-

Accrual-Based Earnings Management in Cross-Border Mergers and Acquisitions: The Role of Institutional Differences and Geographic Distance

Accrual-Based Earnings Management in Cross-Border Mergers and Acquisitions: The Role of Institutional Differences and Geographic Distance -

Navigating the Trade-Offs: The Impact of Aggressive Working Capital Policies on Stock Return Volatility

Navigating the Trade-Offs: The Impact of Aggressive Working Capital Policies on Stock Return Volatility -

A Supply and Demand Framework for Bitcoin Price Forecasting

A Supply and Demand Framework for Bitcoin Price Forecasting -

Risk-Adjusted Performance of Random Forest Models in High-Frequency Trading

Risk-Adjusted Performance of Random Forest Models in High-Frequency Trading -

Blockchain Technology in the Process of Financing the Construction and Purchase of Commercial Vessels

Blockchain Technology in the Process of Financing the Construction and Purchase of Commercial Vessels

Journal Description

Journal of Risk and Financial Management

Journal of Risk and Financial Management

is an international, peer-reviewed, open access journal on risk and financial management, published monthly online by MDPI.

- Open Access— free for readers, with article processing charges (APC) paid by authors or their institutions.

- High Visibility: indexed within Scopus, EconBiz, EconLit, RePEc, and other databases.

- Journal Rank: CiteScore - Q1 (Business, Management and Accounting (miscellaneous))

- Rapid Publication: manuscripts are peer-reviewed and a first decision is provided to authors approximately 21 days after submission; acceptance to publication is undertaken in 3.8 days (median values for papers published in this journal in the second half of 2024).

- Recognition of Reviewers: reviewers who provide timely, thorough peer-review reports receive vouchers entitling them to a discount on the APC of their next publication in any MDPI journal, in appreciation of the work done.

Latest Articles

How Does Climate Finance Affect the Ease of Doing Business in Recipient Countries?

J. Risk Financial Manag. 2025, 18(5), 263; https://doi.org/10.3390/jrfm18050263 - 13 May 2025

Abstract

Developing countries face a disproportionate degree of threat from climate change. As such, they require and receive significant financial support to address the menace. However, little is known about the potential externalities of this form of external liquidity for the business sector. This

[...] Read more.

Developing countries face a disproportionate degree of threat from climate change. As such, they require and receive significant financial support to address the menace. However, little is known about the potential externalities of this form of external liquidity for the business sector. This paper evaluates the impact of climate finance on the ease of doing business (EODB). On the one hand, climate finance might lead to an improved business environment as the funds facilitate infrastructure provision, technological innovation, and international collaboration for recipient countries. On the other hand, however, the business environment might be negatively impacted by complex new regulations, disruptive technological transitions, market distortions, and resource diversions. Countries receiving climate funds may also introduce new environmental and business regulations, implement new technologies, and divert resources to new programs to justify the receipt of aid or demonstrate a commitment to balancing economic development with environmental objectives. We theorize that given the expected disruptions to business, climate finance should negatively impact the EODB. We also argue that this negative impact will be more severe for resource-rich countries than for their resource-poor peers. Countries rich in natural resources might experience higher disruptions to business operations as they attempt to balance resource-dependent economic operations with environmental objectives mandated by climate finance. Utilizing panel data for 86 recipient countries for the 2002–2021 period, we test our hypotheses using the Generalized Methods of Moments (GMM) technique. The baseline results suggest that climate finance has a weak positive impact on the EODB. However, as argued, resource-dependence heterogeneity analysis reveals that climate finance significantly negatively disrupts the EODB in resource-rich countries. Furthermore, a sectoral comparative analysis shows that while climate finance has a significant positive impact on the growth of the service sector, it significantly slows the growth of the resource sector, affirming the argument that climate finance might attract higher disruptions to resource-dependent business operations. By implication, lowly diversified economies might realize more negative than positive effects of climate finance, and investors should consider providing support to ease the pains of transitioning from resource-intensive growth to clean energy-driven development strategies.

Full article

(This article belongs to the Special Issue Featured Papers in Climate Finance)

Open AccessArticle

Auditor Expertise and Bank Failure: Do Going Concern Opinions Predict Bank Closure?

by

Kose John and Shirley Liu

J. Risk Financial Manag. 2025, 18(5), 262; https://doi.org/10.3390/jrfm18050262 - 12 May 2025

Abstract

This study investigates how the quality of engagement auditors, assessed using the auditor’s industry expertise and size at both national and state levels, influences the likelihood of going concern opinion (GCO) issuance for U.S. banks from 2002 to 2023. We also examine how

[...] Read more.

This study investigates how the quality of engagement auditors, assessed using the auditor’s industry expertise and size at both national and state levels, influences the likelihood of going concern opinion (GCO) issuance for U.S. banks from 2002 to 2023. We also examine how auditor quality affects the accuracy of GCOs, specifically regarding Type I (false positive) and Type II (false negative) errors in GCO issuance. Using a dataset of 4992 bank-year observations from 414 unique banks, we analyze the correlations between auditor characteristics and these error types. We find that state-level audit industry experts issue significantly more accurate GCOs, demonstrating lower rates of both Type I and Type II errors compared to their counterparts. National-level experts and larger audit firms primarily show a reduced likelihood of Type II errors, indicating a more conservative approach. Our findings underscore the importance of localized auditor expertise in assessing bank financial health and suggest that enhanced collaboration between auditors and regulators could improve the predictive power of GCOs. These results offer important implications for regulatory policy and emphasize the need for improved audit standards to bolster financial system stability.

Full article

(This article belongs to the Special Issue Financial Reporting and Auditing)

Open AccessArticle

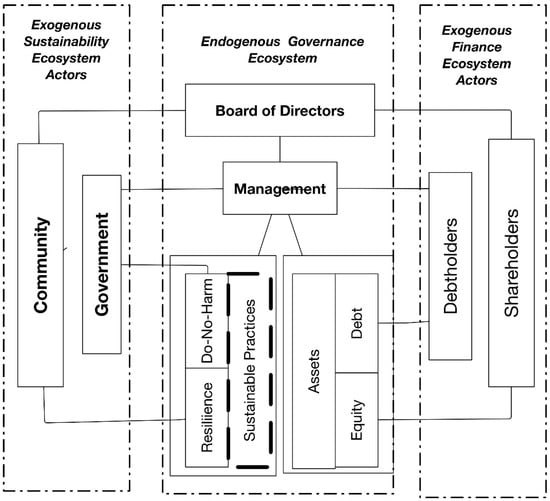

Integrating Circular Economy Principles in Water Resilience: Implications for Corporate Governance and Sustainability Reporting

by

Ronald C. Beckett and Milé Terziovski

J. Risk Financial Manag. 2025, 18(5), 261; https://doi.org/10.3390/jrfm18050261 - 12 May 2025

Abstract

This paper makes an empirical contribution to the relatively sparse literature on the relationship between corporate governance and sustainability disclosure in mandatory reporting. We study the pursuit of UN SDG 6—clean water and sanitation—as an instance of sustainability and make observations from the

[...] Read more.

This paper makes an empirical contribution to the relatively sparse literature on the relationship between corporate governance and sustainability disclosure in mandatory reporting. We study the pursuit of UN SDG 6—clean water and sanitation—as an instance of sustainability and make observations from the literature considering water resilience scenarios, circular economy perspectives, as well as governance and integrated reporting requirements. The term “water governance” has been used to characterize operational actions needed to maintain a balance with water scarcity being a dominant theme. Continuing adaptation to emergent conditions is needed and we draw on an agile structuration theory model to help understand how a succession of innovation projects supports the transition to a circular economy. Our theoretical discussion is reinforced by an in-depth longitudinal case study of Yarra Valley Water (YVW), an innovative Australian water utility. The longitudinal case study analysis provides insights into several different types of innovative projects that demonstrate how circular economy principles in water resilience are integrated for corporate governance and sustainability reporting. Several case studies could be a topic for future research drawing on the agile structuration theory model presented in this paper.

Full article

(This article belongs to the Special Issue Sustainability Reporting and Corporate Governance)

►▼

Show Figures

Figure 1

Open AccessArticle

Government Ownership as a Catalyst: Corporate Governance and Corporate Social Responsibility in Jordan’s Industrial Sector

by

Abdelrazaq Farah Freihat and Renad Al-Hiyari

J. Risk Financial Manag. 2025, 18(5), 260; https://doi.org/10.3390/jrfm18050260 - 11 May 2025

Abstract

This research examines how corporate governance (CG) affects corporate social responsibility (CSR) disclosure with government ownership as a moderation factor by analyzing panel data from 30 industrial firms listed on the Amman Stock Exchange during 2018–2022. The study employed board of directors and

[...] Read more.

This research examines how corporate governance (CG) affects corporate social responsibility (CSR) disclosure with government ownership as a moderation factor by analyzing panel data from 30 industrial firms listed on the Amman Stock Exchange during 2018–2022. The study employed board of directors and audit committee characteristics as independent variables to represent CG while developing a CSR disclosure index. The research controlled for company size and financial leverage in its model. The findings demonstrate that corporate governance dimensions affect CSR disclosure, while government ownership significantly enhances this relationship in a positive direction. Government ownership increases R2 values, which shows that corporate governance merged with government ownership modifies the corporate governance and CSR disclosure relationship by strengthening the impact when government stakes rise. Statistical analysis revealed that board independence, board duality, audit committee size and independence, along with audit committee meeting frequency, all had positive effects on CSR disclosure. The study found no statistically significant effect of board size, frequency of board meetings, or the financial expertise of audit committee members on CSR disclosure. Based on the findings, this study outlines recommendations to strengthen governance practices that support social disclosure.

Full article

(This article belongs to the Special Issue Environmental, Social, and Governance (ESG), Corporate Social Responsibility (CSR), and Green Finance)

Open AccessArticle

Bitcoin vs. the US Dollar: Unveiling Resilience Through Wavelet Analysis of Price Dynamics

by

Essa Al-Mansouri

J. Risk Financial Manag. 2025, 18(5), 259; https://doi.org/10.3390/jrfm18050259 - 9 May 2025

Abstract

This paper investigates Bitcoin’s resilience against the U.S. dollar—widely recognized as the global reserve currency—by applying a multi-method wavelet analysis framework to daily price data of Bitcoin, the USD strength index (DXY), the euro, and other assets ranging from August 2015 to June

[...] Read more.

This paper investigates Bitcoin’s resilience against the U.S. dollar—widely recognized as the global reserve currency—by applying a multi-method wavelet analysis framework to daily price data of Bitcoin, the USD strength index (DXY), the euro, and other assets ranging from August 2015 to June 2024. Quantitative measures—particularly the Frobenius norm of wavelet coherence and an exponential decay phase-weighting scheme—reveal that Bitcoin’s out-of-phase relationship with the dollar is lower and more sporadic than that of mainstream assets, indicating it is not tightly governed by dollar fluctuations. Even after controlling for the euro’s dominant influence in the DXY, BTC continues to show weaker coupling than mainstream assets—reinforcing the idea that it may serve as a partial hedge against dollar-driven volatility. These results support the hypothesis that Bitcoin may serve as a resilient store of value and hedge against dollar-driven market volatility, placing Bitcoin within the broader debate on global monetary frameworks. As global monetary conditions evolve, the resilience of Bitcoin (BTC) relative to the world’s leading reserve currency—the U.S. dollar—has significant implications for both investors and policymakers.

Full article

(This article belongs to the Special Issue Risk Management and Return Predictability in Global Markets)

►▼

Show Figures

Figure 1

Open AccessArticle

How Do Segment Disclosure and Cost of Capital Impact the Investment Efficiency of Listed Firms in Nigeria?

by

Dolapo Faith Sule and Tankiso Moloi

J. Risk Financial Manag. 2025, 18(5), 258; https://doi.org/10.3390/jrfm18050258 - 9 May 2025

Abstract

The demand for improved segment disclosure is driven by the need to address investment inefficiencies and boost investors’ confidence in listed companies around the world. Transparency in corporate activities is essential for investors to determine the parameters of their stock return and investment

[...] Read more.

The demand for improved segment disclosure is driven by the need to address investment inefficiencies and boost investors’ confidence in listed companies around the world. Transparency in corporate activities is essential for investors to determine the parameters of their stock return and investment efficiency across various segments of firms. Previous studies have primarily focused on a broader investment landscape in Nigeria, without paying adequate attention to the impacts of segment disclosure and cost of capital on the investment efficiency of listed firms. Against this backdrop, this study represents the first empirical research to examine the joint impact of segment disclosure and cost of capital on the investment efficiency of listed firms in Nigeria. Using a longitudinal research design, secondary data from 2015 to 2022 were extracted from the annual reports of 85 listed firms on the Nigerian Exchange Group (NGX). The data were analysed through descriptive and inferential statistical methods. Firms that reported their business or geographic segments were purposively selected for this study. The findings show that the cost of capital of the examined firms has a negative and significant impact on their investment efficiency (coefficient = −0.0268, p-value = 0.03079). On the other hand, the segment disclosure of the firms has a positive impact on their investment efficiency (coefficient = 0.0119, p-value = 0.0303). Lastly, total segment disclosure and cost of capital jointly have positive and significant effects (coefficient = 0.0192, p-value = 0.0030) on the investment efficiency of the firms. This study contributes to the growing research on segment disclosure by providing evidence that increased segment disclosure and a lower cost of capital can improve the investment efficiency of listed firms in Nigeria. Thus, this study recommends that the management of firms in Nigeria should disclose more segment information in their annual reports. This could consequently boost investors’ confidence in the reporting practices of firms, reduce the cost of capital of firms, and improve firms’ investment efficiency.

Full article

(This article belongs to the Special Issue Corporate Sustainability and Firm Performance: Models, Practices and Policy Perspective)

►▼

Show Figures

Figure 1

Open AccessEditorial

Editorial: Durable, Inclusive, Sustainable Economic Growth and Challenge

by

Cristina Raluca Gh. Popescu

J. Risk Financial Manag. 2025, 18(5), 257; https://doi.org/10.3390/jrfm18050257 - 8 May 2025

Abstract

Nowadays, sustainability and sustainable development play vital roles in our lives [...]

Full article

(This article belongs to the Special Issue Durable, Inclusive, Sustainable Economic Growth and Challenge)

Open AccessArticle

Voluntary Audits of Nonfinancial Disclosure and Earnings Quality

by

Sunita S. Rao, Carlos Ernesto Zambrana Roman and Norma Juma

J. Risk Financial Manag. 2025, 18(5), 256; https://doi.org/10.3390/jrfm18050256 - 8 May 2025

Abstract

We investigate the association between voluntary assurance of a firm’s corporate social responsibility (CSR) report and earnings management. A concern with CSR reports is they are used to promote a socially responsible image without a meaningful commitment to CSR activities, referred to as

[...] Read more.

We investigate the association between voluntary assurance of a firm’s corporate social responsibility (CSR) report and earnings management. A concern with CSR reports is they are used to promote a socially responsible image without a meaningful commitment to CSR activities, referred to as “greenwashing”. To credibly signal the CSR report is reliable, a firm can incur the additional costs to voluntarily obtain assurance. Our results show that strong corporate governance plays a crucial role in limiting earnings management. The most consistent improvements in earnings quality occur when firms combine strong governance with CSR assurance from a non-accounting provider (NonACCT). The combination of strong governance and NonACCT assurance appears to be mutually reinforcing, suggesting a symbolic legitimacy strategy that is also substantively effective.

Full article

(This article belongs to the Special Issue Emerging Trends and Innovations in Corporate Finance and Governance)

Open AccessArticle

Exploring Platform Trust, Borrowing Intention, and Actual Use of PayLater Services in Indonesia and Malaysia

by

Tri Kartika Pertiwi, Corina Joseph, G. Oka Warmana, Fani Khoirotunnisa and Nanik Hariyana

J. Risk Financial Manag. 2025, 18(5), 255; https://doi.org/10.3390/jrfm18050255 - 8 May 2025

Abstract

This study explores how system-based and cognitive-based factors affect platform trust and its role in the actual use of PayLater services (buy now, pay later or BNPL) in Indonesia and Malaysia. PayLater, a fintech innovation, provides fast and convenient payment options through online

[...] Read more.

This study explores how system-based and cognitive-based factors affect platform trust and its role in the actual use of PayLater services (buy now, pay later or BNPL) in Indonesia and Malaysia. PayLater, a fintech innovation, provides fast and convenient payment options through online platforms. By incorporating platform trust into the technology acceptance model (TAM), the research investigates whether borrowing intention acts as a mediator between platform trust and actual usage. Utilizing a quantitative approach with purposive sampling, data were gathered from 106 respondents in Indonesia and 169 in Malaysia, with 62 and 85 respondents meeting the criteria, respectively. Partial least squares (PLS) analysis indicates notable differences in how Indonesian and Malaysian users perceive platform trust, while the effect of platform trust on borrowing intention remains consistent across both nations. Borrowing intention emerges as a crucial factor influencing the actual use of PayLater services. The results offer important insights into the adoption of fintech services in emerging markets, highlighting the significance of platform trust in shaping user behavior. This research provides practical suggestions for fintech providers to improve platform trust and user engagement in cross-country scenarios.

Full article

(This article belongs to the Section Financial Technology and Innovation)

►▼

Show Figures

Figure 1

Open AccessArticle

What Do Children with Above-Average Abilities Understand About Financial Literacy?

by

Eulália Santos, Fernando Oliveira Tavares and Cátia Maurício

J. Risk Financial Manag. 2025, 18(5), 254; https://doi.org/10.3390/jrfm18050254 - 7 May 2025

Abstract

Metaphors help to simplify complex concepts, making them more accessible and understandable for children. Children can build a more concrete understanding of these concepts by associating abstract financial ideas with familiar situations or objects. The present study aims to explore what children with

[...] Read more.

Metaphors help to simplify complex concepts, making them more accessible and understandable for children. Children can build a more concrete understanding of these concepts by associating abstract financial ideas with familiar situations or objects. The present study aims to explore what children with above-average abilities understand by financial literacy, using words and images as tools of expression. During a workshop, 22 children with above-average abilities participated in two tasks, one individual and one group task. The results showed that “save” (90.9%), “money” (63.9%), “invest” (59.1%), and “bank” (54.5%) are the words most strongly associated with the concept of financial literacy among the children. Regarding images, money (M = 1.77), a clock or calendar (M = 2.50), a pig (M = 2.75), and a house (M = 2.84) were identified as the most representative symbols of financial literacy for this group of children. In the group task, children perceive financial literacy mainly as managing and using money to satisfy needs and desires. The results can inform educators about the need to adapt educational materials to match children’s level of understanding better, promoting more effective and accessible financial education.

Full article

(This article belongs to the Special Issue Role of Financial Education, Capital Markets and Digital Finance)

►▼

Show Figures

Figure 1

Open AccessArticle

The Role of Tax Planning Incentives in the Use of Earnouts in Taxable Acquisitions

by

Dennis Ahn and Terry Shevlin

J. Risk Financial Manag. 2025, 18(5), 253; https://doi.org/10.3390/jrfm18050253 - 7 May 2025

Abstract

In an acquisition, an earnout is a component of transaction price that is contingent upon future events. Despite its usefulness to acquirers in mitigating valuation risk, using an earnout also has a potentially undesirable tax consequence for the acquirer because there is no

[...] Read more.

In an acquisition, an earnout is a component of transaction price that is contingent upon future events. Despite its usefulness to acquirers in mitigating valuation risk, using an earnout also has a potentially undesirable tax consequence for the acquirer because there is no immediate step-up in tax basis for the earnout portion of deal consideration until the resolution of associated contingencies. We thus hypothesize that acquiring firms with high marginal tax rates (MTRs) are less likely to use earnouts. We analyze a sample of taxable acquisitions by U.S. public companies, holding constant other non-tax determinants of earnout use from prior research, and we find results consistent with our prediction. We also find some evidence that strong tax incentives can offset the effect of target valuation uncertainty, suggesting that acquiring firms facing sufficiently high MTRs are willing to trade off mitigating valuation risk for a full, immediate step-up in tax basis. We contribute to the prior literature on determinants of earnout use as well as the role of tax planning incentives in firm choices within mergers and acquisitions.

Full article

(This article belongs to the Special Issue Tax Avoidance and Earnings Management)

Open AccessArticle

Foreign Aid–Human Capital–Foreign Direct Investment in Upper-Middle-Income Economies

by

Kunofiwa Tsaurai

J. Risk Financial Manag. 2025, 18(5), 252; https://doi.org/10.3390/jrfm18050252 - 6 May 2025

Abstract

The study examined the influence of foreign aid on foreign direct investment (FDI) in upper-middle-income economies using panel data (2011–2021) analysis methods such as two-stage least squares (2SLS) and system GMM (generalized methods of moments). The study also explored if human capital development

[...] Read more.

The study examined the influence of foreign aid on foreign direct investment (FDI) in upper-middle-income economies using panel data (2011–2021) analysis methods such as two-stage least squares (2SLS) and system GMM (generalized methods of moments). The study also explored if human capital development enhanced foreign aid’s influence on FDI in upper-middle-income economies during the same timeframe. The conflicting, divergent, and mixed results and views on the relationship between foreign aid, human capital development, and foreign direct investment (FDI) motivated the undertaking of this study to fill in the existing gaps. Apart from FDI enhanced by its own lag, foreign aid significantly improved FDI (under system GMM). FDI was also improved significantly by human capital development across all two panel methods. Under 2SLS and system GMM, foreign aid significantly improved FDI through the human capital development channel. To promote FDI inflows, upper-middle-income economies should develop and implement policies aimed at attracting foreign aid and enhancing the development of human capital. The study suggests that further research on threshold regression analysis on foreign aid–FDI nexus in upper-middle-income economies could better help develop an FDI policy that is beneficial toward economic growth.

Full article

(This article belongs to the Section Banking and Finance)

Open AccessArticle

Drivers and Barriers of Mobile Payment Adoption Among MSMEs: Insights from Indonesia

by

Aloysius Bagas Pradipta Irianto and Pisit Chanvarasuth

J. Risk Financial Manag. 2025, 18(5), 251; https://doi.org/10.3390/jrfm18050251 - 6 May 2025

Abstract

Mobile payment systems have rapidly expanded globally, especially in developing countries like Thailand, Malaysia, and Indonesia. Technological advances, public acceptance, and increased adoption during the COVID-19 pandemic drive this growth. Mobile payments involve key stakeholders: technology providers, end-users, government regulators, and merchants, each

[...] Read more.

Mobile payment systems have rapidly expanded globally, especially in developing countries like Thailand, Malaysia, and Indonesia. Technological advances, public acceptance, and increased adoption during the COVID-19 pandemic drive this growth. Mobile payments involve key stakeholders: technology providers, end-users, government regulators, and merchants, each contributing to the adoption ecosystem. Users prefer mobile payments for their speed and convenience over traditional cash transactions. This study explores the driver and barrier factors influencing mobile payment QR adoption among merchants, particularly from the MSME perspective, using existing frameworks based on previous research adapted to MSME conditions. Conducted in Indonesia with 418 MSME business respondents, this study employs a quantitative, cross-sectional methodology with a 95% confidence level and an SEM analysis. The findings reveal that perceived ease of use does not significantly impact perceived experience, while perceived usefulness does. Perceived risk, convenience, experience, and word-of-mouth learning statistically significantly influence merchants’ intention to use mobile payments. However, customer engagement, cost, trust, and complexity appear less influential. Overall, this research advances understanding of the key factors affecting merchants’ adoption of mobile payment and provides insights relevant to MSME economic growth.

Full article

(This article belongs to the Special Issue Financial Technology (Fintech) and Sustainable Financing, 3rd Edition)

►▼

Show Figures

Figure 1

Open AccessSystematic Review

Risks of the Use of FinTech in the Financial Inclusion of the Population: A Systematic Review of the Literature

by

Antonija Mandić, Biljana Marković and Iva Rosanda Žigo

J. Risk Financial Manag. 2025, 18(5), 250; https://doi.org/10.3390/jrfm18050250 - 6 May 2025

Abstract

Financial technology (FinTech) has significantly changed access to financial services, particularly benefiting historically marginalized communities. While it offers many advantages, FinTech also brings substantial risks associated with this digital transformation. Recent studies highlight the significant impact of FinTech on financial inclusion, especially for

[...] Read more.

Financial technology (FinTech) has significantly changed access to financial services, particularly benefiting historically marginalized communities. While it offers many advantages, FinTech also brings substantial risks associated with this digital transformation. Recent studies highlight the significant impact of FinTech on financial inclusion, especially for marginalized populations. To investigate the benefits and drawbacks of FinTech and identify specific risks affecting users, particularly vulnerable groups, we employed the PRISMA method. A systematic literature review was conducted using the Web of Science database to explore recent research on FinTech and its relationship with financial inclusion, focusing on associated risks. The search covered 2010–2025; however, after applying inclusion criteria, the final dataset comprised publications from 2012 to 2025. Unlike previous bibliometric studies broadly addressing FinTech innovations, this review identifies and categorizes key risks affecting financial inclusion, emphasizing regulatory barriers, digital literacy, and socio-cultural challenges. The review is limited by the exclusive use of Web of Science and the English language, suggesting future research avenues using additional databases and multilingual sources. Findings reveal a notable increase in research activity surrounding FinTech and financial inclusion. This highlights challenges such as data privacy, regulation, and financial literacy. By mapping FinTech-related risks, this study aims to inform policymakers and stakeholders about effective strategies to mitigate these challenges and promote safe, inclusive financial ecosystems.

Full article

(This article belongs to the Section Financial Technology and Innovation)

►▼

Show Figures

Figure 1

Open AccessArticle

Monetary Policy via Bank Lending Channel: Evidence from Lending Decomposition

by

Putra Pamungkas, Fadli Septianto, Irwan Trinugroho, Rossazana Ab-Rahim, Masagus M. Ridhwan and Bruno S. Sergi

J. Risk Financial Manag. 2025, 18(5), 249; https://doi.org/10.3390/jrfm18050249 - 5 May 2025

Abstract

This paper examines the regional dimension of monetary policy transmission through the component of the bank lending channel in Indonesia. Understanding the effectiveness of this transmission channel at a regional level is crucial, given the diverse economic characteristics across Indonesian provinces. We employ

[...] Read more.

This paper examines the regional dimension of monetary policy transmission through the component of the bank lending channel in Indonesia. Understanding the effectiveness of this transmission channel at a regional level is crucial, given the diverse economic characteristics across Indonesian provinces. We employ panel regression to analyze the panel data consisting of provincial quarterly data from 2010–2023 for 33 provinces in Indonesia. The robustness of the results is further assessed through GMM estimation techniques. We find evidence of the bank lending channel through the use of the policy rate. Our findings are meaningful in the SME and consumer lending channel and are also more profound in Java than in the non-Java region. Further, using GMM estimation, we show that our results are robust. Our study highlights the significant role of regional differences in Indonesia when examining monetary policy effectiveness. Policymakers should therefore consider regional disparities and lending categories to enhance the efficacy of monetary policy interventions.

Full article

(This article belongs to the Special Issue Banking Practices, Climate Risk and Financial Stability)

Open AccessArticle

The Impact of Corporate Reporting Quality on Sustainable Growth Through Integrated Reporting Lens in Thai Listed Companies

by

Wilawan Dungtripop, Pankaewta Lakkanawanit, Trairong Sawatdikun, Muttanachai Suttipun and Lidya Primta Surbakti

J. Risk Financial Manag. 2025, 18(5), 248; https://doi.org/10.3390/jrfm18050248 - 3 May 2025

Abstract

The study investigates the relationship between corporate reporting quality, viewed through an integrated reporting perspective, and sustainable growth among Thai-listed companies during the period from 2019 to 2022. Utilizing a sample of 59 SET50 companies and analyzing 232 annual reports, an Integrated Reporting

[...] Read more.

The study investigates the relationship between corporate reporting quality, viewed through an integrated reporting perspective, and sustainable growth among Thai-listed companies during the period from 2019 to 2022. Utilizing a sample of 59 SET50 companies and analyzing 232 annual reports, an Integrated Reporting Quality Index (IRQI) was developed to assess reporting quality across three principal components—capitals, guiding principles, and content elements—as well as their respective sub-components, enabling comprehensive evaluation at both macro and micro levels. Although the component-level analysis identified no significant relationships with sustainable growth, the sub-component analysis revealed critical insights. Information connectivity, conciseness, and business model disclosure demonstrated positive associations with sustainable growth, whereas strategic focus exhibited a negative relationship. These findings contribute to the extension of stakeholders and signaling theories within emerging market contexts, emphasizing the importance of effective communication mechanisms over the sheer volume of disclosures. The study further documents substantial improvements in reporting quality following the implementation of the One Report framework, suggesting that well-designed regulatory interventions can elevate corporate disclosure standards. The results offer valuable implications for managers, regulators, and investors, underscoring that fostering effective information connectivity, conciseness, and clear articulation of business models contributes more significantly to sustainable growth than simply increasing the quantity of disclosed information.

Full article

(This article belongs to the Section Business and Entrepreneurship)

Open AccessArticle

Unlock Your Firm Value with ESG Performance? Evidence from ASX-Listed Companies

by

Jingyan Zhou, Wen Hua Sharpe, Abdel K. Halabi, Helen Song and Sisira Colombage

J. Risk Financial Manag. 2025, 18(5), 247; https://doi.org/10.3390/jrfm18050247 - 1 May 2025

Abstract

A research gap exists concerning the moderating roles of corporate governance mechanisms on the nexus of environmental, social, and governance (ESG) performance and firm value. This study aims to address this gap in the Australian corporate context. We examine whether ESG performance can

[...] Read more.

A research gap exists concerning the moderating roles of corporate governance mechanisms on the nexus of environmental, social, and governance (ESG) performance and firm value. This study aims to address this gap in the Australian corporate context. We examine whether ESG performance can enhance firm value and whether this relationship is moderated by the corporate governance mechanisms to balance stakeholder interests. Drawing on a sample from the ASX, we find that while high ESG performance can increase firm value, this effect diminishes in the presence of the large number of supply chain contracts. We further discovered a negative moderating effect of board independence and audit quality on ESG performance and firm value. Our findings highlight the contingent nature of ESG value creation, indicating that while ESG activities can enhance firm value, their impact depends on firms’ governance context and contractual arrangements that shape shareholders’ outcomes collectively.

Full article

(This article belongs to the Special Issue Emerging Trends and Innovations in Corporate Finance and Governance)

►▼

Show Figures

Figure 1

Open AccessArticle

“Feeling Stressed?” A Critical Analysis of the Regulatory Prescribed Stress Tests for Financial Services in the UK

by

Stavros Pantos

J. Risk Financial Manag. 2025, 18(5), 246; https://doi.org/10.3390/jrfm18050246 - 1 May 2025

Abstract

This paper captures a qualitative review of the regulatory prescribed stress tests for UK financial services designed by the Bank of England and the Prudential Regulation Authority (PRA)/Financial Conduct Authority (FCA) after the Global Financial Crisis. It presents a critical analysis of the

[...] Read more.

This paper captures a qualitative review of the regulatory prescribed stress tests for UK financial services designed by the Bank of England and the Prudential Regulation Authority (PRA)/Financial Conduct Authority (FCA) after the Global Financial Crisis. It presents a critical analysis of the use of stress testing as part of supervisory practices for UK banking institutions and insurance undertakings, commenting on their qualitative characteristics, after looking at the regulatory prescribed stress tests from three key categories: the macroeconomic scenarios for banks, denoted as the bank stress tests (BST), the insurance stress tests (IST), and the biennial exploratory scenarios (BES). In this study, five trends describing regulatory prescribed stress are identified: (1) the regulatory collaboration, (2) cross-industry stress tests, (3) exploratory scenarios, (4) reporting and disclosure requirements, and (5) the underlying modelling capabilities and tools. The associated challenges of (A) governance, (B) frequency, (C) individual disclosures, (D) data and modelling, and (E) capabilities and skillset from participating institutions underpinning these stresses are highlighted, shaping the policy recommendations for future exercises. These address the gaps identified from existing stress tests towards the effective prudential supervision of UK financial services, based on each scenario category, for improvements and advances to practices.

Full article

(This article belongs to the Special Issue Financial Markets and Institutions and Financial Crises)

►▼

Show Figures

Figure 1

Open AccessArticle

The Moderating Role of Finance, Accounting, and Digital Disruption in ESG, Financial Reporting, and Auditing: A Triple-Helix Perspective

by

Enkeleda Lulaj and Mileta Brajković

J. Risk Financial Manag. 2025, 18(5), 245; https://doi.org/10.3390/jrfm18050245 - 1 May 2025

Abstract

This study investigates the moderating role of finance, accounting, and digital disruption (FADD) in the relationship between auditing and sustainability (AS) and financial reporting and ESG integration (FRESGI) through the triple-helix perspective. Drawing on data from 200 experts across corporate, academic, and governmental

[...] Read more.

This study investigates the moderating role of finance, accounting, and digital disruption (FADD) in the relationship between auditing and sustainability (AS) and financial reporting and ESG integration (FRESGI) through the triple-helix perspective. Drawing on data from 200 experts across corporate, academic, and governmental sectors in Kosovo (2024–Q1 2025), the research applied advanced statistical techniques, including EFA, CFA, and moderation analysis using SPSS and AMOS, to explore both direct and interaction effects. The results reveal that FADD significantly enhances ESG integration, with strong direct effects observed in the corporate sector (β = 0.259, p < 0.001) and public institutions (β = 0.281, p < 0.001). However, the moderation analysis shows that the government dimension of FADD (FADD_2) negatively influences the relationship between corporate sustainability practices (AS_1) and ESG reporting, indicating limited coordination across sectors. These findings highlight the need for aligned, sector-specific strategies that harness digital innovation and financial transformation to strengthen sustainable auditing and reporting practices. This study provides actionable insights for policymakers, practitioners, and academics working to advance ESG integration across complex institutional ecosystems.

Full article

(This article belongs to the Special Issue Finance and Accounting in Times of Global Uncertainty: ESG, SDGs, and Digital Disruption)

►▼

Show Figures

Figure 1

Open AccessArticle

The Mediating Role of Conscientiousness in the Relationship Between Auditors’ Ethical Idealism and Fraud Detection

by

Abdulrahman Almalki, Yousef Basodan and Helmi Boshnak

J. Risk Financial Manag. 2025, 18(5), 244; https://doi.org/10.3390/jrfm18050244 - 1 May 2025

Abstract

Despite the recognized importance of ethical idealism in enhancing fraud detection in the audit context, there remains limited understanding of the mediating role of conscientiousness in the relationship between auditors’ ethical idealism and fraud detection. The purpose of this paper is to analyze

[...] Read more.

Despite the recognized importance of ethical idealism in enhancing fraud detection in the audit context, there remains limited understanding of the mediating role of conscientiousness in the relationship between auditors’ ethical idealism and fraud detection. The purpose of this paper is to analyze the influence of auditors’ ethical idealism on fraud detection via using the conscientiousness of auditors as a mediator. This study employs a cross-sectional approach, and quantifiable data were gathered via structured surveys from 401 external auditors employed in offices licensed to practice the accounting and auditing profession in Saudi Arabia. Accidental sampling was used to ensure a representative sample of auditors in Saudi audit firms. This study utilized the Structural Equation Modeling (SEM) technique to examine the relationships between ethical idealism (as independent variable), conscientiousness (as mediating variable), and fraud detection (as dependent variable). The result showed that ethical idealism has a positive effect on auditors’ detection of fraud. However, the proposed mediation effect of conscientiousness between ethical Idealism and fraud detection was not statistically significant. The research underscores that the ethical idealism of auditors can enhance fraud detection, especially when accounting firms give priority to ethical training programs, ensuring that they are guided by strong ethical idealism rather than personal conscientiousness.

Full article

(This article belongs to the Special Issue Financial Reporting and Auditing)

►▼

Show Figures

Figure 1

Highly Accessed Articles

Latest Books

E-Mail Alert

News

Topics

Topic in

Clean Technol., Economies, FinTech, JRFM, Sustainability

Green Technology Innovation and Economic Growth

Topic Editors: David (Xuefeng) Shao, Miaomiao Tao, Selena ShengDeadline: 31 December 2025

Topic in

Economies, IJFS, JRFM, Risks, Sustainability

Insurance and Risk Management Advances in the 4A Era—AI, Aging, Abruptions, and Adoptions

Topic Editors: Xiaojun Shi, Lingyan Suo, Feng Gao, Baorui DuDeadline: 30 May 2026

Topic in

Economies, IJFS, Sustainability, Businesses, JRFM

Sustainable and Green Finance

Topic Editors: Otilia Manta, Maria PalazzoDeadline: 31 October 2026

Conferences

Special Issues

Special Issue in

JRFM

Sustainable Production: Finance, Technology, and Institutional Quality

Guest Editor: Gouranga Gopal DasDeadline: 15 May 2025

Special Issue in

JRFM

Corporate Governance and Earnings Management

Guest Editor: Sebahattin DemirkanDeadline: 31 May 2025

Special Issue in

JRFM

Leading Change in Disruptive Financial Times

Guest Editors: Mihail Busu, Petre CaraianiDeadline: 31 May 2025

Special Issue in

JRFM

Financing the Path to a Low-Carbon Economy: Challenges and Opportunities

Guest Editors: Mirela Panait, Eglantina Hysa, Justice G. Djokoto, Felizia Arni Rudiawarni, Manuela Rozalia GaborDeadline: 31 May 2025