A Remedial Strategic Scheduling Model for Load Serving Entities Considering the Interaction between Grid-Level Energy Storage and Virtual Power Plants

Abstract

:1. Introduction

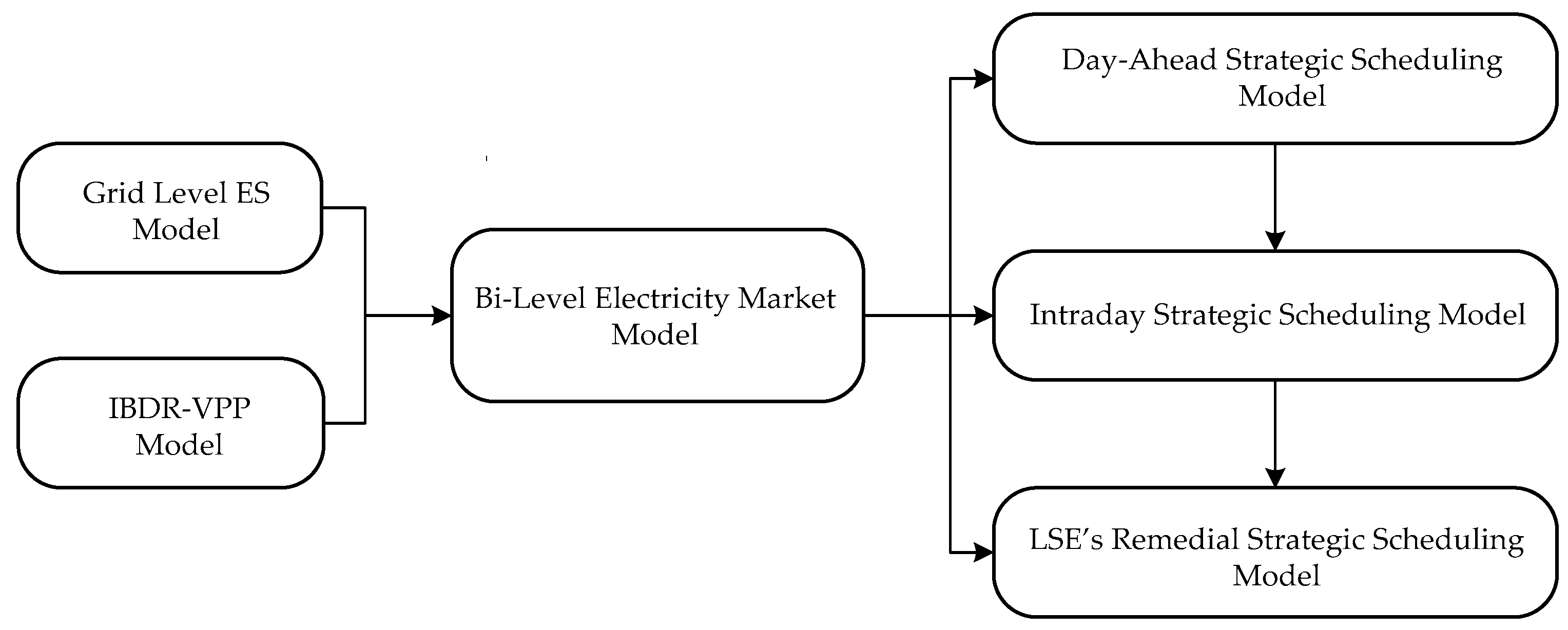

2. Strategic Scheduling Model for LSEs

2.1. Grid-Level ES Model

2.2. Interruptible Load-Based Demand Response Virtual Power Plant Model

2.3. Bilevel Electricity Market Models

2.3.1. Day-Ahead Strategic Scheduling Model

2.3.2. Intraday Strategic Scheduling Model

2.3.3. LSE’s Remedial Strategic Scheduling Model

3. Mathematical Solutions

3.1. Formulation of a Mathematic Program with Equilibrium Constraints (MPEC)

3.2. Mixed-Integer Linear Programming (MILP) Solution

4. Case Study

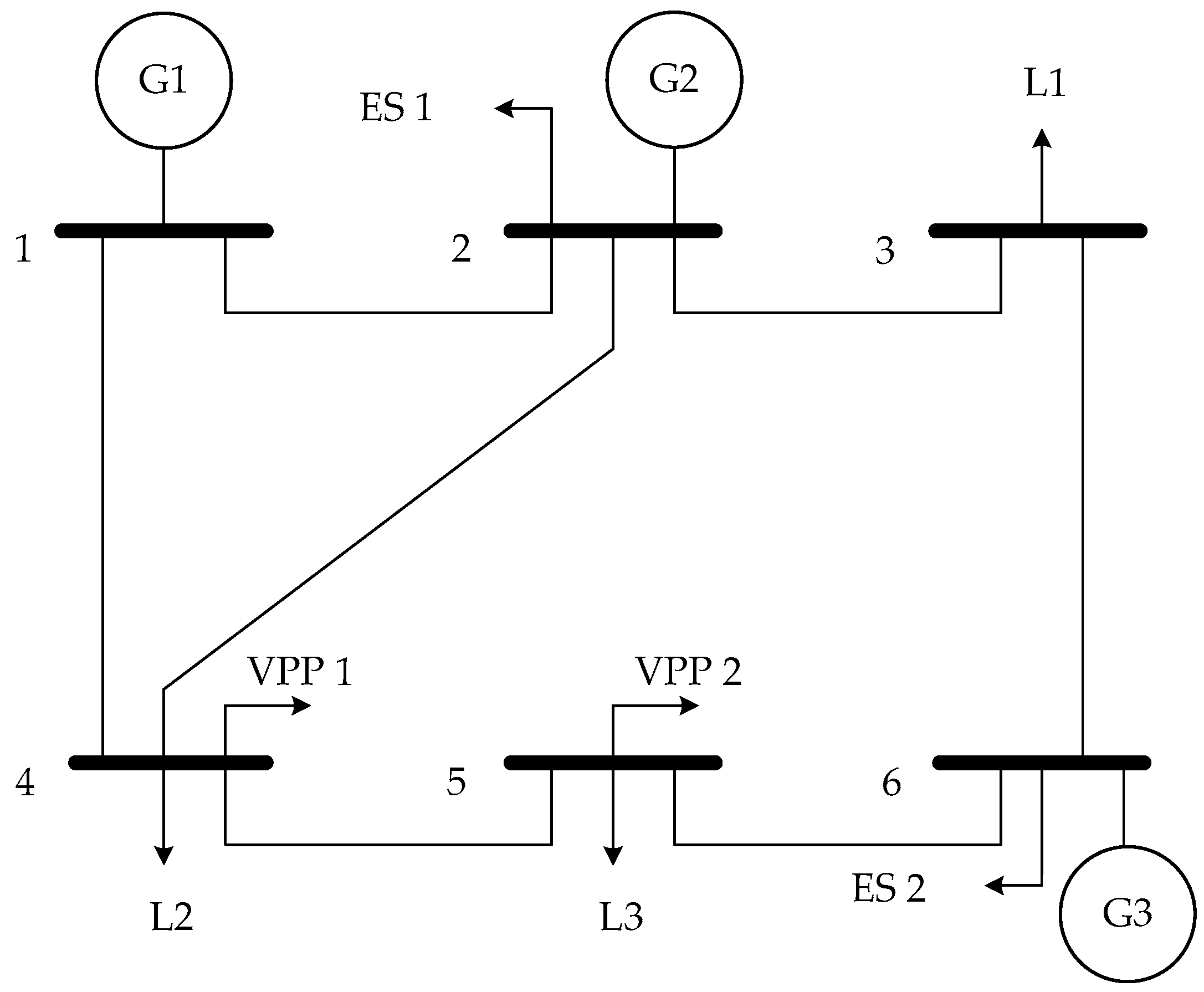

4.1. Six-Bus Test System

- LSE’s basic strategic scheduling with ES and IBDR-VPP in the DA market;

- Impact of ES/ IBDR-VPP outage on LSE’s strategic scheduling without contingency anticipation time (CAT) in the ID market;

- LSE’s remedial strategic scheduling with CAT under the impact of ES/ IBDR-VPP outage.

4.2. IEEE 118-Bus Test System

5. Discussion

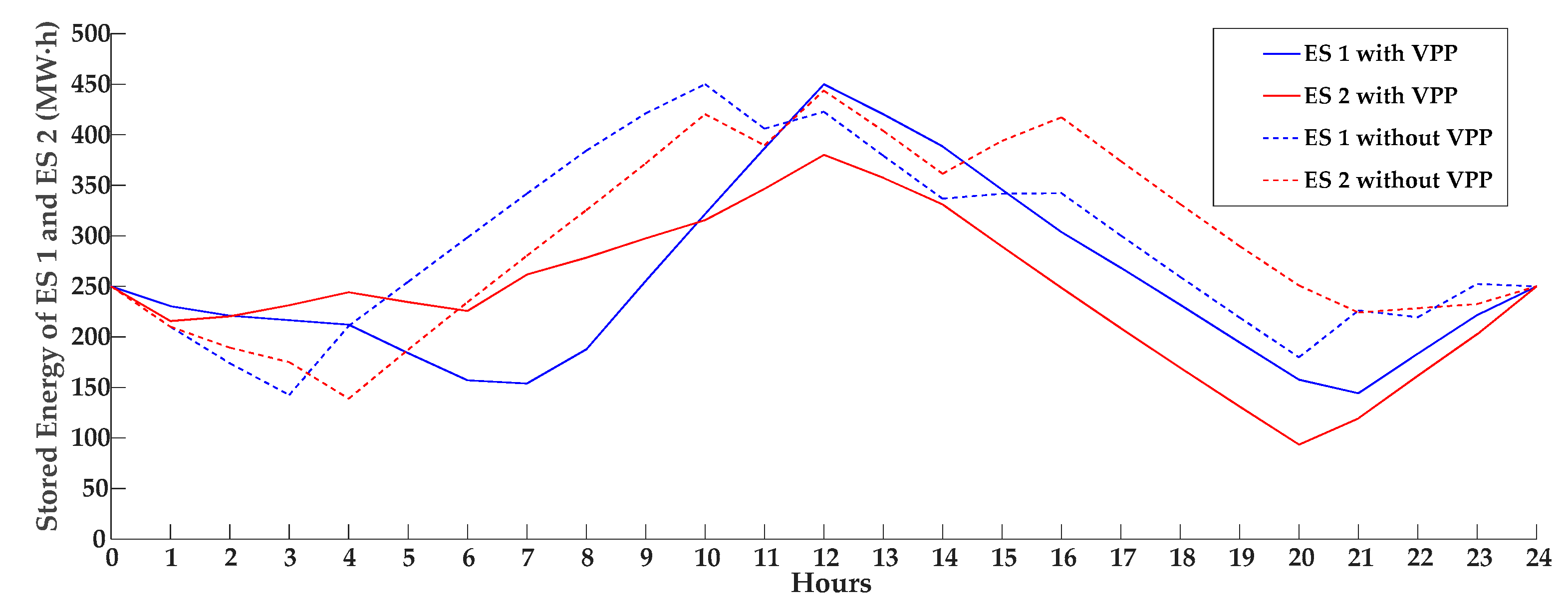

- With the integration of VPPs in the modified six-bus test system, the output of ES 1 reduces from 35 MW·h to 14.62 MW·h (58.22% lower), and the output of ES 2 reduces from 35 MW·h to 29.35 MW·h (16.14% lower) at the peak load hour. The VPPs significantly support the ESs (especially ES 1) on the peak-shaving objective.

- With the rescheduling process in the ID market, LSEs can reduce more losses using scheme 2 than scheme 1. For instance, under the ES 2 outage and VPP 2 outage in the modified six-bus test system, the LSE’s daily profits after using scheme 1 as the rescheduling strategy are $23,133 and $22,167, respectively. By contrast, the daily profits with scheme 2 are $23,605 ($472 higher) and $27,282 ($5115 higher), respectively.

- With more contingency anticipation hours, the LSE will further reduce the losses based on the proposed remedial strategic scheduling approach. Typical results are selected to illustrate this viewpoint. In the modified six-bus test system, under the ES 1 outage, the daily losses of the LSE with 6 h CAT and 1 h CAT are $1027 and $7274, respectively. In the modified IEEE 118-bus test system, under the ES 4 outage, the daily losses of the LSE with 3 h CAT and 1 h CAT are $1103 and $4357, respectively.

6. Conclusions

- VPP integration has a notable impact on ES scheduling. Meanwhile, when coordinated with ES, VPP has a supplemental function of peak-shaving and valley-filling.

- The rescheduling process in the ID market is capable of reducing the LSE’s loss caused by contingencies. Also, the LSE will further reduce the loss with more contingency anticipation time based on the remedial strategic scheduling approach.

- The remedial approach provides a quantitative assessment of the LSE’s loss redeeming, which can be applied in the power system dispatching to help the LSE deal with contingencies.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Indices | |

| i | Index of buses |

| l | Index of lines |

| t | Index of hours |

| Parameters | |

| Initial energy stored in the ES on bus i (MW·h) | |

| Self-discharged factor of the ES on bus i | |

| Charging/discharging efficiency of the ES on bus i | |

| Rated charging power of the ES on bus i (MW) | |

| Contract price for IBDR customers on bus i at time t provided by the LSE ($/MW·h) | |

| Contract price for ES charging on bus i at time t provided by the ISO ($/MW·h) | |

| Upper charging/discharging capacity of the ES on bus i due to the contract (MW·h) | |

| Daily scheduling hour | |

| Biding price for the conventional generator on bus i at time t ($/MW·h) | |

| Upper/lower power limit of the VPP on bus i (MW·h) | |

| Upper/lower power limit of the ES on bus i in discharging model (MW·h) | |

| Maximum/minimum output of the conventional generator on bus i (MW·h) | |

| Generation shift factor | |

| Limit of the transmission line l (MW) | |

| Variables | |

| Stored energy in the ES on bus i at time t (MW·h) | |

| Self-discharged energy in the ES on bus i at time t (MW·h) | |

| Charging/discharging capacity of the ES on bus i at time t (MW·h) | |

| Charging power of the ES on bus i at time t (MW) | |

| Binary variables corresponding to ES status on bus i at time t ( represents that ES is in charging mode, and represents that ES is in discharging mode) | |

| Status of the virtual power plant on bus i at time t | |

| Number of hours the VPP on bus i must stay offline due to the previous status | |

| Minimum offline hours of the VPP on bus i | |

| Maximum online hours of the VPP on bus i | |

| Locational marginal price (LMP) of bus i at time t ($/MW·h) | |

| Output of the VPP on bus i at time t (MW·h) | |

| Output of the conventional generator on bus i at time t (MW·h) | |

| Biding price for the VPP on bus i at time t ($/MW·h) | |

| Biding price for the ES on bus i at time t ($/MW·h) | |

| Power demand on bus i at time t (MW) | |

| Dual variable regarding the power balance at time t | |

| Dual variables regarding the maximum/minimum output of the VPP on bus i at time t | |

| Dual variables regarding the maximum/minimum output of the ES (in discharging model) on bus i at time t | |

| Dual variables regarding the maximum/minimum output of the conventional generator on bus i at time t | |

| Dual variables regarding the maximum/minimum capacity of transmission line l at time t | |

| The rest of the virtual generator’s capacity at time t (MW·h) | |

| The rest of the ES’s charging/discharging capacity at time t (MW·h) | |

| The rest of the conventional generator’s capacity at time t (MW·h) | |

References

- Karim, M.E.; Munir, A.; Karim, M.A.; Muhammad-Sukki, F.; Abu-Bakar, S.; Sellami, N.; Bani, N.; Hassan, M. Energy Revolution for Our Common Future: An evaluation of the emerging international renewable energy law. Energies 2018, 11, 1769. [Google Scholar] [CrossRef]

- Baharvandi, A.; Aghaei, J.; Niknam, T.; Shafie-Khah, M.; Godina, R.; Catalao, J. Bundled generation and transmission planning under demand and wind generation uncertainty based on a combination of robust and stochastic optimization. IEEE Trans. Sustain. Energy 2018, 9, 1477–1486. [Google Scholar] [CrossRef]

- Acuna, L.; Padilla, R.; Mercado, A. Measuring reliability of hybrid photovoltaic-wind energy systems: A new indicator. Renew. Energy 2017, 106, 68–77. [Google Scholar] [CrossRef]

- Mazzeo, D.; Oliveti, G.; Baglivo, C.; Congedo, P. Energy reliability-constrained method for the multi-objective optimization of a photovoltaic-wind hybrid system with battery storage. Energy 2018, 156, 688–708. [Google Scholar] [CrossRef]

- Mohamad, F.; Teh, J. Impacts of energy storage system on power system reliability: A systematic review. Energies 2018, 11, 1749. [Google Scholar] [CrossRef]

- Hatwig, K.; Kockar, I. Impact of strategic behavior and ownership of energy storage on provision of flexibility. IEEE Trans. Sustain. Energy 2016, 7, 744–754. [Google Scholar] [CrossRef]

- Pieroni, T.; Dotta, D. Identification of the most effective point of connection for battery energy systems focusing on power system frequency response improvement. Energies 2018, 11, 763. [Google Scholar] [CrossRef]

- Rodrigues, E.; Godina, R.; Catalao, J. Modelling electrochemical energy storage devices in insular power network applications supported on real data. Appl. Energ. 2017, 188, 315–329. [Google Scholar] [CrossRef]

- Hidalgo-Leon, R.; Siguenza, D.; Sanchez, C.; Leon, J.; Jacome-Ruiz, P.; Wu, J.; Ortiz, D. A survey of battery energy storage system (BESS), application and environmental impacts in power systems. In Proceedings of the IEEE Second Ecuador Technical Chapters Meeting (ETCM), Salinas, Ecuador, 16–20 October 2017. [Google Scholar]

- Farhadi, M.; Mohammed, O. Energy storage systems for high power applications. In Proceedings of the Industry Applications Society Annual Meeting, Addison, TX, USA, 18–22 October 2015. [Google Scholar]

- Rahmann, C.; Mac-Clure, B.; Vittal, V.; Valencia, F. Break-even points of battery energy storage systems for peak shaving applications. Energies 2017, 10, 833. [Google Scholar] [CrossRef]

- Krishnamurthy, D.; Uckun, C.; Zhou, Z.; Thimmapuram, P.; Botterud, A. Energy storage arbitrage under day-ahead and real-time price uncertainty. IEEE Trans. Power Syst. 2018, 33, 84–93. [Google Scholar] [CrossRef]

- Cui, H.; Li, F.; Fang, X.; Chen, H.; Wang, H. Bilevel arbitrage potential evaluation for grid-scale energy storage considering wind power and LMP smoothing effect. IEEE Trans. Sustain. Energy 2018, 9, 707–718. [Google Scholar] [CrossRef]

- Khani, H.; Mohannad, R.; Zadeh, D. Real-time optimal dispatch and economic viability of cryogenic energy storage exploiting arbitrage opportunities in an electricity market. IEEE Trans. Smart Grid 2015, 6, 391–401. [Google Scholar] [CrossRef]

- Luburic, Z.; Pandzic, H.; Plavsic, T. Assessment of energy storage operation in vertically integrated utility and electricity market. Energies 2017, 10, 683. [Google Scholar] [CrossRef]

- Zhang, G.; Jiang, C.; Wang, X.; Li, B.; Zhu, H. Bidding strategy analysis of virtual power plant considering demand response and uncertainty of renewable energy. IET Gener. Transm. Distrib. 2017, 11, 3268–3277. [Google Scholar] [CrossRef]

- Shi, Q.; Cui, H.; Li, F.; Liu, Y.; Ju, W.; Sun, Y. A hybrid dynamic demand control strategy for power system frequency regulation. CSEE J. Power Energy Syst. 2017, 3, 176–185. [Google Scholar] [CrossRef]

- Wei, C.; Xu, J.; Liao, S.; Sun, Y.; Jiang, Y.; Ke, D.; Zhang, Z.; Wang, J. A bi-level scheduling model for virtual power plants with aggregated thermostatically controlled loads and renewable energy. Appl. Energy 2018, 224, 659–670. [Google Scholar] [CrossRef]

- Abbasi, E. Coordinated primary control reserve by flexible demand and wind power through ancillary service-centered virtual power plant. Int. Trans. Electr. Energy 2017, 27, 1–18. [Google Scholar] [CrossRef]

- Garcia-Gonzalez, J.; De La Muela, R.; Santos, L.; Gonzalez, A. Stochastic joint optimization of wind generation and pumped-storage units in an electricity market. IEEE Trans. Power Syst. 2008, 23, 460–468. [Google Scholar] [CrossRef]

- Akhavan-Hejazi, H.; Mohsenian-Rad, H. Optimal operation of independent storage systems in energy and reserve markets with high wind penetration. IEEE Trans. Smart Grid 2014, 5, 1088–1097. [Google Scholar] [CrossRef]

- Mnatsakanyan, A.; Kennedy, S. A novel demand response model with an application for a virtual power plant. IEEE Trans. Smart Grid 2015, 6, 230–237. [Google Scholar] [CrossRef]

- Al-Awami, A.; Amleh, N.; Muqbel, A. Optimal demand response bidding and pricing mechanism with fuzzy optimization: application for a virtual power plant. IEEE Trans. Ind. Appl. 2017, 53, 5051–5061. [Google Scholar] [CrossRef]

- Wang, Y.; Ai, X.; Tan, Z.; Yan, L.; Liu, S. Interactive dispatch modes and bidding strategy of multiple virtual power plants based on demand response and game theory. IEEE Trans. Smart Grid 2016, 7, 510–519. [Google Scholar] [CrossRef]

- Ott, A. Experience with PJM market operation, system design, implementation. IEEE Trans. Power Syst. 2003, 18, 528–534. [Google Scholar] [CrossRef]

- Analui, B.; Scaglione, A. A dynamic multistage stochastic unit commitment formulation for intraday markets. IEEE Trans. Power Syst. 2018, 33, 3653–3663. [Google Scholar] [CrossRef]

- Weber, C. Adequate intraday market design to enable the integration of wind energy into the European power systems. Energy Policy 2010, 38, 3155–3163. [Google Scholar] [CrossRef]

- Soysal, E.; Olsen, O.; Skytte, K.; Sekamane, J. Intraday market asymmetries—A Nordic example. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017. [Google Scholar]

- Cui, H.; Li, F.; Hu, Q.; Bai, L.; Fang, X. Day-ahead coordinated operation of utility-scale electricity and natural gas networks considering demand response based virtual power plants. Appl. Energy 2016, 176, 183–195. [Google Scholar] [CrossRef] [Green Version]

| Time | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| VPP 1 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 26.62 | 34.48 | 40 | 0 | 0 |

| VPP 2 | 40 | 40 | 38.51 | 32.57 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 |

| Time | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| VPP 1 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 | 0 | 0 |

| VPP 2 | 40 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 35.06 |

| Contingency No. | C1 | C2 | C3 | C4 |

|---|---|---|---|---|

| Scheme 1 | 23,556 | 23,133 | 29,447 | 22,167 |

| Scheme 2 | 23,556 | 23,605 | 29,447 | 27,282 |

| CAT | tP = 6 | tP = 7 | tP = 8 | tP = 9 | tP = 10 | tP = 11 | tP = 12 |

|---|---|---|---|---|---|---|---|

| C1 | –1027 | –1629 | –2342 | –3816 | –5470 | –7274 | –9257 |

| C2 | 1664 | –361 | –1925 | –2707 | –4146 | –6528 | –9208 |

| C3 | –3123 | –3123 | –3123 | –3123 | –3123 | –3369 | –3369 |

| C4 | –5287 | –5287 | –5287 | –5287 | –5287 | –5531 | –5531 |

| Time | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| VPP 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 |

| VPP 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 5 | 16.8 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 6 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 7 | 0 | 23.14 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 8 | 40 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 9 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| VPP 10 | 40 | 40 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 |

| Time | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| VPP 1 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 2 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 3 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 4 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 5 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 6 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 7 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 8 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 9 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| VPP 10 | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 40 | 40 | 40 | 0 | 0 |

| CAT | tP = 6 | tP = 7 | tP = 8 | tP = 9 | tP = 10 | tP = 11 | tP = 12 |

|---|---|---|---|---|---|---|---|

| Cv,1 | –800 | –800 | –800 | –800 | –800 | –800 | –800 |

| Cv,5 | –800 | –800 | –800 | –800 | –800 | –800 | –800 |

| Ce,1 | 3738 | 3721 | 3680 | 918 | 918 | –2338 | –5518 |

| Ce,4 | 5983 | 3951 | 1221 | –1103 | –1176 | –1202 | –4357 |

| Ce,9 | 4616 | 2058 | 328 | 260 | –1103 | –2921 | –2921 |

| Ce,12 | 4039 | 1481 | 1431 | 1363 | –1103 | –1825 | –5005 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, H.; Cui, H.; Gao, S.; Shi, Q.; Fan, A.; Wu, C. A Remedial Strategic Scheduling Model for Load Serving Entities Considering the Interaction between Grid-Level Energy Storage and Virtual Power Plants. Energies 2018, 11, 2420. https://doi.org/10.3390/en11092420

Han H, Cui H, Gao S, Shi Q, Fan A, Wu C. A Remedial Strategic Scheduling Model for Load Serving Entities Considering the Interaction between Grid-Level Energy Storage and Virtual Power Plants. Energies. 2018; 11(9):2420. https://doi.org/10.3390/en11092420

Chicago/Turabian StyleHan, Haiteng, Hantao Cui, Shan Gao, Qingxin Shi, Anjie Fan, and Chen Wu. 2018. "A Remedial Strategic Scheduling Model for Load Serving Entities Considering the Interaction between Grid-Level Energy Storage and Virtual Power Plants" Energies 11, no. 9: 2420. https://doi.org/10.3390/en11092420

APA StyleHan, H., Cui, H., Gao, S., Shi, Q., Fan, A., & Wu, C. (2018). A Remedial Strategic Scheduling Model for Load Serving Entities Considering the Interaction between Grid-Level Energy Storage and Virtual Power Plants. Energies, 11(9), 2420. https://doi.org/10.3390/en11092420