Economic Impact of Net Carbon Payments and Bioenergy Production in Fertilized and Non-Fertilized Loblolly Pine Plantations

Abstract

:1. Introduction

2. Methodology

2.1. Data Input and Assumptions

2.2. Growth and Yield Model

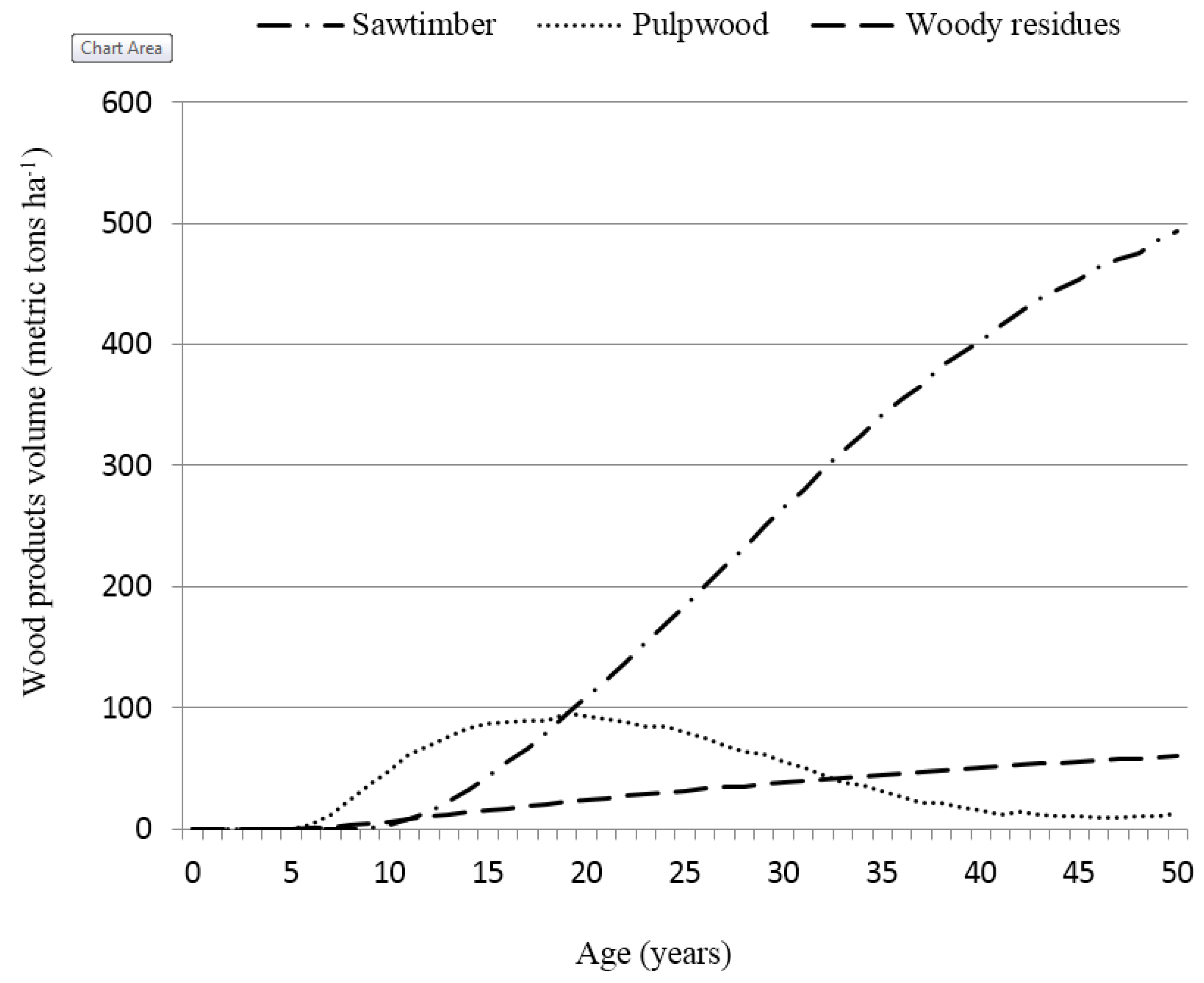

2.3. Amount of Wood for Bioenergy

2.4. Amount of Carbon Sequestered and Emissions Saved from Bioenergy

2.5. Amount of Carbon Emitted from Management and Harvesting

2.6. Amount of Carbon Emitted from Decay of Wood Products

2.7. Economic Analysis

2.8. Sensitivity Analysis

3. Results and Discussion

| Bioenergy Price | CO2e Price | LEV ($ha−1) | |||||

|---|---|---|---|---|---|---|---|

| High Products Price * | Average Products Price ** | Low Products Price *** | |||||

| ($Mg−1) | ($Mg−1) | Thinning only | Thinning and fertilization | Thinning only | Thinning and fertilization | Thinning only | Thinning and fertilization |

| 0 | 0 | 806.4 | 820.9 | 501.4 | 404.9 | 195.6 | −10.5 |

| 2 | 1034.8 | 1168.0 | 732.7 | 752.1 | 429.8 | 341.8 | |

| 5 | 1405.5 | 1688.7 | 1103.3 | 1278.5 | 800.5 | 874.6 | |

| 15 | 2689.3 | 3455.5 | 2407.3 | 3059.8 | 2124.9 | 2687.5 | |

| 25 | 4067.9 | 5262.8 | 3811.6 | 4891.9 | 3555.9 | 4520.2 | |

| 5 | 0 | 848.7 | 888.9 | 543.7 | 471.3 | 237.9 | 54.4 |

| 2 | 1075.7 | 1234.4 | 773.6 | 818.4 | 470.7 | 406.1 | |

| 5 | 1446.4 | 1755.0 | 1144.2 | 1342.8 | 841.4 | 936.9 | |

| 15 | 2726.0 | 3517.8 | 2444.1 | 3119.9 | 2161.4 | 2744.9 | |

| 25 | 4102.7 | 5319.5 | 3843.9 | 4948.6 | 3588.3 | 4576.9 | |

| Bioenergy Price | CO2e Price | Optimal Rotation Age (Year) | |||||

|---|---|---|---|---|---|---|---|

| High Products Price * | Average Products Price ** | Low Products Price *** | |||||

| ($Mg−1) | ($Mg−1) | Thinning only | Thinning and fertilization | Thinning only | Thinning and fertilization | Thinning only | Thinning and fertilization |

| 0 | 0 | 28 | 24 | 28 | 25 | 28 | 26 |

| 2 | 31 | 25 | 31 | 25 | 31 | 26 | |

| 5 | 31 | 25 | 31 | 26 | 31 | 27 | |

| 15 | 36 | 27 | 36 | 28 | 37 | 30 | |

| 25 | 38 | 30 | 41 | 30 | 41 | 30 | |

| 5 | 0 | 28 | 24 | 28 | 25 | 28 | 25 |

| 2 | 31 | 25 | 31 | 25 | 31 | 26 | |

| 5 | 31 | 25 | 31 | 26 | 31 | 27 | |

| 15 | 36 | 27 | 36 | 28 | 36 | 30 | |

| 25 | 38 | 30 | 41 | 30 | 41 | 30 | |

3.1. Land Expectation Value by Products Prices and Management Regimes

3.2. Optimal Rotation Age by Products Prices and Management Regimes

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Miner, R.A.; Abt, R.C.; Bowyer, J.L.; Buford, M.A.; Malmsheimer, R.W.; O’Laughlin, J.; Oneil, E.E.; Sedjo, R.A.; Skog, K.E. Forest carbon accounting considerations in US bioenergy policy. J. For. 2014, 112, 591–606. [Google Scholar]

- Ter-Mikaelian, M.T.; Colombo, S.J.; Chen, J. The burning question: Does forest bioenergy reduce carbon emissions? A review of common misconceptions about forest carbon accounting. J. For. 2015, 113, 57–68. [Google Scholar] [CrossRef]

- Timmons, D.S.; Buchholz, T.; Veeneman, C.H. Forest biomass energy: Assessing atmospheric carbon impacts by discounting future carbon flows. GCB Bioenergy 2015. [Google Scholar] [CrossRef]

- Hall, D.O.; Scrase, J.I. Will biomass be the environmentally friendly fuel of the future? Biomass Bioenergy 1998, 15, 357–367. [Google Scholar] [CrossRef]

- Schubert, R. Future Bioenergy and Sustainable Land Use; Earthscan: Quicksilver Drive, Sterling, VA, USA, 2010. [Google Scholar]

- Nepal, P.; Grala, R.K.; Grebner, D.L. Financial Feasibility of Sequestering Carbon for Loblolly Pine Stands in Interior Flatwoods Region in Mississippi. In Proceedings of the Southern Forest Economics Workers, Savannah, GA, USA, 9–11 March 2008; pp. 52–62.

- Richards, K.R. A brief overview of carbon sequestration economics and policy. Environ. Manag. 2004, 33, 545–558. [Google Scholar] [CrossRef] [PubMed]

- Sedjo, R.A. Forest Carbon Sequestration: Some Issues for Forest Investments; Resources for the Future: Washington, DC, USA, 2001. [Google Scholar]

- Sedjo, R.A.; Sohngen, B.; Jagger, P. Carbon sinks in the post-Kyoto world. Clim. Chang. Econ. Policy Wash. DC. Resour. Futur. 2001, 134–142. [Google Scholar]

- Shrum, T. Greenhouse Gas Emissions: Policy and Economics: A Report Prepared for the Kansas Energy Council Goals Committee; Kansas Energy Council: Topeka, KS, USA, 2007. [Google Scholar]

- Gower, S.T. Patterns and mechanisms of the forest carbon cycle 1. Annu. Rev. Environ. Resour. 2003, 28, 169–204. [Google Scholar] [CrossRef]

- White, M.K.; Gower, S.T.; Ahl, D.E. Life cycle inventories of roundwood production in northern Wisconsin: Inputs into an industrial forest carbon budget. For. Ecol. Manag. 2005, 219, 13–28. [Google Scholar] [CrossRef]

- Skog, K.E.; Nicholson, G.A.; Joyce, L.A.; Birdsey, R. Carbon Sequestration in Wood and Paper Products; USDA, Forest Service, Rocky Mountain Research Station: Fort Collins, CO, USA, 2000. [Google Scholar]

- Markewitz, D. Fossil fuel carbon emissions from silviculture: Impacts on net carbon sequestration in forests. For. Ecol. Manag. 2006, 236, 153–161. [Google Scholar] [CrossRef]

- Johnson, L.R.; Lippke, B.; Marshall, J.D.; Comnick, J. Life-cycle impacts of forest resource activities in the Pacific northwest and southeast United States. Wood Fiber Sci. 2007, 37, 30–46. [Google Scholar]

- Karjalainen, T.; Zimmer, B.; Berg, S.; Welling, J.; Schwaiger, H.; Finer, L.; Cortijo, P. Energy, Carbon and Other Material Flows in the Life Cycle Assessment of Forestry and Forest Products; European Forest Institute: Torikatu, Finland, 2001. [Google Scholar]

- Catron, J.F.; Stainback, G.A.; Lhotka, J.M.; Stringer, J.; Hu, L. Financial and management implications of producing bioenergy in Upland Oak Stands in Kentucky. North. J. Appl. For. 2013, 30, 164–169. [Google Scholar] [CrossRef]

- Susaeta, A.; Lal, P.; Alavalapati, J.; Mercer, E.; Carter, D. Economics of intercropping loblolly pine and switchgrass for bioenergy markets in the southeastern United States. Agrofor. Syst. 2012, 86, 287–298. [Google Scholar] [CrossRef]

- Nesbit, T.S.; Alavalapati, J.R.R.; Dwivedi, P.; Marinescu, M.V. Economics of ethanol production using feedstock from slash pine (Pinus Elliottii) plantations in the southern United States. South. J. Appl. For. 2011, 35, 61–66. [Google Scholar]

- Susaeta, A.; Alavalapati, J.R.R.; Carter, D.R. Modeling impacts of bioenergy markets on nonindustrial private forest management in the southeastern United States. Nat. Resour. Model. 2009, 22, 345–369. [Google Scholar] [CrossRef]

- Stainback, G.A.; Alavalapati, J.R.R. Economic analysis of slash pine forest carbon sequestration in the southern US. J. For. Econ. 2002, 8, 105–117. [Google Scholar]

- Van Kooten, G.C.; Binkley, C.S.; Delcourt, G. Effect of carbon taxes and subsidies on optimal forest rotation age and supply of carbon services. Am. J. Agric. Econ. 1995, 77, 365–374. [Google Scholar] [CrossRef]

- Dwivedi, P.; Bailis, R.; Stainback, A.; Carter, D.R. Impact of payments for carbon sequestered in wood products and avoided carbon emissions on the profitability of NIPF landowners in the US South. Ecol. Econ. 2012, 78, 63–69. [Google Scholar] [CrossRef]

- Dwivedi, P.; Alavalapati, J.R.R.; Susaeta, A.; Stainback, A. Impact of carbon value on the profitability of slash pine plantations in the southern United States: An integrated life cycle and faustmann analysis. Can. J. For. Res. 2009, 39, 990–1000. [Google Scholar] [CrossRef]

- Hartman, R. The harvesting decision when a standing forest has value. Econ. Inq. 1976, 14, 52–58. [Google Scholar] [CrossRef]

- Nix, S. Ten Most Common Trees in the United States. Available online: http://forestry.about.com/b/2012/07/21/ten-most-common-trees-in-the-united-states.htm (accessed on 24 January 2013).

- Baker, J.B.; Langdon, O.G. Pinus Taeda. In Silvics of North America; Burns, R.M., Honkala, B.H., Eds.; U.S. Department of Agriculture, Forest Service: Washington, DC, USA, 1990; pp. 497–512. [Google Scholar]

- Eisenbies, M.H.; Vance, E.D.; Aust, W.M.; Seiler, J.R. Intensive utilization of harvest residues in southern pine plantations: Quantities available and implications for nutrient budgets and sustainable site productivity. Bioenergy Res. 2009, 2, 90–98. [Google Scholar] [CrossRef]

- Amateis, R.L.; Burkhart, H.E.; Allen, H.L.; Montes, C. Fastlob: A Stand-Level Growth and Yield Model for Fertilized and Thinned Loblolly Pine Plantations; Computer Software: Blacksburg, VA, USA, 2001. [Google Scholar]

- Amateis, R.L.; Burkhart, H.E.; Liu, J. Modeling survival in juvenile and mature loblolly pine plantations. For. Ecol. Manag. 1997, 90, 51–58. [Google Scholar] [CrossRef]

- Pienaar, L.V.; Shiver, B.D. Survival functions for site-prepared slash pine plantations in the flatwoods of Georgia and northern Florida. South. J. Appl. For. 1981, 5, 59–62. [Google Scholar]

- Curtis, R.O.; Marshall, D.D. Technical note: Why quadratic mean diameter? West. J. Appl. For. 2000, 15, 137–139. [Google Scholar]

- Alabama Forestry Commission. Carbon Sequestration. Available online: http://www.forestry.state.al.us/CarbonSequestration.aspx?bv=5&s=0 (accessed on 11 June 2012).

- Birdsey, R.A. Carbon storage for major forest types and regions in the conterminous United States. In Forests and Global Change; Sampson, R.N., Hair, D., Eds.; American Forests: Washington, DC, USA, 1996; Volume 2, pp. 1–25. [Google Scholar]

- Lemoine, D.M.; Plevin, R.J.; Cohn, A.S.; Jones, A.D.; Brandt, A.R.; Vergara, S.E.; Kammen, D.M. The climate impacts of bioenergy systems depend on market and regulatory policy contexts. Environ. Sci. Technol. 2010, 44, 7347–7350. [Google Scholar] [CrossRef] [PubMed]

- Bridgwater, A.V.; Toft, A.J.; Brammer, J.G. A Techno-economic comparison of power production by biomass fast pyrolysis with gasification and combustion. Renew. Sustain. Energy Rev. 2002, 6, 181–246. [Google Scholar] [CrossRef]

- Energy Information Administration. How much Electricity Is Lost in Transmission and Distribution in the United States? United States Energy Information Administration: Washington, DC, USA, 2012. Available online: http://www.eia.gov/tools/faqs/faq.cfm?id=105&t=3 (accessed on 13 January 2013).

- Fox, T.R.; Allen, H.L.; Albaugh, T.J.; Rubilar, R.; Carlson, C.A. Tree nutrition and forest fertilization of pine plantations in the southern United States. South. J. Appl. For. 2007, 31, 5–11. [Google Scholar]

- Timber Mart-South. In Market News Quarterly: 4th Quarter 2014; Center for Forest Business, Warnell School of Forestry and Natural Resources, Frank W. Norris Foundation: Athens, GA, USA, 2014.

- Potomac Economics. In Market Monitor Report for Auction 19; Regional Greenhouse Gas Initiative: New York, NY, USA, 2013.

- Point Carbon. CCAs Rise 6 Percent on Strong Auction Results; A Point Carbon News; Carbon Market North America. 2013. Available online: http://www.pointcarbon.com/news/1.2202575 (accessed on 28 March 2013).

- Shouse, S.; Mountain Association for Community Economic Development, Berea, KY, USA. Personal communication, 12 February 2013.

- Shrestha, P.; Stainback, G.A.; Dwivedi, P.; Lhotka, J.M. Economic and life-cycle analysis of forest carbon sequestration and wood-based bioenergy offsets in the central hardwood forest region of United States. J. Sustain. For. 2015, 34, 214–232. [Google Scholar] [CrossRef]

- Schaberg, R.H.; Aruna, P.B.; Cubbage, F.W.; Hess, G.R.; Abt, R.C.; Richter, D.D.; Warren, S.T.; Gregory, J.D.; Snider, A.G.; Sherling, S. Economic and ecological impacts of wood chip production in north Carolina: An integrated assessment and subsequent applications. For. Policy Econ. 2005, 7, 157–174. [Google Scholar] [CrossRef]

- Snider, A.G.; Cubbage, F.W. Economic analyses of wood chip mill expansion in north Carolina: Implications for Nonindustrial Private Forest (NIPF) management. South. J. Appl. For. 2006, 30, 102–108. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shrestha, P.; Stainback, G.A.; Dwivedi, P. Economic Impact of Net Carbon Payments and Bioenergy Production in Fertilized and Non-Fertilized Loblolly Pine Plantations. Forests 2015, 6, 3045-3059. https://doi.org/10.3390/f6093045

Shrestha P, Stainback GA, Dwivedi P. Economic Impact of Net Carbon Payments and Bioenergy Production in Fertilized and Non-Fertilized Loblolly Pine Plantations. Forests. 2015; 6(9):3045-3059. https://doi.org/10.3390/f6093045

Chicago/Turabian StyleShrestha, Prativa, George Andrew Stainback, and Puneet Dwivedi. 2015. "Economic Impact of Net Carbon Payments and Bioenergy Production in Fertilized and Non-Fertilized Loblolly Pine Plantations" Forests 6, no. 9: 3045-3059. https://doi.org/10.3390/f6093045