Mechanism of Fiscal and Taxation Policies in the Geothermal Industry in China

Abstract

:1. Introduction

2. Literature Review

2.1. Reviews of Geothermal Development

2.2. Government Support on Geothermal Industry

3. Utilization of Geothermal Resources in China

3.1. Geothermal Utilization of Geothermal Energy

3.2. Geothermal Power Generation

4. Research Methods

4.1. Characteristics of the Effects of Fiscal and Taxation on Geothermal Industry

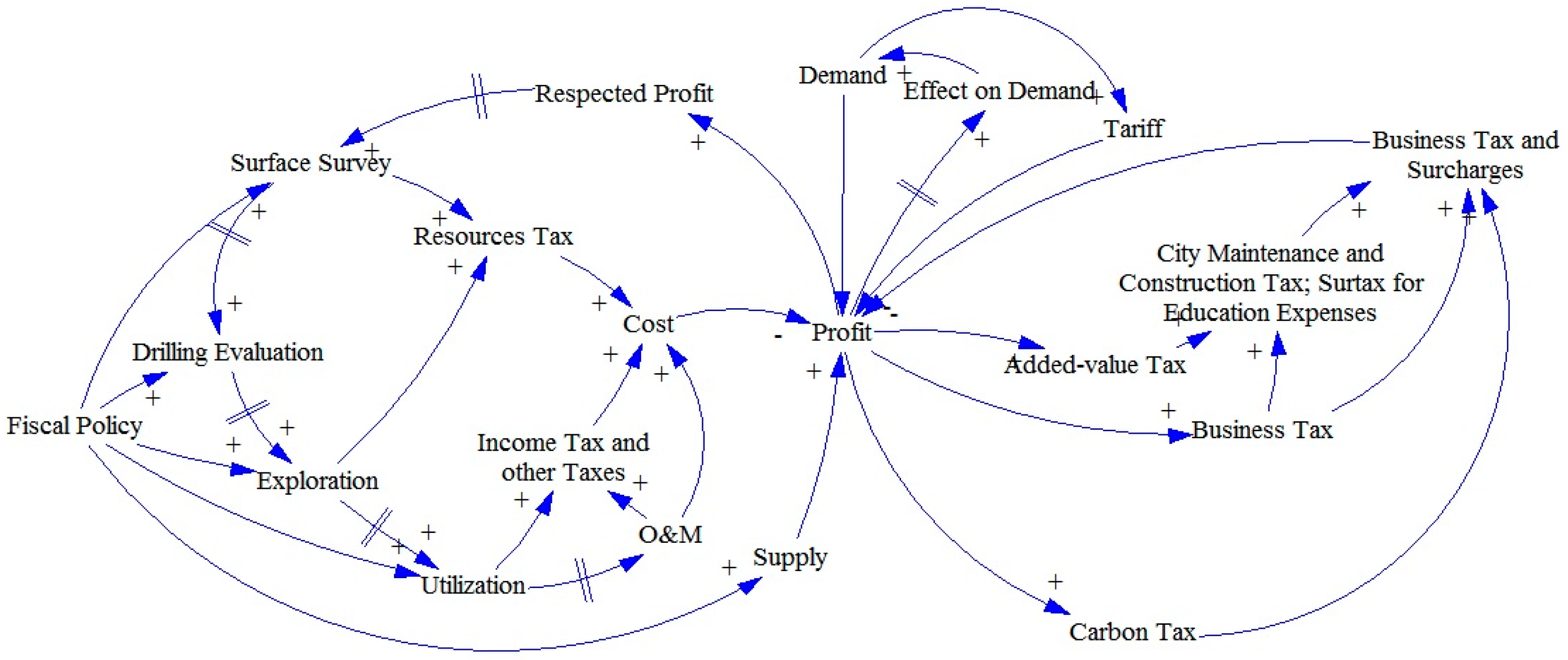

4.2. Systematic Dynamic Model

- (1)

- The mechanism of fiscal and taxation is a complex system which includes different kinds of variables such as subsidies for surface surveys, drilling evaluation, exploration, utilization, O&M and taxes including circulation tax, resources tax, income tax, etc. Different kinds of variables influence the development of the geothermal industry in various nonlinear relations and interconnect with each other.

- (2)

- The mechanism is also a long term system and has a long term cause-and-effect relationship. If the activities of surface survey slows, the utilization of geothermal energy will have a feedback effects.

- (1)

- Increase the fiscal support from surface survey of geothermal resources to start the geothermal industry;

- (2)

- Approve the subsidy for surface survey, drilling evaluation, exploration and utilization to cut the costs of the geothermal industry, and a long term subsidy to stimulate the geothermal industry;

- (3)

- Lower the circulation tax, resources tax, corporate income tax and other taxes and increase the carbon tax, to encourage technical research to promote the development of the geothermal industry;

- (4)

- Provide carbon taxes to restrict the use of the traditional resources;

- (5)

- Lower the costs of the geothermal industry to increase the profit to affect the demand for geothermal energy.

5. Results

5.1. Fiscal Policies Affecting on Geothermal Industry

5.2. Tax Policies on Geothermal Industry

5.2.1. Circulation Tax

5.2.2. Resources Tax

5.2.3. Carbon Tax

5.2.4. Corporate Income Tax and Other Taxes

5.2.5. Profits Affecting on Geothermal Industry

5.2.6. Taxation in the Geothermal Industry

6. Conclusions

- (1)

- Promoting the geothermal industry is a complex system involving exploration, evaluation, development and utilization. In China, every stage of the geothermal industry should be focused on. Even though China’s recent policies actions have broken the high-cost limitation and stimulated investment in the geothermal industry, utilization of geothermal heating and geothermal electricity are undoubtedly facing enormous development opportunities.

- (2)

- From the results of a systematic study of the fiscal and tax dynamics in the geothermal energy sector, fiscal and taxation policies interact with each other in the development of the geothermal industry. Regarding China is in the pre-commercialization stage, the various subsidies should be put into the geothermal industry such as surface survey, drilling evaluation, exploration, utilization and O&M. The government should increase the the initial investment of survey and drilling to the manufacturers which plays an important role to start the geothermal industry and strengthen support for the innovation of geothermal technologies and grant feed-in tariffs to consumers. These provide fiscal support to convert small electricity consumers to producers. Before the geothermal industry comes to the commercialization stage, China should give various and long term subsidies and levy less tax while it should levy the tax when the market of the geothermal industry becomes mature.

- (3)

- Geothermal enterprises pay various taxes in the different stages of the geothermal industry. The government should use taxation policies as a leverage to enhance the development of the geothermal industry before and after commercialization.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Kana, J.D.; Djongyang, N.; Raïdandi, D.; Nouck, P.N.; Dadjéa, A. A review of geophysical methods for geothermal exploration. Renew. Sustain. Energy Rev. 2015, 44, 87–95. [Google Scholar] [CrossRef]

- Malafeh, S.; Sharp, B. Role of royalties in sustainable geothermal energy development. Energy Policy 2015, 85, 235–242. [Google Scholar] [CrossRef]

- Han, Z.-S.; Zhen, K.-Y.; Bin, D.-Z. Working Group on Middle to Long Term Development Strategy of Energy in China. In The Mid and Long-Term (2030, 2050) Development Strategy of Energy in China; Renewable Energy; Science Press: Beijing, China, 2011. [Google Scholar]

- Jin, H.; Lior, N.; Zhang, X. Energy and its sustainable development for China: Editorial introduction and commentary for the special issue of energy—The international journal. Energy 2010, 35, 4246–4256. [Google Scholar] [CrossRef]

- Ma, L.; Allwood, J.-M.; Cullen, J.-M.; Li, Z. The use of energy in China: Tracing the flow of energy from primary source to demand drivers. Energy 2012, 40, 174–188. [Google Scholar] [CrossRef]

- Gallup, D.L. Production engineering in geothermal technology: A review. Geothermics 2009, 38, 326–334. [Google Scholar] [CrossRef]

- Kana, J.D.; Djongyang, N.; Raïdandi, D.; Nouckd, P.N.; Nouayoud, R.; Tabode, T.C.; Sandaf, O. Geophysical investigation of low enthalpy geothermal potential and ground water reservoirs in the Sudano-Sahelian region of Cameroon. J. Afr. Earth Sci. 2015, 110, 81–91. [Google Scholar] [CrossRef]

- Trumpy, E.; Donato, A.; Gianelli, G.; Gola, G.; Minissale, A.; Montanari, D.; Santilano, A.; Manzella, A. Data integration and favourability maps for exploring geothermal systems in Sicily, southern Italy. Geothermics 2015, 56, 1–16. [Google Scholar] [CrossRef]

- Van der Meer, F.; Hecker, C.; Ruitenbeek, F.V.; van der Werff, H.; de Wijkersloothb, C.; Wechslerb, C. Geologic remote sensing for geothermal exploration: A review. Int. J. Appl. Earth Observ. Geoinform. 2014, 33, 255–269. [Google Scholar] [CrossRef]

- Geirdal, C.A.C.; Gudjonsdottir, M.S.; Jensson, P. Economic comparison of a well-head geothermal power plant and a traditional one. Geothermics 2016, 53, 1–13. [Google Scholar] [CrossRef]

- Liu, F.-G.; Hu, -D.; Wu, M.; Lu, Y. Economic analysis on investment in geothermal power generation. Sin-Glob. Energy 2014, 19, 24–30. [Google Scholar]

- Ibrahim, R.; Fauzi, A.; Suryadarma. The progress of geothermal energy resources activities in Indonesia. In Proceedings of the World Geothermal Congress 2005, Antalya, Turkey, 24–29 April 2005.

- Zarrouk, S.J.; Moon, H. Efficiency of geothermal power plants: A worldwide review. Geothermics 2014, 51, 142–153. [Google Scholar] [CrossRef]

- Hähnlein, S.; Bayer, B.; Ferguson, G.; Blum, P. Sustainability and policy for the thermal use of shallow geothermal energy. Energy Policy 2013, 59, 914–925. [Google Scholar] [CrossRef]

- Martín-Gamboa, M.; Iribarren, D.; Dufour, J. On the environmental suitability of high- and low-enthalpy geothermal systems. Geothermics 2015, 53, 27–37. [Google Scholar] [CrossRef]

- Shortall, R.; Davidsdottir, B.; Axelsson, G. Geothermal energy for sustainable development: A review of sustainability impacts and assessment frameworks. Renew. Sustain. Energy Rev. 2015, 44, 391–406. [Google Scholar] [CrossRef]

- Guan, X. Adopting the experiences to promote geothermal industry. Hydrogeol. Eng. Geol. 2011, 38, 1–5. [Google Scholar]

- Daysh, S.; Chrisp, M. Environmental planning and consenting for Wairakei: 1953–2008. Geothermics 2009, 38, 192–199. [Google Scholar] [CrossRef]

- Zhou, G.-H.; Huang, R.; Xie, P.-P. Component analysis of geothermal industry. Sci. Technol. Manag. Land Resour. 2014, 20, 47–53. [Google Scholar]

- Guo, L.-H. Study on the Industry Investment Fund under the Exploitation of Geothermal Resources. Ph.D. Thesis, Gilin University, Changchun, China, 2009. [Google Scholar]

- Van Bart Campen, B.; Petursdottir, H. Geothermal sustainability regulation in Iceland and New Zealand. In Proceedings of the European Geothermal Congress 2016, Strasbourg, France, 19–24 September 2016.

- Kaneko, M.; Kaneko, M.M.; Akakura, K.; Yamamur, S.; Inoue, Y. A proposal of fiscal incentives to accelerate geothermal development in Indonesia. J. Geotherm. Res. Soc. 2010, 32, 97–108. [Google Scholar]

- Hayashi, M.; Kuge, K.; Sato, H.; Tanaka, H. Cooperation in geothermal development at Great Rift Valley in Africa. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Lund, J.W.; Bloomquist, R.D. Development of geothermal policy in the United States. In Proceedings of the Thirty-Seventh Workshop on Geothermal Reservoir Engineering, Stanford, CA, USA, 30 January–1 February 2012.

- Campen, B.V.; Rai, K. Geothermal Policy and Regulation-Cases from Chile, Kenya, New Zealand and the Philippines; Technical Report; University of Auckland Geothermal Institute; International Renewable Energy Agency (IRENA): Auckland, New Zealand, August 2015. [Google Scholar]

- Ulgado, A.F.; Butiu, E.D. Policy reforms in geothermal energy resource development and utilization in the Philippines. GRC Trans. 2006, 30, 1097–1100. [Google Scholar]

- Budd, A.R.; Gerner, E.J. Externalities are the dominant cause of faltering in Australian geothermal energy development. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Imolauer, K.; Ueltzen, M. Risk mitigation systems in Comparison. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Dumas, P.; Angelino, L. Financing geothermal energy. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Bommensatt, N.; Maestro, A.C.; Laplaige, P. French financial incentives to promote geothermal heat. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Hidefumi, N.; Sukenori, H.; Toshiyuki, T.; Tadaaki, S. On the Japan’s geothermal energy development and the role of JOGMEC. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Zhao, X.-G.; Wan, G. Current situation and prospect of China’s geothermal resources. Renew. Sustain. Energy Rev. 2014, 32, 651–661. [Google Scholar] [CrossRef]

- Miao, S. Foreign geothermal policies affecting on China. J. Chifeng Univ. 2015, 31, 87–90. [Google Scholar]

- Zeng, B.Y. Recommendations on improving fiscal and taxation policies of shale gas industry in China. Open J. Soc. Sci. 2016, 4, 48–54. [Google Scholar] [CrossRef]

- Gao, L.Z. The long-term relationships among China’s energy consumption sources and adjustments to its renewable energy policy. Energy Policy 2012, 47, 456–467. [Google Scholar]

- BP Statistical Review of World Energy 2016 Workbook 2016. Available online: http://www.bp.com/ (accessed on 20 August 2016).

- Evans, A.; Strezov, V.; Evans, T.J. Assessment of sustainability indicators for renewable energy technologies. Renew. Sustain. Energy Rev. 2009, 13, 1082–1088. [Google Scholar] [CrossRef]

- Jiang, J. China’s Energy Policy 2012; Information Office of the State Council: Beijing, China, 2012.

- Long, H.; Zhu, Q.; Tian, P.; Hu, W. Technologies and applications of geophysical exploration in deep geothermal resources in China. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Tester, J.W. The Future of Geothermal Energy: Impact of Enhanced Geothermal Systems (EGS) on the United States in the 21st Century; Massachusetts Institute of Technology: Cambridge, MA, USA, 2006. [Google Scholar]

- Zhou, Z.-Y.; Liu, S.-L.; Liu, J.-X. Study on the characteristics and development strategies of geothermal resources in China. J. Nat. Resour. 2015, 30, 1210–1221. [Google Scholar]

- Zhang, J.-H.; Wei, W. Discussion on distribution characteristics and utilization of geothermal resources in China. Nat. Resour. Econ. China 2011, 8, 23–28. [Google Scholar]

- Zheng, K.-Y. Speeding up industrialized development of geothermal resources in China—Country update report 2010–2014. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Zhu, J.-L.; Ku, K.-Y.; Lu, X.-L.; Huang, X.; Liu, K.; Wu, X. A review of geothermal energy resources, development, and applications in China: Current status and prospects. Energy 2015, 93, 466–483. [Google Scholar] [CrossRef]

- Zhou, D.-J. The overview of geothermal power generation. Electr. Power Surv. Des. 2003, 3, 1–6. [Google Scholar]

- Xu, Y.-B.; Wang, M.; Pan, J.; Li, B. Characteristics of geothermal resource-based power generation technology and development trends. Sino-Glob. Energy 2012, 17, 29–34. [Google Scholar]

- Zheng, K.-Y.; Pan, X.-P. Status and prospect of geothermal generation development in China. Sino-Glob. Energy 2009, 14, 45–48. [Google Scholar]

- Zheng, K.; Mo, Y.; Chen, L. Twenty years of geothermal heat pumps in China. In Proceedings of the World Geothermal Congress 2015, Melbourne, Australia, 19–25 April 2015.

- Zheng, K.; Dong, Y. The possible role of geothermal energy to the Chinese energy development. In Proceedings of the 8th Asian Geothermal Symposium, Hanoi City, Vietnam, 9–12 December 2008.

- Ngugi, P.K. Risks and risk mitigation in geothermal development. In Proceedings of theUtilization of Low- and Medium-Enthalpy Geothermal Resources and Financial Aspects of Utilization, Santa Tecla, El Salvador, 23–29 March 2014.

- Hance, C.N.; Gawell, K. Factors affecting cost of geothermal power development and production. GRC Trans. 2005, 29, 449–454. [Google Scholar]

- Li, K.-W.; Bian, H.-Y.; Liu, C.-W.; Zhang, D.; Yang, Y. Comparison of geothermal with solar and wind power generation systems. Renew. Sustain. Energy Rev. 2015, 42, 1464–1474. [Google Scholar] [CrossRef]

- Annual Energy Outlook 2016; U.S. Energy Information Administration: Washington, DC, USA, 2016.

- Kenny, R.; Law, C.; Pearce, J.M. Towards real energy economics: Energy policy driven by life-cycle carbon emission. Energy Policy 2010, 38, 1969–1978. [Google Scholar] [CrossRef]

- Barbier, E. Geothermal energy technology and current status: An overview. Renew. Sustain. Energy Rev. 2002, 6, 63–65. [Google Scholar] [CrossRef]

- Huttrer, G.W. The status of world geothermal power generation 1995–2000. Geothermics 2001, 30, 1–27. [Google Scholar] [CrossRef]

- Koul, S.; Falebita, O.A.; Akinbami, J.F.K.; Akarakiri, J.B. System dynamics, uncertainty and hydrocarbon resources modelling: A systematic review. Renew. Sustain. Energy Rev. 2016, 59, 199–205. [Google Scholar] [CrossRef]

- Sterman, J.D. Systems Thinking and Modeling for A Complex World; Business Dynamics; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Eker, S.; Van Daalen, C.E. Investigating the effects of uncertainties associated with the unconventional gas development in the Netherlands. In Proceedings of the 3 International Engineering Systems Symposium, CESUN2012, Delft, The Netherlands, 18–20 June 2012.

- Richardson, G. Reflections on the foundations of system dynamics. Syst. Dyn. Rev. 2011, 27, 219–243. [Google Scholar] [CrossRef]

- Freeman, R.; Yearworth, M.; Cherruault, J.V. Review of Literature on Systems Thinking and System Dynamics for Policy Making; Department for Environment, Food and Rural Affairs: Bristol, UK, 2014.

- Forrester, J.W. Information sources for modeling the national economy. J. Am. Stat. Assoc. 1980, 75, 555–566. [Google Scholar] [CrossRef]

- Forrester, J.W. System dynamics—Future opportunities. Manag. Sci. 1980, 4, 7–21. [Google Scholar]

- Elshorbagy, A.; Jutla, A.; Kells, J. Simulation of the hydro logical processes on reconstructed watersheds using system dynamics. Hydrol. Sci. J. 2007, 52, 53–61. [Google Scholar] [CrossRef]

- Zhang, B.; Yuan, Y.-G. Theoretic and Experimental Thinking of Systematic Dynamics; China Environmental Science Press: Beijing, China, 2010; Volume 8, pp. 5–30. [Google Scholar]

- Wang, T.-M. The Study on Fiscal and Taxation Policy of Natural Gas Industry in China. Ph.D. Thesis, China University of Petroleum, Beijing, China, 2013. [Google Scholar]

- Tao, Z.-P. The Myth of Systematic Dynamics; China Environmental Science Press: Beijing, China, 2010; Volume 8, pp. 5–71. [Google Scholar]

- Garcia, E.; Mohanty, A.; Lin, W.; Cherry, S. Dynamic analysis of hybrid energy systems under flexible operation and variable renewable generation—Part II: Dynamic cost analysis. Energy 2013, 52, 17–26. [Google Scholar] [CrossRef]

- Santiago, M.; Luis, J.M.; Felipe, B. A system dynamics approach for the photo-voltaic energy market in Spain. Energy Policy 2013, 60, 142–154. [Google Scholar]

- Liu, L.; Zong, H.; Zhao, E.; Cheng, C.; Wang, J. Can China realize its carbon emission reduction goal in 2020: From the perspective of thermal power development. Appl. Energy 2014, 124, 199–212. [Google Scholar] [CrossRef]

- Zhao, X.; Ma, Q.; Yang, R. Factors influencing CO2 emissions in China’s power industry: Co-integration analysis. Energy Policy 2013, 57, 89–98. [Google Scholar] [CrossRef]

- Ali, K.; Mustafa, H. Exploring the options for carbon dioxide mitigation in Turkish electric power industry: System dynamics approach. Energy Policy 2013, 60, 675–686. [Google Scholar]

- Feng, Y.; Chen, S.; Zhang, L. System dynamics modeling for urban energy consumption and CO2 emissions: A case study of Beijing, China. Ecol. Model. 2013, 252, 44–52. [Google Scholar] [CrossRef]

- Li, F.; Dong, S.; Li, Z.; Li, Y.; Li, S.; Wan, Y. The improvement of CO2 emission reduction policies based on system dynamics method in traditional industrial region with large CO2 emission. Energy Policy 2012, 51, 683–695. [Google Scholar] [CrossRef]

- Nastaran, A.; Abbas, S. A system dynamics model for analyzing energy consumption and CO2 emission in Iranian cement industry under various production and export scenarios. Energy Policy 2013, 58, 75–89. [Google Scholar]

- Guo, X.P.; Guo, X.D. Nuclear power development in China after the restart of new nuclear construction and approval: A system dynamics analysis. Renew. Sustain. Energy Rev. 2016, 57, 999–1007. [Google Scholar] [CrossRef]

- Guo, X.P.; Guo, X.D. China’s photovoltaic power development under policy incentives: A system dynamics analysis. Energy 2015, 93, 589–598. [Google Scholar] [CrossRef]

- Seyed, H.H.; Hamed, S.G. A study on the future of unconventional oil development under different oil price scenarios: A system dynamics approach. Energy Policy 2016, 91, 64–74. [Google Scholar]

- Salman, A.; Razman, M.T.; Firdaus, M.S.; Ruzairi, A.R. Application of system dynamics approach in electricity sector modelling: A review. Renew. Sustain. Energy Rev. 2016, 56, 29–37. [Google Scholar]

- Wu, X. The Reserch of Supporting and Encouraging Policies of Our Country’s Geothermal Resource’s Development and Utilization. Master’s Thesis, China University of Geosciences, Wuhan, China, 2013. [Google Scholar]

- Liu, N.-N. The fiscal support on development of shale gas industry. Tax. Res. 2014, 355, 21–24. [Google Scholar]

- Li, B.-Q. Research of Financial Policy and Taxations to Promote Renewable Energy Development. Ph.D. Thesis, Ministry of Finance, Beijing, China, 2010. [Google Scholar]

| Country | Surface Survey | Drilling Evaluation | Plant Construction | Risk | Note |

|---|---|---|---|---|---|

| Peru | Private | Private | Private | High | Owner of responsibility in development risks might shift to the government |

| Indonesia | Government | Government; Private | Private | - | - |

| Kenya | Government | Government | Government; Private | Low | At Suswa, 300 MV project will be conducted by a private company |

| Ethiopia | Government | Government | Government; Private | Low | - |

| Japan | Up to 50%–100% of necessary funds (depends on terms and conditions) | Up to 50% of equity capital | Up to 80% of loan provided by financial institutions | Low | - |

| No. | Law or Regulation | Time | Contents |

|---|---|---|---|

| 1 | Notice of the Ministry of land and resources on Further Strengthening the geothermal mineral water resources management | December 2002 | The geothermal resource is a valuable mineral resource as one of the important clean energy. Promotes the survey geothermal resources exploration; strengthen the development and utilization of geothermal resources and protection; develops geothermal projects and ground water recharge to realize the sustainable utilization of geothermal resources |

| 2 | Guidelines of Renewable energy industry development | November 2005 | Lists geothermal power generation, geothermal heat pump as the key projects and geothermal drilling equipment as the recommended device |

| 3 | Renewable energy law | January 2006 | Lists geothermal energy development and utilization into the scope of encouraged new energy development |

| 4 | National Long-term Scientific and Technological Development Plan (2006–2020) | December 2005 | Promotes development and utilization of geothermal energy as a key field |

| 5 | Technical code for ground source heat pump systems | January 2006 | Provides specification for the design, construction and acceptance of ground source heat pump system projects and ensuring safe and reliable system operation |

| 6 | Land and resources “eleven five year” plan | April 2006 | Increases the intensity of mineral resources exploration, carries out geothermal hot dry rock resources potential evaluation, and designs the prospective development zone |

| 7 | The decision of the state council on energy saving | August 2006 | Proposes to make great efforts in the development of renewable energy source, including wind, solar, biomass, geothermal and water energy |

| 8 | Interim Measures for the administration of special funds for the development of renewable energy | August 2006 | Strengthens the management of special funds for renewable energy development, focuses on supporting the development and utilization of fuel ethanol, biomass, solar energy, wind energy and geothermal energy; focus on the application of solar energy, geothermal energy in buildings |

| 9 | Notice of the ministry of construction and the ministry of finance on the implementation comments for application of renewable energy in building | August 2006 | Lists ground source heat pump application among key technological fields |

| 10 | Comprehensive working program on energy saving and emission reduction | June 2007 | States that the energy structure adjustment and the scientific research development and construction of building integrated with geothermal energy shall be actively promoted, and the resource investigation and assessment shall be enhanced |

| 11 | Chinese National Climate Change Program | June 2007 | Points out that the promotion and protection of water resources to meet the environmental requirements of the geothermal heating and ground source heat pump technology |

| 12 | National Renewable Energy Long-Term Planning | September 2007 | Puts forward to promote large-scale application of solar energy and geothermal energy in buildings |

| 13 | Ordinance on civil-building energy conservation | August 2008 | States that China encourages and supports geothermal energy application |

| 14 | Notice on the promotion of shallow geothermal energy development and utilization | December 2008 | Makes deployment for the promotion of survey assessment, development and utilization planning and monitoring of shallow geothermal resources |

| 15 | Scheme of "Twelfth Five Year" comprehensive energy-saving emission reduction work | August 2011 | Adjusts energy structure to develop wind energy, solar energy, geothermal energy and other renewable energy |

| 15 | “Twelfth Five-Year Plan” in renewable energy development | August 2012 | Promotes the reasonable development and utilization of geothermal energy, and points out to construct the key geothermal projects for electricity and direct use |

| 16 | National “Twelve Five-Year” energy plan | January 2013 | Increase proportion of geothermal energy use in buildings |

| 17 | Guidelines on promoting of geothermal energy development and utilization | January 2013 | Sets a goal for geothermal energy development and utilization in 2015 and 2020, refers to the key tasks and subsidy policies |

| Year | Power Generation Energy Development/MWe | Direct Use/MWt | |||

|---|---|---|---|---|---|

| High Temperature | Low-Medium Temperature | EGS | Low-Medium Temperature | Shallow Geothermal | |

| 2020 | 75 | 2.5 | Experiment | 4000 | 10,000 |

| 2030 | 200 | 20 | 25 | 6500 | 20,000 |

| 2050 | 500 | 100 | 200 | 10,000 | 50,000 |

| Use | 2009 | 2014 | ||

|---|---|---|---|---|

| Installed Capacity (MWt) | Annual Energy Use (TJ/Year) | Installed Capacity (MWt) | Annual Energy Use (TJ/Year) | |

| Individual Space Heating | - | - | - | - |

| District Heating | 1291 | 14798 | 2946 | 33710 |

| Air Conditioning (Cooling) | - | - | - | - |

| Greenhouse Heating | 146 | 1688 | 154 | 1797 |

| Fish Farming | 197 | 2171 | 217 | 2395 |

| Animal Farming | - | - | - | - |

| Agricultral Drying | 82 | 1037 | 95 | 1198 |

| Industrial Process Heat | 145 | 2733 | 169 | 3304 |

| Snow Melting | - | - | - | - |

| Bathing and Swimming | 1826 | 23886 | 2508 | 31,637 |

| Other Uses (Specify) | - | - | - | - |

| Subtotal | 3687 | 46,313 | 6089 | 74,041 |

| Geothermal Heat Pumps | 8898 | 75,348 | 11,781 | 100,311 |

| Total | 12,585 | 12,1661 | 17,870 | 174,352 |

| Type | U.S. Capacity-Weighted Average LCOE (2015 $/MWh) for Plants Entering Service in 2022 | Payback (Years) | Construction (Years) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Capacity Factor (%) | Levelized Capital Cost | Fixed O&M | Variable O&M (including Fuel) | Transmission Investment | Total System LCOE | ||||

| Wind | 42 | 43.3 | 12.5 | 0.0 | 2.7 | 58.5 | 0.4–1.4 | <1 | |

| Solar PV | 26 | 61.2 | 9.5 | 0.0 | 3.5 | 74.2 | 1–2.7 | 0.3–0.5 | |

| Geothermal | 91 | 27.8 | 13.1 | 0.0 | 1.4 | 42.3 | 5.7 | 3–5 | |

| Hydroelectric | 60 | 54.1 | 3.1 | 5.0 | 1.5 | 63.7 | 0.5 (large) | 10–20 | |

| 11.8 (small) | 1 | ||||||||

| Advanced Nuclear | 90 | 75 | 12.4 | 11.3 | 1.0 | 99.7 | - | - | |

| Natural gas-fired | Conventional combined cycle | 87 | 12.8 | 1.4 | 41.2 | 1.0 | 56.4 | - | - |

| Advanced combined cycle | 87 | 15.4 | 1.3 | 38.1 | 1.1 | 55.8 | - | - | |

| Conventional combustion turbine | 30 | 37.1 | 6.5 | 58.9 | 2.9 | 105.4 | - | - | |

| Advanced combustion turbine | 30 | 25.9 | 2.5 | 61.9 | 3.3 | 93.6 | - | - | |

| Stages | Surface Survey and Evaluation | Research and Development | Utilization and O&M | Beginning of Commercialization | Commercialization (Market) |

|---|---|---|---|---|---|

| Fiscal policies | Main | Main | Main | Supplement | Supplement |

| Tax policies | Free | Free | Tax preference | Supplement | Normal |

| Risk | The higher | high | Medium | low | The lower |

| Code | Explanation |

|---|---|

| If X increase (decrease), Y increase (decrease) above (below) the amount of the original data. |

| If X increase (decrease), Y decrease (increase) below (above) the amount of the original data. |

| Period | Research and Development; Surface Exploration and Drilling | Field Development Including Production Drilling and Surface Equipment | Direct Use | Electrical Use | Funding Type | |

|---|---|---|---|---|---|---|

| Private | Public | |||||

| 106 USD | 106 USD | 106 USD | 106 USD | % | % | |

| 2000–2004 | 5.4 | 80.9 | 172.8 | - | 97.9 | 2.1 |

| 2005–2009 | 8.2 | 207.8 | 1142.9 | 2.2 | 97.7 | 2.3 |

| 2010–2014 | 28.5 | 424.7 | 1485.8 | 54.8 | 91.3 | 8.7 |

| Tax | Content | Before | After | Merchandised |

|---|---|---|---|---|

| Resources Tax (RT) | Tax on profits generated from the drilling exploration of geothermal resources and it adjusts the interests of the relationship between the various economic agents of a fiscal and taxation system | Exploration fee: 100 RMB/km2·year from 1–3 years and an increase of 100 RMB/km2·year from the 4th year; the highest fee is no more than 500 RMB/km2·year; Mining royalties: 1000 RMB/km2·year; Resources ecological compensation fee: mineral sales revenue×compensation rate (2%–4%) × Ratio of Mining Recovery | Free | 5% |

| Corporate Income Tax (CIT) | Tax imposed on individuals or entities that varies with the income or profits | 25% | 15% | 17% |

| Value-Added Tax (VAT) | Tax levied on the production of geothermal energy | 17% | 6% | 13% |

| Business Tax (BT) | Tax payable against turnover by all enterprises and individuals undertaking the following business activities: providing taxable services, including communication, transport, heating or electricity power construction, finance and insurance, and service industries; transferring the provision of intangible assets; and selling immovable properties | 6% | Free | 6% |

| Tariff | Tax on imports or exports | 3% | Free | 3% |

| Urban Maintenance and Construction Tax (UMCT) and EDUCATION Surcharge (ES) | Taxes based on value add tax, business tax and consumer tax | UMCT = (VAT + BT) × 7% ES = (VAT + BT) × 3% | Free | Free |

| Carbon Tax | Tax levied on the carbon content of fuels | - | Free | 10 RMB/ton |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Y.; Lei, Y.; Li, L.; Ge, J. Mechanism of Fiscal and Taxation Policies in the Geothermal Industry in China. Energies 2016, 9, 709. https://doi.org/10.3390/en9090709

Jiang Y, Lei Y, Li L, Ge J. Mechanism of Fiscal and Taxation Policies in the Geothermal Industry in China. Energies. 2016; 9(9):709. https://doi.org/10.3390/en9090709

Chicago/Turabian StyleJiang, Yong, Yalin Lei, Li Li, and Jianping Ge. 2016. "Mechanism of Fiscal and Taxation Policies in the Geothermal Industry in China" Energies 9, no. 9: 709. https://doi.org/10.3390/en9090709