1. Introduction

With the development of distributed photovoltaic (PV) systems, PV prosumers (i.e., commercial buildings, residential houses, factories, etc.) have developed widely. Gradually, the concept of the PV cluster (PVC) has also emerged, which consists of a number of neighboring prosumers that are connected to the same microgrid or distribution grid [

1,

2]. In the PVC, the prosumers with different load profiles can share the produced PV energy and reduce the power fed to the utility grid [

3]. In order to facilitate the energy sharing, an internal price is required for billing between the PVCO and prosumers [

4,

5]. Moreover, if the prosumers have flexible load resources, the dynamic internal pricing can be utilized as a demand response (DR) tool that regulates their power consumption behaviors to enhance the local consumption of PV energy [

6,

7]. As each prosumer is an independent and autonomous entity, the multi-party energy management of the PVC is an important component for realizing the optimal operation.

Until recently, there have been numerous studies focused on the related problems. Generally, these studies can be divided into two categories. The first category of methods are those that set the internal pricing based on the marginal cost of the distributed generator. In order to optimally manage the microgrid resources on both the generation and demand side, [

7] presents a stochastic resource planning strategy to improve the operation efficiency based on an internal pricing strategy. Considering the uncertainty of marginal revenue and marginal cost in the inner power market of the microgrid, [

8] proposes a price setting strategy that can deal with the power fluctuations caused by the wind and solar energy. Based on the marginal cost of power generation, optimal dispatching for interconnected microgrids is proposed in [

9] by setting the dynamic selling price of electricity. Considering the relationship between the cost of distributed generators and feed-in tariff, [

10] formulates an optimal scheduling model for the industrial enterprise microgrid. For the aforementioned studies, although the marginal cost of each power generation unit could be helpful to set a fair and reasonable internal price, it could not be used for setting the electricity price of PV energy, due to the uncertainty power output and zero fuel consumption.

The second category of methods mainly focuses on the energy management with renewable energy sources by using dynamic pricing mechanisms. For instance, [

11] uses a real-time dynamic pricing strategy to set the internal buying and selling price of electricity, and thus, the profit of service providers can be maximized on the basis of reasonable revenue of end users. Moreover, [

12] proposes an efficient and competing mechanism to solve the demand and supply problem in a microgrid with many consumers and suppliers, which is modeled as a Potluck Problem. Internal pricing is also used in [

13] to determine the energy management scheme for a smart community combined with distributed energy resources. A non-cooperative Stackelberg Game is proposed to achieve optimal solutions for both entities. Furthermore, as also proposed for a smart community, [

14] assumes that each residential unit has an energy storage system and they can share them with the coordinator to improve the benefits of both sides, and an auction-based mechanism is designed to determine the internal prices of renewable energy sources.

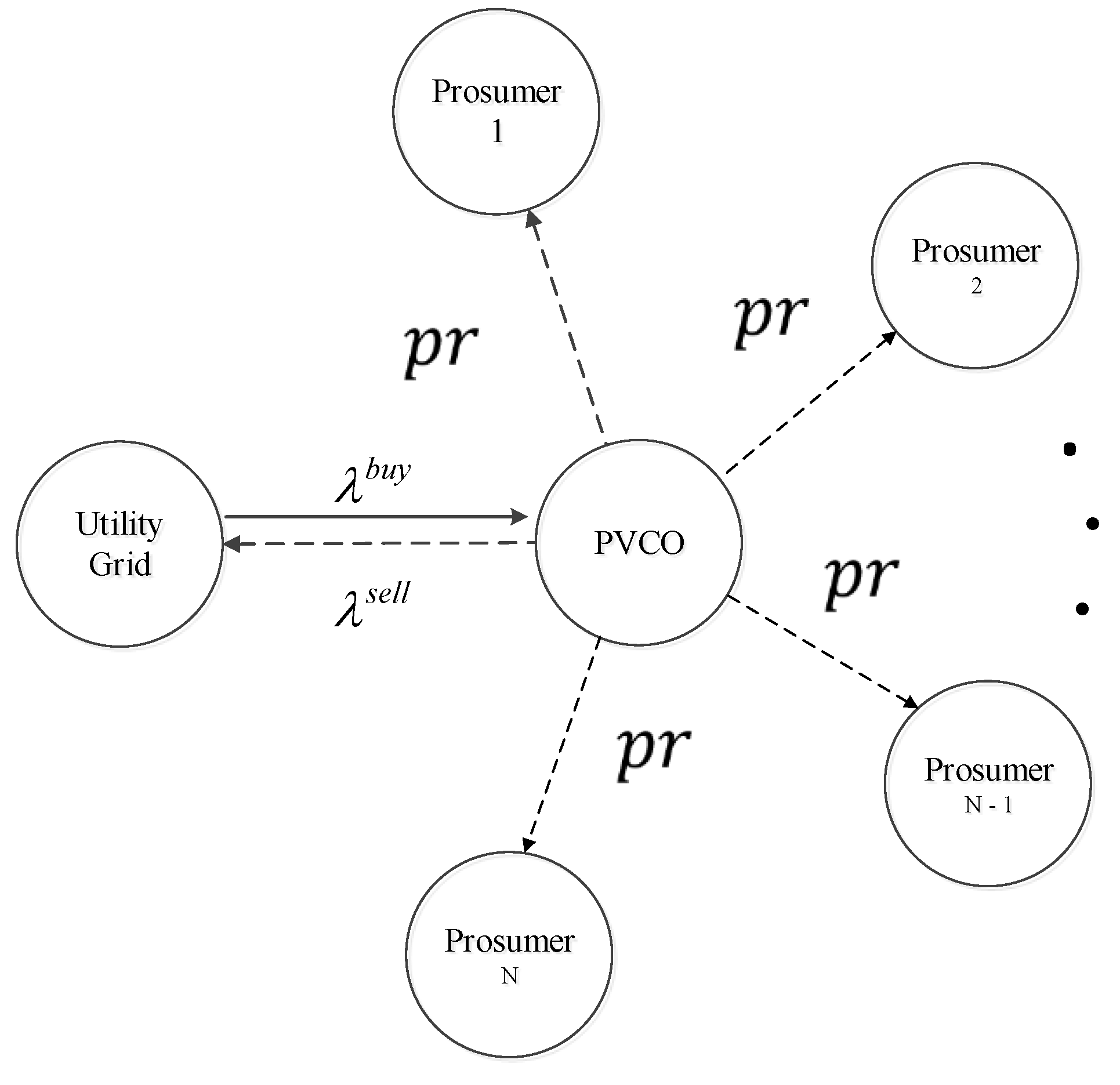

In this paper, we focus on the multi-party energy management problem of roof-leased PVCs. Generally, the roof-leased mode is a new emerging business mode for PV development, which means that the PVCO has invested on the PV systems and installed them on the roofs leased by the prosumers. By using this business mode, the PVCO can get profit from the produced electricity while the prosumers can save the power consumption cost with a lower electricity price. However, the supply and demand in the PVC cannot be balanced in most of the time. That is, the PVC should also interact with the utility grid to export the surplus PV energy or import the insufficient energy for load demand. Therefore, there are three types of entities involved in this energy management problem, including the PV prosumers, the PVCO, and the utility grid. According to the feed-in-tariff and electricity prices of many countries, the export and import prices of PV energy are constant for a certain time period. In this regard, the PVCO acts as a coordinator to optimize the operation of PVC by setting the internal prices, which under the constraints of feed-in-tariff and electricity price of utility grid. Moreover, prosumers can be regarded as an autonomous entity with a flexible load to be scheduled with the variation of internal prices. The utility grid is only regarded as the balancer in the problem. To the best of our knowledge, the multi-part energy management of the PVC is a new problem with the development of the roof-leased mode of PV prosumers, which is different from the aforementioned studies.

To this end, this paper proposes a multi-party energy management method for clusters of roof-leased PV prosumers. The main contributions are as follows: (1) according to the feed-in tariff policy of distributed PV in China, a dynamic internal pricing model for PVC under the roof-leased mode is proposed; (2) after analyzing the DR behavior of prosumers, a non-cooperative game among prosumers is formulated, and the existence and uniqueness of the Nash Equilibrium (NE) are also proved; (3) an iterative algorithm is proposed to approach the NE, which can be adopted by the prosumers in a distributed and autonomous manner.

The remainder of the paper is organized as follows:

Section 2 introduces the structure and function of PVC.

Section 3 and

Section 4 propose the economic model and DR model of PVC, respectively.

Section 5 provides the case study and the conclusion is given in

Section 6.

2. Structure and Function of the PVC

According to the feed-in-tariff scenario, all the PV output power is encouraged to be consumed locally inside the PVC. If there is a PV power surplus, the excess PV energy is sold to the utility grid by the PVCO. Otherwise, if the PV power is insufficient, electricity is purchased from the utility grid by PVCO to meet the demand of prosumers.

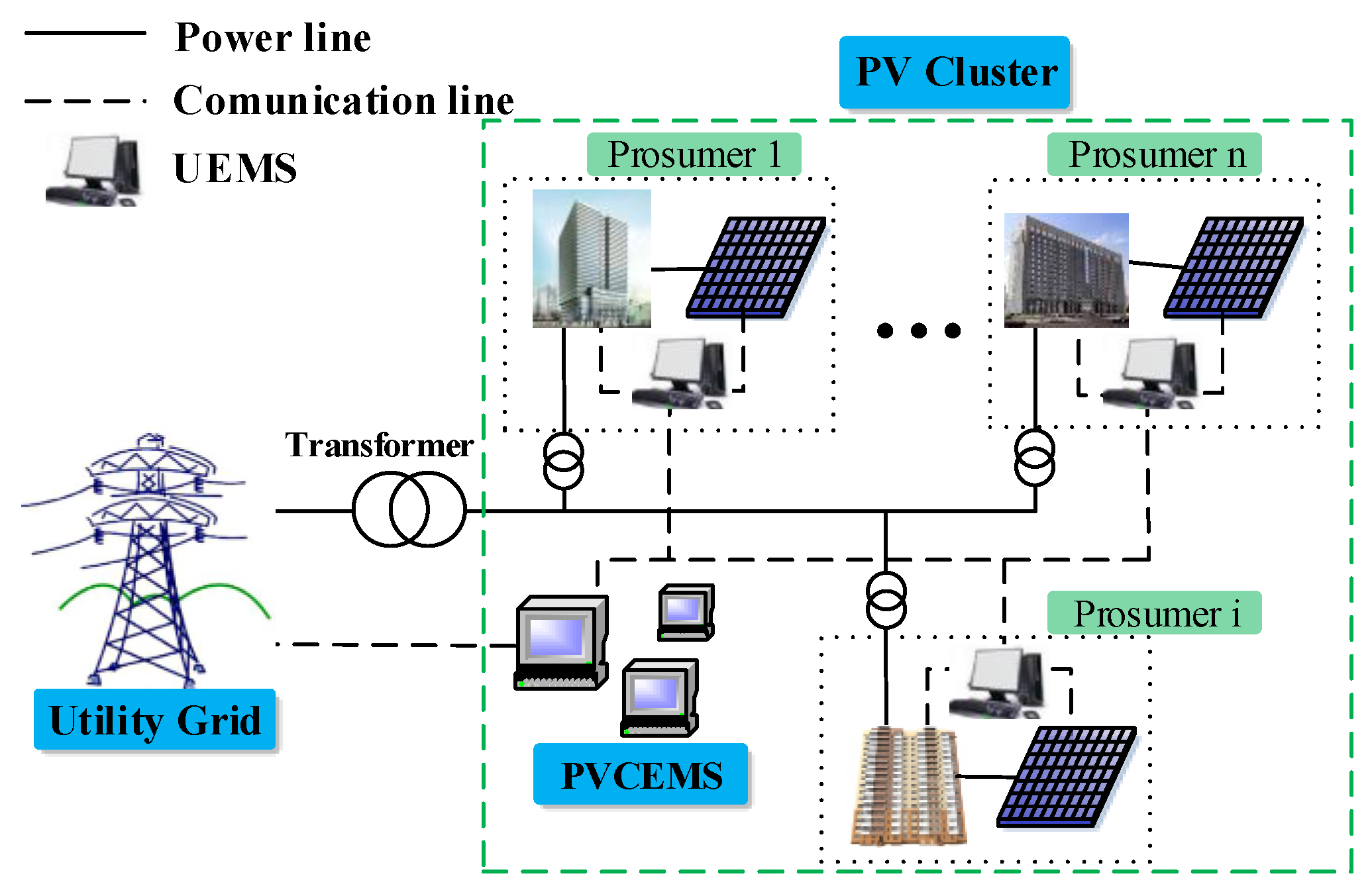

As shown in

Figure 1, the PVC contains a certain number of prosumers, who have leased roofs to the PVCO for the installation of PV panels. The PV power generated is assumed to be owned by the PVCO and the PVCO is assumed to supply cheaper energy to the prosumers. The prosumers are connected in the same microgrid or distribution grid. Meanwhile, every prosumer has a user energy management system (UEMS) for collecting local information, and participates in DR to promote his utility by scheduling of power consumption, according to the electricity price [

15,

16].

As a coordinator, the PVCO is obligated to decide the real-time internal prices based on the supply and demand conditions of the PVC. In order to facilitate the management, the energy management system (EMS) of PVC has two tasks: (1) it forecasts the PV energy of PVC, and distributes the forecasted value to all the prosumers; (2) collects the scheduled energy consumption of prosumers, and distributes other prosumers’ total energy consumption to each prosumer.

4. PVC Demand Response Model

4.1. DR Model Based on a Non-Cooperative Game

The interaction among rational, mutually aware players, where the decisions of some players impact the payoffs of others, is defined as a non-cooperative game. A game, usually denoted by G, is described by its game player, each player’s strategies, and the resulting payoffs from each outcome. For example, there are N game players, the set including all the optional strategies of every game player is called strategy spaces, expressed by . means the j-th strategy of game player n. represents the utility of player n. Non-cooperative game G of N players is expressed as .

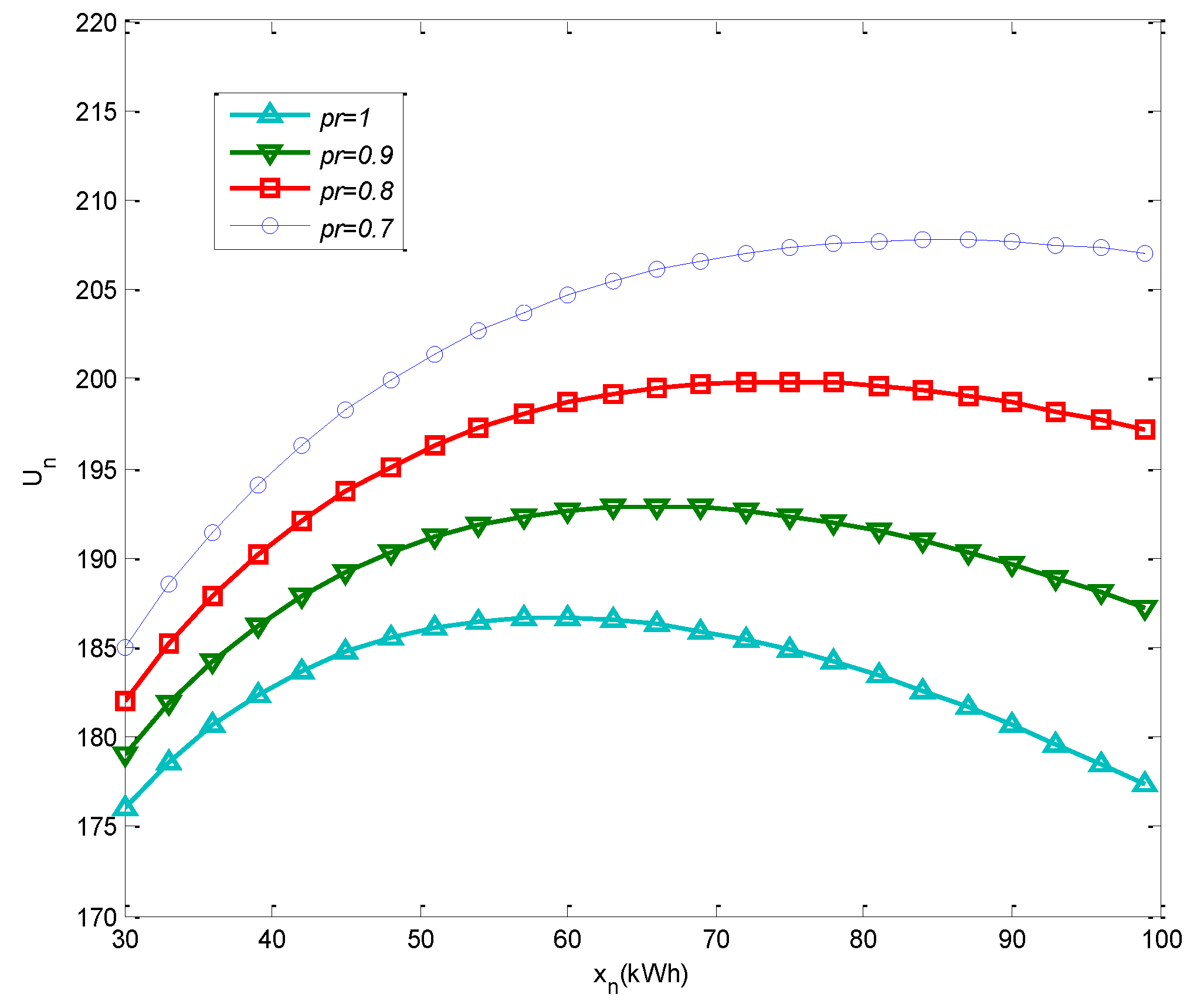

The problem of DR in the PVC is essentially a non-cooperative game for prosumers in pursuit of self-utility maximization. Because the internal buying price given by Equation (4) is a function of the total PVC loads, the utility of every prosumer is related with other prosumers’ power consumption. For example, when DSR is small at one point, the internal buying price is relatively low. Prosumers tend to consume more power in order to promote their utilities. DSR and power cost of this moment both increase because of this power consumption behavior, so every prosumer needs to play the game with others’ power consumption arrangement, and searches for the best power consumption. The non-cooperative game of this PVC can be expressed as:

where prosumers are the game players,

is the available strategy set for prosumer

,

is the integral utility function of the prosumer

.

4.2. Proof of Nash Equilibrium’s Existence and Unique of

A Nash Equilibrium, named after John Nash, is a set of strategies, one for each player, such that no player has incentive to unilaterally change his/her action [

20].

’s Nash Equilibrium is defined as follows:

Definition 1.

In the game , a certain strategy set composed of one strategy for each game player, and strategy of any game player n is the best strategy of other game players’ strategy combination. That is to say, is true for any , is a Nash equilibrium of .

Theorem 1. When the utility function is strictly quasi-convex function, unique Nash equilibrium exists in the game [21]. For the power consumption

of any prosumer

n, there is corresponding power consumption of other prosumers. We use

to denote the power consumption of all prosumers except prosumer

n. Assuming that while prosumer

n adjusts its power consumption according to other prosumers’ power consumption, the power consumption of other prosumers

. is fixed. Best response of prosumer n can be obtained by solving:

As for prosumer

n and power consumption of other prosumers, we have:

Then, the integral utility of prosumer

n can be expressed as:

According to (12), under the circumstances that

is fixed, the integral utility of prosumer

n is the function of

. In order to prove that

is a strict quasi-convex function of

, the second derivative of

to

is needed to be proved less than zero:

where

and

. It can be obtained that the second derivative of

to

is less than zero. Then it can be obtained that

in the

is a strict quasi-convex function. According to Theorem 1, a unique Nash Equilibrium exists in the

. Obviously, in the strategy combination of the Nash Equilibrium, no prosumer is willing to change its power consumption unilaterally. The game reaches convergence, and the solution of Nash Equilibrium can be regarded as the optimal power consumption of every prosumer.

4.3. Nash Equilibrium’s Distributed Solution of

According to Equation (12), under the condition that power consumptions of other prosumers are fixed, the integral utility of prosumer n is the function of its own power consumption. Combined with Definition 1, it can be obtained that optimal strategy of prosumer n is the optimal respond strategy to other prosumers. When every prosumer has reached the optimal power consumption strategy under other prosumers’ power consumption strategy, the Nash Equilibrium of game is reached.

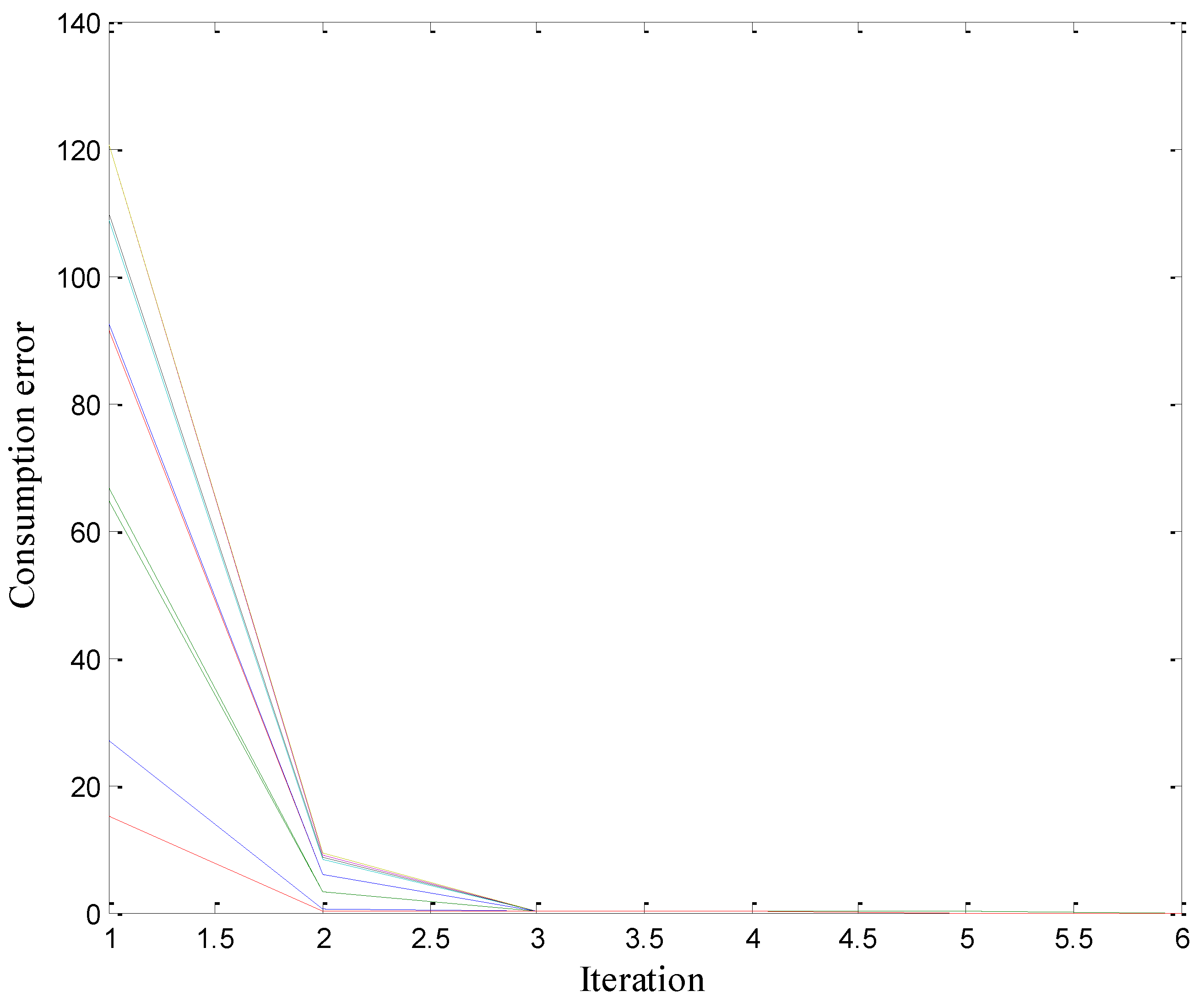

The calculation process is shown in Algorithm 1, where an iterative method was used to solve the Nash Equilibrium of game . is the power consumption corresponding to the utility electricity price before prosumers participate in the PVC. During the iteration process, PVCO sends the power consumption to prosumer n and receives the optimal power consumption response of prosumer . All the prosumers are regarded to reach the Nash Equilibrium when the difference of power consumptions between two successive iterations is lower than . Finally, the power consumptions of prosumers at this time period have formed the Nash equilibrium strategy of game .

| Algorithm 1. Distributed solving algorithm |

| 1: , //initialization |

| 2: while |

| 3: for n = 1 to N |

| 4: PVCO calculates , and sends it to prosumer n |

| 5: , uploads to PVCO |

| 6: end |

| 7: k = k + 1 |

| 8: end |

In Algorithm 1, PVCO coordinates the power consumption among prosumers. All prosumers get the instead of the power consumption strategy of a single prosumer, which protects their privacy to some extent. Moreover, by using the distribution algorithm, prosumers can autonomously schedule the optimal power consumption through the acquisition of .

6. Conclusions

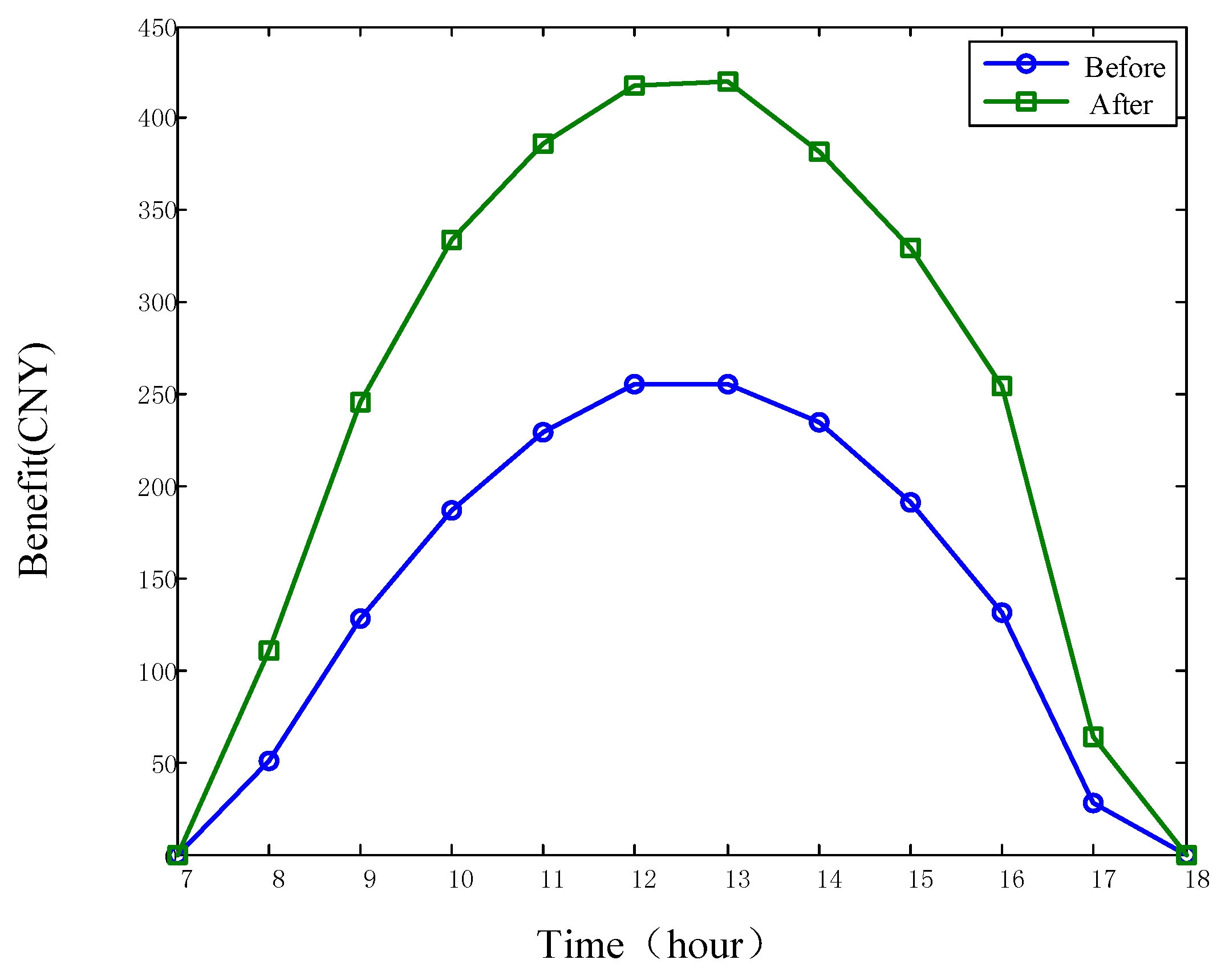

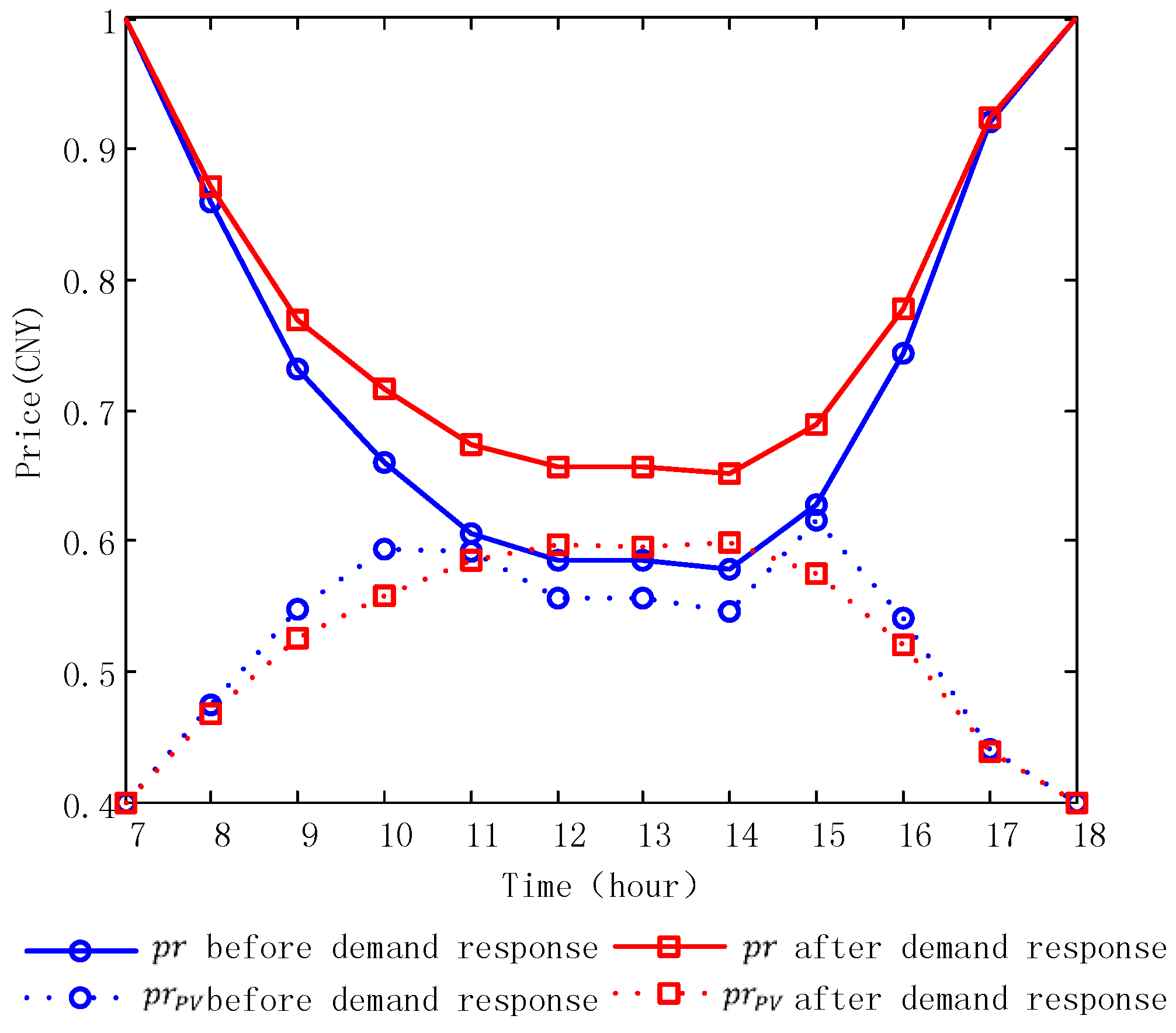

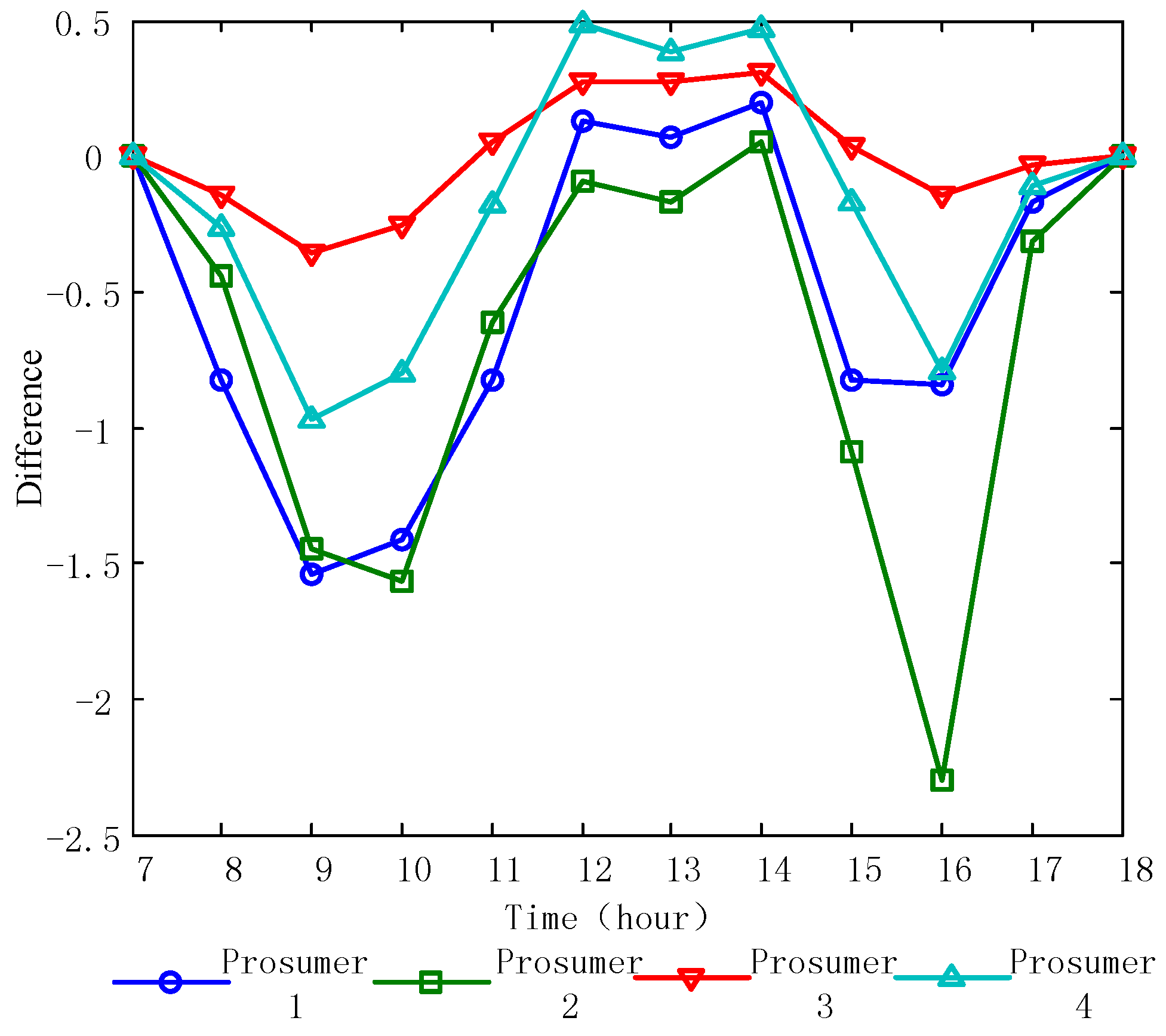

In this paper, we have proposed a multi-party energy management for PV clusters of leased- roof prosumers. According to the economic principle of demand and supply, we have formulated a dynamic internal pricing model for the PVCO and prosumers. We have shown that the internal pricing model can simultaneously promote the integral utilities of prosumers and the benefit of PVCO. Moreover, if the prosumers have flexible load or battery energy storage system resources, the DR can be used in the PVCO to improve the local consumption of PV energy. We have formulated the DR problem in the PVC as a non-cooperative game among prosumers, and proved the existence and uniqueness of the Nash Equilibrium. We have also shown that the DR is effective when the PV energy is at a surplus. Finally, we have investigated the sensitivity of the adjustment parameter of the price level. According to China’s energy policy and the cost of investment, a reasonable value for α to be set is between 0.5 and 0.3.

The proposed work can be extended in various ways. For instance, if pure consumers, which have no roofs for leasing, would like to participate in the PVC, the pricing model should be discriminated [

23], since their contributions to the PVC are not as obvious as those of the roof-leasing prosumers. Furthermore, we can also discuss the crowdfunding model for PV systems. Although the consumers cannot offer their roofs for leasing, they can still participate in the PVC by a crowdfunding mechanism of investment. Another interesting extension is the sizing and energy management of battery storage systems. For the PVC, the battery storage can be configured centralized with the PVCO or distributed with each prosumer. The effectiveness and the related energy management strategies need to be investigated in the future.