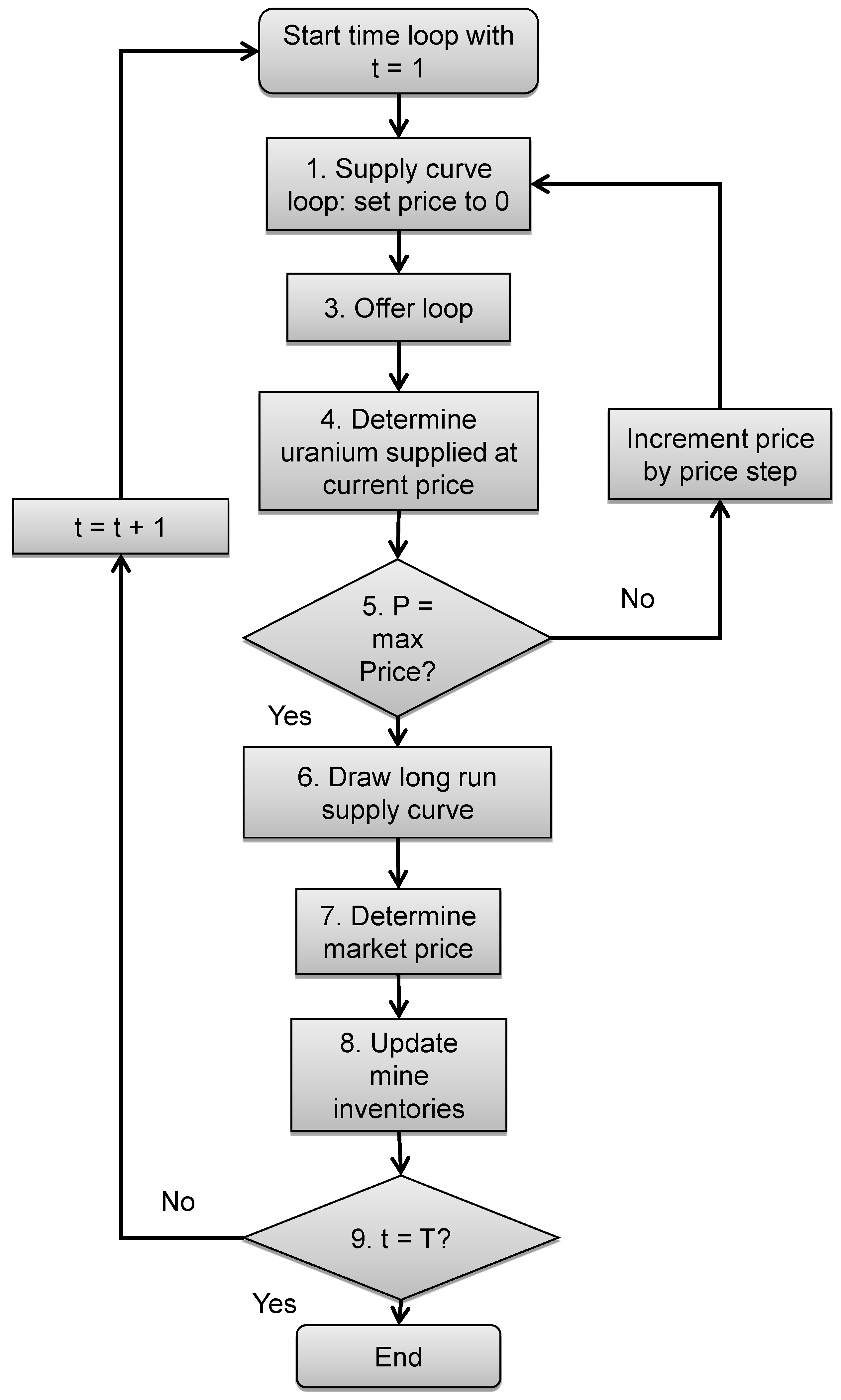

The work presented here builds upon the market clearing model of the uranium and enrichment industries described in [

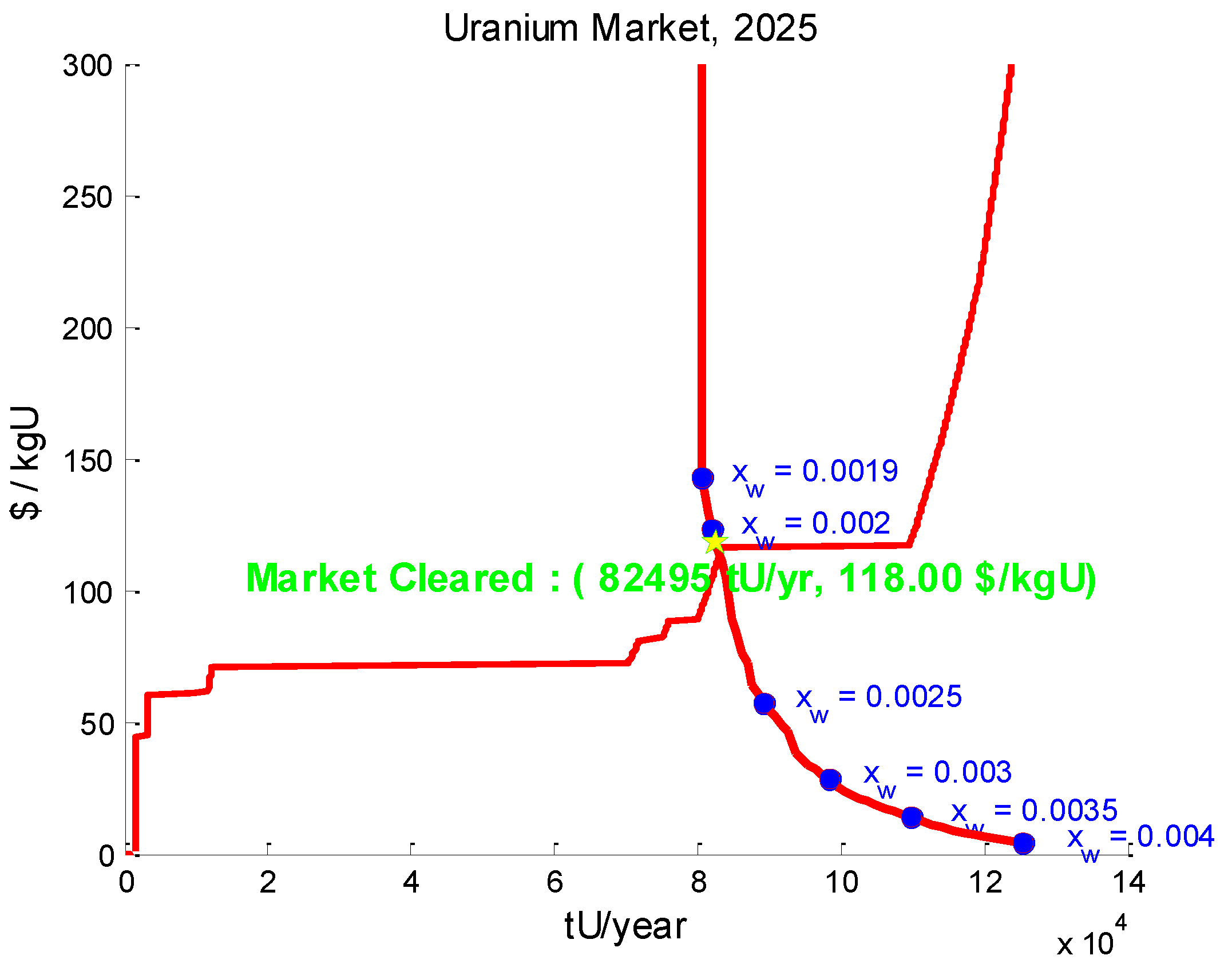

4]. That model is built upon databases of primary and secondary uranium resources as well as enrichment facilities, with each enrichment facility having a unique cost structure. The model derives market-clearing conditions by locating the intersections between the annual supply and demand curves for uranium and enrichment services while also considering the effects of secondary supplies including highly enriched uranium down blending and sale of natural uranium inventories. Therefore, the model incorporates the coupling between the uranium and enrichment markets. For instance, an increase in uranium prices will lead to decreased tails assays, more demand for enrichment, higher enrichment prices and ultimately reduced demand for natural uranium.

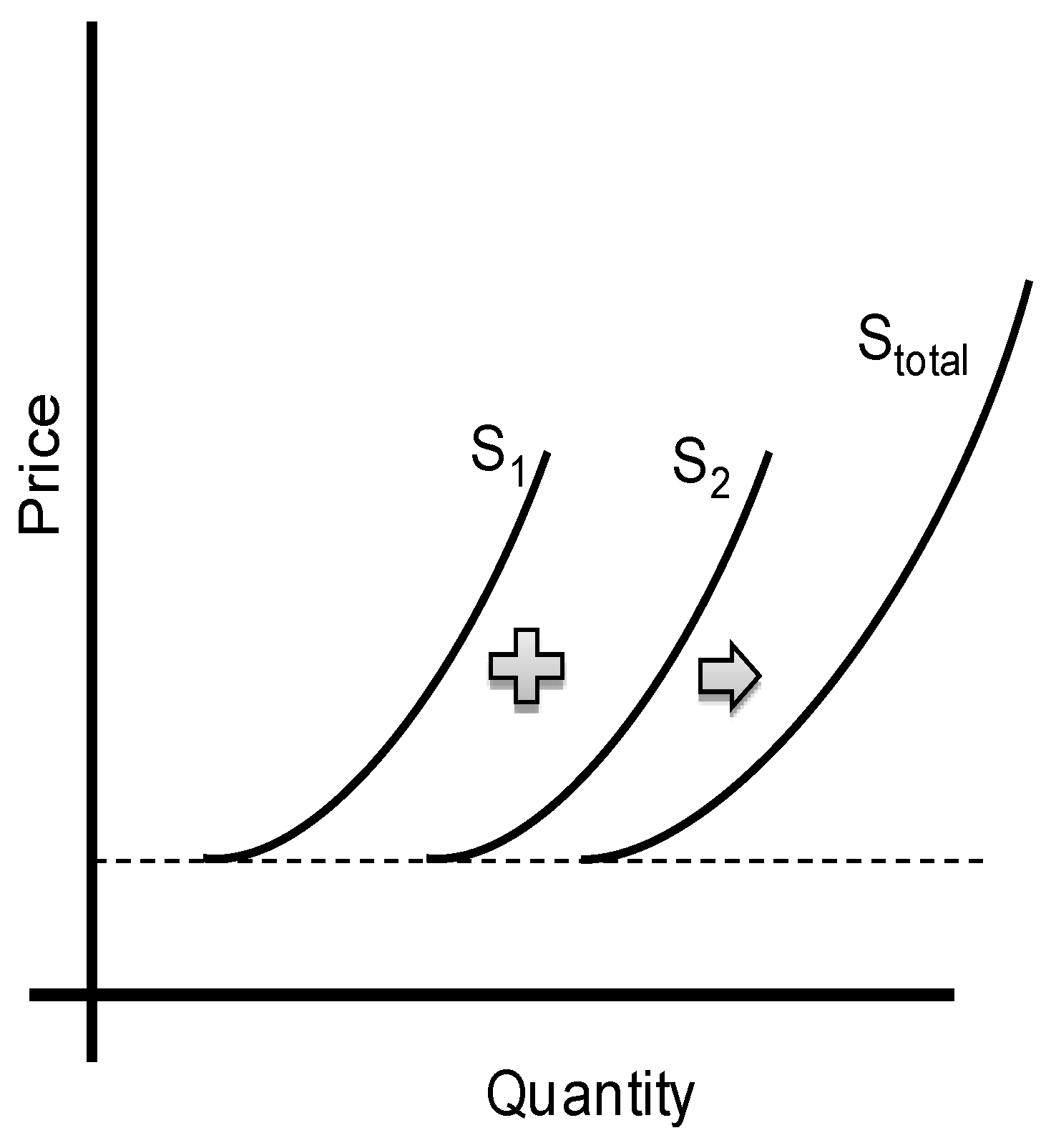

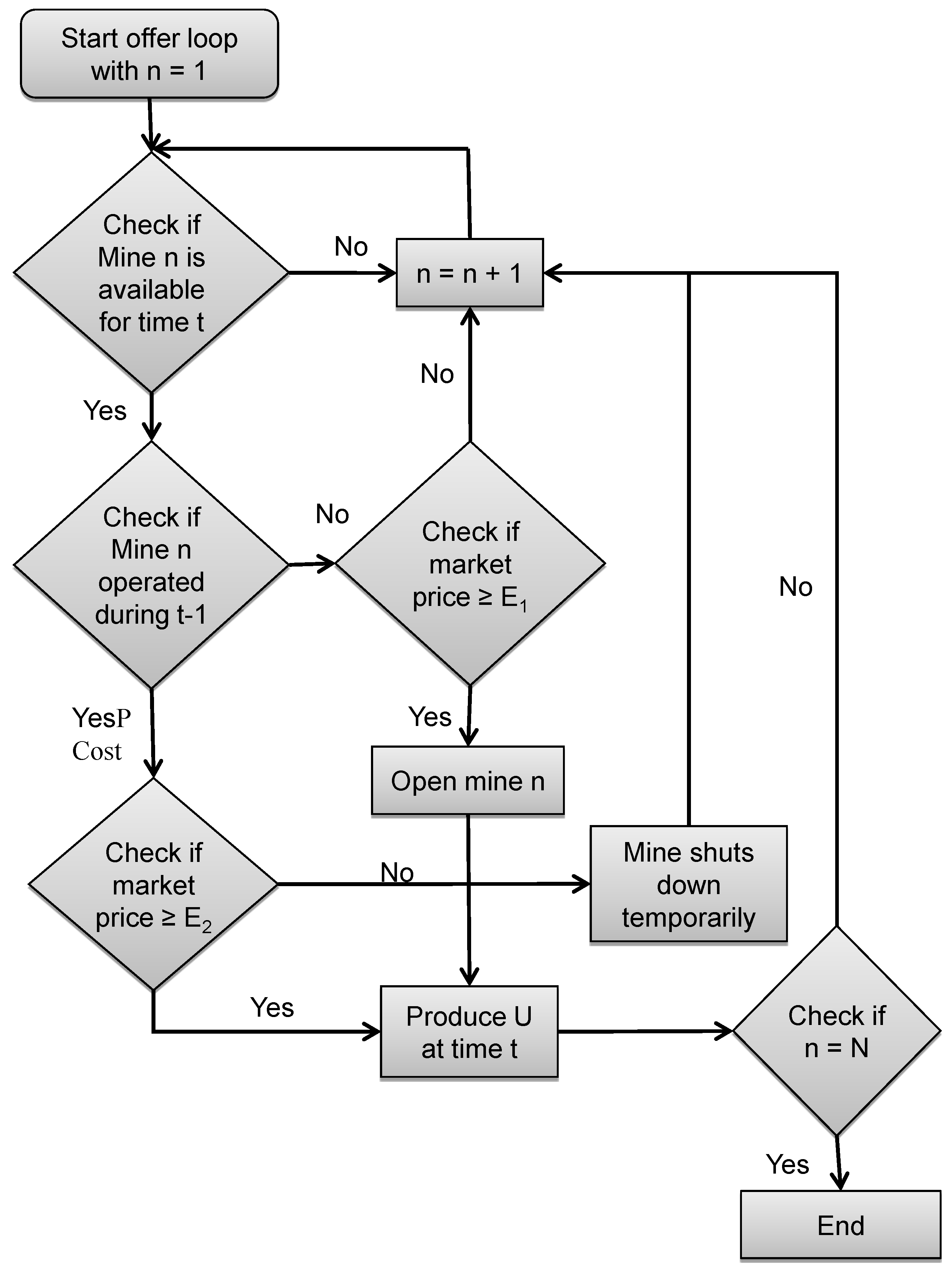

Each mine in the simulation has unique characteristics including total uranium reserves, earliest feasible opening date, capital and operating costs and others detailed below and in [

4]. Since these characteristics are fixed, the supply curve for each individual mine is also the same in every time period as long as the mine still possesses uranium reserves it can produce. Therefore the production decisions of each mine can be determined based on the short-run market price, which is in turn set by the industry short run supply curve aggregated over all mines that are able to produce in that time period. The aggregated short run industry supply curve displays all uranium mines which can potentially produce in a given time period if the price is high enough.

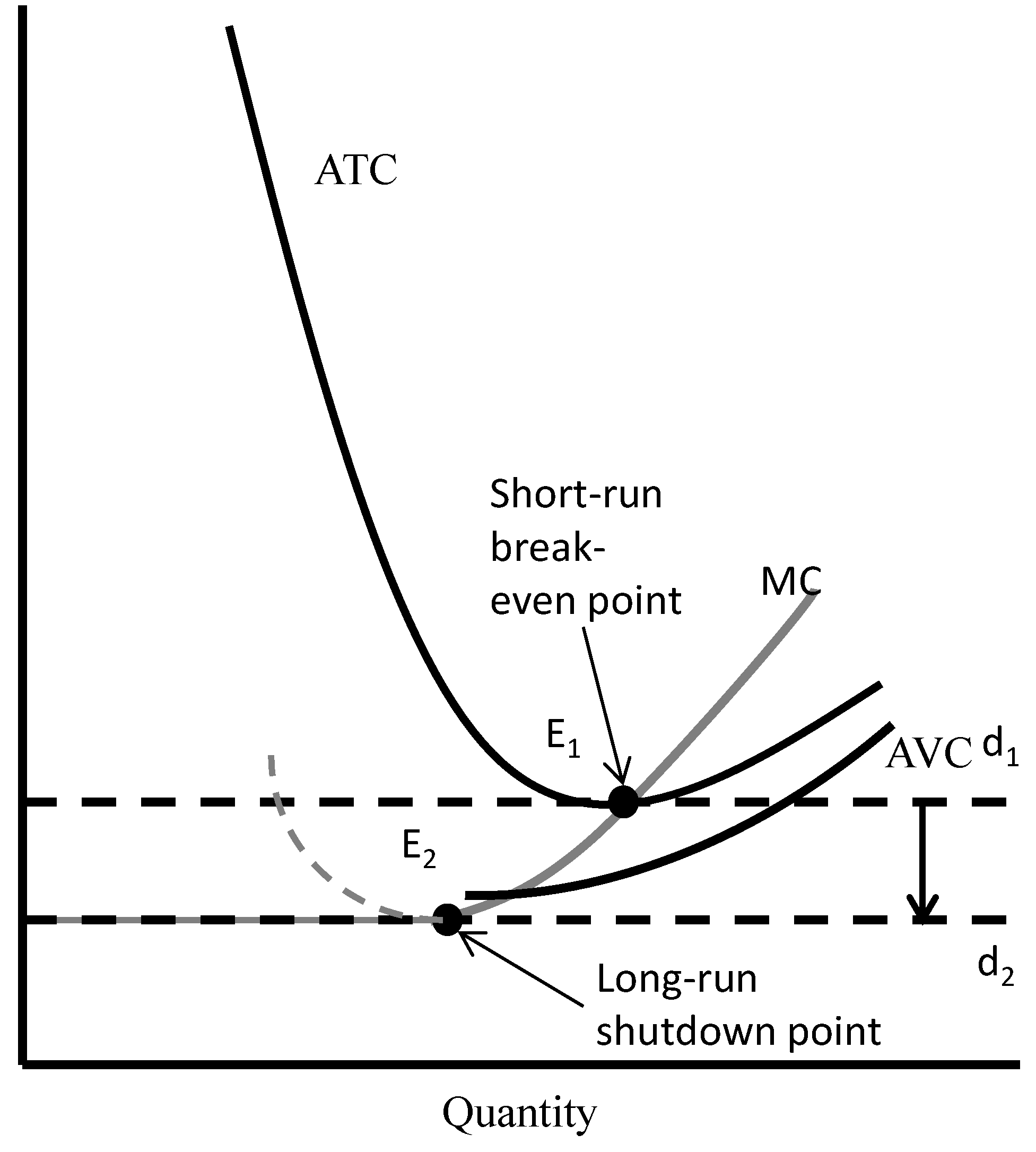

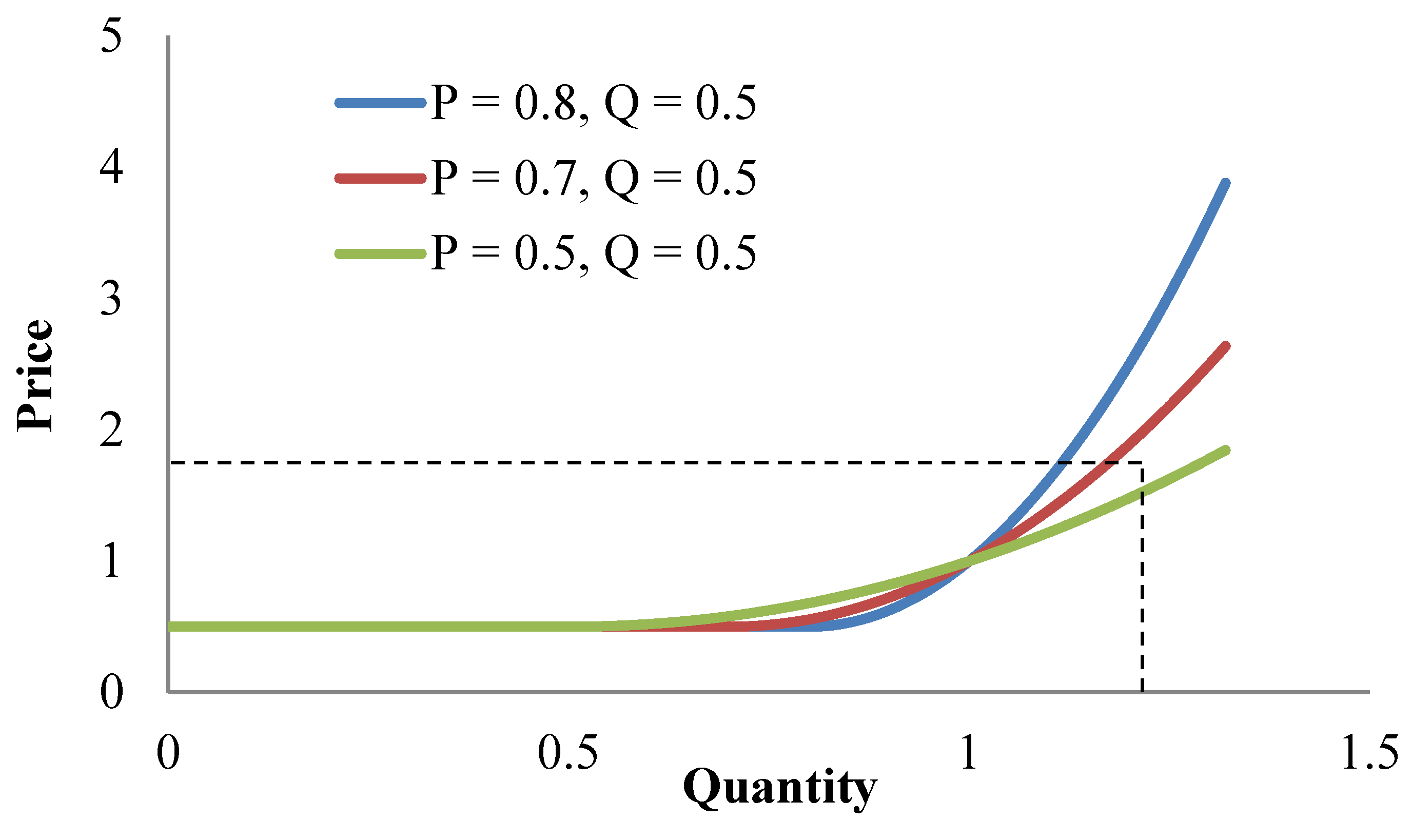

Figure 1 distinction between an individual mine “shutting down” in the short run and “exiting” price in the long run.

Figure 1 follows the economic rules, which are described in [

7]. The marginal cost (MC) is the variable cost incurred by producing one additional unit of output. The average variable cost (AVC) is the average value of the MC for all units of output produced. The average total cost (ATC) is the AVC plus the amortized capital cost (ACC) divided by the number of units of output. For a mine to operate, its economic costs must be covered. The MC curve crosses ATC at its lowest point (E

1) because the MC is of producing an additional unit of output is averaged into the ATC. When the MC is less than the ATC, each new unit of output lowers the ATC. A new mine will not begin to operate unless its average total cost of producing uranium is less than or equal to the mine’s MC. This point is known as the short-run breakeven point (E

1 in

Figure 1). If a mine is currently operating it will continue to operate until the market price drops below the minimum value of its AVC. This is known as the long-run industry exiting point (E

2).

Figure 1.

Cost curves for a single uranium mine.

2.1. Short Run Individual Mine Supply Curve

The original model’s database does not include information about capital, operation and maintenance or decommissioning costs for individual uranium mines, only their unit cost of uranium production at a reference output level. Operating cost information is required to allow the simulator to make short run operation decisions, while capital costs become relevant when determining whether to open or decommission a mine. Disaggregated capital, operating and decommissioning cost data is available from WISE Uranium Project for a limited number of mines [

8].

One representative mine of each type, underground (UG), open pit (OP) and

in situ leach (ISL), is chosen from this data set. The Generation-IV Economic Modeling Working Group (EMWG) unit cost calculation procedure is used to compute unit production costs—UC ($/kg U), for these mines [

9]. All other mines of that type are assumed to adhere to the same relative distribution of capital, operating and decommissioning costs. Hence these costs are obtained by scaling the costs for the reference mine by the ratio of unit costs, as detailed below. This simplification was made in response to the unavailability of detailed cost structure breakdowns for individual mines. The representative disaggregated costs available in [

8] are used in this paper in order to demonstrate the implementation of the model.

Table 1 provides the reference data set for each mine type. The methodology for relating TOC, OM, and DD to UC is described next. The unit cost, UC, is calculated from:

Where M: Annual production (throughput) of product in kg of basis unit/yr; technology-specific basis unit may be U, SWU (separative work unit),

etc. ADD: Amortized annual decommissioning costs.

The unit cost components are calculated as above. The amortization factor (AF) is given by:

where

r: Real discount rate,

T0: Duration (years) of operation.

A sinking fund amortization factor (SFF) with a lower rate of return applies to decommissioning costs. It is calculated from:

where

rSF: Real sinking fund rate,

T0: Duration (years) of operation. Then TOC, IDC (interest during construction) and DD are calculated from the reference data:

where

Tc: Duration (years) of construction.

The next step is to calculate the scaled costs for other mines of the same type. In the discussion that follows, variables subscripted “

r” apply to the reference mine of a given type (OP, UG, ISL). Unsubscripted quantities apply to another mine of the same type. The amortized annual capital, OM and DD costs and interest during construction are scaled from reference values as follows:

The OM, is interpreted as the AVC at the reference annual production level, M. In reality, individual mines would increase or curb production as conditions warranted; however the existing model [

4] permits mines to function at their reference capacity or not at all. By formulating a mine-specific supply curve, the modification described next enables each mine to select its own production level at every time step.

A bottom-up engineering cost analysis would be needed to construct such a supply curve. Since the objective of this work is to demonstrate a method for making use of such data in a simulation, a plausible functional form was chosen to represent a generic short run supply curve, which shows the quantity supplied by individual U mine at certain price level. The form chosen is quadratic, as was proposed in [

10]. It is and given by:

where Q: supply quantity in given period (usually one year), P: marginal cost of supplying an additional unit at quantity Q; a, b, c: coefficients to be determined.

For each uranium mine, the existing database from [

2] provides a reference capacity (tonnes of uranium produced per year) and a reference production cost ($ per kilogram of uranium produced), from which is calculated marginal cost of supplying. Therefore, to determine the coefficients a, b, and c the following criteria are imposed:

Here Q1 and P1 are the reference capacity and cost from the database. Economic theory provides that a firm’s short run marginal cost curve exhibits a U shape, as predicted by Equations (12). The shape arises because costs per unit of production first decrease as production rises from very low levels and scale benefits are realized. As additional capital and labor inputs are applied to increase production, though, the marginal benefit of these inputs begin to decline as they outstrip the ability of a firm’s infrastructure to effectively use them. Although there exists insufficient historical mine data to calibrate the marginal cost curve, the U shape of Equations (12) provides the correct type of feedback to the cost model. The point P2 = 0.5P1 and Q2 = 0.7Q1 the marginal cost of mining an additional unit of uranium is assumed to reach its lowest value, 70% of the reference cost P1, when the mine’s production stands at half of the reference level Q1.

The individual mine supply curve is the upward sloping part of the marginal cost curve (the part above the average cost curve). The portion of the marginal cost curve above ATC (

Figure 1) is a profit maximizing individual mine supply curve. Portions of the marginal cost curve to the left of the shut-down point (E

2) are not part of the short run supply curve, because to produce on the left side of the E

2 MC costs increase (dashed line in

Figure 1) and ATC costs significantly increase. Operation in this part of the MC curve is uneconomical.

Table 1.

Reference data for costs calculation from the WISE Uranium Project Calculators.

Table 1.

Reference data for costs calculation from the WISE Uranium Project Calculators.

| Reference U mines | Type | UG | OP | ISL |

|---|

| Data from [3]: | TOC, $ | 2.81 × 108 | 3.47 × 108 | 1.11 × 108 |

| OM, $/yr | 1.04 × 108 | 1.62 × 108 | 1.73 × 107 |

| DD, $ | 3.39 × 107 | 5.92 × 107 | 2.86 × 107 |

| M, kg/yr | 7.72 × 105 | 3.16 × 106 | 4.12 × 105 |

| Calculated from data following procedure in text | ACC, $/yr | 4.25 × 107 | 7.93 × 107 | 2.67 × 107 |

| ADD, $/yr | 1.07 × 106 | 5.78 × 106 | 3.07 × 106 |

| IDC, $ | 4.36 × 107 | 5.37 × 107 | 1.72 × 107 |

| UC, $/kg U | 192 | 77.9 | 114 |