1. Introduction

Everyday life starts with the use of a toothbrush and toothpaste, which are complementary products. Then, the energy for the whole day is derived from the breakfast where at least one seasonal fruit is mandatory for good health. The seasonal fruit can be replaced by another fruit based on the availability and price and is substitutable product. Whenever the increasing price of one product indicates the increasing sales rate of another product, then those products substitute each other [

1]. Increasing the price of one item can help to increase the sale of another substitutable item. For example, Coca-Cola and Pepsi are two substitutable products as both can satisfy the purpose. One customer can buy Pepsi instead of Coca-Cola in any circumstances. Complementary products are used in combination with another product [

2]. Single use of any part of complementary products has limited usage. The overall utility is increased whenever both products are used together. The market demand of complementary products depends upon both products [

3]. Car and fuel, camera and memory card, toothpaste and brush—these are a few examples of complementary products. A car cannot move without proper fuel, which implies that the car is useless without fuel, and fuel is no longer important if the car is not there. To earn in all aspects, the manufacturer introduces substitutable as well as complementary products in the business. From the perspective of the inventory, complementary products need more storage and inventory, as both products are important. In reality, substitutable products give the manufacturer tough competition, as it is important to choose alternative products very wisely such that it can satisfy the demand as well as the quality of the original product. The pricing factor is the next important thing for substitutable products. The price of the alternative should be less than or equal to the original product. The situation may differ in case of the reverse situation when the alternative’s price is greater than the original price. The situation gets more complicated when the product deteriorates in nature.

There are several researches who focus on substitutable and complementary products, while none of them have investigated both inventory and pricing decisions of the products simultaneously. Moreover, this investigation is done for deteriorating products. In this paper, four models are discussed for pricing and inventory decisions of two types of items, which may be complementary or substitutable, and deteriorating or non-deteriorating. The rest of the present paper is organized as follows:

Section 2 presents a literature review, whereas problem definition, notation, and assumptions are defined in

Section 3, and the mathematical modeling is presented in

Section 4. Numerical examples, a sensitivity analysis, and managerial insights are provided in

Section 5.

Section 6 concludes the achievements of this proposed model. The last section provides the References of the study.

2. Literature Review

Pricing policy is an important part in the field of supply chain management [

4,

5,

6,

7]. Several research articles have been studied on inventory and pricing decisions for single or multi-products inventory models [

8,

9,

10]. However, few of them studied pricing decisions for complementary or substitutable products. In such cases, the price, quality, and durability of the products play a crucial role to attract customers [

5,

9]. On the other hand, retailers face the cross-selling phenomenon for complementary products. McGillivray and Silver [

11] investigated the full substitutability and its effect on total cost within an inventory model. Zhang et al. [

12] illustrated an inventory system when the demand of a minor and a major item is correlated with cross-selling. Zhang [

13] discussed an inventory problem for multiple products with the inventory replenishment. They proposed a search method which gives a global optimum solution. Yue et al. [

14] investigated a duopoly market dealing with complementary products.

An inventory model was discussed by Liu and Yuan [

15] for two types of products where the consumption rates of those products are correlated, and the replenishment rates are coordinated. Wei et al. [

9] analyzed a non-coordination supply chain management consisting of two manufactures with one retailer for two complementary type products with the help of five different game theories: manufacturer-leader Bertrand, manufacturer-leader Stackelberg, retailer-leader Bertrand, retailer-leader Stackelberg, and Nash game (NG) models. Guchhait et al. [

16] studied an advertisement-dependent demand scenario within supply chain management. They used a Stackelberg game policy to solve the model. Shavandi et al. [

17] extended the pricing and lot sizing model of Abad [

18] for multiple products. They proposed several pricing strategies of multi-products for deteriorating items which may be complementary, substitutable, or independent. The aim of the research was to maximize the profit optimization, along with optimum prices and production quantities.

An inventory model was studied by Balkhi and Benkherouf [

19] for deteriorating products. The market demand was stock dependent and time dependent. A procedure was proposed by them to achieve the optimum replenishment schedule. Anjos et al. [

20] considered perishable products and presented a continuous pricing strategy where the optimal pricing strategy can be explicitly characterized and easily implemented. Dye [

21] extended an inventory model for perishable items with a time-dependent backlog by assuming a price-sensitive demand and variable deterioration with time. In that article, an improved algorithm was proposed by them to find out the optimal selling price of a product and replenishment schedule. Panda et al. [

22] considered a single-item economic order quantity (EOQ) model with discounted sale as products were perishable in nature, and the demand was stock dependent. Pang [

23] studied optimal dynamic pricing policies and inventory control policies for deteriorating products within a periodic type inventory model. Sarkar and Saren [

24] investigated the effect of the trade-credit policy for exponentially deteriorating products. Sarkar et al. [

25] developed a two-echelon supply chain model for deteriorating items, where single-setup-multi-delivery (SSMD) transportation policy was adopted.

Sett et al. [

26] and Sarkar et al. [

27] studied fixed lifetime products and their replenishment policy. The deterioration rate was variable, and the backlog was time dependent. Sarkar et al. [

28] applied preservation technology for seasonal deteriorating products while Ullah et al. [

29] used the preservation for waste generation. Recycling of the deteriorated products was investigated by Iqbal and Sarkar [

30]. The market demand can be affected by the deterioration and a backlog scenario may appear in that case. The service level can help to get rid of this situation [

31]. Gürler and Yilmaz [

32] studied a supply chain management with two substitutable products in a newsboy problem. Demands for both products were independent, and the aim of the research was to maximize the retailer’s and manufacturer’s profits jointly. Kim and Bell [

33] proposed that the production system of a firm sold their products to multiple market segments for a specific period. A price-driven scenario was examined by them, and the effect on the pricing strategy and production capacity of the firm were discussed.

Stavrulaki [

34] investigated an inventory model for substitutable products. They explained the combined effect of the demand stimulation for stochastic demand. Karakul and Chan [

35] studied the analytical implications of product substitutability and procurement decisions in a newsboy problem with two products. Thereafter, they established the unimodality of the expected profit of their previous work [

36] with respect to the procurement and price of quantities. Birge et al. [

37] developed an inventory model for substitutable products where market demand follows a uniform distribution. Netessine et al. [

38] determined the optimum procurement for multi-substitutable items under exogenous prices of an integrated inventory-pricing problem. Parlar and Goyal [

39] developed two integrated production–inventory models of two substitutable products under different prices and assumptions [

40]. Tang and Yin [

41] discussed an improved procedure to find the optimum selling price within an inventory framework where demand is price sensitive for substitutable products. Xia [

42] suggested a two-echelon supply chain model including competitive multiple suppliers and multiple buyers, where each supplier offers one type of substitutable product to the buyers. Netessine et al. [

43] discussed about centralized inventory policy where market demand is substitutable.

Table 1 gives the contribution from different authors associated with the area of research.

3. Problem Description, Notation, and Assumptions

3.1. Problem Definition

Consider a market where the retailer intends to determine the order quantities of different products. The products may be complementary or substitutable, for which two different scenarios exist.

In case of complementary products, the retailer expects a higher consumption rate of a product when the consumption rate of its complementary product increases and vice versa. Moreover, the demand of every complementary product depends upon the price of the other such that the high price of one of them decreases the demand of the complementary product and vice versa. Obviously, the degree of complementarity between two products, which is between 0 and 1, has the main effect on the changes between their respective demands and prices. In this situation, the retailer determines the optimal order quantity and selling price of each product in such a way that the retailer can maximize the total profit.

In the second scenario, each product can be used instead of another one in the case of substitutable products. In this situation, the retailer faces the situation that the decreasing demand of a substitutable product increases the other product’s demand. The demand of each substitutable product depends upon its own price and the price of another one such that the higher price of one of them increases the demand of its substitutable product and vice versa because the customer intends to use the substitutable product, which has a lower price compared to the other. Generally, the degree of substitutability between two products, which is between 0 and 1, has the main effects on the changes between their demands and prices. Therefore, the retailer should determine the optimum order quantity such that the total profit should maximize.

3.2. Notation

The notation related to this study is given in the Nomenclature section at the end of the study.

3.3. Assumptions

Assumptions are used to formulate the model are as follows:

A retailer maximizes the profit based on an economic order quantity (EOQ) model. The demand is dependent upon selling prices and lot sizes of two types of products. The demand of two complementary products is dependent upon each product’s selling price and the degree of complementarity.

After a certain time, products start to deteriorate with a constant deterioration rate. As deterioration is considered in this model, deterioration cost per time unit for the product m is ($ per unit). The deterioration rate of product 1 and product 2 is .

The degree of complementarity between two products is given by , where and the degree of substitutability between two products is given by d, where .

The lead time is zero, and there are no shortages for both types of products.

The time horizon is infinite.

4. Mathematical Model

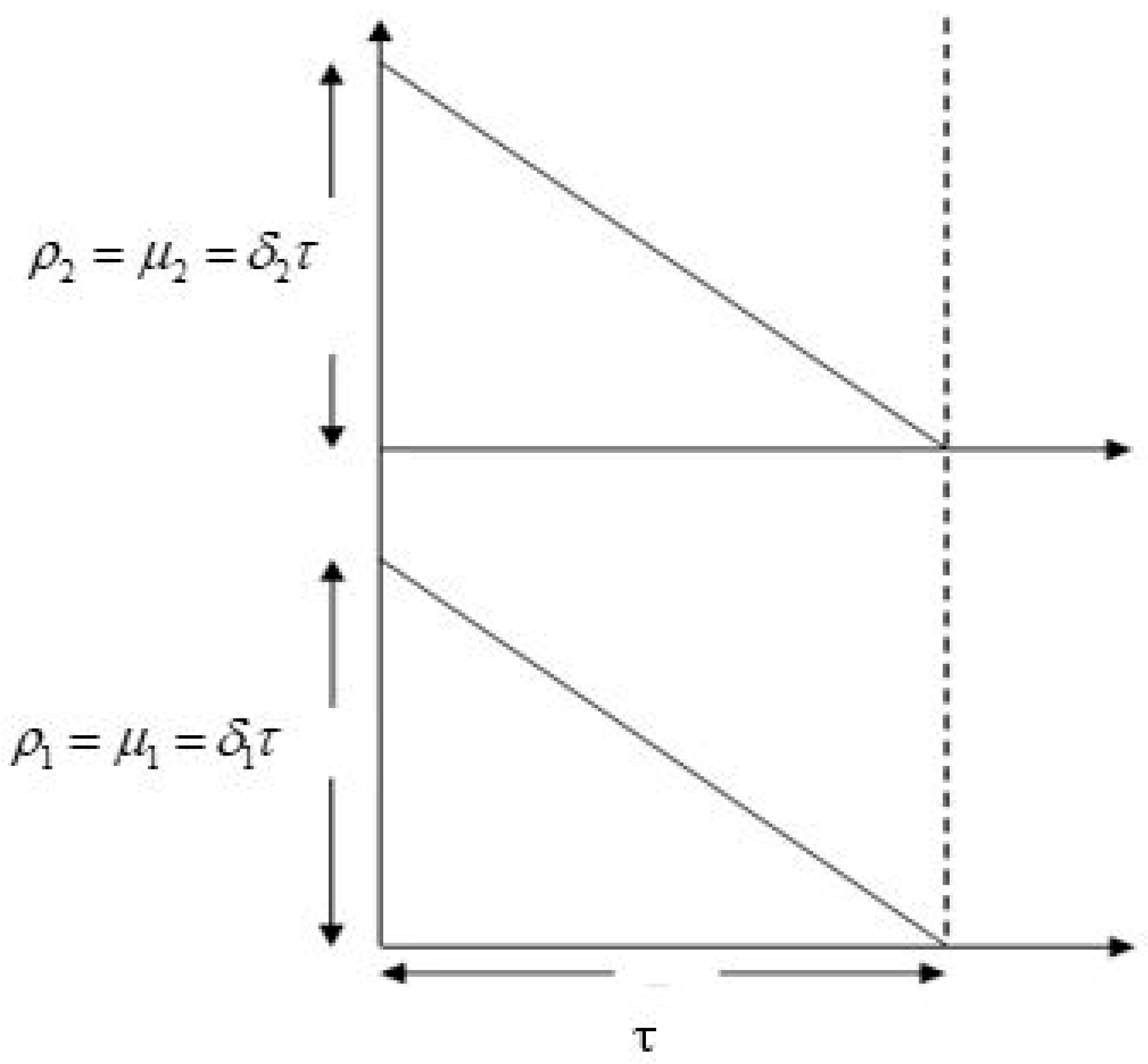

The scenarios for both non-deteriorating (

Figure 1) and deteriorating (

Figure 2) products are discussed.

In all cases, the aim is to find the optimal values of the order quantity, the cycle length, and selling prices for profit maximization.

4.1. Non-Deteriorating Complementary Products

This section discusses the complementary products when products are of a non-deteriorating type. The demand [

35,

44] of two complementary products, product 1 and product 2, are

respectively. Here, all parameters (

) are non-negative. The retailer is trying to obtain the optimal values of decision variables. Therefore, the average profit is

Expression (1) gives the revenue from product 1. Expression (2) explains the revenue from product 2, and Expression (3) defines the summation of ordering costs and holding costs. The purpose is to maximize the profit, using the following theorem:

Theorem 1. is strictly concave if Substituting the values of

and

within the first order derivative of the Equation (3) with respect to the decision variable

τ, one can obtain

The first order derivatives of Equation (3) with respect to the variables

and

are given by

The required optimum values of

and

are as given by the following expressions as:

Using Equations (7) and (8) on the right-hand side of Equation (4) and equating them to zero, one can obtain

where

Equation (9) is a cubic polynomial and the discriminant is

According to Δ, the discriminant has three types of values. Δ > 0 gives three real roots of distinct quality, Δ = 0 gives multiple real roots, and Δ < 0 gives one real root and two complex roots. The following improved solution procedure has been developed to solve the problem numerically.

Solution algorithm

- Step 1.

Using Equations (10)–(12), calculate the coefficients of polynomial shown in Equation (9).

- Step 2.

All positive real roots of Equation (9) are found by using MATLAB software. Go to the Step (3).

- Step 3.

Determine the values from Step (2).

- Step 4.

For all combinations of , obtain the profit and check the concavity clause (Theorem 1). Select the maximum value as an optimal value of the profit. Then the related optimum decision variables are , and .

- Step 5.

Determine the optimal values of the order quantities using and .

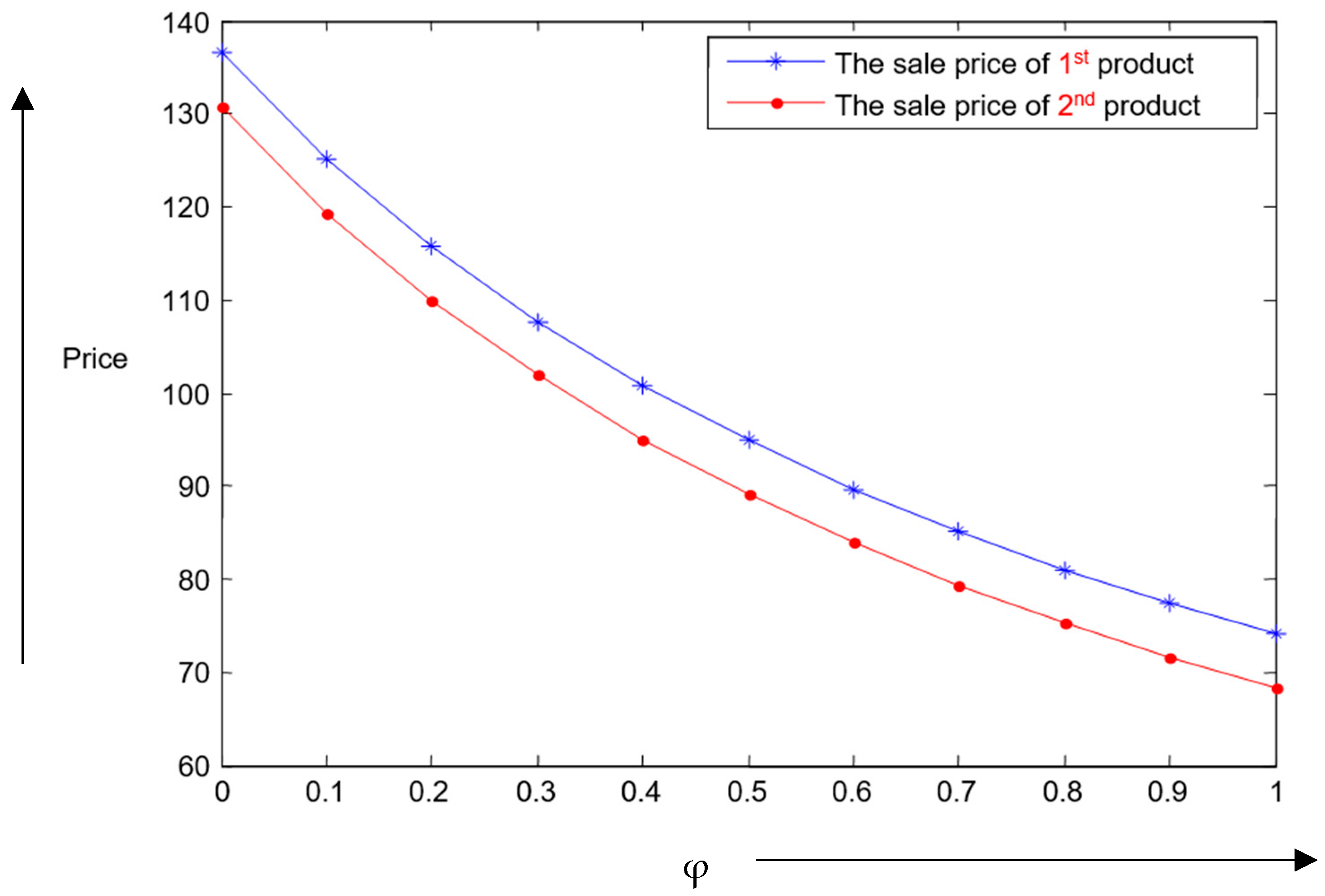

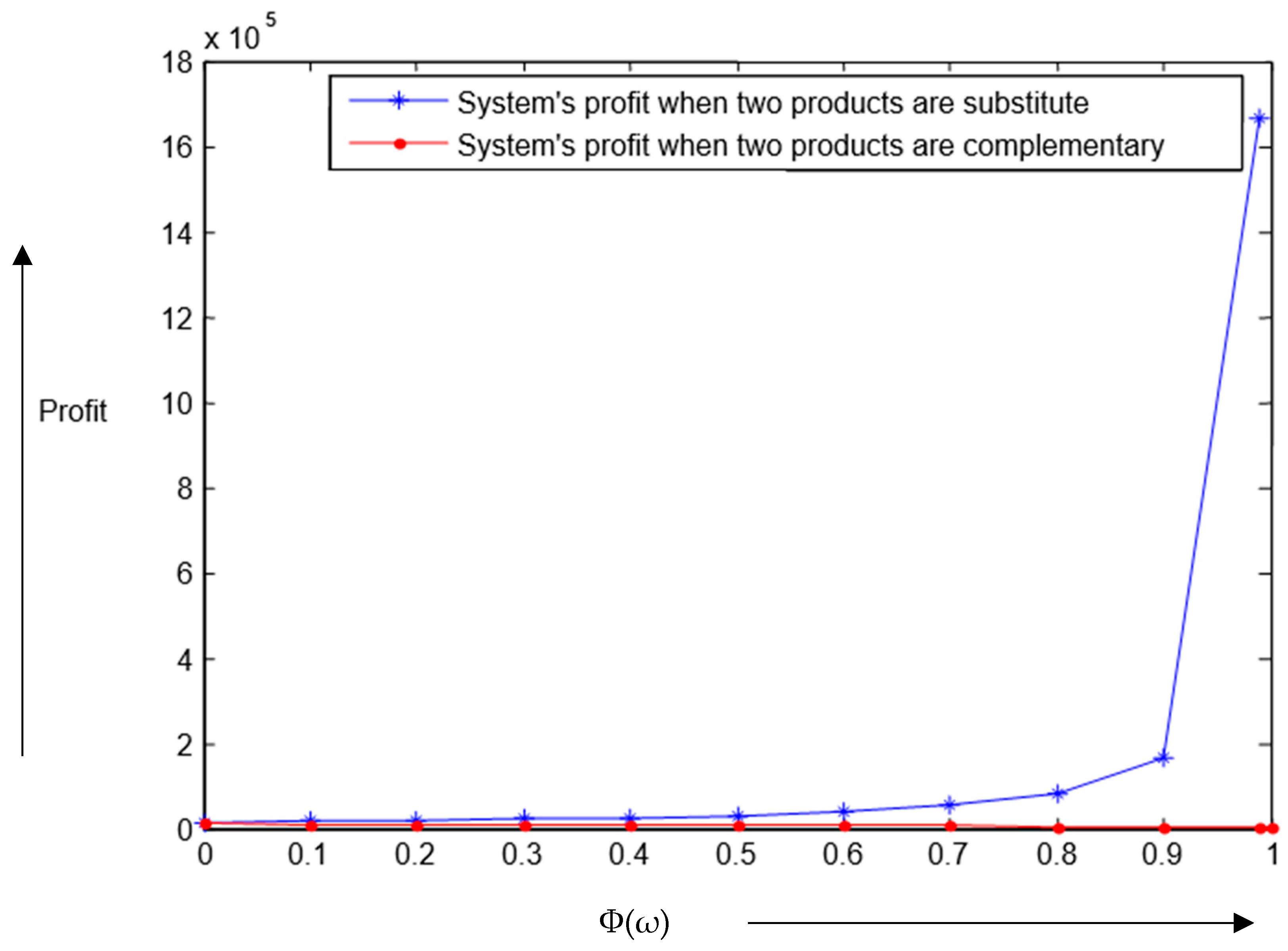

4.2. Non-Deteriorating Substitutable Products

This section discusses about non-deteriorating substitutable products. The demand of two substitutable products, product 1 and product 2, is defined as follows:

where all parameters are non-negative. The average profit is

The following theorem is used to maximize the above profit.

Theorem 2. is strictly concave Now, Equation (16) gives the following expression with respect to the variables

τ,

, and

.

Equations (18) and (19) give the optimum values of

and

as

Using Equations (20) and (21) on the right-hand side of Equation (17) and equating them to zero, one can obtain

where

According to the discussion about the discriminant of cubic polynomial above, the following solution procedure is suggested for the substitutable products case.

Solution algorithm

- Step 1.

Using Equations (23)–(25), calculate the coefficients of the polynomial in Equation (22).

- Step 2.

After finding all possible roots of Equation (22) with the help of MATLAB software, go to the Step (3).

- Step 3.

From Step 2, determine the values of .

- Step 4.

For all values of , determine the total profit and check the concavity clause (Theorem 2). Then select the maximum value as the optimum one. The related decision variables associated with the maximum profit are , and .

- Step 5.

Determine optimal values of order quantities using and .

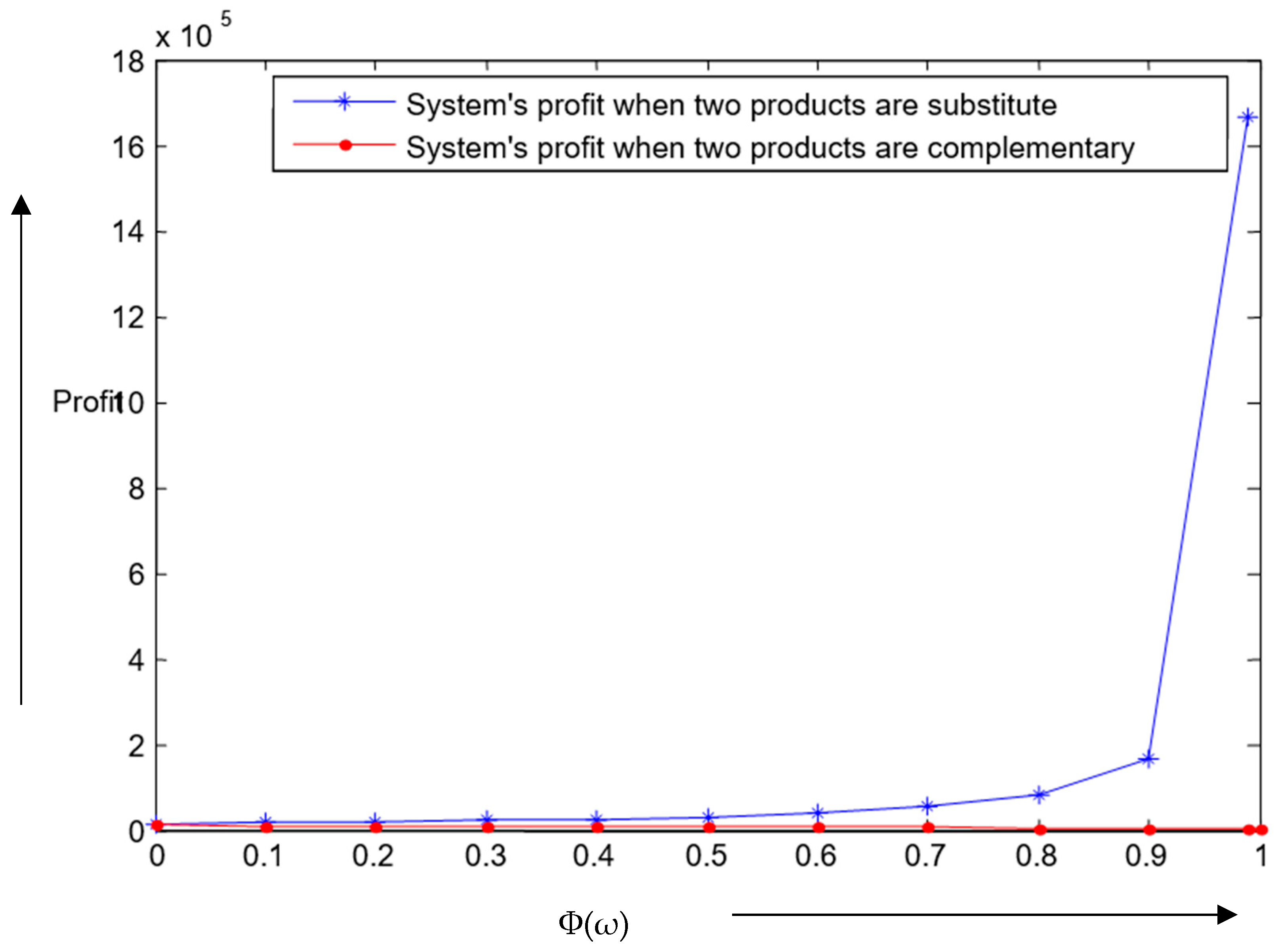

4.3. Deteriorating Complementary Products

In this case, it is assumed that the retailer is doing the business with two deteriorating complementary products. For both products, the deterioration rates are constant. The differential equation

shows that the inventory level changes over time, where

. Solving this differential equation yields

, and according to

Figure 2, the order quantity of each product is equal to

. The holding cost is given by

Moreover, the deterioration cost is

The total cost after utilizing the approximation of the Taylor series expansion,

, is

The demand of two deteriorating complementary products, product 1 and product 2, is as follows (as defined in

Section 4.1):

Finally, the average profit is

To optimize the profit, the following theorem is used.

Theorem 3. is strictly concave if Here, the first order derivative of Equation (31) with respect to T yields

The first order derivatives of the Equation (31) for variables

and

are given by

Optimum values of the decision variables

and

are

Using Equations (35) and (36) in Equation (32) and equating them to zero for optimality, one can obtain

where

According to the discussion about the discriminant of cubic polynomial provided above (

Section 4.1.), the following improved solution procedure is suggested for finding optimum solutions.

Solution algorithm

- Step 1.

Using Equations (38)–(40), calculate coefficients of polynomial shown in the Equation (37).

- Step 2.

Equation (37) gives all roots by using MATLAB software and then go to the Step (3).

- Step 3.

Determine all values of for period from the Step (2).

- Step 4.

For all possible combinations of , determine the total profit and check the concavity clause (Theorem 3). Select the maximum value as the optimal value of the profit. Then optimal values of the decision variables are , and .

4.4. Deteriorating Substitutable Products

This case discusses deteriorating substitutable products. The demand of two deteriorating substitutable products, product 1 and product 2, is

where all parameters are non-negative. The average profit function is calculated as

With the help of the following theorem, this profit can be optimized.

Theorem 4. is strictly concave ifholds. From the necessary condition, Equation (43) gives the following expressions

Setting Equations (45) and (46) equal to zero,

and

are given as follows:

Using Equations (47) and (48) on the right-hand side of the Equation (44) and equating them to zero, one can obtain

where

According to the discussion about discriminant of cubic polynomial provided above (

Section 4.1), the following solution procedure can help to find the numerical solution for substitutable products.

Solution algorithm

- Step 1.

Calculate the coefficients of polynomial from the Equation (49) by using Equations (50) to (52).

- Step 2.

Equation (49) gives the roots of the equation using MATLAB software. Move to the Step 3.

- Step 3.

Find using Step 2.

- Step 4.

For , obtain the profit and check the concavity clause (Theorem4). Choose the maximum value as the optimal value of the profit. Then related decision variables for the maximum profit are given by , and .

- Step 5.

Determine optimal values of order quantities using and .