Rating a Wildfire Mitigation Strategy with an Insurance Premium: A Boreal Forest Case Study

Abstract

:1. Introduction

2. Materials and Methods

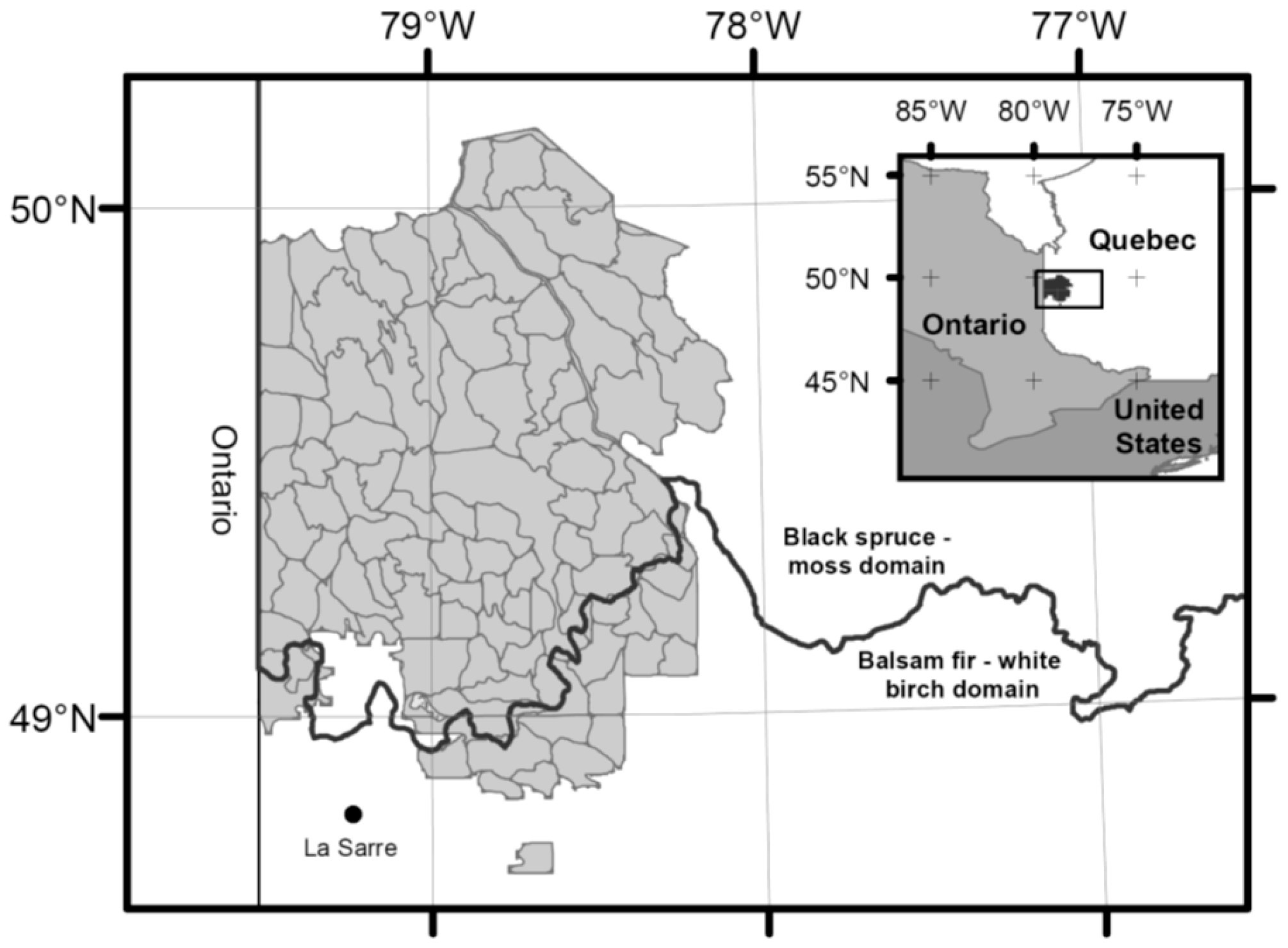

2.1. Study Area

2.2. Timber Supply Model

2.3. Interaction between Harvest Scheduling and Stochastic Processes

2.4. Risk Management

2.4.1. Risk Characterization

2.4.2. Insurance Premium

2.4.3. Timber Supply Reduction

2.5. Comparison of Risk Management Strategies

3. Results

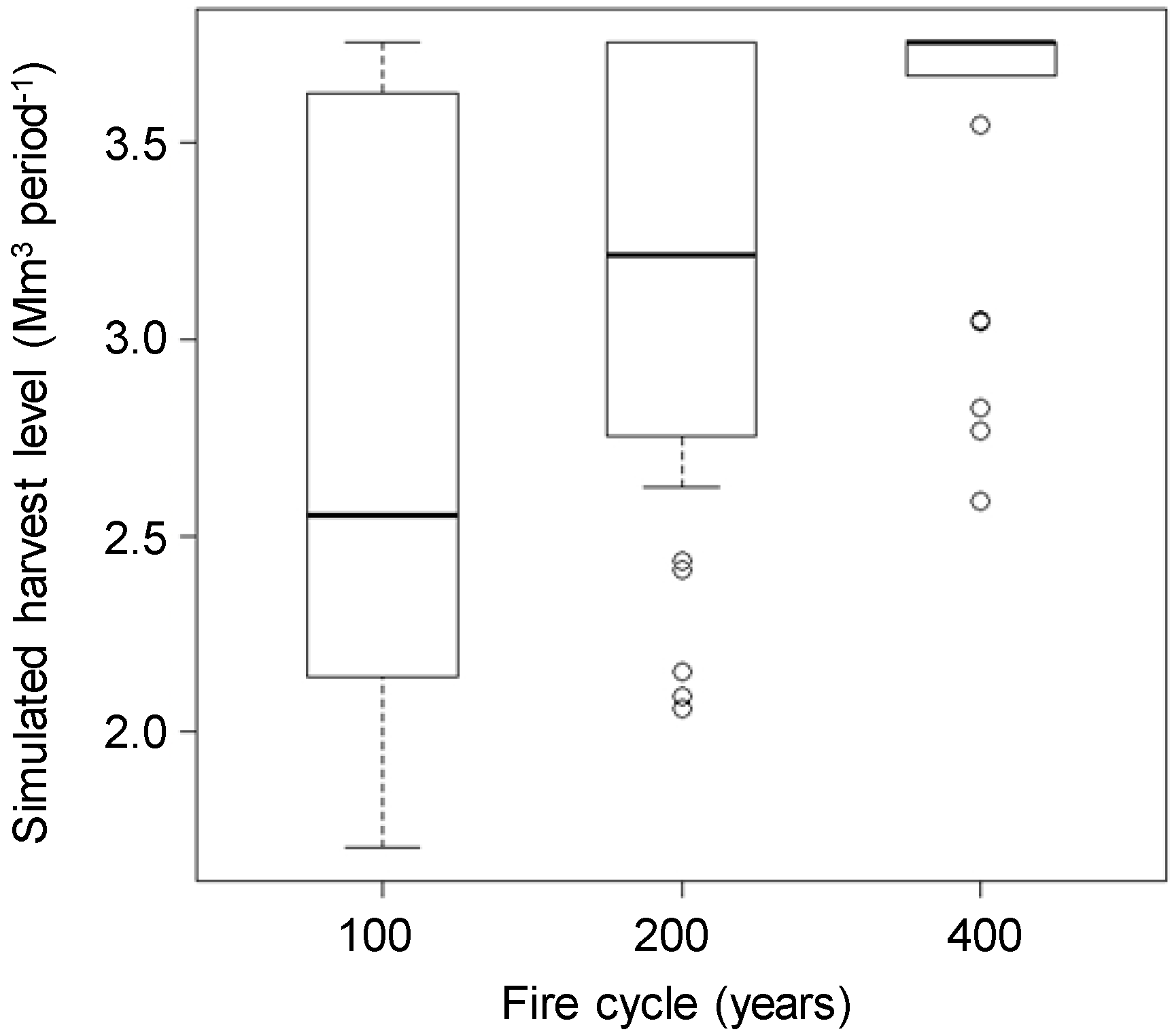

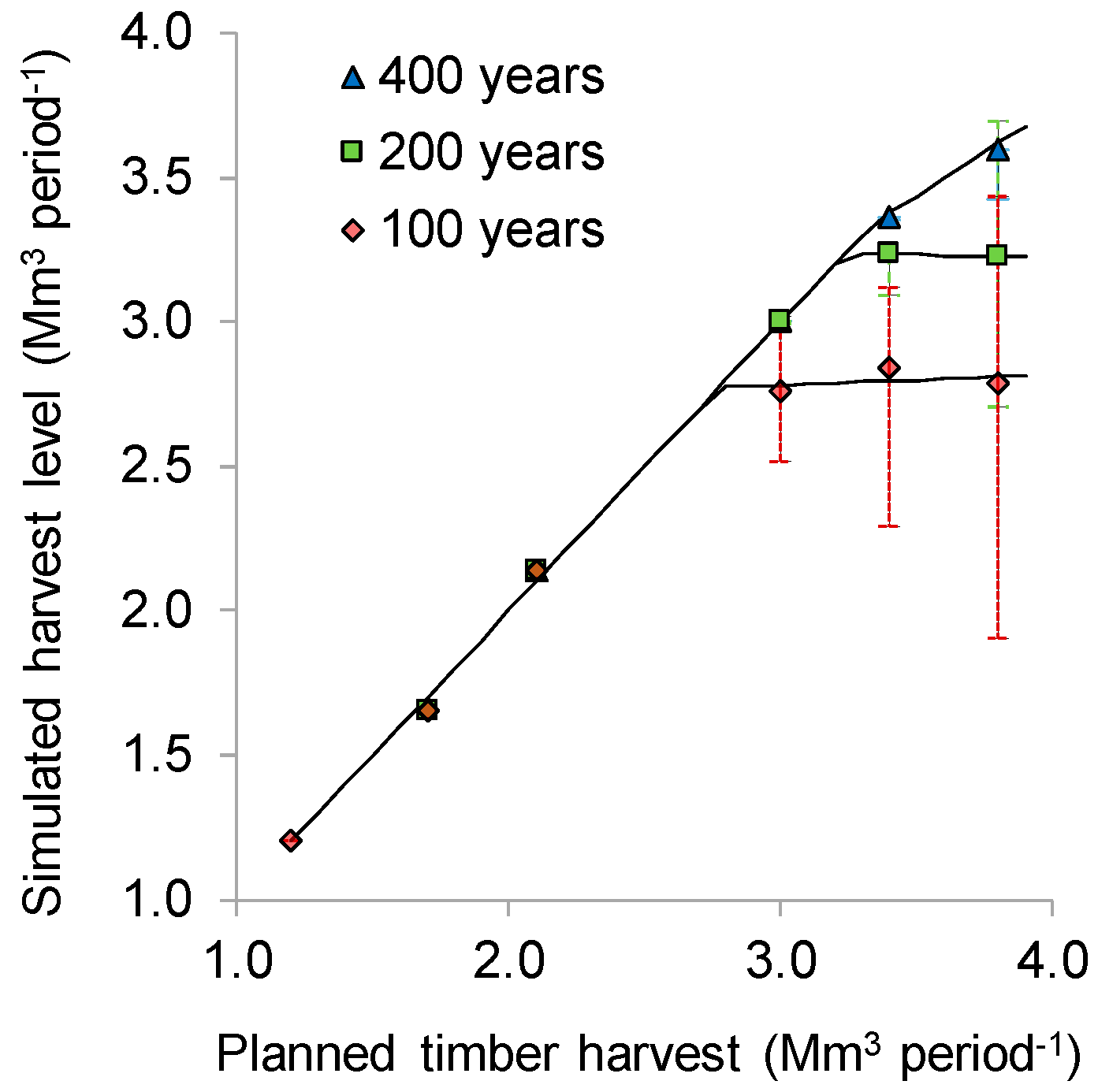

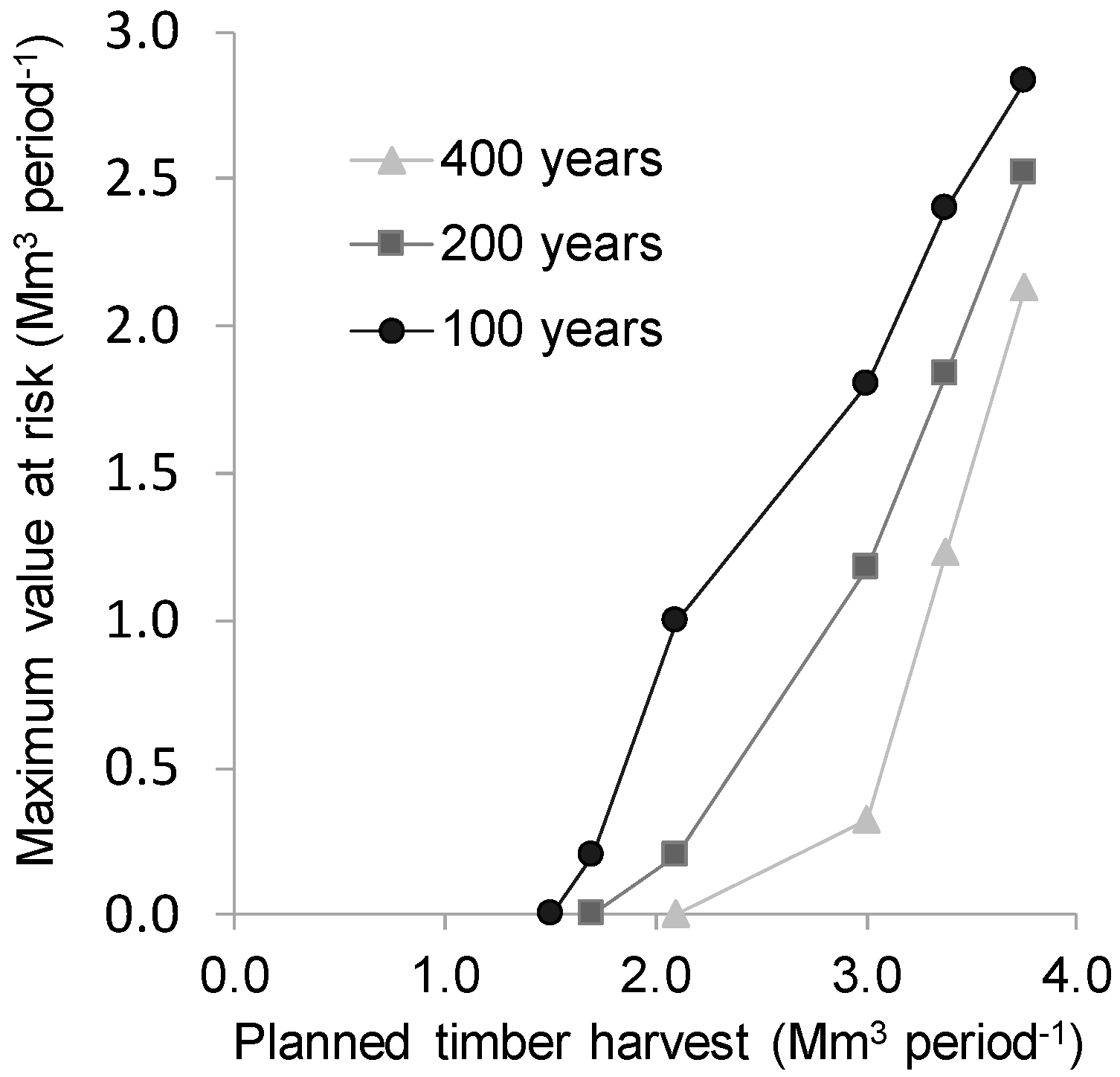

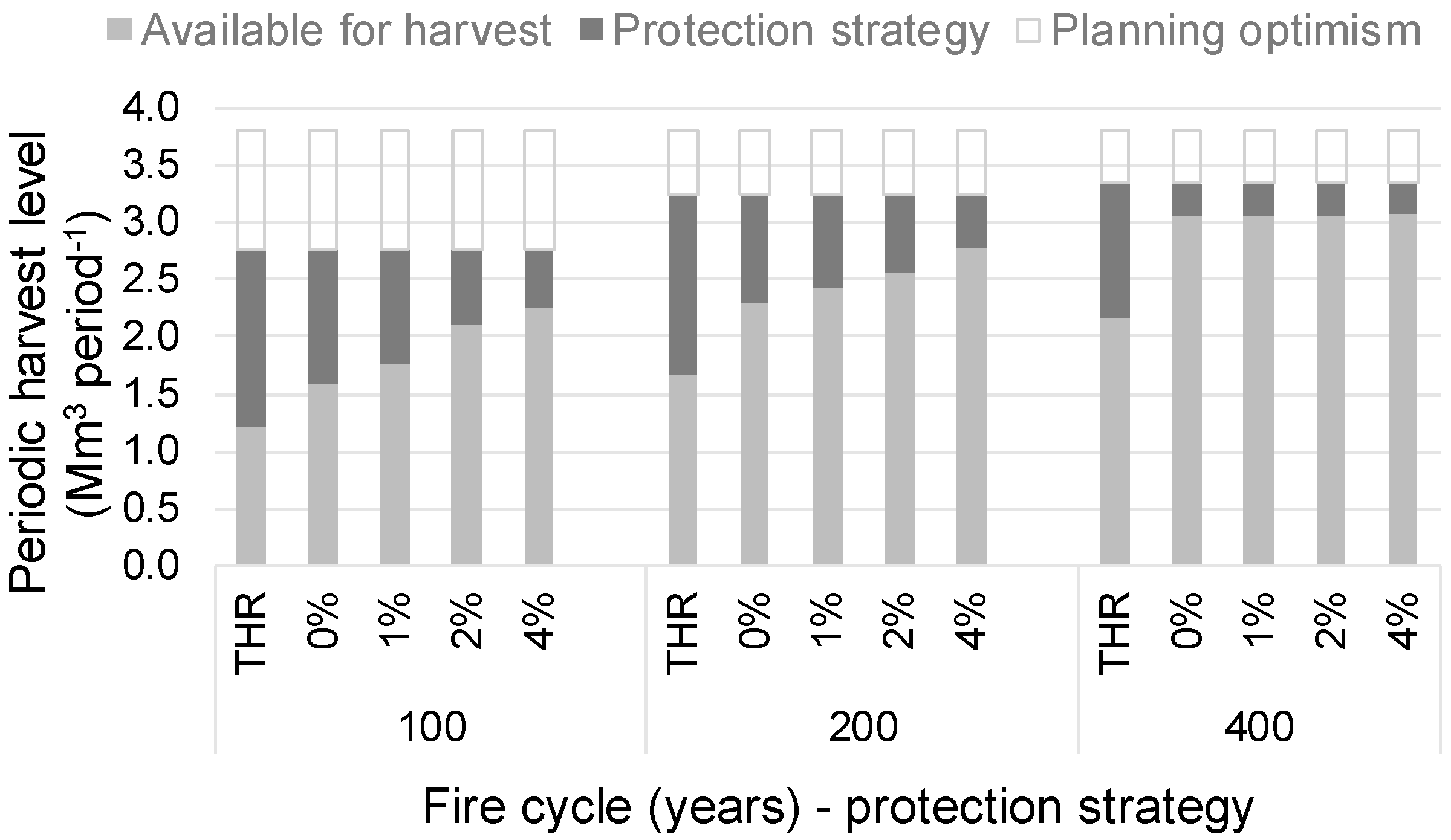

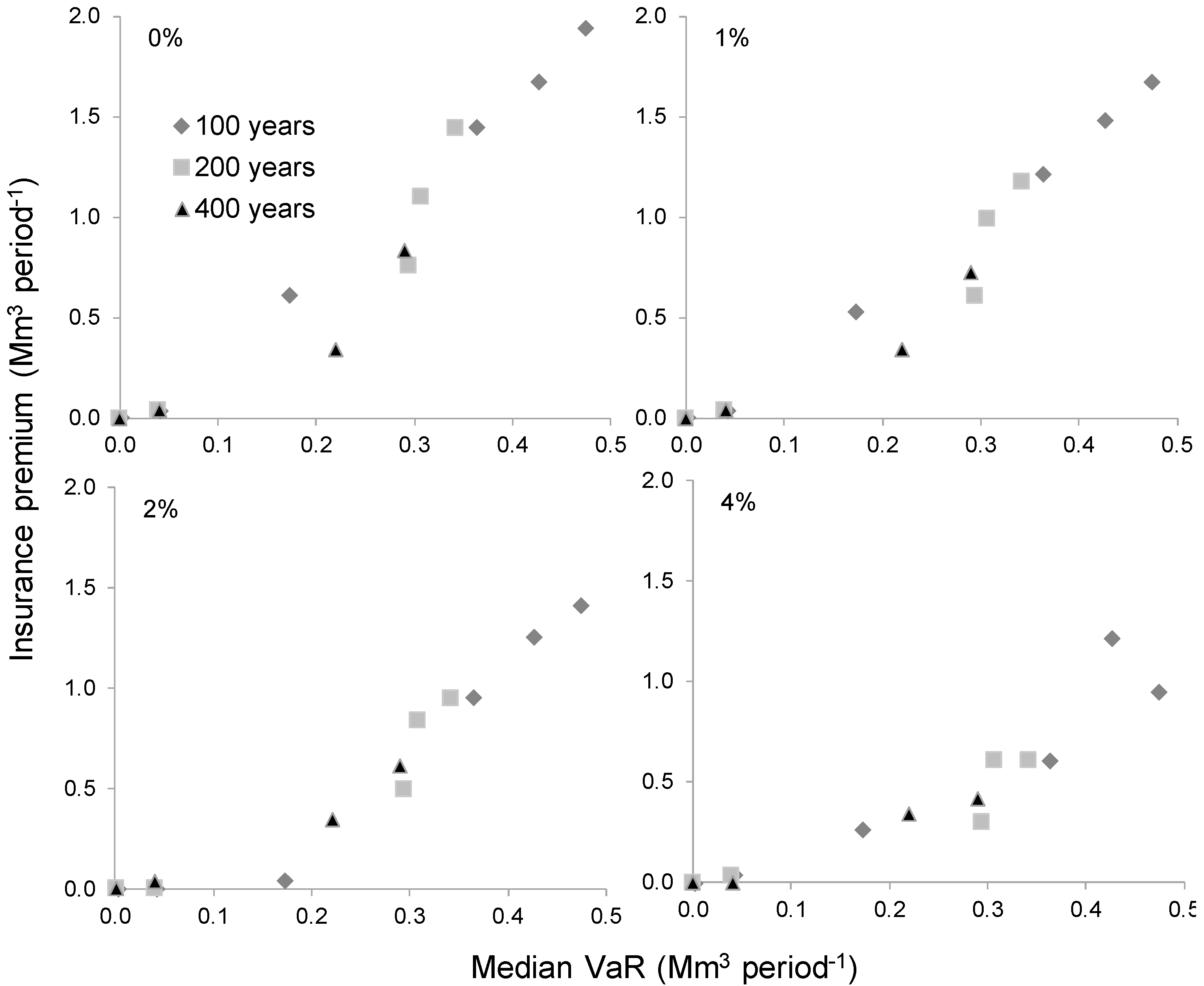

3.1. Risk Assessment

3.2. Risk Management Strategies

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Kangas, J.; Kangas, A. Multiple criteria decision support in forest management—The approach, methods applied, and experiences gained. For. Ecol. Manag. 2005, 207, 133–143. [Google Scholar] [CrossRef]

- Wynne, B. Uncertainty and environmental learning: Reconceiving science and policy in the preventive paradigm. Glob. Environ. Change 1992, 2, 111–127. [Google Scholar] [CrossRef]

- Peterson, G.D.; Cumming, G.S.; Carpenter, S.R. Scenario planning: A tool for conservation in an uncertain world. Conserv. Biol. 2003, 17, 358–366. [Google Scholar] [CrossRef]

- Hoffman, F.O.; Hammonds, J.S. Propagation of uncertainty in risk assessments: The need to distinguish between uncertainty due to lack of knowledge and uncertainty due to variability. Risk Anal. 1994, 14, 707–712. [Google Scholar] [CrossRef] [PubMed]

- Bagajewicz, M.; Uribe, A. Financial Risk Management in Refinery Operations Planning Using Commercial Software; XIV Latin Ibero-American Congress on Operations Research: Cartagena de Indias, Colombia, 2008. [Google Scholar]

- Armstrong, G.W.; Cumming, S.G. Estimating the cost of land base changes due to wildfire using shadow prices. For. Sci. 2003, 49, 719–730. [Google Scholar]

- Bertsimas, D.; Lauprete, G.J.; Samarov, A. Shortfall as a risk measure: Properties, optimization and applications. J. Econ. Dyn. Control 2004, 28, 1353–1381. [Google Scholar] [CrossRef]

- Hildebrandt, P.; Knoke, T. Investment decisions under uncertainty—A methodological review on forest science studies. For. Policy Econ. 2011, 13, 1–15. [Google Scholar] [CrossRef]

- Von Gadow, K.; Hui, G. Modelling Forest Development; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2001; pp. 1–23. [Google Scholar]

- Yousefpour, R.; Jacobsen, J.B.; Thorsen, B.J.; Meilby, H.; Hanewinkel, M.; Oehler, K. A review of decision-making approaches to handle uncertainty and risk in adaptive forest management under climate change. Ann. For. Sci. 2012, 69, 1–15. [Google Scholar] [CrossRef]

- Pasalodos-Tato, M.; Mäkinen, A.; Garcia-Gonzalo, J.; Borges, J.G.; Lämas, T.; Eriksson, L.O. Assessing uncertainty and risk in forest planning and decision support systems: Review of classical methods and introduction of innovative approaches. For. Syst. 2013, 22, 282–303. [Google Scholar] [CrossRef]

- Flannigan, M.D.; Krawchuk, M.A.; de Groot, W.J.; Wotton, M.; Gowman, L.M. Implications of changing climate for global wildland fire. Int. J. Wildl. Fire 2009, 18, 483–547. [Google Scholar] [CrossRef]

- Taylor, P.D.; Fahrig, L.; Kimberly, A. Landscape connectivity: A return to the basics. In Connectivity Conservation; Crooks, K.R., Sanjayan, M., Eds.; Cambridge University Press: Cambridge, UK; 2006; pp. 22–43. [Google Scholar]

- Martell, D.; Gunn, E.; Weintraub, A. Forest management challenges for operational researchers. Eur. J. Oper. Res. 1998, 104, 1–17. [Google Scholar] [CrossRef]

- Boychuk, D.; Martell, D.L. A multistage stochastic programming model for sustainable forest-level timber supply under risk of fire. For. Sci. 1996, 42, 10–26. [Google Scholar]

- Kaya, A.; Bettinger, P.; Boston, K.; Akbulut, R.; Ucar, Z.; Siry, J.; Merry, K.; Cieszewski, C. Optimisation in forest management. Curr. For. Rep. 2016, 2, 1–17. [Google Scholar] [CrossRef]

- Bettinger, P.; Chung, W. The key literature of, and trends in, forest-level management planning in North America, 1950–2001. Int. For. Rev. 2004, 6, 40–50. [Google Scholar] [CrossRef]

- Siry, J.P.; Bettinger, P.; Merry, K.; Grebner, D.L.; Boston, K.; Cieszewski, C. Forest Plans of North America; Academic Press: London, UK, 2015. [Google Scholar]

- Gunn, E.A. Models for strategic forest management. In Handbook of Operations Research in Natural Resources; Weintraub, A., Romero, C., Bjørndal, T., Epstein, R., Eds.; Springer: New York, 2007; pp. 317–341. [Google Scholar]

- Acuna, M.A.; Palma, C.D.; Cui, W.; Martell, D.L.; Weintraub, A. Integrated spatial fire and forest management planning. Can. J. For. Res. 2010, 40, 2370–2383. [Google Scholar] [CrossRef]

- Van Wagner, C.E. Simulating the effect of forest fire on long-term annual timber supply. Can. J. For. Res. 1983, 13, 451–457. [Google Scholar] [CrossRef]

- Reed, W.J.; Errico, D. Optimal harvest scheduling at the forest level in the presence of the risk of fire. Can. J. For. Res. 1986, 16, 266–278. [Google Scholar] [CrossRef]

- Armstrong, G.W. Sustainability of timber supply considering the risk of wildfire. For. Sci. 2004, 50, 626–639. [Google Scholar]

- Eid, T. Use of uncertain inventory data in forestry scenario models and consequential incorrect harvest decisions. Silva Fenn. 2000, 34, 89–100. [Google Scholar] [CrossRef]

- Borders, B.E.; Harrison, W.M.; Clutter, M.L.; Shiver, B.D.; Souter, R.A. The value of timber inventory information for management planning. Can. J. For. Res. 2008, 38, 2287–2294. [Google Scholar] [CrossRef]

- Duvemo, K.; Lämas, T.; Eriksson, L.O.; Wikström, P. Introducing cost-plus-loss analysis into a hierarchical forestry planning environment. Ann. Oper. Res. 2014, 219, 415–431. [Google Scholar] [CrossRef]

- Banks, E. Risk and Financial Catastrophe; Finance and Capital Markets Series; Palgrave Macmillan: Hampshire, Great Britain, 2009; p. 213. [Google Scholar]

- Baranoff, E.Z.; Baranoff, E.Z. Risk Management and Insurance; John Wiley and sons: Hoboken, NJ, USA, 2004; pp. 48–52. [Google Scholar]

- Jorion, P. How informative are value-at-risk disclosures? Account. Rev. 2002, 77, 911–931. [Google Scholar] [CrossRef]

- Ardia, D. Financial Risk Management with Bayesian Estimation of GARCH Models; Springer: Heidelberg, Germany, 2008; p. 161. [Google Scholar]

- Hoogerheide, L.; Van Dijk, H.K. Bayesian forecasting of value at risk and expected shortfall using adaptive importance sampling. Int. J. Forecast. 2010, 26, 231–247. [Google Scholar] [CrossRef]

- Bagajewicz, M.J.; Barbaro, A.F. Financial risk management in the planning of energy recovery in the total site. Ind. Eng. Chem. Res. 2003, 42, 5239–5248. [Google Scholar] [CrossRef]

- Holecy, J.; Hanewinkel, M. A forest management risk insurance model and its application to coniferous stands in southwest Germany. For. Policy Econ. 2006, 8, 161–174. [Google Scholar] [CrossRef]

- Shepard, H.B. Forest fire insurance in the Pacific Coast states. J. For. 1935, 33, 111–116. [Google Scholar]

- Shepard, H.B. Fire insurance for forests. J. Land Pub. Util. Econ. 1937, 13, 111–115. [Google Scholar] [CrossRef]

- Lankoande, M.; Yoder, J.; Wandschneider, P. Optimal wildfire insurance in the wildland-urban interface in the presence of a government subsidy for fire risk mitigation. Available online: http://faculty.ses.wsu.edu/WorkingPapers/Yoder/LankoandeEtAl_InsuranceSubsidiesWildfire_2005.pdf (accessed on 11 May 2016).

- Chen, H.; Cummins, J.D.; Viswanathan, K.S.; Weiss, M.A. Systemic risk and the interconnectedness between banks and insurers: An econometric analysis. J. Risk Insur. 2014, 81, 623–652. [Google Scholar] [CrossRef]

- Robitaille, A.; Saucier, J.P. Paysages Régionaux du Québec Méridional; Les publications du Québec: Ste-Foy, QC, Canada, 1998; p. 213. [Google Scholar]

- Nguyen-Xuan, T. Développement d’une stratégie d’aménagement forestier s’inspirant de la dynamique des perturbations naturelles pour la région nord de l’Abitibi. Available online: http://chaireafd.uqat.ca/pdf/nguyen1.pdf (accessed on 11 May 2016).

- Bergeron, Y.; Leduc, A.; Harvey, B.D.; Gauthier, S. Natural Fire Regime: A Guide for Sustainable Management of the Canadian boreal forest. Silva Fenn. 2002, 36, 81–95. [Google Scholar] [CrossRef]

- Gauthier, S.; Nguyen, T.; Bergeron, Y.; Leduc, A.; Drapeau, P.; Grondin, P. Developing forest management strategies based on fire regimes in northwestern Quebec. In Emulating Natural Forest Landscape Disturbances: Concepts and Applications; Perera, A., Buse, L.J., Weber, M.G., Eds.; Columbia University Press: New York, NY, USA, 2004; pp. 219–229. [Google Scholar]

- Bergeron, Y.; Cyr, D.; Drever, C.R.; Flannigan, M.; Gauthier, S.; Kneeshaw, D.; Logan, K. Past, current, and future fire frequencies in Quebec’s commercial forests: Implications for the cumulative effects of harvesting and fire on age-class structure and natural disturbance-based management. Can J. For. Res. 2006, 36, 2737–2744. [Google Scholar] [CrossRef]

- Bergeron, Y.; Cyr, D.; Girardin, M.P.; Carcaillet, C. Will climate change drive 21st century burn rates in Canadian boreal forest outside of its natural variability: Collating global climate model experiments with sedimentary charcoal data. Int. J. Wildl. Fire 2010, 19, 1127–1139. [Google Scholar] [CrossRef]

- Cyr, D.; Gauthier, S.; Bergeron, Y.; Carcaillet, C. Forest management is driving the eastern North American boreal forest outside its natural range of variability. Front. Ecol. Environ. 2009, 7, 519–524. [Google Scholar] [CrossRef]

- Belleau, A.; Légaré, S. Project Tembec: Towards the implementation of a forest management strategy based on the natural disturbance dynamics of the northern Abitibi region. In Ecosystem Management in the Boreal Forest; Gauthier, S., Vaillancourt, M.-A., Leduc, A., de Grandpré, L., Kneeshaw, D., Morin, H., Drapeau, P., Bergeron, Y., Eds.; Presses de l’Université du Québec: Québec, Canada, 2009; pp. 479–499. [Google Scholar]

- Bergeron, Y.; Gauthier, S.; Flannigan, M.; Kafka, V. Fire regimes at the transition between mixedwood and coniferous boreal forest in northwestern Quebec. Ecology 2004, 85, 1916–1932. [Google Scholar] [CrossRef]

- Dhital, N.; Raulier, F.; Asselin, H.; Imbeau, L.; Valeria, O.; Bergeron, Y. Emulating boreal forest disturbance dynamics: Can we maintain timber supply, aboriginal land use, and woodland caribou habitat? For. Chron. 2013, 89, 54–65. [Google Scholar] [CrossRef]

- Groot, A.; Lussier, J.-M.; Mitchell, A.K.; MacIsaac, D.A. A silvicultural systems perspective on changing Canadian forestry practices. For. Chron. 2005, 81, 50–55. [Google Scholar] [CrossRef]

- Raymond, P.; Bédard, S.; Roy, V.; Larouche, C.; Tremblay, S. The irregular shelterwood system: Review, classification, and potential application to forests affected by partial disturbances. J. For. 2009, 107, 405–413. [Google Scholar]

- Davis, L.S.; Johnson, K.N.; Bettinger, P.S.; Howard, T.E. Forest Management to Sustain Ecological, Economic, and Social Values; McGraw Hill: New York, NY, USA, 2001; p. 804. [Google Scholar]

- Fall, A.; Fall, J. A domain-specific language for models of landscape dynamics. Ecol. Modell. 2001, 141, 1–18. [Google Scholar] [CrossRef]

- Cumming, S.G. A parametric model of the fire-size distribution. Can. J. For. Res. 2001, 31, 1297–1303. [Google Scholar] [CrossRef]

- Fall, A.; Fortin, M.-J.; Kneeshaw, D.D.; Yamasaki, S.H.; Messier, C.; Bouthillier, L.; Smith, C. Consequences of various landscape scale ecosysteme management strategies and fire cycles on age-class structure and harvest in boreal forest. Can. J. For. Res. 2004, 34, 310–322. [Google Scholar] [CrossRef]

- Bouchard, M.; Pothier, D. Long-term influence of fire and harvesting on boreal forest age structure and forest composition in eastern Québec. For. Ecol. Manag. 2011, 261, 811–820. [Google Scholar] [CrossRef]

- Gauthier, S.; Raulier, F.; Ouzennou, H.; Saucier, J.P. Strategic analysis of forest vulnerability to risk related to fire: An example from the coniferous boreal forest of Quebec. Can. J. For. Res. 2015, 45, 553–565. [Google Scholar] [CrossRef]

- Raulier, F.; Dhital, N.; Racine, P.; Tittler, R.; Fall, A. Increasing resilience of timber supply: How a variable buffer stock of timber can efficiently reduce exposure to shortfalls caused by wildfires. For. Policy Econ. 2014, 46, 47–55. [Google Scholar] [CrossRef]

- Schruben, L.W. Designing Correlation Induction Strategies for Simulation. Current Issues in Computer Simulation. J. Am. Stat. Assoc. 1979, 73, 504–525. [Google Scholar] [CrossRef]

- Law, A.M.; Kelton, W.D. Simulation Modelling and Analysis; McGraw-Hill, Inc.: Boston, MA, USA, 1982. [Google Scholar]

- R Foundation for Statistical Computing. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2014. [Google Scholar]

- Leduc, A.; Bernier, P.Y.; Mansuy, N.; Raulier, F.; Gauthier, S.; Bergeron, Y. Using salvage logging and tolerance to risk to reduce the impact of forest fires on timber supply calculations. Can. J. For. Res. 2015, 45, 480–486. [Google Scholar] [CrossRef]

- Moore, M.A.; Boardman, A.E.; Vining, A.R.; Weimer, D.L.; Greenberg, D.H. “Just give me a number!” Practical values for the social discount rate. J. Policy Anal. Manag. 2004, 23, 789–812. [Google Scholar] [CrossRef]

- Peter, B.; Nelson, J. Estimating harvest schedules and profitability under the risk of fire disturbance. Can. J. For. Res. 2005, 35, 1378–1388. [Google Scholar] [CrossRef]

- Gassmann, H.I. Optimal harvest of a forest in the presence of uncertainty. Can. J. For. Res. 1989, 19, 1267–274. [Google Scholar] [CrossRef]

- Tomlin, B. On the value of mitigation and contingency strategies for managing supply chain disruption risks. Manag. Sci. 2006, 52, 639–657. [Google Scholar] [CrossRef]

- Manley, B.; Watt, R. Forestry Insurance, Risk Pooling and Risk Minimization Options; Ministry of Agriculture and Forestry: Wellington, New Zealand, 2009. Available online: http://maxa.maf.govt.nz/climatechange/reports/forestry-insurance-risk-pooling-and-minimisation.pdf (accessed on 11 May 2016).

- Brumelle, S.L.; Stanbury, W.T.; Thompson, W.A.; Vertinsky, I.B.; Wehrund, D.A. A framework for the analysis of risks in forest management and silvicultural investments. For. Ecol. Manag. 1990, 35, 279–299. [Google Scholar] [CrossRef]

- Savage, D.W.; Martell, D.L.; Wotton, B.M. Evaluation of two risk mitigation strategies for dealing with fire-related uncertainty in timber supply modelling. Can. J. For. Res. 2010, 40, 1136–1154. [Google Scholar] [CrossRef]

- Gauthier, S.; Bernier, P.Y.; Boulanger, Y.; Guo, J.; Beaudoin, A.; Boucher, D. Vulnerability of timber supply to projected changes in fire regime in Canada’s managed forests. Can. J. For. Res. 2015, 45, 1439–1447. [Google Scholar] [CrossRef]

- Bettinger, P.; Boston, K.; Siry, J.P.; Grebner, D.L. Forest Management and Planning; Academic Press: Burlington, MA, USA, 2009; p. 331. [Google Scholar]

- Sturtevant, B.R.; Miranda, B.R.; Yang, J.; He, H.S.; Gustafson, E.J. Studying fire mitigation strategies in multi-ownership landscapes: Balancing the management of fire-dependent ecosystems and fire risk. Ecosystems 2009, 12, 445–461. [Google Scholar] [CrossRef]

- James, P.M.A.; Fortin, M.J.; Fall, A.; Kneeshaw, D.; Messier, C. The Effects of Spatial Legacies following Shifting Management Practices and Fire on Boreal Forest Age Structure. Ecosystems 2007, 10, 1261–1277. [Google Scholar] [CrossRef]

| Fire Cycle | Threshold PTH (Mm3 Period−1) | β |

|---|---|---|

| 100 | 2.77 (0.18) | 0.04 (0.26) a |

| 200 | 3.23 (0.15) | −0.01 (0.39) a |

| 400 | 3.34 (0.18) | 0.60 (0.25) |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodriguez-Baca, G.; Raulier, F.; Leduc, A. Rating a Wildfire Mitigation Strategy with an Insurance Premium: A Boreal Forest Case Study. Forests 2016, 7, 107. https://doi.org/10.3390/f7050107

Rodriguez-Baca G, Raulier F, Leduc A. Rating a Wildfire Mitigation Strategy with an Insurance Premium: A Boreal Forest Case Study. Forests. 2016; 7(5):107. https://doi.org/10.3390/f7050107

Chicago/Turabian StyleRodriguez-Baca, Georgina, Frédéric Raulier, and Alain Leduc. 2016. "Rating a Wildfire Mitigation Strategy with an Insurance Premium: A Boreal Forest Case Study" Forests 7, no. 5: 107. https://doi.org/10.3390/f7050107

APA StyleRodriguez-Baca, G., Raulier, F., & Leduc, A. (2016). Rating a Wildfire Mitigation Strategy with an Insurance Premium: A Boreal Forest Case Study. Forests, 7(5), 107. https://doi.org/10.3390/f7050107