- Article

The Corrosive Grip: How Corruption Inhibits Green Finance in Enhancing Environmental Sustainability

- Levi Mbaka Matimbia,

- Abraham Deka and

- Sindiso Deka

- + 1 author

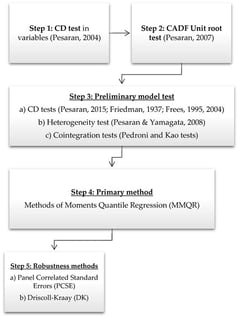

Ecological sustainability is one of the key dimensions of sustainable development in any economy. Developing economies exhibit high-risk levels in terms of political stability and corruption, thereby inhibiting them from successfully adopting techniques for ecological sustainability. A framework that comprises a strong financial system for green financial investment, coupled with correct policy frameworks becomes fundamental in the attainment of sustainable environments. Pervasive corruption in developing nations is a formidable barrier that impedes financial development and undermines green finance initiatives’ efficacy in fostering ecological sustainability. This research takes the data of the Central African nations, which is analyzed with the ‘Methods of Moments Quantile Regression’ technique. The major results presented show that digitalization, renewable energy, and governance support ecological sustainability. Institutional quality and green finance are expected to increase ecological sustainability, but the findings show that in the Central African countries with high corruption they tend to reduce ecological sustainability. The poor institutional quality in the Central African nations, because of high corruption and political instabilities, impedes the efficacy of financial development and green finance in advancing ecological sustainability. The Central African nations can achieve sustainability by fostering digitalization and renewable energy, as well as reducing corruption and political instabilities.

2 February 2026