1. Introduction

In recent years, with the continuous development of China’s wind power industry, the total installed capacity of wind power has increased. Wind power is leading the transition from fossil energy to clean energy globally. By the end of 2015, China’s cumulative wind power installed capacity reached to 145,104 MW, making China the largest wind power installation country with 33.6% of the global share. China is a major country in both of the wind power installed capacity and wind power curtailment. In the first half of 2015, the average rate of wind power curtailment in China had reached 15.2%, resulting in direct economic losses of more than 16 billion yuan. Hence, it is urgent to solve the wind power curtailment problem caused by large-scale wind power penetration in the power system. Traditional power generation dispatch plans are based on the consideration of controllable power output and predictable load characteristics [

1,

2,

3]. After an uncontrolled power supply like wind power is introduced, the research points of optimized dispatch are mainly reflected in two aspects: the first is how to establish a more accurate forecasting model of wind power output [

4,

5,

6]; the second is how to make conventional generators leave reasonable reserve capacity in response to uncertainties of wind power producers [

7,

8,

9]. Traditional reserve capacity is obtained from the deterministic calculation method, that is, the fixed proportion of system load and the largest single capacity in the system. However, due to the stochastic fluctuation characteristics of wind power, the traditional method cannot meet the requirements of the economics and reliability of the system. Therefore, it is necessary to research the day-ahead market clearing model with the large-scale wind power penetration, which can lay a foundation for the gradual promotion of China’s spot electricity market.

The spot market refers to the market that focuses on short-term and instant electricity transactions, which is an important part of the electric power trading mechanism. Firstly, affected by the power system, it is usually in the day-ahead stage that the ISO can accurately confirm the operation and starting conditions of each generating unit, and analyze the network structure of power systems. Therefore, establishing the spot market at this time can make the result of the transaction be more in line with the actual situation, which can really help to ensure the safe and stable operation of the power grid. Secondly, through the competition of the spot market, the daily peak-to-valley electricity price, even the real-time electricity price signal, can accurately reflect the real electrical market supply and demand in different times. Thirdly, the spot market can guide the power generators to meet the requirement of electric system peak regulation initiatively by the real-time electricity price signals, and lay a mechanism for the implementation of demand side response. In addition, it can also optimize all the resources in the power grid, so as to effectively promote renewable energy accommodation and reduce the wind power curtailment. Finally, the price signal generated by the spot market is produced by the sufficient competition of all the market participants, which can provide an effective quantitative reference for optimizing resource allocation, planning investment, medium and long-term power trading and power financial market. Besides, the price signal also helps to further stabilize the medium and long term market, and achieve the agreement between the medium and long-term transactions and the real time operation of the power system. The convergence and coordination between the medium and long-term markets and spot transactions help maintain market stability and avoid price fluctuations [

10,

11,

12].

The day-head market is the main trading platform in the spot markets, using “one day” as a suitable advanced time to organize the market, in which the market participants can more accurately predict their own power generation capacity or demand for electricity, so as to form a trading plan which is adaptive and executable to the operation of the power system. However, due to the integration of wind power into the power system, it will make the market supply side uncertain, increasing the decision-making difficulty of the Independent System Operator (ISO). The clearing of day-ahead market is based on the reasonable dispatch made by ISO, so the ISO must take into account the uncertainty of wind power output characteristics when making day-ahead clearing trading plan. Reasonable dispatch means wind power should be accommodated as much as possible in the dispatch, and the conventional generator should leave enough reserve capacity for the uncertainty of wind power. In the market environment, the user transaction settlement mode can be divided into regional marginal electricity price model and locational marginal price model. Compared with the regional marginal price model, the locational marginal price model can effectively use the Optimal Power Flow (OPF) technology to deal with network congestion, so it is widely used. In this paper, the locational marginal price will be used for day-ahead market clearing. ISO, in the dispatch process, will generate a reasonable price, that is, the locational marginal price [

13,

14].

As for the problem of the power system dispatch caused by the error of wind power output prediction, there are two main kinds of solutions in the existing literature: stochastic optimization methods and robust optimization methods. Stochastic optimization methods are more effective in dealing with the optimization problem with uncertain factors, and how to accurately describe the uncertainty of wind power in the power system is the key to solve the problem of economic dispatch. Stochastic optimization methods mainly describe the uncertainty by a stochastic variable, mainly including chance constrained method and conditional value at risk (CVaR) method [

15]. The opportunity-constrained method assumes that the prediction error of wind power or wind power output is subject to a particular type distribution, so as to establish a stochastic programming model that satisfies a certain probability level either by the Weibull distribution of the long-term distribution characterizing wind speed or by the normal distribution [

16] and

distribution [

17] characterizing wind power prediction errors. However, the opportunity constraint is not convex in mathematics, resulting that it is difficult to obtain the overall optimal solution, and the solution obtained by the intelligent algorithm cannot get the definite solutions [

18]. By contrast, CVaR introduces a convex function in the modeling process, which can effectively obtain the overall optimal solution [

19]. But this kind of solution needs to use Monte Carlo sampling linearization to produce a large number of discrete sample points, resulting in huge computational complexity. In the reference [

20], after considering the wake effect, the probability distribution of wind speed was converted into the probabilistic analytic model of the active output of wind power producer, and the dynamic economic dispatch model of power system was established based on wind power cost. The reference [

21] forecasted wind speed by probability density function and employed the scenario method to solve the dispatch problem of power system with wind power. In the reference [

22], a single period of power system pricing model was established based on the multiple scenarios stochastic programming (MSSP) method considering wind power outputs, finding that the stochastic optimization method often requires a large number of stochastic scenarios in order to ensure the accuracy of the calculation, resulting that the variables are numerous and all have high dimensions. According to the existing method, when solving this problem, stochastic optimization methods will result in huge computation and low computational efficiency [

23], which makes it more difficult to meet the practical demands of large scale wind power on-grid.

Robust optimization is an uncertainty decision making method based on interval disturbance information, whose goal is to achieve optimal decisions in the worst conditions of uncertain parameters, so robust optimization is usually called the maximum minimum decision problem [

24,

25]. Because the robust optimization method has advantages of not requiring the exact probability distribution information of uncertain parameters, quick calculation and suitable for solving large-scale system problems, it has a wide application prospects in power system dispatching problems. According to the relationship between time and space in the wind power producers, the dynamic uncertainty set was constructed in [

26], which coupled the perturbation implementation condition of the previous period with the uncertainty set of the current stage, so as to form an adaptive multi period dynamic economic dispatch robust optimization model. This robust optimization model improves the operational efficiency and reliability of decision-making compared with the static economic dispatch. In addition, Xie et al. [

27] adopted the advanced dispatching robust optimization model to verify the advantage of the space-time-related wind power forecasting model in improving the utilization of wind power and reducing the total operating cost of the system, and shows that, in the robust optimization model considering wind power fluctuation, the improvement of wind power output prediction accuracy plays an important role in narrowing the range of uncertain collections and controlling the degree of conservativeness in decision making. It is important to note that there is a mutual exclusion relationship between the ability of the system to accept the power disturbance and the economics of the dispatching result. In order to reflect the influence of the two factors on the dispatching results, Li et al. [

28] took the maximal upper limit of wind power output and the minimal power generation cost as the optimization objectives to establish robust interval dispatch model. To further clarify the master-slave sequence of safety objectives and economic objectives, Li et al. [

29] constructed a real-time dispatching model with two-layer objectives, which formed a two-layer optimization problem. The first layer quantifies the maximum disturbance acceptance ability of the system. On this basis, the second-layer optimization can obtain the most economical dispatch decision results under the condition of maintaining the given disturbance acceptance ability. However, robust optimization also has some shortcomings, that is, the result of the solution is too conservative. In [

30], in order to make up the issue that the robust dispatch model result is too conservative, a robust interval dispatch model based on a certain confidence level for wind power output was established, which transformed the problem into single-layer nonlinear programming problem and solved it by Internal Point Method. In [

31], the cost function in the objective function was divided into two parts, one part corresponded to the expected cost under the action of stochastic optimization, and the other part corresponded to the worst condition cost which is introduced by the robust optimization method. By assigning the weight coefficient for the two parts, the two optimization methods were unified into one model. By selecting different weight coefficient, the ISO can adjust the conservatism of the unit combination model. However, the influence of power flow constraint on the dispatch results is less considered in the dispatch of power system. In addition, when using the robust optimization method to solve the problem of economic dispatch, the curtailment of wind power is not considered. Wind power, as a clean energy source with low operating costs, should avoid over-curtail, so as to maintain the economic efficiency of the power system operation.

Compared with the method of stochastic optimization, which is widely used in uncertain programming problems, robust optimization has the following characteristics: (1) the decision-making of robust optimization model focuses on the boundary conditions of uncertain parameters, and does not need to know the form of accurate probability distributions. (2) Generally speaking, the robust optimization model can be solved by transforming into its equivalent model, and the scale of the solution is relatively small compared with the stochastic optimization method. In addition, the decision of robust optimization is carried out on the condition that the uncertain parameter is unknown, and a definite numerical solution can be obtained. The decisive result of the robust optimization is sufficient to deal with all the uncertainties, while the constraint of the model is satisfied when the uncertain parameters are taken in a predetermined set of uncertainty sets. Therefore, the effective solution of the robust optimization model is a set of numerical solutions ensuring that all constraints are feasible when the model parameters are arbitrarily taken in the uncertainty set.

On the basis of the above discussion, the robust optimization method is applied to analyze how to carry out the dispatch of the day-ahead market and establish the clearing mechanism in the power system with large-scale wind power penetrating to the grid. However, in the previous robust model, the result of the day-ahead market clearing is formed on the basis of the direct consideration of the uncertainty of the wind power real time output in the objective function which has the worst impact on the operating cost of the system [

26,

27,

28,

29]. In the above robust models, the dispatching results may be too conservative, that is, the operation cost of the day-ahead market is too high. On the whole, according to the previous researches, the contributions of this paper mainly include the following two aspects:

(1) If the objective function only includes the minimum operating cost of the system, it may result in less wind power accommodation, making it difficult to fully utilize the renewable energy. Therefore, in this paper, apart from the system operation cost, we also consider reducing the curtailed of wind power as much as possible, so as to establish a multi-objective function. Furthermore, the influence of the change of the curtailed wind power on the average locational marginal price is further analyzed, and the average locational marginal price increases with the increase of the curtailed wind power.

(2) Based on the theory of robust optimization, this paper proposes an approach to improve the day-ahead market clearing model, which is different from some previous reference [

26,

27,

28,

29]. This model considers whether the day-ahead clearing results in the feasible region can leave sufficient reserve capacity for the uncertainty caused by the real time output of wind power in the balance stage, instead of direct consideration of the uncertainty of the wind power producers real time output in the objective function which has the worst impact on the operating cost of the system.

The rest of this paper is organized as follows:

Section 2 reports the mathematical expressions of the robust day-ahead market clearing model.

Section 3 conducts the simulation and comparisons.

Section 4 concludes this paper.

4. Conclusions

In this paper, we present a robust market clearing mechanism for the day-ahead electricity market and used the proposed model to simulate the day-ahead market clearing, which contains wind power producers. Because this market clearing mechanism of the day-ahead market is built-in the robust optimization framework, the robustness of the dispatch result can be ensured. In addition, the model presented in this paper is also an improvement on the previous day-ahead market robust clearing model, which reduces the conservativeness. With employing the robust market clearing model, day-ahead economic dispatch solution of the power market can be accommodated against any uncertainty output within the wind power uncertainty set, which not only ensures the wind power regulation capability in the electricity market, but also generates reasonable locational marginal prices.

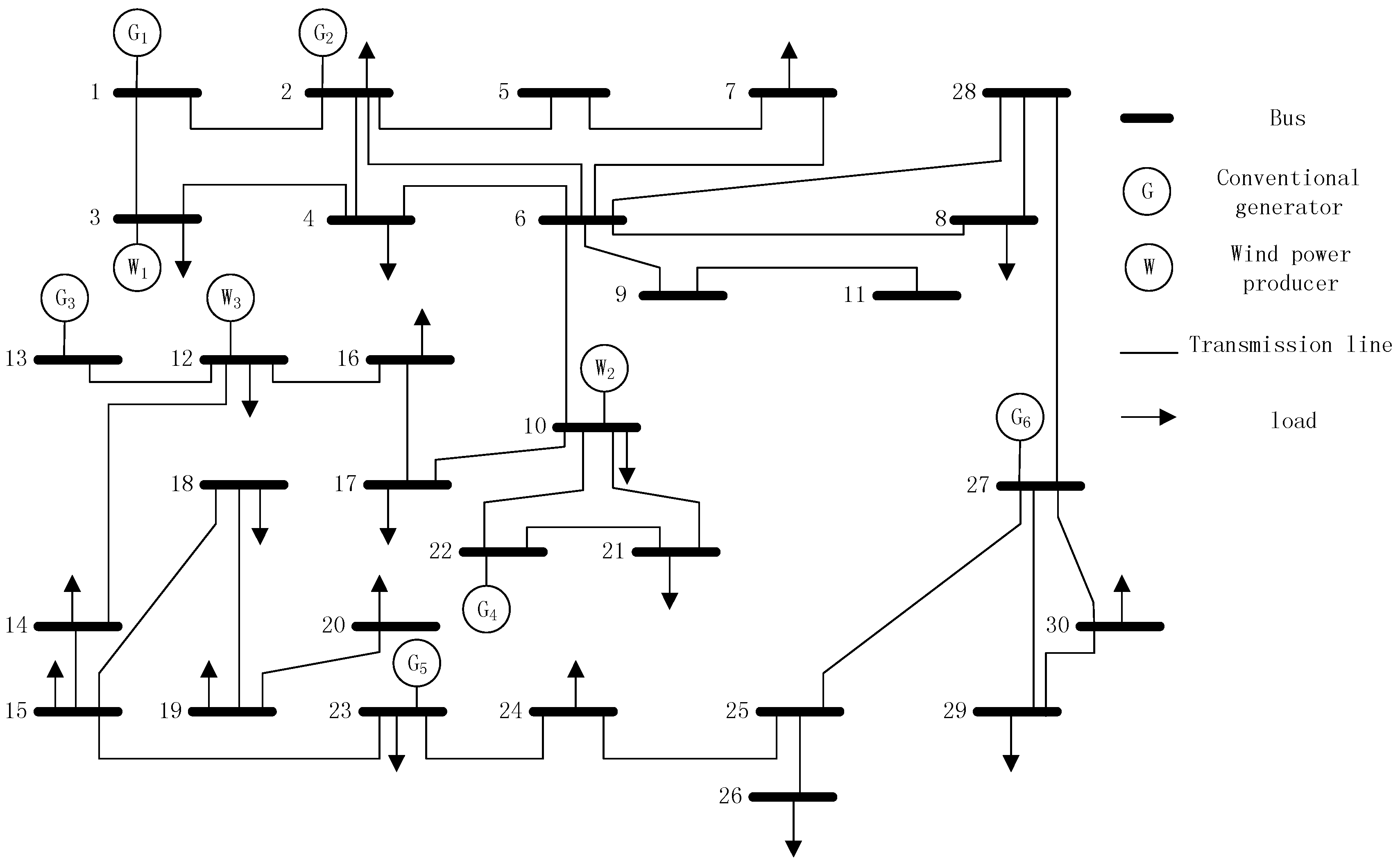

Besides, there is a contradiction between the minimization of system operating costs and the minimization of wind power curtailment, which cannot be achieved at the same time. In order to accommodate the deviation due to the uncertainty of wind power producers output, it is necessary to dispatch the output of conventional generators, which will increase the total operating cost of the system. If the wind power output deviation is not accommodated, it may result in excessive wind power curtailment. In order to make full use of renewable energy and analyze the relationship between two variables, the variable of curtailed wind power is introduced into the objective function to establish the bi-objective function of minimizing the system operation cost and the least wind power curtailment. Thus, the priority dispatching of renewable energy such as wind power can be ensured, reducing waste of resources. However, as suggested by the empirical findings, it should be noted that excessive attention to reducing wind power curtailment will increase system operating costs, revealing that it is necessary to weigh the importance of the two objective functions according to the actual situation. Finally, the low computing time (simulation on the IEEE 30-bus test system, with only 50.69 s to get the final result) makes the proposed method easy to promote, providing a reasonable test bed for the more realistic and complex electric market system.