Exploring Economic Criteria for Energy Storage System Sizing

Abstract

:1. Introduction

2. Materials and Methods

2.1. Power Supply Model of the Microgrid

2.1.1. Modeling of WT Power

2.1.2. Modeling of PV Power

2.1.3. Modeling of ESS

2.2. ESS Economic Operation Model

2.2.1. Objective Function

2.2.2. Constraints

2.3. Improved Hybrid Particle Swarm Optimization for Solving the Economic Operation Model

- Enter the WT power, and PV power and load profiles.

- Initialize the SOC of ESS during each period.

- Use the heuristic charging and discharging adjustment strategy of the ESS to adjust its charge and discharge behavior to meet the constraints and ensure the power balance of the entire microgrid system. Details are as follows:

- Judge whether or not the SOC of the ESS exceeds the limit. If the maximum value is exceeded, is taken as . If is lower than the minimum value , it is taken as .

- Let t = 2, …, T. If the adjacent period satisfies Equation (16), adjust the by Equation (17). If the adjacent period satisfies Equation (18), adjust the by Equation (19).

- Judge whether or not the SOC of the start and end times of the scheduling cycle satisfies Equation (11). If the equation is satisfied, proceed to step 4. Otherwise, let () and t = T, …, 2. If the adjacent period satisfies Equation (16), adjust by Equation (20). If the adjacent period satisfies Equation (18), adjust by Equation (21).

- Judge again whether or not Equation (11) is satisfied. If it is satisfied, proceed to step 4. Otherwise, resume step 3 again.

- Calculate the fitness value of each particle and update the individual extremum and population extremum.

- Update the particle velocity and position according to Equations (12) and (13) and perform crossover and mutation.

- Repeat steps 3, 4, and 5 until the convergence condition or maximum number of iterations is reached.

2.4. Economic Criteria for ESS Investment

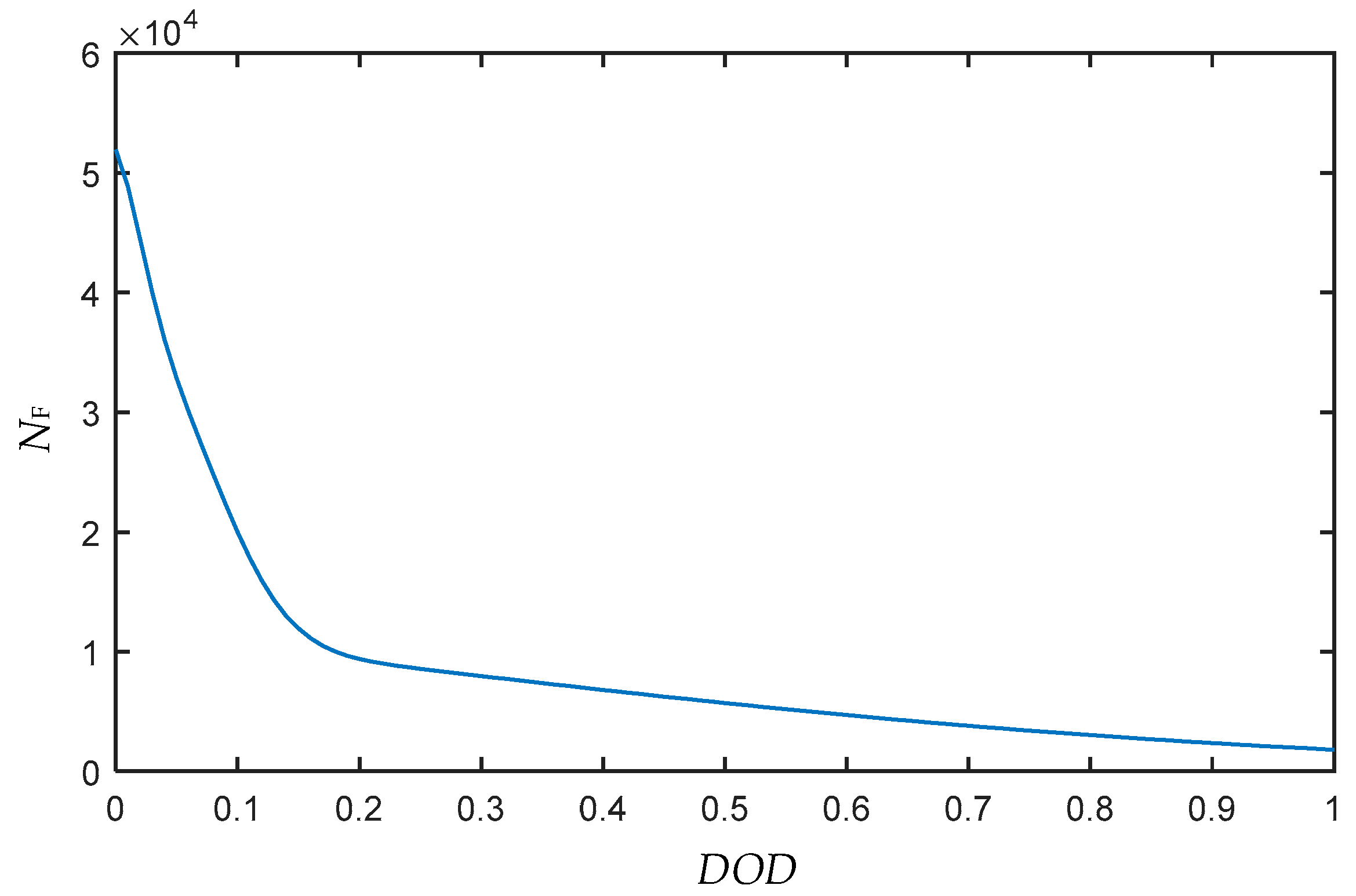

2.4.1. ESS Life Model

2.4.2. Economic Criteria

3. Results and Discussion

3.1. The Base Case

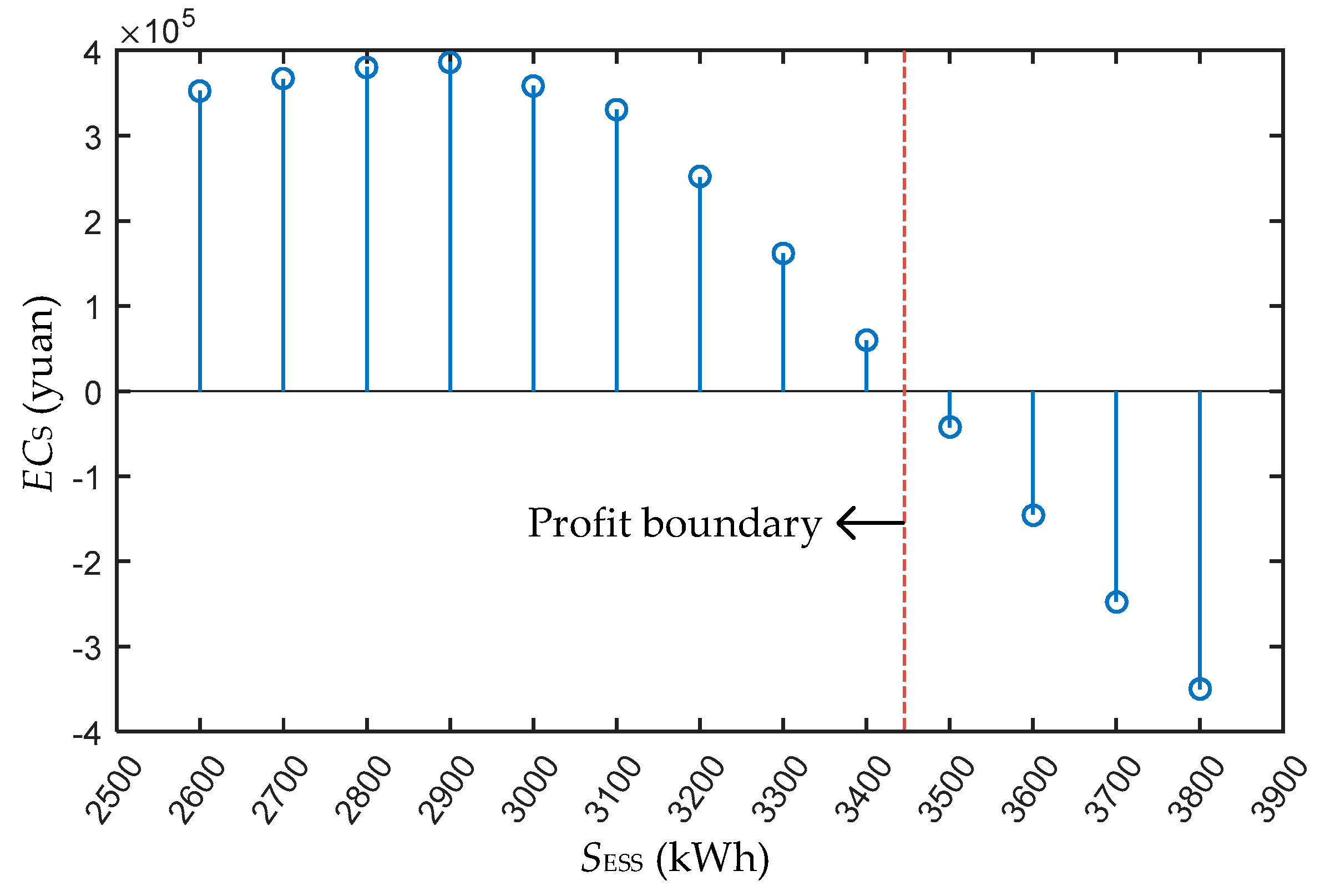

3.2. Profit Boundary of Investment

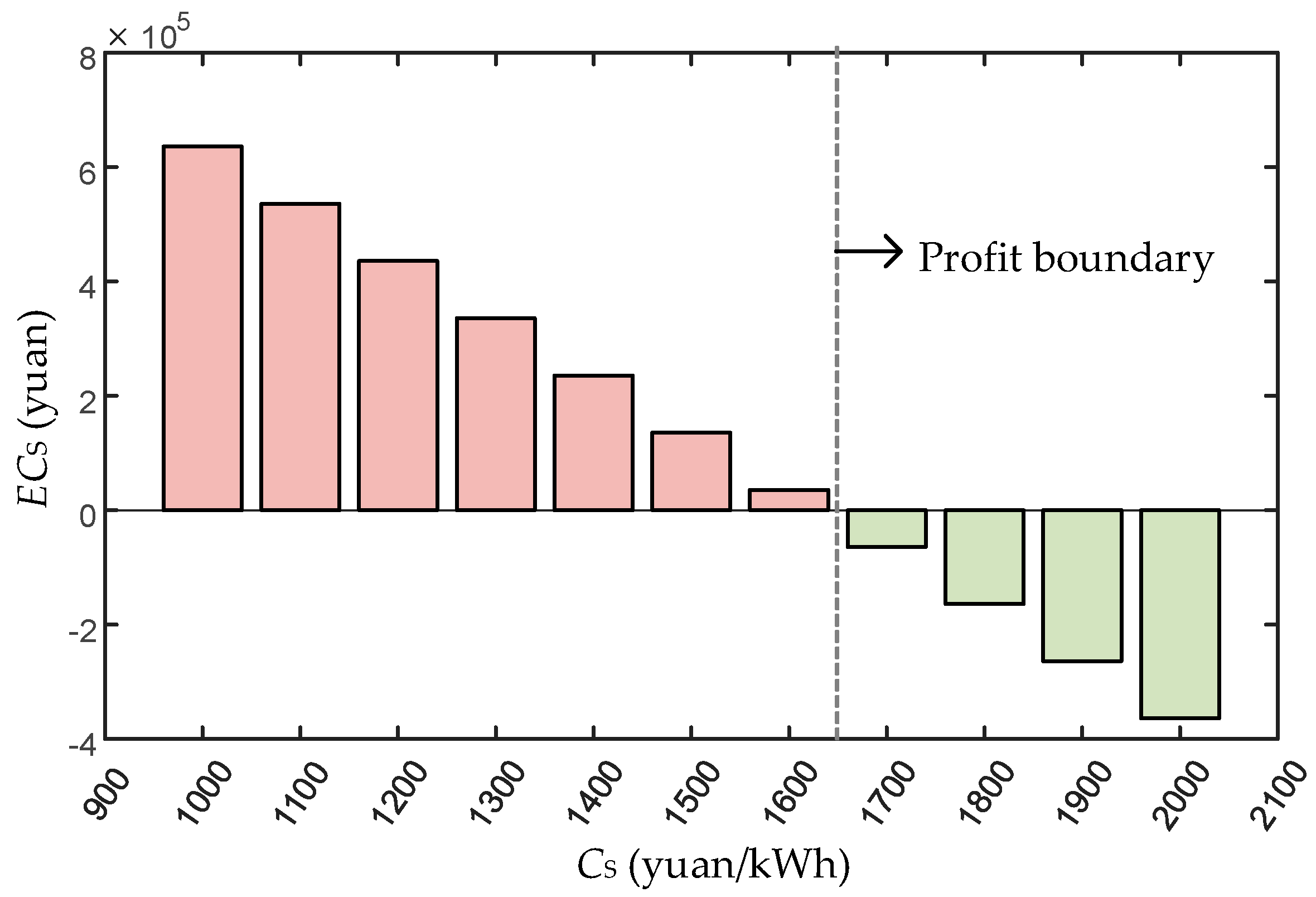

3.3. Sensitivity Analysis of Price

3.4. Criterion for Long-Term Investment Project

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| WT output power | |

| rated power of WT | |

| wind speed | |

| cut-in wind speed | |

| cut-off wind speed | |

| rated wind speed | |

| PV output power | |

| conversion efficiency of the solar cell array | |

| solar cell array area | |

| solar radiation | |

| outside air temperature | |

| ESS charging power at time t | |

| ESS discharging power at time t | |

| SOC of ESS at time t | |

| charging efficiency of ESS | |

| discharging efficiency of ESS | |

| time interval | |

| operational benefits of integrating ESS in a scheduling cycle | |

| T | hours of a scheduling cycle |

| power purchase from upper grid at time t without ESS | |

| power purchase from upper grid at time t with ESS | |

| electricity price | |

| ,, | values of electricity price during peak, normal, and valley periods |

| ,, | set of peak, normal, and valley periods |

| output power of the WT at time t | |

| output power of the PV at time t | |

| load power at time t | |

| maximum charging power | |

| maximum discharging power | |

| minimum values of SOC | |

| maximum values of SOC | |

| SOC of the ESS at the start of the scheduling period | |

| SOC of the ESS at the end of the scheduling period | |

| initial set value of SOC | |

| inertia weight | |

| M | dimension of the search space |

| N | number of particles |

| particle velocity of the kth iteration | |

| particle position of the kth iteration | |

| individual extremum of the kth iteration | |

| population extremum of the kth iteration | |

| c1, c2 | non-negative constants called acceleration factors |

| r1, r2 | random numbers distributed in the interval [0, 1] |

| maximum particle position | |

| maximum particle velocity | |

| depth of the ith discharging | |

| SOC of start time of ith discharging process | |

| SOC of end time of ith discharging process | |

| capacity of ESS | |

| life loss ratio of ESS in a scheduling cycle | |

| n | total number of cycles in a scheduling cycle |

| maximum cycles at depth of discharge of the ith discharge | |

| service life of ESS | |

| float life of ESS | |

| government subsidies in a scheduling cycle | |

| benefits of integrating ESS during the life cycle of the energy storage device | |

| coefficient of subsidies | |

| investment cost of ESS during the life cycle of the energy storage device | |

| initial investment cost | |

| operation and maintenance cost during the life cycle of the energy storage device | |

| unit capacity price of initial investment | |

| unit capacity operation and maintenance price per year | |

| static investment economic criterion indicator | |

| benefits of integrating ESS during the predefined project engineering cycle | |

| predefined project engineering cycle | |

| discount rate | |

| investment cost of ESS during the predefined project engineering cycle | |

| operation and maintenance cost during the predefined project engineering cycle | |

| renewal cost of energy storage device | |

| residual value of energy storage device at the end of the project cycle | |

| unit capacity update cost of energy storage device | |

| K | number of energy storage device updates |

| dynamic investment economic criterion indicator |

| VRE | variable renewable energy |

| DRGs | distributed renewable generations |

| ESS | energy storage system |

| PV | photovoltaic |

| WT | wind turbine |

| TOU | time-of-use |

| SOC | state of charge |

| PSO | particle swarm optimization |

References

- Zhang, W.; Qiu, M.; Lai, X. Application of energy storage technologies in power grids. Power Syst. Technol. 2008, 32, 1–9. [Google Scholar]

- Zia, M.F.; Elbouchikhi, E.; Benbouzid, M. Microgrids energy management systems: A critical review on methods, solutions, and prospects. Appl. Energy 2018, 222, 1033–1055. [Google Scholar] [CrossRef]

- Khiareddine, A.; Salah, C.B.; Rekioua, D.; Mimouni, M.F. Sizing methodology for hybrid photovoltaic/wind/hydrogen/battery integrated to energy management strategy for pumping system. Energy 2018, 153, 743–762. [Google Scholar] [CrossRef]

- Luthander, R.; Widén, J.; Munkhammar, J.; Lingfors, D. Self-consumption enhancement and peak shaving of residential photovoltaics using storage and curtailment. Energy 2016, 112, 221–231. [Google Scholar] [CrossRef]

- Liu, J.; Yang, D.; Yao, W.; Fang, R.; Zhao, H.; Wang, B. PV-based virtual synchronous generator with variable inertia to enhance power system transient stability utilizing the energy storage system. Prot. Control Mod. Power Syst. 2017, 2, 39. [Google Scholar] [CrossRef]

- Bahramirad, S.; Reder, W.; Khodaei, A. Reliability-constrained optimal sizing of energy storage system in a microgrid. IEEE Trans. Smart Grid 2012, 3, 2056–2062. [Google Scholar] [CrossRef]

- Karami, H.; Sanjari, M.J.; Tavakoli, A.; Gharehpetian, G.B. Optimal scheduling of residential energy system including combined heat and power system and storage device. Electr. Mach. Power Syst. 2013, 41, 765–781. [Google Scholar] [CrossRef]

- Feng, L.; Zhang, J.; Li, G.; Zhang, B. Cost reduction of a hybrid energy storage system considering correlation between wind and PV power. Prot. Control Mod. Power Syst. 2016, 1, 11. [Google Scholar] [CrossRef]

- Xiang, Y.; Han, W.; Zhang, J.; Liu, J.; Liu, Y. Optimal sizing of energy storage system in active distribution networks using Fourier-Legendre series based state of energy function. IEEE Trans. Power Syst. 2017, 33, 2313–2315. [Google Scholar] [CrossRef]

- Tewari, S.; Mohan, N. Value of NAS energy storage toward integrating wind: Results from the wind to battery project. IEEE Trans. Power Syst. 2013, 28, 532–541. [Google Scholar] [CrossRef]

- Xiang, Y.; Wei, Z.N.; Sun, G.Q.; Sun, Y.H.; Shen, H.P. Life cycle cost based optimal configuration of battery energy storage system in distribution network. Power Syst. Technol. 2015, 39, 264–270. [Google Scholar]

- Wu, W.; Hu, Z.; Song, Y. Optimal sizing of energy storage system for wind farms combining stochastic programming and sequential Monte Carlo simulation. Power Syst. Technol. 2018, 42, 1055–1062. [Google Scholar]

- Bendato, I.; Bonfiglio, A.; Brignone, M.; Delfino, F.; Pampararo, F.; Procopio, R.; Rossi, M. Design criteria for the optimal sizing of integrated photovoltaic-storage systems. Energy 2018, 149, 505–515. [Google Scholar] [CrossRef]

- Zsiborács, H.; Hegedűsné Baranyai, N.; Vincze, A.; Háber, I.; Pintér, G. Economic and technical aspects of flexible storage photovoltaic systems in Europe. Energies 2018, 11, 1445. [Google Scholar] [CrossRef]

- Home-Ortiz, J.M.; Pourakbari-Kasmaei, M.; Lehtonen, M.; Mantovani, J.R. Optimal location-allocation of storage devices and renewable-based DG in distribution systems. Electr. Power Syst. Res. 2019, 172, 11–21. [Google Scholar] [CrossRef]

- Liu, Z.; Chen, Y.; Zhuo, R.; Jia, H. Energy storage capacity optimization for autonomy microgrid considering CHP and EV scheduling. Appl. Energy 2017, 210, 1113–1125. [Google Scholar] [CrossRef]

- Atia, R.; Yamada, N. Distributed renewable generation and storage system sizing based on smart dispatch of microgrids. Energies 2016, 9, 176. [Google Scholar] [CrossRef]

- Atia, R.; Yamada, N. Sizing and Analysis of renewable energy and battery systems in residential microgrids. IEEE Trans. Smart Grid 2016, 7, 1204–1213. [Google Scholar] [CrossRef]

- Chen, S.X.; Gooi, H.B.; Wang, M.Q. Sizing of energy storage for microgrids. IEEE Trans. Smart Grid 2012, 3, 142–151. [Google Scholar] [CrossRef]

- Xiao, H.; Pei, W.; Yang, Y.; Qi, Z.P.; Kong, L. Energy storage capacity optimization for microgrid considering battery life and economic operation. High Volt. Eng. 2015, 41, 3256–3265. [Google Scholar]

- Lorestani, A.; Gharehpetian, G.B.; Nazari, M.H. Optimal sizing and techno-economic analysis of energy- and costefficient standalone multi-carrier microgrid. Energy 2019, 178, 751–764. [Google Scholar] [CrossRef]

- Alsaidan, I.; Alanazi, A.; Gao, W.; Wu, H.; Khodaei, A. State-Of-The-Art in microgrid-integrated distributed energy storage sizing. Energies 2017, 10, 1421. [Google Scholar] [CrossRef]

- Xiang, Y.; Liu, Y.; Liu, J.; Liu, Y.; Zuo, K. An economic criterion for distributed renewable generation planning. Electr. Power Compon. Syst. 2017, 45, 1298–1304. [Google Scholar] [CrossRef]

- Sideratos, G.; Hatziargyriou, N. An advanced statistical method for wind power forecasting. IEEE Trans. Power Syst. 2007, 22, 258–265. [Google Scholar] [CrossRef]

- Tao, C.; Shanxu, D.; Changsong, C. Forecasting power output for grid-connected photovoltaic power system without using solar radiation measurement. In Proceedings of the 2nd International Symposium on Power Electronics for Distributed Generation Systems, Hefei, China, 16–18 June 2010. [Google Scholar]

- Balci, H.; Valenzuela, J. Scheduling electric power generations using particle swarm optimization combined with the Lagrangian relaxation method. Int. J. Appl. Math. Comput. Sci. 2004, 14, 411–421. [Google Scholar]

- Jiang, Y.C.; Wang, Z.G.; Yang, C.Y.; Li, M.; Zhang, J.P. Multi-objective optimization strategy of controllable load in microgrid. Power Syst. Technol. 2013, 37, 2875–2880. [Google Scholar]

- Luo, Y.; Liu, M. Research on environmental and economic dispatch for isolated microgrid system taken risk reserve constraints into account. Power Syst. Technol. 2013, 37, 2705–2711. [Google Scholar]

- Shen, Y.; Hu, B.; Xie, K.; Xiang, B.; Wan, L. Optimal economic operation of isolated microgrid considering battery life loss. Power Syst. Technol. 2014, 38, 2371–2378. [Google Scholar]

- Rydh, C.J.; Sandén, B.A. Energy analysis of batteries in photovoltaic systems. Part I: Performance and energy requirements. Energy Convers. Manag. 2005, 46, 1957–1979. [Google Scholar] [CrossRef]

- Yan, G.; Liu, D.; Li, J.; Mu, G. A cost accounting method of the Li-ion battery energy storage system for frequency regulation considering the effect of life degradation. Prot. Control Mod. Power Syst. 2018, 3, 4. [Google Scholar] [CrossRef]

- Tran, D.; Khambadkone, A.M. Energy management for lifetime extension of energy storage system in micro-grid applications. IEEE Trans. Smart Grid 2013, 4, 1289–1296. [Google Scholar] [CrossRef]

| Parameter Type | Parameter Value | Parameter Type | Parameter Value |

|---|---|---|---|

| 1000 kWh | 1500 yuan/kWh | ||

| 200 kW | 200 kW | ||

| 1000 kWh | 300 kWh | ||

| 300 kWh | 0.3 yuan/kWh | ||

| 6a | 30 yuan/kWh | ||

| 0.85 | 0.85 |

| Scenario # | SESS (kWh) | CS (yuan/kWh) | Electricity Price Type | Is There Government Subsidy? | ECS (yuan) | Is Energy Storage Economically Needed? |

|---|---|---|---|---|---|---|

| 1 | 3400 | 1500 | #1 | Yes | 59,819.42 | Yes |

| 2 | 3500 | 1500 | #1 | Yes | −42,646.24 | No |

| 3 | 3500 | 1200 | #1 | Yes | 1,005,303.40 | Yes |

| 4 | 4800 | 1200 | #1 | Yes | 64,906.61 | Yes |

| 5 | 4900 | 1200 | #1 | Yes | −7081.25 | No |

| 6 | 1000 | 1500 | #1 | Yes | 135,856.94 | Yes |

| 7 | 1000 | 1500 | #2 | Yes | 180,012.00 | Yes |

| 8 | 1000 | 1500 | #3 | Yes | 1,557,148.99 | Yes |

| 9 | 1000 | 1500 | #1 | No | −620,143.05 | No |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Chen, Z.; Xiang, Y. Exploring Economic Criteria for Energy Storage System Sizing. Energies 2019, 12, 2312. https://doi.org/10.3390/en12122312

Liu J, Chen Z, Xiang Y. Exploring Economic Criteria for Energy Storage System Sizing. Energies. 2019; 12(12):2312. https://doi.org/10.3390/en12122312

Chicago/Turabian StyleLiu, Jichun, Zhengbo Chen, and Yue Xiang. 2019. "Exploring Economic Criteria for Energy Storage System Sizing" Energies 12, no. 12: 2312. https://doi.org/10.3390/en12122312