A Resampling Slack-Based Energy Efficiency Analysis: Application in the G20 Economies

Abstract

:1. Introduction

2. Super-SBM Model

2.1. The Triangular Distribution

2.2. Data Processing

2.3. How to Determine Error Rate of p and q

- (1)

- Let (t = 1, 2,…, T; k = 1, 2,…, n) be the past t periods data for a certain input or output, where T is the current (latest) period;

- (2)

- Compare with ;

- (3)

- Evaluate error variation rates of the lower (upper) bond () for the period t.

2.4. Estimating through Historical Data

2.5. Lucas Weight

2.6. Super-SBM Model

- x: inputs of labor (i = 1, 2, , m)

- e: inputs of energy (r = 1, 2, , f)

- : outputs of GDP (j = 1, 2, , o)

- : outputs of CO2 (u = 1, 2, , g)

- Super-efficiency scores of (,):

- (a)

- We first calculate the super-SBM efficiency value in the last period’s

- (b)

- Then, we build the confidence interval through the iteration of historical data (,)

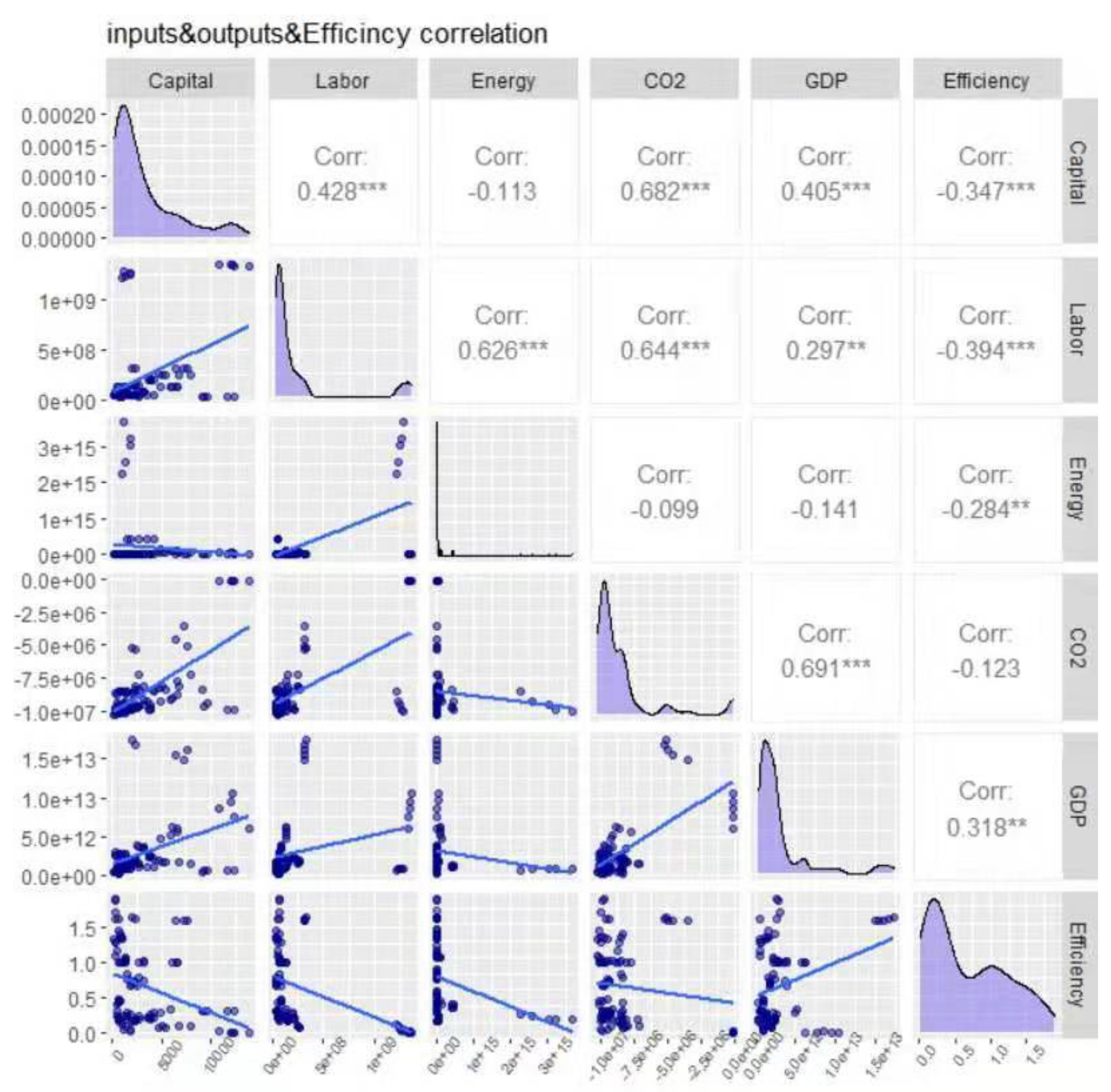

3. Estimation of Energy Efficiency: Super-SBM Model

4. Further Estimates of Energy Efficiency: Past-Present Model with Resampling

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Sueyoshi, T.; Goto, M. Returns to scale and damages to scale with strong complementary slackness conditions in DEA assessment: Japanese corporate effort on environment protection. Energy Econ. 2012, 34, 1422–1434. [Google Scholar] [CrossRef]

- Hong, L.; Zhou, N.; Fridley, D.; Raczkowski, C. Assessment of China’s renewable energy contribution during the 12th Five Year Plan. Energy Policy 2013, 62, 1533–1543. [Google Scholar] [CrossRef]

- Song, M.L.; Zhang, L.L.; Liu, W.; Fisher, R. Bootstrap-DEA analysis of BRICS’ energy efficiency based on small sample data. Appl. Energy 2013, 112, 1049–1055. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Meta froniter energy efficiency with CO2 emissions and its convergence analysis for China. Energy Econ. 2015, 48, 230–241. [Google Scholar] [CrossRef]

- Chiu, Y.H.; Shyu, M.K.; Lee, J.H.; Lu, C.C. Undesirable output in efficiency and productivity: Example of the G20 countries. Energy Sources Part B Econ. Plan. Policy 2016, 11, 237–243. [Google Scholar] [CrossRef]

- Guo, X.; Lu, C.C.; Lee, J.H.; Chiu, Y.H. Applying the dynamic DEA model to evaluate the energy efficiency of OECD countries and China. Energy 2017, 134, 392–399. [Google Scholar] [CrossRef]

- Fernández, D.; Pozo, C.; Folgado, R.; Jiménez, L.; Guillén-Gosálbez, G. Productivity and energy efficiency assessment of existing industrial gases facilities via data envelopment analysis and the Malmquist index. Appl. Energy 2018, 212, 1563–1577. [Google Scholar] [CrossRef]

- Antonietti, R.; Fontini, F. Does energy price affect energy efficiency? Cross-country panel evidence. Energy Policy 2019, 129, 896–906. [Google Scholar] [CrossRef]

- Qi, S.; Peng, H.; Zhang, X.; Tan, X. Is energy efficiency of Belt and Road Initiative countries catching up or falling behind? Evidence from a panel quantile regression approach. Appl. Energy 2019, 253, 113581. [Google Scholar] [CrossRef]

- Farrell, M.J. The measurement of productive efficiency. J. R. Stat. Soc. 1957, 120, 253–281. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Hsieh, J.C.; Ma, L.H.; Chiu, Y.H. Assessing China’s Use Efficiency of Water Resources from the Resampling Super Data Envelopment Analysis Approach. Water 2019, 11, 1069. [Google Scholar] [CrossRef] [Green Version]

- Tone, K.A. Slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef] [Green Version]

- Tone, K.A. Slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef] [Green Version]

- Tone, K.; Quenniche, J. DEA scores’ confidence intervals with past-present and past-present-future based resampling. Am. J. Oper. Res. 2016, 6, 121–135. [Google Scholar] [CrossRef] [Green Version]

- Simar, L.; Wilson, P.W. Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Manag. Sci. 1998, 44, 49–61. [Google Scholar] [CrossRef] [Green Version]

- Simar, L.; Wilson, P.W. A general methodology for bootstrapping in non-parametric frontier models. J. Appl. Stat. 2000, 27, 779–802. [Google Scholar] [CrossRef]

- Tone, K. Resampling in DEA; National Graduate Institute for Policy Studies: Tokyo, Japan, 2013. [Google Scholar]

- Fang, H.H.; Lee, H.S.; Hwang, S.N.; Chung, C.C. A slacks-based measure of super-efficiency in data envelopment analysis: An alternative approach. Omega 2013, 41, 731–734. [Google Scholar] [CrossRef]

- Arabi, B.; Munisamy, S.; Emrouznejad, A. A new slacks-based measure of Malmquist–Luenberger index in the presence of undesirable outputs. Omega 2015, 51, 29–37. [Google Scholar] [CrossRef] [Green Version]

- Lozano, S.; Gutiérrez, E. Slacks-based measure of efficiency of airports with airplanes delays as undesirable outputs. Comput. Oper. Res. 2011, 38, 131–139. [Google Scholar] [CrossRef]

- Chiu, Y.H.; Chen, Y.C.; Bai, X.J. Efficiency and risk in Taiwan banking: SBM super-DEA estimation. Appl. Econ. 2011, 43, 587–602. [Google Scholar] [CrossRef]

- Li, H.; Shi, J. Energy efficiency analysis on Chinese industrial sectors: An improved Super-SBM model with undesirable outputs. J. Clean. Prod. 2014, 65, 97–107. [Google Scholar] [CrossRef]

- Du, H.; Matisoff, D.C.; Wang, Y.; Liu, X. Understanding drivers of energy efficiency changes in China. Appl. Energy 2016, 184, 1196–1206. [Google Scholar] [CrossRef]

- Zhang, J.; Zeng, W.; Wang, J.; Yang, F.; Jiang, H. Regional low-carbon economy efficiency in China: Analysis based on the Super-SBM model with CO2 emissions. J. Clean. Prod. 2017, 163, 202–211. [Google Scholar] [CrossRef]

- Zhou, C.; Shi, C.; Wang, S.; Zhang, G. Estimation of eco-efficiency and its influencing factors in Guangdong province based on Super-SBM and panel regression models. Ecol. Indic. 2018, 86, 67–80. [Google Scholar] [CrossRef]

- Li, Y.; Chiu, Y.H.; Lu, L.C.; Chiu, C.R. Evaluation of energy efficiency and air pollutant emissions in Chinese provinces. Energy Effic. 2019, 12, 963–977. [Google Scholar] [CrossRef]

- Bai, X.; Zeng, J.; Chiu, Y.H. Pre-evaluating efficiency gains from potential mergers and acquisitions based on the resampling DEA approach: Evidence from China’s railway sector. Transp. Policy 2019, 76, 46–56. [Google Scholar] [CrossRef]

- Luo, G.; Wang, X.; Wang, L.; Guo, Y. The Relationship between Environmental Regulations and Green Economic Efficiency: A Study Based on the Provinces in China. Int. J. Environ. Res. Public Health 2021, 18, 889. [Google Scholar] [CrossRef]

- Lo Storto, C. Performance evaluation of social service provision in Italian major municipalities using Network Data Envelopment Analysis. Socio-Econ. Plan. Sci. 2020, 71, 100821. [Google Scholar] [CrossRef]

- Ma, L.-H.; Hsieh, J.-C.; Chiu, Y.-H. A study of business performance and risk in Taiwan’s financial institutions through resampling data envelopment analysis. Appl. Econ. Lett. 2020, 27, 886–891. [Google Scholar] [CrossRef]

- Chang, T.-S.; Tone, K.; Wu, C.-H. Past-present-future Intertemporal DEA models. J. Oper. Res. Soc. 2015, 66, 16–32. [Google Scholar] [CrossRef]

- Lo Storto, C. A double-DEA framework to support decision-making in the choice of advanced manufacturing technologies. Manag. Decis. 2018, 56, 488–507. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C.A. Kand Pasurka, C. Multilateral Productivity Comparisons When Some Outputs are Undesirable: A Nonparametric Approach. Rev. Econ. Stat. 1989, 71, 90–98. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- Mehrotra, R.; Shrama, A. A Resampling Approach for Correcting Systematic Spatiotemporal Biases for Multiple Variables in a Changing Climate. Water Resour. Res. 2019, 55, 754–770. [Google Scholar] [CrossRef] [Green Version]

- Kuramochi, T.; den Elzen, M.; Peters, G.P.; Bergh, C.; Crippa, M.; Geiges, A.; Godinho, C.; Gonzales-Zuñiga, S.; Hutfilter, U.F.; Keramidas, K.; et al. Global emissions trends and G20 status and outlook—Emissions gap report Chapter 2. In Emissions Gap Report; UNEP: Nairobi, Kenya, 2020; pp. 3–22. [Google Scholar]

- Lui, S.; Kuramochi, T.; Smit, S.; Roelfsema, M.; Hsu, A.; Weinfurter, A.; Chan, S.; Hale, T.; Fekete, H.; Lütkehermöller, K.; et al. Correcting course: How international cooperative initiatives can build on national action to steer the climate back towards Paris temperature goals. Clim. Policy 2020, 21, 232–250. [Google Scholar] [CrossRef]

- Mi, Z.; Guan, D.; Liu, Z.; Liu, J.; Viguié, V.; Fromer, N.; Wang, Y. Cities: The core of climate change mitigation. J. Clean. Prod. 2019, 207, 582–589. [Google Scholar] [CrossRef]

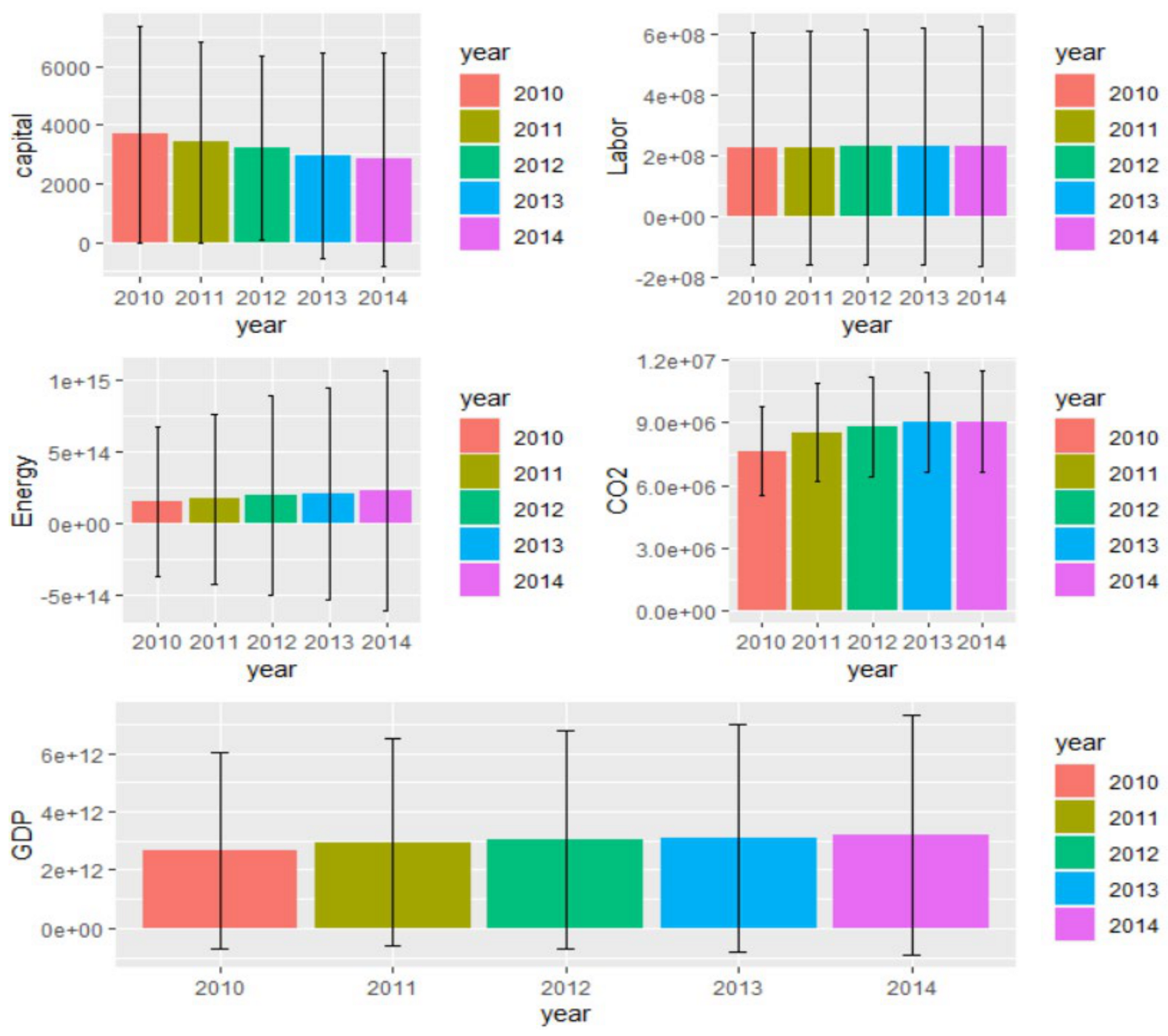

| Year | Indicator | Capital Stock | Labor | Energy Consumption | CO2 | GDP |

|---|---|---|---|---|---|---|

| (Million Dollars) | (Kilotons) | (Million Dollars) | ||||

| 2010 | Mean | 149,478,189 | 108,316,017 | 3692.56 | 7,646,724.5 | 2,660,091 |

| Standard deviation | 505,038,661 | 186,929,215 | 3607.73 | 2,094,422.84 | 3,294,967 | |

| Maximum | 2,256,935,300 | 779,956,733 | 13,931.6 | 8,776,040.4 | 14,964,372 | |

| Minimum | 247,717 | 9,834,264 | 285 | 187,919.08 | 375,298 | |

| 2011 | Mean | 169,230,754 | 108,814,101 | 3410.5254 | 8,543,152.14 | 2,955,362 |

| Standard deviation | 577,458,420 | 187,495,914 | 3335.3605 | 2,265,896.44 | 3,473,192 | |

| Maximum | 2,583,242,604 | 783,018,630 | 12,419.9829 | 9,733,538.12 | 15,517,926 | |

| Minimum | 254,402 | 10,487,696 | 231 | 191,633.753 | 416,878 | |

| 2012 | Mean | 192,298,266 | 109,598,429 | 3216.8684 | 8,811,079.76 | 3,032,865 |

| Standard deviation | 673,764,086 | 187,953,077 | 3075.9077 | 2,308,862.99 | 3,660,775 | |

| Maximum | 3,021,664,869 | 785,504,321 | 10,907.5 | 10,028,573.9 | 16,155,255 | |

| Minimum | 265,549 | 11,202,506 | 249 | 192,356.152 | 396,333 | |

| 2013 | Mean | 203,087,907 | 110,539,620 | 2,958 | 9,034,164.41 | 3,106,234 |

| Standard deviation | 719,496,298 | 189,008,990 | 3396.7 | 2,360,714.98 | 3,803,718 | |

| Maximum | 3,229,586,653 | 787,010,207 | 11,948 | 10,258,007.1 | 16,691,517 | |

| Minimum | 272,062 | 11,845,700 | 182 | 189,851.591 | 366,810 | |

| 2014 | Mean | 227,358,805 | 111,457,383 | 2828.4632 | 9,071,316.71 | 3,190,252 |

| Standard deviation | 814,347,761 | 190,020,711 | 3534.57 | 2,378,675.01 | 4,010,851 | |

| Maximum | 3,657,154,385 | 788,179,264 | 12,403 | 10,291,926.9 | 17,393,103 | |

| Minimum | 276,246 | 12,339,232 | 246 | 204,024.546 | 351,119 |

| Economies | 2010 | 2011 | 2012 | 2013 | 2014 | Time_AVE |

|---|---|---|---|---|---|---|

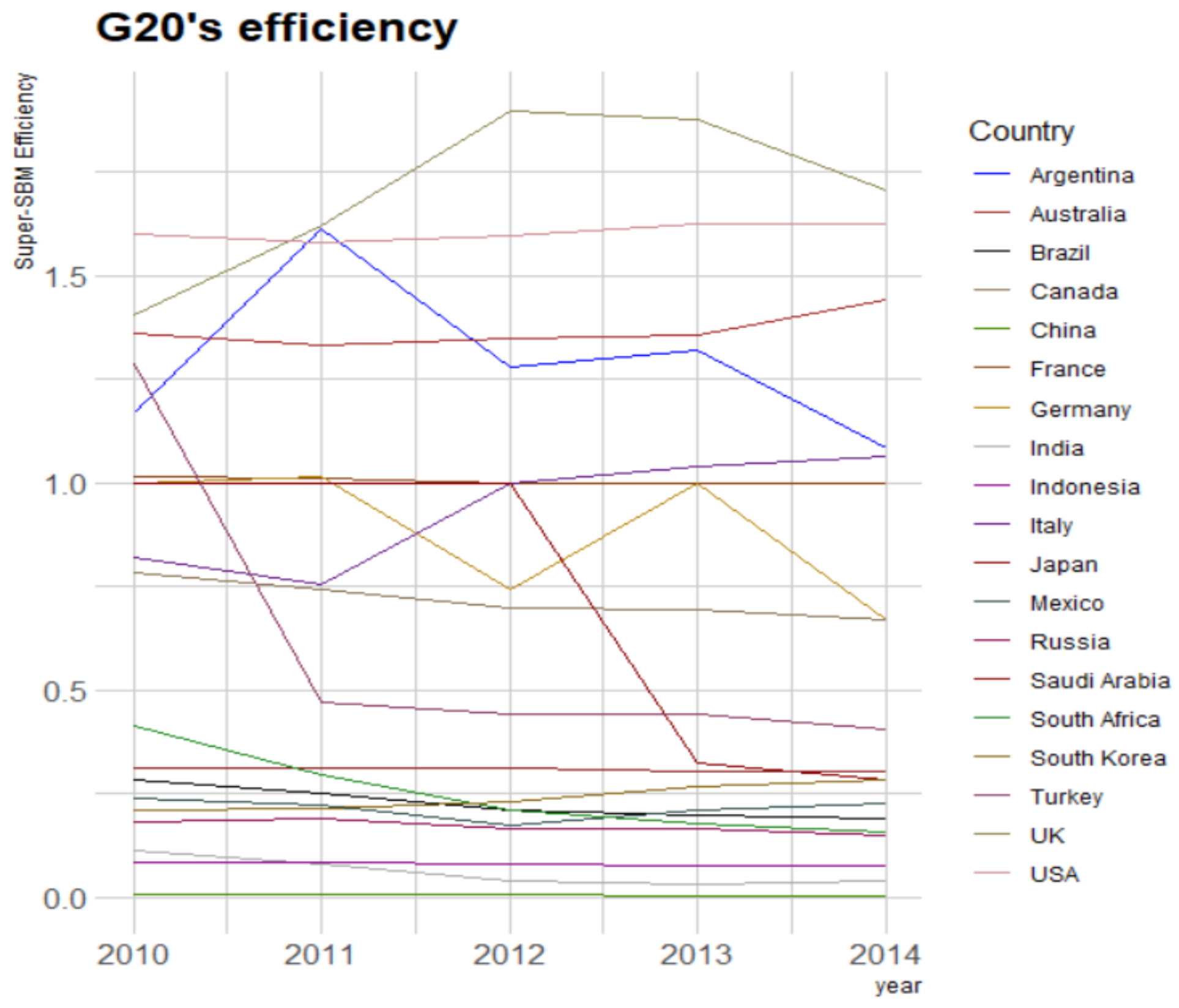

| Australia | 1.3596 | 1.3315 | 1.3476 | 1.3559 | 1.443 | 1.368 |

| Canada | 0.7836 | 0.7447 | 0.6979 | 0.6957 | 0.6689 | 0.718 |

| France | 1.0148 | 1.0108 | 0.9997 | 0.9997 | 0.9997 | 1.005 |

| Germany | 0.9992 | 1.0173 | 0.7451 | 0.9995 | 0.6701 | 0.886 |

| Italy | 0.822 | 0.7545 | 0.9996 | 1.0405 | 1.0641 | 0.936 |

| Japan | 0.9999 | 0.9999 | 0.9999 | 0.3254 | 0.285 | 0.722 |

| South Korea | 0.2125 | 0.2139 | 0.2294 | 0.2688 | 0.2843 | 0.242 |

| UK | 1.4052 | 1.6203 | 1.8975 | 1.8763 | 1.7056 | 1.701 |

| USA | 1.6008 | 1.5784 | 1.598 | 1.6246 | 1.6263 | 1.606 |

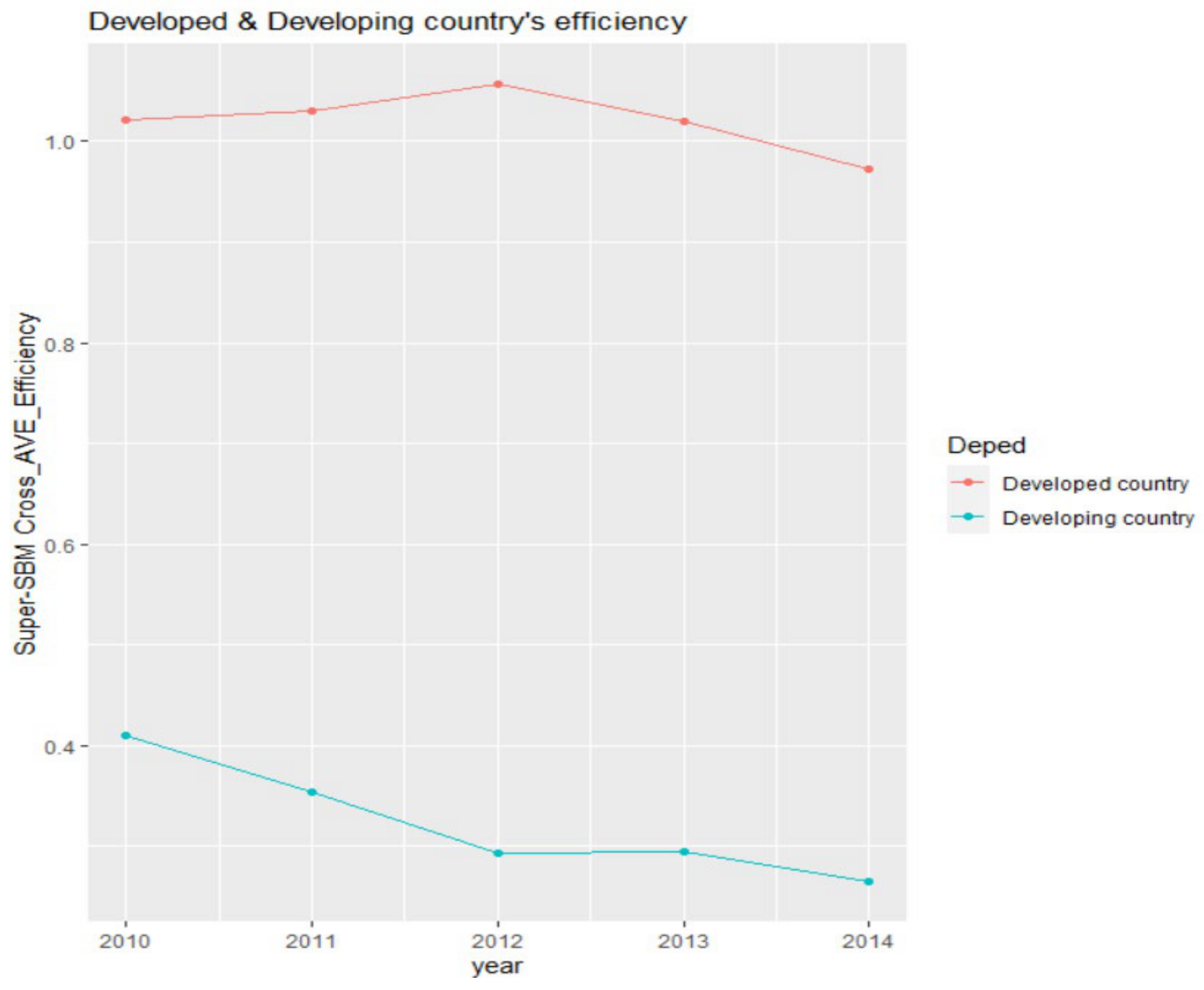

| Developed country Cross AVE | 1.022 | 1.030 | 1.057 | 1.021 | 0.972 | 1.020 |

| Argentina | 1.1697 | 1.6128 | 1.2784 | 1.3183 | 1.0865 | 1.293 |

| Brazil | 0.2844 | 0.2504 | 0.211 | 0.2001 | 0.1922 | 0.228 |

| China | 0.0059 | 0.0065 | 0.0082 | 0.005 | 0.0053 | 0.006 |

| India | 0.1127 | 0.0813 | 0.039 | 0.0314 | 0.0411 | 0.061 |

| Indonesia | 0.0841 | 0.0833 | 0.0818 | 0.0775 | 0.0772 | 0.081 |

| Mexico | 0.2396 | 0.2239 | 0.1758 | 0.2129 | 0.2255 | 0.216 |

| Russia | 0.1822 | 0.191 | 0.1674 | 0.1667 | 0.1517 | 0.172 |

| South Africa | 0.4139 | 0.2977 | 0.2116 | 0.1795 | 0.1575 | 0.252 |

| Saudi Arabia | 0.3119 | 0.3128 | 0.311 | 0.3047 | 0.3034 | 0.309 |

| Turkey | 1.2894 | 0.4726 | 0.442 | 0.4437 | 0.4044 | 0.610 |

| Developing country Cross AVE | 0.409 | 0.353 | 0.293 | 0.294 | 0.265 | 0.323 |

| Cross_AVE | 0.700 | 0.674 | 0.655 | 0.638 | 0.600 | 0.653 |

| DMU | Efficiency Value | Corrected Efficiency Value | Deviation | Lower Bound (2.5%) | Upper Bound (97.5%) |

|---|---|---|---|---|---|

| Australia | 1.3959 | 1.4105 | −0.0146 | 1.2956 | 1.5265 |

| Canada | 0.6589 | 0.7792 | −0.1203 | 0.5960 | 1.0515 |

| France | 0.9996 | 0.8707 | 0.1289 | 0.5011 | 1.1120 |

| Germany | 0.6393 | 0.8573 | −0.2180 | 0.5484 | 1.0711 |

| Italy | 1.1235 | 1.0556 | 0.0679 | 0.5986 | 1.1687 |

| Japan | 0.2543 | 0.4064 | −0.1521 | 0.2488 | 0.9999 |

| South Korea | 0.3327 | 0.3635 | −0.0308 | 0.1959 | 0.9997 |

| UK | 6.4996 | 4.1660 | 2.3336 | 1.1959 | 11.0024 |

| USA | 1.6593 | 1.6374 | 0.0219 | 1.5623 | 1.7072 |

| Developed country Cross AVE | 1.507 | 1.283 | 0.224 | 0.749 | 2.293 |

| Argentina | 1.0740 | 1.1669 | −0.0929 | 0.3359 | 1.6533 |

| Brazil | 0.1711 | 0.2576 | −0.0865 | 0.1584 | 0.9996 |

| China | 0.0044 | 0.0055 | −0.0011 | 0.0027 | 0.0112 |

| India | 0.0099 | 0.0455 | −0.0356 | 0.0092 | 0.1225 |

| Indonesia | 0.0653 | 0.0741 | −0.0088 | 0.0600 | 0.0976 |

| Mexico | 0.1400 | 0.3776 | −0.2376 | 0.1196 | 1.0700 |

| Russia | 0.1324 | 0.1516 | −0.0192 | 0.1163 | 0.2058 |

| South Africa | 0.1271 | 0.3063 | −0.1792 | 0.1270 | 0.9994 |

| Saudi Arabia | 0.3004 | 0.4752 | −0.1748 | 0.2457 | 0.9999 |

| Turkey | 0.3050 | 0.4768 | −0.1718 | 0.2022 | 0.9998 |

| Developing country Cross AVE | 0.233 | 0.334 | −0.101 | 0.138 | 0.716 |

| Cross_AVE | 0.8365 | 0.7834 | 0.0531 | 0.4273 | 1.4631 |

| DMU | Efficiency Value | Corrected Efficiency Value | Deviation | Lower Bound (10%) | Upper Bound (90%) |

|---|---|---|---|---|---|

| Australia | 1.3959 | 1.4105 | −0.0146 | 1.3333 | 1.4851 |

| Canada | 0.6589 | 0.7792 | −0.1203 | 0.6262 | 1.0224 |

| France | 0.9996 | 0.8707 | 0.1289 | 0.542 | 1.0416 |

| Germany | 0.6393 | 0.8573 | −0.218 | 0.5954 | 1.048 |

| Italy | 1.1235 | 1.0556 | 0.0679 | 0.9998 | 1.1337 |

| Japan | 0.2543 | 0.4064 | −0.1521 | 0.2592 | 0.9995 |

| South Korea | 0.3327 | 0.3635 | −0.0308 | 0.2271 | 0.4785 |

| UK | 6.4996 | 4.166 | 2.3336 | 1.3696 | 7.9619 |

| USA | 1.6593 | 1.6374 | 0.0219 | 1.5841 | 1.6914 |

| Developed country Cross AVE | 1.507 | 1.283 | 0.224 | 0.837 | 1.874 |

| Argentina | 1.074 | 1.1669 | −0.0929 | 1.0366 | 1.3685 |

| Brazil | 0.1711 | 0.2576 | −0.0865 | 0.1686 | 0.2969 |

| China | 0.0044 | 0.0055 | −0.0011 | 0.0034 | 0.0086 |

| India | 0.0099 | 0.0455 | −0.0356 | 0.0099 | 0.0833 |

| Indonesia | 0.0653 | 0.0741 | −0.0088 | 0.0626 | 0.0873 |

| Mexico | 0.14 | 0.3776 | −0.2376 | 0.1285 | 0.9998 |

| Russia | 0.1324 | 0.1516 | −0.0192 | 0.1226 | 0.1841 |

| South Africa | 0.1271 | 0.3063 | −0.1792 | 0.1395 | 0.9957 |

| Saudi Arabia | 0.3004 | 0.4752 | −0.1748 | 0.2745 | 0.9996 |

| Turkey | 0.305 | 0.4768 | −0.1718 | 0.231 | 0.9996 |

| Developing country Cross AVE | 0.233 | 0.334 | −0.101 | 0.218 | 0.602 |

| Cross_AVE | 0.8365 | 0.7834 | 0.0531 | 0.5113 | 1.2045 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, D.; Lu, C.-C.; Tang, P.-Y.; Wang, M.-L.; Yang, A.-C. A Resampling Slack-Based Energy Efficiency Analysis: Application in the G20 Economies. Energies 2022, 15, 67. https://doi.org/10.3390/en15010067

Wu D, Lu C-C, Tang P-Y, Wang M-L, Yang A-C. A Resampling Slack-Based Energy Efficiency Analysis: Application in the G20 Economies. Energies. 2022; 15(1):67. https://doi.org/10.3390/en15010067

Chicago/Turabian StyleWu, Dan, Ching-Cheng Lu, Pao-Yu Tang, Miao-Ling Wang, and An-Chi Yang. 2022. "A Resampling Slack-Based Energy Efficiency Analysis: Application in the G20 Economies" Energies 15, no. 1: 67. https://doi.org/10.3390/en15010067