1. Introduction

Recently, electronic commerce is growing at an unprecedented rate with the popularization of the Internet. More and more manufacturers compete with retailers by multi channels, consisting of indirect channels and direct channels [

1,

2,

3]. Direct channel operations have been added by a large number of manufacturers: Nike, IBM, Hewlett-Packard, and Eastman Kodak, for example [

4]. In such instances, the direct channel of the manufacturer competes with the traditional channel of the retailer; as a result, the traditional retailer ordinarily complains that the demands that are satisfied through the manufacturer’s direct channel should belong to the retailer’s traditional channel [

5]. This may result in the channel conflict, which weakens the attempts to build the cooperative relationship for channel members [

6]. Sales through the manufacturer’s direct channel dramatically cannibalize the market share and profits of the traditional retailer. Some operational strategies have been adopted (such as providing services and value-added products) by a lot of traditional retailers to strengthen their core competitiveness. As reported by the New York Times, there are roughly 42% of manufacturers reconstructing the traditional channel structures through adding direct online sales to satisfy different customer segments that are not reachable by the traditional channel, which are generating the combination channel of the traditional channel and booming the direct online channel (also called the dual-channel). The proliferation of the direct supply channel has evoked concerns about manufacturer encroachment as a hot topic of discussion [

7]. However, not all studies have found that the addition of direct channel creates conflicts, some researchers have shown that the addition of a new channel is beneficial to other channel members. For example, Arya et al. [

8] demonstrated the bright side of manufacturer encroachment. Therefore, on this basis, we study the interesting issues of whether a manufacturer opens a new direct channel in the supply chain, where green complementary products are sold, and how other channel members adopt strategies when adding an online channel into the traditional channel.

Green production has gradually become a popular and growing field due to its important role in economic and environmental sustainability. Some researchers focus on the issue of green product to reduce environment damage while maintaining profits [

9]. Now, as the laws and regulations become more and more rigorous, the organizations cannot ignore product green level. For example, the company Apple, as core designer of the product, sets the green product target, then for satisfying the target its suppliers will increase the recycling of manufacturing material and reduce the use of toxic metal. This paper mainly considers the sales of green complementary products.

The meaning of complementary products refers to when customers must buy above one product to acquire the products’ entire utility at the same time [

10], such as camera and film, memory card and mobile phone, pencils and erasers. Unlike substitutable products, the feature about the complementary products is that the sales of the products benefit from sales of each other [

11]. In that case, the demands for manufacturers’ products are interlinked in the same market. Market performance of one manufacturer would be affected by another manufacturer’s marketing decision.

The green complementary products refer to environmentally friendly complementary products, for example, a practical case of green products is about the house decoration business—when Noritz sells an energy-saving water heater, Chicago Furnace also provides environmentally friendly faucets with water-saving outlet options (Contractor Magazine. Oct 2017, Vol. 64 Issue 10, p43.). Therefore, the manufacturers of green complementary products may confront the problem of channel selection and pricing in the supply chain.

Previously, the manufacturers always are powerful in a supply chain. The power of supply chain members lies in their ability to affect the decision variables of other members [

12]. The last several decades, however, have seen the emergence of powerful retailers (also known as “dominant retailers”) like Best Buy, Walmart, and Home Depot. The rise of dominant retailers has aroused discussions about their effects on supply chain members, since dominant retailers can be dominating and tough when dealing with manufacturers [

13,

14].

In this paper, we study a supply chain which consists of a dominant offline retailer and two manufacturers (integrated manufacturer and traditional manufacturer), who sell the retailers green complementary products. The integrated manufacturer represents the manufacturer that can sell the product through two channels: the direct online channel and traditional offline channel, while the traditional manufacturer means that the manufacturer only sells product through the traditional offline channel. We examine whether the integrated manufacturer should add a new online channel and how the online entry would affect other channel members. The issue is addressed by the following questions:

Under what circumstances should the integrated manufacturer in the traditional channel add the online channel?

How should channel members make their decisions in the online and offline channels?

How does the online expansion of the integrated manufacturer in a traditional channel affect the channel members’ prices, demands, and profits?

This paper involves three streams of research: manufacturer encroachment, dual-channel/multi-channel supply chains, and complementary products. We briefly review the literature in the following three areas.

The effects of manufacturer encroachment have been widely discussed. Most of the literature indicates that manufacturer encroachment harms retailers through intensifying the channel competition [

15,

16]; however, some scholars show that manufacturer encroachment is beneficial to both the manufacturer and retailer. Chiang et al. [

5] illustrated that Pareto gains occur as the manufacturer adds a direct channel. Arya et al. [

8] demonstrated the bright side of manufacturer encroachment, which benefits the retailer from online channel entry. More recently, Guan et al. [

17] investigated the manufacturer’s voluntary disclosure strategy; selling to the end consumers directly can infringe on the retailer’s business. Zhang and Li [

18] demonstrated the effect of asymmetric demand information and endogenous quality decision on manufacturer encroachment. Unlike the above studies, our paper studies manufacturer encroachment in the context of complementary products rather than substitute products in the supply chain.

The dual-channel supply chain literature considers mainly the scenario where all the supply chain members offer substitute products or a single product. A significant amount of study about dual-channel supply chains has concentrated on pricing decisions of substitute products. Chen et al. [

19] studied single period pricing strategies of substitute products in supply chain. Yao and Liu [

20] demonstrated that the addition of online channels about a single product causes competitive prices and payoffs. Cai [

21] evaluated the impact of pricing schemes with a single product and price discount contracts on competition in the dual-channel supply chain. Kurata et al. [

22] studied the pricing decisions of substitute products in the supply chain, where there is a contest between the store brand and the national brand. Batarfia et al. [

23] studied the theme that the manufacturer sells the consumers the customized products by the online channel and sells them the pre-configured products directly in a dual-channel. However, only a few studies have focused on the pricing problems of complementary products in dual-channel supply chains.

Much of the literature has researched complementary products from different perspectives. Li et al. [

24] researched whether the policy of markdown pricing in the sales cycle is inferior to bundling complementary products. Yue et al. [

11] and Wei et al. [

25] studied the information sharing of two duopoly companies providing complementary products. Only a few papers have investigated the pricing decisions of complementary products [

26,

27,

28,

29], but they either focused on channel members’ different powers regarding the complementary products in the traditional channel [

26], or considered the power structure of supply chains [

30,

31,

32]. Our analysis is most closely related to Zhao et al. [

28] and Wang et al. [

29], who both studied the complementary products in the dual-channel supply chain. Wang et al. [

29] considered both the service and price decisions of complementary products with varying supply chain structures, while Zhao et al. [

28] derived the optimal pricing strategies for complementary products under different power structures. Our paper departs from these studies in that we consider manufacturers’ online entry in the existing traditional channel for complementary products.

The two most relevant studies studied the impact of different market powers and two types of channel pricing forms on supply chain profits by formulating four game models. However, in all these studies, the manufacturer was modeled as the leader in the market. Our work differs in part by exploring whether the powerful retailer influences integrated manufacturers’ decisions on their online entry. Our contributions to this paper are four-fold. First, we demonstrate under what conditions the integrated manufacturer in the traditional channel should add an online channel. Second, how the added online channel affects the demands, prices, and profits of channel members is discussed. Third, supply chain members should strive to make the degree of complementarity between online and offline for the two products lower than that between the offline channels, which will benefit the supply chain members. Fourth, when the online and offline market bases are almost the same and the level of complementarity is moderate, the integrated manufacturer does not add the online channel, and the traditional supply chain may bring more revenue.

The remainder of this paper is arranged as follows. The problem statement and the model description are presented in

Section 2. The equilibrium analyses are conducted and feasibility conditions are discussed in

Section 3.

Section 4 compares the profits and strategies across models, and determines the effect of the online channel entry on channel members. In

Section 5, we have some extensions on the complementarity between the online and traditional channels. Finally,

Section 6 concludes the implications of the findings.

2. Notation and Model

This study considered a supply chain consists of two manufacturers (denoted as the integrated manufacturer and the traditional manufacturer) and a retailer (she), who sell two complementary products. The product is produced through the manufacturer (he) with unit cost , then they wholesale the product to the offline retailer with unit price , next the retailer resells the product to final consumers with retail price , where , . The product 1 and product 2 are complementary to each other. The decision variables are chosen by the retailer and the two manufacturers for maximizing their own profits. We further suppose that the two manufacturers and the retailer are risk neutral. Manufacturer 1 is now wondering whether they should add a new online channel to sell product 1 directly, in order to improve their profits. In this paper, Manufacturer 1, who sells product 1 by dual channel, is called the integrated manufacturer, and Manufacturer 2, who sells product 2 only via traditional channel, is called the traditional manufacturer.

The retailer-Stackelberg game represents the rise of the dominant retailer, which is the result of the transfer of the power from other channel members to the retailer. Some retailers, for example, Walmart, Home Depot, and Best Buy, can boost product sales by reducing price, and meanwhile maintaining their own marginal profits by squeezing profits from suppliers (manufacturers). In this paper, we constructed the channel structure model for the sequential noncooperative game, in which the Stackelberg leader is the offline retailer, while the followers are the integrated manufacturer and the traditional manufacturer. In addition, both manufacturers own the same power in the game, that is, the two manufacturers move simultaneously.

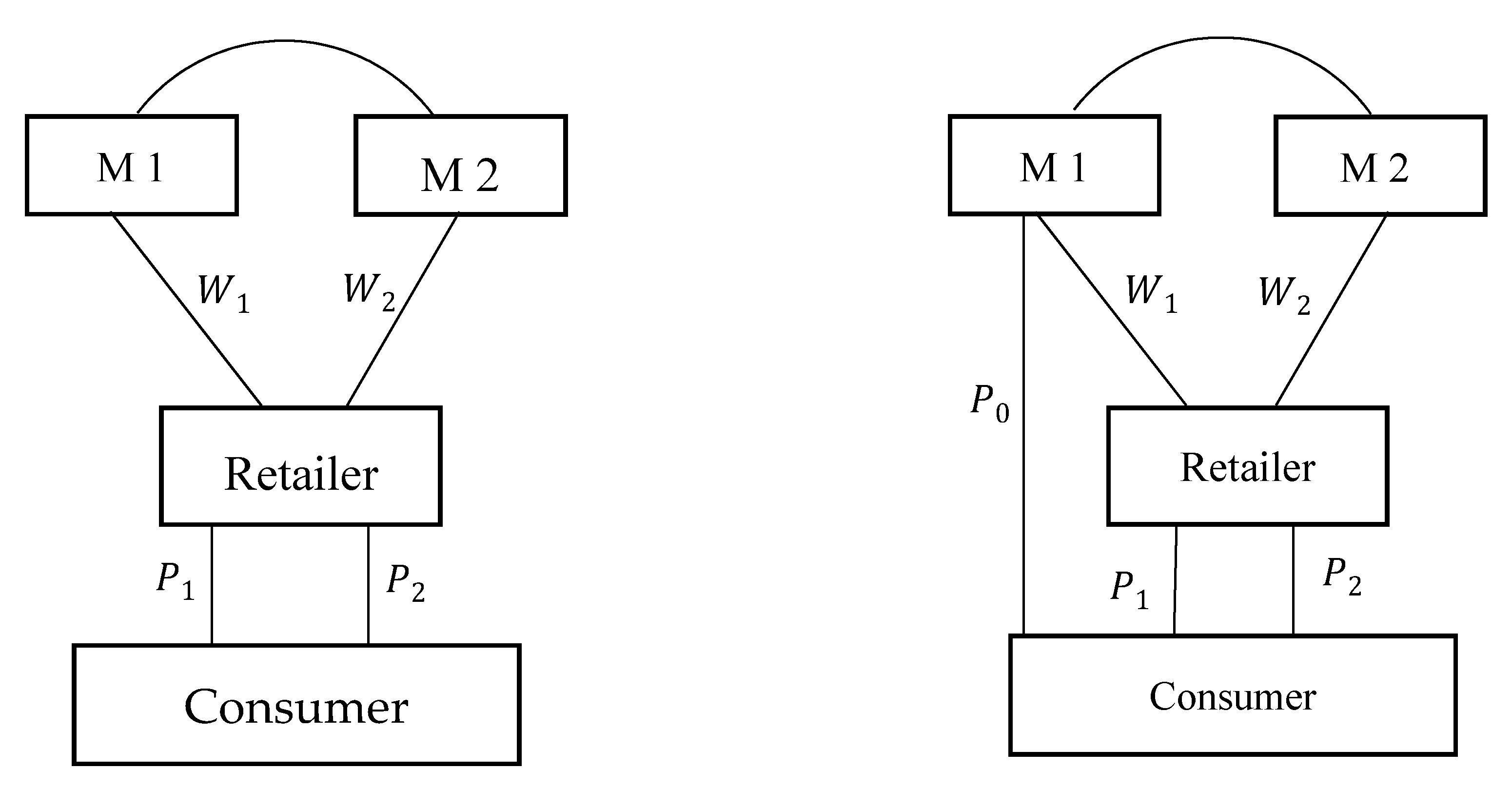

We considered two modeling scenarios. The first was the benchmark scenario, where the integrated manufacturer does not add a new online channel, and we call it

Scenario N, the second was the case that the integrated manufacturer adds an online channel, and we denote it

Scenario E. The channel structures of the two scenarios are described in

Figure 1.

2.1. The Benchmark Model (Scenario N)

In this section, the benchmark scenario that the integrated manufacturer does not add a new online channel is analyzed. The two complementary products are only sold to the dominant offline retailer from the two manufacturers. Let

and

denote the demand for product 1 and product 2, respectively, then we have:

where the parameters

,

denote the base demand of the product 1 and product 2, respectively, the parameter

represents the degree of complementarity between product 1 and product 2 in traditional channels, also known as the cross-price sensitivity. It is clear that

. For simplicity, own price sensitivities for both products are assumed to be identical and normalized to 1. We assume all other parameters are nonnegative. Own price sensitivities are assumed to be greater than the cross-price sensitivity, because the products’ demands are often more sensitive to the change in their prices than to those of their complementary products.

With the above notation, the profits of the offline retailer, traditional manufacturer, and integrated manufacturer can be written by:

2.2. Dual-Channel Model (Scenario E)

In this model, the integrated manufacturer sells product 1 directly via the added online channel and at the same time continues to sell through the offline retailer to reach the end customers. The traditional manufacturer only sells product 2 to the offline retailer, who resell it in turn to the final customers. The decision variables of the retailer and the traditional manufacturer remain unchanged, but the integrated manufacturer needs to set a direct-channel sales price for his product.

denotes the direct-channel sales price for product 1. The unit cost of the integrated manufacturer’s direct sales to consumers is normalized to

. When the integrated manufacturer adds an online channel, product 1 can be purchased by consumers either offline from the retailer or online directly from the integrated manufacturer. The demand functions are given, respectively, by:

Most of the assumptions discussed in the previous section remain unchanged. The parameter represents the online base in the market, which is the percentage of base demand for the online channel. It captures the scale of the online base demand, that is, consumer willingness to buy product 1 online. The parameter also indicates product 1′s compatibility in the new online channel (Yan, 2011). The market of product 1 is segmented according to channel usage, and hence the offline market base increases as the online market base decreases. Parameter represents the competition degree between the offline channel and online channel, which is seen as a measurement of the ability of product demand to respond to changes in its price under different distribution channels. The price sensitivities for each of these three channels are assumed to be normalized to 1, it means own price sensitivities are assumed to be greater than the cross-price sensitivities, as mentioned before. The parameter denotes the degree of complementarity existing between product 1 of the new online channel and product 2, and denotes the level of complementarity existing between two products in the offline channels.

Based on the above notations, the expressions of the profits for all supply chain members are obtained as follows:

5. Extension

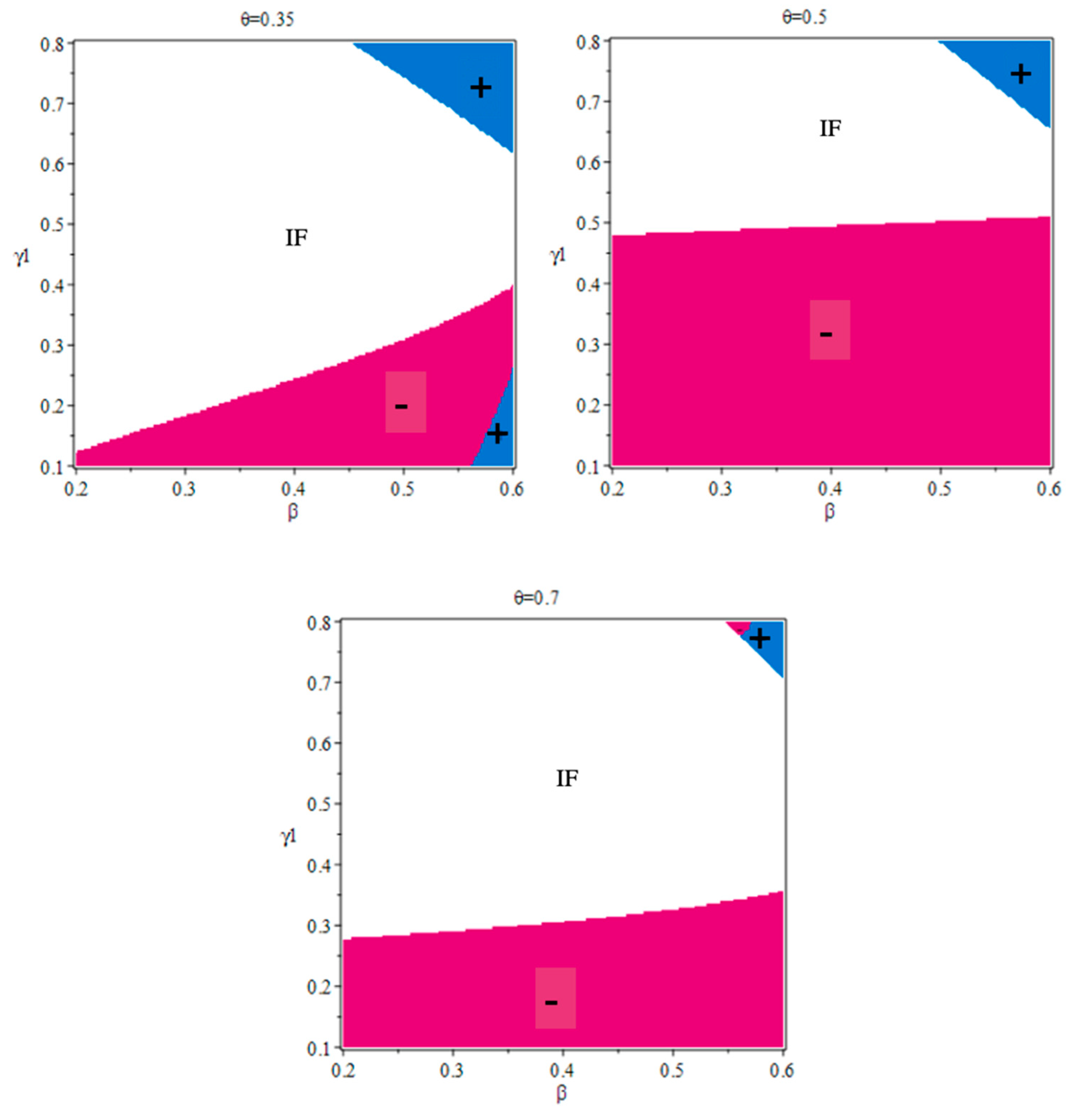

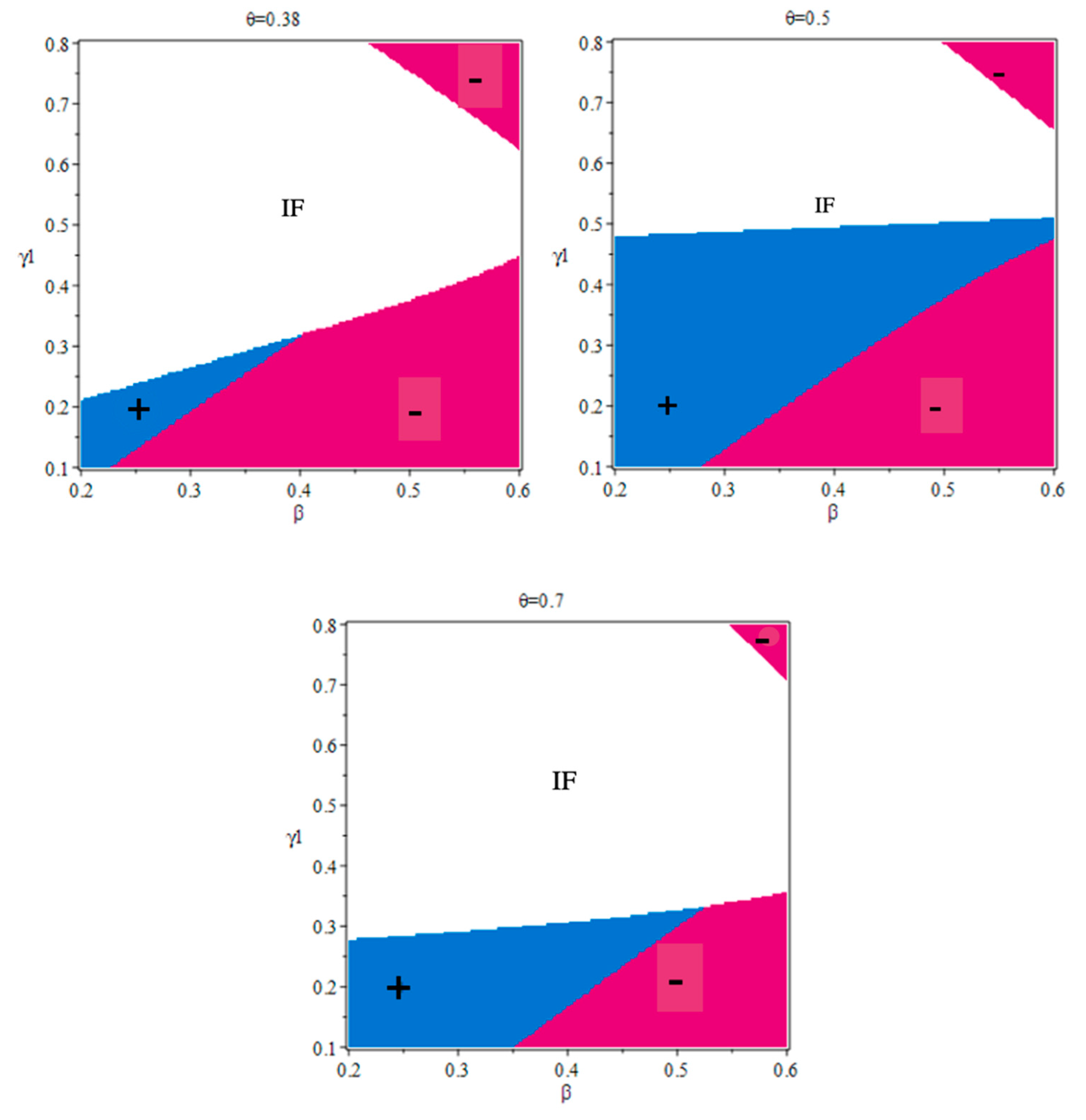

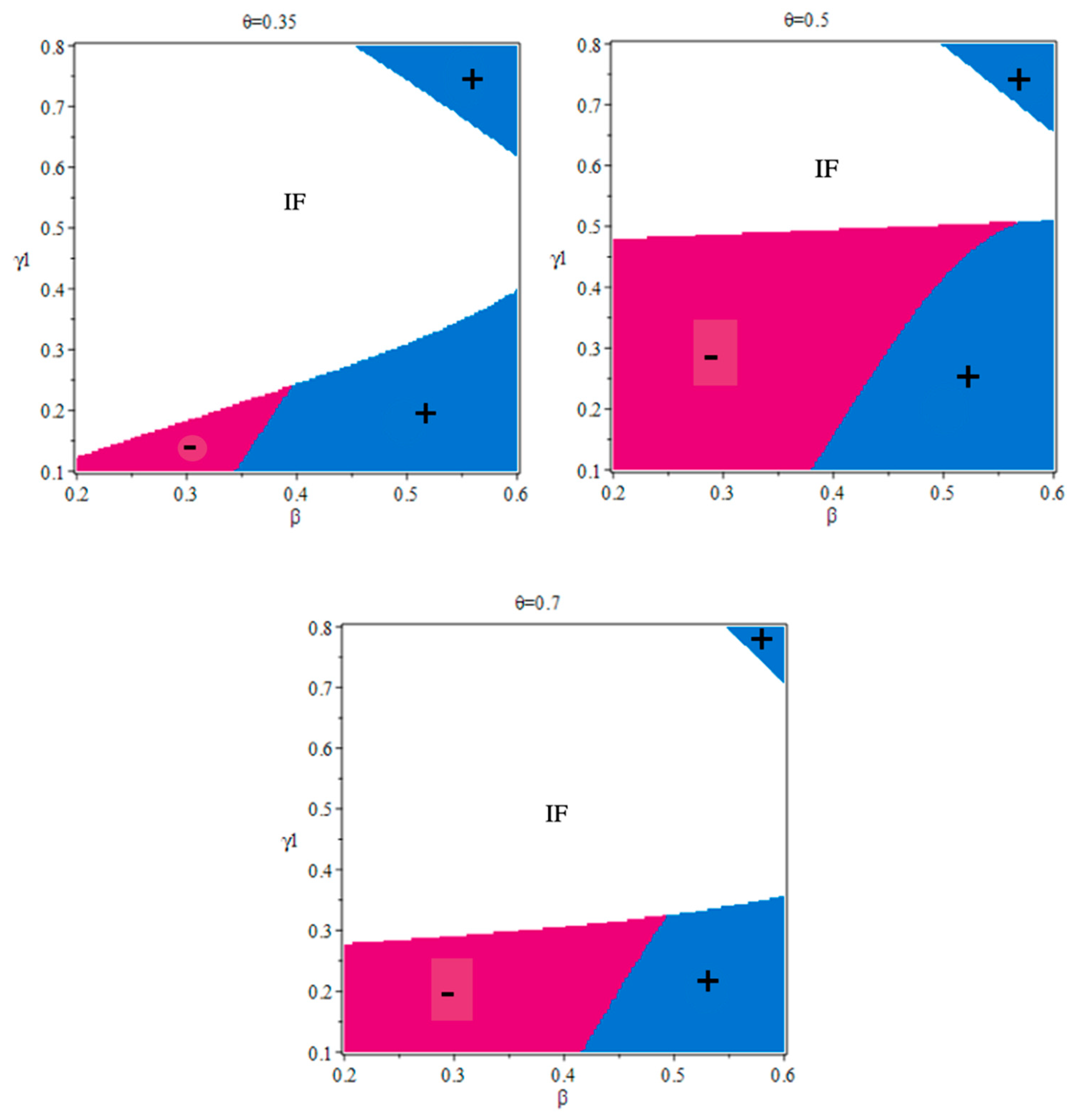

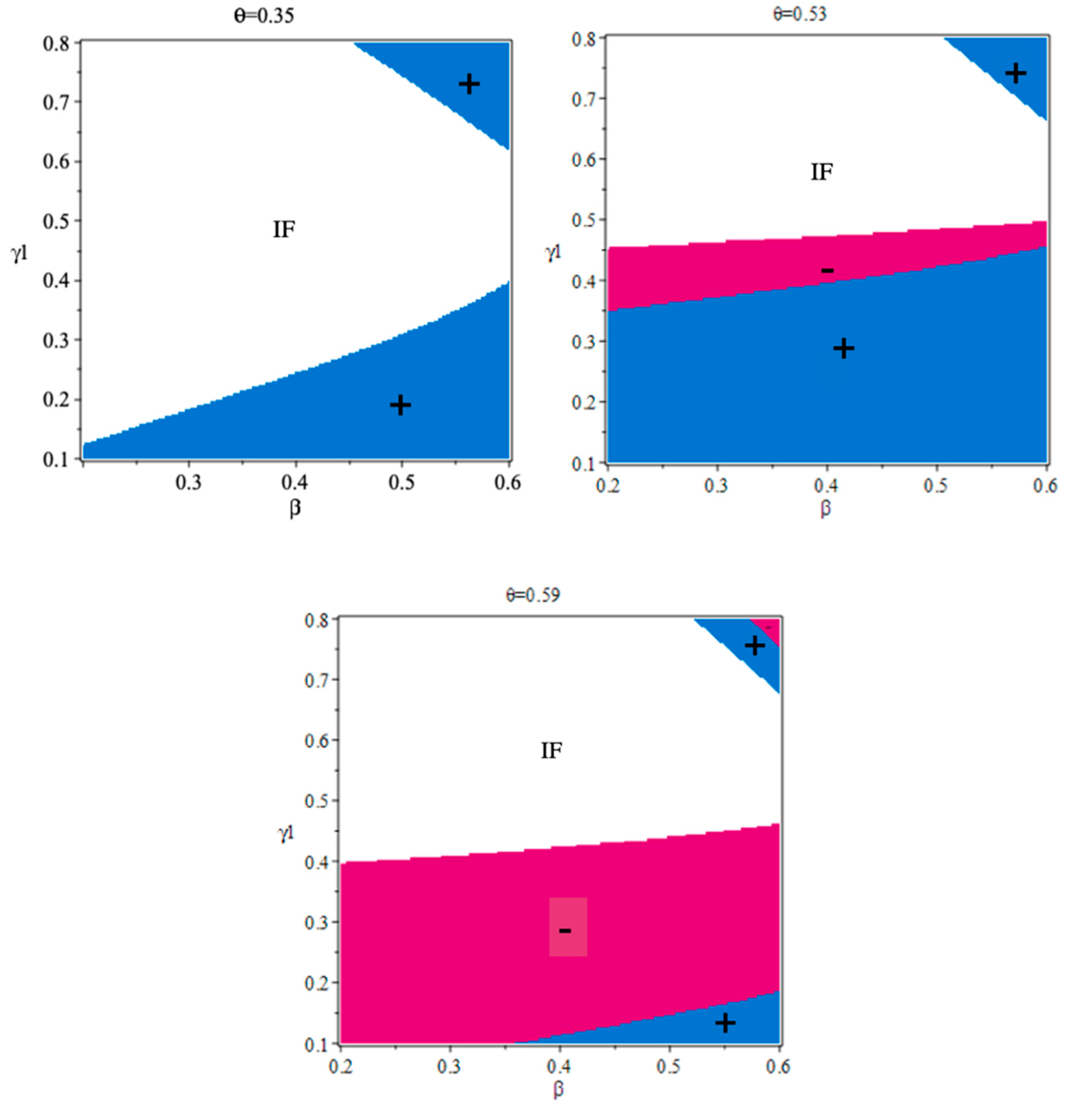

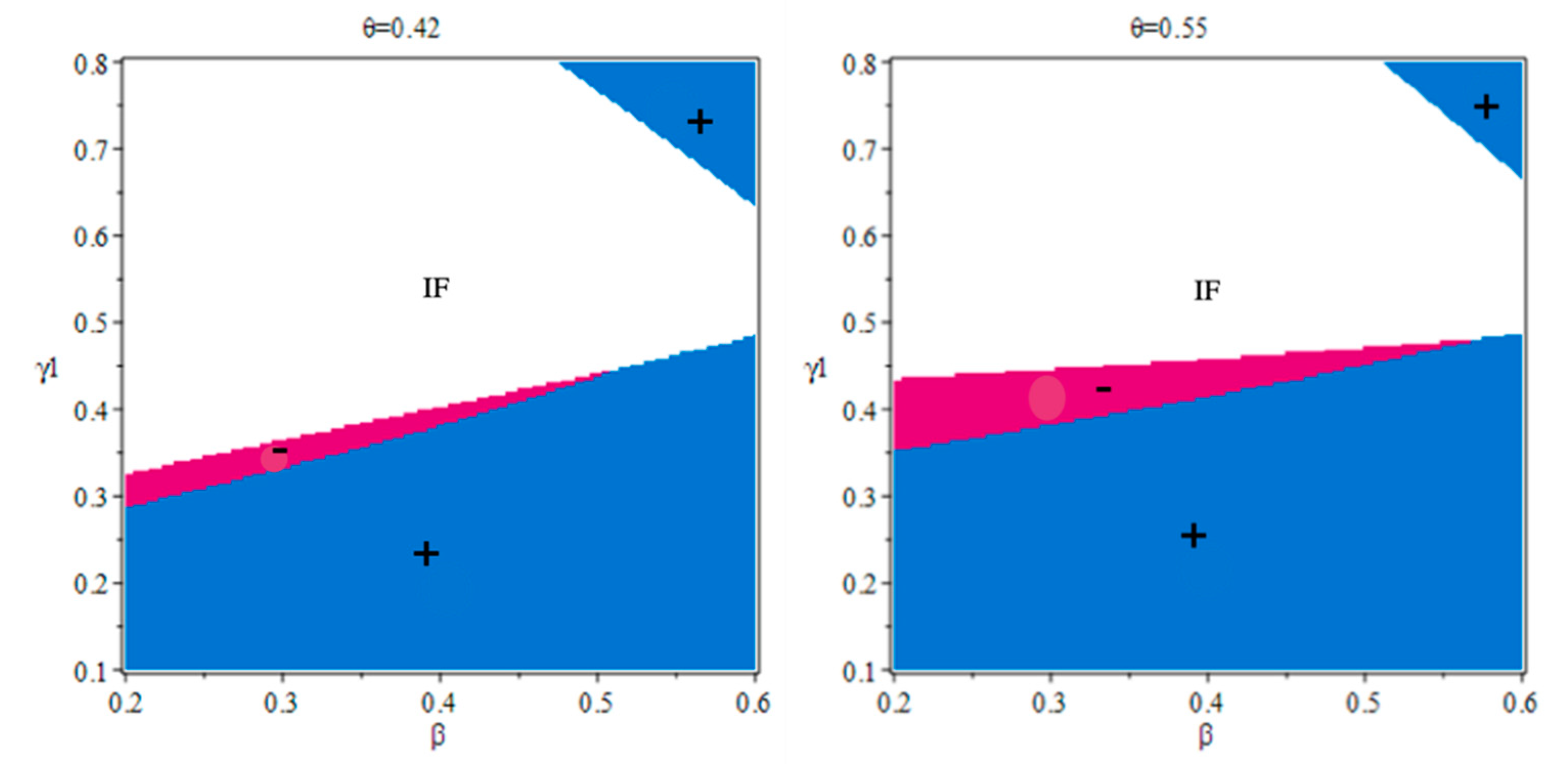

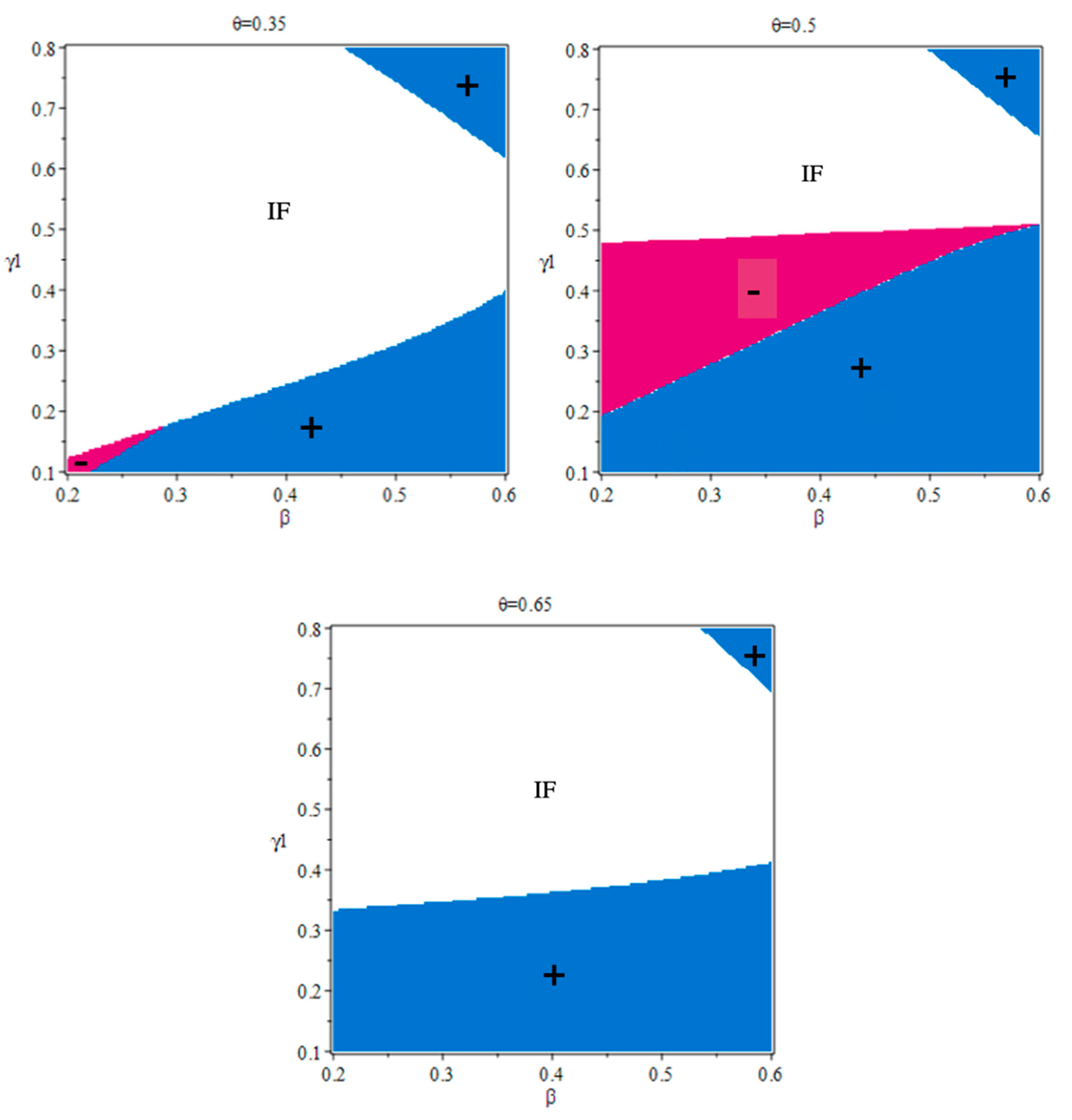

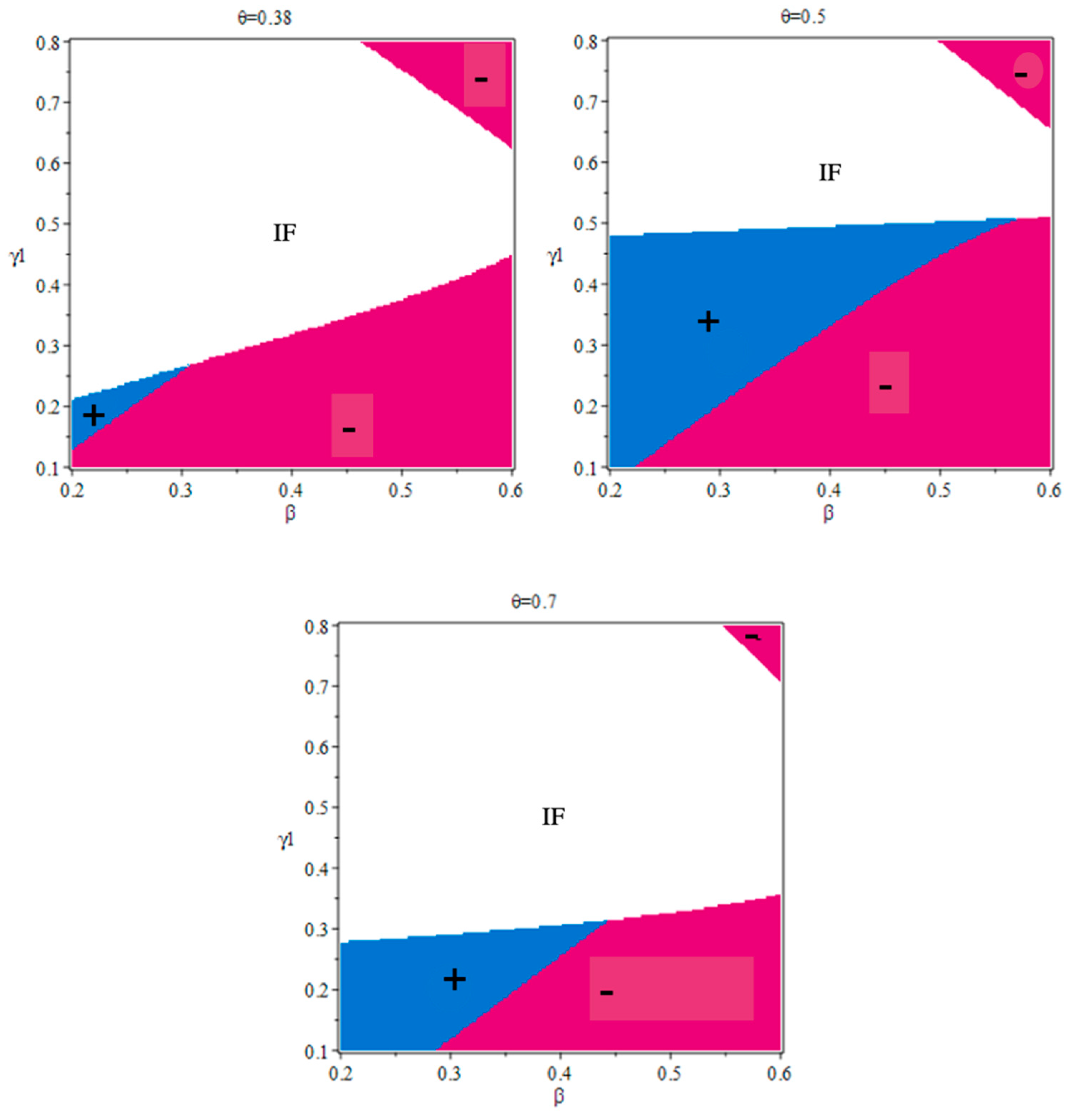

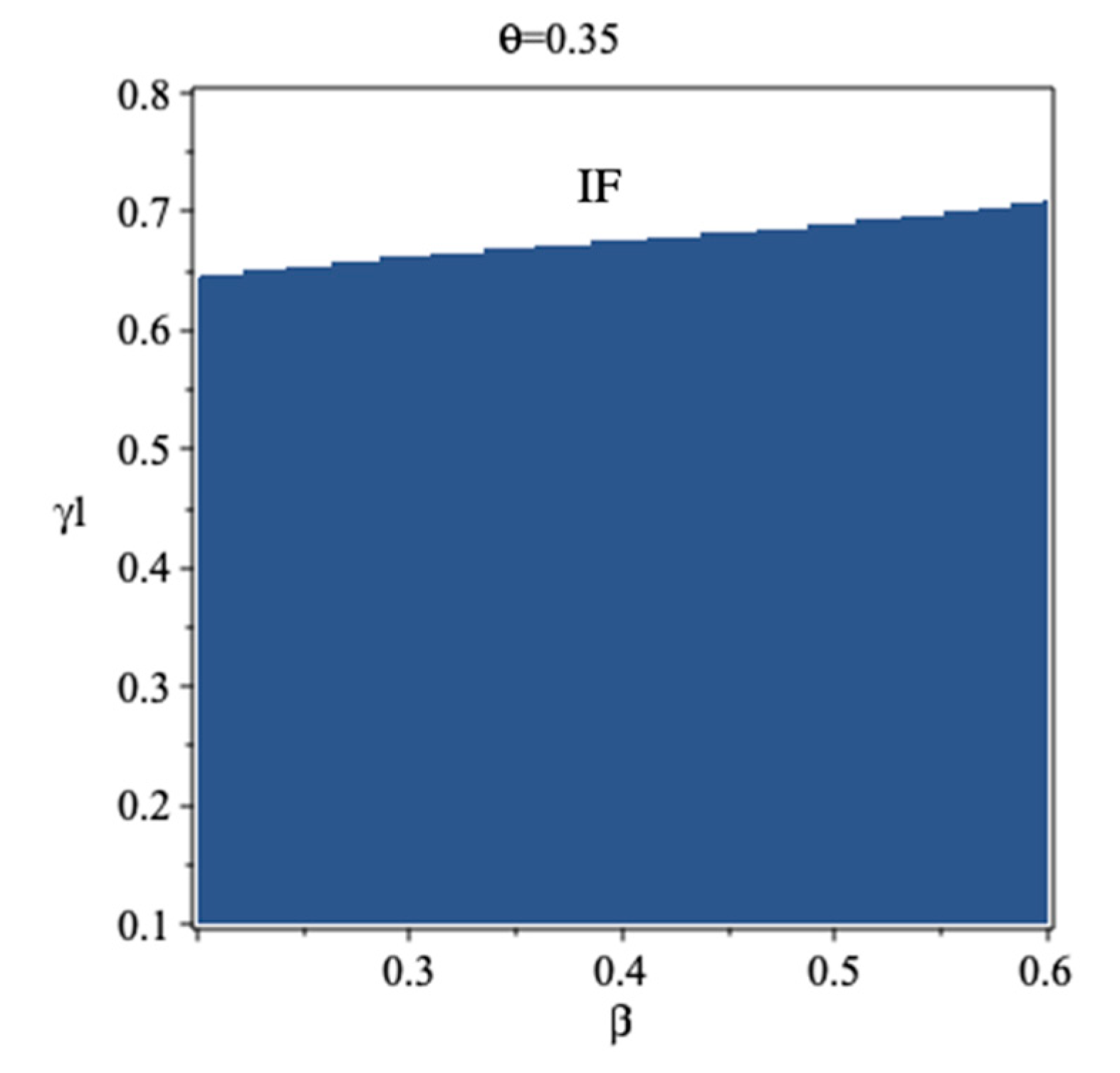

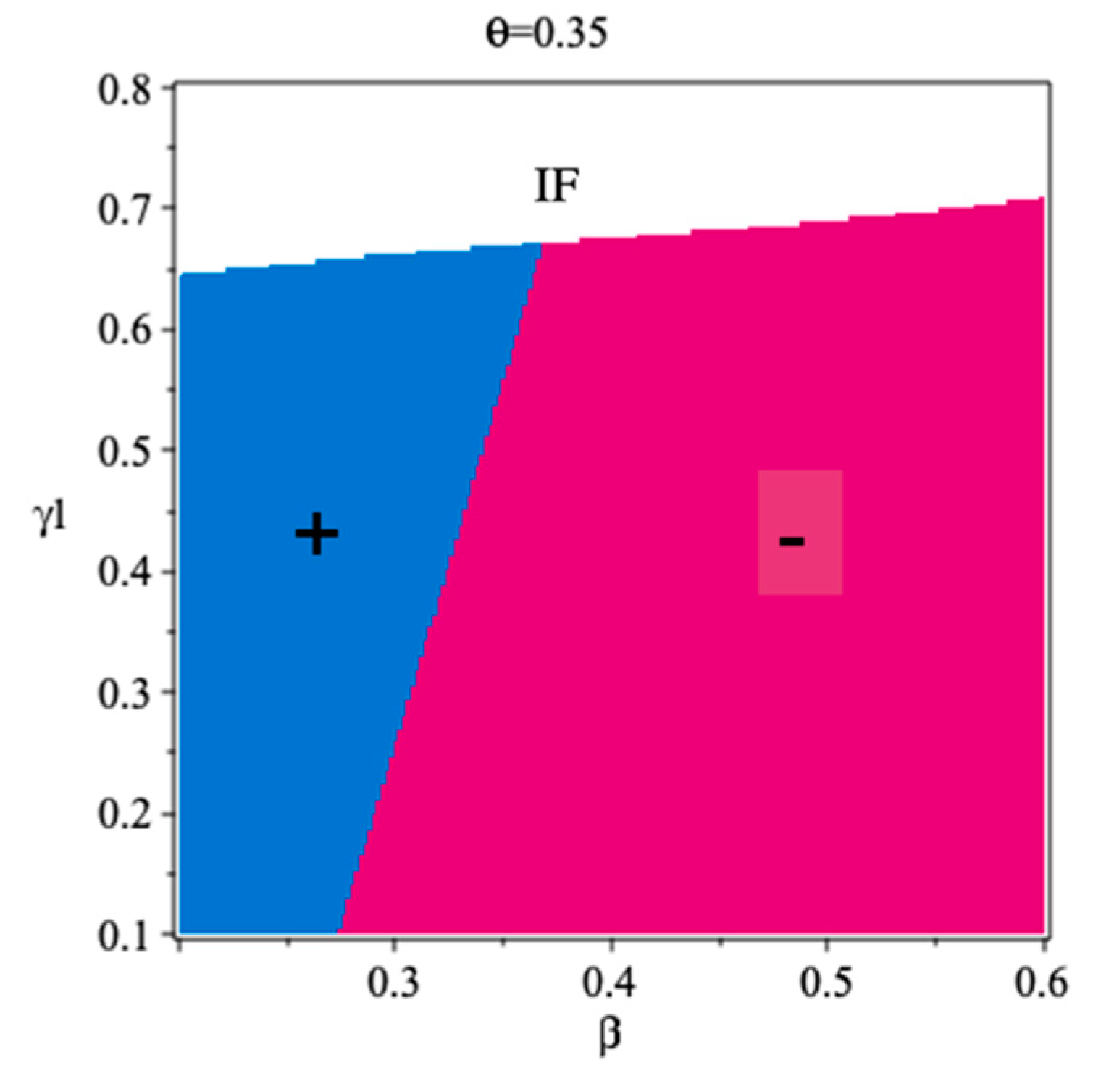

Until now, we have assumed that is equal to . The main reason for this assumption was to make the analysis easier. Based on corollary 3, we found that the relationship between and affects the change of the demand for product 2. In this section, we extend our analysis to the circumstance that the degree of complementarity between product 1 in the online channel and product 2 in the offline channel is smaller than the level of complementarity between two products in the offline channels.

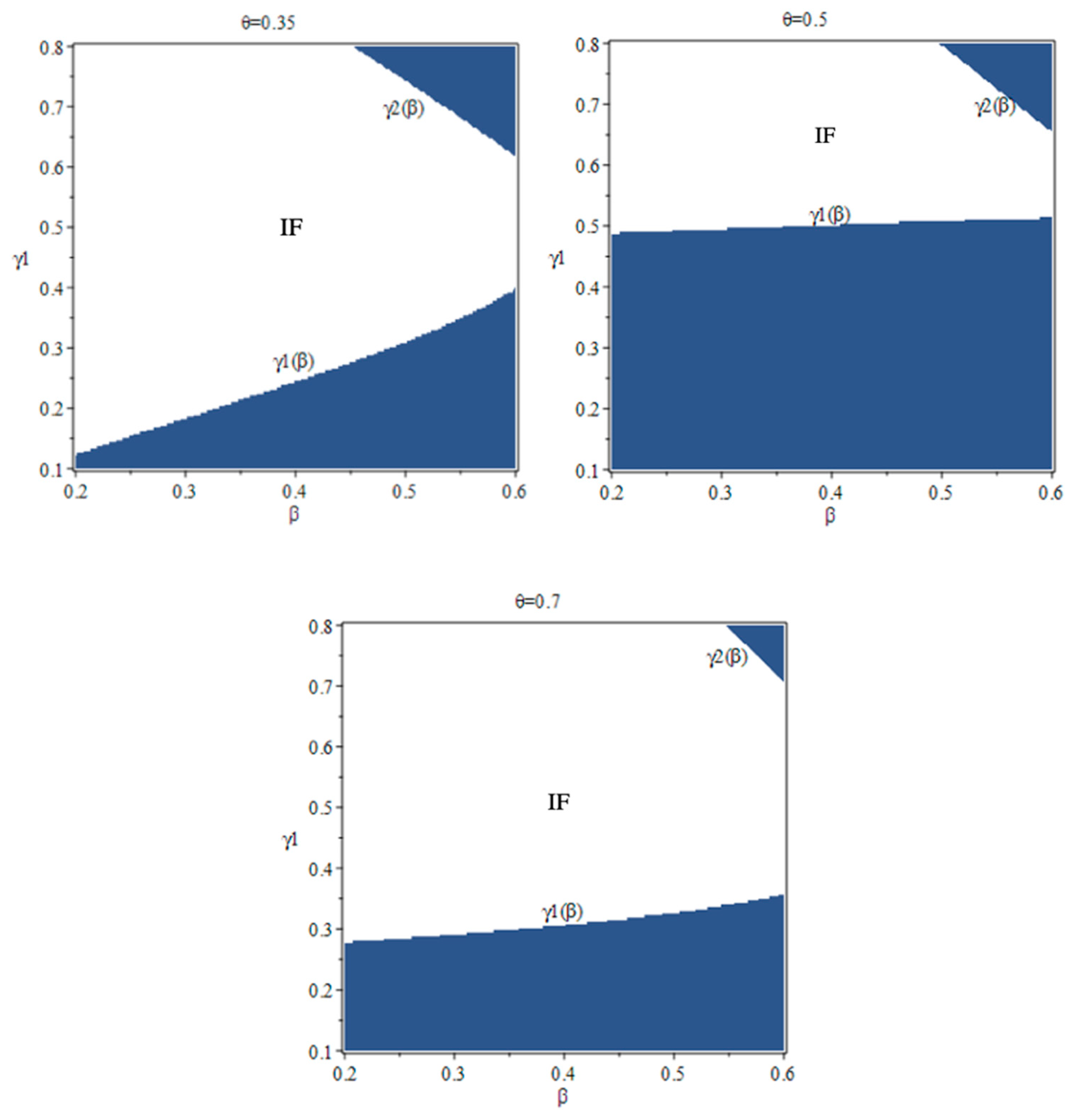

For ease of exposition, we set

in the extended numercal study. Our analysis showed that when the online market base

is small enough, the integrated manufacturer tends not to add the online channel unless the level of complementarity (

) between the two offline channels is relatively low. Under such a situation, as shown in

Figure 12, the feasible domain expands significantly and covers a wider range of

. Otherwise, the feasible domain remains comparable to that in the previous study when

.

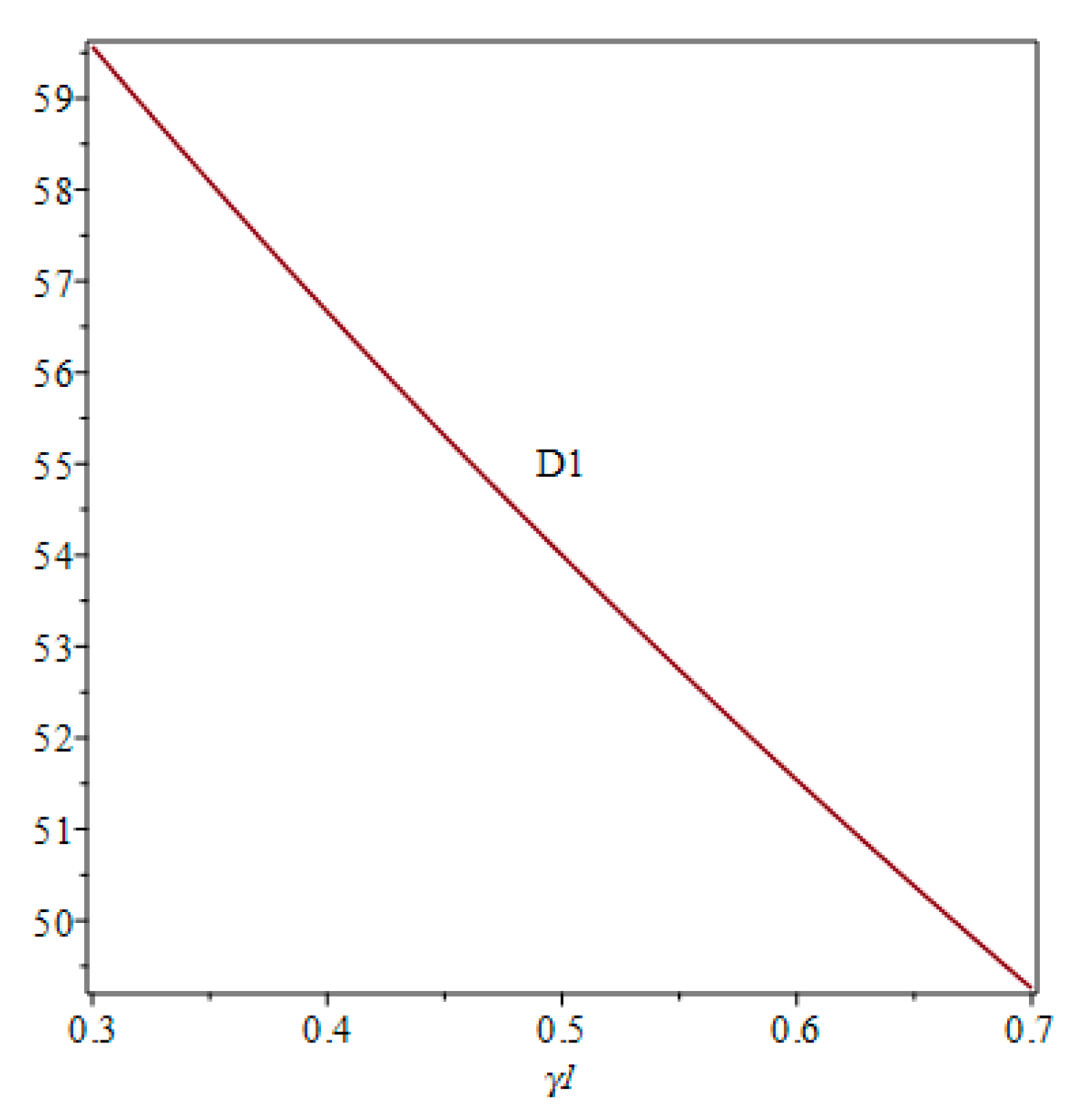

There is more room for the integrated manufacturer to make more profits when adding the online channel as the feasible domain expands. Meanwhile, the monopolistic retailer is still worse off when the online channel is added. However, we found that the earning of the traditional manufacturer is different from the previous result. After the addition of online channel, the traditional manufacturer could earn more when the competition intensity between offline and online channels is relatively small. From corollary 3, we found the demand of product 2 and the online base are positively correlated when the degree of complementarity (

) between two offline channels is larger than the degree of complementarity (

) between the offline and the online channels; this is due to the rising competition intensity between product 1 from two different channels. As shown in

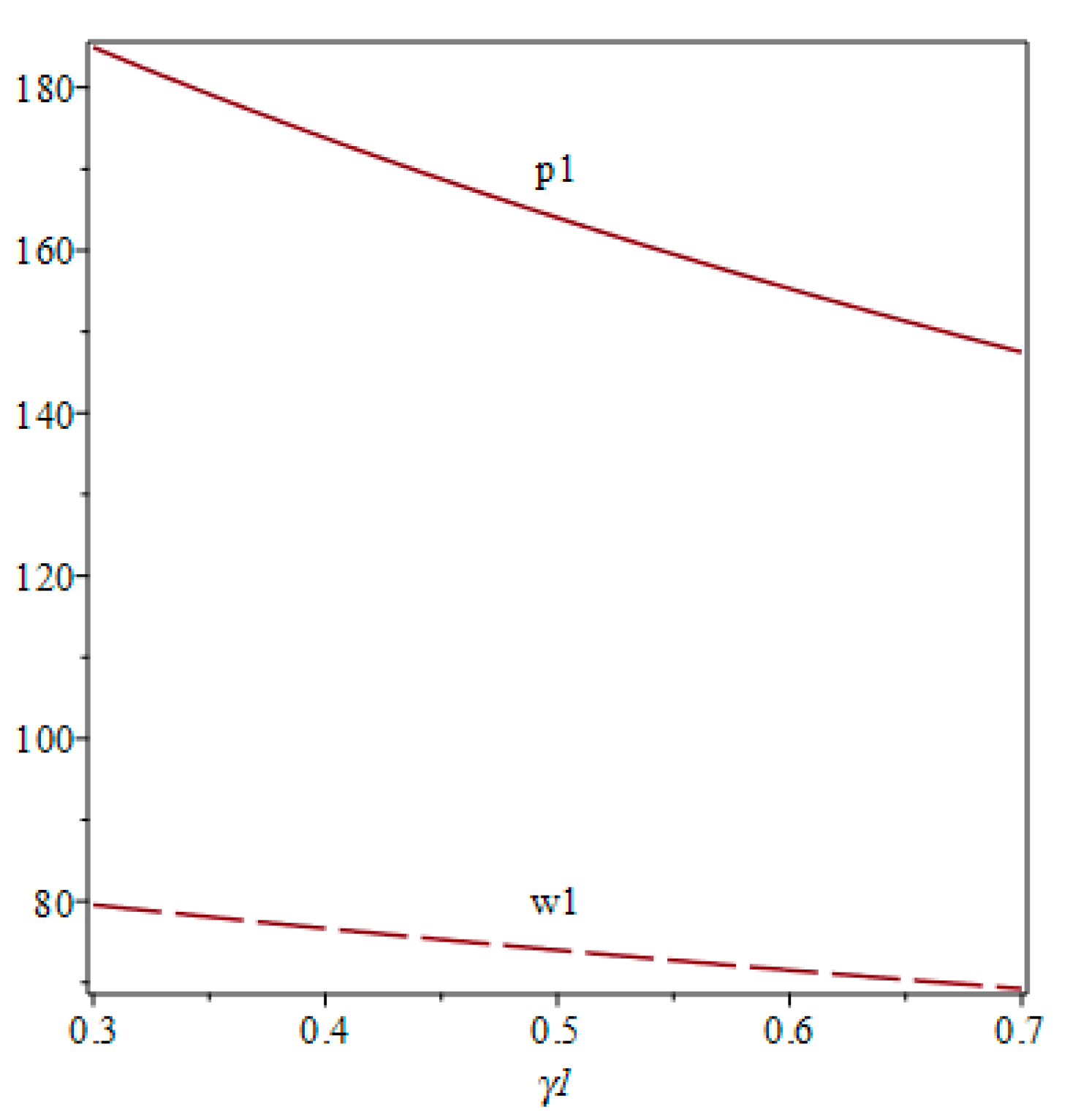

Figure 8, the online price of product 1 is more likely to be higher than its offline retail price for relatively large online market base, so the low degree of complementarity between the online channel and offline channel drives the demand of product 2 to increase when the competition intensity is fairly small (see

Figure 13), and consequently, the profit of traditional manufacturer also increases. One might expect that an encroaching channel makes for the market power of the traditional manufacturer under certain conditions.

6. Conclusions

This paper considered a supply chain that the two manufacturers sell green complementary products to a dominant offline retailer, who leads the green supply chain as a core member. We investigated whether a manufacturer (the integrated manufacturer) should add an online channel by analyzing and comparing the following two models: (1) Scenario N: the benchmark model where the integrated manufacturer does not add an online channel; (2) Scenario E: the dual-channel model where the integrated manufacturer adds an online channel. We formulated power structure as a retailer-Stackelberg model and analyzed channel members’ pricing decisions. The main contributions are summarized as follows. First, supply chain members should strive to make the degree of complementarity between online and offline for the two green complementary products lower than that between the offline channels, which will benefit the supply chain members. Second, when the online and offline market bases of the green complementary products are almost same and the level of complementarity is moderate, the integrated manufacturer does not add the online channel, and the traditional supply chain may bring more revenue.

We determined under what conditions it is a good choice for the integrated manufacturer to add the online channel. Due to mathematical tractability, we referred to numerical studies to characterize the optimal solutions and derive meaningful insights. For ease of exposition, we set the degree of complementarity between product 1 in the online channel and product 2 in the offline channel equal to that between two green complementary products in the retail channels. Not all values of parameters satisfied the necessary conditions for ensuring channel members’ participation. Our analysis showed that the integrated manufacturer is willing to add the online channel as the online market base is relatively large, however, the integrated manufacturer’s profit could be lower in scenario E than that in scenario N, as the online market base is fairly small. What is more, the integrated manufacturer would not add the online channel when online and offline market bases are comparable and the level of complementarity is moderate. The retailer’s profit generated by the sale of product 1 decreases with adding an online channel, while its profit from selling product 2 may either increase or decrease. This result is congruent with the view that adding online channel by a manufacturer undermines the offline retailer’s channel power [

33]. The profits of the retailer come from both green complementary products. The integrated manufacturer competes directly with the retailer by the online channel. Consequently, the profit of the dominant retailer from selling product 1 is actually lower after the addition of a new online channel. The retailer, as the Stackelberg leader, can exercise their power to raise her profit margin of product 2 to compensate the profit loss in selling product 1. The added online channel damages the market power of the traditional manufacturer when the degree of complementarity between the two offline channels is not larger than the degree of complementarity between the online channel and offline channel, and as a result, the traditional manufacturer tends to charge a lower wholesale price in order to expand their demand.

In the extended study, we found that the smaller degree of complementarity between the online channel and offline channel benefits the duopolistic manufacturers. In particular, the traditional manufacturer could earn more, as the competition intensity between the offline and online channels is relatively small. What is more, with the demand of product 2 increasing, the retailer will have more total sales of two products. Our results provide several managerial implications. First, it is beneficial for the retailer to balance the online and offline market bases of product 1 by improving the sales environment of the physical store, in such a situation, the integrated manufacturer would have less incentive to add the new online channel, and hence, the retailer’s profit will not be damaged. Second, the integrated manufacturer can vary their marketing actions for decreasing complementarity level between the online and retail channels to get support from the traditional manufacturer. Lastly, the traditional manufacturer can take steps to increase the degree of complementarity between the two offline channels, aiming at reducing the complementarity of the two green products between the online and offline channels.

We can extend this paper in several aspects in the future. First, this study assumed that the demand is a linear function of certain parameters and deterministic. However, in reality, random variations often occur. Incorporation of randomness into the model will make the analysis very complicated but merits further exploration. Second, in this paper the two manufacturers had symmetrical power, but in the real market, there is power asymmetry between manufacturers. Therefore, it is interesting to examine how power asymmetry would impact channel members’ decisions. Third, we supposed that the monopoly retailer and the two manufacturers are risk neutral. In future studies, we can analyze the effect of risk aversion on optimal decisions and pricing strategies of channel members. Lastly, a bundle sale of complementary products by the retailer can be another possible direction for future studies.