The Decomposition of Malmquist Productivity Indexes. J. Product. Anal. 2003, 20, 437–458. [Google Scholar] [CrossRef]

- Fare, R.; Grosskopf, S.; Pasurka, C.A., Jr. Accounting for Air Pollution Emissions in Measures of State Manufacturing Productivity Growth. J. Reg. Sci. 2001, 41, 381–409. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity Growth, Technical Progress, and Efficiency Change in Industrialized Countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Dakpo, K.H.; Jeanneaux, P.; Latruffe, L. Modelling pollution-generating technologies in performance benchmarking: Recent developments, limits and future prospects in the nonparametric framework. Eur. J. Oper. Res. 2016, 250, 347–359. [Google Scholar] [CrossRef]

- Raab, R.; Lichty, R. Identifying subareas that comprise a greater metropolitan area: The criterion of county relative efficiency. J. Reg. Sci. 2002, 42, 579–594. [Google Scholar] [CrossRef]

- The White House. Statement by President Trump on the Paris Climate Accord. Available online: https://www.whitehouse.gov/the-press-office/2017/06/01/statement-president-trump-paris-climate-accord (accessed on 10 August 2017).

- Cornwall, W. Can U.S. states and cities overcome Paris exit? Science 2017, 356, 764. [Google Scholar] [CrossRef] [PubMed]

- Miller, D. Why the oil companies lost solar. Energy Policy 2013, 60, 52–60. [Google Scholar] [CrossRef]

- CNN. These Countries Want to Ban Gas and Diesel Cars. Available online: http://money.cnn.com/2017/09/11/autos/countries-banning-diesel-gas-cars/index.html (accessed on 30 December 2017).

- Sprengel, D.; Busch, T. Stakeholder engagement and environmental strategy—The case of climate change. Bus. Strategy Environ. 2011, 20, 351–364. [Google Scholar] [CrossRef]

- Wang, D. Unraveling the Effects of Environmental Technology Portfolio on Corporate Sustainable Development. Corp. Soc. Responsib. Environ. Manag. 2017, in press. [Google Scholar]

| Total Assets | Operational Expense | Wells Drilled | Oil Production | Natural Gas Production | Revenue | GHG Emissions | |

|---|---|---|---|---|---|---|---|

| Unit: | Million $ | Million $ | No. | MBbls/Day | MMcf/Day | Million $ | Thousand Tons |

| 2011 | |||||||

| Mean | 13,384 | 2701 | 363 | 69.17 | 714.09 | 4307 | 1340 |

| Std. dev. | 16,309 | 3698 | 364 | 187.56 | 1394.04 | 5924 | 1254 |

| Min | 1615 | 160 | 24 | 0.01 | 0.48 | 337 | 149 |

| Max | 60,044 | 15,837 | 1282 | 1043.31 | 7327.46 | 24,119 | 4824 |

| 2012 | |||||||

| Mean | 14,578 | 3217 | 349 | 82.94 | 753.82 | 4458 | 1330 |

| Std. dev. | 17,561 | 3748 | 330 | 211.36 | 1351.41 | 6044 | 1179 |

| Min | 1992 | 283 | 41 | 0.01 | 0.39 | 321 | 161 |

| Max | 64,210 | 14,010 | 1272 | 1178.10 | 6934.35 | 24,253 | 4439 |

| 2013 | |||||||

| Mean | 15,607 | 3344 | 320 | 96.69 | 744.66 | 4973 | 1328 |

| Std. dev. | 18,243 | 3941 | 277 | 238.89 | 1219.73 | 6460 | 1260 |

| Min | 2331 | 401 | 45 | 0.01 | 0.32 | 411 | 123 |

| Max | 69,443 | 15,437 | 985 | 1333.80 | 6020.49 | 25,736 | 5279 |

| 2014 | |||||||

| Mean | 16,312 | 3903 | 353 | 89.93 | 742.01 | 5438 | 1430 |

| Std. dev. | 16,768 | 5140 | 244 | 171.74 | 1116.87 | 6501 | 1391 |

| Min | 2173 | 567 | 30 | 0.01 | 0.63 | 472 | 63 |

| Max | 60,967 | 19,648 | 869 | 937.27 | 5222.85 | 23,125 | 5578 |

| 2015 | |||||||

| Mean | 11,507 | 5913 | 217 | 96.16 | 740.32 | 3156 | 1321 |

| Std. dev. | 11,612 | 6735 | 141 | 177.12 | 1038.01 | 3414 | 1223 |

| Min | 525 | 659 | 15 | 0.01 | 0.74 | 208 | 67 |

| Max | 46,414 | 31,683 | 603 | 964.61 | 4572.25 | 12,764 | 4580 |

| Company | 2011 | 2012 | 2013 | 2014 | 2015 | 2011–2015 |

|---|---|---|---|---|---|---|

| Pioneer Natural Resources Company | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Laredo Petroleum Holdings, Inc. | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Swift Energy Inc. | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| PDC Energy, Inc. | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Occidental Petroleum Corporation | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Ultra Petroleum Corporation | 0.969 | 1.000 | 1.000 | 1.000 | 1.000 | 0.994 |

| Bill Barrett Corporation | 0.961 | 1.000 | 1.000 | 1.000 | 1.000 | 0.992 |

| EXCO Resources, Inc. | 0.953 | 1.000 | 1.000 | 1.000 | 1.000 | 0.991 |

| Range Resources Corporation | 0.951 | 1.000 | 1.000 | 1.000 | 1.000 | 0.990 |

| Denbury Resources Inc. | 0.938 | 1.000 | 1.000 | 1.000 | 1.000 | 0.988 |

| Antero Resources Corp. | 1.000 | 1.000 | 0.964 | 0.960 | 1.000 | 0.985 |

| SM Energy Company | 1.000 | 1.000 | 1.000 | 0.961 | 0.933 | 0.979 |

| Cabot Oil & Gas Corporation | 0.943 | 0.939 | 1.000 | 1.000 | 1.000 | 0.976 |

| Murphy Oil Corporation | 1.000 | 1.000 | 0.942 | 1.000 | 0.939 | 0.976 |

| Berry Petroleum Company | 0.954 | 1.000 | 0.903 | 1.000 | 1.000 | 0.971 |

| Southwestern Energy Company | 0.963 | 1.000 | 1.000 | 0.822 | 1.000 | 0.957 |

| Marathon Oil Corporation | 1.000 | 1.000 | 1.000 | 0.953 | 0.755 | 0.942 |

| Cimarex Energy Co. | 0.957 | 0.932 | 0.930 | 0.913 | 0.887 | 0.924 |

| EQT Corporation | 0.886 | 0.966 | 0.921 | 0.921 | 0.920 | 0.923 |

| Whiting Petroleum Corporation | 0.969 | 0.851 | 0.907 | 0.850 | 1.000 | 0.915 |

| WPX Energy, Inc. | 0.894 | 0.887 | 0.842 | 0.925 | 1.000 | 0.910 |

| Newfield Exploration Company | 0.864 | 0.890 | 0.902 | 0.869 | 1.000 | 0.905 |

| Energen Corporation | 1.000 | 1.000 | 0.766 | 0.884 | 0.857 | 0.901 |

| Linn Energy, LLC | 0.941 | 1.000 | 0.835 | 0.669 | 0.931 | 0.875 |

| SandRidge Energy, Inc. | 0.829 | 0.925 | 0.838 | 0.866 | 0.891 | 0.870 |

| Continental Resources, Inc. | 0.890 | 0.874 | 0.887 | 0.844 | 0.828 | 0.865 |

| EOG Resources, Inc. | 0.807 | 0.786 | 1.000 | 1.000 | 0.724 | 0.863 |

| Chesapeake Energy Corporation | 0.635 | 0.582 | 1.000 | 1.000 | 1.000 | 0.843 |

| QEP Resources, Inc. | 0.730 | 0.913 | 0.754 | 0.924 | 0.873 | 0.839 |

| Anadarko Petroleum Corporation | 0.625 | 1.000 | 0.691 | 0.846 | 0.710 | 0.774 |

| Apache Corporation | 0.460 | 0.741 | 0.691 | 0.638 | 0.773 | 0.661 |

| Company | 2011 | 2012 | 2013 | 2014 | 2015 | 2011–2015 |

|---|---|---|---|---|---|---|

| Occidental Petroleum Corporation | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Anadarko Petroleum Corporation | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Pioneer Natural Resources Company | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Chesapeake Energy Corporation | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| Apache Corporation | 0.894 | 1.000 | 1.000 | 1.000 | 1.000 | 0.979 |

| Range Resources Corporation | 0.960 | 1.000 | 1.000 | 1.000 | 0.880 | 0.968 |

| Laredo Petroleum Holdings, Inc. | 1.000 | 0.949 | 1.000 | 0.862 | 0.869 | 0.936 |

| Ultra Petroleum Corporation | 0.890 | 1.000 | 0.907 | 0.832 | 0.794 | 0.885 |

| Denbury Resources Inc. | 0.592 | 1.000 | 0.935 | 0.859 | 1.000 | 0.877 |

| Swift Energy Inc. | 0.916 | 0.943 | 0.882 | 0.847 | 0.782 | 0.874 |

| EOG Resources, Inc. | 0.771 | 0.818 | 0.856 | 1.000 | 0.812 | 0.852 |

| Marathon Oil Corporation | 1.000 | 0.842 | 0.827 | 0.764 | 0.744 | 0.836 |

| Murphy Oil Corporation | 1.000 | 0.861 | 0.663 | 0.697 | 0.904 | 0.825 |

| EQT Corporation | 0.569 | 0.934 | 0.767 | 0.902 | 0.830 | 0.800 |

| Antero Resources Corp. | 0.862 | 0.660 | 0.781 | 0.807 | 0.848 | 0.792 |

| Bill Barrett Corporation | 0.665 | 0.599 | 0.739 | 0.884 | 1.000 | 0.777 |

| EXCO Resources, Inc. | 0.783 | 0.800 | 0.740 | 0.792 | 0.759 | 0.775 |

| Berry Petroleum Company | 0.655 | 0.618 | 0.591 | 1.000 | 1.000 | 0.773 |

| WPX Energy, Inc. | 1.000 | 0.674 | 0.671 | 0.629 | 0.582 | 0.711 |

| Cabot Oil & Gas Corparation | 0.595 | 0.595 | 0.800 | 0.860 | 0.689 | 0.708 |

| SandRidge Energy, Inc. | 1.000 | 0.652 | 0.658 | 0.605 | 0.545 | 0.692 |

| Whiting Petroleum Corporation | 0.823 | 0.773 | 0.654 | 0.574 | 0.605 | 0.686 |

| PDC Energy, Inc. | 0.773 | 0.647 | 0.689 | 0.689 | 0.625 | 0.685 |

| Southwestern Energy Company | 0.655 | 0.674 | 0.668 | 0.694 | 0.718 | 0.682 |

| SM Energy Company | 0.766 | 0.660 | 0.691 | 0.673 | 0.614 | 0.681 |

| Newfield Exploration Company | 0.662 | 0.747 | 0.735 | 0.635 | 0.604 | 0.676 |

| Linn Energy, LLC | 0.796 | 0.640 | 0.668 | 0.645 | 0.578 | 0.665 |

| Continental Resources, Inc. | 0.559 | 0.646 | 0.663 | 0.664 | 0.651 | 0.637 |

| QEP Resources, Inc. | 0.615 | 0.629 | 0.618 | 0.585 | 0.580 | 0.605 |

| Cimarex Energy Co. | 0.687 | 0.610 | 0.596 | 0.559 | 0.558 | 0.602 |

| Energen Corporation | 0.440 | 0.520 | 0.537 | 0.452 | 0.476 | 0.485 |

| UEN | UEM | ||||||

|---|---|---|---|---|---|---|---|

| MI | EFF | TECH | MI | EFF | TECH | ||

| 2011–2012 | Mean | 0.985 | 1.025 | 0.972 | 1.022 | 1.005 | 1.021 |

| Std. dev. | 0.118 | 0.120 | 0.089 | 0.203 | 0.219 | 0.058 | |

| Min | 0.559 | 0.893 | 0.537 | 0.635 | 0.652 | 0.931 | |

| Max | 1.344 | 1.601 | 1.058 | 1.647 | 1.689 | 1.215 | |

| 2012–2013 | Mean | 1.007 | 1.006 | 1.009 | 0.999 | 1.003 | 0.997 |

| Std. dev. | 0.165 | 0.159 | 0.044 | 0.111 | 0.109 | 0.038 | |

| Min | 0.833 | 0.691 | 0.921 | 0.799 | 0.771 | 0.806 | |

| Max | 1.711 | 1.717 | 1.206 | 1.349 | 1.345 | 1.037 | |

| 2013–2014 | Mean | 1.003 | 1.006 | 1.001 | 1.045 | 1.011 | 1.035 |

| Std. dev. | 0.063 | 0.081 | 0.009 | 0.154 | 0.153 | 0.040 | |

| Min | 0.832 | 0.801 | 0.970 | 0.876 | 0.841 | 0.925 | |

| Max | 1.188 | 1.225 | 1.020 | 1.746 | 1.691 | 1.156 | |

| 2014–2015 | Mean | 1.007 | 1.007 | 1.008 | 0.980 | 0.983 | 0.997 |

| Std. dev. | 0.081 | 0.094 | 0.043 | 0.127 | 0.097 | 0.087 | |

| Min | 0.710 | 0.724 | 0.805 | 0.699 | 0.801 | 0.780 | |

| Max | 1.198 | 1.217 | 1.026 | 1.375 | 1.296 | 1.195 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; Li, T. Carbon Emission Performance of Independent Oil and Natural Gas Producers in the United States. Sustainability 2018, 10, 110. https://doi.org/10.3390/su10010110

Wang D, Li T. Carbon Emission Performance of Independent Oil and Natural Gas Producers in the United States. Sustainability. 2018; 10(1):110. https://doi.org/10.3390/su10010110

Chicago/Turabian StyleWang, Derek, and Tianchi Li. 2018. "Carbon Emission Performance of Independent Oil and Natural Gas Producers in the United States" Sustainability 10, no. 1: 110. https://doi.org/10.3390/su10010110