Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method

Abstract

:1. Introduction

2. Materials and Methods

2.1. Development of Hydropower in Poland

2.2. Levelized Cost of Electricity

- average price of the electric energy in the time of the analysis,

- It

- capital expenditures in a year t,

- Ot

- operational expenditures in a year t,

- Et

- production of the electric energy in a year t,

- r

- discount rate (the weighted average cost of capital WACC),

- t

- time in years from 0 to n,

- n

- analysis period.

- M

- installed capacity [MW],

- CAPEX

- unit capital expenditures [EUR /MW],

- OPEX

- unit operational expenditures [EUR /MW],

- Cf

- capacity factor [h],

3. Results

3.1. Estimation of LCOE in Hydropower Plants in Poland

- For two periods of analysis: 15 and 50 years;

- For two discount rates: 7 and 11.4%.

3.2. Evolution of RES Support System in Poland

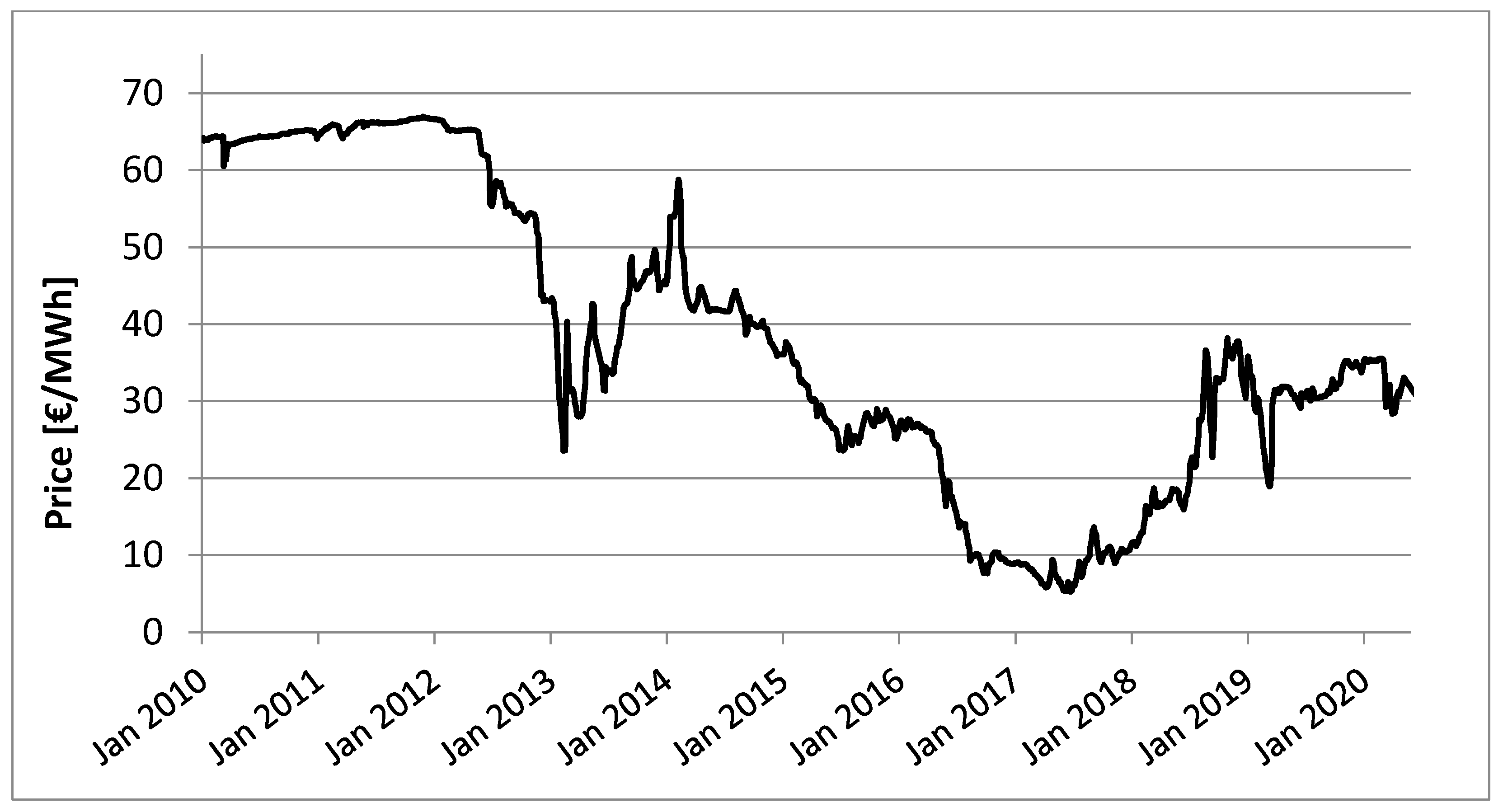

3.2.1. Green Certificates

- Significant investments and growth of an installed power of the RES installations, in particular, wind power plants and bio-mass power plants;

- In 2012–2015 there was too low growth of obligatory share of the green energy in total annual sale of the electric energy (in 2012—10.4%; 2013—12.0%; 2014—13.0%, 2015—14.0% [44]), while, after investments made recent years, the production capability of the RES installations gained the level in: 2012—13.2%; 2013—13.3%; 2014—15.3%; 2015—17.7% [45];

- The effect of uncertainty in the market of green certificates caused by amendments of the law (the draft in subsequent versions was presented to the public by the Ministry of Economy in 2011–2014), the final draft was submitted to the Sejm in July 2014, in subsequent versions it was planned to introduce FIT tariffs and auctions of green certificates instead of tariffs.

3.2.2. System of Auctions

3.2.3. Guaranteed Tariffs

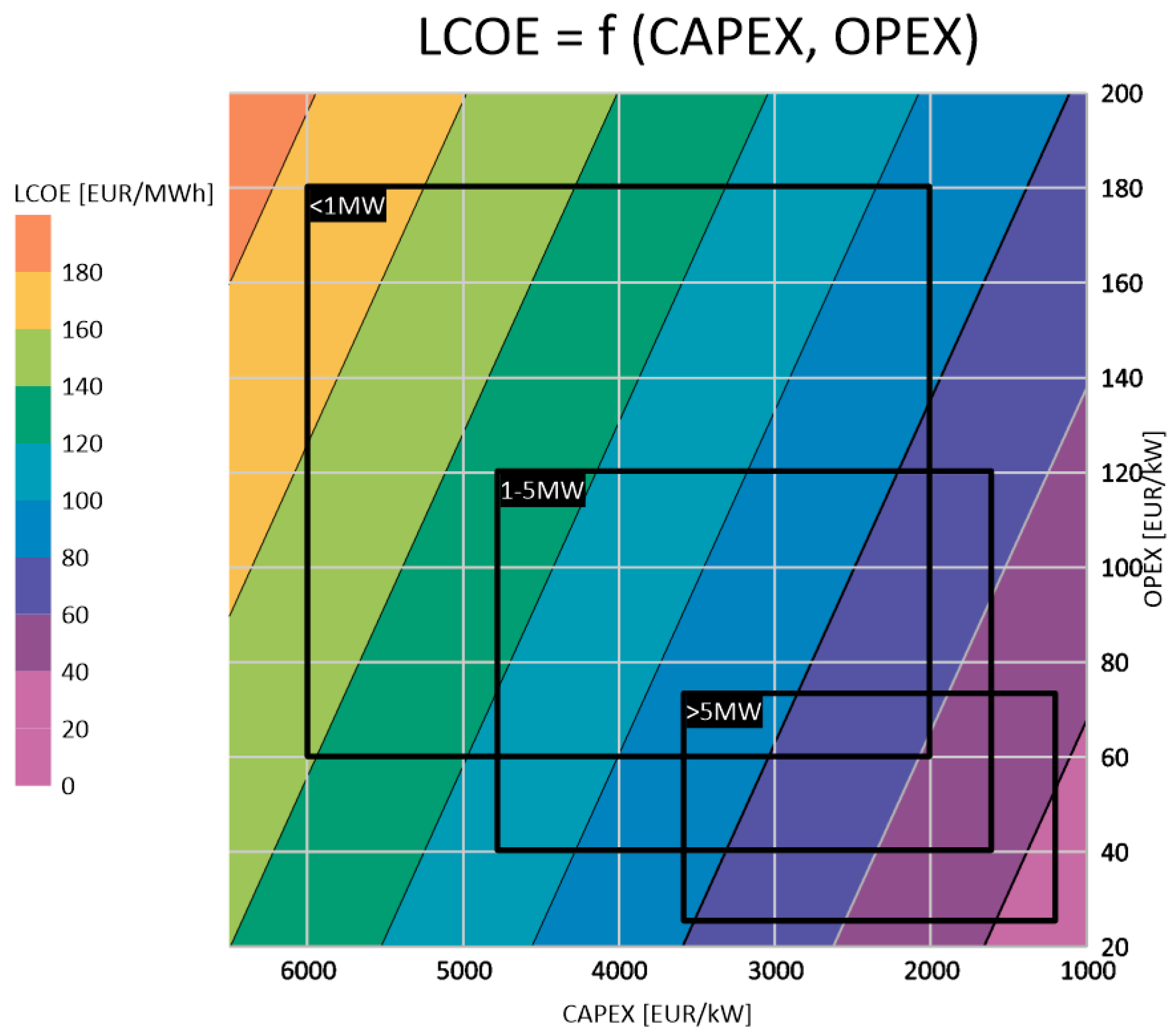

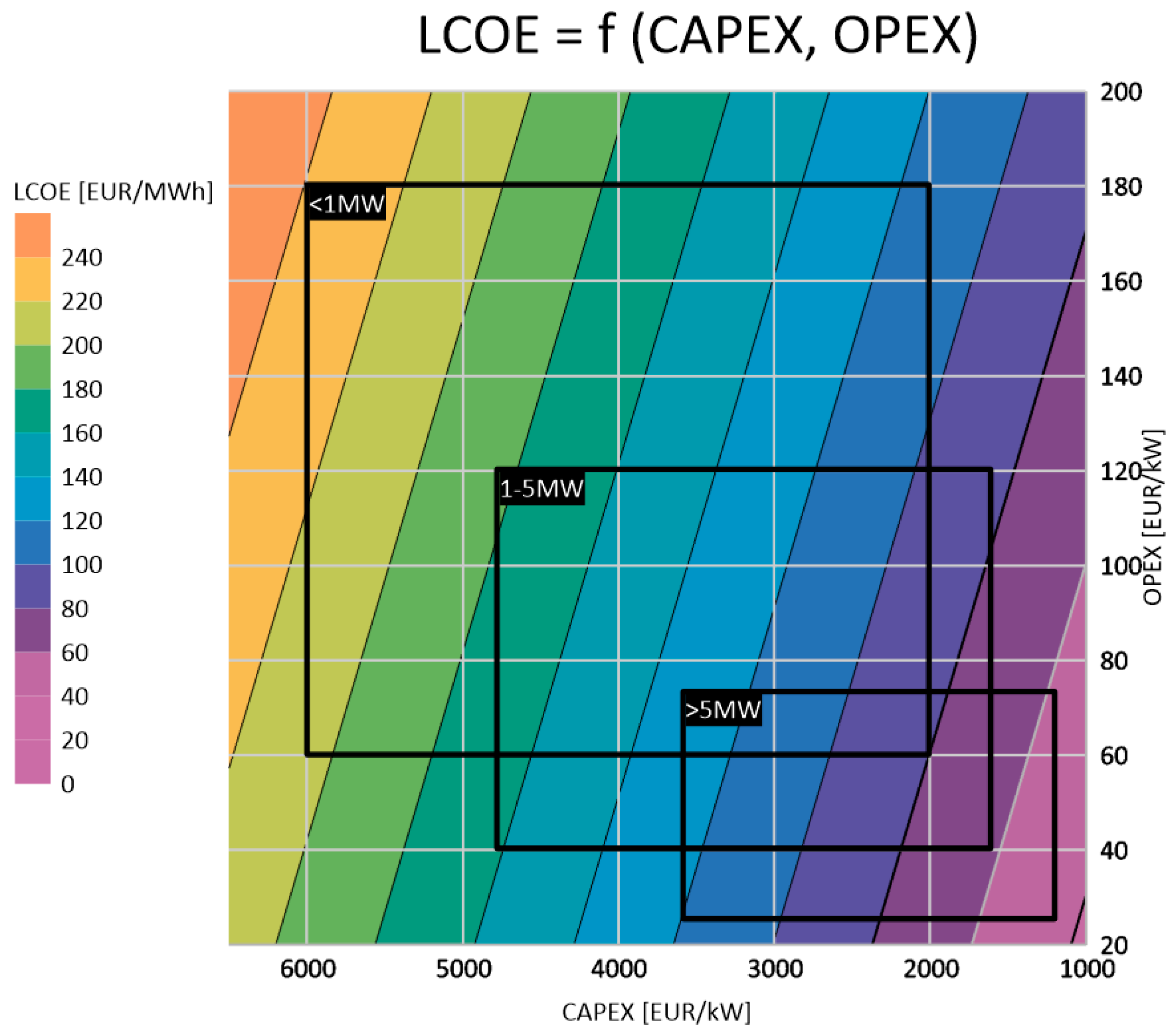

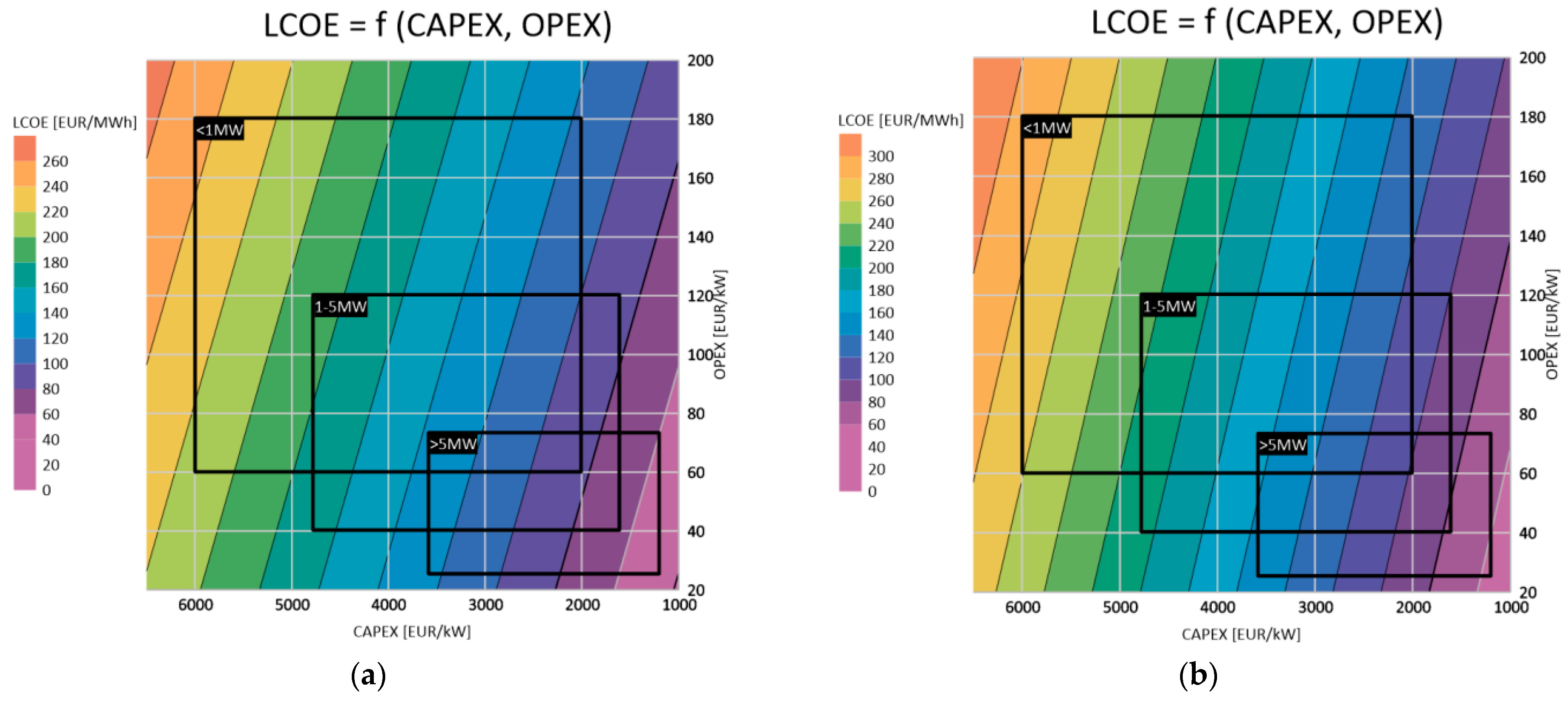

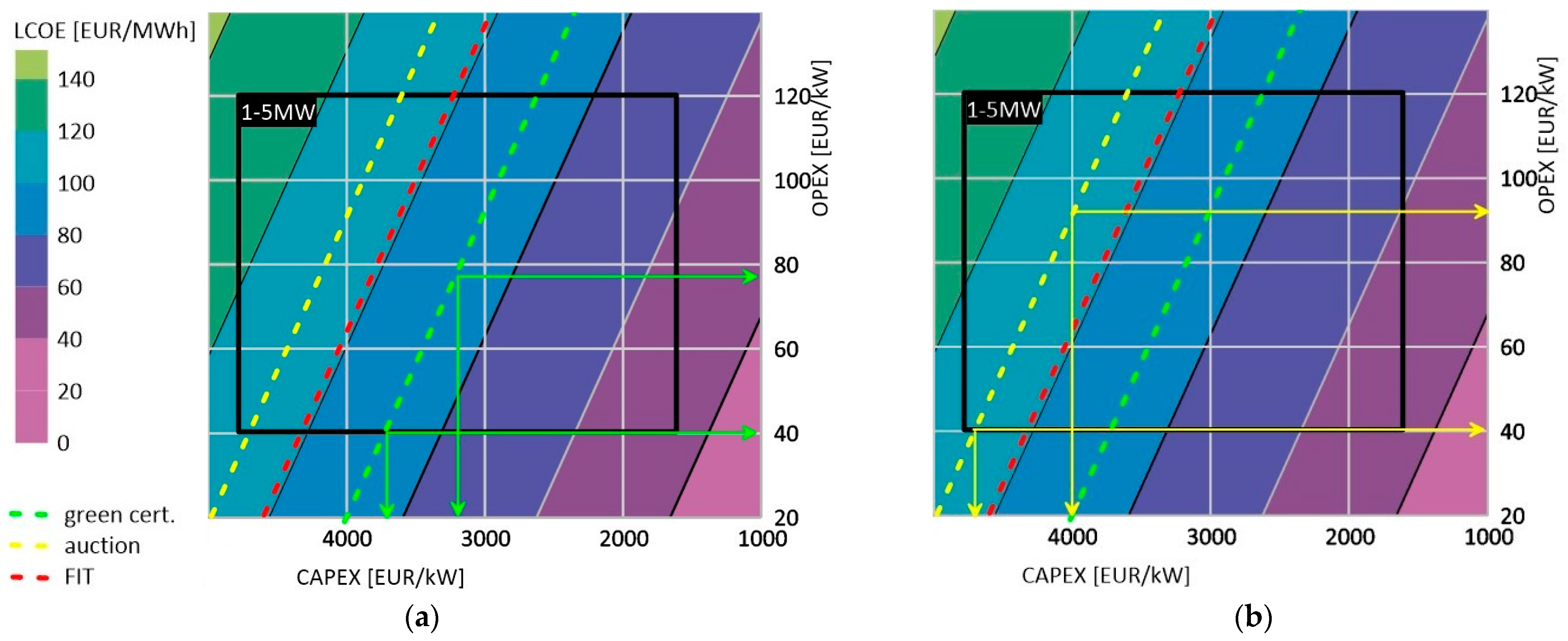

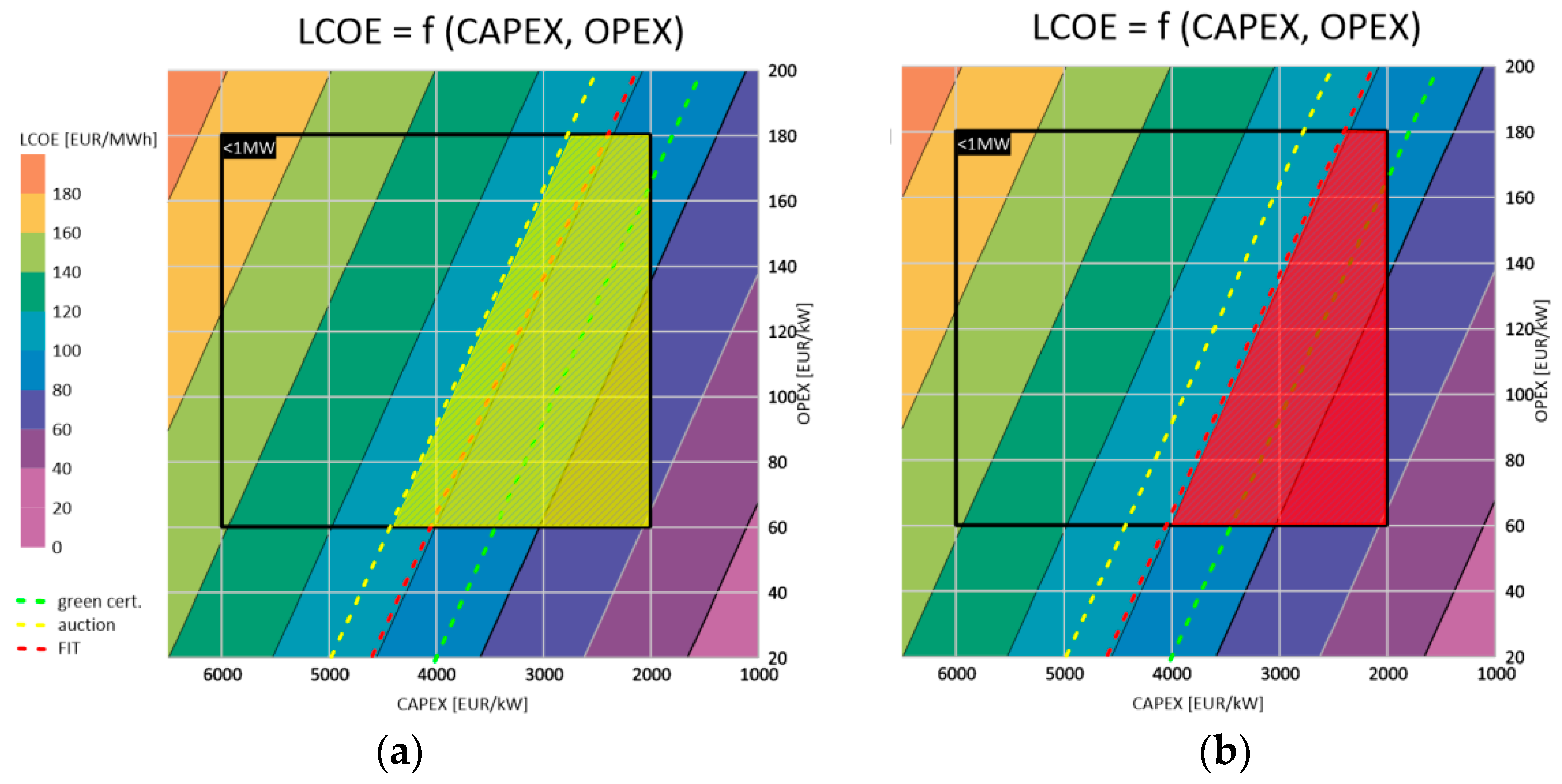

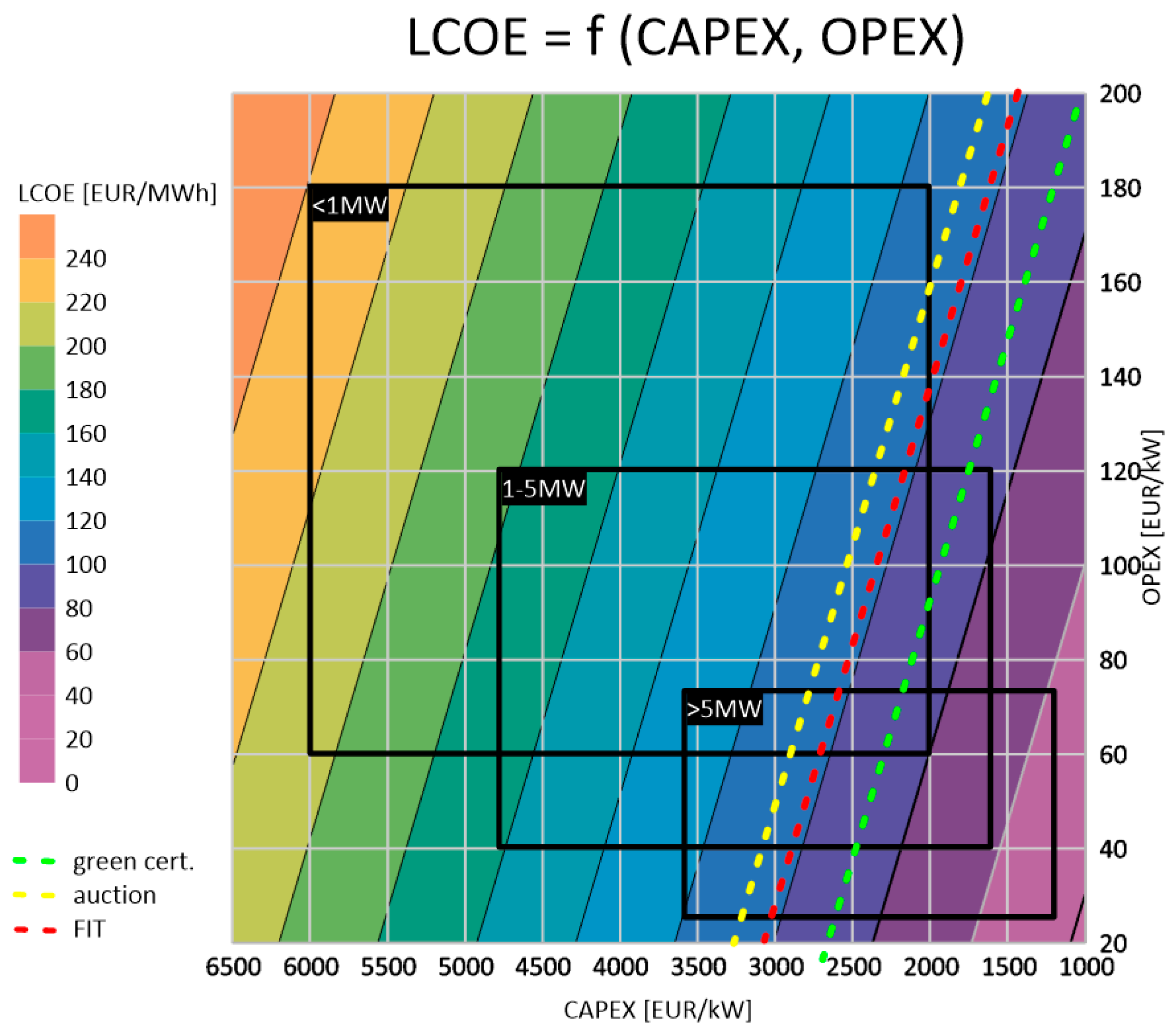

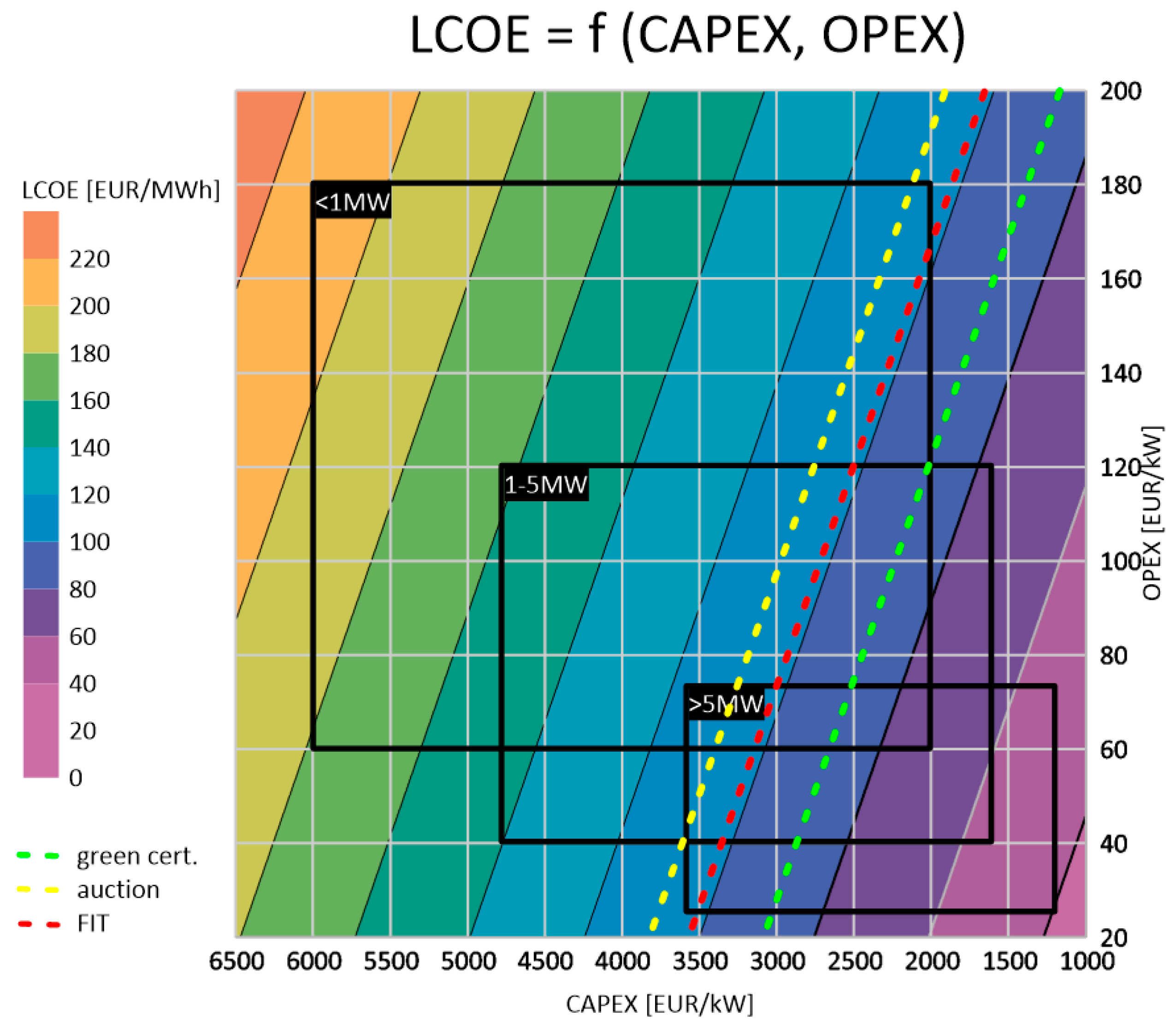

3.3. Evaluation of Support Systems Using LCOE

- green certificates, income at the level approx. EUR 87/MWh (market energy price EUR 57/MWh (2019) + price of green certificates EUR 30/MWh),

- the average price from auction system (2018): EUR 108/MWh,

- guaranteed prices FIT: EUR 102/MWh.

- Figure 6a for CAPEX EUR 3700, OPEX can be at most at the level of EUR 40, but with a lower construction cost, e.g., EUR 3200, OPEX even at the level of EUR 77 still ensures LCOE on the border of revenues from green certificates (87 EUR/kW);

- Figure 6b for CAPEX EUR 4700, OPEX can be at most at the level of EUR 40, but with a lower construction cost, e.g., EUR 4000, OPEX even at the level of EUR 92 still provides LCOE at the limit of revenues from the auction (108 EUR/kW).

- Figure 7a for CAPEX EUR 4400, OPEX can be at most at the level of EUR 60, but with a lower construction cost, e.g., EUR 4000, OPEX even at the level of EUR 90 still provides LCOE at the limit of revenues from the auction (108 EUR/kW);

- Figure 7b for CAPEX EUR 4000, OPEX can be at most at the level of EUR 60, but with a lower construction cost, e.g., EUR 3000, OPEX even at EUR 135 still ensures LCOE on the border of revenues from FIT (102 EUR/kW).

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- European Parliamen; Council of the European Union. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources. Off. J. Eur. Union 2018, 328, 82. [Google Scholar]

- Communication from the Commission. Guidelines on State Aid for Environmental Protection and Energy 2014–2020; European Commission: Brussels, Belgium, 2014; p. 55. [Google Scholar]

- IRENA. Country Profiles. Available online: Irena.org/Statistics/View-Data-by-Topic/Renewable-Energy-Balances/Country-Profiles (accessed on 13 August 2021).

- Council of European Energy Regulators. Status Review of Renewable Support Schemes in Europe for 2016 and 2017; Public Report; Council of European Energy Regulators: Brussels, Belgium, 2018. [Google Scholar]

- Poullikkas, A.; Kourtis, G.; Hadjipaschalis, I. An overview of the EU Member States support schemes for the promotion of renewable energy sources. Int. J. Energy Environ. 2012, 3, 553–566. [Google Scholar]

- Legal Sources on Renewable Energy. Available online: http://www.res-legal.eu/search-by-country/ (accessed on 31 July 2021).

- Tomczyk, P.; Wiatkowski, M. Challenges in the Development of Hydropower in Selected European Countries. Proceedings 2020, 51, 8. [Google Scholar] [CrossRef]

- Adachi, M.; Metzger, M.; Wu, J.P.; Sproll, M.; Teipen, C.; Truger, A.; Wissen, M.; Zimmer, R. Success and Failure of Renewable Energy Policies in the EU: A Comparative Study of Bulgaria and Poland; Berlin School of Economics and Law. Work. Pap. 2020, 131, 2020. [Google Scholar]

- Local Data Bank. Statistics Poland, Warsaw, Poland. Available online: https://bdl.stat.gov.pl/ (accessed on 29 August 2021).

- Ordinance of the Minister of Energy Dated 11 August 2017 on the change in the quantitative share of the total electricity resulting from permanent certificates of origin confirming the production of electricity from renewable energy 2018–2019. Dz.U.2017.1559.

- Energy 2021. Statistics Poland, Warsaw, Poland. Available online: https://stat.gov.pl/en/topics/environment-energy/energy/energy-2021,1,9.html (accessed on 29 August 2021).

- National Energy and Climate Plan for the years 2021–2030. Ministry of Climate and Environment, Warsaw, Poland. Available online: https://www.gov.pl/web/klimat/national-energy-and-climate-plan-for-the-years-2021-2030 (accessed on 20 November 2020).

- Energy from Renewable Sources in 2019. Statistics Poland, Warsaw, Poland. Available online: https://stat.gov.pl/en/topics/environment-energy/energy/energy-from-renewable-sources-in-2019,3,12.html (accessed on 29 August 2021).

- Polityka Energetyczna Polski do 2030 Roku (Polish Energy Policy until 2030). Ministry of Climate and Environment, Warsaw, Poland. Available online: https://www.gov.pl/web/klimat/polityka-energetyczna-polski-do-2030-roku (accessed on 20 November 2020).

- Draft of Polish Energy Policy until 2040. Ministry of Climate and Environment, Warsaw, Poland. Available online: https://www.gov.pl/web/klimat/projekt-polityki-energetycznej-polski-do-2040-r (accessed on 20 November 2020).

- Martín, H.; Coronas, S.; Alonso, À.; de la Hoz, J.; Matas, J. Renewable Energy Auction Prices: Near Subsidy-Free? Energies 2020, 13, 3383. [Google Scholar] [CrossRef]

- Trypolska, G. Support Scheme for Electricity Output from Renewables in Ukraine, Starting in 2030. Econ. Anal. Policy 2019, 62, 227–235. [Google Scholar] [CrossRef]

- Aldersey-Williams, J.; Broadbent, I.D.; Strachan, P.A. Better Estimates of LCOE from Audited Accounts—A New Methodology with Examples from United Kingdom Offshore Wind and CCGT. Energy Policy 2019, 128, 25–35. [Google Scholar] [CrossRef]

- Liu, Y.; Li, F.; Yu, X. Gas Supply, Pricing Mechanism and the Economics of Power Generation in China. Energies 2018, 11, 1058. [Google Scholar] [CrossRef] [Green Version]

- Castro-Santos, L.; Silva, D.; Bento, A.; Salvação, N.; Guedes Soares, C. Economic Feasibility of Wave Energy Farms in Portugal. Energies 2018, 11, 3149. [Google Scholar] [CrossRef] [Green Version]

- Stegman, A.; de Andres, A.; Jeffrey, H.; Johanning, L.; Bradley, S. Exploring Marine Energy Potential in the UK Using a Whole Systems Modelling Approach. Energies 2017, 10, 1251. [Google Scholar] [CrossRef] [Green Version]

- Godyn, I.; Potocki, A.; Indyk, W. Poland’s Hydropower: Current Status and Future Prospects. In Proceedings of the 2015 3rd International Renewable and Sustainable Energy Conference (IRSEC), Ouarzazate, Morocco, 10–13 December 2015; pp. 1–6. [Google Scholar] [CrossRef]

- Ouyang, X.; Lin, B. Levelized Cost of Electricity (LCOE) of Renewable Energies and Required Subsidies in China. Energy Policy 2014, 70, 64–73. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, W.; Zhao, C.; Yuan, J.; Liu, Z.; Zhang, W.; Zhao, C.; Yuan, J. The Economics of Wind Power in China and Policy Implications. Energies 2015, 8, 1529–1546. [Google Scholar] [CrossRef] [Green Version]

- Hwang, S.-H.; Kim, M.-K.; Ryu, H.-S.; Hwang, S.-H.; Kim, M.-K.; Ryu, H.-S. Real Levelized Cost of Energy with Indirect Costs and Market Value of Variable Renewables: A Study of the Korean Power Market. Energies 2019, 12, 2459. [Google Scholar] [CrossRef] [Green Version]

- Muradin, M.; Joachimiak-Lechman, K.; Foltynowicz, Z.; Muradin, M.; Joachimiak-Lechman, K.; Foltynowicz, Z. Evaluation of Eco-Efficiency of Two Alternative Agricultural Biogas Plants. Appl. Sci. 2018, 8, 2083. [Google Scholar] [CrossRef] [Green Version]

- Onea, F.; Rusu, E.; Onea, F.; Rusu, E. An Assessment of Wind Energy Potential in the Caspian Sea. Energies 2019, 12, 2525. [Google Scholar] [CrossRef] [Green Version]

- Melicher, R.W.; Norton, E.A. Introduction to Finance: Markets, Investments, and Financial Management, 16th ed.; Wiley: Hoboken, NJ, USA, 2016. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2019; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- Wiśniewski, G.; Dziamski, P.; Kunikowski, G.; Ligus, M.; Curkowski, A.; Michałowska-Knap, K.; Rosołek, K.; Oniszk-Popławska, A.; Więcka, A.; Mroszkiewicz, T. Analiza Dotycząca Możliwości Określenia Niezbędnej Wysokości Wsparcia Poszczególnych Technologii OZE w Kontekście Realizacji Krajowego Planu Działania w Zakresie Energii Ze Źródeł Odnawialnych; Instytut Energetyki Odnawialnej: Warszawa, Poland, 2013. [Google Scholar]

- Steller, J. Hydropower and Its Development. Acta Energ. 2013, 3, 7–20. [Google Scholar] [CrossRef]

- Impact Assessment of Planned Policies and Measures to the Draft of Poland’s National Enengy and Climate Plan for the Years 2021–2030. Ministry of Energy, Warsaw, Poland. Available online: https://www.gov.pl/web/klimat/draft-of-national-energy-and-climate-plan-for-the-years-2021-2030 (accessed on 20 August 2021).

- Stolzenberger, C.H.; Then, O. Levelised cost of electricity 2015. VGB PowerTech 2015, 95, 94–96. [Google Scholar]

- ETRI 2014 Energy Technology Reference Indicator Projections for 2010–2050; Joint Research Centre: Luxembourg, 2014. [CrossRef]

- Technology Roadmap—Hydropower. IEA, Paris, France. 2012. Available online: https://www.iea.org/reports/technology-roadmap-hydropower (accessed on 20 November 2020).

- Ondraczek, J.; Komendantova, N.; Patt, A. WACC the Dog: The Effect of Financing Costs on the Levelized Cost of Solar PV Power. Renew. Energy 2015, 75, 888–898. [Google Scholar] [CrossRef]

- Discount Rates for Low-Carbon and Renewable Generation Technologies. Oxera. Available online: https://www.oxera.com/insights/reports/discount-rates-for-low-carbon-and-renewable-generation-technologies/ (accessed on 20 August 2021).

- IEA & NEA. Projected Costs of Generating Electricity—2020 Edition. Available online: https://www.oecd-nea.org/jcms/pl_51110/projected-costs-of-generating-electricity-2020-edition?details=true (accessed on 16 June 2021).

- Vartiainen, E.; Masson, G.; Breyer, C.; Moser, D.; Medina, E.R. Impact of Weighted Average Cost of Capital, Capital Expenditure, and Other Parameters on Future Utility-Scale PV Levelised Cost of Electricity. Prog. Photovolt. Res. Appl. 2020, 28, 439–453. [Google Scholar] [CrossRef] [Green Version]

- Badouard, T.; Moreira de Oliveira, D.; Yearwood, J.; Torres, P.; Altmann, M. Cost of Energy (LCOE): Energy Costs, Taxes and the Impact of Government Interventions on Investments: Final Report; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar] [CrossRef]

- Mikołajuk, H.; Duda, M.; Radovic, U.; Skwierz, S.; Lewarski, M.; Kowal, I. Aktualizacja Analizy Porównawczej Kosztów Wytwarzania Energii Elektrycznej w Elektrowniach Jądrowych, Węglowych i Gazowych Oraz Odnawialnych Źródłach Energii; Agencja Rynku Energii Spółka Akcyjna (ARE S.A.): Warszawa, Poland, 2016; p. 146. [Google Scholar]

- IEA & NEA. Projected Costs of Generating Electricity—2015 Edition. Available online: https://www.oecd-nea.org/jcms/pl_14756/projected-costs-of-generating-electricity-2015-edition?details=true (accessed on 17 June 2021).

- Bachner, G.; Mayer, J.; Steininger, K.W. Costs or Benefits? Assessing the Economy-Wide Effects of the Electricity Sector’s Low Carbon Transition–The Role of Capital Costs, Divergent Risk Perceptions and Premiums. Energy Strategy Rev. 2019, 26, 100373. [Google Scholar] [CrossRef]

- Ordinance of the Minister of Economy of 18 October 2012 on Detailed Range of Obligations to Be Fulfilled in Order to Get Certificates of Origin and to Apply for Their Cancellation, and on Paying the Replacement Fee, on Purchase of the Electric Energy and Heat Manufactured from Renewable Energy Sources and on Obligation to Confirm Data Regarding Quantity of the Electric Energy Manufactured from Renewable Energy Sources. Dz.U.2012.1229. 1229.

- Share of the Electric Energy from RES in Domestic Sale of the Electric Energy to End Users in 2005–2019. Available online: https://www.ure.gov.pl/pl/oze/potencjal-krajowy-oze/ (accessed on 31 July 2020).

- The Act of 20 February 2015 on Renewable Energy Sources. Dz.U.2015.478.

- Union, E. European Council Directive 2009/28/EC on the Promotion of the Use of Energy from Renewable Sources. Off. J. Eur. Union 2009, 140, 16–62. [Google Scholar] [CrossRef]

- Del Río, P.; Linares, P. Back to the Future? Rethinking Auctions for Renewable Electricity Support. Renew. Sustain. Energy Rev. 2014, 35, 42–56. [Google Scholar] [CrossRef] [Green Version]

- Ordinance of the Minister of Climate and Environment of 14 April 2021 on the reference price of electricity from renewable energy sources in 2021 and the periods applicable to producers who won auctions in 2021. Dz.U.2021.722.

- Ordinance of the Minister of Climate of 24 April 2020 on the reference price of electricity from renewable energy sources in 2020 and the periods applicable to producers who won auctions in 2020. Dz.U.2020.798.

- Ordinance of the Minister of Energy of 15 May 2019 on the reference price of electricity from renewable energy sources in 2019 and the periods applicable to producers who won auctions in 2019. Dz.U.2019.1001.

- Ordinance of the Minister of Energy of 16 March 2017 on the reference price of electricity from renewable energy sources in 2017 and the periods applicable to producers who won auctions in 2017. Dz.U.2017.634.

- Ordinance of the Minister of Energy of 16 October 2016 on the reference price of electricity from renewable energy sources in 2016 and the periods applicable to producers who won auctions in 2016. Dz.U.2016.1765.

- Ordinance of the Minister of Economy of 13 November 2015 on the reference price of electricity from renewable energy sources in 2016. Dz.U.2015.2063.

- Announcements and Auction Results. Energy Regulatory Office. Available online: https://www.ure.gov.pl/pl/oze/aukcje-oze/ogloszenia-i-wyniki-auk (accessed on 8 November 2021).

- Average Selling Price of Electricity on the Competitive Market (Annual and Quarterly). Energy Regulatory Office. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/ceny-wskazniki/ (accessed on 29 August 2021).

- The Act of 18 April 2002 on the State of Natural Disaster. Dz.U.2002.62.558.

- Ragwitz, M.; Held, A.; Resch, G.; Faber, T.; Haas, R.; Huber, C.; Morthorst, P.E.; Jensen, S.G.; Coenraads, R.; Voogt, M.; et al. Assessment and Optimisation of Renewable Energy Support Schemes in the European Electricity Market; OPTRES: Karlsruhe, Germany, 2017. [Google Scholar]

- Koper, M.; Klessmann, C.; Von Blücher, F.; Sach, T.; Brückmann, R.; Najdawi, C.; Spitzley, J.B.; Banasiak, J.; Isi, F.; Breitschopf, B.; et al. Technical Assistance in Realisation of the 4th Report on Progress of Renewable Energy in the EU-Final Report; Ecofys: Utrecht, The Netherlands, 2019. [Google Scholar]

- Winkler, J.; Magosch, M.; Ragwitz, M. Effectiveness and Efficiency of Auctions for Supporting Renewable Electricity–What Can We Learn from Recent Experiences? Renew. Energy 2018, 119, 473–489. [Google Scholar] [CrossRef]

- Energy Regulatory Office. Register of Energy Producers in a Small Installation. Available online: https://bip.ure.gov.pl/bip/rejestry-i-bazy/wytworcy-energii-w-male/2138,Rejestr-wytworcow-energii-w-malej-instalacji.html (accessed on 8 November 2021).

- The Strategy for Responsible Development for the Period up to 2020 (Including the Perspective up to 2030); Council of Ministres: Warszawa, Poland, 2017. Available online: https://www.gov.pl/web/fundusze-regiony/informacje-o-strategii-na-rzecz-odpowiedzialnego-rozwoju (accessed on 8 November 2021).

- Justification of the Draft of the Act of 28 June 2017 on Amendment of the Act on the Renewable Energy Sources and Certain Other Acts. Ministry of Energy. Available online: https://legislacja.gov.pl/projekt/12299905 (accessed on 8 November 2021).

- Pyrgou, A.; Kylili, A.; Fokaides, P.A. The Future of the Feed-in Tariff (FiT) Scheme in Europe: The Case of Photovoltaics. Energy Policy 2016, 95, 94–102. [Google Scholar] [CrossRef]

- Kylili, A.; Fokaides, P.A. Competitive Auction Mechanisms for the Promotion Renewable Energy Technologies: The Case of the 50 MW Photovoltaics Projects in Cyprus. Renew. Sustain. Energy Rev. 2015, 42, 226–233. [Google Scholar] [CrossRef]

- Shrimali, G.; Konda, C.; Farooquee, A.A. Designing Renewable Energy Auctions for India: Managing Risks to Maximize Deployment and Cost-Effectiveness. Renewable Energy 2016, 97, 656–670. [Google Scholar] [CrossRef]

- Extension of Renewable Energy Support Scheme—Policies. Available online: https://www.iea.org/policies/12350-extension-of-renewable-energy-support-scheme-yekdem (accessed on 10 December 2021).

- Frey, G.W.; Linke, D.M. Hydropower as a Renewable and Sustainable Energy Resource Meeting Global Energy Challenges in a Reasonable Way. Energy Policy 2002, 30, 1261–1265. [Google Scholar] [CrossRef]

- Alsaleh, M.; Abdul-Rahim, A.S. Moving toward Sustainable Environment: The Effects of Hydropower Industry on Water Quality in EU Economies. Energy Environ. 2021, 1–22. [Google Scholar] [CrossRef]

- Carpejani, P.; de Jesus, É.T.; Catapan, B.L.S.B.; da Costa, S.E.G.; de Lima, E.P.; Tortato, U.; Machado, C.G.; Richter, B.K. Affordable and Clean Energy: A Study on the Advantages and Disadvantages of the Main Modalities. In International Business, Trade and Institutional Sustainability; World Sustainability Series; Springer: Cham, Switzerland, 2020; pp. 615–627. [Google Scholar] [CrossRef]

- Tahseen, S.; Karney, B.W. Reviewing and Critiquing Published Approaches to the Sustainability Assessment of Hydropower. Renew. Sustain. Energy Rev. 2017, 67, 225–234. [Google Scholar] [CrossRef]

- Pata, U.K.; Aydin, M. Testing the EKC Hypothesis for the Top Six Hydropower Energy-Consuming Countries: Evidence from Fourier Bootstrap ARDL Procedure. J. Clean. Prod. 2020, 264, 121699. [Google Scholar] [CrossRef]

- Pata, U.K.; Kumar, A. The Influence of Hydropower and Coal Consumption on Greenhouse Gas Emissions: A Comparison between China and India. Water 2021, 13, 1387. [Google Scholar] [CrossRef]

- Bildirici, M.E.; Gökmenoğlu, S.M. Environmental Pollution, Hydropower Energy Consumption and Economic Growth: Evidence from G7 Countries. Renew. Sustain. Energy Rev. 2017, 75, 68–85. [Google Scholar] [CrossRef]

| Total RES Capacity [MW] | Wind Energy [MW] | Solar Energy [MW] | Renewable Hydropower [MW] | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2019 | 2010 | 2019 | 2010 | 2019 | 2010 | 2019 | ||

| 1 | Austria | 16,177 | 20,627 | 1016 | 3159 | 89 | 1578 | 12,895 | 14,554 |

| 2 | Belgium | 3041 | 9318 | 912 | 3780 | 1007 | 4531 | 118 | 112 |

| 3 | Bulgaria | 2707 | 4482 | 488 | 699 | 25 | 1065 | 2184 | 2524 |

| 4 | Croatia | 2218 | 3014 | 79 | 606 | 0 | 69 | 2129 | 2200 |

| 5 | Cyprus | 97 | 299 | 82 | 158 | 7 | 129 | ||

| 6 | Czechia | 3400 | 4349 | 213 | 339 | 1727 | 2070 | 1049 | 1092 |

| 7 | Denmark | 4916 | 9012 | 3802 | 6117 | 7 | 1079 | 9 | 9 |

| 8 | Estonia | 256 | 694 | 108 | 320 | 0 | 107 | 6 | 7 |

| 9 | Finland | 5127 | 8062 | 197 | 2282 | 7 | 215 | 3155 | 3287 |

| 10 | France | 31,717 | 52,928 | 5912 | 16,260 | 1044 | 10,571 | 23,617 | 24,086 |

| 11 | Germany | 56,545 | 125,476 | 26,903 | 60,840 | 18,006 | 49,018 | 5407 | 5595 |

| 12 | Greece | 4756 | 9805 | 1298 | 3547 | 202 | 2763 | 3215 | 3409 |

| 13 | Hungary | 862 | 2153 | 293 | 329 | 2 | 1277 | 53 | 57 |

| 14 | Ireland | 1664 | 4555 | 1390 | 4172 | 1 | 36 | 237 | 237 |

| 15 | Italy | 29,507 | 55,315 | 5794 | 10,758 | 3597 | 20,906 | 17,563 | 18,960 |

| 16 | Latvia | 1622 | 1801 | 30 | 78 | 0 | 3 | 1576 | 1565 |

| 17 | Lithuania | 278 | 850 | 133 | 546 | 0 | 103 | 116 | 117 |

| 18 | Luxembourg | 126 | 356 | 44 | 136 | 29 | 150 | 34 | 34 |

| 19 | Malta | 1 | 158 | 0 | 0 | 1 | 154 | ||

| 20 | Netherlands | 3032 | 12,075 | 2237 | 4463 | 90 | 6725 | 37 | 37 |

| 21 | Poland | 2178 | 9326 | 1108 | 5917 | 0 | 1300 | 936 | 968 |

| 22 | Portugal | 9607 | 14,082 | 3796 | 5233 | 134 | 842 | 5106 | 7249 |

| 23 | Romania | 6791 | 11,190 | 389 | 3040 | 0 | 1386 | 6382 | 6621 |

| 24 | Slovakia | 1803 | 2330 | 3 | 3 | 19 | 472 | 1600 | 1612 |

| 25 | Slovenia | 1133 | 1450 | 0 | 5 | 12 | 222 | 1074 | 1164 |

| 26 | Spain | 42,246 | 54,592 | 20,693 | 25,553 | 4605 | 11,065 | 16,086 | 16,781 |

| 27 | Sweden | 22,707 | 30,984 | 2017 | 8888 | 11 | 644 | 16,624 | 16,431 |

| 27-UE | 254,512 | 449,286 | 78,937 | 167,228 | 30,622 | 118,479 | 121,208 | 128,707 | |

| Capacity change 2019/2010 | 177% | 212% | 387% | 106% | |||||

| Country | Share of Hydropower in RES Capacity in 2019 | Hydropower Capacity Change 2019/2010 | Type of Support of Hydropower | |

|---|---|---|---|---|

| 1 | Portugal | 52% | 42% | FIT |

| 2 | Estonia | 1% | 22% | FIP, Tenders |

| 3 | Bulgaria | 56% | 16% | FIT until 2018, FIP from 2018 |

| 4 | Austria | 71% | 13% | Subsidies, FIT |

| 5 | Slovenia | 80% | 8% | Loans, Subsidies, Tenders |

| 6 | Italy | 34% | 8% | FIP, Tax regulation mechanisms (Reduction in real estate tax) |

| 7 | Hungary | 3% | 7% | FIT& FIP, Loans, Subsidies |

| 8 | Greece | 35% | 6% | FIT, Net-Metering, FIP, Subsidies, Tax regulation mechanism (Development Law) |

| Poland | 10% | 3% | Tenders, FIT & FIP from 2019, Green certificates, Loans, Subsidies |

| Specification | 2010 | 2015 | 2016 | 2017 | 2018 | 2019 | 2030 5 | 2040 5 |

|---|---|---|---|---|---|---|---|---|

| Wind | 1.7 | 10.9 | 12.6 | 14.9 | 12.8 | 15.1 | 38.3 | 55.2 |

| Biomass | 5.9 | 9.0 | 6.9 | 5.3 | 5.4 | 6.4 | 11.6 | 10.3 |

| Hydro | 2.9 | 1.8 | 2.1 | 2.6 | 1.7 | 1.7 | 3.0 | 3.1 |

| Biogas | 0.4 | 0.9 | 1.0 | 1.1 | 1.1 | 1.1 | 3.9 | 5.8 |

| Photovoltaics | 0.0 | 0.1 | 0.1 | 0.2 | 0.3 | 0.7 | 6.8 | 14.8 |

| Others RES 1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.5 |

| Total RES | 10.9 | 22.7 | 22.8 | 24.1 | 21.6 | 25.4 | 59.6 | 88.4 |

| Share of electricity generation from RES 2 | 6.9% | 13.8% | 13.7% | 14.2% | 12.7 | 15.5 | 31.8% | 39.7% |

| Legal obligation of share of RES in electricity generation 3 | - | 14.0% | 15.0% | 16.0% | 17.5 | 18.5 | ||

| Share of RES in gross final energy consumption 4 | 9.3% | 11.9% | 11.4% | 11.1% | 11.5% | 12.2% | 23.0% | 28.5% |

| Specification | CAPEX Micro Hydropower (<1 MW) [EUR 2019/kW] | CAPEX Small Hydropower (1–5 MW) [EUR 2019/kW] | CAPEX Mid Hydropower (5–20 MW) [EUR 2019/kW] |

|---|---|---|---|

| CAPEXmin = 50%CAPEXavg | 2000 | 1600 | 1200 |

| CAPEXavg | 4000 | 3200 | 2400 |

| CAPEXmax = 150%CAPEXavg | 6000 | 4800 | 3600 |

| Specification | OPEX Micro Hydropower (<1 MW) [EUR 2019/kW] | OPEX Small Hydropower (1–5 MW) [EUR 2019/kW] | OPEX Mid Hydropower (5–20 MW) [EUR 2019/kW] |

|---|---|---|---|

| OPEXmin = 50%OPEXavg | 60 | 40 | 24 |

| OPEXavg | 120 | 80 | 48 |

| OPEXmax = 150%OPEXavg | 180 | 120 | 72 |

| Micro Hydropower (<1 MW) | Small Hydropower (1–5 MW) | Mid Hydropower (5–20 MW) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Min | Mean | Max | Min | Mean | Max | Min | Mean | Max | |

| CAPEX [EUR 2019/kW] | |||||||||

| 2000 | 4000 | 6000 | 1600 | 3200 | 4800 | 1200 | 2400 | 3600 | |

| OPEX [EUR 2019/kW] | |||||||||

| 60 | 120 | 180 | 40 | 80 | 120 | 24 | 48 | 72 | |

| life time = 50 years; WACC = 7% | LCOE [EUR 2019/MWh] | ||||||||

| 58 | 117 | 175 | 45 | 89 | 134 | 32 | 63 | 95 | |

| life time = 15 years; WACC = 7% | LCOE [EUR 2019/MWh] | ||||||||

| 80 | 160 | 239 | 62 | 123 | 185 | 44 | 89 | 133 | |

| life time = 50 years; WACC = 11.4% | LCOE [EUR 2019/MWh] | ||||||||

| 82 | 117 | 82 | 45 | 82 | 134 | 82 | 63 | 82 | |

| life time = 15 years; WACC = 11.4% | LCOE [EUR 2019/MWh] | ||||||||

| 98 | 197 | 295 | 76 | 153 | 229 | 56 | 111 | 167 | |

| Type of RES Installation | Referential Price [EUR /MWh] | ||||

|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Hydropower | |||||

| ≤0.5 MW | 109 | 112 | 128 | 128 | 144 |

| 0.5–1 MW | 109 | 112 | 116 | 116 | 130 |

| >1 MW | 112 | 112 | 112 | 112 | 124 |

| Solar energy ≤ 1 MW | 108 | 105 | 98 | 90 | 84 |

| Solar energy > 1 MW | 104 | 99 | 93 | 85 | 79 |

| Onshore wind ≤ 1 MW | 70 | 74 | 74 | 74 | 74 |

| Onshore wind > 1 MW | 90 | 81 | 81 | 66 | 58 |

| Auction No. | Description of Installations Admitted to the Auction (Installation Capacity: ≤ or >1 MW, CO2 Emission: ≤ or >100 kg/MWh; Annual Operation ≤ or >3504 h) | Quantity of the Energy Sold at the Auction [MWh] | |

|---|---|---|---|

| Planned | Real | ||

| 1/2016 | agricultural biogas, ≤1 MW | 2,113,887 | 824,629 |

| 2/2016 | agricultural biogas, >1 MW | 2,309,382 | 0 1 |

| 3/2016 | installation: ≤1 MW, CO2 > 100 kg/MWh, ≤3504 h | 1,575,000 | 1,567,289 |

| 4/2016 | installation: ≤1 MW, CO2 < 100 kg/MWh, >3504 h (incl. hydropower) | 1,306,870 | 416,554 |

| 1/2017 | installation: ≤1 MW, CO2 > 100 kg/MWh, ≤3504 h | 4,725,000 | 4,720,962 |

| 2/2017 | installation: ≤1 MW, CO2 < 100 kg/MWh, >3504 h (incl. hydropower) | 1,484,764 | 312,441 |

| 1/2018 | other biogas, biomass/waste, CHP, >1 MW | 33,864,470 | 0 1 |

| 2/2018 | agricultural biogas, >1 MW | 1,467,617 | 0 1 |

| 3/2018 | hydropower, bioliquid, offshore, ≤1 MW | 1,475,211 | 0 1 |

| 4/2018 | agricultural biogas, ≤1 MW | 1,149,296 | 0 1 |

| 5/2018 | other biogas, biomass/waste, CHP, ≤1 MW | 915,336 | 0 1 |

| 6/2018 | onshore wind, photovoltaics, >1 MW | 45,000,000 | 41,996,772 |

| 7/2018 | other biogas, biomass/waste, CHP, >1 MW | 57,699,309 | 972,000 |

| 8/2018 | agricultural biogas, ≤1 MW | 13,311,000 | 0 1 |

| 9/2018 | onshore wind, photovoltaics, ≤1 MW | 16,065,000 | 8,169,917 |

| 10/2018 | hydropower, bioliquid, offshore, ≤1 MW | 3,750,000 | 0 1 |

| 11/2018 | agricultural biogas, ≤1 MW | 11,700,000 | 3,489,766 |

| 12/2018 | hydropower, bioliquid, offshore, >1 MW | 5,400,000 | 816,000 |

| 13/2018 | agricultural biogas, >1 MW | 3,510,000 | 717,280 |

| 1/2019 | other biogas, biomass/waste, >1 MW | 33,864,470 | 0 1 |

| 2/2019 | agricultural biogas, >1 MW | 1,467,617 | 219,837 |

| 3/2019 | hydropower, bioliquid, offshore, ≤1 MW | 1,475,211 | 0 1 |

| 4/2019 | agricultural biogas, ≤1 MW | 1,149,296 | 0 1 |

| 5/2019 | other biogas, biomass/waste, CHP, ≤1 MW | 1,120,000 | 0 1 |

| 6/2019 | onshore wind, photovoltaics, >1 MW | 113,970,000 | 77,837,230 |

| 7/2019 | other biogas, biomass/waste, CHP, >1 MW | 14,190,000 | 972,000 |

| 8/2019 | agricultural biogas, ≤1 MW | 140,400 | 0 1 |

| 9/2019 | onshore wind, photovoltaics, ≤1 MW | 11,445,000 | 11,436,780 |

| 10/2019 | agricultural biogas, ≤1 MW | 1,341,821 | 0 1 |

| 11/2019 | hydropower, bioliquid, offshore, ≤1 MW | 594,000 | 0 1 |

| 12/2019 | agricultural biogas, >1 MW | 1,170,000 | 0 1 |

| 1/2020 | agricultural biogas, >1 MW | 2,500,000 | 501,214 |

| 2/2020 | other biogas, combustion of biomass/waste, >1 MW | 10,950,000 | 319,606 |

| 3/2020 | hydropower, bioliquid, offshore, ≤1 MW | 540,000 | 0 1 |

| 4/2020 | other biogas, biomass/waste, CHP, ≤1 MW | 375,000 | 0 1 |

| 5/2020 | hydropower, bioliquid, offshore, ≤1 MW | 1,080,000 | 0 1 |

| 6/2020 | agricultural biogas, >1 MW | 1,800,000 | 0 1 |

| 7/2020 | onshore wind, photovoltaics, >1 MW | 46,290,000 | 41,939,089 |

| 8/2020 | onshore wind, photovoltaics, ≤1 MW | 11,760,000 | 11,747,068 |

| Auction No. | Description of Installations Admitted to the Auction | Prices [EUR /MWh] | ||

|---|---|---|---|---|

| Minimum | Maximum | Average | ||

| 1/2016 | agricultural biogas, ≤1 MW | 117 | 117 | 117 |

| 3/2016 | photovoltaic, onshore wind, ≤1 MW | 59 | 95 | 82 |

| 4/2016 | hydropower, biogas and biomass, ≤1 MW | 7 1 | 109 | 87 |

| 1/2017 | photovoltaic and onshore wind, ≤1 MW | 45 | 93 | 87 |

| 2/2017 | hydropower, biogas and biomass, ≤1 MW | 67 | 110 | 86 |

| 6/2018 | onshore wind, photovoltaics, >1 MW | 37 | 50 | 46 |

| 7/2018 | other biogas, biomass/waste, CHP, >1 MW | 93 | 93 | 93 |

| 9/2018 | onshore wind, photovoltaics, ≤1 MW | 67 | 85 | 82 |

| 11/2018 | agricultural biogas, ≤1 MW | 125 | 133 | 131 |

| 12/2018 | hydropower, bioliquid, >1 MW | 97 | 112 | 108 |

| 13/2018 | agricultural biogas, >1 MW | 115 | 120 | 118 |

| 2/2019 | agricultural biogas, >1 MW | 144 | 147 | 146 |

| 4/2019 | agricultural biogas, ≤1 MW | 149 | 155 | 153 |

| 6/2019 | onshore wind, photovoltaics, >1 MW | 38 | 54 | 49 |

| 7/2019 | other biogas, biomass/waste, CHP, >1 MW | 93 | 93 | 93 |

| 9/2019 | onshore wind, photovoltaics, ≤1 MW | 63 | 76 | 74 |

| 1/2020 | agricultural biogas, ≤1 MW | 146 | 152 | 150 |

| 2/2020 | other biogas, biomass/waste, CHP, >1 MW | 88 | 95 | 90 |

| 7/2020 | onshore wind, photovoltaics, ≤1 MW | 44 | 58 | 52 |

| 8/2020 | onshore wind, photovoltaics, ≤1 MW | 52 | 63 | 60 |

| Micro HP (Up to 50 kW) | Micro HP (Capacity 50–500 kW) | |||

|---|---|---|---|---|

| Number of Plants | Total Capacity [MW] | Number of Plants | Total Capacity [MW] | |

| 31 December 2018 | 281 | 8.06 | 346 | 54.37 |

| 31 December 2019 | 292 | 8.36 | 349 | 54.46 |

| 31 December 2020 | 298 | 8.53 | 351 | 54.73 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Godyń, I.; Dubel, A. Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method. Energies 2021, 14, 8473. https://doi.org/10.3390/en14248473

Godyń I, Dubel A. Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method. Energies. 2021; 14(24):8473. https://doi.org/10.3390/en14248473

Chicago/Turabian StyleGodyń, Izabela, and Anna Dubel. 2021. "Evolution of Hydropower Support Schemes in Poland and Their Assessment Using the LCOE Method" Energies 14, no. 24: 8473. https://doi.org/10.3390/en14248473