Perception and Prediction of Factors Influencing Carbon Price: Multisource, Spatiotemporal, Hierarchical Federated Learning Framework with Cross-Modal Feature Fusion

Abstract

1. Introduction

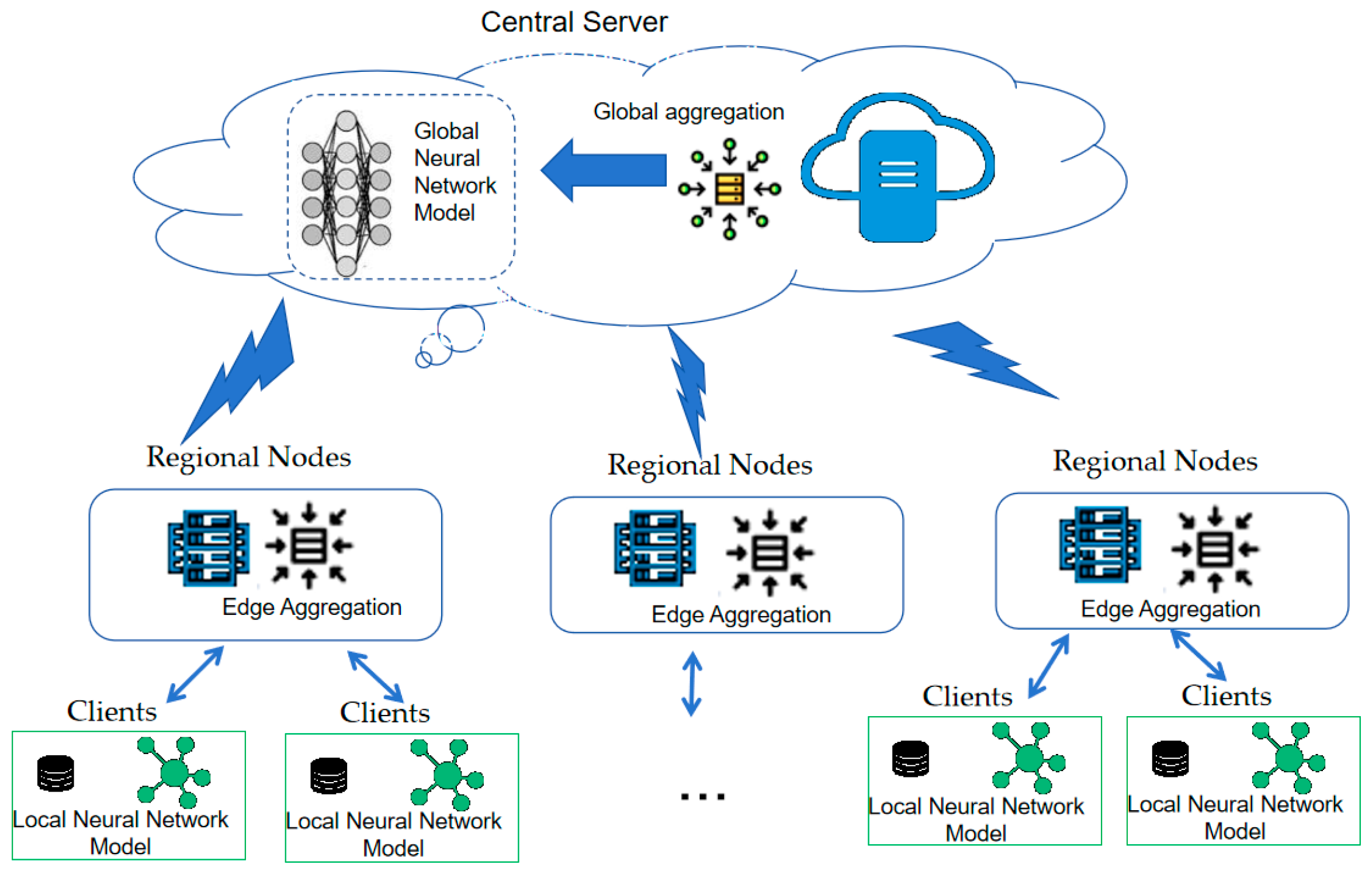

2. Hierarchical Federated Learning Cross-Modal Spatiotemporal Enhanced Attention Construction

2.1. Hierarchical Federated Learning Framework

2.2. Cross-Modal Spatiotemporal Enhanced Attention Model

- Horizontal Federation Aggregation Carbon Price Data: This layer accepts raw carbon prices and influencing factor time series. It utilizes time–frequency decomposition techniques for denoising and trend extraction. The goal is to perform quantitative analysis and eliminate the noise component of carbon price fluctuations, enabling the model to focus on stable trends and critical dynamics. Unified data descriptors are established during the feature engineering phase to ensure consistency across regional feature spaces.

- Vertical Federation Alignment Feature Space: To reduce dimensionality and model complexity, this layer computes the feature importance scores for each time–frequency component using mutual information, correlation metrics, or model-based ranking. Only the top-ranked features are passed on to subsequent layers. This step ensures that only the most relevant lagged features are retained for training. Privacy protection technology enables cross institutional data collaboration. In the gradient aggregation stage, weights are dynamically adjusted based on the contribution of features to model loss to optimize the fusion effect of market related features.

- Spatiotemporal Enhanced Attention Mechanism: The time attention mechanism is used to adaptively weigh the impacts of key time points. The spatial attention constructs a region correlation matrix through graph neural networks, highlighting the contribution of highly correlated nodes. The horizontal federated learning achieves collaborative training under multisource data privacy protection and combines time-delay dynamic weighting and multimodal fusion to improve carbon price prediction accuracy.

- Output Layer: The perception terminal sends the locally updated model parameters to the aggregation server. The server aggregates parameters such as weight matrix and bias vector.

3. Cross-Modal Horizontal–Vertical Hybrid Federation

3.1. Horizontal Federation Aggregation Carbon Price Data

3.1.1. Construction of a Time–Frequency Matrix for Carbon Price Series

3.1.2. Modal Feature Extraction and Iterative Decomposition Analysis

3.2. Vertical Federation Alignment Feature Space

3.3. Modeling of Hysteresis Effects and Automated Feature Selection

3.3.1. Hysteresis Effect Identification and Modeling

Time-Shifted Cross-Correlation Analysis

Granger Causality Test

Lagged Variable Regression Modeling

3.3.2. Automated Selection of Influential Features

- Step 1: Initialize candidate set .

- Step 2: Evaluate function value , and compute initial evaluation set .

- Step 3: Build the surrogate model from .

- Step 4: Choose the next evaluation point by minimizing the acquisition function:

- Step 5: Add the new evaluation to the evaluation set:

- Step 6: Repeat until convergence and return the best hyperparameter combination .

4. Spatiotemporal Enhanced Attention Mechanism

4.1. Multiscale Spatiotemporal Modeling

4.2. Cross-Modal Attention Fusion Hierarchical Federated Learning

- Step 1: The cloud server initializes the global model and regularization coefficient .

- Step 2: The cloud server selects edge nodes to participate in this round of training according to the data distribution strategy. The total number of edge nodes is denoted as .

- Step 3: Each edge node downloads the initial model parameters from the cloud server, including global model weights , hyperparameter configurations, and training control parameters.

- Step 4: Each edge node synchronously connects to a group of clients.

- Step 5: Each client uses its local data to train the received model.

- Step 6: After local training, each client updates its local model parameters .

- Step 7: Upon completing training, each client uploads the updated parameters to its corresponding edge node.

- Step 8: Each edge node aggregates all uploaded client parameters (e.g., , , ) to form an intermediate edge-level model using incremental aggregation.

- Step 9: Each edge node uploads the aggregated parameters to the cloud server, reducing communication frequency through the edge-level computation.

- Step 10: The cloud server aggregates all model parameters uploaded by the edge nodes (i.e., , , across all clients and nodes) to update the global parameters .

- Step 11: The cloud server executes the optimization objective (Equation (45)) and broadcasts the updated global model parameters to all edge nodes to start the next training iteration.

5. Results and Discussion

5.1. Evaluation Metrics

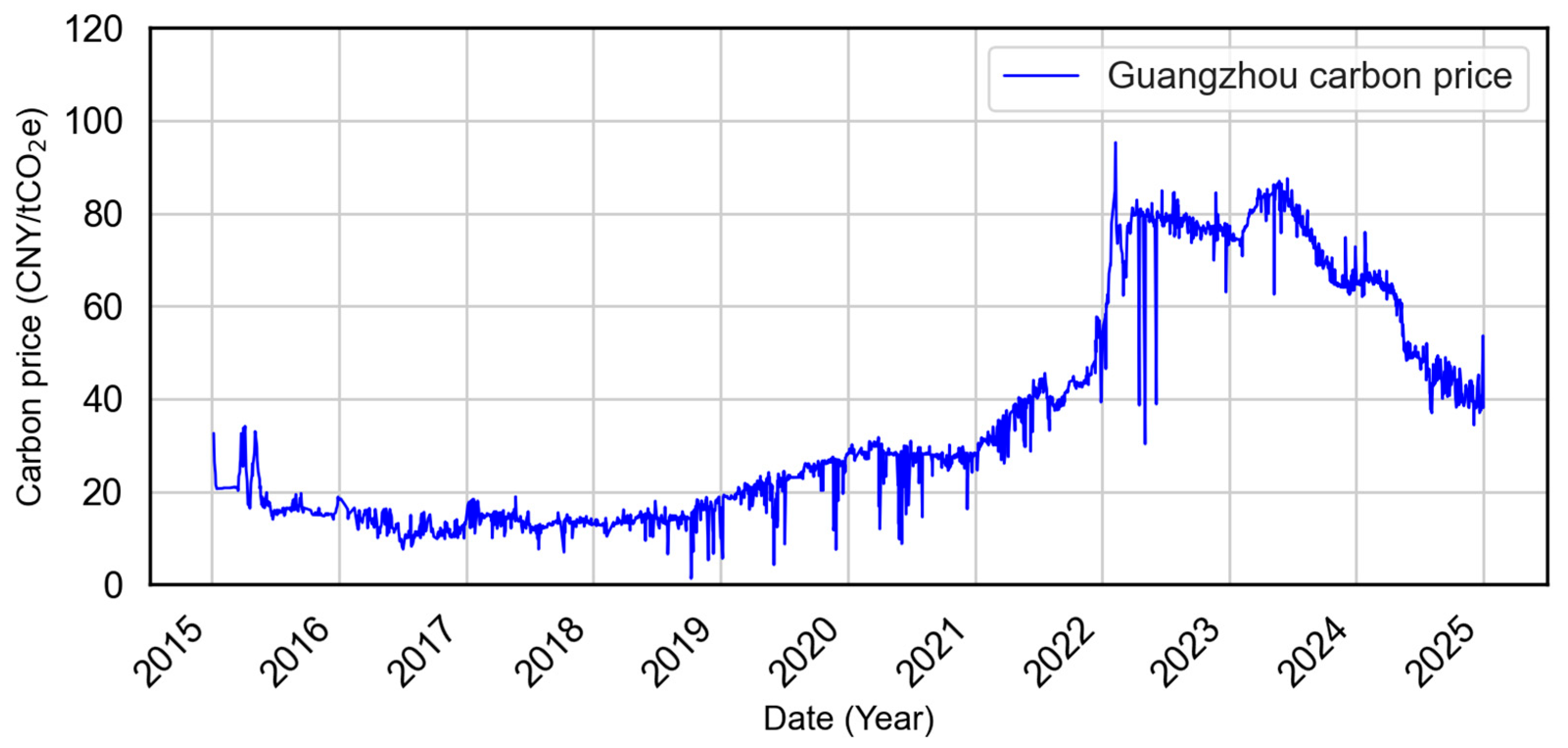

5.2. Effectiveness of Carbon Price Decomposition

5.3. Impact of Feature Selection and Lag Modeling

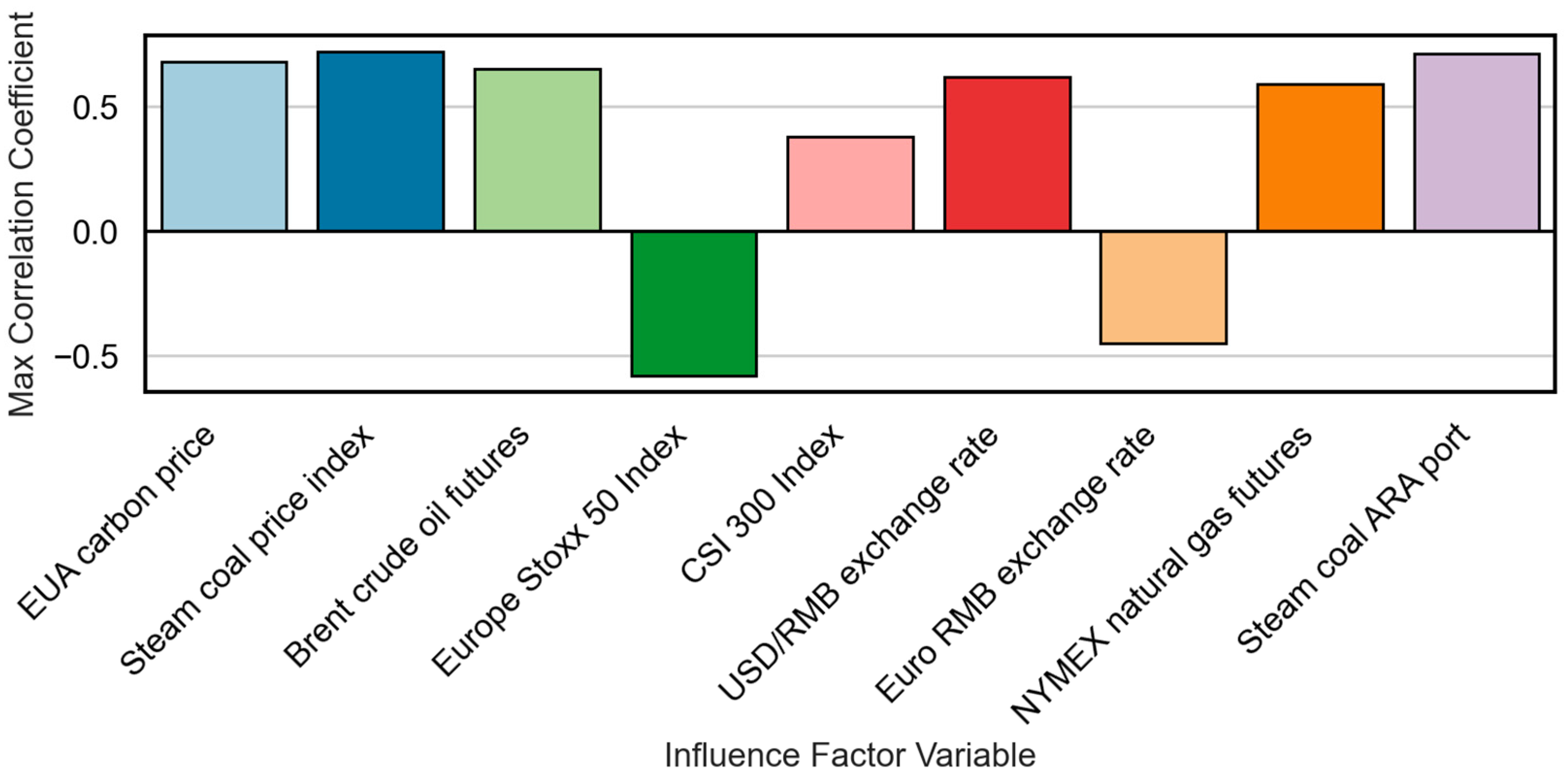

5.3.1. Selection and Analysis of Influencing Variables

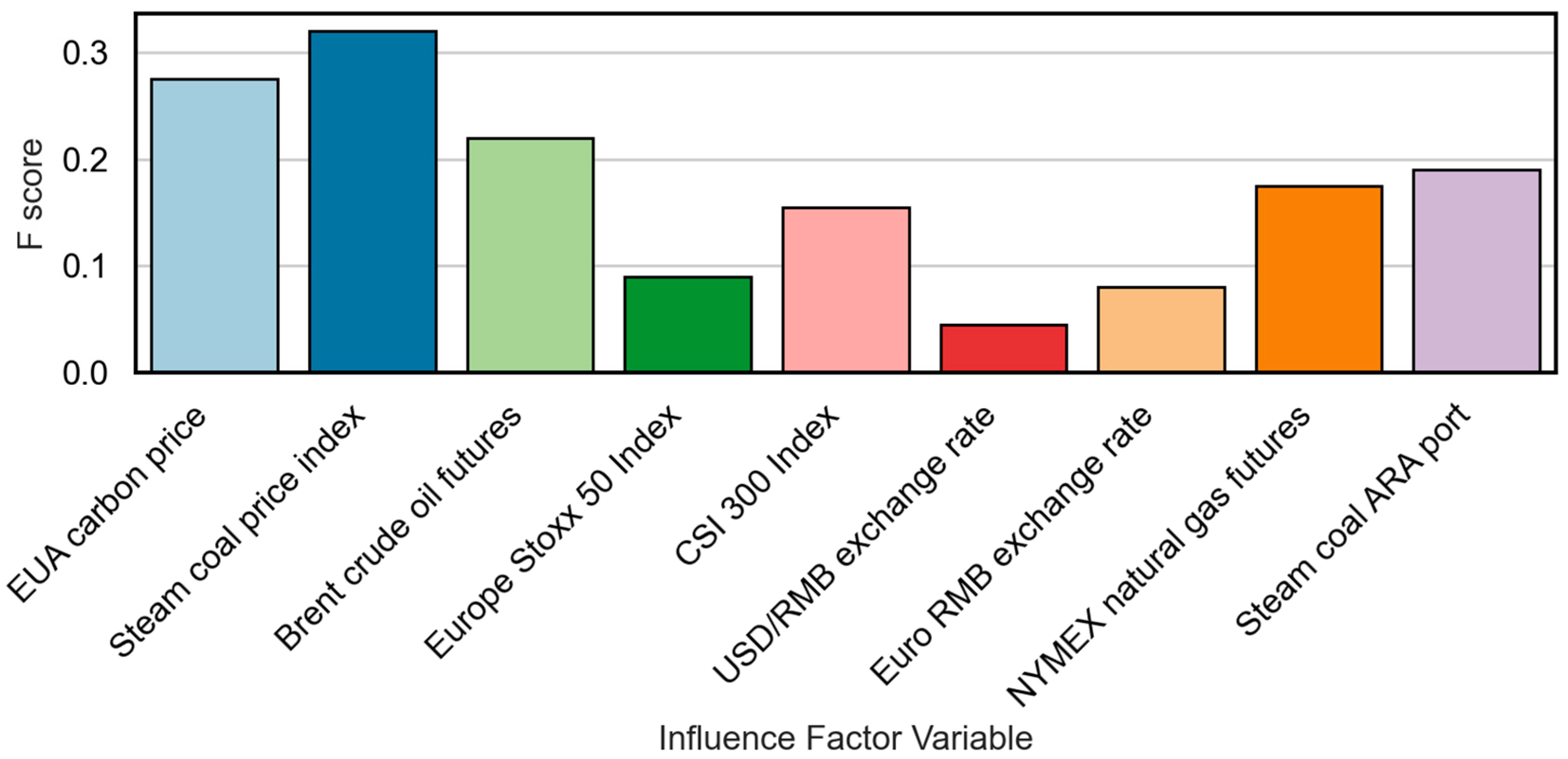

- EUA Carbon Price: The allowance price in the EU Emissions Trading System, representing international carbon market trends. Data are sourced from www.carbonmonitor.org.cn.

- Steam Coal Price Index: A domestic index reflecting the average cost of thermal coal in China, indicative of power generation costs. Data are sourced from the China Coal Transportation and Distribution (CCTD) website.

- Brent Crude Oil Futures: A benchmark for global crude oil prices, affecting fuel substitution and overall energy market sentiment. Data are sourced from investing.com.

- Europe Stoxx 50 Index: A major European equity index used as a proxy for economic growth and investment sentiment in developed economies. Data are sourced from investing.com.

- CSI 300 Index: Represents the performance of the top 300 A-share stocks in Shanghai and Shenzhen, reflecting domestic financial market conditions. Data are sourced from the China Financial Futures Exchange.

- USD/RMB Exchange Rate: Captures fluctuations in the value of the Chinese yuan relative to the US dollar, impacting import energy prices. Data are sourced from investing.com.

- Euro/RMB Exchange Rate: Represents the currency linkage with the Eurozone, affecting import/export cost structures. Data are sourced from xe.com.

- NYMEX Natural Gas Futures: Reflects international gas price trends, providing insight into fuel substitution and emissions displacement. Data are sourced from investing.com.

- Steam Coal ARA Port Spot Price: The spot price of coal at Amsterdam-Rotterdam-Antwerp, serving as a global benchmark for seaborne thermal coal. Data are sourced from Platts Energy Information.

5.3.2. Feature Importance Ranking and Final Selection

5.4. Prediction Accuracy Comparison

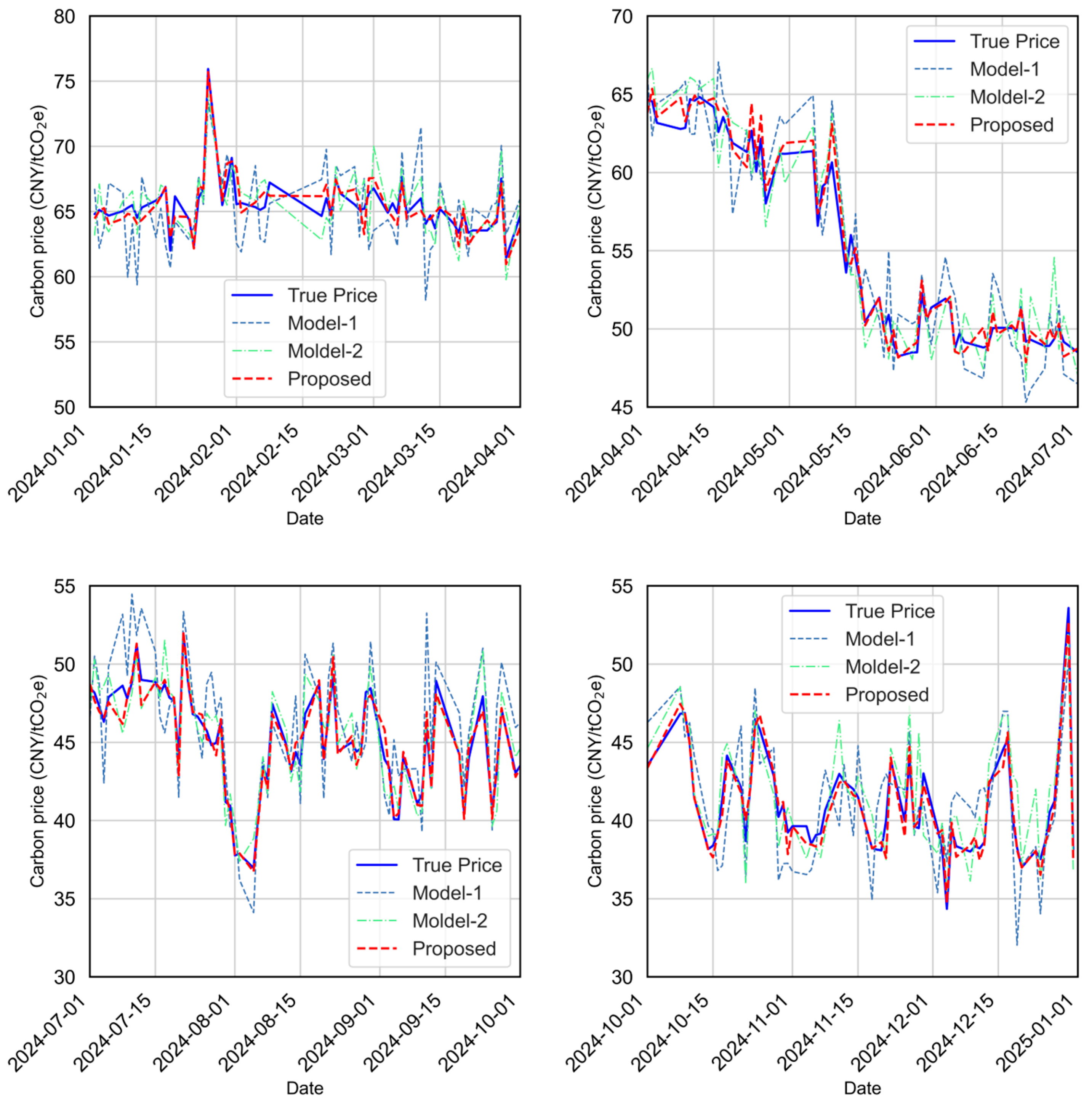

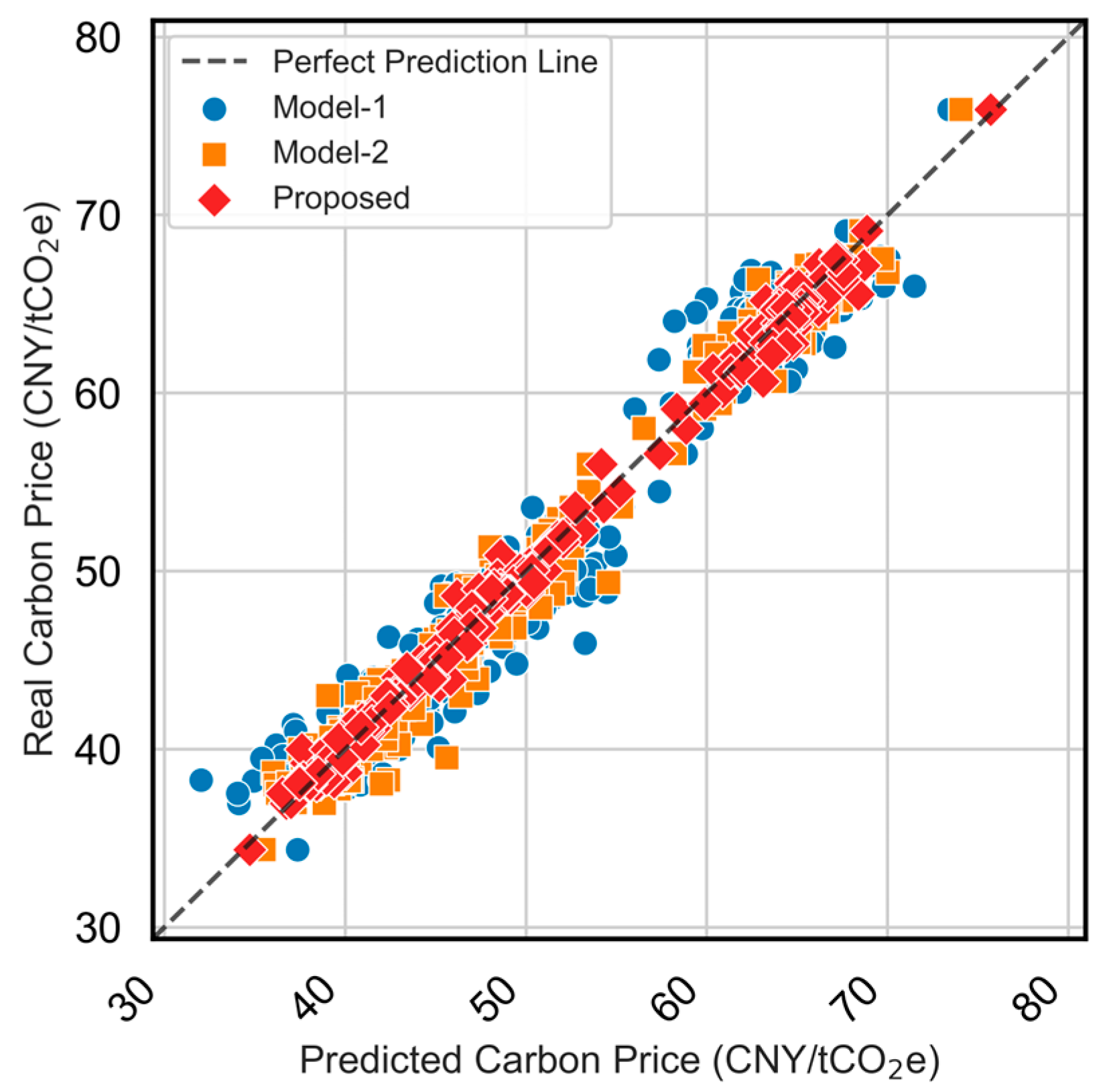

5.4.1. Ablation Study: Effect of Model Components

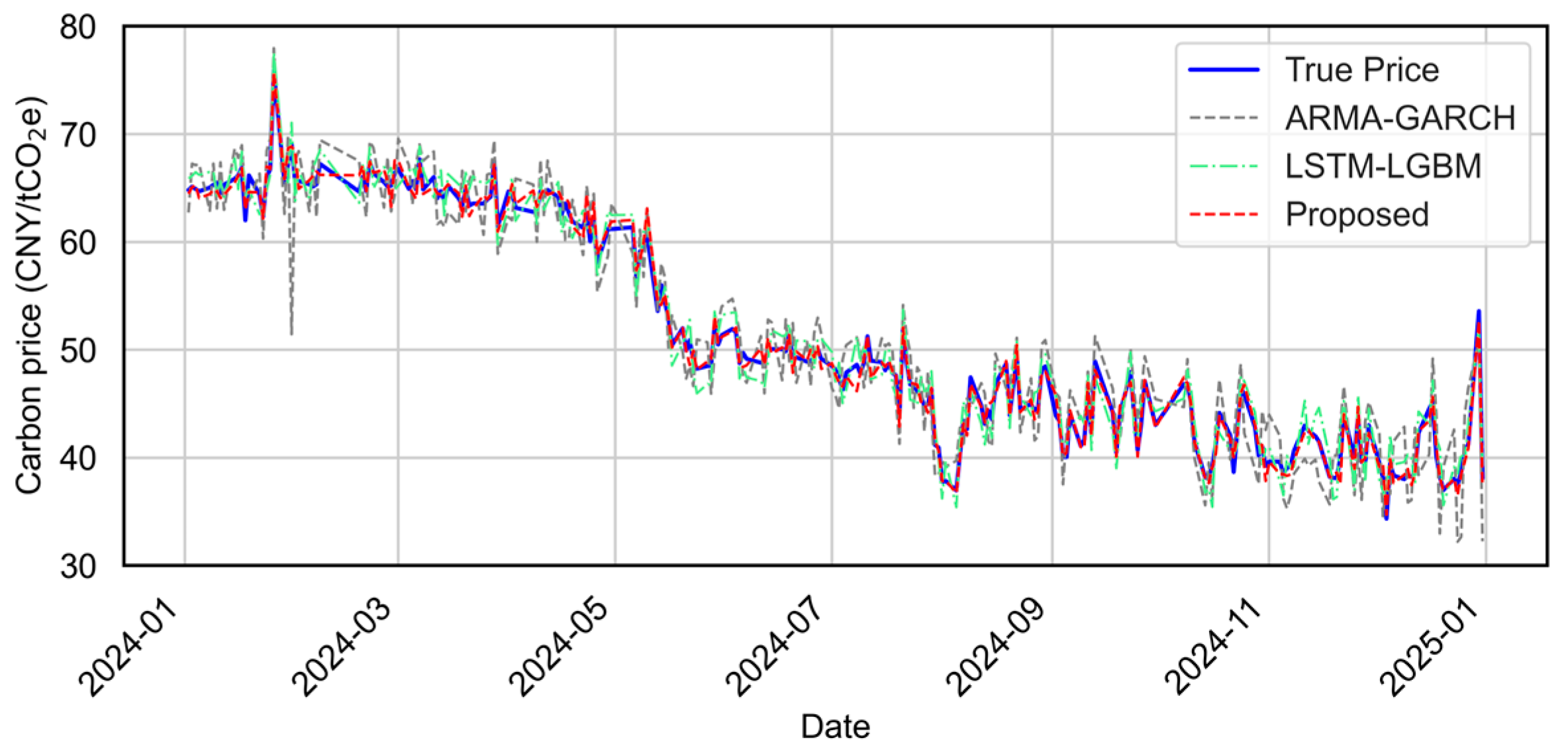

5.4.2. Comparison with Baseline Models

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ACMD | Adaptive Chirp Mode Decomposition |

| ARMA | Autoregressive Moving Average |

| BO | Bayesian Optimization |

| EEMD | Ensemble Empirical Mode Decomposition |

| GARCH | Generalized Autoregressive Conditional Heteroskedasticity |

| KPCA | Kernel Principal Component Analysis |

| LGBM | Light Gradient Boosting Machine |

| LSTM | Long Short-Term Memory |

| MAE | Mean Absolute Error |

| MAPE | Mean Absolute Percentage Error |

| RMSE | Root Mean Square Error |

| RBF | Radial Basis Function |

| SSA | Sparrow Search Algorithm |

| TCN | Temporal Convolutional Network |

| VAR-VEC | Vector Autoregression–Vector Error Correction |

| VMD | Variational Mode Decomposition |

| XGBoost | Extreme Gradient Boosting |

References

- Hong, Q.; Cui, L.; Hong, P. The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China’s carbon emissions trading pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

- Ji, C.J.; Hu, Y.J.; Tang, B.J. Research on carbon market price mechanism and influencing factors: A literature review. Nat. Hazards 2018, 92, 761–782. [Google Scholar] [CrossRef]

- Li, H.; Lei, M. The influencing factors of China carbon price: A study based on carbon trading market in Hubei province. Proc. IOP Conf. Ser. Earth Environ. Sci. 2018, 121, 052073. [Google Scholar] [CrossRef]

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Jin, Y.; Liu, X.; Chen, X.; Dai, H. Allowance allocation matters in China’s carbon emissions trading system. Energy Econ. 2020, 92, 105012. [Google Scholar] [CrossRef]

- Rambeli, N.; Jalil, N.A.; Hashim, E.; Mahdinezhad, M.; Hashim, A.; Bakri, S.M. The impact of selected macroeconomic variables on Carbon dioxide (CO2) emission in Malaysia. Int. J. Eng. Technol. 2018, 7, 204–208. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Hines, E. The effects of combined-cycle generation and hydraulic fracturing on the price for coal, oil, and natural gas: Implications for carbon taxes. Energy Policy 2018, 118, 603–611. [Google Scholar] [CrossRef]

- Li, Z.; Wu, H.; Wu, F. Impacts of urban forms and socioeconomic factors on CO2 emissions: A spatial econometric analysis. J. Clean. Prod. 2022, 372, 133722. [Google Scholar] [CrossRef]

- Li, X.; Li, Z.; Su, C.-W.; Umar, M.; Shao, X. Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol. Forecast. Soc. Change 2022, 178, 121601. [Google Scholar] [CrossRef]

- Batten, J.A.; Maddox, G.E.; Young, M.R. Does weather, or energy prices, affect carbon prices? Energy Econ. 2021, 96, 105016. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Influencing factors and fluctuation characteristics of China’s carbon emission trading price. Phys. A Stat. Mech. Its Appl. 2019, 524, 459–474. [Google Scholar] [CrossRef]

- Sheng, Z.; Han, Z.; Qu, Y.; Zeng, B. Study on Price Fluctuation and Influencing Factors of Regional Carbon Emission Trading in China under the Background of High-quality Economic Development. Int. Energy J. 2021, 21, 201–212. [Google Scholar]

- Lu, H.; Ma, X.; Huang, K.; Azimi, M. Carbon trading volume and price forecasting in China using multiple machine learning models. J. Clean. Prod. 2020, 249, 119386. [Google Scholar] [CrossRef]

- Wang, J.; Zhuang, Z.; Gao, D. An enhanced hybrid model based on multiple influencing factors and divide-conquer strategy for carbon price prediction. Omega 2023, 120, 102922. [Google Scholar] [CrossRef]

- Sun, W.; Xu, C. Carbon price prediction based on modified wavelet least square support vector machine. Sci. Total Environ. 2021, 754, 142052. [Google Scholar] [CrossRef]

- Sun, W.; Li, Z. An ensemble-driven long short-term memory model based on mode decomposition for carbon price forecasting of all eight carbon trading pilots in China. Energy Sci. Eng. 2020, 8, 4094–4115. [Google Scholar] [CrossRef]

- Zhou, J.; Wang, S. A Carbon Price Prediction Model Based on the Secondary Decomposition Algorithm and Influencing Factors. Energies 2021, 14, 1328. [Google Scholar] [CrossRef]

- Li, H.; Jin, F.; Sun, S.; Li, Y. A new secondary decomposition ensemble learning approach for carbon price forecasting. Knowl.- Based Syst. 2021, 214, 106686. [Google Scholar] [CrossRef]

- Chen, S.; Yang, Y.; Peng, Z.; Dong, X.; Zhang, W.; Meng, G. Adaptive chirp mode pursuit: Algorithm and applications. Mech. Syst. Signal Process. 2019, 116, 566–584. [Google Scholar] [CrossRef]

- Ji, H. Analysis of national average carbon trading price fluctuation based on GARCH family model. China Price 2022, 6, 96–98. [Google Scholar]

- Zhang, W.; Wu, Z.b. A decomposition-integration forecasting method of carbon emission based on EMD-PSO-LSSVM. Control. Decis. 2022, 7, 1837–1846. [Google Scholar]

- Li, Y.; Yang, N.; Bi, G.; Chen, S.; Luo, Z.; Shen, X. Carbon price forecasting using a hybrid deep learning model: TKMixer-BiGRU-SA. Symmetry 2025, 17, 962. [Google Scholar] [CrossRef]

- Huang, Y.; He, Z. Carbon price forecasting with optimization prediction method based on unstructured combination. Sci. Total Environ. 2020, 725, 138350. [Google Scholar] [CrossRef]

- Huang, Y.; Dai, X.; Wang, Q.; Zhou, D. A hybrid model for carbon price forecasting using GARCH and long short-term memory network. Appl. Energy 2021, 285, 116485. [Google Scholar] [CrossRef]

- Sun, W.; Huang, C. A novel carbon price prediction model combines the secondary decomposition algorithm and the long short-term memory network. Energy 2020, 207, 118294. [Google Scholar] [CrossRef]

- Liu, H.; Shen, L. Forecasting carbon price using empirical wavelet transform and gated recurrent unit neural network. Carbon Manag. 2020, 11, 25–37. [Google Scholar] [CrossRef]

- Xu, J. A hybrid deep learning approach for purchasing strategy of carbon emission rights—Based on Shanghai pilot market. arXiv 2022, arXiv:cs.LG/2201.13235. [Google Scholar]

- Chen, X.; Gong, S.; He, Y.; Cao, W.; Liu, H. Carbon price forecasting in Chinese carbon trading market based on multi-strategy CNN-LSTM. China J. Econom. 2022, 2, 237. [Google Scholar]

- Bai, S.; Kolter, J.Z.; Koltun, V. An Empirical Evaluation of Generic Convolutional and Recurrent Networks for Sequence Modeling. arXiv 2018, arXiv:cs.LG/1803.01271. [Google Scholar] [CrossRef]

- Deng, Z.; Sun, R.; Xue, M.; Wen, S.; Camtepe, S.; Nepal, S.; Xiang, Y. Leakage-Resilient and Carbon-Neutral Aggregation Features the Federated AI-Enabled Critical Infrastructure. IEEE Trans. Dependable Secur. Comput. 2022, 22, 3661–3675. [Google Scholar] [CrossRef]

- Deng, Z.; Sun, R.; Xue, M.; Ma, W.; Wen, S.; Nepal, S.; Xiang, Y. Hardening LLM Fine-Tuning: From Differentially Private Data Selection to Trustworthy Model Quantization. IEEE Trans. Inf. Forensics Secur. 2025, 20, 7211–7226. [Google Scholar] [CrossRef]

| Learning Rate | Max Depth | Subsample | Colsample Bytree | MAE | RMSE |

|---|---|---|---|---|---|

| 0.001 | 3 | 0.6 | 0.6 | 0.177 | 0.215 |

| 0.001 | 5 | 0.8 | 0.8 | 0.205 | 0.253 |

| 0.001 | 7 | 1.0 | 1.0 | 0.191 | 0.227 |

| 0.01 | 3 | 0.6 | 0.6 | 0.142 | 0.182 |

| 0.01 | 5 | 0.8 | 0.8 | 0.107 | 0.121 |

| 0.01 | 7 | 1.0 | 1.0 | 0.157 | 0.213 |

| 0.1 | 3 | 0.6 | 0.6 | 0.150 | 0.200 |

| 0.1 | 5 | 0.8 | 0.8 | 0.135 | 0.197 |

| 0.1 | 7 | 1.0 | 1.0 | 0.159 | 0.214 |

| Model | MAE | MAPE | RMSE | R2 |

|---|---|---|---|---|

| Model-1 Model-2 | 2.284 1.357 | 0.046 0.028 | 2.571 1.622 | 0.934 0.975 |

| Proposed | 0.576 | 0.011 | 0.772 | 0.994 |

| Model | MAE | MAPE | RMSE | R2 |

|---|---|---|---|---|

| ARMA-GARCH LSTM-LGBM | 2.645 1.513 | 0.054 0.031 | 2.911 1.568 | 0.918 0.976 |

| Proposed | 0.576 | 0.011 | 0.772 | 0.994 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, P.; Zhou, X. Perception and Prediction of Factors Influencing Carbon Price: Multisource, Spatiotemporal, Hierarchical Federated Learning Framework with Cross-Modal Feature Fusion. Sensors 2025, 25, 7274. https://doi.org/10.3390/s25237274

Wang P, Zhou X. Perception and Prediction of Factors Influencing Carbon Price: Multisource, Spatiotemporal, Hierarchical Federated Learning Framework with Cross-Modal Feature Fusion. Sensors. 2025; 25(23):7274. https://doi.org/10.3390/s25237274

Chicago/Turabian StyleWang, Peipei, and Xiaoping Zhou. 2025. "Perception and Prediction of Factors Influencing Carbon Price: Multisource, Spatiotemporal, Hierarchical Federated Learning Framework with Cross-Modal Feature Fusion" Sensors 25, no. 23: 7274. https://doi.org/10.3390/s25237274

APA StyleWang, P., & Zhou, X. (2025). Perception and Prediction of Factors Influencing Carbon Price: Multisource, Spatiotemporal, Hierarchical Federated Learning Framework with Cross-Modal Feature Fusion. Sensors, 25(23), 7274. https://doi.org/10.3390/s25237274