1. Introduction

At present, China’s economy has further developed. However, there is no denying that economic development has also brought various negative consequences, such as an energy crisis (from supply) and environmental pollution problems, which are inseparable from the current extensive economic development [

1]. Because the energy and environmental problems are without borders, the extensive mode of economic development has brought huge challenges for sustainable global development, especially the global climate issue. More and more countries have realized that economic development accompanied by CO

2 emissions has caused a huge challenge to the biosphere [

2]. China produces large amounts of CO

2; the environmental effects of CO

2 cannot be ignored. In order to deal with the challenges of global climate change, more and more countries are trying to create their own low carbon development strategies to minimize emissions of CO

2 at the national level [

3].

As one of the key solutions to global climate change, low-carbon policies have gained more and more popularity among countries. Taking the Europe Union as an example, in order to build a low-carbon society, the EU has announced that by 2020, it will achieve the goal of reducing greenhouse gas emissions by 20% relative to 1990 [

4]. In November 2013, the 19th Conference of the Parties to the United Nations Framework Convention on Climate Change and the 9th Conference of the Parties to the Kyoto Protocol were held in Warsaw, Poland, with topics focusing on the “Green Development Fund”, which calls for developed countries to provide technology and capacity-building and financial support to developing countries to help them cope with climate change [

5]. Developing countries, known for large CO

2 emissions, also expressed their strong willingness to cut CO

2 emissions [

6]. In China, for example, a report on low-carbon planning for China’s social development issued by China’s National Development and Reform Commission points out that by 2020, the CO

2 emissions per unit of GDP will be reduced by 40% to 45% compared with 2005 [

7]. In 2007, China’s National Development Committee announced “China’s National Climate Change Program”. This program pointed out that China would start to impose a carbon tax on some enterprises in 2012. Despite the fact that China’s current macro-policy has paved the way for its low-carbon development, because of historical reasons and technical limits, the increasing CO

2 emissions in China’s economic development have been more and more questioned by the international community, and China is facing greater pressure because of its CO

2 emissions. If China refuses to assume responsibility for reducing emissions with the excuse of its right to development as a developing country, China will be confronted with unnecessary obstructions to its future economic development.

At present, theoretical and practical circles both at home and abroad usually make pollutants and CO

2 emissions in industrialization and urbanization a focus of attention, covering areas like general industry and the construction industry. It is undeniable, however, that large amounts of CO

2 are also produced in the agriculture-related sectors. Data released by the IPCC (Intergovernmental Panel on Climate Change) in 2007 showed that agricultural CO

2 emissions have become the world’s second largest source of CO

2 [

8]. Different data from FAOSTAT (Food and Agriculture Organization of the United Nations Statistics) in 2014 showed that agricultural CO

2 emissions in 2011 exceeded more than 10 billion tons of CO

2 equivalents, accounting for 14% of global CO

2 emissions [

9]. As a traditionally agricultural country, China has a large rural population and a complex agricultural industry structure. The extensive agriculture, together with the large demand for agricultural products in other nonagricultural sectors, has resulted in huge CO

2 emissions from the agricultural sectors and has brought severe challenges to the environment in China. Based on relevant data from China’s Statistical Yearbook [

10] and China’s input-output table in 2012 [

11], and according to the specific input-output path of the intermediate production process of each sector, it can calculate CO

2 emissions in the main sectors of agriculture in China (including rice planting; wheat planting; corn planting; beans and potato planting; peanut, rapeseed, and sesame planting; cotton and hemp planting; tobacco planting; tea planting; fruit and other planting; animal husbandry; forestry; the fishery industry) due to the consumption of coal, oil, natural gas and electricity, which totals 26.94 million tons. The above data are only considered for CO

2 emissions in the intermediate production process due to coal, oil, and natural gas and electricity consumptions and do not take into account the final consumptions from households and other sources in agriculture such as fertilizers and pesticides. If they are all taken into account, CO

2 emissions will be even more significant. In addition, according to statistics, China’s agricultural CO

2 emissions contribute 17% of the country’s total CO

2 emissions, much higher than the contribution of China’s transportation industry [

12]. Moreover, in many European countries (not only in China), the extensive agriculture, together with the large demand for agricultural products in other nonagricultural sectors, has resulted in huge CO

2 emissions and brought severe challenges to the environment [

13,

14]. In this case, how to balance economic development and the sustainable development of agriculture has become particularly important.

CO

2 emissions reduction has become a hot issue in the international community, and in particular, the decoupling of CO

2 emissions from economic growth is receiving increasing attention. However, one fact cannot be ignored: at current rates and levels of development, the important roles that fossil fuels play in economic development will not be replaced in the near future, nor can the new carbon capture technology be widely adopted in the short term, owing to high costs and lack of supported techniques [

15,

16,

17]. However, as one of the important carbon emission reduction measures, a carbon tax has been postulated for China, and it is worth considering whether the carbon tax is suitable for China. By analyzing and studying the carbon tax rates, we can find measures for decreasing adverse effects on economic development. Moreover, by levying a carbon tax on agriculture-related sectors, we want to find whether carbon tax is a feasible way to reduce carbon emissions in China.

In order to evaluate the influence of a carbon tax on China’s macroeconomy and agriculture-related sectors, it is necessary to rely on a reasonable and effective model to simulate the structural effects of the carbon tax policy under the macroeconomic framework. In this regard, the Computable General Equilibrium (CGE) model provides the possibility of the above assumptions. The CGE model is a class of economic model and by taking each component of the national economy and every link of the economic cycle into a united framework, the model can simulate the final structural influence of the changes in energy and climate policies on the national economic sectors [

18,

19,

20].

At present, the CGE model has been widely adopted for estimating the effectiveness of energy policy [

21,

22]. Mahmood and Marpaung [

23] used a 20-sector CGE model to investigate the respective effects of a scenario with a carbon tax and a scenario with the cooperative implementation of a carbon tax and energy on the Pakistani economy. The results show that the impact of levying a carbon tax on the GDP is negative, but the impact on reducing emissions of pollutants is positive. Markandya et al. [

24] used the CGE model to analyze and compare the differences between developing countries and developed countries in a trade-off between traditional economic development and low-carbon development and found that the adverse impact of the implementation of emissions reduction policies on developing countries is huge. Springmann et al. [

25] explored the distribution of carbon quotas among different provinces in China. The results show that eastern China outsourced 14% of its own carbon quotas to central and western regions. Yan et al. [

26] used the CGE model to study the environmental and economic effects of the carbon tax on China’s net exports from a multiregional and multicommodity perspective. The simulation results show that China was lacking a driving force to reduce domestic carbon emissions. Carlos et al. [

27] studied the impact of the carbon tax on China’s smart-power-generation industry. The study shows that the effectiveness of the carbon tax policy is closely related to the variables that are not affected by policy makers’ decisions, such as natural gas prices, the feasibility of the use of resources, etc. Yang et al. [

28] studied the impact of the carbon market on China’s environment and economy from the medium term to the long term by constructing a CGE model. The results show that the carbon market will have a positive impact on China’s R&D investment.

From the existing literature, we can see that most scholars are focusing on exploring ways to control the reduction of CO

2 emissions and explore reduction degrees. Although many scholars focus on agricultural issues, such as the impacts of the export ban on the corn industry and the overall state of society [

29] and the impacts of climate change on yields, production, and prices [

30]. However, due to economic system and data constraints, the application of the CGE model to analyze the impacts of carbon tax on agricultural-related sectors is not systematic. Based on China’s realities and the CGE model’s theory and technology, this study builds a dynamic CGE model with a complex structure that reflects the energy-economy-environment system of Chinese agriculture-related sectors. The system simulates the impact of levying a carbon tax on the macro-environment, macroeconomic variables, and the agricultural-related sectors, so as to reveal the implementation effect of a carbon tax on agricultural related sectors.

2. Methods and Materials

2.1. Model Construction

As an energy reduction policy, carbon taxes achieve the ultimate goal of reducing fossil fuel consumptions and CO

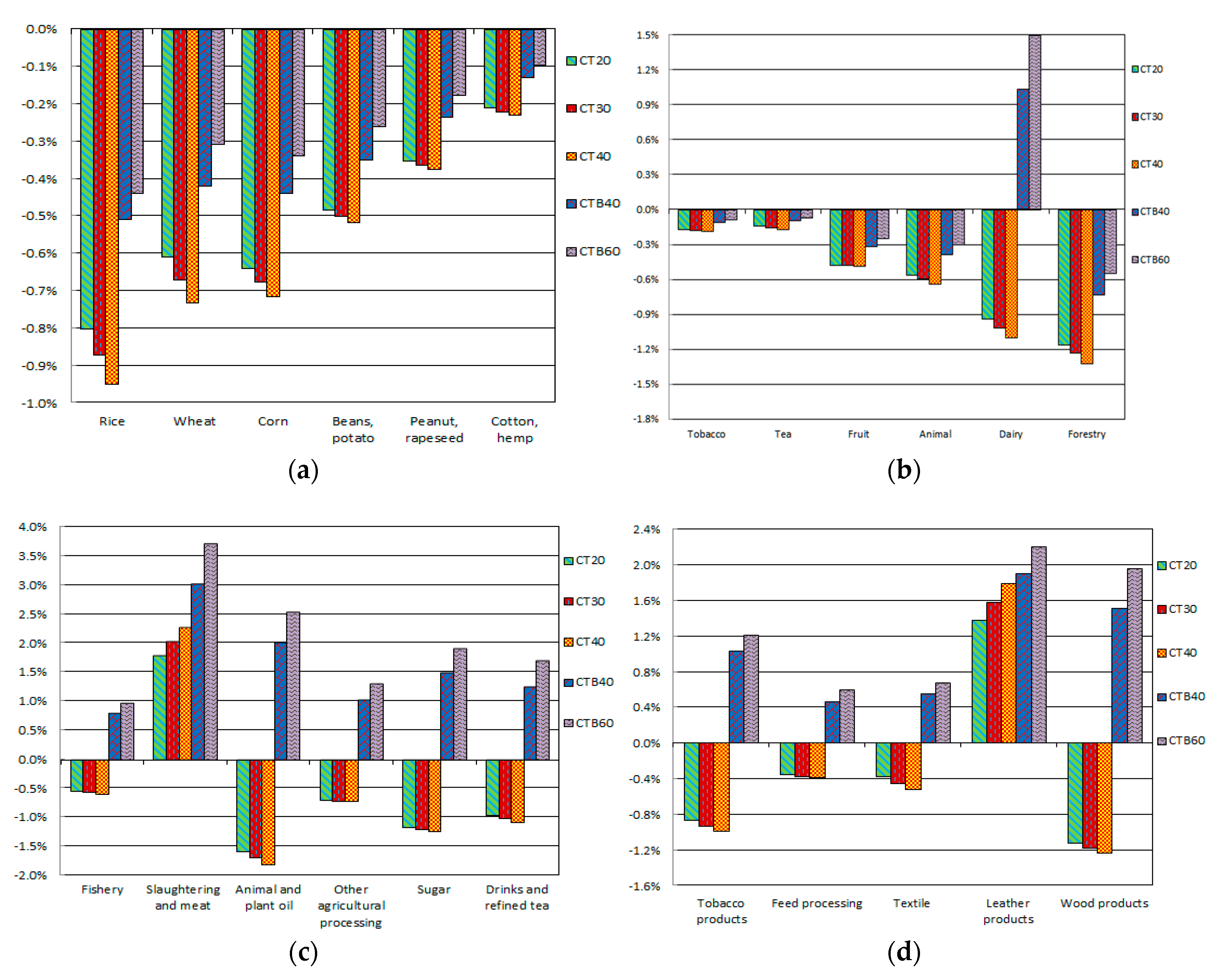

2 emissions by levying tax on fossil fuel products such as coal, oil, and natural gas based on the proportion of carbon content. In order to simulate the impact of the carbon tax on macroeconomy and different agricultural-related sectors, an economy-energy-environmental-agricultural-dynamics CGE model (3EAD-CGE) is constructed in this article to comprehensively analyze the impact of the carbon tax on the production processes of Chinese agriculture-related sectors. In this regard, this study mainly involves 23 agriculture-related sectors, including rice planting; wheat planting; corn planting; beans and potato planting; peanut, rapeseed, and sesame planting; cotton and hemp planting; tobacco planting; tea planting; fruit and other planting; animal husbandry; the dairy industry; forestry; the fishery industry; the slaughtering and meat processing industry; the animal and plant oil processing industry; vegetables and other agricultural processing industries; the sugar products processing industry; the drinks and refined tea processing industry; the tobacco products processing industry; the feed processing industry; the textile industry; the leather products industry; and the wood products processing industry. The rest of the industries are combined into the manufacturing and mining industry, construction industry, transport industry, and service industry. The specific sector definition is shown in

Table 1.

The main economic entities in the 3EAD-CGE model include households, enterprises, and the government. The model is responsive to population, GDP, and capital recursive growth.

The 3EAD-CGE model normally consists of five modules, including the production block, the market block, the income block, the expenditure block, and the overall balance block. In this paper, in order to reflect the influence of carbon tax on the macroenvironment, the macroeconomy, and the agricultural sectors, we choose the above blocks as a whole to analyze.

The relationship between the specific blocks is shown in

Figure 1.

In general, in the production block, the total output is decomposed in the form of the CES total output function, and corresponding to the market block, the total output consists of two parts, one for export and the other for domestic supply. The domestic supply plus the import component constitutes the total domestic consumption. In the income block, the labor and capital from the production block constitute the source of income. The income is divided into enterprise income, household income, and government income. The three parts are linked through transfer payment and taxation. Corresponding to the income block, the expenditure block mainly describes the expenditure status of enterprises, household, and the government and the expenditure is equal to the income. The specific relationship of each part is described below.

2.1.1. Production Block

In the model, we assume that the agriculture-related sectors are perfectly competitive enterprises and that scale returns remain unchanged. Based on this, we construct a multilevel nested constant elasticity of substitution (CES) production function to describe the substitutability of different factors of production. The production block is divided into five levels. In the first level, the inputs of the aggregation of intermediate commodities and the aggregation of capital-energy-labor are transformed into the total output in the form of the CES total output function. The first-level module formulas are as follows:

In time point

t, where

denotes the output in

i sector,

is the size parameter under the

i department output,

is the share parameters of the output of capital-energy-labor in department

i, is the demand for finished products of capital-energy-labor in department

i, is the substitution parameter between intermediate inputs and capital-energy-labor in department

i, is the requirements of intermediate inputs in department

i, is the price of finished products of capital-energy-labor in department

i, is the price of intermediate inputs in department

i. In the second level, the aggregation of capital-energy-labor is decomposed into the synthesis beam of capital-energy and the labor force. The second-level module formulas are as follows:

In time point t, where denotes the size parameter for finished products of capital-energy labor in department i, is the share parameters of the output of capital-energy in department i, is the demand for finished products of capital-energy in department i, is the demand for labor in department i, is the substitution parameter between labor and products of capital-energy in department i, is the price of finished products of capital-energy in department i, is the average price of labor.

For the nonenergy intermediate inputs in the second level, the Leontief production function is used to represent the intermediate input requirements and prices. The specific formulas are as follows:

In time point t, where denotes the requirements of intermediate inputs in ne by produce unit i, is the direct consumption coefficient of the intermediate input, is the price of intermediate inputs in ne by produce unit i, is the price of intermediate inputs in ne.

In the third level, the synthesis beam of capital-energy is further broken down into two parts: capital and energy. The specific formulas for the module are as follows:

In time point t, where denotes the size parameter for finished products of capital-energy in department i, is the share parameters of the energy of capital-energy in department i, is the demand for energy in department i, is the substitution parameter between labor and energy in department i, is the demand for capital in department i, is the price of finished products of energy in department i, is the price of capital input in department i.

In the fourth level, the synthesis beam of energy is further decomposed into fossil energy and electricity in the form of the CES function. The specific formulas for the module are as follows:

In time point t, where denotes the size parameter for finished products of energy in department i, is the demand for thermal power-energy in department i, is the substitution parameter between thermal power and the composite beam of fossil energy in department i, is the demand for the composite beam of fossil energy in department i, is the price of finished products of thermal power-energy in department i, is the price of the composite beam of fossil energy in department i.

In the last level, the synthesis beam of fossil energy is further decomposed into coal, oil, and natural gas in the form of the CES function. The specific formulas for the module are as follows:

In time point t, where denotes the size parameter of the composite beam of fossil energy in department i, is the share parameters of coal in department i, is the share parameters of oil in department i, is the demand for coal in department i, is the demand for oil in department i, is the demand for natural gas in department i, is the substitution parameter of coal, oil, and natural gas in department i, is the price of coal in department i, is the price of oil in department i, is the price of natural gas in department i.

In the part of

Section 2.1.1, in order to facilitate the calculation, all the input units of demand are 10,000 Yuan. For example, the units of

,

, and

are 10,000 Yuan. In addition, the above demands a calculated in one year.

2.1.2. Market Block

In the 3EAD-CGE model, assuming that the market clears, the number of commodities supplied on the market

is the sum of the quantity of imports

and the quantity of goods produced domestically

in the CES form. Under Ammington’s condition, the quantity of the products supplied by enterprises to the market

can maximize the profits of the enterprises. The specific formulas for the module are as follows:

In time point t, where denotes total supply of goods i in the domestic market, is the size parameter of the supply of goods i in the domestic market, is the quantity of imported goods i, is the quantity of the synthetic products in the domestic market, is the substitution parameter of the synthetic products and imported goods i, is the price of imported goods i, is the price of the synthetic products i in domestic market.

In Equation (15), the domestic price of imported goods is determined by the world exchange rate

and the international price

, which includes the import duty rate

. The specific formula for the module is as follows:

Similarly, the total output of the sector

is the sum of the domestic market supply and exports. Under Ammington’s condition, the number of products that enterprises supply to the market can minimize the cost of the enterprises. The specific formulas for the module are as follows:

In time point t, where denotes the size parameter of producing goods i in domestic market, is the share parameters of export goods i, is the quantity of goods i produced domestically for export, is the quantity of goods i produced domestically and used domestically, is the substitution parameter of domestic sales and exported goods i, is the price of goods i produced domestically for export, the price of goods i produced domestically and used domestically.

In Equation (18), the domestic price of the exported commodity is determined by the world exchange rate

and the international price

, which includes the import duty rate

. The specific formula for the module is as follows:

Similar to

Section 2.1.1, in this part, in order to facilitate the calculation, the units of all kinds of quantity of goods are 10,000 Yuan, such as the

,

, and

, etc.

2.1.3. Income Block

The income block mainly describes the income distributions of the households, the enterprises, and the government. The specific formulas for the module are as follows:

In time point t, where denotes the households’ income, is the transfer payment for households from enterprises, is the transfer payment for households from government, is the enterprise income, is the share parameters of income distribution to the enterprise from capital, is the share parameters of income distribution to the household from capital, is the transfer payments to the enterprise from government, is government revenue, is the production of indirect tax income, is the production tax rate of goods i, is the rate of households’ income taxes, is the rate of enterprise income taxes, is carbon tax, is tariffs.

In this study, we follow the assumption that direct and indirect taxes are defined as fixed shares in the model. In addition, the assumption that government financial revenues and expenditures are balanced is applied in this model.

Similar to

Section 2.1.1, in this part, in order to facilitate the calculation, the units involved in the income are all 10,000 Yuan, such as the

,

, and

, etc.

2.1.4. Expenditure Block

Corresponding to the income block, the expenditure block mainly describes the operations of the market economy in the process of the households, the enterprises, and the government spending and saving. The relationship between savings, income, and expenditure is as follows:

In time point t, where denotes households’ consumption, is residents’ marginal propensity to consume, is household savings, is enterprise savings, is enterprise spending, is government savings, is government spending, is total investment, is total savings, is foreign investment, is households’ marginal propensity to consume, is export tax rebate.

Similar to

Section 2.1.1, in this part, in order to facilitate the calculation, the units involved in the expenditure are all 10,000 Yuan, such as the

,

, and

, etc.

2.1.5. Closed Module

For the balance of payments, the exchange rate of the general equilibrium is determined according to Equations (32)–(34). The specific formula is as follows:

where

donates the capital supply of industry

i in period

t, is the size of the labor force in

t of department

i.For the savings-investment closure, this paper uses neoclassical closure rule, that is, savings decide investments. All the savings in the economic entities will be transformed into investment and the specific formula is shown as follows:

For the zero profit condition, this paper uses the unit product price equal to unit sales price to determine the level of production activities in a balanced state.

2.2. Dataset

Based on the basic principles of the input-output table of China in 2012 [

11] combined with the China Statistical Yearbook [

10] and the China Financial Yearbook [

31], which are authorized by the Ministry of Finance, the National Bureau of Statistics, and other related central ministries and commissions as well as information from social research, this article has compiled a social accounting matrix (SAM) of Chinese agriculture-related sectors, which is coordinated with the 3AED-CGE model. Because the input-output table of China in 2012 includes 139 sectors, for the purposes of this analysis, the agricultural industry is decomposed and 23 agriculture-related sectors are selected based on this decomposition. The rest of the industries are combined into the manufacturing and mining industry, construction industry, transport industry, and service industry.

CO2 emissions are mainly reflected in the production block. Based on social accounting matrix which can reflect the input-output situation of different agriculture-related sectors in China, and on the proportion of other sectors which consume in the intermediate production process of different agricultural-related sectors accounting for the total output of the sector, CO2 emissions of agricultural-related sectors in the intermediate production process can be calculated due to the consumption amount of coal, oil, natural gas, and electricity by other sectors. Correspondingly, in the production structure, the carbon tax is levied on the basis of CO2 emissions of agriculture-related sectors. The result of the carbon tax will affect a variety of energy substitutions as well as energy and capital substitutions. As the scope of carbon tax levied mainly due to the combustion of fossil fuels caused by CO2 emissions, based on this, this paper does not consider other CO2 sources such as pesticide, fertilizer, and agricultural film.

Moreover, the State Council Development Research Center of China pointed out that China’s economy will experience a weak resurgence in 2013 with hope for year-on-year growth of 8.1%. From 2013 to the next decade, China’s economy will change to a medium growth at a rate of 6% to 8% [

32]. According to the above analysis, from 2013 to 2020, China’s GDP growth rates are set at 7.55%. From 2021 to 2050, the GDP growth rate refers to the research of Wang et al. [

33]. For the population, according to the estimate in the Research Report of Chinese Population Development Strategy [

34], the population will increase by 8 million annually in China. Based on 135,404 million people in China in 2012, it is possible to roughly estimate the growth rate of China’s population by 2050. Specifically, China’s GDP and population growth rates from 2012 to 2050 are shown in

Table 2.

The 3AED-CGE model uses a recursive dynamic mechanism, which can be used to solve the equilibrium solution in each period from the base year to 2050. The specific formulas are as follows:

represents the capital supply of industry i in period t + 1, and represents the current depreciation rate of industry i. is the current investment of industry i. represents the size of the labor force in t + 1 of department i, and is the labor growth rate.

A small number of the parameters in each function in the 3AED-CGE model are exogenously determined and estimated. Such as the substitution parameters which are reflecting the substitution between different factors. Most of the parameter values are obtained by substituting data from the SAM in the base year and then inversely deducing the values of unknown parameters such as the size parameters which are reflecting the efficiency of the overall use of society, the share parameters which are reflecting the contribution of factors in the production process, etc. For the size parameters, according to the Equations (1), (3), (7), (9), (11), (14) and (17), the size parameters of the respective variables can be obtained. For example, the size parameter

can be obtained in the following formula converted by Equation (1):

The remaining size parameters can also be obtained in a similar manner.

For the share parameters, the values can be obtained according to the Equations (2), (4), (8), (10), (12), (13), (15) and (18). For example, the share parameter

can be obtained in the following formula converted by Equation (2):

The remaining share parameters can also be obtained in a similar manner. The derivation of the size parameters and share parameters can be found in Pan [

35].

For the substitution parameters that are exogenously determined and estimated, this study mainly refers to the results of Pan [

35] and Dai et al. [

36] who think that the substitution parameters are homogenous between different departments. The specific values are as follows:

is −0.11,

is −0.43

is −0.43,

is −0.43,

is −0.43,

is −0.25, and

is −0.25.

2.3. Scenarios Design

Since Finland first implemented a carbon tax policy in 1990, the policy of a carbon tax as a response to global warming has been adopted by some Western countries. Carbon tax policy implementation has been brewing in China. The task force of the National Development and Reform Commission and the Ministry of Finance has pointed out that 2012 would be the appropriate time to launch a carbon tax. In addition, due to the most recent year of China’s input-output table being 2012, and from the practical significance of this study and the data acquisition point of view, in this analysis, the carbon tax base period is set in 2012. Through the 3EAD-CGE model, during 2012–2050, a carbon tax on CO2 from the consumption of fossil fuels in the production processes of agriculture-related sectors and from the consumption of energy products in the production processes is simulated.

China has made an ambitious commitment to cut down its carbon dioxide emissions of GDP per unit from 40% to 45% by 2020 compared with that in 2005. Accordingly, CO

2 emissions come from the fossil energy consumption when enterprises produce their products. And all sectors should take emissions reduction into account and then decide the appropriate activity level. Agricultural-related sectors are no exception. According to the above analysis, the carbon tax may be an effective means of reducing emissions. Internationally, most countries impose a fixed carbon tax rate, and the fixed carbon tax rate is usually lower in the early period of introduction and then is gradually increased. However, carbon tax levied in China has not really been implemented, and the tax rate is still no basis to determine the level of carbon tax to be imposed. In this regard, referring to the international carbon tax precedent, Li et al. [

37] whose research introduces carbon tax into China, Meng and Pham [

38] whose research introduces carbon tax into the tourism sector in Australia, and Meng [

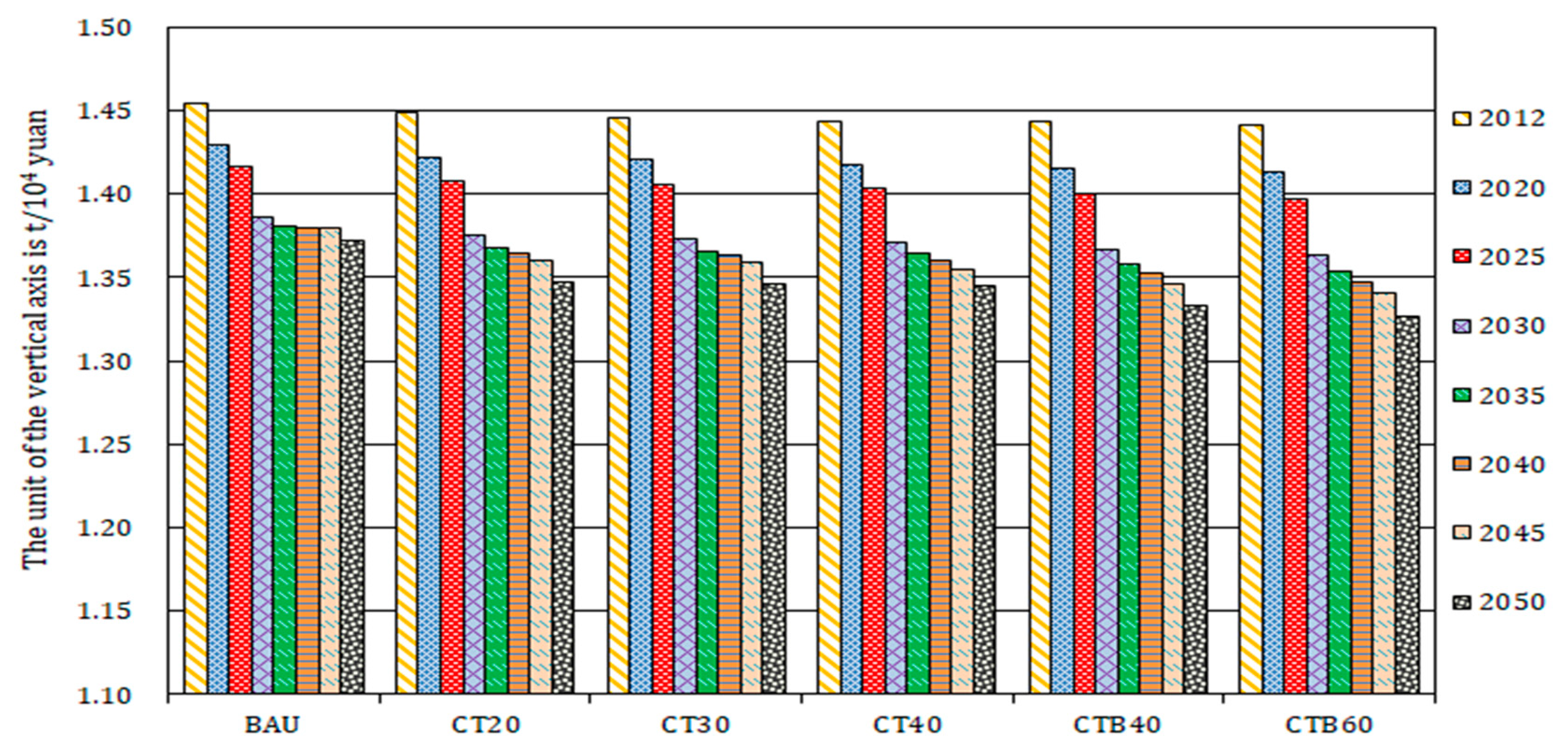

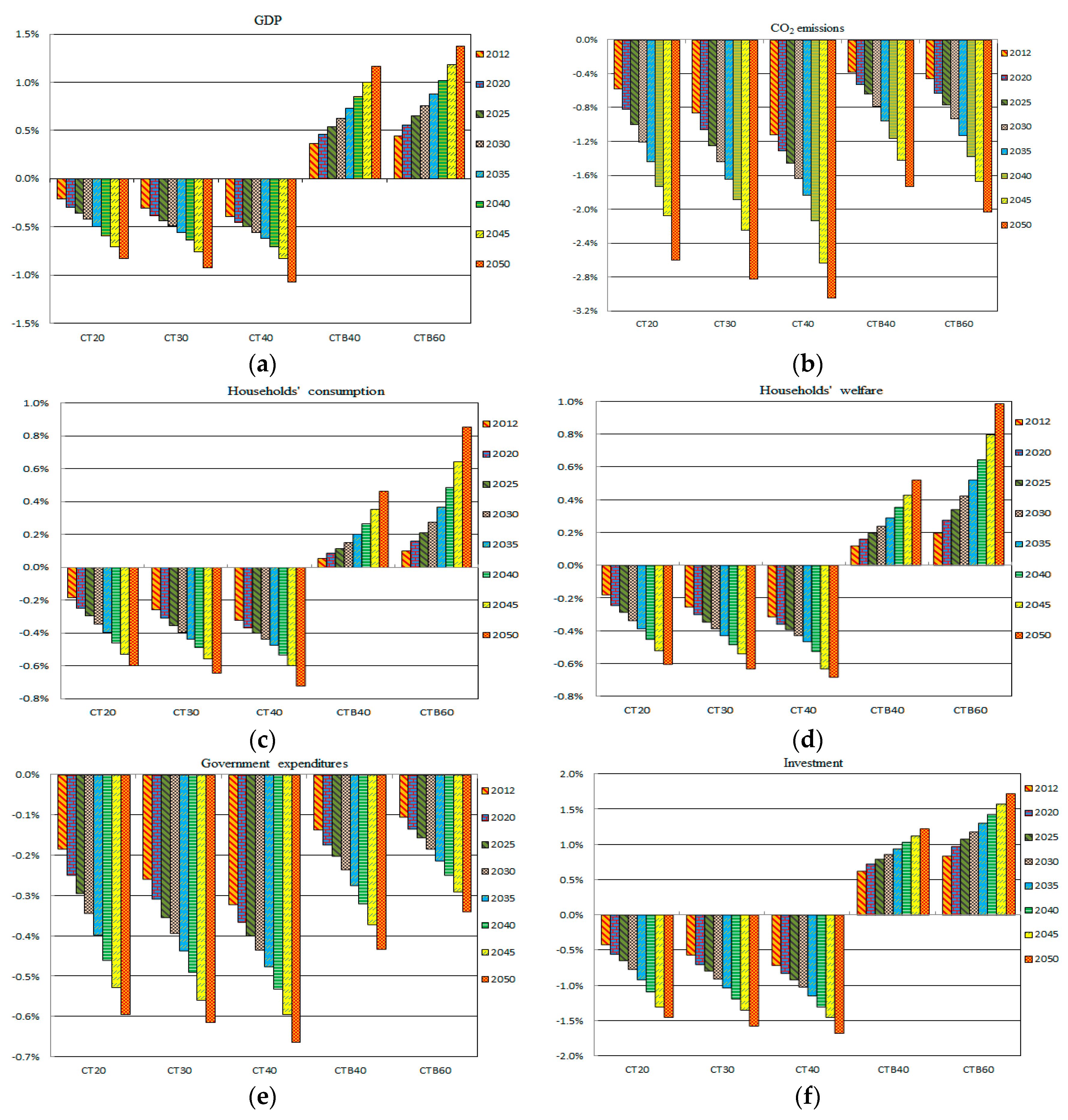

39] whose research focuses on the impact of carbon tax on electricity sector, this article sets up six different scenarios to impose a carbon tax on agriculture-related sectors. Among them, according to the international general experience, the carbon tax should be set gradually in accordance with the low to high, and it is not reasonable to set the carbon tax too high, otherwise the impact on the macroeconomy will be more significant. Scenario 1 is the business as usual (BAU) scenario, in which China does not implement a carbon tax policy between 2012 and 2050. Scenario 2, scenario 3, and scenario 4 can be referred to as CT20, CT30, and CT40 based on the carbon tax rates 20 yuan/ton, 30 yuan/ton, and 40 yuan/ton, respectively. In these scenarios, starting in 2012, the carbon tax rate is increased by 4.33%, 3.22%, and 2.44% per year, respectively, until they each reach 100 yuan/ton in 2050. Scenario 5 and scenario 6, which can be referred to as CTB40 and CTB60, implement balanced tax rates. In scenario 5 and 6, the carbon tax rates are assumed to be 40 yuan/ton and 60 yuan/ton, the indirect production tax is reduced proportionally so that the total tax burden is unchanged. The specific scenarios are shown in

Table 3.

4. Discussions

4.1. Policy Implications

Through the above analysis, we can see that in order to achieve agricultural CO2 emissions reductions, we cannot blindly imitate foreign advanced concepts and successful practices. On the contrary, we should combine these concepts with the specific circumstances of the various regions of China, according to local conditions, to explore suitable paths and methods for China’s agricultural CO2 emissions. Specific practices are as follows:

(1) Find the optimal combination of carbon tax policies.

The simulation results show that levying a carbon tax at the same time as cutting indirect taxes in proportion can reduce the negative impact on agriculture-related sectors. Therefore, the government should determine the carbon tax levied and at the same time set a reasonable carbon tax levy and increase the implementation of transfer payments and other supporting measures to ensure that energy-saving emission reduction measures are effective.

(2) Consider the time effect of the carbon tax.

Given that the effect of the carbon tax in the short term is stronger than in the long term, in the short term, a carbon tax can be the main measure to reduce emissions. In the long term, a carbon tax is as a supplemental tool, and other energy-saving emission reduction methods are the main measures.

(3) Actively explore ways to reduce CO2 emissions in agriculture-related sectors.

As the results of this study show, due to the natural fragility of China’s agriculture-related sectors, a carbon tax would impose a serious impact on China’s economy of agriculture-related sectors. There is an urgent need to explore other ways to solve the problem of agricultural CO2 emissions reductions, such as improving energy efficiency or using alternative energy sources, etc., in order to minimize the intensity of the impact on agriculture-related sectors.

As the scope of carbon tax levied mainly due to the combustion of fossil fuels caused by CO2 emissions, this paper does not consider other CO2 sources such as pesticide and fertilizer. Finally, the relevant policy recommendations based on the results mainly reflect the impact of the carbon tax levied on the intermediate production process of agricultural-related sectors. Therefore, when considering limiting CO2 emissions in agricultural-related sectors, on the one hand, tax means can be useful; on the other hand, reducing the intensity of agricultural chemicals, and gradually increasing the input proportion of organic fertilizer, biological pesticides, and other low-carbon green production can limit CO2 emissions effectively.

4.2. Future Prospects

Although the carbon tax is considered to be one of the most efficient policy means for reducing emissions, it has been controversial about how exactly the carbon tax is levied. Due to the limitations of research conditions, research level, and time, this paper has some of the shortcomings. In the future, efforts and improvements can be made in the following aspects.

- (1)

Introduce carbon trading mechanism to make the scenarios more colorful under the premise of the combination of the carbon tax policy and the carbon trading mechanism.

- (2)

Further improve the accuracy of the data. Most of the parameters in this model refer to the existing research results. In future research, more detailed data surveys should be conducted to calibrate the parameters more accurately and should be more in line with the characteristics of the real economy.

- (3)

Strengthen the model scenarios design to improve the degree of discrimination of carbon tax impacts between different scenarios.

- (4)

Update the basic data in a timely manner to improve the accuracy of the results.