The peak in domestic oil production and the associated decline in EROI coincide with important economic, social, and political changes in the US and FSU. In the US, the declining supply and quality of oil coincided with the end of the postwar economic expansion (To test whether there are meaningful changes in economic or social indicators and whether these changes coincide with the changes in the energy surplus, I fit a simple equation to the time series

Y (

Yt = α + β

Yeart + μ

t) and test whether the constant (α) and/or trend (β) changes in a statistically meaningful fashion using a test statistic developed by Bai and Perron [

34]. This test statistic is generated by estimating the following equation

in which

and

YearBreak is the year of the break. I allow for up to five breaks, each of which has a minimum size of 10 observations. The number of breaks is chosen using the test statistic and the timing of these breaks is described below. I recognize that these results are not definitive given that the time series probably are not trend stationary). In the FSU, the declining supply and quality of oil coincided with the end the end of the “communist bloc” and the Soviet Union itself [

35]. In this section, I describe how these changes can be interpreted as possible responses to a shrinking energy surplus.

4.1. Social and Economic Responses to Shrinking Oil Surpluses in the US

In a market economy, a shrinking oil surplus is perceived through the lens of higher oil prices. In 1973–1974, the real price of oil increased about 40 percent (EIA). Prices rose another 190 percent between 1979–1981, such that the real price of oil in 1981 was $61 per barrel (2005$), compared to $13 (2005$) in 1970. Prices shrank back to 1974–1975 levels in 1986, but even the Asian financial crisis did not drop prices to the level that prevailed during the post war expansion. In addition, after 2000, prices rose steadily from $30 (2005$) to $85 ($2005) in 2012.

Before describing the impacts of the 1973–1974 price increase, a short aside on how this price increase is related to the declining quantity and quality of US oil production. Prior to 1973, the US acted as the marginal supplier of oil [

36]. The Texas Railroad Commission (and other state commissions) maintained price stability by opening and shutting spare capacity to balance supply and demand [

37]. Following this strategy, the Texas Railroad Commission allowed only 30 percent of capacity to operate in 1963. After that trough, Texas lost its spare capacity such that fields operated at 100 percent of capacity in 1973 [

37]. At this point, the US lost its ability to offset OPEC production decisions. As such, OPEC became the marginal supplier of oil in 1973 and thereby gained the ability to influence price [

38,

39]. The potential for this loss of spare capacity to affect OPEC’s ability to influence oil prices was described six months before the October 1973 oil shock in the April 1973 issue of

Foreign Affairs [

40].

Higher oil (energy) (Oil prices drive changes in the price of other fuels [

41,

42] undermined the basic strategy that powered US economic growth during the previous sixty years. As energy prices rose relative to capital and labor, it no longer made economic sense to subsidize labor with increasing quantities of energy. Consistent with this change, US energy consumption increased 0.8 percent per year between 1975 and 2012, as opposed to 3 percent per year between 1950 and 1975 [

32].

The slow-down in energy consumption relative to population growth ended the steady growth in the quantity of energy used per worker hour in the US (

Figure 1). Without more nail guns or more powerful tractors, carpenters no longer drove more nails per hour and farmers did not expand the amount of land he/she cultivated. This stagnation slowed technical change, labor productivity, and economic growth.

The emphasis on energy supply separates cause and effect. Labor productivity stagnated for more than a decade starting in the early 1970s because the end of cheap oil undermined the economic logic of subsidizing labor with increasing quantities of energy. Put simply, the marginal return to technical innovation declined in large part because the cost of implementing those innovations increased.

Although the slowing the growth of energy consumption per worker was not discussed widely, its effects on the US economy were highly visible. As the amount of energy used to subsidize workers stopped growing, the marginal product of labor stopped growing.

Consistent with this thermodynamic axiom, wages stopped growing in the early 1970s (

Figure 2). Statistical tests identify two breaks in the time series for real wages, 1973 and 1996 (if a single break is imposed on the data, the break occurs in 1979, the time of the second oil shock). Consistent with the first break, real wages (2005$) in manufacturing grew in the forty-plus years from 1929 ($5.28) through the 1973 ($17.72). However, after 1973, real wages were constant for nearly 25 years. Wages did not rise beyond the 1973 level until 1997, which coincides with the second break identified by statistical tests.

Figure 1.

The relationship between energy use per worker hour (red line) in the manufacturing sector and labor productivity (green line) in the manufacturing sector for the entire period for which data are available. Data for energy use, production worker hours, and value added use are from Annual Survey of Manufacturers (various years). Data for value added are deflated by PPI. Both time series are divided by their respective values in 1977 to derive an index with a base value of 1.0 in 1977.

Figure 1.

The relationship between energy use per worker hour (red line) in the manufacturing sector and labor productivity (green line) in the manufacturing sector for the entire period for which data are available. Data for energy use, production worker hours, and value added use are from Annual Survey of Manufacturers (various years). Data for value added are deflated by PPI. Both time series are divided by their respective values in 1977 to derive an index with a base value of 1.0 in 1977.

Figure 2.

Real wages ($2005) in the US manufacturing sector. Data from the Bureau of Labor Statistics [

43].

Figure 2.

Real wages ($2005) in the US manufacturing sector. Data from the Bureau of Labor Statistics [

43].

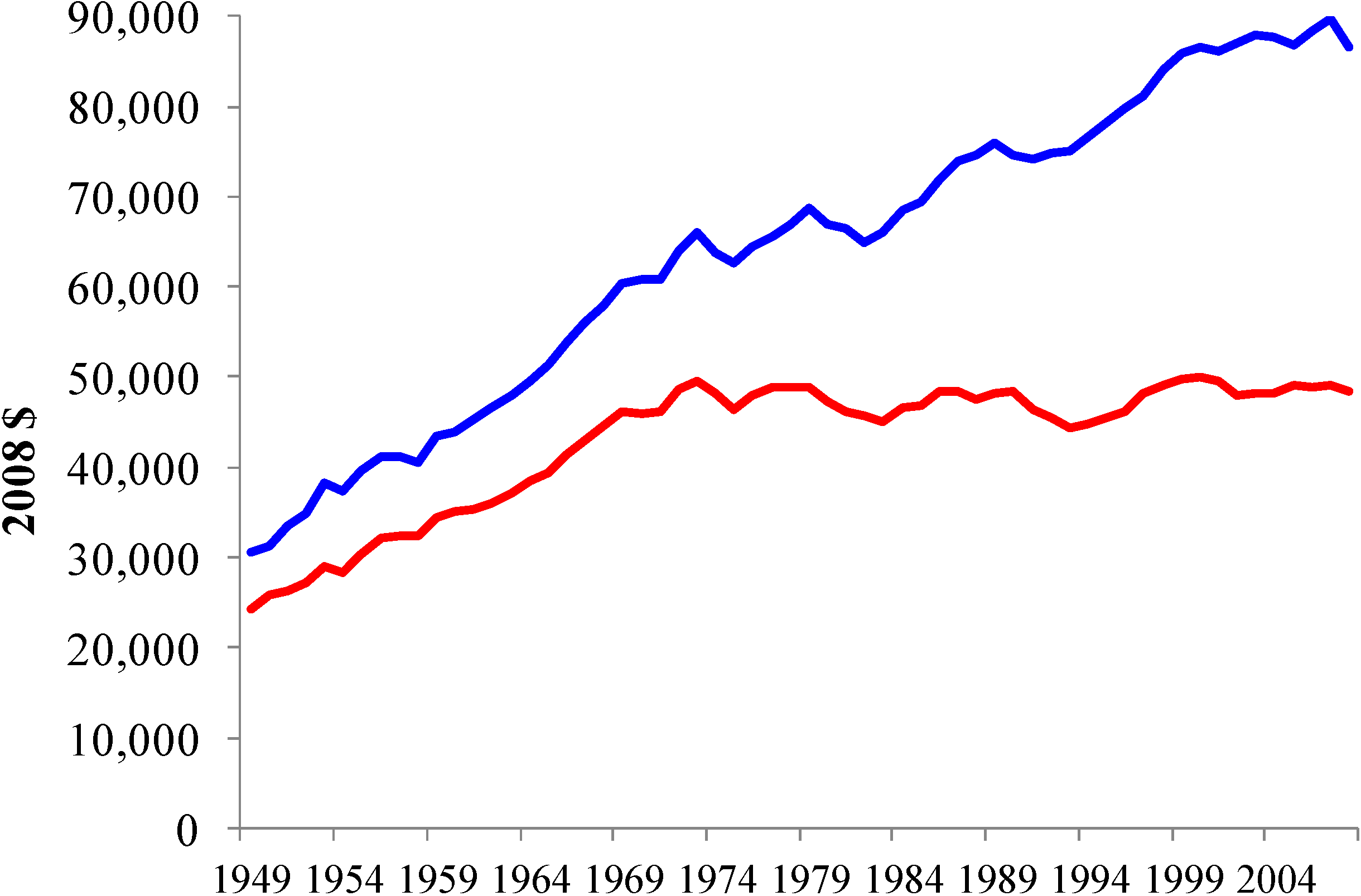

The sudden end in wage increases was mirrored by real family income (

Figure 3). Statistical tests identify two breaks, 1971 and 1996. Real income for families with a single male income rose steadily from $24,200 ($2008) in 1949 to $46,200 ($2008) in 1971. After 1971, real family income with a single male breadwinner did not rise significantly. In 2008, income for the “traditional” American family was $48,500, only slightly more than the $46,200 in 1971.

The lack of income growth violated an important component of the American Dream; each generation will be financially “better off” that the one that precedes it [

44]. Although average income for males in the baby boom generation did not rise, this stagnation did not stop families from trying to increase their standard of living. These efforts triggered a series of economic, social, and political changes that are described below.

Figure 3.

Median real family income for married couples in which wife is not in the paid labor force (red line) and wife is in the paid labor force (blue line). Data from the Bureau of Labor Statistics [

43].

Figure 3.

Median real family income for married couples in which wife is not in the paid labor force (red line) and wife is in the paid labor force (blue line). Data from the Bureau of Labor Statistics [

43].

In an era of slow wage growth, one way to expand family income was to increase the number of workers per family—specifically have women work outside of the house. Consistent with this strategy, female participation rates increased from 43.3 percent in 1970 to 50.9 percent in 1979. This 7.6 percentage point increase was the largest decadal rise in the twentieth century. For comparison, the female participation rate rose 5.6 percentage points in the 1960s and 1980s.

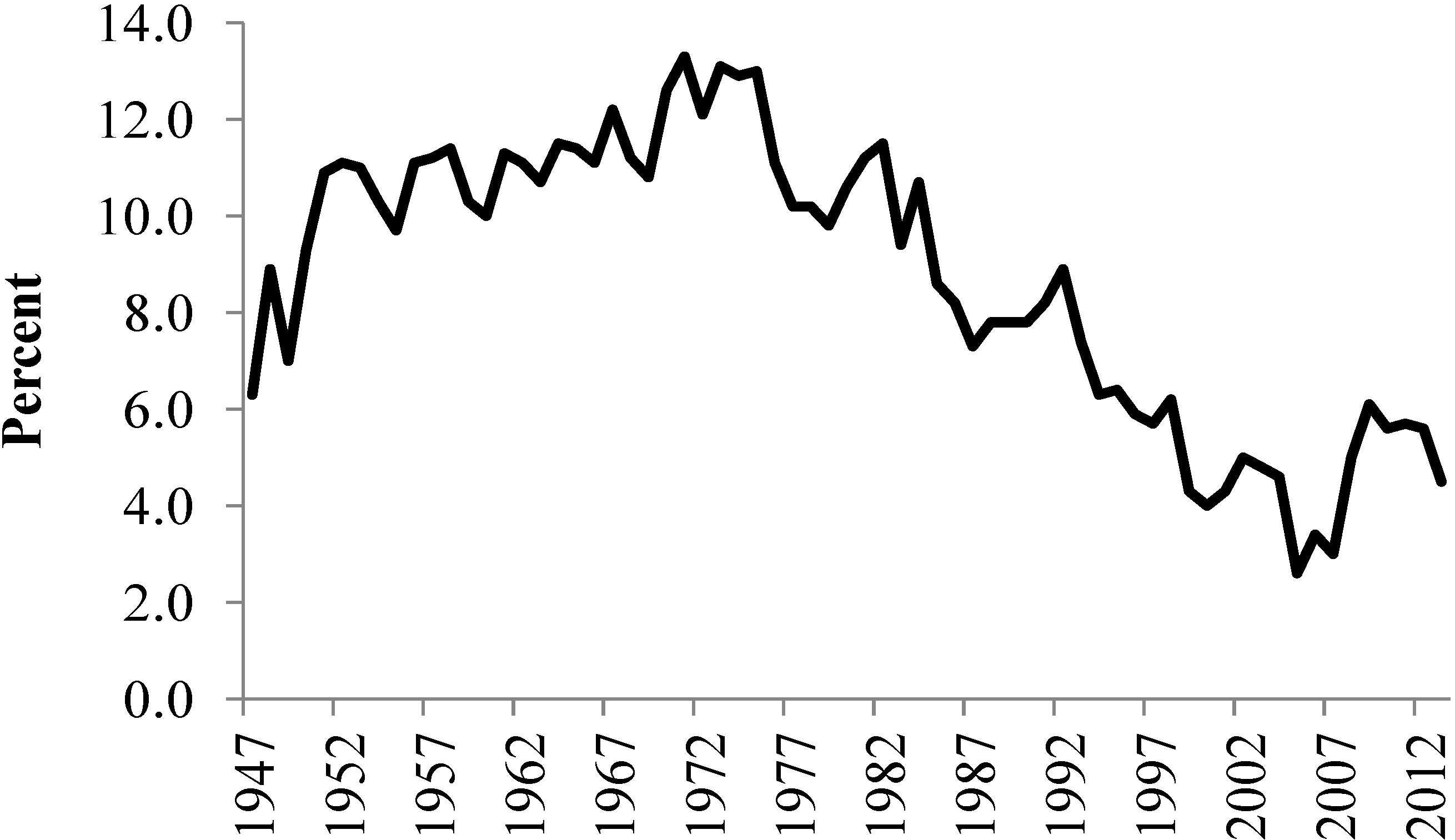

Because increasing female participation rates generated only small increases in family income (

Figure 3), families pursued other strategies. One strategy supplemented consumption by reducing the savings rate. This time series of the US savings rate shows two breaks, 1975 and 1998. Between 1947 and 1975, the US savings rate grew (

Figure 4). These savings were used to fund investments in new capital, which increased the productive capacity of the economy, and to pay for “big ticket items”, which were purchased by consumers. After 1975, the US savings rate declined.

Lowering the savings rate to supplement stagnant family incomes prompted changes elsewhere in the economy. By reducing the domestic savings rate, the US economy had to rely on to foreign sources of capital. This helped reverse the international investment position of the US economy. During the post war economic expansion, the US had a positive international investment position (a net creditor). This position was reversed in 1986, when the US became a net debtor nation (negative position). This position became increasingly negative thereafter.

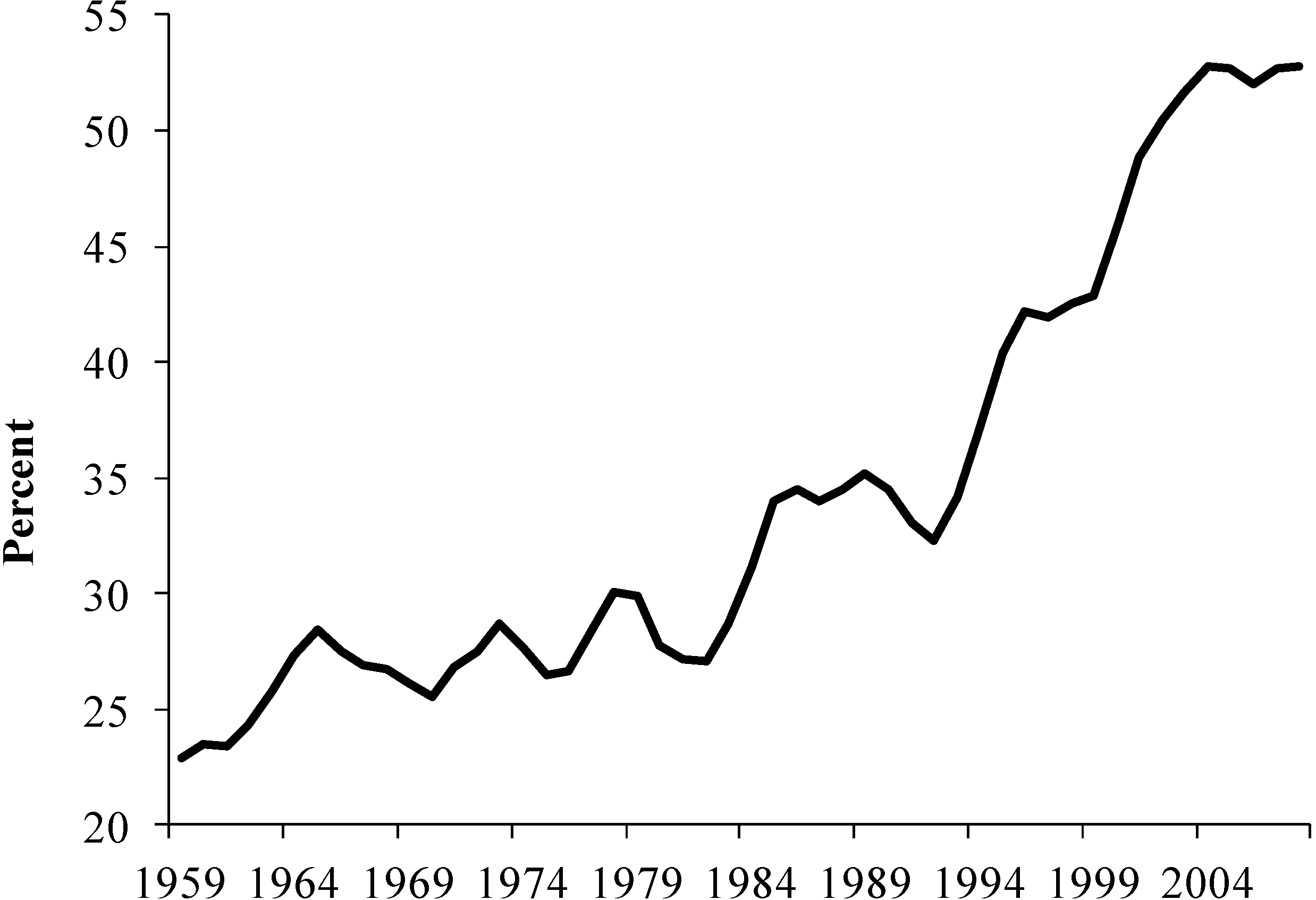

At the individual level, savings were no longer available to fund large purchases. To maintain/increase their standard of living, consumers continued to expand their purchases, but relied on credit. Consumers’ reliance on credit can be measured by the ratio of outstanding consumer credit (divided by the number of US families), divided by median family income. By this measure, outstanding consumer credit rose slowly but steadily between 1959 and 1993 (

Figure 5). However, after 1993, statistical tests indicate a measureable acceleration such that outstanding consumer credit exceeded 50 percent of family income in 2002.

Figure 4.

Personal saving as a percentage of disposable personal income, percent, annual, not seasonally adjusted. Data from US Federal Reserve Bank of St. Louis [

45].

Figure 4.

Personal saving as a percentage of disposable personal income, percent, annual, not seasonally adjusted. Data from US Federal Reserve Bank of St. Louis [

45].

Figure 5.

Outstanding consumer credit, divided by the number of families and average family income. Data from the Board of Governors of the Federal Reserve System [

46].

Figure 5.

Outstanding consumer credit, divided by the number of families and average family income. Data from the Board of Governors of the Federal Reserve System [

46].

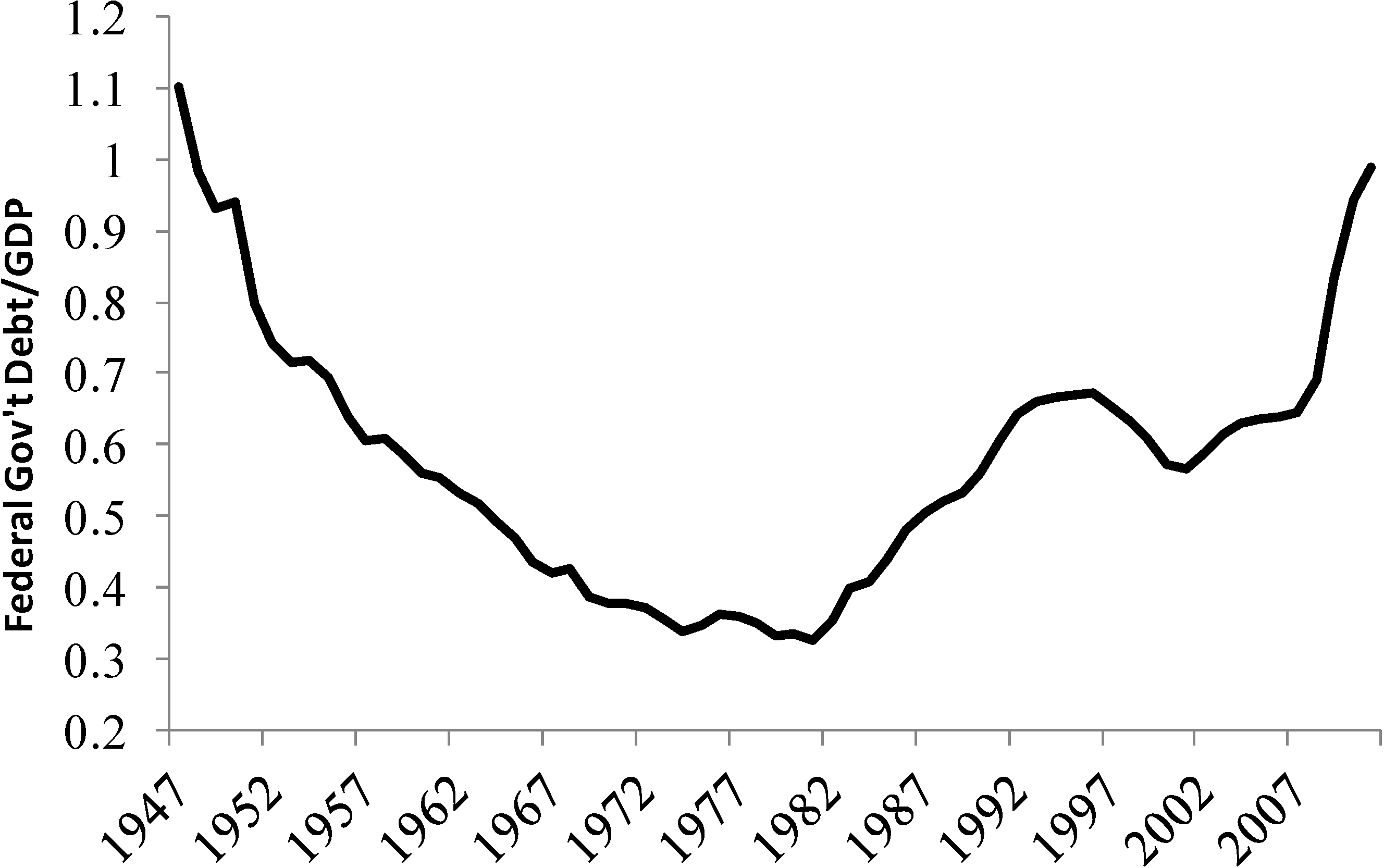

Assuming debt to maintain or expand living standards extended to the government through a single-minded focus on cutting taxes. Single minded because the Federal government cut taxes, which reduced government receipts, without cutting government outlays. Outlays were not cut because government purchases and services support economic wellbeing by simulating demand and by supporting individual incomes. In short, this strategy inflated economic well-being by allowing citizens to enjoy the benefits of government services without paying for them. Not surprisingly, this “something for nothing” strategy proved to be politically popular.

To reap the benefits of government services without paying for them, the electorate chose to add the costs of unfunded services to government debt. During the post war economic expansion, outlays by the federal government were a relatively constant fraction of GDP (15–20 percent). Despite occasional deficits that were associated with recessions (economic slow-downs reduce tax receipts), the US government paid off debts incurred during World War II. By doing so, the ratio of US Federal Government debt to GDP declined steadily from 120 percent in 1946 to 34 percent in 1971 (

Figure 6). Statistical tests indicate identify a break in 1977, after which the ratio starts to rise, with a second break in 1996. By 2011, the ratio of US Federal Debt to GDP was 99 percent, which equaled its 1948 value.

Figure 6.

US Federal government debt as a faction of current year GDP. A value of 1.0 indicates debt equals the current year’s nominal GDP. Nominal values of GDP and US Federal government debt are obtained from US Government Printing Office [

47].

Figure 6.

US Federal government debt as a faction of current year GDP. A value of 1.0 indicates debt equals the current year’s nominal GDP. Nominal values of GDP and US Federal government debt are obtained from US Government Printing Office [

47].

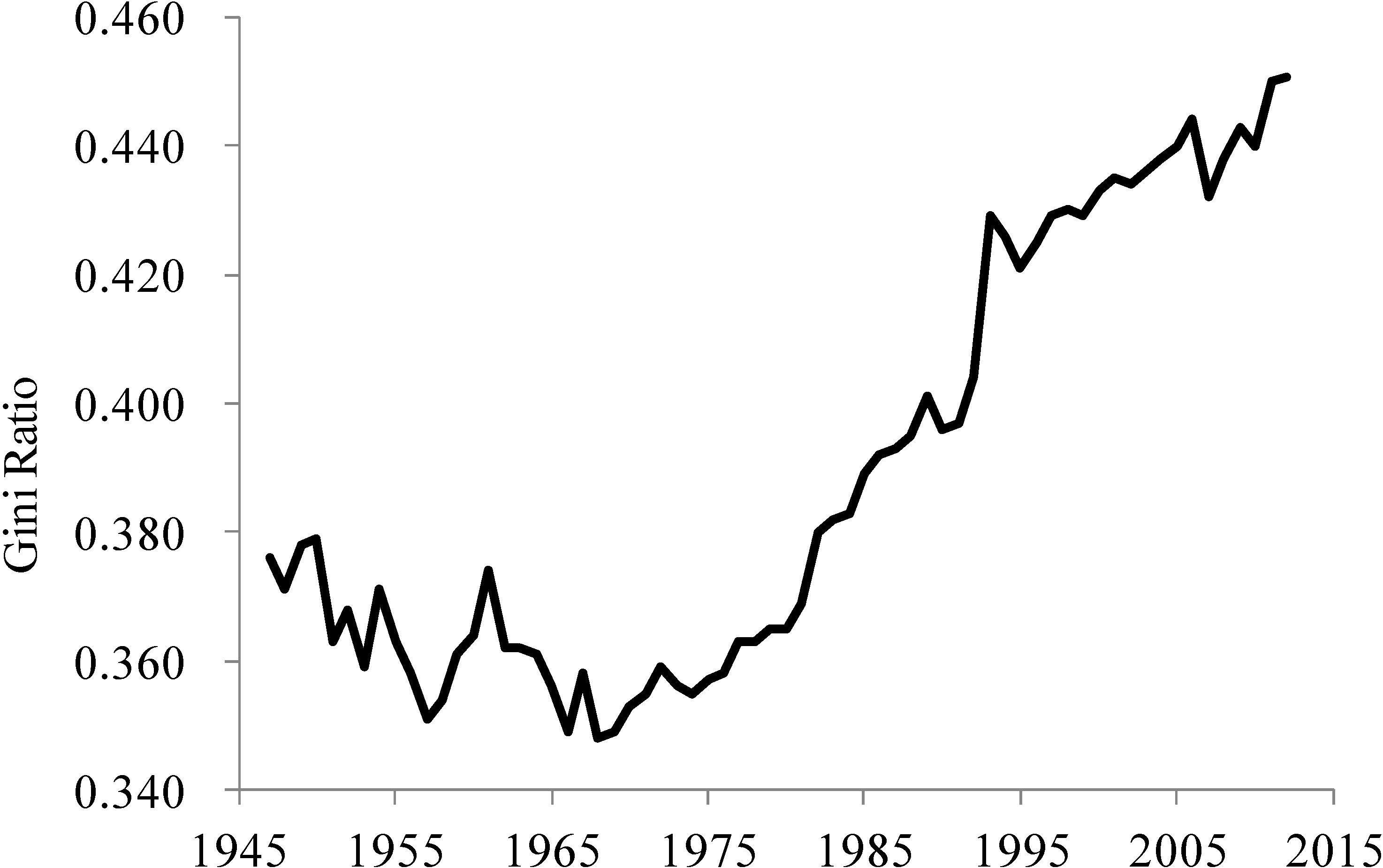

Despite efforts to hide the income effects, the end of cheap oil also is responsible for increasing income inequality. Cheap oil created the world’s first large middle class. This middle class was supported largely by manufacturing jobs, which subsidized workers with increasing amounts of energy and so supported high wages. These high wages and rising family incomes reduced income inequality between 1947 and 1972, as measured by Gini ratios (zero indicates all values are equal whereas a value of one indicate maximum inequality among values) for all US families (

Figure 7).

Figure 7.

Gini ratios for all US Families. Data from U.S. Census Bureau [

48].

Figure 7.

Gini ratios for all US Families. Data from U.S. Census Bureau [

48].

Without abundant supplies of cheap oil, the US economy lost many of its manufacturing jobs. Without these jobs, a significant fraction of the displaced workers (and new entrants to the labor force) were forced into jobs that were not subsidized by large amounts of fossil fuels, such as retail. Without a large energy subsidy, these jobs pay lower wages, and the shift towards these “less energy subsidized sectors” reversed the US economy’s post-war movement towards greater equality. Statistical tests indicate that income inequality started to grow in 1972 and continued to rise through 2012 with a second jump in 1990.

4.2. Collapse of the Communist Bloc and the Former Soviet Union

Like the US, the FSU used the increasing quality and quantity of oil to support a growing standard of living for its inhabitants. However, unlike the US, the FSU used their expanding supply of oil for three purposes; to raise domestic living standards (to ensure domestic peace), to earn hard currency (to pay for imports from the West), and to expand sales to East European allies (to ensure cooperation). As long as the quantity and quality of its domestic oil production expanded, the FSU was able to satisfy these three economic and political objectives. However, the end of cheap oil in the FSU created a zero sum game in which the FSU had to choose among allocating its surplus to the domestic economy (to sustain domestic peace), to subsidized exports to Eastern Europe (to sustain cooperation), and to hard currency sales to the West (to import food and technology).

Many allocations among these three uses are possible; the FSU cut energy allocations to all three uses. Some of the decline in the energy surplus was allocated to the domestic economy, which undermined the strategy for domestic economic growth that succeeded during the previous half century. The productivity of both capital and labor inputs declined sharply between 1976 and 1980 relative to previous five year periods [

49]. For example, annual growth in labor productivity declined from about 4 percent between 1961 and 1975 (3.9 percent in 1971–1975) to 0.6 in 1976–1981 and −0.5 percent in 1981–1982 [

49]. Consistent with this slowdown, the growth rate for total industrial output slowed from about 6 percent between 1960–1975 (5.9% between 1971–1975) to less than 3 percent from 1976–1982 [

49].

Perhaps the most obvious (and damaging) example of domestic energy shortages is illustrated by agricultural problems in the fall of 1989. Although both official policy and black markets provided considerable incentives, crops that were ready for harvest rotted in the fields. Reynolds [

35] argues that this failure occurred because domestic shortages of gasoline and diesel prevented farmers from harvesting crops and prevented truckers from transporting them to market.

Some of the decline in the FSU energy surplus also was allocated to Council for Mutual Economic Assistance (CMEA) allies. During the Soviet post war economic expansion, many East Europe nations were largely dependent on imports to satisfy their oil demand, and most of these imports came from the Soviet Union. For example, Poland imported about 97 percent of the oil it consumed between 1970 and 1994 and over 90 percent of this oil originated in the FSU. As such, oil from the FSU was an important source of energy for Eastern Europe.

The Soviet Union used this dependence as both a carrot and a stick. To nurture dependence by their partners in the CMEA, the FSU sold oil to CMEA customers at below market prices [

50]. In 1974, the FSU sold crude oil to its East European allies at $2.50 per barrel (the world price was about $10 per barrel). Such sales reduced Soviet revenues and discouraged improvements in energy efficiency. Conversely, CMEA allies were cut-off from inexpensive sources of oil if they rebelled (e.g., Hungary, 1956; Czechoslovakia, 1968).

As production stagnated and the world price of oil rose, each barrel sold to CMEA allies at below market prices cost the FSU increasing quantities of hard currency. To keep up with rising prices, the FSU set prices for the East European allies based on a three-year running average. In 1989, the FSU announced a 10 percent supply cut for 1990 and required CMEA nations to pay for oil in hard currency [

50]. Higher prices and lower supplies caused economic difficulties for East European nations and reduced incentives for economic cooperation.

Finally, reductions in the oil surplus reduced the FSU’s ability to earn hard currency from oil exports. The reduction in hard currency reduced the economy’s ability to pay foreign debts and import food and technology. These changes reduced living standards both in the short run (fewer consumer goods) and the long-run (less technology based capital investments).

The political and economic uses of the energy surplus by the FSU (as opposed to the largely economic use by the US) and the collapse of the FSU (as opposed to economic and social changes within the US economic system) greatly complicates any link between the declining energy surplus and the collapse of the FSU. There is no simple cause and effect relation between a declining energy surplus and socioeconomic collapse in the FSU (as opposed to social and economic changes within the existing system in the US). There might have been no collapse if the Soviets had used a different allocation, if the economy had more efficient, if its administrators had been less corrupt, and/or had there been more (or less) economic reform under perestroika. Although these “what-ifs” prevent me from drawing a straight-line from the declining surplus to collapse, the timing and magnitude of this decline and the creation of a zero sum game is consistent with Reynolds’ [

35] conclusion “Certainly, there were many factors that played a role in the fall of the Soviet Union. Nonetheless, the straw most capable of breaking the proverbial camel’s back was oil”.