Ethylene Supply in a Fluid Context: Implications of Shale Gas and Climate Change

Abstract

:1. Introduction

2. Materials and Methods

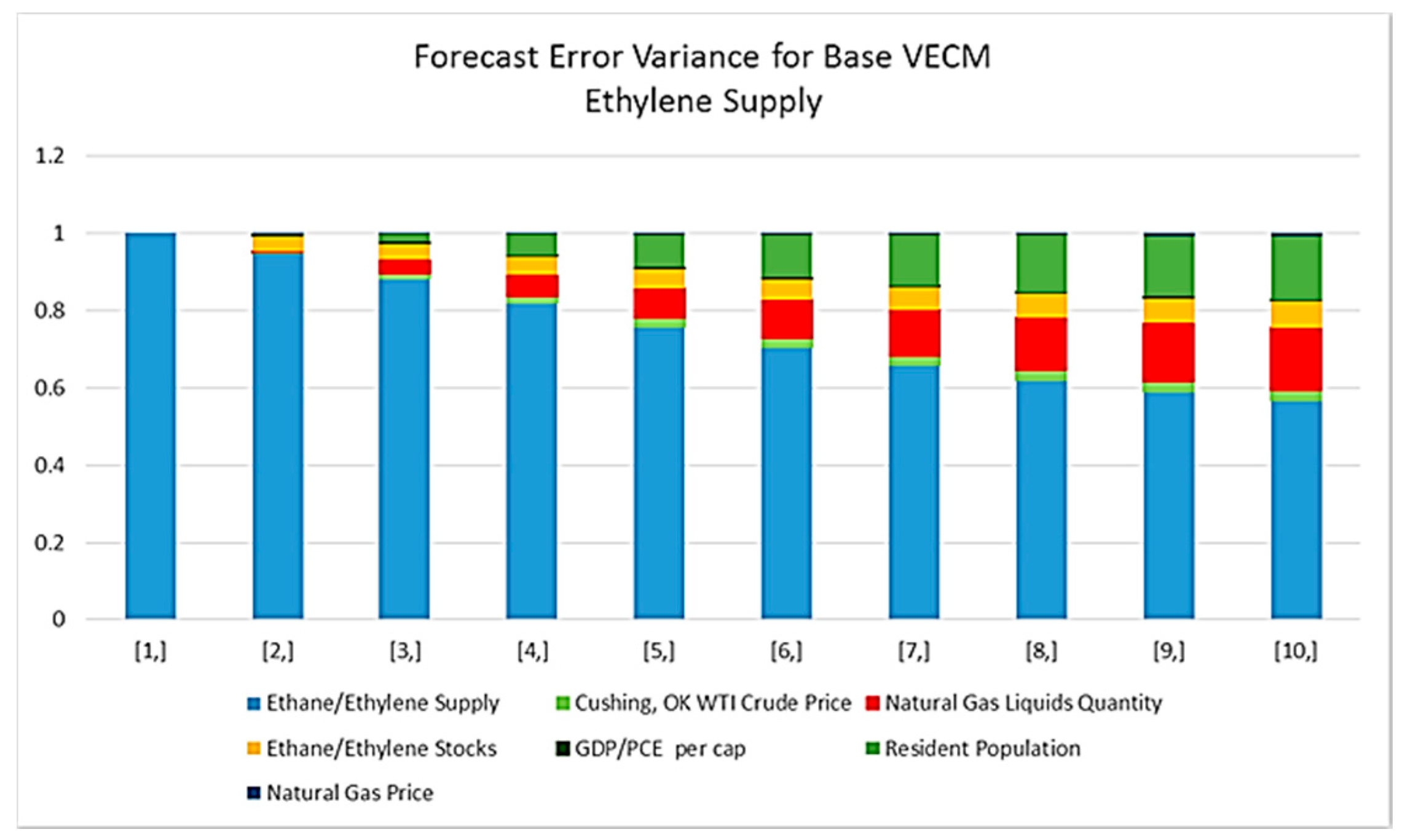

- The first step was to create a business-as-usual “base” model that projects future ethylene supply from production and socio-economic data. This historical data describes the system of ethylene supply in the U.S. without regard to climate change implications. This projection was used as a baseline in this analysis. To do this, an econometric VECM of the U.S. ethylene supply was developed with time series data (1986–2014). A VECM is an autoregressive model designed to account for co-integration amongst the variables. See Model Estimation below.

- The second step created the climate change relevant scenarios by applying the SSP socioeconomic drivers in the VECM. The SSPs were recently developed by a consortium of climate change researchers to “serve as a framework for systematic future research of climate change mitigation, climate impacts and adaptation as well as broader sustainability issues aiming to integrate studies from a great diversity of research fields” [20].

- A third step built a range of natural gas prices into the model. Finally, the greenhouse gas emissions of the quantities of ethylene supplied under each scenario were estimated.

- Socioeconomic challenges to mitigation—“(1) factors that tend to lead to high reference emissions in the absence of climate policy because, all else equal, higher reference emissions makes that mitigation task larger; and (2) factors that would tend to reduce the inherent mitigative capacity of a society” [33].

- Challenges to adaptation—“a function of the socioeconomic determinants of exposure to climate change hazards, sensitivity to these hazards, and the adaptive capacity to deploy coping measures” [33].

- SSP1 “Sustainability”: low challenges to adaptation and mitigation (progress towards a sustainable low carbon economy) [35];

- SSP3 “Regional Rivalry”: high challenges to adaptation and mitigation (heavy fossil fuel use, low global cooperation on environmental issues, low economic growth rates, and low investment in education with high birth rates in some countries and low birth rates in the U.S.) [35]; and

- SSP5 “Fossil-Fueled Development”: high challenges to mitigation and low challenges to adaptation resulting in heavy fossil fuel use [35].

3. Results

3.1. Relationships between Variables

3.2. The Future of Ethylene Supply

3.3. The Future of Climate Impacts from Ethylene Supply

4. Discussion

5. Conclusions

- Lifecycle perspectives are needed to inspire alternative low-carbon feedstocks for ethylene and its uses.

- Policies that target reducing the consumption of ethylene-based products, such as plastics, are needed.

- Better recovery and reuse of ethylene-based products is needed with the aim of reducing consumption.

Supplementary Materials

Funding

Acknowledgments

Conflicts of Interest

References

- Broeren, M. Production of Bio-Ethylene—Technology Brief. Available online: IRENA-ETSAP Tech Brief I13 Production_of_Bio-ethylene.pdf (accessed on 18 September 2018).

- Plotkin, J.S. Beyond the Ethylene Steam Cracker. Available online: https://www.acs.org/content/acs/en/pressroom/cutting-edge-chemistry/beyond-the-ethylene-steam-cracker.html (accessed on 30 August 2018).

- Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990–2015. Available online: https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks-1990-2015 (accessed on 18 September 2018).

- U.S. Product Supplied of Ethane-Ethylene (Thousand Barrels). Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=metupus1&f=m (accessed on 18 September 2018).

- Koottungal, L. International survey of ethylene from steam crackers. Oil Gas J. 2012, 110, 85. [Google Scholar]

- True, W.R. Global ethylene capacity poised for major expansion. Oil Gas J. 2013, 111, 90–95. [Google Scholar]

- Facts and Figures of the European Chemicals Industry 2016. Available online: http://www.cefic.org/Facts-and-Figures/ (accessed on 18 September 2018).

- Annual Energy Outlook 2014: With Projections to 2040; US Energy Information Administration: Washington, DC, UK, 2014.

- True, W.R. Global ethylene capacity continues advance in 2011. Oil Gas J. 2012, 110, 78–84. [Google Scholar]

- Lippe, D. 2013 ethylene output rises; growth to continue in early 2014. Oil Gas J. 2014, 112, 84. [Google Scholar]

- Facts and Figures of the European Chemicals Industry 2014. Available online: https://www.google.com.tw/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&ved=2ahUKEwjmvcyLmK3eAhWMabwKHYCSDwsQFjABegQIABAC&url=http%3A%2F%2Fwww.cefic.org%2FDocuments%2FFactsAndFigures%2F2014%2FFacts%2520and%2520Figures%25202014%2520-%2520The%2520Brochure.pdf&usg=AOvVaw3v6YC2aFFHO8gK5KOC3o2C (accessed on 18 September 2018).

- Fattouh, B.; Brown, C. US NGLs Production and Steam Cracker Substitution: What Will the Spillover Effects Be in Global Petrochemical Markets. Available online: https://www.oxfordenergy.org/publications/us-ngls-production-and-steam-cracker-substitution-what-will-the-spillover-effects-be-in-a-global-petrochemicals-market/ (accessed on 18 September 2018).

- Liverman, D. From uncertain to unequivocal. Environ.Sci. Policy Sustain. Dev. 2007, 49, 28–32. [Google Scholar] [CrossRef]

- Remer, D.S.; Jorgens, C. Ethylene economics and production forecasting in a changing environment. Eng. Process Econ. 1978, 3, 267–278. [Google Scholar] [CrossRef]

- Dornburg, V.; Hermann, B.G.; Patel, M.K. Scenario projections for future market potentials of biobased bulk chemicals. Environ. Sci. Technol. 2008, 42, 2261–2267. [Google Scholar] [CrossRef] [PubMed]

- Broeren, M.; Saygin, D.; Patel, M.K. Forecasting global developments in the basic chemical industry for environmental policy analysis. Energy Policy 2014, 64, 273–287. [Google Scholar] [CrossRef]

- Hermann, B.G.; Blok, K.; Patel, M.K. Producing Bio-Based Bulk Chemicals Using Industrial Biotechnology Saves Energy and Combats Climate Change. Environ. Sci. Technol. 2007, 41, 7915–7921. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ruth, M.; Amato, A.D.; Davidsdottir, B. Carbon emissions from us ethylene production under climate change policies. Environ. Sci. Technol. 2002, 36, 119–124. [Google Scholar] [CrossRef] [PubMed]

- Masih, M.; Algahtani, I.; De Mello, L. Price dynamics of crude oil and the regional ethylene markets. Energy Econ. 2010, 32, 1435–1444. [Google Scholar] [CrossRef]

- Bauer, N.; Calvin, K.; Emmerling, J.; Fricko, O.; Fujimori, S.; Hilaire, J.; Eom, J.; Krey, V.; Kriegler, E.; Mouratiadou, I.; et al. Shared socio-economic pathways of the energy sector–quantifying the narratives. Glob. Environ. Chang. 2016, 42, 316–330. [Google Scholar] [CrossRef]

- R Development Core Team. R: A Language and Environment for Statistical Computing. Available online: https://scholar.google.com.tw/scholar?hl=zh-TW&as_sdt=0%2C5&q=R%3A+A+language+and+environment+for+statistical+computing.&btnG=19 (accessed on 18 September 2018).

- Pfaff, B. VAR, Svar and Svec models: Implementation within R package vars. J. Stat. Softw. 2008, 27, 1–32. [Google Scholar] [CrossRef]

- Pfaff, B.; Stigler, M.; Pfaff, M.B. Package ‘Urca’. Available online: https://www.google.com.tw/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=2ahUKEwjL1Oruma3eAhXGjLwKHcorCYMQFjAAegQIARAC&url=https%3A%2F%2Fcran.r-project.org%2Fweb%2Fpackages%2Furca%2Furca.pdf&usg=AOvVaw0SmP8V1aQQoA0bKmW44LTk (accessed on 18 September 2018).

- Lütkepohl, H. New Introduction to Multiple Time Series Analysis; Springer Science and Business Media: New York, NY, USA, 2005. [Google Scholar]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: representation, estimation, and testing. J. Econ. Soc. 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S. Interpretation of cointegrating coefficients in the cointegrated vector autoregressive model. Oxf. Bull. Econ. Stat. 2005, 67, 93–104. [Google Scholar] [CrossRef]

- Pfaff, B. Analysis of Integrated and Cointegrated Time Series with R; Springer Science & Business Media: New York, NY, USA, 2008. [Google Scholar]

- U.S. Energy Information Administration. Price Difference between Brent and WTI Crude Oil Narrowing. Available online: https://www.eia.gov/todayinenergy/detail.php?id=11891 (accessed on 18 September 2018).

- Table 2.8.5. Personal Consumption Expenditures by Major Type of Product, Monthly. Available online: https://www.google.com.tw/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwiNrOH-mq3eAhWCXbwKHY_jDTUQFjAAegQICRAB&url=https%3A%2F%2Ffred.stlouisfed.org%2Frelease%2Ftables%3Feid%3D3220%26rid%3D54&usg=AOvVaw2RlNWPcF64Hj-wKor5AzK- (accessed on 18 September 2018).

- U.S. Census Bureau, P.D. Historical Population US Census. Available online: https://www.google.com.tw/url?sa=t&rct=j&q=&esrc=s&source=web&cd=3&cad=rja&uact=8&ved=2ahUKEwi0_6-im63eAhVIvLwKHRPNA-EQFjACegQICBAB&url=https%3A%2F%2Fwww.census.gov%2Fhistory%2Fwww%2Freference%2Fpublications%2Fdemographic_programs_1.html&usg=AOvVaw3gwcYffZ_XjLxbQfegneat (accessed on 18 September 2018).

- Table 2.8.4. Price Indexes for Personal Consumption Expenditures by Major Type of Product, Monthly. Available online: https://www.google.com.tw/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwihqOaLna3eAhWCWLwKHRykCAsQFjAAegQICRAB&url=https%3A%2F%2Ffred.stlouisfed.org%2Frelease%2Ftables%3Feid%3D3208%26rid%3D54&usg=AOvVaw3ZKqLdUe8CC33ltJGDYCt6 (accessed on 18 September 2018).

- O’Neill, B.C.; Kriegler, E.; Riahi, K.; Ebi, K.L.; Hallegatte, S.; Carter, T.R.; Mathur, R.; van Vuuren, D.P. A new scenario framework for climate change research: the concept of shared socioeconomic pathways. Clim. Chang. 2014, 122, 387. [Google Scholar] [CrossRef]

- Jiang, L.; O’Neill, B.C. Global urbanization projections for the Shared Socioeconomic Pathways. Glob. Environ. Chang. 2015, 42, 193–199. [Google Scholar] [CrossRef]

- O’Neill, B.C.; Kriegler, E.; Ebi, K.L.; Kemp-Benedict, E.; Riahi, K.; Rothman, D.S.; van Ruijven, B.J.; van Vuuren, D.P.; Birkmann, J.; Kok, K.; et al. The roads ahead: Narratives for shared socioeconomic pathways describing world futures in the 21st century. Glob. Environ. Chang. 2017, 42, 169–180. [Google Scholar]

- Samir, K.; Lutz, W. The human core of the shared socioeconomic pathways: Population scenarios by age, sex and level of education for all countries to 2100. Glob. Environ. Chang. 2014, 42, 181–192. [Google Scholar]

- Dellink, R.; Chateau, J.; Lanzi, E.; Magné, B. Long-term economic growth projections in the Shared Socioeconomic Pathways. Glob. Environ. Chang. 2017, 42, 200–214. [Google Scholar] [CrossRef]

- Measuring the Economy: A Primer on GDP and the National Income and Product Accounts. Available online: https://www.bea.gov/resources/methodologies/measuring-the-economy (accessed on 18 September 2018).

- Changing the Game? Emissions and Market Implications of New Natural Gas Supplies. Available online: https://www.osti.gov/biblio/1411245 (accessed on 18 September 2018).

- Riahi, K.; van Vuuren, D.P.; Kriegler, E.; Edmonds, J.; O’Neill, B.C.; Fujimori, S.; Bauer, N.; Calvin, K.; Dellink, R.; Fricko, O. The shared socioeconomic pathways and their energy, land use, and greenhouse gas emissions implications: An overview. Glob. Environ. Chang. 2017, 42, 153–168. [Google Scholar] [CrossRef]

- Armor, J.N. Emerging importance of shale gas to both the energy & chemicals landscape. J. Energy Chem. 2013, 22, 21–26. [Google Scholar]

- Pearce, F. Peak planet: Are we starting to consume less? New Sci. 2012, 214, 38–43. [Google Scholar] [CrossRef]

- Cohen, M.J. Collective dissonance and the transition to post-consumerism. Futures 2013, 52, 42–51. [Google Scholar] [CrossRef]

- U.S. EPA. Greenhouse Gas Equivalencies Calculator. September 2017 edition. Available online: https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator (accessed on 28 August 2018).

- Lucas, R.E. Econometric policy evaluation: A critique. In Carnegie-Rochester Conference Series on Public Policy; Elsevier: Amsterdam, The Netherlands, 1976; pp. 19–46. [Google Scholar]

| Variable | Obs | Mean | Standard Deviation | Median | Trimmed Mean | Median Absolute Deviation | Minimum | Maximum | Range | Skewness | Kurtosis | Standard Error |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ethane/Ethylene Supply (Thousand Barrels) | 348 | 9.93 | 0.23 | 9.93 | 9.93 | 0.23 | 9.43 | 10.46 | 1.04 | 0.06 | −0.66 | 0.01 |

| Cushing, OK WTI Crude Oil Price (Dollars per Barrel) | 348 | 3.51 | 0.68 | 3.27 | 3.48 | 0.62 | 2.43 | 4.9 | 2.47 | 0.47 | −1.28 | 0.04 |

| Natural Gas Liquids Quantity (Thousand Barrels) | 348 | 10.93 | 0.16 | 10.91 | 10.91 | 0.11 | 10.64 | 11.48 | 0.85 | 1.33 | 1.92 | 0.01 |

| Ethane/Ethylene Stocks (Thousand Barrels) | 348 | 9.97 | 0.24 | 9.94 | 9.96 | 0.23 | 9.47 | 10.62 | 1.16 | 0.52 | −0.21 | 0.01 |

| GDP/PCE per Capita (in 2009 $U.S.) | 348 | 8.95 | 0.36 | 9.02 | 8.97 | 0.43 | 8.21 | 9.5 | 1.29 | −0.25 | −1.07 | 0.02 |

| Resident Population | 348 | 19.45 | 0.09 | 19.46 | 19.45 | 0.11 | 19.29 | 19.58 | 0.29 | −0.19 | −1.23 | 0 |

| Natural Gas Price (Dollars per Thousand Cubic Feet) | 348 | 1.47 | 0.4 | 1.35 | 1.44 | 0.44 | 0.96 | 2.52 | 1.56 | 0.55 | −0.91 | 0.02 |

| SSP Scenarios | Natural Gas Feedstock Price Scenarios | ||

| SSP1 Sustainability EIA Ref. Gas Price | SSP1 Sustainability Low Gas Price | SSP1 Sustainability High Gas Price | |

| SSP3 Regional Rivalry EIA Ref. Gas Price | SSP3 Regional Rivalry Low Gas Price | SSP3 Regional Rivalry High Gas Price | |

| SSP5 Fossil-Fueled Dev. EIA Ref. Gas Price | SSP5 Fossil-Fueled Dev. Low Gas Price | SSP5 Fossil-Fueled Dev. High Gas Price | |

| Variables with Significance Codes | Constant |

|---|---|

| Ethane/Ethylene Supply (Thousand Barrels) | −23.6 |

| Cushing, OK WTI Crude Oil Price (Dollars per Barrel) | 5.53 |

| Natural Gas Liquids Quantity (Thousand Barrels) *** | −1.65 |

| Ethane/Ethylene Stocks (Thousand Barrels) *** | 14.00 |

| GDP/PCE per Capita (in 2009 $U.S.) * | 1.36 |

| Resident Population *** | 0.02 |

| Natural Gas Price (Dollars per Thousand Cubic Feet) | 2.50 |

| -OLS regression of the unrestricted VECM (lags 1–3) |

| Years and % Change | “Base” VECM | SSP1 Sustainability EIA Ref. Gas Price | SSP1 Sustainability Low Gas Price | SSP1 Sustainability High Gas Price |

| 2014 (actual) | 375,309 | 375,309 | 375,309 | 375,309 |

| 2035 (projection) | 441,771 | 633,244 | 655,684 | 579,193 |

| 2050 (projection) | 481,183 | 716,908 | 752,334 | 633,876 |

| % Change from 2014–2035 | 18% | 69% | 75% | 54% |

| % Change from 2014–2050 | 28% | 91% | 100% | 69% |

| % Change from Base 2035 | 43% | 48% | 31% | |

| % Change from Base 2050 | 49% | 56% | 32% | |

| Years and % Change | “Base” VECM | SSP3 Regional Rivalry EIA Ref. Gas Price | SSP3 Regional Rivalry Low Gas Price | SSP3 Regional Rivalry High Gas Price |

| 2014 (actual) | 375,309 | 375,309 | 375,309 | 375,309 |

| 2035 (projection) | 441,771 | 435,267 | 450,691 | 398,117 |

| 2050 (projection) | 481,183 | 340,796 | 357,636 | 301,327 |

| % Change from 2014–2035 | 18% | 16% | 20% | 6% |

| % Change from 2014–2050 | 28% | −9% | −5% | −20% |

| % Change from Base 2035 | −1% | 2% | −10% | |

| % Change from Base 2050 | −29% | −26% | −37% | |

| Years and % Change | “Base” VECM | SSP5 Fossil-Fueled Dev. EIA Ref. Gas Price | SSP5 Fossil-Fueled Dev. Low Gas Price | SSP5 Fossil-Fueled Dev. High Gas Price |

| 2014 (actual) | 375,309 | 375,309 | 375,309 | 375,309 |

| 2035 (projection) | 441,771 | 830,595 | 860,029 | 759,698 |

| 2050 (projection) | 481,183 | 1,212,416 | 1,272,330 | 1,071,991 |

| % Change from 2014–2035 | 18% | 121% | 129% | 102% |

| % Change from 2014–2050 | 28% | 223% | 239% | 186% |

| % Change from Base 2035 | 88% | 95% | 72% | |

| % Change from Base 2050 | 152% | 164% | 123% |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Foster, G. Ethylene Supply in a Fluid Context: Implications of Shale Gas and Climate Change. Energies 2018, 11, 2967. https://doi.org/10.3390/en11112967

Foster G. Ethylene Supply in a Fluid Context: Implications of Shale Gas and Climate Change. Energies. 2018; 11(11):2967. https://doi.org/10.3390/en11112967

Chicago/Turabian StyleFoster, Gillian. 2018. "Ethylene Supply in a Fluid Context: Implications of Shale Gas and Climate Change" Energies 11, no. 11: 2967. https://doi.org/10.3390/en11112967