Lifecycle Energy Accounting of Three Small Offshore Oil Fields

Abstract

:1. Introduction

1.1. Lifting Energy

1.2. Drilling Energy

1.3. Construction Energy

1.4. Lifting Costs

- Gross rate;

- Oil rate;

- Gas rate;

- Injection water rate;

- Oil wells count;

- Gas wells count;

- Injection wells count.

1.5. Internal vs. External Energy Sources

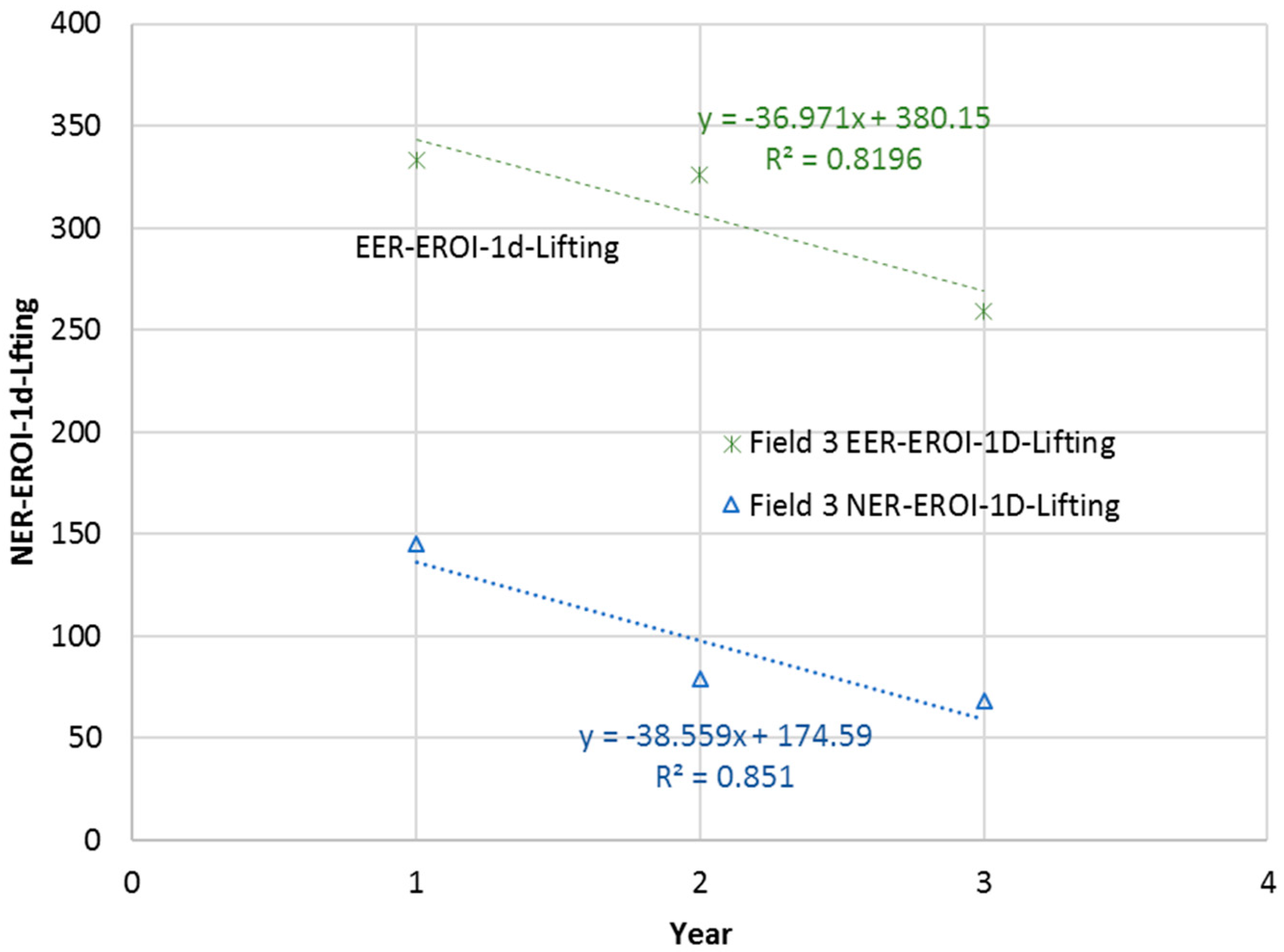

- NER-EROI-1dLifting

- EER-EROI-1dLifting

- EER-EROI-1dLifting+Drilling

- EER-EROI-1dLifting+Drilling+Construction

1.6. Previous Work on Field-Specific EROI Derivations

1.7. Summary of EROI Literature Influencing This Research

1.8. Case Studies

2. Results and Discussion

- Actual cumulative energy profile;

- The energy breakeven point for all the 3 fields;

- The annual proportion of energy-in from lifting, drilling, and construction;

- The overall (field-life) proportion of energy-in from lifting, drilling, and construction.

3. Material and Methods

- Gather energy inputs and outputs for three small offshore fields;

- Calculate time series EROI-1d values for each field;

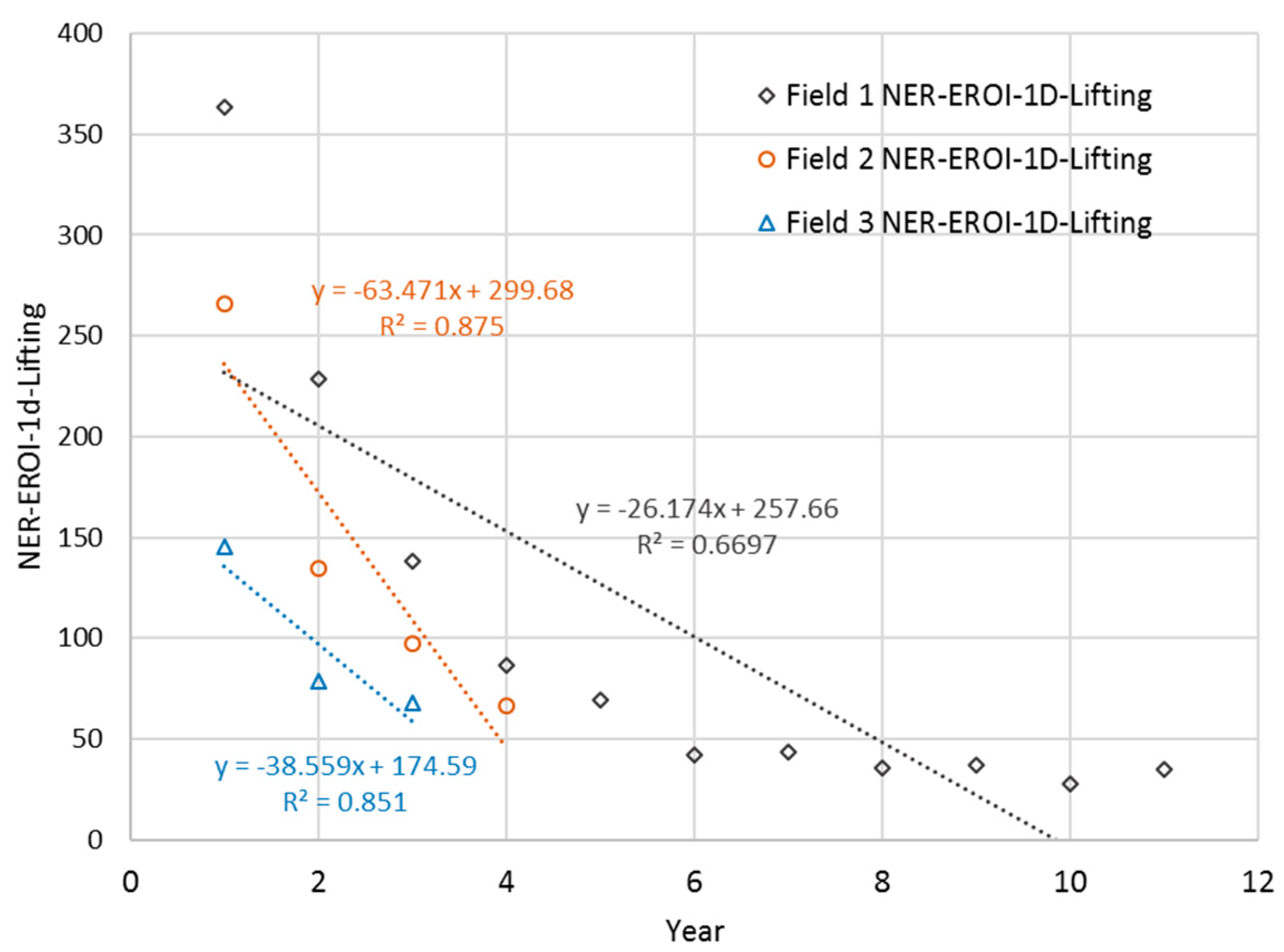

- Apply regression analysis to the time series data where appropriate;

- Calculate lifting costs for three small offshore fields;

- Analysis of results.

3.1. Energy Outputs

3.2. Energy Input—Lifting Energy

3.3. Energy Input—Drilling Energy

3.4. Energy Input—Construction Energy

3.5. Derivation of EROI-1d

3.6. Lifting Cost

4. Conclusions

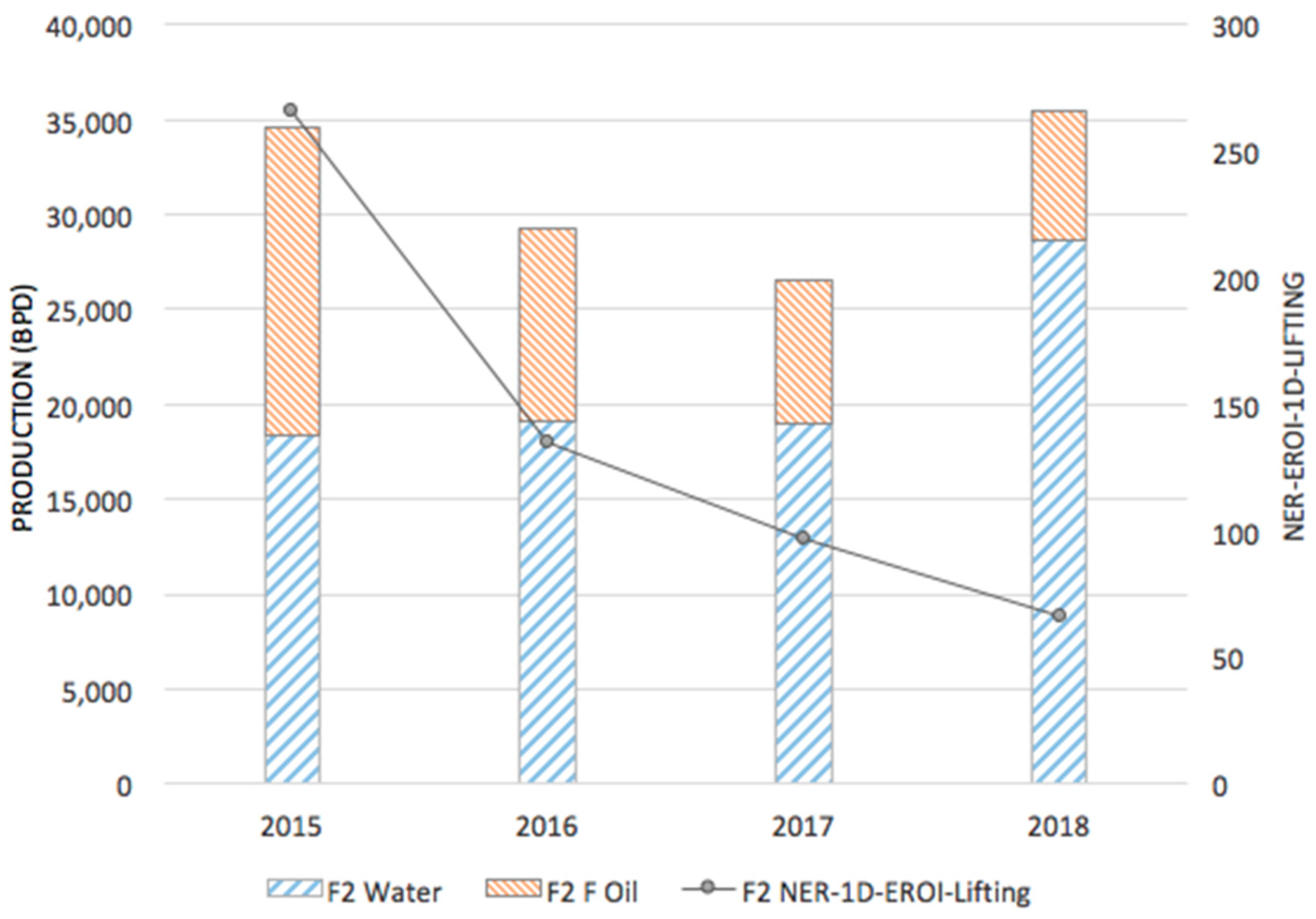

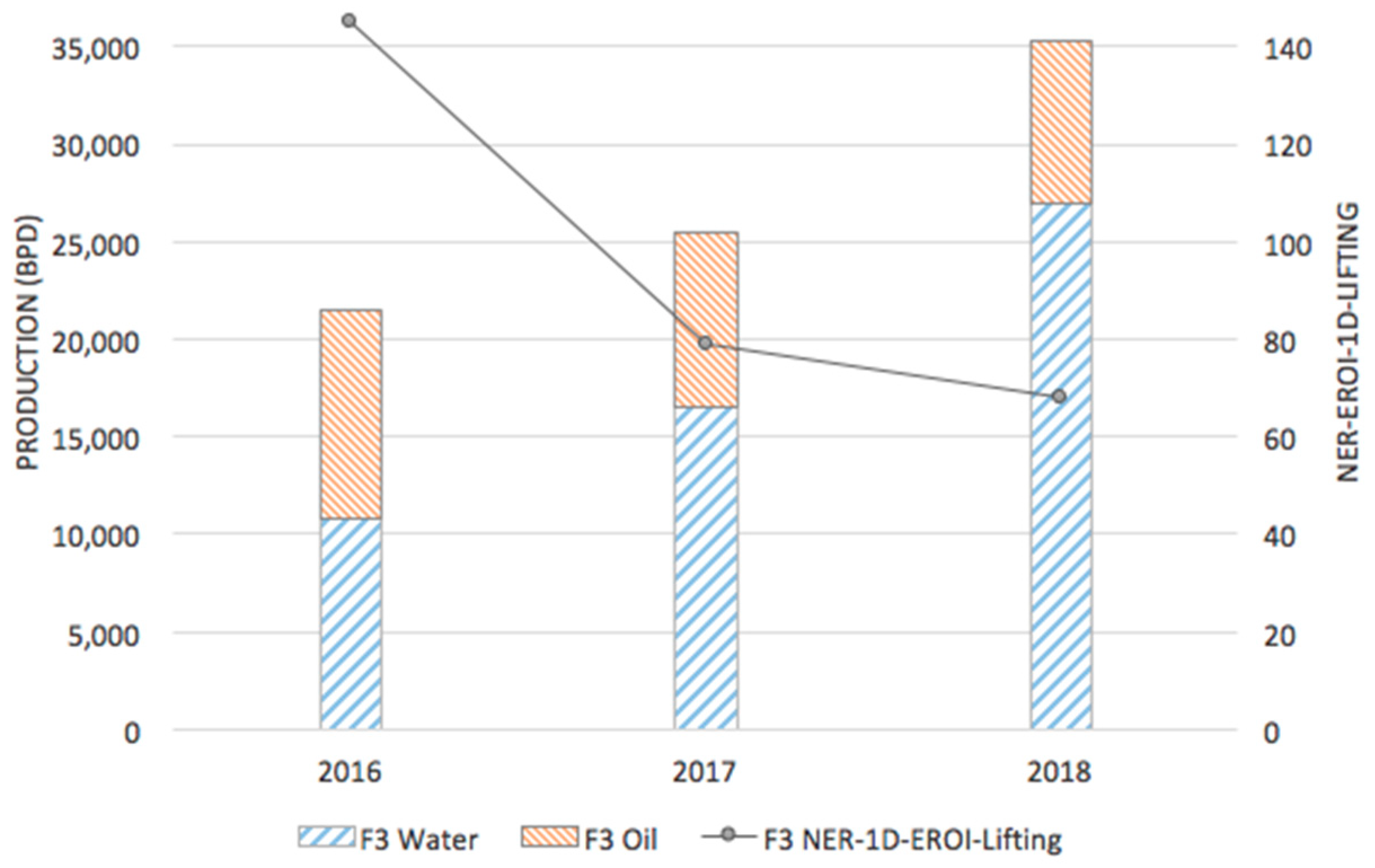

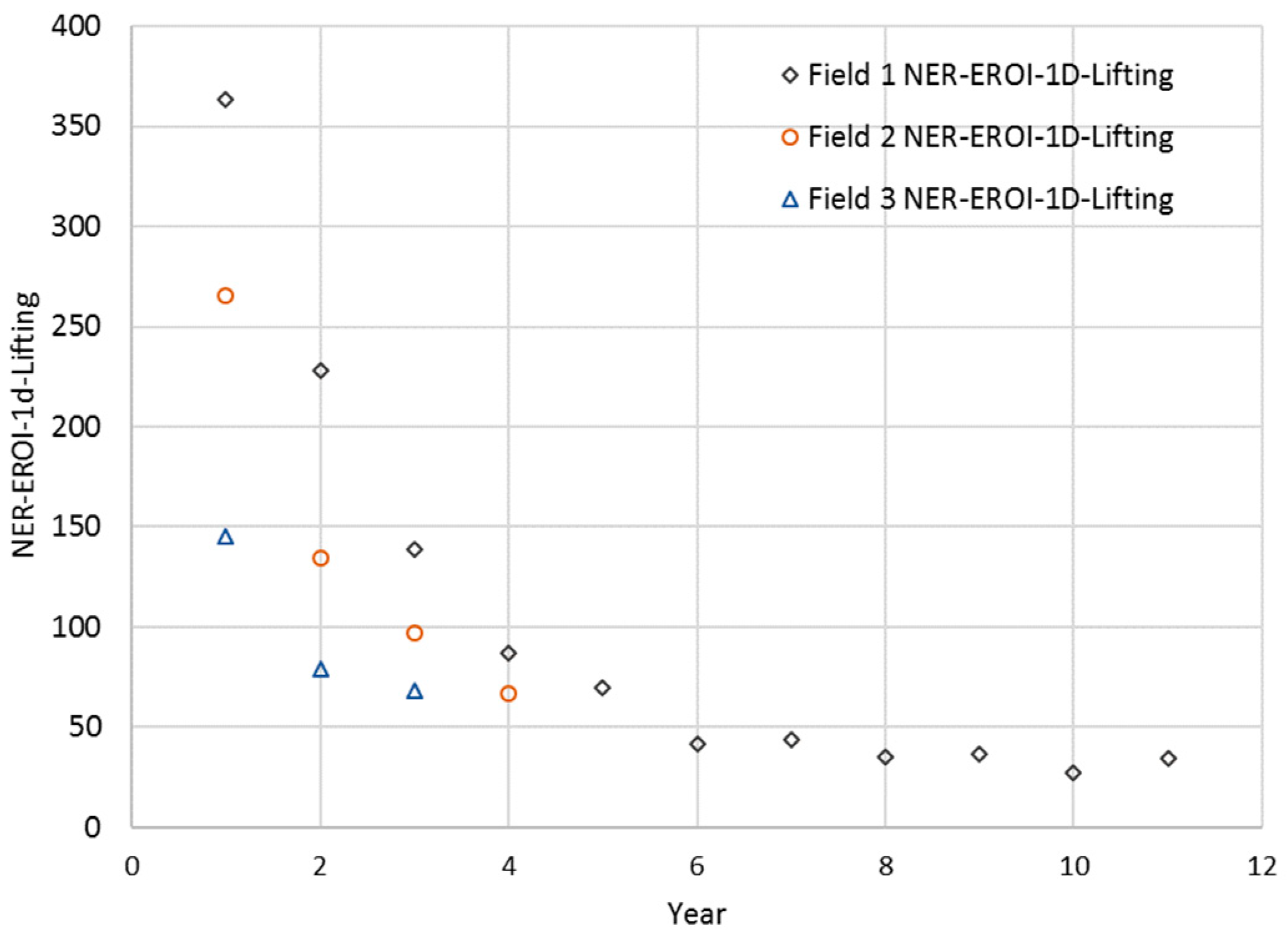

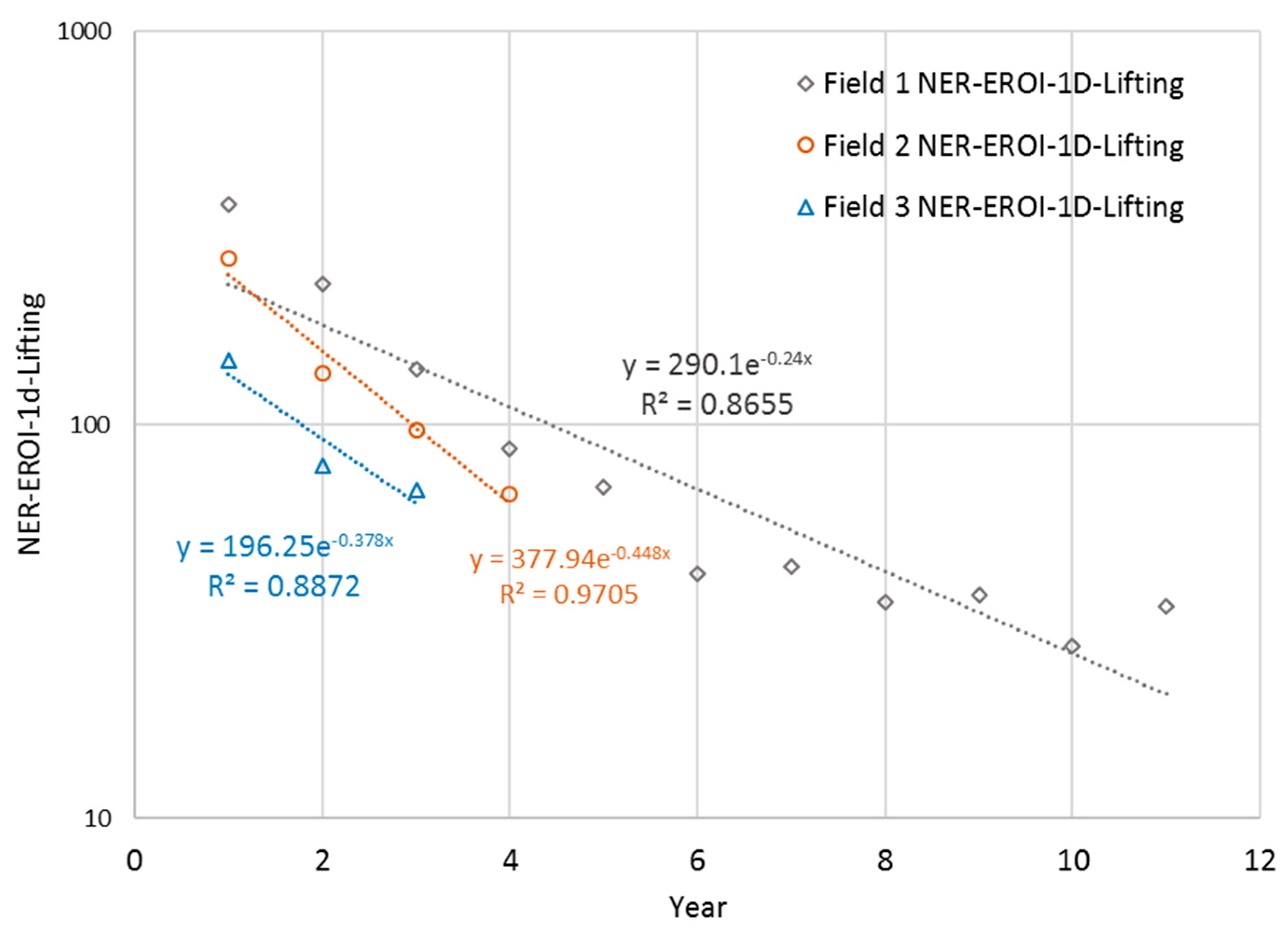

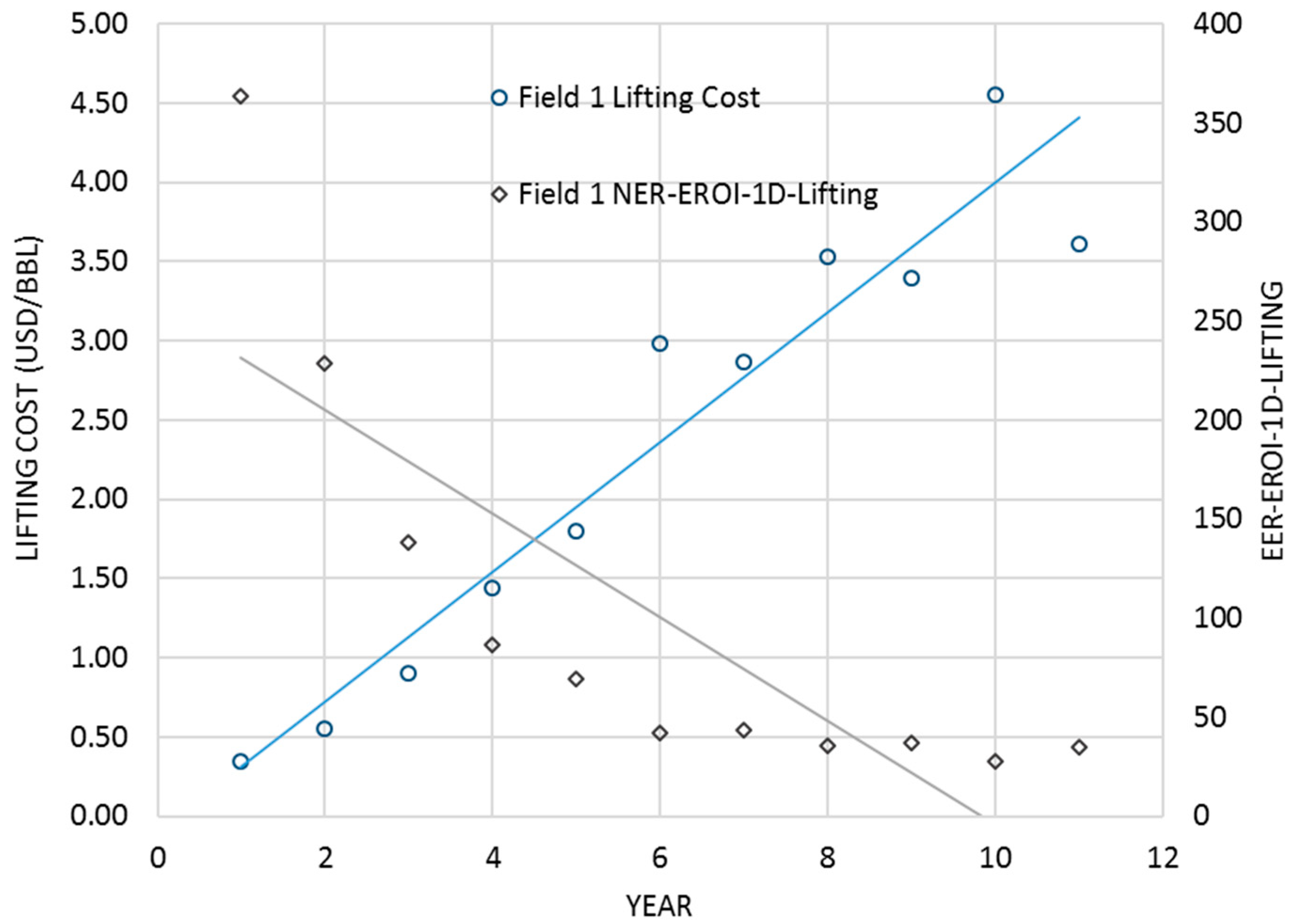

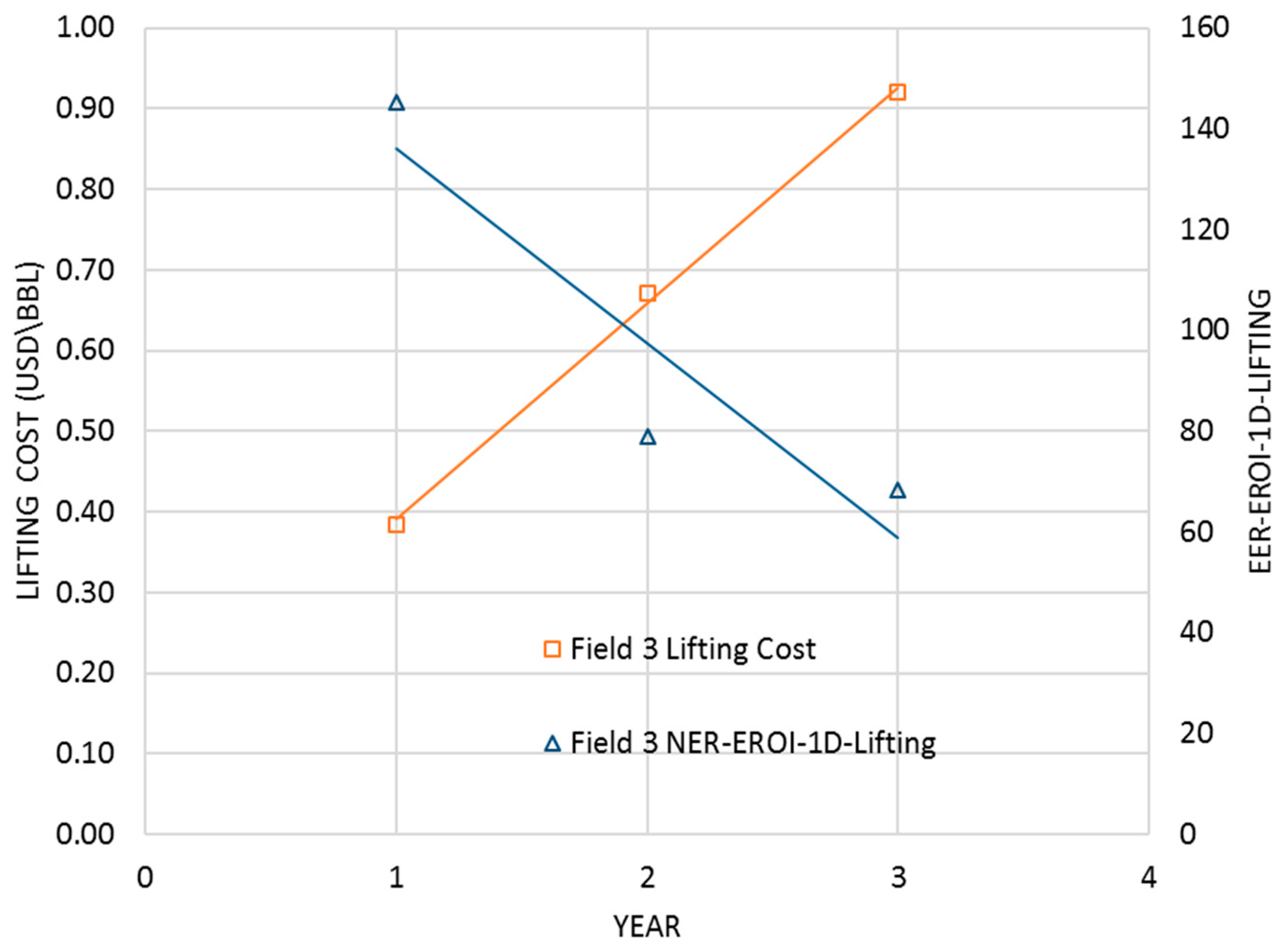

- All three fields indicate a steeply declining EROI-1d trend. The EROI-1dLifting decline can be directly attributed to the lifting process becoming more energy intensive over time. This applies equally to Field 1, despite the fact that the recovery method was changed, employing low pressure water disposal rather than high pressure water injection. Without the change in recovery strategy, the EROI-1dLifting trend would have declined more steeply from 2011 onwards.

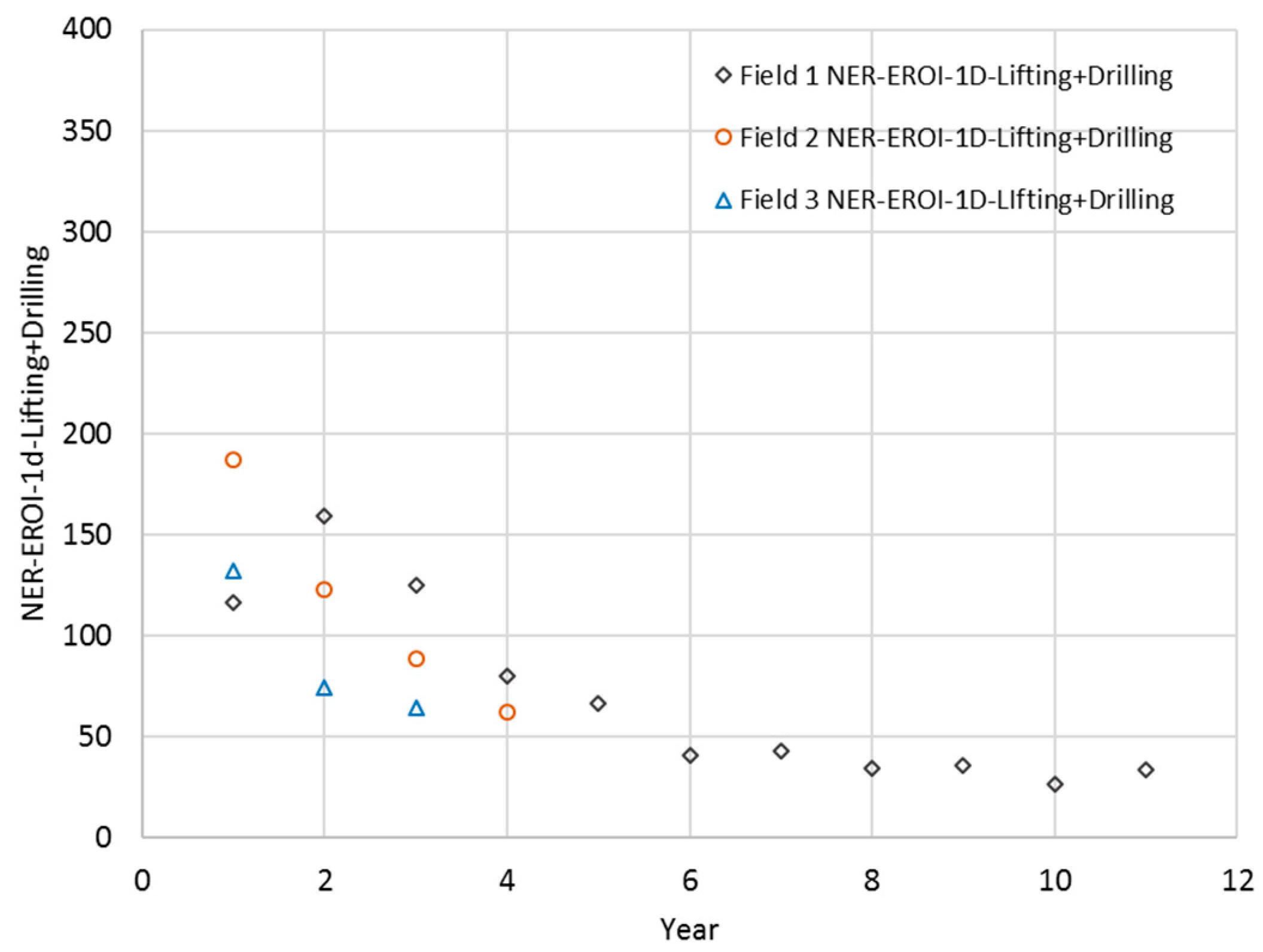

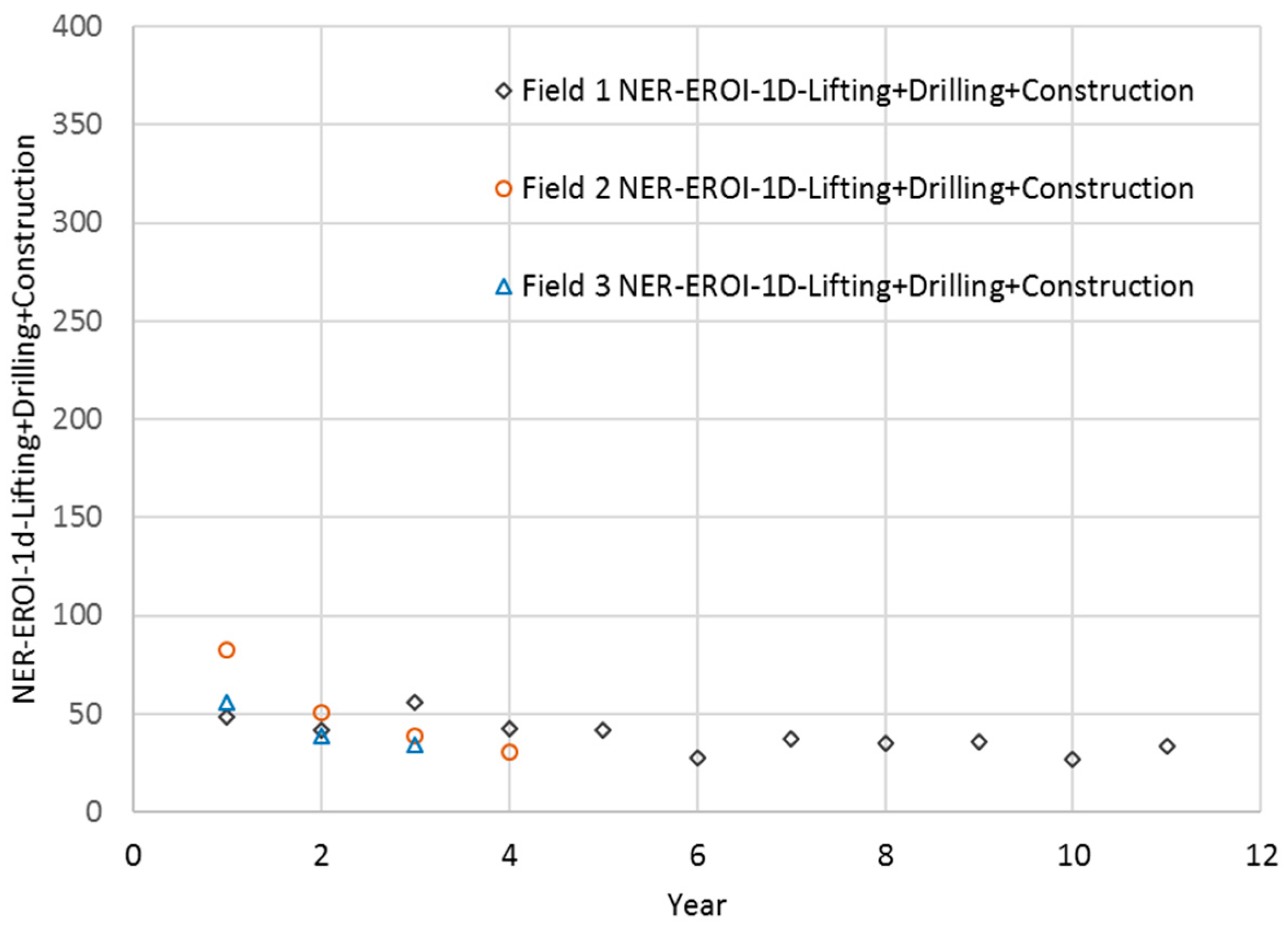

- The decreasing EROI-1d trend also holds true for the EROI-1dLifting+Drilling and for the EROI-1dLifting+Drilling+Construction parameters, but to a lesser extent, since (1) drilling energy intensity decreases after the initial production wells are drilled, and (2) the methodology used amortized the construction energy evenly over the first three years of production.

- Production decline modeling in an oilfield is an intensely studied topic. Energy return decline modeling generally receives very little attention, and is therefore not as well understood. It is suggested that more vigorous efforts should be made to understand the EROI decline behavior of oilfields, since it has a direct impact on the efficiency and economics of the field, even more so than the production decline.

- Drilling and construction energies constitute a substantial component of the total energy consumption. The drilling contribution to energy consumption is related to the drilling intensity over the life of the field, which usually starts with a large number of initial development wells and then tapers off to a lesser number of wells per year later in the field life. Construction energy, on the other hand, is completely expended just prior to first production. The energy breakeven point was found to occur within the first year of production for all three fields, due to the large energy gains obtained by early high production rates.

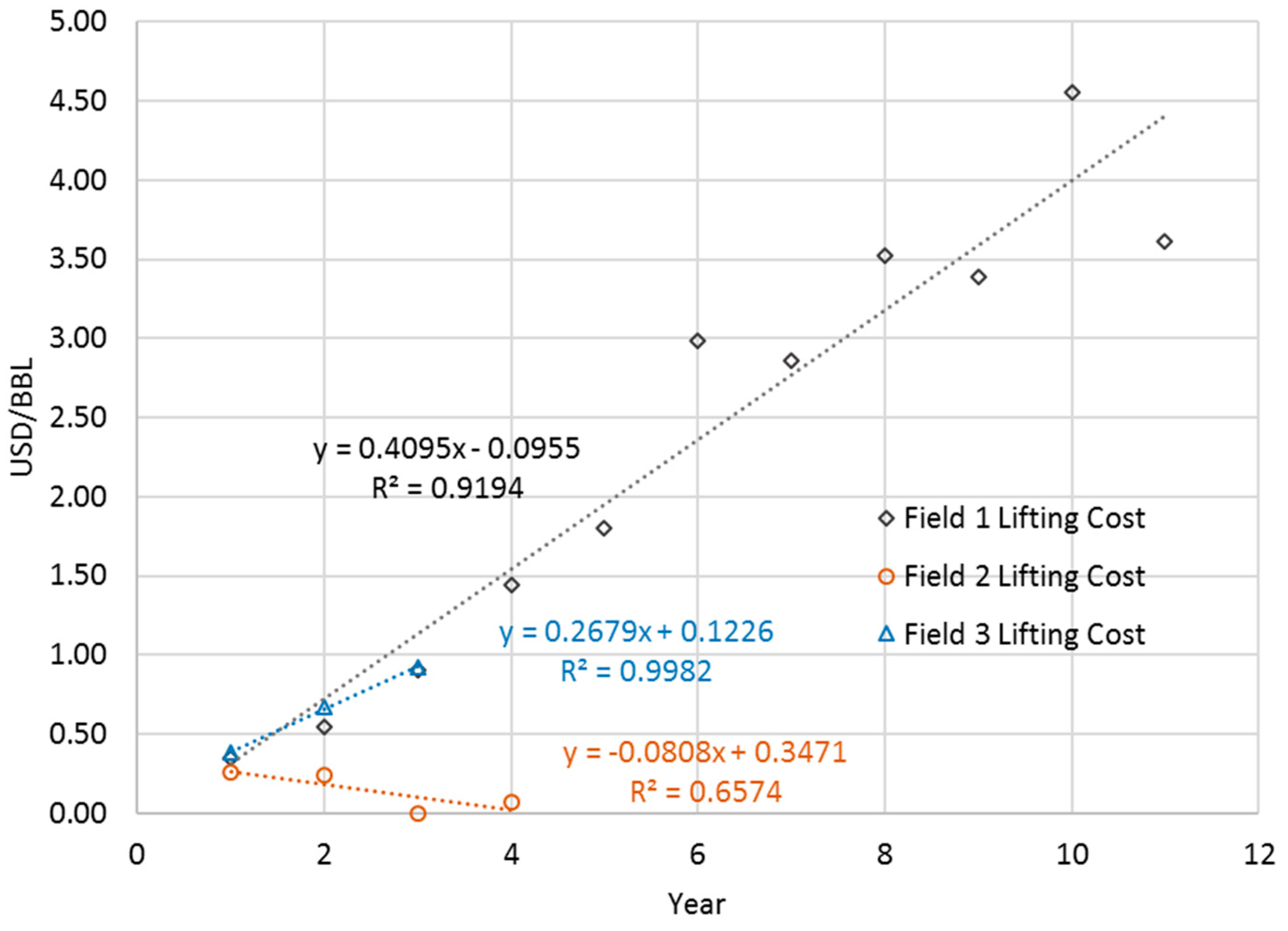

- EROI-1dLifting and lifting costs are found to be inversely related, since the input energy has a cost, such as the cost of diesel fuel. The magnitude of the lifting cost and the degree by which lifting costs increase over time depends on the mix of fuels used, which can range from complete reliance on procured diesel fuel (Field 1) to total fuel self-sufficiency when sufficient quantities and quality of internally derived natural gas are available (Field 2). In between these two extremes is the case where there is a mixture of internal and external fuels sources applied (Field 3).

- This method describes a more rigorous approach to understanding and estimating lifting costs and highlights the impact on costs of the source of energy consumptions with respect to internal vs. external.

4.1. Limitations of This Work

4.2. Future Work

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Höök, M.; Hirsch, R.; Aleklett, K. Giant oil field decline rates and their influence on world oil production. Energy Policy 2009, 37, 2262–2272. [Google Scholar] [CrossRef] [Green Version]

- Sorrell, S.; Speirs, J.; Bentley, R.; Miller, R.; Thompson, E. Shaping the global oil peak: A review of the evidence on field sizes, reserve growth, decline rates and depletion rates. Energy 2012, 37, 709–724. [Google Scholar] [CrossRef]

- Bullard, C.W., III; Herendeen, R.A. The energy cost of goods and services. Energy Policy 1975, 3, 268–278. [Google Scholar] [CrossRef]

- Herendeen, R.A.; Cleveland, C. Net energy analysis: Concepts and methods. Encycl. Energy 2004, 4, 283–289. [Google Scholar]

- King, C.W.; Hall, C.A. Relating financial and energy return on investment. Sustainability 2011, 3, 1810–1832. [Google Scholar] [CrossRef]

- Cleveland, C.J. Energy quality and energy surplus in the extraction of fossil fuels in the US. Ecol. Econ. 1992, 6, 139–162. [Google Scholar] [CrossRef]

- Cleveland, C.J. Net energy from the extraction of oil and gas in the United States. Energy 2005, 30, 769–782. [Google Scholar] [CrossRef]

- Gagnon, N.; Hall, C.A.; Brinker, L. A preliminary investigation of energy return on energy investment for global oil and gas production. Energies 2009, 2, 490–503. [Google Scholar] [CrossRef]

- Dale, M.; Krumdieck, S.; Bodger, P. Net energy yield from production of conventional oil. Energy Policy 2011, 39, 7095–7102. [Google Scholar] [CrossRef]

- Grandell, L.; Hall, C.A.; Höök, M. Energy return on investment for Norwegian oil and gas from 1991 to 2008. Sustainability 2011, 3, 2050–2070. [Google Scholar] [CrossRef]

- Brandt, A.R. Oil depletion and the energy efficiency of oil production: The case of California. Sustainability 2011, 3, 1833–1854. [Google Scholar] [CrossRef]

- Guilford, M.C.; Hall, C.A.; O’Connor, P.; Cleveland, C.J. A new long term assessment of energy return on investment (EROI) for US oil and gas discovery and production. Sustainability 2011, 3, 1866–1887. [Google Scholar] [CrossRef]

- Murphy, D.J.; Hall, C.A.; Dale, M.; Cleveland, C. Order from chaos: A preliminary protocol for determining the EROI of fuels. Sustainability 2011, 3, 1888–1907. [Google Scholar] [CrossRef]

- Cleveland, C.J.; O’connor, P.A. Energy return on investment (EROI) of oil shale. Sustainability 2011, 3, 2307–2322. [Google Scholar] [CrossRef]

- Poisson, A.; Hall, C.A. Time series EROI for Canadian oil and gas. Energies 2013, 6, 5940–5959. [Google Scholar] [CrossRef]

- Nogovitsyn, R.; Sokolov, A. Preliminary Calculation of the EROI for the Production of Gas in Russia. Sustainability 2014, 6, 6751–6765. [Google Scholar] [CrossRef] [Green Version]

- Brandt, A.R.; Sun, Y.; Bharadwaj, S.; Livingston, D.; Tan, E.; Gordon, D. Energy return on investment (EROI) for forty global oilfields using a detailed engineering-based model of oil production. PLoS ONE 2015, 10, e0144141. [Google Scholar] [CrossRef]

- Brandt, A.R.; Yeskoo, T.; Vafi, K. Net energy analysis of Bakken crude oil production using a well-level engineering-based model. Energy 2015, 93, 2191–2198. [Google Scholar] [CrossRef] [Green Version]

- Tripathi, V.S.; Brandt, A.R. Estimating decades-long trends in petroleum field energy return on investment (EROI) with an engineering-based model. PLoS ONE 2017, 12, e0171083. [Google Scholar] [CrossRef]

- Court, V.; Fizaine, F. Long-term estimates of the energy-return-on-investment (EROI) of coal, oil, and gas global productions. Ecol. Econ. 2017, 138, 145–159. [Google Scholar] [CrossRef]

- Feng, J.; Feng, L.; Wang, J. Analysis of Point-of-Use Energy Return on Investment and Net Energy Yields from China’s Conventional Fossil Fuels. Energies 2018, 11, 313. [Google Scholar] [CrossRef]

- Brandt, A.R.; Yeskoo, T.; McNally, M.S.; Vafi, K.; Yeh, S.; Cai, H.; Wang, M.Q. Energy intensity and greenhouse gas emissions from tight oil production in the bakken formation. Energy Fuels 2016, 30, 9613–9621. [Google Scholar] [CrossRef]

- Hall, C.A.; Balogh, S.; Murphy, D.J. What is the minimum EROI that a sustainable society must have? Energies 2009, 2, 25–47. [Google Scholar] [CrossRef]

- Pashakolaie, V.G.; Khaleghi, S.; Mohammadi, T.; Khorsandi, M. Oil production cost function and oil recovery implementation-evidence from an iranian oil field. Energy Explor. Exploit. 2015, 33, 459–470. [Google Scholar] [CrossRef]

- Stermole, F.J.; Kifer Ten Eyck, D. Cost Per Barrel as an Economic Decsion Tool. Soc. Pet. Eng. J. SPE-16994-MS. 1987. Available online: https://www.onepetro.org/general/SPE-16994-MS (accessed on 17 July 2019).

- Martinez, R.E. Forecast Techniques for Lifting Cost in Gas and Oil Onshore Fields. In Proceedings of the SPE Latin American and Caribbean Petroleum Engineering Conference, Buenos Aires, Argentina, 25–28 March 2001. [Google Scholar]

- Brundred, L.L. Economics of Water Flooding. J. Pet. Technol. 1954. [Google Scholar] [CrossRef]

- Cobb, W.; Marek, F. Determination of volumetric sweep efficiency in mature waterfloods using production data. In Proceedings of the SPE Annual Technical Conference and Exhibition, San Antonio, TX, USA, 5–8 October 1997. [Google Scholar]

- Alhuthali, A.; Oyerinde, A.; Datta-Gupta, A. Optimal waterflood management using rate control. SPE Reserv. Eval. Eng. 2007, 10, 539–551. [Google Scholar] [CrossRef]

- Chang, H.L. Polymer flooding technology yesterday, today, and tomorrow. J. Pet. Technol. 1978, 30, 1113–1128. [Google Scholar] [CrossRef]

- Sheng, J.J.; Leonhardt, B.; Azri, N. Status of polymer-flooding technology. J. Can. Pet. Technol. 2015, 54, 116–126. [Google Scholar] [CrossRef]

- Kumar, S.; Mandal, A. A comprehensive review on chemically enhanced water alternating gas/CO2 (CEWAG) injection for enhanced oil recovery. J. Pet. Sci. Eng. 2017, 157, 696–715. [Google Scholar] [CrossRef]

- Afzali, S.; Rezaei, N.; Zendehboudi, S. A comprehensive review on enhanced oil recovery by water alternating gas (WAG) injection. Fuel 2018, 227, 218–246. [Google Scholar] [CrossRef]

- Santos, R.; Loh, W.; Bannwart, A.; Trevisan, O. An overview of heavy oil properties and its recovery and transportation methods. Braz. J. Chem. Eng. 2014, 31, 571–590. [Google Scholar] [CrossRef] [Green Version]

- Keplinger, C. Economic Considerations Affecting Steam Flood Prospects. In Proceedings of the Symposium on Petroleum Economics and Evaluation, Dallas, TX, USA, 8–9 February 1965. [Google Scholar]

- McCarthy, D.W.; Groat, C.; Chen, J.-K.; Liau, T.-H.; Weaver, R.E.; Aldahir, A. Tertiary Oil Recovery Economics in Louisiana. In Proceedings of the SPE/DOE Enhanced Oil Recovery Symposium, Tulsa, OK, USA, 3–5 April 1981. [Google Scholar]

- Chaar, M.; Venetos, M.; Dargin, J.; Palmer, D.B. Economics of steam generation for thermal EOR. In Proceedings of the Abu Dhabi International Petroleum Exhibition and Conference, Abu Dhabi, UAE, 10–13 November 2014. [Google Scholar]

- Aseeri, A.S. How Much is Steam Worth? In Proceedings of the Abu Dhabi International Petroleum Exhibition & Conference (ADIPEC), Abu Dhabi, United Arab Emeriates, 13–16 November 2017. [Google Scholar]

- Gordon, D.; Brandt, A.R.; Bergerson, J.; Koomey, J. Know Your Oil: Creating a Global Oil-Climate Index; Carnegie Endowment for International Peace: Washington, DC, USA, 2015. [Google Scholar]

| Boundaries | Extraction (1) | Processing (2) | End-Use (3) | |

|---|---|---|---|---|

| 1 | Direct energy and materials | EROI 1d | EROI 2d | EROI 3d |

| 2 | Indirect energy and materials input | EROI standard | EROI 2i | EROI 3i |

| 3 | Indirect labor consumption | EROI 1lab | EROI 2lab | EROI 3lab |

| 4 | Auxiliary services consumption | EROI 1aux | EROI 2aux | EROI 3aux |

| 5 | Environmental | EROI 1env | EROI 2env | EROI 3env |

| Sub-Parameter of EROI-1d | Purpose |

|---|---|

| EROI-1dLifting | The Energy Return on Investment for Direct Energies and Materials related to lifting only, which is the incremental energy required to produce a barrel of crude oil. Used to understand lifting energy breakeven points and lifting costs |

| EROI-1dLifting+Drilling | The Energy Return on Investment for Direct Energies and Materials related to lifting and the drilling of wells. Used to understand the main continuous direct energy consumers during the life of the field, post construction phase. |

| EROI-1dLifting+Drilling+Construction | The Energy Return on Investment for Direct Energies and Materials related to lifting, drilling and construction of surface facilities. The original intention of EROI-1d, which includes all direct energy and materials. |

| Year Published | Author/s | Subject | Boundaries and Method | EROI Range, Trend, and Period |

|---|---|---|---|---|

| 1992 | Cutler | EROI methodology described, including quality corrections based on thermal equivalents and other measures. Time series for petroleum and coal production in the United States. | Sector: U.S. petroleum Method: Top-Down Extraction only by converting direct costs to energies. | EROI: 10 to 15 Trend: Indiscernible/Fluctuating Period: 1954 to 1984 |

| 2001 | Cutler | EROI methodology described with further consideration of quality issues. EROI time series for U.S. petroleum sector. | Sector: U.S. petroleum. Method: Top-Down Extraction only by converting direct costs to energies. | EROI: 16 to 24 Trend: Indiscernible/Fluctuating Period: 1954 to 1994 |

| 2009 | Gagnon et al. | EROI time series of global oil and gas production. Method includes converting published costs to energy inputs. | Sector: Global petroleum. Method: Top-down based on published production rates and costs. | EROI: 25 to 20. Trend: Declining. Period: 1992 to 2006 |

| 2011 | Dale et al. | EROI and Net Energy Yield (NEY) concept and methodology. | Case studies not included. | - |

| 2011 | Grandell et al. | EROI time series for Norwegian oil and gas sector. | Sector: Norwegian petroleum. Method: Hybrid based on published production rates and costs. Takes into account specific fuel consumption data collected by the Norwegian authorities. | EROI: 40 to 57. Trend: Fluctuating. Period: 1991 to 2007 |

| 2011 | Brandt | Introduces variants of EROI regarding Net Energy Return and External Energy Return. EROI time series for California oil and gas production. | Sector: California petroleum. Method: Hybrid Based on published production rates and costs. Differentiates between EER and NER. | NER-EROI: 65 to 10. Trend NER: Decreasing. Period: 1950 to 2010. EER-EROI: 90 to 8. Trend NER: Decreasing. Period: 1950 to 2010 |

| 2011 | Guilford | Long-term assessment of U.S. oil and gas production EROI. | Sector: U.S. petroleum. Method: Top-down. | EROI: 24 to 15. Trend: Fluctuating/Decreasing. Period: 1920 to 2010 |

| 2011 | Murphy et al. | Discussion on a refined methodology covering boundaries and EROI subdivisions. | Case studies not included. | - |

| 2011 | Cleveland and O’Connor | Analysis of EROI of Oil Shale in the United States. | Sector: U.S. Oil Shale. Method: Hybrid | EROI: 1.4 to 2. Trend: Single Point Estimate. Period: 2010 |

| 2013 | Poisson and Hall | EROI time series analysis for Canadian oil and gas production | Sector: Canadian petroleum. Method: Top-down. Separates direct and indirect energies. | Direct energy only EROI: 17 to 14. Trend: Declining. Period: 1990 to 2010. Direct and Indirect EROI: 15 to 12. Trend: Declining. Period: 1990 to 2010 |

| 2014 | Nogovitsyn and Sokolov | EROI time series analysis for overall Russian hydrocarbon production, with a separate analysis for gas production by major fields. | Sector: Russian petroleum. Method: Top-down for overall hydrocarbon, hybrid for field-specific estimates. All estimates include transportation. | Hydrocarbons EROI: 36–30. Trend: Declining. Period: 2005 to 2012. Gas EROI: Point estimates of Gas only EROIs for specific fields range from 70 to 129. Period: 2010 to 2013 |

| 2015 | Brandt et al. | NER-EROI and EER-EROI based on detailed field-level engineering analysis using published data. | Sector: Forty specific global fields. Method: Hybrid. Engineering review includes a detailed analysis taking into account thermal EOR properties, lifting energies, drilling energy intensities, as well as processing practices. | NER-EROI total: 122 to 18. NER-EROI oil only: 120 to 5. Trend: Point estimates for 2015. Period: 2015 |

| 2017 | Tripathi and Brandt | Boundary model expanded. NER-EROI and EER-EROI time series for six major oil and gas fields. | Sector: Six specific fields: Cantarell, Forties, Midway-Sunset, Prudhoe Bay, and Wilmington fields. Method: Hybrid. Engineering review, includes a detailed analysis considering production method, field properties, fluid properties, production and processing practices, and transportation. | Field: Cantarell. NER-EROI total: 72 to 5. Trend: Decreasing. Period: 1978 to 2012. Field: Forties. NER-ERO total: 28 to 16. Trend: Decreasing. Period: 1974 to 1999. Field: Midway-Sunset. NER-ERO total: 12 to 3. Trend: Decreasing. Period: 1965 to 2007. Field: Prudhoe Bay. NER-ERO total: 19 to 6. Trend: Decreasing. Period: 1977 to 2004. Wilmington fields NER-EROI total: 60 to 12. Trend: Decreasing. Period: 1955 to 2007 |

| Field | Water Depth | Production Period Evaluated | Processing Requirements | Lifting Mechanism | Recovery Method | Fuel |

|---|---|---|---|---|---|---|

| Field 1 | 60 m | 2008 to 2018 | Crude/water/gas separation, crude stabilization, and associated water treatment and disposal. | Electrical Submersible Pumps (ESPs) | Initially secondary recovery, employing water injection at > 1000 pounds per square inch (psi) at the wellhead. In 2012. the field switched to primary recovery, with associated (produced) water disposal at low pressure <300 psig. | Exclusively diesel since the gas produced is of insufficient quality and quantity (High CO2) (100% diesel) |

| Field 2 | 55 m | 2015 to 2018 | Crude/water/gas separation, crude stabilization, associated water treatment and injection. | Electrical Submersible Pumps (ESPs) | Secondary recovery, employing associated (produced) water injection >1000 psig at the wellhead. | Primarily produced natural gas (approximately 95% natural gas) |

| Field 3 | 70 m | 2016 to 2018 | Crude/water/gas separation, crude stabilization, associated water treatment and injection. | Electrical Submersible Pumps (ESPs) | Secondary, employing associated (produced) employing water injection >1000 psig at the wellhead. | Combination of natural gas and diesel (approximately 40% natural gas, 60% diesel) |

| Field | Crude Oil | Produced Water | NER-EROI-1d-Lifting |

|---|---|---|---|

| Field 1 | Decreasing | Increasing | Decreasing |

| Field 2 | Decreasing | Increasing | Decreasing |

| Field 3 | Decreasing | Increasing | Decreasing |

| Field Name | Field Start Year | Number of Production Platforms | Number of Wells | Fuel Source | Peak Production Rate (BPD) | Power Generation |

|---|---|---|---|---|---|---|

| Field 1 | 2007 | 6 | 100 | Diesel fuel | 20,000 | 17 Diesel Generators |

| Field 2 | 2014 | 1 | 12 | Natural Gas | 15,000 | 3 Gas Generators 1 Diesel Generator |

| Field 3 | 2015 | 2 | 25 | Diesel and Natural Gas | 12,000 | 3 Dual Fuel Generators 2 Diesel Generators |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grassian, D.; Olsen, D. Lifecycle Energy Accounting of Three Small Offshore Oil Fields. Energies 2019, 12, 2731. https://doi.org/10.3390/en12142731

Grassian D, Olsen D. Lifecycle Energy Accounting of Three Small Offshore Oil Fields. Energies. 2019; 12(14):2731. https://doi.org/10.3390/en12142731

Chicago/Turabian StyleGrassian, David, and Daniel Olsen. 2019. "Lifecycle Energy Accounting of Three Small Offshore Oil Fields" Energies 12, no. 14: 2731. https://doi.org/10.3390/en12142731