1. Introduction

Significant determinants of economic development in any country include the activity of both domestic and foreign investors, the optimal balance between labor market demand and supply, the availability of free financial resources, particularly credit facilities, the presence of raw material reserves, the efficient functioning of logistics systems, and optimistic business expectations, among others. For businesses, psychological factors such as expectations, trust, and confidence in the future play a crucial role in influencing economic growth and resilience. These factors affect the overall functioning of organizations, particularly decision-making processes, and contribute to ensuring their stable development [

1,

2,

3,

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15]. For example, the higher the level of business trust in the prospects of economic growth, particularly in industrial production, the greater its confidence and resilience.

The relevance of the article is substantiated by the fact that contemporary businesses, relying on available information, are able to anticipate certain changes in economic development and draw corresponding conclusions. Conversely, surveys of organizational leadership regarding expectations of future economic performance enable national governments to identify emerging trends in economic dynamics, particularly with respect to industrial production, the expansion of the service sector, and related domains.

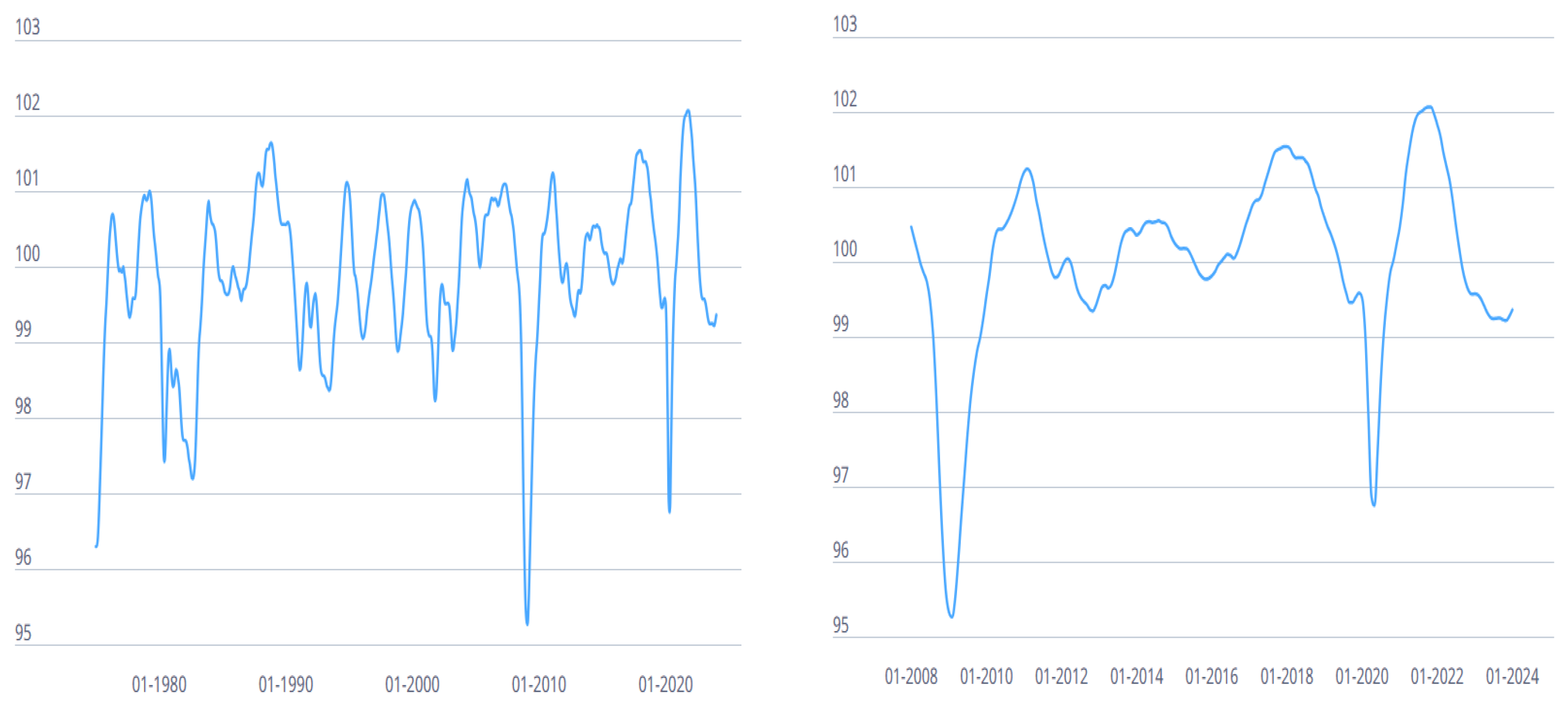

Figure 1 presents data on the Business Confidence Index across OECD member countries.

The data presented in

Figure 1 vividly illustrate the dynamics of changes in business confidence across OECD countries during 1980–2024. They demonstrate that following periods of crisis—such as the Cold War, the energy crisis, the dissolution of the USSR, financial and economic downturns, pandemics (including COVID-19)—phases of recovery typically emerge, largely driven by the resurgence of business optimism.

Thus, the Business Confidence Index across OECD countries during the corresponding period exhibited an unclear trend of development, as it was influenced by global crises, external shocks, and an unstable geopolitical environment. Among the most significant events were the sovereign debt crisis in the Eurozone (2010–2012), which undermined confidence in European economies; Brexit (2016), which created uncertainty for businesses in the United Kingdom and EU member states; and the war in Ukraine (February 2022), which triggered an energy crisis and disrupted global supply chains. These factors collectively exerted a considerable impact on the economic development of all OECD member states. Additionally, fluctuations in the index were affected by inflationary pressures and interest rate dynamics, which reduced investor motivation to finance business development due to diminished confidence in future economic conditions.

This, in turn, fosters economic growth, resilience, and an increase in the Business Confidence Index. When considering the values of the Business Confidence Index within the European Union (

Figure 2), it becomes evident that in recent years the situation in the EU has been almost identical to that observed across OECD countries as a whole.

The information presented in

Figure 2 indicates that the Business Confidence Index in the EU-27 declined during 2022–2024. This trend suggests a deterioration of economic processes within the EU and the potential onset of a recession, driven by factors such as Russia’s war against Ukraine and trade conflicts involving the United States—particularly the U.S.–EU-27 trade agreement, which appears disadvantageous for the European side.

The Business Confidence Index in the EU-27 countries during 2016–2024 (

Figure 2), similar to the Business Confidence Index across OECD countries (

Figure 1), exhibited an unstable development pattern characterized by alternating periods of growth and decline. The primary reasons for this instability lie in the continuously changing business environment, shaped by internal and global crises, political disruptions (such as Brexit and armed conflicts), and economic shocks (including inflation and the COVID-19 pandemic). These factors negatively influenced business expectations worldwide, particularly within the EU. Consequently, the periods of optimism illustrated in

Figure 2 were frequently followed by waves of pessimism, which hindered the sustained growth of business confidence indices.

Although positive tendencies of economic recovery, especially within the Eurozone, were observed in 2021–2022, the intensification of financial challenges has subsequently dampened business expectations [

15], thereby constraining economic development, including entrepreneurial activity [

18].

Thus, business expectations influence not only the overall trajectory of economic development but also such a crucial sector as industrial production. Optimistic or pessimistic business sentiments largely depend on how the economy is expected to evolve in the short, medium, and long term; on the dynamics of the consumer price index (inflationary processes); on domestic and external demand for industrial products; and on the development of national investment and credit policies, among other factors. Consequently, the impact of business expectations on industrial production may manifest in several key dimensions, including: stimulating investment in industrial production; creating new jobs, which positively affects broader socio-economic processes, particularly by scaling up production; fostering the development of related sectors such as mechanical engineering, construction, transport, communications, and mining; and attracting investment and financial resources to ensure the production of competitive, high value-added goods that meet the needs of the economy. Ultimately, the higher the level of business confidence, the greater the pace of economic development, particularly in industrial production. Conversely, under conditions of financial and economic crises, pandemics, wars, and other socio-economic and political threats, business expectations become pessimistic, leading to future recession and depression. The relationship between business expectations and the development of industrial production has been confirmed in the works of scholars [

19,

20,

21,

22,

23,

24,

25,

26,

27].

There is no doubt that the manufacturing sector constitutes the foundation for enhancing labor productivity and driving economic growth, as evidenced by the experience of countries such as the United States, the European Union, the United Kingdom, China, India, Singapore, Hong Kong, Taiwan, South Korea, Vietnam, and others. Moreover, the relevance of manufacturing sector development today is reinforced by the fact that industry, innovation, and infrastructure are designated as Sustainable Development Goal 9 [

28]. The more advanced a country’s manufacturing sector, the greater its capacity to facilitate the achievement of other Sustainable Development Goals. In particular, it contributes to the eradication of such pressing challenges as hunger and poverty; supports the advancement of education, healthcare, culture, and social justice; promotes the reduction of inequality; and fosters improvements in environmental sustainability, among other outcomes.

Thus, business confidence, trust, and expectations represent an important indicator of economic development, particularly in the industrial sector, as they are shaped by investment, managerial, financial, and political decisions. Effective state policies in these domains foster optimistic business expectations and, consequently, stimulate economic growth, especially in such a crucial area as industry. Conversely, pessimistic expectations—arising from socio-economic, political, and other crises—lead to recession and depression among economic actors. For this reason, the present article proposes to investigate the relationship between IBCI and the actual dynamics of IPI under conditions of war, using Ukraine as a case study.

2. Literature Review

Business trust, confidence, and expectations of future economic changes are crucial factors in managerial decision-making [

29], which rely on the assessment of both internal and external information. Firms are often inclined to develop highly optimistic expectations regarding their future growth prospects [

30]. The most optimistic expectations are typically observed among entrepreneurs who establish their own businesses and enter the market [

31]. Business expectations are of particular importance to entrepreneurs, as they substantially determine the decision-making process and ensure the stable development and functioning of the organization.

At the same time, economic literature provides limited insights into the process of expectation formation during the pre-market entry stage [

32], when entrepreneurs begin to accumulate their first experiences based on available external information while pursuing their mission [

33]. The experience of the vast majority of businesses demonstrates that miscalculations are an anticipated outcome of entrepreneurial activity [

34], and these must be taken into account in order to achieve success and stimulate further development. Expectations associated with opportunities, in particular, can drive businesses to invest resources in the implementation of their business ideas [

35]. Entrepreneurs are generally characterized by higher levels of expectations [

36], and they often substantially overestimate their chances of success compared to competitors.

An important research question concerns the role of experience in shaping optimism in the business sphere. For instance, Mehrabi and Kolabi [

37] argue that experience strengthens the tendency toward excessive optimism among entrepreneurs, while Koellinger et al. [

38] demonstrate that inexperienced entrepreneurs are often more optimistic about their prospects than those with greater experience. The tendency toward heightened optimism is also evident when firms possess large volumes of information [

39]. A substantial stock of quantitative and qualitative information enables entrepreneurs to implement business decisions more effectively and to generate corresponding economic outcomes [

40], which in turn raise expectations for future development. Overall, there is evidence that higher levels of expectations are strongly associated with the process of information acquisition [

41].

The study by Pindard-Lejarraga and Lejarraga [

42] emphasizes that entrepreneurs’ expectations regarding business performance outcomes vary depending on the sources of information they rely upon. The relationship between information sources and expectations is moderated by industry-specific conditions that determine the likelihood of success. Under favorable industry conditions, experience generally generates higher levels of expectations, whereas under unfavorable conditions the opposite effect is observed. Furthermore, the authors stress that expectations constitute an important motivating force for business development, while information plays a decisive role as a factor that strengthens business confidence.

In management science, business confidence encompasses several key elements that constitute its essence: social capital, social interactions, organizational resources, and the expectations and beliefs of managers and employees [

1]. The main forms of business confidence include deterrence-based trust, knowledge-based trust, identification-based trust, and consumer trust [

43]. Trust serves as the foundation of business relations between partners. Positive experiences of interaction with reliable partners enhance trust, which in turn indicates the stability of future relationships and the likelihood of favorable expectations regarding economic development. Entrepreneurial investment decisions, to a certain extent, depend on expectations concerning the trajectory of economic and business growth [

7]. These business expectations may thus be understood as business confidence—expressed either in terms of optimism or pessimism regarding the prevailing business climate [

44].

For instance, Konstantinou and Tagkalakis [

45] demonstrate that business confidence increases in response to lower taxation and higher government expenditures, while rising wages and expanded public investment exert a negative effect. Moreover, effective monetary policy has been found to strengthen business expectations and improve decision-making processes in business development [

46], whereas monetary policy instability undermines business trust.

Additional factors also influence business confidence and expectations. One such factor is interest rate volatility, which affects the future trajectory of economic and business processes. Evidence from Germany and the United States indicates that heightened volatility in interest rates negatively impacts business expectations and overall economic performance [

47]. Corruption is another critical determinant [

48], as it impedes investment flows and hinders business development. Both corruption and socio-economic and political crises generate uncertainty and foster pessimistic business sentiments.

Accordingly, economic policy uncertainty can adversely affect demand and supply [

49], pushing entrepreneurs into the shadow economy. Business confidence is undermined not only by economic policy uncertainty but also by fluctuations in energy prices, particularly oil. Nevertheless, Adekoya and Oliyide [

50] argue that economic policy uncertainty exerts a greater influence on business confidence than oil price volatility.

There is a clear relationship between business confidence and economic development. An important sector underpinning this relationship is manufacturing (industrial production), which is widely regarded as a driving force of economic growth [

51], particularly in the context of the transition from Industry 4.0 to Industry 5.0. The latter emphasizes three fundamental development trajectories: human-centricity, sustainability, and resilience. This relationship may be assessed through the lens of the business confidence indicator and the economic development index. Business expectations are frequently employed to forecast the future trajectory of the economy. However, business confidence is shaped by numerous variables that are difficult to quantify, such as political stability, the threat of frequent legislative changes, and the broader socio-economic environment alongside its regulatory framework [

21]. A crucial indicator of business expectations is the business expectations index, which serves as a forecasting tool within the early warning system for shifts in the economy [

1]. These shifts, however, depend on multiple factors, many of which remain highly uncertain and challenging to predict [

52].

In the economic literature, various indicators are employed to assess the economic development of countries, particularly in the industrial sector, among which the business sentiment indicator holds a central role [

53]. Evaluating business expectations provides insights into the future trajectory of the economy, including inflationary, financial, credit, and other processes. Governments, in turn, rely on business expectations to adjust these processes, either to prevent economic overheating or to mitigate the risks of recession and depression [

54]. Such expectations may encompass opposing dimensions, namely confidence (optimism) and uncertainty (pessimism) [

55]. However, some studies argue that business expectations cannot reliably predict future economic development, particularly industrial production [

56]. Moreover, they are often grounded in the subjective assessment of business processes [

57], shaped by individual forecasts and specific interests [

58].

Business expectations are evaluated using a variety of indicators, including the Business Confidence Indicator, the Consumer Confidence Indicator, and others [

16,

17,

59]. According to OECD experts, the Business Confidence Indicator reflects firms’ perceptions of future developments in production, orders, and stocks of finished goods in the manufacturing sector, based on survey evidence. It is applied to analyze shifts in industrial output and to forecast production dynamics [

16]. A value above 100 signals optimism regarding near-term business prospects, whereas a value below 100 reflects pessimism about future business trends. Other indicators are also widely used, such as the Business Climate Indicator, the Consumer Confidence Indicator, the Economic Sentiment Indicator, and the Employment Expectations Indicator [

17,

60]. Furthermore, Ref. [

61] emphasizes that the Business Confidence Indicator in the manufacturing sector has a significant impact on economic development. For instance, empirical evidence shows that in an EU country such as Belgium, this indicator exerts a substantial influence on economic conditions across EU member states.

In Ukraine, the following business expectation indicators are employed: business confidence indicators in industry; business confidence indicators in construction, retail trade, and services; the business climate indicator in industry; the economic sentiment indicator; the business expectations index; the index of business activity expectations; the index of expected changes in the financial and economic situation at enterprises and in agriculture; the business expectations index; and the business barometer [

59]. These indicators, based on surveys of business expectations among managers of small, medium, and large enterprises, are used to assess prospective economic development trends and likely market conditions [

62]. Business expectation indicators, in particular the Business Activity Indicator, reflect the current business and economic situation in the country [

63] and make it possible to identify the relationship between business expectations and economic development, thereby justifying relevant cause–effect linkages [

64]. Establishing such relationships enables the construction of economic models aimed at evaluating the current economic situation and forecasting future economic trends. However, some studies, such as [

65], highlight the inconsistency of business leaders’ expectations with the actual economic situation.

The study emphasizes the relationship between business expectations and industrial production. For instance, research [

22] concludes that the business confidence indicator significantly affects the development of industrial production. Similar evidence is provided in [

23], where the authors examined the interrelation between business expectations and industrial production in Germany and found that business sentiment constitutes a substantial foundation for production growth, particularly in the industrial sector. Comparable findings were obtained by Aarle and Kappler [

24], who, using the case of EU countries, demonstrated that the business expectations index has a direct and proportional impact on economic development, especially on industrial output.

Of particular relevance to this study is the research by Suhanyiova et al. [

21], who evaluated the relationship between the business confidence indicator (BCI) in the manufacturing sector and the following independent variables: industrial production, the producer price index (PPI) in manufacturing, short-term market interest rates, and long-term market interest rates. The authors analyzed data from two EU countries—Slovakia and Hungary—covering the period 2016–2022. The applied methodology included cluster analysis and mathematical modeling, specifically multiple regression analysis. The findings for Slovakia demonstrate that BCI is positively associated with industrial production and long-term interest rates, while showing a negative relationship with the producer price index and short-term interest rates. For Hungary, the results were largely consistent, with the exception that short-term interest rates showed no significant relationship with BCI. The multiple regression models constructed by the authors indicate that variability in BCI can be explained by up to 50.0% in the case of Slovakia and approximately 38.0% for Hungary.

Bruno et al. [

25] investigated the relationship between the manufacturing confidence indicator and the industrial production index, taking into account the effects of the “Great Recession” through the application of a linear correlation–regression model. The study revealed a stable relationship between the two indicators. A distinctive feature of the research was the identification of long-term industrial activity trends as an important factor influencing production development. Furthermore, it was found that variations in the relationship are driven by cyclical rather than structural causes. Specifically, the stability of business entities was shown not to affect the manufacturing confidence indicator. Instead, both the confidence indicator and the industrial production index are significantly influenced by the adjustment of production plans by firms under crisis conditions.

Using mathematical modeling—specifically regression analysis—Cizmesija et al. [

26] concluded that there is a significant relationship between business expectations and industrial production. They noted that changes in business confidence indicators can be used to predict likely trends in industrial output. Similar findings were reported by Ptáčková and Fischer [

27], who assert that industrial business sentiment is closely linked to industrial production. Industrial sentiment not only allows for forecasting growth levels in industrial output but also exhibits a feedback relationship, whereby the level of industrial development can influence business sentiment, thereby motivating firms to expand their operations. Business confidence is regarded as an important factor in assessing and fostering economic development. Previous research has examined the interrelationships between the business confidence indicator in the manufacturing sector and variables such as producer prices and interest rates in countries including Hungary and the Slovak Republic [

14]. The author considers the manufacturing sector a driving force of the economy, exerting a substantial influence on other economic sectors. Business confidence affects not only the level of output in the manufacturing sector but also the trajectory of sustainable economic development. To evaluate the relationship between business confidence and the development of the manufacturing sector, a multiple regression model was employed. The model incorporated additional variables such as long-term and short-term interest rates and producer price indices. The findings suggest the existence of a positive relationship; however, the coefficients of determination are relatively low when interest rates are included in the model. Specifically, the coefficient of determination equals 0.5 for Slovakia and 0.4 for Hungary. When business confidence is introduced as an explanatory variable, the coefficients of determination are somewhat higher.

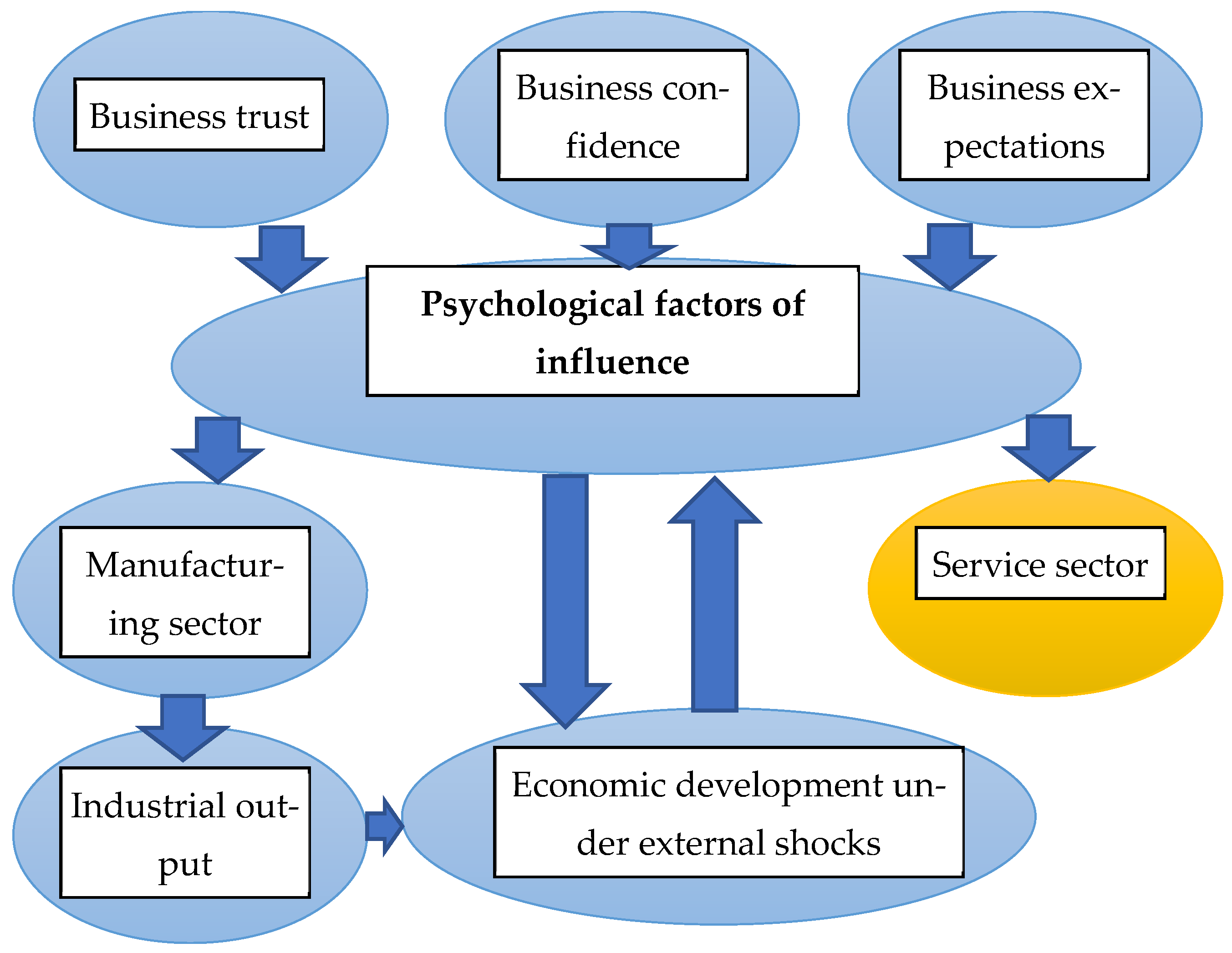

To highlight the originality of this study within the context of the aforementioned theoretical contributions, a conceptual framework is proposed. This framework illustrates the key theoretical insights derived from the literature review and identifies the central research direction of the present study (

Figure 3).

Thus, the logic of the literature review is structured as follows. First, it aims to determine the significance of psychological factors—such as business trust, business confidence, and business expectations—in ensuring economic development. Second, it seeks to examine, at the theoretical level, the potential influence of these psychological factors on the development of the manufacturing sector as a key component of the economy. Third, the literature review reveals a limited number of studies that analyze the impact of psychological factors on economic development, particularly on industrial production under external shocks, which further underscores the relevance of the chosen research topic. Fourth, the study focuses on Ukraine—a country currently experiencing wartime conditions—thereby making this research, in our view, unique compared to many analogous studies.

3. Methodology

In the current context of economic instability, there is an increasing need to identify effective tools for assessing and forecasting economic processes. One such approach involves the use of business expectation indicators of economic entities. The industrial production sector, which plays a crucial role in driving economic development, is of particular relevance in this regard. Therefore, examining the association between enterprises’ business expectations and the actual state of industrial output makes it possible to identify patterns that can be utilized to improve economic planning, crisis management across enterprises of various ownership forms, and state policies aimed at supporting industrial production. This analysis is particularly significant for Ukraine—a country with a transforming economy that is currently operating under wartime conditions. In such circumstances, the role of subjective expectations in shaping economic decisions becomes increasingly important, especially under the influence of external and internal shocks.

The research hypothesis posits the existence of a statistically significant association between the business expectations of industrial enterprises and the actual indicators of industrial output performance. In particular, it suggests that a positive dynamic in business expectations precedes and potentially anticipates the subsequent growth in industrial production volumes.

The study involves the following stages: analyzing the IPI averaged across the EU-27 countries (based on data available in the Eurostat database); visualizing the IPI data averaged across the EU-27 countries for the first quarter of 2025; analyzing the IPI in Ukraine for the period 2015–2025, including monthly data, and comparing it with the EU-27 data (according to Eurostat and the Ministry of Finance of Ukraine); analyzing the Purchasing Managers’ Index for the manufacturing sector in selected countries for the period January 2023–May 2025 (according to the National Bank of Ukraine); analyzing the Business Activity Expectations Index in Ukraine, particularly in the industrial sector, for 2019–2025 (according to the State Statistics Service of Ukraine); providing an example of the calculation of the IBCI based on the IPI volume and production orders (according to the State Statistics Service of Ukraine); analyzing IBCI in Ukraine’s manufacturing sector for 2020–2024; investigating the impact of the IBCI (according to the State Statistics Service of Ukraine); constructing a correlation–regression model of the IBCI on the IPI; and forecasting the effect of the IBCI for 2026–2030.

The assessment of the relationship between IBCI and the actual dynamics of production will be conducted using two indicators: the IBCI and the IPI. The IBCI is calculated based on the provisions of the Methodology (On Methodological Provisions, 2020) [

59,

66,

67,

68,

69] and other legislative and regulatory documents containing data on the calculation of business activity indicators within the EU’s Joint Harmonized Programme. In EU member states, as well as in Ukraine, the following business expectation indicators are used: business confidence indicators in sectors such as manufacturing, retail trade, construction, and services; the business climate indicator; the consumer confidence indicator; the economic sentiment indicator; and the employment expectations indicator [

59]. These indicators are calculated and published on a monthly basis by institutions such as the Directorate-General for Economic and Financial Affairs of the European Commission, the State Statistics Service of Ukraine, and the National Bank of Ukraine.

The information base for calculating the IBCI is provided by the State Statistics Service of Ukraine and includes data on IPI volumes, inventories of finished goods, demand for industrial products, and the expectations of industrial enterprises regarding the prospects for economic development, including export operations. In addition, information from external sources is considered, such as consumer expectations regarding their personal financial situation over the next twelve months, the national unemployment rate, and household savings levels.

The primary statistical reporting form for calculating the Industrial Business Confidence Indicator (IBCI) is Form No. 2K_P (monthly)—“Survey of Business Activity of Industrial Enterprises”. The IBCI is calculated according to the formula provided in [

59]:

where IBCI—Impact of the Business Confidence Indicator; X

1t—seasonally adjusted balance of the assessment of the current volume of production orders (demand) in the manufacturing sector at time t; X

2t—seasonally adjusted balance of expected changes in the volume of production in the manufacturing sector over the next three months at time t; X

3t—seasonally adjusted balance of the assessment of the current volume of inventories of finished goods in the manufacturing sector at time t.

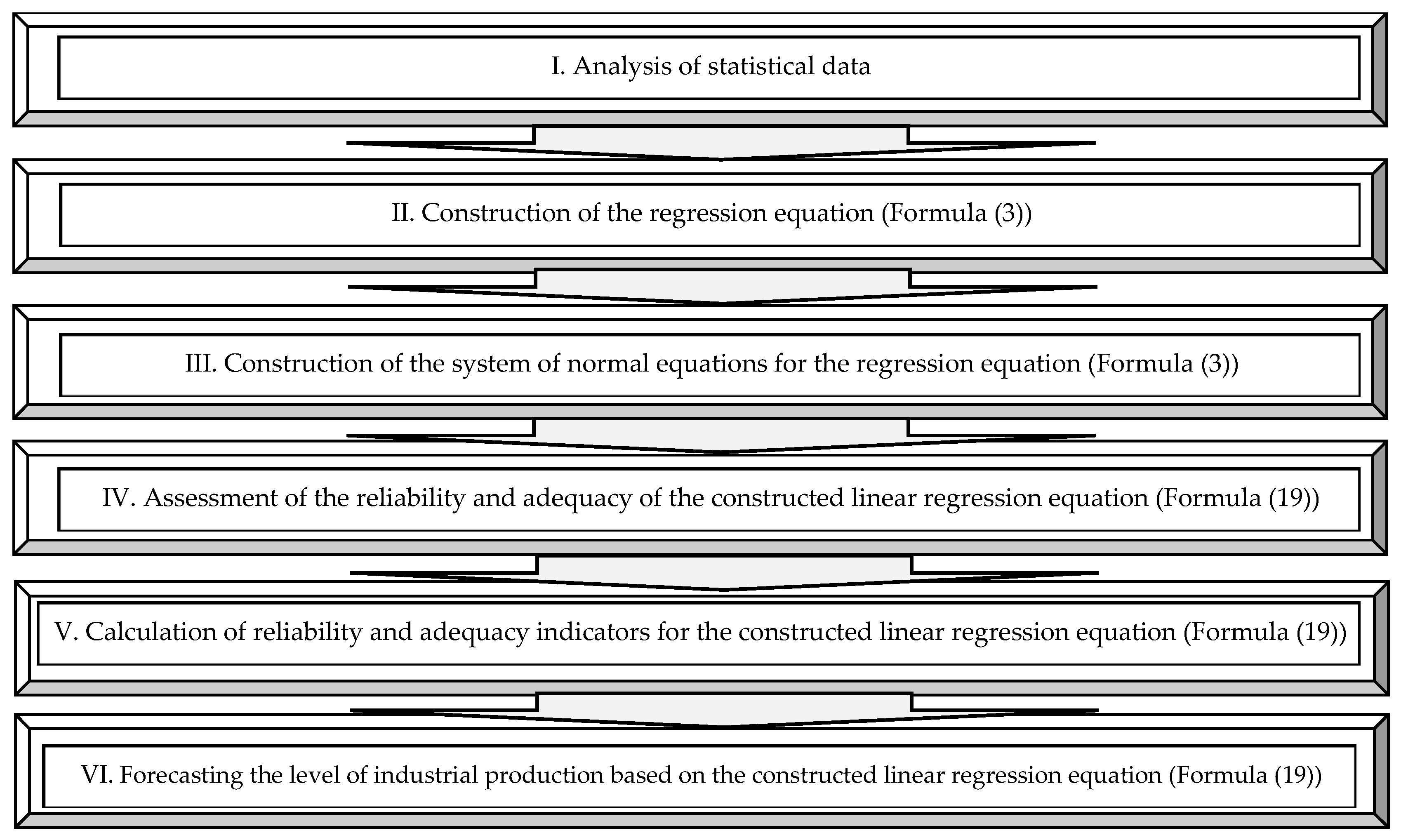

The algorithm for calculating the IBCI in accordance with EU requirements is presented in

Figure 4.

The next indicator used to assess the relationship between business expectations and the actual dynamics of production is the Industrial Production Index (IPI). This index is also referred to as the industrial production index or index of industrial output. The calculation of the IPI is based on a methodology that determines a weighted average using the distribution of value added across different types of industrial activities for specific industrial products. The base year is 2016. The index is calculated monthly relative to the average monthly value of the base year using the Laspeyres formula. Based on this index, indices are derived for the previous month, the corresponding month, and the same period of the previous year. The Laspeyres formula is as follows [

70]:

where p

1, p

0—prices of goods at the beginning of the year and in the base period, respectively; q

0—quantity of goods in the base period.

The statistical observations cover business entities that account for at least 90.0% of industrial production volume and the total volume of products sold within the industrial sector. Both the Industrial Production Index (IPI) and the Industrial Business Confidence Indicator (IBCI) are calculated based on statistical data from the State Statistics Service of Ukraine for territories under Ukrainian control; data from temporarily occupied territories are not included in these calculations. Monthly statistical surveys include industrial enterprises of large- and medium-sized businesses with 50 or more employees, as well as enterprises established by individual entrepreneurs with fewer than 50 employees, in order to ensure the representativeness of the data [

59].

The impact of the level of IBCI (x) on the level of IPI (Y) was determined using correlation–regression analysis. Conducting correlation–regression analysis to assess the influence of IBCI on IPI involves constructing a correlation equation [

71]:

where

Yx—linear equation; a

0, a

1—parameters (coefficients) of the equation; x—influencing factor.

The unknown parameters of the regression equation (a0, a1) are proposed to be estimated using the least squares method, for which a system of normal equations is constructed. The strength of the relationship is assessed using the linear correlation coefficient. The proportion of the variation of the dependent variable (Y) explained by the influence of factors (x) included in regression Equation (3) is determined using the coefficient of determination (D). The significance of the multiple correlation coefficient (as well as the regression equation as a whole) is proposed to be evaluated through the calculation of the F-test (F). In addition to the strength of the relationship, the adequacy of regression Equation (3) for representing real processes is assessed using other relevant indicators:

sample correlation coefficient (z);

standard error (Se);

lower bound of the correlation coefficient confidence interval (rL);

upper bound of the correlation coefficient confidence interval (rU).

the method is based on testing for causality using the Granger causality approach Formulas (4) and (5);

the method examines the dynamic relationships between variables, taking into account their time lags ARDL (Formula (6))/VAR (Formula (7));

stationarity tests within the context of the overall diagnostic methodology (ADF (Formula (8)), KPSS and DW (Formula (9)));

tests for autocorrelation (Breusch–Godfrey) (Formulas (10) and (11));

tests for heteroskedasticity (White test (Formulas (12) and (13)), Engle’s ARCH test) (Formulas (14) and (15));

tests for regression standard error (SER) (Formula (16)).

The validation of the constructed linear correlation equation in this study is carried out using the following methods. The causality between two time series is tested based on the Granger causality methodology. The essence of this methodology is that a variable (

X) is said to Granger-cause another variable (

Y) if past values of

X contain information that helps predict

Y beyond the information already contained in past values of

Y itself. As part of this approach, two regression models are estimated: a baseline model (without

X) and a model that includes the lagged values of

X [

71]:

extended model (without

Y):

where Y

t—current value of the dependent variable; Y

t−1—lags of the variable itself; X

t−1—lags of the variable X (tested for causality);

—random error; p, q—lag orders.

The study tests the following hypotheses: H0 (null hypothesis): X does not cause Y; H1 (alternative hypothesis): X causes Y. If H0 is rejected, it is concluded that X Granger-causes Y.

The next method investigates the dynamic relationships between variables while accounting for their time lags. Two commonly used approaches are ARDL (AutoRegressive Distributed Lag) and VAR (Vector AutoRegression). The ARDL methodology is a single-equation model used to analyze the relationship between a dependent variable and its own lags, as well as the lags of independent variables. Its utility becomes particularly evident when the data series have different levels of integration, with some variables being (I

0), and others (I

1). The ARDL model can be applied to estimate both long-run and short-run relationships. The general form of an ARDL (p, q) model is as follows [

71]:

where

—dependent variable; p, q—lag orders;

—independent variable;

—random variable.

The next method is VAR (Vector AutoRegression). VAR is a multivariate model in which all variables are treated as endogenous. Each variable is modeled as a function of the lags of all variables in the system, including its own lags. Importantly, VAR does not require a priori classification of variables into dependent and independent categories. The general form of the VAR model is as follows [

71]:

where

—vector of variables of dimension;

—coefficient matrix of dimension;

—vector of random errors.

In the subsequent analysis, the study employs statistical model diagnostics to verify whether the fundamental assumptions of the constructed models are satisfied, including stationarity, absence of autocorrelation, and the stochastic properties of residuals. Specifically, stationarity is tested using the ADF (Augmented Dickey–Fuller) test, which examines the presence of a unit root in a time series, indicating non-stationarity or instability. The null hypothesis is tested (H

0)—the series has a unit root—non-stationary; alternative hypothesis (H

1)—the series is stationary (no unit root). The ADF test is estimated using the following equation [

71]:

If p-value < 0.05, the null hypothesis (H0) is rejected—the series is stationary; if p-value > 0.05, the null hypothesis (H0) is not rejected—the series is non-stationary.

The next method is the KPSS (Kwiatkowski–Phillips–Schmidt–Shin) test for stationarity. This approach provides an alternative means of testing for stationarity, employing a different formulation of hypotheses compared to the ADF test, particularly with a distinct null hypothesis (H0)—the series is stationary; alternative hypothesis (H1)—the series is non-stationary (has a unit root). If p-value < 0.05, H0 is rejected—the series is non-stationary; if p-value > 0.05, H0 is not rejected—the series is stationary. When ADF and KPSS tests yield consistent results, the conclusion is more reliable; if the results conflict, further investigation is required.

The next method is the Durbin–Watson (DW) test for residual autocorrelation. This test examines the presence of autocorrelation in the residuals of a regression model, specifically of the first order, and is calculated using the following Formula (9) [

71]:

where e—model residuals.

The Durbin–Watson (DW) statistic is interpreted as follows: a value of 2 indicates no autocorrelation, which is the ideal case; values less than 2 suggest the presence of positive autocorrelation, while values greater than 2 indicate negative autocorrelation. In practice, DW values between 1.5 and 2.5 are generally considered acceptable.

The following Breusch–Godfrey model enables the assessment of autocorrelation in the residuals. It tests the hypotheses: H

0—the null hypothesis (no autocorrelation in the residuals of order

); (H

1)—the alternative hypothesis (autocorrelation exists in at least one of the lags). The Breusch–Godfrey model is specified as follows [

71]:

where

—the independent variables are those from the original model, and

denotes the number of lags being tested.

Next, the KM (Lagrange Multiplier) statistic is calculated using the following Formula (11) [

71]:

where

—the coefficient of determination from the auxiliary regression; n—the number of observations.

Next, the statistics are compared with the critical value (x2) at degrees of freedom. If , the null hypothesis (H0) is rejected, indicating the presence of autocorrelation; if , no autocorrelation is detected.

The next model is the White test, which assesses the presence of heteroskedasticity in the model (i.e., whether the variance of the residuals is constant) using the following Formula (12):

The above model tests the following hypotheses: H

0—the residuals have constant variance (homoskedasticity); (H

1)—the residuals exhibit varying variance (heteroskedasticity). The model includes the independent variables, their squares, and cross-products, thereby assessing the “general form of heteroskedasticity”, and the corresponding test statistic is calculated using the following Formula (13) [

71]:

where R

2—coefficient of determination from the auxiliary regression; df—number of regressors.

Interpretation of the model: if , the null hypothesis (H0) is rejected, indicating the presence of heteroskedasticity; if , the residuals’ variance is constant.

The ARCH test (Engle’s ARCH test) detects serial dependence in the variance of the model’s residuals. The hypotheses are as follows: H

0—no ARCH effect (the residual variance does not depend on past residuals); H

1—an ARCH effect is present (conditional heteroskedasticity exists). This method uses the residuals obtained from the regression model [

71]:

Next, the equation is tested as follows [

71]:

Interpretation of the model: if , an ARCH effect is present; if , no ARCH effect is detected.

The next method for assessing the reliability of a fitted linear regression equation is the Standard Error of Regression (SER), which measures the average deviation of observed values from the regression line, i.e., the root mean squared deviation of the residuals. It indicates how much, on average, the actual values (

) deviate from the predicted values (

). The formula for the standard error of regression is as follows [

71]:

where

—sum of squared residuals;

—number of observations;

—number of independent variables;

—actual value;

—predicted value.

The smaller the SER, the better the model fits the data; conversely, a large SER indicates substantial prediction errors, suggesting that the model has poor explanatory quality.

The algorithm for identifying the IBCI on the level of IPI is presented in

Figure 5.

The adequacy and reliability of the constructed correlation–regression equation (Formula (3)) for determining the IBCI on the level of IPI were assessed using MS Excel. The F-test and its critical value were calculated using functions from the statistical tools available in MS Excel.

In forecasting the Industrial Production Index (IPI), a trend analysis approach was employed. The rationale for choosing trend analysis under the given conditions is as follows. First, the war has created a context of high volatility, characterized by frequent fluctuations in prices, business sentiment, and other economic indicators. In contrast, other forecasting methods—such as the ARIMA (AutoRegressive Integrated Moving Average) model—require statistical stationarity of the data, that is, the stability of the time series structure. The method applied in this study accommodates structural breaks and enables the identification of an overall trend even under unstable wartime conditions. In other words, it can be effectively used in systems where external shocks (such as military events) cause short-term deviations, while the underlying dynamics remain intact. Moreover, the indicator used in the study—the Industrial Business Climate Index (IBCI)—is based on subjective assessments derived from survey data, which tend to change more rapidly than real economic indicators. This analytical approach allows for the comparison between changes in IBCI and IPI values, thereby making it possible to identify the lag in the industrial sector’s response to shifts in business sentiment. It is also important to note that, due to the ongoing Russian–Ukrainian war, statistical data are often incomplete, irregular, and at times distorted—owing to factors such as territorial occupation, population displacement, relocation of organizations, and the loss of infrastructure and enterprises. Therefore, even under such conditions, trend analysis applied to incomplete time series provides satisfactory forecasting results. Furthermore, the trend captures the “underlying trajectory” of the economic system, which persists even amid external shocks such as war.

In forecasting the IPI values, linear regression based on the Ordinary Least Squares (OLS) method was applied, which enabled the estimation of both the direction and the magnitude of changes in the corresponding data series [

71] (Formula (17)):

where

—is the value of the indicator at time

(e.g., month, quarter, or year); a

0—the initial level (the intercept term of the equation); b—trend coefficient (rate of change);

—random error.

The assessment of statistical uncertainty is proposed to be conducted using Student’s

t-distribution for constructing the confidence interval [

71] (Formula (18)):

where

—the quantile of Student’s

t-distribution with the corresponding degrees of freedom; S—the standard error of the forecast at point

, which accounts for data variability and the distance from the mean value of t.

4. Results

This section analyzes the IBCI averaged across the EU-27 countries; it visualizes the IBCI data for the first quarter of 2025 for countries including Belgium, Bulgaria, Denmark, Germany, Estonia, Ireland, Spain, France, Italy, Latvia, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovenia, Slovakia, Iceland, and Norway; examines Ukraine’s IBCI for 2015–2025 on a monthly basis and compares it with EU-27 data; analyzes the Manufacturing Purchasing Managers’ Index of selected countries for the period January 2023–May 2025; evaluates the Business Activity Expectations Index in Ukraine, particularly in the industrial sector, for 2019–2025; provides an example of calculating the IBCI based on production volume and order volume; analyzes Ukraine’s IBCI for 2020–2024; investigates the IBCI on the IPI; constructs a correlation–regression equation for the effect of IBCI on the IPI; and forecasts this relationship for 2026–2030.

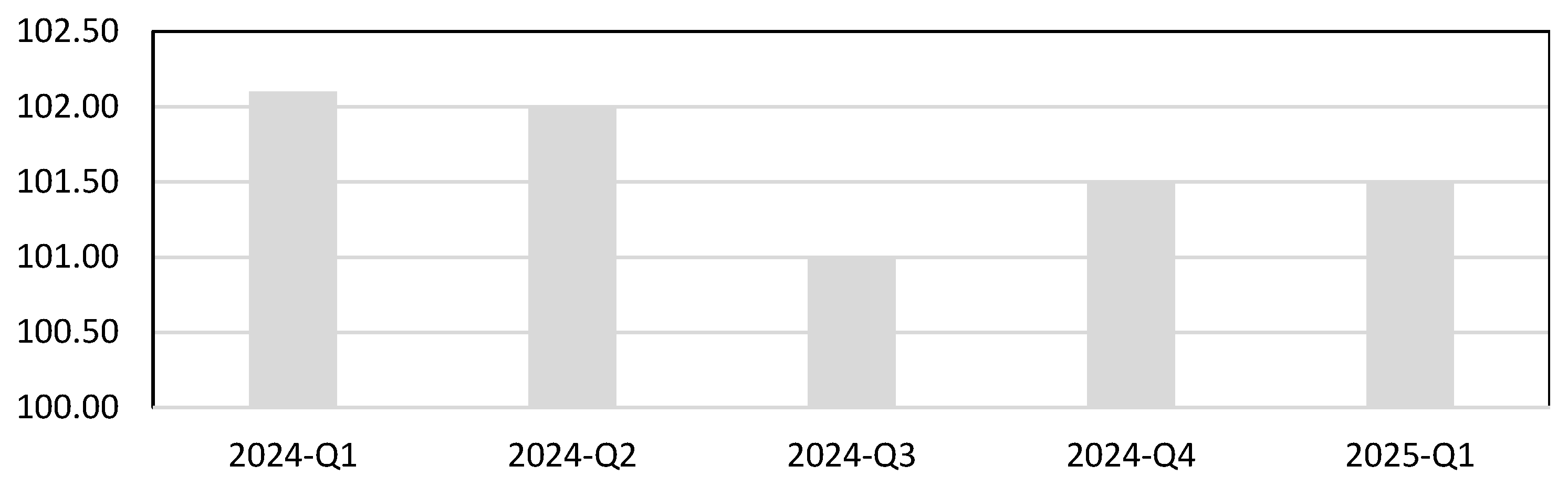

4.1. Analysis of Industrial Statistics

Contemporary global trends in the industrial sector are unstable and influenced by both internal and external factors. Currently, global factors affecting the world economy, particularly industrial production volumes, include wars and trade conflicts. Since 2025, the United States has imposed import tariffs on products and services from many countries, including China, Canada, European nations, South American countries, and the Global South in general. In response, other countries have implemented tariffs on U.S. goods and services. This has caused a trade shock, resulting in instability in international trade relations, particularly affecting the supply of energy resources to global markets. The Industrial Production Index (IPI) in EU countries is shown in

Figure 6.

Starting from Q2 2024, the IPI across the EU-27 began to decline, reaching 101.5% in Q4 2024 and Q1 2025, which is 0.6 percentage points lower compared to Q1 2024. IPI values for individual EU countries are presented in

Figure 7. In

Figure 7, IPI values below 100% are marked in red and orange, while those above 100% are shown in green and light green. Analysis of the IPI by country shows that in Q1 2025 the highest IPI levels were recorded in Denmark (110.3%), Greece (109.0%), Iceland (105.4%), and Finland (104.9%). Countries with an IPI below 100% (indicating a decline) included Belgium (99.6%), Bulgaria (92.7%), the Czech Republic (95.9%), Estonia (93.3%), Hungary (96.5%), Latvia (98.2%), Lithuania (98.7%), and Poland (98.2%).

Comparing Q1 2025 with the same period in 2024, the IPI declined in Austria by 1.9 percentage points, in Belgium by 1.7 p.p., in the Czech Republic by 1.9 p.p., in Estonia by 3.4 p.p., in France by 0.2 p.p., in Germany by 0.4 p.p., in Hungary by 0.3 p.p., in Iceland by 0.8 p.p., in Lithuania by 0.2 p.p., and in Poland by 0.9 p.p. During the same period, the industrial index increased in Greece by 1.4 p.p., in Denmark by 1.9 p.p., in Ireland by 2.6 p.p., in Italy by 0.3 p.p., in Latvia by 1.9 p.p., and in Norway by 2.2 p.p.

At the end of Q4 2024, the highest IPI levels were recorded in the following countries: Denmark—109.5%; Cyprus and Greece—108.5%; Ireland—107.6%; Norway—107.4%; the Netherlands—106.0%; Iceland—105.7%; Malta—104.5%; Italy—103.8%; France—102.4%; Finland—101.7%; Austria—101.6%; Germany—100.8%; Luxembourg—101.1%; Belgium—100.0%. Declines were observed in Bulgaria—92.5%; Czech Republic—95.9%; Estonia—95.5%; Hungary—97.3%; Latvia—94.4%; Lithuania—98.9%; and Poland—98.5%.

The main well-known factors contributing to the decline in the Industrial Production Index include, in particular, weak external and domestic demand resulting from the slowdown of the global economy in 2024–2025, which has reduced demand for industrial goods from the EU and consequently lowered export volumes; high interest rates and expensive credit, which have constrained investment financing in the industrial sector; energy prices in EU countries that remain somewhat higher than in, for instance, Asian or U.S. markets, thereby rendering certain industries—such as metallurgy, chemicals, and machinery—less competitive; and geopolitical instability and related risks for EU countries, particularly stemming from the ongoing Russian–Ukrainian war.

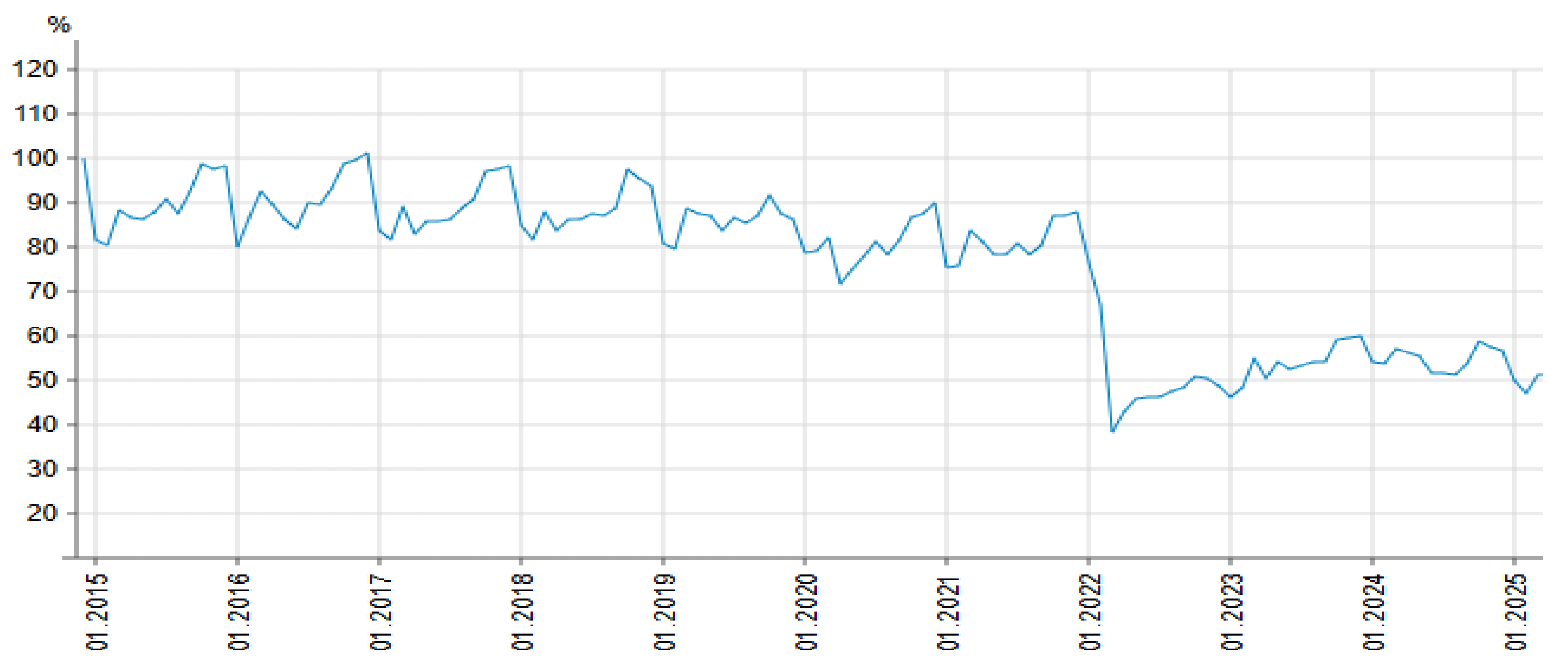

In Ukraine, the cumulative dynamics of the IPI for the period 2015–2025 are presented in

Figure 7.

The information presented in

Figure 7 demonstrates a declining trend in industrial production volumes in Ukraine compared to 2015. Specifically, as of January 2016, the IPI decreased by 20% relative to January 2015, reaching 80%. During the period from January 2017 to January 2020, the IPI remained largely stable, although it occasionally rose to 90% of the base value in economically active months. Military actions in Ukraine caused a significant reduction; for instance, in February 2022, the index fell to approximately 38% of the January 2015 level. By January 2025, the index had recovered slightly to around 50%, indicating that by early 2025, Ukraine’s industrial production had halved compared to 2015. Monthly dynamics of the IPI for 2010–2025 are presented in

Table 1.

The least productive month for industrial production is January, when business activity, as in many countries worldwide, declines due to the beginning of the year and New Year holidays. Overall, on an annual basis, the IPI experienced growth in 2010–2011, 2016, 2020, and 2023. In 2024, compared to 2023, the index fell to 93.9%, representing a decline of 6.1 percentage points. Annual data depict a pattern similar to that observed in certain EU countries such as Bulgaria, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, and Poland. However, when compared to a base year like 2015, the situation in Ukraine is much less favorable, as industrial production volumes have halved. Considering consumer price indices alongside this comparison makes the situation even more critical. According to [

72], for the first three months of 2025 (cumulative), Ukraine faced a critical situation in the production of computers, electronics, and optics—49.8%; repair and installation works—65.9%; coke and petroleum products—66.4%; gas production and distribution—70.8%; production of other transport equipment—77.8%; oil and gas extraction—77.7%; manufacturing of fabricated metal products, machinery, and equipment—80.0%; coal mining—89.0%; and extractive industry—82.0%. At the same time, industrial output increased in sectors such as electrical equipment, leather and other material products—150.0%; motor vehicles—128.1%; pharmaceuticals—114.0%; beverages—112.1%; wood products—110.0%; and rubber, plastics, and other non-metallic products—108.1%. Thus, the main factors behind the decline in Ukraine’s Industrial Production Index during 2015–2025 include: the loss of several key industrial regions since 2014; the full-scale Russian–Ukrainian war, which has led to the destruction of industrial facilities and severe logistical disruptions; persistent challenges in economic modernization and investment attraction, despite substantial volumes of foreign assistance primarily directed toward supporting Ukraine’s social sector; and massive military attacks on the energy infrastructure, among other factors. This situation underscores the need to identify reserves for increasing industrial production volumes, with raising the level of business confidence being a key potential lever.

4.2. Analysis of the Impact of the Business Confidence Indicator

An important indicator that allows assessing the stability and activity of business development globally, including in Ukraine, is the Purchasing Managers’ Index. This index enables the analysis of economic development trends, its cyclical nature, and the forecasting of potential periods of expansion or contraction.

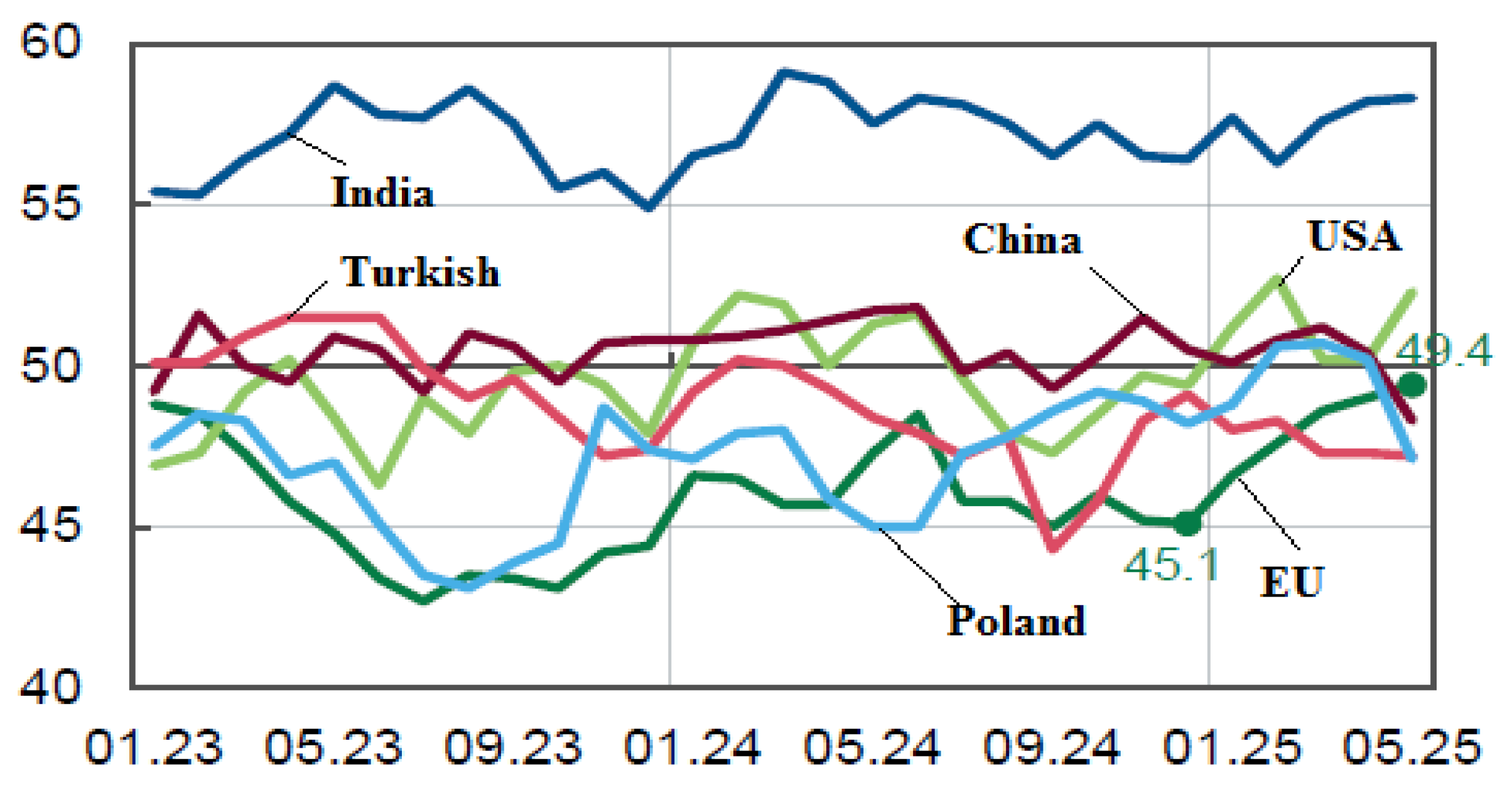

Figure 8 presents the Purchasing Managers’ Index, which characterizes the development of the manufacturing sector in selected countries worldwide.

Based on the manufacturing Purchasing Managers’ Index shown in

Figure 8, it is evident that between January 2023 and May 2025 the manufacturing sector in the countries mentioned developed unevenly. The most unstable development occurred in the EU countries, where during this period the index fell below 50%, indicating that the overall economy of the EU-27 entered a recessionary cycle. However, starting from January 2025, the Purchasing Managers’ Index level began to rise from 45.1% to 49.4% by 2025. The highest and relatively stable Purchasing Managers’ Index levels were recorded in India, reaching 58.0% in 2025, which is 8.6 percentage points higher than the average for EU member states. Although the index in India is approaching 60.0%, indicating a potential overheating of the economy that may trigger inflation. The most optimal development in terms of this indicator is observed in India and Turkey, which maintain steady growth in economic activity.

In Ukraine, numerous indicators are employed to measure business activity, including: the Industrial Business Confidence Indicator (IBCI); confidence indicators in construction, retail trade, and services; the Industrial Business Climate Indicator; the Economic Sentiment Indicator; the Business Expectations Index; the Business Activity Expectations Index; the Index of Expected Changes in the Financial and Economic Situation at the Enterprise Level and in Agriculture; the Business Expectations Indicator; and the Business Barometer. The primary compilers of these indices are the State Statistics Service of Ukraine and the National Bank of Ukraine. A comparison of the overall trends reflected in

Figure 8 with the corresponding indicator (Business Activity Expectations Index) is presented in

Table 2.

Over the period 2019–2024, the Business Activity Expectations Index in Ukraine remained below the threshold of 50.0% and demonstrated a downward trend, declining from 47.8% in 2019 to 45.9% in 2024, i.e., a decrease of 1.9 percentage points. This indicates a contraction in industrial production volumes. The trend is particularly evident in the following components:

production volume—decreased by 4.0 p.p. over the period;

volume of orders for production—increased by 1.3 p.p.;

volume of new export orders—decreased by 7.0 p.p.;

volume of unfinished production—decreased by 6.7 p.p.;

stock of finished goods—decreased by 2.9 p.p.;

inventories of raw materials and supplies—decreased by 5.0 p.p.;

prices for raw materials and supplies—decreased by 17.7 p.p.;

prices of domestically produced goods—increased by 12.6 p.p.;

total number of employees—decreased by 1.2 p.p.

Among the structural elements of the IBCI, only the prices of domestically produced goods exhibited positive growth, while the others either remained relatively unchanged or moved in a negative direction.

The article focuses on the IBCI, which is calculated using a somewhat different methodology as outlined above. An example of calculating the IBCI balance based on two indicators—production volume and volume of production orders—is presented in

Table 3 for the period June 2024 to September 2024. The sample comprises 1102 Ukrainian enterprises.

According to the survey of Ukrainian enterprises [

74], the volume of production has remained practically unchanged, with 52.0% of respondents emphasizing this point. An increase in production volumes was reported by 22.0% of enterprises, while a decrease was indicated by 26.0%. Consequently, the balance change equals “minus” 4.0 p.p. (percentage points) (26.0 − 22.0). The dynamics of industrial business confidence indicators are presented in

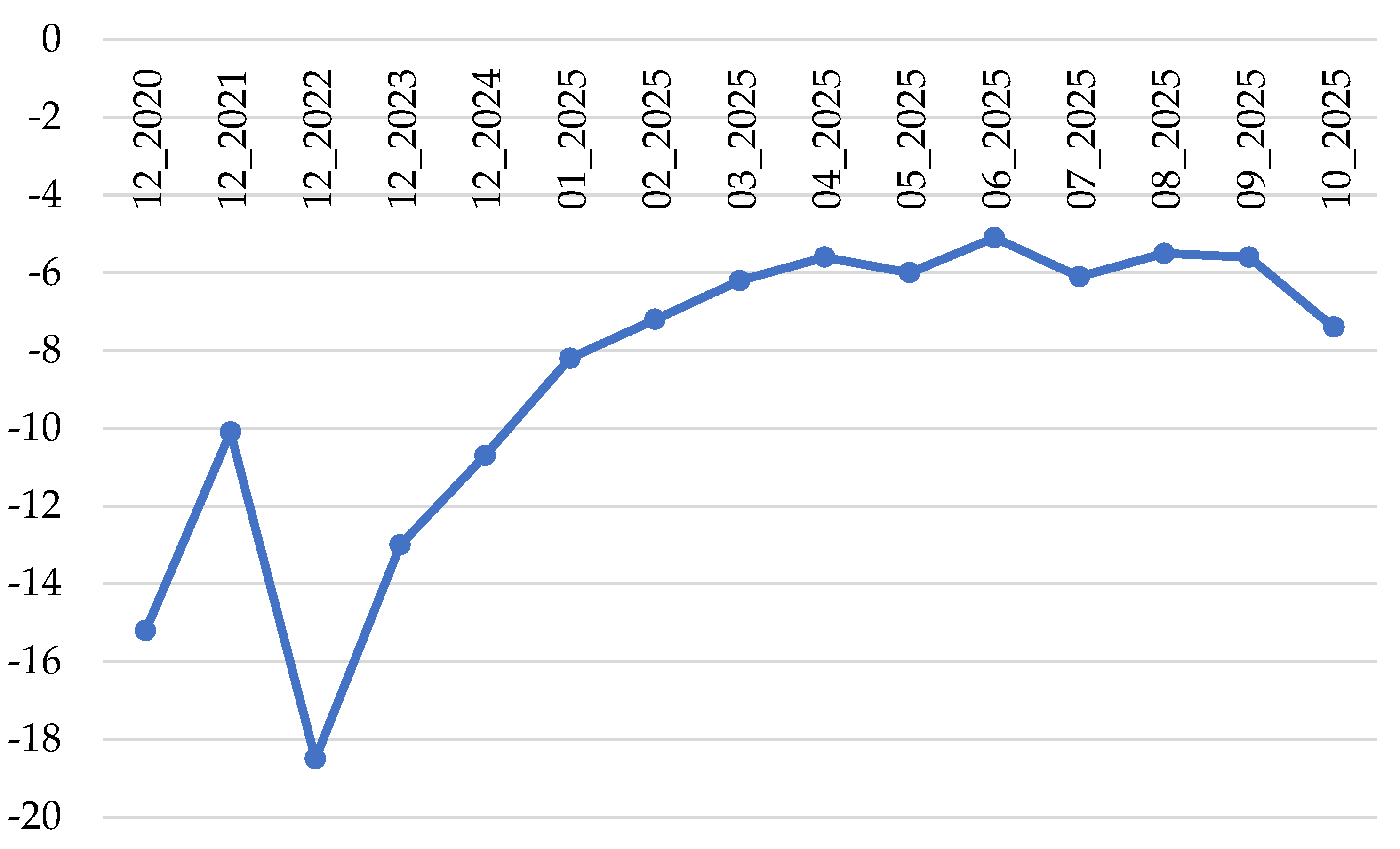

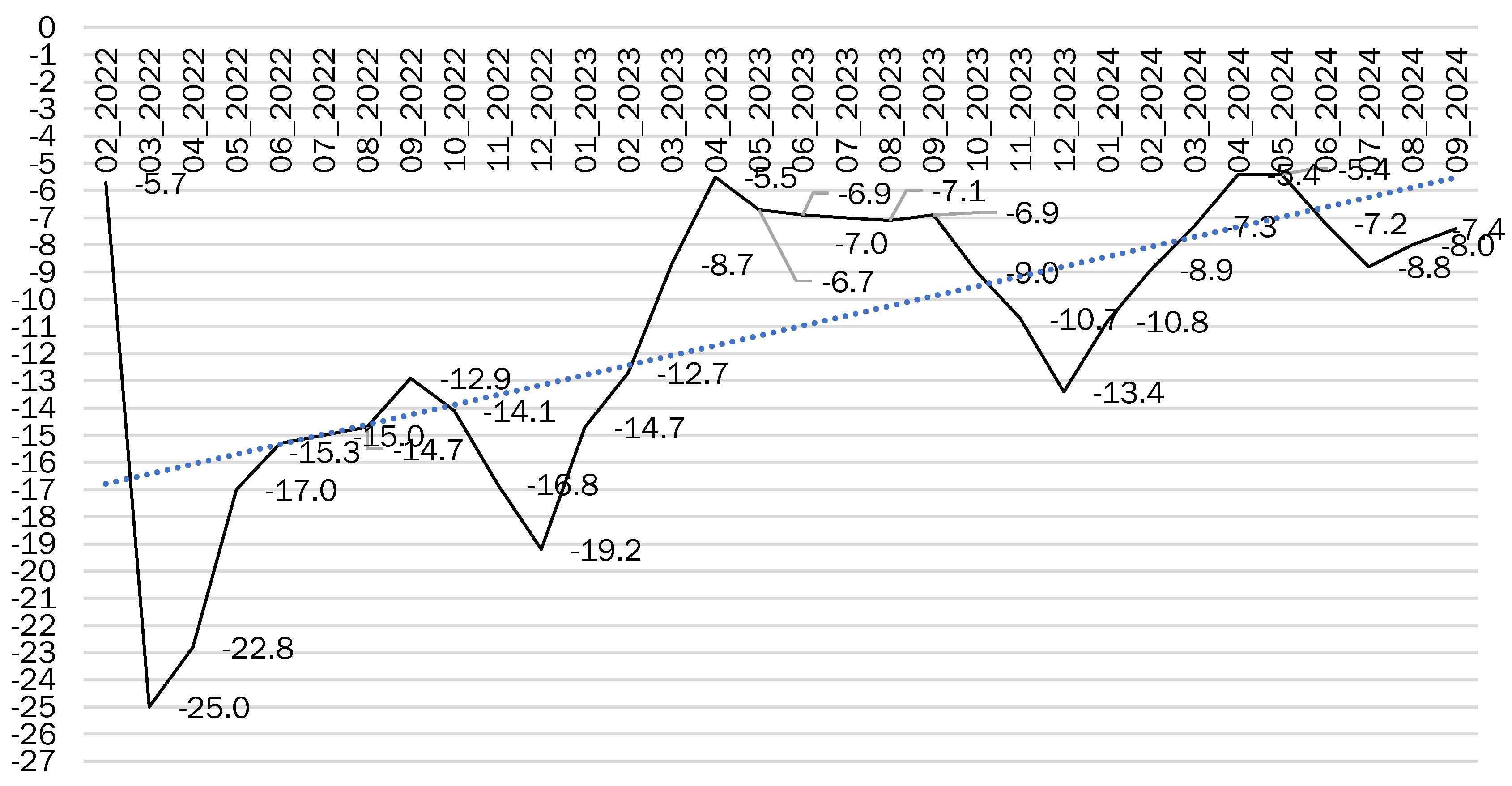

Figure 9.

Figure 9 presents the IBCI in Ukraine’s industry for the period 2020–2025. The reported values exhibit a wave-like pattern [

75]. Respondents expressed a rather pessimistic level of business confidence throughout 2020–2024. The most negative business sentiments were recorded in 2020 and 2022. The underlying reasons include the global spread of the COVID-19 pandemic, particularly in Ukraine, as well as the war in Ukraine [

76]. Following the end of the pandemic and the subsequent recovery of the global economy from 2021, together with encouraging signals regarding a potential resolution of the war in Ukraine, the IBCI became somewhat more optimistic. Nevertheless, during the period 2020–2024, surveyed respondents did not provide sufficiently positive assessments to allow IBCI—both for industry as a whole and for its individual sectors—to cross the zero mark on the corresponding graph.

According to

Figure 9, as of September 2024, the IBCI increased by 0.6 percentage points compared to August 2024, reaching a value of −7.4%, while in the manufacturing sector it decreased by 0.1 percentage points to −8.1%. An analysis of the IBCI balance for September 2024 shows that the volume of industrial production amounted to −4; the volume of industrial production orders (demand) stood at −40.0; the assessment of current foreign orders for industrial production (export demand) was −28 p.p.; and the evaluation of current inventories of finished goods was −9 p.p. It is important to note that only 1% of industrial enterprises (out of 1102 surveyed) reported that it was easy to ensure the future development of their business situation, while 3% stated it was relatively easy. In contrast, 54% of respondents assessed this task as rather difficult, and 42% as difficult. Thus, the IBCI in September 2024 reflected predominantly pessimistic expectations regarding the development of business conditions in the industrial sector.

4.3. Impact of the Business Confidence Indicator on the Industrial Production Index

To investigate the IBCI on the IPI, a correlation–regression analysis was conducted, involving the construction of regression equations (Formula (3)) and summarizing the results in

Table 4.

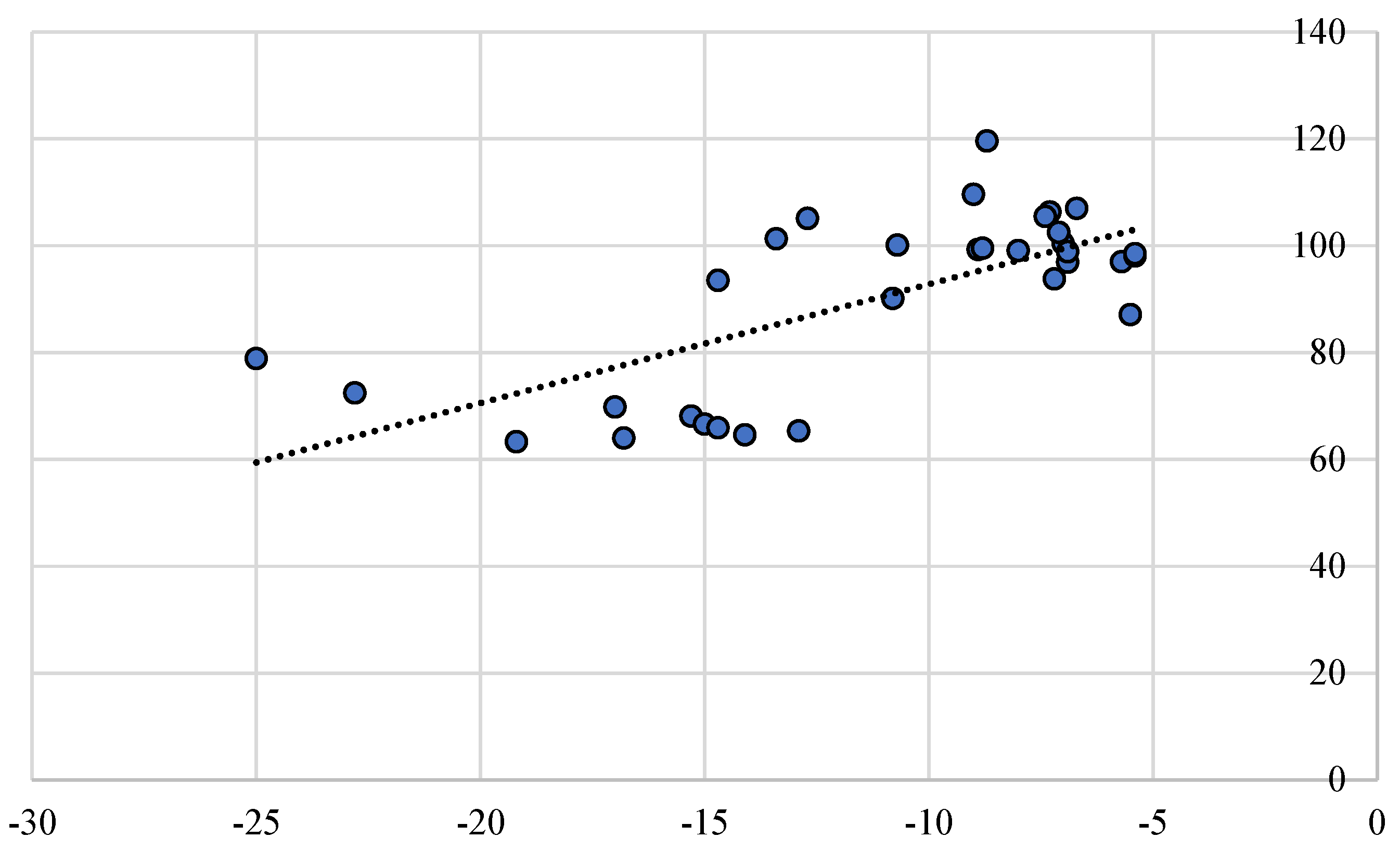

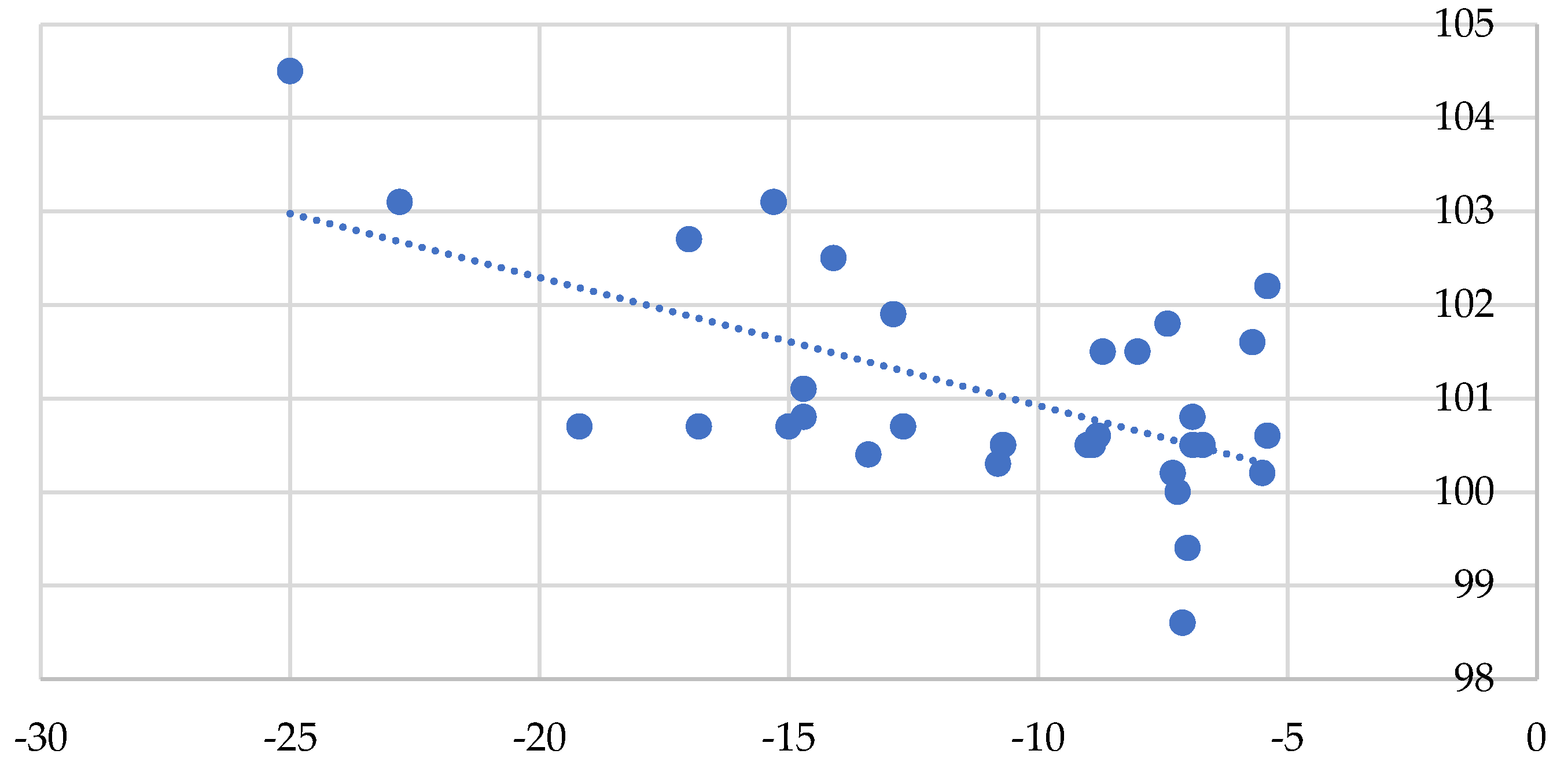

To provide visual support for the regression equation, a graph (

Figure 10) was constructed to display the statistical data IBCI and IPI.

As shown in

Figure 10, the mathematical function appears linear, taking the form of a straight-line equation.

Based on the conducted correlation–regression analysis (using the data from

Table 4), a correlation–regression equation was constructed:

The constructed correlation–regression equation (Formula (19)) is characterized by the following parameters: ; ; the Fisher coefficient () exceeds the critical (tabular) value (), i.e., ; ; ; ; ; .

Thus, the conducted correlation–regression analysis revealed a strong positive linear relationship between industrial enterprises’ business expectations (IBCI) and actual production volumes (IPI) (

). It was established and statistically confirmed that, with an increase of 1 percentage point in positive business expectations—holding other influencing factors not included in the model constant—there is a tendency for production activity in the manufacturing sector to increase by 2.23 index points. The calculated coefficient of determination (

) indicates that approximately 49% of the variation in industrial production levels can likely be explained by changes in business expectations. The results of diagnostic tests for evaluating the constructed linear correlation (Formula (19)) are presented in

Table 5.

Moreover, the Granger causality test indicated, given the positive slope in the baseline regression, a likely rejection of in favor of IBCI influencing IPI; reverse causality may be weaker or absent (actual -value depends on the full sample). The ARDL model demonstrated that the long-run coefficient (from cointegration) , consistent with the +2.23 effect. The VAR model suggested that a positive shock in IBCI increases IPI over a horizon of several months. The estimated parameters of the linear correlation model (; ; ; ) confirm a positive and statistically significant relationship between IBCI and IPI. Methodologically, it is expected that the Granger test detected causality from IBCI to IPI, while ARDL and VAR models highlight both short- and long-term positive effects.

Let us attempt to apply a multifactor regression model by introducing an additional factor—the Consumer Price Index, % (CPI) (

) (Formula (20)):

To this end, we analyze the model factors

and

for multicollinearity between IBCI (

) and the CPI (which reflects the level of inflationary pressure directly affecting production losses, price expectations, and business sentiment) (

). The data are summarized in

Table 6.

To provide visual support for the analysis of multicollinearity between the model factors

and

(Formula (20)), a graph was constructed (

Figure 11).

Based on the conducted correlation–regression analysis (using the data from

Table 6), a correlation–regression equation was constructed (Formula (21)):

The constructed correlation–regression equation (Formula (21)) is characterized by the following parameters: ; ; the Fisher coefficient () exceeds the critical (tabular) value (), i.e., ; ; ; ; ; . Therefore, there exists an economically meaningful relationship between and .

We assess the correlation between the two independent variables,

and

, using the Pearson correlation coefficient (Formula (22)):

In our case (Formula (23)):

Thus, since

, this indicates a moderate level of correlation, suggesting potential multicollinearity. Moreover, the points on the graph (

Figure 11) do not exhibit sufficient dispersion. Therefore, the multifactor regression model (Formula (20)) incorporating the additional factor—the Consumer Price Index—was not constructed.

This indicates that and are interdependent, exhibiting an average level of collinearity. Consequently, it is difficult to construct a multifactor linear regression model to determine the influence on IPI of factors other than IBCI that are available in the statistical data. Other statistical data, aside from the CPI indicator (for corresponding periods), are not available in the statistical databases, including those of the State Statistics Service of Ukraine. Therefore, the CPI factor cannot be introduced into the above model, as doing so may increase the standard error of the coefficient estimates, alter the signs or magnitudes of the coefficients, and impair the economic interpretability of the model.

According to the constructed correlation–regression equation, the level of IPI depends on the IBCI agents by 49.0%, all else being equal, while the remaining 51.0% of the influence is determined by other factors. This equation indicates that the effect is positive and directly proportional. That is, a 1.0% increase in the IBCI of Ukrainian enterprises is associated with a 2.23% increase in the level of IPI. The constructed correlation–regression equation allows for forecasting changes in IPI depending on the level of IBCI. The results of the conducted regression analysis and the construction of the linear regression equation, along with the calculated statistical indicators confirming its reliability, provide the basis for forecasting IPI levels up to 2030. This enables the development of an economic model for medium-term forecasting of the industrial sector, specifically for Ukraine under wartime conditions.

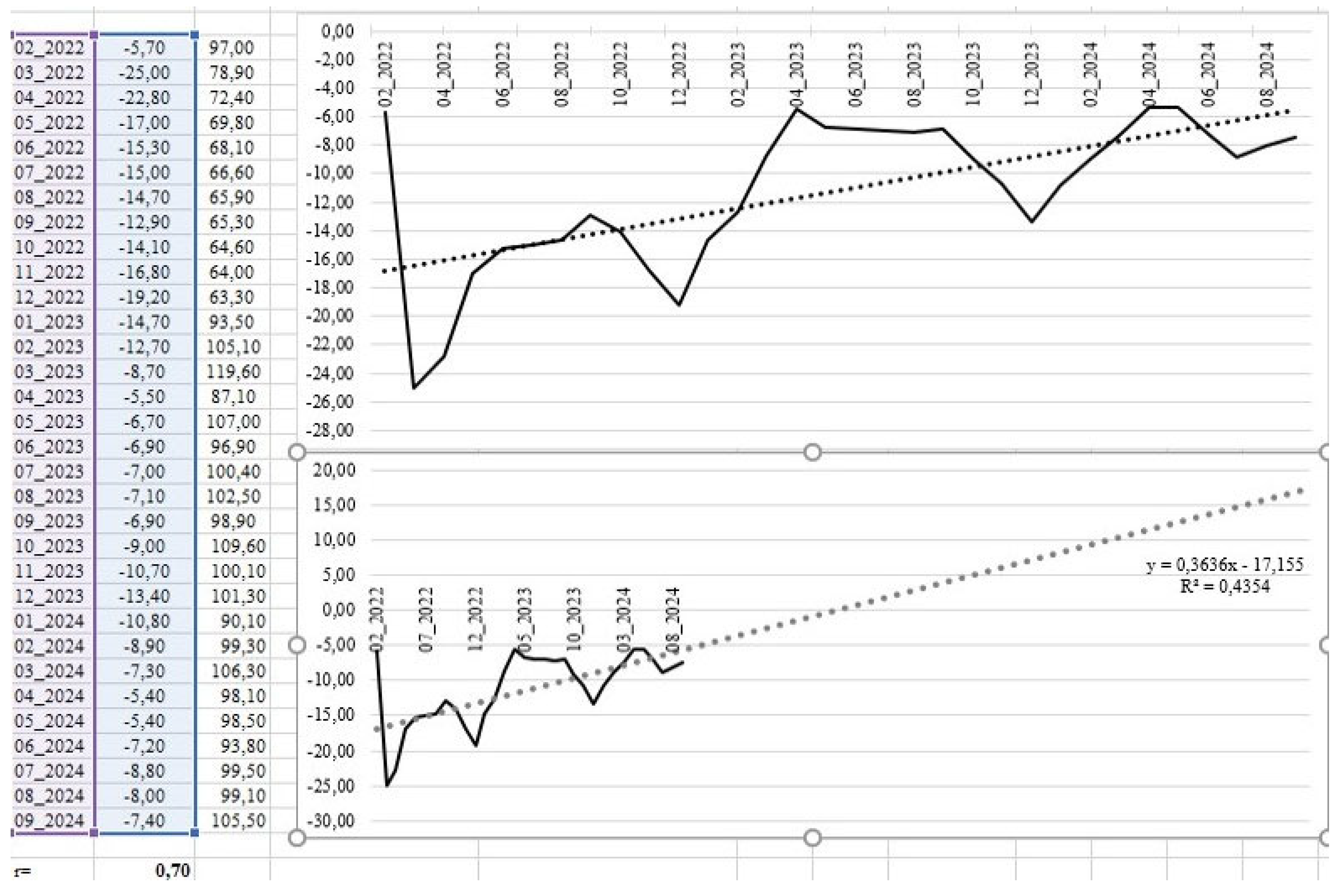

To determine the predicted value of the indicator

, the method of approximation or trendline construction using MS Excel was applied (

Figure 12).

Assuming the continuation of existing trends and based on the trendline constructed in

Figure 12, the probable values of the IBCI at the beginning of the year were estimated. For greater clarity, a graph of the forecasted IBCI data is presented, constructed using the Ordinary Least Squares (OLS) method, which allowed for the estimation of the direction and magnitude of changes in the series. To assess statistical uncertainty, Student’s

t-distribution was used to construct a confidence interval, taking into account data variability and sample size. The trend equation for forecasting was generated using the MS Excel program (

Figure 13).

Based on the calculations, the trend equation will take the following form (Formula (24)):

The main statistical indicators of the above trend equation are as follows: mean value—–11.2; standard deviation—5.2; number of observations—32; 95% confidence interval for the mean

(–13.0, –9.3); slope—0.36, indicating a positive trend; initial value—–17.16; coefficient of determination—0.44. Thus, the trend equation reflects a tendency toward a reduction in the negative values of IBCI, indicating an improvement in this indicator over time, while the confidence interval reflects moderate statistical uncertainty. As shown in

Figure 14, the trend line can be used to forecast the level of IBCI up to 2030 and to extend the projection over a longer-term period.

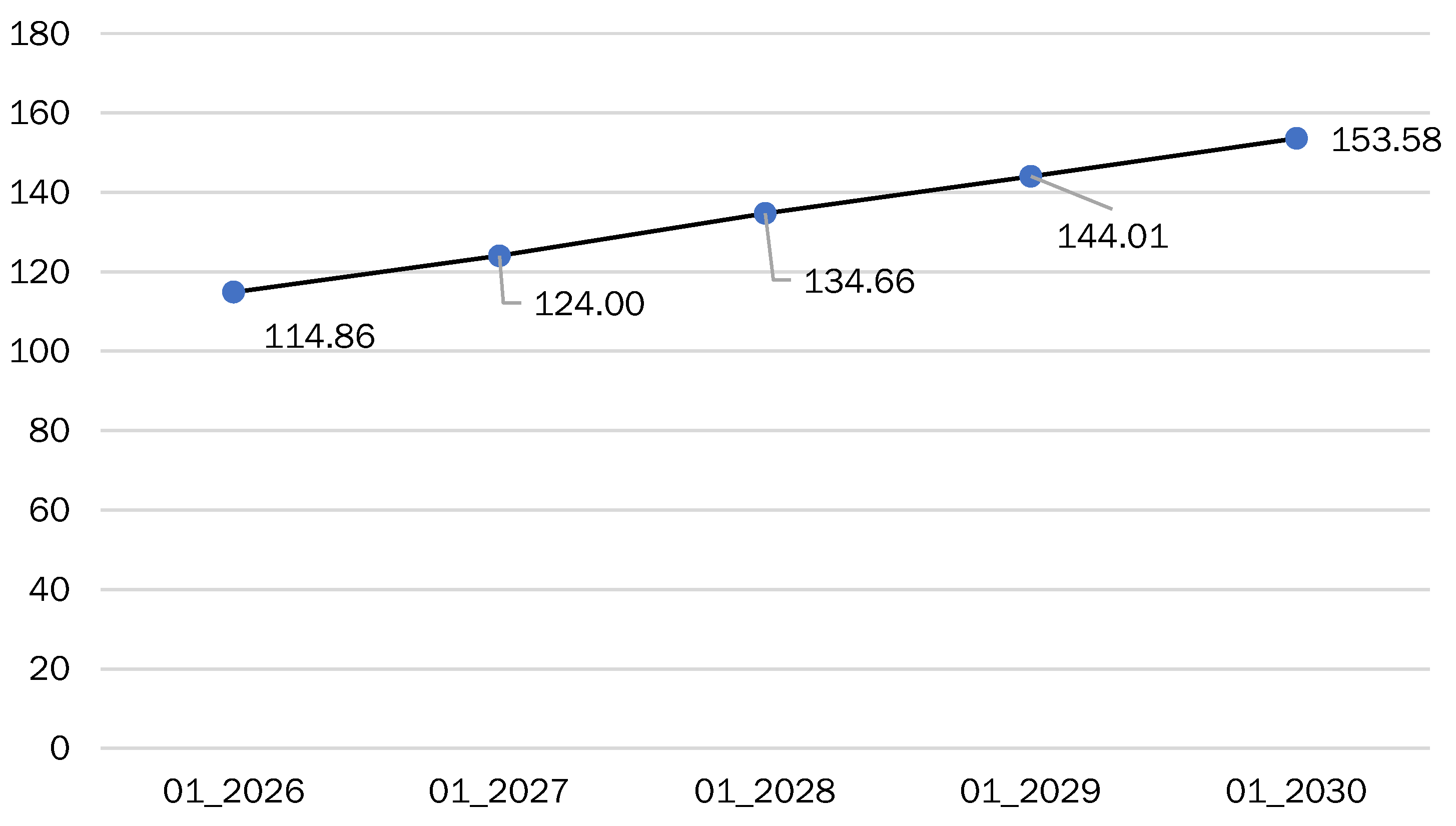

Specifically, the IBCI is projected as follows: January 2026—0.1%; January 2027—4.0%; January 2028—8.8%; January 2029—13.0%; January 2030—17.3%. The forecasted values were calculated based on the trend line constructed in MS Excel. A general excerpt of the calculation on the spreadsheet is shown in

Figure 14. By drawing a perpendicular from the

x-axis to the intersection with the trend line, the above forecasted IBCI values are obtained, which are then substituted into Formula (19) to derive the forecasted IPI values. Assuming that the IPI develops according to the constructed trendline, it is hypothetically possible to determine the forecasted values of industrial production for the corresponding period using Formula (19) and the projected IBCI data for 2026–2030 (

Figure 14).

The data in

Figure 14 provide information on the probable increase in the level of IPI depending on the growth of IBCI among Ukrainian enterprises. Specifically, as of January 2026, this level is projected to reach 114.9% (assuming a forecasted IPI of −0.1%); January 2027—124% (corresponding to 4.0%); January 2028—134.7% (8.8%); January 2029—144.0% (13%); and January 2030—153.6% (based on the forecasted IPI). Thus, the projected level of IPI at the beginning of 2030 is expected, all else being equal, to increase by 63.5 percentage points compared to the beginning of 2024.

5. Discussion

This article examines how business confidence (measured using the IBCI) affects the level of production development (measured using the IPI). It demonstrates that higher levels of IBCI correspond to higher levels of IPI [

77,

78,

79]. According to conclusions drawn from the review of the literature [

1,

7,

43,

44], elements of expectations include, in particular, business expectations [

1], while its form is represented by business trust [

43].

The analysis of the business activity expectations index in Ukraine for the period 2019–2024 allowed us to conclude that, under conditions of war, pessimistic sentiments among economic agents are associated with a tendency for production levels—including production output, production order volumes, new export order volumes, work-in-progress, finished goods inventories, raw material and supplies stocks, prices of raw materials and supplies, and total number of employees—to decline, and conversely.

The importance of business expectations for further development is confirmed in subsequent studies [

32,

33,

34,

35,

36,

37,

38,

39,

40,

41,

42], which emphasize the aspects of obtaining timely and comprehensive information from both internal and external sources. It is evident that timely and reliable information [

32,

39,

41,

42] forms the foundation for businesses to make correct decisions, ultimately enabling their continued development and financial–economic stability. It is also important to highlight the role of experience [

37,

38]; the greater the experience, the more likely there are higher expectations and confidence in the effectiveness of managerial decision-making.

Therefore, in future research, it is crucial that mathematical models assessing the IBCI on IPI development take these two key factors—information and experience—into account.

Considering the form of business expectations—business trust—the analysis of the literature in this article reveals certain trends. Specifically, as macroeconomic indicators improve, the level of business trust increases. This is particularly evident in relation to: taxation and government expenditures [

45]; the state’s monetary policy [

46]; interest rates [

47]; corruption [

48]; and economic policy, including energy price regulation [

49]. Researchers argue that improvements in macroeconomic performance and the implementation of effective state economic policies promote higher levels of trust, which, in turn, enhance business expectations. Consequently, this fosters greater business confidence, particularly in terms of capital investment in the development of the economy, including industrial production.

The results obtained in this article provide partial evidence that, under conditions of war, there is a close and reliable relationship between IBCI and the development of IPI. The experimental findings presented, without accounting for external shocks, are consistent with the results of previous studies [

21,

22,

23,

24,

25,

26,

27]. These studies concluded that there is a significant interrelationship between business confidence and the development of industrial production. Furthermore, they emphasize that business sentiment constitutes a crucial foundation for production development. particularly in the industrial sector [

21,

22,

23,

24].

Moreover, the literature includes studies that argue that forecasting future economic development, particularly industrial production, based on business expectations is a questionable process [

56]. Additionally, the issue of business expectations is associated with the subjective evaluation of business processes [

57]. Some studies indicate that the challenge of accurate forecasting lies in the inherent motives and anticipations of businesses [

58], which may distort research outcomes and introduce subjectivity. Thus, certain positions remain debatable and should be taken into account in future research to provide a more objective assessment of the factors influencing industrial production development.

In this context, it is advisable for future studies to incorporate into mathematical models evaluating industrial production development key elements that shape business confidence, such as the quality of information, experience, and macroeconomic components of economic development. This approach would require the creation of an integrated system using mathematical modeling combined with artificial intelligence techniques.

The findings of this article align with previous conclusions [

21,

22,

23,

24,

25,

26,

27] that an increase in business confidence leads to higher levels of industrial production. This, in turn, enables the forecasting of real economic processes at both micro and macro levels, contributing to enhanced resilience across economic, financial, social, political, environmental, demographic, and other dimensions.

An unresolved and promising area of research is identifying commonalities between Ukraine and countries that have experienced war shocks [

77,

78]. For instance, study [

78] highlights the prolonged psychological pressure on populations—such as depression and anxiety disorders—caused by war, as seen, for example, in the Rwandan genocide, which often persists for many years after the conflict. Such mental health issues slow labor productivity growth, reduce workforce participation, and lower overall business activity [

78]. In the case of Bosnia and Herzegovina following the early 1990s war, many individuals exhibited stress reactions, psychoses, and other mental health disorders both during and after hostilities. Economic challenges were compounded by massive internal migration, infrastructure destruction, public distrust in state institutions, weak investment activity, and brain drain, among other factors [

79].

Study [

80] emphasizes that war not only causes physical harm to people but also leads to institutional degradation, increased corruption, and a decline in societal trust, which psychologically weakens motivation for investment, business creation, and production modernization. Furthermore, the study argues that a pervasive sense of danger and instability—both external and internal—impedes long-term business planning, the implementation of investment projects, the development of innovations, and the restoration of infrastructure.

Due to the war in Ukraine, an increase in anxiety, fear, and emotional stress has been observed among the population in Germany [

81,

82]. For example, the study “Mental Health in Germany in the First Weeks of the Russo-Ukrainian War” documents a significant rise in anxiety, fear, and emotional stress among the German population as a result of the war. Similar trends are evident in Ukraine itself, where heightened psychological pressure on both businesses and the general population—stemming from the war, losses, and uncertainty—may reduce productivity and investment activity.

Studies [

82] indicate that among residents of contemporary Germany, which experienced World War II, events in Ukraine have a significant psychological impact. Germans report fears of financial losses and rising prices, particularly for energy, which constitute a major source of anxiety. Businesses also face heightened uncertainty, negatively affecting the German economy, particularly its industrial sector. A similar situation exists in Ukraine, where businesses often refrain from investing or modernizing due to fears of further escalation of the war. Additional challenges include energy supply issues and socio-economic and political instability. Historical data [

82] show that Germany after World War II (1939–1945) experienced destruction of industrial and residential infrastructure, declines in production volumes, business closures, and rising unemployment. In the current context, Germany is affected by the consequences of the Russo-Ukrainian war, exacerbating energy and industrial crises. In Ukraine, industry has suffered from physical destruction, logistical constraints, labor outflows, and instability in production and investment environments. The scale of urban destruction in Ukraine surpasses what Germany experienced during the war.

Thus, the psychological impact of the war, particularly in Ukraine, represents a key factor influencing industrial activity, business confidence, and overall industrial development. This underscores the need for further research and the development of new methodological approaches for calculating indicators of economic development, especially in the production sector. Such approaches should incorporate not only economic metrics but also indicators of psychological stress, population mental health (including workers), and the level of uncertainty regarding future socio-economic, political, demographic, and other processes in Ukraine.

6. Conclusions

Studies have demonstrated that the level of IBCI, particularly business trust, based on the experience of OECD and EU-27 countries, depends on multiple factors, including macroeconomic stability at the national level and micro-level factors within organizations (such as information, experience, and capabilities). When the economy begins to recover from economic, political, environmental, or natural shocks, the level of IBCI increases. Therefore, in this study, and in line with its objectives, it became necessary to assess the dependence of IPI performance on business expectations, using Ukraine as a case study under conditions of external shocks, specifically the war of Russia against Ukraine.

A strong relationship has been established between IPI levels and IBCI (r = 0.70; D = 0.49). The constructed correlation–regression equation demonstrates statistical reliability (F = 5.303; Ft = 2.042; z = 0.86; Se = 0.45; C_95% = 1.96; rL = 0.46; rU = 0.84). The calculated correlation value indicates that, with a 1-percentage-point increase in positive business expectations (IBCI), and holding other factors not included in the model constant, IPI is expected to increase by 2.23 index points. The calculated coefficient of determination () means that approximately 49% of the variation in industrial production levels can be explained by changes in business expectations. The results of this study provide the basis for forecasting changes in industrial production at the national level depending on business confidence. This is particularly important, as future economic growth rates, especially in a key sector such as industry, will depend on the extent to which trust, expectations, and confidence among economic agents—including small, medium, and large businesses—are strengthened.

Assuming an increase in IBCI, for example, in Ukrainian industrial production in January 2027 at −0.1, the IPI is projected to reach 124.0%. Correspondingly, if the IBCI level in 2030 reaches 17.3%, the IPI is expected to be 153.6%. Thus, the results of the study indicate that IPI volumes, and the economy as a whole, will significantly depend on the level of IBCI.

Thus, the study statistically confirms the existence of a reliable positive relationship between IBCI and IPI. The positive dynamics of IBCI development are leading in nature, meaning that increases in the confidence of Ukrainian enterprises during wartime precede actual production growth. The IBCI indicator can be used as an operational tool for monitoring business economic activity, in contrast to statistical indicators, which are published significantly later and do not allow for timely and effective managerial decision-making.