Ambiguity in Timber Trade Regarding Efforts to Combat Illegal Logging: Potential Impacts on Trade between South-East Asia and Europe

Abstract

:1. Introduction

1.1. Background

1.2. Reasoning and Objectives

2. Ambiguity: Theoretical Setting and Relevance for International Trade

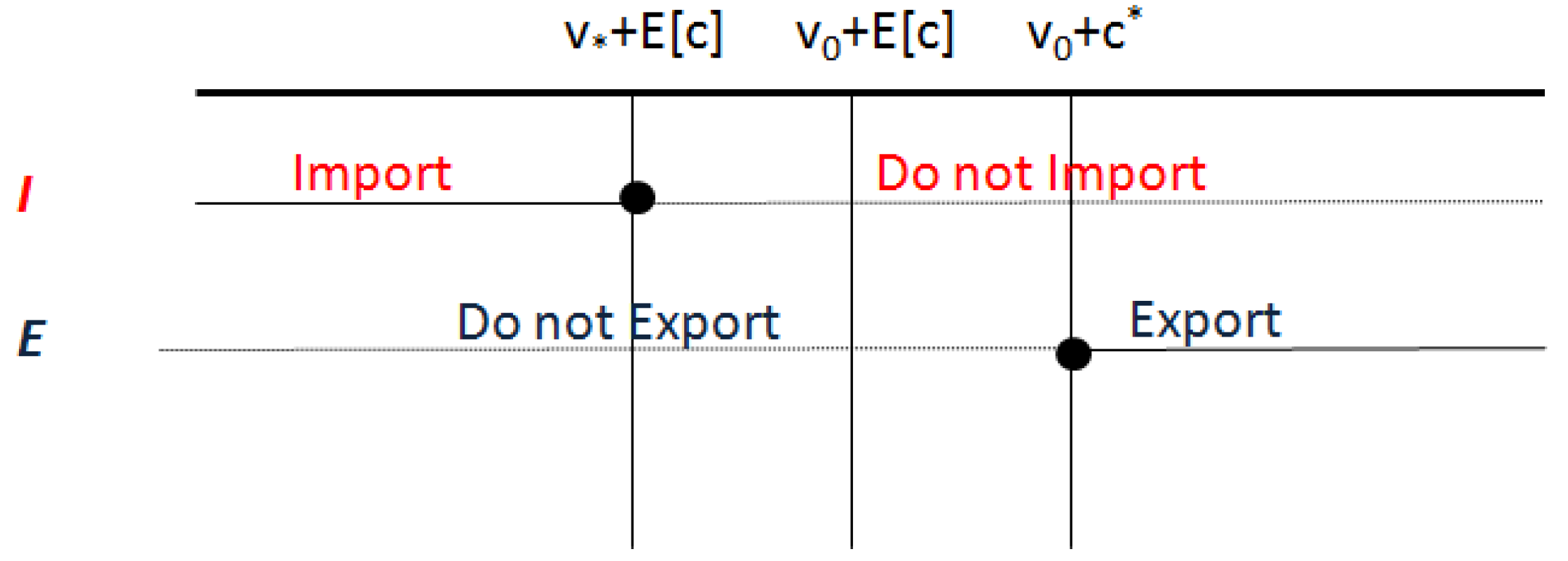

2.1. No-Ambiguity

2.2. Ambiguity

3. Materials and Methods

3.1. Literature Search

3.2. Trade Data Analysis

3.2.1. Econometric Analysis

3.3. Questionnaires

4. Results and Discussion

4.1. Ambiguity in the International Timber-Trade

4.1.1. Substitution: Comparing Oak and Tropical Lumber Imports

| GDP | PriceTropical | PriceOak |

|---|---|---|

| 0.768 | −1.798 | 1.233 |

4.1.2. Trade Diversion

5. Conclusions

- (i)

- Substitution: as a result of the general uncertainty concerning FLEGT’s interpretation, UK importers are opting for temperate hardwoods to the detriment of tropical hardwoods in order to avoid risks. There is indeed evidence that oak lumber is a possible substitute for tropical hardwood lumber.

- (ii)

- Trade diversion: since EU’s legality requirements are not fully understood and they are associated with extra costs necessary to provide certification and/or required documentation, Indonesian exporters are choosing to export timber to other markets characterized by less stringent regulatory frameworks (e.g., China).

Acknowledgments

Conflicts of Interest

References and Notes

- Eba’a Atyi, R.; Assembe-Mvondo, S.; Lescuyer, G.; Cerruti, P. Impacts of international timber procurement policies on Central Africa’s forestry sector. The case of Cameroon. For. Policy Econ. 2013, 32, 40–48. [Google Scholar] [CrossRef]

- Li, R.; Buongiorno, J.; Turner, J.A.; Zhu, S.; Prestemon, J. Long-term effects of eliminating illegal logging on the world forest industries, trade, and inventory. For. Policy Econ. 2008, 10, 480–490. [Google Scholar] [CrossRef]

- Moiseyev, A.; Solberg, B.; Michie, B.; Kallio, I.; Maarit, A. Modeling the impacts of policy measures to prevent import of illegal wood and wood products. For. Policy Econ. 2010, 12, 24–30. [Google Scholar] [CrossRef]

- Luttrell, C.; Obidzinski, K.; Brockhaus, M.; Muharrom, E.; Petkova, E.; Wardell, A.; Halperin, J. Lessons for REDD + from Measures to Control Illegal Logging in Indonesia; Working paper 74; United Nations Office on Drugs and Crime, Center for International Forestry Research: Jakarta and Bogor, Indonesia, 2011; p. 76. [Google Scholar]

- Sann, K.; Thornber, K. Global Project: Impact Assessment of Forest Products Trade in the Promotion of Sustainable Forest Management. Impact of Market-Based Instruments and Initiatives on the Trade in Forest Products and Sustainable Forest Management; (GCP/INT/775/JPN). LTS International Ltd.: Edinburgh, UK, 2003. Available online: http://foris.fao.org/static/data/ trade/pdf/lts.pdf (Accessed on 21 April 2013).

- Support Study for Development of the Non-Legislative Acts Provided for the Regulation of the European Parliament and of the Council Laying down the Obligations of Operators Who Place Timber and Timber Products on the Market; European Forest Institute: Joesuu, Finland, 2011. Available online: http://www.illegal logging.info/uploads/eutrfinalreport.pdf (Accessed on 5 February 2013).

- Forest Products Annual Market Review 2010–2011; Geneva Timber and Forest Study Paper #20123064737; United Nations Economic Commission for Europe: Geneva, Switzerland, 2011.

- PEFC. Facts & Figures. Available online: http://www.pefc.org/about-pefc/who-we-are/facts-a-figures (Accessed on 20 February 2013).

- FSC. Facts & Figures. Available online: https://ic.fsc.org/facts-figures.19.htm (Accessed on 2 September 2013).

- Cashore, B.; Stone, M.V. Can legality verification rescue global forest governance? Analyzing the potential of public and private policy intersection to ameliorate forest challenges in Southeast Asia. Forest Policy Econ. 2012, 18, 13–22. [Google Scholar] [CrossRef]

- Communication from the Commission to the Council and the European Parliament–Forest Law Enforcement Governance and Trade (FLEGT)–Proposal for an EU Action Plan; European Commission: Brussels, Belgium, 2003.

- Van Heeswijk, L.; Turnhout, E. The discursive structure of FLEGT (Forest Law Enforcement, Governance and Trade): The negotiation and interpretation of legality in the EU and Indonesia. For. Policy Econ. 2012, 32, 6–13. [Google Scholar] [CrossRef]

- Carden, C.; Wijers, R.; Zambon, P. FLEGT, VPA, EUTR and Their Possible Impact on the Bolivian Timber Sector; CBI Ministry of Foreign Affairs of the Netherlands: Bolivia, 2012. Available online: http://www.cbi.eu/system/files/marketintel/FINAL_REPORT_CBI_BOL_Eng. pdf (Accessed on 6 February 2013).

- Tropical Timber Market Report. International Tropical Timber Organization, 16th–31st May 2013; Volume 17. No. 10. Available online: http://www.itto.int/mis_download/ (Accessed on 3 June 2013).

- Annual Review and Assessment of the World Timber Situation 2011; International Tropical Timber Organization, Division of Economic Information and Market Intelligence: Yokohama, Japan, 2011.

- Tropical Timber Market Report. International Tropical Timber Organization, 16th–31st January 2013; Volume 17. No. 2. Available online: http://www.itto.int/mis_download/ (Accessed on 1 February 2013).

- We assume that both agents would prefer to trade with each other rather than with the alternative partners.

- Without loss of generality, we assume that E[c] is simply the mean between c* and c*.

- Knight, F.H. Risk, Uncertainty, and Profit; Hart, Schaffner & Marx: Boston, MA, USA, 1921; p. 315. [Google Scholar]

- Camerer, C.; Weber, M. Recent developments in modeling preferences: Uncertainty and Ambiguity. J. Risk Uncertainty. 1992, 5, 235–370. [Google Scholar]

- Ellsberg, D. Risk, ambiguity, and the savage axioms. Q. J. Econ. 1961, 75, 643–669. [Google Scholar] [CrossRef]

- Etner, J.; Jeleva, M.; Tallon, J.M. Decision theory under uncertainty. Doc. de Travail du Centre d’Economie de la Sorbonne 2009, 64, 2–48. [Google Scholar]

- Schmeidler, D. Subjective probability and expected utility without additivity. Econometrica 1989, 57, 571–587. [Google Scholar] [CrossRef]

- Dow, J.; Werlang, S.R. Uncertainty aversion, risk aversion, and the optimal choice of Portfolio. Econometrica 1992, 60, 197–204. [Google Scholar] [CrossRef]

- UN COMTRADE. Trade Statistics Database. Available online: http://comtrade.un.org/db/mr/rfCommoditiesList.aspx?px=H1&cc=4407 (Accessed on 12 February 2013).

- World Bank. Available online: http://data.worldbank.org/indicator/ (Accessed on 18 February 2013).

- Buongiorno, J. Long-term forecasting of major forest products consumption in developed and developing economies. For. Sci. 1977, 23, 13–25. [Google Scholar]

- Buongiorno, J. Income and price elasticities in the world demand for paper and paperboard. For. Sci. 1978, 24, 231–246. [Google Scholar]

- Yin, K. Case Study Research; Sage: Beverly Hills, CA, USA, 1984; p. 160. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar]

- Ragin, C. The Comparative Method: Moving beyond Qualitative and Quantitative Strategies; University of California Press: Berkeley, CA, USA, 1987; p. 185. [Google Scholar]

- Glaser, B.G.; Strauss, A. The Discovery of Grounded Theory: Strategies for Qualitative Research; Aldine Publishing Co.: Chicago, IL, USA, 1967. [Google Scholar]

- Durst, P.; McKenzie, P.J.; Brown, C.L.; Appanah, S. Challenges facing certification and eco-labeling of forest products in developing countries. Int. For. Rev. 2006, 8, 193–200. [Google Scholar]

- Lawson, S.; MacFaul, L. Illegal Logging and Related Trade Indicators of the Global Response; Chatman House: London, UK, 2010. Available online: http://www.chathamhouse.org/sites/ default/files/public/Research/Energy,%20Environment%20and%20Development/0710pr_illegallogging.pdf (Accessed on 13 March 2013).

- Status of Tropical Forest Management 2011; International Tropical Timber Organization: Yokohama, Japan, 2011.

- Meyfroidt, P.; Rudel, T.K.; Lambin, E.F. Forest transitions, trade, and the global displacement of land use. Proc. Natl. Acad. Sci. USA 2010, 107, 20917–20922. [Google Scholar] [CrossRef]

- Hapla, F.; Mohr, E. Identification and Description of Selected Tropical Timbers, Unpublished manuscript.

- Schwarze, R.; Niles, J.O.; Olander, J. Understanding and managing leakage in forest-based greenhouse-gas-mitigations projects. Philos. Phil. Trans. R. Soc. Lond. A 2002, 360, 1685–1703. [Google Scholar] [CrossRef]

- Jonsson, R.; Mbongo, W.; Felton, A.; Boman, M. Leakage Implications for European Timber Markets from Reducing Deforestation in Developing Countries. Forests 2012, 3, 736–744. [Google Scholar] [CrossRef]

- A Disharmonious Trade. China and the Continued Destruction of Burma’s Northern Frontier Forests. Global Witness. 2009. Available online: http://www.globalwitness.org/library/disharmonious-trade-china-and-continued-destruction-burmas-northern-frontier-forests (Accessed on 20 May 2013).

- European Commission. Timber regulation. Available online: http://ec.europa.eu/environment/forests/timber_regulation.htm#products (Accessed on 2 September 2013).

Supplementary

Questions and answers from the UK

Questions and answers from Indonesia

© 2013 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Giurca, A.; Jonsson, R.; Rinaldi, F.; Priyadi, H. Ambiguity in Timber Trade Regarding Efforts to Combat Illegal Logging: Potential Impacts on Trade between South-East Asia and Europe. Forests 2013, 4, 730-750. https://doi.org/10.3390/f4040730

Giurca A, Jonsson R, Rinaldi F, Priyadi H. Ambiguity in Timber Trade Regarding Efforts to Combat Illegal Logging: Potential Impacts on Trade between South-East Asia and Europe. Forests. 2013; 4(4):730-750. https://doi.org/10.3390/f4040730

Chicago/Turabian StyleGiurca, Alexandru, Ragnar Jonsson, Francesca Rinaldi, and Hari Priyadi. 2013. "Ambiguity in Timber Trade Regarding Efforts to Combat Illegal Logging: Potential Impacts on Trade between South-East Asia and Europe" Forests 4, no. 4: 730-750. https://doi.org/10.3390/f4040730

APA StyleGiurca, A., Jonsson, R., Rinaldi, F., & Priyadi, H. (2013). Ambiguity in Timber Trade Regarding Efforts to Combat Illegal Logging: Potential Impacts on Trade between South-East Asia and Europe. Forests, 4(4), 730-750. https://doi.org/10.3390/f4040730