Development of the Biomethane Market in Europe

Abstract

:1. Introduction

- (a)

- Pre-search to plan the review and define its purpose;

- (b)

- Full search and literature retrieval;

- (c)

- Extraction and ocean of the harvested material;

- (d)

- Synthesis and analysis of results;

- (e)

- Making the results available.

2. Biomethane—Characteristics and Production Methods

2.1. Biogas Upgrading

| Gas Composition | Biogas * | Biomethane ** | Natural Gas *** |

|---|---|---|---|

| CH4 | 50–75% | 94–99.9% | 93–98% |

| CO2 | 25–45% | 0.1–4% | 1% |

| Nitrogen | <2% | <3% | 1% |

| Oxygen | <2% | <1% | - |

| Hydrogen | <1% | - | - |

| H2S | 20–20,000 ppm | <10 ppm | - |

| Water | 2–7% | - | - |

| LHV | 16–28 MJ/m3 | 36 MJ/m3 | 37–40 MJ/m3 |

2.1.1. Membrane Separation

2.1.2. Physical Absorption

2.1.3. Chemical Absorption

2.1.4. Pressure Swing Absorption

2.1.5. Cryogenic Separation Process

2.2. Biomass Gasification

3. The Regulatory and Policy Framework for Biomethane Production in Selected EU Countries

3.1. EU’s Strategic Regulations

- −

- EU’s target of RES share in the energy mix in 2030 on 32% of gross final energy consumption (Article 3(1), point 128);

- −

- EU’s target RES share in the transport sector of 14% (3.5% of advanced biofuels) (Article 25(1));

- −

- Regulations for energy prosumers;

- −

- A standard set of rules for the use of renewable energy in all sectors;

- −

- A guarantee of origin system;

- −

- Sustainability criteria for bioenergy.

3.2. Updated Energy and Climate Regulations

- −

- A new reference level of 49% renewable energy use by 2030 in buildings;

- −

- A new benchmark of a 1.1 percentage point annual increase in the use of energy from renewable sources in the industry;

- −

- A binding annual increase of 1.1 percentage points for the Member States in the use of renewable energy sources for heating and cooling.

- −

- Proposal for a Directive of the European Parliament and of the Council on common rules for the internal markets in renewable and natural gases and in hydrogen COM(2021) 803 final [70];

- −

- Proposal for a Regulation of the European Parliament and of the Council on the internal markets for renewable and natural gases and for hydrogen (recast), COM(2021) 804 final [73].

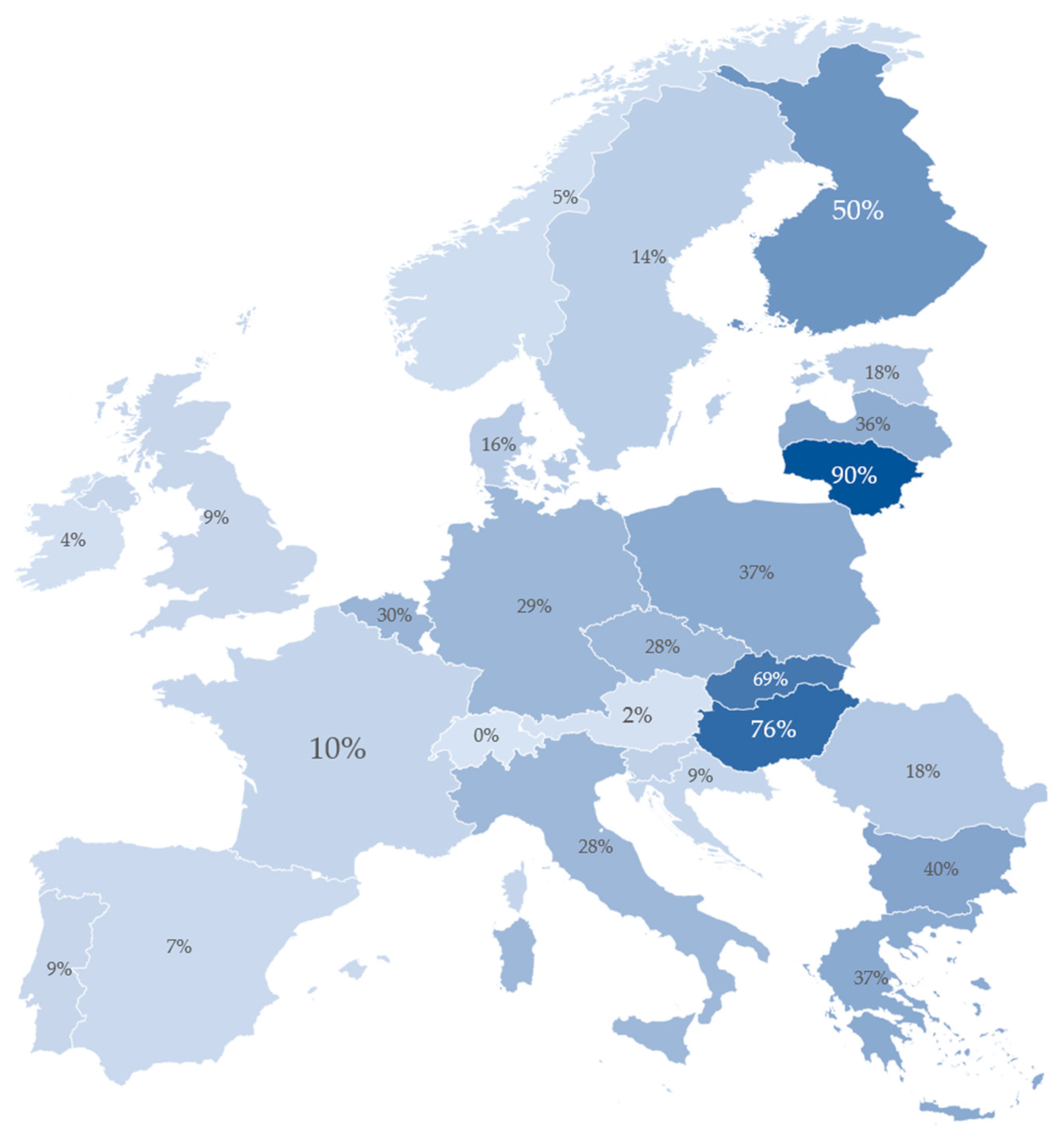

3.3. RE Power EU Action Plan—Biomethane Role in the Context of the 2022 Energy Crisis

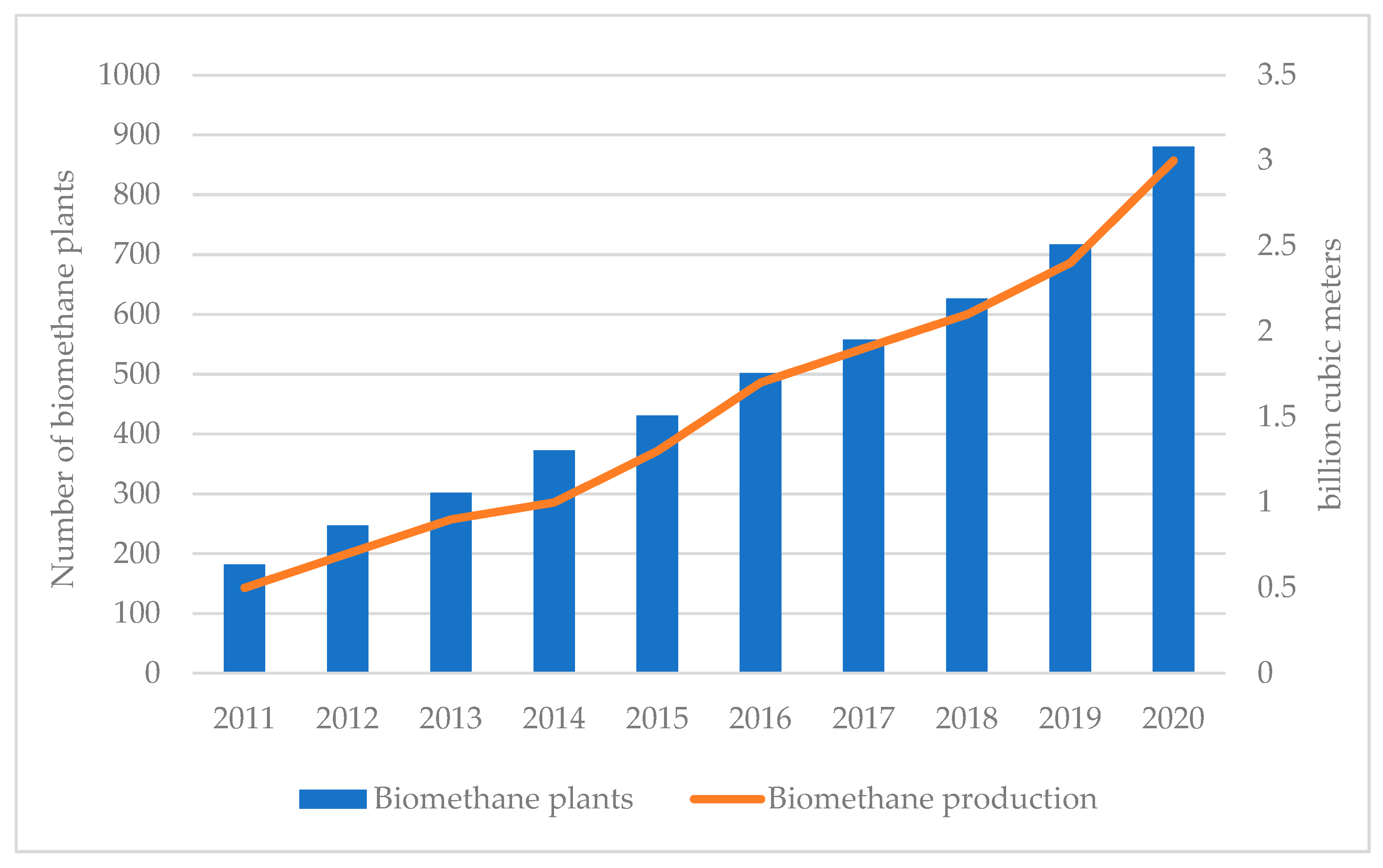

4. Biomethane Market in EU—Current Situation and Development Potential

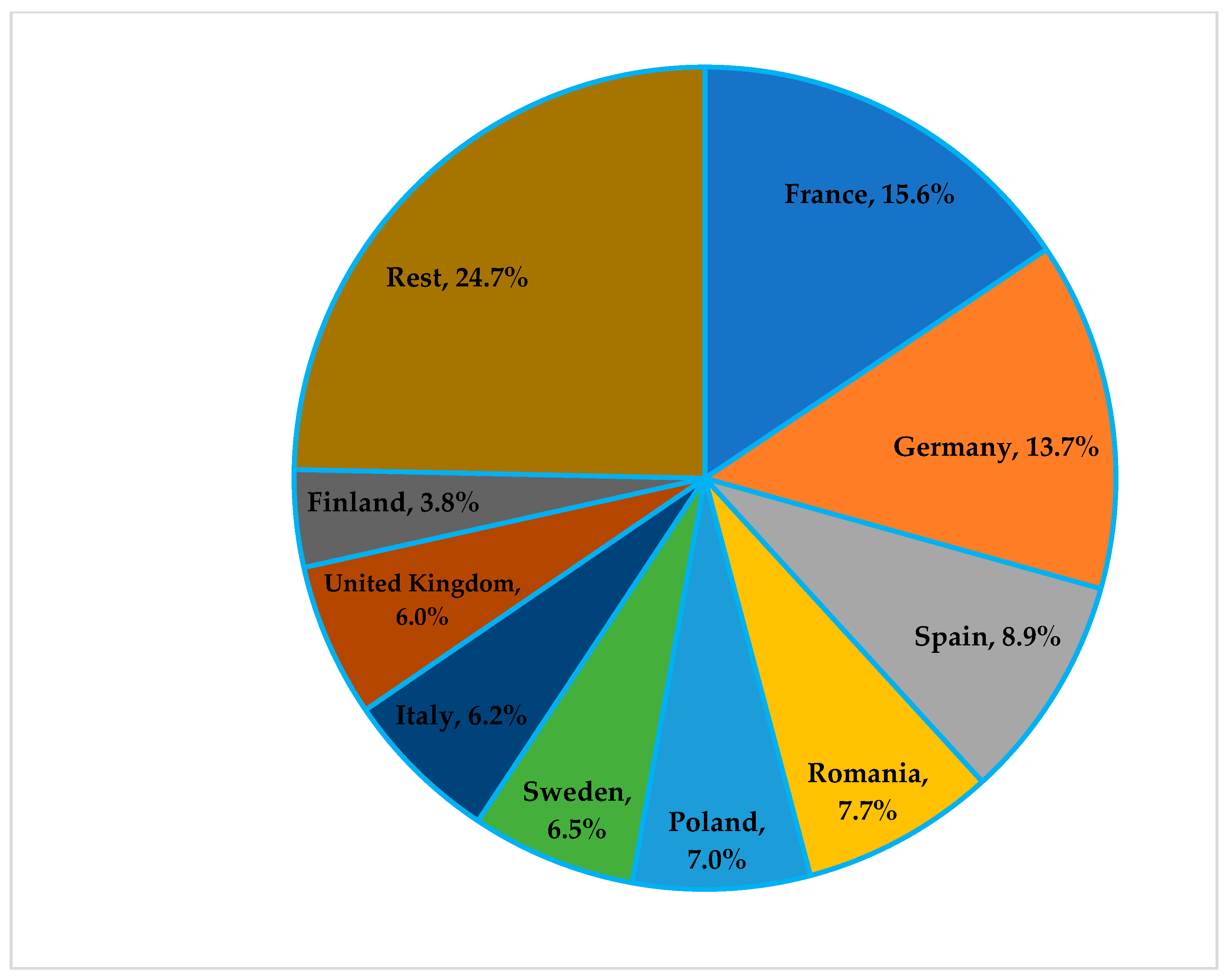

4.1. Current Situation

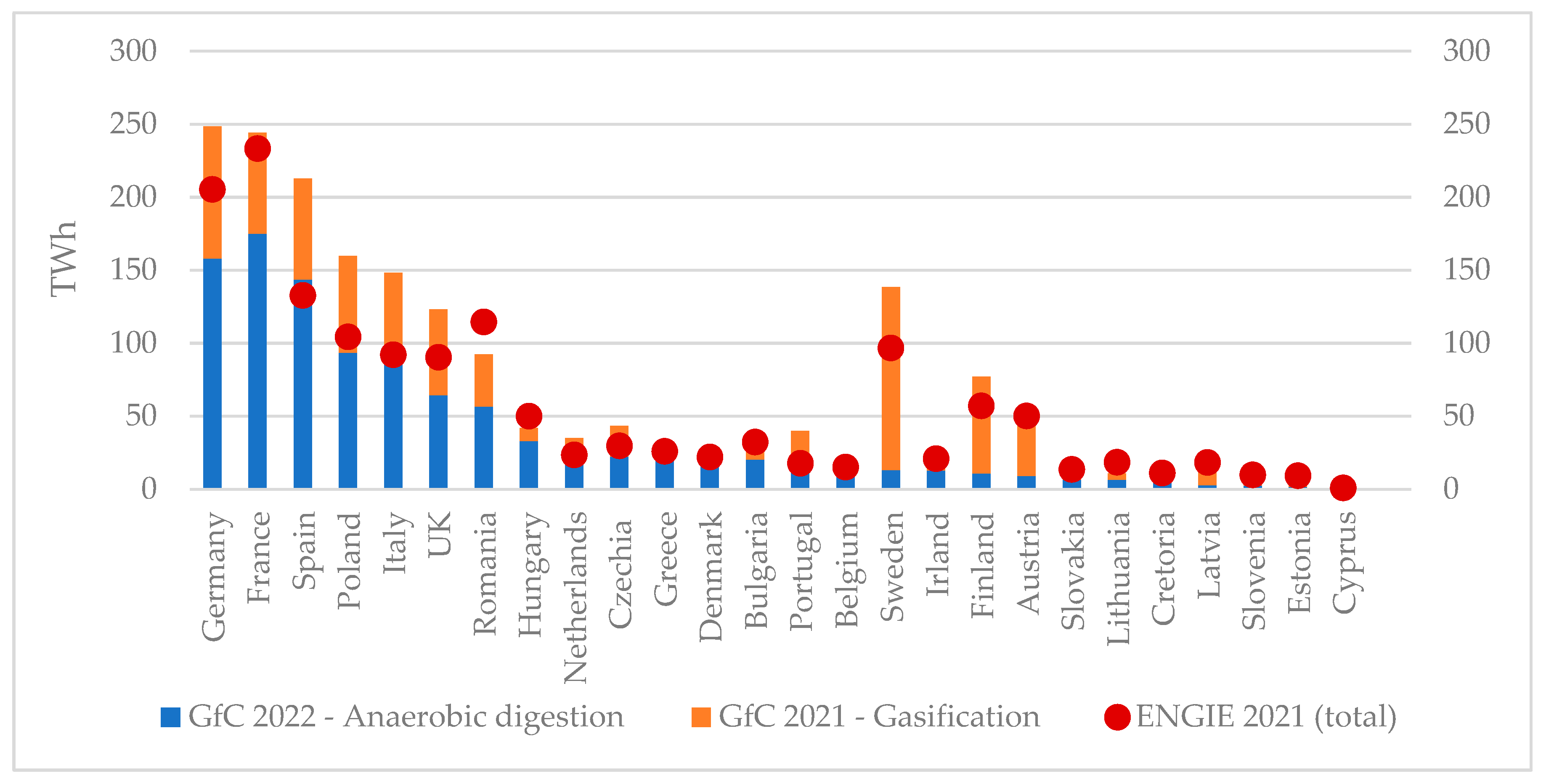

4.2. Potential for the Development of Biomethane Production

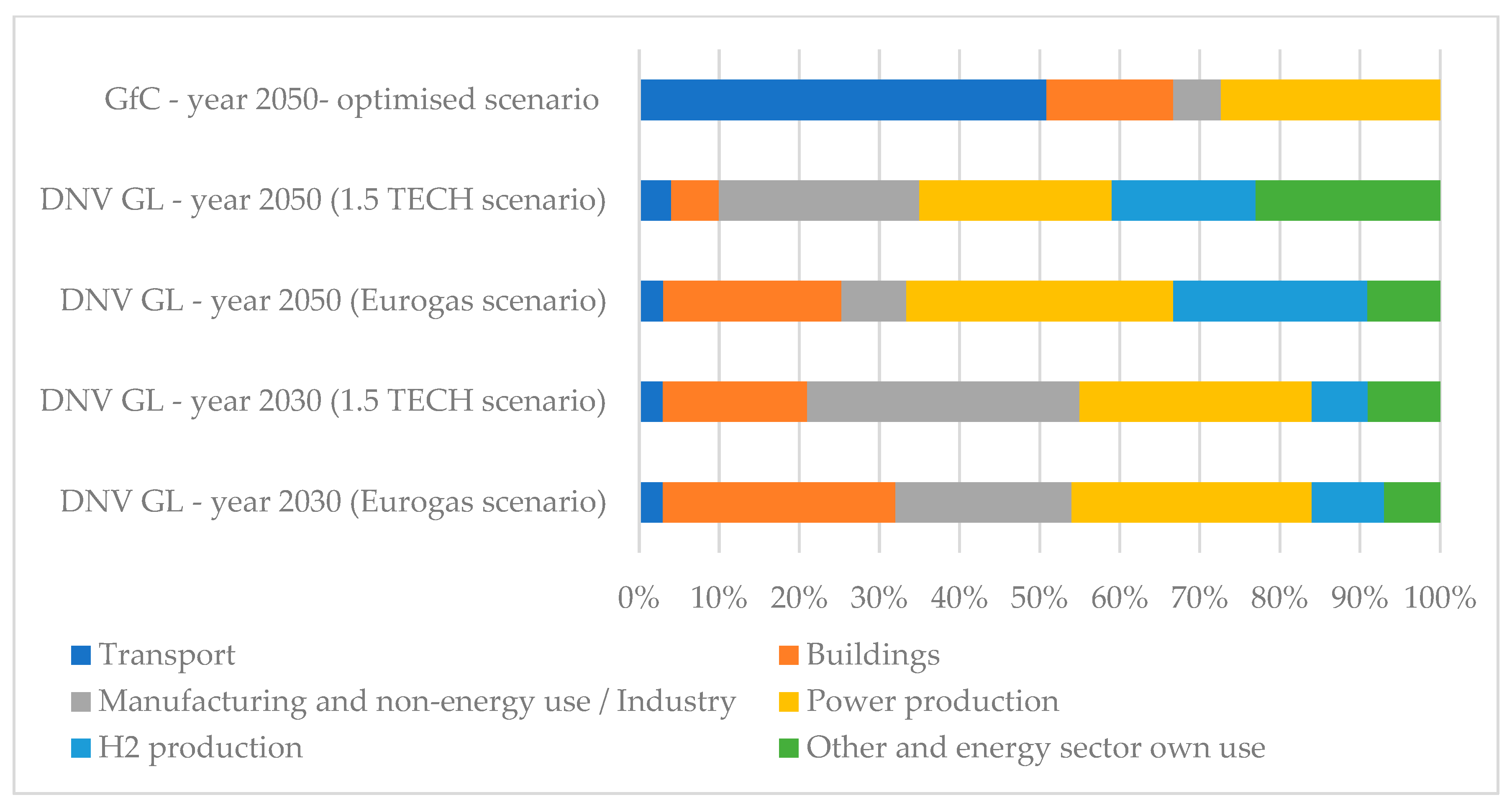

4.3. Potential Demand for the Biomethane

4.3.1. Demand for Biomethane—Applications and Market Conditions

4.3.2. Biomethane Demand Potential—Findings of Current Studies

5. Economics of Biomethane Production

5.1. Biogas Production

- Feedstock (In several papers, feedstock cost was excluded from OPEX its total distribution cost was presented) and transportation;

- Digestate managing;

- Heat and electricity;

- Labor;

- Maintenance and overhead (M&O);

- Insurance.

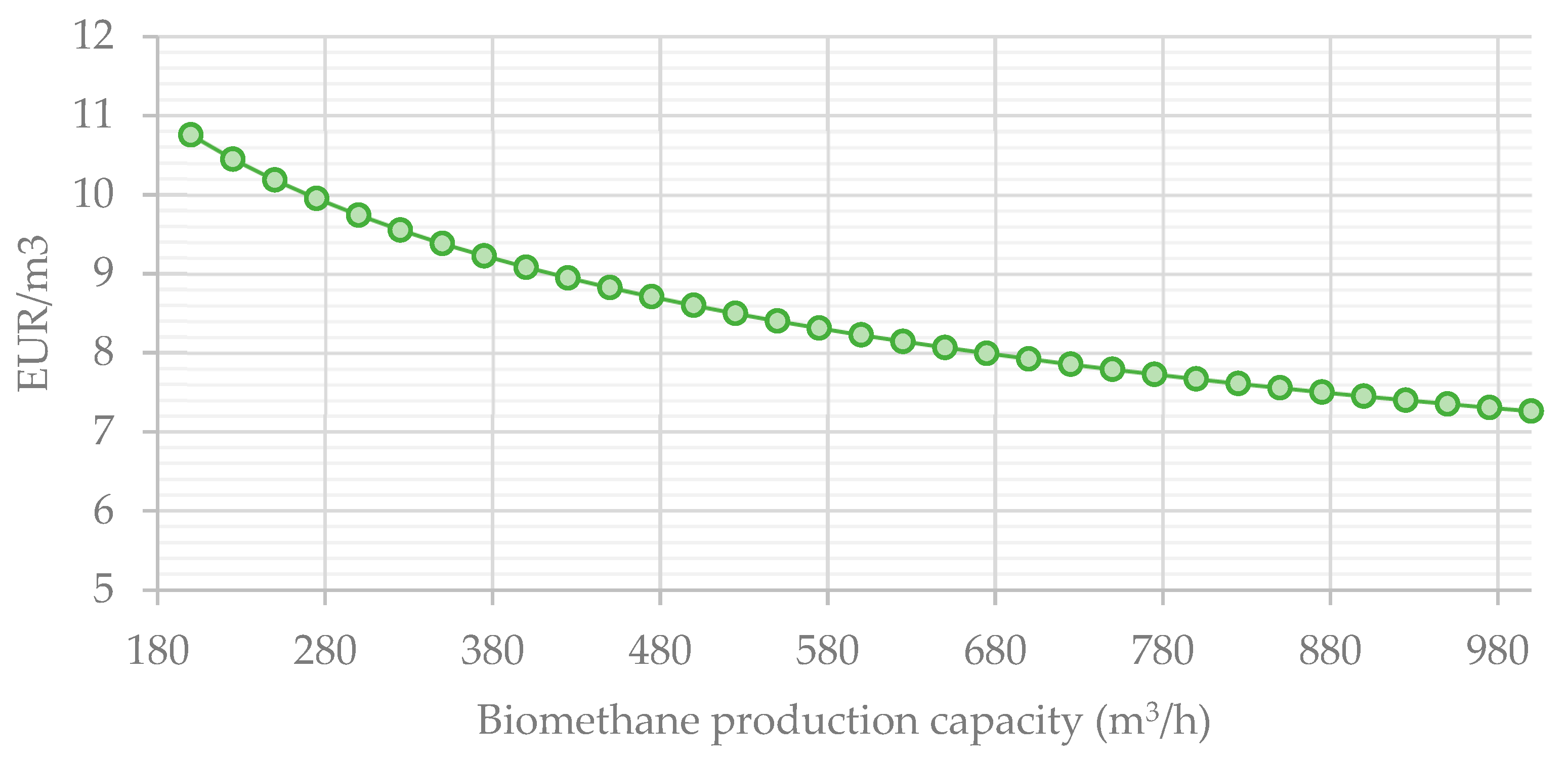

5.2. Biogas Upgrading

5.3. Total Costs of Biomethane Production

5.4. Biomethane Production by Gasification

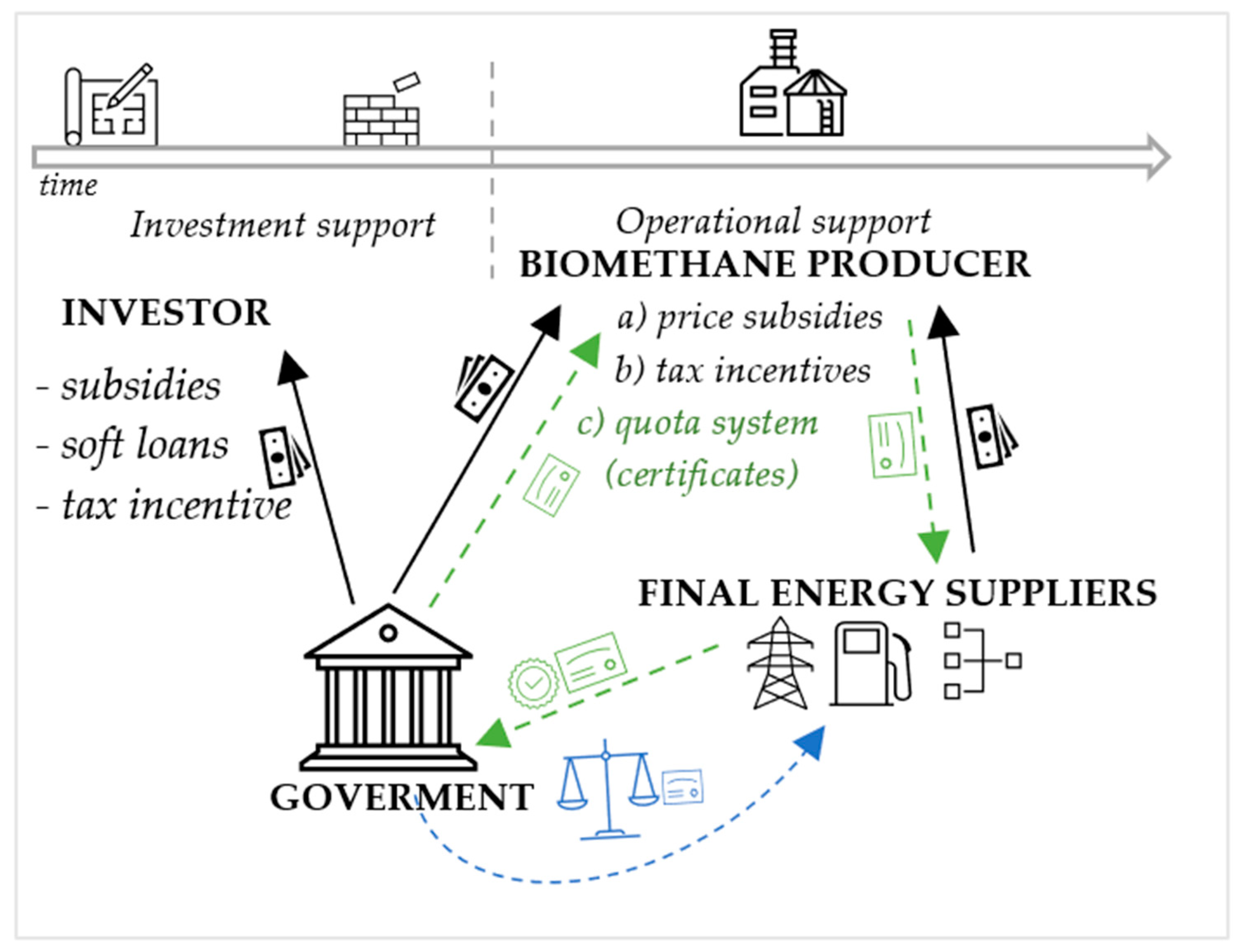

6. Biomethane Production Support Systems

6.1. Current EU Policy

6.2. The General Framework of Biomethane Support Schemes

- −

- Feedstock obtaining—support for the use of specific substrates (premies for manure utilization);

- −

- The production process itself (investment support, feed-in tariff for gas);

- −

- Biomethane final use—quota systems in particular sectors, bonuses for gas use in the transport sector.

- −

- One-off (usually investment support);

- −

- Operating subsidy for certain years.

6.3. Support Schemes in Selected EU Countries

6.3.1. Italy

6.3.2. Denmark

- −

- Price surcharge 1: Annually indexed surcharge;

- −

- Price surcharge 2: Adjusted for natural gas price;

- −

- Price surcharge 3: Reduced annually by 2 DKK/GJ from 1 January 2016.

6.3.3. Germany

6.3.4. France

6.3.5. Sweden

7. Conclusions

8. Policy Implication

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IPCC. Mitigation of Climate Change Climate Change 2022 Working Group III Contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC: Geneva, Switzerland, 2022. [Google Scholar]

- European Union: Energy System Restructuring towards a Long-Term Low-Emission Pathway Where Are We? Available online: https://unfccc.int/sites/default/files/resource/365_COMMIT%20Fact%20Sheet%20EU%20-%20a%20long-term%20low-emission%20pathway.pdf (accessed on 15 November 2022).

- Olhoff, A.; Christensen, J. Emissions Gap Report 2021. The Heat Is On. A World of Climate Promises Not yet Delivered; United Nations Environment Programme: Nairobi, Kenya, 2021. [Google Scholar]

- Kowalczyk-Juśko, A. Biogazownie i Instalacje Do Biometanu, Jako Element Dochodzenia Do Neutralności Emisyjnej, Poprawy Wizerunku Hodowli i Wsparcie w Budowie Obiektów Inwentarskich. In Wieprzowina—Nowa Perspektywa; Kowalski, A., Ed.; Związek Polskie Mięso: Warszawa, Poland, 2021. [Google Scholar]

- Fritsche, U.R.; Gress, H.W. Renewable Gas-Deployment, Markets and Sustainable Trade Summary Report of the IEA Bioenergy Intertask Project Renewable Gas: Deployment, Markets and Sustainable Trade Renewable Gas-Deployment, Markets and Sustainable Trade Summary Report of the IEA Bioenergy Intertask Project “Renewable Gas: Deployment, Markets and Sustainable Trade.” IEA Bioenergy. 2022. Available online: https://www.ieabioenergy.com/wp-content/uploads/2022/03/Fritsche-et-al-2022-IEA-Bioenergy-Renewable-Gas-Intertask-Summary-Report.pdf (accessed on 15 November 2022).

- European Biogas Association. EBA Statistical Report 2020; European Biogas Association: Brussels, Belgium, 2020; Available online: https://www.europeanbiogas.eu/wp-content/uploads/2021/01/EBA_StatisticalReport2020_abridged.pdf (accessed on 10 December 2022).

- Riley, D.M.; Tian, J.; Güngör-Demirci, G.; Phelan, P.; Rene Villalobos, J.; Milcarek, R.J. Techno-Economic Assessment of CHP Systems in Wastewater Treatment Plants. Environments 2020, 7, 74. [Google Scholar] [CrossRef]

- Grecchi, M.; Stroppa, S.; Baiocchi, F. Biomethane, the Green Molecule to Enable Energy Transition Challenges and Barriers of a Developing Market in Italy; Business Integration Partners: Milan, Italy, 2022. [Google Scholar]

- Eyl-Mazzega, M.-A.; Mathieu, C. Biogas and Biomethane in Europe: Lessons from Denmark, Germany and Italy, Études de l’Ifri; IFRI: Paris, France, 2019; Available online: https://www.ifri.org/sites/default/files/atoms/files/mathieu_eyl-mazzega_biomethane_2019.pdf (accessed on 10 December 2022).

- IEA. Outlook for Biogas and Biomethane 2020. Prospects for Organic Growth. Available online: https://iea.blob.core.windows.net/assets/03aeb10c-c38c-4d10-bcec-de92e9ab815f/Outlook_for_biogas_and_biomethane.pdf (accessed on 15 December 2022).

- Alberici, S.; Moultak, M.; Peters, J.; Guidehouse. The Future Role of Biomethane Gas for Climate, Gas for Climate 2021. Available online: https://gasforclimate2050.eu/wp-content/uploads/2021/12/The_future_role_of_biomethane-December_2021.pdf (accessed on 10 December 2022).

- Economic and Social Committee and the Committee of the Regions Repowereu: Joint European Action for More Affordable, Secure and Sustainable Energy. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_1511 (accessed on 15 November 2022).

- Koonaphapdeelert, S.; Aggarangsi, P.; Moran, J. Biomethane: Production and Applications; Springer: Singapore, 2020; ISBN 978-981-13-8306-9. [Google Scholar]

- IEA. World Energy Investment 2022; IEA: Paris, France, 2022; Available online: https://iea.blob.core.windows.net/assets/b0beda65-8a1d-46ae-87a2-f95947ec2714/WorldEnergyInvestment2022.pdf (accessed on 15 December 2022).

- Pelkmans, L. IEA Bioenergy Countries’ Report-Update 2021 Implementation of Bioenergy in the IEA Bioenergy Member Countries; IEA Bioenergy: Paris, France, 2021; Available online: https://www.ieabioenergy.com/wp-content/uploads/2021/11/CountriesReport2021_final.pdf (accessed on 15 December 2022).

- National Centre for Emission Management (KOBiZE). Poland’s National Inventory Report 2022 Gas Inventory for 1988–2020; Ministry of Climate and Environment: Warsaw, Poland, 2022. Available online: https://unfccc.int/documents/461818 (accessed on 15 December 2022).

- Berdechowski, K. Analysis of Biohydrogen Production Methods in Terms of GHG Emission Value. Naft.-Gaz 2019, 4, 230–235. [Google Scholar] [CrossRef]

- Holewa, J.; Kukulska-Zając, E.; Pęgielska, M. Analysis of the Possibility of Introducing Biogas into the Transmission Network. Naft. -Gaz 2012, 8, 523–529. [Google Scholar]

- Grządzielski, W.; Dziadowiec, M.; Blacharski, T. Planning the Development of a Distribution Gas Network Fuelled by Liquefied Natural Gas or Biogas. Rynek Energii 2017, 3, 77–84. [Google Scholar]

- Abdalla, N.; Bürck, S.; Fehrenbach, H.; Köppen, S.; Staigl, T.J. Biomethane in Europe; Institut für Energie und Umweltforschung Heidelberg GmbH: Heidelberg, Germany, 2022. [Google Scholar]

- Pfau, S.F.; Hagens, J.E.; Dankbaar, B. Biogas between Renewable Energy and Bio-Economy Policies—Opportunities and Constraints Resulting from a Dual Role. Energy Sustain. Soc. 2017, 7, 17. [Google Scholar] [CrossRef] [Green Version]

- Piechota, G.; Iglí Nski, B.; Zaborowicz, M.; Qiao, W. Biomethane in Poland—Current Status, Potential, Perspective and Development. Energies 2021, 14, 1517. [Google Scholar] [CrossRef]

- Pavičić, J.; Mavar, K.N.; Brkić, V.; Simon, K. Biogas and Biomethane Production and Usage: Technology Development, Advantages and Challenges in Europe. Energies 2022, 15, 2940. [Google Scholar] [CrossRef]

- Casasso, A.; Puleo, M.; Panepinto, D.; Zanetti, M. Economic Viability and Greenhouse Gas (Ghg) Budget of the Biomethane Retrofit of Manure-Operated Biogas Plants: A Case Study from Piedmont, Italy. Sustainability 2021, 13, 7979. [Google Scholar] [CrossRef]

- Alberici, S.; Grimme, W.; Toop, G. A Gas for Climate Report Feasibility of REPowerEU 2030 Targets, Production Potentials in the Member Biomethane Production Potentials in the EU; Gas for Climate: Utrecht, The Netherlands, 2022. [Google Scholar]

- Decorte, M.; Tessens, S.; Fernández, D.; Repullo, F.; McCarthy, P.; Oriordan, B.; Maggioni, L.; Pieroni, C.; Protas, M.; Rogulska, M.; et al. D6.1 Mapping the State of Play of Renewable Gases in Europe. 2020. Available online: https://www.regatrace.eu/wp-content/uploads/2020/02/REGATRACE-D6.1.pdf (accessed on 7 December 2022).

- Booth, A.; Sutton, A.; Papaioannou, D. Systematic Approaches to a Successful Literature Review; SAGE Publications: Los Angeles, CA, USA; London, UK; New Delhi, India; Singapore; Washington, DC, USA; Melbourne, Australia, 2016; ISBN 978-1-4739-1245-8. [Google Scholar]

- Szymańska, M.; Ahrends, H.E.; Srivastava, A.K.; Sosulski, T. Anaerobic Digestate from Biogas Plants—Nuisance Waste or Valuable Product? Appl. Sci. 2022, 12, 4052. [Google Scholar] [CrossRef]

- Hofmann, F.; Plättner, A.; Scholwin, F.; Kaltschmitt, M. Institute for Energy and Environment Möglichkeiten Der Einspeisung von Biogas in Das Österreichische Gasnetz. 2005. Available online: https://www.e-control.at/documents/1785851/1811042/studie-biogaseinspeisung-ife-2005.pdf/ (accessed on 15 November 2022).

- Wojnowska-Baryła, I.; Gołaszewski, J.; Bernat, K. Conversion of Waste from Agri-Food Industry to Biogas—A System Approach; Wydawnictwo Uniwersytetu Warmińsko-Mazurskiego w Olsztynie: Olsztyn, Poland, 2014. [Google Scholar]

- Agroenergetyki, I. Biogazownia w Twojej Gminie, Praktyczny Przewodnik Dla Pracowników Samorządu Terytorialnego; Instytut Agroenergetyki Sp. z o.o.: Warszawa, Poland, 2014. [Google Scholar]

- Angelidaki, I.; Treu, L.; Tsapekos, P.; Luo, G.; Campanaro, S.; Wenzel, H.; Kougias, P.G. Biogas Upgrading and Utilization: Current Status and Perspectives. Biotechnol. Adv. 2018, 36, 452–466. [Google Scholar] [CrossRef] [Green Version]

- Persson, M.; Jönsson, O.; Wellinger, A. Biogas Upgrading to Vehicle Fuel Standards and Grid Injection; Task 37; IEA Bioenergy: Paris, France, 2006; Available online: https://www.ieabioenergy.com/wp-content/uploads/2007/12/upgrading_report_final.pdf (accessed on 7 December 2022).

- Herout, M.; Malaták, J.; Kucera, L.; Dlabaja, T. Biogas Composition Depending on the Type of Plant Biomass Used. Res. Agric. Eng. 2011, 57, 137–143. [Google Scholar] [CrossRef] [Green Version]

- Moya, C.; Santiago, R.; Hospital-Benito, D.; Lemus, J.; Palomar, J. Design of Biogas Upgrading Processes Based on Ionic Liquids. Chem. Eng. J. 2022, 428, 132103. [Google Scholar] [CrossRef]

- Rasi, S. Biogas Composition and Upgrading to Biomethane; University of Jyväskylä: Jyväskylä, Finland, 2009; Available online: https://jyx.jyu.fi/bitstream/handle/123456789/20353/9789513936181.pdf?seque (accessed on 11 December 2022).

- Scholz, M.; Melin, T.; Wessling, M. Transforming Biogas into Biomethane Using Membrane Technology. Renew. Sustain. Energy Rev. 2013, 17, 199–212. [Google Scholar] [CrossRef]

- IEA Bioenergy. Membrane Up-Grading of Biogas to Biomethane for Grid Injection. Available online: https://www.ieabioenergy.com/wp-content/uploads/2018/01/success_bruck_austria2013.pdf (accessed on 7 December 2022).

- Towler, G.; Sinnott, R.K. Chemical Engineering Design—Principles, Practice and Economics of Plant and Process Design, 2nd ed.; Butterworth-Heinemann: Oxford, UK, 2013. [Google Scholar]

- Yoo, M.; Han, S.J.; Wee, J.H. Carbon Dioxide Capture Capacity of Sodium Hydroxide Aqueous Solution. J. Environ. Manag. 2013, 114, 512–519. [Google Scholar] [CrossRef]

- Augelletti, R.; Conti, M.; Annesini, M.C. Pressure Swing Adsorption for Biogas Upgrading. A New Process Configuration for the Separation of Biomethane and Carbon Dioxide. J. Clean Prod. 2017, P3, 1390–1398. [Google Scholar] [CrossRef]

- Bauer, F.; Persson, T.; Hulteberg, C.; Tamm, D. Biogas Upgrading—Technology Overview, Comparison and Perspectives for the Future. Biofuels Bioprod. Biorefining 2013, 7, 499–511. [Google Scholar] [CrossRef]

- Ryckebosch, E.; Drouillon, M.; Vervaeren, H. Techniques for Transformation of Biogas to Biomethane. Biomass Bioenergy 2011, 35, 1633–1645. [Google Scholar] [CrossRef]

- Hashemi, S.E.; Sarker, S.; Lien, K.M.; Schnell, S.K.; Austbø, B. Cryogenic vs. Absorption Biogas Upgrading in Liquefied Biomethane Production—An Energy Efficiency Analysis. Fuel 2019, 245, 294–304. [Google Scholar] [CrossRef]

- Calise, F.; Cappiello, F.L.; Cimmino, L.; D’accadia, M.D.; Vicidomini, M. A Review of the State of the Art of Biomethane Production: Recent Advancements and Integration of Renewable Energies. Energies 2021, 14, 4895. [Google Scholar] [CrossRef]

- Thieme, E.; Fischer, E.; Schuhmann, E.; Hofmann, J.; Janke, L.; Stur, M.; Manig, R.; Schmidt, T.; Raabe, T.; Becher, U.; et al. Coletânea de Publicações do Probiogás Série Desenvolvimento do Mercado de Biogás; Ministério das Cidades: Brasilia, Brazil, 2015. Available online: https://www.giz.de/en/downloads/probiogas-catalogo.pdf (accessed on 11 December 2022)ISBN 9788579580383.

- Sinigaglia, T.; Evaldo Freitag, T.; Machado, A.; Pedrozo, V.B.; Rovai, F.F.; Gondim Guilherme, R.T.; Metzka Lanzanova, T.D.; Dalla Nora, M.; Santos Martins, M.E. Current Scenario and Outlook for Biogas and Natural Gas Businesses in the Mobility Sector in Brazil. Int. J. Hydrogen Energy 2022, 47, 12074–12095. [Google Scholar] [CrossRef]

- Kruse, A. Hydrothermal Biomass Gasification. J Supercrit Fluids 2009, 47, 391–399. [Google Scholar] [CrossRef]

- Ardolino, F.; Arena, U. Biowaste-to-Biomethane: An LCA Study on Biogas and Syngas Roads. Waste Manag. 2019, 87, 441–453. [Google Scholar] [CrossRef]

- de Kam, M.J.; Vance Morey, R.; Tiffany, D.G. Biomass Integrated Gasification Combined Cycle for Heat and Power at Ethanol Plants. Energy Convers Manag. 2009, 50, 1682–1690. [Google Scholar] [CrossRef]

- van der Meijden, C.M.; Veringa, H.J.; Rabou, L.P.L.M. The Production of Synthetic Natural Gas (SNG): A Comparison of Three Wood Gasification Systems for Energy Balance and Overall Efficiency. Biomass Bioenergy 2010, 34, 302–311. [Google Scholar] [CrossRef]

- Li, H.; Larsson, E.; Thorin, E.; Dahlquist, E.; Yu, X. Feasibility Study on Combining Anaerobic Digestion and Biomass Gasification to Increase the Production of Biomethane. Energy Convers. Manag. 2015, 100, 212–219. [Google Scholar] [CrossRef]

- Searle, S.; Baldino, C.; Pavlenko, N. What Is the Role for Renewable Methane in European Decarbonization? The Growing Focus On Renewable Methane. 2018. Available online: https://theicct.org/sites/default/files/publications/Role_Renewable_Methane_EU_20181016.pdf (accessed on 12 December 2022).

- Jafri, Y.; Waldheim, L.; Consulting, W.; Lundgren, J. Emerging Gasification Technologies for Waste & Biomass; IEA Bioenergy, 2020. Available online: https://www.ieabioenergy.com/wp-content/uploads/2021/02/Emerging-Gasification-Technologies_final.pdf (accessed on 15 December 2022).

- Jaro, J.; Gräf, D.; Schimmel, M. A Gas for Climate Report Market State and Trends in Renewable and Low-Carbon Gases in Europe. Guidehouse Netherlands B.V.: Utrecht, The Netherlands, 2021; Available online: https://www.europeanbiogas.eu/wp-content/uploads/2021/12/Gas-for-Climate-Market-State-and-Trends-report-2021.pdf (accessed on 12 December 2022).

- Terlouw, W.; Peters, D.; van Tilburg, J.; Schimmel, M.; Berg, T.; Cihlar, J.; Mir, G.; Spöttle, M.; Lejaretta, A.V.; Buseman, M.; et al. Gas for Climate. The Optimal Role for Gas in a Net Zero Emissions Energy System; Navigant: Utrecht, The Netherlands, 2019. Available online: https://gasforclimate2050.eu/wp-content/uploads/2020/03/Navigant-Gas-for-Climate-The-optimal-role-for-gas-in-a-net-zero-emissions-energy-system-March-2019.pdf (accessed on 11 December 2022).

- European Union. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, The European Green Deal; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- United Nations. Paris Agreement; United Nations Framework Convention on Climate Change: Paris, France, 2015. [Google Scholar]

- Directorate-General for Energy (European Commission). Clean Energy for All Europeans; Directorate-General for Energy (European Commission): Luxembourg, 2019. [Google Scholar]

- European Union. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources. RED II; European Parliament and the EU Council: Brussels, Belgium, 2018. [Google Scholar]

- Zachmann, G.; Holz, F.; Roth, A.; McWilliams, B.; Sogalla, R.; Meissner, F.; Kemfert, C. Decarbonisation of Energy Determining a Robust Mix of Energy Carriers for a Carbon-Neutral EU STUDY Requested by the ITRE Committee; European Parliament: Luxembourg, 2021. [Google Scholar]

- European Union. Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 Establishing the Framework for Achieving Climate Neutrality and Amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’); The European Parliament and the Council of The European Union: Brussels, Belgium, 2021. [Google Scholar]

- European Union. Regulation (EU) 2018/1999 of the European Parliament and of the Council of 11 December 2018 on the Governance of the Energy Union and Climate Action; European Parliament and the EU Council: Brussels, Belgium, 2018. [Google Scholar]

- European Union. “Fit for 55”: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- European Union. Fit for 55—The EU’s Plan for a Green Transition—Consilium. Available online: https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/ (accessed on 8 January 2023).

- European Union. Proposal for a Directive of the European Parliament and of the Council Amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the European Parliament and of the Council as Regards the Promotion of Energy from Renewable Sources, and Repealing Council Directive (EU) 2015/652; European Parliament: Brussels, Belgium, 2021. [Google Scholar]

- BP. Full Report—Statistical Review of World Energy 2021; BP: London, UK, 2021. [Google Scholar]

- Schwartzkopff, J. The Future Role of Gas in a Climate-Neutral Europe. Report Based on the Discussions of an Expert Group Convened by the Heinrich-Böll-Stiftung European Union and Environmental Action Germany (Deutsche Umwelthilfe); Heinrich-Böll-Stiftung European Union and Environmental Action Germany (DUH): Brussels, Belgium, 2022; Available online: https://eu.boell.org/sites/default/files/2022-06/Future_role_of_gas_EU_FINAL.pdf (accessed on 16 December 2022).

- Birman, J.; Burdloff, J.; de Peufeilhoux, H.; Erbs, G.; Feniou, M.; Lucille, P.-L. Geographical Analysis of Biomethane Potential and Costs in Europe in 2050: Potential and Cost in 2050. ENGIE. 2021. Available online: https://www.engie.com/sites/default/files/assets/documents/2021-07/ENGIE_20210618_Biogas_potential_and_costs_in_2050_report_1.pdf (accessed on 11 December 2022).

- European Commission. Proposal for a Directive of the European Parliament and of the Council on Common Rules for the Internal Markets in Renewable and Natural Gases and in Hydrogen; COM(2021) 803 final; European Commission: Brussels, Belgium, 2021; Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:2f4f56d6-5d9d-11ec-9c6c-01aa75ed71a1.0001.02/DOC_1&format=PDF (accessed on 5 January 2023).

- European Commission. Commission Proposes New EU Framework to Decarbonise Gas Markets, Promote Hydrogen and Reduce Methane Emissions. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_6682 (accessed on 5 January 2023).

- Nevzorova, T.; Kutcherov, V. Barriers to the Wider Implementation of Biogas as a Source of Energy: A State-of-the-Art Review. Energy Strategy Rev. 2019, 26, 100414. [Google Scholar] [CrossRef]

- European Union. Proposal for a Regulation of the European Parliament and of the Council on the Internal Markets for Renewable and Natural Gases and for Hydrogen (Recast); European Parliament the Eu Council: Brussels, Belgium, 2021. [Google Scholar]

- Raimondi, P.; Bianchi, M. Energy Unity or Breakup? The EU at a Crossroads. IAI Comment. 2022. Available online: https://www.iai.it/en/pubblicazioni/energy-unity-or-breakup-eu-crossroads (accessed on 5 January 2023).

- IEA. National Reliance on Russian Fossil Fuel Imports—Analysis. Available online: https://www.iea.org/reports/national-reliance-on-russian-fossil-fuel-imports/which-countries-are-most-reliant-on-russian-energy (accessed on 4 January 2023).

- Anderson, R.J. Europe’s Dependence on Russian Natural Gas: Perspectives and Recommendations for a Long-Term Strategy. 2008. Available online: https://www.marshallcenter.org/en/publications/occasional-papers/europes-dependence-russian-natural-gas-perspectives-and-recommendations-long-term-strategy-0 (accessed on 5 January 2023).

- Eurostat from Where Do We Import Energy? Available online: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html (accessed on 8 January 2023).

- European Union. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions Repowereu Plan; European Commission: Brussels, Belgium, 2022. [Google Scholar]

- European Union. Commission Staff Working Document Implementing the Repower eu Action Plan: Investment Needs, Hydrogen Accelerator and Achieving the Bio-Methane Targets; European Commission: Brussels, Belgium, 2022. [Google Scholar]

- IGU. Global Renewable and Low-Carbon Gas Report 2021; IGU: Egham, UK, 2021. [Google Scholar]

- Czekała, W.; Dach, J.; Jasiński, T.; Kolasiński, M.; Kowalczyk-Jusko, A.; Kulesa, M.; Majchrzak, H.; Orzech, A.; Piechota, G.; Pituła, M.; et al. Raport Biogaz w Polsce 2022; Magazyn Biomasa: Poznań, Poland, 2022. [Google Scholar]

- European Biogas Association. EBA Statistical Report 2021; European Biogas Association: Brussels, Belgium, 2021; Available online: https://www.europeanbiogas.eu/wp-content/uploads/2021/11/EBA-STATISTICAL-REPORT-2021-SHORT-VERSION.pdf (accessed on 10 December 2022).

- Cozzi, L.; Gould, T.; Bouckaert, S.; Coppel, J.; McGlade, C.; Spencer, T.; Wanner, B.; Wetzel, D. World Energy Outlook 2022. DVN: Høvik, Norway, 2022. [Google Scholar]

- Liebetrau, J.; Fritsche, U.; Gress, H.W. Biomethane-Factors for a Successful Sector Development. Synthesis Report of WP1 of the IEA Bioenergy Intertask Project “Renewable Gas: Deployment, Markets and Sustainable Trade” Biomethane-Factors for a Successful Sector Development Synthesis. Report of WP1 of the IEA Bioenergy Intertask Project Renewable Gas-Deployment, Markets and Sustainable Trade. Available online: https://www.ieabioenergy.com/wp-content/uploads/2022/03/IEA-Bioenergy-Renewable-Gas-Intertask-WP1-Synthesis-report_2021.pdf (accessed on 5 December 2022).

- ten Kate, W.; van den Noort, A.; Vos, M.; Özgün, O. European Carbon Neutrality: The Importance of Gas—A Study for Eurogas Report No. OGNL.180049. 2020. Available online: https://www.europeangashub.com/wp-content/uploads/2020/07/DNV-GL-Eurogas-Report-Reaching-European-Carbon-Neutrality-Full-Report.pdf (accessed on 10 December 2022).

- Moraga, J.L.; Mulder, M.; Perey, P. Future Markets for Renewable Gases and Hydrogen. What Would Be the Optimal Regulatory Provisions? CERRE. 2019. Available online: https://cerre.eu/wp-content/uploads/2020/05/cerre_report_future_markets_for_renewable_gases_and_hydrogen.pdf (accessed on 5 December 2022).

- European Union. In-Depth Analysis in Support of the Commission Communication Com(2018) 773: A Clean Planet for All—A European Long-Term Strategic Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy; European Union: Brussels, Belgium, 2018; Available online: https://climate.ec.europa.eu/system/files/2018-11/com_2018_733_analysis_in_support_en.pdf (accessed on 5 December 2022).

- Kampman, B.; Leguijt, C.; Scholten, T.; Tallat-Kelpsaite, J.; Brückman, R.; Maroulis, G.; Lesschen, J.P.; Meesters, K.; Sikirica, N.; Elbersen, B. Optimal Use of Biogas from Waste Streams. An Assessment of the Potential of Biogas from digestion in the EU beyond 2020. European Commission. 2016. Available online: https://energy.ec.europa.eu/system/files/2017-03/ce_delft_3g84_biogas_beyond_2020_final_report_0.pdf (accessed on 5 December 2022).

- Magness, J. European Renewables an Increasingly Attractive Environment. EDISON. 2022. Available online: https://d3s3shtvds09gm.cloudfront.net/cba8c7214608d417d09a53879af95334.pdf (accessed on 10 December 2022).

- IEA. Scaling up Biomethane in the European Union: Background Paper. Available online: https://iea.blob.core.windows.net/assets/9c38de0b-b710-487f-9f60-f19d0bf5152a/IEAWorkshop_Scalingupbiomethane_backgroundpaper.pdf (accessed on 12 November 2022).

- IRENA Global Energy Transformation. Available online: https://irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition (accessed on 12 August 2020).

- Peng, W.; Pivato, A. Sustainable Management of Digestate from the Organic Fraction of Municipal Solid Waste and Food Waste Under the Concepts of Back to Earth Alternatives and Circular Economy. Waste Biomass Valorizat. 2019, 10, 465–481. [Google Scholar] [CrossRef]

- Ricardo Energy & Environment. Assessment of Cost and Benefits of Biogas and Biomethane in Ireland; Ricardo Energy & Environment: Dublin, Ireland, 2017; Available online: https://www.seai.ie/publications/Assessment-of-Cost-and-Benefits-of-Biogas-and-Biomethane-in-Ireland.pdf (accessed on 12 August 2020).

- Mertins, A.; Wawer, T. How to Use Biogas? A Systematic Review of Biogas Utilization Pathways and Business Models. Bioresour. Bioprocess. 2022, 9, 59. [Google Scholar] [CrossRef]

- Labriet, M.; Tosato, G. Biogas and Bio-Syngas Production. Available online: https://iea-etsap.org/E-TechDS/PDF/P11_BiogasProd_ML_Dec2013_GSOK.pdf (accessed on 5 December 2022).

- Liberti, F.; Pistolesi, V.; Mouftahi, M.; Hidouri, N.; Bartocci, P.; Massoli, S.; Zampilli, M.; Fantozzi, F. An Incubation System to Enhance Biogas and Methane Production: A Case Study of an Existing Biogas Plant in Umbria, Italy. Processes 2019, 7, 925. [Google Scholar] [CrossRef] [Green Version]

- Mao, C.; Feng, Y.; Wang, X.; Ren, G. Review on Research Achievements of Biogas from Anaerobic Digestion. Renew. Sustain. Energy Rev. 2015, 45, 540–555. [Google Scholar] [CrossRef]

- McKendry, P. Overview of Anaerobic Digestion and Power and Gas to Grid Plant CAPEX and OPEX Costs Citation: McKendry P (2019) Overview of Anaerobic Digestion and Power and Gas to Grid Plant CAPEX and OPEX Costs. Int. J. Bioprocess. Biotech. Rev. Artic. McKendry P. Int. J. Bioprocess. Biotech 2018, 2, 109. [Google Scholar] [CrossRef]

- Huseby, H.H. Biogas Upgrading: Techno-Economic Evaluation of Different Technologies Based on Norwegian Potential of Raw Materials. Master’s Thesis, Norwegian University of Life Sciences, Ås, Norway.

- Bortoluzzi, G.; Gatti, M.; Sogni, A.; Consonni, S. Biomethane Production from Agricultural Resources in the Italian Scenario: Techno-Economic Analysis of Water Wash. Chem. Eng. 2014, 37, 259–264. [Google Scholar] [CrossRef]

- Stürmer, B.; Kirchmeyr, F.; Kovacs, K.; Hofmann, F.; Collins, D.; Ingremeau, C.; Stambasky, J. Deliverable: Technical-Economic Analysis for Determining the Feasibility Threshold for Tradable Biomethane Certificates D3.4. European Biogas Association—BIOSURF. 2016. Available online: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5aa5ba7aa&appId=PPGMS (accessed on 12 December 2022).

- Havrysh, V.; Kalinichenko, A.; Mentel, G.; Olejarz, T. Commercial Biogas Plants: Lessons for Ukraine. Energies 2020, 13, 2668. [Google Scholar] [CrossRef]

- Tsiropoulos, I.; Hoefnagels, R.; de Jong, S.; van den Broek, M.; Patel, M.; Faaij, A. Emerging Bioeconomy Sectors in Energy Systems Modeling—Integrated Systems Analysis of Electricity, Heat, Road Transport, Aviation, and Chemicals: A Case Study for the Netherlands. Biofuels Bioprod. Biorefining 2018, 12, 665–693. [Google Scholar] [CrossRef]

- Teferra, D.M.; Wubu, W. Biogas for Clean Energy. In Anaerobic Digestion; Rajesh Banu, J., Ed.; InTechOpen: London, UK, 2018; Available online: https://www.intechopen.com/chapters/62959 (accessed on 5 December 2022). [CrossRef] [Green Version]

- Heiker, M.; Kraume, M.; Mertins, A.; Wawer, T.; Rosenberger, S. Biogas Plants in Renewable Energy Systems—A Systematic Review of Modeling Approaches of Biogas Production. Appl. Sci. 2021, 11, 3361. [Google Scholar] [CrossRef]

- Lawson, N.; Alvarado-Morales, M.; Tsapekos, P.; Angelidaki, I. Techno-Economic Assessment of Biological Biogas Upgrading Based on Danish Biogas Plants. Energies 2021, 14, 8252. [Google Scholar] [CrossRef]

- Hoyer, K.; Hulteberg, C.; Svensson, M.; And, J.J.; Nørregård, Ø. Biogas Upgrading-Technical Review; 2016. Available online: https://lup.lub.lu.se/search/publication/9e1c64bd-efe6-4cc4-88d5-c79eab06fcc5 (accessed on 5 December 2022).

- Vo, T.T.Q.; Wall, D.M.; Ring, D.; Rajendran, K.; Murphy, J.D. Techno-Economic Analysis of Biogas Upgrading via Amine Scrubber, Carbon Capture and Ex-Situ Methanation. Appl. Energy 2018, 212, 1191–1202. [Google Scholar] [CrossRef]

- Paturska, A.; Repele, M.; Bazbauers, G. Economic Assessment of Biomethane Supply System Based on Natural Gas Infrastructure. Energy Procedia 2015, 72, 71–78. [Google Scholar] [CrossRef] [Green Version]

- Angelidaki, I.; Xie, L.; Luo, G.; Zhang, Y.; Oechsner, H.; Lemmer, A.; Munoz, R.; Kougias, P.G. Biogas Upgrading: Current and Emerging Technologies. Biofuels Altern. Feed. Convers. Process. Prod. Liq. Gaseous Biofuels 2019, 817–843. [Google Scholar] [CrossRef]

- Ea Energy Analyses. Biogas Og Andre VE Braendstoffer Til Tung Transport. Analyse Af Muligheder Og Udfordringer Ved Udfasning Af Fossile Brændsler. 2016. Available online: https://ens.dk/sites/ens.dk/files/Bioenergi/biogas_og_anden_ve_til_tung_transport.pdf (accessed on 10 December 2022).

- European Biogas Association. EBA Statistical Report 2022; European Biogas Association: Brussels, Belgium, 2022; Available online: https://www.europeanbiogas.eu/wp-content/uploads/2022/12/EBA-Statistical-Report-2022_-Short-version.pdf (accessed on 10 December 2022).

- ENEA. Renforcer La Compétitivité de La Filière Biométhane Française: De Nombreux Leviers Activables à Court et Moyen Termes; ENEA: Paris, France, 2018; Available online: https://www.enea-consulting.com/static/2c384b567e2a1180be38aebfec309344/enea-renforcer-la-competitivite-de-la-filiere-biomethane-francaise.pdf (accessed on 12 December 2022).

- European Union. Communication from the Commission Guidelines on State Aid for Climate, Environmental Protection and Energy 2022; European Commission: Brussels, Belgium, 2022. [Google Scholar]

- European Union. Communication from the Commission Temporary Crisis Framework for State Aid Measures to Support the Economy Following the Aggression against Ukraine by Russia; European Commission: Brussels, Belgium, 2022. [Google Scholar]

- Couture, T.D.; Cory, K.; Kreycik, C.; Williams, E. Technical Report: A Policymaker’s Guide to Feed-in Tariff Policy Design; 2010. Available online: https://www.nrel.gov/docs/fy10osti/44849.pdf (accessed on 12 December 2022).

- Menanteau, P.; Finon, D.; Lamy, M.L. Prices versus Quantities: Choosing Policies for Promoting the Development of Renewable Energy. Energy Policy 2003, 31, 799–812. [Google Scholar] [CrossRef]

- EurObserv’ER. Country Policy Profile Croatia. Log File of Changes in Support Policies as Compared to Latest Member State Progress Report. Available online: https://www.eurobserv-er.org/pdf/res-policy/EurObservER-RES-Policy-Report-Country-Profile-2014-10-Croatia.pdf (accessed on 12 December 2022).

- European Union. State Aid SA.48424 2017/N Support Scheme for Advanced Biomethane and Other Advanced Biofuels for Use in Transport in Italy; European Commission: Brussels, Belgium, 2017; Available online: https://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_48424 (accessed on 12 December 2022).

- European Union. State Aid SA.36659 2013/N Aid for All Forms of Biogas Use—B; European Commission: Brussels, Belgium, 2015. [Google Scholar]

- Dano, J. New Record for Biogas in the Gas System in 2021. Available online: https://en.energinet.dk/About-our-news/News/2022/01/07/New-record-biogas/ (accessed on 5 January 2023).

- Yuxia, Y.; Ryssel, M.; Scholwin, F.; Grope, J.; Clinkscales, A.; Bowe, S. Biomethane Production and Grid Injection: German Experiences, Policies, Business Models and Standards; National Energy Administration: Beijing, China; Berlin, Germany, 2020. Available online: https://www.energypartnership.cn/fileadmin/user_upload/china/media_elements/publications/Biomethane_German_Experience_Study_EN_Final.pdf (accessed on 5 January 2023).

- Reizine, S. Biomethane Injection in France; Ministère de l’Ecologie. du Développement durable et de l’Energie: Paris, France, 2015. [Google Scholar]

- European Commission. Statligt Stöd SA. 43302 (2015/N)—Sverige—Skattebefrielser För Biogas Som Används Som Motorbränsle. 2015. Available online: https://ec.europa.eu/competition/state_aid/cases/260835/260835_1759154_146_2.pdf (accessed on 5 January 2023).

- Natural Gas Supply Statistics—Statistics Explained. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Natural_gas_supply_statistics (accessed on 8 February 2023).

| Membrane Separation | Water Scrubbing | Organic Solvent Scrubbing | Chemical Scrubbing | PSA | Cryogenic | |

|---|---|---|---|---|---|---|

| The basis of the operation | Differences in the solubility and permeability of different gases through the membrane | Different solubility levels of gases in water | Different solubility levels of gases in an organic solvent | Amine-based solvent absorbs and chemically reacts with CO2 | CO2 adsorption with, e.g., activated carbon, zeolite, or silica gel | Different liquefaction and solidification temperatures |

| Consumption of raw biogas (kWh/Nm3) | 0.18–0.20 | 0.25–0.3 | 0.2–0.3 | 0.05–0.15 | 0.23–0.30 | 0.76 |

| Energy requirement | Medium | Medium | High | High | Medium | High |

| Heat demand (°C) | 55–80 | 120–160 | −110 | |||

| Final CH4 concentration (%) | 92–98 | 80–99 | >97 | 95–99 | 96–98 | 96–98 |

| CH4 losses (%) | 1–9 | 0.5–2 | 1–4 | <0.1 | 1–8 | 2 |

| Pre-purification | Recommended | Recommended | Recommended | Recommended | Recommended | Recommended |

| Operation pressure (bar) | 5–20 | 4–10 | 4–8 | 1.01325 | 3–10 | 80 |

| Cost | High | Medium | Medium | High | Medium | High |

| Other | Multiple modules are required for high efficiency | Biomethane drying is required | High energy needs for solvent regeneration | Possible reaction between O2 and amines, high corrosion rates | Complicated process control | Potential for producing liquefied biomethane |

| Share in the market (%) | 27 | 37 | 19 | 15 | 2 | |

| Proposals | Significance for the Biomethane Market |

|---|---|

| RES share from 32 to 40% by 2030, The share of advanced biofuels and biogas (produced from Annex IX substrates) in total energy supplied to the transport sector is expected to be 2.2% in 2030) | Without a significant increase in the share of biomethane, targets in the heating and transport sectors will be difficult to meet [25,68] |

| 49% of energy use from renewable sources by 2030 in buildings; 1.1 p.p. annual increase in the use of RES in industry | Biomethane can be a valuable source of energy in the:

|

Strengthened sustainability criteria for biomass:

| Due to the woody biomass supply possible decrease, biogas upgrading might be a dominant biomethane-obtaining technology [10,56,69] |

| Source | Study/Scenario | Date of Publication | Biomethane Potential (TWh) | |

|---|---|---|---|---|

| 2030 | 2050 | |||

| Gas for Climate | Biomethane production potentials in the Member States and outlook to 2050. | 2022 | 404 | 1039 |

| Gas for Climate | The optimal role for gas in net-zero emissions energy system. Navigant. | 2019 | 370 | 1010 |

| CE Delft, Eclareon, Wageningen Research—“Growth Scenario” | Optimal use of biogas from waste streams. An assessment of the potential of biogas from digestion in the EU beyond 2020 | 2016 | 335 | - |

| CE Delft, Eclareon, Wageningen Research—“Accelerated growth scenario.” | Optimal use of biogas from waste streams. An assessment of the potential of biogas from digestion in the EU beyond 2020 | 2016 | 467 | - |

| EC—2030 | In-Depth Analysis In Support Of The Commission Communication COM (2018) 773. A Clean Planet for all A European long-term strategic vision for a prosperous, modern, competitive, and climate neutral economy | 2018 | 349 | - |

| EC—Energy Efficiency Scenario | In-Depth Analysis in Support of The Commission Communication Com(2018) 773. A Clean Planet for all A European long-term strategic vision for a prosperous, modern, competitive, and climate neutral economy | 2018 | - | 523 |

| EC—P2X scenario | In-Depth Analysis in Support of The Commission Communication COM(2018) 773 A Clean Planet for all A European long-term strategic vision for a prosperous, modern, competitive, and climate-neutral economy | 2018 | - | 919 |

| ENGIE | Geographical analysis of biomethane potential and costs in Europe in 2050 | 2021 | 1495 | |

| ICCT (The International Council on Clean Transportation) | What is the role of renewable methane in European decarbonization | 2018 | - | 382 |

| DNV-GL | European Carbon Neutrality: The importance of Gas. A study for Eurogas. | 2020 | - | 1008 |

| IEA | Outlook for biogas and biomethane. Prospects for organic growth—year 2040 | 2020 | - | year 2040: 1248 (EU); 1700 (total Europe) |

| Centre on Regulation in Europe | Future markets for renewable gases and hydrogen. What would be the optimal regulatory provisions? | 2019 | ~1300 TWh (without indication-specific year) | |

| CAPEX | OPEX |

|---|---|

1. Biomethane production

| 1. Biomethane production

|

| Production Scale (Nm3/h) | Average Investment Cost MEUR2015 | Capital Cost Level (EUR2015/MWh of Production) |

|---|---|---|

| Small (to 500) | ≈1.5 | 25–35 |

| Medium (500–800) | 3.10–5.86 2.8–4.3 | 20 |

| Large (above 800) | 7.5–9.89 | 15 |

| Biogas Upgrading Method | The Equation for Calculation of the Specific Investment (x—Biogas Input Flow in m3/h; y—Investment Cost in EUR | R Squared |

|---|---|---|

| Water scrubbing | y = 980,693x−0.991 | 0.86 |

| Amine scrubbing | y = 239,254x−0.696 | 0.99 |

| Membrane separation | y = 81,046x−0.534 | 0.98 |

| Physical scrubbing | y = 980,693x−0.991 | 0.86 |

| Pressure swing adsorption | y = 185,034x−0.67 | 0.98 |

| Upgrading Technology | Capacity (Nm3 CH4/h) | CAPEX (EUR/(Nm3 CH4/h)) | OPEX (EUR/(Nm3 CH4/h)) | Source | Comments |

|---|---|---|---|---|---|

| Water scrubbing | 2000–~100 | ~1000–5000 | n.d. | Vo et al., 2018 | - |

| 80 | 2300 | 1750 | Stürmer et al. 2016 | including injection | |

| 500 | 734 | 1026 | Stürmer et al. 2016 | including injection | |

| Amine scrubbing | 800 | 1936 | n.d. | Vo et al., 2018 | - |

| ~600–~1800 | ~3200–1800 | n.d. | Vo et al., 2018 | - | |

| 80 | 2038 | 1862.5 | Stürmer et al. 2016 | including injection | |

| 500 | 832 | 1376 | including injection | ||

| Membrane separation | 80 | 1812.5 | 1750 | including injection | |

| 500 | 798 | 1324 | including injection | ||

| Pressure swing adsorption | 80 | 2237.5 | 1512.5 | including injection | |

| 500 | 826 | 1114 | including injection | ||

| Biological metanation | 800 | ~3900 | - | Vo et al., 2018 | - |

| Amine + biological Methanation | 800 | ~5000 | - | Vo et al., 2018 | - |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sulewski, P.; Ignaciuk, W.; Szymańska, M.; Wąs, A. Development of the Biomethane Market in Europe. Energies 2023, 16, 2001. https://doi.org/10.3390/en16042001

Sulewski P, Ignaciuk W, Szymańska M, Wąs A. Development of the Biomethane Market in Europe. Energies. 2023; 16(4):2001. https://doi.org/10.3390/en16042001

Chicago/Turabian StyleSulewski, Piotr, Wiktor Ignaciuk, Magdalena Szymańska, and Adam Wąs. 2023. "Development of the Biomethane Market in Europe" Energies 16, no. 4: 2001. https://doi.org/10.3390/en16042001