Methodological Proposal for the Development of Insurance Policies for Building Components

Abstract

:1. Introduction

2. Description of the Problem

3. State of the Art

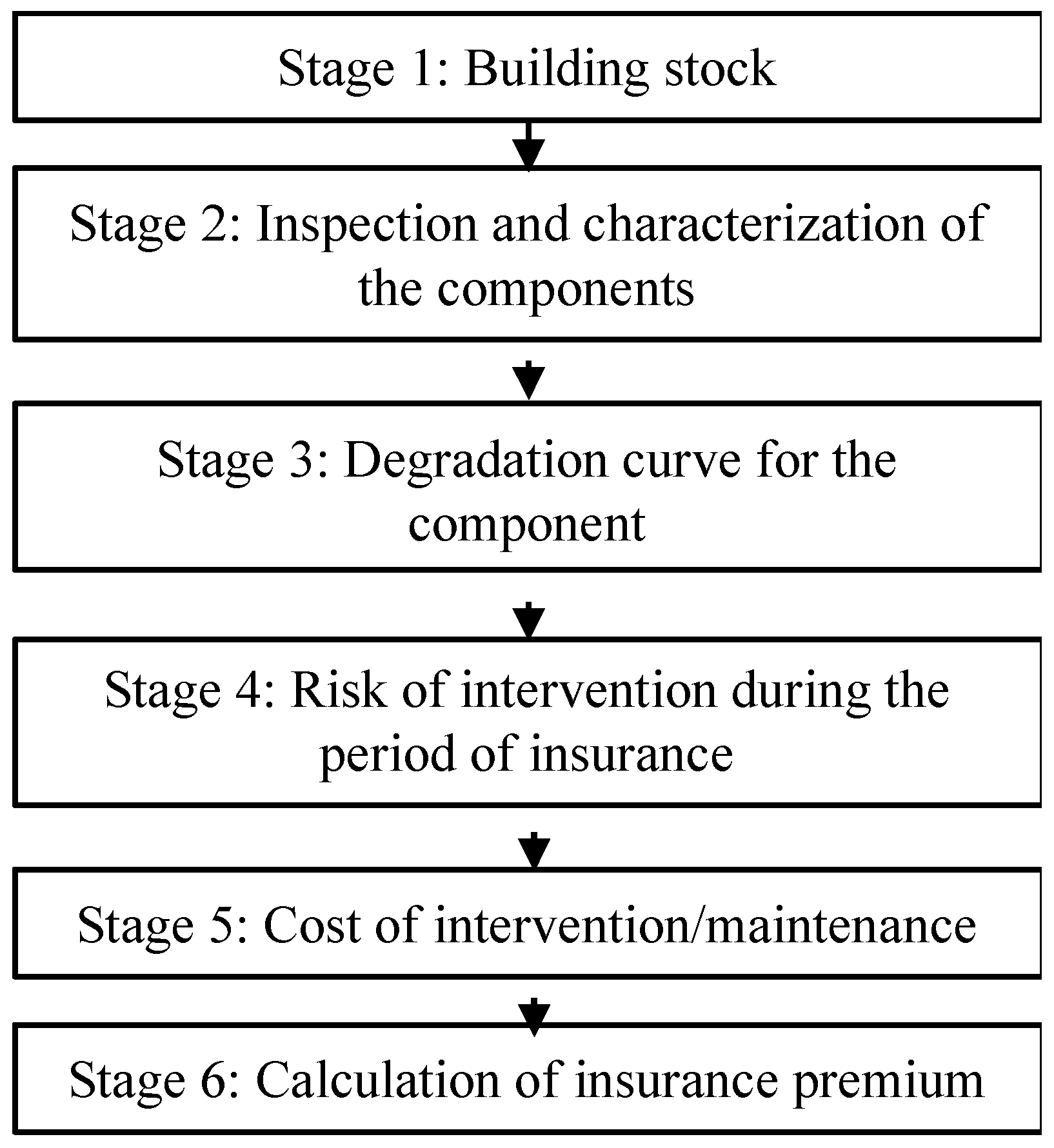

4. Materials and Methods

4.1. Context

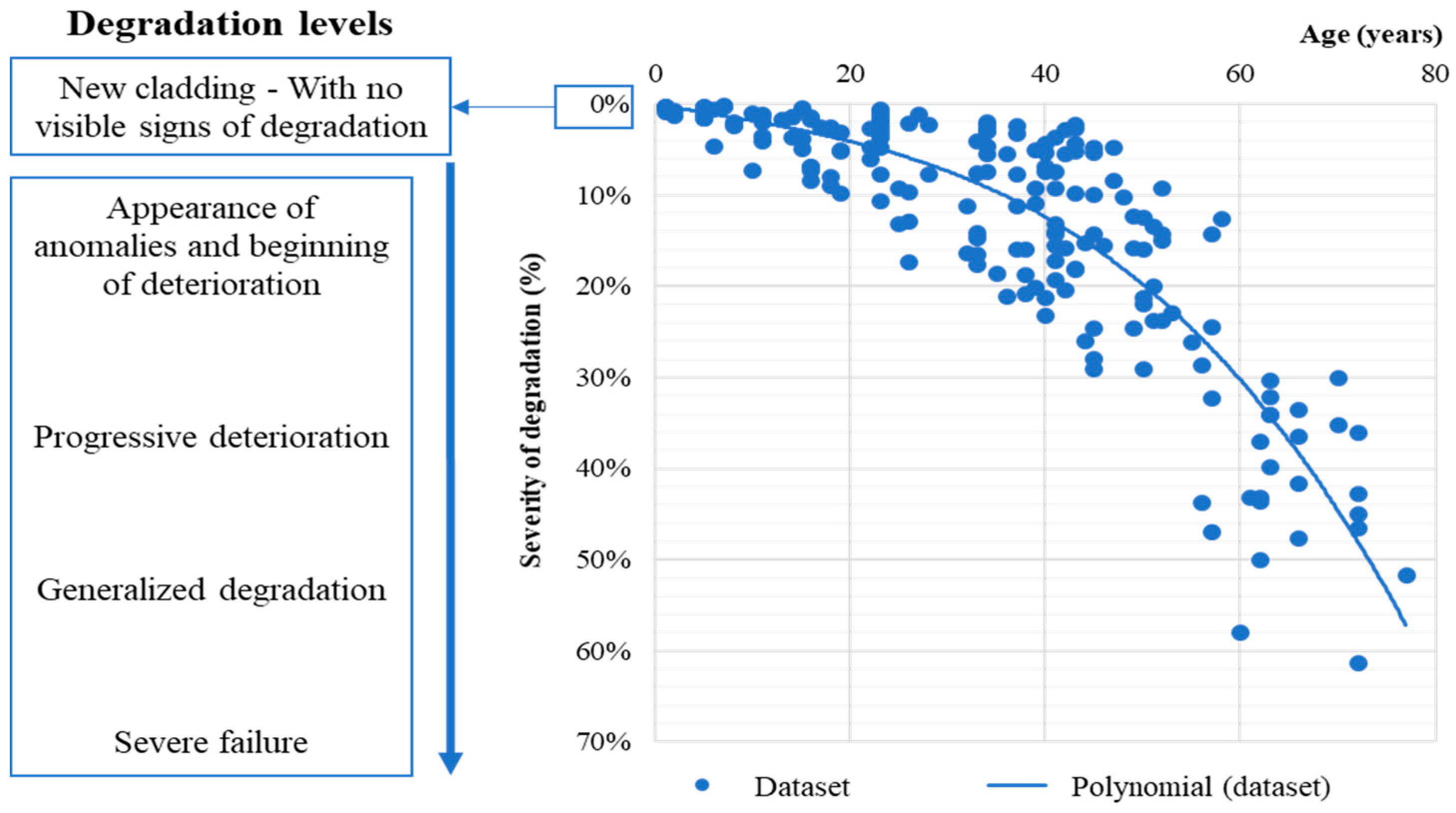

4.2. Types of Models Proposed for Service Life Prediction

4.3. Model Parameters

4.4. Calculation of the Insurance Premium

5. Results, Discussion, and Limitations of the Proposed Models

6. Conclusions

- In residential condominiums, the insurance can be issued by sharing risks within the households and resulting in a reduced premium for each household; it promotes more durable and sustainable building construction with higher quality and performance levels, since the insurance discourages inadequate options in materials and construction practices;

- Insurance companies schedule and perform the “examination”, when the claim is made, unlike what happens in most of housing. As they have no interest in delaying building maintenance, the insured units gain a renewed look, benefitting the image of the neighborhood and city at large;

- The insurance product developed in this fashion can be summarized as a service given to the clients, so its usefulness raises the global value of the building having coverage. This allows commercializing the insurance by real estate promotion, apart from the usual distribution channels (e.g., internet, banks, brokers, and agents).

- This product can also be especially interesting to specialized maintenance companies, since it allows for an additional degree of protection against the risk of early degradation of materials.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Akintoye, A.S.; MacLeod, M.J. Risk analysis and management in construction. Int. J. Proj. Manag. 1997, 15, 31–38. [Google Scholar] [CrossRef]

- El-Adaway, I.H.; Kandil, A.A. Construction risks: Single versus portfolio insurance. J. Manag. Eng. 2010, 26, 2–8. [Google Scholar] [CrossRef]

- Yang, R.J.; Zou, P.X.W. Stakeholder-associated risks and their interactions in complex green building projects: A social network model. Build. Environ. 2014, 73, 208–222. [Google Scholar] [CrossRef]

- Bunni, N.G. Risk and Insurance in Construction, 2nd ed.; Routledge: Abingdon, UK, 2003. [Google Scholar]

- Kunreuther, H. Reducing losses from catastrophes: Role of insurance and other policy tools. Environment 2016, 58, 30–37. [Google Scholar] [CrossRef]

- Brechin, S.R.; Espinoza, M.I. A case for further refinement of the green climate fund’s 50:50 ratio climate change mitigation and adaptation allocation framework: Toward a more targeted approach. Clim. Chang. 2017, 142, 311–320. [Google Scholar] [CrossRef]

- Suweero, K.; Moungnoi, W.; Charoenngam, C. Outsourcing decision factors of building operation and maintenance services in the commercial sector. Prop. Manag. 2017. [Google Scholar] [CrossRef]

- Shohet, I.M.; Nobili, L. Application of key performance indicators for maintenance management of clinics facilities. Int. J. Strateg. Prop. Manag. 2017, 21, 58–71. [Google Scholar] [CrossRef]

- Blong, R. Residential building damage and natural perils: Australian examples and issues. Build. Res. Inf. 2004, 32, 379–390. [Google Scholar] [CrossRef]

- Flage, R.; Aven, T.; Zio, E.; Baraldi, P. Concerns, Challenges, and Directions of Development for the Issue of Representing Uncertainty in Risk Assessment. Risk Anal. 2014, 34, 1196–1207. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Colyvan, M. Is probability the only coherent approach to uncertainty? Risk Anal. 2008, 28, 645–652. [Google Scholar] [CrossRef] [PubMed]

- Gaspar, P.L.; de Brito, J. Limit States and Service Life of Cement Renders on Façades. J. Mater. Civ. Eng. 2011, 23, 1396–1404. [Google Scholar] [CrossRef]

- Shohet, I.M.; Puterman, M.; Gilboa, E. Deterioration patterns of building cladding components for maintenance management. Constr. Manag. Econ. 2002, 20, 305–314. [Google Scholar] [CrossRef]

- Silva, A.; de Brito, J.; Gaspar, P.L. Methodologies for Service Life Prediction of Buildings; Springer International Publishing AG: Basel, Switzerland, 2016. [Google Scholar]

- Silva, A.; de Brito, J.; Gaspar, P.L. Comparative analysis of service life prediction methods applied to rendered façades. Mater. Struct. Constr. 2016, 49, 4893–4910. [Google Scholar] [CrossRef]

- Ranasinghe, M. Risk management in the insurance industry: Insights for the engineering construction industry. Constr. Manag. Econ. 1998, 16, 31–39. [Google Scholar] [CrossRef]

- Madrigal, L.O.; Bretones, J.M.F.; Lanzarote, B.S. Proposed method of estimating the service life of building envelopes. Rev. Constr. 2015, 14, 60–68. [Google Scholar]

- Stapleton, R.C.; Brealey, R.; Myers, S. Principles of Corporate Finance; Tata McGraw-Hill Education: New York, NY, USA, 2006. [Google Scholar]

| Insurance Company | Insurance Type | Duration | Type of Building | Coverage |

|---|---|---|---|---|

| Evolution Insurance Group | Building Warranties & Latent Defects Insurance | 10 years | Residential and commercial | Partial or full reconstruction against construction defects or structural anomalies Repair of roofs, façades and windows |

| BLP Insurance | BLPSECURE | 10 or 12 years | All types | Partial or full reconstruction against construction defects or structural anomalies |

| BLPSECUREPLUS | 10 or 12 years | All types | All of the above plus replacement of non-structural elements within their expected service life | |

| BLPASSET | 6, 10 or 12 years | All types | Partial or full reconstruction against construction defects | |

| Local Authority Building Control (LABC) + MD Insurance Services Ltd | LABC New Home Warranty | 5 years after construction + 10 years = total coverage of 15 years | Social housing, Residentia, | Protection against insolvency of the contractor Protection against construction defects. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Macedo, M.; Brito, J.d.; Cruz, C.O.; Silva, A. Methodological Proposal for the Development of Insurance Policies for Building Components. CivilEng 2020, 1, 1-9. https://doi.org/10.3390/civileng1010001

Macedo M, Brito Jd, Cruz CO, Silva A. Methodological Proposal for the Development of Insurance Policies for Building Components. CivilEng. 2020; 1(1):1-9. https://doi.org/10.3390/civileng1010001

Chicago/Turabian StyleMacedo, Miguel, Jorge de Brito, Carlos Oliveira Cruz, and Ana Silva. 2020. "Methodological Proposal for the Development of Insurance Policies for Building Components" CivilEng 1, no. 1: 1-9. https://doi.org/10.3390/civileng1010001